9.1 – The Harami Pattern

Before you get thinking, the word ‘Harami’ does not stand for the word harami used in Hindi :). Apparently, it is the old Japanese word for ‘pregnant’. You’d appreciate the intuitiveness of this word when you see the candlestick formation.

Harami is a two candle pattern. The first candle is usually long, and the second candle has a small body. The second candle is generally opposite in colour to the first candle. On the appearance of the harami pattern, a trend reversal is possible. There are two types of harami patterns – the bullish harami and the bearish harami.

9.2 – The Bullish Harami

As the name suggests, the bullish harami is a bullish pattern appearing at the bottom end of the chart. The bullish harami pattern evolves over a two day period, similar to the engulfing pattern.

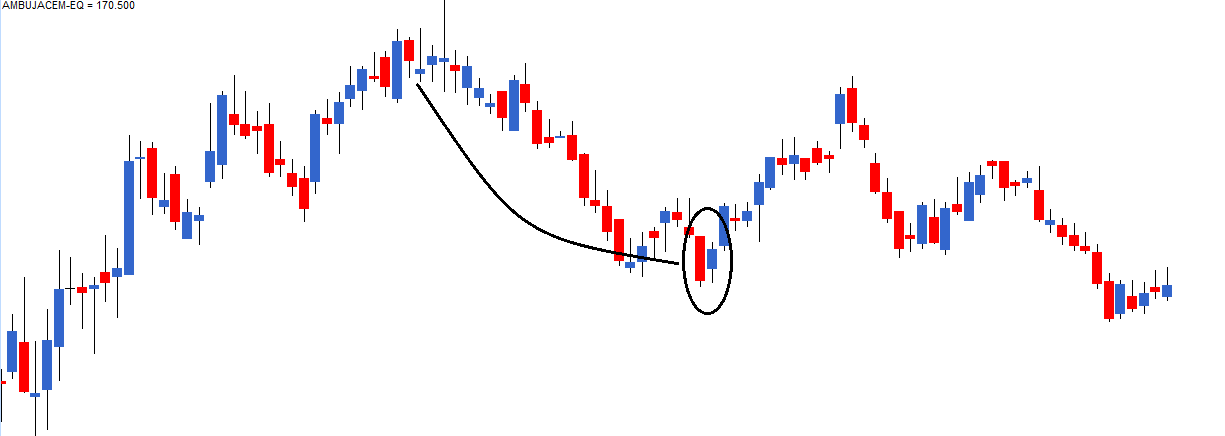

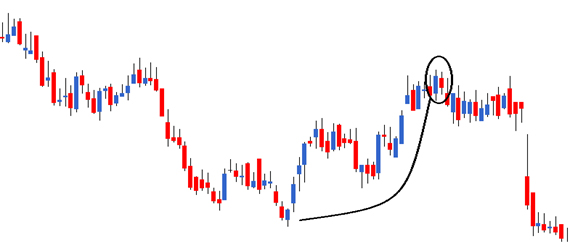

In the chart below, the bullish harami pattern is encircled.

The thought process behind a bullish harami pattern is as follows:

- The market is in a downtrend pushing the prices lower, giving the bears absolute control over the markets.

- On day 1 of the pattern (P1), a red candle with a new low is formed, reinforcing the bear’s position in the market.

- On day 2 of the pattern (P2), the market opens at a price higher than the previous day’s close. On seeing a high opening price, the bears panic, as they would have otherwise expected a lower opening price.

- The market gains strength on P2 and manages to close on a positive note, thus forming a blue candle. However, P2’s closing price is just below the previous days (P1) open price.

- The price action on P2 creates a small blue candle which appears contained (pregnant) within P1’s long red candle.

- The small blue candle on a standalone basis looks harmless, but what really causes the panic is that the bullish candle appears suddenly when it is least expected.

- The blue candle not only encourages the bulls to build long positions but also unnerves the bears.

- The expectation is that panic amongst the bears will spread faster, giving a greater push to bulls. This tends to push the prices higher. Hence one should look at going long on the stock.

The trade setup for the bullish harami is as follows:

- The idea is to go long on the bullish harami formation.

- Risk takers can initiate a long trade around the close of the P2 candle.

- Risk takers can validate the following conditions to confirm if P1 and P2 together form a bullish harami pattern:

- The opening on P2 should be higher than the close of P1.

- The current market price at 3:20 PM on P2 should be less than P1’s opening price.

- If both these conditions are satisfied, one can conclude that both P1 and P2 form a bullish harami pattern.

- The risk-averse can initiate a long trade at the close of the day after P2, only after confirming that the day is forming a blue candle.

- The lowest low of the pattern will be the stoploss for the trade.

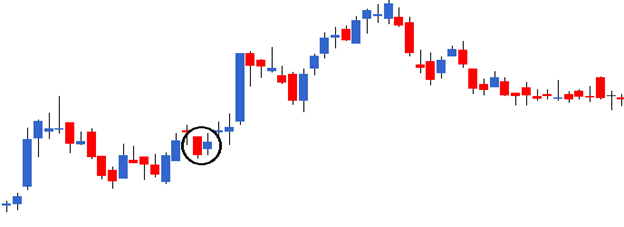

Here is a chart of Axis Bank; the bullish harami is encircled below:

The OHLC details for the pattern are as follows:

P1 – Open = 868, High = 874, Low = 810, Close = 815

P2 – Open = 824, High = 847, Low = 818, Close = 835

The risk-taker would initiate the long position at the close of P2, which is around 835. The stop loss for the trade would be the lowest low price between P1 and P2; which in this case, it is 810.

The risk-averse will initiate the trade the day near the close of the day after P2, provided it is a blue candle day, which in this case is.

Once the trade has been initiated, the trader will have to wait for either the target to be hit or the stop loss to be triggered.

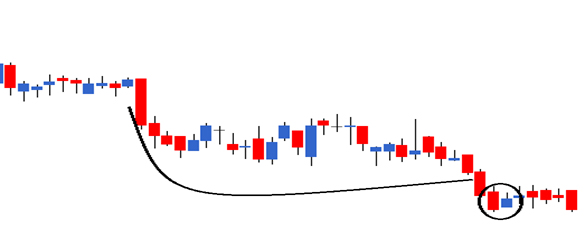

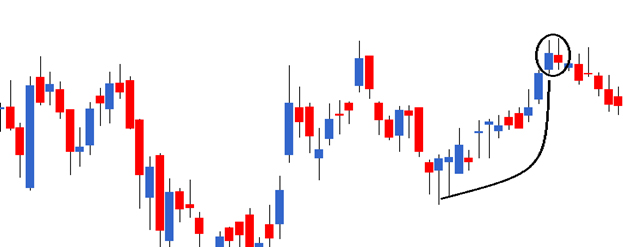

Here is a chart below where the encircled candles depict a bullish harami pattern, but it is not. The prior trend should be bearish, but in this case, the prior trend is almost flat, which prevents us from classifying this candlestick pattern as a bullish harami.

And here is another example where a bullish harami occurred, but the stoploss on the trade triggered a loss.

9.3 – The bearish harami

The bearish harami pattern appears at the top end of an uptrend, allowing the trader to initiate a short trade.

The thought process behind shorting a bearish harami is as follows:

- The market is in an uptrend, placing the bulls in absolute control.

- On P1, the market trades higher and makes a new high and closes positively forming a blue candle day. The trading action reconfirms bulls dominance in the market.

- On P2 the market unexpectedly opens lower, displaces the bulls, and sets in a bit of panic to bulls.

- The market continues to trade lower to an extent where it manages to close negatively forming a red candle day.

- The unexpected negative drift in the market causes panic making the bulls to unwind their positions.

- The expectation is that this negative drift is likely to continue, and therefore one should look at setting up a short trade.

The trade setup for the short trade based on bearish harami is as follows:

- The risk-taker will short the market near the close of P2 after ensuring P1 and P2 together forms a bearish harami. To validate this, two conditions must be satisfied:

- The open price of P2 should be lower than the close price of P1.

- The close price of P2 should be greater than the open price of P1.

- The risk-averse will short the market the day after P2 after ensuring it forms a red candle day.

- The highest high between P1 and P2 acts as the stoploss for the trade.

Here is a chart of IDFC Limited where the bearish harami is identified. The OHLC details are as follows:

P1 – Open = 124, High = 129, Low = 122, Close = 127

P2 – Open = 126.9, High = 129.70, Low, = 125, Close = 124.80

The risk-taker will initiate the trade on day 2, near the closing price of 125. The risk-averse will initiate the trade on the day after P2, only after ensuring it forms a red candle day. In the above example, the risk-averse would have avoided the trade completely.

The stop loss for the trade would be the highest high between P1 and P2. In this case, it would be 129.70.

Key takeaways from this chapter

- The harami pattern evolves over 2 trading sessions – P1 and P2.

- Day 1 (P1) of the pattern forms a long candle and day 2(P2) of the pattern forms a small candle which appears as if it has been tucked inside the P1’s long candle.

- A bullish harami candle pattern is formed at the lower end of a downtrend. P1 is a long red candle, and P2 is a small blue candle. The idea is to initiate a long trade near the close of P2 (risk taker). A risk-averse trader will initiate the long trade near the close of the day after P2 only after ensuring it forms a blue candle day.

- The stop loss on a bullish harami pattern is the lowest low price between P1 and P2.

- The bearish harami pattern is formed at the top end of an uptrend. P1 is a long blue candle, and P2 is a small red candle. The idea is to initiate a short trade near the close of P2 (risk taker). The risk-averse will initiate the short near the day’s close only after ensuring it is a red candle day.

- The stop loss on a bearish harami pattern is the highest high price between P1 and P2.

Thanks for the explanation, i can not go through with all questions and so apologies if its a repeat. Will the pattern be Bullish or Bearish harami if the P2 has a long wick but still closed under the body of P1 and meet all required criteria?

You can ignore the wick Ramendra. The main idea is to look at the price action and what it conveys. YOu can check this video – https://youtu.be/z0Rwoz6PduM?si=sGyQOUYihq-RNTP4

I have a question which I have always wondered. When the market is falling why will someone buy that share? If market is falling and I\’m selling the stock then someone must be buying that share. Why is the other person buying a falling share and what is his mindset when buying a falling stock?

In a hope that in future it will bounce back and will give more returns.

or may he think that the stocks price is less than its actual value so getting good stock in chipper will benefit you more.

or he might be following the contradictory investing that when most of the people sell he will buy at bottom and when most people will be greedy he will set at the top.

basically in short he think that this might be the lowest price and so he buys that stock.

understood.. thanks for the reply.

there are some companies which many ppl know are not good or fraud. Take example of Bharat Global Developers. I saw that it is hitting lower circuit daily but there are people who are still buying this. Also BGD was banned by SEBI last year for some violations and promoter shareholding is 0%.

There are many such companies. Why do u think people buy these shares knowing that company is fraud.

Please check this module, Ajay – https://zerodha.com/varsity/module/introduction-to-stock-markets/

Nice chapter and explanation. Just a thought.

The engulfling, piercing/dark cloud & Harami patterns are really much similar. Just the concept of changing the trends and its extent. The stop/loss also have same pattern in these concepts.

Yes, in fact at one point you will realize that most of these patters are manifestation of price actions.

how a harami pattern is different from spinning top

Spinning top is a single candle, indicates indecision. Basically it does not convey direction. Harami on the other hand indicates either bullishness or bearishness.

Thank you for this information. Very helpful!

I wanted to understand a little more about the patterns when they occur within the same day. Since there is no gap between the candlesticks within 1 training session, CP or previous stick is OP of next one, Patterns like the Harami can\’t be formed right?

I might have misunderstood. Just wanted to confirm this. Any pattern that requires a gap would mean the trading session closed. So do these patterns also have implications on trades within the day if we are using 1 hour candlesticks for example.

All these patterns can form across any timeframe and not necessary they do on EOD basis (gaps can occur intrday too). The way you trade these would be exactly the same.

Do check this – https://youtu.be/m8uOKO6cCkE?si=CtSx2q3cATypCBD-

why SL was put on lowest of p1 and p2. can we put SL on the Opening price?

Lowest point denotes the lowest point from where the price bounced back. So in that sense, its a price action point of relevance to the trade. Opening price denotes just the demand at open. However, if you want to try placing the SL at open, please backtest it once.

sir, i can\’t understand this point – if we have to buy any bullish pattern at close price of it, then why should we wait till 3.20pm to validate it and then buy. even if we give buy order at 3.20pm at closing price of the bullish pattern how the buy order will be accepted – i mean we should buy at market price right??

The only reason to wait is to affirm the fact that this is a indeed a bullish/bearish pattern that you are evaluating. Transaction should not be a problem.

hello kartik sir aditya here, i had a doubt ,why is it that in multiple candlestick pattern ,like in harami,engulfing , the stop loss is usually either the high or low of the pattern, why is it that we take high or low as the stop loss and not the close or open

Its just that at these high/low points, we see price reversals hence they kind of act at the trigger point.

I am confused regarding the doji/spinning top in this case. Does it means that on the P2 if there is doji/spinning top but has body shorter then P1\’s then do harami patterns seems forming right ? I mean i know doji & spiining top are single candle stick patterns but still a little bit confused.

For all practical purposes, doji and spinning tops are similar. Treat them as the same candle and expected outcome. Reason for this is that the real body in both patterns is similar with open and close being same.

For the Hamrami Pattern:

Bearish H

Why should the close of P2 > open of P1.

Shouldn\’t it imply stronger Bear sentiment is Close is further lower?

Same question for the bullish as well?

In bearish harami, the close on P2 is lower P1 open right?

My bad; What I meant to ask was

Why is there a limiting factor that close of P2 should be greater than close of P1. Or incase of a Bullish. Why is close of P2 supposed to be smaller than close of P1??

Just want to understand why is there a limiting factor?

It\’s not a limiting factor, but rather a price action that in elementary form indicates the sentiment of bulls or bears. I have a video on this, please check if this address your concern – https://youtu.be/z0Rwoz6PduM?si=cdHi_QtfJQRiD53l

Hi Karthik,

Not very clear.

In case of Bullish Harami, why close of P2 should be lower than open of P1? It would be stronger signal no, if it moves beyond open of P1?

Vice versa for Bearish Harami

Saumya, it casts a spell of doubt in bears, and the hope is that day 3 onwards the bulls can take on comfortably. Btw, if it does close above P1, that would be an engulfing pattern.

Hi Karthik,

For the Bearish Harami.

The market is on an uptrend –> P1 formed a big blue candle.

P2 movement –> Unexpectedly opens at a lower price thus causing panic amongst the bulls. This causes the bears to take control pushing the price down and then closing higher than the low of the day; leaving a shadow underneath.

Will your reservation explained during the Hanging Man not hold good here?

i.e – If the price went down to the Low why did it come up?

Hanging man is a single candlestick pattern, this one is across 2 trading sessions.

Fair enough. The sentiment regarding the lower shadow does imply that bulls were in control at some point; right?

More specifically, the recovery from the lower shadow indicates the presence of bulls.

Good learning

Sure, happy learning!

Hello Karthik, I am a complete beginner, I would like to know that, if as per the above trade setup, if we buy the stock, as per the favorable conditions, at 3:20 that i.e. near about closing time, then when should we set the target for the exit?

The target is expected to occur over the following trading sessions.

hi just above 9.3 how was the stop less triggered. the candle next to the bullish one did not go down to the lowest

The red candle at the end did trigger the SL right?

Sorry re the typo. – Will it still be considered a bullish harami if P2’s high surpasses P1 high but closes below P1’s opening?

Not really. But it will still be considered bullish. Do check this – https://www.youtube.com/watch?v=1kQjXFL4Mfc&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=10

Hi Karthik

Will it still be considered a bullish harami if P2\’s high surpasses P1 high but closes below P2\’s opening?

That would just create a long upper shadow right?

Kiran, can you please share your personal email ID. I\’m interested to know about your API.

Hello Karthik,

I was going through comments since 2014 and noticed that the images and charts shared at that time are no longer accessible. I believe these would be helpful for better understanding. Is there a way to view them or a workaround for this issue?

Ah, let me check this. Btw, can you try using another browser?

Oh, yeah right! Thank you so much, means a lot.

And you rock! <3

Happy learning!

Question –

October 18, 2019 at 7:19 pm

Sir

In bullish harami pattern, if close of P2 is higher than open of P1.Why won’t it be more reliable than ‘close of P2 lower than open of P1’?

Your reply –

October 19, 2019 at 9:21 am

The idea with this pattern is sudden, intense, and short price action by bulls. A close above P1’s open will not have the desired impact.

Question –

Why would it not have the desired impact as it clearley conveys that the bulls are pushing right? Am I missing something here?

This pattern tries to ascertain that the bulls have made an entry in otherwise a bear strong hold. This creates some panic and confusion for the bears. A close above also does this, but we look at that as an piercing patter.

😊 Thanks!

Have a successful and a great day.

You too! Good luck.

Dear Kartik Ji, I owe a lot to you for my success as a trader. You and Abid Hasan Ji are my Gurus.

I would love to watch your market analysis like KLRHM by Abid Ji. Sincerely.

Thanks, Ashutosh. I\’m happy to note that 🙂

Not sure if I can do that, but definitely will give it a thought 🙂

As per my understanding, harami pattern is an inside bar,bullish or bearish. Or else, here also the real body is contained within the previous candle and the wicks are immaterial?

Yes, in the bar chart, this is considered as an inside chart.

Hi, sir. The modules are easy for beginners to learn about the stock market. Thank you for your efforts. I have a question: can we take a trade on a Bullish Harami if the downtrend is small? Also, do I need to consider anything else before taking the trade?

I\’m glad you found the modules easy Ragunathan. Ideally, the downtrend should be at least 5% or more to qualify as a \’prior trend\’.

Hi,

Thank you for the content.

Axis Bank Chart in Bullish Harami section(Chart 2), the first candle(with second assumption on candlesticks – to have some Flexibility) seems a bearish Marubozu. If yes, then the Bearish Marubozu affirms the bearish trend. However, the next day/session, Bullish Harami takes place and trend reversal happens. Could this be taken as Multiple Candle Pattern takes precedence over Single Candle? Or the first candle is not a Marubozu?

Thanks for your consideration. 🙂

Yes, but I\’d also suggest you check this video on how to consider Candlesticks patterns – https://www.youtube.com/watch?v=1kQjXFL4Mfc

Hi Sir,

In Bullish harami pattern, what should be the minimum length of p2, for other candlesticks I have kept 1% as minimum length criteria, but for harami can we consider p2 of 0.5% as well?

Thanks

More than the length, you need to ensure that P2 is contained within P1. Given this, you can look at P2 in isolation.

Thank you for correcting me.

But can we Predict expected price movement of the stock?

Is there any module related to this?

Till now in the Modules, I haven\’t seen any such topic.

There are techniques like TA which helps you do this, apart from that there are quantitative techniques too. But regardless, they all come with some degree of speculative aspect, which you need to be aware of.

Hi, Karthik!

When we talk about that one should not exit the trade in between unless the target hits or stoploss gets triggered.

In a trade setup We get to know (From Module) what should be the Stoploss but didn\’t get what should be the target.

I know Target depends on persons greed but isn\’t there any theory related to Target.

I mean a decent target.

Target does not depend on greed, target depends on the expected price move. Your final P&L depends on greed 🙂

Hi, Can you please share the api with me and how to implement it? as zerodha pi is no more , does it work in kite (google chrome/ firefox etc??)

https://kite.trade/ – you can check this.

Alright, so what can I possibly do to capitalise on a single stock [Qty-1, since I\’m still learning 🙂 ] that I have a bearish view for the next few days.

YOu can use that to learn to place different order types.

Hello Karthik,

Why is it that in equity I can\’t short and carry forward the position for a few days just like I do with long positions?

Its becuase of the the settlement process, Royce.

In above axis bank chart of bullidh Harami, hoe the low is less than the close.

P1 – Open = 868, High = 874, Low = 810, Close = 815

Low is the lowest traded price during the day. So it can be a number lesser than close or open right?

Isn\’t the engulfing pattern stronger than the harm pattern? After reading both tha\’s what I thought

Ah, nothing like that Suneel 🙂

Hi Karthik Sir,

In last example image of this chapter a risk-averse have seen a bearish harami on D2 but as he is risk-averse he will wait for D3 and on D3 blue candle has appeared but market went and on D4 red candle has appeared so is it okay to take trade on D3 close as D2 close is greater than D3 close and we have to short on only so we will make profit as because of this gap in D2 close and D3 close we can conclude that bears are take the game from bulls?

Yeah, you can. End of the day, some of these things are flexible and with experience you will know when to initiate that trade.

I am interested in knowing about how do you achieved that can you help me.

i have a very basic question….

what is the reason forming a blue candle and a red candle?

The colour of the candle depends on the price movement, Aryan. Bullish price movements have blue candle and bearish price movements have red candle.

Thank you!!

Happy learning!

Hi Karthik,

After recognizing a candlestick pattern, you say that a risk averse trader would verify that is appropriate red or blue candle day and trade accordingly.

Now , the risk takers makes the trade around 3.20 PM on the same day a particular candlestick forms.

What about the risk averse trade? At what time (range) should he/she be initiating the trade?

They can initiate the trade around the same time, just that the trade should in overnight derivative contracts that you can carry forward overnight.

Karthik sir, I did not understand this. Why will this not be called a price reversal ?

The trend changes and the prices reverses into the opposite direction. Thats why.

In case of Bullish harami, according to the conditions mentioned above it says that closing of P2 should be lower than opening of P1. Why is that necessary? Even if the closing of P2 is higher than opening of P1 , it should work right? according to the same thought process.

All these price movements make up for the actual pattern, Sriraj. Eventually, you will have to understand the \’why\’, of the price action rather than how. I\’ve made a video on this topic, I\’d suggest you watch the same – https://www.youtube.com/watch?v=z0Rwoz6PduM&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=3

Karthik sir very very thanks 🙏

Virendra, happy learning 🙂

Unable to see these charts on different browser also. Please help and guide Karthik sir 🙏.

These charts are not browser dependent, should work seamlessly across browsers, Virendra.

I means attached chart by readers

Got it. Please see the previous reply.

Karthik sir you are doing great job and the way of your teaching is excellent.

My question is — in comments section I am unable to see the chart of readers. How can i see these chart . Thank a lot 🙏

Can you please try a different browser? Also, most of the links are uploaded on user\’s Gdrive, not sure if they changed the location of those files.

Thanks for the excellent tutorial.One thing i could not fathom was the neccesity of closing price of P2 lower than P1 opening price.

So these little things add that overall quality of the pattern. Remember, each movement in the candle is a reflection of price action, so it matters.

\”The current market price at 3:20 PM on P2 should be less than P1’s opening price.\”

Why is this condition necessary to initiate a trade (for bullish harami)?

If the current price is higher than P1\’s open, doesn\’t that indicate a much more bullish sentiment than harami?

All these conditions are basically a reflection of the price action in the market. A pattern is recognized as a pattern only if they all fall in place 🙂

Sir , can we use these patterns for weekly and monthly candles also.

Yes, you can Manoj.

Hello sir,

In Bullish Harami why should be the close of P2 should be lower than open of P1 ? Same Q. for Bearish Harami why should be the close of P2 should be higher than open of P1 ?

what if the close of P2 is higher than open of P1 in Bullish and close of P2 is lower than P1 in Bearish … ? what is the interpretation if this happens ?

Thank you for this amazing content. 🙂

Harit, the pattern gains significance only if the close is below P1\’s open. Its the price action that matters here. I\’d suggest you watch this – https://www.youtube.com/watch?v=z0Rwoz6PduM&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=3

Thanks!

Happy learning 🙂

Hi Karthik, thank you for the beautiful tutorials! I wanted to ask whether a bullish engulfing pattern can be considered a stronger indicator of future bullishness of the market than a bullish harami, as the closing price on P2 in engulfing actually crosses the opening on P1, thus recovering completely from the decrease in price from the previous day?

Sort of yes, its one of the better indicators of bullishness 🙂

is it important to consider shadow for both engulfying and harami?

like in engulfing p2 body engulf p1\’s half shadow only! and in harami p2 shadow is higher than p1! can anyone explain please.Thank you

You can ignore the shadows since the shadows can be caused due to spike or freak trades. Consider just the real body of the candle.

Hi Karthik, In General, when a stock is making higher high formation on daily basis then my entry should be above the closing price OR the high of the previous day Daily timeframe candle. Trying to understand the significance of high (from where price rejection happened) Vs closing price in terms of my entry for next day.

It depends on the pattern. Generally, when you are riding momentum, the buys would be on higher highs itself.

why the current market price of p2 should be less than opening price of p1.

Thats the pattern mandate, Kamalesh. Thats how the pattern is defined.

Hi Karthik Sir

If a bullish engulfing pattern is accompanied by a doji but the open and close of the doji is greater than the open and close of P2 candle, will it imply a reversal pattern with wide range.

Yeah, I\’d still consider it as a reversal pattern 🙂

Hello Karthik,

Can you you point me to a topic on targets. how to set the targets? whet to consider before setting the targets.

You can check this – https://zerodha.com/varsity/chapter/support-resistance/

Sir, are all these analysis applicable on every chart. I mean on 1 minute chart, 5 minute chart, 15 min chart, daily chart, monthly chart. Correct?

Yes, they are. But from my experience, these are better on longer-term charts.

are bears the ones selling the stock (after buying) or the ones that short the stock?…

Bears are selling, Ayush.

A Question

) For the risk averse traders, what will be the stop-loss? ( ref. eg. Axis Bank Chart )

Thank you for your assistance Sir, It really helps, as a novice traders this learning part plays a very crucial role.

THANK YOU !!!

Low of the pattern if you are going long, high of the pattern if you are shorting. Happy learning 🙂

Harami pattern and Inside candle are same or different ?

They are somewhat similar, Deepak.

Does this pattern only work on \”Day\” intervals?

Would this pattern work on say a 5 minute chart? or 30 minute chart..

How do we know which candlestick pattern works on which time frame effectively?

No, these apply to all these timeframes, Akshansh.

What time frame and candlestick duration are you referring to in in single and multiple candlestick patterns brother?

It is end-of-day candles mostly, but in a few places its intraday as well. I guess I have mentioned this whenever I have posted a chart.

in both Bearish and Bullish Harmis What would be the target?

Target depends on your outlook on the market. It could be based on S&R or it could be a fixed % target as well.

I didnt understood the 3rd chart under the bullish harami pattern, i mean the prior trend is bearish then i can find a new low how is it not forming a bullish harami pattern?

The P1 and P2 candles together form a bullish Harami, Akhil.

Hello Karthik Sir,

Can we consider this as a Bullish Harami Pattern

https://drive.google.com/file/d/1PKkquLM2pszgPQZzlqFXI2hvZNk09rbU/view?usp=sharing

Thanks in advance!!

Yup, but would have been nicer to see a slightly bigger blue candle.

Hi Karthik,

Thanks for the great tutorials.

I have a question, in multiple candle stick patterns (harm/engulfing patterns) you mention, two candles have to be formed on 2 different days. As in, the 1st candle should be formed at 3:20 pm on day 1 & 2nd one on the next day. This is not necessarily intra-day, is it?

Can\’t we use these patterns during the day ( eg at 11 am) over different charts like 5 or 15 mins & make our trades?

Pls note, I am very new to trading & its concepts. Hence, the question.

Look forward to the answer.

Thanks!

Yes, this is not necessary for intraday.

Long position in this chapter implies for intraday trade & not for CNC, am I right?

It can be both.

I\’m new to technical analysis. But when I look into the charts, the trends and patterns change drastically when I change the frequency from 1 day (possibility of price increase) to 3 hours (possibility of price decrease) to 2 hours, sometimes pointing in totally opposite directions. So what should we do in that cases

I agree. So you need to be clear about your trading strategy – if it\’s intraday, then look for intraday charts and it will be great if both EOD and intraday charts point to the same outcome. However, that need not be true about positional trades where you hold positions for a few days. In this case, you can look at just EOD charts.

THESE GAPS LIKE P2 OPENING PRICE HIGHER THAN P1 CLOSING PRICE.. THIS DOESNT HAPPEN IN CRYPTO.. THAN WHAT?? THESE PATTERNS WITH THIS EXPLANATION ARE NOT VALID FOR TRADING CRYPTO??

I\’ve never traded crypto, but even if I were to, I\’d use it the same way.

Hello sir, hope you are doing great!

Small correction required in 9.3 IDFC limited example. On P2, the low>the close, which doesn’t make sense.

Checking this, thanks for pointing.

Dear Sir, Please explain about tweezer top and botoom

Hmm, maybe I\’ll put up a note sometime.

What is target in this kind of patterns?

today i saw head and shoulder pattern in HDFC stock(EOD).. do you think it is head and shoulder pattern?

I\’m not really good at identifying H&S, hence not covered it Varsity as well 🙂

Thanks sir,

So to qualify harami pattern

body of P2 should be more than spinning top and P2 definitely should not be like doji, hammer or shooting star like pattern (i am talking about

Only shape and size of P2)

Yeah, ideally it should be within P1, with a small real body.

Hello sir,

I have one doubt, is the nifty 50 had formed bullish harami toady (21/12/21) in eod chart

Thanks in advance …

Not really, it does not qualify in terms of the real body, right?

Harami patter use in intraday?

You can use the same. In fact, all candlestick patterns can be used for intraday.

In downtrend, If p2candle opens above the previous close (assuming the previous candle is red) and then engulfs, then it forms blue candle engulfing previous candle(but it does not opens below or equal to previous candle for considering engulfing pattern) then will it consider as trend reversal(bullish or start of uptrend)?

Pavan, you need to look at this in the larger context of the trend and take a call. It is very hard to generalize it.

Hello sir,

1)In downtrend, candle opens above previous close and engulfs previous candle then it become trennd reversal?

2)for Gap up,gap down openning, are sometimes not become trend reversals, for considering them as trend reversal what parameters we need to consider?

1) If it opens above the previous close (assuming the previous candle is red) and then engulfs, then it implies the 2nd-day candle is also bearish, hence the trend continues right?

2) Yes, gaps can lead to trend reversals. But it\’s hard to predict them.

Will these candlestick pattern be applied in intraday trades?

Yes, Sanket, it is possible.

In Harami patterns, the two candles must be opposite?

Lets an example

P1:Open-180 Close-160

p2:Open-172 Close-164

1)Here P1 and P2 both are red and will form bullish harami?

2)If yes is it applicable to bearish harami also?

Yes, they should be of the opposite colour.

Hi Karthik,

Very well explained..

am yet to read further..i am investor but want to understand concepts of CE and PE. if i face difficulty, i will ask for help.

PLease do, Deepak. Happy learning 🙂

Which other indicators can be used to confirm the reversal with harami.

Its just the candlestick patterns that is useful.

Please ignore this comment as you have already answered this in the previous comments.

Are these patterns relevant for intra-day trading where all the trades initiated at the beginning of trading session have to be squared off by the end of the trading session ?

Not really, you can use the same for day trading as well.

Hi

What does shorting mean? selling the stock

Shorting means you sell fist and then buy back later.

Hi Kiran,

Can you share the API details for the candle pattern?.

Thanks

Sorry, thats not available Vivek.

Kiran, can you please share your email id

Hey,

When you mention either stoploss will be triggered or target will be reached.

What do you exactly mean by \”Target\”

Kindly Explain.

Thanks

Target is the price target Frank.

Hello Sir,

Why is it important for P2 to close below P1\’sprice in Bullish harami?

What if the closing price is above the opening of P1 in Bullish harami. It will indicate a strong bull presence. then why are we restraining this statement.

P2 can close below or above, based on which its either bullish harami or engulfing. If its above, its the bullish engulfing.

Dear Sir,

You are doing really a great work by educating all of us about the stock market, explaining its complex concepts in easy to understandable way.

Its very appreciable work done by Zerodha.

Thanks a lot!!!

Happy learning 🙂

What do you mean by trend reversal? Can you give example.

Trend reversal is the price reversing and moving in the opposite direction. For example, the trend reversal for a bullish stock is bearish.

The stock is at uptrend, so what pattern can we consider this as-https://www.tradingview.com/x/csHKA6xV/

Is this an engulfing pattern? I am confused as the opening of the second candle is above the closing of the 1st candle:)

Yes, looks like a bearish engulfing pattern. Would have preferred to see it close below the previous candles open though.

okay sir after complete this module I will do it thanks for your reply.

Good luck, Babu.

Sir what is the different between consolidated and standalone?.. I have absolutely no idea about it sir, can you explain me clearly.

Please do read the module on fundamental analysis.

Hi Karthik,

In Harami pattern, can we say P1 engulfs P2?

Yes, you can look at it that way as well.

Hey Karthik,

Can this be called any pattern? when in a downtrend p1 is a red candle and the next day p2 directly opens higher than the close of the red p1 candle (around 50%) and closes above the high/open of the red p1 candle?

Thanks a lot 🙂

Yeah, some sort of an englufling pattern 🙂

Is there a way I can upload an image here?

Not possible I think. But maybe you can upload it on a drive and share the link.

In the last point of bullish harami the stoploss is triggered… But what if we dont put the stoploss, and wait for a long run as in the module it is said that bullish harami have a long run.

Yes, you can choose not to place a stop loss, but the issue is that you will have an unprotected trade and in case of a crash, losses can be high.

Sir, how to set target price , here?

You can use S&R levels for this.

does all this can taken into account while using 15 and 5 min TF.

Yes, you can.

sir, to validate these pattern you are saying to see the market at 3:20 so that means we have to trade within the last 10 mints of the day? or should we take the trade on the next day say P3?

You take these positions by reviewing the market end of the day, positions can be initiated in F&O.

Hi, Don\’t you think it\’s better to have a Harami bullish pattern where in a downward trend the P2 close is higher than the P1 opening. It means bulls are so heavy in P2 that they took the price above P1 Open. Somewhere you mentioned that P2 close it should be lower than P1\’s open for it to be a trend reversal pattern.

I\’d rate both bullish harami and engulfing as equals, Asbhishek. While one pattern may work on stock, the other may not. Hence its a good idea to keep an open perspective about these patterns and know which one works best for a given stock.

Dear sir,

i guess there is mistake in IDFC LTD berish harami OHLC details in Day P2 candle.

Let me check, Omkar.

Hello sir,

Kindly explain difference between inside bar pattern n Harami candlestick pattern.

Thanks in advance

Logic wise, they are similar, Rahul.

Hi,

When you say 2 days pattern for engulfing/ piercing/ Harami etc. then, does it mean it has to be ‘2 full days’ or it can be 2 sessions also of 15 min. or 30 min. etc. ?

Yes, 2 full trading session if you are looking at EOD chart. Basically 2 full candles of whichever time frame you are looking at.

What is the importance of stock price on day 2 closing below the opening of stock price on day 1 during a bullish harami pattern? Similarly for bearish Harami pattern, what is the importance of price on day 2 closing above open price on day 1?

This is the price action part. Have explained this in the chapter itself right?

first of all thank you so much sir, and zerodha

you are a great teacher and im really greatfull

so,as i learned these candlestick pattern, sir you taught that risk averse can take trade the day after pattern formation… like if i notice bullish engulfing pattern and i want to take trade on p3 but on p3 the day is red so i avoid…. but what should we do further ? can we completly ignore that pattern and look for another opportunity or day p4 should be fine sir ?

Yes, if there is too much time after the pattern formation, then maybe you should look for something else.

Here is both engulfing and harami looks like confusing pattern . Can you elaborate more about this two things to differentiate when use of this pattern will more useful .because when i read this topic this two pattern looks same their is no different

Englufing pattern ensures that P2 candle covers P1 completely, while its only half in Harami.

Hi Karthik,

In all the examples you mention 3:20 pm before the market closes.

I intend to use TA for intraday trades. How good these analyses are for trades let\’s say at 11:30 am?

And will a 15 min candlestick pattern provides the same insights?

3:20 here refers to the close of the EOD candle. If you are using a 15-minute candle, then the reference point would be the 13th or 14th minute. Basically, the idea is to act after confirming if the candle is forming the desired pattern, which you can, near the close because the chance of forming something else is low.

sir, are these one day candle charts? are these candles of one single single day? and does these patterns works on 15 min or 5 min intraday basis? or is this for going long

These are EOD charts, but it is the same with intraday as well.

Thanks Karthik. Thanks for creating such an amazing content.

Happy learning, Girish!

I was checking INTELLECT daily candle stick chart and after 3-4 days (11th, 12th, 15th, 16th march) of uptrend, a bearish engulfing pattern is getting formed (16th, 17th March) followed by Doji on 18th march. Does that suggest strong sell sign for INTELLECT on 19th March? I can\’t post the image, but it is pretty much visible in Kite.

16th March

Open = 527. 05

Close = 617

Low = 527. 05

High = 626.20

17th March

Open = 606.50

Close = 588.60

Low = 531

High = 647.55

18th March

Open = 597.50

Close = 595

Low = 564.40

High = 624.20

I\’d not consider this as a strong sell, the bullish candle on 16th looks quite strong given the volumes as well. Would wait and watch for price action before taking any action.

I am feeling i have read so much but i won\’t be able to implement it in actual market and will loose money

Ah, take one thing at a time, Saksham. For example, concentrate on just 1 pattern, forget about everything else. Try and spot just that 1 pattern and see how you can trade that. Get good at it and then move to the next one.

Hello, First i am saying thanks for varsity app. i am getting good clear from this.

Here my doubt :

Bullish and Bearish Engulfing pattern want to see in Higher time frame (HTF) dayTF and above, only. we can\’t follow this pattern at LTF ? because your examples at LTF only… you are preferring day only?

YOu can apply and trade these patterns on an intraday basis as well.

Hello sir, a small correction on 9.3 the close price on p2 should be greater than the price of P1 (bearish harami)

Let me check this again, Harish. Thanks.

in the last bullish harami example, how did the stop loss on the trade trigger a loss?

Ah, I\’ve explained this in the comments, please do check the same. Thanks.

Is Harami pattern a really strong pattern to be traded ?

No pattern is inherently strong or weak, it depends on the overall market context. Remember these patterns only improve the odds of success in the market, no guarantee as such 🙂

Hi Karthik

After going through engulfing , piercing and harami . My understanding is that engulfing is the strongest among the three with the other two in descending order am I right in interpreting the same ?

Hard to say that, you need to look at it from the overall market perspective and then take a call 🙂 But yeah, I personally like the engulfing 🙂

Are all these candlestick pattern also applicable for a 5 minute window rather than a window of 1 day?

Yes, they are. All pattern applicable across all timeframes.

Hmm sir, a spinning top after a big red candle doesn\’t mean it\’s a bullish harami? U need something bigger than that?

Yup, the candle on P2 should be a small red candle.

But sir the approach behind a bullish harami is such that it\’s formed after a bearish candle, so how can we look at a series of dojis? I mean one bullish harami after a bearish candle at the end of the trend signifies it.

Yes, but if the candle on P2 is a spinning top, then I\’d prefer to see 2-3 spinning tops after P1. That\’s what I meant.

But sir a candle like a spinning top can also be a bullish or bearish harami at the end of the trends, right? A bit confused sir.

Thats right, Nikhil. But it cant be based on just 1 spinning top, it has to be based on a series of spinning tops and doji\’s.

Sir, why is the opening on top in the red candle? I have been trying to figure out.

That is the pattern, top opening and closes down.

Sir, I have read this topic before but I came back here for revision n noticed something I hadn\’t noticed before. A bullish harami at times looks like a spinning top, you agree?

Hmm, not really since the candle on P2 is not as small as a spinning top, although it can be.

Kiran can u share me the link for the API

What time frame in these candlesticks will validate something like a harami being formed? A day based candle can only be used right in this case?

You can use any timeframe, Pranay. These patterns are valid across all time frames.

Hi Sir ,

Can Harami , Engulfing , piercing & dark cloud be applied on intrady or it is only viewed on 2 day timeframe . And if it can be used in intrady what should be the body range because in 5 min chart it\’s very rare to find 1 % body range

Yes, it can be applied to intraday trading as well, Ayush.

Is it necessary in bullish harami pattern that the open on day 2 should be higher than close of day 1 ?

Yup, that is a necessary condition.

The market gains strength on P2 and manages to close on a positive note, thus forming a blue candle. \”However P2’s closing price is just below the previous days (P1) open price\”.

Why is it necessary for P2 Closing Price to be lesser than P1 Opening? Even if P2C>P1O, would it not be an indicator of bullish sentiments in the marker?

Think about the price action, the bears would think they are still in control, while at the same time losing grip slowly. Leads to a price squeeze.

Could you please tell us that what time period you have put to get this chart pattern? I am very confused in this , which is correct time period to see which chart pattern has occurred.

Thanks in Advance.

These are end of day candles, Madhav.

Sir should we consider wick or shadow in harami..does the wick also should be within the range of P1 Or close within the range of P1 candle

Hmm, not really. Pay particular attention to the really body.

How many days must be well spaced or candles for defining the trend

At least 3 weeks.

After reading about these candlestick pattern, it is still not guaranteed whether there will be a reversal in trend or not, it is still just a probability ,right ,its basically guessing based on previous trends(like in some patterns, reversals happen, so it is probable that it might happen again since we saw this pattern ), is it right.

That\’s right, there is no guarantee, these are just probabilities at the end of the day 🙂

Please take a look at:

https://drive.google.com/file/d/1FeDlIWrrypyXE-sBbnpeIrvhj-Gi3A5z/view?usp=sharing

Look at these 3 candles. The first red candle and the second green candle form a bullish Harami. The Harami was formed on 29th and 30th Oct at the S1 level of 1854.77. 30th Oct was the last trading day in the month of October. In the month of November, the S1 level is at 1730, which is very different from the S1 level in October, when the trade was taken. The immediate next trading after Oct 30th happened on 2nd November 2020 which is a different month altogether with a different S1 level. In this case, the candle on Nov 2nd 2020 is a red candle , whose low is lower than the lowest low of the Harami formed in October. Should a loss be booked and the trade be exited, even though the S1 level in the month of November is much lower now, than it was in October?

How do we approach the trade here?

Regards,

Kiran Hegde

Why are you looking at pivots fro S&R? You can plot these levels manually, right? Its much better that way. Else if you want to use pivot, then these level shifts are inevitable.

Hi Karthik,

In the bearish Harami Pattern, we set the stoploss to be the highest of the high between P1 and P2. This would obviously be higher than the current trading price (on P2). So what significance does stoploss have when it is higher than the LTP?

Thanks!

Since you are short, you want the SL to be higher right?

Hi Sir,

This is in reference to your previous response regarding trailing SL.

Karthik Rangappa says:

August 18, 2020 at 9:15 pm

Trail SL should be based on the number of points or on a % basis. For example, you trail the SL when the stock moves every 5 points in your favour or say 1% in your favour.

Suppose if I go long at Rs 100 with SL 95. Stock moves to 103 and I trailed my SL as 98. But again stock retraced back to 101. What I should do in such situation ? Stick to revised SL 98 or shift SL as 96 ? or again shift SL at original SL that is 95 ?

Regards,

Rajnish

Nope, you stick to 98. Also, I\’d move to 98 if the stock moved to say 105.

Hello Karthik,

Thanks for the responses so far.

I need clarity on the following part in your previous response:

My question: Would it be fair to say that with a prior down trend, as long as the P1 red candle ***engulfs*** the P2 green candle, a bullish Harami is formed?

Your response: If it engulfs, its an engulfing pattern right and not a harami pattern?

1)What exactly is the difference between \”engulfing\” and \”appears contained (pregnant) within P1’s long red candle\”?

For a bullish Harami, the phrase that has been used is: appears contained (pregnant) within P1’s long red candle?

2)Why wouldn\’t you say that in a Bullish Harami P2 blue candle is \”engulfed\” within P1\’s red candle?

Why is there a need to use the phrase: appears contained (pregnant) within P1’s long red candle

Regards,

Kiran Hegde

Yes, that would be a bullish harami.

1) The price action is slightly different. In an engulfing pattern, the conviction of the bulls is higher.

2) How else would you describe P1 and P2?

Hello Karthik,

Thanks a ton for your previous answers. Its been very very helpful.

I have been getting a lot of questions in my mind as I start trading in the markets. Apologies if this is too overwhelming for you to answer.

However, I think your answers benefit a lot of traders just getting started and hence, is helping the investing community as a whole.

1)How is the bullish harami different than the bullish engulfing? Why is there a need for distinction here?

The reason I ask this is, for both a bullish harami as well as bullish engulfing, the green candle appears ***all of a sudden on P2*** when it was least expected. The P1 candles in both cases is a red candle.

2)In terms of ***sentiment***, how is the bullish harami different from bullish engulfing?

Remember, the P2 candle is green in both cases.

3)Would it be fair to say that with a prior down trend, as long as the P1 red candle ***engulfs*** the P2 green candle, a bullish Harami is formed?

4)For a bullish Harami, what characteristics should the P1 and P2 candles have?

Something on the lines of : P1 candle\’s body should be x times bigger than the P2 candle\’s body

Should the P2 candle be small or big or how big should be the real body of the P2 candle?

5)In the chart of Axis bank at: https://drive.google.com/file/d/135iVA0y8C8x5b1t7uIw1OYPTc9D4UXOg/view?usp=sharing, Kite indicates a bullish Harami.

However, the second green candle looks like a spinning top to me.

Hence, this looks like a bug in Kite, giving a false indication as bullish Harami.

Could you please confirm?

Thanks,

Kiran Hegde

1) These two are similar, except for the amount of conviction developed for the bulls. That\’s the only difference.

2) In terms of sentiment, if I were to trade, I\’d deploy the entire designated capital on an engulfing pattern and maybe about 60% on a Harami pattern.

3) If it engulfs, its an engulfing pattern right and not a harami pattern?

4) P1 should be a red candle, P2 should open lower than P1\’s close and power its way to recover at least 50% of P1\’s losses. Thats all. No other specifics.

5) Its not a bug, that\’s the way the indicator works. I\’d suggest you ignore it.

Hello Karthik,

Thanks for the prompt response as always and patiently answering my queries. I still have few questions which I guess need clarification.

Now what confuses me is that, all through varsity, it has been mentioned that the lookback period should be the last 8-12 sessions for determining a trend. Now, this makes perfect sense for \”day\” charts.

However, the above statement just does not add up when it comes to \”1m,5m,10m,15m,30m\” charts.

Two questions:

1)Does your previous response mean that the 1m,5m,10m,15m,30m charts can also be used for \”swing\” trading where the position is held for about 8-10 days?

If yes, wouldn\’t EOD charts make more sense for swing trading?

2) It\’s my understanding that 1m,5m,10m,15m,30m are only to be used for intraday trading and the lookback period should be the last 8-12 candles on the \”very same\” day prior to the point of trade.

Am I mistaken here?

3)Why would we want to look at the charts of the past few days for \”1m,5m,10m,15m,30m\” charts when there are enough candles available on a single day itself?

Regards,

Kiran Hegde

Do read my previous comment, hopefully, that will give you the answer you are looking for.

Hello Karthik,

Thanks for responding back.

I am confused with your last response. Couple of questions.

1)We are talking about 15 mins chart here. You have stated lot of times that to determine the trend, we look at the last 8-12 sessions. For a 15 min chart, we have about 25 candles on a particular day. If that\’s the case, shouldn\’t just looking at 8-12 15 min candle formations on a single day be sufficient?

Why do we need to look at the last 2-3 days for a 15 min chart?

2)Also kindly clarify on the following timeframes:

a)Weekly

b)monthly

Regards,

Kiran Hegde

Kiran, depends on how long you want to position the trade. If its a proper swing trade that you have in mind, say position held for 8-10 days, then go back 25 days. Else a shorter lookback period is also ok.

Hello Karthik,

It has been mentioned that to determine a trend, we need to look at the last 5-8 trading sessions.

How do I correlate this to a 15 min timeframe? Should it be the last 5-8 candles on a 15 min chart?

How about the following timeframes:

-Weekly chart

-Monthly chart

Regards,

Kiran Hegde

If you are looking at 15 mins chart, then you need to look at the 15min chart for at least 2-3 days to get a sense of the prior trend.

Hi,

In the candlestick patterns, while analysing daily charts, how many days of data should be studied to classify the data as uptrend/downtrend?

Thanks.

I\’d suggest you look for at least 1 to 1.5 years of data.

In daily chart for PNB Housing, the combination of candles for 12th June and 15th June are said to be forming a Harami pattern when you enable the candlesticks in Studies. But the closing price of P2 candle is quite less than the opening of P1 candle. How is that a Harami pattern.

Its not very accurate, I\’ve mentioned it in this chapter – https://zerodha.com/varsity/chapter/the-central-pivot-range/

Why can\’t Q1 in the question above be classified as a bullish harami (provided that P2 doji is completely contained within the limits of P1 ? Strictly speaking it will be a bullish harami. If not, why ? Can you please clear this doubt ?

You need to have a proper candle on P2, unlike a doji or spinning top. Only then, by definition, it is considered a bullish harami.

Hello Karthik,

I have a question with respect to the daily charts of Eclerx.

Eclerx formed a bullish Marabuzo on 13th August 2020. On 17th and 18th August, a bearish Harami has been formed.

Now in cases like this, what candlestick pattern should be considered and why?

Any advice would be very much appreciated.

Depends on which pattern you acted first. If it is the Marubuzo, then after you initiate, stick to your Tgt or SL. If its the bearish Harami, then stick to that. The point is that if you\’ve acted on a certain pattern, ignore everything else till you trigger your Tgt or SL.

Thanks for prompt response.

With reference to my query no.1, if there is green colored Spinning Top in place of Doji then can we consider it as bullish harami ?

Regards

Not as convincing as a small green candle, but yes, you can considering the overall circumstance.

Hello Karthik,

Thanks again for the wonderful training material and for your continuous support.

Please clarify these queries for me :

1. In downtrend, on P1 red candle, P2 Doji (green colour, I know colour is not important in Doji). Can we consider this pattern as bullish harami ?

2. What should be basis of trailing SL ? For example stock X bought on Monday @ Rs 100 and SL 95. On Tuesday, EOD close price of stock is 105 and low price is 101. Should be trail SL as 101 for Wednesday onwards ?

Or, we should trail SL on basis of next support/resistance ?

What should be correct method to trail SL? Please guide.

3. On P2, if i miss to take position at 3.20 pm, should i place order next day at 9 am ?

Regards

1) No, this cannot be considered as a harami

2) Trail SL should be based on the number of points or on a % basis. For example, you trail the SL when the stock moves every 5 points in your favour or say 1% in your favour

3) Yes, you can look for the immediate next entry point

Hello Karthik

\”The risk taker will short the market near the close of P2 after ensuring P1 and P2 together forms a bearish harami. \”

So if I\’m being the risk taker here , I sell the stock at end of the day? how exactly does that work? Is there something like STBT? or can these be used for intraday ?at what timeline?

I went through all the comments searching for the answer , but only a few were there and those did not give me a clear picture to my doubt. I believe most beginners will have the same doubt So could please elaborate the same.

On a side note , Amazing content out here, really helpful , kudos for that !

Sham, if you are selling then you need to do this via a Futures or options, this way you can carry forward your position on an overnight basis.

hi kartik ,

i had a question regarding bearish harami !

In bearish harami is it necessary that the close of P2 should be higher than open of P1 , or it could be equal also and same goes with bullish harami that close of P2 should be lower than open of P1 or it could be equal also ?

Yes, the close of P2 should be higher than P1\’s opening. Equal would make it a bearish engulfing pattern.

Hi Karthik,

1. For the Bullish & Bearish Harami Pattern, on P-2 what causes the prices to open higher & lower than from the previous day\’s close? My guess is that when the bears exit their position before starting another round of selling the bulls caught hold and vice versa.

2. Similarly, how does gap opening works, you did explain that bulls are willing to buy at any price and bears are willing to sell at any price resulting in a gap, however, the only logical reason to do so should come from strong fundamentals of the underlying or are there any other reasons?

3. Is varsity the the only medium through which we can ask you questions as I have multiple other questions which are not related to this module?

1) It is usually an attempt by the bulls (for bullish harami) and bears (for bearish harami) to move the prices in the desired direction. The attempt is not successful, hence the short candle. But nevertheless it is an attempt.

2) Gaps are usually a function of excess supply or demand

3) This is the best way, although I do respond on Twitter as well.

Hello,

In case of Bullish Harami, if the closing of P2 is more than the opening of P1 (given that opening on P2 is higher than the close of P1), why won\’t the same principles apply? I think the same principles should apply because the market is anyway showing strength for the bulls on day 2.

The thought process behind the price action is very similar.

Hello Sir,

Thanks for such great learning material.

For justifying prior trend as a bullish or bearish, how much should be the price change for particular stock? Is there any relation between price change over number of trading session to justify it as a trend?

Usually, the trend should last for 8-10 trading session with at least 10% price change.

Hi Karthik,

Thank you for sharing these candlestick patterns, it has really improved my knowledge and has definitely set me on the right track as far as TA is considered.

Happy trading and learning, Pradeep!

Respected Sir, when we combine all the previous patterns mentioned i.e. bullish harami, bullish engulfing and the piercing pattern; a combined conclusion can be made that if at the end of a downward trend, you observe a red candle followed by a green candle then that shows there is an opportunity for long trading i.e. trend reversal.

Am I right, sir? and if yes, then what purpose do they solve by getting classified into different categories, instead of a single one? Thank you.

True, in fact, that is the purpose of candles, to help you identify patterns which are nothing but the manifestation of price action.

Hi Karthik,

Suppose with a prior downtrend, a Gap Up Green Candle is formed but by the end of the day, it closes above the open of the previous day\’s Red Candle. It would neither be a Bullish Harami, nor an engulfing and neither a piercing. So how would we classify such a candle? Is it to be considered an opportunity to go Long?

Thanks.

Sharan, just because a candle cannot be classified as a pattern, does not mean you don\’t trade on it. Candlesticks are all about price action with 100\’s of patterns. So yeah, if this looks convincing for you, then yes, you can track it and paper trade and gain experience. Next time you spot the same, perhaps take the trade 🙂

Thanks a ton Kartik !!

The sense is much clearer now.

Also, I quickly understood to some extent what quantifying actually means.

Thank you once again.

Good luck, Mrinal!

I mean to ask does it qualify truly as a Bullish Harami ?

Hi Kartik,

In the last chart in 9.2, (4th one in the chapter)…where you mention that the stop loss triggered leading to a loss…

Isn\’t the prior trend a bit dicey ?? As in, it\’s not actually a down trend…but a minor down and then almost flat trading ??

Just wanted to check if I am developing the right sense for reading the charts.

The best thing to do is to quantify, Mrinal. For example, you can define a downtrend only if the stock has declined 5-8% over at least 4-5 trading session. I\’ve just given an example, you can improvise on this. In fact, you can quantify every aspect of TA like this and make it more tangible.

Good day Sir,

In order to find out a pattern, do we take OHLC values and plot one candle per day in order to find out the trend?

Pardon the ignorance.

Thanks

Yes, that is right, these are called End of day candles. You can look at the end of days candle to identify trading opportunities.

sir downwards trend — then sudden Marubozu — then downwards trend following

I\’m seeing this kind of pattern more and more, am I missing anything, since Marubozu is a trend reversal pattern

https://imgur.com/a/D0ILaPd

Yes, but then you need to avoid trading on long candles, I\’ve explained why in this chapter.

Hi Karthik,

Taking bullish piercing into consideration,we say that the open on P2 should be lower than that of P1\’s close,in order to show the continuity of P1\’s sentiments,so after contemplating on P2,the long decision can only be taken at EOD ?

Whereas in Bullish Harami ,the open of P2 is more than P1\’s close giving a clear indication ?

The close again as we say is lower than p1\’s open ? Could you highlight the fundamentalism behind this.

I\’ve discussed this in the chapter itself, is there anything specific you are looking at?

Hey Karthik,

In Indian markets we cannot short on a CNC trade right? We can only short on intraday!?

No, to short and carry forward, you need to do in futures.

Are candlestick patterns useful on pullbacks?

Yup, they do. However, in most cases, look for pullback to an average.

Hi Karthik,

Thanks for wonderful content you have put together. A quick question: Can I apply the candlestick pattern to any length of session – eg instead of a day can it be a minute or 10 mins or 15 mins or 1 hour etc while intraday trading? Would it still hold good? TIA.

Yes, you can apply any asset any time frame.

Dear kartik bhai, thank you very much for all these detailed tutorials. I have just started reading this zerodha varsity.

However i have confusion about p2 day and thought process of whole pattern.

1) Here according to pattern, p2 day\’s candlestick should be in under shadow of p1 candlestick. Like most of the charts you mentioned follow this. Is it what pattern wants to convey?

2) your mention : \”However P2’s closing price is just below the previous days (P1) open price\” .

Now my confusion is in p2 candlestick. Lets say in harami bullish pattern p2 candlestick close is above p1 candlestick\’s open. If we interpret it with the thought process you mentioned we can say on p2 day bulls are in more strong position than actual harami bullish pattern. What should we do in this case?

1) Yes, that\’s what it means 🙂

2) Please treat this from a case to case basis. Not every candle had the same P2 inference

Thanks for your prompt reply Karthik

Happy learning 🙂

Dear Karthik,

Many thanks to you for bringing this amazing material. As I am progressing with Varsity modules, I am enjoying more and more. However, I have a query. Whether this candlestick patterns work in the extreme situation such as present pandemic or negative news flow such as bad news flow for banking industry?

Also, I have gone through few QA here and found that many readers have uploaded charts to clarify their doubts. But, I am not able to see them. Is there anyway to see those QA with the images?

Again, Much appreciated for your efforts to provide great content.

Regards,

Nirav

Glad to note that, Nirav 🙂

When you have a fundamental situation in the market, TA has very little relevance. I\’d suggest you don\’t rely on TA for this.

Images are user uploaded, they may have deleted the same.

Hi sir,

1. In Piercing pattern, should there be only gap down opening by P2? or, gap up also is OK?

2. In Kite charts, are the pivot points same as the Resistance and support levels studied in R&S chapter? Or should we plot R&S separately as told in that chapter?

1) Gap down

2) They are somewhat similar, I\’d suggest you stick to S&R

Are these correct assumptions?

1. An engulfing pattern is a stronger indication than a harami.

2. A piercing star is more commonly seen than a bullish engulfing (and similarly the bearish counterparts)

1) Yes, but this is just my personal opinion

2) Cannot comment on that though.

Sir,

Can you tell me the difference between The Piercing Pattern and Bullish Harami as both should have a prior down tend and The second candle is generally opposite in colour to the first candle?

Yes, the difference is in the positioning of the candle on P2.

If I am looking at daily data, how many previous candlesticks do I need to look at to recognize a trend?

For short term, at least 6 months.

Dear Sir,

An explanation in the first paragraph, you have written that On day 1 P1 and day 2 P2, sir my doubt is these P1 and P2 can form in the same day.

No, P1 and P2 are two different days, unless you are looking at intraday in which case P1 and P2 can be same day.

If Bullish harami is formed in UPTREND, it has no significance. Is it Correct?

In general, Can we say if a pattern is formed opposite to its trend in which it should have formed then it as no Significance.

Am I correct?

Sir do replay.

That\’s right, it is not a valid pattern if the prior trend does not support.

Sir, can you please explain how the triggering of the stoploss lead to a loss, in the image just above the title \”9.3 – The bearish harami\” ?

Stoploss implies that the stock has gone in the opposite direction of your trade position. Hence, a loss.

Hi Karthik

is trading can only With Futures or even it can be happen with CNC model. my question is considering deposit charges charged by DP\’s.

Yup, possible. Take delivery hold for few says and sell. This is called swing trading.

Hi Karthik, Have few doubts.

In the Harami pattern, do you recommend being risk taker or risk averse, since this is also a multiple candlestick pattern like Engulfing. For engulfing pattern you recommended being risk taker.

And if two stocks have harami and engulfing at same time, which one should be preferred

Hmm, it is hard to recommend as it really depends on many factors. If I were to trade this, I\’d imagine myself to be a risk-taker in most of the cases. Between the two patterns, I\’d go for the one which has a higher volume.

Sir

In bullish harami pattern, if close of P2 is higher than open of P1.Why won\’t it be more reliable than \’close of P2 lower than open of P1\’?

The idea with this pattern is sudden, intense, and short price action by bulls. A close above P1\’s open will not have the desired impact.

hello karthik

if shooting star appears in a downtrend so what it means ?

It simply means that the bearishness is emphasised and you should look for shorting opportunities.

Also during an uptrend or downtrend should the end value of the trend be either all time low or all time high or what is the reference point?

No, not necessarily.

it has been stated that the harmani pattern develops over two days and does this mean if we are using minute charts in intraday trading it happens and we get a confirmation in two minutes. And can someone please clarify me on basically if this is the best for intraday because all these examples over here are illustrated on the basis of days and not according to what an intraday trader would like to have.

//please help me out with the proper way to learn and practice trading even though varsity is a good material is there any other sources that can I rely on. please also feel free to mail [email protected]

Kishore, all examples are with respect to intraday, however, you can use the same techniques for day trading. For example, if you are looking at a bullish harami over a two-minute chart, then the pattern will complete at the end of 2 candles (which is 4 minutes) and you can take the trade on the 5th minute.

In my opinion, however, you should not be looking at 2 minutes charts to trade intraday 🙂

Sir, does Asian paints qualify bullish harami pattern on 11 April 19

If only it had opened a little higher 🙂

Oh.. Thanks

Hi,

For a piercing pattern, is P2\’s opening being lesser than P1\’s closing, a necessary condition?

If no, a Harami pattern that covers more than 50% of P1, could that also be interpreted as Piercing?

It should be lesser than P1\’s close or at the most equal to it.

Hi Karthik,

Would like to validate my understanding.

Can I say Maruti has formed a bullish Harami, as on 1st Mar evening? I have the trade setup as below

Stock: Maruti

Pattern: Bullish Harami

Buy: around 6930+

Target: 7300

SL: 6800

Prior trend: Downtrend – (From feb 8th it has come down, though last few sessions have been flat).

Please advise.

Regards

Bharani

Yes, it has formed a Bullish Harami. However, I think 7200 is a more reasonable target.

Thanks for the quick response Karthik.

I thought as per the charts the resistance level should be 7300 – are we choosing 7200, to be on the safer side or is there any other reason, that I am missing?

Regards

Bharani

Plotting S&R is a very visual concept and may differ from person to person (but not by a huge margin). I thought 7200 had a fair amount of price action. Why don\’t you recheck once?

Sure.. Thanks Karthik for the wonderful training material and for your continuous support

Good luck, Bharani!

Why will the bears panic if day 2 opening price is more than day 1 closing price?

The losses would mount for the bears, Diganta, hence they would panic.

Whether all these analysis apply to intraday trading as well? I mean, if the candles are 15 min candles can i use the same analysis?

Yes, the candlestick pattern can be applied to any asset (equity spot, eq futures, commodities, currencies) across any timeframe (5mins, 10 mins, 15 mins, EOC etc).

Hey Karthik,

Thanks for the excellent tutorial.

Just a small query, if after forming the pattern, the stock does not jump immediately but forms another bearish candle the next day, however the stoploss does not get triggered, does the pattern yet remain valid or is that considered the failure point?

Bearish pattern (except for marubuzo) will not matter. Remember for a bearish pattern we need the prior trend to be upwards.

https://drive.google.com/file/d/1ZJ-CIFVQF3MoVRT2AnYdezhgd1MjZ1nq/view?usp=drivesdk

Here is the link sir.

Not working, Srinath!

Sir can we consider the pattern formed in m&m as bullish harami with good volumes and price around support and go long here but macd is below signal line what would be your opinion in this kind of trades.

Sir can we consider this as bullish harami pattern with good volumes and price around support and go long here but macd is below signal line what would be your opinion in this type of trades.

https://drive.google.com/file/d/1b2P984WWz9yRIF4RlzFaQmxSVM65m4DJ/view?usp=drivesdk

Unable to open the link, Srinath.

You can check it now sir it\’s opening.

Not luck!

Hello Karthik,

Please clarify this query for me

Using these candle stick patterns in Intraday Trading , as a RISK AVERSER

1. for eg : if I see Shooting star pattern on two different occasions on the same day like one at 11a.m and another at 02;00 p.m is it safe to enter into trade for a quick shorting or should I wait for more than that to confirm a proper shorting situation.(Bulls are in control)

2. If I need to wait for more than 2 patterns to be formed wouldn\’t I missing the opportunity to trade for that day as I might not even get a similar pattern after that .

3. If two formations are enough for me to do a quick shorting then what is the time gap between these patterns should be or it doesn\’t really matter.

4. Similar above mentioned questions for Hammer or hanging man pattern as well.

Thankyou.

1) Since this is intraday, maybe you should enter the take the trade

2) Yup, hence evaluate other things in the grand checklist and take the trade if required

3) Again, these are intraday trades. It does not really matter

4) Works for all candlestick patterns

Sir..You Are Really Doing A Great Work..It is Really Very Very Helpful..

I Have Doubt..If a Stock is in downtrend and then For Few Trading Sessions it is Side way range..So Can We Apply The Candlestick Pattern Technique in Those Situation

Of course, you can, Rishabh. Look specifically for Marubuzo patterns here.

Thanx a Lot Sir..So You Mean In General Candlestick Pattern Will apply But Marubuzo Will Be More Benefiable..Am i right??..And Any Specific Reason For That Sir

Yes, specifically in sideways markets.

Thanx Sir..Is there any Telegram Group Managed By You..If There Plzz Share the Same

Nope, no telegram group.

Which is more reliable/strong among three(Engulfing/Piercing/Harami) candle stick pattern? I think Engulfing is most reliable for reversal….what do you think?

I like both Engulfing and harami patterns. I\’m not a big fan of the piercing pattern.

\”On day 2 of the pattern (P2) the market opens at a price higher than the previous day’s close\”

Shouldnt the opening price of a stock on a given day be equal to the closing price of the stock on the previous day??

No, the pattern (bullish harami) suggests that the opening on P2 is above the close of P1.

Sir,

I failed to get the point on Axis bank of 1st Oct trading results with previous days candle stick pattern.

pl explin if possible

Murali, which part are you getting stuck with? Will be happy to explain.

Dear Sir,

Many thanks for such wonderful information.

Can you please help me understand the below points?

1) While considering bullish or bearish trend, what\’s the typical timeframe/duration to be considered for assuming the trend? Is it 6 months?

2) How to take a short position for a shorter term trader? Is it to be taken in derivatives?

Thanks.

1) Look at both 6 months and shorter-term time frame (like 5-8 trading sessions)

2) Ideally yes, but no harm initiating short-term equity trades.

Hi Karthik, I really like the way you explain which has also enhanced my interest towards candle stick.

But I want to know that these candle stick tell us the trend but what should be our target. At what point we should square off the trade. You often speak about stoploss. Kindly guide

Arun, the best part of candlesticks patterns is that it comes with inbuilt risk management mechanisms (SL). However, it does not gives you insights into placing targets. For this, I think simple techniques like support and resistance helps.

Please Explain:

How the bullish harami pattern lead to loss after applying stop loss.(In the last chart of the bullish harami pattern)

Image address

https://zerodha.com/varsity/wp-content/uploads/2014/10/M2-Ch9-chart4.jpg

Apurva, like I have explained, CS patterns only enhance your probability of success. There are no guarantees here.

\”The risk averse will initiate the trade the day near the close of the day after P2, provided it is a blue candle day, which in this case is.\”

Doe this mean the risk averse will have to initiate the trade during closing time around 3.20 PM on the next day after P2?

or its nearer the close price of P2 on the next day?

Nearer to the close price of P2, the next day.

Hi Karthik Sir,

I have tried to identify instances of Bullish and Bearish Harami in the IDEA chart here.