9.1 – How to Analyse a Bank?

The banking sector can be analyzed by studying its sources of revenues, capital adequacy, and asset quality, among other parameters. The previous chapter, Banking – Part 1, covered sources of revenues and capital adequacy. This chapter will cover asset quality, liquidity, and others.

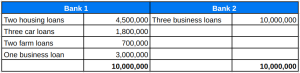

Asset quality: Let’s compare two banks. Both have given loans totaling ₹1 Cr. This table shows a breakdown of their loan portfolio. Which bank has a better asset quality?

We know how risk can be mitigated through diversification. Therefore, with its loan book diversified across various categories, Bank 1 seems to have a better asset quality.

Diversified or not, every loan book will have some defaults. Meaning some borrowers may not repay part or all of their dues. These are bad loans or non-performing assets.

Why are bad loans called non-performing assets? Loans are a liability. Why are they called assets? If you are a borrower, a loan is your liability to the bank. It also means that your loan is the bank’s asset. So, when people do not repay their loans on time, their loans are called non-performing assets. For simplicity, some banks call them non-performing loans (NPLs) too. Don’t be confused; both are the same.

The asset quality of a bank can be quantified with the help of three ratios – GNPA, NNPA, and PCR. Again, you do not have to calculate these, as the banks have to report them every quarter.

This snapshot from ICICI Bank’s investor presentation shows these three ratios. The figures highlighted in blue in this image are of the most recent period, i.e., March 2023.

-

- Gross Non-Performing Assets (GNPA) Ratio: GNPA is the amount of money that borrowers have failed to pay to the bank on time. GNPA ratio is GNPA divided by the gross total loans given out.

- Net Non-Performing Assets (NNPA) Ratio: Banks have to anticipate some level of bad loans and accordingly set aside provisions for those bad loans. Net NPA is GNPA minus provisions.

- Provision Coverage Ratio (PCR) Ratio: This ratio shows what percentage of GNPAs are covered through provisions. In the above snapshot, 82.8% of GNPAs are covered through provisions. The uncovered portion is the NNPA.

Lower NPAs are preferred. Comparing the NPAs of a bank with peers helps understand their relative performance. A bank with 1% GNPA is doing better than a bank with 2% GNPA. Comparing NPAs with the previous quarters can suggest if the bank’s asset quality is improving or deteriorating.

Higher PCR eats into profits. Therefore, a PCR suggests that a bank is prudent and conservative. If a bank can consistently grow profits while maintaining a high PCR, it is said to have a high quality of performance and reporting.

Deposits: The following snapshot shows that ICICI bank has given ₹10839 bn worth of loans. However, its own net worth is ₹2145 bn, and it has borrowings of ₹1891 bn. Where did the bank get the rest of the money to lend? Deposits. ICICI Bank had deposits with ₹12108 Cr. It used these deposits from customers to give loans to customers.

Deposits can be further categorized into CASA and Term deposits. CASA is an acronym for Current Account-Savings Account. Banks are always looking to increase their CASA ratio. Why?

Because CASA is the cheapest source of funds for the banks. They usually pay 3-4% interest on savings accounts and nearly nothing on current accounts. Banks borrow from the RBI at the repo rate, which is at 6.5% currently. Borrowings in the form of debentures and bonds are even more expensive. Therefore, banks keep chasing CASA deposits. A higher CASA ratio is preferred.

An issue with CASA deposits is that they are demand-based. Customers can place and withdraw deposits as and when they want. Therefore, term deposits or fixed deposits are also chased. Banks have to pay slightly higher interest on fixed deposits but have more certainty about the availability of funds.

Advances (Loans): Core banking is about taking deposits and giving loans. If deposits are the first leg, advances are the second leg.

As an investor studying a bank, check out what its loan book is made up of. More than half of ICICI Bank’s loan book is retail. Having a large, diversified retail loan book is good. Each loan amount is small, and a default by one or a few borrowers will have a negligible impact on the bank’s balance sheet. Retail loans can be further de-risked by giving loans for housing, auto, credit cards, personal loans, consumer durable goods, etc.

Corporate loan amounts are large, and loan book is built up fast. However, a single corporate loan default can hurt the balance sheet significantly. Basically, risks are concentrated in the case of corporate loans. A healthy mix between corporate and retail loans is preferred.

Banks also report a credit rating-wise break-up of the overall health of their corporate loan book. Credit ratings of A or above are safer. Some banks might also show the NPAs in each loan category. This metric can give insights into the tension or potential in any particular sector.

Liquidity: Banks must maintain a certain minimum level of liquidity to ensure that the depositors have access to their funds when required. The RBI mandates the banks to maintain two ratios.

-

- Cash Reserve Ratio (CRR): CRR is the minimum cash a bank has to maintain as a percentage of total deposits. As of this writing, in July 2023, banks have to maintain a minimum CRR of 4.5% of the net deposits. The idea of maintaining CRR is to ensure that depositors have easy and continuous access to their deposits.

In times of stress or bad news around a bank, depositors rush to take their money out of the bank. The bank should have enough cash to service these withdrawal demands. When the first wave of demands is serviced, the rest of the depositors might see it as a sign of assurance of the bank’s financial stability.

- Statutory Liquidity Ratio (SLR): This is a second-order liquidity ratio after CRR. After providing cash for CRR, 18% of net deposits have to be maintained in SLR. The idea is that the bank should be able to service withdrawal demands even after exhausting CRR. However, maintaining so much liquidity in cash would mean the bank cannot use it to run or grow its business. Therefore, SLR can be maintained in the form of liquid securities such as gold or government bonds. These securities deliver at least some gains apart from maintaining liquidity.

- Cash Reserve Ratio (CRR): CRR is the minimum cash a bank has to maintain as a percentage of total deposits. As of this writing, in July 2023, banks have to maintain a minimum CRR of 4.5% of the net deposits. The idea of maintaining CRR is to ensure that depositors have easy and continuous access to their deposits.

Digitalization: This aspect does not include any ratio. It is more qualitative in nature. The number and growth of accounts opened, FDs booked, loans approved, and credit cards issued through digital channels are important indicators of a bank’s progress in digitalization. Digitalization has become more of a hygiene factor for banks. Digitalization may not make a bank unique, but not having a digital presence is a sure deterrent to its growth. In their annual reports and quarterly investor presentations, banks often give an update on the progress of their digital initiatives.

Branches and other infrastructure: The number of branches, ATMs, employees, credit cards, and customer base are some infrastructural parameters that you could look at. However, more or less of these parameters may not necessarily mean good or bad for a bank. For example, a bank might have issued a large number of credit cards, but spending per credit card could be low. Similarly, a bank focusing on corporate banking might have a few high-value customers, while a bank focusing on retail banking might have many low-value customers.

The idea is to look at external trends and see which banks stand to benefit from those trends. For instance, if there is stress in the balance sheets of businesses, perhaps the bank focusing on corporate banking might underperform. The approach here is nuanced and subjective to your interpretation of economic trends. If you believe the whole banking industry will do well, you could even buy into a banking ETF or index fund.

9.2 – The Checklist

This table contains all the parameters covered above and the previous chapter on banking, with FY23 numbers for the five largest Indian banks by market capitalization. You may use this as a ready checklist to ensure you have covered all the parameters in your banking sector analysis.

9.3 – RBI On The Banking Sector

The RBI publishes views on the banking sector and the economy in various annual and semi-annual reports. A few examples are listed below.

-

- The Financial Stability Report is published semi-annually. It comments on the state of the global and domestic economy. It also mentions the industry-wide average capital adequacy and asset quality ratios. The RBI applies stress tests to ascertain the overall health of the banking sector. According to the Financial Stability Report for June 2023, Scheduled Commercial Banks (SCBs) will be able to maintain capital adequacy even under severe stress scenarios. You could use this report to have a bird’s eye view of the banking industry.

-

- Report on Trends and Progress of Banking in India is a report card of the banking sector. This report is published annually. Apart from its comments on digitalization, profitability, interest rates, and financial health, the report also shows how the sector and the regulator are addressing stressed assets (NPAs). Regulatory updates are part of this comprehensive report, too.

Apart from these reports, the banking industry’s trends, health, and potential can be studied from the RBI’s annual report and the regular bulletins on its website.

While the financial statements of banks are often considered difficult to understand, I believe the easy availability of complex ratios and loads of data from the RBI make banking a relatively comfortable sector to analyze. 🙂

The next chapter is going to be a little challenging, I think. Stay tuned.

Key Takeaways

-

- Analyzing a bank involves studying its revenue structure, interest margins, capital adequacy, asset quality, deposits, loan book, and liquidity.

- Revenues sources generally include corporate, retail, treasury, and others (investment banking, insurance, etc.)

- Capital adequacy is judged from a bank’s tier-1 and tier-2 capital

- Asset quality is judged by a bank’s Gross NPA, Net NPA, and Provision Coverage Ratio (PCR)

- It is imperative for every bank to have a robust digital infrastructure.

- The RBI’s regular and frequent reports on the banking landscape of India are a good source of information for anyone analyzing the sector.

- Analyzing a bank involves studying its revenue structure, interest margins, capital adequacy, asset quality, deposits, loan book, and liquidity.

Hi,

I want to understand which is the best way to identify intrinsic value of banking sector companies( like HDFCBANK, ICICIBANK). currently I am using DCF analysis for other companies.

Thank You for this much needed module on sector analysis Vineet. I would like to appreciate the fact that this passing of baton from Mr Karthik has not dent the quality of education from Zerodha Varsity.

Can we expect another chapter on analysis of NBFCs\’ Vineet?

If not, then how one analyses it?

Thank You Vineet.

God Bless.

Thank you for the kind words, Awanish. I shall include NBFCs in my list of sectors to add. 🙂

Hi, This content really helps me understand how bank business works. Will you please analyse sectors like healthcare and pharma? and I want to say \”Hi\” to Rangappa, and please talk more about personal finance.

Hi Vineet,

Thanks for making this module simple. After reading this module I was finding to get the exact numbers from ICICI annual report -2023 and below are my observations.

Ex –

1) NII in your table is 70,523 crores vs NII in annual report is 621.29 billion crores ?

2) How to get the corporate revenue ?

3) I also didn\’t find any \’PIE\’ chart in the annual report of 2023 as shown in this module.

Hi Varun, thank you. 🙂

1. The amount of 70,523 is consolidated and 62,129 is standalone.

2. Corporate revenue is the same as Wholesale revenue. You will find it in the segment revenues in the annual report and investor presentation.

3. You will find the Pie chart in the investor presentation.

Thanks a lot for this explanation. I have 2 questions Sir.

1. HDFC bank\’s ratio for contingent liabilities to network was above 600% based on calculations from FY23 Annual Report. Definitely not a figure to ignore. However the bank is also known for its good management. In a situation like this, assuming if other parameters are fundamentally good, is it fine if one gives lesser importance to this ratio in case of banks. I understand that this is subjective, but your opinion would help.

2. My question is in relation to valuation for banks. I use a model called excess returns model from Mr.Aswath Damodar\’s book, which throws excellent results if a conservative estimate is used. Apart from this, I also use price to book, but its only useful upto a certain extent as a relative valuation tool. Would you like to suggest something else for bank valuation or do you feel these methods are sufficient?

Thanks

Hi Sathish, let me attempt both your queries.

1. Given the size and asset quality of HDFC Bank, I would not be worried so much. Since you are reading their annual report, you will see that the largest portion of contingent liabilities is towards foreign exchange and derivative contracts. A lot of these are swaps based on notional principal amounts. These are not really liabilities. For example, if you and I were to enter in an interest rate swap, where I pay you fixed and you may pay me floating interest rate, the principal we agree upon is notional. We do not really exchange the principal, but it will be recorded as a contingent liability in our books. Also, derivative contracts can be rolled over.

To sum it up, you could give lesser importance to contingent liabilities.

2. I think the two models you have chosen are adequate. Some research analysts might use more models, but assign subjective weights to them.

Thank you for this excellent content. I have a question on contingent liabilities. Based on what I see, many banks like even big banks like HDFC bank and ICICI bank have huge contingent liabilities as a percentage of their networth. Usually in case of non financial companies, this is seen as a red flag. But is it normal in case of banks? I don\’t understand as to how to interpret this.

Should one ignore if the contingent liabilities of banks or NBFCs are very high with relation to its total networth? Thanks.

Hi Sathish. Contingent liabilities are liabilities that may or may not arise. It is in the nature of banks to have more contingent liabilities. For example, banks may act as guarantors for exports or for other banks. They may also hold some derivative contracts against which a huge cash outflow might occur. All these are possible obligations, not certain. The RBI may prescribe a certain way of calculating contingent liabilities but some level of subjectivity cannot be ruled out.

It could be a red flag if a particular bank\’s contingent liabilities make a larger percentage of its net worth when compared with other banks, or if this percentage has been increasing year-on-year. It could mean that the bank is taking on more contingent risk. It could also mean that it is reporting more conservatively than others.

Dear Vineet, thank you so much for simplifying these concepts for us.

Should Small Finance Banks also be analyzed with the same metrics, or is there anything additional to watch out for.

Thank you, Sowmya :).

The same metrics will apply to small finance banks. Additionally, you may check for the composition of their loan book and how they are trying to diversify it. It is a good possibility that their loan book will mostly be composed of farm loans, microfinance loans, or other priority sector loans. See if there are efforts to diversify into consumer loans, business loans etc. A well-diversified loan book is a hedge for its own risks.

Dear Sir,

there are lots of ratios But in this module I find a few so when will all other ratios come?

We have covered the most essential ones that can be applied to many sectors. Apart from these, there are sector specific ratios which you can check here – https://zerodha.com/varsity/module/sector-analysis/

Try to cover

Pharma in detail-Hospital/CDMO/AGRO Chemical/etc..

Thanks Madhavi. That is on my to-do list. 🙂

Hi, It is one of the best modules that I have ever come across on the analysis of banking sector.

Can\’t thank you enough for the same.

Could you please suggest a book or any resource material for analyzing the financial statements of the banking institutions, as they are prepared in a different manner given the uniqueness of a bank\’s assets and liabilities.

Any material for understanding the dynamics of the banking would also be highly appreciated.

Thank you very much once again

And all the best!

Best Regards

Thank you, Shambhavi, for reading and appreciating the chapters.

I used the CFA curriculum and Aswath Damodaran\’s 2009 paper and other work on financial institutions as a guide to writing this chapter.

Happy learning. 🙂

This question is for karthik rangappa, which according to you are must read books for an options trader?

Option pricing by Sheldon Natenberg.

After analyzing the bank\’s fundamentals how to decide whether to buy the stocks or not. How to identify if the selected banking stock is overpriced or underpriced?

Hi Iqubal, you will have to apply valuation models for that.

You could refer to the Integrated Financial Modelling module for that.

Dear Vineet,

I cannot express my appreciation in writing for the efforts you have put into writing this module.

After Technical Analysis, Fundamental Analysis, and Personal Finance modules by Karthkik sir, I find this module super simple to understand. Being an engineer without any knowledge of business, it was vital for me to understand a business in the simplest form, like a teacher is teaching me and I\’m clearing my doubts just by asking him. You did it through writing. Hats off. God bless you.

—

Thanks & Regards,

Sanjay Kumar Jena

Dear Sanjay,

Your message has made me swell with pride. Thank you for the kindest words. Happy learning. 🙂

Will the energy sector be covered in the future?

Sure Manob. But energy is a vast sector – petroleum & gas exploration, transmission, and marketing; power generation, transmission, and distribution. Each might need a separate chapter. So it will take a little while.

Very insightful!

Could you tell me from where you get the information?

If I want to analyze a sector from where I can get the information?

Thank You😊

Hi Himanshu, annual reports are the richest source of information. If it is a regulated sector, you can get information from the regulator\’s website too. For example, RBI for banking and IRDAI for insurance.

dear sir

i had registared for varsity certifide and my exam was scheduled on 16 sep 2023 from 4 pm to 6 pm.but i have not got any link or communiction from varsity regarding exam.hence i mailed but got no response.therefore i am writing here as i dont know where to raise this issue.

Suresh, I\’d suggest you speak to a support desk of create a ticket for this. I\’m not sure why you\’ve not received the link.

Whats the next topic??? When will it be Released…

Hi Siva, we are planning to do Steel and Hotel sectors next. But it might take a little while.