The 20 Market Depth (level 3 data) Window

I’ve driven a car for many years and I’ve even changed my car a few times now. Each time I changed my car, the engine remained more or less the same, but the features within the vehicle and its aesthetics continuously changed. Air conditioner, power steering, and power windows were all luxury features in the car at one point, but today, I guess no one buys a car without these essential features. The game-changer for me though was parking assist. The little camera at the back of the car gave me complete visibility of the parking space available. I was no longer required to pop and twist my head out and struggle to park the car, nor did I have to bug my co-passenger to get down and help me navigate my way into a parking spot. The parking assist feature did everything and helped me execute a perfect parallel park. The parking assist feature was my edge for hassle-free car parking.

I feel the same edge while trading the markets with the level 3 data 🙂

Level 3 or the 20 market depth feature is unique and has multiple uses. You’ll probably appreciate the level 3 market window if you have traded at an institutional desk. A regular retail trader would not understand this feature anytime soon, simply because this feature was unavailable all these years until we introduced it for the very first time to the Indian retail traders.

The purpose of this chapter is to help you understand how useful this feature is and get you started on building trading strategies around this feature.

If you are entirely new to this, I’d suggest you read this blog to understand what the level 3 data is all about.

Assuming you know what it is, this chapter will help you understand the multiple uses of this feature.

Contract availability

For the option traders, the 20-depth order book gives great visibility into the availability of contracts to trade and help identify better price points to execute these trade. Without this visibility, it becomes really hard to trade illiquid contracts. While I’m specifically talking about options here, you can extend this to Futures contracts as well, especially the illiquid ones.

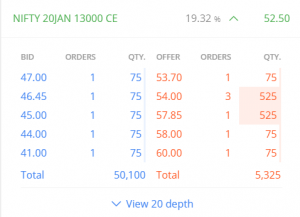

Let us put this in context, have a look at the regular market depth (i.e. the top 5 bid-ask) of the 13000 CE expiring in Jan 2020.

We can see narrow bids on the left and a notch better offer on the right. You’d probably hesitate to trade this contract if you are someone looking at trading a few lots of Nifty.

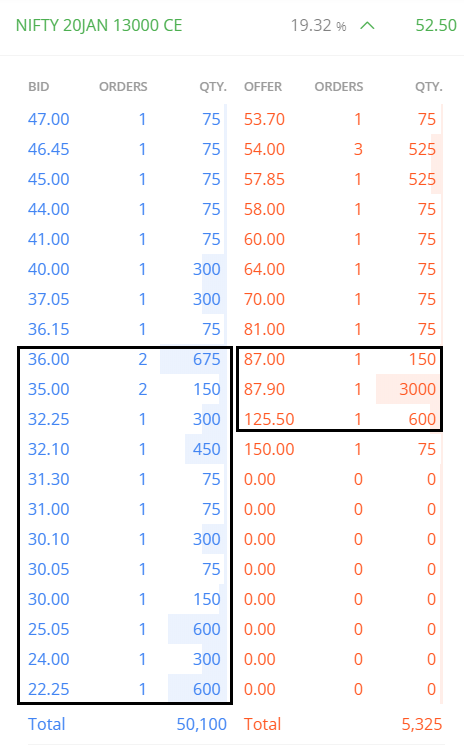

But check what’s hiding under the hood here by opening the level 3 data –

As you can see, there are many contracts available, but they are not visible in the regular market depth. In fact, the bid and offer quantities are heavily concentrated below the 8th row respectively.

Given the availability of the contracts in this strike, the perspective to trade or not completely changes and will now depend upon your trading strategy.

Execution control

Level 3 data gives you full visibility of the approximate execution price for your trade. This is particularly useful when you decide to scalp the market. When you scalp the market —

- You trade large quantities, i.e. buy and sell large amounts in quick succession to profit from small tick moves in the stock

- Since these are quick trades, you place market orders only

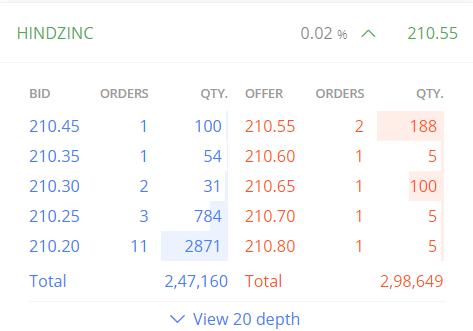

Let us say you want to buy and sell 5000 shares of Hindustan Zinc; the regular market depth window gives you the following information —

As you can see, there is no visibility on how these 5000 shares will get filled. Now, take a look at the 20 depth window —

The 20 depth window paints an entirely different picture. It not only tells me that I’ll get the 5000 shares, but it also gives me information about the approximate buy price. If I were to place a market order for 5000 shares, I’d be buying this order book from 210.5 to 211.25. I also see at 211; there are 2425 shares available, so I can expect the average price is at or around 211.

Now, my decision to scalp the stock should depend on the pop I’d expect over and above 211. Maybe 211.5 or so. Of course, you’ll get the exact breakeven (post charges) if you were to use a brokerage calculator.

Position sizing

Level 3 market window plays a critical role in ‘guesstimating’ the number of shares to trade, given the liquidity of the stock. For the sake of this discussion, we will assume that the availability of capital is not an issue.

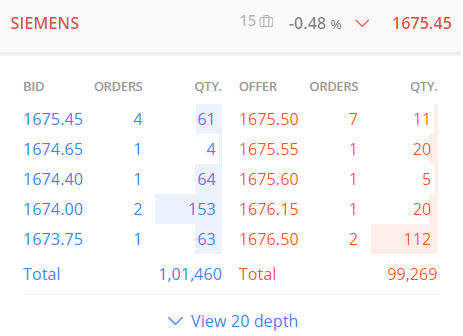

Now, have a look at the regular market depth —

You expect Siemens to move from 1675 to about 1690 over the next hour. So, given the fact that you are not constrained by capital, how many shares will you buy for this intraday trade?

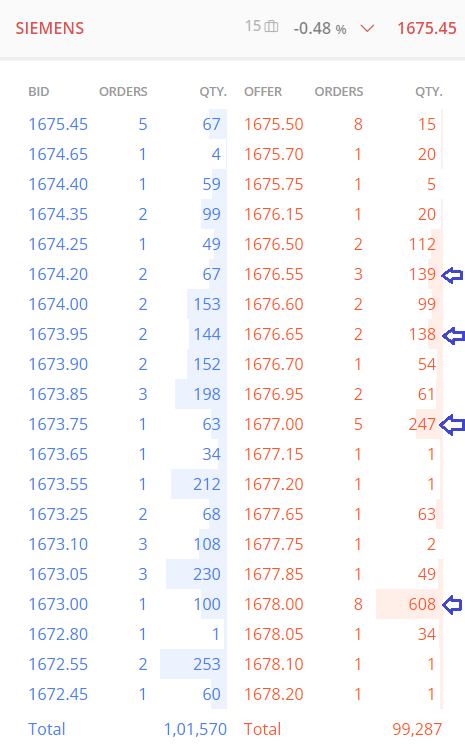

The regular market depth window suggests that you can buy close to 175 shares. However, the 20 depth opens up a different perspective altogether —

In fact, the liquidity in this stock lies below the best five bid and ask, and the impact cost is reasonable. The regular market depth window fails to capture this information. Assuming you intend to buy about 1500 shares, the buy price will lie somewhere within 1675.5 to 1678, which is spread of 0.149%.

In this case, assuming you are sure about the target price (1690), you can go all in and buy through whatever is available at that moment.

Order placement

You can extend the position sizing concept and use the 20 depth market watch to place a stop loss or a limit order. Assume you have an intraday buy position in VST Tillers at 1313.8.

The question is, where you would place the stop loss for this trade? Can the 20 market depth help us with this?

Of course. Have a look at the 20 depth window for VST Tillers. As you can see, there is a concentration of bids in 1290. The good part is that the number of order count is also the highest (35) in 1290.

This implies that several traders have placed an order at 1290, indicating some sort of price action at that level. This perhaps builds a case for placing the stop-loss.

A prudent trader would probably place a stoploss not at 1290, but maybe at a price just below it.

So I was a buyer in this stock, then purely based on 20 depth I’d probably place my SL at 1290 or below, maybe at 1287 and by the same logic, set my target at 1340 or at 1338.8.

Validate the support and resistance level

I find this extremely interesting. In the example above, we identified 1290 as the stoploss price, simply because there was a concentration of bids. In other words, we expect 1290 as a support price.

If this is indeed true, then it should show up on the charts as well, right? Have a look at the chart below –

Clearly, there is some price action around 1296. Remember, support and resistance is not one price point, but rather a range. Therefore 1290 – 1300 marks as an intraday support for this stock.

This is a perfect example of seeing the price action concept play out in the market.

Another way to look at this is first to identify the S&R level and then check the 20 depth to figure if there is a concentration of bids/offers in that zone.

Hopefully, by now you’ve started to appreciate the immeasurable value 20 depth order book brings to you while trading.

Remember, irrespective of which technique you use to develop a point of view (technical or quantitative analysis), things boil down to price, and the action trades take at that price.

The 20 depth market window is essentially your ticket to validate the truth of this price action. Make sure you use your card wisely!

Do post your comments and tell us how differently you will use the 20 depth window for identifying trading opportunities.

Good luck!

Finally, completed the Module 1 after days of reading. Thanks a lot for the work you are doing.

Now i have only two doubts form the module 1) in the market window, bid price, offer price, quantity is clear. So Orders = number of traders available at that point of time willing to buy or sell their shares at that particular price. Am i right?

2) under order placement, you said

\”A prudent trader would probably place a stoploss not at 1290, but maybe at a price just below it.\”

Why it is so? .., pls explain

Thank you🙏

How would you detect if algorithmic trading is manipulating the offers and bids to push you (retail investor) into a certain trading decision?

Very hard. However, in my opinion your trading decisions should come from your trading thesis, not influenced by external factors.

Very surprised to see such heavy concepts being taught early on, am i missing anything in the flow .

Hmm, its an extension of the market depth discussion we had earlier in the module 🙂

First of all, thank you so much for imparting all this knowledge. i didnt understand support and resistance. For the first time, today i understood how to get stoploss and target.

Thanks Shubhalatha. Happy to note that you got the SL and target bit. Whats is it that you find difficult about support and resistance? Will be happy to help 🙂

Good morning, Sir. I watched your video on daily analysis where you mentioned that elections affect the market. I understand that central policies directly impact the economy, but how do state elections—like those in Maharashtra—affect the market? Is it because the BSE building is in Maharashtra? And how do elections in states like Rajasthan and Uttar Pradesh affect the market? Shouldn’t states like Haryana and Karnataka, which are more prominent in IT, have a bigger impact?

Also, I’m struggling to properly read charts and fully understand technical analysis from your module. Could you please suggest any good books besides your module that can help? I’m not sure what mistakes I’m making when applying price action and other techniques

As far as the markets are concerned, the state elections are only indicators of the local sentiment and what impact that might have on at the national level. Nothing besides that. BSE/NSE being in MH is not really connected with MH\’s election.

Thank you for putting efforts in this training. This is very helpful.

Glad to hear that, Prashanth. Happy learning 🙂

sir, we don\’t understand this topic at all please explain in detail with example, data and explainations given in this chapter are not resembling so we are not understand.

Hmm, which part Sunil? Is there anything in particular that you want me to explain?

contract availability sub topic in which charts and their data provided.

Sorry, unable to understand your query. Can you please give more context?

Best course for starting the stock market journey.

Happy learning 🙂

ARE THE CONTENTS ON VARSIRTY APP AND WEB SAME? SEEMS TO BE UPDATED ON WEB AND NOT ON APP.

Yes. App will go through an update soon.

Thank you so much sir for this incredible efforts for teaching. this is my first comment after completing the whole module of varsity. such a great information.

Nirali, thanks and I\’m glad you liked Varsity! Happy learning 🙂

Thank you sir for this information

Sure Vinay, happy learning 🙂

Hi Sir, What is price action? how is this used in trading?

Could you please help me to understand the concept in detail or direct me to any source of yours?

Hi Mounika, do check this video, I\’ve explained price action – https://youtu.be/1kQjXFL4Mfc?si=4AvdDaaewIAK3h6X

Amazing learning.

Glad to know, happy learning 🙂

In the youtube video(https://youtu.be/GYMqpIaWMck?si=UmFrYVi8IGmc76di) they were talking about being able to view 200+ levels on liquid scrips!

They deleted the video 🙁

Yes, was asking about full depth. Dhan offers it: https://blog.dhan.co/introducing-full-market-depth/

It provides fantastic insight into market behaviour. Institutions have built advanced tools by making use of the full order book

I\’ll share the feedback with the product team Vivek.

Hi karthik,

This is with reference to the comment above: https://zerodha.com/varsity/chapter/supplementary-note-the-20-market-depth/?comments=all#comment-521280

I was wondering how deep the order book went. Upstox now offers 30 depth. Dhan offers FULL depth to unlimited levels(https://youtu.be/GYMqpIaWMck?si=UmFrYVi8IGmc76di)

Does Zerodha have any plan to give more depth or preferably even full depth?

Not sure, will check . Are you looking for full depth?

Please provide me market depth data in index.i am using zerodha for a long time

It does not work that way. Check Nifty futures instead.

Please provide me market depth in index

Index is not traded right?

I had attempted tests for Module 1-Stock Market Basics for Beginner, Intermediate and Advanced. I had qualified for Beginner and Advanced. I had not qualified for Intermediate but I had viewed my answers by mistakes. Could you please help me attempt the Module 1-Stock Market Basics for Beginner final certification test.

Waiting for your positive response.

Hey Manoj, can you pls drop us an email about this – [email protected] ?

Is Level 3 data now available for option contracts?

Ah, no, I dont think so 🙂

Hi Karthik,

This is very insightful. Thanks a ton.

Just to clarify, the Stop Buy and Stop sell orders are held at the brokers end, right?

All these orders are limit orders, and can also represent profit booking orders, right?

Thanks Nikhil. By \’held at the broker end\’, you mean ordered routed via a stock broker? If yes, then yes :).

You can use these orders to for any sort of execution – to buy, sell, book profit, exit at stop loss etc.

I checked for level 3 data today and it keeps changing so fast. So my question is how can find out the concentratiin of bids and offer to decide the support and resistanc

The only option is to eye ball for concentration. Else you will have to code this.

Dear Team,

I am not able to see level 3 data for Nifty 50 options. Is there anything i need to do to see 20 market depth for Nifty weekly option

Ah, its for stocks. Please do call the support desk for this.

Love the initiative Karthik. You honestly are doing a great job👍

Thanks for the kind words, Arnav. Happy learning 🙂

Can you explain more about the three headings (bid orders and qty)? Couldnt get a clear explanation on any of the before chapters!!!

Please do check this – https://zerodha.com/varsity/chapter/the-trading-terminal/, have explained the terms here.

How can I download zerodha varsity PDFs in hindi

Hindi PDFs arent there yet I guess.

Okay! Are the modules linked to one another? Should I complete the technical analysis module before going for the fundamental analysis module?

Not really. You can however check the video series – https://www.youtube.com/watch?v=yzRP-mA2eiE&list=PLX2SHiKfualH_xMbGM-3zWC47s9gUjGR_

Hey Karthik! Hope this comments find you well. As you said that the market depth data keeps updating every second and is influenced by new trades . Don\’t you think this will affect price action?

It will, the point is to figure this and place your trades accordingly.

Hi Karthik!

Thank you for creating such wonderful content. I am completely new to the world of stock markets and trading. I have finished this module. I intend to identify some stocks in which I can invest my capital for a long period of time (years) instead of intraday trading. Which modules would you recommend me to study in this case?

I\’d definitely suggest you look at the fundamental analysis module for this 🙂

Check this – https://zerodha.com/varsity/module/fundamental-analysis/

WHY IS THERE NO \”SUPPLEMENTERY NOTE\” IN STOCKS MARKET BASIC PDF?? WHY???

Hmm, I guess the chapter was updated later on.

what about time and sales?

20 depth is price based. There is no time stamp data available.

Thank Karthik……After I posted the query I myself had a little bit of an insight if i may call it that. I began wondering if the maximum depth of the book might be equal to the maximum distance at which I can place a limit order and so I googled \”how far away can you place a limit order NSE\” and got some references to stuff like operating price range (OPR) and Limit Price Protection (LPP) on nseindia but ran out of time to investigate further. I\’ll just try placing an order 10% away and see what happens

Ah, yes, I should have pointed that out to you, dont know how I missed it. But yeah, best way is to experiment and figure. Good luck 🙂

Karthik, just out of curiosity how deep does the order book go? Is it possible to some day have access to 100 depth instead of the 20 we get today? Do institutions/market makers/HFT firms get to have the entire order book to unlimited depth?

Good question, I dont really know how deep the order book can run. Will try and figure 🙂

But for most traders, the top 5 bid-ask positions is good enough. Some traders prefer 20 depth order book, to see where liquidity lies. Beyond that I dont really know how it can benefit most traders, unless you are running an institutional book.

But as far as I know, even the institutions have 20 depth access.

Is the l3 data available through the kite connect API if, not how would one go about getting this data for programmatic use-case?

Not sure actually, request you to please check the document here – https://kite.trade/docs/connect/v3/

Hi Karthik,

very well written article. Thank you for this.

1 Question , \”If this is indeed true, then it should show up on the charts as well, right? Have a look at the chart below –\”

I can see the the 1290- 1310 acting as a resistance on older dates rather than support.

Can you please help elaborate more on this ?

There is price action around the stated price, hence it acts as resistance or support. Support and resistance levels can interchange, check this – https://zerodha.com/varsity/chapter/support-resistance/

IS 20 DEPTH ALSO AVAILABLE FOR COMMODITY MCX TRADING?

Nope.

Hii karthik,

This is om i have question is this varsity course fully updated? Because i can see here some comments are from 2014, 2017 and 2019…

Yes, the content is relevant as they are finance concepts which dont really change, and we\’ve been answering readers queries since 2104 🙂

Hello Sir,

How can i find the name of investors more that 5% stake in quaterly or annual report.

Regards,

Madhusudan

Please check the shareholding pattern published in the company\’s report, Madhu.

Hello sir I am very new to market… My question may sound absurd

Even if the 20 depth is displayed then also we can trade( buy shares) only on the last traded price … So if I open a 20 depth parameter of a particular share which I want to buy, showing last traded ( offer price) 1500 but somewhere down there in 20 depth parameter it\’s showing like 1400 rupees so how can I select that price and buy..

I don\’t even know what I am asking is a correct question or not? Plz help/clarify

You cant select a particular price on 20 depth, Kunal. The 20 depth gives you a cue on how the prices are trending, basis which you need to place your trades. So consider the 20 depth only as a guide to the price at which you want to buy or sell.

But how are the bids and offers of different different prices if the price of the stock is same for everyone ? Sir please reply !!

Think about as different prices at which people wish to transact in (bid-offer), but a transaction will take place only if the bid and offer match, and that is a trade.

Thanks for the clarification karthik

Sure, happy learning 🙂

Hi karthik, is there any other blog post where you have discussed how the total figure at the bottom of the market depth is arrived at? For example considering the siemens example above, the total bid qty is 1,01,570 and total ask qty is 99,287. These values keep changing throughout the course of the day, and unlike total traded qty/volume- which can only increase throughout the day, and can even go down as the day progresses. So if the total bid qty is 1,01,570 at 10:00 am, it can come down to 99,800 or thereabouts at 10:05 am. So does this total represent the outstanding qty that has not yet been matched yet or something else? How is the total computed?

Thats right. The bid and ask represents the total quantity that the traders intend to trade, but the trade happens only when the bid and ask match at a price, and thats traded quantity. The traded quantity can only increase over the course of the day. The bid-ask numbers keep changing based on the perception traders have on the stock.

GOOD

i want to know about charts with 30/60/75/ minutes duration. where can i found details about 75 minutes charts.

On kite itself, Gurjeet.

Therefore 1290 – 1300 marks as an intraday support for this stock. will it be support or resistance?

If its below the current market price, then support else resistance.

BankNIfty options doesn\’t have 20 level market depth. What about that?

Just I am starting study this varsity….

Feeling like I found awesome stuff.

May be I am too late but thankful for all the stuff you nailed here.

If you give questionnaire link for a learners after each chapter or each module that will be somehow helpful to us to build confidence.

Thanks Samuel, its already there on the mobile app, suggest you please download the same 🙂

The description about Price Action and Support & Resistance is simple and superb and clearly understandable.

Glad you liked it, Sriraman, happy learning 🙂

Why F&O have only level 2 depth?

Sorry, not sure what you mean. Can you kindly eloborate?

good work

Happy learning!

hi

do you have pdf in hindi

No, we dont.

Hi karthik ,There are some stocks in which I CANNOT SEE full 20 market depth, i am only able to see 5 bid, what is the reason for this.For eg as of today i am not able to see PFC 2O market depth but I am able to see ITC.Is this due to less traded quantity and volumes or what.

The 20 depth is available only for NSE stocks, Hardik.

Hello Kartik, Well designed module 🙂

In \”Order placement\” point the example you took:

You buy VST Tillers at a price of 1313.8 to target at a price of 1340. In window as it is appearing that interest start building at a price of 1290 with 35 bid with quantity of 644; which means it started showing support at 1290 but on chart isn\’t the red line showing the resistance zone instead of support zone; it might be go up. Please clarify. Also, correct me if I\’m wrong.

The chart is of EOD basis and the 20 day depth is intrday, Navneet.

Thanks Karthik.

Thanks Karthik for answering my query.

Could you please also elaborate a bit on how are the multiple orders within a second clubbed by the exchange and displayed on broker terminal?

Let’s say we have 10 orders going through in a second. 5 are hittting the bids and the other 5 hitting the offer. Does it display the bigger or heavier side of the trade. Like if the buy order was greater than the sell, then it would add the buy order quantity and display the avg. price of the buy trade.

Please let me know if my understanding is correct?

All trades are displayed. The bids-offers that you see is a collective order from multiple traders, but all wanting to transact at the same given price.

Hi Karthik,

For most of the stocks i could see the spread is 5 paise. Is this something standard for the Indian market or is it decided by the broker platform?

Why I\’m asking this is since I\’m learning trading watching traders from outside india, I could see the level 2 prints having all decimal places like 60.41, 60.46, 101.3 etc.

Also, if you could please elaborate a bit on the difference between tick by tick data and a 1 second snapshot data?

Does zerodha provide the 1 second snapshot data? If yes, how are all the orders clubbed for 1 particular second.

In India, tick size is 5 paise, pretty standard across all contracts. Tick by tick data captures all the trades that happens in the market and 1 second is the snapsot of the trades that happen within that second. There could be multiple trades within that 1 second.

I think I got the concept but not clear, so in general terms if I was ready to buy 100 shares at 28.5

and from 20 depth I see 80 shares at 27 rs so now I will place a limit order at 27rs. Sry if I\’m not clear to put down my doubt.

The idea is to see the way bid and asks are flowing and then figure where maximum liquidity is, Vinod.

Hi Karthik,

The level 3 data is actually helping me a lot in understanding the order flow. Thanks a lot for this feature.

Would it be possible for kite platform team to print the time and sales in a separate window as a list to compliment the level 3?

This would really help in finding the hidden orders and understand the orderflow better. This is the only piece i find missing.

Glad to know, Umesh. No, I dont think that will be possible 🙂

HI karthik,

Could you please let me know if your platform provides the feature of

real time time and sales feature for NSE Equity trading for

tape reading analysis along with Market Depth?

If yes, could you please share me the video or the document on how it

can be enabled on your web trading platform?

Regards,

Umesh Gupta

We do provide data real time via APIs, Umesh. Check this – https://kite.trade/

Hello Karthik,

I am very new to trading .should i first read all the chapters on the kite before starting my first trade or should proceed for trading.. The query is not very interesting but i hope i\’ll get guidance.

It probably helps if you read these once before you start 🙂

\”Contract availability For the option traders, the 20-depth order book gives great visibility into the availability of contracts to trade and help identify better price points to execute these trade.\” Yet I am unable to find 20 -depth order book. I am able to view 5 depth order book but unable to view 20-depth. I am able to view 20-depth order of an stock but fail to view option\’s 20 depth . I have tried this on using kite.zerodha on my desktop but still the same. If there are any requirement for this please let us know

Kedar, why dont you call the support desk for this. They will help you sort this out.

As stated earlier,

We can only see 5 market depth in zerodha for option contracts.. Why there in no 20 market depth in zerodha for option contracts..?

Could you please let us know when it will be available?

Or Could you suggest any other software for level 3 data???

Is there any other API to get level 3 information…?

Can you please call the support desk for this? They will help you with it.

Sir,

Suppose I want to study an industry business flow and related factors who impact the industry positively/negatively. can you suggest from where can I specially get to know a particular industry business flow? Any reference pls?

We have started to write about it – https://www.youtube.com/watch?v=dMjce5P4j-Y&list=PLX2SHiKfualE4o4joBMXM_YHGBKnZSQbs

Sir,

How many types of industries are there under Nifty 500? Can you share a link mentioning the list?

You can check the Nifty indices website for this Anirban.

Sir,

I am doing a job now and trying rigorously to learn your material in Zerodha since the past 5.5 months. I can afford to give 2 hrs daily on reading. Now, since I am already learning the basics of capital markets, all the 2 hours are getting devoted to learning now. Keeping in view of this, however, I have thought of studying the business newspaper but it is quite difficult to learn this since all the time is now getting to learning. Request your suggestion on ways how to keep me updated on daily news. Should I start reading any business newspaper or there is any weekly newspaper which I can learn at the weekend. I thought of LiveMint but I have no experience on time consumption to cover the newspaper daily. Please suggest ways out.

Anirabn, you can track all news here – https://pulse.zerodha.com/ , its a one stop place. Even Twitter is a decent place to track news 🙂

Hello sir, is this feature still available? one of my friend is recently opened account in zerodha. he is not getting the feature may be due to RS 100 brokerage is not generated by his account. Is that much brokerage required is still a condition?

Kiran, not true. This is open and free for all now.

Reason?

We can only see 5 market depth in zerodha for option contracts.. Why there in no 20 market depth in zerodha for option contracts..?

Its temporarily disabled but will be back soon.

Can I buy the offer at a lower price and sell(bid) at a higher price?

That may not be possible 🙂

Thank you for such a quick response.

Happy learning!

Hi Karthik,

By far the best content to understand markets!

I am going crazy with understanding the bids and asks! Please advise.

So there are over 250000 bid quantity at say Rs. 100. This means there are so many buyers here that the market will not go below 100. But this also means someone is selling those to buyers. Does it mean there is a support or resistance? Will market go up from this point or will there be a fall because of all the sellers selling at Rs. 100 to the buyers???

More Bids = support??

More asks = Resistance???

Thanks Sonal. Bids and Asks keep changing, so its very hard to consider these as S&R levels. Do watch this video – https://www.youtube.com/watch?v=-h1R5oIL0PI&list=PLX2SHiKfualH9XGLv9r1sdKucoGky35J7&index=5

First of all great content. I mean I finished the first module now and I love it. Thanks for this type of content.

Happy learning 🙂

I can\’t wait to explain this to others and let them know the significance of 20 depth.

Sure, happy learning 🙂

Dear Karthik Sir, I am proposing a minor change to a word in this chapter,

Current Sentence:

`and the action trades take at that price.`

Corrected Sentence:

`and the action TRADERS take at that price.`

Noted.

Dear Karthik Sir, I would like to propose a small change to a sentence in this chapter,

Current Sentence:

`We can see narrow bids on the right and a notch better offer to the left`

Corrected Sentence:

`We can see narrow bids on the left and a notch better offer to the right`

Ah, thanks for pointing this. Will change.

I this Varsity is one the best authentic source on Share market concepts. Keep up the good work

Glad you liked the content, Jatin. Keep learning 🙂

HOW TO WATCH COMPLETE ORDER BOOK/FULL MARKET DEPTH ?

You get order book with top 20 bid-ask at best.

Thankyou

I have been looking for this has been the silver bullet that I have needed to execute any trades

Thankyou

Now I need to find who can provide level 3 can you help Thankyou

Zerodha does 🙂

Having mentioned that this is useful for Options trading, how useful is it for intraday trading?

Just like the way futures and equity trading 🙂

Dear Karthik,

From 0 knowledge to something in markets, definitely because of these modules, thanks a lot for those.

I had a question regarding foreign organizations, like Indian organizations publishing (D)RHP or Annual Reports contains all organizational level data including manufacturing units, number of employes, models their prepare, area of business.

I Didn\’t find this type of data for foreign companies like Meta.

require your valuable insights…!

Charan, they too publish this data. Check for SEC filings for Meta or any company of your choice and you will get all the info.

such an amazing explanation.

Able to develop a new POV

Happy learning, Sourabh!

I am unable to see 20 market depth for Nifty or Bank Nifty Options. Stocks 20 depth is working fine but options is not

Only on stocks for now.

These all were wonderfully written Modules and really appreciate what all you are doing. Thank you publishing such awesome content FREE of COST and learners like me will thrive for a life on this.

Written back then is still so relatable. Cheers!

Happy learning, Shubham 🙂

Is 20 depth only valid for Future and Options? Like if I only want to trade in cash, is this still valid?

Disha, 20 depth is available on all NSE stocks and F&O. Not available for BSE, MCX, and CDS.

I have completed module 1 and I have gained so much information about the markets

Thanks for your wonderful insight

Happy to note that, Manikanda! Hope you continue to enjoy learning on Varsity 🙂

sir i actually didnt understand this chapter much. do you think i will better grasp this after i read the TA module

Venkatesh, we also have a set of videos that you can watch – https://www.youtube.com/watch?v=yzRP-mA2eiE&list=PLX2SHiKfualH_xMbGM-3zWC47s9gUjGR_

Do we also have details of the type of traders (institutional/market makers etc) that are buying and selling a stock like in Nasdaq Level 2 data.

Yes, we have level 2 data as discussed in this chapter.

I sincerely appreciate all the effort that was put into making these modules. They are very informative and easy to understand. Learning about the markets has become fun because of the way concepts are explained here. Thank you sincerely to the team and people behind it.

You\’re literally feeding our minds one module at a time.

Happy learning, Shreya 🙂

Thanks for the kind words, Shreya. Happy learning 🙂

hi sir..

can you please explain me about bid and offers, And how this details will be helps to trade.

Have done that earlier in the module. You can also check this video – https://www.youtube.com/watch?v=5t5O0MnNJNE&list=PLX2SHiKfualH9XGLv9r1sdKucoGky35J7&index=9

Great Start For Who Want To Be In Stock Market For Life Time 🔥Thankyou so much 🙏

Happy learning!

Hi Karthik, just out of curiosity – Does Zerodha have to pay extra to the exchange for obtaining this level 3 data?

i guess if we need to understand this module first we need a good clarity on the future and options .

Not really. This is the basics module.

Good explanation, Sir

Thank you..

Happy learning!

How did we end up with the 0.14% spreed.thank you

I have explained this in the chapter itself I guess.

Hey, can we have this level3 data in the form of priceladder like how fyers has(there price ladder lags like crazy though).

Also why does the API not let us get the level3 data?

Sharing this as feedback to the team.

Thanks sir for this information i need this kind of Knowledge.

Happy learning 🙂

Yes, appreciate the immeasurable value of 20 Depth Order book u have depicted as well as ur selfless style of presentation,word of clarity etc. for everything.

Happy learning!

Hi how can I have data level3?

Its enabled for you, click on market depth and open it.

Hey Karthik, have you guys thought of displaying this level3 data in the form of a price-ladder?

Its pretty weird but no trading terminal/software in India, provides a price ladder for >5 market depth, even though its a common feature outside India.

Or you could consider partnering with platforms like GoCharting/Sierra Charts/Bookmap and provide them your level 3 data that could be displayed in DOM price ladder.

Hey Tom, thanks for the feedback. I guess the team had explored the possibility of a price ladder. Let me check with them to figure out what constraints we have for not doing this.

1) I have an online trading account with Angel broking and have some equity shares of different companies.

2) I want to open an online trading account with Zerodha.

3) is it possible to transfer all the shares from angel broking to Zerodha online without any paperwork?

4) I wouldn\’t like to continue with angel. How can I close demat & trading account of angel?

5) Please guide me the transferring process.

Yes, that\’s possible. Here is how you can do that – https://support.zerodha.com/category/account-opening/getting-started/other-queries/articles/how-do-i-transfer-shares-from-another-demat-account-to-my-zerodha-demat

Last question is based on, when we are doing option trading in nifty and banknifty

Can we get data of traded quantity in terms of no of buyers and sellers during live trading (in 5 min candle) ?

Please do check the market depth window for this.

The provided in the 20 depth, one of them is total bids vs total offer. Now, if I am wathing this data @ 11:30 and my chart is 5 min candle then @ 11:35 total no of bid and offer that will be shown in the dropdown will be from since opening of market or between 11:30 to 11:35?

If we have total bids and offers since opening market how can we get it for 5 min candle? ie No of executed orders (option contracts) during those 5 min chart?

You just have to track the volume information, Anupam. The volume will give you a sense of how many trades have taken place for the day/moment.

In this supplementary useful knowledge we get to know how many order quantity are either being put for buy or sell. But how can we know or get the data for no. of order quantity which got executed squared off or bought oe sold. I want the data for executed orers. How to get it?

Thats the traded quantity, and the end-of-day total volume is the traded quantity for the entire day.

20 depth is very good thing but it oy show the data of ZERODHA traders not all the active participation in the share market….so how much i can be assure on zerodha\’s 20 depth structure????

20 depth is across the market and not just Zerodha.

why we place stoploss at price(Rs.1290) with which more sellers are placed order?

Its the buyers, Dilshad.

hi,

i am placing a options sell order after looking at level-3 data, the price there is much higher than level-1 data but the order is not getting executed despite placing a price matching order. can you please help in understansing the price discrepancy.( it is 10-12 rs. higher)

Jagdish, as you go deeper down the price ladder, liquidity dries up, which means the bod and ask spread increases.

HI, TODAY NIFTY FEB 17300 CE TRADING AT 88.

5 BIDS AND OFFERS ARE BETWEEN 87 AND 88.

BUT 20 DEPTH BID AND OFFER PRICES ARE BETWEEN 104 AND 106.

HOW DO WE INTERPRETE THIS.

PL REVERT.

NOTE- STUDYING THIS ON VARIOUS STUDIES SINCE A FEW DAYS

That\’s because the liquidity dries up after the initial few bids and offers, Percy.

Hi sir,

Sir can I add my Varisty certificates on Linkedin under licenses and certifications

I think you can Chandu.

What is the difference between order and quantity?

Order is the act of placing an order in the exchange, quality is how much you intent to buy or sell.

What is ojas TECHNOCHEM share price

Sir

Please give the solution of my problem.

Many days I feel unmotivated in market and feel boring. Many days i think what I can do in market, feel hesitate in market. And loosing my knowledge is required when no trading signal . I use grand checklist but never it\’s 6 point matched in signal.

Feeling demotivated is a natural. Especially on days when you make a loss. But if markets are an area of interest to you, then the bounce back from the demotivated state is quick. If you are unable to bounce back quickly, then you need to reevaluate if markets are really for you. Do introspect if you got into markets out of some external pressure or compulsion. If the answer is yes, then maybe you should stay away till you feel naturally motivated again.

Good luck!

Sir,

Your work is phenomenal and I am very grateful. It is my personal request to you to create a similar content on crypto and forex, or atleast suggest some source of equal value.

Thanks,

Thanks, Chandan. I dont know much about crypto, so cant really write about it 🙂

very happy to complete module 1! heading over to module 2 soon!

Happy learning, Ahishek!

Excellent content and clarity.

Thanks Karthik and zerodha for knowledge sharing

Happy learning, Anand!

Hello Karthik,

Thanks for an insightful view on how to create Position Sizing through Market Depth. But just curious to understand, let\’s say in the Siemens example above, where we have the Totals in Blue (1,01,507) & Red (99287), does it in anyway imply that the short term view of price action is Bullish (& vice-versa) to make our POV more solid about it being bullish to take a long trade ? Please advise accordingly. Thanks in advance, and once again Kudos to you and your team for creating absolute Encyclopaedical Knowledge for everyone on Stock Markets.

Gaurav, the thing with bid-ask total is that it\’s very transient in nature. It changes so quickly that it is difficult to build a fresh thesis, but you can use it as a tool to support your thesis. For short term take, you need to check the prices (price is the key driver), and then associate them with the bid-ask tally.

A follow up comment:

What will be the nature of DOM when the price is moving sideways.

Karthik, what I am trying to understand is, how will the order book act, when the stock is (intraday) Bullish, Bearish and sideways.

It would make it very ease, if you could answer questions from both the comments.

Thank you,

J.

So the way to look at this is straightforward, look at the price, direction, and the order book in conjunction. If there is a lot of movement backed by volumes in the orderbook, then you can expect the directional move to continue, simply by virtue of a fat orderbook. But this is very transient, the very next second the dynamic of the order book may change. So the point is, any trade decision that you take based on level 2, make sure to cover that position quickly.

Hi Karthik,

Can DOM, be also used to partially confirm the direction of a move?

Assumption: Stock A Might break an intraday resitance level, and may go long unitl held.

Questions:

1. What is the possible scenario happening in the DOM, will I see increased quantities of bid, or will I notice offers being filled very quickly? Or offers moving very intensely?

2. And If I had taken a long position, where can I anticipate myself being stopped out, in other words, what would be the nature of DOM, when the price may start reversing.

3. How can one use DOM to anticipate a reversal, when the price is trading at all times high.

Thank you,

J.

Its possible, but this is purely for scalp trades.

When a quick move happens, backed by heavy either bids or asks, then you can expect a lot of orders hitting the exchange, and the trend to continue. About stopping out, dont think DOM will be of much use.

Is there any other type of securities?

As in?

What is securities? And what it\’s type? Sir please explain in simple…

Stocks are also called securities.

really very helped to me. thank u and love you zerodha

Happy reading!

Why 20 depth not working for voltas future? Any specific reason only VOLTAS not showing 20 depths

Perhaps there was no liquidity beyond the first 5 bid-ask?

I am beginner, and learning a lot things from this. Thanku Sir.

Happy learning, Harsh!

I am reading about the market for the first time so is it wrong that I could understand half of this chapter ??..or should I read a few later chapters and then come back here ???

Chetan, I\’d suggest you start from the first chapter and get back to this chapter later on.

Is 20th market depth available in zerodha? Can I monitor it from there?

Yes, it is.

Happy Teacher’s Day,

Learned a lot from this wonderful creations.

Thanks, Vijay! Happy learning 🙂

Appreciable article on DOM.

This attracted me to open account with Zerodha

but I am bit skeptical on extra charges if any

to avail 3 level DOM facility for a new and novice trader like me.

Thank you very much !!

No extra charges, DOM is free for all now.

Thanks

only limit orders will be shown in market depth right ?

Yes, because market orders get filled.

Sir please provide the hindi pdf also.

needs hands on training. wld be grateful if u make a live vdo. please

I see the button for 20 depth sometimes, but otherwise I see 5 levels only. Why is that?

It is available only for NSE scrips, Maz.

Best for retail investor

Can it get on kite connect api???

Sir the third module after technical analysis is option trading in the app whereas in the website it\’s fundamental analysis.which one should be followed?

You can take up what interests you, Sharal.

Have been using 20 Market depth for last years never thought from the support and resistance POV. Thanks for this amazing POV @karthik sir!

Happy learning, Manish!

As 17yr old newbie to this feature , I feel like as if my brain is completely being destroyed and rewired to the opportunities this can present .

Thank you Karthik sir.

Happy reading Steven! Glad you started this at a young age 🙂

Wishing you the best!

We often see large sums order on the lower side of the bid/ask which are pending but when their order comes closer to the execution they just fade away, is this a way by market makers spoof us?

Ah, a lot of orders gets placed and cancelled. IOC order types 🙂

very well explained about the market depth, contract position, how to estimate the buying and stop loss preference, thanks lot

Good luck and happy trading, Jagan!

Very nicely written, thank you..

Happy reading, Suneesh.

Hi Karthik,

What is Support & Resistance? Is there a way to offer a better explanation of this concept.

I\’ve explained this to the best of my capacity here – https://zerodha.com/varsity/chapter/support-resistance/, do check the comments as well.

Great initiative! Financial literacy is the need of the hour. I myself am new to this arena and I found Varsity quite helpful. Thank you.

Happy reading, Manasi! Hope you continue enjoying reading on Varsity.

Please ,make a book of varcity in hindi or english version that we can buy it

Hi, this chapter is a bit confusing to me. Is there any blog/video where I can refer to the concepts explained here in detail?

Some things I did not understand:

For the intraday VSTTillers trade:

\”So I was a buyer in this stock, then purely based on 20 depth I’d probably place my SL at 1290 or below, maybe at 1287 and by the same logic, set my target at 1340 or at 1338.8.\”

Why would you place a SL at 1290 or lower?

Not sure if there are any videos on this topics. 1290 or lower has a maximum concentration of order, hence.

Nice

Hi Nikhil sir

Thanks you for sharing the educational content with the world. Your efforts mean a lot to us.

I have one query with regard to certification, can I receive a credential id and credential url post completing the module quiz. It will be helpful for me while sharing it in my Linkedin profile or resume

Hope, you can help me with this.

Thanks again.

Sharing this with the team, thanks for the feedback Shubham.

Hi sir

Great work I learn lots of things through this…

Credits to – Mr.Rangappa

Happy learning, Vignesh!

In case of VSTTILLERS, what\’s the logic in setting SL at 1287 and not 1290? And similarly the Target at 1338.8?

Hmm, I\’ve explained this in the chapter, right?

This is weirdly answered in a way that it\’s easy to understand

Happy learning, Aradhya 🙂

Sir you block is great

Thanks Karthik for this wonderful explanation!

Happy reading, Omkar.

To be honest I didn\’t quite grasp the concept entirely, but I understood it to be a feature that shows more than the normal market depth window, enabling traders to make more informed decisions.

Yup, that\’s about right. If you are comfortable using the 5 depth, then this is just an extension to it 🙂

It is for show off only. Whenever there is big move then it is getting stucked for even an hour also. Then what is the use if it doesn\’t work in crucial time.

There was a small issue, but not anymore. Please check.

Holy Crap! I am new to trading futures and options and finally understood what \”Support\” prices are and how they are identified. This will surely help me in setting the right SL and Target prices! So insightful.

Good luck 🙂

Zerodh team always different from other , excellent

Thanks

Happy learning, Rakesh!

is there any material to study

Hi Karthik,

So as you told, you are converting tick by tick data into 20 depth.

1. Why 20 only, why not more than 20 which can cover more price range than 20 depth.

2. Is it possible to get more depth if we buy API from you or in any other way

Please let me know in detail

Thank you very much.

1) This is relayed by the exchange, btw, 20 depth covers most of the orders anyway.

2) Nope.

I am not able to get 20 depth

I tried several times to as mentioned phone no

Very difficult to reach staff

Kindly up date to me immediately

Regards

Ashok Kumar

Senior executive engineer

There is a small issue with it, you should be able to view it t\’row.

Hi karthik,

Yesterday and today also level 3 data not getting. When we can expect it. Plz resolve it ASAP. Tq.

Most likely tomorrow.

Hey!

Should I finish every module first before starting to invest?

Or can I just start right now and learn in the process?

Also, any specific order in which I should follow this course?

I\’d suggest you learn Fundamental Analysis before you get into investing.

Hi Karthik

Level 3 data not getting in kite. Please check it.

I think the 20-depth feature on Kite will not be available today due to a connectivity issue with the exchange colo (from where we receive tick by tick feeds through which we create 20 depth). You should be able to use the feature normally from tomorrow

Whenever i decide to buy shares for intraday, i first check the total quantity of bid and offer and if the bid side is more than offer ,i buy the shares thinking that the price will go up.idont know how this technique clicked in my mind,whereas nobody has explained abt it anywhere,but whenever i do i mostly succeed.any idea abt this?

Pallavi, I\’d suggest you pay more attention to the candlestick pattern than this, it is far more effective.

As every one told, it is amazing feature but, I believe for options trading especially for buyers this 20 depth is not sufficient because it covers range of +/- Rs.1 from LTP. Is it possible to provide range of +/- Rs.20 from LTP in separate window ? so we can guess big move in that option.

For example NIFTY 20th May is trading at Rs.21.75. If u provide depth for

1. Rs.20-21,

2. Rs. 21-22,

3. Rs 22-23 and so on for offer side.

What do you think, karthik ?

These quotes are directly from the exhange. We show what the exchange provides, we don\’t have control over this data.

It was working for equity but for options getting stucked. I will also check on Monday and let you know.

Sure, good luck Sivasankar.

Read the first module. Loved it and looking forward to learning to trade with varsity. 🙂

Happy learning, Arihant!

It i.e level3 data is getting stucked in kites many times but 5 bid ask window working properly. Plzzz improve it

It was working good at my end today. Let me check on Monday again.

thank you Karthik !

Great job Zerodha Team !

You guys are creating a new India by spreading financial awareness.

will try to join your revolution somehow 🙂

Happy trading and happy learning, Sudhanshu!

Sir, are you going to add financial modelling as a module in varsity?

Yes, hopefully soon.

Very nicely explained.

From the above examples i have some doubts….

1. When the current of the scrip is at 1313, then why should some one place buy orders at 1290, 23 points away on an intraday basis.

2. Also the stop loss and profit target are two large… And it may not be possible to reach in intraday…. So the orders which are not executed will open for the next day also.

1) For a better buy price?

2) Hmm, you will have to think in terms of percentage.

hello, how i could get the certificate of your course.

Please download the app, its available both on iOS and Android. The certification is available there.

Thanks Karthik that was pretty simple one. And I thought derivatives were tough one. Need more clarity on each topic ahead. Tha ks again.

Happy learning 🙂

Excellent content !!! Simply fabulous !!

Thanks, Ashok.

In Zerodha, 20 market depth cannot be seen in currency derivatives and commodities. can you pl guide how I have to go for it in Zerodha.

Its only for Equities for now.

thank you zerodha…

Good luck and happy trading!

Hi Sir,

I would like to ask a doubt regarding a statement you told in the comments section : \”there is no way one can identify disclosed quantity. By the way, level 3 helps you identify contract availability. Given this, the disclosed quantity, if any, will only make the liquidity situation better.\”

What is meant by a disclosed quantity and how will it make the liquidity situation better?

Not really because disclosed quantity never gets exposed in any order book. It is like buying wanting to buy 5 chocolates at a shop, but you keep buying 1 chocolate at a time, the shop keeper will not know how many you really want but will keep selling you 1 chocolate every time you ask for it.

Thanks – worked like a charm! Just read it yesterday nite & used it today & works to the T!!

Happy reading and trading, Gautham!

I can still see numbers under market depth.. after trading hours .. what does they indicate?

…ya I am new to this field

Maybe the post-close you\’ve looked at. Its open from 3:40 to 4 PM.

This 20 market depth data does help in identifying support & resistance in intraday trading… This can be used in conjunction with chart(minutes based) in the background on Kite….

Would be very useful if traded in high volumes.

Thank you team Zerodha for providing this facility for retail traders👏

Keep developing & incorporating new software technologies on your platform 👍

Happy trading and learning, Neeraj!

Hey the 20 market depth visible on a stock is order placed in the market server or at Zerodha server???

All feeds are directly from the exchanges, Sohail.

Is there any certificate available to complete this course?

You get a certificate if you manage to clear the quizzes and certificate on the Varsity app.

Okay, but I think we can guess based on bid/ask volume ratio.

Is the \”total bid\” in the above chart means the volume of shares that is sold to bidder, or is it only the bid offer that is not traded yet? Please clarify this one.

Thanks.

These are the quantities available to trade at this moment, it can be traded. But remember the traders can cancel these trades before they execute.

Is the \”total\” in Bid/Ask chart is Bid/Ask Volume? Bid/Ask Volume is the number of shares changing hands, Am I right?

if the Bid volume is double than Ask volume, price is likely to go down?

If the Ask volume is double than bid volume, price is likely to go up, is that Correct?

Thanks in advance.

Manish, it is very hard to conclude the direction of the price based on bid/ask since the bids and asks keeps changing every second.

Thank you so much! reread is another form of practice and this will help in long run to understand the market for newbie.

Good luck, Kunal!

Hi

Can k but or well stock in point means for example A company share 831 market price i want to sell it 834.5. is it possible in zeroda.

Sorry, I\’m not sure about your query. Can you please give context?

Me and my mother were discussing about tata chemicals and we found that near the start of 2020 the prices shown by different platforms like moneycontrol , kite ,tickertape and trading view do not match.

Please check why is there difference in prices shown by different platforms , and which one\’s data is right.

Are you sure you are checking EQ series? Prices cannot differ. Or maybe there was a corporate action and that dint reflect on other platforms?

You mentioned – \”We can see narrow bids on the right and a notch better offer to the left. You’d probably hesitate to trade this contract if you are someone looking at trading a few lots of Nifty\”

Has the image been changed as bids are on left while offers are on right. Not that I want to point out a gap but I just want to be clear with all the terminology being used here

Must be an oversight, let me check this again. Thanks.

Please add volume in it if possible or we have to use chart to check volume at saturated levels.

Pradeep C Pradhan

You want to add volume to?

Thank you for clearing this basic concept…cheers

Good luck!

In the market depth data what does the color(blue or red) on the numbers inidicate. Like in the above example of Seimens, some data is shaded in blue or red depending on Bid or Offer data.Further some data is partially shaded and while others are not or completely shaded.Please clarify.

Blue is the price at which you buy and red is the price at which you sell. The shaded part indicates the quantity available.

Very informative. But for retailers it seems not so realistic to use it. Market changes in seconds and one should have at least some time to analyze.

It is best to use it to get an overall perspective.

hi I am a ca student with very much interest into the stock market would it be enough to start my trading after completion of these modules, and I would thank Zerodha for providing wonderful content free of cost. i would like to receive assistance from you to enter into the market .

Yes, this will help you to some extent. But your real insights will come from real trading experience 🙂

I think even though disclosed quantity may not give the actual numbers for an offer or say 100% accurate info, the quantity across all the 20 depths may be considered to have similar variance between actual and disclosed and hence, still may give us a general idea and help in utilizing the information gainfully, as intended in your article.

Hmm, the objective of disclosed qty is to not give the accurate order info, else oy would defeat the purpose 🙂

Is it possible to check view chart and market depth on mobile kite in single screen.

Nope.

I want more on level 3 in f

need API for kite connect for data , to apply own strategy , is it possible?

YEs, do check Kite Connect for more details.

Ok.Thanks.

Good luck!

Prints show the buy orders and sell orders executed in a separate window.If bid orders are repeatedly printing with lower prices the stock price is coming down and vice versa.I think foreign brokerages show the trades executed in a separate window.Also called time and sales if i am not mistaken.

Hmm, I know, but I guess this will be tough. Will share a word with the team.

Hi,

Any plan on adding prints to the level 3 data feature.

Prints?

Sir, Can you please clarify that If some one writes false information in disclosed quantity how can we truly understand the actual size at that level ? For ex- an Ask size at a price 100.0 is showing 350qty but actually the seller placed order to sell 500qty. He disclosed 350qty only making the size small.

Please correct me If I am wrong some where

No, that is not possible as the system wont allow that.

Please let me know when will your team fix this patch. I will then download the pdf\’s accordingly.

Thanks & regards

Hi Karthik, I saw on this particular module and some others, that the number of chapters mentioned in the module, all of them are not coming in the pdf. A couple of chapters are missing in some modules. Anyway you can fix this please?

Regards

These are new chapters which got added recently. Will try and get them updated.

You have given to look from another perspective and I have applied it today it works 110%. Thank you for sharing this gem!

Happy trading, Arshad!

Chapter 15 is not integrated in Module 1 PDF. Same is with some other modules as well. Can you please fix??

Thank you

Thanks, will point this out to the team.

Regarding the usage of this data for placing options trading.

Does that mean, if I put limit buy order at the prices shown in offer, then that would be fulfilled? or would the order be first full-filled for the lowest offer first?

What would be a trading strategy in such a case?

Limit order helps you fulfill the order at the specified price, Dinesh.

Dear Karthik,

I know this may sound silly but i am not able to understand the pictures which have the blue and the red text on em. If its not too much, could you explain it to me in much simple terms?

Rishi, that is called the bid and ask price. Do check this chapter, section 9.6 – https://zerodha.com/varsity/chapter/the-trading-terminal/

Hi, Karthik… Thanks a lot…

I had started few days back and reach up to here. You had not told anything about finding of S&R level.

Can you brief something on that or does we have separate module on S&R level finding?

Not sure how you missed this. Check this – https://zerodha.com/varsity/chapter/support-resistance/

Hello Karthik, compliments for the quality and simplicity of the write up.

Any updates on the depth 20 for commodity?

Not yet, Yatesh.

completed the first module. it really helpful for new traders. thank u sir.

i have a doubt

if number of total bids are more compared to total offers in a share , then that share will form bullish and if it is vice versa means stock moving bearish. Is this really true?

That\’s not true at all. In fact one of the most common misconceptions in the market. I\’d suggest you ignore it completely.

Sir i am not able to understand this concept of market depth 20 and how it can benefit me in trading please explain

I\’ve tried to explain the same here in this chapter, Pratham.

Hi,

When I downloaded the pdf for different, I found that few chapters in many modules are not included in the downloaded pdf. Is it a bug or is it going to come into the pdf in the future?

Thanks.

It should be updated, let me recheck.

Why this facility is not available in BSE

Not for now.

Oh.. Ok. Np 🙂

Can u kindly make me understand the reason behind it??

Is it because of bandwidth issue or are there any regulations restricting it? Because since you are providing level 3 data(eg : depth upto 20) on kite application what is restricting you do the same for api?

No, not bandwidth issue 🙂

If there is lack of liquidity, then it does not matter which one you look at – top 5 or top 20, the order book will be empty 🙂

Hello Sir,

This is a nice initiative. Kite connect API are providing level 2 data as of now. Is there any plans of providing level 3 data through api\’s??

Not for now, Harsha.

sir, i didn\’t understand why to place SL order at 1290 in above example.

That is the likely support area, Prem. Please do read up the chapter on Support and Resistance – https://zerodha.com/varsity/chapter/support-resistance/

I am writing about the message from Neeraj on November 9, 2019. The reply button does not work for some reason, hence posting a new message…

I totally agree with what Neeraj is requesting. Whole point behind 20 depth data is to identify high volume bids/offers and then use this info to either identify SR levels OR to identify the price spread of your market order. The rate at which the level 3 data refreshes makes it very difficult to process this. Instead visibility to top 5 or 7 levels with highest volume on bid/offer side would be really handy. Please check the technical feasibility of providing this.

Very happy to see you providing level 3 data already… but yeh dil mange more 🙂

And we love to do as much as possible 🙂

Very elaborate content. learnt a lot guys, thank you. keep up the good work.

Happy reading!

Very nicely explained. Very easy to understand

Happy reading!

I couldn\’t have expected a better explanation and usecase of 20 market depth. This would definitely help long way.

Thank you so much !

Good luck, Ajit.

Hello Karthik sir,

Thanks so much for the lessons on stock market. Please I wish to know if someone in Africa can trade in the Indian stock market and even that of other countries.

Thanks again as I await your response!

Hey Jude 🙂

Foreign nationals can invest in India via the FPI route, which may be a complex process for an individual. The best way is to invest in an India ETF if offered by any of the financial institute in your country.

FPI – http://www.in.kpmg.com/TaxFlashNews-INT/KPMG-Flash-News-SEBI-FPI-Regulations-2019.pdf

Hello Karthik sir

Firstmost, you have been active in replying all our queries, so a big THANK YOU. I would like to ask here that I have been into stockmarket from 2017. Till 2019 , I have been doing gamble around and lost many lacs. It was in this year I decided to learn complete ly in stock markets and then Invest. So even during gambling, I took aroung 1% knowledge. Now in last 2 months saw various vedios, webinars, learned multiple startegies and all but have not gone into basics of technical analysis, fundamental and all. I know how MACD works, what is MA, Bracket orders, MO and etc. as this are shown in every videos. But somewhere or the other in heart, I feel something is still missing and I may have taken giant step rather than micro step. . You may highilght on this. In this , I sold all loss making stocks which were 90% down in portfolio just to see them rise in next one month. I did this to release some funds but still feel like I should have waited. So please guide me what to do in all this current scenarios. In this market, you have so much to read and see, how do I start is the biggest question since I already know things that are advanced as said earlier. Can zerodha modules help me in this. Am I doing too much or too less is also a question here

Pratik, this is exactly how one starts, so don\’t get worked up 🙂

At a stage, you\’ll figure that you know things but everything is scrambled. You need to connect the dots and ensure there is an order in this madness. You will find this order only with more market experience and by going through multiple market cycles. Until then, reduce your capital exposure in the market and trade with sums which will help you validate all the learnings in the market.

Good luck and stay profitable 🙂

Sir can you please explain how to use market depth data…how to interpret it in live market

This chapter is about that no 🙂

What is meant by spread of 0.149%?

Difference between the bid and ask.

What do you mean by Contract availability ? Can you please elaborate.

One value addition to this web Page can you put the post comment tab above the comment & discussion area.

since a person has to come all along down to post.

Contract availability = liquidity. Basically you should be able to easily buy and sell the contract. Thanks for the suggestion, Asif, I will bounce this to the tech team.

Dear Kartik,

Is it better to trade in options or trade big quantities in intraday?

It all depends on how you trade right?

Sir,

this feature will likely save from excessive stop loss hunting in intraday also. I just started micro trading and now i know how to save myself from stop loss hunting…

Hmm, you may also want to read this – https://tradingqna.com/t/a-query-on-stop-loss-hunting/38650

For fundamental..

Hello Karthik Sir,

I have just started reading from module 1. Just need to know how this chapter of supplementary note can be a part of introduction to stock markets. Because, a person like me who have just heard of options but dont know of it is reading this chapter will be confused. I think this chapter must be part of F&O section is what I feel. Do comment back.

Also, need a small guidance from your side. I am daily looking around various videos, attending various webinars and reading various books on trading and investing. I am a bit of confused somewhat and when I go in live market I feel like what to do now even after reading and watching so much. What should be the best approach to avoid this and be consistent in trading and investing. Any inputs from your side is valuable to me

Pratik, yes, what you say makes sense. I included this chapter here thinking that this is a feature on the trading terminal. Too late to move, but will add a disclaimer here.

I understand that it can get overwhelming. Set yourself small goals in the market and try to focus and achieve only that. For example, goal for day 1 can be to figure out how to place a market order, the goal for day 2 can be to figure limit order, day 3 may be to read how bid-ask changes. Do this for a month – small learning objectives on a daily basis and after a month, you yourself will feel that you\’ve learnt quite a bit. If you have any queries, feel free to ask us.

Hii Karthik sir,

Ur articles are soo great!, infact I got lot of information related to tarding and investing frm varsity zerodha…

I am newbie in stock market…

I wanted know more about how to calculate intrinsic value in depth…

Can u pls suggest any blog so that I can access to it….

And, if I want access historical ratio\’s where do I have to search for it?

Rehka, I\’m glad you liked the content. YOu\’d like to calculate intrinsic value of which one? Stock (fundamentals) or options?

completed 1st module. was very knowledgeable and easy to understand. hope these pace is through out the course.

I hope so too, happy reading 🙂

hi karthik sir,

is there any knowledge needed to understand this whole topic coz i\’m finding difficulties in understanding this concept.

Will you please help me gaining right knowledge

seriouslly i didn\’t understood a single point in this

Start from the first chapter, Himanshu. Let me know if you are stuck anywhere. Will be happy to help.

Hi,

could 20depth data be used to identify the trend direction ? Bullish or bearish , can number or volume of bid/ask suggests direction of trend ?

Hmm, not really. It is best if used keeping intraday trades in perspective.

Yes sir

Hi Karthik Sir,

I must say my foundation for trading started with varsity, i am glad i came to know about varsity which has the knowledge shared by a person like you with vast experience in trading & investing, how simpler can someone make the concepts of trading & investing understandable to others so that even a person like me could understand about it atleast to an extent, it was after reading the topics in varsity i was able to understand the terminologies used in trading & investing when i read a book or when others are talking about it, it really helped me to learn gradually and explore things which i really needed, 20 market depth is really useful tool for me when i combine it with VSA concept sir, hope you come up with an elaborate topic on VSA in trading thank you sir

Thanks for the kind words, Rajan 🙂

By VAS do you mean Volume spread analysis?

Karthik, Nicely written in simple terms a very good refresher of jargons and Knowledge. Examples were relatable, 20 market depth level 3 analysis is slightly confusing for me. Considering I\’m a retail investor its a good to know not a must know.

Thank you for the material. All the best

Happy trading, Teja 🙂

Yes, this is good to know and not really required to move forward.

Sir, your material and practical approach is even better than an MBA college. This material has given me more knowledge than my college. Why don\’t you launch your books for CFA, FRM….

Happy to note that, Sandeep. The current focus is to develop content to help the trading and investing community at large, so hopefully after this goal is done 🙂

Hello Zerodha team, Nice article about bridging the \’informational assymetry\’ gap for retails traders! Thanks for making life easier for retail traders. Quick question: It seems like Level 3 data is mostly useful for intraday trading or short term trading. How is this useful for long term investors?

You are right, level 3 is mainly used for intraday trading/scalping. It is of no use to long term traders.

apart from annual report how can i get knowledge of that particular sector?

You can look for sectoral reports from the industry body. For example, SIAM is the industry body for auto, TRAI for telecom, etc.

Sir if i want to invest in a fmcg company….

So i need to study the fmcg sector….

So how to study that particular sector ..

I mean what are the sources to study a particluar sector?

Pick up the annual report of an FMCG company and start reading it. This is the best way to develop a sense of whats happening in the industry.

SIR

the 20 depth move so fast one ia not able to grasp the content. what is the remedy

Tis an incredible tool not only for perfect scalping but a good intraday swing trade can be executed with a limited sl. I really appreciate the effort Zerodha has taken to take our broking industry to next level.

However sometimes I feel a problem when level 3 gets stuck and if youre in the middle of trade that too in a large turns out PAINFUL. I shouldn\’t whine though.

Thanks, Ravi 🙂

Hi, Is this available in MCX also.

Not yet, Amit.

great information karthik…please keep us updated with such tools and information 🙂

Will do, Shubham 🙂

Hi Karthik,

Can i get kite 20 level data in google sheet or in excel or in Json format to my analysis.? Also will you provide any kite API to consume this 20 level data to another platform ( even with some pricing model like per user billing ) ?

No APIs or other formats for level 3 data, Vicky.

Hey man !

I just want to say, Thank you.

I\’ve been reading a lot of investment books but I was still overwhelmed about trading. After carefully going through the first full chapter. I am a lil bit confident to get onboard now. Thanks to your well written and superb simplified examples it was easier to grab on.

Thanks for letting us know, Abhishek! Happy reading 🙂

Hi Zerodha Team,

1) 20 level data only beneficial when you can save as a historic order flow data for future use else no one can make decision basis on 20 level data or 5 level of data.

2) As you already having 20 level bid ask data, Can zerodha provide historical order flow levels,real time order flow via heatmap like Bookmap providing.

3) Can you please provide cumulative delta and AVWAP in kite?

1) Depends on your trading strategy

2) This is not possible, I will anyway check with the team

3) For the delta bit, I guess you can check with Sensibull team. Maybe they can.

If I have my brokerage with in FEB 2020 is above 100 but what if, If i fail to pay the same brokerage next month. Will my account he out of the factility

Sir, I have my Demat and trading account with you.,

I need your help to get this level 3 depth data into excel or google sheet table.

Please advice me how to pull it.

Thanks again!

This may not be possible. However, I\’ll double confirm this from the team.

Sir may I know who to get this 20 depth figures real time data into excel or google sheet.

Can you help me!

Thank You.

Hmm, this can be tricky. Not sure if this can be done.

Hello Team Zerodha,

My currently paid brokerage is more than 100 rs in this month but still not see this option

The list will get updated soon. Else, I\’d suggest you speak to the support team for this.

Is it Availabe on Pi ?

Nope, Kite only for now.

Hi Karthik,

A Newbie this side, as per my understanding, as a buyer I should be looking at the offer price section right? If yes, I would always look at the lowest price to buy the shares, and the lowest price is always at the row 1 of the offer section, in that case how is the rest of the data in the other offer section rows helping me to buy the shares? Please help me understand this

I had generated more than Rs100 brokerage but still I can\’t see 20 Dept

The list will be updated frequently. I\’d also suggest you create a ticket here – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/articles/view-20-depth

How can saw 20 market dept

Click on the market depth to see this option.

Hi sir,

Thanks for such a nice initiative. Pray and hope we make best use of it and get the benefits.

However, is there an example of how retail investors can use it to avoid being stoploss hunted.

Also, is it only for Shares currently. Not seeing for CrudeOil.

Thank you.

Its not available for crude oil/MCX contracts yet.

Zerodha is just fooling people,if they really want to help then at least they should provide the bridge for connecting kite to tools like ninja trader

John, how is this fooling people?

Hi,

The feature is really good.

But I have a suggestion, can zerodha implement top 50 gainers and losers.

Thanks, will pass this feedback to the dev team.

Level 3 or 2 is useless unless these data can be imported into tools like ninja trader,jigsaw.i had requested for a bridge for kite and ninja trader ,I was ready to pay for the bridge but I was turned off,your support team said I will have to develop it my self,I am not from IT background so it is not possible for me to develop the bridge,in short level 3 is useless ,in fact it will do more harm by using it without the tools

Thanks for the feedback, John. Will pass this to the dev team.