While discussing candlestick patterns, we had learnt about the entry and the stoploss points. However, the target price was not discussed. We will discuss the same in this chapter.

The best way to identify the target price is to identify the support and resistance points. The support and resistance (S&R) are specific price points on a chart expected to attract the maximum amount of either buying or selling. The support price is a price at which one can expect more buyers than sellers. Likewise, the resistance price is a price at which one can expect more sellers than buyers.

On a standalone basis, traders can use S&R to identify trade entry points as well.

11.1 – The Resistance

As the name suggests, resistance is something which stops the price from rising further. The resistance level is a price point on the chart where traders expect maximum supply (in terms of selling) for the stock/index. The resistance level is always above the current market price.

The likelihood of the price rising to the resistance level, consolidating, absorbing all the supply, and declining is high. The resistance is one of the critical technical analysis tools which market participants look at in a rising market. The resistance often acts as a trigger to sell.

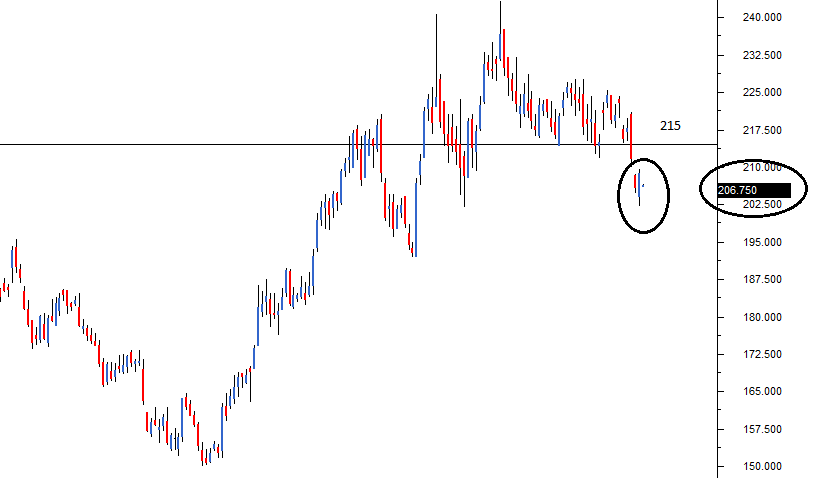

Here is the chart of Ambuja Cements Limited. The horizontal line coinciding at Rs.215 on the chart, marks the resistance level for Ambuja Cements.

I have deliberately compressed the chart to include more data points, the reasons for which I will shortly explain. But before that there are two things that you need to pay attention to while looking at the above chart:

- The resistance level, indicated by a horizontal line, is higher than the current market price.

- While the resistance level is at 215, the current candle is at 206.75. The current candle and its corresponding price level are encircled for your reference

For a moment let us imagine Ambuja cement at Rs.206 forming a bullish marubuzo with a low of 202. We know this is a signal to initiate a long trade, and we also know that the stoploss for this trade is at 202. With the new-found knowledge on resistance, we now know that we can set 215 as a possible target for this trade!

Why 215 you may wonder? The reasons are simple:-

- The resistance of 215 implies there is a likelihood of excess supply.

- Excess supply builds selling pressure.

- Selling pressure tends to drag the prices lower.

Hence for reasons stated above, when a trader is long, he can look at resistance points to set targets and to set exit points for the trade.

Also, with the identification of the resistance, the long trade can now be completely designed as follows:

Entry – 206, Stoploss – 202, and Target – 215.

The next obvious question is, how do we identify the resistance level? Identifying price points as either a support or resistance is extremely simple. The identification process is the same for both support and resistance. If the current market price is below the identified point, it is called a resistance point; else it is called a support point.

Since the process is the same, let us proceed to understand ‘support’, and we will follow it up with the procedure to identify S&R.

11.2 – The Support

Having learnt about resistance, understanding the support level should be quite simple and intuitive. As the name suggests, support is something that prevents the price from falling further. The support level is a price point on the chart where the trader expects maximum demand (in terms of buying) coming into the stock/index. Whenever the price falls to the support line, it is likely to bounce back. The support level is always below the current market price.

There is a maximum likelihood that the price could fall until the support, consolidate, absorb all the demand, and then start moving upwards. The support is one of the critical technical level market participants look for in a falling market. The support often acts as a trigger to buy.

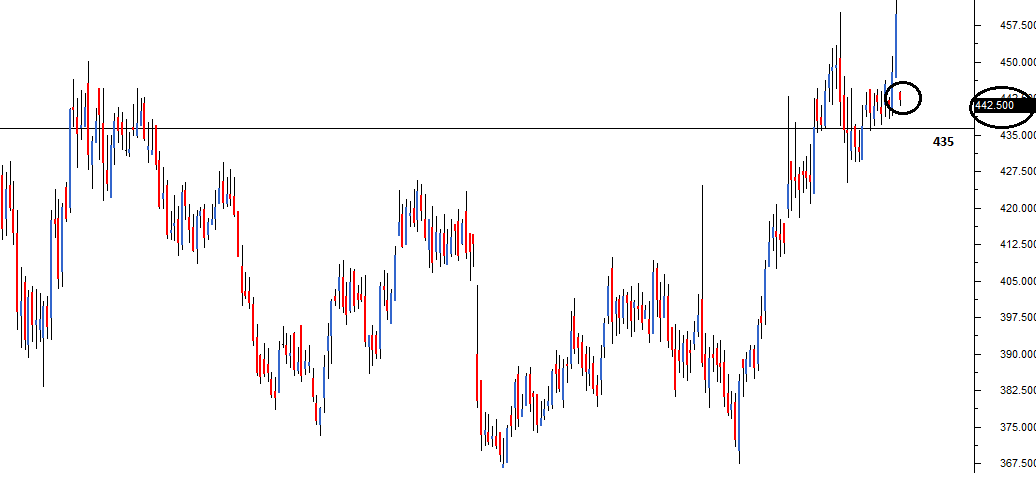

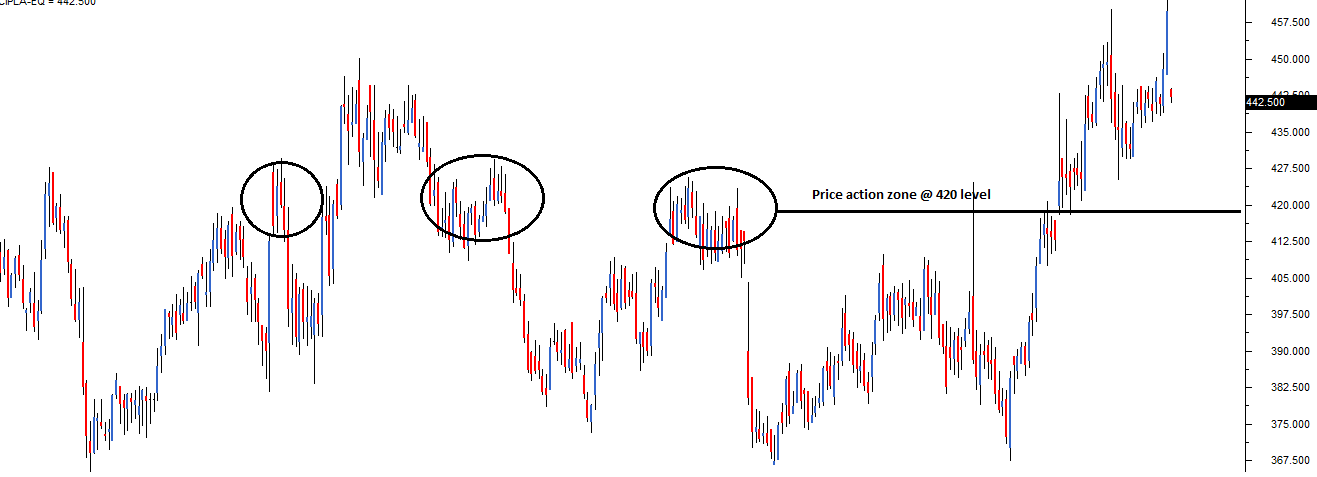

Here is the chart of Cipla Limited. The horizontal line coinciding at 435 on the chart marks the support level for Cipla.

Few things that you need to notice on the chart above:

- The support level, indicated by the horizontal line is below the current market price.

- While the support level is at 435, the current candle is at 442.5. The current candle and its corresponding price level are encircled for your reference

Like we did while understanding resistance, let us imagine a bearish pattern formation – perhaps a shooting star at 442 with a high of 446. Clearly, with a shooting star, the call is too short Cipla at 442, with 446 as the stoploss. Since we know 435 the immediate support, we can set the target at 435.

So what makes Rs.435 target worthy? The following reasons back the decision:

- Support at 435 implies there is a maximum likely hood of excess demand to emerge.

- Excess demand builds buying pressure.

- Buying pressure tends to drag the price higher.

Hence for the reasons stated above, when a trader is short, he can look at support points to set targets and to set exit points for the trade.

Also, with the identification of the support, the short trade is now completely designed.

Entry – 442, stoploss – 446, and target – 435.

11.3 – Construction/Drawing of the Support and Resistance level

Here is a 4 step guide to help you understand how to identify and construct the support and the resistance line.

Step 1) Load data points – If the objective is to identify short term S&R load at least 3-6 months of data points. If you want to identify long term S&R, load at least 12 – 18 months of data points. When you load many data points, the chart looks compressed. This also explains why the above two charts look squeezed.

- Long term S&R – is useful for swing trading.

- Short term S&R – is useful intraday and BTST trades.

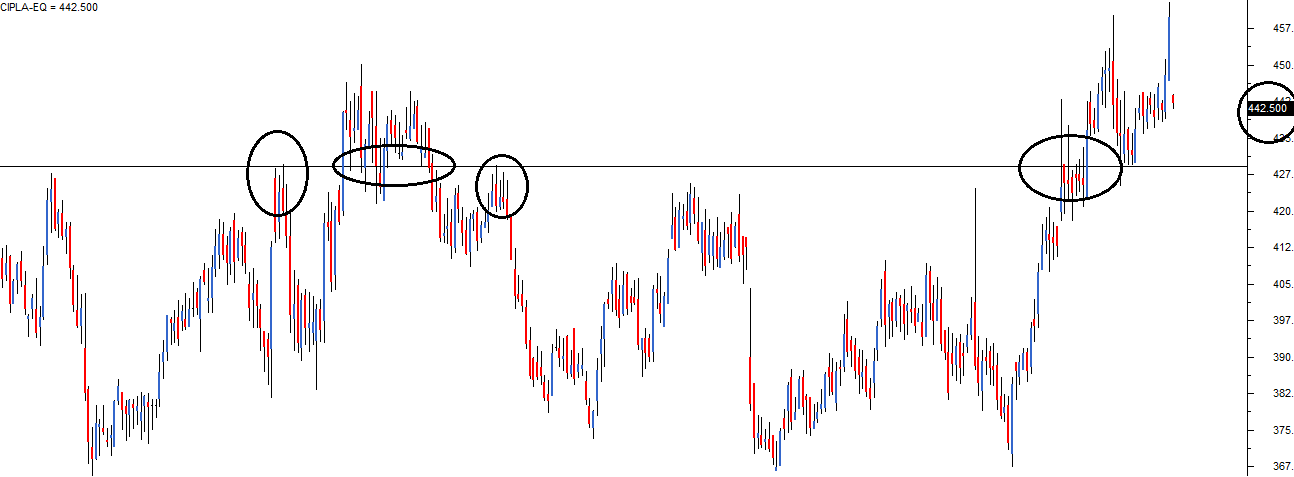

Here is a chart where I have loaded 12 months of data points

Step 2) Identify at least 3 price action zones – A price action zone can be described as ‘sticky points’ on the chart where the price has displayed at least one of the behaviours:

- Hesitated to move up further after a brief up move

- Hesitated to move down further after a brief down move

- Sharp reversals at a particular price point

Here are a series of charts that identifies the above 3 points in the same order:

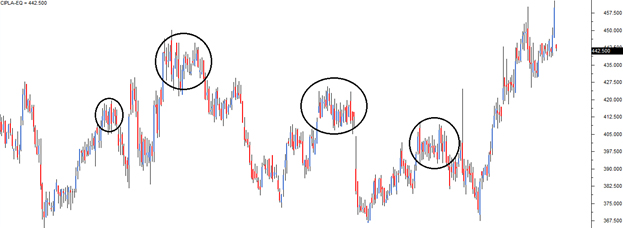

In the chart below, the encircled points indicate the price hesitating to move up further after a brief up move:

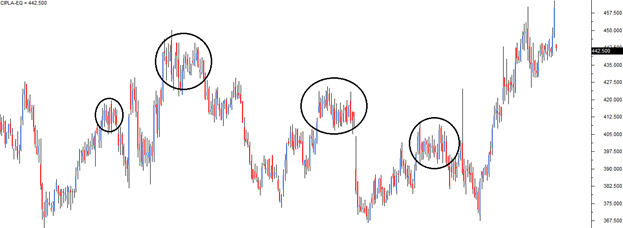

In the chart below, the encircled points indicate the price hesitating to move down further after a brief down move:

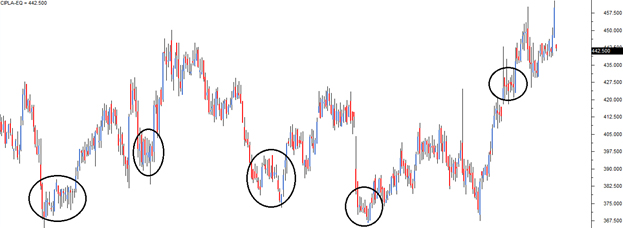

In the chart below, the encircled points indicate sharp price reversals:

Step 3) Align the price action zones – When you look at a 12-month chart, it is common to spot many price action zones. But the trick is to identify at least 3 price action zones at the same price level.

For example here is a chart where two price action zones are identified, but they are not at the same price point.

Look at the following chart, I have encircled 3 price action zones that are around the same price points:

A critical point to note while identifying these price action zones is to make sure these price zones are well spaced in time. Meaning, if the 1st price action zone is identified on 2nd week on May, then it will be meaningful to identify the 2nd price action zone at any point after 4th week of May (well spaced in time). The more distance between two price action zones, the more powerful is the S&R identification.

Step 4) Fit a horizontal line – Connect the three price action zones with a horizontal line. Based on where this line fits in concerning the current market price, it either becomes support or resistance.

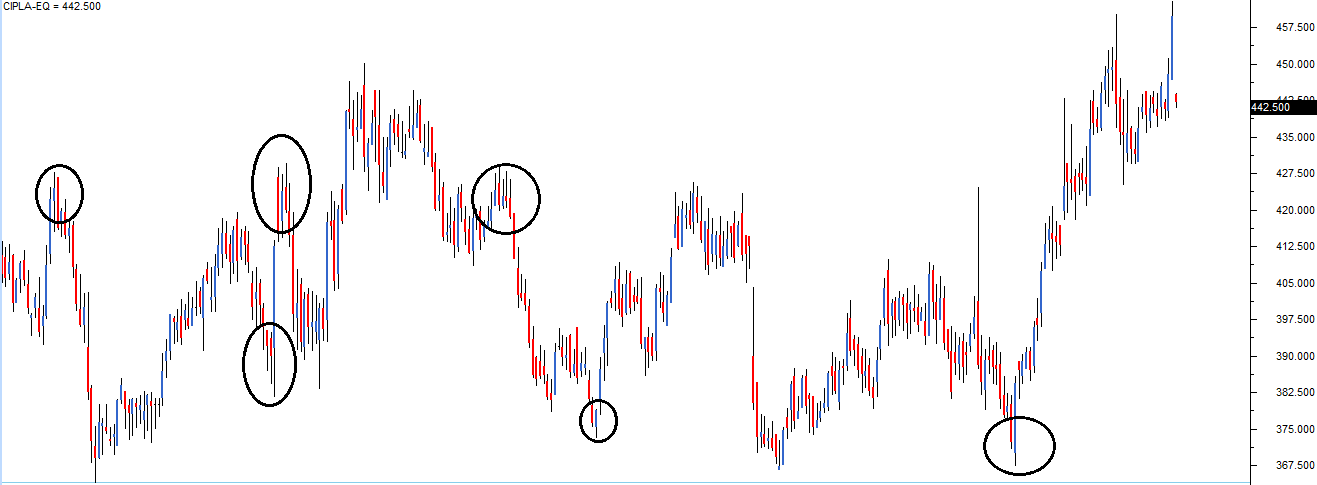

Have a look at this chart

Starting from left:

- The 1st circle highlights a price action zone where there is a sharp reversal of price.

- The 2nd circle highlights a price action zone where the price is sticky.

- The 3rd circle highlights a price action zone where there is a sharp reversal of price.

- The 4th circle highlights a price action zone where the price is sticky.

- The 5th circle highlights the current market price of Cipla – 442.5

In the above chart, all the 4 price action zones are around the same price points, i.e. at 429. Clearly, the horizontal line is below the current market price of 442.5, making 429 an immediate support price for Cipla.

Please note that whenever you run a visual exercise in Technical Analysis such as identifying S&R, you run the approximation risk. Hence always give room for error. The price level is usually depicted in a range and not at a single price point. It is actually a zone or an area that acts as support or resistance.

Going by the above logic, I would be happy to consider a price range around 426 to 432 as a support region for Cipla. There is no specific rule for this range; I just subtracted and added 3 points to 429 to get my price range for the support!

Here is another chart, where both S&R have been identified for Ambuja Cements Limited.

The current price of Ambuja is 204.1, the support is identified at 201 (below current market price), and the resistance at 214 (above current market price). So if one were too short Ambuja at 204, the target, based on support, can be at 201. Probably this would be a good intraday trade. For a trader going long at 204, 214 can be a reasonable target expectation based on resistance.

Notice in both the support and the resistance level, there at least 3 price action zone identified at the price level, all of which are well spaced in time.

11.4 – Reliability of S&R

The support and resistance lines are only indicative of a possible reversal of prices. They by no means should be taken for ascertain. Like anything else in technical analysis, one should weigh the possibility of an event occurring (based on patterns) in terms of probability.

For example, based on the chart of Ambuja Cements –

Current Market Price = 204

Resistance = 214

The expectation here is that if Ambuja cement starts to move up at all, it is likely to face resistance at 214. Meaning, at 214 sellers could emerge who can potentially drag the prices lower. What is the guarantee that the sellers would come in at 214? In other words, what is the dependence of the resistance line? Honestly, your guess is as good as mine.

However, historically it can be seen that whenever Ambuja reached 214, it reacted in a peculiar way leading to the formation of a price action zone. The comforting factor here is that the price action zone is well spaced in time. This mean 214 stands as a time tested price action zone. Therefore keeping the very first rule of technical analysis in perspective, i.e. “History tends to repeat itself” we go with the belief that support and resistance levels will be reasonably honoured.

Purely from my personal trading experience, well constructed S&R points are usually well respected.

11.5 – Optimization and checklist

Perhaps, we are now at the most important juncture in this module. We will start discovering a few optimization techniques which will help us identify high-quality trades. Remember, when you seek quality, quantity is always compromised, but this is a compromise that is worth making. The idea is to identify quality trading signals as opposed to identifying plenty but worthless trades.

Optimization, in general, is a technique wherein you fine-tune a process for best possible results. The process in this context is about identifying trades.

Let us go back to candlesticks patterns, maybe to the very first we learnt – bullish marubuzo. A bullish marubuzo suggests a long trade near the close of the marubuzo, with the low of the marubuzo acting as the stoploss.

Assume the following credentials for the bullish marubuzo:

Open = 432, High = 449, Low = 430, Close = 448

Hence the entry for the long trade is approximately at 448, with 430 as the stoploss.

Now, what if the low of the marubuzo also coincides with a good time tested support? Do you see a remarkable confluence of two technical theories here?

We have a double confirmation to go long. Think about it on the following terms:

- A recognized candlestick pattern (bullish marubuzo) suggests the trader initiate a long trade.

- Support near the stoploss price suggests the trader the presence of significant buying interest around the low.

While dealing with a fairly random environment such as the markets, what a trader really needs is a well-crafted trade setup. The occurrence of the above two conditions (marubuzo + support near the low) suggests the same action, i.e. to initiate a long trade in this case.

This leads us to an important idea. What if we had a checklist (call it a framework if you like) for every trade we consider? The checklist would act as a guiding principle before initiating a trade. The trade should comply with the conditions specified in the checklist. If it does, we take the trade; else we drop it and look for another trade opportunity that complies with the checklist.

Discipline, they say makes up for the 80% of the trader’s success. In my opinion, the checklist forces you to be disciplined; it helps you avoid taking an abrupt and reckless trading decision.

In fact, to begin with, we have the first two critical factors of the checklist:

- The stock should form a recognizable candlestick pattern.

- Note: We have learnt some of the popular patterns in this module. To begin with, you can use just these patterns to comply with the checklist

- S&R should confirm to the trade. The stoploss price should be around S&R.

- For a long trade, the low of the pattern should be around the support.

- For a short trade, the high of the pattern should be around the resistance.

From now on in this module, as and when we learn new TA concepts, we will build this checklist. But to quench your curiosity, the final checklist will have 6 checklist points. In fact, when we have the grand 6 checklist points, we will weigh down each one of them. For example, checklist point number 4 may not be as important as point number 1, but it is more important than 100 other factors that distract the trader.

Key takeaways from this chapter

- S&R are price points on the chart

- Support is a price point below the current market price that indicate buying interest.

- Resistance is a price point above the current market price that indicate selling interest.

- To identify S&R, place a horizontal line in such a way that it connects at least 3 price action zones, well-spaced in time. The more number of price action zones (well spaced in time) the horizontal line connects, the stronger is S&R

- S&R can be used to identify targets for the trade. For a long trade, look for the immediate resistance level as the target. For a short trade, look for the immediate support level as the target.

- Lastly, comply with the checklist for optimal trading results

Hello,

Thanks for all your effort in giving us the high quality content.

I am a bit puzzled when drawing any trend line whether to consider wick or just a body of the candle and when to consider. Could you provide a little more clarity please?

I am more involved in short term trading(I am an impulsive, FOMO filled and a revenge trader). Trying to learn the basics to get back with a good risk management.

Hi Manikandan,

So you can ignore the wick and just consider either the closing or opening (based on the candle type). Also, I understand the FOMO bit 🙂

Here is mu suggestion though – its very rare for traders to identify that they are impulsive and FOMO driven type. Now that you are self aware, at least cut down the position size. Dont bet heavily on any single trade that has a chance of blowing up so bad that it will ruin you. Keep you trades to an extent where you can satisfy your trading itch as well as be smart about risk of ruin.

Hello Karthik,

Thanks for sharing all this knowledge. I am having a query since a long time. It is about support zone/resistance zone. Let me explain my query with one example..Suppose 25550 is 1 hour support and now while going up, I can see 1 hour resistance high at 25552..should i consider that it is resistance due to 25550 support or if resistance high is between 25550 and 25551 then only consider it resistance due to support 25550? What exactly points range I should consider in nifty/banknifty for support/resistance zone? Thanks in advance

Its best to think of this in percentage terms, give it at least 0.5% or more.

Thanks For reply.. 0.5% percentage of? For Nifty it will be? Thanks in advance

Its 0.5% (or whatever you deem suitable) of the price.

hello sir, i am new to investing, how do i decide which company i should invest in from the vast choices available. How do i know which company i should keep track of?

If you are new, I\’d suggest you take a look at the Nifty 50 until you get comfortable.

To look at companies in Nifty 50 or the index itself? Please clarify.

Nifty 50 is the Index. You can start with this.

Thanks a lot for providing such a great content free of cost.

Sir there is a situation where bullish harami pattern is formed. In which I will create a long position. At the price of closing of P2 that is 1473 Okay. And my SL will be the low of that pattern, which is 1454. Okay. And the target that is being made according to the resistance is 1597. And the support zone is 1397- 1403. The SL isn\’t in my support zone, it\’s above it, so should I take this trade or not?

You can take it. What you can also do is see if your SL price and support price is close by, if it is, then maybe you can take a price that is somewhere near the support itself. If they are far apart, then stick to the SL price as suggested.

Sir difference between sl and support is around 50. Is it considered as Far apart.

In the above topic you teach us if the sl is not lie in support zone avoid the trade.

And now you are saying if they are far apart take sl as per pattern.

Please clarify.

50 is far apart or not depends on the stock price. Better you use % terms. Please remember, support or resistance for that matter is just one aspect of the trade, if the other things in the trade convinces you then sure, go ahead and take the trade despite SL not being in the zone. It all boils down to conviction and the way you look at markets 🙂

Hello Karthik,

Im interested in day trading, if I search for support and resistance for 3 to 6 months, then I think the support and resistance could be too long from current price.Since, I am day trader.i follow chart for entry and exit on 15 and 5 min chart.if I check for support and resistance in 15 or 5 min time frame I may get support and resistance lines at early only which is suitable for day trading,than check for 3 to 6 months data points.i have this doubt.which is better to point support and resistance 5,15 or 3to 6 months data points for same day buy and sell..

For shorter term and intraday, I\’d suggest you look at 15 mins, Kishore.

Fantastic material and great explanations. This should be sold as a handbook with alternate blank pages for notes!

My question on Support & Resistance.

I plan to trade over a few days or weeks. I understand that I should load charts for a period of 1 to 2 years.

Over a 2 year period there would be many price action zones and sharp reversals.

Should the recent ones (3-6 months) be considered or given priority over the older data?

Does the \”Pivot\” help in identifying support and resistance levels automatically? If so what is the simplest way to use it?

Thank you.

Thanks, Sanjay.

Yes, it makes sense to look at 1 or 2 years chart for longer term perspective and then zoom out to shorter term perspective, maybe 3 months or so. This way you have a fair understanding of whats happening on the long term and also on the short term basis.

Hi Karthik,

Q- I am using 3-6 months data to plot a line, however I am confused as which timeframe to select? daily? weekly or monthly? please let me know.

I\’d suggest you use a EOD candle, Rushi.

Hi Karthik Sir,

First of all kudos to the team for crafting such a fabulous contest from basics to advanced.I am generally a swing trader, so my doubt was on finding the resistance and support points. Normally, I take single day time frame to find the points (since it is swing), but should I also use 4 hour, 1 hour timesframes as well? And I use breakout and price Action strategies to enter into a trade.But mostly I get stuck on when to book the profit or keep the stoploss as swing is generally from few weeks to months. Since after a breakout,there will be multiple resistance points above and supports below as well, I get totally confused if it is better to wait to bounce back or exit. Would be greatly helpful to know your input on this matter.

Thanks Addul, glad you liked the content. I\’d suggest you stick to EOD charts, as I think I its better for swing trading. Any intraday time frame will add complexity to your analysis with very little value add. As far as profit booking is concerned, I think what you are facing is a common issue 🙂

You can opt for trailing stoploss where you keep locking in the price as and when the stock/index moves in your favor.

Thanks for for the input.Could you also suggest the risk reward ratio that i should follow if for instance using 1 Lakh capital and split into 4-5 trades? What percentage target and stoploss should I be keeping for that is in general for a swing trade?

The other way to look at this is – for every 1 rupee of risk, what is minimum reward you expect? It its intraday, I\’d say at least 25 paisa. This really depends on your risk and reward appetite.

Sir can we use technical tool for plotting SnR like there is tool in kite chart ..and what if market is all time high how can we identify resistance at that time? and support at that time if all time low?

Its not possible to plot resistance when the market is at an all time high, hence you need to look at the trendlines.

Where is video no.8 in technical analysis please let me know

You can check the entire series here – https://youtube.com/playlist?list=PLX2SHiKfualH_xMbGM-3zWC47s9gUjGR_&si=VlMEzsA6CRF5Oei1

my mindset was for positional trading but my profit target /stop loss hit early. what should I do at that. situation?

sir what if a stock which i am trying to trade is at all time high right now and it has been constantly bullish since long time, and when i try to draw S&R line, the support price is too low compared to current price and there is no resistance price. In this case how to make a trade ?

Krishna, yes, at such times there is no point trying to apply S&R. What you can do though is use the upward sloping trendline to get a sense of the S&R levels.

thank you sir for your guidance.

Happy learning, Krishna!

Hi Kartik! I’m learning about trading for the first time and have been trying to apply it in real life side by side. I am unable to understand how to plot long termS&R levels for a stock where noticeable price action zones are too far from current market price?

Prerna, do check this video – https://youtu.be/UBkCkBme2Hg?si=DACvS3wDtdkzNZgo

Hello Sir,

I am not able to differentiate between a normal reversal and a sharp reversal, I have marked them in the chart below. 2 of them are clearly visible sharp reversals, but what about the other two, the trend has reversed but they increase in price is not swift, so should we consider them price action zones or not. I am not able to exactly differentiate between them, can you please guide me through the same.

https://drive.google.com/file/d/1pPQVm_CRZ1mVCr26sIR_FiStNGZQ0Mco/view?usp=sharing

I\’m unable to open the link, but a sharp reversal is usually V shape in nature. Otherwise, the reversals are fairly well spread out.

Sir, What should be the ideal time frame to consider for drawing S&R if I am doing intraday trading in Nifty50 options?

TIA…

There is no such thing as an ideal time frame. For example, I personally plot S&R on an EOD chart even for intraday trading – although we are not allowed to trade at Zerodha :).

But that said, you can try plotting S&R at 15-30mins chart as well.

Thank you… Appreciate your help…

Happy learning!

Hello, I have a question.

When identifying support and resistance levels, should we focus only on points where the trend has reversed? For example, if I\’m looking for a resistance level, should I only consider points where the price moved upward, hit a high, and then reversed downward, or ideally stay around the same level each time?

Or is it also valid to include points where the price reversed from a downtrend to an uptrend?

If yes, why is that acceptable? Because resistance usually refers to the price reversing from an upward move to a downward one.

And does the same logic apply when identifying support levels?

I\’m not sure if I get your query fully.

It is valid to look at price points where the price has reversed. In fact, that\’s why we look these price action zones and assess if there could be a support or resistance.

While plotting support and resistance on a 15-minute chart for intraday trading, there are instances where certain stocks may not exhibit at least three price action zones, with only one or two being identifiable. In such situations, what steps should be taken to address this issue?

In that case , switch to 10 minute or 5 minute time frame. For Intraday , other than 15 minutes , 10 and 5 are also acceptable.

Yes, you can do that as well. But this to some extent is like force fitting data 🙂

Go ahead with 2, but remember in the back of your mind that it\’s not time-tested, hence your reliance on that should be just about ok.

Hello, the Ambuja chart for resistance looks more like a support to me. Why is the resistance not be taken at a higher level say 225?

The first chart? Clearly, it\’s resistance, right?

Hi Karthik,

I found that many people are repeating the same question while I was going through the comment section, and you also answered them without any hesitation. Hats off to you! However, if you give a standard answer that \’\’It is already discussed in the comment section and answered\’\’ that will help readers skip such questions to save time. Anyway, it is up to you. Thanks so much for your service.

Thanks, sometimes people prefer to see a fresh answer, gives them reassurance. For me its a quick few minutes job 🙂 – From Karthik

Hello Karthik, I have learnt almost all basic things like candlesticks, S&R, Volume, trend, chart patterns, but I am not able to initiate the trade, could you please help me that, as I a beginner, how I can do so?

I\’d highly encourage you to join one of these classes – https://varsitylive.zerodha.com/home. Here you can try to place the trade live.

I tried to access the live session to register , It is asking for OTP but unable to receive OTP and tried couple of time

Ah, let me check on this.

sir last me checklists wala point thora nhi samjha . like 6 chevklist point kon sa hai

Check this – https://youtu.be/UBkCkBme2Hg?si=WR5Pc-XPt39udCCr

Might I suggest back testing? They can\’t do everything for us lol

Hello Karthik!

When I change timeframes from lets say Daily to Weekly, Support and Resistance lines change as well; what looked like a support on a daily chart, is not a support for the weekly chart. How to choose the right S/R?

Thats right. So the way to approch this is to ensure you are clear about the timeframe you like to deal with. That way, you know what frequency you are looking at and stick to it.

Sir, what is Identification point?

Identification for which one, Subhendu?

By loading the data, I mean time period I should look back to construct S&R.

Yes, that depends on the time frame you are looking at trading. For overnight positions, maybe 6 months data?

Hello Karthik,

I have two questions:

1. Can we create S&R on a 15-minute chart? If so, what time period should be loaded?

2. Can we use S&R constructed on a daily chart on a 15-minute chart?

> Of course you can, you need to laod 15 min chart for this.

> Yes, but it wont be referred to as a daily chart, as it is a 15 mins chart.

It’s I and not U in the above question. Apology for the typo

Thats alright 🙂

U have read all the chapters in this module and tried to trade intraday but couldn’t find much success

Could u pls recommend how u can scale up my game and also recommend some books for intraday trading and in general strengthening technical analysis

We are actually doing a live course on this – https://varsitylive.zerodha.com/programmes/f4747acb-e1f7-458a-94bb-1a154d256795, why dont you join 🙂

Of course its free 🙂

Oh yes, that makes perfect sense! But my question is \”do we consider 230 as a support even if it is in [250,231] range\” just because it has broken that once before? As in, I feel that psychologically we humans would like to give more weightage to the fact that the \”230\” was always acting as resistance (the first 3 times it did), so I was hesitant in that sense. But I think now I get it. It\’s testing the support once it has broken, and IF it comes below that, then 230 becomes the resistance! And if we see a huge downtrend, say it went to 500 and now is in downtrend, then yeah we have to be very careful because the whole up-trend seems to have broken, right? Thanks soooo much for creating Varsity. You have no idea how much impact you & Zerodha have had on my financial journey Karthik!

Thats right Srihari. End of the day a price action zone is a point when traders in the market took some action (either bought, paused, or sold), and they are expected to take similar action in the future if the price were to visit the same price action zone.

Today\’s support can becomes t\’row resistance if the CMP goes lower than support price.

Today\’s resistance can become t\’row\’s support if the CMP goes higher than the resitance price.

Good luck!

Karthik, how does it (x) become a resistance? The CMP is still \’x+100\’ and coming down. My question is, since it has passed this \’x\’ level 3 times before, and all of those times it has only fallen (making that a resistance from that time POV). But, it did for a fourth time cross it and now is coming down to test that support. This question can be heavily correlated to the image below these lines here (https://zerodha.com/varsity/chapter/support-resistance/#:~:text=Look%20at%20the%20following%20chart%2C%20I%20have%20encircled%203%20price%20action%20zones%20that%20are%20around%20the%20same%20price%20points%3A).

Now my dilemma is, are we supposed to consider this as a support, since I mean the sticky points exist and although it has fallen 3 times before, the 4th time it did go up. Probabilistically speaking, it makes sense that we should NOT consider this as a support. BUT, does the market still consider this as a support? I hope my question makes sense 🙁

So here is what I mean –

1) Lets say CMP is 250, and we notice a price action zone at 230. Assume the stock has touched 230 multiple times in the past.

2) Stock declines from 250, toches 230, in this case we assume the stock is testing the previously establised support.

3) However, stock breaks 230, slides to 215

4) Now since CMP = 215, 230 becomes a resistance.

Thats what I meant 🙂

Ideally, we should take entry in terms of buying when the price is around the support price. But what if it breaks the support line, and now the support line becomes a resistance line? We will incur a loss, right?

Support and Resistance lines can interchange, and thats quite normal. This is the reason why you need to have a stop losses in place.

Hi Karthik, thanks for laying out such a beautiful collection of analysis and your experiences. After analysing the S&R, I have a question that has been bugging me since yesterday.

Lets say we have identified 3 zones (at price \’x\’) where we had seen only \”sticky points\” before. Lets also assume that the trend was downtrend until \’x\’, and after the \”stickyness\”, it went downtrend again. (Lets also assume it did hover around the sticky zone for quite a few trading days). According to the behaviour (b: Hesitated to move down further after a brief down move), this does qualify to be considered as a price-action zone.

Now, say we have CMP as \’x + 100\’ with a downtrend incoming. My qustion is, is \’x\’ still conisdered a support? It is if we base our idea on \”sticky pattern\”, but it isn\’t if we consider the fact that the stock fell after the \”stickyness\” all 3 times before. Thanks for creating Varsity, I am highly indebted to you!

Shrihari, so the previous X now becomes the resistance…this is assuming the new sticky price point i.e X+100 also is a price action zone.

Yes thank you

Happy learning 🙂

Why does Gap up and gap down occur.?. I understand it can be because of quarterly results and such but still I can\’t get the idea that without trading activity how does price go up or down.?

Novak, you can check this – https://www.youtube.com/shorts/5uhDBpH3Og4 , it should give you a perspective on why gap ups and gap downs occur.

Hi sir,

I\’m doing options trading, how to find out support and resistance of options trading? Can you pls explain me sir, I\’m struggling more! If I get bullish engulf candle pattern is not further moving up, but it create some high wick and it\’s goes down.

These chart patterns only suggest what can happen, but there are guarantees in the market 😀

Hi Sir,

In a sharp reversal, can the candles have gaps between them.

Thank you

Yes, it can. Why not 🙂

Hi Karthik,

As a positional trader (swing trader), if I use 2 years lookback data to draw the S&R, most of the stocks in the NIFTY 50 universe seems to have 2-3 S&R zones.. How to fix a unique S&R in this case?

Thats the idea, there is no unique S&R positions. For every stock, there will be multiple S&R levels.

Hello Sir

Support and Resistance (S&R) is a crucial concept in both trading and investing. Equally important is the Breakout + Retest strategy, whether holding long-term positions or engaging in short-term trades. In the context of swing trading, for example, if you\’re holding stocks for 4-6 months, you’ll find that about 70% of stocks tend to retest after a breakout. Let’s take Imagica as an example: as of October 10, its NSE price is ₹78.40. If you analyze its price history, you\’ll notice key levels—₹88 as a recent high, and a significant support at ₹70. The price is currently consolidating between ₹70-₹72, a level that previously acted as resistance but now serves as a crucial support. This demonstrates how Breakout + Retest plays out in real-time. Could you also guide us further on how to best utilize this strategy?

How did you pull that 70% stat 🙂

But anyway, yes stocks do tend to retest before they move another leg up. But for this to happen the market has to be conducive. In a bear market, this could very well tend to be a false breakout.

In case of support, the stock prices are increasing every year.

1. How can we plot support in this case where there are no price action zones to compare?

2. If we cannot plot, is there any alternative?

3. Is there any other way to set target price without support?

4. If a stock price has increased 8% in total this week and is in the high price zone, how to predict whether the price will continue to rise or fall?

1) Not possible

2 & 3) You can check pivot points as a proxy for S&R

4) You can look at the trend and make some approximations.

Hi Karthik, I am thankful for providing this quality content modules with us for free but please can you make a module for specifically swing/short term traders, it would be great if you can post a module for that 😊

Thanks for the kind words, Tanmay. Point noted, will try my best to put this up 🙂

Hi,

For the (first) chart (Ambuja) showing resistance at 215, shouldn\’t the resistance be above the current market price. That to me looks like a support level.

Thats right, 215 is the resistance.

Sir, which indicator will tell the best support and resistance? in zerodha which indicator describes support and resistance?

You can use the classic support and resistance technique itself, Sachin.

Hi. I have a doubt.

How do we find resistance level when the market is continuously forming higher highs?

You cant really find, Madhu. Traditional S&R levels don\’t help, you will have to look at trend levels.

Hi Karthik,

Excellent initiative to teach complex stuff in such simple words. Kudos to you!

What if a stock is trading at an all time high and there is no prior data to identify the resistance point?

Would it mean that we should look for a support price and short the stock despite candlesticks forming bullish patterns?

Or do we always identify trading opportunities through candlesticks and then decide upon targets?

Would love to have some clarity on this.

Vedant, if a stock is at ATH or ATL, then the classic S&R techniques may not help. You will have to plot the the S&R by dropping a trend line.

Hi sir,

Have I marked the support level correctly, specially the price action zones.

https://drive.google.com/file/d/1JeafJX5LTztQLkfjJORzkp35oUIm4vwT/view?usp=sharing

Thanks sir.

Yeah, works.

In the explanation of \’Support\’ taking Cipla as an example, I think in the sentence \”Clearly, with a shooting star, the call is too short Cipla at 442, with 446 as the stoploss.\”, \”to\” should be in place of \”too\”, making the sentence \”Clearly, with a shooting star, the call is to short Cipla at 442, with 446 as the stoploss.\”.

Thank you!

Ah, yes, please excuse my typo.

Hello Karthik,

You mentioned BTST trades for short term S&R. Can you give me more details regarding BTST trades?

Do check this – https://support.zerodha.com/category/trading-and-markets/corporate-actions/general/articles/btst-meaning

Hello Karthik,

Thank you for this wonderful material. I have read a few books in the past trying to learn the ropes, but after spending a few thousand bucks, all I got was a bunch of patterns and indicators. Your approach of having a checklist and how to scout an opportunity universe step-by-step finally gave me the end-to-end picture I was looking for.

I also want to thank the other users of Varsity, I have learned as much from the Q&A as from the articles themselves.

I am practicing the step-by-step checklist-based approach. This is more for learning as I am far away from having the confidence to trade. One area I would like to get some confirmation on is support and resistance. I have uploaded 5 charts in the link below where I have tried to identify the support and resistance lines closest to the CMPs. For Bajaj Finserv, Britannia and Kotak Bank, do you think I have correctly identified these? If not, please guide me on where these lines should be on these charts and how you do the identification. For Hero Moto Corp and Indus Bank, as these are very close to their 52-week highs, my understanding is that support and resistance lines cannot be drawn due to a lack of price history. Is the understanding correct?

Once again, hat’s off to you and the entire Varsity team!

Thank you.

https://drive.google.com/drive/folders/1at3U7KrkVw178mosbMIWcNaOsYj7mipN?usp=drive_link

Thanks Prasum for the kind words 🙂

I checked these charts, they are largely correct. Few points –

Britania – 4900-4950 is where there is some price action along with what you\’ve marked.

Hero – Not possible as its trending. You will have to use a trendline.

Indus – 1450 is a decent support.

Hello Karthik Rangappa,

Before i ask something i want to thank you for educating us.

I have a question on how to plot S&R when market is at all time high.

Please do let me know, Sourabh 🙂

Sir,

In the previous comment, you replied \”1) YOu need to look at few time frames, my preferce – 6 months to get a slightly longer term trend, 2-3 weeks to get mid term trend, and 1 day to get the pulse\”. In this context, could you please clarify the below?

(i) To see the 6 month chart and to understand the trend, which chart you would suggest to observe 1D or in hours?

(ii) Similarly, to see 2-3 week, which chart you would suggest to observe 1D or in hours?

(iii) Likewise, to see for a day, which chart you would suggest to observe ? Is it in hour/min?

To me, I feel selection of chart to observe a particular frame is more tricky. Hence, I sought your advice here please.

Sir,

You have mentioned to look charts of 3-6 months and 12-18 months for S&R for long term and Intraday/BTST trades respectively. However, could you suggest the following?

(i) What should be your suggestion to select the time frame while looking for Intraday/BTST considering that I need to look for the past 3-6 months data to select S&R?

(ii) What should be your suggestion to select the time frame while looking for relatively long term swing considering that I need to look for the past 12-18 months data to select S&R?

1) YOu need to look at few time frames, my preferce – 6 months to get a slightly longer term trend, 2-3 weeks to get mid term trend, and 1 day to get the pulse

2) At least 6 months.

Hello Karthik,

For the first time, I have read an approach towards drawing S&R lines. However ,I was a bit confused on the support line for CIPLA @Rs 429(Step 4- Fit a horizontal line). While the line at 429 seems right, looking at the chart, it seems to me that this level is actually a resistance line. The stock has been trading below this 429 line for about 80% of the 12 month period. There have been some brief periods of optimism as circled by you, but my interpretation is the market is more comfortable with a price below 429.

Would appreciate if you can point of the flaw in my logic.

Secondly, would be good to have the latest comments appearing first.

The thing is that the S&R lines keep interchanging based on the current price of the stock. If the stock is below support line, than the same line is considered resistance and vice versa.

Got it.

Thanks for the reply!

Happy learning!

Hey Karthik

I\’m a bit late to the party haha. Is there any ideal range for the S(or R) region? I tried plotting S&R for Asian Paints and got a region of about 3% width. How should I place my trade (target/SL) with a rather wide region?

Amazing content btw, having tonnes of fun going through this.

Thanks

Better late than never!

No, there is no idea or minimum range and that the best part about it. The range varies for each stock and it purely depends on the price action for that particular stock.

Sir,

I have been struggling in intra-day equity trading, and not able to setup a filter for setting up which stocks to trade. I only focus on NSE top gainers and losers at 9:30am , go long and go short (only when it breaks 15 min candle day\’s high or day\’s low with high volume). But most of the time the trade hits stop loss. Can you please help me how to take better decisions while trading in intraday equity part, it will be really helpful for me. 🙂

I\’d suggest you stop intrady all together. But if you really want to, then please shift your focus to EOD chart and try and get the overall direction for the day and place trades accordingly. 15 mins can be a bit noisy.

Hi sir,

If a Stock\’s CMP is 8% below ATH, and there is only one Price action zone (Sharp reversal) above it, and not 3 PA zones, will the only PA zone act as resistance for the stock?

Thanks

Not really, you will have to go with the trend and probably use volatility or a trend-line to identify the stoploss.

Thanks for explaining how to draw support & resistance lines. However Support & Rsistance values are readily available on various sites. Therefore an individual need not really draw support & resistance lines. Is this statement correct. Please explain

The readily available ones are I think Pivot points and this is the support and resistance points. Do double check once.

Hello Sir! Your lectures are very useful.

I want to ask, How many points should coincide with our support/resistance zone?

And is it necessary to draw only horizontal zones?

Thanks Shashank. At least 3 points should confirm to make a price action zone a support or a resistance point. Yes, horizontal lines gives you some sort of consistency.

Can you tell me the final checklist (6 checklist points).

Do check the later chapters for the entire list.

Hi,supposed we are getting two resistance level,one at 1200 another at 1300 suppose our first Target is hit i.e 1200 after forming bullish pattern.should we now at 1200 consider the second resistance lvl as target or exit the trade after hitting our first target

Yes, with the first resistance becoming the support.

Is it a reasonable assumption that, if market is not in a strong bullish or bearish trend, and if there is no news in the stock, the stock price would remain mostly sideways?

If yes, would the support zone then give a rough idea of the valuation of the stock? As most participants buy at that price range?

Just a thought.

Yes, if there are no triggers, the stock may not really move much. That means, the stocks may trade within a trading range and therefore the support and resistance zone will work well. But this does not have anything to do with the valuation of the stock.

Sir, Please Advice me which share to be taken for long term basis. please guide

Sorry, we dont really advice on which stocks to buy or sell 🙂

Thank you so much for the help.

Happy learning 🙂

Hii..

my doubt is that if i enter the trade to go long with an SL which is around support where a lot of buying action happens, what if my SL gets triggered and i make loss instead of my trade going up at support.

You always keep the SL slightly below the support to give room for the volatility around the support.

How do i read BSE chart, it has gone beyond its support level and we don’t nt see support level . How to define support and resistance level in this case.

Dines, you cant really plot a support or resistance for a stock which is in all time high or low zone.

Thank you very much sir… I am Samujjwal 18 years old learning TA ad making notes from your modules..I have a doubt I don\’t know whether you will still reply or not but I am just asking…Sir Can you tell me what should I do if a chart first forms bullish marubuzo and after 2-3 candles it forms bearish marubuzo…soo what should I do?? Should I go for Buy or short?? And you know what sir I had tried it on Tradingview papertrade and u got profit because I choose to short the stock…but I am totaly confused…plz help..

Thanks Sam and yes, I\’m still replying 🙂

So you would have bought based on bullish engfuling….after you buy, you need to wait for either the stoploss to trigger or the target to hit, irrespective of what other patterns form on the chart.

why we have to look prior 8 to 12 months for technical analysis for swing trading i.e trading for few days or week as technical analysis is for short term.

At least 6 months, Pujan.

In which time frame to draw support resistances while daytrading

I\’d suggest end of day timeframe.

Amazing sir. I have been going through lot of stuff including youtube video and literature on share markets. but I must confess that the way Varsity explains, no one could ever. Karthik sir, you done fabulous job. Kudos to you. Thanx

Thanks for letting is know, Sandip. Happy learning 🙂

Hello sir , I have read candle patterns (both single and multiple) provided by varsity and it is very useful. However i have some doubts. In varsity it said, for intraday trading conforming the candlestick pattern at 3:20 pm and then taking the position. My doubt is, the market was closing at 3:30pm and if i take intraday trade at 3:20 it will square off at 3:30 ( the time market close)… please explain what is the time to take a position for intraday after finding a standard pattern

You can initiate the trade at the close of market by taking on positions in futures and option segment. So you do you analyais using TA, execute using F&0. But if you are trading intrday, then even Equities short works.

Can you plot S&R for a particular stock on the kite trading terminal? If so, how do you do it?

Yes, you can do that. I\’d suggest you talk to a support executive for this, will be easier to explain on phone.

Hi Karthik,

if stock price is all time high, then how can we draw the resistance for that stock?

You cant as there is no price point to draw reference to. You can probably extend a trend line and extrapolate the future resistance points.

what is the best time frame to draw S&R for swing trading and intraday

There is no such thing as best time, Suryakanth. You do it when the situation demands.

What is the difference between Demand & Supply Zone and Support & Resistance?

If possible, an example with chart will help.

What is the difference between support and All Time Low and

resistance and All Time High?

Can any one explain pls

Support or resistance is where price action is spread across historical data.All time high or low is a new price point which is happening for the first time and cannot be considered as a support or a resistance point.

Under the para 11.3 – Construction/Drawing of the Support and Resistance level, the example of Ambuja makes a statement \” So if one were too short Ambuja at 204, the target, based on support, can be at 201\”

I think the word \”too\” should be replaced with \”to\”.

Thanks

Ah yes, will change 🙂

Sir if I want to do intraday trading then how much back should I see to draw support and resistance line

Look for at least 5-6 months of data. That is a good starting point.

Hi Karthik,

Please help with the below doubt:

In a long trade, Lets day the support zone is at 100-102 and the lets say the lowest part of candle is a little below the support zone at say 98. Can you tell me in this case, can we proceed with the long trade and if so, what would be the SL? Is it 100 or 98? Please guide:)

Yeah, ensure the close is above the support zone, and you can ignore the shadows.

sir

I see pivot point standard for support and resistance, from my view all indicators, anything has limits. It also, Please tell it is enough support resistance for intrady.

I prefer the traditional way of doing the S&R line, Vishal 🙂

Hi,

Once I manually mark the support and resistance zones, how do I save it so that I don\’t have to keep redrawing it every time

You can save it as a template. Do check with support desk, they will help you with this.

Hi Karthik,

Thanks a lot for creating such a visionary master piece course content.

I just wanted to know if I can use \”pivot points\” from kite studies to get the S&R lines? Please guide.

Thanks

Chandan

Chandan, thanks for the kind words. Yes, you can use pivot point as an alternative to S&R, although I\’m not a big fan of pivot points. I prefer the traditional way of using S&R lines 🙂

Sir

What are uses of tags in order placing.is at any work, why you give us

Helps you keep tab on things 🙂

https://support.zerodha.com/category/trading-and-markets/kite-features/tags/articles/add-tags-on-console

Sir

Is any option in which we buy intarday or sell intraday. Have options to put both stop loss and take profit at a time.

You can explore GTT for this. https://support.zerodha.com/category/trading-and-markets/kite-features/gtt/articles/how-can-i-use-the-gtt-feature

sir

how much far supoort and resistance valid after candle forming.

is it any percentage

Once formed, these levels stay valid throughout Vishal.

Can we use option chain for identification of stoploss and target?and if so,can you please elaborate 🙏🏼

Sam, you can check this – https://www.youtube.com/watch?v=bCRw8YN-4QY&list=PLX2SHiKfualE4o4joBMXM_YHGBKnZSQbs . The 2nd video has the details but do watch the first one as well to understand the overall context.

My ques is regarding \’Construction/Drawing of the Support and Resistance level\’

In point 4: \’Fit a horizontal line\’, you are connecting the prize zones (at least 3) and based on where the line fits in concerning the current market price, it either becomes support or resistance.

But shouldn\’t it be that:

– For Support – we should determine and connect only the price zones that meet the behavior of

1) Hesitated to move down further after a brief down move

2) Sharp Reversals towards higher side

– For Resistance – we should determine and connect only the price zones that meet the behavior of

1) Hesitated to move up further after a brief up move

2) Sharp Reversals towards lower side

Basically, intuitively what comes to mind for S&R is that, it is irrespective of the current market price, that we determine the S&R levels from the past prices.

The graph that you have shown in the \’Step 4) Fit a horizontal line\’ – I am not able get it intuitively i.e. how can 1st circle & 3rd circle be a support as the prices continue to fall down after the reversal

That\’s right, the way we define a price action zone is by the nature of the price movement and its hesitation to either cross a certain price threshold or break below a certain price threshold. The more number of times the price hesitation happens, the better it is.

As far as the placement of line is concerned, you just need to ensure that you identify a few of these price action zones and connect them, but ensure they are well spaced in time.

Hey Karthik, Thanks for the great content. Can we use the \”pivot points\” in the Zerodha charts to draw the support and resistance lines? Is there any content that describes how to use and interpret that?

Also, you have referred to \”Pi\” as a charting software. Hasn\’t Zerodha shut it down?

Yes, you can use Pivot Points for S&R. Pivot points is another technique to identify S&R. Yes, this is available in Kite. Pi, is no longer supported.

does it mean brief up/down move can be any % in terms of number but what matters is the rejection at resistance and price absorption at support?

Yeah, the activity around these levels is what defines the strength of the support and resistance levels.

Sri what do you mean by

\”The critical bit is the rejection at resistance and price absorption at resistance.\”

Does it means brief upmove /downmove can be any number in terms of percentage

For any S&R points to be valid, the price action zone should ensure that at the resistance level, the prices should retreat or get rejected, and at the support, the price should be absorbed or get filled. That\’s what I mean 🙂

sorry , I forgot to mention in swing trading

Thats fine 🙂

sir,

for marking of price action zone does brief up move and down move need to be above specific percentage

The critical bit is the rejection at resistance and price absorption at resistance.

How much period or no of candlesticks shall we consider for drawing support and resistance on a daily time frame?

At least 8-12 months Tejas.

How to draw support and resistance line.

Please see the chapter, I\’ve explained 🙂

Sir as you have said that 3-4% seems enough diffrence for S&R ,

But is such case RRR in most of cases is less than 1 or around 1

So should we consider taking such trade when RRR is around or less than 1 but other points of checklist are satisfying?

Advit, it all depends on the time frame of your trades. Its unlikely you will get trade with better RRR on an intraday basis, so 1:1 is ok. But for longer-term trades, you should look at trades with better RRR.

Is it necessary that always the high of pattern is lower than resistance?

Or

It is the body of pattern forming candlestick which should be lower than that resistance and high can cross the resistance

Remember, S&R is not a specific price point, but rather a zone. Given this, its ok if the prices move \’in and around\’, the resistance point(s).

Sir,

I want to ask that for swing trading what should the minimum percentage difference between support and resistance?

In stock of ULTRACEMENCO I found that there are some support and resistance within 3-4 percent of each and after forming pattern sometime target is just achieving in one day in such case of S&R

3-4% seems good enough for a short term trade 🙂

Hi sir, it\’s a set of well crafted and well curated modules. Thanks a lot sir.

Happy learning 🙂

In Intraday trading, like Bank Nifty and Nifty, how can we set Support and Resistance ?

The same way as you\’d for any other stocks.

Hello Karthik!

I have seen examples where the support and resistance lines were made slant (connecting all highs and all lows) for a given trend for a given time period. I was wondering about the reliability of those slant S&R lines in comparison to the horizontal lines explained in this chapter. What does it mean to draw S&R lines slant connecting price points at different price levels. Why is it that we observe hesitation in the movement of price at these different price levels connected by our slant line?

Thank you!

It just indicates that the stock is trending and making either higher highs or lower lows. When a stock is trending, this is the only option to plot support and resistance lines as regular S&R line (horizontal lines) wont work.

Hello!

Can we have multiple support and resistance lines over the same time frame say 12 months???

(My understanding is that the target which we place is the immediate support or resistance line and not the farthest one)

Yes, thats a possibility to have multiple S&R zones in the given time frame.

Sir,

In the previous answer, Did you try to mean that \”same\” action zones should be considered corresponding to support/ resistance? Or you try to mean \”some\” action? Is there a typo error in your previous answer with \”some\”? Will it be \”same\” instead?

I meant to say same. The logic being the S&R with frequent price action is better compared to others with lesser price action.

Sir,

To identify a support, should we consider only those sticky zones which had previously fallen and then rise?

Likewise for a resistance, should we consider only those sticky zones which had previously risen and then fall?

Or, can we consider all sticky zones (irrespective of risen/fallen) for either resistance/ support?

Specifically, I like to know if sticky zones\’ past nature also consider their consideration for support & resistance?

Anirban, it\’s best to consider the zones where the price has previously received some action.

sir on Construction/Drawing of the Support and Resistance level in this part the 4th point and the last part sir mensioned this(I just subtracted and added 3 points to 429 to get my price range for the support!) i didt under stand sub with what sir some one replay

As I\’ve explained, Vinayak, this is about developing a range instead of a specific price as either support or resistance. This is to avoid approximation risk, as I\’ve explained in the chapter.

In case a stock or index breaks out an all time high, how to determine resistance? Thanks

Its not possible in such cases as there is no data point to base the S&R values.

sir can you explain me about trend line or in which module it is present.

You can check the chapter on Support and resistance. S&R is an indicator of trend.

For swing Trading, which type of chart we use? Can we use monthly or day chart

You can use day chart.

Hi sir can you verify this BTC Chart that I drawn SUPPORT & RESISTANCE

https://www.tradingview.com/chart/tg7l8Ebc/?symbol=BITSTAMP%3ABTCUSD

Dear Sir,

In intraday trading, would it be helpful to apply below rules which we covered in this chapter:

1.The index should form recognizable candlestick pattern.

2.Pattern must be recognized either at Support or Resistance

If yes, which is the recommended time frame ( 1 minute, 3 minutes etc?) to observe the Price action/pattern for Intraday trading.

Thanks

1) Yes

2) Yes

I\’d suggest you start with End of day candle, Narendra.

Dear Kartik,

Thank you for your responses to my previous queries. This query is regarding SL and Target prices for Intraday EQ trading.

Say, X stock made a morning star pattern yesterday on the stocks support zone (on a DAY frequency candle). Now, I wish to trade this intraday today. Now, the SL will be the lowest low of the stock as per the Candle-Sticks module, which brings the SL around 100 points below my today\’s entry. Based on historical data, I think the target can be set to 20-25 points for today.

My RRR on this trade is 0.25. If I consider this strategy for any other trades, I end up with the same RRR.

Another alternative I tried is finding support on 15 mins candles; I end up with only one or two price action zones with 50-60 points of SL.

Please suggest how can I overcome these problems in my setup and guide me on how to approach SL and Targets in Intraday.

Thank You very much!!!

Shubham, one of the easiest way is to traded basis % points. Keep a fixed % SL and Target. On a related topic, check this – https://www.youtube.com/watch?v=1kQjXFL4Mfc&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=12

Hi Karthik,

Loaded the data with 1 Day time frame and 1 Year look back period to mark the price action zone to figure out the S&R. Sometimes I get the Resistance line only, not the Support. Opposite is also possible. How do we workaround such cases?

Load more data points 🙂

But that said, it should be possible to spot both S&R in most cases, especially if the stock has not trended in a single direction.

Hello karthik sir, I am new to the market. I looking at all the videos in zeerodha varsity. My question is that, are index and stocks trading same?? Do technical analysis, candle stick patterns all these analysis are same for both index and stock??

Thats right, Purushotham, the analysis is the same 🙂

What does that mean-Pivot levels? And how should I verify whether I am right or wrong while plotting SR?

And what about TCS and Infosys query? Are you not allowed to answer that? OK then just tell me the SR levels. So that I can check where I am wrong

Pivot levels is a technique to find S&R, it is a different technique and hence you are bound to get different values. Yeah, I\’m not allowed to answer stock specific queries 🙂

Good morning Karthik Sir

How should I verify that the support and resistance drawn by me on one year chart and intraday chart are right? Though I join all the sticky points, I suppose its not the same as given on other sites that I googled just to verify whether I am on right track or not. Also can you please help me to know the 6 months-1 year SR of TCS and Infosys both, as I have shares of these companies at 3227 and 1459 levels respectively. Now my problem is when should I exit? What should be the strategy? I thought TCS has broken its resistance on Friday but today it fell and same is the case with infosys (May be I am wrong). Should I sell? Please guide

Most likely other site infer the S&R points via Pivot levels, hence the difference Kiran.

Thanks a lot Karthik Sir for your prompt response. I will do the same

Sure, good luck Kiran.

Thanks a lot Karthik Sir for your motivation. Really a good advice, should I start with Tata steel or Tata power or L & T ? I mean large cap or mid cap.

I humbly request you to suggest me 5 stocks out of Nifty 50 that I should study, on which it will be easy for me to apply TA principles. And needless to say that in this journey of stock market learning, I will always trouble you with silly doubts of mine , hope you don\’t mind answering those 🙂

I dont mind answering your queries, as long as I know the answers myself. So don\’t hesitate 🙂

Start with 2 large and maybe 3 mid-cap stocks. See how this goes and build on this.

Hello Karthik Sir

First of all, Thanks a lot for writing such a wonderful course because its such a great help for a novice like me. Though I have understood the TA concepts because of your simple and easy explanation with examples yet the only problem is that I am not as fast as these youngsters in applying the concepts practically . I want to start intraday trading but how is the big question! (for me, may be not for other beginners). Can you guide me? If possible, then pl tell how should I proceed step by step. Hope it does not sound silly as here on the forum people ask about their trades taken and problems related to it, they are not stuck like me.

Kiran, the best part about the market is that the market is not in a hurry. There are 100s of opportunities every day, and the market is ready when you are ready. So it is ok to take time and deal with it patiently.

Start by focusing on just one stock and analyze it everyday through the lens of TA, that\’s the best way to get started 🙂

Hello.

Thanks for the detailed and systematic technical analysis course. Have definitely learned a lot and still learning.

I have a questions regarding plotting S&R. When plotting the long term S&R should I change candlestick pattern to a weekly chart or should I let it be a daily chart. Sometimes the points tend to differ in both charts.

Also for short term S&R, I have been using the daily charts but is there any other way I should consider supposedly if I am looking at the past 3 months to plot my S&R?

Thanks.

I tend to use the daily chart for both short term and long term, but no harm in using both 🙂

Sri,

Good evening!!!…

What is best time frame for Intraday – equity cash trading

No specific timeframe as such, Arun. Experiment with as many as you can and stick to the one which matches your risk and reward.

thank you so much. i will re-read it now..

Sure! Happy reading.

Ok, thanks.

you mean minimum of 15 sessions is something you look for to consider it for S& R?

Yeah, at least 15 sessions.

Dear Sir,

I am quite confused with resistance and support.

Here in below attached screenshot, you have mentioned that, the encircled points indicate the price hesitating to move up (marked in black) further after a brief up move and i have marked other zones in red. why the one marked in red are not price action zones? or is my understanding is not aligned.

https://drive.google.com/file/d/1rcbF9UxJQwaLT8sp7go-2c33RKzKdOls/view?usp=share_link

Please suggest.

You need a series of trading sessions where the stock has hesitated to break a price point, that\’s when you get a S&R point. The points you have marked may have at the most about 4 or 5 sessions.

Thanks for bringing the market to the retailers… I have been doing equities since 2019 through zerodha kite. And earned returns @ 60%, reading your fundamental analysis module.. Now testing options and learning the basics.. Thanks for the thorough knowledge..

Happy learning, Gaurav 🙂

Hi Kartik,

When a stock is at all time high, current example is canara bank. Then it shows evening star pattern, where it\’s 3rd day red candle breaks 20 day EMA support and volumes are touching 10 day average and MACD shows convergence and there is also evening star pattern in bank nifty, how do I figure out how much the canara bank would drop?

The extent to which the stock will drop is anybody\’s guess, Vinit. CS pattern will only suggest a direction of trade and the SL point. Target and the time to hit the target is something CS patterns don\’t suggest 🙂

I have question for Intra day trading, Suppose i calculated pivot point value form previous HLC and accordingly i calculate the S & R points.

So in which point i should buy the trade and Short the trade?.

If market move above from P point should i buy? and if market trade below the P point should i short the trade?

Example

P 33773.89

R1 33904.73

R2 34,029.3

S1 33649.32

S2 33,518.48

So you keep the price point as a reference point and initiate either a long or short at around these points. For example, if you are suggested a long at 33649 based on previous day\’s HLC, then you wait for the price to reach this point in today\’s session and initiate a long.

explanation is very effective

Happy learning 🙂

Hello sir,

How much should be the length of the candle in percentage, to consider it a sharp reversal

Thank you for your valuable time.

There is no standard fixed answer to this, Dhruv. It depends on the stock under consideration.

Can we use line charts in higher time frame like weekly or monthly to identify the sticky price action zones for swing trade?

Yes, you can as long as the idea is to just figure the overall trend and price action zones.

Hello Sir!!

I\’m a CFA L3 student. Few days back, I saw your video regarding career opportunities in investment bank.In that video, u said that trading activities in different asset classes in investment bank in India is not there and is only there in western countries and sir I\’m very much interested in such an opportunitues but the problem is that I want to stay in India only😁.

Sir there is no possibility of such an opportunity in India? How can I expose myself to the same by staying in India only?

PS:May be this is not the right place for such career counselling questions but I do not know any other platform where I can communicate with you sir.

Abhishek, the market is slowly opening up. Look for AIFs in India, these folks employ traders, but the list is small. Apart from this, look for Indian-origin investment banks; you may also find opportunities in these organizations.

Is 1 day(daily) timeframe suitable for swing trading?

If no, then which timeframe is suitable?

Yes, it is.

Hi Karthik,

Thanks for designing such a beautiful and comprehensive course. I have posted 2 queries in the past few days and await your reply. Meanwhile, I was studying Adani Power chart and am confused between 2 support lines that I see. As a swing trader, which one should I choose? One is a longer timeline and another shorter. My chart image with markings is here: https://invst.ly/zl14v

Thanks Priya; not sure how I missed your query. Can you repost the same, please? About Adani, I\’d suggest you consider the one closer to your entry price.

Can gap ups or downs in the past act as support or resistance?

Yes, sometimes it does. But I\’d not rely much on gaps for S&R.

Hello sir,

Can you please tell me for intraday or option trading which timeframe is the best for drawing support and resistance?

Btw, it is great content I don\’t even see this type of structured content in share market at one place on the internet.

thanks.

I\’d suggest EOD chart. Glad you liked the content. Happy learning 🙂

https://invst.ly/zjh57

in this image, 2021 is in a lower price zone and 2022 is in a higher zone. how do we determine the S and R in such a scenario? Even Adani Ports has a similar trajectory.

Priya, in such cases, the lower prices almost become redundant given the price movement. You will have to pay attention to the recent moves.

As a swing trader: for loading data points, do we look at 12 months of Day charts or 12 months of 1month charts?

I\’d suggest you check the day chart.

Sir which one is more reliable or can provide better results-fibonacci or traditional pivot points?

Very hard to say. It\’s best if you back-test and validate both patterns.

Hello Karthik sir,

You mentioned to spot atleast 3 price action zones that are hesitant to move up after a brief up move or vice versa for down move

My doubt is how much percentage move can be called a brief move if we keep in mind plotting S&R for swing trading

At least 5 to 8%, Dhruv.

Sir I\’m a swing trader(generally holding positions for few days) and if I use moving averages for determining whether any stock is in uptrend or downtrend then what should should be the length of moving averages 10dma or 21 dma or 50dma or 100dma or 200dma?

Yes, averages like 21, 50, and 100 are useful for short-term swing positions.

Thank u sir for this amazing module.

Sir how to determine whether any stock is in an uptrend or downtrend?

You can use simple trend lines and moving averages to figure this, Abhishek.

Thank you so much sir for your kind replies.

Happy learning 🙂

Sir I\’m getting little confused.

Swing trading means holding positions for few days and this few days can go on for two to three months or even longer. Am I correct sir?

Also,if I\’m a swing trader then long term S&R i.e,100 day or 200 day ema is relevant for me.Am I correct sir?

Thats right. The expectation is that it can be held for a few days, and can go for longer.

Sir if I want to determine the S & R of a stock using moving averages then what should be the length of moving averages like 10 day ema or 21 day ema or 50 day ema or 200 day ema assuming I\’m a swing trader? Also, I trade on the basis of daily charts(end of the day charts).

Depends. If you are looking for short-term S&R, then use 21-day EMA. Maybe 100 and 200 EMA for longer-term S&R.

Sir, I\’m unable to find the video.Please help me out

All our videos are here, Abhiskek – https://www.youtube.com/channel/UCQXwgooTlP6tk2a-u6vgyUA

How to find the target price of a stock if there is a candlestick pattern around all time high price?

Hey Abhishek, please watch our youtube channel. We will be putting a video on this topic either today or t\’row 🙂

Is it good to enter position (1 day timeframe) at breakout price or closing price of the breakout day sir?

Depends on several factors, including your risk appetite. Not sure if you had asked this query earlier – you take position for half the capital and the rest when the momentum picks up.

Thankyou for clarifying my doubt sir.

Happy learning 🙂

Hello karthik sir,

I have a doubt in breakouts sir. If we find breakout its better to go long/short at breakout price or closing price of breakout day or at/after retest period? Some breakout has retest period and some doesn\’t. How to find whether this breakout will surely have retest period? Many times I booked loss in retest period and other times I missed breakout waiting for retest period but the price keeps on rising? What should I do sir?

Kindly answer me sir

Take a position at breakout, but with half the planned quantity. If the breakout sustains, then add in the other half.

Hi Sir! Hope You are doing well. I want to thank you for sharing your knowledge about stock markets through varsity. I have read this chapter a couple of times and though I understand the theory part in my head but practically when I try to identify support and resistance in the market I find it quiet difficult to actually spot the support and resistance zone. So, if you could suggest me some tips and tricks through which I can identify support and resistance it would be of immense help. Thank You.

Hardik, compress the chart to load more data points, look for price action zones, and start marking that with horizontal lines. You know you\’ve got either S or R, when 3-4 such price action points are connected via the horizontal line.

hello sir

very useful content of knowledge.

vedios and reading is much better according to me.

just now started to go through the comment section.

Q and A is also very usefull.

gaining knowledge rather than taking tips or advise is always better.

zerodha varsity and you are doing a great work.

i am sure this will benefit to all who want to make concepts clear.

thanks a lot

Thanks for the kind words, Milind! Happy learning 🙂

Hi Karthik,

First of all thank you very much for this wonderful knowledge sharing modules.

I really didn\’t understand \”Sharp reversals at a particular price point\” Identification in the charts.

can you please help me with that.

Thanks,

Vinayak

Which part are you getting stuck with, Vinayak?

Hi, I am new to trading, and I am having some difficulties in building a checklist. Can you help me out?

I\’ve put up a checklist towards the end of this module, can you go through that once?

Can you please suggest whether we should use the support and resistance level explained in this chapter or pivot point in kite application while doing trading.

While the end objective is the same, the process of identification of S&R is different. Pick a method which you understand better.

Found my comment sir, it was under volume chapter, sorry for the confusion, my apologies , will continue from there. Sorry and thank you.

Sure. Happy learning 🙂

Sir,

Seems my earlier question is not visible any more, cannot understand why? In the comments you have mentioned that to show 10 days avg volume , one should select MA and select field has \” Volume \”

But in new verion of Kite under MA there is no option to select \” Field \” rather we have \” source \” , can you please tell us , how to have the 10 days avg volume line overlaid on volume?

If you have already mentioned this, then please forgive me for being a pest, I would be highly obliged if you would direct me towards the link. Thank you.

Bhaskar, so in source, select volume. Its will plot a SMA over volume.

Excellent tutorials,thanks.