Basics – Trading Interest rate futures

Traders,

NSE has just relaunched Interest rate futures, and after speaking to other traders and the way the contract is designed, the feeling is that trading action on the newly launched contracts should pick up considerably even in the retail trading community. As traders, I guess we trade anything that moves. I will try to explain in this post, basics of what moves Interest rate futures, and all you need to know to put that first trade.

For starters, the positive aspect of trading Interest rate futures is that there is no STT (Security Transaction Tax), and there is a bonus of not having to pay brokerage until 31st of March 2014 at Zerodha.

Underlying?

Futures are derivative contracts, whose value is derived from an underlying. For example, the value of Nifty futures are derived from the price of Nifty Index which is the underlying.

First thing about Interest rate futures is that the underlying is not an interest rate, but the “Bond price”. NSE, MCX-SX, and BSE (launching on 28th Jan 2014) have just launched futures contract on two Government of India (GOI) Bonds: “8.83% GOI 2023 (Maturity – Nov 25, 2023)” and “7.16% GOI 2023 (Maturity – May 20, 2023)”.

Reasons why the earlier attempts of launching Interest rate futures didn’t take off

- When they first launched trading in IRF in 2008, the underlying for Interest rate futures was a notional Government Bond of 10 years maturity with an interest (coupon) rate of 7% p.a. Since the underlying was a notional product, futures on this underlying was never accepted. With the newly launched Interest rate futures (IRF), the underlying unlike earlier is not a notional product, but are very popular and traded GOI Bonds.

- Earlier, though the Futures trading was on a notional product, it was settled with physical delivery on expiry. So if you held a contract until expiry, you would have to either buy/sell from a basket of deliverable Bonds mandated by the Exchanges. The new product has fixed the problem by making the contract completely cash settled. So similar to Nifty Futures trading, on expiry there is no exchange of underlying, but the contract is cash settled.

What are Bonds and what causes their prices to move?

We now know, when trading Interest rate futures, we are actually trading futures of Bond prices rather than the interest rates. The next question to ask is, what makes Bond prices to move up or down, so as traders we can profit from either going long or short.

The topic of Interest rate futures is a huge discussion, and the purpose of this post is to initiate the idea and get started. I will be writing only the basic aspects, and if you are interested, a good starting point would be the NCFM module on Interest rate derivatives, which can be downloaded here. Since the discussion revolves around Interest rate futures that have GOI Bonds as their underlying, here is an introduction.

Government of India (GOI) Bond

Government of India like any business needs money for its expenses like building roads, supplying basic amenities and a lot more. In times of deficit, which is when the spending is more than the revenue, it borrows money. Like any other financial institution GOI gives an interest (also called coupon amount) on the amount borrowed, and a promise in writing (Bond) to give back the principal on maturity or end of tenure. The maximum tenure for borrowing is upto 30 years, but usually the range is between 5 to 15 years. All such government bonds having a tenure of 1 year or more are also called G-Secs (GS). All such Bonds are issued by RBI (Reserve bank of India) on behalf of GOI.

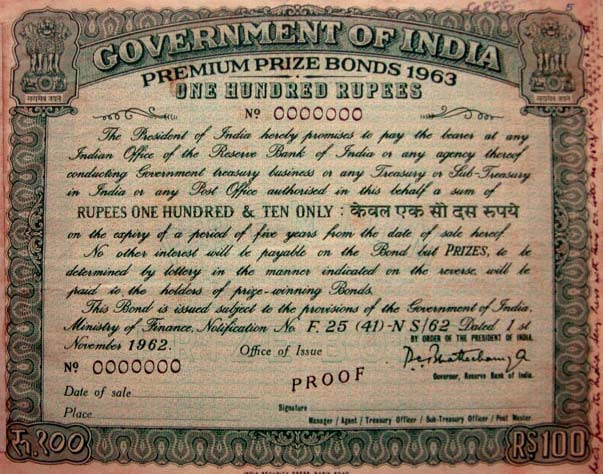

GOI Bond from 1963

Following are examples of GOI Bonds which are also underlying for IRF (interest rate futures) – 8.83% GOI 2023 (Maturity – Nov 25, 2023), and 7.16% GOI 2023 (Maturity – May 20, 2023) Similar to this every Bond will have:

- A maturity date, Nov 25 2023 and May 20, 2023 respectively in the examples above.

- Coupon rate or Interest rate – Yearly rate of return you get for holding the Bond, 8.83%, and 7.16% respectively.

- Name of the issuers (GOI).

As mentioned earlier, the Interest rates are fixed for the Bond as in examples above of 8.83% and 7.16%, and you can’t really trade a value which is fixed. So, I guess the next question would be :What moves which can be traded”.

Bond Prices and how they move

A Bond when issued for the first time by GOI, has a face value to it, which is basically the amount of money the issuer pays the holder of the Bond when the Bond matures. The face value of both the Bonds which are underlying in case of the IRF’s (8.83% GOI 2023 and 7.16% GOI 2023) is Rs.100.

Along with the face value, the other component is the coupon or interest amount that the holder of the Bond gets paid either annually or semi-annually. So, if you have invested Rs 100 at face value in an 8 % GOI Bond, maturing 10 years from now with a semi-annual coupon, you get Rs 4 (Rs 8/2, Rs 8 is 8% of Rs 100 invested) every 6 months for the next 10 years, and get back the Rs.100 on maturity after 10 years.

Here are two cases for you to ponder:

- Case 1: After your investing into the 8% GOI Bond, the general interest rates in the markets are reduced by RBI to help growth of the economy. What do you think happens to the Bond price of Rs.100 that you had paid?

- Answer: The interest rates are dropping, but you are holding a Bond that yields higher interest rates. The demand for your Bond goes up and hence value of Bond prices also goes up (price discovery), so the Rs.100 goes up higher, and you can sell it if you wish at a profit.

- Case 2: After your investing into the 8% GOI Bond, the general interest rates in the economy is moving up because RBI is worried about inflation. What do you think happens to the Bond price of Rs.100 that you had paid?

- Answer: The interest rates are going up, but you are holding a Bond whose interest rate is fixed, the demand for your Bond goes down, and hence the value will go below Rs.100.

Bond Price inversely related to Interest rate, like in case of a negative and a photo

In summary, Bond prices are inversely related to interest rates in the economy, so:

- If your view is that interest rates will go up, you short Bonds as the Bond prices will go down and you can profit.

- If your view is that interest rates will go down, you buy Bonds as the Bond prices will go up.

Other factors like currency movement also contribute to how Bond prices move, for example FII’s are a big community investing into GOI Bonds, and their appetite for Bonds depends on currency rates also.

Here is the most interesting aspect, GOI Bonds don’t trade on NSE, and also one of the issues trading an underlying like Bond, similar to stocks, is that you cannot profit if your view is to be short or value of Bond prices are coming down. This is the reason for introducing Interest rate futures that have the Bond prices as the underlying.

- If your view is that interest rates are going up, “Short” Interest rate futures (you profit because when interest rates go up, Bond prices come down).

- If your view is that interest rates are going down, “Buy” Interest rate futures (you profit because when interest rates go down, Bond prices go up).

The view on interest rates is dynamic, and changes every fraction of a second, and hence the Bond prices itself, as it affects many people from retail to financial institutions, from insurance companies to governments. Thus, Interest rate futures turnover is many times greater than equity futures turnover in the developed markets.

Bond yields?

Along with Bond prices, Bond yield is a very popular way of tracking the performance of a Bond, and hence an important concept to understand.

Since the net return you make by investing into Bonds vary based on the price at which you buy, the Bond yield is a way to measure the exact % return you make by purchasing the Bond. The two most commonly used measures of yield are Coupon yield and Yield to maturity.

Coupon Yield

Coupon Yield in % = (Coupon Amount/Bond Price) x 100

If you bought a 10% GOI Bond at a value of Rs.80 , the yield for you = (Rs.10/ Rs.80) x 100 = 12.5 %, which means in net you are actually making 12.5% even though you are buying a 10% GOI Bond. Similarly if you buy the same Bond at Rs.120 the yield = (Rs.10/ Rs.120) x 100 = 8.33%.

Yield to Maturity (most popular way of measuring yield)

YTM (Yield to maturity) uses a complex formula to calculate the internal rate of return for the investor who buys the Bond, by using all the future cash flows (interest payments as well as ultimate principal repayment). Calculation of YTM assumes that the Bond is held to maturity. The difference between Coupon yield and YTM is that Coupon yield uses only a single coupon amount (interest amount) to calculate the yield, whereas YTM uses all the future coupon payments, and principal payment discounted to present values. If someone on TV or a bond trader is talking about yields, you can safely assume that it is measured using YTM method, the most popular way to calculate Bond yields.

Interest Rate Futures

3 Future contracts each (present, near, and far month) on the bond prices of both the following are available on NSE,MCX-SX, and BSE (launching on 28th Jan).

- 8.83% GOI 2023 (Maturity – Nov 25, 2023)

- 7.16% GOI 2023 (Maturity – May 20, 2023)

Presently all trading activity is in futures of 8.83% GOI 2023.

Important things to know:

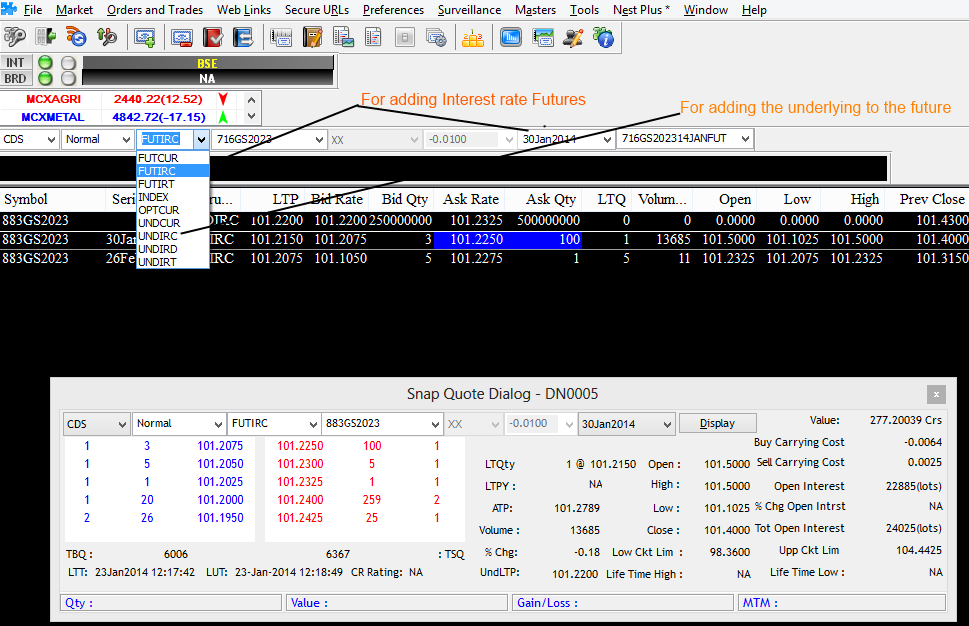

- Instrument Type: FUTIRC (NSE) & FUTIRF (MCX-SX).

- Trading symbol: Examples : 883GS202314JanFut, this is the Jan 2014 future contract for 8.83% GOI Bond (also called Gsec(GS)), and similarly 883GS202314FebFut is the Feb future.

- Unit of trading: 1 lot , 1 lot is equal to 2000 Bonds.

- Contract Value: If the Bond price is Rs.100, contract value is Rs 2lks (Rs.100 x 2000).

- Tick size: Rs 0.0025 (minimum movement in Bond price).

- Rupees made/lost for every tick change per lot: Rs 5.

- If Bond price moves by Rs.1 which is 400 ticks, profit/loss made is Rs.2000.

- Margin requirement: 3.3% of the contract value (SPAN margin of 2.8% + Exposure margin of 0.5 %). You can check margins for the interest rate futures under our margin calculator. So, if 883Jan future is trading at Rs.101, the contract value is around Rs 2.02 lks, and margin required to trade 1 lot would be around 3.3% of this Rs 2.02 lks, which is around Rs.6000 per lot.

- Rs.6000 blocked as margin per lot, the profit/loss per tick (change of 0.0025) is Rs 5, and per Rs 1 movement in the bond price is Rs 2000.

- Trading hours: Monday to Friday 9.00 AM to 5.00 PM.

- Expiry day: Last Thursday of the month.

- Margin requirement for Calendar Spread: Rs 800 per contract (Where you buy and sell different expiry of the same contract, lesser because it is completely hedged).

- Product Type to be used while Trading: NRML.

Adding the contracts on the trading platform

See the picture below to know how you can add both Interest rate futures, and the underlying Bond onto the Marketwatch. Note that, you cannot trade the underlying; you can can trade only the Interest rate futures on the underlying.

Adding Interest rate futures and Underlying on the marketwatch

If you are interested to know more,

- Read the NCFM Module

- Read the product note from NSE

- Once you have your basics right, there are tons of content available online

At Zerodha, we believe that active trading in products like Interest rate futures, and derivatives on Volatility which will most likely be launched soon, are critical for us as an exchange, and as an economy to catch up with the developed markets.

Best of luck,

Client ID :- ON0175

Complaint about my portfolio regarding ruchisoya i have 200 shares in my portfolio,As seen from my portfolio there is no ruchisoya Company, so verify the company as soon possible.

Hi. Ruchi Soya has been suspended from trading temporarily, which is why you wouldn’t be able to see it.

Amazing explanation , very easy to understand from this blog. Thanks who wrote this article.

what is the interest rate for future contract , ex if Gail current price is 122 and I brought 1 lot ( 5332 quntity) for GAILAUG2019, and I hold it for 10 days then how much interest i have to pay

please explain in 2 scenario ( 1) if i have profit RS10000 and (2) if I loss RS10000.

There is no interest charged on positions if you have the cash margin required to carry the position. Interest is only applicable in case you have insufficient cash margin and is charged at 18% per annum or 0.05% per day.

Hii my user id RA7440

I transferred money from my icici account and money deducted from account but money does not updated in my zerodha… What to do

I want to buy Government Bond 7.75% which is likely to be launced by Jan 10,2018. I read article that these Bond should be bought from Nationalized bank (SBI, HDFC).

Can Zerodha’s Demat Account should allow me buy bond? Or Should i have Bank’s Demat Account to buy.

I am new to this, any advise would help

You can give your Zerodha demat account as the beneficiary account to purchase.

Can u pl share the brokerage and other charges levied on IRF. How to calculate those charges

How do i rollover my current position to next month in f&o?

Exit the current position and take a fresh one.

“Appreciated Nithin, This was the best and simplest way one could make understand IRF. One humble suggestion would be to add some short video clips of trading portal to make understand naive investors.

Hi Nithin,

This post may not belong to this thread but pls clarify;

The following line appears in NSE’s NCFM guideline and it goes like this:

” runaway gaps are caused by trading limits imposed by the exchanges”

What is this trading limits that imposed by the exchanges?

Thanks

hmm.. I think what they mean is the circuit limit. All stocks (apart from those on F&O) have a circuit limit every day. Basically a maximum % which a stock can either go up or down.

how currency spread contract works? how profit or loss calculated? please brief us on currency spread contracts with example in lay man’s language.

Check this chapter on calendar spreads: http://zerodha.com/varsity/chapter/the-usd-inr-pair-part-2/, also the entire module on currency

Query regarding IPO

If i apply in a IPO through SBI bank by giving my Zerodha demat account and PAN details and if i allotted shers than will it be credited automatically into my zerodha demat account?

Yes.

what kinde of charges you are taking as STT and stamp. duty every time what is this ??????????

as 0% brockage as no-meaning due to this type of charges when we consider it for small transaction…….

please give valuable replay……..

Check our brokerage calculator to know the charges: https://zerodha.com/brokerage-calculator

STT is payable to Govt. of India, Stamp duty to State Govt. These are statutory charges all brokers will levy that has to be compulsorily paid to State/Central Government.

The only charge a broker makes is brokerage which is waived off for all delivery trades at Zerodha. It’s charged regardless of how big/small your transaction is.

continuing the previous post ,how one can trade the interest rate futures keeping eye on INR/$ as RBI policy will be one time event in a qtr,but the Currency rates are daily thing to watch out for

Sir,

you explained how RBI rate and Interest rates are Inversely related , but in today’s scenario when INR/$ is highly fluctuating how this currency rates and interest rate futures are related ?

Dear sir,We are interested in day trading ….We required basic information for beginer ,we know half information far that reason we have burn our fingers when we trade, so please help us and guide safe path in trading high way. and also portfolio service is available from your organization plzzz

Have you checked Varsity http://zerodha.com/varsity/

Hi Nithin,

I am planing to start my first trading this week. i have few doubts.

Suppose, I bought 100 shares of Rs 1000(ie, 1000*100=100000Rs) and sold it after 10 min with a profit of Rs 10( 1010*100=101000). Here at the ordering time Rs 100000 reduces from my trading account. How long should I wait for placing next order after selling this share? (ie, How long it will take to credit the money back to my trading account after the sell order)

Is the duration same for future options also?

Regards,

Renjith

Hey Ranjith,

You’ll be able to use the 1 lac immediately. Yes,the duration is the same for F&O also.

You can use the credit realised from sale of option immediately. The systems will allow you you. However you may be levied a penalty. Why penalty? Explained here: http://tradingqna.com/615/options-tuesday-bought-options-immediately-charged-penalty

Nitin, Thanks for the IRF basic introduction.

Can you organize a seminar or training program in Kolkata on IRF. It can be a good initiative.

Anirban, we haven’t yet started taking the route of seminars yet. But it is on our scheme of things, probably online webinars.

hai Nithin Kamath

i am new to ZERODHA and i love very much in ZERODHA

i need some help from you

i am tamilnadu and my state stamp duty is very high 0.006 % in all other state

every day i would pay more than 2400 rs

pls give me some idea

other wise i can sniffed to Bangalore 😉

regards

D SARAVANAN

Saravanan, :), you know what to do.

Hi Nithin,

In Zerodha Online Brokerage Calculator, stamp duty is not getting added in the calculation. We need to to do some aftermath, which is not quite useful, I believe.

Actually for instance I buy in Intraday170 shares at 2421.1 and sell at 2422.2, the brokerage calculator shows 7.34 Profit and breakeven 1.06

When I get my settlement on that day, I actually get -42, which is 42 INR loss for me due to stamp duty charges.

Is it possible, if I choose Tamil Nadu in the state drop down box, the brokerage calculator can include the stamp duty charges also, of course considering the worst case 0.006% stamp duty and not considering max 50 INR.

Even if the real trade gives 50 INR as max stamp duty, it will be profitable only, so considering 0.006% stamp duty, is it possible to modify the online brokerage calculator.

Of course if no state is chosen, the calculations could consider zero stamp charges and ask the user to do the aftermath later.

Also, the Online Brokerage Calculator, only allows one decimal place for 4 digit numbers, while actual trading values are 2 digits after decimal place.

For instance, I can enter 2500.5 in buy price and not 2500.55, my actual trade value could be 2500.55.

For 3 digit prices, no issue, it allows eg, 340.65 perfectly.

This is fixed now.

One of the reasons we didn’t add the stamp duty there was because a bunch of states have maximum stamp duty of Rs 50, so if someone is checking only for a single trade, the cost would seem much higher. But, yeah I get your point, let me talk to the boys here and see what can be done.

Thanks for your quick reply.

Even the same formulae put in an excel sheet could work for me, but during trading, the Online Brokerage Calculator acts as a ready reckoner for modifying orders and is very helpful, rather than looking for some excel sheet in my computer.

Some of my friends from Zerodha too, wish this feature of including stamp charges.

Thanks for your support.

Dear Sir, im having a account in Zerodha, i want to refer my aunt for opening an account. She is in Bahrain, what are the documents needed? Whether there is separate taxation applied? Whether NRI account will be different from Normal account?…..pls clarify

By

Hawwa

No NRI is not allowed to open account like a normal resident, the taxation differs and all the trades has to be routed through a PIS account that you should open with the bank account. NRI’s are not allowed to trade in F&O unless if there is a custodial account that is opened.

Cheers ,

dear Nithin,

i am 5 years old zerodha member.

i like nifty option trading, but do not any support by your zerodha company.

please help me for nifty options trading.

thank you

What kind of support do you need Sushil?

Hi.. Can someone give one hypothetical example to show how interest rate future settlement is done.

Sahil,

It is exactly like Nifty futures, there is an Interest rate future and there is an underlying, on the expiry day all your existing futures positions is cash settled based on the underlying price.

NIthin,

I think 7.73 is the live example at present vis a vis 8.83. I think 10 Yr gilt is the most attractive asset class among’st the all. Load as much as you can. And along with it exposure to it will only 6000 per contract is nothing. Its a SITTER as per my opinion.

Any one with different opinion ??

Hi Nitihin,

What will be the case if new 10 Yr benchmark is introduced. Their are talks that in May we could have a New 10 Yr Benchmark. In present case their is no trading happening in 7.73%, so would it be the same case with 8.83% in May. Someone holding May contract would not be able to sell in such case.

Amol,

We will need to see how it plays out, but ideally the 8.83 on the 2023 should continue trading for atleast a few years.

Cheers,

interest rate futures-explained well

Hi,

Need to do paperwork to get this instrument enabled? I can’t see it in the market watch futures’ list.

Thanks

Joe, if you are enabled on currency trading, you should be able to see it. If not, you need to sign segment addition forms and send out to us. https://zerodha.com/download/Change%20Of%20Information%20Documents/Addition%20Segments.doc

I tried to place order under both (NRML and MIS)

It getting rejected inspite of having enough margin

Pl. Guide

Devendra,

You will be able to start trading on it from Wednesday, there were some small little starting issues.

Best of luck,

also, if possible, pls state the individual items with their respectiv values that one would have to factor in for the calculation of the points to BE like for instance education cess, sebi chrgs, brokrg, trans chrgs, avg bid-ask spread etc etc

Brokerage is the same Rs20 or 0.01% whichever is lower. Other charges: 0.0019% STT: 0 , Sebi charges: 0.0001%, the liquid contract right now is the future on 883GS and the spread is really tight, 0.0025 to 0.0050

You can add the contract on your marketwatch to start tracking.

so, whats the points to BE for these bond futures(assuming the 883 contracts, for 1 lot, assuming market price:101.0000 rs) after march 31st i.e. after the brokerage-free period ends?whats the points to BE for the period between jan 21-march 31?….this metric is usually easily available on the zerodha brokerage calculator but i think it’ll take some time for it to be updated

Vivek, we will have the brokerage calculator updated soon, but just as an example, if you buy and sell 5lots of 883GS at Rs 100 which requires around Rs 30,000 margin, the breakeven should will be around 0.0075 to 0.01 points on the bond. So if you buy at 100, breakeven will be around 100.0075 to 100.0100 including all charges, which is around 3 to 4 ticks on the bond price.

We will have the brokerage calculator by next week,

Cheers,

How is the liquidity part of the contracts, i could see only 32085 lots in 8.83 GOI and 103 lots in 7.16 GOI as open interest.Is there a risk of your position getting stuck when you want to square off.Also could you simplify spread positions more for this asset class.And, is it advisable to take a position till RBI policy is announced.

Thanks!

Priya,

The 883 contracts are quite liquid, and the volumes should pick up as the product gets popular, it is just the 1st week of trading. Spread positions are very similar to calendar spreads on any other product, when you expect the difference between 2 different month contract of same underlying to reduce, you buy the lower price and short the higher price. Once the difference comes down, you take an opposite position to make profit. Since such a position is completely hedged the margin blocked by the exchange is also quite less, in the case of IRF it is Rs 800 against the more than Rs 6000 if you took a naked position.

Cheers,

Brilliant, I had read about trading interest rate futures in MBA, couple of years back, idea is finally clear, wasted money on my MBA. 🙂

Hi,

am quoting from a query in which u hav answered—>>>

……………………………………………………………………..

……………………………………………………………………..

” Hanan

Manoj, I think you want to know the number of shares that were traded for a stock at a certain price? I think this is what they call ‘Time & Sales’ data on Nasdaq. We call it vWap statistics or Hourly statistics or even Data Table. You have to right click on your market watch and select the option Tools. In Tools, please select vWap Statistics. It’ll show you the prices it traded for in a given minute. As a broker, Zerodha automatically gives you this data for 22 trading days at any given point. If you want more data, you have to save it or buy it from professional data vendors.

We presume this is what you’d like to know. If you think you had a different question, please elaborate so we can help you. ”

………………………………………………………………………..

…………………………………………………………………………

Now my question is how do i get the data of previous 22 trading days ?? all i can access is todays data..

Thanks in advance–

P.S : here is the link in which u had answered ——- http://zerodha.com/z-connect/tradezerodha/nest-plus-for-ztrader/charting-adding-multiple-indicators

To access the data table of the past 22 days you have to first open the Nest Plus chart by pressing (Shift+P) or you can invoke the chart by right clicking on the scrip and choosing Plugin Commands > Plus Chart. Once the Plus Chart is open, you can right click on the chart and choose Data Table or you can simply use the shortcut Ctrl+D.

In short, selecting the scrip and pressing Shift+P and Ctrl+D gives you Data Table.

Oh,that was easy 😀 thanks a lot 🙂 hav a nice day !!

Explain in simple way that comman people can understand by Zerodha…

Anand, tried my best to be as simple as possible, the scope of this topic can’t really be explained in 1 post. 🙂

The main thing to understand is, if you think interest rate is going up, short Interest rate futures, and if you think interest rate will go down, buy interest rate futures. Since IRF is starting off in India, it will take a while it becomes popular and people understand this like gold futures or nifty futures.

Cheers,

IT IS INTERESTING NITIN.

Hi,

Can IRF (NSE) be stetted by taking delivery? And is 8.83 goi 2023 the only bond i can work with? Can i take delivery of an equivalent CTD bond. I know the underlying theory of IRF and fixed income securities but have no practical experience. So kindly pardon if a come across as noob. Thanks 🙂

hey Pratik, all futures on NSE are cash settled including interest rate futures. Currently all the trading activity is on 840 GS 2024, btw the trading activity is really small :), the product never really took off.

What is the other charges ? Could not found in Brokerage calculator !

Brokerage calculator is not updated yet, other charges should be around 0.0019%

Suppose i want to short Tatamotors 26oct17 my span margin is 46,300 and 29183 as market closing 24 august 2017.suppose its shoots up by 10 % at tomorrow opening price. will my loss limited to only 46,300 or it can go further also.

to be in simple terms is my loss limited to span margin of any script or it can be more also.

Note:- there is no extra money in my account other than my margin requirement.

On rare occasions, your losses can definitely exceed available margins in your account. In such cases, your account may go into a debit and you’ll have to bring in funds. Also, your position will get squared off for lack of funds.

today i enquired at Zerodha about this it was informed that int derivative treading facility is no available ? plinform when it will start

Apologies for the wrong info provided. All of Zerodha’s clients can trade Interest Rate futures. The active contract right now is 883GS2023 for March expiry. Give it a shot.