3.1 – Overview

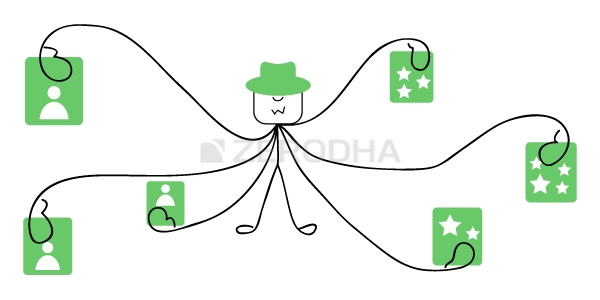

Many corporate entities work in tandem to ensure transactions in the market flow smoothly. Right from the time you log in to a trading terminal (let’s say to buy shares), to the time these shares hit your DEMAT account, market intermediaries work seamlessly together to ensure your transactions flow without any hiccups.

These entities play their role quietly behind the scene, always complying with the rules laid out by SEBI and ensuring an effortless and smooth experience for your transactions in the stock market. These entities are generally referred to as Financial Intermediaries or market intermediaries.

Together, these financial intermediaries, interdependent on one another, create an ecosystem in which the financial markets operate. Let us quickly review a few of these key market intermediaries and the roles they play in the ecosystem.

3.2 – The Stock Broker

3.2 – The Stock Broker

The stockbroker is probably one of the most important financial intermediaries you need to know. A stockbroker is a corporate entity registered as a trading member with the stock exchange and holds a stockbroking license. SEBI grants the license through due diligence, and the broker is expected to comply with the rules prescribed by SEBI.

A stockbroker is your gateway to the stock markets to make investments in stocks, bonds, ETFs, and Mutual funds. To transact in the stock market, you must set up (open account) with a stockbroker of your choice. Many stock brokers are registered in India, and you can choose a broker based on personal criteria. A few popular filters based on which people select stockbrokers are –

-

- The simplicity of the broker platform

- The efficiency of the broker’s support system

- Access to ready reports – Profit & Loss reports, Tradebook, Tax P&L

- Broker’s net worth (you dont want to deal with a broker who is not profitable or does not have a good P&L)

- Initiatives like education

Once you decide on your broker and open a trading and DEMAT account, you can start transacting in the stock market. After setting up your account, there are a few standard ways to interact with your broker.

-

- You can call your broker, identify yourself with your client code (account code) and place an order for your transaction. The dealer at the other end will execute the order for you and confirm the status of the same while you are still on the call.

- Do it yourself – this is perhaps the most popular way to transact in the markets. The broker gives you access to the market via a ‘Trading Terminal’. After you log in to the trading terminal, you can view live price quotes from the market and place orders yourself. For example, Zerodha’s trading platform is called ‘Kite’.

- Advanced users can access the market programmatically via APIs. Some of the brokers provide APIs for a fee.

The essential services provided by the broker include…

-

- Access to the markets and allow you to transact

- Margins for trading, we will discuss this point at a later point

- Support in terms of call and trade, help you resolve queries, educate you on markets

- Issue contract notes for the transactions – A contract note is a written confirmation detailing the transactions you have carried out during the day.

- Facilitate the fund transfer between your trading and bank account

- Provide you with a back-office. The back office is a portal to access many reports about your account. Zerodha’s back office is called Console.

- The broker charges a fee for the services provided, also called the ‘brokerage charge’ or just brokerage. The brokerage rates vary, and it’s up to you to find a broker you think strikes a balance between the brokerage charged and the services provided.

3.3 – Depository and Depository Participants

3.3 – Depository and Depository Participants

When you buy a property, the only way to identify and claim that you own the property is by producing the property papers. Hence, it becomes essential to keep the property papers safe and secure.

Likewise, when you buy a share (a share represents part ownership in a company), the only way to claim ownership is by producing your share certificate. A share certificate is nothing but a document entitling you as the owner of the shares in a company. Before 1996 the share certificate was in paper format; however, post-1996, the share certificates were converted to digital form. Converting a paper format share certificate into a digital format share certificate is called “Dematerialization,” often abbreviated as DEMAT.

Did you know the Harshad Mehta scam of 1992, played a significant role in digitizing the share certificate? I’d suggest you watch the SonyLiv series on the Harshad Mehta saga, it gives you a good perspective of the market’s ecosystem before it went digital.

The share certificate in DEMAT format has to be stored digitally. The storage place for the digital share certificate is the ‘DEMAT Account. A Depository is a financial intermediary that offers the Demat account service. Think of the demat account as a digital vault for your shares. As you may have guessed, your broker’s trading account and the DEMAT account from the Depository are interlinked.

For example, if your idea is to buy Infosys shares, then all you need to do is open your trading account, look for Infosys’ prices, and buy it. Once the transaction is complete, the role of your trading account is done. After you buy, the shares of Infosys will automatically get credited to your demat account.

Likewise, when you wish to sell Infosys shares, you must log in to your trading account and sell the stock. The act of selling is carried out in your trading account. But in the backend, because your trading account and demat account are linked, the broker debits your demat account of the shares you have sold.

At present, only two depositaries offer DEMAT account services. The National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited. There is virtually no difference between the two, and both operate under strict SEBI regulations.

You cannot walk into National Stock Exchange’s (NSE) office to open a trading account, likewise, you cannot walk into a Depository (NSDL or CDSL) to open a demat account. To open a demat account, you must speak to a Depository Participant (DP). A DP helps you set up your DEMAT account with a Depository. A DP acts as an intermediary between you and the Depository. Even the DP is governed by the regulations laid out by the SEBI.

Zerodha is a depositary participant of Central Depository Services (India) Limited (CDSL).

3.4 – Banks

3.4 – Banks

Banks play a straightforward role in the market ecosystem. They help facilitate the fund transfer from your bank account to your trading account. Both the trading account and bank account are linked. Broker’s link these accounts after verifying your bank account.

You can link multiple bank accounts to your trading through which you can transfer funds and trade. Irrespective of how many bank accounts you choose to link with your trading account, funds can be withdrawn to only one bank account. The account you choose to withdraw funds (from your trading account) is called the ‘Primary account.’ At Zerodha, you can add one primary bank account and up to 2 secondary bank accounts. You can add funds to all the bank accounts, but withdrawals are only processed to the primary bank account.

Also, dividend payments and money from buybacks will be sent to the primary bank account. The primary bank account is connected to your trading account, the Depository, the Registrar, and the transfer agents (RTA).

At this stage, you must have realized that the three financial intermediaries operate via three different accounts – a trading account offered by your broker, demat account offered by the depositary participant, and a Bank account offered by a bank. All three accounts operate electronically and are interlinked, giving you a seamless experience.

3.5 – NSE clearing Limited and ICCL

3.5 – NSE clearing Limited and ICCL

NSE Clearing Limited and Indian Clearing Corporation (ICCL) are wholly owned subsidiaries of the National Stock Exchange and Bombay Stock Exchange, respectively.

The job of the clearing corporation is to ensure guaranteed settlement of your trades/transactions. For example, if you buy one Biocon share at Rs.446 per share, someone must sell that one share to you at Rs.446. For this transaction, you will be debited Rs.446 from your trading account, and the seller must be credited that Rs.446 toward the sale of Biocon. In a typical transaction like this, the clearing corporation’s role is to ensure the following:

-

- Identify the buyer and seller and match the debit and credit process

- Ensure no defaults – The clearing corporation also ensures no defaults by either party. For instance, after selling the shares, the seller should not be able to back out, thereby defaulting in his transaction.

For all practical purposes, it’s ok not to know much about NSE Clearing Limited or ICCL simply because you, as a trader or investor, would not be interacting with these agencies directly. You need to know these institutions are also heavily regulated and work towards a smooth settlement and efficient clearing activity.

Clearing corporations are also involved in the margining process, which is critical while trading complex instruments like futures and options. Perhaps, we will discuss this aspect in a related discussion.

The key takeaway from this chapter

- The market ecosystem is built by a cluster of financial intermediaries, each offering services unique to the functioning of markets.

- A stockbroker is your market access, so choose a broker that matches your requirements.

- A stockbroker provides you with a trading account that is used for all market-related transactions (buying and selling of financial instruments like shares)

- A Depository is a corporate entity that holds the shares electronically in your name in your account. Your account with the depository is called the ‘DEMAT’ account.

- There are only two depositories in India – NSDL and CDSL.

- To open a DEMAT account with one of the depositaries, you must liaise with a Depository Participant (DP). A DP functions as an agent to the Depository

- A clearing corporation works towards clearing and settling trades executed by you.

Plus one, i have same doubt

Can\’t a depository participant and a stock broker be the same entity? Also could you clearly distinguish between a stock broker and a Depository participant?

They are the same entity. Its like a stock broker having the DP license from Depository.

Hi @kartik rangappa

I have a doubt. Every now and then i keep getting debited Rs 2000 from my account and it shows that the money was debited from the ICCL (Indian Clearing Corporation Limited)

Can you please help me understand what this means and why i am getting debited the 2000 Rs ?

Thanks,

Rishab

This is against purchase or sale of stocks.

Can we say that these broking companies are known as DP ?

Yes, you can say that.

Hi Karthik, really appreciate your efforts for creating this knowledge sharing platform and improving financial literacy in India, it is really helpful for beginners like me. One question I\’d like to ask you is that, what prompted the need to make Stock broker, Depository and Clearing House as separate entities? Wouldn\’t it be more cost effective and efficient to have a single entity perform all these tasks? Is it to safeguard investors in case one of these entities fail? Or is it because of regulations?

Ishan, each of these entities have several moving parts. Not easy or wise to club them 🙂

Trading Account, Demat account and Bank account are interlinked.

Zerodha as DP provides us the DEMAT Account.

Who is providing the Trading Account.

Zerodha itself 🙂

Hello Kartik,

At 45, I am quite late into this journey. I had tried earlier 4 years ago and gave up on chapter 1 (due to lack of discipline) I had even left a time stamp there 🙂

Starting over again. I\’m hoping this time would be different.

Going through every single comment is long but sometimes there are hidden gems. So worth it.

I have a situation similar to https://zerodha.com/varsity/chapter/financial-intermediaries/#comment-61774 I was hoping if there is an answer.

My mother owned physical shares of Reliance Industries. (No nominees recorded then) She passed away and we never transferred those shares. They are still in physical format.

My father passed away last year.

My sister and I live abroad and want these shares transferred into our names.

I understand from the past that we will need to go through the process of creating a Succession Certificate.

My question. Would this be the following process

1. Hire a consultant (advocate someone) to help with the succession certificate. Does Zerodha provide any references for the same?

2. Create a joint ac with Zerodha

3. Initiate the process of transfer.

In case my sister is okay with transferring it in my name (due to the logistics of her coming down with the kids) I guess that she has to provide some NOC. Does this work differently for the transmission of shares?

Appreciate your and Zerodha\’s initiative.

Thanks,

Glen

Hi Glen, welcome back 🙂

As a first step, I\’d suggest you reach out to the DP team from Zerodha to get an overview of the process and then follow it accordingly. It will be much easier that way. I\’m assuming you have an account with us already?

i would like to know if every stock broker is allotted the same intermediary bank or different intermediary banks? and what is zerodha s responsibility if there is an issue going on with its intermediary bank?

Brokers have no control over banking operations, Puneet. This is outside broker\’s scope of work.

A very concerning development today. I had invested in tax saving units of kotak in march 2019. The nsdl statement at end of march2019 shows the units in my demat account with hdfc bank demat. Now in 2024 i find out that the units are not reflecting in the demat account. On enquiring repeatedly and after a long one month back and forth CAMS tells me that they reversed the Units on 15 April 2019. HDFC Demat team informed me that the Units were redeemed in July 2019.

HDFC securities through whom i conducted the transaction has not credited my account with any refund. On enquiring with them they have confirmed no such refund transaction to my account. The payment has been made from my HDFC Bank account.

It is ridiculous that HDFC Demat has fraudulently withdrawn Units from my demat account without any express instruction from me. I have been kept in the dark and just found out after 5 years, on checking and tallying the demat account.

Is HDFC Bank Demat allowed to withdraw my units without informing me and without even paying refund of the original amount which I had invested? The amount i had invested has appreciated by more than 150% but now i find that the very units are cancelled. Who is responsible for this loss of mine and against whom should i file case against??

This is unfortunate. Firstly, the funds or securities cannot be withdrawn or moved without your consent. The good thing with the system is that there is a proper trail of money and securities. Here is what you can do, and I\’m guessing you\’ve already done this, but anyway –

1) Show the NSDL statement to indicate that your DEMAT had the MF Units.

2) Show bank statement (or trading account ledger) to show debit of funds towards the purchase of securities.

3) Show the bank statement for April, May, June, July, Aug etc to indicate that there is no refund of funds.

With these documents, you can reason with the staff of the broking company. If there is no proper explanation, then you can take this to the regulators via SCORES platform – https://scores.sebi.gov.in/

Good luck.

hi karthik,

i doesn\’t understood the role of clearing corporation, like if clearing corporation make settlement of trades then what stock broker will do. can you explain what is the how a stock broker is differ from a clearing corporation ?

Stock broker is the conduit for all transactions. Imagine, if you are with Zerodha and someone else is trading with ICICI, then without a central agency, how can trades clear?

thanks

Karthik sir my question is –

Why do maximum brokers become DP for CDSL and not NSDL ? Because i checked on official websites of CDSL and NSDL and i noticed that many brokers such as Zerodha, Groww, Angel One, etc. are DP for CDSL and not NSDL

I\’m tempted to tell you that Zerodha on boarded with CDSL and created a playbook, and the rest copied 🙂

Can we change the primary account.??

the point that has mentioned in filters to check before selecting stockbrokers.

Of course, you need to ensure you are with the right broker.

Can you please explain about efficiency of broker\’s support system?

You mean how quickly broker\’s respond to support tickets?

What are APIs and how to place orders through it?

You can check this – https://kite.trade/

What is the difference between depository and depository participant?

Its the same analogy as Stock exchange and stock broker. Here Depository offers the service of safe guarding your shares in DEMAT mode, and DP manages client relationships and managing accounts.

GREAT WORK…..amazing content. it is really helpful for people. Gaining too much knowledge from the module.

Happy learning, Manya!

May I know the need for a DP? Can\’t brokers, who are facilitating the investors in opening the DEMAT account, connect directly with depositories?

Brokers are DPs 🙂

Sir abhi Tredington ke bare m jada kuch nahi pata kya m zerodha se gyan prapth kr skta hu

will the process carry out automatically, if i bought shares from NSE (in that case my shares will be sitting in NSDL) and after few days i wanted to sell in BSE. Will the shares be transferred from NSDL to CDSL? And can we generally buy and sell shares bought in different exchanges.

You can, once the shares are fully settled.

Taking as a comparitive example, If I think Stock Exchange as a bank, depository as as locker and stock broker as a bank employee stock broker can act as a link between investor, depository and stock exchange. Then why is the DP required. I am trying to understand DP in detail. Can you help me understand with some real life example? Thank you.

Just like how a customer cannot interact with the exchanges directly and would need a broker, likewise for a depository. Customers would need a depository participant (DP) to liaison between the depository and the customer.

\”You can add funds to all the bank accounts, but withdrawals are only processed to the primary bank account.\”

Does it mean that funds can be added from all the bank accounts but withdrawals can be done to primary account only?

Yes. You can link more than 1 bank account to your trading account.

Possible changes:

1) Broker’s net worth (you dont want to… ~ change \”dont\” to \”don\’t\”

2) Did you know the Harshad Mehta scam of 1992, played… ~ Change to \”Did you know that the Harshad Mehta scam of 1992 played…\”

3) Broker’s link these accounts… ~ Change to \”Brokers link…\”

4) A stockbroker is your market access… ~ A stockbroker facilitates your market access… ?

5) A DP functions as an agent to the Depository ~ add full stop

Thanks so much for pointing these, will fix them 🙂

Hi Karthik,

The course content is really good and you are providing free access to the content and that\’s really great. I have one suggestion though. Could you please introduce Previous and Next buttons at the end of the chapters, so that it is easy to directly go to the previous or next chapters.

Thanks, Amarnath. We will do that soon. Thanks.

Really amazing less, I went through. Happy that I\’ve started market with Zerodha.

\”Broker’s net worth (you dont want to deal with a broker who is not profitable or does not have a good P&L)\”

How is broker\’s net worth related to chose a broker when all the transactions are done by user alone.

There are so many instances where a broker funds your trade, as a user, you may not realize this. So its important to choose a broker who is financially strong.

What is the difference between a Stock broker, Depository Participant?

Is Zerodha or any other firms like Upstox, Angel Broking, Motilal Oswal DP or stock brokers?

We have explained all these and more in the chapter itself 🙂

are all stock brokers depository participants? if some stock broker is not a DP – how does it work?

So – I\’ve registered with Zerodha and I can do the whole process of selling and buying stocks and they come into my account.

So – if i had registered with a non-DP stock broker – say X. How would the transactions take place without a demat account – as X is not related to any depository?

They have to tie up with a DP for this. With Zerodha, you can. There is no restriction as such in terms of transaction limits.

i have a suggestion please explain the concepts by portraying diagrams or flow chart wherever required it would be helpful in understanding more clearly

We have done that across most of the chapters, Yashwanth.

Hello Karthik,

Someone had queried about RTAs in comments earlier too.

I believe a section for this group of intermediaries will be useful as well, especially for retailers who use mutual funds via SIPs etc.

Groww provides a very good explanation in their Personal Finance pages here: https://groww.in/p/registrar-and-transfer-agents

Will include it, Alok. Thanks for pointing out.

Hey, so you said that when we buy shares of a company through the trading terminal, we take small ownership of the company ( in shares), so obviously this process is only possible when there are some shares of the company available for sale, but what if all shares are sold out, I know this would not be a practical question but still, what wold happen and has this ever happened before?

This does not happen, markets are a place where different opinions (about the price of a stock) floats. At every price point there is a buyer and a seller 🙂

In that case how I treat the bank just a normal bank or broker or both to me, if I open my trading account in that bank. Any example Sir

You can treat it as a regular bank. I\’d suggest you open a trading account with a regular broker.

I think all depositary participants are broker like ZERODHA but all brokers are not depositary participant. Am I right Mr. Karthik?

No, even banks can be depositary participants.

Maybe a silly question but theoretically speaking, suppose I sell a share but there is no one to buy or vice-versa. How does that work? Is that possible?

In that case, the order won\’t be fulfilled Som and it will be left pending in the system.

Hello, great content. Can someone please explain where a custodian comes into the picture in this ecosystem?

These entities play an important role in the mutual fund eco system, Arnab.

Ok got it. Thanks

Sure, let me know if you need any more clarifications.

I am a bit confused about what exactly is the depository, DP.

Also, how come Zerodha is a DP?

Think of this relationship – Stock exchange and Stock broker. Likewise, think of this relationship – Depositary and Depositary participant.

I want to buy share 07/04/023 on dated pls suggest the best companies

Sorry, we dont recommend stocks for trading or investing 🙂

Can a broker settle any trade client to client only.

I bought 50 shares of RIL which were not delivered to me. After 2 days money was returned and broker told that auction happened and as the seller was also their client so they have cash setelled it without following the proper aution process.

This is possible, Mohit.

Hey Karthik,

I have been studying about the markets for a year now, I trade in stocks too and I want to make my career in this field, may you suggest me the job positions or the roles I can play for the intermediaries(brokers, ICCL and depositories)?

Check this Rudra – https://www.youtube.com/watch?v=qI_Dr9P76Bw

What is the difference between functions of a broker and depository participant? I mean I find both are always the same. Or is it possible to have a different broker and a different DP – e.g can I have Zerodha as a broker and , say, SBI securities as the DP, or vice versa?

Technically you can, but it makes life very difficult. Broker provides you with a platform via which you can buy and sell in markets. DP is like an electronic vault in which you safeguard your assets like shares and bonds.

Hi,

While serching some information on Google, came across this link.

Very much intersted for all chapters as getting thorough knowledge from very basic. Very impressed and keen on complete all chapters.

Thank you for sharing this level of detailed explanation. Kindly keep spreading this awareness..

Thanks for letting us know! Happy learning 🙂

Thanks very much sir for giving such knowledge in a very easy 🥳💝

Its a great content as I mentioned earlier in another post. However, the way Video series and regular chapters are organised is a little confusing! For instance, the video series has ten chapters and the regular textual content has 15 chapters. I am unable to correlate which chapters in the text correspond to the chapter in video series. Becomes tedious when we are taking notes.

Look at both separately. The idea is, at the end of either watching 10 videos or reading 15 chapters, you should have gained similar knowledge.

Hi Karthik,

Thank you so much for providing us the comprehensive text on this subject. but one queries here that

When I downloaded the pdfs, the content is different as compared to the online texts given here. For example point 3.4 that explains about Banks role. So when can we expect to get the updated pdfs?

The PDF is largely the same. Small difference could be there, request you to overlook that as it wont make any difference to learning.

Thanks a lot for the great explanation.

Happy learning!

Hi Team Zerodha.

1. Why have a Trading account/Wallet? why not DP take money instantly from our Bank account like UPI when performing transactions?

2. Is there a way to have a look at someone\’s DEMAT account? How does everyone know Rakesh Jhunjhunwala\’s or other high net worth investors\’ stock picks?

3. Apple company has a 2B$ loan. Why do they want money from common investors then, when they can get a loan? (Getting a loan will be less risky right, Govt can bail them if they lose everything, in the shares market, a company usually have to give above-market returns to maintain its reputation)

4. . Can a company be listed on Stock Market and have private investors?

Adding to the above question. When I own a share of a company. I will have voting power, etc (heard this not sure). Then how are large companies like Reliance run by Ambani Families and their children? (Is it legal, even though Ambanis own 51% of RIL?)

5. Heard there are Class A, B, C shares, etc. What type of shares are traded on Stock Market? How to access other class shares? (Even if there are different class shares, will be valued at the same price for everyone)?

6. Google and Meta bought Reliance shares last year. It was told that Reliance sold its share to Google at a lower price than what it sold to Meta, How is that possible? (Isnt it against SEBIs rules)

7. . Recently Elon Musk said he would buy Twitter, It was a public traded company. does that mean, All the investors will be forcibly asked to sell their shares?

8. My mother purchased a gold bond in Canara bank. These are bonds issued by RBI on behalf of GOI. (where is NSDL, CDSL or Stock exchange involved here)? (Isn\’t it against SEBI rules)

9. Are there any shares reserved for Intraday trading and shares reserved for Long term investing? or is it people playing around with the huge pool of shares.

11. For investing in MF, We don\’t need to have a DEMAT account. Then how does SEBI take care of the investors in MF? It just regulates Fund Manager, is it?

Thanks for the great explanation.

1) You want to buy a stock, its time critical, and payment fails. What will you do?

2) Not possible. But when you buy large chunk of shares, it either gets reported by regulation or is self-declared

3) They would have raised money via equity, which is a cheaper form of fundraising compared to debt

4) Nope

5) These are in US, not India.

6) Not reliance, it was in Jio, a separate private company

7) Elon operates in a different orbit. That said, no, why will the public be forced to sell, unless its a very compelling open offer 🙂

8) The gold bonds will still in your mother\’s demat account held with either NSDL or CDSL

9) No, nothing like that

10) Demat is a means of storage. Its good to have shares and MF units in demat, but not necessary.

Happy reading!

Good work. BTW, due to recent SEBI regulations for Mutual funds, we end up needing to know ICCL. May be we could update this page. Thanks.

I have an account on Zerodha. Also on other broker services. I came to know that I can view all the DEMAT account details, trades, holdings etc on CDSL, and NSDL. But do not know the log-in process. Are there any details on this that I can read and understand here on Varsity? Thank you.

Yes you can. You can register and log in from here – https://www.cdslindia.com/Footer/Easiest.html

Like all the explanation & clarification.

Is it possible to order the comments with `Recent First` mode like any other platform does ? It\’s not so intuitive to read older comments first. A small change but can make big difference. People will really see that this product is still relevant after a decade (approx) from knowledge standpoint.

#just_a_suggestion

I know, Ketan. Will bring this up with tech team.

Hii Karthik, this is by far the best knowledge and content of share market i have come across ,Especially for someone from non financial background this is god sent .Right from the design and language and format everything is put in is just brilliant .Thank you for such great work ,And Zerodha varsity for bringing this knowledge to everyone .

Thanks for the kind words and I\’m really glad you liked the content Yogeesh. Happy learning 🙂

Great tips. I love reading this article.

I got the fact that we need to DEMAT Account to store the certificates, Trading Account to do the transactions(buy/sell), and Bank Account to debit/credit the money. Why do we need these 3 accounts? Why can\’t everything be merged into a single Bank Account so that we don\’t have to worry about all these things and we can straight away do the transactions using Bank Accounts and store the certificate in it only?

Because these are offered by 3 different entities, Shahroz. Also, the three accounts are seamlessly integrated, so it does not make a big difference.

So basically a DP(zerodha) helps us to open a demat account but I can\’t right away buy shares unless I have a trading account so whom should I open a trading account with. I mean does zerodha offer that to our a common investor like me who doesn\’t want to perform like daily trading activities doesn\’t need to open a trading account with a stock broker and if I need to plzz can someone tell me a good stock broker

Ayush, thats right. You need a trading account to buy and sell shares. You can open an account and use it to your preference, no need to actively day trade.

Everything was fine and easy to understand.

Can You Make videos of this it will be more easy then

Noted 🙂

thank u karthik.

Welcome!

Sir ,

Can I do trading or investment just by understanding all the chapters in varsity?

You will get a great start for sure, further, it depends on how you progress along in live markets.

Hi,

Refer section 3.5 above regarding NSCCL and ICCL. Understand these are the only clearing corporation and their job is to ensure settlement. Then how come zerodha is a clearing member? Had read a blog from zerodha which claims that zerodha is a clearing member now and therefore don\’t charge CM charges. Enclosing the link of the blog: https://support.zerodha.com/category/account-opening/charges-at-zerodha/articles/what-are-clearing-charges-and-is-there-any-at-zerodha

Clearing members like Zerodha should be associated with one of the clearing corporations, Vinod.

Hello sir

1. Supposed company publish 1000 shares and all shares sold out then?

2. How they increase the price of share

1) Then there is no liquidity in the market

2) Bids and ask goes up, hence price expectation also moves higher.

Hi Karthik , thank you for all the help and explanation , truly awesome !!

Some questions

1) Can one DEMAT be shared by 2 or more brokers ? If no please explain ?

2) Can we transfer share held in 1 DEMAT account to another DEMAT in case we hold more than 1 DEMAT account ? if whats the process like ? and is this Time consuming ?

3) IF the Broker goes bankrupt , will the shares held in the DEMAT account connected with his trading account be SAFE and can we still access them and sell it through another broker ? how easy is the process?

1) Its a very cumbersome process and not practical to execute. So, not, not possible 🙂

2) Yes, possible. For example, check this – https://support.zerodha.com/category/account-opening/getting-started/other-queries/articles/how-do-i-transfer-shares-from-another-demat-account-to-my-zerodha-demat

3) Yes, the shares are held by the depositaries.

Registrar and transfer agents (RTA)

Sir what is the role of RTAs????

They are responsible for a lot of your mutual fund allotment process plus the corporate action process.

Thanks

Hi,

Is there any foolproof system deployed in NSCCL ICCL? to avoid any false transaction during the clearing process..

The have robust process in place.

Hi Karthik,

I was wondering is there any website where I can find the ratio/Percentage of FIIs, DIIs and Retails investors investment and participation in the Indian market?

I tried googling but I couldn\’t find any reliable website.

Thanks

Sandesh Shetty

Sandesh, you need to check SEBI and NSE site for this.

understood the content

Hello! Thanks for al these insightful blogs. 🙂

Quick question. Can I use 1 demat account with two trading accounts? I have a Demat/Trading with HDFC. I\’m unable to buy Direct MFs via HDFC trading (only regular). I\’m thinking of opening a traiding account with zerodha but don\’t want the hassle of two different DP accounts.

So, to summarize, can I have my HDFC Dmat account linked with Zerodha trading account?

That won\’t be possible Neil.

Understood

how to search market capital

Type the company name and market cap in Google and you\’ll get it.

Hi Karthik,

This may be a silly doubt, but – What a depository participant (DP) to a DEMAT Account is like what an accountant is to a bank or what a teacher is to a school. Right?

Hmm, not really. What a DP is to a DEMAT is like what a Bank is to a bank account or what an Insurance company is to your insurance policy. BAsically, DPs offer you a DEMAT account which is used to store the shares digitally.

Thanks Karthik for the wonderful job. I have a query.

If I short sell a share by mistake, what would happen? Will it amount to being a financial fraud?

No, its not a financial fraud. If you have short sold on intraday, without buying back, then it may result in an auction. Check this – https://support.zerodha.com/category/trading-and-markets/trading-faqs/general/articles/what-is-short-delivery-and-what-are-its-consequences

I will follow your advice,

Thanks Karthik for your valuable suggestion.

Good luck, Rahul.

As we know , in any field to be a master you have give 10000 hr dedicately , does it work for trading and will it be worth it for me (19 yr old).

I have got mixed answer of this from different mediums still confused, just wanted to know your opinion on this.

Thats right. But please do check my previous reply to your query. You are better off giving this 10000hrs to another field where odds of success is high.

Hi, kartik I am 19 yr can I see trading as a full time career, if yes then how much capital is needed to start..

Rahul, please consider my advice. Don\’t look at trading as a full-time career, it is not easy and the odds of failure is quite high. You may as well choose a career path where you have higher odds of success.

Is it possible to buy the shares and sell those within minutes on the same day ‽

Yes, thats possible. This is called intraday trading.

It would be nice if there was an optional section in this module that maps all the intermediaries to the Zerodha Kite sign up process. I am a completely newbie to this whole process (just started working a few years ago) and wanted to learn. I signed up for a Kite account, and provided all the necessary documents. But I can\’t map Kite to these entities mentioned here.

1. Is Kite a Depository Participant? Or a Stockbroker in this case?

2. Does my trading account lie with Kite, or with Zerodha (the company)?

3. When I add funds to Kite to buy a share, am I moving the cash from my banking account to, what, a demat account, or a \”wallet\” of some type?

4. Where, within Kite, can I view whether I am on NSDL or CSDL, and how can I switch accounts if I want to?

All these and many more questions! I understand that Varsity is just for general education, and you cannot promote your own product here, but a SEPARATE, optional module at the end of this, would have helped clarify things a lot more!

Shikhare, I understand. Will put up a note on this. Meanwhile, here is a note for you –

An entity is called a stock broker, if the entity has a membership with a stock exchange. Zerodha is a stockbroker since we are a member of both NSE and BSE (stock exchanges). A stock broker gives you access to trade the market via a trading account. Our trading account (or portal) is called Kite. So Kite is a trading platform offered by Zerodha, the stock broker.

Zerodha also offers DEMAT account for you to hold your shares, hence we are a depository participant with CDSL. Note only a depository participant can offer your DEMAT accounts.

When you move funds from your bank, it moves to your trading account. Think of trading account as a wallet to transact in the stock market.

Login to kite and check the profile section to see your demat details.

Are NSCCL and ICCL subsidiaries of the SEBI or are they independent? If independent, why the need arose for them to exist when SEBI could have simply done their job?

These are owned by exchanges. Also, I didn\’t understand your 2nd question. SEBI is a regulator and not a financial service provider 🙂

Dear Mr. Karthik ji,

There are many types of orders like cover order, bracket order, limit order, stop loss order.

Out of ignorance, I have invested in equities for long term holdings with LIMIT ORDER type. Is it going to impact in any way ? May suggest if they can be converted.

Regards,

No, these orders are just a different way of transacting. So don\’t worry much about it.

Hi,

What is the difference between a trading account and a Demat account?

Regards

Trading account if for transactions, to buy and sell shares. DEMAT is to hold shares.

Is it compulsory to have a DEMAT account ? can we buy and sell stocks only having a trading account?

Yes, it required to have a demat account.

Thanks 👍👍👍

Custodian with regards to holding of shares, A custodian is a bank or financial institutions that hold financial securities such as stock, bonds etc.

so Karthik as per your article above, can we call cdsl and nsdl as depository as well as custodian?

Charan, on a regular basis, you\’d not need a Custodian to transact in the market. Yes, CDSL/NSDL are depositaries and act as a custodian of your shares. Note, when I say \’act as a custodian of your shares\’, take that in a literal sense. There are financial intermediaries called \’Custodians\’, whose services you will not need unless you particularly opt for it.

with regards to my above question, as per the article, who will be the custodian here?

Custodians with regard to?

who will be the custodian in the above scenario?

Hey Karthik!

Why don\’t depositories themselves offer the service of DEMAT Accounts and instead require a DP to be the liaison?

If I owned a bank with enough space to store your valuables, the bank would offer the service of lockers independently and not rely on a third party to set up and handle the locker operations.

I just don\’t seem to completely understand the necessity of DPs.

DPs and exchanges are not equipped to do client-facing business. Do check this for some perspective – https://zerodha.com/z-connect/rainmatter/direct-market-access-dma-for-retail-investors

Could you please explain what is the relationship between DP and a broker?

DPs hold your stocks, while the broker helps you transact with the stocks. A broker can also hold a DP licence.

\”A\” has 200 shares of RIL in paper format with his brother \”B\” being the second holder. Now \”A\” is no more. He has a son as his sole heir. So to whom would the 200 shares go.. to the second holder or the sole heir ?

To the 2nd holder.

I have understood the concept.

Good luck!

My query is – (1) I wish to know whether trading account – which is used by me to buy & sell shares & my DMAT account – in which shares held by me remain stored till they are sold or transferred – are two separate accounts with two different nos ? (2) Where can I find my trading account no & DMAT account No ?

That\’s right. They are two different accounts. Please check the profile section in Kite or Console.

Whether No of Trading Account and DMAT account is different or same one and where & how can I know what are my numbers

Sorry, I dint get your question, can you please elaborate a bit?

hello karthik sir,

i am absolutely beginner in stock market.i started learning about stock market from few days. i watch videos on YouTube at different channel ,but they are very confusing.some you-tubers says apply this strategy and some says other,some says do technical analysis and some says do fundamental analysis.

my query is as simple as that,can in this platform(varsity) as i read and understand every article step by step ,that help me to understand stock market and boost my confidence?

We have done our best to keep it simple and straightforward, so if you ask me, stick to Varsity and go with the flow 🙂

Thank you for this platform i was learning lot of things

Happy reading!

Hi,

As mentioned above there are too many intermediants like Depository, DP & clearing corporations, banks etc. My query is

1. Are we paying them any fee from our pocket or who paid them for doing these all things.

2. If we paid then how much are the fees to each of them.

1) Yes, there are charges for this. Check this – https://zerodha.com/charges , these entities exist to bring transparency into system.

2) See the link above.

don’t take it against you, i’m asking just for my awareness that your have salient knowledge of stock market. then why you and all market experts doing jobs ? they can’t get enough money by investing in market.

I\’ve never claimed that I\’m a good trader. I\’ve struggled and I have learnt from my mistakes and I\’m still learning. Its just that we are sharing our trading experience and learning to make it easy for others in their learning journey. I\’ve had a fair bit of success in Investing, and I intent to continue investing. There is no end point to investing.

I cant comment on others, Aditya.

Hi Karthik, does that mean that depository participants and brokers are same? If not, then what’s the difference?

They are two different companies, but yes, the same entity. For example, Zerodha Securities is the DP and Zerodha Broking is the stock broking arm.

What is the difference between Squaring off the trade and shortening the trade,Karthik?

If you travel from home town to a neighbouring city for work and after you complete the work, you square off. Meaning you get back home. Likewise, you initiate a long or short position with a certain desired outcome. After achieving that (or maybe not) you square off by doing the opposite trade. This is called square off. Shorting is to take a sell position first and then buying it back later. The buying it back later is the square off-trade for the short position.

It might not be relevant to what great work you guys are doing. I am pretty new to this and learning the trade through this excellent basic guide. However, I have seen that you are not being \”Inclusive\” and most of the content has only \”He\” mentioned everywhere. It might be true that most of the brokers are Male (I am guessing and not at all aware about this) but we need to include our better halves as well. Hope you will consider! Thanks in Advance.

P.S. : I have no intention to point out your mistake or show myself over smart. However, just a suggestion. I am sure you have female customers as well, who will love this gesture.

Thanks, Raghav. I completely understand your point. It is just that when I\’m writing, I only think about the subject and ways in which I can convey my thoughts better. I don\’t pay too much attention to any other things, but I guess I have to. Thanks for pointing.

Good day Karthik, How are u doing?

1. Only one bank account can be linked to one trading account. Can the same bank accounts be linked with two or more trading accounts with different brokers?

2. If I have two different trading accounts with different brokers, is the DMAT account common to both the trading accounts or there are two different DMAT accounts?

Thanks,

Shashanka

1) You can link multiple bank accounts and transfer money from these accounts to your trading account, but you can transfer money from your trading account to only 1 designated bank account called the primary bank account. Yes, you can link the same bank account to multiple trading accounts with other brokers.

2) You can have a common DEMAT, but its a mess. Better to have a two different accounts.

as i buy shares through a particular dp [eg;zerodha] will he can see the shares which i have bought…or if he can see how come this will be safe that he will not pass such information to others

Yes, the DP will have access. But most of these processes are system driven as the daily transaction volumes run into a few million rows.

Please share all the videos of the chapter on you tube..eagerly waiting to see more of them and their are many friends who wanna see them as well

make all the videos the chapter. on you tube as I have seen only 2 of them

We dont intend to make videos, Ratik.

Hi Karthik, thanks a lot for the wonderful website. I just want to know

1. Whether the T+2 settlement is applied to all the CNC orders? If not then how it is decided?

2. Why it sometimes says, this particular order is not supported MIS take CNC instead?

3. Why negative position is not supported in CNC orders?

1) Yes, to all orders

2) You cannot do MIS in few stocks, this msg is to warn you about it

3) No, to sell in CNC, you need to have the shares in your DEMAT

Hi Kartik,

Recently I have opened trading account in zerodha, As you mentioned earlier trading account is just to make financial transaction like buy and sell the shares. In order to hold the shares in your account DEMAT account is required .

I have simple query on this do i need to open separate DEMAT account apart from trading account to do the trading.

If yes then guide the process.

Yes, you need to open both DEMAT and Trading account.

Can you please clear exactly who is trader and who is broker? Zerodha is a trader or a broker?

Hi Syam, a Trader is a person that invests in the capital markets, in a simpler way one who buys and sells stocks and securities for his personal benefit. And Broker is an entity that facilitates the buying and selling of the stocks and securities on behalf of its clients. Hence, Zerodha is a Stock Broker – to learn more about us you can visit our website http://www.zerodha.com.

Zerodha is a broker. You are a trader.

if someone want to open account in Zerodha without POA is it possible to open?

What is alternative to POA if you want to buy/sell on yearly basis? (i mean if some want to do passive investment)

Yes, you can use the consent route, check this – https://support.zerodha.com/category/account-opening/online-account-opening/articles/what-is-power-of-attorney-and-why-is-it-needed

Sir,

This is in reference to your comment \”DIS is required when you have to transfer shares from one DP to another. It is not required when you plan to sell them via a trading terminal\”.

1) As per my understanding, there is limited PoA to the broker to transfer shares during the settlement process, the absence of which necessitates a DIS instruction. Have I inferred it right?

2)Such transferred demat shares lie in the pool a/c of the broker for utmost 24 hours before the settlement process draws to a close. Is this true?

3)Does this PoA exist over the bank a/c that is linked to the trading account or is there a similar mechanism as DIS for funds outgo each and every time a trade is executed?

4)What are the checks and balances that are in place to see that the PoA is not misused?

Hi,

Do the Bid and Ask quantities are across that broker or through the whole exchange?

Yes, this is consolidated across all brokers.

Thank you So much Karthik 🙂

I am really enjoying these modules.Great resource to learn equity market.

Happy to note that, Sandip!

Hi ,Where can i get this my DEMAT Account No and DP No and trading Account Number?

You should log into Console and check the profile section – https://console.zerodha.com/profile

Main article is well supported with the Q&A thread which reinforce the understanding. I liked it..

Happy reading!

Hello, Karthik many things have been not updated in the download pdf option, like in this chapter under bank section you can compare the two things both are different. Please update them

Thanks, Aryan. Will check.

Thank you so much for the very informative articles.

Although slightly out of context may I ask this query?

If the bank where the primary bank account does not provide facility for rights issue subscription via ASBA (Application Supported by Blocked Amount) channel, What is the possibility of using the bank account of a relative or a new account of the same account holder with another compatible bank.

That will not work, Rafi. You need to use the bank account linked to your DEMAT.

sir

1. to claim business expenses ,what kind of (proof of various expenses ) are needed to be shown while filing ITR .

2. for few small expenses which usually don\’t contains ((proof of expenses (receipt)) like newspaper etc, is it necessory to provide

proof of expense.

Hey,

Thanks a ton for putting up such a complex wisdom into simple words for lay humans like us.

So with Zerodha, one can open a trading account or Demat account or both?

Thanks,

You can open both trading and demat account with, Zerodha – https://zerodha.com/?ref=varsityhttps://zerodha.com/?ref=varsity

Happy reading!

hlo sir,

I am totally new to the market. Would like to thank you for the efforts you have put in and helped us with the study material.

would soon get in touch with your team.

Good luck, Roopinder. Keep going!

Good article and tried in best to explain the functionalities

Happy reading, Arun:)

Does brokers earn bank interest on money which clients deposit in their trading accounts .

There is a marginal amount of float that the broker gets, but this can be small amounts. The bulk of the revenue comes from the brokerage income. So you can imagine how much a broker who charges 0.25% or more would make 🙂

Many many thanks for these notes. They are more helpful than most others.

Happy learning, Anany!

Can there be a situation, a person attempts to Buy a particular Share, But no one is Selling that Share and vice versa.

Yes, quite possible.

Thank you so much for Varsity. I\’m a B.Com final year student having interest in the Stock market. What are the courses that I can pursue after B.Com to get jobs in this area. Also I have a question : what if there are no buyers/sellers at the price quoted by us? Will the company buy it back in such a case? Same in the case of MF. What if there are no buyers when we want to encash MF?

Sarath, I think you should try and do a CFA and try and get a job in the asset management industry. MF orders will always go through, you need not worry about this.

Great lessons. Came to know the difference between demat and trading accounts…

Good luck, Dhinesh.

This is awesome basic covering about stock market. I understood lot of thing as a beginner as i started before a week. Still there are few points in little complex language . But great stuffs at a single place to start. And where is second module ? Thanks

Glad to know that, Jay. All modules are here – https://zerodha.com/varsity/

Karthik,

You are an awesome trainer.

My 3 questions ..

1. Why makes a a broker choose nsdl over cdsl and vice versa .I mean who is more competitive nsdl or cdsl ..

2. If there is no competitive difference to prioritize nsdl over cdsl and vice versa then why there are 2 depositories ..

3. Can one buy and sell shares say at nse but stores securities in cdsl. Is this possible ?

Thanks for your time karthik ..

1) Both are equally good. I guess it just boils down to geographical conveniences 🙂

2) Because monopoly in such systemically important financial activity is not good for he eco system.

3) Yes, it does not really matter which exchange you buy from and which depository you opt to store the shares in.

As very well explained there are three accounts linked to seamless trading experience. Now in case I have a trading account with Zerodha and an DP open with help of Zerodha. Let\’s say I have one more DP \”XX\” with other trading company, I want to start trading on Zerodha platform with the \”XX\” account. Is it possible? If yes how do I do it?

Technically yes, you can link and trade. But this will be a very broken experience for you. By the way, going forward, Zerodha will not allow linking of 3rd party DP accounts with Zerodha trading account.

When we open account with zerodha, Is it a trading account cum demat account?

Yes, you can opt to open a trading and DEMAT account together. Click here to open the account – https://zerodha.com/?ref=varsity

I already created an account without knowing difference b/w trading a/c and demat a/c. I have already done lot of buy transactions and bit of sell transactions. Does that mean by default both are created?

Yes, if you have managed to sell, then your DEMAT is also in place.

HI Karthik,

Thank you for these wonderful work its well structured and well organised.

I bought some shares with Ashok leyland on 22/06/2018 and as per the details the dividend announcement date is on 18/5/2018 and effective date is on 9/07/2018.

My query is regarding dividend payment, correct me if I am wrong, anyone who holds the share on or before 09/07/2018 will get the dividend paid in his primary account. Also should I hold the shares until the dividend is paid in my primary account? if not whats the criteria for dividend payment and the dividend payment date as I am not able to find this info in the website. Kindly advise.

Regards,

Balaji

Yes, if your name is recorded as a shareholder before the effective date, then you are eligible to receive the dividends. You can hold the shares till the effective date, maybe a few more days extra and then sell the shares. You will still receive the dividend.

Hi Karthik – Thank you for doing this topics this is wonderful I regret that I discovered this very late any person who wants to understand stock market can easily read this to know and I must appreciate that you taken in to account everyone and have covered every little details topic from scratch.. 🙂

I have a personal clarification, My father held some shares of Eicher motors as part of his employment benefits in physical format after he passed away in 1993 my guardian somehow changed it to his name (myself & my sister were minors back then) we recently came to know about it and have issued a legal notice to him however he has now agreed to transfer it back to us but he is persistent that it be transferred to both to myself & my sister name together, how should we go about it ?

Should we open a joint Demat account like a Joint SB account ? or is there what are the options available. ? Once it gets transferred we also need to De-materialize it so there shouldn\’t be any issues later..

Looking forward to your suggestion. Thanks.

Senthil, I\’m glad you liked Varsity 🙂

Yes, I think the best option here is to open a joint DEMAT account and then De-materialize the shares. Please do decide on which broker you wish to DEMAT this with, if it is with Zerodha, I can help you with this.

Good luck.

Thanks for your response Karthik, I already have a account with Zerodha can i convert that in to a joint account by including my sisters name ? or should i open a new joint demat account all together…

Senthil, you cannot add another name to make it a joint DEMAT. I\’ll email you separately on this.

Thanks for your prompt response Karthik will follow-up with Mr. Venu.

Small suggestion: If there is a notification to the queries raised it would be really helpful… hope you understand 🙂

Yes, I do Senthil..but the queries run up in great numbers and the notifications can turn into SPAM, hence we disabled it 🙂

Hi.. I m totally new to shares and stocks,and most of the terms do not make any sense at all (still learning) . Firstly,Whats the difference between shares and mutual funds. I mean, MFs are also subjected to market risks,then why r they considered safer to stocks?

Deva, I\’d suggest you go chapter by chapter in this module and by the end of it, you will have answers to most of the basic questions.

3.4 Banks withdrawals are only processed to the secondary bank account. it is not correct as withdrawals are only processed to primary bank account

Transfer can be from any of the registered bank accounts, but withdrawal is only to the primary account.

Hi Karthik – Even i noticed the same sentence while going through the chapter and questioned myself why withdrawals are only processed to secondary account as per the statement..

\”3.4 Banks withdrawals are only processed to the secondary bank account\”

Request to kindly correct the sentence for the benefit of others who would be new to this world, thank you.

Thanks, will fix this.

Hi,

I just open trading account in Zerodha. It\’s amazing experience to learn and use it for making money.

I suggest to add more pictorial view in chapters for more easy understanding whenever possible.

For example – links (by arrow) between different accounts (bank, trading, demat), BSE, SEBI, CSDL, DP, etc.

Dipak, welcome to Zerodha family! I\’m happy to note your experience has been great so far.

Thanks for the suggestion, will keep this in mind 🙂

Sir….i knw how and where to open demat account….can u plz tell me from where i can open my trading account….like demat account from zerodha n trading account from?????

You can open the account online if you have an AADAHR card, follow the on screen instructions here – https://zerodha.com/?ref=varsity

Sir is zerodha is offering both demat and trading account????

Yes, we do offer both trading (EQ & Commodity) and DEMAT account. You can open the account online (instantly) if you have AADHAR number. Click here for to open one – https://zerodha.com/?ref=varsity 🙂

Hi again,

How to open the Trading account through Zerodha?

Can you tell me the difference between the trading account and DEMAT account in simple words?

I\’m really confused.

Trading account is a transactional account, used to buy and sell listed financial instruments on the exchange. DEMAT is like your bank account, instead of money, you store all your shares in it.

Very well Explained Sir.

But I\’ve got a little confusion about linking multiple bank accounts to my trading account.

As I use Zerodha & they told me that I can link up to 5 Bank accounts to my trading account but here you are suggesting that only one bank account can be linked at a time.

Can you please clear this ambiguity.

Yes, you can link upto 3 bank accounts to your trading account, and one out of the three is considered \’Primary account\’. While funds can be transferred from any of the 3 accounts to the trading account, the withdrawal is only to the primary account.

Also, thanks for pointing this out. I\’ll make the necessary correction.

Sir i need buy shares for longterm that means permanent holding,, , which option got confused that (mis or cnc)to select.. now i purchsing but it got sold at the end the of day

MIS only for intraday positions. For long-term buy – use CNC.

if the volume of particular stock is around million , will it be easy to buy and sell the share within seconds

Yes, it should be.

Hi Karthik,

I am going thru your articles here and are pretty good to understand the basics.

As i am new to this world, is there any platform in zerodha family where suggestions to buy a particular stock/share. As i see lots of analysis and technical skills about the market are required to play in. Yeah, its take time to learn, but to help to the beginners on the small investments and not to get demotivated by the losses.

Regards,

Ishwar

Hello,

I had a query.

What if the person defaults in paying for the shares he bought. As in he buys the share but doesn\’t have enough funds in his trading account and either forgets or doesn\’t transfer funds from his savings a/c to trading a/c.

What happens then?

Who pays the seller of the share- broker, exchange?

What does the broker do?

Thanks

This cannot happen, as your buy order will not go through if you do not have funds. However, if you do an intraday short or forget to square off, then you will have to deal with bad delivery. Check this – https://zerodha.com/z-connect/queries/stock-and-fo-queries/consequences-of-short-delivery-nse-bse

hi,

i m new to trading. please tell me how much money is needed to open DP and DEMAT account in zerodha? do tell me what are all the accounts can i open/needed in zerodha, for seamless trading?

BTW, i have started to read this blog today only… my friend suggested, and i \’m liking it. and please provide fullforms in separate page or in a corner of the page. f&o?

Welcome to Zerodha, Darshan!

1) You will need an Eq Trading & DEMAT account – Rs.300

2) If you plan to trade in Commodity account – Rs.200

F&O stands for Futures and Options.

Please provide the link to register to zerodha and also what are all the facilities i can get from registering to zerodha? like ll i get any supporting software access to trade?

You can open your account online, almost instantly here – https://zerodha.com/?ref=varsity . Yes, you will get access to trading terminals, through which you can trade.

Hi. I wanted to know if there are any special requirements for opening a trading and DEMAT a/c (with zerodha, for example) for a person who is an Indian citizen but is working in the US on a H1-B visa.

Thanks.

Not really as you are still an Indian citizen. If you have an AADHAAR number, then you can open an account with Zerodha instantly – https://zerodha.com/open-account . But please be aware, you will receive a couple of OTP on your registered mobile number, so make sure you are connected on your mobile while opening the account. If you have trouble, feel free to reach out to [email protected].

Hi, I want to know how can reading newspapers improves stock market earnings and understanding?

Hello Karthik,

Great work man, I really appreciate your contribution to traders community. I think this is one of the most liked blogs I have ever seen.

well anyway, I will be in touch soon.

Take care and keep sharing knowledge.

Regards

Kushal

Happy to note that, Kushal! Hope you continue to like the contents on Varsity.

Happy learning.

Hi karthik bro as you said as brokers are for markets (nse and bse). DPS are for NSDL and CSL. I have seen some of the requirements for brokers. What are requirements for Dps? And how a broker can be dp. Just for example Rj sir maintains rare enterprises what is broker and DP here? Thank u in advance

I\’m really not sure who RJ\’s broker or DP is 🙂

Check this – https://www.cdslindia.com/dp/dpeligibility.html it will give you the details for becoming a DP.

Thanks for the info bro. Great pleasure to join with zerodha community cheers.

Welcome! Happy learning 😉

After demerge if someone not sold his shares to company in buyback, then shares will not trade in future, how can he sale it letter ? and all the shares of the promoters will be there in their demat account ? will I get dividenend if share is demerged and I still hold ?

* demege… unlist from the market

Delisted you mean? Yes, you will have to tender the shares in buyback. No dividend if the stock is delisted/demerged.

How promoters pledge their share ? and where these shares will be ( In who\’s demat account ? ) ? Before pledgeing the shares promoters need approval from share holders ?

They can pledge it with banks, brokers, or any financial entities. No, they do not need approval from shareholders.

I am an NRI. I would like to do trading with Zerodha platform.

I am confused whether I have to do trading with my NRI account which requires a PIS account where the charges are high or to start a demat account on my mothers name staying in India and do trading from here (outside India) on behalf of her.

It really is your call, Deepak. But yea, NRI account needs PIS and other associated docs.

Dear Karthik,

I am new to trading. To be honest I am under tons of debt and increasing ever. To cope with this I decided to learn about everything of trading with basic to advance level. I tried many trading edu sites but i must say zerodha has explained excellently. It gets very clear to a beginner like me. Thank you for this educational articles and your chat support.

I have 2 queries.

1. Please show me a roadmap to learn trading (equity and f&o) with advance level of analysis, where i can be make myself expert in it. ( I want to put my everything to clear my debt, just to give you an idea that i have 5k in hand at this moment and my debt is x2000 times of it.)

2. Intraday or delivery? By which I can make good profit quickly? Please provide advanced lessons for that too.

3. In this chat forum i learn that, i can but shares today and if i hold it then i can sell it after 2-3days. What if i want to sell shares next morning. I read its as BTST, pls give me info for btst too.

Thanks for your help and support that you provide here.

Prashant

Happy learning, Prashant.

Also, a piece of unsolicited advice, please don\’t mind – if you are under the belief that you can trade and repay your debt, then I\’m afraid this is not easy. There is a higher probability to lose this money and you slip into a deeper debt trap. Trading is best when you don\’t have these external pressures.

1) Follow the Varsity sequence module and chapter wise, this will help you develop a comprehensive view. Again, recovering 2000x from 5K is not possible – please do not approch markets with these expectations.

2) Both techniques are good

3) More on BTST here – https://zerodha.com/z-connect/queries/stock-and-fo-queries/btstatst-buyacquire-today-sell-tomorrow

What is the reason (apart from arbitration) some people trade through BSE when the liquidity in NSE is much higher than that in BSE ?

There are only two reasons – liquidity and availability of the stock (in terms of listing). Apart from this – its just loyalty to exchange I guess.

Hi Kartik

excellent work, I have just opened an account with zerodha (trading and demat). I have my saving account attached to trading account, I want to know that it is necessary for me to transfer money from my sbi saving account to zerodha trading account or it can be done automatically (money deleted from my saving account?

You need to initiate the fund transfer, Durgesh.

Does opening an account with Zerodha means opening both the accounts(demat and trading)

You can choose to open just a trading account if you need. However, its best if you have a DEMAT if you plan to buy and sell equities for delivery.

Thank you very much. I was doing commodity trading with you people. Now was thinking of doing equity as well

. Can you tell suppose i am buying ABC company shares where i can online check that how much shares have been traded at any particular time in a given day .how much are left .on nse india site there is a parameter called traded (volume )shares .that is the parameter kya . Thanks

Happy to hear that Puneet, I\’d suggest you log into Kite and look for the market depth, in your market watch.

How is it possible that every time i want a buy a share there is a seller at the other end. Is it something related to market makers.

No, just like how you intend to buy, there are people intending to sell. The market is an ocean of buyers and sellers…the more people doing this, the better it is.

So what are market makers.

Market makers provide liquidity to market participants. Although this is not popular in India, it is quite popular in developed markets. Suppose you want to buy 10000 shares of Infy, a market maker will sell you 10K shares, and at the same time, he will offset this position with someone who wants to sell 10K shares of Infy.

Thank you very much. Do you have any tutorial regarding the commodity and F N O market. If have please let me know. Thanks

Check this – https://zerodha.com/varsity/module/commodities-currency-and-interest-rate-futures/

When do I need to pay income tax for profits made on equities.?

For example: I have transferred 1000 Rs. from bank account to trading account. Now I bought shares worth rs.1000. In 2 months value became rs.1500 and I sold the shares.

Now where my money will go. In trading account or Bank account.

Also, do I need to pay tax on money which is on my trading account?

Taxes are applicable on the profits that you make. Rs.500, in this case. Also, if you hold the shares for more than a month, then the long term capital gains taxes are not applicable.

sir with reference to above comment it is one month or one year. further kindly also let me know if we can get statement of short tem profits made through out the year on which tax is payable. can we pay the tax at the time of filling itr and show the income in others

Have you checked our tax reports on Q back office?

I used to earlier have a trading account with IDBI capital. The DP was Vijaya bank and the Demat is with NSDL. If I want to start trading with Zerodha, then what should I do with my existing broker, DP and demat account?

Its best if you have both trading and DEMAT with Zerodha as this will give you a seamless experience while transacting in the markets.

Hi,

Can we trade with any exchange market through a single demat and trading account or do we need a seperate account for different exchange markets?

Single DEMAT and Trading account with a single broker is good enough.

Hi karthik

I have got my CMR copy where in it states the status as Active.

I recvd a call that i need to transfer 5000/- for activating my account.

Is it necessary to transfer the amount immediately ? Or within particular time frame ?

Thanks

Mehul, I\’m not too familiar with the sales process. However, there is no harm in transferring the funds I guess, its your trading account anyway.

Suppose I have purchased stocks for intraday but the stocks fell and I am loosing money but I feel the stock will rise in few days and I want to have them as cash and carry. Is it possible to convert my trade from intraday to delivery using Zerodha kite?

Of course, you can convert the position from intraday to delivery. Goto position, click on the arrow and click on convert position.

Dear sir IT is said that one who refers a client to zerodha will get commission which is a % of the brokerage earned by zerodha as long as the refered /new client trades with zerodha. Suppose one approaches DIRECTLY zerodha to open a trading a/c what will be the discount in brokerage for the new client?

There are no discounts as such. Check our brokerage charges – https://zerodha.com/charges

Dear sir (1) IT is mentioned that DEMAT charges for the shares sold @ Rs 13.50 per scrip. IS it applicable even when the client sold the shares thro Zerodha? (2) Suppose for intraday 400 shares are bought thro FOUR orders and sold the 400 shares thro FIVE orders will the brokerage be calculated as per turnover or on the basis of number of orders?

Brokerage is charged on number of executed order. Have a look at this – https://zerodha.com/charges. DP charges are not applicable for intraday sales.

Suppose if i sell a share with prfit of 23 ruppess and for that sell DP charges of 23 will be deducted ???..in that case i have gained nothing right???

DP charges at 13+GST, about 15 bucks. So you will get roughly about 8 Rupees.

Dear sir Sorry … one more doubt. IS there charges to receive CONTRACT NOTES of daily trades thro EMAIL?

Nope.

in which medium (like email or post) i will get my contract note. is it mandatory? is there any charges for that? Expecting more details about it. Thanks for reply in advance.

You will receive the contract note on the registered email id, no charges for that.

What is Contract Note I am confused ?

Please Help

Consider the contract note as an invoice for all the trading activity you\’ve done for the day. It will have the details of the price at which you\’ve bought/sold and all the applicable charges.

Stock Holding Corporation of India is also a Depository Participant, who holds demat accounts with them( general public)? What is their role in the stock trading?

There are only two Depositories in India – CDSL and NSDL. SHCI is a member to one of these depositories – pretty much like how Zerodha is to CDSL.

Hi Karthik,

When there is no difference and both the CDSL and NSDL are backed by the stock exchanges then what is the point of having two Depositories. Both these can work with NSE and BSE. Both are regulated the same way. Both can give you the same benefits then why two. Why can\’t it be just one Depository?

Moreover, when I open my DEMAT account I am not worried about it because I am either way able to trade in both the exchnages.

Thanks

Avinash

I think the reason there are 2 depositories is to promote competition in the space, otherwise it\’d become a monopoly and customers end up losing out. Depositories being in the service sector need to be competitive since it helps drives performance, innovation thereby benefiting consumers resulting in the overall development of the capital markets.

If there is no difference between the two as an investor/trader then what\’s the point of having a \’competition\’ ? It just adds overhead and creates confusion. If two have a unique prospective then Zerodha should have tied up with both.

Anon, there is no confusion here. Just like the way BSE and NSE co exisit and offer their own unique propositions, these depositaries also do the same. As far and I\’m aware, you can only become a DP with one depositary, maybe Venu can clarify this. Given this, we have opted for CDSl. Btw, you may want to check this as well – https://www.thehindubusinessline.com/economy/sebi-may-allow-corporate-entities-to-provide-depository-services/article23041847.ece

What is the advantage of using CDSL vs NSDL (by Zerodhara)?

What is the relation between depository and clearing corporation? Do they come under same management?

Both Depository and Clearing corporation are owned by government,right?

There\’s no distinct advantage that you get as an investor by having an account with CDSL/NSDL primarily because you get serviced by the Depository Participant; Zerodha in this case. NSDL is backed by NSE with other promoters being IDBI, UTI etc. CDSL is promoted by BSE along with SBI and other banks. There\’s no relationship between the Depository & Clearing corporations. Just that each of the Exchanges have their own clearing arm – NSCCL being NSE\’s clearing corporation while ICCL is BSE\’s clearing corporation.

I read somewhere that NSE stocks are stored in NSDL and BSE stocks are in CDSL . Then how zerodha is providing DEMAT with CDSL only, why not NSDL also.

This is not true Karn. You can demat them across any depository, it does not make any difference.

cpm full form

CMP means \’Current market price\’ , not sure about CPM.