22.1 Trade from charts

If you are familiar with Zerodha’s trading terminal, Kite, you probably know that you can choose to analyze stock/index charts either on Tradingview or on ChartIQ. These two charting platforms are probably the most powerful charting engines to analyze charts. As a customer of Zerodha, you have access to both these platforms without having to pay for it.

ChartIQ recently had an update, and with this update, there are many cool indicators and studies that you can use. Let me list a few –

- Candlestick Patterns

- Stochastic RSI

- RSI divergence

- MACD divergence

- Stochastic divergence

- Central pivot range (CPR)

- Trade from chart

I particularly find the candle pattern, CRP, and the trade from chart quite useful, hence this quick supplementary note to bring you up to speed.

Ensure you have opted to look at charts from ChartIQ. You can do this by clicking on the profile section in Kite.

Now, open any chart from your market watch –

On the top right, you can now see a Trade button. Click on the trade button to invoke the quick order window.

This is a floating order window and helps me drag the order window to key price points and fire order from the chart itself. For example, when I look at this Ashok Leyland chart, I know the stock is moving sideways from the last couple of trading sessions. I may consider a buy position if the stocks break out from the trading range.

From the chart, I know the break out point is around 45 or thereabouts. All I have to do is click, drag the order window, and drop it in a place that I think is relevant on the chart. Once I do, I can place an order to either buy or sell. I can even choose between a delivery/CNC and MIS for intraday.

In Ashok Leyland’s case, I want to be a buyer at around 45.40, a price I think is crucial for momentum to pick up.

As you can see, I’ve dragged the order window up to 45.40, and I can fire an order within the charts without going back to the marketwatch and getting distracted with other quotes. The current market price, i.e. 42.45, is seen with the red background.

Please use this feature; I think this is a great way to isolate yourself from the information clutter and focus purely on the price action.

22.2 – Candlestick Pattern

Candlestick pattern is an interesting addition in the recent update. The candlestick pattern study helps you identify the candlestick formation from the charts. The candlestick pattern identification is a great way to validate the patterns. However, I was hoping you could use this with some caution.

To load a candlestick pattern, select the same from studies –

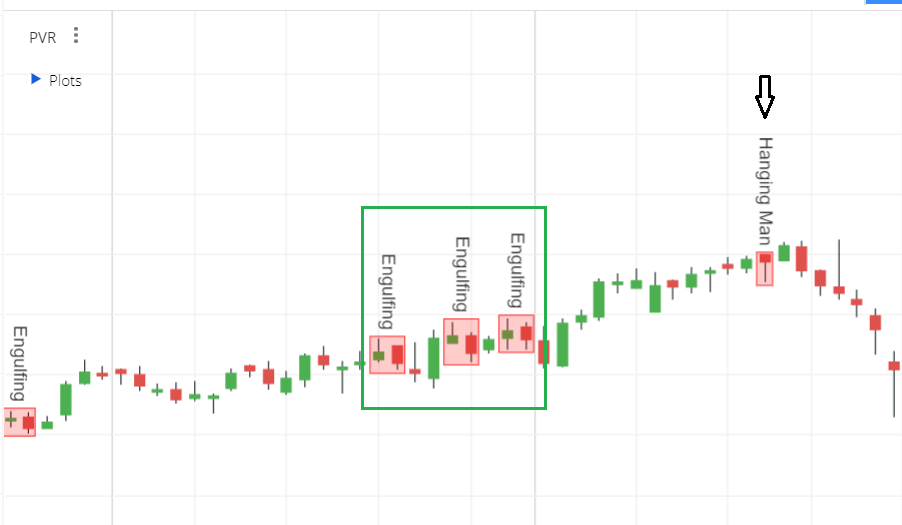

Once you load from studies, you can see that the system automatically identifies the candlestick patterns.

ChartIQ identifies candlestick patterns on the chart. I’m looking at the EOD chart here, but you can do this on intraday charts as well.

While this is a great way to validate the candlestick pattern, there is one problem with this. The identification process does not consider the ‘prior trend’, rule that is critical to candlestick pattern.

For example, the three engulfing patterns are accurate, but one should not trade based on this, given the fact that the prior trend is missing. However, look at the hanging man pattern; this is one makes sense.

So how should one use this?

Well, I’d suggest you carry out your analysis as usual, and once you are convinced that there is a trading opportunity based on a candlestick pattern, then switch on the candlestick pattern studies and validate the pattern. The pattern you have in mind and the one ChartIQ should match.

For example, here is the chart of DCB Bank. Pay attention to the encircled part here.

There are a couple of things that are happening –

- Stock is in a downtrend

- P1 formed a long bearish candle

- P2, after a gap down, forms a spinning top

- P3, after a gap up, forms a long bullish candle

- P1, P2, and P3 together appears to be forming a morning start

A trader would probably go long based on the above. However, before placing the order, I’d now want to switch on the candlestick pattern in studies to validate the pattern –

I get the confirmation of the pattern; hence I’d be more confident in placing my buy trade here.

22.3 – Central Pivot Range

The Central Pivot Range (CPR) is an indicator to identify key price points to set up trades. CPR is beneficial for intraday trading.

Before you understand the CPR, it is important for you to know the Support and Resistance; I’d suggest you read through this chapter to know what more about Support and Resistance before proceeding further.

The CPR consists of three components –

- Pivot

- Bottom Central Pivot (BC)

- Top Central Pivot (TC)

These are derived out of the underlying’s High, Low, and Close calculations –

Pivot = (High + Low + Close)/3

Bottom CPR = (High + Low)/ 2

Top CPR = (Pivot – BC) + Pivot

Spend a minute to understand the formula. These are simple averages and manipulation to the averages. In any technical indicator, the moment you see averages, you need to associate the indicator to the underlying trend.

The CPR does just this, i.e. helps the trader identify key price points and the associated trend around these price points.

Today’s CPR values act as the reference for tomorrow’s trading. We will get back to this in a bit.

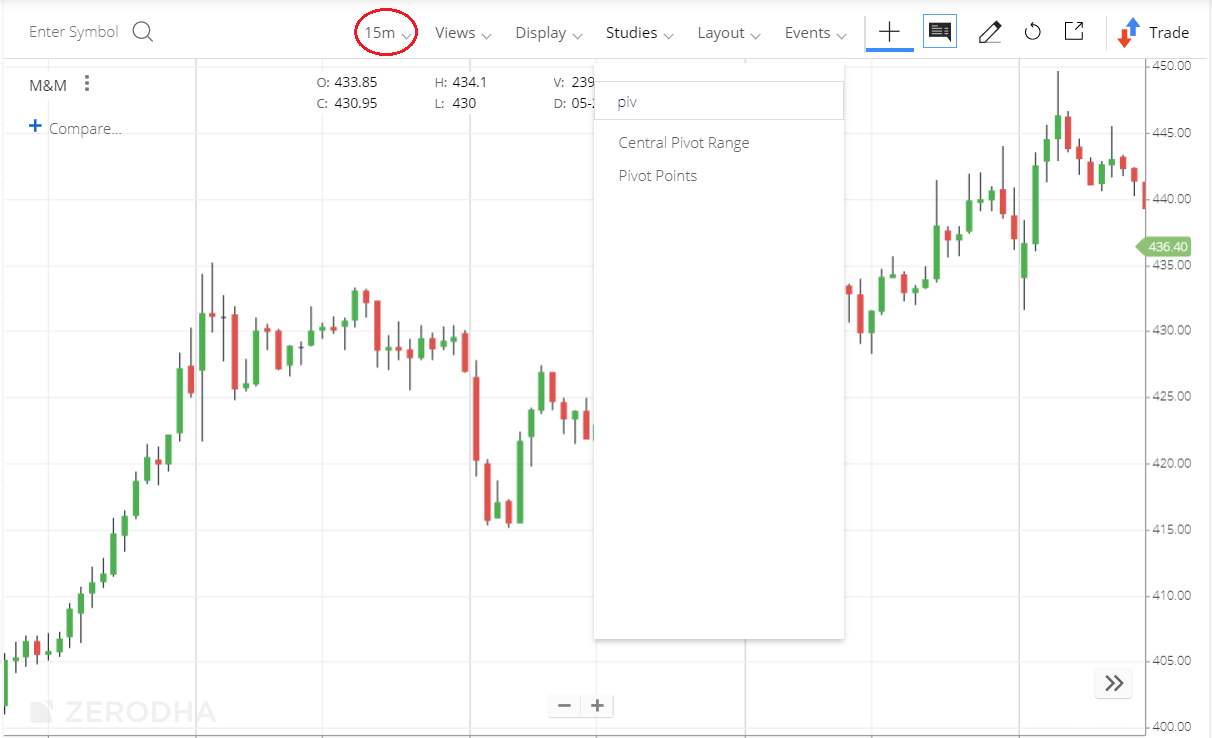

On Kite search for ‘Pivot’ in studies, and you’ll find the CPR indicator –

I’m looking 15-minute chart of M&M here. Once you load the CPR, the CPR loads as three horizontal lines, as seen below.

One thing that stands out is the varying width of the CPR. I’ve marked three points on the chart to discuss this.

I want you to look at the first arrow starting from left, ignore the CPR but look at the price action itself. Remember this is the 15-minute chart, and it is quite clear that the day started with a small green candle with not much movement through the day. The open and close were close to each other.

Whenever, we have a sideways movement, the next day’s CPR narrow ranged, this is exactly what we observe on the next day. Now the 2nd day itself was trending day. Hence the CPR for 3rd day was a wide-ranged one.

So the point is –

- If today is a narrow range day, tomorrow’s CPR will be a narrow ranged CPR.

- If today is a trending day, tomorrow’s CPR is a wide-ranged one. Higher the trend, wider is the CPR.

Alright, so how do we use the CPR? Well, this is quite straightforward –

Bullish outlook, look for buying opportunities when the current market price is higher than ‘Top central pivot’ (TC).

Let me elaborate. Assume a stock has rallied for a bit. The current market price is higher than the TC, and you are looking for an opportunity to set up a buy trade.

You can now wait till the stock arrests its rally and retraces back to the TC line.

I’ve highlighted a possible opportunity here –

From a price action perspective, when the current market price is higher than the TC, it indicates that the traders are willing to buy even though the average price is higher. Hence, it would help if you are looking for buying opportunities. Remember, when CMP is higher than TC, the TC now acts as a support line.

Likewise, when the stock or the index is trading lesser than the “Bottom Central Pivot’ (BC). When the current market price is less than that BC, it implies that there is bearishness in the market, hence look for selling opportunities.

Again, look for a price pull back to the BC line before initiating a fresh short.

You can even trade the stock while it is within the CPR. Trading while the stock price is within the CPR is like a range trade.

You buy when the stock is at BC, with TC as a target and sell (fresh short) when the stock is at the TC with an expectation that the price declines to BC soon.

Of course, I know many traders who prefer not to trade the range and prefer to trade only the pullbacks. I too would prefer to use CPR only to trade the pullbacks.

Lastly, here is something that you need to be aware of when trading the CPR.

- When you plot the EOD CPR, the previous month’s OHLC is referenced.

- Previous week’s OHLC is a reference when you plot CPR for 30mins and 1-hour candles.

- Previous day’s OHLC is referenced when you plot CPR for 1, 3, 5, 10, and 15 minutes candles.

Happy trading.

Key Takeaways from this chapter

- You can trade from the chart by selecting the trade button.

- The trade button is a floating window which you can place anywhere on the chart.

- The candle pattern helps identify the candlestick patterns, use this to reconfirm the pattern.

- CPR helps you identify the S&R pattern

- It is considered bullish if the current market price is higher than the TC line.

- It is considered bearish if the current market price below the BC line.

Hi Karthik,

Firt of all Thanks for this wonderful material.

I have took the final assessment for Module 2. Is there a key available? I want to know what I marked wrong.

Ah, unfortunately there is no answer key I guess. Let me check though.

Dear sir , please explain the following line u have said in the context–

\”While this is a great way to validate the candlestick pattern, there is one problem with this. The identification process does not consider the ‘prior trend’, rule that is critical to candlestick pattern.\” Please explain this. I am unable to understand this line how priority trend is missing? On the chart , we can see the chart as long as I want

Prior trend is basically shows the movement of the stock before the pattern occurs. Its important to figure whats happening with the price before you can take any action or trade. In short – if you are looking at a bullish trade, then the prior trend should be bearish, and vice versa.

Hello sir,

First thank you for writing this grand compendium. Have been studying from it like I used to, in school/college. Loved every line of it. Excellent knowledge and it\’s free. (Feels like you\’ve created Linux in trading,haha)

I just had one small query. I’ve recently completed the Technical Analysis module and have been actively trading in options for the past few weeks. Since I’m focused on options trading, I was wondering — should I skip the Fundamental Analysis module for now and jump straight into the Options Theory and Strategies module? Or would you recommend following the modules in the given order?

Thanks so much for the kind words, and I\’m glad Varsity is of help to you 🙂

You can skip FA and move straight to Options if thats what you want. No problem with that.

Hello Karthik sir!

As a 24-year-old beginner, I have a few questions:

#1. What should be the minimum capital to start stock trading?

#2. What are the requirements to become a pro trader?

#3. Is it a good approach to start with F&O as a beginner?

1) There is nothing like a minimum required. You can start with as small as 1000 too 🙂

2) Good understanding of markets, human behavior, risk management, and discipline

3) Nope, start small and slow before you take on F&O and leverage trades.

Okay sir. Btw I want to start paper trading before jumping straight into real trading. Is TradingView a good platform for that? Can you suggest some more terminals?

Yes, you can look into that 🙂

Ok. Thanks for your guidance 🙂

sir, I have some queries

1. what is streak? For what purpose can I use it?

2. what does the meaning of these lines mentioned in CPR topic -\”when EOD CPR is calculated, previous month\’s OHLC is referenced and so on\” Is it means that if I see today\’s CPR range, its data is of previous month.

3. I did not find floating order tab to buy or sell while using chartiq?

1) Its a back testing platform

2) The line explains what it means, not sure if I get your query fully

3) I\’d request you to call the support desk for this.

(1) Sir, do you think that retail traders don\’t have any kind of edge when it comes to intraday/Positional trading in F&O, people like jane street and other prop traders are using algorithms and High frequency trading and all.

(2) You views on EMH ( Efficient Market Hypothesis) theory.

1) Edge comes from your intellect in markets, and it plays out well when it comes positions that can be held for longer periods. Scalping, HFTs etc latency matters, and there systems and execution matters. Retail does not have much chance there in my opinion.

2) Well, all public information is easily factored in by the prices, but I think there is still scope for superior analysis stemming from deep domain understanding.

Sir, really keen to learn how to use Kite APIs to automate trading.

(1) Will you teach non tech folks like me who want to benefit from this. You simplifying it through varsity would be bliss.

(2) If not you, please ask someone from your team to make videos on how to use Kite APIs to automate trading. Really need of time.

Please keep a track here – https://varsitylive.zerodha.com/home we may announce something soon 🙂

Hello Kartik sir Aditya here, i am 18 yrs told ( just finished my 12th ), i finished reading the technical analysis

module 2 weeks ago and since 1 week i was seeing all the nifty 50 companies and according to the checklist that u had given , i was trying to find trading options ,( so sir for a beginner like my what i am doing is right or there something else i can do ) ,i have not started investing real money yet i just do paper trading , i mean i wanted to know sir for a beginner have i started in the right way like directly jumping into paper trading or is there some more theory or smtg that i need to learn

Happy to note that Aditya. I\’d not suggest you to get into options right now. Please take time to paper trade, get better with basic buy and hold and then figure other things. Tune your mind to think long term and not short term trades. Short term can happen at a much later stage in your life. Good luck.

Ohk sir, actaully by trading options i meant trading opportunities,but sir i was reading the futures trading module now ,so sir should i stop reading this module and read it in future and was trading like a techincal analyst so sir ur saying its better for me to focus completely on fundamental analysis rather than TA at this stage in my life ( btw i am science student 😀)

Yes, focus on FA, learn TA, and mix a bit of both and develop long term thinking in markets. This mind set will help you get better in the long run. Good luck!

Thank you so much sir for your valuable time ,

Happy learning, Aditya. Good luck.

Happy learning, Aditya. Keep the curiosity going 🙂

Hello kartik sir , Aditya here again, sir i was finding it difficult to identify the price action zones while finding the support and resistance level . The first problem was , you had told sir that where prices hesitate to move up or down that region can also be classified as a price action zone but sir how many candles should be in that range or for how many trading session stock should trade in that region . Secondly, sir also u had said if price either moves up or down after hitting a certain level that price range can also be called price action zone , sir so if just 1 or 2 candles hit a price and suddenly stock price drops after that is it still a price action zone or there should be a few candles , i am getting confused on how to properly identify price action zones like are there some numeric factors on that , and also sir one last question about setting targets while trading, is using resistance and fib retracements enough for that i am not confident on setting target either sir, Please could u help me

How many candles = while there is no prescribed number of candles, look for at least 5-8. Thumbrule is that you want the price to hit a certain price point as many times as possible. This is like a validation for that price to be called a support or resistance.

I\’d pay more attention to regular S&R levels rather than fib retracements, but this is my personal opinion though 🙂

Hello kartik sir aditya here , i had a doubt , for example in a engulfing pattern or a harami pattern is it neccesry that the candle on P-2 should cover the entire candle on P-1 ( by entire i mean including the shadows) or is just covering the body of the candle good enough ?sorry if u had already mentioned this and i missed it sir ,

Just the real body is good enough, Aditya.

thank you sir

Most welcome! Happy learning 🙂

Hello kartik sir aditya here , sir recently the Q1 earning of this year of various companies has been announced bcz of this there is a huge dip or increase in prices so sir in such a situation is better to not sell or buy stocks for few sessions ?

It all depends on how well you understand the business and how convinced you are about the future prospects 🙂

Hello kartik sir aditya here, i have read botht the modules of TA and FA , so sir i have a doubt when in some candlestick pattern like bullish engulfing patttern we say its foun on top of a uptrend sir so how many candles before that are enough to say that its in a uptrend , for day trading candles, like are 4 to 5 trading sessions of upward trend enough to stay that the stock is in uptrend?

I\’d suggest you look for at least 2 weeks of data, that means 10-14 candles at least.

thank you sir, sir if the trend only last for smtg less than 4 candles (ie the market is moving sideways with the trend changing every 3 to 4 days ) then it would be better not to invest right sir

Yes, you are better off waiting for a proper trend to emerge and basing your trading decision on that.

thank you so much sir for your valuable time

Happy learning!

Hi Sir,

Is CPR is removed from kite . Its NOT Available in chart.

Not sure, request you to please speak to the support team for this.

hello kartik sir adity here , in the initial few chapters i rembered u had told us to avoid trading candles tht are les than 1% and greater than 10percent of the range , is this applicable to all candlestick pattern or just the marubozu

I\’d extend this to all CS patterns and not just Marubozu.

Hello Kartik sir Aditya here, \”Previous week’s OHLC is a reference when you plot CPR for 30mins and 1-hour candles.\” sir i didn\’t understand this statement what is the meaning of reference here like do thee previous weeks high , low ,close define CPR for 30 mins or 1hours candles , is it smething like this or what ,sir ?

Does Zerodha provide the ATR indicator using which we can find the stop loss value based on volatility. It does provide ATR band indicator but not ATR value alone.

ATR value also allow to measure volatility also

ATR is there right? on both ChartIQ and TV?

Is it possible to add add Previous Day High and Low points in CPR on ChartIQ?

Ah, we can pass this as feedback to the ChartIQ team. Thanks.

sir,

1.today is 2nd may and axis bank spot chart has formed a shooting star.i was looking for support level which i identified is at 1110.am i correct?

2.when i asked chat gpt about support for swing trading it mentioned weekly support at 1160 and monthly at 1110.and suggested me to use weekly one.but according to the method of finding support we look at 9-10months trend in swing trading.so if the support i chose was right then what to go with???

Maybe you should also ask Chatgpt what technique it is using to identify the support level.

Sir,i have read your every module till marcket stratergies.i want to do swing trading initially.I have thoroughly read your technical analysis module.but please tell me how to start like-

1.initially i was thinking to use trading view free version for analysis.is it right?or any better option is available

2.i dont know which stocks to look for initially everyday.can you pls tell me a way to choose stocks for analysis.

Glad you have read the modules, hope you found them useful.

1) Yes, you can even use the version on Kite

2) You can start with the Nifty 50 stocks.

Sir,i wanted to ask

1.if a price is in uptrend and we see a bearish candlestick pattern emerging.volumes are also in favour but we cant find the resistance as the price was above the point it had ever reached.then what to do in this situation and how to find resistance.

2.i am not finding trading view that helpful due to lavk of some basic features.can kite be used fkr technical trading?

1) You can think of exiting the position if you already had one or maybe reduce the qyantity

2) Yes, Kite has a version of TV that you can use.

HEY!! I wanna ask is that possible to be the TC line below the PP and if yes… then what\’s that mean cause as I go with the formula in one stock i calculate TC line above PP and BC line below PP but in other stock, I calculate it as the TC line below PP and BC line above PP. plis help me in that…

Madhav, since these are at broad-level average, they can technically be above or below.

When we able to sell or by in direct from charts

Please add CPR ( central pivot range) indicator in zerodha individual section

Individual section as in? Sorry, can you pls share more context?

Sir,

I mean to convey something different. Trying below:

Suppose a script, for example Infy.

Last 1 year CAGR say- 5

Last 3 year CAGR say- 8

Last 10 years CAGR say-10.

Since, its inception, say the CAGR – 14.

So, in this context, can one predict its normal CAGR which one can expect from Infy, going forward say in the upcoming 3-5 years? Any suggestion on how to look this type of situation.

N.B: Assume fundamentals of the company is good, no catastrophe in economy occurs in any form from anywhere.

Again, it depends on your investment time horizon. If say it is 3 years, then you can keep 8% as a reference.

Sir,

Is there any way to understand the natural CAGR (approx.) that a particular stock possess? Any idea/way to gain atleast some insight on it?

CAGR is the average, so that is the natural CAGR…of sorts 🙂

Sir, i can see, we can able to drag the floating order window to buy or sell anything from chartiq. And sir, I assume we cannot set target price or stop loss while trading using charts.

Let\’s say I have bought reliance shares through the floating order window and let\’s say I manually set target price and stop loss from the order tab.

Will my stoploss and target price which I set manually will be reflected in the chart? so that I can able to drag my stop-loss and target price accordingly as I make any profits?

Even manually placed orders (aka without using the floating order window from chart) will show up on the chart.

1. Sir, if i have to use floating window to buy bank nifty options, can i use the CE or PE chart? will this be recommended?

2. As i am gonna use CE OR PE chart for buy and sell bank nifty options, can i use the CPR of same rather than bank nifty spot chart? so that it is easy to set target price to exit my existing buy position?

1) You can use the chart of the underlying itself right?

2) Yes, but please back test before you proceed.

Karthik, are there modules for Stochastic divergence and Stochastic RSI?

I dont think I\’ve covered that.

What\’s the difference btw CPR and S&R?

S&R is a place of demand and supply coming in for the stock. CPR is a price base indicator, identifying the same.

Plz provide CPR indicator in kite mobile app.

Sharing this feedback.

The article says:

-> When you plot the EOD CPR, the previous month’s OHLC is referenced.

-> Previous week’s OHLC is a reference when you plot CPR for 30mins and 1-hour candles.

-> Previous day’s OHLC is referenced when you plot CPR for 1, 3, 5, 10, and 15 minutes candles.

Which OHLC values do I use for Weekly, monthly, Quarterly and Yearly CPR plotting?

Sorry, not sure if I get your query fully. Do you want to calculate CPR across all these time period? If you are trading short term, maybe stick to Weekly?

when i want to plot the End of Week CPR or End of MOnth CPR then what period\’s OHLC is reference? Yearly?

No Rahul, check for monthly OHLC, not yearly.

I tried to find out CPR with given formulas but for tomorrow that is 20 August 2024 the Top Centre is less than Bottom and Pivot hws that possible….I tried many times.

High 50728

Low 50283

Clos 50368

Vineet, I think you need to double check your formula once, especially if you are doing this on excel. Pls also compare it with ChartIQ\’s formula.

Hi Karthik

The scan on … feature to find the stock for CASH segment is not available in Streak. Will you please let us know when it will be added or whether it will not be added?

I\’d request you to pls reach out to support desk for this 🙂

Great module sir.

I have one request. If time permits to you and your team, kindly dedicate a separate module for QUANTITATIVE ANALYSIS as well. Kindly suggest books or sources as well to deep dive into it.

Thank You.

Best Regards,

Gautam

Some of the modules are quantitative in nature – https://zerodha.com/varsity/module/risk-management/ and this – https://zerodha.com/varsity/module/trading-systems/

Thank U zerodha for giving such a wonderful tool like CPR its better to see in zerodha trading view version also

Glad to know, happy learning Jyothi.

Sir,

Please take my kind regards.

Learning through the whole zerodha material and studying the markets on daily basis since the last 1 year 5 months, I could do the below two things with good accuracy:

(i) Buy good companies at cheapest prices through fundamental research. However, I could not guarantee when the prices will shoot up.

(ii) Buy companies at such a timing that it can fetch me 12-15% average profit in upcoming 4-6 months time.

The above two has considerably helped me grow.

But after understanding the whole market, I am now daring to take the following:

(i) Trade with stoploss and exit.

(ii) Regarding F&O, I am finding myself averse with regular trades and finding to bet only when markets are giving good opportunity. (May be 3-4 times yearly).

Before coming to the market, I had the desire to be good with trading which I am finding difficult to commensurate with my mind. Could you kindly suggest how to march from this point?

Anirban, I\’m glad you are doing well. Yes, please do keep the stoploss and its ok to trade once in a way, only when your conviction is high on the trade.

Sir,

Any update on when the CPR indicator would be available in Zerodha on Trading View Charts please? Its been long pending since July 2020 as seen in the comments. This is available in ChartIQ, but I find TV is much better aesthetically. Not sure it would take 4 years to develop 1 indicator after so many requests 😉

While calculating CPR range, which closing value do we consider??

Day before close value, or means of previous and today\’s closing value, or post market closing value..??!!

Jignesh, for this, please go through the documentation provided by the charting engine. You will get the exact formula they use.

Thanks a lot!!

Happy learning 🙂

Hi There,

I\’m unable to put CPR in the trading view platform. When I searched in indicators for CPR it is not showing.

Only I can get in the Trading IQ version 2, but not in the trading view platform.

Please let me know anyone what to do.

I\’d suggest you speak to a support executive for this, they will help you with it.

Will be great if you can help/provide formulae for CPR Width calculation.

Anil, I think ChartIQ platform has a documents that explains how CPR is calculated, with all the relevant formulas. Request you to check.

Hi Karthik,

Thank you for all the great work, sir.

I have a question. Based on your experience, which is the best performance indicator for option trading? You have suggested some of these in the Technical Analysis chapter. Could you please provide three or four strong indicator names that work well?

There is no best or worst indicator. They all depend on the market conditions 🙂

Hey @Kartik, while the module for Technical analysis has all the required knowledge for understanding about the trade, can course be added how to set up a trade using all the knowledge here in the trading platform and backtest it? it will be of great help as implementing in real with all the theories mentioned here is always difficult considering only <30% is absorbed from what is read/heard/seen.

You can enrol here for a live class – https://varsitylive.zerodha.com/home

calculated cpr vs charts cpr are different why??

Ah, not sure about that. Even I\’ll have to google it 🙂

Central pivot range is very good indicator. Dont know if the formula is actually correct or not

You can use the indicator directly, without having to worry about the formula 🙂

This is so cool

Happy learning 🙂

yes sir,few of them like trend line,continuos,channel have understood and found very helpful.Some more like elliott wave,time cycle,volume profile,regression line,or anything that could help to analyse charts ,would like to learn and use it.

Sure, we will try and do that Pallavi. More on videos, so please do subscribe to Varsity Youtube channel 🙂

Thanks a lot karthik sir,wld also like to learn different drawing tools in chart iq.I guess even this might be very helpful but dont know their purpose and how to use them.So request you to provide some knowledge about this too.

Thanks, Pallavi. Is there anything specific you\’d like to know about?

CPR indicator not available in trading veiw charts…please update with CPR indicator…and in IQ charts there in S1 And R1…so without these Indicator useless… Please update this indicator in trading veiw charts also… please please…1000 times please…

Sharing the feedback with the charting team, thanks.

Dear Sir,

Is there any source from which I can receive quarterly results of the companies which are publishing results on the same day along with stating whether it is meeting analysts expectations or not.

If it is so, it will be helpful if you could kindly share the link.

Check out BSE XRBL filings for result information, but that wont give you opinions on meeting analysts expectations. Maybe you can check Tijori for that.

It is considered bullish if the current market price is higher than the TC line.

It is considered bearish if the current market price below the BC line.

for this statement which time frame should be referred?

You can use end of day frequency, Amar.

All discount brokers are providing CPR indicator in trading view charts. why zerodha trading view charts not providing. Request to include and also elder impulse indicator

I\’ll pass the feedback. But there is CPR is ChartIQ.

Sir plz refer some books to understand more about technical analysis

You can check out the book on Japanese Candlestick pattern by Steve Nison.

Hi Kartik Rangappa,

The downloadable PDF link on the module doesn\’t include the 21st & 22nd Chapters. Kindly update it.

Checking on this, Ashok.

KYA CPR NIFTY/BANKNIFTY KE SPOT CHART MEIN USE KARNA CHAHIYE YA PHIR FUTURE CHART MEIN ?

When Pivot (h+l+c)/3 is lesser than BC (h+l)/2,then how to calculate TC… As value of TC is less than BC..

But why do you want to make this calculation when these points are readily available to you in the charting engine?

Kindly update cpr on charts..Thanks

When will this indicator be available in Zerodha mobile app ?

It is still not available.

Hopefully soon, Kishor.

Please remove this last \’t\’ in above article:

Thank you.

Checking, will do.

Why doesn\’t the calculated CPR align with the indicator displayed on the charts? I attempted to plot it using the High, Low, and Close of the day, generating CPR for the next day. However, upon activating the indicator, the results diverged significantly from the expected outcome based on the formula. Additionally, there\’s a curiosity about the TC formula—shouldn\’t it be 2xP-BC instead of (P-BC)+P? This is essentially same to the Central Pivot, with a marginal difference. Could you please confirm?

The difference as you said is basis the formula used by the charting engine. You can check the documentation provided by th charting engine company to see their exact expression along with the explanation. Additionally, small differences can also come up based on the closing prices.

Will there be more content in the video series or that\’s it ?

Yes, we are constantly updating the content on our channel – https://www.youtube.com/@varsitybyzerodha

Reg. Central Pivot Range:

In 2020 is was said \”Soon it will be updated on mobile as well.\”. Its 2023, the Company should look into it.

Kya pivot Point indicator ko support and resistance ke liye faydemand mana ja shkta hai

Kya isko use kar shkte hai intraday trading me

HOW TO TRACK ALL THE COMMON STOCKS IN NSE & BSE WITH THEIR RESPECTIVE PRICES IN EXCEL/SMOETHING AND TRACK LIVE OTHER THAN TRADING TERMINAL. IS IT POSSIBLE? LIKE:

COMPANY NAME NSE PRICE BSE PRICE AND SO ON

IS IT POSSIBLEL LIKE THAT TO LIVE TRACK IT?ANYWHERE

Yes, please load the stocks in your Marketwatch.

I want to add all the Common stocks from NSE & BSE in my watchlist and also their prices respectively, Is it possible?

Sir,

Since I begin the first module, my vision on capital market was different and more I keep on going forward (Now in Personal finance), my vision is getting changed every time. Meanwhile, I am stuck with one rather dearth of understanding, as below:

i) Is there way (Technical/ Fundamental) to time market regarding entry & exit?

If yes, I would request if sometime you could kindly float some material on the approach. It would be more a practical thing for newbie like me. Thanks.

1) There are techniques, but none of them are perfect. They all come with their own strengths and weakness 🙂

Hi, I am viwing Trading view for charts on zerodha. I do not see indicator Swing CPR available here. Also Do not see any drawing tool available to draw trendlines.Please help me if i am missing something. Please send copy of reply to my mail as well. Thanks – Shridhar

Can you check ChartIQ once?

Bringing the CPR in mobile is bliss to me…Thank you

Happy trading!

I can see the chart now in kite indicator ?? Is it removed now ???

No Arun, its not.

Hello sir, do you think the pivot points indicator gives accurate S&R levels?

These are all approximates, anyway 🙂

Remember, S&R levels are not exact price points, these are ranges.

Hi just completed the 2nd module and it was as great as the 1st one.

Since I am into trading.. can I skip the 3rd module and directly get into the 4th one i.e. Futures?

Glad you enjoyed reading through both modules. Yes, you can 🙂

Sir,

I have long some shares under CNC for long term investment. However, recently, I noticed that few of the stocks are reflecting under \”Auction\” tab. Why is it so? I am a bit panicked.

Check this – https://support.zerodha.com/category/trading-and-markets/kite-features/auctions/articles/participation-in-the-auction

In trading view chart :

when the CPR will be added?

Sir, I would like to know more on intraday trades. Can you suggest some good sources/ material/book on it?

All the patterns that we discussed here can actually be used for intrday also.

Sir pls put study material for using draw tool for average line, volume profile , Tireoneline, regress line

This is the study material, Usha.

Best lag raha he

Hi Karthik,

I love the article but, i have one question.

Why the TC position is changing with times. Some times BC is on top and some times TC is on top. This really confusing me. Could you please provide more detail on this please.

With moving prices, these are bound to change. However, the rate of change of TC and BC varies.

When will these feature available in phone?

On line 16 it’s written CRP I/o CPR

Checking on this.

very detailed and simple language and well illustrated. Summary of points /check list is very good

Happy learning!

When will this be made available on TradingView charts?

No timelines for this, Shiva.

Can I use this standard CPR indicator in Tradingview platform in Zerodha?

CPR is available in ChartIQ, not Tradingview.

We need CPR indicater….in kite app it\’s a request from users

Noted, I will share the feedback with the team.

sir,i completed learning technical analysis that you taught us very well.Its been 6 months i\’ve been trading with indicators.Now i\’m using chart patterns , price action methods like supply and demand,that is more interesting to learn also.i\’m not good at price action because i didn\’t learnt it from any where rather than some youtube videos.So i kindly request you to make learning sessions about price action that will let everyone including me to read the charts properly by drawing trendlines and all those stuff.

Arijith, do check this video once 🙂

https://www.youtube.com/watch?v=z0Rwoz6PduM&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=3

The pattern at the DCB bank chart cannot be a morning star cause the P3 candle\’s CMP is below the P1 candle\’s opening, also P3 doesn\’t open on a gap-up.Neither does P2 look like a spinning top. Doesn\’t this violate almost all the rules of being a morning star that you mentioned, Karthik sir ??

Mrinal, you will have to look at this from a price action perspective. Do check this – https://www.youtube.com/watch?v=z0Rwoz6PduM&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=3

Could you check this please……If today is a narrow range day, tomorrow’s CPR will be a narrow ranged CPR…

If today is narrow range day than Tomorrow\’s cpr will be wide right

Supar

Can you publish pivot point concept . I mean pivot point indicator in Zerodha Chart IQ

Making a note, will try and update.

Cpr not available in kite

Yes, it is. This chapter is about that right?

CAN TC AND BC CHANGE THEIR POSITION? SOMETIMES TC IS BELOW AND BC IS ABOVE AND SOMETIMES BC IS BELOW AND TC IS ABOVE.

They are averages right? The change with prices.

thank u 🙂

Sir, where can I learn tread lines, breakouts, types of trends, eg. Cup n handle and all, please add the reference.

I\’d suggest you pick up any book on dow theory, that will give you all the information.

Hey Kartik

The CPR indicator on Zerodha doesn\’t seem to indicate the correct levels. I matched it with CPR indicators from many charting softwares.

Can you cross verify if the CPR levels are accurate in Zerodha, and that it is consistent with all the indicators generated by others?

Thanks

I guess you are referring to intraday values? It\’s mainly to do with the way you consider OHLC.

Hi Karthik sir,

I verified the data and it is fine, only doubt is Can the Bottom CPR value be above the top CPR ?

if closing price is near to low, I am getting top CPR line below the CPR line and bottom CPR line is above the CPR.

I couldn\’t find the answer on the internet, please clarify this.

Thanks

Satya

It maybe be possible, although I need to double-check this once.

Sir, the CPR is not available. Pls could you advise how to get.

Check ChartIQ for this.

Hello Karthik sir,

I need your small help to understand the CRP. if the prices are High: 109 Low 100 and Close is 102, then

Pivot = (109+ 100+ 102)/3 = 103.66

Bottom CPR = (109+ 102)/ 2 = 105.50

Top CPR = (103.66– 105.50) + 103.66 =101.82.

If closing price is near to low, then bottom CPR is higher than the top CPR. Can the Bottom CPR value be above the top CPR. Am I missing some thing here ?

Thanks

Satya

Satya, I\’m not sure..maybe you are missing some point here. Maybe in calculation. Can you recheck the data once?

Very informative…

Need more in depth.

Sure, in which area do you need more coverage?

CPR – R1,R2,R3 & S1,S2,S3 are not showing in ChartIQ

Please do check with support for this.

what is formula for camarilla pivot and woodie pivot in zerodha latest version

Not sure. If you are looking at tradingview then search Camarilla formula + trading view formula and you will get the document.

Why there are difference in value of TC & BC in zerodha and tradingview. Sometimes there is narrow CPR in zerodha and wide CPR in trading view and viseversa.

Can you check with the support for this?

When cpr will come on mobile app

Not sure at this point, but hopefully soon.

Great work i have to say. Enjoyed reading this stock market educative Chapters. Hats off to the Author.

Happy learning, Sathya!

Candle stick indicator is not available to me in kites iq chart

Not sure why, please call the support desk, they will guide you on this.

Why Now CPR Indicator not in Zerodha Kite Platform…Please add

I am not getting CPR Indicator

You must be looking at Tradingview; try ChartIQ instead.

sir can you tell which specific area are you talking about

now I can trade by using technical analysis or I should wait till i complete read all modules

Why dont you start paper trading with whatever you\’ve learnt and evaluate and improve on specific areas.

How to add Money Zone Pivot Levels and Camarilla Pivot Levels

I did googled but i cant find these important things

Please do check with the support team once. Thanks.

Zerodha ki ak badi gandi Kami h Trading view jysa chart nahi h … trading view me koi bhi setting apne aap auto save ho jati h baad me kabhi bhi koi bhi stock ho wahi setting milti h template ki lakin zerodha me nahi yahi sabse gandha kaam h zerodha ka …

Excellant chapter

Happy reading!

Please tell me how to draw a circle(not ellipse) on the zerodha trading view chart.

I\’d suggest you call the support desk and get help on this.

sir please tell me regarding the lookback period for intraday ,swing trading ,and also for scalping.

For intraday, I\’d suggest 15 mins chart for at least 3 months. For positional, I\’d look at EOD charts for at least 1 year.

Very useful indicator for intraday trading.

Regards,

http://www.TractorJobs.in

For beginners like me it\’s great lerning

Happy learning.

When it will be present in TradingView charts ?

No timelines on that, Sandeep.

Hello !! I want to learn about advanced technical analysis and I have completed this module. Can you please suggest me some best books\’ names that can help me in this ?

Shubham, I\’d suggest before you read anything more, practice what you have learned for a few months. You will then know which areas you\’d need improvement in.

cpr is not avilable in indicator list. please add

Its available on ChartIQ right?

In mobile kite doesn\’t show CPR and total OI chart plz include it

Noted, Sagitha.

The candlestick pattern is not loading in mobile app i guess.I tried it in chart iQ.😔

Ah ok. Try it on web 🙂

How to apply charts in CPR?

Sorry, as in?

Hi, why don\’t you accommodate CPR in trading view charting, bit useful to us

Will pass this as a feedback to the team.

CPR option is not there when I try to use the split screen with 2 charts. Could you please resolve this.

Passing this as a feedback to team.

Sir so far could not find CPR on mobile kite pls do it will be helpful for many of us .

It is not available on Kite mobile.

so which to follow , which is better any idea ?

I\’d always prefer simple S&R levels and moving averages.

sir , why there is two different level of pivot points levels , as in chart Iq as compared to trading view . THE cpr is the middle value of pivot point in chart iq not in trading view why ? pls tell .

Anukool, the way these are calculated is different. Hence the final values are different as well.

why CPR is not available on tradingview chart software

Because that indicator is not supported in the version we have. ChartIQ is great though.

Will we ever add Visible Range Volume Profile? https://www.youtube.com/watch?v=i1xjh79XC4U

Its about time premium version of Trading view can be added at a fee on Zerodha

what if the stock breaks CPR ?

Then the expectation is that the stock price will continue to decline.

If the current market price of a stock is at 50 and its upper circuit value is 10% i.e, 55

A-If I place a buy order at 54 and at the same time my friend places an order for 54 then will the order be executed,

B -Even if the both orders (mine and my friend\’s) wont get matched but can someone buy a stock at a price higher than the latest trading price and if there are sellers on that price then will the order get executed

If the order will get executed at 54 then will it show in the candlestick chart (closing price may be near 50 as it was at that demand zone but will the candlestick show the high price as 54?

1) Yes, provided 54 is within the execution range

2) Yes, this is how the best bid and sell get built

3) Yes, if 54 is the high price, then the candle will have an upper shadow marking the high as 54.

In the year 2020 you told it CPR will be updated in mobile app, still it is not deployed…

This CPR is static CPR. is there any Developing Pivot Range(CPR) available in study of zerodha chart? it would be helpful if added.

Not sure, need to check.

Hello Karthik,

Warm Greetings 🌹

I hope you are doing well 😊.

I would like to ask you if the technical analysis works in any situation? With the war between Russia and Ukraine the market looks highly volatile and I am not sure if it is good for trading (price action).

How should a trader behave under such circumstances. Is it advisable to take new positions based on price action if all the criteria in your checklist are met. Or, is it best avoided to trade under such circumstances as the market looks highly volatile. Can you please shed some light on this.

This particular phase should be very interesting for traders (especially those who are new and learning) to observe how the market behaves under such situations.

Thank You

I\’d generally suggest you decrease your positions when trading the market in such situations. There is too much volatility in the market right now, and you don\’t want to expose your capital to such volatility.

In kite

How can we check the candlestick patterns in chart using chart IQ

There is an indicator called candle patterns from the drop-down menu, please click on that and load the indicator.

Sir, you say you trade only the pullbacks. What\’s really the logic behind this?

In case you missed the original rally, then pullbacks give you another chance to enter the trade.

Candlestickpatterns ko identify karane wala point

Sir where I will find the candlestick pattern point

Pattern point? Not sure what that is Keshav.

hey ! do you have any plans on teaching about Elliot wave anytime.

if no, then where can I learn best about it the way you teach

Not really, Shivansh.

P3 opening should be a gap up, plus the current market price at 3:20 PM should be higher than the opening of P1

In the above candlestick pattern CMP is not more that p1 opening price then how it would be morning star candlestick pattern?

Its the close price on P3 we are referring to, Keshav.

What if the current price is below the CPR and trend is bullish. Also the CPR is Wider ranged .

Naveen, I\’d suggest you place your decisions mainly based on candlesticks patterns (bullish trend) and look at the indicators as a supplement study.

Understood Sir 🙂

Karthik Sir, i have read TA module fully, worth sir thanks a ton and sir i came cross one indicator which quite famous which \”super trend indicator\” yours views on this Sir?

Muthu, most of these indicators are systems developed by someone else. I personally don\’t like to rely on it much. The bulk of my trading decisions is based on candlestick patterns themselves. Indicators are a good supplemental tools for helping me make my decision, but not the main one.

Thank you for your reply Karthik. I am amazed how you are able to reply to our comments and that too well with in a day. There are many other modules and I can see you there as well. I am spellbound 🙏🏻

I guess you are really enjoying & loving what you are doing. That\’s some character you have showing the upbringing of you by your parents🧡

I mean LBP is the Look Back Period. All the questions I am asking are relating to Chapter 19, I am unable to post a comment over there (not sure why), so posting here.

For you reference I am posting my query again here:

1 & 2) Referring to Chapter 19, 19.3 – Look Back Period: Look back period is simply the number of candles you wish to view before taking a trading decision.

What is that we are exactly viewing in the candles in this LBP? Can you please specifically mention few things (at least 1 or 2 points) that we are looking in the candles in this LBP. Like if prior trend can be determined, S&R can be plotted etc.

4) Prior Trend – This is where I am getting a bit confused – if I can make out the prior trend for my particular trading decision based on prior 8-10 trading sessions, then what is the Look back period of 6months – 1year is for in swing trading?

Referring to Chapter 19, 19.3 – Look Back Period: Look back period is simply the number of candles you wish to view before taking a trading decision.

What is that we are exactly viewing in the candles in this LBP? Can you please specifically mention few things (at least 1 or 2 points) that we are looking in the candles in this Look Back Period. Like if prior trend can be determined, S&R can be plotted etc.

If Prior trend can be determined from Look Back Period, doesn’t this trend differ from the prior trend that we make out viewing prior 8-10 candles? If so how should our trading decision be made?

Thanks for the kind words, Jidugu. Yes, I love markets and helping people find their way through this 🙂

I should have guessed what LBP means, don\’t know how I missed that 🙂

1&2) When you look back at the candles, you are simply trying to gauge the market sentiment for a given period. For example, if I\’m doing a swing trade, I\’ll look at the market from say 10-15 sessions prior to get a sense of how the market is moving. If I\’m planning a long trade, and the candle suggests a reversal, then the look-back period should suggest a bearish trend.

4) For 6 to 1 year kind of trades, look at least 1 year of data (end of day data) to get a sense of how the market is doing. YOu want to see momentum driving the stock prices for the last year and you should be buying in during a short-term correction.

I hope this gives a perspective to your other queries as well 🙂

Hello Karthik,

Last couple of days, I have been asking few questions in different chapters of this TA module and am receiving your reply for all of them. I wholeheartedly Thank you for solving my queries.

I have a couple of queries in this chapter as well- (I am asking these from Swing trading perspective)

1) LBP of 6m-1y for swing trading – What is that we are exactly viewing in the candles in this LBP? Can you please specifically mention few things (at least 1 or 2 points) that we can look in or make out of LBP. Like if prior trend can be determined etc.

2) LBP for S&R at least 2years: Please let me know if my understanding is right – Say today in Feb 2022 I identified Bullish Engulfing pattern, if I plot the S&R levels, will the S&R lines look like they run from Feb 2020 to Feb 2022. Is this what the LBP mean in this context?

3) BTST – To avoid the risks involved in BTST you advised us to trade highly liquid stocks. How high the liquidity has to be? Can you please quote a number? May be 30,00,000? Because in general you asked us to look at stocks with volume of at least 5,00,000.

4) Prior Trend – How many previous candles should be looked at to determine the prior trend? There could be at least two prior trends isn’t it? If I look the previous 20-30 candles it could give us most recent short term prior trend and we use the LBP of 6m-1y, it could give us prior trend from longer perspective. Should both the trends be same when making a trading decision? As in the above example, if the short prior trend (previous 20-30 candles) is downtrend for a bullish Engulfing pattern but the longer prior trend (based on LBP 6m-1y) is not downtrend. Should this trade be avoided/skipped? Or can we say that it need not be avoided, but if the long prior trend is also the same, that could be a double confirmation to our trading decision?

5) Time Frame – Can we use the same EOD charts for:

a) Identifying candlestick patterns,

b) Identifying Prior Trend,

c) Plotting S&R levels etc.

For what other purposes we may use the EOD time frame for?

Is there any time when we may be required to use Weekly time frame or other time frame for swing trading?

6) Referring to 19.5, part 2, point 7: “If the steps 1 to 5 are satisfactory, I proceed to calculate the risk to reward ratio (RRR)”:

There are actually 6 steps mentioned over there and the 6th step being Dow patterns confirmation. Is this a typo error or only following the first 5 steps is enough for calculating the RRR.

Can I take the trade without confirming the trend with Dow patterns? What could be the chance of successful trade ignoring Dow Patterns.

Thanks a ton for reading through our long queries and addressing all our concerns. Thanks a lot.

Can we use emojis in our comments? Because when I use emojis the comment is not getting posted.

Glad you found my comments helpful 🙂

1 & 2) LBP, not sure what this means, can you please share some context?

3) To get a sense of liquidity, see the difference between the bid and offer price. The lower the difference (spread), the higher the liquidity. Nifty/Reliance/Infy/TCS Futures is highly liquid, see the spread on these and then compare that with the stock you are looking at.

4) Again, I\’m unable to figure what LBP is, but to get a sense of prior trend, evaluate your trading time period. If its say for swing positions, then at least 8-10 trading sessions will help

5) I personally end up using EOD almost always 🙂

6) Must be a typo 🙂

There are no guarantee in markets and TA, just that these things enhance your odds of making a profitable trade, keep that in perspective 🙂

Emoji – I always use this \’ 🙂 \’

Thank you for the reply.

I posted another query in Chapter 19-The Finale – Helping you get started, but I dont see the question over there. It took good one hour to put my question in the right way to hep you understand what I intended to ask, But alas, I think I need to do it all over again.

Is there is possibility to check if the question I asked reached you.

Thank You.

Ah sorry about that, I don\’t know why the post got missed. Did it include a URL?

Hello Karthik,

Warm Greetings,

The candle stick pattern on the Chart IQ is a brilliant feature. Its a boon for beginner like me who can use it for learning purpose. I think it would best suit us to first identify patterns and cross check it with this feature to check if are on the right path. That\’s just brilliant. Thank you for bringing such a fantastic feature.

Can you tell me if there is any such feature that identifies S&R levels. That would be a cherry on the cake.

Thank You 🙂

YOu can try using the pivot points to get a sense on S&R, but from my experience, I think plotting them manually is better 🙂

I am not able to use Central Pivot Range indicator in my Kite mobile app.Why?

Its not available on Kite mobile yet, Gurpreet.

There is a diff in the CPR values for the 5, 15 min time frame when compared to the Trading view. Can it please be fixed so that there is no confusion. No sure how much reliable CPR values are in Kite.

Kanhu, please check this – https://tradingqna.com/t/why-does-two-charts-of-the-same-timeframe-look-different-on-the-same-platform/4715

Yet to get this feature in mobile app 🙁

Sir,cannot find CPR in kite!

Please switch to chartIQ, you will find CPR.

I have observed that on Daily chart CPR changes after one month and on hourly chart CPR changes after a week. What is the logic behind this and how do I calculate CPR for daily, weekly and monthly charts?

Thats because of the way how OHLC is considered for the different time periods. Check this thread – https://tradingqna.com/t/why-does-the-same-technical-charts-for-the-same-stock-from-nse-tame-google-finance-yahoo-finance-amibroker-not-match/1688

I am unable to use CPR in zerodha\’s mobile app

Its not available on mobile yet, Gurpreet.

I got problem regarding Certification test at varsity app.

In instructions it shows that you can give 3 attempts to qualify the test but it didn\’t gave me second chance for the test.I get 170/250 in first attempt and didn\’t get in the passing criteria. (75%).

Kindly guide me how will I get second attempt for the exam.

Checking this, Amit.

Super 💯 & very simple tell you thank u very much

Happy learning 🙂

In Tradingview chart Please do avilable facility of chart layout save in cloud. so we can use it at any laptop with login, At present its only save in current session.

Noted, will pass this as a feedback.

hey, I want to use a trading view of yours, but there I haven\’t found CPR indicator can you guys please do so which is very useful.

CPR is available only on ChartIQ for now.

How to add central pivot range on zerodha charts? It doesn\’t show in the indicator list

I\’d suggest you call the support desk for this, they will guide you easily.

Dear Sir,

It is noted that sometimes in options, even though the underlying is moving well, the option is not moving and stuck at one place.

Why is this so? And how can we avoid this?

I generally buy ATM calls.

Thanks and Regards,

Satish NL

Its because option premium is a function of many different variables, not just the movement in price.

Is it possible that BC is higher than Pivot point??

That is unlikely.

In 22.3, Top CPR = (Pivot – BC) + Pivot ie, Top CPR = BC

Right?

In my tools there is not cpr I\’m mobile

CPR is not yet available on mobile, Manoj.

I cannot find central pivot range in my app please help !!

Renu, switch to ChartIQ in Kite web and you\’ll find CPR.

Calculation of Central Pivot Points is incorrect. Please check.

It\’s not the standard calculation due to the way ticks are streamed. There will be some differences with respect to standard CPR math.

Unable to find cpr in study section

How to find cpr in zerodha?

Manish, please switch to ChartIQ in Kite to get CPR.

Where is Central pivot range in kite , it\’s not showing there

Try ChartIQ.

I am using Zerodha kite since last one year over my SmarPhone..But I am not getting CPR…STOCHASTICRSI…Other additional indicator in CHART IQ…As mentioned by you.

To get those additional Indicators in my chartIQ..What shd I do..Plz advice

CPR is not yet available on mobile, hopefully soon.

thank you so much Karthik sir & team varsity. All modules are very simple & understandable, not get bored for a single minute while studying. Very useful study material. Thank you again.

Glad to know you liked the content, Vicky! Happy learning 🙂

Sir

Updated in mobile as well..

Is CPR available for Kite mobile now?

Not yet, Venki.

Do not see CPR indicator in the current Kite( Oct 21) has it been removed?

Nope, it is still available in ChartIQ.

When is CPR and Anchored VWAP coming kite mobile app?

Thank you foe the information. but i am not able to select the CPR when i select the trading view options in settings

CPR is in chartIQ, please check there. Thanks.

When this feature is available on kite mobile

Can you throw some light on this confusion for traders. With respect to Technical analysis tools, what do we decide when different indicators are indicating contradicting outlook. For e.g., if RSI is giving a buy whereas Pivot is giving a bearish signal, then in such cases how do we go about taking a decision. In general, 1) what are some important technical tools that we can rely on ? 2) how important is the tool itself for a buy/sell decision. This is all in the context of swing trading.

I\’d always suggest you base your decision on candlestick patterns, and not really on indicators. Indicators can be confusing. In fact, I\’d suggest you stick to just 1 or 2 indicators that you know really well and stick to it.

Why study option is not available on trading view? I prefer trading but it has less indicators than chartiq.

In flag pattern we keep pole of the flag as target from breakout point

Should one avoid even if there is any previous resistance

And if there is bearish engulfing in a uptrend and target is not achieved should one wait till target is achieved or exit

Sir I asked lot of questions..I\’m really confused no friend or person is there to discuss

Thank you

Bharath, once you initiate the trade, you need to ensure that you stay invested either till target or SL is triggered. Btw, feel free to discuss here, don\’t hesitate 🙂

I\’m implementing what I learnt..just keeping low of the candle my sl gets hit and moves

Which method should I follow.. just follow current one

Any advice

Good luck, Bharath!

Sir stock as given breakout but RSI is above 75-80 levels should one enter

Or avoid..it\’s overbought

75-80 suggests an oversold region, have explained this in the chapter 🙂

Thank you!

Happy learning!

Pls update cpr in kite mobile version

I am not able to insert CPR in 2 split windows (ex. i need cpr setup for nifty and bank nifty )

Got it. Thank you.

I don\’t have this menu (view, display, studies, layout, events). i have these lists (compare, indicators and templets). not able to include CPR as per your notes.

Please check chartIQ, not trading view.

Please add the cpr indicator

Hello sir there\’s another question linked up from the same chart that there are two trend lines-

i) The trendline from the head and shoulders pattern

ii) The most tested trendline

which one should be considered as important here and please tell the reasoning also, it would be a great help to me:)

https://www.tradingview.com/x/FHSbmTCN/

1) Not convincing for me

2) The first line, because there are more price action zones touching the trend line.

Hello sir, can this be considered as a possible inverted head & shoulders pattern reversing the trend.

If yes then, should we trade this pattern when the price retests the resistance line(earlier a support) or the monday\’s closing price?

https://www.tradingview.com/x/JhOyJjZ0/

Hmm, I dont see how, Mohit. Not too convincing for me I guess 🙂

But how do we fix stop loss in quick trade window?

You cant, please use the main order window.

Happy Teachers day Sir

Thanks, Sriram!

Please add settings for cpr line style(dotted)

Sir,

How to trade with stocks which are trading at all time high.

There is no Resistance.

I do swing trading in CNC.

Please let me know what are things one must see while stock price is trading at all time high?

Thank you.

It is best to swing trade these with a tight trailing SL.

CONGRAT, kartik. The discussion is lively, useful . Your in-depth knowledge in intraday trading and efficiency in handling multitude of queries is what makes you unique and indispensable to Zerodha. Continue like a TREND, thank you, Kartik.

Thanks for the kind words, Anjum. Happy learning!

How to use CPR in kite app

It\’s not available yet, Paresh.

Hi Karthik,

Would you please suggest filter to find Institutional buying stocks in Nifty. I mean by volume and price filter or something else as per your experience.

Hmm, not really sure, Haresh. Maybe you should check screener for this?

Ah, yes sir. I have read it sir. I have been trading consistently for 3 years now.

If I google, there are n number suggestions, so I thought of asking you.

Sure, good luck Mani. I hope you have the best trading experience 🙂

Hello sir, can you suggest books on price action trading.

This module on candlesticks is about price action 🙂

Allright, but atleast create a seperate module for intraday trading strategies, which should have topics on how to select stocks for intraday, etc.

If you have above topics covered then please let me know where.

Noted, Haresh.

CPR seems to be not available when using multiple charts in Kite.Is there anyway to get it added

We will be adding this soon.

Hi Karthik,

I am customer of Zerodha, I oberserved few topics are missing in Versity mobile application. It\’s been a while you commented to cover this topics. However, we are still missing it in Versity app.

Further, I would like to encourage you to conduct a training classes from scratch to advance, because majority of retail traders can\’t \”Trade\” in Market by just reading. Because, I believe there are still certain \”Secrets\” of trading yet to disclose atleast to us as a customer, to be loyal on how a HNI/Institutions Trade is something different I hope you are getting my point. So, I would like to request you to start a initiative to provide training to customers.

Training courses may not be possible, Haresh. We have shared whatever we know here and we will continue to do that 🙂

We are updating the app almost on a regular basis.

Sir when this feature will came on mobile??

We are looking for it.

Please sir do as possible as early

We are waiting on mobile…

Hopefully soon Sir.

When it will be available for mobile?

Also it is not available for multichart setup in Kite Web

Its on the list of things to do, Devdatta.

now remove this chart in zerodha kite why this Central Pivot Range remove pls tell me why this remove in zerodha

Its not removed, still available in Kite (ChartIQ).

Why the CPR is not available in the Trading view chart?

Trading view has not made it available yet.

Will there be any updates on candlestick pattern for trading view

Nothing in the near future.

Hi Karthik,

If a stock is trading at all time high, then what could be the Target price while trading ?

Its tough to set targets, best if you keep tight stop loss and trail the position.

Sir,

Your work is phenomenal and I am vary grateful. It would be better if you throw some light on Elliott Waves and Gann Theories. In this regard, it is requested to cover these in the way as you have done others.

Thank You.

Thanks for the kind words, Chandan. I\’ve not used these theories myself, hence I don\’t have any experience to share 🙂

when is this feature coming to mobile?

The team has this on the list of things to do.

How to add CPR indicator in kite app in mobile. Not getting the CPR indicator itself when tried on mobile.

Its not available on the app yet, Mahesh.

What the correct bottom CPR

If the market price is very high from the cpr so should we take a long trade or should we wait to let the price come down to cpr

I\’d suggest you wait. See how it goes on a paper trade and then develop your logic.

In kite app, full cpr not able to see. Means CPR 3 line,TC,BC and central pivot. Pls provide solution.

Hmm, not sure why. Maybe you should look at this again.

Dear Sir,

I have observed that the CPR calculation value in the KITE is different from the Trading view application, could you please explain which one to be considered.

Regards

Srikanth

Thats because of the way OHLC is treated, I think the chapter has this explanation I suppose.

When it will be available in Mobile?

Why didnt u give full info of CPR consisting S1,S2, S3 and R1,R2 and R3?

I\’ve shared whatever I know about it.

Why CPR indicator is different in zerodha kite mobile application ..

CPR is not available in Kite yet, Sandeep.

Please provide R1 ,R2 ,R3 AND S1 S2 S3 in CPR

Why didn\’t zerodha added some last chapters in PDF?

I Will have this checked, thanks, Aditya.

When compared to trading view and chariq there is lot of difference in the cpr points.same foemula is used to derive in tradeiq but the lines are totally differnt in chartiq.this is mislead the trading analysis.

Every engine used a slightly different formula, hence the minor difference. You need to see which works better for you.

i use this strategy in crypto trading works most of the time

Ah ok. I\’ve never looked at Crypto 🙂

how to trade with quarterly results ? sometimes even after posting expected estimates price sharply fall for 2-3% & vice versa

Yup, it depends on what the street expects versus the actual results.

Hi Team,

Not able to save multiple charts window with new Save name.

daily we need to set multiple charts(2/4) as per our study/style of trade requirements, it consumes more time to do daily.

in multiple charts section have only to save individual charts to save option.

Ex – Need Reliance, HDFC, SBI, Kotak on one window (zerodha have multiple charts options to view these in one window using 2/4 multiple charts option under display section)

but not able to save this whole window and next day again we need to add all 2/4 stocks using multiple charts.

Checked in all the way dint get any information regarding multiple charts save steps it consumes more time to do daily.

could you please help me on the above or i missing any content.

Laxman, I\’d suggest you speak to the support desk about this. Easier to help over the phone.

When i plot 2 charts in the same tab and try to put the CPR study on it , it doesn\’t work out

Please do call the support desk for this, Prashant.

Hi,

Is this cpr introduced in kite or not?I\’m not able to find it.

Yes, its available. Check chartIQ.

why is this feature not in mobile.?

Hello – not able to find candle study pattern in kite. Is name changed ?

No Sir, it is the same. Thanks.

Unable to update CPR

Is there an option on Trading View where if I use a drawing tool(trend line/ Fibonacci etc) on a particular stock and after reopening the same I do not need to redraw the same?

Also kindly please an alert feature on TradingView if possible, that would be of huge help.

Thank you.

Yes, you can save it as a template. Check this – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/charts/articles/tvlayout

How save trendlines in chart

Yes, please.

Please add more indicators(Candlestick Pattern, Pivot range, etc) on Trading view.

Noted.

Also, it is requested to keep updating the pdf in case new chapters are incorporated in future.

Sir,

The pdf provided for the technical analysis module contains only 20 chapters whereas the module contains 22 chapters. It is requested to add the remaining chapters as well.

Noted.

Thank You

Good luck!

Please update one more indicator.

\”Relative strength compare to Index\”

I\’m not sure, need to look it up myself 🙂

Hello Sir,

Back in the day when you actively traded did you work from home or had to go to an office?

Why did you stop if you were profitable? Was joining Zerodha\’s education team a more profitable venture to make you stop trading?

Was working out of the office with the Zerodha team 🙂

Dint really plan anything in life, just went with the flow.

Hi, I\’m not able to find cpr indicator in mobile app. Is it removed?

Its not enabled yet.

Hello Sir,

What was you basic set up back then? Did you use multiple screens or only used a single screen?

Also doesn\’t Nikhil Kamath trade, is he allowed to?

Single screen…but later had a dual-screen for a while. Nikhil is the only exception, he runs a hedge fund 🙂

Central pivot range indicator is not available in zerodha ChartIQ chart when you use multicharts. Please look into the matter so that trader can use cpr with chartIQ multichart layout

Checking.

Hello Sir,

What exactly is your trading set up?

What indicators do you generally use?

Do you use different indicators for different time frame and different for F/O and Delivery and Intraday cash?

I\’ve stopped trading, Harmen. No one at Zerodha is permitted to trade.

Hi Karthik, I couldn\’t find a reference in the chapter or in the comments where it explained why it was directional downtrend even though CPR width was wider. Can you please guide me to it.

The stock\’s general direction is in a downtrend, that\’s what I mean.

it is really helpful for many beginners sir so pls make more and make many happy traders sir

ps:

thank you so much sir

Good luck, Aravind.

In the graph for section \”current market price is less than that BC\”, the market trended downwards even more than previous day, even though the CPR width is greater than previous day. Would appreciate your view on this.

Hmm, I\’ve tried to explain this bit in the chapter and in the comments Prabhat. Please do check. Thanks.

After nearly one year CPR is not provided for mobile

Sir,

Why is there no option for CPR and candlestick patterns in TV? Why are the indicators not saved on TV?

It will take time, Manash.

Sir,

The candlestick identification and CPR is not being found in the mobile app. How can it be found??

It will take some time to show up in the app.

While calculating pivot points for EOD or swing trades shoul we take weekly or monthly H,L,C

And number of pivots back,should I leave it as default

EOD data is fine, Bharath.

Ghatiya site hai ekdum

Hi Team,

Could you please make CPR tool available for \”trading view\” type of charts? only pivot points standard is available.

Thanks,

Umashankar

It is on the list, but will take a bit longer.

Karthik Sir, can you please confirm; whether Candlestick Pattern feature shows Dow formations, or not? Thanks.

No, these two are different. However, the more experience you gain, you can start to notice Dow behaviour in candles as well.

Kb aayega CPR and OrB

I can\’t find this on kite search.

Please look at this in ChartIQ.

How to set targets for swing trading?

You can look at the support and resistance levels to set targets.

CPR, Stockchastic RSI etc these new tools are no updated in my kite app.

Or is there any procedure to update the new tools.

CPR is not available on the app yet.

When CPR will be working on kite mobile app?

Hopefully soon.

Hello Sir,

What is the difference between Central Pivot and Fib Pivot and Carmilla Pivots?

Could you care to explain?

I\’ve not really used Carmilla Pivots, so can\’t really comment on it.

We are not to plot cpr on chart on kite. Cpr tool not available on study tools.pl. provide us this tools.

Are you using Tradingview or ChartIQ? You need to use ChartIQ for CPR.

How do we scan stocks for this? Is there any way we can use previous close nse/bse data to identify stocks?

Can we also use this swing trader if used on a day candle/heikenashi?

thanks

Vishal, maybe you should check with Streak for this.

Please add this chapter in hindi soon

I request you to start my all indicator

Candlestick Patterns

Stochastic RSI

RSI divergence

MACD divergence

Stochastic divergence

Central pivot range (CPR)

Trade from chart

Nothing to start, it\’s available to you by default.

Dear sir please activate

Candlestick Patterns

Stochastic RSI

RSI divergence

MACD divergence

Stochastic divergence

Central pivot range (CPR)

Trade from chart

my id NT2273

Dear sir please activate pivot range

my id NT2273

Candlestick Patterns

Stochastic RSI

RSI divergence

MACD divergence

Stochastic divergence

Central pivot range (CPR)

Trade from chart

Dear sir please activate pivot range my id NT2273

It is available for all to use.

hey when are we having risk to reward position indicator [long and short position] in chart iq i think it is only there in trading view it is not in chart iq

Not sure, need to check with the team.

My kite app doesn\’t show CPR in studies, how to get it?

Its not available on the app yet.

While placing two chartes in one screen i m not able to use CPR indicator in chart iq. Can you pls fix it. Because for trading one needs to go through multiple charts.

sir in which time frame its works the best.Plzz reply

EOD if you as me.

Hello sir

I have read all the pdfs but I am still not feeling confident to enter market.

I want to learn more where will I get more material about stock market plz help

That is a never-ending quest 🙂 I\’d suggest you start with a small amount and take a few trades to see how it goes for you. Dont be afraid to make small mistakes. You can learn from this experience. Good luck 🙂

CPR is entered as CRP at the top after \”Let me list a few\”…

Ah ok, thanks for pointing 🙂

Dear Sir,

Many thanks for your tutorials.

Can we use CPR for swing trading(5-10 days )?