Trading Q&A

Traders,

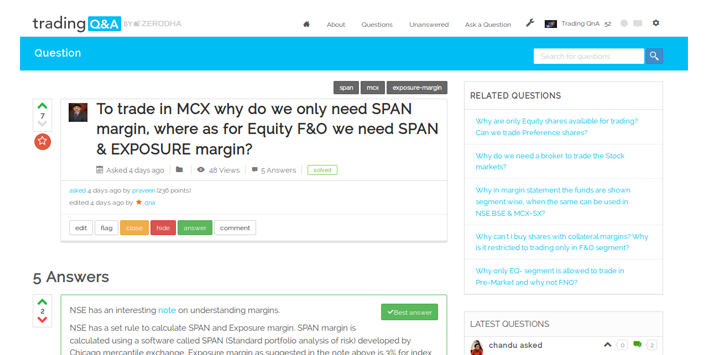

Today, we announce the launch of Trading Q&A — tradingqna.com, a new initiative in our quest to empower retail traders & investors with knowledge.

In 2012, we started Z-Connect as a way to converse and connect with you and to provide you with up-to-date information on all aspects of trading with us. Soon, Z-Connect grew into something bigger, a very active educational portal covering a wide variety of topics on trading and markets. We were immensely happy that the trading community, you, embraced Z-Connect and sparked countless insightful discussions. However, we also realised that it is not an easy endeavour to produce, classify, and disseminate quality information, and definitely not by one or two people in the form of a blog. We realised that it was the need of the hour to have a better platform, much better than anything that is currently available to the Indian trading and investment community, given the pitiful state of the popular trading forums out there that severely lack quality, spread misinformation, and are painful to use.

Enter Trading Q&A—a community maintained, self-curated, question and answer site for all things related to trading and stock markets. It is absolutely free to use, open, and community powered. Unlike a forum, where discussions often turn long winded and useful information gets lost in the countless pages spawned by threads, Trading Q&A enables you to ask a question and get direct, to the point answers from the community. Members of the community vote up or down questions and answers posted based on the quality and merit of the content, and as a result, good questions and good answers naturally rise to the top. An open and democratic way of learning and sharing knowledge.

How does it work?

- Ask a question pertaining to trading and markets

- Wait for the community to answer

(Remember, you are the community, so when someone asks a question that you are knowledgeable about, it’s your turn to answer) - Look out for answers that have been upvoted the most, and select the best answer based on merit

To get a gist of how it works, see this example question: To trade in MCX why do we only need SPAN margin, where as for Equity F&O we need SPAN & EXPOSURE margin?

Points

Beside quality content, the best part about Trading Q&A is the points system. When you post a good question or a good answer, the community will show their appreciation by up-voting your submissions. Each up-vote earns you points. These points depict your “reputation” in the community. The higher the number of points you have, the better your contribution to the community. The points can also earn you privileges in the community, such as gaining content moderation abilities, or becoming an “Expert”. You can read more about points here.

Zerodha’s role

As administrators of the platform, we consider it our responsibility is to keep it entirely neutral, clean, and free of spam. We will strive to make the platform a high quality repository of curated knowledge that is up-to-date, relevant, and continually growing, backed by a strong and dedicated community. One of the things we’ve done to ensure openness and to really give ownership to the community, is to license all user generated content in the public domain (cc by-sa 3.0 with attribution required), similar to what Wikipedia does.

In addition, though the community will be self curated, we as Zerodha will keep finding market experts to join and participate, and moderators to keep everything neat and tidy.

Stock tips – a big No

As you already know, we’ve never promoted, nor will we give stock tips and recommendations. Trading Q&A follows the same principle. The community will neither encourage, nor tolerate solicitation and publishing of stock tips and recommendations. For it to grow as quality repository of information, it is important to keep the questions and answers generated by the community as objective as possible.

Finally

We are very excited to see how the Trading Q&A community grows. Together, we can make it the best community and the highest quality store of trading and market knowledge in India.

As always, looking for your continued support.

Team Zerodha

Is the 2% increase in the Extreme Loss Margin (ELM) on the day of expiry applicable only for Index Derivatives? Or it is applicable for Equity Derivative as well

Hi Tanmoy, the additional 2% ELM is on index derivatives. Explained here.

Good Initiative

What is the new rule that says only accredited investors will be allowed to trade in fno, will it effect trading journey of small traders who just started and has the capital of 40k, plz brief on this.

Please add tradingview feature % LTP based definition for Renko brick size. Trading view public platform already has this. Please extend in Kite app

Is Reliance Power is good to Hold?

I have been trading from 2015 that is last 9 years. Still not gotten over the psychological element in trading.

I take good trades 75% of the time, but still on the losing side.

My biggest problem is I enter a good trade, not able to wait the course of the trade and trail my gains. I exit the trade within 1 or 2 minutes with some gains like 500 or 700 bucks in NIFTY and FINNIFTY options and immediately chase the same trade again and re-enter with a bigger premium and wait for 1 or 2 minutes, this time the trade pulls back and gives me a loss of 2000. Next trade i enter and like this I do 40 trades in a day and mostly end up on the losing side losing 10,000 to 15,000 on some days. This type of over trading approach eats a lot of my money on brokerage and other charges too apart from the trading loss.

What do i need to do to develop patience in a good trade & stay the course of the trade, let the profits run & keep trailing my trade on intraday basis. Why do i become so impulsive to exit trade early & very impulsive to re-enter, actually i am not trading at all. I am scalping & gambling 90% of the time.

Please suggest some corrective course of action so I can improve my trading.

Sir,

Sub :- Need a Clarity On TAX AUDIT.

Share Trading Is My Only Business.

I Do Only and Only Cash Buy / Sell.

And Sometimes INTRADAY.

( No Futures N Options )

My Turnover I Keep Below 10 Crore.

Till Now I have Booked Profit Only at Minimum 6 %.

Now I Intend To Book Profit at Less than 6%.

May be 3 To 4%.

Whatever Yearly Profit I will Make, I check Through ZERODHA Tax P/L Statement and will file my returns accordingly.

So Then…

Sir…

Is the TAX AUDIT Required in My Case… Just Because My Profit is BOOKED Below 6 %…???

( My Income is Above Taxable Limits )

Waiting For a Straightaway Fixed 6 % Profit in Shares Is Becoming bothersome,and Too long Waiting and Uncertainty.

Hence I wish to Book Profit at Lesser Percentage.

At the same time…want to avoid the Hassles of a TAX AUDIT.

Kindly Clarify…???

Do I Need To Go For an Audit… Just Because My Profit percentage is Less then 6%.

Thanks

Tushar Arvind mody

In option we can trade multiple times in the same strike. It will affect our p&l or that strike will average each time after my 1st trade is over(In intraday)

Ex: 1st trade-If I buy 21000ce at 30rs ,then sell it 37rs

2nd trade-

After again few hours later same strike I buy at 5 rs it was expiry day so much decay then I sell it for 8rs

Is there any connection with 1st and 2nd or totally it will understand different Trade??

Anyone who know clearly please explain briefly and simplicity so 18 year boy understanding easily??

Suppose I have Rs. 30000 in my Zerodha account for trading. For swing trade, shares of how much amount I can purchase. Is it more than Rs. 30000?

Hi Dhananjay, there is no leverage provided for overnight positions, so you will be able to buy shares worth 30,000 only.

If i place an intra day buy limit order, it gets executed at 1 pm, at 1.30 pm i convert it to CNC ie i take delivery. Will i be charged Rs 20 for intra day transaction in addition to stt etc payable for delivery. Same question if i sell on intraday basis but later, before 3 pm i convert it to CNC as i already have shares in my demat account.

Hi if i buy shares on CNC ie delivery basis and later on the same day sell these on CNC basis, will i be charged short delivery auction penalty because I have sold shares before reaching demat account? Suppose the person from whom i have bought fails to deliver shares in time. Second question will zerodha charge Rs 20 in this case for intra day transaction? Assuming i don’t have those shares in my demat account. I am first buying and then selling. When I am selling after 3.15 pm it has to be CNC.

Hi Mahesh, buying and selling shares in CNC on the same day will not lead to the short delivery. This will be considered intraday trade. Also, the charges will be applicable as per intraday. Please check this article for more information.

Thanks Shubham

I have read on Varsity that in Short Condor strategy margin decreases by Buying one deep OTM Call option and selling one OTM Call option , Similarly in Put Option also.

But when I tried to execute it was failed because of margin. I had selected Intraday.

Please explain why more than 1 lakh margin money required although in Varsity it was written 40000.

Hi Sanyukta, the margin requirements can change based on changes in price and volatility. To place orders in the basket you need to have sufficient ’required margin’. The final margin is the eventual margin that will be blocked after all the orders are executed. Explained here.

hi for intraday option selling trade can i use 100% non-cash component pledge margin

Hi Gokul, yes, you can. Only for overnight F&O positions, 50% of the margin needs to compulsorily come in cash and the remaining 50% in terms of collateral margin. More here.

I need a list of ETFs traded on zerodha kite, with their full form/name and code used in the watchlist. Is this available somewhere?

Hey Bharat, the list of tradeable Exchange Traded Funds (ETFs) with the symbol and underlying can be found on the NSE website and BSE website.

Hi Nithin /Team,

From July 1st ,As usual I have transferred amount through coin using upi..but h I see my mutual funds orders not yet placed or processed.

and i See the link: https://support.zerodha.com/category/mutual-funds/coin-app/buying-and-selling-through-coin/articles/add-funds-coin-new

But however if i follow same process then I to have transfer amount for each Mutual Fund ,which is becoming very ridiculous and redundant so request you to please have work around on this like earlier and do needful.

Example:

I can able to pay individually but which is not good at all (To many redundant work). Lets say for example .

if i have 20 MF of SIP each of Rs 1000 then i have to do 20 transactions. Actually i would like to transfer Rs, 20,000 so automatically based on SIP amount will get deduct in this case Rs 1000 for each Mutual fund. Please find the attached screenshot for your reference (ticket number #20220703119380. and its really becoming difficulty for users and which is not user friendly

Hey Ajay, for now, you’ll have to make the payment individually for each SIP. However, we’ll soon have a single payment for all orders and mandates as well. Will keep you posted.

thank you . Single payment for all order is user friendly as Mandates works like Emi options… if i dont have enough amount in bank then some penalty will get deducts .. anyway waiting for solution/fix for current issue. thanks again.

Also ,if i want to run my SIP’s on 10th of every month and 20th of every month… which cannot able done in mandate option. so single payment for all order would be benefit the customer . please help us fast track and thanks for understanding.

I want to trade ”options”.

Instead of holding cash, I want to pledge bonds & bees. As there is a requirement for keeping 50% cash for the overnight holding & ”Liquid bees” are considered as quasi cash. My doubt is that…

If my Capital = ₹3,50,000/-.

Can I keep the pledging portfolio as

Government Bonds = ₹ 1,50,000

Liquid Bees = ₹ 1,00,000

Cash = ₹ 50,000

Do I get margin around ₹ 3,00,000 for Options trading ? Pls Help. I am new in Zerodha.

Hey Maddy, you can check the haircut percentage and collateral margin you’ll get from pledging each security here.

Hi nitin

I want to open trading account of my LLP firm and I have 5-6 employees it is possible to open 1 trading account with 5-6 client account for my employes from which they can trade for my firm

Hi I got a short margin penalty. I generally do option trading. But I can remember that end of the day I cleared all my positions. So my question is whether margin penalty can be levied even if during the day I have short margin.

Hey Sanika, there is now a peak margin penalty applicable if there is a margin shortfall during the day. Please check out this post for more details. For further assistance, please create a ticket at http://support.zerodha.com. We’ll have this checked and clarified for you.

What will be my account balance if I sell all my stock holdings,

square off all my open positions including futures and options ?

Is it same as ”Account Value” displayed in console ?

Does kite have functionality of saving plotted charting studies (Support, Resistance, Trendlines, Chart Patterns, Wave Structure) for multiple (50-100) charts?

If I place a after market order at 7:00 AM today say…it gets sent to the exchange at 9:00 AM…9:00 AM is start of pre market …so will it be treated as Pre market order? Will treatment be same or different?

Hey Ayush, market and limit AMO orders in equity segment (NSE and BSE) are sent to the exchange at 9 AM. If your order is matched, it’ll execute in pre-open session itself. If it isn’t, it’ll be carried forward to normal market hours. You can learn more on pre-market session here.

not able to see 28th October CE and PE options of Nifty and Banknifty??? Can anyone explain this

Why I am not able to see 28th October CE and PE options of Nifty and Banknifty

Why I am not able to see 28th October CE and PE options of Nifty and Banknifty??? Can anyone explain this.

Why Zerodha not showing 28 October week expiry

I bought a stock yesterday in longterm and sold it today in longterm – Buy and sell completed

Today after selling again i bought the same stock same qty will this be consider as different trade or combine with previous one.

if i want sell my cnc holdings on t plus 1 day, the any charges will applicable to me

My question about F&O.

If I use NRML to buy and sell a share on the same day.

Is there any charges required?

can we purchase in commodity on market open price

I couldn’t able to find Visesh infotecnics on my holding as well as watchlist. What’s the issue?

Why am I not able to find visheshinfo on zerodha?

Is it allowed to sell the shares bought in IPO Pre-Open on the same day?

Zerodha Team,

Please respond to my tickets as I see no response for the past 5 days..I have placed a request for Orbis account and have queries related to it…

No support from Zerodha support team as they are not mentioning a definitive timeline for Orbis migration and there was no call back arranged from Zerodha related to Orbis account after speaking to customer care more than 3 times in last 3 days..

Please respond to the below tickets ASAP on priority as I am not able to do any trades…

Client ID : LR0733

Ticket No below:

20210712350617

20210709768341

When i try to buy commodity, it guve error 1506 client not registered

Same problem is happening with me, are you facing this problem right now or has been sorted out.

If your problem has sorted out

Plz tell what to do for the solution of this problem.

Please share link to get the RE for vikas Ecotech

What will happen if I BUY the restricted strike price in option trading by creating GTT ? and Can I exit my position afterwards that GTT order executed ?

axha ab smjh aaya zerodha ab contract note kyu nhi send krta h roj ki roj bcz kyu ki isse customer ko pta hi nhi chalega ki kitni brokerage debit hui h aur paisa bhi chahe future ya option ya phir cash equity aur brokerage firm ke comparison me 1 din baad hi dete h taki customer bhool jae acha tarika h ye zerodha ka chori krne ka customer jaan bhi nhi paega aur kaam bhi ho jayega , ab to contract note ki liye bhi bahut mehnt krni pdti

In my account latest trading call or put option not showing ….why this happen

I have found zerodha as the best broker in the market. BUT, there is only one limitation i.e. OI limit on strike price and being an option trader, this is the biggest limitation for me. I want to know whether Zerodha is going to remove the OI limits on strike prices so that we can buy deep OTM options in times to come.

Hey, this limit exists only for naked buy positions due to an exchange limit on the total OI a broker can hold. Until there is a change in regulation, there is little we can do.

Hello

I have just registered an account with Zerodha.

But I just noticed a mistake in the registered account. How can I update my account before the account gets created or verified.

Hi,

Im keep getting unwanted calls from unknow numbers and in a frustrating situation i have asked the executive that, from where you people are getting the numbers and as per their answer, it is zerodha that making spam

The new sebi rule regarding selling…where OTP will have to be mentioned…is it applicable for intraday selling also..that is same day selling of stocks

I bought 210 units of liquidbees and created pledge for margin. Afterwards I purchased 190 units of Liquidbees. When I tried to pledge the 190 units,, the thread opened has a column showing UNPLEDGE but PLEDGE FOR MARGIN option is not avialable. Is it I have to unpledge 210 units first and then pledge for margin all 400 units at one time ? . Iam unable to carry F&O trade because of this and not getting answer though I raised the issue in SUPPORT app. Iam not able to contact Zerodha over phone since IVRS of no use.

Can somebody help me out.

Hello All,

I’m unable to download the 60 day challenge winners certification after the completion with the WON status.

There was a download certificate button available, but no action, If I click. I have tried different browser and the result is same.

I have contacted customer support and there is no reply yet, since 6 days.

Please someone can help me to sort this?

Hello

zerodha streak team its great to know that kite and angle broking has been added with API for algo kindly move forward for more brokers as zerodha has higher intraday margin as compared to other brokers .

Regards

Why is RSI in kite (using TV view) and TradingView different. Isn’t kite using TV indicators in TV view.

If these could be different, which RSI is Zerodha using. TV uses Exponential RSI.

Could this be due to the fact that though both are exponential but the start dates are different. Leading to differences in RSI.

Nifty Option Chain query :

While looking to NSE Option Chain for 7th Jan21 Settlement – I found 15000 Strike period with sufficient OI even on 6th Jan21 and this quoted whole the day between Rs.1.05 – 80p even when the Nifty was about 100 points down. My query is when we all are over sure that Nifty will not touch 15000 by 7th Jan.21, the settlement day, then how and why OI and trading is going on and who are the operators i.e. writers and buyers, and what interest / profit they do have here. The 15000 Strike Price Option Chain as on 6th Jan21 (settlement 7th Jan21) is furnished below for view and review / comments : –

Calls Side Figures

———————————————————————————–

OI Change in OI Volume bid quantity ask quantity

———————————————————————————-

2,078,175 311,025 42,009 4800 3000

===============================================

Puts Side Figures

————————————————————————————–

OI Change in OI Volume bid quantity ask quantity

—————————————————————————————

7,875 — 9 75 750

==================================================

Hi

Is there any changes from December 1st in equity trading?

I heard that, If I sell a CNC share from my Dp, can’t re-purchase the same shares same day. However I can buy another share as CNC or use the sale amount to do intraday in any other scrip.

Please clarify

In my windows tab, right mouse is not working within the chart to enable zoom in,zoom out,horizantal line etc.,

how to overcome this?

My primary account which used to be Vijayabank is merged with Bank of baroda and they have given us a new bank account and IFSC code. What should I do?

Sir

Last 4 years I am trading CNC with zerodha.I am adding funds through my IOB account.But 19/10/2020 I am send 18000rs but no idea where is that money and which time it will be credited.please respond

I am new to mutual funds and my doubt is regarding coin platform.(it might be stupid though)

1.Charges for using coin is 50RS /month Right. So from where will the money get deducted? From linked bank account or from the money available in the trading account? If second,what happens if there is not enough money in trading account?

2. Charges during mutual fund redemption is dp charges (~5RS)and 18%gst.does that mean my returns will be negative if the invested fund don’t give 18+. % return?

Thanks in advance for your time.

My zerodha account is in Vijaya bank now it is merged to bank of baroda so plz tell me wt should I do

There’s nothing you need to do.

Hi,

According to new rules can I buy option from the premium I get from selling option on same day (T day).

And can I use my profit that I got from selling holdings to buy other stocks on the same day (T day).

No, you cannot, Mohit.

hi,

i have a Doubt why this system is taking extra 2 tiks for Triggering price (Stoploss)

here is my Order details :

Time Type Instrument Product Qty. Avg. price Status

10:46:05 SELL SBIN NSE CO 1 / 1 184.10 / 184.20 trg. COMPLETE

10:45:16 BUY SBIN NSE CO 1 / 1 184.50 / 184.20 trg. COMPLETE

why this order covered extra 2 Tiks extra????

Hi, Can you make the preset quantity of 1 share ’selected’ as default when opening order placing window in kite. After the new update, we have to delete the 1 and type new quantity whereas previously we just had to type the quantity and the ’1’ would have been replaced. Sometimes I am placing 150 instead of 50 due to this.

sir, i have a question…… yesterday 31.08.2020 i earned rs.350 in sunpharma stock by buying…………… but today its not effecting in my mtm……….. why so ????? the rule has been changed from today…. right ????

Help me sir regarding below queries.

Suppose i have 50k in my account and i want to do iron condor strategy on weekly expiry (near call sell far call buy same with put). Then how can i do ???

Is it possible that i have to buy far CE & PE first

Then after sell near CE&PE. Will i get margin facilities for that move ?????

And u should do the multileg order facility as soon as possible.

Waiting for ur reply sir. Thank you

My one and only primary bank account with zerodha is Vijaya bank, now its merged with Bank of Baroda ….now my Vijaya bank account no, IFSC code, MICR are changed. In these circumstances can i add or withdraw funds to/from my Zerodha account…. if not what I have to do to make it changed…should i send any physical attachments….please inform me

hi , how i put banknifty various option strike price in single basket order in live market without auto triggering . i want make entry of that basket by manual order placing. By using sentinel , is it possible to place basket order manually in live trade?

Unable to create account on tradingqna. Surprising that there isn’t a login with kite option.

ZERODHA

PLEASE “ADJUST” THE “INCORRCT CHART REFRESH” & “INCORRECT HIGH & LOW OF A CANDLE” ON ”HEIKEN ASHI CHART” OF “KITE 3.0 WEB” …. ITS VERY DIFFICULT TO DO “FAST TRADING” ON IT

SPECIALLY FACING PROBLEMS ON “HEIKEN ASHI” CHARTS …. “PRICE TAG” IS ALSO “INCORRECT” ON “HEIKEN ASHI” CHART

“PLEASE SOLVE THESE 3 PROBLEMS”

Hello,

Please answer my below query:

Suppose on 28th July Tuesday, I buy a stock option OTM at 1rs premium 10 lots of say reliance 2400 CE and if it gives 10% move on next 2 days and i don’t square off my position on thursday expiry(monthly). What will happen ? Will It get the entire premium if I don’t square off by call buy position ?

Please help me to create these 4 below-mentioned strategies on Zerodha Streak.

Please add the details in your Streak and share screenshot of the strategy for better under standing.

THANK YOU SO VERY MUCH IN ADVANCE.

===========================================

HEIKIN ASHI::MIS(intraday):: 30MIN:: PRICE STOCKS- 4000-6000:: SL-0.3% and TGT-1%

Strategies 1. Buy when PSAR moves below from above of the candle.

Exit: Exit when PSAR moves high from below of the candle.

Strategies 2. Sell when PSAR moves high from the below of the candle.

Exit: Exit when PSAR moves below from the above of the candle.

Strategies 3. Buy when PSAR moves below from above of the candle.

Exit: Exit when PSAR moves high from below of the candle OR next candle is LOWER than the previous.

Strategies 4. Sell when PSAR moves high from the below of the candle.

Exit: Exit when PSAR moves below from the above of the candle OR next candle HIGHER than the previous.

im buy 4 lac worth share sbin and wanna sell ce far otm……..wil i’ll get some margin to sell – my capital will be 4 lac over all or do i have to pledge and sell option —— what zerodha offers the best in this.

2) suppose i pledge 4 lac shares and pledge – will i be able to do spreads with pledging margn as u dont allow buy in pledge – how does it work?

plz waiting for your reply

The charts are getting updated delayed.why chart view is getting slow after updation of web kite? It takes time to displayed. I am using broadband network so there is not network issue. try to fix the issue.Hoping for a positive response.

When these indicators will be available in trading view charts , pls do needfull

Dear Zerodha team

Kudos to your effort for new indicators like anchored vwap , pls inform how an indicator can have an overlay on another seems to be not working at the moment

hi

same naye wale features kya aap trainQ main be lane wale ho

ye bahot hi sahi features hai

hi

new update win 7 ke chrome ke upper nahi dikate

aap uske liye kuch karne wale hai kya ?

thank you

hi

comment karte hi aa gaya

thank u

🙂

sir, i have put gtt order for selling of iolcp, showing the order as triggered, but the sold amount is not reflecting in my dash board. again order is taking when i try to sell the same stock. i have the doubt whether my stock was sold or have to sell again. clarify the doubt.

Hey Lakshmi, it is possible that the GTT was triggered but the order wasn’t executed. Check your order book.

Hyy, Actually i am using zerodha from a long time its good. But now days many broker provide single margin system for equity and commodity so why zerodha is not providing .. And if zerodha is planning about that when can it will be possible… If zerodha will not give that facility i have to change the broker…

Hey Krishna, this is on our list of things to do.

i am new .

i need to know best tools for trading

eg: best screener etc

suggest me ASAP

Team Zerodha….

I am using Zerodha… need to clarify the below and sell my stock… Pls answer

i have some illiquid shares to Sell, when i make a sell, its states ” share can’t be sold bough today, intraday trades are not allowed” but its already in my Demat Accounts and 5 days over of purchase…

Team Zerodha….

I am using Zerodha… need to clarify the below and sell my stock… Pls answer

i have some illiquid shares, when i make a sell, its states ” share can’t be sold bough today, intraday trades are not allowed” but its already in my Demat Accounts and 5 days over of purchase…

i have some illiquid shares, when i make a sell, its states ” share can’t be sold bough today, intraday trades are not allowed” but its already in my Demat Accounts and 5 days over of purchase…

Dear sir

pls inform ichimoku indicator will give which signal ( is it a croosover of conversion line with base line ) whci can be further used with other indicator

as strategy creation sheet of streak ask for entry of ichimoku.

Regards

Hi – It looks like Zigzag indicator is based on Low of the day. Can we have option to get this based on closing price of the day?

Do I still have to use TPIN to sell stocks or kite PIN. There was a message saying there are some TPIN problems.

I have selected the following ETF to buy (hold / delivery position) from zerodha platform. The investment amount is 1,00,000/- (one lakh in one go). Take below as an example. Amounts taken to nearest round value for easy understanding.

niftybees @ rs. 100 @ 200 qty = 20,000/-

setfnif50 @ rs. 100 @ 200 qty = 20,000/-

setfnn50 @ rs. 250 @ 200 qty = 50,000/-

icicinifty @ rs. 100 @ 100 qty = 10,000/-

The biggest query is that VOLUME & VOLATILITY. I heard that apart from NIFTYBEES , other ETF are not- recommended by many analyst, youtube experts , as instantly 100 or 200 quantity buying/ selling couldn’t be possible in one go due to less interest / low demand / less traders on those. So it would not be possible to trade as short term and buy sell 100-200 quantities in one go. How far it is true / correct ?

(Note – I don’t want to treat ETFs as SIP or mutual fund as I have some different outlook on it , and I already have diversified SIP portfolios. This ETF investment I only want to take tension free gain. Once nifty become up , then take the profit by selling and buy on low again and go on , rather investing in stocks and watch , monitor )

So please advise , whether the above 4 ETF are ok to invest , or only at NIFTYBEES considering my above concept.

I was trading in zinc mini and each Rs 1 movement equal to Rs 1000 P/L.

Then zinc mini removed from zerodha….and I was trading in zinc and till the Rs 1 movement zinc equal to Rs 1000 P/L.

But today I trade on zinc …and now Rs1 movement equal to 5000 rs ..!!?? Why?

How can I Trade in zinc mini??

unable to modify or exit order

Has zerodha increased brokerage charges for intraday…Please explain..

The maximum brokerage per order is still Rs. 20, however, the minimum has been changed from 0.01% to 0.03%. Explained here.

Please explain how brokerage charges are deducted. Is it calculated on a daily basis or weekly basis. Today I find approximately Rs 100 deducted and i took one trade today.

How can we auto trade in Nifty Futures, based on Nifty 50 Index?

Normally, my strategy consists of zones at different price levels.

So, is there any way so that I would automatically enter the trade in nifty futures by entering the trigger price of Nifty index?

Similarly exit the trade when nifty index reaches particular price?

To be simple, I want to know whether there is any chance to enter & exit the Nifty Futures by using the Nifty 50

THis would amount to algo trading, which is not allowed for retail.

Today there is a difference of Rs. 0.70 between the chart prices and the prices on the watch list…Please explain why so? Anyways there is always a difference of Rs. 0.30 minimum between these two prices.

Explained here.

in zerodha margin calculator site, in USDINR MAY 2020 its given lot size -1000, nrml margin – 2271 , mis margin-1135

In Margin calculator option there, If I enter Rs1000 as cash available, its showing number of lots that can be bought is zero.

But, if I enter Rs 4000 as cash available its showing number of lots that can be bought is 1.

Does that mean I need a minimum of Rs4000 cash available to buy 1135 shares in MIS.?

Cant I enter this USDINR MAY 2020 trade with cash lesser than Rs4000 through MIS?

The SPAN calculator only shows you NRML margin. A percentage of this is required for MIS trades. Check out that percentage here.

Please explain how brokerage charges are calculated for intraday and cnc trades. I have gone through the brokerage charges calculator but I find that charges are being deducted even on days when I have not taken any trade.

When brackets and cover orders start again?

Please include alert facility of trading view in chart

I tried to find NIFTY 23rd APR 8900 PE under the watchlist section but it isn’t showing. I can’t add it.

It happened earlier too when I wanted some put option but wasn’t able to find it in the search section.

In the Trading View chart, when I pop out the chart that gets open in a new window that is expected behavior but whatever indicators I have set up in a normal window that gets lost in the popout window.

If you could fix this that would be very helpful.

Hi,

I plotted 50 days EMA on daily chart and when compress (more data points) or expand the chart (less data points), why does EMA line changes in value.

Example for Apollo Types when I have my chart from Sept 2019 to Apr 2020, the EMA 50 is above any price point but when my chart is from Jan-2019 till current date then the EMA is below the price point for the same period Sep-2019 to Apr-2020.

Since this is Average so it should not change and remain fixed at all times . Is this a bug?

This is because the EMS is only calculated with the candles visible on the chart, this isn’t a bug, this is how any charting platform works.

I want to understand the meaning of these two terms and how to apply them in zerodha

SELL ABC BELOW 181

SL 184

TGT 178-175

BUY XYZ ABOVE 32

SL 28

TGT 38-43

faiz Siddiqui

Wed, Mar 25, 11:23 AM (12 hours ago)

to support

Dear SIR/Mam

Just wanted to know, how is it that my Yes Bank shares -1380 inquantity that I had purchased on Tuesday March 24 2020 for Rs 49983 with Rs 36.22 as average cost on Wednesday March 25 showing Rs 40368 as total investment done by me with average price reducing to 29.25……….Please revert and do the needful…………thanks…….

Hey Faiz,

The average price we show is always the average of your total holdings. Your YESBANK holding average is calculated including the locked-in shares in your account.

hii… zerodha , why are you increasing the rates of call and trade , you are already taken a large amount of amc charge comparion to other brokers near 386 with GST and other brokers take only 150₹ and your team increase the unnecessary charges it’s is the moto only how to pull out the money from customer pocket . if i paid to u 50₹ and 386₹ for amc then it is so better i opened a new account our nearest house broker

I bought yes bank shares on Friday the 13th and still I don’t see them in my demat and thus not able to sell even 25%

May I know when will it be done ?

tomorrow margin will be same as on 17 th march or there will be an increase

my zerodha account was blocked please help.

i can’t trade but i was add mzy money on my account.

solve my problem immediately.

What is the error you see while trying to login? Have you tried to reset your password using the forgot password option?

Sir Iam online account open form fill-up 3 day ago but still now account not open and no reply my mail please solve it

Name _ bittu dey

Mob ,9851194316

Hi Bittu, extremely sorry about that. We’re seeing a lot of applications due to which the standard wait time of 24 hours is longer now. We’ll process your application and email you the account details as soon as possible.

sir mene dmart ka share kharida CNC me or aaj hi square off krna chahta hu position ko. lekin order daalne par bta rha hai ki aapke pas pahle se holding nhi hai. ab me kya karu. muze soda aaj hi katna hai. delivery le kar nhi jani hai

You can go to open positions and exit the position in such cases.

I had some shares of visesh infotechnics. I have not sold it. But now it is missing from my account. And I can’t even look it up on the watch list in kite. It was a near zero stock. Please let me know what happened…

Hey Jerin, the company is suspended from trading due to compliance reasons.

How to sell the share then?

Hi All,

I have seen today (9-Mar-20) that in MCX there is no chance of buying MIS/CO/BO, my simple query is does a pond,lake,sea,ocean etc etc meant only for big fish ? Do small fish like us don’t have any scope of surviving in such critical cases where we can able to earn based on our luck,study,analysis etc etc…each time when there is a huge volatality this stops working and won’t allow us to place the orders… seriously you guys are providing good stuff.but let small fish like us also survive by not blocking such orders during volatality time. Hope you can understand and support us

Even option also didn’t allowed to place

Hey Chaithanya, you could still trade on MCX with full margins. On volatile days, the risk associated with offering margins is significantly higher than normal for us, hence the block. For instance, if we allowed a customer to take an MIS position in Crude Oil on Monday, the client may end up losing a lot more money than what is available in the account and we would have to still pay that to the exchange from our pockets.

i got levarage problem in gold…i can’t buy gold in mis order under 1 lakh…what is matter sir ?

i want to answer fast ?

Dear sir

Mujhe order place main problam aarhi hai

Sir maine 240rs pr share buy kiya n main un share ko 245 pr sell krna ke liye limit order place kiya but sir us time pr share 241 ki price par tha tho sir wo sare share 241 pr excute ho gye

Sir aese kis karn ho rha hai

Jabki maine limit lga rakhi thi

That’s not possible. Best create a ticket on our Support Portal with the order details and someone will check and get back to you.

i did’t get my zarodha user id contect : 9205529882

i did’t get my user name of my zarodha id

complain about miscalculation in equity fund.

Best create a ticket on our Support Portal.

Dear Sir

My name is Mahesh Mulik and Clint ID QT0810. Last two days in intraday facing with Leverage problem. When Start the Intraday in MIS showing the Intraday square off with extra leverage. I can not do intraday with bracket order. Please solve the problem or will see another option.

Thanks

Mahesh Mulik

I HAVE TO APPLY ON IPO OF SBI CARD MY LINK ACCOUNT WITH ZERODHA IS OVERDRAFT ACCOUNT

CAN I APPLY THROUGH MY OVERDRAFT AC LINKED ZERODHA DEMATE ACCOUNT

Sir mujhe account change karane k liye kya kya Dena hoga

What account do you want to change?

Hi sir SEBI Is going to reducing margins in near future they Will reduce margins for all strategies like Collar, calendar , covered call or only will reduce for limited strategies

The margin requirements will be based on the risk for all positions combined. In fact, this is how it has always been, only margin benefits will increase.

Hi,

Why there is a restriction of 20,000 share per order in Zerodha? Is there a way in Kite to place single order for than 20k shares especially for low price shares?

Hey Tulsi, this restriction is part of our risk-management policy. You will have to place multiple separate orders. We are working on making basket orders available on Kite where you can place multiple orders of 20k stocks in a single basket.

Thanks Matti. I have been placing multiple orders of 20k shares but loosing lot of time at important time and ended up loosing the golden opportunities because of this.

When is the basket orders option expected to be available?

Hey Tulsi, while we are currently working on the baskets feature, I wouldn’t be able to give you a timeline at this time.

Ok 🙁

Please provide open interest chart or table, top gainer looser on both equity and derivatives on mobile platform so we can easily analyze stocks and trade

Please provide option chain analysis on mobile platform

Hey Saurabh, option chain is available on the latest version of the Kite mobile app. Please check.

hii, i am a currency trader and not understand that currency turnover is grater than nifty turnover but there is less talking or news on Currency target, which global/indian news affect usdinr, gbpinr and how much affect means how much fluctuation . so sir please lell how can anyone guess GBPINR, USDINR Trend. now i am thinking BREXIT affect on USDINR, GBPINR. any website any website provides such information? please tell somthing.

Hey. Check out this module on Varsity.

I am a professional worker. so if you provide the option to see stock price in the mobile widget so we could monitor our stock price continuously. Otherwise every time we need to login and check. so if it is a kind of desktop screen widget like crick score. we could check out stock price frequently in desktop as like clock

Will look into the possibility.

I am trying to place an order for Jan Call option but the expiry date showing 20th Jan instead of 30 Jan which is last Thursday of the Jan month

20Jan refers to the year. This will be changed to just Jan on Jan 1st.

I have placed sell order in MUL and 7NR but it is not being executed

Please help

What is the error message you see when the order is placed?

how short in cnc trade

Hi Nitesh, you cannot short a stock overnight. Consider shorting the future, call option, or buying puts.

I just want to know , I have Mauriya udyog share is it possible to transfer the shares to yours and sell it

How to add column Chng in OI in PI?

Hi Nitin,

I am using Google Chrome/Firefox web browser to open zerodha kite on my laptop. In order to add fund I am clicking on the option ”Add Funds” but a blank window is opening again and again. What may be the possible reason?

Thank you.

Hi Nishant, this should be fixed now.

I have 460 CE sun pharma, if ITM tomorrow , should I sell it physically or else the system will square off? I got a message saying I should do physical delivery . But I don’t have enough margin which is going to get blocked when I sell when it’s in ITM. Can someone help? I wanted to hold it till 3Pm tommorow .Does it square off automatically and will i get prfoits?

How to know if my account is in debit balance in zerodha. I want to know this so as to avoid interest 0.05% per day fees.

1. The funds page in Kite has an Available Cash field which shows the balance in your account excluding the collateral component. In case this is in debit balance, you will be charged interest on the debit balance.

2. You can also refer to the daily margin statement you receive on every traded day. If the total funds value is less than 50% of the total margin requirement, you will be charged interest on the shortfall.

Hi Nitin,

It has been ages we are waiting for MCX bracket order and single margin account. Can you guys speed this up.

Regards

Hi how to write a call option in zeroda

Simply place a sell order for the contract you want to write on Kite.

I want to ask is commodity form will be accepted if it will be black and white

Hi,

I have a question on the HDFC screenshots given for 20 depth

In the given example of HDFC Market Depth, total buyers 269,171 and total sellers 948103.

However, the 20 depth shows around 6000 buyers and 10,000 sellers. There is a huge difference compared to the total. It means the 20 depth shows only 2% of volume.

Where are the other bids and what could be the motivation for keeping the prices for those bids below/beyond the current prices?

Can there be any fraudulent interests for placing such bids at far prices? If yes, what could they be?

Why someone has a bid or ask at a given price is very subjective. The 20 depth, however, gives you an idea of what most likely to be traded. Explained in more detail here.

On 23 October 2019 I have purchased 20 shares of Yes bank for Rs 51.60 in CNC, and on 24 October 2019 again I purchased 220 shares of Yes bank for Rs 48.50 in CNC. Now it’s showing only 220 shares in my holdings with an average of 48.78. why it’s not showing the remaining 20 shares in the holding?

Can anyone please help me.

Zerodha platform is a most powerful to all are improve in the life saving and economy the will improve

how can i download chart bank nifty future or any other equity.. with indicator that i have already applied..with differnt time frame…. there i can use my strategy and can change it with back testing.

please suggest me if any thing available like this.

How to add or change bank account in zerodha

Hey there, just a small query. I was trying to find BANK NIFTY 3rd Oct 29900 PE & CE. But on search i only found BANK NIFTY OCT 29900 PE & CE expiring on 10th Oct, 2019. Why is that most of the call and put options of BANK NIFTY with specific expiry date could not be found and why is that customers/ traders are made to trade in a given option chain and not the one in which they wish too. kindly reply.

*** Correction: expiring on 10th Oct, 2019 be read as 19th Oct, 2019

HDFC bank split 4 days ago but but my stocks not get doubled, what is the reason?

The stocks were credited to your demat account on Saturday. Since Saturday was a holiday, you wouldn’t have seen them on Kite today. You’ll see them tomorrow, though.

I had 3 hdfc bank shares in my kite app in past. But after 1:2 split it still showing only 3 shares at half price however it should be 6 hdfc bank shares at half price. Why changes are not reflecting with 6 shares.

The split shares were credited to your demat account on Saturday. These will be visible on the platform from tomorrow.

I was trying to find NIFTY 26TH SEP 11200CE option in Zerodha Kite web for last 3 days but i was unable to find any call/put options for 26th September ( even 31st October and 28th November call/put options are also not showing in Zerodha Kite web ) and because of that i had to buy call options of 3rd October paying double price ( compared to 26th September call options ) on 20/9/2019 and because of that my profit was half. It was a once in decade chance and i did not make most out of it because of not finding 26th September option. I am a new trader. So please help me to find the missing call/put options

26th September being the monthly expiry, it’s the same contract as the monthly contract. Search for Nifty SEP 11200CE.

Hi,

I am unable to find jan option for Nationalum

Kindly help

withdraw money not received

Client ID: YE1364

I am Withdraw on 13/9/2019 Friday

How to place nifty option order on 11000 strike price

In Pi, MCX expired contracts are still a part of the watchlist drop down menu. It is creating a lot of confusion.

Kindly rectify

I forgot the user id

Plz help me

I want to create in zerodha coin account but its says the email and mob no and pan card already registered…..

Are sir me share kharid nhi pa rha hu error show ho rha …16388 krke kuchh aata h mujhe invest krna h lekin har baar yahi aata h 16388 error kya me jaanta hu ki ye sb kya…aur kyu ho rha h…..aur aap logo ka no. Bhi nhi lgta

This is probably due to the fact that you were placing IOC orders that were cancelled because they remained unmatched.

How much exposure do ul provide in margin trading

By mistake nithin sir

I have account in Zerodha my id is ZE1923 my quistain to Nitin sir is why Zeroda do not provide free mt4 chart? its global famous chart and user friendly people all over the world use mt4 chart and thair broker give it free of cost but in india Zerodha is leading best broker whan we will get free mt4 chart in Zerodha ?

Since we have our own charts on Kite, offering a third-party solution is not something we’re looking at.

Sir

i am government employee.

My net income through employment for the year 2018 – 19 is 9 lakh rupees.

i am also trader cum investor in Zaroda.

My short term capital gain for the year 2018 – 19 is 1.25 lakh rupees.

My long term capital gain for the year 2018 – 19 is 1 lakh rupees.

i don’t have any other income.

which ITR i should use for e-filing.

Best check out the taxation module on Varsity.

Sir

is the time schedule has been announced for the buy back of S H Kelkar (539450).

what is the last date to participate in it.

No, the schedule of activities isn’t announced yet.

Suppose I have a long position in a stock by bracket order.

If i place a counter bracket order

Will it exit the long position or average it

Or it will create a new short position in the same stock

How can i participate in the buyback of S H KELKAR AND COMPANY LIMITED.

i am having shares in zaroda

Hey Surya, the buyback order window will be opened in Console at the start of the tender period. You can go through this support article to know how to place the order on Console.

why Zerodha is not allowing to trade in banknifty june expiry 31000 CE (when spot price is near 30400) saying to choose the closer spot price? As closer strike price premium is too high required more capital. Dont understand the policy of zerodha. Please explain.

This is explained here. Trading members have OI restriction set by the exchange that forces us to do this.

Hi all,

Any one can help me in clearing ESOP doubt regarding taxation,

regarding ESOP of Federal Bank,

I m working in federal bank, m eligible for 4500 equity shares of different rates like 28/-,42,52,62/- etc for last different years,

I m in tax bracket of 5-10 lakhs, want to know the tax aspects of this transaction if I execute sell all shares next month, some body from bank says bank deducts TDS of 30.9% as perquisites tax on profits earned from this transaction and if I sell immediately with in an year short term capital gains of 15%**,and if m holding it more than one year there is no tax if the gain is below 1 lakhs..

I m not purchased it still.. plan to purchase(exercise the option) in next montg

when the option exercised,(exercised price- allotted price), and this difference amount is treated as salary and add to my total income and claim the refund from income tax if I m eligible in lowest slab..,

Is it like that? Or plz rectify if m wrong..

The difference between the strike price to market price on the day it got allotted is considered as income/salary. You have to pay as per tax slabs. From that price to when you sell, it will be considered as a capital gain.

Dear sir/mam

Why BO order is not active in commodity segment.zerodha should active this because we are small traders we do sycling for 10 20 points many broker provide BO in commodity like upstox but I trust only on zerodha

I never used call trade option till from last one year

but you are deducting amount for call n trade charges

kindly check in this issue

You’ll have left intraday positions open that were closed by a dealer at Zerodha. The charge is explained here.

thanks for the information and posts

Hi,

I’m a sub broker with zerodha!

How do I withdraw funds from zlm?

Thanks

Kya zerodha form ko hum dono side print kar sakte hai.

Yes.

Dear sir,

Few days before i have bought 50 shares of Generic Pharmasec ltd. Now today share has split by face value from Rs. 10 to Rs. 1. But in my holdings this share is suddenly disappeared. What to do?

Can we see our portfolio holdings with market capitalization? i.e Whether the stock falls in the Large cap, Mid cap, or Small cap? As it will help in maintaining portfolio health.

Hey Ranveer,

This is available on the Smallcase fundamentals tool on Kite. Click on the more option on any of the scrips in your holdings or marketwatch to find the fundamentals option.

Can I buy and sell stocks on the same day using CNC order type? Is there any risk involved? Will I be prone to any kind of penalty?

You can, indeed, use CNC for buying and selling on the same day. No CNC specific risk or penalty as such.

removing the MTM option from snapquote is wrong decision in PI. Its basic requirement for intraday. there is no breakdown of PROFIT OR LOSS if trade on multiple stocks IN PI. instead improving and adding new features, removed the existing features not a good idea. I hope its restore ASAP.

If I sell 100 shares bought in CNC on the same day. Will it affect my holding date of same shares (already have)? Is FIFO rule applicable?

Please clarify..

Can I send my POA after 1 month for account opening.

Today i was trading Bank nifty 27100CE, of expiry this week. To my biggest disappointment my stop loss was hit at 12.19.22 by around 20 paisa difference, that time frame candle was no where near my stoploss.

(my stop loss was Rs. 69.05// that candle which took my stoploss is 12.19 pm// that candle low was Rs.69.25.)

I have the proof in JPEG format.

Can Zerodha team explain?

Explained here.

Not all trades executed on the exchange are captured in the charts as we get limited ticks from the exchange. Read this post for more information.

You can also verify your trades on NSE.

closing time of currency trading F&O can be extended to 4.50pm

Nithin Kamathji,

What a wonderful platform created by Zerodha.

Can’t you solve single most important (and must be the easiest to solve) problem. i.e ”View Saving”

(It takes all the efforts in the world to save simply a chart setting!)

Names can not be renamed, & worst is, sometimes all views gets deleted automatically (happened with me, feels very bad).

What’s wrong with all your technical team that didn’t solve this problem yet.

-Sorry but ”saving settings” is the first and foremost thing you must think to solve now,

I just feel like leaving Zerodha for such a small reason. (but it’s not small it’s a huge problem, facing since beginning).

Please answer me what’s the problem and exactly when will it get solved ?

Hi,

I use VWAP ( Volume weighted average price) indicator with 1Minute time frame to analyze the market trend.

Issues:

1. There is VWAP indicator inZerodha Kite, but candles will repaint/skip data on chart… So i need to refresh chart frequently, then take decision to enter trade(place orders). Hence there is delay

2. So Please suggest me which PAID DATA FEED (For Amibroker) i should subscribe to over come this problem.

Note: I have VWAP indicator with amibroker

3. Do we need Level-3 or tick by Tick data to calculate VWAP ? OR Level-1/Level-2 data is sufficient? from Data provider

Thanks in advance

You’ll see ”Avg. Price” in the market depth. That is essentially the VWAP that is streamed by the exchange. You can use this value. It’s real-time and independent of charts.

I want to place buy/sell order in 3 different peoples trading account with same parameters. Is it possible?

My purpose is I want to manage their portfolio’s.

Dear Sir/madam , can i buy 5 lakh shares (MIS trade) of a liquid stock at Rs 100 through market order?

Yes, but 5 Lakhs shares will still be a significant quantity and your order will get executed beyond the 5 step market depth increasing your impact cost.

Its recommended you place a limit order with the maximum price at which you want to buy(can be higher than the LTP).

Faisal sir, So you are saying that only one lakh shares will be placed at a time through market order🤔

I did not say that. What I’m trying to say is there might not necessarily be enough liquidity in the 5 market depth that you see on Kite. It is best you look at the market depth and figure at what price your full 5 lakh quantity will get filled at. Read the bid and ask price section of this chapter in Varsity to understand this better.

Thnku faisal sir

Hi,

I am currently running an options strategy. Are there any API’S that will help in automating it where I can slice my orders, automatically choose the best bid and ask?Because there is a lot of slippage when I am hitting my orders on NEST.

Nishant, we do expose APIs to link your trading account. However, you will not be able to fully automate your trades due to restrictions from the exchange(You need to get your algorithm approved from the exchange if you want to automate).

Do check out the Kite Connect Documentation and Developer Forum if you have any further queries

Sir,Please tell me

What’s the monthly or yearly charges of CDSL demat account.i have only EQ. Account and my second question -What zerodha will charge for maintaining my account?

Hey Mayank, we charge Rs. 300 + GST as demat AMC. There are no maintenance charges for the Zerodha trading account.

Sir/madam , can i buy 5 lakh shares (MIS trade) of a liquid stock at Rs 100 through market order?

Is there a way i can carry forward Orders in zerodha for next days.

Basically, i just want to put a order , say good for 30days/60days for equity. I do not want to check the stock price everyday, and have definite limits. whenever it crosses the limit i want to bull/sell.

Hey Ramprasad, long-standing orders are on our list of things to do. For now, however, you can set alerts on Sentinel for your price condition and place a basket order for all stocks. Explained here.

dear sir/madam,

I want to trading in cross currency and on feb 2018 sebi given permission to trade in cross currency also. But zerodha almost 10 months over not yet updated cross currency trading in their plateform. So I want to know how much time spent to update cross currency in zerodha.

thanks

rohit

Dear, Nitin Kamath

Your zerodha brokerage firm is largest brokerage firm in India it is good now but I want to give a suggestion you do something for the new agers students I think many students who came here and open a account and trade but these students are newly in this market and I saw many student who wants earning from this market for our tuitions fee clg fee etc. They have much burden on his soldiers like 18+ age students .

And after this age his pocket income is closes by his parents .My moto is only that please give some relaxation in the brokerage in commodity and equity like you give 70- 100 trades free in every month bcz these students are less risky game changers and he want to only achieve 0.10-0.15 paise trgt in commodity but brokerage is so high and he wait for 0.40 trgt and after he doesn’t achieve trgt and is getting a loss .

In end of only in please give some trades free of cost give only students who filled student profile in account opening time

Your one step in good side taking low brokerage for low brokerage

Thank you.

LTP Percentage for buy orders is not good..

Zerodha should remove that LTP percentage and needs to give freedom to customer to chose their own put or call option in bank nifty.

Otherwise it’s a black mark for zerodha.

sir , i have written pe 9500 nifty dec and 9300 pe both one lot yesterday , sir volume in both the option is meager today , do i need to worry up that how i will square off till expiry .

Sir at 9:15 how many shares can i buy of a stock with 14 times leverage?

Hey Amit,

You can find this out in the margin calculator – https://zerodha.com/margin-calculator/Equity/

Sir i am trying to ask that is there any limit on(buy/sell) no. Of shares of a particular stock by mis trade?

Amit, there are no such limits placed by us as long as you are able to provide the required margin required for the MIS position.

Will zerodha change my email id in exchanges and the depository or I have to change my email in exchanges and the depository.

Hey Mayank,

If you change your email id & phone no. on our records, we will get it changed in the exchange and depositories accordingly. The procedure to do so is explained here – https://support.zerodha.com/category/your-zerodha-account/login-credentials/q-login/articles/how-do-i-change-my-registered-mobile-number-and-email-id

Sir,i have lost my gmail account and couldn’t able to recover my GMAIL ID.please tell if I change my gmail id in zerodha account.Zerodha will charge 50 rupees.

Second question is-

How can I get email or update from Depository Participant(DP) account.if I change email id .

Yes, there will be a charge of Rs 50 per email change request. This is because the email ID has to the updated with the exchanges and the depository.

Yes, your email ID with the depository will also be updated.

Hey Mayank,

Yes, the charge for change in registered email or mobile no is Rs 50. This charge is because we also update the same in the Exchange and depository records.

Today when I logged in my Zerodha account in the early morning I hav observed very huge figures of Trade and profit without any relevance to my trading activities.This happens only during early hours and that creates anxiety and suspicions on the figures . Please clarify why it is happening and why the bug is not being fixed.

Another issue is with the Trading account where I am not able to find the product of my daily trade instead only quantity and price is given and I am not able to tally with the exchange figures reported at the end of the day.Kindly clarify..

I have opened an account in Zerodha on my wife’s name, but it got rejected and as per them it’s because the bank statement I submitted is not bank statement but OD…I have no clue what they are talking about. I downloaded the bank statement from SBI net banking…Can anyone explain me what does it mean? No one in Zerodha can clearly explain the reason….Very upset because of lack of communication from Zerodha…!

I have ABC company shares ( CNC) at price 30. Buying price is 25. I want to hold these shares. But want to work with stop loss. How to apply. Which is helpful for me. SL/ SLM/ BO/CO ???? Please reply

You can use SL/SLM orders as stoploss.

Do we have Demand Index indicator in the Kite?

Any comment?

Hi Team,

Is it possible for me to initiate trade (Bracket order with same Target, SL & Trailing SL) on regular time intervals… Say every 30 Mins

Hi, It’s been a week that I have opened the zerodha account, but when I try to login to ”Q back office login ”, it displays a message ”User not synced, wait for 24hours if you are new user”. Everyday I try to login but I get this message everyday and it’s been more than 5 days already. What do I do?

While using Stochastic RSI (or any other indicator for that matter), during trading, I just found that the data and trend shown, varies from other websites such as investor.com or chartink.com…please reply…data shown on kite are reliable ?

Hi Zerodha team,

1) How can I assign individual keys for market price, limit order and SL as changing parameter I find to time consuming and not handy.

2) How can I cancel all the other pending orders by single click?

Dear Mr. Nothinji,

i ma struggling to connect Kite with python. below message is coming.

could you please help me on this?

kite connect’ object has no attribute ’request_access_token’

Best regards

Khalid

Best post on the Kite Connect developer forum.

What is RMS:Rule: options strike price based on LTP % for the buy orders of entity account holder . . . For across exchange, across segment/across product . .

Status rejected

Hey Umesh, this has been explained here.

Thanks

If I have placed a buy Cover Order of 100 shares, and I want to sell 50 of them at a certain point, how would I do that? Because placing a sell order would initiate a new position.

Hi,

Need to understand how can we trade ETF, is it like stocks we trade in cash market???.(delivery & intraday)

What will be brokrage/charges for that.

Pls reply..

You can buy/sell ETFs just like stocks from the cash market.

While STT is lower for ETFs at 0.01%, all other charges are same as equities

One of the stupid and pathetic service providers, I have seen.

The helpline is not attentive. I had lock complain above 1 week ago and the ticket is not resolved yet. It’s related to the fund transfer and I am not able to use my amount. Even the support guys not responding on the created ticket after giving transfer details.

Shweta, I believe your issue concerning fund transfer was fixed on the same day.

Few banks(like yours) do not provide us the necessary details to credit the funds to your trading account, hence, we require you to update the details in the backoffice

if i sell ITM put or call and remains ITM till expiry then what will be stt rate and exchange transaction rate ?

You will STT when you sell(0.05% of the premium) and there is no STT charged on expiry as you are an option writer. ETT will apply as mentioned in the charges list: zerodha.com/charges

Sir,

When Bracket order option will start in Commodity..

This facility stared in other service provided but why not in Zerotha.

Pls start Bracket order option in MCX..

We are internally testing this. We plan to launch this soon

how to add basing(boring) candles in chart, is zerodha supports basing candle ?

Saravanan, this is not possible on Kite

I have submitted hard copy of Primary bank account change form 2 times also cancelled cheque to zerodha support for Changing Primary Bank account but no action is taken yet…

Can I know how much time will it require to complete the process.

when u will be introducing BO in commodity section..waiting for BO in commodity section eagerly..Zerodha team …please introduce it asap..

Rajeev, there have been a few delays concerning this.

We will be implementing it soon.

I buy a stock for intraday and I sell the stock before 3:20.but call and trade charges are applicable in my account why

Was this order placed using our Call and Trade desk?

Otherwise, please contact our Support desk.

How to check daily LTP percentage for option treding . ?? Becouse every time the order is rejected for reasone of ltp percentage ..

The allowed strikes are mentioned here, Bhargav.

Hi nithin sir I just want to that ”W.e.f 25th April 2018, we have discontinued the referral bonus of giving out a percentage share of brokerage. However, we’ll clear the payout which is due already and stop further payments. ”. It’ s open now or close . You not give commission refferral someone?

Hey Shubhankar, no brokerage sharing is done post April 25th 2018.

Is zerodha providing cdsl easiest feature to its customers if yes then how to proceed for easiest registration.If i register for it then how will i sell my holdings in market.On cdsl website i read that cdsl easiest has two account type a.trusted account and b.account of choice so if one registers for easiest then should he give zerodha pool account in trusted account.please clarify this

Hi.. I want to know about weekly bank nifty expiry… if the expiry is weekly why all the out of money options do not have the worthless prices each thursday….

I am unable to buy options, some error message that ” Market wide position …crossed…

I am can’t trade in radico

No issues with trading Radico on Kite. Can you contact Support? Might be an account specific issue

I holding 30 reliance share in cnc. today I sell these share these are seen in position and the quantity is -30 . Plz reply

Hi Shubhankar, this has been explained here. Nothing to worry about. This is normal behaviour.

worst expirence ever . whatever price i give stock comes to @ the market price . i have recorded the trade. no matter what price i put stock comes to me at market price .eq i quoted adaniports s@ 394.95 stock was immidiately purchased @ market price which was 396.25. i mean why was the order executed.it is happening since 2 days.i have recorded this trade..

This would only happen if there’s a better price available in the market than your quote. To place buy orders at higher prices/sell orders at lower prices, you’d need to use SL/SLM orders.

Hello Sir,

I’m a regular trader in Zerodha.

I’m doing lot of technical analysis to come up with a strategy of my own.

Please help me with the formula of how the time based renko chart is calculated in kite.

It is different from the conventional non time base renko chart calculation.

I tried a lot to understand, but my calculation is not matching with the kite tool.

Thanks in advance.

Regards

Manjunath

Hi Manjunath, there is no concept of time when you talk about Renko charts.

Hello Sir,

In kite, Renko chart for different time frames looks different for the same brick size.

You can check for nifty in the kite platform, you will see the difference for different time frames.

The original form of Renko chart will not depend upon time, but here in ’kite’ their is relation ship established with time as well.

Please help me understand the relationship & also the formula behind it.

Regards

Manjunath

Can you Please reply to my question..?

Hi, I have to fill the return. I am a private employee and I do trading in both stocks and options. Help me to tell the section on short-term profit/loss section and options section in return form. Thank you.

Hi sir, I buy reliance share on Friday ( 27/7/2018) on CNC. Yesterday (31/7/2018) it shows t1 holding. Today’s (1/8/2018) not showing anything ( t1 or t2) . What’s happened? And these share are credit my demat ac. Or not? Plz reply

Hey Shubhankar, you should be able to see the stocks purchased in your holdings. Can you log out, log in and check?

Hi matti, I log out and then log in. I see stock in holding but there not showing (t1 or t2 ) . I don’t understand the stock in demat ac or not? I fear that if I sell the share than it go auction. Plz explain

Please clarify your Call and Trade charges. I think there is no system at all. As far as know you declared that Rs.20 extra for the same. But have debited haphazardly for call and trade charges.

For example.. today there was 600 qty PCJewllers shorted in just a Single trade which undergoes call and trade. But zerodha charges Rs 354 for the same.

Hey Bidhan, best get in touch with our support desk on 080-40402020 for account specific details. Alternatively, you can raise a ticket on the Support Portal.

and suddnly come to 18.7 again

Hey Rajnish, this could happen for any number of reasons. This basically means that a trade happened at that price at the exchange.

dear sir today24 july 18, gmr infra traded at 18.7 and suddnly make a high of 19.5 how it is possible. explain.

per new BO (bracket order)…why does Zerodha does not allow to change SL price.

Hey Rajnish, the stoploss order was changed from SLM to SL as a market protection measure. To improve chances of execution, we don’t allow changing of the price field.

Sir, I have a account with zerodha having user id DA3222. My annual Tax PnL Report is not showing transactions concerning my mutual funds investment. I checked everywhere, from back-office to coin platform but no use. I called zerodha support 4-5 times, they told to call back me but they didn’t. Where should i check that?? Pls help immediately I have to file income return.

Hello Sir,

I’m a regular trader in Zerodha.

I’m a salaried employee in a software company & I also trade in Nifty options, either Intraday/Very short term of 1 week maximum.

I have a loss which I would like to carry forward to offset it for the profit which I may make in next few years.

How do I show it to Income tax dept, while filing IT returns, Please help me.

Regards

Manjunath

Best check out the taxation module on Varsity.

i have canara bank ac. I see that zerodha allowed 21 bank. there canara bank was not list . so i open demat ac through canara bank? plz suggest.

sir i open zerodha demat account tow weeks befor but till the account does not activeted ,

your represent yemuna she does not answer properly and she does not take my phone calls . please return my admission mony or give an account .

immidiatly call to me in tamil.

my account cell number-7092378293

please riplay i am witing for your call meny days i take leave my work for this process please riplay to me

I tried to short BANKNIFTY Options, but my orders were rejected and the reason being the following:

RMS:Rule: Option Strike price based on Ltp percentage for entity account-DK2822 across exchange across segment across product

Can you please explain what this means and why order is rejected?

dear sir i am fan of zerodha i want to know in pre market session what is meaning of -0.1 in both side bid and ask total qty, total order, can take any idea about today more buy or sell.

This is the data we receive from the exchange.

Thanks Matti!

simply you means that one should buy stock before ex date and hold it utpto the ex date? what if i sell before ex date which i purchased one month earlier?

Apart from this, the respond could have contain two or three scenerios which could happen regarding dividend’s ex date purchasing or selling the stocks.

Hi Nitin,

We appreciate your efforts making trading seamless for normal/small trader.

since it seems that you are going to sunset your support by email and starting some kind of automated/AI processes to answer queries on tickets. It is well deserved step but i guess you need to have some physical person for support that can be straighforword to the user’s questions. Your AI doesn’t look like that much smarter yet. so kindly facilitate us needed support.

yesterday i created ticket #201807033994412 and i am not okay with your automated reply.

here is my query:

i bought shares on 2nd july

companies ed-date was 3rd july and record date is 5th july. payment date is 1st august.

if i sell shares on 4th july will i get dividend(ignore short delivery case)? or else what will happen if i sell on 5th july?

please guide ASAP

Hey Yash, you’ll receive the dividend even after selling if you held the stock on the ex-date. In this case, since you’ve bought before ex-date, you’ll receive the dividend.

Also, regarding the support, whenever you create a ticket, it is always assigned to a real person. 🙂 The idea is that most queries are generic and are answered on the portal. If you still have questions, you can raise a ticket and an agent will answer. Now that you know the answer, we’d appreciate it if you could respond to your ticket with feedback as to how it could have been answered better. 🙂

Hey matti,

Please have a look into assigned ticket #201807033994412. We search for answers on portal first if found unsatisfactory then we will create ticket or query. And as you say that ticket is assigned to a pysical person then are they responding without reviewing the question and respond with what category fits the question’s headlines like a google search.

Also we can find answers on open forum but that are not trustworthy at all.

”The more active and satisfactory your tech support team the better convenient your client will feel and being loyal to you” this is the main thing we focus in IT industries and results are well known for everyone.

If you are looking for good tech support then hire me and i’ll handle for all best assistance and can handle team as well. I am having suffice experience.

Thanks

dear sir i am fan of zerodha i want to know in pre market session what is meaning of -0.1 in both side bid and ask total qty total order can take any idea about today more people intrested in buy or sell.

Hi Nithin,

Its regarding ticket number : 20180626806288. i had invested Rs 16000 to Hdfc balanced fund through Coin.

However which has been changed to HDFC Hybrid Equity Fund from june 1st. but , as per your team they are saying they have moved all invested amount from hdfc balanced fund to hdfc hybrid equity fund with amount of. Rs 15,674.27.

but i have invested amount of rs 16000 in Hdfc balance fund. Luckily i have screen shot proof of amount invested, which i have sent to your team as well.

If i didn’t had any screen shot . it will be loss for me right. ? like this ,its happening many times in zerodha. could you please do look at this.

as Its an trust of zerodh a,where we are investing our money .Please do needful.

thanks,

Ajay Patil

hi there..

I purchased stock from kite on 14th & 15th June 2018 , as i didn’t submitted my POA i am aware that i can only check my holdings in Q backoffice and it the same stock has been shown in holdings till 18th but as on 19th i can only see the stock i purchased on 15th and i don’t see anything about stock i purchased on 14th and have same with equity and cash balance the amount value reflecting is also not inclusive of stocks purchased on 14th.

could you please explain what happened to my amount or the stocks i purchased on 14th.

Hey Moulika, can you please create a ticket here.

i wanted to know how to connect to amibroker from pi bridge , i am not getting pi bridge option in pi software , and also where can i get pi bridge extension

Hey Kiran, you can. Check this post for more.

G.Ravikumar says:

June 11, 2018 at 12:22 pm

Dear Sir..

I am in bahrain. I wanted to do trading here. what are the possibility ways to transfer funds

to my account. I forgot my Online Account userid and Password. Is there any possibility or no…….

plz reply me as soon as possible….

Dear Sir..