10.1 – The directional dilemma

How many times have you been in a situation wherein you take a trade after much conviction, either long or short and right after you initiate the trade the market moves just the other way round? All your strategy, planning, efforts, and capital go for a toss. I’m certain this is one situation all of us have been in. In fact this is one of the reasons why most professional traders go beyond the regular directional bets and set up strategies which are insulated against the unpredictable market direction.

Strategies whose profitability does not really depend on the market direction are called “Market Neutral” or “Delta Neutral” strategies. Over the next few chapters we will understand some of the market neutral strategies and how a regular retail trader can execute such strategies. Let us begin with a ‘Long Straddle’.

10.2 – Long Straddle

Long straddle is perhaps the simplest market neutral strategy to implement. Once implemented, the P&L is not affected by the direction in which the market moves. The market can move in any direction, but it has to move. As long as the market moves (irrespective of its direction), a positive P&L is generated. To implement a long straddle all one has to do is –

- Buy a Call option

- Buy a Put option

Ensure –

- Both the options belong to the same underlying

- Both the options belong to the same expiry

- Belong to the same strike

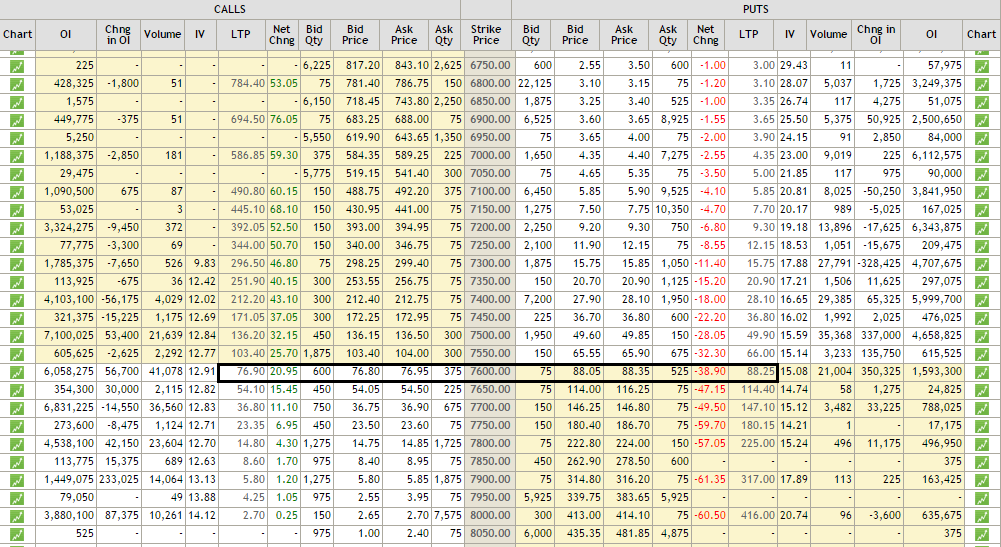

Here is an example which explains the execution of a long straddle and the eventual strategy payoff. As I write this, the market is trading at 7579, which would make the strike 7600 ‘At the money’. Long straddle would require us to simultaneously purchase the ATM call and put options.  As you can see from the snapshot above, 7600CE is trading at 77 and 7600 PE is trading at 88. The simultaneous purchase of both these options would result in a net debit of Rs.165. The idea here is – the trader is long on both the call and put options belonging to the ATM strike. Hence the trader is not really worried about which direction the market would move.

As you can see from the snapshot above, 7600CE is trading at 77 and 7600 PE is trading at 88. The simultaneous purchase of both these options would result in a net debit of Rs.165. The idea here is – the trader is long on both the call and put options belonging to the ATM strike. Hence the trader is not really worried about which direction the market would move.

If the market goes up, the trader would expect to see gains in Call options far higher than the loss made (read premium paid) on the put option. Similarly, if the market goes down, the gains in the Put option far exceeds the loss on the call option. Hence irrespective of the direction, the gain in one option is good enough to offset the loss in the other and still yield a positive P&L. Hence the market direction here is meaningless. Let us break this down further and evaluate different expiry scenarios.

Scenario 1 – Market expires at 7200, put option makes money This is a scenario where the gain in the put option not only offsets the loss made in the call option but also yields a positive P&L over and above. At 7200 –

- 7600 CE will expire worthless, hence we lose the premium paid i.e Rs. 77

- 7600 PE will have an intrinsic value of 400. After adjusting for the premium paid i.e Rs.88, we get to retain 400 – 88 = 312

- The net payoff would be 312 – 77 = + 235

As you can see, the gain in put option after adjusting for the premium paid for put option and after adjusting for the premium paid for the call option still yields a positive P&L.

Scenario 2 – Market expires at 7435 (lower breakeven) This is a situation where the strategy neither makes money nor loses any money.

- 7600 CE would expire worthless; hence the premium paid has to be written off. Loss would be Rs.77

- 7600 PE would have an intrinsic value of 165, hence this is the gain in the put option

- However the net premium paid for the call and put option is Rs.165, which gets adjusted with the gain in the put option

If you think about it, with respect to the ATM strike, market has indeed expired at a lesser value. So therefore the put option makes money. However, the gains made in the put option adjusts itself against the premium paid for both the call and put option, eventually leaving no money on the table.

Scenario 3 – Market expires at 7600 (at the ATM strike) At 7600, the situation is quite straight forward as both the call and put option would expire worthless and hence the premium paid would be gone. The loss here would be equivalent to the net premium paid i.e Rs.165.

Scenario 4 – Market expires at 7765 (upper breakeven) This is similar to the 2nd scenario we discussed. This is a point at which the strategy breaks even at a point higher than the ATM strike.

- 7600 CE would have an intrinsic value of 165, hence this is the gain in Call option

- 7600 PE would expire worthless, hence the premium paid towards the option is lost

- The gain made in the 7600 CE is offset against the combined premium paid

Hence the strategy would breakeven at this point.

Scenario 5 – Market expires at 8000, call option makes money Clearly the market in this scenario is way above the 7600 ATM mark. The call option premiums would swell, so much so that the gains in call option will more than offset the premiums paid. Let us check the numbers –

- 7600 PE will expire worthless, hence the premium paid i.e Rs.88 is to be written off

- At 8000, the 7600 CE will have an intrinsic value of 400

- The net payoff here is 400 – 88 – 77 = +235

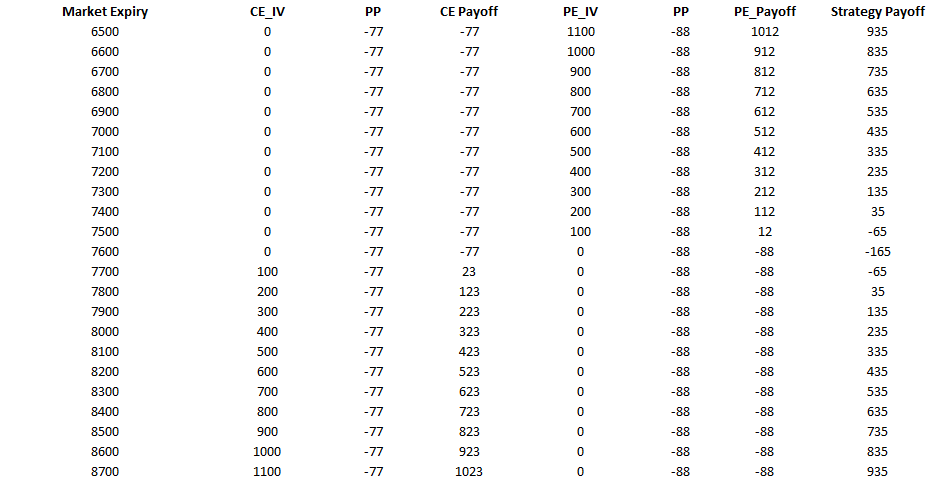

So as you can see, the gain in call option is significant enough to offset the combined premiums paid. Here is the payoff table at different market expiry levels.  As you can observe –

As you can observe –

- The maximum loss (165) occurs at 7600, which is the ATM strike

- The profits are unlimited in either direction of the market

We can visualize these points in the payoff structure here –  From the V shaped payoff graph, the following things are quite clear –

From the V shaped payoff graph, the following things are quite clear –

- With reference to the ATM strike, the strategy makes money in either direction

- Maximum loss is experienced when markets don’t move and stay at ATM

- Max loss = Net premium paid

- There are two breakevens – on either side, equidistant from ATM

- Upper Breakeven = ATM + Net premium

- Lower Breakeven = ATM – Net premium

I’m certain, you find this strategy quite straight forward to understand and implement. In summary, you buy calls and puts, each leg has a limited down side, hence the combined position also has a limited downside and an unlimited profit potential. So in essence, a long straddle is like placing a bet on the price action each-way – you make money if the market goes up or down. Hence the direction does not matter here. But let me ask you this – if the direction does not matter, what else matters for this strategy?

10.3 – Volatility Matters

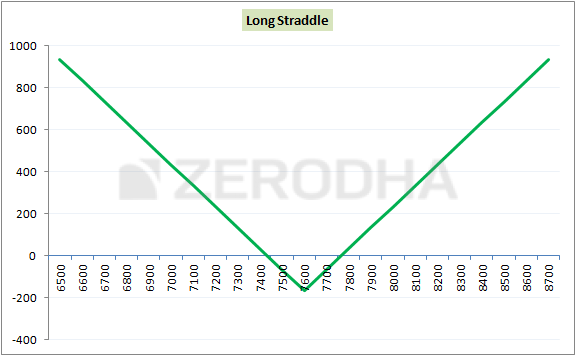

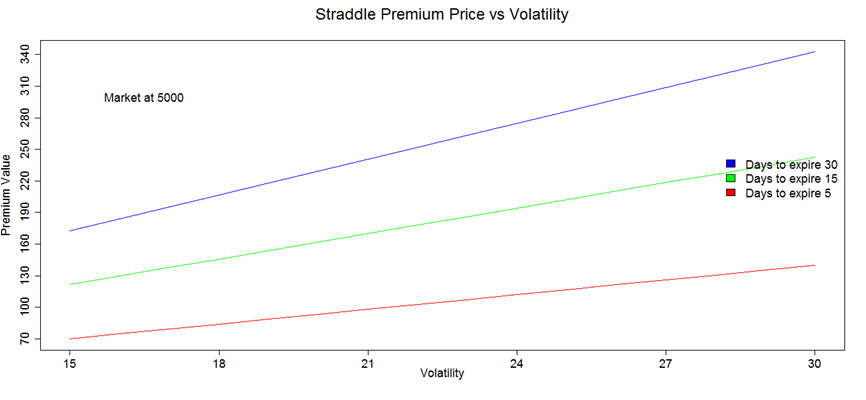

Yes, volatility matters quite a bit when you implement the straddle. I would not be exaggerating if I said that volatility makes or breaks the straddle. Hence a fair assessment on volatility serves as the backbone for the straddle’s success. Have a look at this graph below –  The y-axis represents the cost of the strategy, which is simply the combined premium of both the options and the x-axis represents volatility. The blue, green, and red line represents how the premium increases when the volatility increases given that there is 30, 15, and 5 days to expiry respectively. As you can see, this is a linear graph and irrespective of time to expiry, the strategy cost increases as and when the volatility increases. Likewise the strategy costs decreases when the volatility decreases.

The y-axis represents the cost of the strategy, which is simply the combined premium of both the options and the x-axis represents volatility. The blue, green, and red line represents how the premium increases when the volatility increases given that there is 30, 15, and 5 days to expiry respectively. As you can see, this is a linear graph and irrespective of time to expiry, the strategy cost increases as and when the volatility increases. Likewise the strategy costs decreases when the volatility decreases.

Have a look at the blue line; it suggests when volatility is 15%, the cost of setting up a long straddle is 160. Remember the cost of a long straddle represents the combined premium required to buy both call and put options. So at 15% volatility it costs Rs.160 to set up the long straddle, however keeping all else equal, when volatility increases to 30% it costs Rs.340 to set up the same long straddle. In other words, you are likely to double your money in the straddle provided –

- You set up the long straddle at the start of the month

- The volatility at the time of setting up the long straddle is relatively low

- After you set up the long straddle, the volatility doubles

You can make similar observations with the green and red line which represents the ‘price to volatility’ behavior when the time to expiry is 15 and 5 days respectively. Now, this also means you will lose money if you execute the straddle when the volatility is high which starts to decline after you execute the long straddle. This is an extremely crucial point to remember. At this point, let us have a quick discussion on the overall strategy’s delta. Since we are long on ATM strike, the delta of both the options is close to 0.5.

- The call option has a delta of + 0.5

- The put option has a delta of – 0.5

The delta of call option offsets the delta of put option thereby resulting in a net ‘0’ overall delta. Recall, delta shows the direction bias of the position. A +ve delta indicates a bullish bias and a -ve delta indicates a bearish bias. Given this, a 0 delta indicates that there is no bias whatsoever to the direction of the market. So all strategies which have zero deltas are called ‘Delta Neutral’ and Delta Neutral strategies are insulated against the market direction.

10.4 – What can go wrong with the straddle?

On the face of it a long straddle looks great. Think about it – you get to make money whichever way the market decides to move. All you need is the right volatility estimate. Therefore, what can really go wrong with a straddle? Well, two things come in between you and the profitability of a long straddle –

- Theta Decay – All else equal, options are depreciating assets and this particularly hurts long positions. The closer you get to expiration, the lesser time value of the option. Time decay accelerates exponentially during the last week before expiration, so you do not want to hold onto out-of-the-money or at-the-money options into the last week and lose premiums rapidly.

- Large breakevens – Recollect, in the example we discussed earlier, the breakeven points were 165 points away from the ATM strike. The lower breakeven point was 7435 and the upper breakeven was 7765, considering the ATM strike was 7600. In percentage terms, the market has to move 2.2% (either ways) to achieve breakeven.This means that from the time you initiate the straddle, the market or the stock has to move atleast 2.2% either ways for you to start making money…and this move has to happen within a maximum of 30 days. Further if you want to make a profit of atleast 1% on this trade, then we are talking about a 1% move over and above 2.2% on the index. Such large move on the index is quite a challenge in my opinion and I will explain why in the next chapter.

Keeping the above two points plus the impact on volatility in perspective, we can summarize what really needs to work in your favor for the straddle to be profitable –

- The volatility should be relatively low at the time of strategy execution

- The volatility should increase during the holding period of the strategy

- The market should make a large move – the direction of the move does not matter

- The expected large move is time bound, should happen quickly – well within the expiry

From my experience trading long straddles, they are profitable when setup around major market events and the impact of such events should exceed over and above what the market expects. Let me explain the ‘event and expectation’ part a bit more, please do read the following carefully. Let us take the Infosys results as an example here.

Event – Quarterly results of Infosys

Expectation – ‘Muted to flat’ revenue guideline for the coming few quarters.

Actual Outcome – As expected Infosys announces ‘muted to flat’ revenue guideline for the coming few quarters. If you were the set up a long straddle in the backdrop of such an event (and its expectation), and eventually the expectation is matched, then chances are that the straddle would fall apart. This is because around major events, volatility tends to increase which tends to drive the premium high.

So if you are to buy ATM call and put options just around the corner of an event, then you are essentially buying options when the volatility is high. When events are announced and the outcome is known, the volatility drops like a ball, and therefore the premiums. This naturally breaks the straddle down and the trader would lose money owing to the ‘bought at high volatility and sold at low volatility’ phenomena. I’ve noticed this happening over and over again, and unfortunately have seen many traders lose money exactly for this reason.

Favorable Outcome – However imagine, instead of ‘muted to flat’ guideline they announce an ‘aggressive’ guideline. This would essentially take the market by surprise and drive premiums much higher, resulting in a profitable straddle trade. This means there is another angle to straddles – your assessment of the event’s outcome should be couple of notches better than the general market’s assessment.

You cannot setup a straddle with a mediocre assessment of events and its outcome. This may seem like a difficult proposition but you will have to trust me here – few quality years of trading experience will actually get you to assess situations way better than the rest of the market. So, just for clarity, I’d like to repost all the angles which need to be aligned for the straddle to be profitable –

- The volatility should be relatively low at the time of strategy execution

- The volatility should increase during the holding period of the strategy

- The market should make a large move – the direction of the move does not matter

- The expected large move is time bound, should happen quickly – well within the expiry

- Long straddles are to be set around major events, and the outcome of these events to be drastically different from the general market expectation.

You may be wondering there are far too many points that come in between you and the long straddle’s profitability. But worry not, I’ll share an antidote in the next chapter – The Short Straddle, and why it makes sense.

Key takeaways from this chapter

- Strategies which are insulated to market direction are called ‘Market Neutral’ or ‘Delta neutral’

- Market neutral strategies such as long straddle makes money either which way the market moves

- Long straddle requires you to simultaneously buy the ATM Call and Put option. The options should belong to the same underlying, same strike, and same expiry

- By buying the CE and PE – the trader is placing the bet on either direction

- The maximum loss is equal to the net premium paid, and it occurs at the strike at which the long straddle has been initiated

- The upper breakeven is ‘strike + net premium’. The lower breakeven is ‘strike – net premium’

- The deltas in a long straddle adds up to zero

- The volatility should be relatively low at the time of strategy execution

- The volatility should increase during the holding period of the strategy

- The market should make a large move – the direction of the move does not matter

- The expected large move is time bound, should happen quickly – well within the expiry

- Long straddles are to be set around major events, and the outcome of these events to be drastically different from the general market expectation.

Download Bull Call Spread Excel Sheet

Hi karthik Sir,

As when the results announced, It may differ from the market expectations. On both sides of the results the volatility will increase. For positive and negative. anyway the option premiums will shoot up. Can we enter the trade may be 3 or 4 days before the results, will the volatility for the stock would be less when compared to the result day or day before that.

Yes, you can. The idea is to set up a trade with an expectation that the volatility will increase.

Good Morning sir,

How do I measure the IV,How do i define a stock or Index IV is low or high

You can use any standard B&S options calculator to get the IV.

The delta should be zero in the straddle strategy. This is during taking the trade I suppose.

Since delta is the ratio of the change in the option price upon the change in the underlying price, it implies that

the volatility is embedded in delta. Hence when the underlying moves up drastically the delta should also increase

to make profits.

is this correct? Hence Delta is zero only in the beginning and not during the trade

That is absolutely correct. Delta is zero only at the time you initiate a trade, as the prices move, the postion becomes non zero delta. You can keep adding or removing positions to keep it delta neutral, but the costs for doing this is quite a bit and will eat into your profitability.

Hello,

I have a question. Can i buy PE and CE at different strike price?

E.g Buy CE at 250 and sell CE at 230? If i yea, how can i sell it? Can it be auto squaered off? Does it have to be done simultaneously??

Appreciate any insight!

Thank you

You can do that. Only the strike which is ITM upon expiry will be settled.

Hey Karthik

If one executes when the volatility is high then the premiums will be high as well, as you said one would make loss. My q is how would one make loss tho? according to this strategy if the market moves in either direction, one will make profit right? Then how does buying at low or high volatility matter?

Premium will cool off if the volatility is high at the time you execute your trade and then starts to cool off. With the decline in volatility, so would the premiums.

Sir how to find volatility in a stocks means in index we can find by vix but im individual stock how to find

In stock, you will have to calculate yourself. Have explained how to do this in Options module.

How if i buy a slightly OTM from both size

Sure, the spread widens and so would the breakeven.

in Scenario 3, when you say loss is equal to net premium paid…Rs165 is just the premium loss right.. but we buy it in lots…. so wont the loss be much greater???like for in this eg:lot size*premium paid, so here d loss would be 40*165=6600??

Yes, but premium loss means your investment in the trade is gone 🙂

Hi Sir ,

how to know the volatility % of NIFTY in the past one week ? ?

is there any way to calculate volatility of a stock during the past 3 days ? ?

that is if NIFTY is relatively STABLE or VOLATILE in the past 3 days ? ? how can we know that ?

Regards

You can check the daily volatility, or you can calculate it yourself, and scale it to whatever timeframe you\’d want. I\’ve explained the process in the previous module. Look for it under the volatility chapters.

As far as \’stability\’ is concerned, not sure what you mean given that these are volatile instruments and it is in their nature to move randomly 🙂

Quite simple way to understand such complicated subject, best available course, thanks Zerodha Team.

Glad you liked it, Anoop. Happy learning 🙂

Sir,

VIX value is same in today’s market scenario or it has been changed?

ViX changes daily, Pushkar. Depends on how the market moves.

Sir, What would be the THETA, VEGA & GAMMA for Long Straddle? Say for example THETA, VEGA & GAMMA for CALL side option is -10, 11 & 0.001 respectively. And -11, 12 & 0.0009 respectively for PUT option for the same strike of 7600.

Ah, you will have to key in the strike specific details and figure this out on an options calculator.

Hi karthik, i have a bit out of the topic question. Karthik is a broking business like zerodha or any broker actually a no loss business ? I mean whether the trader profits or looses the broker always gets the brokerage & apart from this i am not able to think of any other consequence. & if this is the reality why everyone didn\’t want to open a broking firm.

Any business, if badly managed can quickly turn into a loss making venture. Its all about how you manage the business and broking is no exception to that:)

Sir, should I buy at the same strike price where there is a significant difference in the premium for CE and PE?

Or would it make more sense to buy at the same price for both sides. For ex. Nifty Feb expiry, 21350 CE and PE have a considerable price difference.

However, 21350 PE and 22000 CE have the same premium price at this time.

What do you suggest would work better?

One size does not fit all :). Which strike to buy, at what price really depends on your trading strategy.

Hi Karthik,

Thanks for all the effort on the modeules, on long straddle if position start giving profit, whats the best time or % one should book it.

That really depends on the makret condition, Vishal. Cant assume a fixed % value here.

Can you bring out a video/blog on gamma scalping? From what I read, gamma scalping is done to adjust the long straddle or strangle to make intermediate profits during the zig zag movements to protect against theta decay. Usually, you should buy long straddle of farther expiry like monthly or next monthly as theta decay is smaller (this also means more capital).

Usually examples given are using buying 2 CE lots and selling 1 lot shares short or buying 100 lots of long straddle. On the index long straddle, its not clear how to short sell shares or whether to sell futures. A description of gamma scalping is available here: https://www.elearnmarkets.com/school/units/option-greeks-1/gamma-scalping

I am assuming that when the author says buy 40 lots of nifty, he means 40 lots of futures.

It also means its quite capital intensive. Is there a way to do gamma scalping with lower capital to start with?

Thanks Kiran, let me check this and see if we can put up something.

Awesome explanation… thank you…

Happy learning!

Should we keep SL in long straddle ? If yes how much is ideal

You should, but how much depends on your capital and how much you are willing to risk.

Will long straddle work in stock options?

Yes, but you need to set it up when the market conditions are right.

Which is expiry good for long straddle, weekly or Monthly

Cane take trade with this strategy with every week or month or should take during event only.

This strategy seems more suitable for working professional who can not monitor chart continuously

Naren, I\’d suggest Monthly. You can take the trade whenever you think Volatility is out of place.

if long straddle works effectively if there is signification price difference between ATM call and put option. It observes that during the start of a monthly nifty series, the call option premium is more than RS 100 than the put option

Perpahse, there are different factors that impact the option premiums.

Karthik Sir

how to take buy option trades on long term expiry ( For example September or December expiry buy trades ) as only current week , and current month options are liquid

Yeah, liquidity is an issue, Arvind.

Thanks for a great chapter Karthik.

Given the stringent conditions for the long straddle to work favorably, would it be prudent to use it on stocks instead of index? Especially stocks that historically have high volatility but are in a cool off mode (lower volatility)?

Yeah, so one advantage (or disadvantage) with stocks is that stocks will have higher volatility compared to index. So the movement will be faster.

I mostly used to see the delta and gamma values before initiating a trade, gamma remains .001 for both CE and PE and delta is 0.49 for CE and 0.52 for PE, market goes down say 100 points, delta for CE changes to 0.44 and 0.57 for PE, In this scenario I except the PE to rise more than the CE, but what happens is PE rises by 25 points means CE reduces by 40+ points, I know due to time decay this long straddle doesn\’t work on Wednesdays and Thursdays, but here am talking on Friday to Tuesdays, few days it works like as expected and few other days it happens like I have mentioned above.

As I mentioned earlier, you also need to look at this from the volatility perspective. See what volatility is doing and how it affects the premiums. Option premiums are a function of multiple greeks and you should evaluate them from all greek perspectives.

Hi Karthik, I have a doubt in this long straddle strategy. This is related to intraday and not positional. I understand when market is flat long straddle goes to loss as both sides the premium gets reduces due to various option greeks. Some days, let say for 100 points move on either side the straddle gives profit and some times it gives loss(not on wednesday and thursday). Example if Nifty is moving up, the strike of PE tends to reduce 2x than the CE strike. why is it so, can you please tell me what is the reason for this, which option greek plays the major factor here.

Yograjan, multiple factors are at play which determine option premiums. Delta is one, that most of us can relate to, but vega too has a significant impact on premiums. You need to consider options premium keeping all these premiums in perspective.

On budget day (1st Feb 2023), which was just a day before weekly expiry, I took one lot of ATM straddle (1 leg of CE and PE each) of banknifty around 10AM with stop loss of 50% on each leg. It cost me around 21,000. But by 12PM, it was showing a loss of 10,000 owing to premium decay and market not moving much. At 12:22, the first sharp green candle appeared on the announcement of new tax slabs. The PE leg hit stoploss and CE made some profit. The overall profit was around 4400 when I exited the CE leg.

At this point, I felt that instead of long straddle, a long OTM strangle would have been much better. First of all, it cost much less, possibly 500/lot, so I could have taken possibly 5-10 legs as it was much cheaper than the ATM straddle. Secondly, I would not put stoploss on any leg as psychologically its easier to handle smaller losses. Lastly, the premium on the OTM CE leg shot up by 4 times at the peak of the market (1PM), and the market crashed where PE leg also shot up by about 4 times. So, both CE and PE legs would have made profit due to large swings in both directions.

I think on an event day, it makes sense to enter an OTM long strangle than ATM straddle. Please explain a situation when is it advantageous to take long straddle over OTM strangle.

Kiran, so what you are suggesting is based on what happened. But when making a decision, you need to work with what information you already have, and basis that, ATM was probably the right thing. We expect rapid movement on either side on a budget day, basically easing volatility with little movement from a delta perspective. Given these things, setting up an OTM trade requires great conviction of a big underlying moment.

But that said, I agree entirely on the psychological aspect of managing the OTM trade.

Sir, Thanks for your detailed explanation on this topic.

I have one question. I thought of going on long straddle for monthly expiry during budget day at ATM on Bank nifty. But I see premium is high due to high volatility on pre events in the market.

Do we need enter long straddle few days before event day so that we can enter with less volatility. If that so, then we cannot determine the correct ATM price.

If volatility decreases over next days even though market trending on either direction will it affect the premium of the options paid i.e. one option will be decayed to zero and another option resulting in less premium.

Thanks.

That is tricky Mani, because the premiums would be high all the way till the event unfolds. You are better of writing these options no?

Hi Karthik sir am from tamil nadu, can you please tell me best option statagy for nifty 50 and bank nifty or please suggest any book .

You just have to experiment with a few, John. There is nothing like a best strategy. They all work under different market conditions.

Long Straddle means the Both ATM Call or Put Buy. If market moving directional then buyer can earn money with the capital of small one. Long straddle required less money then selling.

That\’s because the capital required is only to the extent of buying options. No margin is required for a long position.

sir the strategy is calculated based on expiry does it also work in close before expiry scenario if so please reply with the close before calculation on the above examples.

Yes, it would, you can sq off the position close to expiry.

Hi Karthik

The contents are amzaingly well structured and easy to understand. Your power of explaining the things are magical and very interesting.

Thanks, Sandeep. Glad you liked the content.

Hi,

I have a question for a long straddle.

Suppose if I am playing a result bet for xyz stock price-560 now if the premium of 560 ce is -22 and the prem for 560 pe is – 30 then what does it indicate? shall is still continue with my strategy of shall find a far pe option. Is it necessary to buy both the option at same price if no kindly suggest any alternative for same.

Thanks

If it is a long straddle that you intend to execute, then you need to buy both CE and PE belonging to same strike, Abhishek. But if you buy different strikes, it becomes a long strangle.

Sir if i buy this strategy at very first day of weekly or month expiry.. And keep some small target ex 5000 week and exit.. Not waiting till expiry.. Will it works??

You will have to back-test it, Sardar.

Sir I have doubt , is Friday a good day for execute the long straddle in nifty weekly? And if yes then think if i made a straddle on Friday what if the large move come on the Thursday ( expiry day) would that effect my break even point or it will give me the same profit as it gives any other day like Monday, Tuesday, Wednesday

Its hard to conclude that one particular day is best for executing a particular strategy. It really depends on your market conditions. But yes, if you write on Friday, you do get a maximum premium.

Thanks Karthik. Really appreciate your response.

Any example that you can provide for, How do I know if volatility is already factored in for a stock/index?

Also, a slightly unrelated question, any twitter handle who dissects market movement that happened that day for educational purposes? For example, why market went today etc or what were the reasons of the rally today etc?

Mohit, you can pick any stock due for corporate action and track this. If the stock has rallied or tanked before the event, then the news is getting factored in already. For example, if say a stock is tanking before the quarterly result and the result is positive, then it implies that the market expected a better quaterly result, hence it tanked. So watch out for things like these.

About Twitter handle, I\’m not sure 🙂

Thanks Karthik.

On 1).

How do we know if the

a) Price is already factored in for an event or change?

b) Volatility is already factored in? Was it because the change in volatility was way more than expected in this case? How much more or less determines the \”factored in\” part?

1) General market observation and price behavior will reveal this

2) Yes, again you can observe and calculate this.

Hey Karthik!

1. I implemented a long straddle with bank nifty few days before RBI policy declaration on 8 june 2022. VIX was 20 which I believe is not high but before the announcement the volatility remained same. I believe RBI policy declaration is a pretty important event. Was that because the event was already factored in the current price?

I know that for a long straddle to work all the points should be ticked but I expected at least the volatility to work in my favour. Similarly, as volatility did not increase before/during the event it did not fall after the event.

2. Any pointer on gauging the change in volatility better?

3. Also it appears, to implement iron candor we need to buy far OTM strike but there is a restriction on zerodha to buy far OTM strikes. https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/articles/trade-all-strikes

Once this custodian account is enabled, Can I still trade or buy equities from my normal account?

1) Yup, factored in is the most easiest explanation 🙂 I cant speak of all events, but after the previous rate hike, this one was clearly factored in, making it a non event

2) the Easiest way is to compare current ATM strikes IV with historical volatility to get a sense of where the volatility is

3) YOu get the sell leg first? Also you can shrink the strikes, no need to stick to far OTMs right?

Hi, in point 2) You have mentioned about comparing ATM IV and historical realised volatility, but I read from a book that the corelation between IV and HV is negligible(~0.15) so how does comparing two things that are very less corrlated make sense here?

This comparision is only to give you sense of what the real vol (historical) is and if at all the current IV is too divergent from it. Think of it as a quick and dirty way to get a view on volatility.

Thank you sir for your previous reply which helped me a lot. kindly consider my below doubts.

suppose TCS is currently at 3000 .

Implied volatility of ATM-CE is 28 and ATM-PE is also 28

I observed historical volatility is 35. But I want to short 3200 CE which has implied volatility of 40.

so before shorting 3200 CE, should I compare historical volatility (35) with ATM IV (28) or with 3200 CE (40) which I want to short.

Ideally, you should compare the strike\’s IV with HV. But the 3200 CE may not reflect the accurate IV due to lack of liquidity (this may not be particularly true with TCS), but generally OTMs dont. Hence ATM is a generalization.

Hello Sir,

1) if suppose Today TCS CE ATM strike has Implied volatility- 16 and PE ATM has implied volatility of 19. In this case which IV to use to compare with historical IV to find out if it is in lower side or higher side. I means I will consider 16 or 19 ??

2) kindly mention the formula to find historical volatility with which I will compare the current 16 or 19 .(point no 1)

1) Ideally the IV for CE and PE should be the same. But they differ due to market dynamics. I\’d suggest you go with the conservative approach. For example, if you are looking at writing an option, consider IV at 16 and if you are looking at buying consider IV @ 19. But if the difference is just 3%, it should not really make any difference.

2) I\’ve explained that in the previous module.

Hello sir

Is it true that stock options trading more risky than index option if it expired in the ITM. Then one have to settled the either by paying all the amount of the shares or if you are buyer of the option ; you have to buy all the stock offered by the seller.

Not really, its just that settlement is different for index and stock.

Sir,

In this module everywhere you say that we have to hold our strategy till expiry. Do you mean 3.29 pm or what?

You can hold it till the expiry day and if the position works in your favor you can let it expire as well. But generally its a good idea to close position before 3 PM on expiry days.

Wow. i learned much much better about Straddle Model. The way in which explanation given is give as a live tutor.

I keep learning from Zerodha.

Happy learning 🙂

Can we use implied volatility percentile as to know wheather volatility is high or low ?

I guess you can, I\’ve not tried it though.

Sorry Sir, Can u pls elaborate point no. 5th and 6th.

Thankyou

Hello Sir, Pls clear my doubts:-

(i) If volatility increase then market decrease and vice versa ?

(ii) How to estimate when will be the volatility decrease so that we implement our long straddle strategy ?

(iii) In previous module, u said the slow the market goes in upward direction, the faster time it takes to move downward and here in this module u said Call premium speed is faster than decrease in put premium if market moves in upward direction and vice versa ?

(iv) This strategy should be applied only if there is any result, event, election etc. Right ?

(v) In previous comment u said exit before event then how we capture the movement at the time of event and as u said long straddle is only for movement

(vi) Suppose expiry is on 28th April and result/election is on 25th April so If I implement long straddle strategy on 22nd April than THETA also play an important role at that time which result into may be loss. ? Then what we do in that case

THANK YOU

1) Usually yes. But there are times when markets increase and volatility also increases

2) You can check the current volatility and compare it with historical volatility to get a sense of what is likely to happen.

3) I said that in the context of option writing

4) YOu can apply this otherwise also. For example when you expect markets to remain flat, you can deploy the opposite of this

5) By staying long 🙂

6) I\’d suggest you apply the reverse of this.

Thanks a lot karthik 🙂

Good luck, Prabhu!

Dear Karthik, I\’ve below query help me to understand

Assume I initiated the Long straddle when the nifty is at 17000 ATM and after I initiated it was very bullish

1. Say for example nifty moved from 17000 to 17500, so my question is when it moving should I stick with the 17000 strike(ATM to ITM) or based on the move should I keep shifting the strike (assume I\’ve enough margin)

2.And also after I initiate the long straddle, if the view is bullish and the overall delta would be in positive and same for downside move but it won\’t be the neutral once its started moving, is this correct ?

1) You can shift strikes, but doing this continuously increases your costs

2) No, it won\’t be neutral. Delta will change as and when the underlying price changes.

Hi Sir, where to get chapter 10.5

Sorry dint get that. Section 10.5 is a section within the chapter no?

Very well explained.Would try to implement.

Sure, good luck Naval.

Hi Karthik,

How can we place a trigger on the underlying stock price to sell off both the CE and PE options at once, once we observe good profit payout has accumulated? Is this possible instead of placing GTTs on the individual option prices?

Check this, Prachi – https://support.zerodha.com/category/console/portfolio/holdings/articles/kite-basket-orders

Dear Sir,

Thank you so much for putting your valuable time to create new generation of traders from INDIA by providing this valuable and immense knowledge.

I have implemented this strategy and have some question wrt long straddle.

1. How to find the volatility of any FNO stock to implement this strategy.

2. Normally before events volatility shoots up so weather stock price always go up or it can go down also?

3. What are chart patterns by which we can say volatility is going to shoot up?

4. Can you suggest any indicator to identify the increase the probability of trade?

Just to inform you, I have executed this strategy on stocks.

Just before day ends (3.20-3.30) I buy long straddle and on next day when market opens I sell straddle (9.15-9.20). Does volatility will always be high in the first 15mins?

1) You can use the \’=stdev()\’ function on the returns time series, have explained in the volatility chapter in the previous module

2) No one can predict this 🙂

3) No chart pattern, but you can check out the Bollinger band and ATR indicator, these are based on volatility

4) No indicator as such. But you can backtest the strategy that you are using to figure out the odds

Generally, the volatility is on the higher side at market open, but this is just an observation, not backed by data.

Thanks for the reply Karthik Sir.

In Long Straddle scenario, when we have a Call Option and Put Option at same premiums, then irrespective of VIX increases or decreases, the ney P&L will be in positive right. ( I assume increase in VIX from 19.2 to 20.5 increases PE premium and in the same way if VIX decreases from 19.2 to 18 it increases CE option right ) . Please correct me if my understanding is wrong.

If its just the volatility increasing, then yes. But chances are that your Call option will lose premium.

Thank You for the reply sir.

One more small question Sir. I purchased call option and put option premium at the same price ( Rs.125 ) for Long Straddle Strategy.

I initially saw both the premiums on Green. How can we understand this scenarios?

Majority of the times net P&L of both the premiums are minus. Do we need to wait for a breakout/breakdown and then need to close both positions irrespective of same day closing ? Can you please guide.

When volatility increases so do the premium of options regardless of the call or put option. I guess the volatility increased after you bought these options, hence the premiums.

Wonderful Chapter.

I performed back testing on this and it works quiet well and in this way we can safeguard capital instead doing naked options.

Can someone throw some ideas where/ when exactly we need to close positions. Do we need to close both the positions same time or we need to close one position and average the other position and close with minimal profit/Loss . Kindly share your ideas please.

Its best to close both position at the same time.

how to buy call and put option at one time throght streak on tlhursday

YOu can buy via Kite directly.

Hello Sir, if we build a straddle such that breakeven = opening price of the nifty, then we can make definite profit as nifty moves either direction?

There is nothing like definite or guaranteed in market 🙂

Thank you for sharing such valuable information

Happy trading, Chandra.

Stocks aren’t generally liquid. Say if you pick this strategy for Hero Moto Corp…the current month is Aug 21, there are mixed signals when it comes to directional move (monthly long, weekly and daily short), volatility has dropped after earnings announcement, IV of September is low (more or less similar to Aug), IV is less than historical volatility. So if I want to deploy this strategy or long iron butterfly, liquidity would be a big problem. Add to that European Options vs American Options problem. Also please explain exit strategy for example exiting which legs first in case of profit or loss.

Some of the stocks are liquid, but yes, generally speaking stocks are not as liquid as the indices. Mixed singles is a problem if you are following too many indicators. Follow a few in which you have the highest conviction. European vs American is not a problem 🙂

what can be the minimum amount required to start trading in option buying…

Depends on the option, strike, and premium. But at times it could be as low as 1000 also.

Sir,

Is it necessary to buy straddle at ATM strike price

Ex- if Banknifty opens at 35500, ATM would be 35500pe and 35500ce, but can we buy 35200ce and 35200pe.

Your reply would be life saviour for me.

It\’s best if you can buy it at ATM. But like all things in trading, these are not rigid rules.

Hello Sir,

You have mentioned that volatility rises before the event and crashes right before/after the event.

Couldn\’t I purchase a strangle 5-6 days before an event, watch IV rise and then sell right before the event?

You can. In fact, you can reverse the positions before the event and buy it back post-event. Check how this works on paper a few times before you actually trade it. Good luck!

Hello Sir,

Lets say initiate a long strangle 5 days before.

How much IV do I know said stock will gain? How does one even know that?

And when should one square off the position, post result or before the result?

That\’s hard to estimate, Atul. Although things like Volatility cone can help you get a perspective on this.

Hello Sir,

For implementing long straddles/strangles before quarterly results or rbi events or budgets, when is the ideal time to initiate the strategy? 5 days/10 days before the event to gain on the IV rise, keeping in mind the time till expiry.

Naturally all IVs rise before events

About 5 days in my view.

Sir, in scenario 1 , u consider that IV 400 but as per option chain it is 15.08 . Please clarify it.

IV in this context is intrinsic value and not implied volatility.

Excellent explanation.

Thanks so much sir.

Good luck and happy reading!

Hi Karthik,

How to calculate target date P&L ? I know my P&L on expiry but what to know to how to calculate for target date.

Let\’s say I execute this strategy on 1st of month, how to develop a table of P&L for upcoming days corresponding to spot prices respectively. Sensibull bull gives \”on target date\” data in strategy builder but what is the formula if I want to put it in excel ?

Regards,

Shreesha

I\’d suggest you use Sensibull for this, they have the facility to showcase the P&L before expiry.

Wonderful explanation.

Happy reading!

I have noticed that you rarely mention setting a stop-loss/targer on options trade. is there any particular reason for it, how should one set stop-loss on options.

Not really, you can set SL based on the underlying prices. I\’ve discussed this in the comments I guess. Personally, I prefer to keep like 40-50% SL on the option premium.

Dear Sir,

I trade only on Wednesday and Thursday in index.

I think this strategy is best on weekly expiry day.

I have some questions:-

1. For index should we see VIX or IV of ATM strike.

2. Your example id showing VARIATION in ask and bid price of CALL (equal) and PUT(large gap).. is it matters.

3. What is the best time to execute this trade on expiry. Is it when both call and put premium reaches same value. Most of time one of them shoot up…

Thanks in advance,

Vidyadhan Gedam

1) Both are ok to use, I\’d prefer the ViX

2) Not much

3) Yes, preferably when the premiums are more or less equal

Sir, What I have noted is that when market reacts significantly to certain events and if the long-straddle has been initiated before the spike in the movement and the volatility, better to square off in profit than to hold (for retail traders). Eventually, the euphoria/ desolation will die down and premiums will collapse. That will have serious adverse impact a long-straddle guy \’coz he\’ll be bleeding from both the ends.

Sure, it\’s best to paper trade this on few occasions as well.

I observe that stock price of TCs, infosys, Tata steel etc make strong move in one direction after their quarterly result and this long straddle is ideal strategy for these events. TCS announces their result after market hour and guide me which would be better option for someone to initiate the strategy.

1. Taking the position just before market closing as premium would be lower, no fear of time decay though we would not get the benefit of volatility but strong one sided move may give us good profit

2. Taking the position just few days before to get the benefit of increased volatility . But this would be little bit expensive and time decay factor would be there

1) Yeah, before the event, ideally at least a day to ensure you capture higher premium

2) The play is on losing the volatility premium and not really theta

Hi Sir,

I applied this strategy on budget day and the next day.

Worked wonderfully!!!

Thanks a lot 🙂

-Ganesh

Happy to note, and good luck, Ganesh 🙂

hello sir,

by volatility you mean index vix or strike iv ?

Index ViX as a proxy for market volatility.

Sir,

What should be the preferable order type while executing Long straddle strategy, whether it should be limit order or market order; because if we place a limit order it could happen that due to sudden movement in one direction ; either CE or PE order get filled and the other one remains untriggered ?

Limit is what I\’d suggest. For the same reason that you mentioned, you should not use market orders.

Hi Karthik,

Nifty went from 14433 to 14281 from 15th to 18th which is just two trading days.

What I found is If had bought 14400 CE and PE of 28 Jan exp on EOD on 15th, It would have cost me 250+186.15=436.15 and on the next trading day EOD after Nifty dropped 152 points these same options were trading on 139.85+282.1=421.95 making a -14.2 loss despite a significant movement by Nifty. The change of value of CE (139.85-250)=-110.15 is much more than the Change in value of PE(282.1-186.15)=95.95.

If you can explain how and why this occurs it would help a lot.

Thanks

Karan, the reason for the inflated premium is the higher volatility. Higher the volatility, higher is the cost of the premium. When volatility drops, so would the premium. At times, the effect of volatility (vega) is higher compared to the underlying move itself.

Thank You , Sir.

SIR;

PLEASE HELP ME; SOLVE MY DOUBTS REGARDING THE LONG STRADDLE .

EXAMPLE: SUPPOSE I CONSIDER A STOCK \”ABC\” FOR LONG STRADDLE ; WITH \”X\” NO OF DAYS FOR EXPIRY; AND I HAVE ALSO CONSIDERED THE VOLATILITY TO BE LOW WHILE EXECUTING STRATEGY ( BASED ON VOLATILITY CONE; INDIA VIX AND EVENT STUDY) AND I EXPECT IT TO INCREASE IN NEAR TERM; AND IT IS ALSO A DELTA NEUTRAL EXECUTION ; AND THE EXECUTION IN DONE IN THE INITIAL HALF OF THE SERIES; AND THE VEGA OF THE OPTIONS ARE ALSO PRETTY MUCH CLOSE TO EACH OTHER WHILE EXECUTION; SO BASED ON THIS ;

1. I THINK IRRESPECTIVE OF THE DIRECTION OF THE MOVE; THE DELTA OF THE OPTION SUPPORTED BY THE DIRECTION MOVE WILL BE MORE THEN THE OPPOSITE OPTION ( AS FAVORING OPTION WILL MOVE FROM ATM TO ITM : HENCE RESULTING IN INCREASE IN DELTA AND THE OPPOSITE OPTION WILL MOVE FROM ATM TO OTM AND HENCE RESULT IN DECREASE IN DELTA : THAT MEANS THE DELTA EFFECT WILL BE MORE ON THE DIRECTIONAL MOVEMENT SIDE, (BECAUSE DELTA ITM > DELTA OTM) ).

2. AND ALSO AS I EXPECT THE VOLATILITY TO INCREASE THE PREMIUM FOR BOTH THE OPTIONS SHOULD HAVE A POSITIVE EFFECT OF INCREASE IN VOLATLITY ;(AND ALSO THE VEGA ARE NEAR TO EACH OTHER WHILE EXECUTION AT ATM AND VEGA DECREASE ON BOTH THE SIDES OF THE ATM ; WHETHER IT IS GOING TO BE OTM OR ITM ).

3. AND ALSO THE STRATEGY IS INITIATED IN THE INITIAL HALF OF THE SERIES ( WHEN THETA IS LOW ); AND I DONT WANT TO HOLD THE POSITION IN THE LAST WEEK TO EXPIRY ; TO PREVENT FROM EXTREME THETA DECAY.

SO CONSIDERING THE ABOVE POINTS I HAVE SOME QUESTIONS .

(A) ACCORDING TO THE ABOVE MENTIONED POINTS THE DELTA AND THE VEGA BOTH WILL SUPPORT TO CREATE A POSITIVE P&L; (CONSIDERING THETA NOT TO BIG) IS THIS CORRECT ?

(B) AND IF (A) IS CORRECT; THEN CAN I CLOSE MY POSITION BEFORE THE LAST WEEK TO EXPIRY BASED ON PREMIUM PROFIT, OR IS THE LONG STRADDLE ONLY A EXPIRY STRATEGY?

(C) AND IF THE POSITION CAN BE CLOSED BEFORE EXPIRY; THEN DOES THE BREAKEVEN POINT HAS ANY SIGNIFICANCE ?

SIR; I REQUEST YOUR OPINION ON THIS; AND THANK YOU ONCE AGAIN FOR SOLVING MY THETA RELATED QUESTIONS IN PAST ; THEY ALREADY HELPING ME IN GAINING SOME PROFIT OUT OF IT.

Lionel, please stop using CAPS to type in the query, it is very difficult to read especially when its such a long query.

1) Yes

2) Yes, an increase in volatility has a similar impact on both CE and PE

A) Yes, but the trade has to pan out in your favour

B) Yes, you can. Short is an expiry strategy.

C) Yes, varies based on the market

Hi sir,

For me ,Learning stock market from you is like learning \’Thermodynamics\’ in B.E. from roommate rather than in classroom 😀

Feeling very confident at this stage😎

Happy learning, Tango 🙂

Hi Sir,

I need your mail id

I need to clear some doubts and so want to send you excel sheet and the screenshot of the trade i made.

Warm Regards,

K.R.Shetty

Kishore, can you please try and ask your query here itself? Maybe you can upload the images and share the link. Thanks.

hi,

Some confusion in my understanding. Once I have bought a CE or PE at a particular price, how does it matter if the Geeks change unless i buy additional options for adjustment. If i dont buy adjustment options, then geeks dont matter. Pls clarify.

The price of the premium itself changes, which is dependent on the greeks Gautam.

Hi Karthik,

Even if premium prices drop, we can still make profit by selling at expiry. We just need one large move(around event), Right?

Yeah, a large move can move the option premiums 🙂

Dear Karthik Sir,

Your explanations of options are way simple. I have never touched Greeks, because i could never understand it. You really made it simple through the NSE webinar as well as the VARSITY lessons.

How can long strangle be deployed taking in to consideration the high premiums of ATM call options in gold?

It is only beneficial when the premiums are superb low for the call as well as put option for you to breakeven easily. Please explain ?

Ideally the strategy should work either in favor of CALL or PUT based on the direction of the market but this is only good in books, in practical this may not work as expected.

Today (4th Nov 2020) Banknifty moved up by 0.45% between 9:15 AM to 14:15 PM BANKNIFTY 25600PE moved DOWN by -54.17% as expected but interestingly BANKNIFTY 25600CE also moved DOWN by -20.08%?? Trying to understand how the CE and PE of the same strike price 25600 for same expiry would move in the same (-ve) direction while the underlying is moving up? No doubt buying a straddle in this case would have resulted in loss anyways.

Piyush, this is quite common for both CE and PE Premium to lose value when the volatility drops. The resulting gain in either PE or CE is not restricted to books, it happens if you hold to expiry 🙂

One question. This strategy and all other strategy teaches us theory about profit and loss with strike price and instrinct value. But if i am not wrong in the practical market we mostly trade with premiums only. So will this strategy work if we trade with premiums. And will this work if we trade with premiums irrespective of waiting for the expiry.

That\’s right, practically speaking you only trade the premium, but you can also hold these positions to expiry as well. The logic remains the same.

Hi

Hearty thanks for preparing such a enriched study material, hardly any other one match it, the beauty of this literature is simplification of content in such a way , even a beginner can understand. Definitely Zerodha , deserve a big pat for the lovely work helping budding traders in a big way.

Regards

Neil

Thanks for the kind words, Neil. Happy reading 🙂

Sir

I am trying to contact zerodha helpdesk but it\’s saying \’currently no person\’s available to contact\’.

Can you plz help?

Jitu, you will have to just try again, nothing much that I can do 🙂

Sir

In long straddle strategy,one need not to worry Abt volatility when date of expiry is near…..at that time directional move on either side only matters?

Yes, that right.

After going through the articles in varsity written by you Karthik, I\’m feeling lucky that I opened my account in Zerodha.

I\’m a housewife and thought that understanding options is not my cup of tea. But , your articles bring smile on my face as they give absolute clarity on various topics which make me feel that I get my hands dirty.

I want to thank and appreciate your efforts to help the trader community.

Thanks so much for the kind words, feel humbled 🙂

Hi, Long straddle will work on stock ???

Yup, you can set it up on stocks as well.

I am new to share market just a week ago I started .I want to know about Rossari biotech & Yes bank should I take the stake .

No idea, Satish. We don\’t comment on individual stocks 🙂

Hi Sir,

Nifty jul 10800 ce at 199

nifty jul 10800 pe at 227 7

Now if I buy 10800 ce in one dmat account and sell 10800 pe in another demat account

I get 227 premium and I am paying 199

In this case I am not seeing any loss situation. Can you clarify ?

say market is below 10800 199 gone in one but I got 227 in another so 28 rs profit here

say if market has clsoed at 10900 100 is loss to seller but since I have received 227 still I will be in 127 profit

I see in all scenarios positive pls clarify

Anil, no need to take this trade in two different trading accounts. You can initiate the trade in the same trading account. Yes, as long as the market moves in any direction, you will make money. However, if it stays at 10800, you will lose money on this trade.

Thank you. 🙂

Hi sir,

First of all Thank you so much for Varsity. I mostly find the answers of my doubt. Every morning I read 2-3 articles of Innerworth-Mind over markets and its very helpful to improve the thought process on any trade. It taught me to control the emotions over market.

I wanted to request you something, It would be great if you can write something regarding predicting market fundamentally with option chain like what type of events can affect market in positive or in negative ways. How to understand market sentiment with surrounding clues. And how can we read option chain effectively to get the confirmation of our sentiments (bullish or bearish view). People always says if you have bullish sentiments then buy call or use bull spread or any kind of that strategies and if you have bearish view then use related to that strategies but no one taught how to make those views and decide the strategies accordingly.

Will be very helpful if you guide us something on this.

Thanks 🙂

Also, thanks for the feedback. I will try and put up something on this as and when time permits 🙂

Thanks … Downloaded the pdf version 🙂

Thank you, Sir, for understanding it so clearly keeping volatility and time in the perspective…

Any book you would like to recommend on option strategies ?

Yeah, check this – https://www.amazon.com/Option-Volatility-Pricing-Strategies-Techniques/dp/155738486X

Thank you Karthik,

Let me check on GRACH(1,1). Like delta, do we have any range for vega?

Not really. Good luck!

Hello Karthik,

I simply get amazed by the way you simplify things. If you want to read the same concepts from a foreigner author(Infact I\’am reading one now) he will explain in 30 -50 pages by the time you finish it off, you would have completely lost.

I have few questions related to volatility. I am sure you will enlighten me on this particular topic.

1. Volatility can be any number, to know whether it is high or low, i need to compare how it was historically. For nifty, i can check and volatility ranges between 10 – 38(ignoring what happened in last few months where VIX shot up to 80+. I hardly see IV below 35 for index options these days. does it really make sense to go for straddle? I agree that IV goes till 60, but above 35 IV is at the extreme end. how can i compare IV for a stock?

2. For 1 point increase in spot, how much does volatility increase? Let\’s assume for the sake of discussion,just like delta, it is 0.5. Now, spot increases by 10 points, so volatility for CE will increase by 5 points. For put, volatility decreases by 5 points. That means, call premium will increase by 5rs and put premium will decrease by 5 rupees. am i correct here?

3. Besides spot, what affects IV? I heard and read that IV increases based on market expectation. but how do we quantify market expectation? As you mentioned above, IV shoots up during events, but how much does it shoot up? since options are nothing but math formulas, there should be a way to calculate how much volatility shoots up

4. Premium for options are calculated using Black Scholes model. Once we get the premium, we treat IV as unknown and derive from same BS model. I am not getting this point. how can we derive premium first and use that premium to calculate IV?

I some confused w.r.t IV. please shed some light on above points.

1) 35 can be the new normal, so as the market dynamics change, look for a change in pattern 🙂

2) This is captured by Vega i.e. the change in premium for every % change in volatility

3) The speed at which market is moving is what determines IV. There are quant models to predict this, check for GRACH(1,1) volatility models

4) B&S is not just a premium calculator. It can be used to calculate IV also.

Hope this helps 🙂

Hi,

Can I set up straddle to any strikes other than ATM? If yes, how to identify best strike to setup straddle ?

You can. It depends on the premium and the markets as such.

I was wondering how would the straddle profit/loss chart look like before expiry based on price movement of underlying asset.

For instance :

Today\’s Nifty50 closing price: 9553

NIFTY MAY 9500 PE : 295

NIFTY MAY 9500 CE : 350

Suppose in next 10 days nifty moves to 9000. (Assume Implied Volatality remains same.) If I squareoff the positions at the end of 10th day will I still lose money?

1) Delta neutrality.

2) Volatality remains same.

3) Theta decay

These will make sure I loose money. Or am I missing something?

If you square the position before expiry, what matters is the difference in premium. You can anticipate the change in premium though, I guess Sensibull has this option on their platform.

Sir , if Bank Nifty is so volatile , why don\’t everybody just use the long straddle to earn easy money. It could be a good strategy for daily earning on Bank Nifty right ?

If only life was so simple:)

Brother i cant understand anything easily its so tough to understand.but i like to trade.i am new for share market.what should i do now?

Please do read through and if you have any question then let me know, I\’ll try and help you to the best of my ability.

Brother i have one doubt u are saying buy a one lot.ok but one lot in nifty is 75.now ltp is 15 means i have to pay 15×75=1125 or just 15

Yes, if you are buying options, then the amount you pay = lot size * premium.

Hi Karthik, wanted to know your views on how to appropriately encash the change in volatility keeping an upcoming event in mind.. for example ICICI Bank results are supposed to come out in first week of May, volatility may increase during that time.. what would be the right entry and exit points for this event?

If you expect –

1) Volatility to increase – buy options

2) Volatility to decrease – sell options

Everything revolves around this.

Sir

Its my suggestion that Zerodha should have a platform on Virtual Trading also that covers all F&O stocks and indices and NOT ONLY the Nifty. There are certain brokers that offer virtual trading but for Nifty only. Virtual Trading available at Sensibull is for paid members.

Thanks

It is one of the things on the agenda, hopefully soon.

Sir

In the end of this chapter, it is written \”Download Bull Call Spread Excel Sheet\”. It should be \”Download Long Straddle Excel Sheet\”.

Thanks

Thanks for pointing, will check and update.

Karthik,

I back tested long straddles/strangles on NIFTY and found that they almost always lose money when NIFTY goes up (due to decrease in Volatility) and make money when NIFTY goes down (due to increase in Volatility). That would make them not exactly direction neutral.

Under what condition will these strategies be really delta neutral?

Thanks,

Akshay

The thing, when you set up the straddle or strangle, it will be delta neutral or direction neutral. However, as market moves, it wont be. It has to be constantly adjusted to maintain the neutrality.

Hi Karthik,

Bear with me as I am repeating one of my earlier question.

If I take position with this strategy, then I can skip SL and exit both positions, even before contract expiry, at a point when I\’ve enough profit or reached acceptable loss. Correct?

As usual, thanks for all your knowledge sharing!

-Sachin

Yes, absolutely. No need to wait till expiry.

But let me ask you this – if the direction does not matter, what else matters for this strategy?

Ans: The PROFIT.

Everything else that matters to make a profit matters to the strategy 🙂

Hi I have entered a Long Nifty Straddle today for trading long volatility for tomorrow\’s budget. Please suggest an appropriate exit strategy/timing. I am confused whether I should exit at tomorrow\’s closing, before budget announcements or after the announcement. Please help.

The IVs are likely to drop post budget, which will have a -ve impact on your long positions. Hence its best to close the position at the start or early stages of the budget speech.This is my personal opinion though 🙂

Very informative and useful from Profit as well as risk assessment point of view….Thanks Varsity team

Happy trading, Kishor!

Dear Kartik

Please guide me How to trade in trending market

Today I checked at 11am and saw market is falling. Market halted at 12020. I thought it will respect 12020 and will return. I bought CE Which was against the trend. Market again came down. And I booked loss.

What is the right approach to identify a counter trend or supporting trend.

I am confused. Need help

Satya, in all honesty, you will develop this insight as you trade and spend more time in the market 🙂

I am passionate about options and want to learn

Please guide me

Satya, I\’d suggest you start from here – https://zerodha.com/varsity/module/option-theory/

Hello Karthik,

I have some doubt regarding the long straddle strategy. It would be really helpful if you could clarify it.

Today i have initiated long straddle in YESBANK when spot was trading around 69. I bought DEC 70 CE at Rs7.60 and DEC 70 PE at Rs11.15.

Currently YESBANK is trading at Rs66 but DEC 70 PE is at 11.00 where as DEC 70 CE was at 6.10

My question is when spot price decreased from 69 to 66, PE option should have increased in value where as CE option should have decreased.

Can u please clarify what could be the scenario which didnt let PE option to increase in it value.

Thanks in advance 🙂

Umang, along with the directional movement of the price (delta), you also need to watch for the volatility (vega). With the increase in the volatility, the premium is also supposed to go up and vice versa. I suspect the volatility dropped at the same time, hence the slight decrease in PE premium.

Hi kartik,

Thanks for your reply. Can u advice, how can I get the probable option price at a particular underlying price.

Nifty at 12056

I want to know the price of 12100 pe (now trading@87) will be when market will reach 12010.

Any website or any formula to get that. Greeks will be required. I don\’t have access to Greeks. I need to know this to decide my target and SL

Satya, that depends upon multiple factors. This non-linearity is what makes options difficult to understand.

Dear Kartik, it is true that I should have appetite for risk, but what I found that in a day market gives several safe opportunity to trade where risk is minimum.

But I am finding it difficult to choose the right stop loss in option.

I want to elaborate. Today I guessed that nifty has a strong resistance at 12150. Hence I purchased 12150pe @25.

But to minimise the risk I purchased bo with sl 5 point down with trailing sl of 1 point.

Before moving up to 50 it gave sideways movement for some minutes and my Sl triggered at 24.

I wished if I can know the 12150 pe price at 12150, then I could have given a proper sl.

Can u suggest how to find out the price of option at underlying price at upper or lower side.

Satya, this is common and unfortunate. The only way to avoid this is to have a deeper stop loss with proper reasoning behind it.

Hi karthik,

I am trying to improve my analytical skills and now what I found that candlestick are the best ones.

Then should I buy naked calls based on patterns or I should still follow the different strategies to trade option like sell a strangle, iron condor etc.

Traders base their naked option trades on candlesticks, no harm with that. It is just that you need to build an appetite for risk.

Umm…but say I buy the call options at the start of the month and the straddle breaks off on the 15th day wherein the target is not hit but the stoploss at one end is hit, then should I straddle again till expiry? Or is long straddling a good strategy when the option contract nears expiry (but then again, the closer the expiry, the worse it is for call/put buyer) I\’m confused.

Hmm, near to expiry I\’d prefer a short straddle as opposed to a long straddle. By the way, if the straddle breaks, you can adjust the straddle with the new ATM strike.

The speed at which one option contract hits the stoploss is not the same at which the other hits the target. Hence, the straddle is broken off at one end and before the target price is achieved at the other end, the market turns again, resulting in loss in both.

How to deal with such a situation.

Hmm, hence these spread strategies are best held to expiry.

Ah thanks.

So, I need to modify and exit the position right?

As I put sl sell order for 200 quantities

Do I need to modify that as 100?

Yes, thats right.

Hi Karthik,

This maybe offtopic but I don\’t know where to ask this.

I am confused in executing the orders.

As I m doing intraday, I want to act quick and square off my position..

For eg: I buy 200 lots of banknifty option at 150. When the market goes up, I want to sell only 100 lots at 160 and hold other 100.

For this, how to do. Also, I need to put stop loss too.

Since you want to position size, your only option is to do this manually on Kite. You can do this from the position tab on Kite and sell the desired quantity.

Hi Karthik,

First of all Thank you for an amazing series of modules in zerodha varsity.It gave a lot of insight to newbies like me.

My question.

1)Is it a good idea to buy a long call option with 1 or 2 years of expiry, instead of buying stocks/etfs ,if it is available at low volatility.

2)And in case if market direction reverses buy a put option to hedge it on a short series like monthly expiry,still holding the long term call option.

3)Is the overall strategy a good one.

4)is there any other factors to be considered to make it a more safe bet.

note:- I work in U.S. and as far as know long term u.s etfs and stocks options have good liquidity as compared to nifty.

1) If you have such a long term view, you\’d rather buy the stock right? Anyway, if you do get the pricing right, then maybe its worth it. I\’ve never explored this much by the way (simply because we don\’t have such a market in India)

2) The costs would go up, not sure if you will have any added advantage after considering the cost/tax benefit

3) Yes, provided you get the pricing, tax, and cost angle right

4) Frankly, I can\’t think of any now, have to spend some time understanding these long-dated option contracts (also called leaps)

Dear Kartik, my question was \”Did i miss any candle?

I am a student, therefore I want know, if my observation was right or wrong.

Ah, like that. No, not really Satya.

Kartik,

I have a query regarding Friday 12th July nifty movement. There was a movement of 100 points. Most of the time nifty stayed above pivot. But I couldn\’t identify a single candle which was a clear buy. May b my limited knowledge. I am following 5minutes candle.

Can u please check and elaborate the candles to understand the move.

Satya, if there was no trade opportunity, then it is fine that way. There can be a movement in the market, but if the market does not present you with an entry opportunity, then there isn\’t much that you can do.

Sir Please add other strategies also like iron condor and iron butterfly

Will do, Satyam.

Kartik

I have a query. Today nifty closed to 11950. Then why PE and CE for 11950 became zero. What is the rule. Can u please elaborate on this topic

You must be looking at the weekly expiry. Options that are out of the money and at the money expire worthless, hence the value was 0.

I mean to say an example of an ideal scenario where we can take a position.

Like described in text book

Yes, full margins would be applicable 🙂

Karthik

I have reading your varsity article. They are very good and flow is interesting.

I have a question

How would I manage margin? Zerodha or any broker holds to a big amount as margin. If I carry over a position say Put Spread to next day my money will be held? Is there any way to handle it. Zerodha had products BO and CO but that works for intraday only.. please advise

Thanks.

If you intend to carry forward a position, then you will have to have the entire margin required for it. In fact, any shortfall in the margin, the exchange will levy a penalty on the broker.

Kartik, can u plot a sale with ideal situation.

Like

Range bound market

Delta neutral straddle

Volatility around 17

Gamma?

Theta?

Sorry, I didn\’t quite get your question. Can you please elaborate? Thanks.

Can you please give example

For example, when the budget is around the corner (fundamental event), the candlestick patterns do not play a part.

Kartik,

Day before yesterday, nifty had a bearish candle. Market was waiting for direction to move up or down. International concerns pushed market below. And all indicators were negative. But market sentiment changed yesterday and it went up 100 points.

In this scenario, let\’s say yesterday morning, what could have been done to anticipate the market movements either up or down!

Satya, it is tough to take a call. Most often the cues come from the price action (charts), but then when there is fundamental news, then that has a bigger impact on the market\’s direction.

Where to find greek values Kartik! Including delta figures

Try https://sensibull.com/ for Option Greeks.

Hi kartik,

This market is still a puzzle. And many things to learn.

What I observed that selling a straddle doesn\’t work in a trending market. It works only in a range bound market.

Can u guide regarding choosing the strike price. For intraday straddle

That\’s right, in a trending market you need to be net long delta (if the trend is bullish) or net short delta (in the trend is bearish). Delta neutral works best when the markets are not trending.

What is your opinion. I think this is a perfect point to enter a straddle. Vix is all time low. Some news and events including budget is on monday. Text book copy paste position.

For a long straddle maybe. But I\’d have been more convinced if the volatility was higher to a short straddle.

I want to go for straddle. Which expiry should I choose

I\’d always suggest current month because they have maximum liquidity.

Today I just saw my Zerodha page and it is showing that nifty at 12032 up by 209 points.

Vix is low at 13.9

Can u please help me to understand what is this. How come it is showing a growth of 209 points

Y\’day was mock trading session, Satya. Mock trading sessions are for brokers to test their systems. So the values you saw were all random.

Hi kartik

Now I want to go for straddle ( will buy both PE and ce) only for intraday. Let\’s say I have a capital of 50k. How much exposure I will get for intraday straddle buy. Same question for intraday straddle sell.

I\’d suggest you check the margin calculator – https://zerodha.com/margin-calculator/SPAN/

I am not able to understand span. Because there are 2 options. One is buy and another is sell. But in my case I want to buy both buy PE AND CE.

And want to sell I PE AND CE

Roughly some broker are giving 20x, 50x margin for intraday Index trading.

Satya, to buy options you need to pay up the entire premium required. If you want to hold the short position intraday then yes, you will get some margin advantage, but for all the overnight position you will have to pay the entire margin/premium required. The broker will have to pay a penalty in case of a margin shortfall from the client\’s side.

Kartik, that\’s what I want to know. I want trade intraday straddle with a capital of 50k. How much multiple I will get exposure. How to know it and whom to contact?

Satya, to know the exposure, you will have to add the stock/index name on the span margin calculator and see the margins required. Else, I\’d also suggest you call our support desk for this.

Hi Karthik,

First of all hats off to your amazing knowledge. I read your fundamental posts and now this technical stuff, you seem to know everything 🙂 and have put lot of effort to explain stuff in a simple way. Thanks for this.

On quick question, Is it true that IV will increase in case of both breakout and breakdown? If thats the case consolidating stock will always benefit from long straddle assuming we are beginning of expiry hence insulated from Theta, isnt it?

Regds,