7.1 – In continuation with Part 1

This chapter is in continuation with the previous chapter, Automobiles – Part 1, which sets the context for the automobile industry. So, I suggest you read that before venturing into this one. 🙂

While we have discussed performance parameters for automobile companies, here we will discuss the externalities driving or impacting their performance.

7.2 – Supply-side external factors

For the sake of simplicity, I have split the external factors into supply-side and demand-side. Supply-side factors impact the availability of inputs, raw materials, and labor. Demand-side factors create, drive, or hurt the demand for automobiles. Let us first look at the supply-side factors.

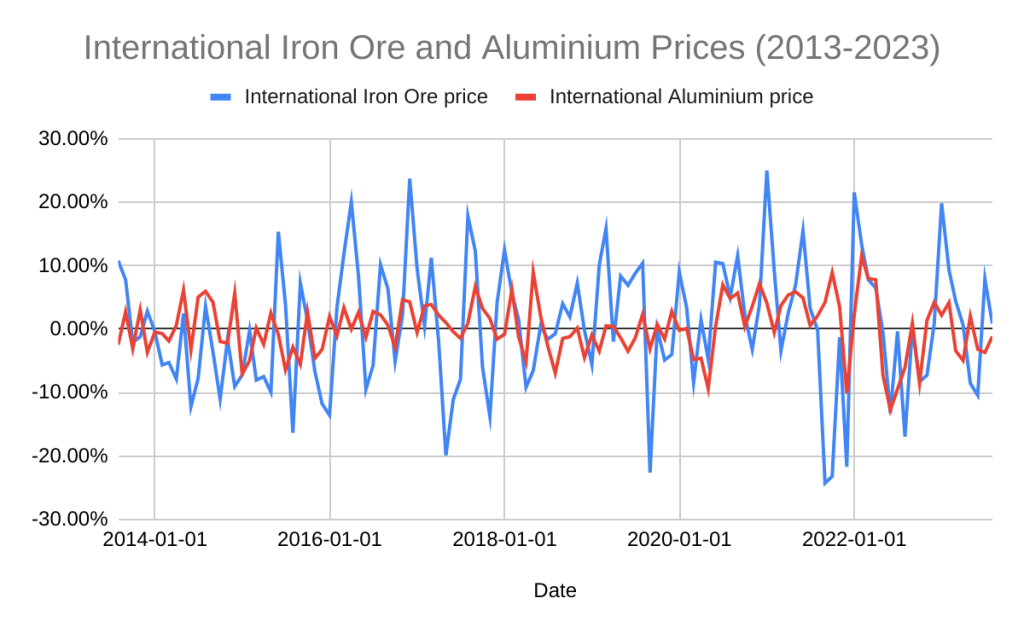

Commodity prices – Steel, iron, aluminium, and magnesium are the most commonly used metals in automobile manufacturing. These metals are commodities. Their prices fluctuate a lot. Excessive upward fluctuations in commodity prices can hurt the gross margin of automakers. This chart of only two base metals, iron ore, and aluminium, shows how their prices have fluctuated over a 10-year period between Jul-13 and Jul-23.

Rubber prices – Rubber is used in several components of a car. Most importantly, it is used in tires. Automakers do not make tires. They buy tires from tiremakers. When rubber prices shoot up, tires can become expensive. This adds to the cost of production.

Batteries – Batteries are primarily made of either lithium or lead. Both are commodities. Lead-acid batteries have long been used for auto-start, headlights, horns, and other support functions. This is mostly applicable to ICE vehicles. Electric vehicles are mainly powered by lithium batteries. The growing adoption of electric vehicles has given a boost to the demand for lithium batteries.

Components – The availability of components is critical for timely production. Quality also must be ensured. Certain components are mission-critical for automobiles. Carmakers maintain teams specifically meant to certify the quality of components that suppliers are delivering.

Suppliers of many components are small enterprises. Their limited capital and resources make them vulnerable to shocks and failures. Remember how Covid hurt small businesses? Shutdowns, production delays, labor shortages, and stuck payments were a few of the many issues that small manufacturers dealt with. Many had to close down their businesses. This contributed to slower production of vehicles in the months when operations resumed post-Covid.

The increasing use of smart devices has digitized several functions of automobiles. The audio systems, parking sensors, dashboard screens, and remote locks are smart functions that run on semiconductors. Post-covid shortage of semiconductors had caused nearly all automakers across the world to suspend or cut production for months.

Labor – The automotive industry is one of the largest users of robotics in the production process. Still, the industry is labor-intensive. Every automaker employs thousands of employees on its shop floor. So the availability of employees is critical to ensuring uninterrupted production. Worker strikes, natural disasters, and pandemics can often hinder worker availability. Maintaining good worker relations, therefore, becomes essential.

7.3 – What can impact the demand for automobiles?

The sector is often touted as the indicator of economic development. Being a high-value consumer product in India, automobile purchase is a big financial and emotional decision for most families. In fact, when a farmer purchases a tractor, it could become a village-level event in some parts of India. So, what drives this demand?

Disposable income – Many industries are hopeful of the rising disposable income of the Indian middle class. Economic growth can improve employment levels and grow household incomes. This, in turn, can create demand for aspirational products. Cars are still an aspirational product – on average, only 1 in 12 Indian households own a car. In contrast, at least half of all Indian households own a two-wheeler.

Cost of running the vehicle – Purchasing an automobile is an expensive affair. But the costs of maintaining a vehicle can be high, too. Fuel, maintenance, servicing, repairs, and insurance are regular costs. Consumers account for these in their purchase decision. Therefore, to influence customer decisions, free services, warranties, and mileage are the most commonly offered features with most vehicles.

After-sales service – This point draws from the previous one. The quality and affordability of after-sales services is a major factor driving vehicle purchase decisions. Carmakers often market the quality of their after-sales services to drive sales.Those living in tier-3 or tier-4 towns often buy cars from brands that have service centers in their towns. They may reject cars with better features just because there are no authorized service centers near them.

Availability of financing – Nowadays, people do not save up for years to buy a car. They can simply take a loan.

Last year, I decided to buy a car, the first in my middle-class household. If I had to save up, I would have taken maybe two or three years to buy the car of my choice. Thanks to easy loans, I could afford a car two or three years earlier. 😀 There are many others like me. The easy availability of loans has made it possible for us to buy a car at an early age.

In fact, the salesperson wanted me to buy a more expensive car because I was eligible for a higher loan. Easy financing often drives a customer to buy a more expensive car.

Financing is a major driver for tractor sales, too. Most farmers buy tractors on loan. Affordability among farmers is anyway a challenge. Therefore, loans are a significant enabler.

Two-wheeler financing is a huge market. India had active two-wheeler loans worth over ₹86,000 crore at the end of FY22. Clearly, people are dependent on financing for all vehicle purchases.

Buses, trucks, and other commercial vehicles are mostly bought by business firms. Businesses are always looking to manage cash flows. A lump sum payment can dent the cash reserves. So, firms also prefer to buy vehicles on loan and pay monthly installments.

Simply put, any vehicle purchase that could be done three years later is done today, thanks to easy loans. Therefore, the availability of financing is seen as a demand driver for automobiles.

Seasons: The focus here is on monsoons. A good monsoon season results in good agricultural produce. This improves farmers’ income, thereby creating demand for tractors and two-wheelers. Since rural income levels are low, two-wheelers are preferred and easy to afford. Two-wheeler makers often comment on the impact of monsoons on rural sales.

This snapshot from a news report by Financial Express attributes erratic monsoon and inflation to lower rural demand for two-wheelers.

And this snapshot argues why tractors and two-wheelers are performing differently in the rural markets. Tractors and two-wheelers are generally expected to perform similarly in rural markets.

Charging infrastructure: This is applicable only to electric vehicles. A wider availability of charging infrastructure can motivate consumers to buy more electric vehicles. The target of achieving 30% EV car adoption by 2030 can be realized only if charging stations could come up faster. After so many years since they were introduced, CNG vehicles have struggled to achieve wider acceptability because of the limited number of gas stations.

The speed of charging is an issue, too. Charging an electric vehicle can run into a few hours. If you forgot to refill the petrol in your car, you could always stop by at the next fuel station. But if you forgot to recharge your EV last night, your journey will be delayed by a few hours. Therefore, fast charging infrastructure is critical to encourage more adoption of EVs.

Battery swapping has often been discussed as an alternative to charging. It involves replacing exhausted batteries with charged ones at swapping stations. This can happen in a few minutes instead of a few hours taken by charging. But it has its own challenges.

We would need a full-fledged battery-swapping infrastructure. For example, battery swapping would be more effective if the battery size and shape were standardized across carmakers. Getting all industry players to agree on one standard can be a tall task. There also are other logistical issues with battery swapping.

Regulations: Regulations can spur or hurt demand for vehicles. Often, safety-related regulations come with an additional cost to the consumer. While safety is preferred, higher prices are a deterrent to demand. I have enlisted a few examples of regulations below.

-

- In 2018, the government increased the maximum allowed load capacity for heavy vehicles like trucks by 20-25%. This one rule suddenly added the transport capacities of transport companies. Essentially, five trucks could do the work of six trucks. While this was an advantage for transport companies, automakers suffered. Suddenly, the demand for new trucks was hit.

- Indian vehicles used to comply with the BS-IV emission norms. Then, starting on 01 April 2020, it became mandatory for all new vehicles to comply with the BS-VI norms. Basically, regulations required the industry to skip the BS-V norms. This was good for the climate, but difficult for the industry. In the year leading up to this switch, automobile makers slowed production.

- Consumers may have also delayed buying to be able to buy the newer BS-VI-compliant vehicles after April 2020. However, the BS-VI-compliant vehicles also came with a price hike. Automakers had to cover the cost of using the new BS-VI technology.

- In April 2023, the industry moved to Phase Two of BS-VI norms, further marginally increasing vehicle prices. Price hikes negatively impact demand.

- Starting 01 October 2023, all new passenger vehicles must be equipped with six airbags. Most cars generally have two airbags. While the policy is meant for passenger safety, the move will increase the cost of production for automakers, thereby increasing the cost of ownership for customers.

- Both central and state governments offer tax breaks in various forms for EV purchases. Individuals taking car loans for EV purchases can claim tax deductions of up to ₹1.5 lakhs on the interest component. Several state governments are also offering subsidies on road tax for EVs.

My effort here was to explain how to interpret externalities rather than give a fixed checklist of externalities. I hope you found it useful. 🙂

Key Takeaways:

-

- Commodity prices, rubber prices, batteries, component availability, and labor impact the production and availability of vehicles

- Demand for vehicles is driven by disposable income levels, availability of financing, cost of running the vehicle, after-sales services, seasons, refueling/recharging infrastructure, and regulations.

- Regulations can be around vehicle insurance, pollution emission of vehicles, safety and quality standards, and taxation, among others.

As part 3, It would be really helpful if you can present it as a case study what led to the fall in the auto sector in the calendar years 2018 and 2019 and which factors effected the auto sector negatively in those two years.

Thanks for the idea, Akhil. 🙂

HEY TANISH HERE, AMAZING INSIGHTS I WOULD SAY.

IF YOU UPLOAD SOLAR INDUSTRY ANALYSIS THAT WOULD BE VERY HELPFULL.😊

Thank you, Tanish.

Adding that to the list.

Hello Vinnet Sir It Was A Well Written Module On Automobile Sector As Always By Varisty, My Question May Be Slightly Off Track As I Want To Do An Intern In Content Writing in Varisty As After Reading Every Module Of Varsity I Am Well Equipped With Finance And Now Looking For Industry Expereince,Most Happy If You Can Guide Me 🙂

Thank you for reaching out, Vamsi. We will let you know when we plan on offering internships.

Sir,

Can we expect material for some more traditional industries like FMCG/Banking?

Hi, Banking should be released next week. FMCG might happen a little after that. 🙂

Can we expect part 3…

We do not plan on it but what would you like to see in Part 3, if we develop it?