In the previous chapters, you learned how investing and trading in the Indian stock market are taxed as per the Income Tax Act. We also touched upon maintaining books of accounts and rules of the tax audit.

Those chapters were written by @Nithin Kamath himself, that too, from an investor/trader’s perspective, giving you a clear picture of Indian markets and taxation.

In this chapter, I, @Satya Sontanam, look at how investments in foreign stocks are taxed in India.

If you think the tax rules of Indian investments are overwhelming, tax laws for foreign investments can get tricky and complicated.

The main challenge comes when the investments are taxed in a foreign country as well. On top of it, the tax laws of all countries differ from one another.

Here, we tried to simplify as much as we could to give you a brief understanding of what to consider when it comes to taxing income from foreign assets. We focus on investments in the stock market abroad and not on other forms of assets, including real estate.

8.1 – First Things First: Rules for Global Investing

When we hear about a few international stocks like Meta, Microsoft, Tesla, and Alphabet, it is totally natural to want to own a piece of these companies, isn’t it?

Lately, Indian investors have caught on to buying international stocks and diversifying their portfolios.

But how to invest in these stocks?

Many fintech platforms in India made investing in some of the foreign country’s stocks and ETFs (exchange-traded funds) simpler for retail investors compared to a few years ago.

But here’s the thing, investing in international stocks isn’t as straightforward as dealing with the Indian stock market. There are a few rules we have to keep in mind before taking the leap.

First, your overseas investments fall under the Liberalised Remittance Scheme (LRS). This is a scheme by the Indian government that lets you send up to 2.5 lakh dollars annually abroad. That’s about Rs 2 crore in Indian currency at the current exchange rate of Rs 82. So, you must keep your investments, along with other foreign trip expenses, abroad education costs, etc.. within that limit.

Next comes the tax collection at source (TCS) at 20% (5% before October 2023) if your foreign spending or investments exceed Rs 7 lakh per year. (Update: the Rs 7 lakh limit has been increased to Rs 10 lakh from FY25 onwards)

That is, even before you invest Rs 100, a tax of Rs 20 is deducted, and the balance is invested. Of course, you can use that Rs 20 to set off with your other tax liability later that year or claim a refund. To give some relief, Budget 2024 made it easier for salaried employees to offset TCS with TDS on their salary. For example, if you have a TCS credit of Rs 1 lakh and the TDS on your salary is around Rs 3 lakh a year, you can provide all the details to your HR, who will offset the TCS with your TDS liability. This results in only Rs 2 lakh being deducted during the financial year. This is a positive for taxpayers as the money deducted as TCS doesn’t get stuck with the government for a long time.

Next is about remittance: When you sell your investments, any money you get from the sale must be brought back to India within 180 days unless invested back. Funds can’t lie idle in foreign bank accounts.

Oh, and one more thing: when you file your income tax return in India, do not forget to disclose your foreign assets separately. The income tax department wants to know about all your global assets.

Remember that these restrictions apply when buying foreign stocks or ETFs directly. If you do not want to deal with LRS, TCS, tax disclosure, and remittance rules, you can also invest through Indian mutual funds in select international stocks and ETFs.

8.2 – Residency Status

An Indian resident must pay taxes on his/her global income, the taxman says.

What does it mean? If you are an Indian resident, you have to pay taxes on any income you earn, whether from India or abroad – be it in the US, UK, Australia, Singapore, or any other country.

But if you are a non-resident, the Indian government does not care about your foreign income. Our friends and family residing abroad investing there would not pay any taxes in India, right?

The taxman has specific rules to decide who is a resident and who is not. Basically, it depends on the period of stay in India. The definition of ‘resident’ is a bit technical. You can refer to the definition in the annexure to this chapter at the end to understand who qualifies as a resident.

The simplistic explanation is that if you are like many – live and work in India – and take occasional trips abroad – you are a resident.

8.3 – Tax In India

When it comes to investments in stocks, there are two types of income to consider: capital gains and dividends.

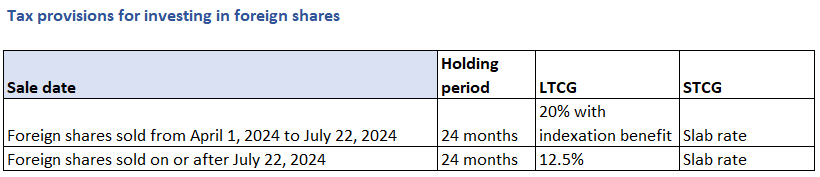

Let’s talk about capital gains first. The taxability of capital gains depends on the holding period of the stocks. If you hold foreign company shares for more than 24 months, the gains are considered long-term capital gains and are taxed at 12.5% (plus applicable surcharge and cess).

On the other hand, if you hold the shares for up to 24 months, any resulting gains are considered short-term capital gains. These are added to your total income and taxed according to the applicable slab rates.

Now, let’s consider an example to understand how this works. Suppose you invested Rs. 1,00,000 in foreign stocks on April 1, 2018, which was equivalent to, say, $1,500.

When you sold your investment on August 31, 2024, say, you received $2,500.

As the stocks are held for more than 24 months, it qualifies for a long-term capital gains tax rate of 12.5%.

For tax purposes in India, you need to convert the sale amount into Indian rupees. You must use the exchange rate (telegraphic transfer buying rate provided by the State Bank of India) on the last day of the month prior to the month in which the sale happened.

In our example, since the sale happened in August, take the exchange rate at the end of July 2024. It was Rs. 83.7.

So, your sale value, as per Indian tax rules, would be about Rs. 2.09 lakh (Rs. 83.7 * $2,500).

Next, let’s calculate the taxable capital gains: Capital gains = Rs. 1,09,250 (Rs. 2,09,250 – Rs. 1,00,000).

Therefore, tax to be paid = Rs 1,09,250*12.5%, about Rs 13,656.

The above mentioned tax rates are applicable for shares that are sold on or after July 23rd, 2024, when Budget 2024 changed the rules. For shares sold between 1st April 2024 and July 22nd 2024, LTCG is taxed at 20% (with indexation benefit) and STCG is taxed at slab rates. The holding period is the same at 24 months.

Moving on to dividend income, it is treated as ‘income from other sources’ that has to be added to the taxpayer’s total income.

Just like with capital gains, you need to convert dividend income into Indian rupees using the exchange rate on the last day of the month prior to the month you received the dividend.

This will be added to your total income and taxed at your slab rate.

So far, we have discussed tax on investing in foreign stocks.

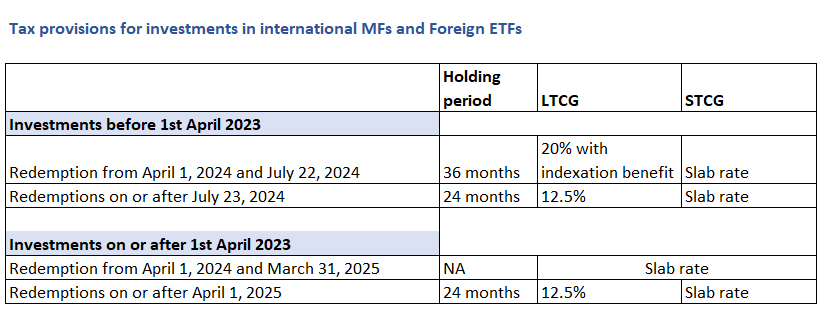

If you invest in foreign ETFs listed outside India directly or Indian mutual funds that are investing primarily in foreign stocks/ETFs, different tax rates are applicable based on the purchase date and the date on which the units are redeemed.

For units bought after April 1, 2023, any capital gains made during the financial year FY25 (April 1, 2024 to March 31, 2025) will be taxed at your income tax slab rate, no matter how long you held the investment. However, starting from April 1, 2025, new tax rules apply:

- If you hold units for 24 months or more, Long-Term Capital Gains (LTCG) will be taxed at 12.5% without indexation.

- Short-Term Capital Gains (STCG), for units held less than 24 months, will still be taxed at your income tax slab rate.

However, if you had invested in Indian-listed ETFs in foreign securities, the time period to differentiate between short—and long-term gains would be 12 months, with LTCG taxed at 12.5% and STCG at the slab rate. This rule, too, is applicable from April 1, 2025, onwards.

Sidenote: Quicko, a tax portal, has helped us in clarifying the tax rules on foreign investments, applicable after Budget 2024.

8.4 – Foreign Tax

Don’t breathe easy just yet. The toughest nut to crack is up next.

Just like non-residents investing in India are taxed in India, Indians investing abroad might face taxation in the foreign country too. You might wonder why you have to pay taxes twice, right?

Well, most governments, too, agree that taxing income twice isn’t fair.

The Indian government offers relief if you are taxed abroad. You might either be exempted from tax in India or receive a tax credit that you can use to pay your taxes here. To figure out which one applies, we have to dig into the Double Taxation Avoidance Agreements (DTAA) that India has with other countries.

Now, if finance stuff is not your cup of tea, these agreements can be pretty overwhelming, especially on the first read. You will need the expertise of a tax consultant to decipher it all.

Your broker or fintech platform might provide tax details on your investments, but you would be better off understanding how it works.

In many DTAA treaties, India follows the credit method to avoid double taxation. This means they give credit for taxes paid in the foreign country. This can set off tax liability on the same income in India. You can claim this credit by submitting Form 67 when filing the income tax return.

Let’s take the example of DTAA with the US-

For capital gains, the DTAA between the US and India states that each country may tax as per the provisions of its domestic law. This implies that both countries can charge tax.

But the US income tax laws do not charge capital gains tax on non-residents. So, the gains of Indians on US stocks are taxed only in India; hence, no double taxation.

Now, dividends. As per the DTAA between the US and India, dividends received from a US company are taxed only in India.

But here comes the catch – there’s a 25% withholding tax on gross dividends in the US. That means 25% is deducted at the source by the US, and you get the rest in your account.

No matter how much you receive, the entire gross dividend (converted into Indian rupees) will be taxed in India. In such cases, you need to submit Form 67 to claim credit for the withholding tax paid in the US.

Remember, these DTAA provisions and available tax credits can vary from country to country. If you are investing in countries other than the US and your broker isn’t helping with precise information, consider consulting your tax advisor. They will guide you through this tax maze!

8.5 – Reporting Of Foreign Assets In ITR

If you hate paperwork and endless documentation, reporting foreign assets and income in your tax return won’t be a walk in the park.

As a resident, you must disclose all foreign assets, like bank and depository accounts, stocks etc., held outside India while filing your income tax return. But if you fail to disclose them, you’ll face penalties and possibly even imprisonment under the provisions of Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

The income tax returns have dedicated schedules to fill in the detail of foreign assets, including foreign stocks.

As of now, there are three schedules (FSI, FA and TR) and one form (Form 67 discussed above to claim credit for tax paid abroad). Select the correct ITR form to fill in these details.

While we cannot discuss every aspect of these schedules, here are a few key points to keep in mind before reporting foreign assets and income. Note that these details are as per the rules as of FY23.

- The calendar year is relevant for reporting, while the financial year matters for taxing the income. So, don’t mix them up!

Here’s an example –

Say, you bought a stock of Microsoft in September 2022, which issued a dividend in November 2022. Take a share of another company – Alphabet – which was bought in January 2023 that gave dividends in March 2023.

For reporting assets and income for FY23, calendar Year 2022 would be applicable.

Microsoft stock: You bought the stock in September 2022. Since the purchase was made in the calendar year 2022, you would need to disclose this investment in your income tax return for the financial year 2022-2023. Even if you sell the company as of the date of filing the return, you still must report it as you held the company at least for a day in the year 2022. If the stock was bought in 2021 or before, and you own it at least for a day in 2022, you still have to report it in the ITR.

The dividend from the stock, which was received in November 2022, has to be reported in schedules as it was received in calendar year 2022. The dividend amount has to be considered for taxability in FY23 since it falls within the financial year period from April 2022 to March 2023.

Alphabet stock: You bought the stock in January 2023. As you do not hold the stock in the calendar year 2022, you do not need to disclose this investment in the schedules.

The dividend from Alphabet stock received in March 2023 would be considered for taxability in 2022-2023 (FY23). But it need not be disclosed in schedules as it was not received in the calendar year 2022.

Income earned from assets held outside India will be taxable as per the provisions of the Income Tax Act, even if it is not required to be disclosed in schedules.

- The schedules may ask for details such as peak balance, opening balance, closing balance, and amount debited and credited from the accounts and assets you have abroad. Keep all the details handy.

- You also need to provide the tax details paid in the other country and how much you are claiming as a tax credit in India.

- To report details in schedules, the rate of exchange for conversion is the telegraphic transfer buying rate of the foreign currency on the specified dates. While most of these details could be provided by the fintech platform through whom you are buying the stocks, always do your due diligence.

- If your total income exceeds Rs 50 lakh per annum, you may also need to provide details of assets (Indian and foreign) held as on March 2023 again in ‘Schedule AL.’

Annexure

Definition of ‘Resident’ as per the Income Tax Act

A taxpayer will qualify as a resident of India if he/she satisfies one of the following two conditions:

- Stayed in India for 182 days or more in a financial year; or

- Stayed in India for at least 60 days in the financial year and 365 days or more in the immediately four preceding years

If you are a citizen of India or a person of Indian origin who leaves India for employment or visits India during a financial year, the conditions are a bit different and also depend if your total income from India is more or less than Rs 15 lakh in that year.

Further, if an Indian citizen is considered ‘stateless’ and earns a total income in India exceeding Rs 15 lakh during a financial year, he/she will be treated as a resident in India for that year.

For example, say you are an Indian citizen who works in a country where people are not subjected to income tax as per local tax laws (For example, UAE). If your income from India during the financial year exceeds Rs 15 lakh, you will be considered a deemed resident in India, even if you haven’t set foot in India throughout the year.

Key takeaways from this chapter

-

- Direct investing in foreign stocks is not as straightforward as investing in the Indian stock market. You need to take into account the LRS, TCS, remittance to India and disclosure rules.

- If you are a ‘resident’ in India, your global income (including gains and dividends from foreign stocks) is taxed in India.

- If you are taxed on those profits in the foreign country as well, you can claim either an exemption or get a tax credit in India on the same income while filing the income tax return.

- Whether an exemption or tax credit is known only by checking the double taxation avoidance agreement (DTAA) entered by India with the other country. This may need an expert’s help to .understand the rules.

- Do not forget to disclose your foreign assets separately in the ITR. The income tax department wants to know about all your global assets.

Disclaimer – The information provided in this article is intended for general informational purposes only and should not be considered as tax, financial, or legal advice. Readers are strongly advised to consult a qualified tax professional or advisor for guidance specific to their circumstances before making any tax-related decisions.

I have purchased ESPO (foreign equity) and also received company-provided RSUs during the period 2023–2025.

I was not aware of the requirement to disclose Foreign Assets (FA) under ITR-2 / ITR-3. For FY 2022–23 and FY 2023–24, I had filed my ITR by enclosing only the income amounts reflected in Form 16, which included RSUs and ESOPs.

I would like to understand:

Whether it is possible to revise the ITR filings for FY 2022–23 and FY 2023–24 to include Foreign Asset disclosures.

If revision is not permitted due to timelines, what would be the correct compliance approach now (e.g., updated return, condonation request, or disclosure in subsequent filings).

Any penalty or implications applicable in such cases and how best to regularize the filings.

Hello Bala,

For FY 2022-23: You can file the updated return By end of march 2026 with 50% penalty on tax payable on any dividend or capital gains on foreign shares.

For FY 2023-24: You can file the updated return By end of march 2026 with 25% penalty on tax payable on any dividend or capital gains on foreign shares.

For FY 2024-25: You can revise the Return by 31st march 2025 without any penalty

Implications of non compliance: The penalty of Rs. 10L may be levied if the value of foreign holdings exceeds 20L

Thanks for your response, Venkatesh 🙂

Hi Bala,

Venkatesh\’s response to your query is appropriate.

Here\’s what Quicko, a tax-filing portal, has to say about your query:

You have two options currently:

First, file an updated return (ITR-U). The 25% / 50% applies only on the additional tax payable, not on income already taxed. If ITR-U is filed merely to complete FA disclosure (ESOP/RSU already in Form 16), the additional income is typically nominal, added only to qualify for ITR-U, and the levy applies only on that marginal tax.

Second, seek condonation u/s 119(2)(b) for a bona-fide procedural lapse. Where there is no revenue loss and no intent to evade tax, condonation is legally available and does get accepted in genuine cases, though it remains discretionary.

In some cases, taxpayers respond only upon receipt of a notice, explaining the bona-fide lapse and seeking relief during proceedings. This is a risk-based approach, not the preferred route, but it does exist in practice where the issue is purely disclosure-related.

Please check whether the perquisite was already taxed and reflected in Form 16. If so, the lapse is only non-reporting under Schedule FA, and any ITR-U filed for regularization would typically involve nil or only nominal additional income, or alternatively support a condonation request.

Hi Satya,

Thanks for your detailed responses; am sure a large number of investors (Zerodha customers and others) are finding it very useful. It also provides a sense of \’reliability\’ due to the Zerodha/Kamath brothers integrity.

A follow up question to the above, related but specific to me. Apologies for this long thread. Am concerned now. Hence, grateful for a response.

Background:

Am a Resident Indian since 2008 and a Zerodha customer. I NOW realise that I have been reporting my LTCG-Foreign shares incorrectly i.e. not on FIFO basis.

As a NRI, all shares of the specific listed foreign company (40,000 shares) were bought (ESOPs) at a uniform price of 18.00 between 2005 to 2007 and later, received 77,000 Bonus shares (zero cost) between 2008 to 2017. So, held a total of 117,000 shares as at 03/2018 against a total cost of 720,000/-.

Been reporting/disclosing all foreign assets in ITRs since 2012. From FY 2017-18 until 2023-24, I have been part-selling these shares, all at a profit.

For LTCG calculation purposes in the ITRs till now, I had taken the acquisition cost on a simple average basis i.e. 720,000/117,000 shares-cost @ $6.15 per share.

The Problem:

I am yet to file ITR FY 2024-25; to file before 31/12/25. Based on the above FIFO clarification, from 2017-18 to 2023-24, I now realise that I have been erroneously reporting significantly \”higher\” LT cap Gains in the initial years. However, no major \’real\’ Tax impact on me as I had significant LT Cap Loss from property sale in the same year which completely offset the cap gain on shares. The said LT Cap Loss was carried forward until 23-24. All of these are duly reported in ITRs since 2017-18.

Going forward, if FIFO has to applied:

The acquisition cost of the initial “paid” shares (using FIFO principle) are at a higher price of $18 whereas I assumed the average price of $ 6.15 for LTCG calculation in all the years. This means that I have erroneously reported significantly \”higher\” cap gains in the initial years. If I now apply the FIFO principle for the remaining shares, then I will have to assume “zero cost” for the remaining ‘Bonus’ shares. It will further increase my LT Cap Gain Tax implications. By the way, I had also not considered Indexation until 2022-23 for your info. Perhaps I chose to be on the safe side i.e. report higher gains/tax than being accused of under-reporting.

My queries:

1. Can I revise my ITRs since 2017-18, explaining to ITDept, only to readjust the “carried forward” LT Cap Loss?? (I will not seek any Tax refunds even if it is applicable).

2. If No to the above, what are the remedies available to me?

3. If No to point 1 above, then what is the method I should use for LTCG calculation for the rest of my zero cost Bonus shares commencing FY 2024-25? I do not have any more LTCG Loss carry forward.

4. Any alternative suggestions.

Thanks.

Hi Joe,

Looks like a tricky case. As far as I understand, you cant revise the returns filed many years ago, but if I am not wrong, you can write or contact the IT department directly to get some relief of the higher taxes paid in the previous years.

Anyways, I will contact quicko.com , a tax filing portal, on what they have to say about your queries. Will get back once I hear from them.

Hi Joe,

This is what Quicko, a tax filing portal, has to say for your query

\”Past Income Tax Returns (ITRs) cannot be revised. However, you may submit a request to the Income Tax Department under Section 119(2)(b), explaining the FIFO-related error and seeking adjustment of carried-forward losses. Approval is at their discretion and not guaranteed.

Going forward, ensure compliance with the FIFO method. This implies that any remaining shares are treated as zero-cost bonus shares, which could result in higher Long-Term Capital Gains (LTCG).\”

Hope this info helps.

Hi Satya,

Thanks very much for your initial and follow-up response.

Really Appreciated.

Joe

Hi,

I have purchsed US ETF via Zerodha Kite (India) namely MON100 and MAFANG and holding for more than 2+ year as I read on miraeassetmf Tax Reckoner FY 2025-26 that these are Foreign Equity ETF (India Domiciled, Listed) and STT is paid.

Ques1: Will this be included in 1.25L expemtion?

Ques2: Will these be included in below 7lakh income 87A rebate?

Updated response:

Hi Anuj,

1. No, as discussed with Quicko, a tax filing portal

2. No, rebate is allowed only for income taxed at normal tax slab rates. However, if your income is less than the exemption limit, then capital gains can be reduced to the extent, until it reaches the exemption limit.

Still trying to find clear answer:

Check \”Bro Tax Sheet\” & \”US Profit Bro\” sheet for referance:

https://docs.google.com/spreadsheets/d/1WrwzqMhzaCBusraE-6eE8fSVDyhXuPo4/edit?usp=sharing&ouid=115555576040278145734&rtpof=true&sd=true

How much tax I have to pay?

Sorry, can\’t open any links. Can you explain your question here? We will try to answer.

Since cap gains from foreign stocks and foreign ETFs are taxed under sec 112, 1.25 lakh capital gains exemption is not applicable. Its not the case for India domiciled funds though. However, its worth noting that fresh investments in india domiciled Nasdaq or FAANG mutual funds or FOF is not possible due to RBI limits on such investment.

Hi Krishna,

you are right. 1.25 exemption will not be applicable in case of the foreign ETFs traded in India.

Rs 1.25 exemption limit is not applicable for foreign ETFs traded in India even if STT is paid.

As per Quicko, a tax filing portal, to qualify for the exemption, the fund would have invested at lest 65% in domestic equities. Since foreign funds have more than 35% exposure to foreign listed securities, sec 112A is not applicable here and hence the 1.25 exemption limit cannot be considered.

I had invested in Mafang ETF in February 2023 and have sold it in December 2024. How do I need to tax the capital gains? By adding in slab at slab rate or by treating as LTCG @ 12.5%?

It\’s slab rate, Gaurav

Hello Sir

Very insightful.

I have ESOP given to me from my company since 2015.

I got my first share at 62.5 dollars on 19th jan 2017.

I sold one share at 434 dollars on 30th sep 2024.

Is grand fathering option available for me ? The grand fathering was 91 dollar on jan 31 2018 when jaitley introduced. So what should be cost i should consider for taxation purpose . Is it 62.5 dollars OR 434 Dollars.

I have never paid any STT on this acquisition of tax ? So is LTCG 20% with indexation benefit is my tax rate

OR

12.5 % without indexation benefit should be considered. Please clarify

Hi Nagendra

Grandfathering is not applicable for foreign shares.

I have a question regarding investment in a foreign private limited company.

How should one report investments in the unlisted shares of a foreign private limited company?

Additionally, if the reporting has not been done for the 3 years since the investment. Can a revised return be filed?

There is no capital gain or income from this investment.

Hi Siddhanth,

Hope you found a way to report your foreign unlisted shares in the ITR, which was due on Sep 16, 2025.

You should have reported them under the financial assets in schedule FA in the ITR.

Coming to your point on revision of returns, the due date for revision of past returns is lapsed. You can revise the FY24-25 return, if you haven\’t reported them. You have time till Dec 2025 to revise this return.

Hi Team,

I made an equity investment in an unlisted foreign company in 2022 – should this investment be declared in income tax filing every year since 2022 or only in the year in which investment was made. Kindly note, there is no income from this investment till date.

Hi Varun,

It should be disclosed every year, since you are mandated to disclose your foreign holdings in the ITR.

Hi,

I have a query, if i am having dividend income from foreign shares. can this be set off against long term capital loss on foreign shares in the same year. If yes, what is the procedure and how to show the same in ITR-2

Hi Meenu,

Loss under the head \’capital gains\’ cannot be set off against income under other heads of income.

hello!

i am a us citizen, with oci card, and a tax resident in india (r-or), due to duration of stay in india.

for calculating capital gains on investments that were held in usa, before becoming a tax resident in india, how are the gains to be calculated, given the depreciation in indian currency?

it seems that even a usd loss, can result in inr gains, if the difference between selling and buying prices are calculated after converting usd to inr, because of depreciation.

this makes very little sense, so can you please elaborate on how handle cases where the investments were made more than a decade ago!

thank you!

Hi Krishna,

This is a very peculiar situation. We reached out to Quicko, a tax filing portal for their opinion. Here\’s what they said –

\”As per our understanding, as a tax resident of India, your global income is taxable here, including gains from US investments. Under Rule 115 of the Income-tax Rules, for converting foreign currency to INR, the telegraphic transfer buying rate on the last day of the month immediately preceding the month of transaction is used both for purchase and sale. This can lead to situations where a USD loss still shows as a gain in INR due to currency depreciation. For long-term assets, cost after conversion can be indexed as per the Cost Inflation Index, if sold before 23 July 2024. Further, if you’ve paid any tax in the US, you can claim foreign tax credit (FTC) in India under the India–US DTAA.\”

Please note that this is just an interpretation and not a advice. Thank you

On the same point,

1. Would Grandfathering be allowed if the foreign shares were bought prior to 31/01/2018 (say in 2007-08)?

2. Indexation allowed?

Am asking because, very old investments does have higher value considering the inflation and it would be very unfair to not allow both stated above.

Hi

1. No, unfortunately, grandfathering is not available on foreign shares.

2. For any sale after July 23, 2024, there is no indexation as well for foreign shares.

Hello, if long term capital gains from foreign stocks happen to an Indian resident after 23rd July 2024 which rate must be taken into consideration, fluctuation rate or constant rate of conversion

Hi Akshitha,

If you are talking about the tax rate, for sale after July 22, LTCG is taxed at 12.5%, while STCG is taxed at your slab rate.

But if you are talking about the foreign exchange rate, there is no change in the treatment.

a) I have opened an account with a broker in US in Greenwich during November 2024 , i have received dividend of 155 dollars and interest of 2.5 dollars in December 24. Brokerage has debited USD 117 AS Commission.Can i deduct the commission charged as expense and deduct it from dividend i received.

Hi Ramasubramanian,

Spoke to Quicko about this. Here\’s their response-

\”Commission or brokerage paid to earn dividend income is not deductible. The income will be taxed under other source.\”

Hi Ramasubramanian,

As per Section 57 of the IT Act, only interest expenses incurred on the loan amount to buy the stocks can be claimed from dividends received from that stock. Also, this interest can only be 20% of the dividend income.

Hence, you cannot deduct the commission from dividend income.

Although when you are going to sell those shares, you can claim all the commission charged by your broker in that financial year. (In India, you cannot claim the securities transaction tax charged by your broker).

HI

I have a query related to foreign RSUs received.

I received 100 US-equity shares in july-2022, which I sold in Dec-2024 (LTCG)

Assuming my LTCG is approx 1000$, where all this needs to be filled in ITR2.

AFIK, it should be declared in schedule FA, but do I need to declare it Schedule FSI as well? There shouldn\’t be any double taxation as I only need to pay capital gain to Indian govt. Will capital gains be calculated based on Schedule FA or Schedule FSI?

Also, can I claim it against Schedule 54F if I have bought an under-construction residential property with hand-over in dec,2027 (on EMI)

Kind Regards

Schedule FA is for reporting.

You also need to report this in FSI and also in Schedule CG.

Hi Ami,

Here\’s what Quicko, a tax filing portal, says about your query

1. In ITR-2, you need to declare the LTCG of $1000 in Schedule CG for tax, and disclose the foreign shares in:

– Schedule FA (foreign asset details)

– Schedule FSI (foreign source income), only if foreign tax is paid. If no taxes are paid, you can still fill it and mention the foreign tax paid as zero.

– Schedule TR + Form 67, if claiming foreign tax credit (FTC)

2. Yes, you can claim exemption under Section 54F for investment in an under-construction residential property, as long as:

a) You invest LTCG in the property before filing ITR or deposit it in the Capital Gains Account Scheme, and

b) Property is handed over within 3 years (by Dec 2027 is valid)

Hope this helps.:)

Hi Satya

I have two questions related to filing of form67:

1. Should RSU dividend / stock sale transactions during calendar year of stock holding country (example USA) be considered or dividend/sale during financial year (Apr-Mar) be considered for filing form67?

2. What documents need to be uploaded along with form67?

Thanks

Hi Abhi,

I reached out to Quicko, a tax filing portal, to help me with this query. Here\’s what they said –

1. Form 67 should include RSU dividends/stock sale transactions based on the Indian financial year (Apr–Mar).

2. Documents to upload with Form 67 can be :

– Foreign tax withholding certificate (e.g., Form 1042-S / 1099 from the USA)

– Brokerage statement or payslip showing income and foreign tax paid

– Any other Proof of tax payment

Hope this helps:)

Is there similar sites like https://www.spectraanalytica.in/ where I can automatically calculate the capitals gains on foreign assets?

I was able to generate Schedule FA for my RSUs but it seems they don\’t support capital gains right now. 🙁

Hey team

What is the tax implication on selling of shares of an Indian to a foreign investor?

Hi Saksham,

Couldn\’t understand your query. Are you talking about an unlisted share of an Indian company?

Hi Team,

As discussed in article & other comments – After selling the my RSU in US I can use that funds to trade or purchase other Equity in US.

But can I also transfer those funds to Dubai Bank Account for real estate investment ?

Obviously declaring the income and gains in US and also the Dubai property in foreign assets.

It will save on the LRS limit and FX Charges for 1 Hop.

Hi Sachin,

We will not be able to answer this question. You may have to consult a FEMA expert.

There is one rule with LRS though that states that any money from your investments abroad, unless reinvested, has to be sent back to India within 180 days. Whether that reinvestment (within 180 days) covers only within that particular country or outside is something we don\’t have an expertise to answer.

Can short term capital loss on foreign shares (Eg loss on seling shares of Tesla) be carried forward ?

Hi Vivek,

As far as we understand, there is no distinction for capital loss from foreign shares to be carried forward compared to other asset classes. It can be carried forward.

Thank you for the detailed article.

I read the article & I have 2 questions about this:

1. Does LTCG made on US listed stocks by the Indian investors can be offset & harvested by both US stocks STCL & LTCL and Indian equity STCL & LTCL or any other asset class losses?

2. Does LTCG from US stock taxed in India at 12.5% have any exemption like 1.25L have for Indian equity LTCG?

Hello Ero,

Here are the responses for your two queries-

1. Capital loss from foreign shares can be adjusted against the profit from Indian shares as well as foreign shares. The same principal applies loss from Indian shares that can be set off against gains from foreign shares. The only condition is that short term capital loss can be adjusted against both short and long term profit but Long term capital loss can only be adjusted against long term profit.

2. No, not available for foreign shares.

Quicko, a tax filing portal, whom I reached out to, confirmed the above answers. Thank you.

Can you provide the section where it is written that the indexation benefit is available for R-OR on selling of Foreign Shares in Income tac act 1961

Hi Tanmay

R-OR refers to Indian resident. You can go through section 48 of the IT ACT that talks about computing capital gains. You can go through second proviso to sec 48 (ii), which talks about the indexed cost.

Having said that, I would like to point out that for any sale after 23rd July 2024, there is no indexation benefit available for sale of foreign shares. Indexation is only available for sale before that date.

Hi Satya,

I was having this doubt , as capital gains are taxed as per tax slab for foreign equity in short term. For a high income individual it is 30% , but domestic equity capital gains are taxed at 20% in short term.So , was thinking if capital gains/losses which are taxed at different rates can be offset against each other, because it looks like a loss to the government , if stcl of a lower tax rate is offset against stcg of a higher tax rate.

No such restriction that we are aware of, Prem.

Hi, can short term profit from foreign shares be offset against short term loss of Indian shares. Ex: I have short term profit of 100$ = 8700rs. I also have short term loss in Indian shares of 8700rs. Can I offset both of them to make my tax=0?

Hi Prem,

To what we understand, there is no restriction on setting off short-term capital loss from investing in Indian shares against profit from investing in the US shares. Short-term capital losses can be set off against long-term and short-term capital gains.

Hi Satya,

Thank you so much for the detailed insight on this subject, this will definitely help me to take better decision on Foreign investing. Also, if you please help me to get answers to my below queries, that will be great help –

1. Can we offset LTCG/STCG from Foreign Shares/ETFs with Basic Exemption limit (Which is 4 Lakh in New regime as per latest declaration) if there is no other source of Income?

2. Can we offset LTCG/STCG from Foreign Shares/ETFs with 87A (which is up to 12 lakh in New regime as per latest declaration) rebate?

3. What is the tax rate for dividend income from Foreign Shares?

4. For a salaried person, any gain/dividend income from Foreign Shares/ETFs in calendar year 2024, by which date Form 67 to be filled?

5. Can someone invest in Foreign Shares/ETFs if the person has no other source of Income?

6. Can HUF invest in Foreign Shares/ETFs?

Hi Tubai,

This is what I think about the points you highlighted –

1. Yes

2. No, rebate is not available for capital gains

3. Will be added to \’other sources of income\’ and will be taxed at your slab rate; if there is a withholding tax, you can claim credit for it

4. On or before the due date to file the return – https://www.incometax.gov.in/iec/foportal/help/statutory-forms/popular-form/form67-um

5. I don\’t think there is any restriction for that.

6. One has to use the LRS route to invest in foreign stocks directly. But LRS is not available for HUFs. – https://www.rbi.org.in/commonman/english/Scripts/FAQs.aspx?Id=1834#:~:text=The%20Scheme%20is%20not%20available,account%20held%20abroad%20under%20LRS.

Hope this helps. I checked with Quicko, a tax filing portal, too, to confirm the answers once.

Hi,

I want More info about Section 54F. I have LTCG in Foriegn assets. I am an indian resident. I am constructing a house from LTCG. Can i avail the benefit under Section 54F

Hi Nilesh,

Section 54F of the Income Tax Act allows you to claim tax benefits if long-term capital gains from ‘any’ long-term capital asset (not being a residential house) are reinvested in a residential property in India. It did not specifically exclude foreign stocks. Hence, we believe that section 54F benefit will be available on LTCG from the US listed shares as well. You can check with tax experts to confirm the same.

Kya canadian company ka stock kharid skta hu

Hi Abdul,

Frankly, I have no idea about it. You can check with the broker platform (foreign broker or the Indian platform that has an association with a foreign broker) through which you are planning to invest if access to Canadian securities is allowed. A few brokers allow access to stocks from multiple countries.

The other indirect route would be to invest in ETFS in the US that has Canadian stocks as underlying securities.

Let us know if you figure out a way. It would be informative for me too. 🙂

Thank you!

If I had purchased US stocks when I was working in the US and sold them returning to India and assume that I have held the stock for 4 years, how do I calculate long term capital gains.

e.g I bought XYZ at $1000 in 2005 [USD-INR exchange rate was say Rs. 60] when I was working in the US (and was an Indian citizen) from my US income. Now I am back in India (Indian citizen, India tax resident) and sell the stock for $1500 [USD-INR exchange rate is Rs. 80]. My long term capital gain in USD is $500. How do I calculate my gain in INR? Will it be (1500*80)-(1000*60) or will it be (500*80)

Hi Ajay,

As per our understanding, as you are resident of India now, you will be capital gains will be charged to tax in India. We assume you are showing these shares as foreign assets in your income tax return. Not very sure of whether it is taxed in the US as well. If yes, please check with your CA on how to claim tax credits.

For tax purposes, capital gains in INR is considered after converting the purchase cost and sale proceeds. let me check with Quicko too for their views.

Did you ever get a reply to your original query Ajay?

OK.

Got to know many things related to foreign stocks and taxation. Thanks! @Satya Sonatanam for your effort to provide us such valuable informations on this topic.

Thanks for your kind words, Aryan. Best wishes 🙂

Hello Satya Sontanam,

Through indian mutual funds means ?

I bought those etfs directly using my demat ac balance,let say with zerodha as we take delivery of shares and hold units in demat form, I mean not invested indirectly through any MUTUAL FUNDS OR FUND of FUNDS available like motilal oswal nasdaq 100 FUND OF FUND.

Now what will happen in my case?

Hi Aryan,

I am assuming you bought the ETFs traded on the Indian stock exchange. They may not be considered as foreign assets to be reported in the ITR. You may refer to this article from Mint as well. https://www.livemint.com/money/personal-finance/income-tax-deadline-of-itr-u-extended-to-48-months-all-you-need-to-know-budget-2025-itr-11738573818881.html

Since this is a subject matter that requires interpretation and understanding, we urge you to check with your CA as well regarding the same.

I have investment in MAFANG etf and MOTILAL NASDAQ 100 ETF .Are they considered foreign asset under income tax ? Shall I have to fill details corresponding to those etfs in shedule FA, FSI(if gain from selling those ETFs) of itr form? If yes, which shedule under shedule FA applicable?

Hi Aryan,

I assume you hold both foreign ETFs through Indian mutual funds. In that case, you are not required to show these assets under foreign assets, in our understanding. Hope this helps 🙂

Related to Tax on foreign equities. Last year Govt. announced LTCG of 12.5% on shares sold after 23rd July 2024 and 20% with indexation on shares sold before 23rd July 2024.

How is following situation handled if I want to offset STCL?

STCL loss: ₹1000

LTCG Total: ₹1600

A: LTCG (Shares sold before 23rd July): ₹800

B: LTCG (Shares sold after 23rd July): ₹800

Where should I offset the 1000 rupee loss? Would it be offset in A or in B? or depends on date of sale of short term shares?

If possible please do share where I can read more about this information?

Hi Jack,

As per my understanding, Budget announcement in July 2024 has no bearing on the set off provisions.

I also reached out to Quicko, a tax filing portal, about their POV on this.

This is what they replied – \”Budget 2024 has had no change in c/f and setting off the loss.

The loss is first adjusted against the higher tax rate i.e 20% in this case. We will have more clarity once the AY 2025-2026 utilities are live.\”

Hope this helps. thank you.

capital loss can only be set off with capital gains

Short term capital loss can be set off with both short term and long term capital gain whereas long term capital loss can only be set off with long term capital gain….If not set off it will be carry forwarded

Well explained. Thanks, Adwaith 🙂

Hi Satya,

Can we set off short-term capital loss from investing in US shares against salary income?

Hi Pavan,

No, capital loss cant be set-off against the salary income.

The articles that you pointed out hold good for someone filing taxes in the US. Looks like if you are reporting capital gains on foreign stocks in ITR forms as a resident of India, FIFO is the only model to follow. Been searching for this information as well since there\’s no concrete data available. Found some references listed below.

https://www.reddit.com/r/IndiaTax/comments/1f5jiud/fifo_applicability_for_foreign_stocks/

https://www.reddit.com/r/IndiaTax/comments/1f718gx/ask_away_your_finance_tax_queries_ca_here_not_a/

Thank you Satya for your prompt responses which have been very informative.

Yes, Karthik.

There seems to be contradictory opinions on this. These are the cases, usually, we see the intent of introducing a particular rule.

As Quicko pointed out, check this circular which talks about why FIFO has been introduced for dematerialised stocks in India. – https://cleartax.in/v/it/income-tax-circulars/768-circular-no-768-dated-24-6-1998-24-june-1998/

It clearly mentions that FIFO is the way to go because all the holdings of a particular security in demat form will be identical and inter-changeable and they will have no unique characteristic such as distinctive number, certificate number, folio number, etc. As the holdings of any securities in dematerialised form is represented only by the account with the depository and all transfers are effected through book entries in the accounts maintained by the depository, under this system it is not possible to link the purchase of a security with its sale by means of its distinctive number, etc.

Going by this, as Quicko stated, if one can clearly identify and specify the stocks being sold, that can be used.

Again, needless to say, this is just an interpretation.

Hi Satya,

Thanks for your detailed responses; am sure a large number of investors (Zerodha customers and others) are finding it very useful. It also provides a sense of \’reliability\’ due to the Zerodha/Kamath brothers integrity.

A follow up question to the above, related but specific to me. Apologies for this long thread. Am concerned now. Hence, grateful for a response.

Background:

Am a Resident Indian since 2008 and a Zerodha customer. I NOW realise that I have been reporting my LTCG-Foreign shares incorrectly i.e. not on FIFO basis.

As a NRI, all shares of the specific listed foreign company (40,000 shares) were bought (ESOPs) at a uniform price of 18.00 between 2005 to 2007 and later, received 77,000 Bonus shares (zero cost) between 2008 to 2017. So, held a total of 117,000 shares as at 03/2018 against a total cost of 720,000/-.

Been reporting/disclosing all foreign assets in ITRs since 2012. From FY 2017-18 until 2023-24, I have been part-selling these shares, all at a profit.

For LTCG calculation purposes in the ITRs till now, I had taken the acquisition cost on a simple average basis i.e. 720,000/117,000 shares-cost @ $6.15 per share.

The Problem:

I am yet to file ITR FY 2024-25; to file before 31/12/25. Based on the above FIFO clarification, from 2017-18 to 2023-24, I now realise that I have been erroneously reporting significantly \”higher\” LT cap Gains in the initial years. However, no major \’real\’ Tax impact on me as I had significant LT Cap Loss from property sale in the same year which completely offset the cap gain on shares. The said LT Cap Loss was carried forward until 23-24. All of these are duly reported in ITRs since 2017-18.

Going forward, if FIFO has to applied:

The acquisition cost of the initial “paid” shares (using FIFO principle) are at a higher price of $18 whereas I assumed the average price of $ 6.15 for LTCG calculation in all the years. This means that I have erroneously reported significantly \”higher\” cap gains in the initial years. If I now apply the FIFO principle for the remaining shares, then I will have to assume “zero cost” for the remaining ‘Bonus’ shares. It will further increase my LT Cap Gain Tax implications. By the way, I had also not considered Indexation until 2022-23 for your info. Perhaps I chose to be on the safe side i.e. report higher gains/tax than being accused of under-reporting.

My queries:

1. Can I revise my ITRs since 2017-18, explaining to ITDept, only to readjust the “carried forward” LT Cap Loss?? (I will not seek any Tax refunds even if it is applicable).

2. If No to the above, what are the remedies available to me?

3. If No to point 1 above, then what is the method I should use for LTCG calculation for the rest of my zero cost Bonus shares commencing FY 2024-25? I do not have any more LTCG Loss carry forward.

Thanks.

Thank you Satya.

Since most of us hold the foreign shares in demat form and cannot identify individual shares or lot via a contract I believe FIFO is the model to follow.

It would be good to update this page given a lot of people are investing in foreign stocks.

Noted, Karthik. Thanks for your feedback.:)

Karthik,

I also want to highlight out one more point. As I understood, in the US, brokers give you options on what method you want to choose for selling shares – FIFO, LIFO, or average cost/specific shares method. Brokers may give a default option, but you can also change as you choose it to be. I urge you to check this with your broker in the US once.

Some articles that helped me in this regard are –

https://www.investopedia.com/articles/05/taxlots.asp

https://www.schwab.com/learn/story/save-on-taxes-know-your-cost-basis

These are not from official tax sites. Just sharing for your reference.

Hi Satya Sontanam, Thanks for the reply. From your reply:

>>There is no restriction on setting off short-term capital loss from investing in US shares against profit from investing in Indian shares. STCL can be set off

I had this doubt because STCG in the US is added to our income and taxed at at income tax slab rate (as high as 30%). So STCG in US (STCG @Slab rate) and India (STCG @20%) are treated differently, So I was not sure if US stocks STCL it can be setoff against Indian STCG. I had checked with a CA, although they were not completely sure about it, they told that there is high change that it can\’t be setoff. Now I\’m a bit confused

Hi Pavan,

You can go through the third FAQ – https://incometaxindia.gov.in/Pages/faqs.aspx?k=FAQs+on+Set+Off+and+Carry+Forward+of+Losses – this link is from the income tax website. They do not have any such restrictions for foreign shares in terms of intra-head set-off provision.

Also, we contacted Quicko, tax filing portal, to get their view on this. As per their interpretation too, capital loss from foreign shares can be adjusted against the profit from Indian shares. Short term capital loss can be adjusted against both short and long term profit. Long term capital loss can only be adjusted against long term profit.

Having said that, your CA would have gone through your specific case or can have a slightly different interpretation. We urge you to note that this is not a tax advice.

Hi, I have 2 questions:

1. Can we setoff Short Term Capital Loss (from investing) in US listed stocks against Short Term Capital Gain earned (from investing) in Indian listed shares.

2. Is there any exemption for Foreign LTCG like 1L (like that for Indian Stocks). Or are the Foreign gains taxed at flat 12.5% even for 1rs

Hi Pavan,

1. There is no restriction on setting off short-term capital loss from investing in US shares against profit from investing in Indian shares. STCL can be set off

against long-term or short-term capital gain.

2. No exemption available for capital gains on foreign shares.

can short term profit from US stocks be offset against short term loss in indian stock

Hi Kamal,

There is no restriction on setting off short-term capital loss from investing in US shares against profit from investing in Indian shares. STCL can be set off

against long-term or short-term capital gain.

can i offset my short term capital gain profit in US stcoks versus my short term loss in indian stock market

Hi Kushal,

There is no restriction on setting off short-term capital loss from investing in US shares against profit from investing in Indian shares. STCL can be set off

against long-term or short-term capital gain.

Additional clarification: Since this is a foreign stock, Am I allowed to report 27500 as capital gains given the flexibility to select any stock to sell or should I follow FIFO for foreign stocks as well assuming I am an Indian resident filing IT returns in India

Hope the response to your previous question helps. 🙂

Thank you. The query is not for reporting the foreign stocks. Please consider the below scenario

Lot1: 10 APPL stocks bought at $50 each on 1st Dec 2020. INR = 60

Lot2: 20 APPL stocks bought at $150 each on 1st Dec 2022. INR = 70

on 1st Dec 2024, APPL stock is at $200, INR = 80. I want to sell 5 APPL Stocks. The brokerage allows me to sell from Lot1 or Lot2.

If I sell from Lot2 my capital gains would be

5 * ($200 * 80 – $150 * 70) = 27500

If I sell from Lot1 my capital gains would be

5 * ($200 * 80 – $50 * 70) = 65000

As per FIFO model stocks I will have to report my capital gains as Rs.65000. Since this is a foreign stock, I am allowed to report 27500 as capital gains given the flexibility to select any stock to sell.

Interesting question, Karthik.

We contacted Quicko, a tax filing portal, for your query. Here\’s their view on this –

\”For shares listed on recognized exchanges in India, the tax treatment is clearly defined under Section 45(2A). However, I could not find any specific case law/section addressing the treatment of foreign shares.

As per our understanding,

Under the Double Taxation Avoidance Agreement (DTAA) between India and the United States Article 13, each contracting state may tax capital gains in accordance with its domestic laws. Based on this, the following treatment can be applied to an Indian resident selling APPL shares:

1. Specific Identification of Shares

If you can clearly identify and specify the stocks being sold (e.g., Lot2 in this case), you may report ₹27,500 as your capital gains. (Circular No. 768, dated 24-6-1998)

2. Dematerialized Shares or No Specific Lot Identified

If the stocks are held in dematerialized form, or if no specific lot is identified at the time of sale, the FIFO method will apply. Under FIFO, the shares from the first lot will be deemed sold first. Consequently, you would need to report ₹65,000 as your capital gains. (Circular No. 704, dated 24-6-1995).\”

Since the answer to your query involved interpretation, we would also urge you to consider getting a tax expert advice on this who looks into your specific question at hand thoroughly and provide a solution.

I have purchased a same stock listed in NASDAQ at different times in the last five years. The brokerage does provide an option to select the specific shares to sell. Selling the recently acquired shares would result in low tax liability.

Can I sell selective stocks and is this allowed from Indian taxation perspective or does FIFO needs to be followed for the foreign stocks as well ?

Hi Karthik,

As far as the reporting of foreign stocks is concerned, stocks purchased at different times have to be reported separately.

This suggests that you can show the closing value of stocks that are bought earlier and capital gains for stocks held for short-term, if you sell them.

Hi and thanks for this very useful information.

Please help me understand the following from this chapter:

\”The tax collection at source (TCS) at 20% (5% before October 2023) if your foreign spending or investments exceed Rs 7 lakh per year\”.

The year is Calendar year or Financial year?

Thanks again.

Hi Anil,

This should be applicable for financial year. Any TCS credit available for the financial year can be off-set with tax liability on your overall income.

Hii,

I am resident in India. I am receiving dividend from investments made in US Stocks. Since dividend receiving in different months, what should be ideal exchange rate to convert into INR for filing ITR? And how to claim 25% withholding tax on those dividends?

Hi Swapnil,

As mentioned in the chapter,- just like with capital gains, you need to convert dividend income into Indian rupees using the exchange rate on the last day of the month prior to the month you received the dividend.

And you need to submit Form 67 to claim credit for the withholding tax paid.

Hi Satya,

I have 2 queries.

Query 1.

I understand that we have to report in ITR schedule FA a foreign share according to calendar year Jan2022-Dec2022 which i held for this period of calendar year, pertaining to Indian FY 2023 . Now lets say i sold that share in Feb-2023.

A> What value i have to provide for schedule FA declaration for this share for the field “” Total gross

proceeds from sale or redemption of investment during the period” ? 0 or sale value or something else?

B> Though i sold the share in Feb-2023, but we still need to mention that share in ITR filing time in Schedule FA for the CY Jan2023-Dec2023? Correct?

If Yes then What value i have to provide for schedule FA declaration for this share for the field “” Total

gross proceeds from sale or redemption of investment during the period” ? Sale value or 0 or something else?

C> The CG has to be reported in FY 2023-2024 as the share was sold according to India FY year 2023-2024. Is this understanding correct?

Query 2: Do we need to make individual entry for each share lot received or we can club them?

For ex: I received 10 RSU shares of my employer in Jan 2023, and again i received 20 shares in March 2023. So can i club and make single entry reporting of 30 shares and average the price to calculate and provide “initial value of investment”? and Mention the the “Date of acquiring interest” as one of the date either Jan 2023 or March 2023?

Thanks

Hi Azeet,

We reached out to Quicko, a tax filing portal, for your queries. Below are their responses. Hope it helps.

Query 1:

a) If the shares are sold on Feb 2023, In Schedule FA, the \”total gross proceed from sale or redemption of Investment during the period?\” will be 0 as of Dec 2022 for FY 2022-2023,

b) Yes, the shares sold in February 2023 should be included in Schedule FA for the financial year 2023-2024. The \”total gross proceeds from sale or redemption of investment during the period\” should be the sale amount, and the closing balance will be 0.

For the financial year 2023-2024, all foreign assets held at any time from January 2023 to December 2023 will be shown.

c) Capital gains tax will apply in the financial year 2022-2023 for the sale of foreign shares in February 2023 following the Indian Financial year.

Query 2:

We should list each individual investment separately, along with its initial value, peak value, acquisition date, and closing balance as of December 31.

To take your example: there would be one entry for 10 RSUs for January 2023 and another entry for 20 RSUs for March 2023.

Hi Satya,

I have 2 queries.

Query 1.

I understand that we have to report in ITR schedule FA a foreign share according to calendar year Jan2022-Dec2022 which i held for this period of calendar year, pertaining to Indian FY 2023 . Now lets say i sold that share in Feb-2023.

A> What value i have to provide for schedule FA declaration for this share for the field \”\” Total gross

proceeds from sale or redemption of investment during the period\” ? 0 or sale value or something else?

B> Though i sold the share in Feb-2023, but we still need to mention that share in ITR filing time in Schedule FA for the CY Jan2023-Dec2023? Correct?

If Yes then What value i have to provide for schedule FA declaration for this share for the field \”\” Total

gross proceeds from sale or redemption of investment during the period\” ? Sale value or 0 or something else?

C> The CG has to be reported in FY 2023-2024 as the share was sold according to India FY year 2023-2024. Is this understanding correct?

Query 2: Do we need to make individual entry for each share lot received or we can club them?

For ex: I received 10 RSU shares of my employer in Jan 2023, and again i received 20 shares in March 2023. So can i club and make single entry reporting of 30 shares and average the price to calculate and provide \”initial value of investment\”? and Mention the the \”Date of acquiring interest\” as one of the date either Jan 2023 or March 2023?

Thanks

I am house wife and income is only investment income.

I have invested in March 2024 to till date in US equity, and sold some equity investment December 2024.

STCG is 750000.

STCG will be add in income and as per income tax slab tax will applicable.

Means 50000 standerd deduction and no tax till 7 Lakhs income.

Is it correct?

Please advice.

Hi Lakshmi,

We shared your query with Quicko – here\’s what they say –

The standard deduction is available only for salary income. In this case, the income is from capital gains and hence, standard deduction will not be allowed.

Moreover, now as the total income exceeds ₹7L, rebate u/s 87A will also not be available and the income will be taxable as per your tax slabs.

Motilal Oswal Nasdaq 100 ETF (MON100) bought in Mar 2023

1) What would the applicable holding period to count it in LTCG? I’m assuming it should be 1 year since it’s listed in India.

2) Would the limit of 1.25L exemption apply to this as well?

3) Does the taxation for this change between this FY and next FY as per the new budget?

Hi Niket,

I covered this point in the story. We got in touch with Quicko to understand this. As per them, since it is listed in India, the holding period to determine CG would be 1 year. This tax rule will be applicable from Apr 2025.

If an Indian AMC having one Mutual Fund Product that invest all the funds in United States Stocks, then as per present Indian Taxation regulatory requirement, will I be taxed or declare it under Foreign Assets Schedule during Income Tax Returns filing ? Please Guide Me. Thanks

Hi S Vasudevan

As mentioned in the article, if you are investing in an Indian mutual fund that invested in foreign securities, that will not be considered a foreign asset for reporting in the income tax purposes. For taxation, please check the table in the story with the title – \’Tax provisions for investments in international MFs and Foreign ETFs\’.

Thank you

How to calculate sale consideration in case of Capital Gain from Sale of Foreign Shares?

Hi Gurudeo,

If the sale happened on or after July 23, 2024, the formula to calculate capital gains is \’sale value – cost of acquisition = capital gains\’

As mentioned in the chapter above, for tax purposes in India, you need to convert the sale amount into Indian rupees. You must use the exchange rate (telegraphic transfer buying rate provided by the State Bank of India) on the last day of the month prior to the month in which the sale happened.

Cost of acquisition is the amount in Indian rupees you used to buy the stock.

Hope this helps.

A little confused on the 25% tax withholding in US. is it a withholding or a tax?

If it is a withholding, then we can claim a refund by filing US tax returns.

if it is a \”tax\” then its pretty clear.

i hope you can provide clarification on that.

Hi Ajay

Let\’s take an example – Let\’s assume X\’s residential status is \’resident of India\’.

If X bought US stocks that issued a dividend, it is taxed at 25% in the US. In India too, X is liable to pay tax on that dividend income. Having said that, as per the DTAA between US and India, X can claim credit of taxes withheld in the US against tax liability in India by filing Form 67.

If your doubt is why is it called \’withholding\’ tax – I guess because the companies/institutions are required to withhold the taxes before giving the crediting the net amount.

Hi

Thnx for the reply.

What will be implications if proceeds are received in foreign bank account.

Hi Manish,

As checked with Quicko again, they mentioned that if you are an NRI receiving the sale proceeds in a foreign bank, you will not be liable to tax in India.

Having said that, we urge you to check with tax advisor as the full specifications of the situation couldn\’t have been covered in the question.

hi,

Is the US capital gain calculated on each stock separately or on the total transaction.

for e.g

If I make a profit of $100 on stock 1 and loss of $50 on stock 2.

Is tax paid on agregate profit of 50 .

Can I set of the loss on stick 2 against profit on stock 1. Both are held for more than 24 months.

Hi Narendra,

Assuming, both the stocks are sold in the same financial year, yes, intra-head set-off provisions of Income Tax Act allows you to set-off loss from one source with income from another source under the same head – capital gains here. Long-term capital losses can be set off against long-term capital gains.

Hi

Thanks for the reply. I will wait for update on tax implication

Hi Manish,

This is the answer from Quicko, a tax filing platform – As the income is received in an Indian Bank account, the capital gains will be taxable. The tax rate for foreign shares is 12.5% for long term gains and slab rate for short term gains. The holding period to determine the type of gains will be 24 months. Moreover, if any tax was withheld on this income, they can claim a credit for the same while filing ITR in India. –

Hi Satya,

Can you please help with how people that are NRIs invest in Indian Equity? What are taxation rules?

Hi Rajat,

I hope the following articles answer your queries-

How NRIs invest in Indian equity – https://zerodha.com/z-connect/varsity/nre-or-nro-pis-or-non-pis-understanding-nri-accounts

Tax rules for NRIs – https://zerodha.com/z-connect/varsity/new-tax-rules-for-nris-starting-fy24

hi

I bought US stocks when I was resident of India in 2022 from my Indian INR account converting to USD. At the time of sale, I have become Non resident . The sale proceeds will be transferred to same Indian INR account . As I am NRI now, will gain from the sale will be subject to tax liability or it will come under my non – taxable global income.

Hi Manish,

As I check with our NRI team, it is understood that once your status changes to NRI, the onus is on the individual to convert the resident savings account to NRI-specific account (NRO). Will get back to you on the tax rules.

from the statement \”Indian residents cannot trade in the US F&O markets\”

Can you please clarify few things?

I have heard about rules that prohibit remittance of money for FnO trades.

most people construe that as plain FnO trading not allowed.

Can you confirm what amongst this is allowed/not allowed

1 remittance of Indian funds to US and trading US equity

2 using dollar proceeds from salaried RSUs for trading US equity (note there is no remittance here)

3 remittance of Indian funds to US and trading US FnO (I believe most people say this is not allowed)

4 using dollar proceeds from salaried RSUs for trading US FnO (this is the item with max confusion)

All of these questions are for people residing in India, with Indian salary but getting RSUs in US Demat through their employer\’s equity program.

Appreciate your time on this.

Hi Nikhil,

I am afraid I will not be able to answer your queries. We will try to find answers. Nevertheless, we request you to check with your broker/platformfor specific compliance related queries.

Hi Nikhil,

We tried to get answers for your query by talking to those who understand FEMA regulations. Below are the answers we gather –

1. Allowed. 2. Allowed, if money has come in US bank account and investment within 180 days of receipt of funds. 3. Not allowed. 4. RSUs when India Citizen, not allowed. But if RSU\’s when the person was a NRI or working in US at that time, then allowed.

Please note that these answers are subject to interpretation and the rules keep changing too. So, please keep an eye out.

Satya,

Can you please share details of the person (who understand FEMA regulations) you got above clarifications.

-Raghu

Hi Raghu,

The answers here are as per the internal discussion and perspectives. This cannot be construed as an advice. 🙂

Nikhil

Did you get a concrete answer from any CA.

-Thanks

Raghu

Hi,

In the example given above related to sale of foreign stocks, should the income not be computed as (2500-1500) * 83.7 = 83700. LTCG = 83700*12.5%

Hi Anurag,

As per the Income Tax rules, the sale consideration has to be converted to Indian rupees. What you shared is converting capital gains to Indian currency, which is not mentioned.

I disagree with your opinion, that as per income tax rules, the sale consideration has to be converted to Indian rupees. I am of the opinion that what Mr. Anurag Modi has suggested is correct that Income is to be multiplied by the exchange rate. His calculation of capital gain is correct i.e. (2500-1500) * 83.7 = 83700. LTCG = 83700*12.5%.

My opinion is derived from the Rule 115 of the Income Tax Act which says that:

Rate of exchange for conversion into rupees of income expressed in foreign currency.

115. (1) The rate of exchange for the calculation of the value in rupees of any income accruing or arising or deemed to accrue or arise to the assessee in foreign currency or received or deemed to be received by him or on his behalf in foreign currency shall be the telegraphic transfer buying rate of such currency as on the specified date.

Explanation.—For the purposes of this rule,—

(f)in respect of income chargeable under the head \”Capital gains\”, the last day of the month immediately preceding the month in which the capital asset is transferred :

Here Rule 115 says that Income is to be multiplied by exchange rate of the last day of the month immediately preceding the month in which the capital asset is transferred.

Hence Income in Foreign currency is to determined first and then multiplied by exchange rate to determine the capital gain in INR.

I would be glad if you tell me that from which section or Rule of the Income Tax Act you have quoted that \”As per the Income Tax rules, the sale consideration has to be converted to Indian rupees\”

Please correct if I am wrong.

Hi Tiwari,

Logically thinking, your interpretation may not be valid because currency devaluation gains will not be captured in the calculation of capital gains, which may not be the intent of the Income Tax Act.

Besides, we reached to Quicko, a tax filing portal, too for their views on this. This is what they shared:

\”It appears to be a different application of Rule 115.

IMO, Rule 115 cannot be read in isolation. For capital gains, the charging and computation mechanism is laid down in Section 48, which requires capital gains to be computed as sale consideration minus cost of acquisition.

Rule 115 only prescribes the rate and timing for converting foreign currency amounts into INR. Accordingly, in case of capital gains, both the sale consideration and the cost of acquisition (each being foreign-currency figures) are converted into INR separately, using the prescribed TT buying rate, and the capital gain is then determined in INR.

Treating capital gain itself as “income expressed in foreign currency” and converting the net gain in one step is not the method contemplated under Section 48. That approach is specifically permitted only under the 1st proviso to Section 48, which applies to non-residents investing in Indian company shares.

If Rule 115 by itself allowed net foreign-currency gains to be converted directly, the 1st proviso to Section 48 would be unnecessary. Hence, for foreign shares held by resident Indians, the rupee-value difference method is the legally accepted approach.\”

Hi team,

can I report income from US stocks as business income?

Hi Nitesh,

It is generally treated as capital gains only.

Even with holding Indian shares, one has to prove the intention when showing gains under the \’business income\’ head instead of capital gains. The frequency of trades and scale at which they are traded would be the key points that will be considered.

Thanks Satya Sontanam for updating this article after tax reforms in 2024.

Sure! Let me know if you have any other further queries, Ajay!

Please help in sharing the information about the reporting of STCG from sale of foreign stocks in ITR.

In which point of Schedule CG we are required to report STCG from sale of foreign stocks.

Hi Ayush,

Once you open schedule CG, click on \’From sale of assets other than all above listed items\’. After that, select short-term capital gains. Here, whether to choose a(i) or a(ii) to fill the sale value is not clear. Different experts have different views; however, in most cases people go for a(ii) option. I urge you to check with your tax planner to confirm the same. Thank you!

Hi, if you have a US stock bought in before 31st Jan 2018, can you claim grandfather law for this stocks as well when filing for ltcg

Thanks

Nikhio

Hi Nikhio,

The grandfathering rule is not applicable to foreign shares.

Hi Satya,

Thanks for your contributions herein; am sure it\’s very helpful to many people.

Could you please provide the relevant clause/rules and/or link regarding this opinion. I mean, the point that Grandfathering is not allowed for calculation of LTCG on foreign shares.

Appreciate a response please.

Hi

Tanks for your kind words.

Please refer to section 55 of the Income Tax Act – subsection 2 clause \’ac\’. It talks about how cost of acquisition for shares acquired before the 1st day of February, 2018. This is in relation to equity assets that are mentioned in section 112A. And Sec 112 A talks about equity shares on which STT is paid.

Since STT is not paid on foreign shares, this grandfathering clause is not applicable on them.

Hope this helps. Thanks:)

I want to know post the July 2024 budget, how will indian ETFs or Indian mutual Funds primarily investing in foreign equity ( like motilal oswal Nasdaq 100Etf or fof) be taxed?

Hi Adesh,

Different tax rules are applicable based on the purchase date and the date on which the units are redeemed.

Assuming that the units are bought after April 1, 2023 and capital gains are accrued in this financial year (FY25), both LTCG and STCG are taxed at slab rate irrespective of the holding period. However, new tax rules are applicable for units that will be redeemed from April 1, 2025 – Holding period is 24 months; LTCG is taxed at 12.5% without indexation and STCG is taxed at slab rate.

Hi Team Zerodha,

So if I invest in any Indian ETF investing in US markets say MON100 or MAFANG. Do they count as foreign assets and do I need to separately declare them on ITR forms as such ?

Hi NJ

No, if you are investing in Indian ETFs with foreign ETFs as underlying assets, you don\’t need to declare them as \’foreign assets\’ separately in your ITR.

Hi,

Can I declare foreign stocks purchased in calendar year 2022 in current ITR??

Hi Balaji,

If you held the stock anytime during 2023, irrespective of purchase, you are liable to show the details of the stock in your FY24 return.

Hi,

Can I declare FA of 2022 in AY 2024 – 25?

I missed to declare in AY 2023-24.

If I have long term capital loss in domestic stocks and long term capital gain in foreign stocks, can I offset domestic ltcl with foreign ltcg?

Hi Micron,

They both under the capital gains head of income. Long term capital loss can be adjusted with long term capital gains.

I own shares in a foreign co. This company declares dividends, but reinvests my dividends in additional purchase of their shares. I doot get any remittance into my account. Am I liable for tax on dividend income every year, or only capital gains (long/short depending on duration) tax when I sell these shares?

Hi Ravi,

irrespective of whether you receive the dividend amount in your hands or not, you are liable to pay tax on dividend income from stocks

After budget 2024 , does indexation still applicable for the sale of foreign listed equities? The budget talked about properties when i heard but all over the internet its written for all asset classes . Also on 6 th aug its rolled back . Can you just clarify if its still applicable or not

Hi Debashish,

As per the updates we have currently, there is no indexation benefit for foreign stocks. Long term capital gains, after 24 months will be taxed at a flat rate of 12.5%. This is applicable for sales from July 23, 2024.