Introducing Portfolio Analytics

While all of us wish that all the stocks we hold go up, it seldom works out that way. There will always be asset classes, sectors, and stocks which underperform your expectations. The “putting all your eggs in one basket” risk with the hope of getting lucky is something all investors need to avoid to increase the odds of succeeding in the long run. Diversification is a technique that reduces this risk by allocating your investment to various assets, sectors, and stocks while also increasing the chances of reaching long term financial goals.

All of us are also influenced by our cognitive biases which lead to concentrated portfolios. The biggest one being the disposition effect — selling investments that have gained in value while holding on to, or even adding more, to the losers.

As Zerodha, we have focused primarily on building platforms, tools and utilities to help you execute a trade as efficiently as possible, or teach you how to trade on Varsity until now. We understand that this isn’t enough; most of our clients don’t have a background in finance, or the bandwidth to learn. We need to do a lot more to help our customers make the right trading decisions. Not by forcing our choices, but by using technology to create subtle, intelligent nudges that educate users, while not intruding on their trading and investing experience.

Introducing the portfolio diversification visualisation

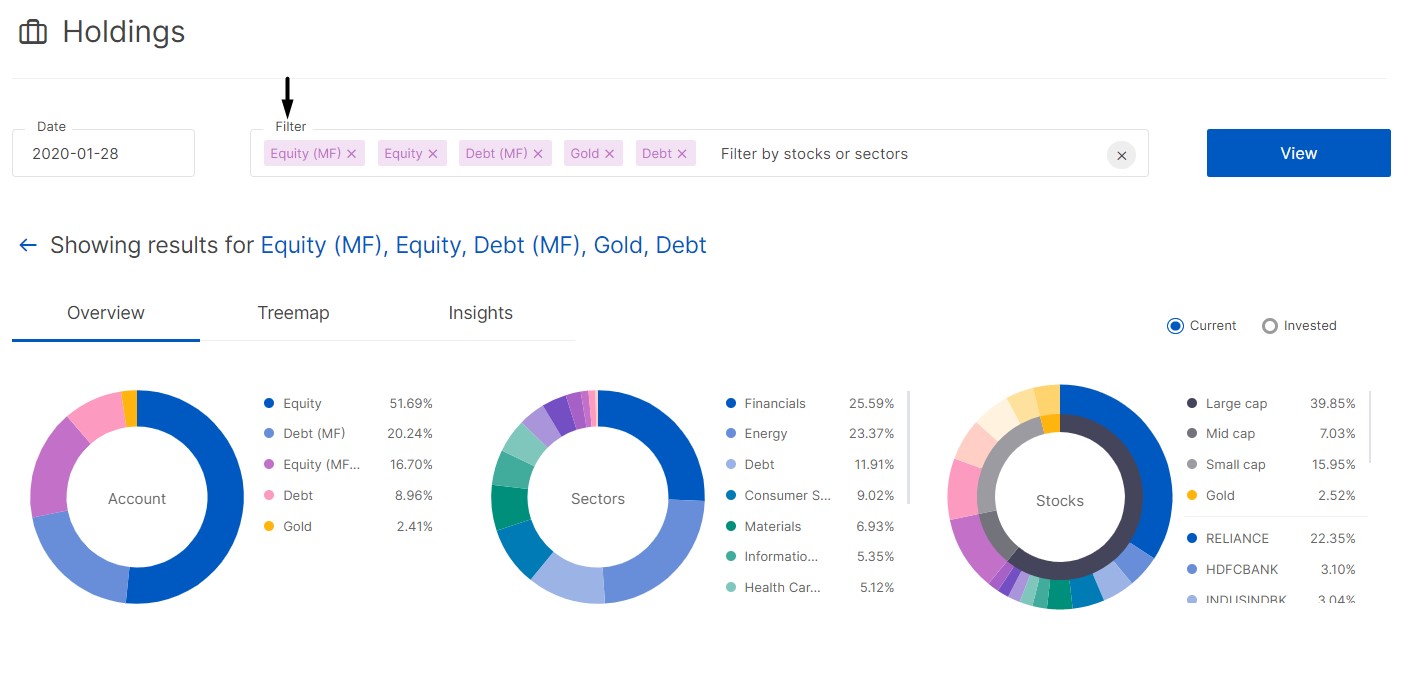

Your portfolio can be comprised of:

- Assets – Equity (stocks), Debt, Equity MFs/ETFs, Debt MFs, and Gold

- Sectors – Financials, Energy, Materials, etc

- Market-cap – Large-cap (top 100), Mid-cap (101-250), Small-cap (251 onwards).

- Stocks – Reliance, HDFC, etc.

The Console holding visualisation now lets you view your portfolio concentration across all of the above. If you are investing directly in stocks and also in mutual funds, the combined exposure to any stock or sector could be much higher than what you’d assume, as Mutual fund underlying holdings could be the same as what you hold directly. So the visualization comes with an option to see stock and sector exposure by including the underlying stock holdings of the Mutual funds you own. The underlying stock holding data from the MF is obtained by the holding disclosures that AMCs are required to make every month.

Note: Since an MF can hold numerous stocks, we import only the top 40 stocks in value to avoid clutter, but we use the entire sectoral exposure for the fund. Since we don’t import all stocks, if you have selected Equity MF, you will not see market cap breakdown of all the underlying stocks of the fund.

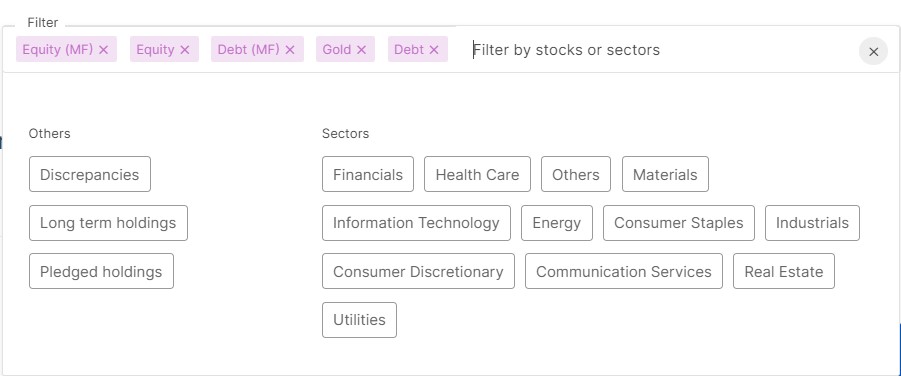

Use the filter option to drill down further.

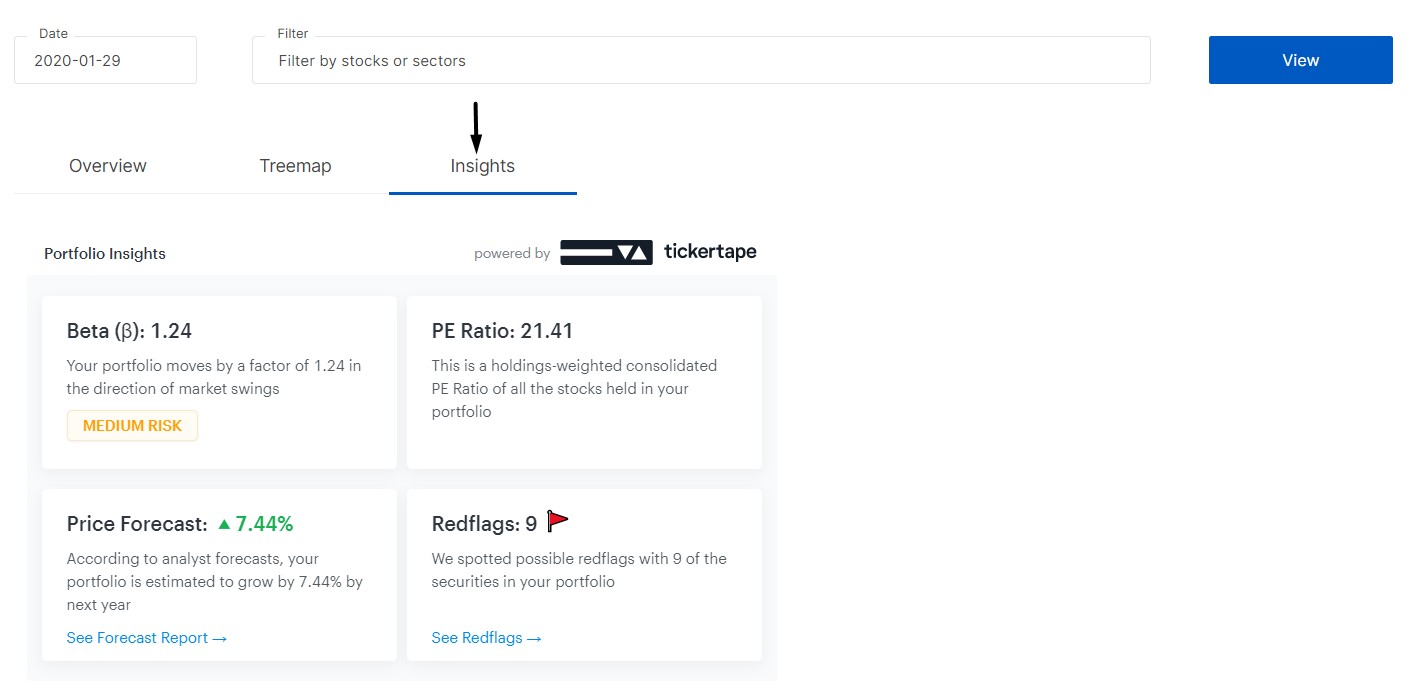

Insights powered by tickertape provide important information on your direct stocks portfolio.

What should an ideal portfolio look like?

There is no single formula, but here are a few general rules of thumb:

- Subtract your age from 100 and allocate that percentage of your portfolio to equity and the rest in debt. So if I am 35 years of age, 65% to equity and 35% to debt.

- Across your direct stocks, MFs, and ETFs, maybe diversify across 10 sectors with no more than 25% in a single sector.

- Across your direct stocks, MFs, and ETFs, hold between 25 to 30 stocks. Maybe lesser if the account size is small. But nothing less than 10 stocks if only direct holding with not more than 25% in a single stock

- Not more than 50% exposure to small-cap stocks.

The above visualization is just a start for our Nudge project (named after a book with the same name by economist Richard Thaler). I hope that for all of you who haven’t taken the effort to transfer stocks and mutual funds to Zerodha, this now gives you another added reason.

Happy Investing,

My ticket No: 20250909490199 and Ticket No:20250915586706 are pending since long but not yet resolved. Daily speaking to Customer Care and sending reminder mail but query not yet resolved.

Hi Zerodha team,

My suggestion is long-term stock and sort-term stock, grouping portfolio in kite App

Swing Trading and Hold long-term monitoring easy

Thanks

Siva

I am agree with your opinion. It will make investing in better way.

I am not ale to get correct buy average buying rate in my portfolio, can you pl help me to understand , pl check for example IGL in my portfolio

How can I see, downloa preview of my whole portfolio in one go. Presently I have morethan 100 stocks.

Ajit ji, you can try console option. In holding section you can download excel file of your holdings.

Can i Compare one index ETF for vs nifty 50 to get my portfolio performance analytics.

Also the same comparision for a index mutual fund vs nifty 50 to get my portfolio performance analytics.

We are very happy with the services of Zerodha Team. Thankyou very much to you for being our Financial Partner. You will be in the hearts of our family members even if we are not there. We are confident that our wealth will be smoothly transfered to our nominees with hassel free.

Expecting further your investment advices and guidance for our future fruitful financial planning.

All our blessings, prayers for your well being. Assuring best co-operation.

Thank you for enabling me to look at portfolio numbers at Family level but the obvious stat is missing. CAGR/XIRR at Family level.

Hi Pratap, we are exploring possibilities for the XIRR for family portfolios. We’ll keep you updated.

Yess please! The family XIRR would be a godsend. What would also be a great feature to have is the ability to track all my investments including FD, EPF, NPS, stocks in other demat etc. There is one other app IndMoney but that doesn’t seem secure enough. I trust the Zerodha platform to give all my information to it but not others. In fact would be happy to pay for such a service honestly!

Can you also include past buy sell transactions in the breakdown of transactions section? That will help know what price I made past transactions if I need to take fresh positions. Currently it only shows the buy transactions

Can I get a chart how much returns I have made Profit or loss with % as Console has data but % will help understanding return on capital

Dear team zerodha,

I have 50 Pcs of XPRO india stock in my pf which is visible on Console, but not on kite. How can i take it back to kite

HELLO,

I CANT SEE MY HOLDINGS DIRECTLY ON THE DASHBOARD I.E. POSITIONS & HOLDINGS TAB…..PLS GUIDE

Hi Pratul, could you please create a ticket at support.zerodha.com with more details and provide a screenshot so we can get this checked?

This is point in time data. I want to see my portfolio trend chart from the time I invested for me any my family.

Hey. Too many discrepancies happen even after placing orders for NFOs directly from Coin. In the portfolio section, the P&L is wrong for 3 MFs that I have.

Please help in correcting the same.

Hey. I have come across the WhatsApp group with name Zerodha Exchange group and are now asking people to trade with them and get lot of profits. Just wanted to check if those are reliable and handled by Zerodha officials? I can send screenshots if needed.

Hi Rahul, this isn’t us, and we don’t offer such services. It’s a fraudulent site impersonating Zerodha. Please refrain from entering or sharing any details. Thank you for reporting this, we’re looking into it as well. https://x.com/zerodhaonline/status/1836728912589836723

Previous version of analytics was better as it shows ETFs categorised as Large cap, mid cap etc. now it is showing index etf as debt.

Need facility to analyse the stocks in portfolio.

Facility to view/sort XIRR, PE, ROE, ROA, P/B at a single place is highly needed to analyse and reshuffle the portfolio.

Same is available but individually.

Is there a way to see the progress of our portfolio over time in terms of valuation and time just like it is there for baskets?

I do agree with this

Hi,

The ’Family Portfolio’ feature in Console is quite useful. However, there are few important features missing.

1. Ability to view XIRR of the Family Portfolio level, so that I can have a consolidated view of 2 or more trading accounts in the family

2. Download holdings of Family Portfolio at one go, including sub-accounts.

3. Ability to integrate and upload Family Portfolio, including sub-accounts, to Tickertape.

Please advise if you have any plans to enable these features and if so, by when. Thanks.

Please provide a curve or excel for Daily Realized and Unrealized profit & loss in order to see the volatility in overall profit potential in Zerodha platform. Currently this information is not available with click of a button. We need to collate the same by referring to Daily Holding Statements on console.

Hi team how do I check my weekly/ specific period portfolio return compared to indices?

Dear Team,

I hold more than 150 Stocks in my portfolio and intending for more till 300. But, daily tracking is difficult , though daily and Net P/L % is given from Buy value, But I need trend of that stock (in chart form also) adjacent to the Stock name in Holdings itself. So that trend can be seen in one shot. Similarly date of purchase or buying point also should be marked in that chart, so-that by scrolling one window of HOLDINGS , I can judge the stocks trends and can take positions, otherwise its very cumbersome to right click then see breakdown and then right click and see chart then again return back to holding window and again repeat same for next stock.

Pls. do consider my request or suggest any simple solution of my problem.

Hi Mohammad, we’ve noted your feedback. Thanks.

Hi Team, When I go to Insights to see my portfolio stocks, Portfolio stocks not showing for all the stocks forecast… looks like it’s a bug… and 1 more thing is it show’s together of all stocks PE and for me it’s -ve…

at the holding or position window, the indices nifty and sensex should be shown at the top. now if we click only it is seen. please show indices on the top when we take holding and position

Hi Prabeesh, you can enable Sticky Pins from the app settings, this will show pinned indices on all screens within Kite.

Hi,

Is it possible to get overall portfolio performance, e.g. if I have invested say 10L over 4 years in staggered manner in multiple stocks and the current value is say 25L? also consider if I have withdrawn some amount in-between and added some amount.

Regards,

Sunil

Hi Team, Please customize the export option for family members stock, so that we can download all the stocks at once.

Hi,

I can’t see my Unlisted shares in the console.

Although i have tried multiple times to sync my MF portfolio with ticker tape , it does not show up , the error message says ” That my phone number is not connected to my PAN ” which is not the case. My PAN and my phone number are accurate and i have re-verified as well

I have raised a case with Ticker Tape also but in vain. On the contrary my stocks portfolio synced seamlessly and is visible in the ticker tape dashboard.

Could you please guide me as to what should i do ?

Hi Anil, could you please create a ticket at support.zerodha.com so we can get this checked?

Hi

It would be great if there is a graph representation of our portfolio with nifty50, nifty100 etc. so that we can check if we are performing better or bad compared to index.

Thanks and regards

Would be good if we can see XIRR for each stock even if a year is not completed

Hello,

Can you please add tools that allows a client to easily calculate important information from their portfolio and play around with parameters like: Sharpe Ratio, Volatility, etc.

Thanks

Your feedback has been noted, Shom. We will check into the possibilities.

Looking at Holdings / Kite , Can we give an option to configure few fields (information) in which individuals are interested ?

Examples…

1) Against each stock listed in my holdings, if Zerodha can start showing their own research recommendation (Buy/Sell/Hold)…

2) Currently Holidings showing (Instrument, Qty, Avg Cost, LTP, Current Value, P&L, Net Chg, Day Chg). Can we have option to see (LTP far from 52 Wk High, 52 Wk Low, Promoter Holding %, FII/DII Holding % etc).

etc

hi, if u can work on features like STP in mfs, it will be highly appreciated. Thanks

Hi Vinita, we are very close to launching STP and expect it to be live soon. Will keep you posted.

how to know the inav for investments in etf,

Hi Team,

Is there any update on displaying CAGR on the portfolio, I have seen some questions below from the last 2 years about CAGR still taking time to implement I guess, or at least in the P&L Report along with Realised P&L for the specific period it would be good if we could display the percentage it will be good, its difficult to do manually by downloading funds added/withdrawn statement and calculating.

Hi

How to get the OPEN LOT for all the available to take call of what to sell and not

PLEASE TELL ME HOW TO VIEW DIVIDENDS EARNED IN THE YEAR 23-24.

OR

PLEASE SEND ME THE PDF ON MY EMAIL.

Hi, ou can track dividends received for a specific period by downloading the Tax P&L statement. We’ve explained how to here.

please introduce a feature to read our total portfolio performance though a chart system.

so that we could analyse our total portfolio size at any point of time; otherwise we won’t be able to read our total P&L’s high,low.

Hi Bipin, you can check the account value graph on the Console dashboard page for this.

How do i check the dividend received for the mutual fund which i have already sold?

Dear Sir, I want to group my stocks of my preference and want to watch the investments in each group. How can i do that in Zerodha. Basically i want to monitor my investment in each group

Hi team,

In this analytics segment, I would like to know why the sum of Large, mid and smallcap stocks( in the 3rd pie-chart) is not 100%? In my portfolio, it is coming out to be only around 60%. I have no other debt items or gold. It is only equity and equity mf’s.

Hi Gaurav, could you please create a ticket at https://support.zerodha.com so our team can have this checked?

sir iam happy to see this page , not aware so far, thanks to anmol mittal of trade chanakya u tube channel ,who regularly brings the features of kite zerodha to many.

sir how are you,

sorry but my english is varry bad so please anderstand with fill

can we start custmer’s portfolio ratting system to help in improove investing

How can I purchase etf gold NFO

Hi Harikrishna, you can purchase the latest gold ETF NFOs here.

can you also show the portfolio alpha, sharpe ratio, and other metrics to analyse the portfolio. currently, it shows only beta.

How to redeem Mutual fund units

Hi, we’ve explained the redemption process here.

Ive been a happy Zerodha user. What youve built and how youve evolved has been interesting. But the biggest peeve I have is that theres no way I can find my portfolio level XIRR for Equity investments. Is that so tough to dveelop for you guys?

In Holding, i do not see proper weightage of stocks as some of them are missing.

Can we have it downloadable weightage percentage of stocks contribution of portfolio in console as existing one is not much user friendly.

Is there a way on Zerodha Concole, where I could see PE ratio and Beta of all my stocks in 1 page?

Suggestion:

In Holding view, it will be good if XIRR for individual stock as well as Overall Portfolio can be added in addition to existing field.

Also, if feasible, please add sub portfolio feature as well in addition to existing Kite Only, Small case and MF.

Hi Sushil, portfolio-level XIRR is on our list of things to do. Will keep you posted. Could you elaborate on what you mean by sub-portfolio feature?

Thank you for your honest and transparent effort to build a good platform. The one and main feature which stops us to think of moving our investments into Zerodha platform is we don’t get to know the CAGR / annualized return. There is no point in using a platform for long term investments purposes, if we dont get to know this basic info year on year…. Can you give some idea by when we can expect this as I see comments around this for the past 2+ years. This helps us to plan accordingly. Thank you.

Hi Arulvel, we’re working on it and will keep you posted. However, cannot provide a timeline at this moment.

This is such a wonderful feature and gives really nice insights about our holdings.

If possible, I would love to see the feature of adding details about assets that I’ve maintained outside Zerodha. This would provide us with an aggregate view our assets. For example, I would like to be able to add details about bank fixed deposits, stocks/bonds, PPF, ULIPs etc held outside Zerodha. At present I do take help of money control portfolio features to record and track my investments. While it does a good job in providing summarised views, it doesn’t even come close to what Zerodha offers in terms of providing insights of investments bundled inside mutual funds.

I’m sure this would give Zerodha an opportunity to pitch client centric product ideas if it itself becomes an AMC.

Hi Akhilesh, allowing users to track their investments is on our list of things to do. We’re hoping that the depositories, RTAs & banks go live on the account aggregator soon.

CAN WE PLEDGE GOVERNMENT BONDS TO TRADE IN F&O SEGMENT.

You can pledge G-Secs and SGBs, Manimaran. You can check the list of approved securities here.

Hi – I saw the XIRR feature in COIN. Can you please enable the same in the portfolio on Kite as well? I guess there is no incremental development give it is already live. I want to know XIRR on my Equity SIPs

Is it possible to provide a chart of the whole portfolio value, how it has performed over the time, like how my portfolio performed for long term investing ? (not sure if this is feasible)

Something similar is on our list of things to do, Palash.

Some of the stocks (e.g., Affle India, Gujarat Flurochem, Happiest Minds) that are there in my portfolio since a long time but these are not getting reflected under Insights tab for analytics and therefore, I believe, the consolidated PE Ratio, Beta (β) and 1-year Price Forecast don’t get calculated accurately. What is the reason behind these missing stocks that lead to confusion? Also, it would be good if XIRR% can be calculated at a portfolio level and displayed for investor’s benefit.

Hi Sandeep, please create a ticket at support.zerodha.com with more details so we can check and have this resolved at the earliest.

How can I transfer my MF portfolio on Coin from KUVERA ?

Hi Bhagirath, you can check the process for transferring mutual fund investments to Coin here.

Good initiative but I believe the definition of large, small and midcap may not necessarily be aligned well as the market cap figures. Additionally sector wise change and portfolio performance breakup w.r.t each of the sector will help

How to export complete family portfolio to Excel File?

Hi Prateek, this is currently not possilbe. We’ll take this as feedback and look into the possibilites of implimenting this feature. Thanks.

We are waiting for XIRR analytics for our portfolio holdings. You had promised sometime back that it would come shortly.

Hi Atul, we’re working on making XIRR available on Console. This has taken some time due to some complexities involved with edge cases. Explained here.

Hi sir, which share is showing in my portfolio INEONNSO1018,I never bought this stock.

Hi Poonam, please create a ticket on: https://support.zerodha.com with more details. We’ll check and have this clarified for you.

Is it possible to have line chart for sip investments? Investment vs returns

Thanks for the feedback, Vaibhav. We’ll look into this.

Hi Nithin & team,

Please guide me your view on my Portfolio.

There are 2 companies with High Pledged Promoter Holding, ASM security & High default related red flags.

Please confirm & guide me actions that I need to take.

Best regards

Rudra

Hi Sir

Good Morning

Please send daily recommendations and tips because I’m a beginner.

Portfolio Analytics does not work when you apply a tag for a group of MFs. The total percentage does not add up to 100. I have 5 MFs for a particular tag and the current holding percentage is about 69%.

Hi Alok, could you please create a ticket at support.zerodha.com so our team can check and assist?

lt is very difficult to connect to Zerodha, can you suggest how to seek advice on authenticator generated otp

not working. shows error. hence using otp from mobile.

Hi Venkatraman, please create a ticket at support.zerodha.com with more details. Our team will check and assist you with it.

This is an amazing feature. Thanks for being so customer obsessed!

Please provide XIRR returns feature for the equities and overall portfolio. This help in analyzing the investment strategy employed by investor. If investor generates less return than nifty by his own strategy, then he will be better off investing in Index Funds.

Hi Ramesh, we’re working on adding XIRR on Console. We’ll keep you posted on it.

I want to download xlsx from console to analyse my portfolio with a column ”Mktcap type” (Large,Small,Mid)

Currently this seems to be missing

unable to see average cost of acquisition and net change in Kite

Hi Avinash, the buy average for some of your holdings may be showing up as NA on Kite today. The correct buy average will be updated by end of day and doesn’t affect your trades or P&L.

Please check the buy average in the tradebook on Console when selling: https://console.zerodha.com/reports/tradebook

lt is very difficult to connect to Zerodha, can you suggest how to seek advice on finding support code, and help to place Infosys shares for Buy Back in open market ?

Hi Anjali, you can find the support code here. We’ve also explained how to offer shares in an open market buyback here.

What do the green numbers (on right side of the Symbol column) indicate? They are not the number of shares held in many cases. I could understand from the tooltip that the calendar symbol means it is a long term holding, but it does not say anything about the number near the calendar symbol.

Hi Vivek, that is the number of shares that are long term holdings, ie. shares that have been in your holdings for more than a year. This helps you quickly determine the capital gains applicability in case you share the shares. Please check this support article for more information.

When you link sub account (from 1 account to another) and see portfolio this is very good feature.

But do not have option to DOWNLOAD it in XSLX which can help to track me with my own formulaes.

can you put an option of DOWNLOAD.

Thanks and ZERODHA rocks.

Hey Miteshkumar, thanks for the feedback. We’ll look into the possibilities of making this available.

In the Family Portfolio option we cannot download the holdings, whereas in Personal portfolio we can do the same.

Kindly incorporate this feature. Still waiting for XIRR feature and as this feature is premium you can charge for the same for a PF above a fixed and give it free to small time investors.

Hope this gets incorporated fast.

Hey Dinesh, thanks for the feedback. We’ll look into the possibilities.

I want to add target price and expexted target date for each stock of my portfolio to track and to take my decision to sell. But this facility is not available. Is there any way to do this? If not, are you planning to build this functionality?

Hey Himanshu, you can create a tag for this using the tagging feature on Console. You can learn more about tagging here.

while you name some not so useful graphs with funky names as portfolio analytics but fail to provide a simple functionality to allow investors to view annualized returns for their stocks…I could not find it myself on the website and your support also could not point me to any such reports…please really think towards providing such a functionality.

Hey Bhavesh, we’re working on adding XIRR on Console. We’ll keep you posted on it.

The gain in coin holdings is shown as absolute gain. It will perhaps be more helpful if the gain shown interms of annualised gain.

hi, how to check all market cap of my investment in mutual fund. It is only showing 70% bifurcation of market cap.

My ’pledged’ shares are not coming up in the ”Portfolio Analytics” – is there a plan to consider them as well in the future ?

This is very good feature specially when all of your family member use ”ZERODHA”. But if we can download this entire family holding than it will be batter. Hope this is in your future plan.

Dear Zerodha Team,

I had purchase 05 – Happiest Minds tech shares , know they aren’t showing in portfolio .

Many investor are asking same question but Zerodha team not responding , why ??

Hey Srikanth, we’re sorry to hear this. Please create a ticket at support.zerodha.com, so we can have this checked and clarified for you.

Insights tab by Tickertape does not give data when applied filters…

It gives the analysis & projection on the total portfolio… In case one wants to choose a selected stocks, mutual funds & then run the insights… it says SOME ERROR OCCURED … and Tickertape team also doesn’t revert…

i have my stock investments in Zerodha and when i am sharing my portfolio in Tickertape, to have a look at my portfolio at a galnce to know where my portfolio is heading, i want to draw your kind attention that, ticertatpe is not showing all my stocks in their analysis of my portfolio, which is very surprising and confusing…will anybody help me out in solving my querry at the earliest……

Hey Ashish, please create a ticket at support.zerodha.com so that our team can have this checked and assist.

Any idea when the portfolio XIRR % feature will be rolled out?

I think the users have been asking for it for a long time and you have acknowledged you have been working on it.

We dont mind if you add a BETA tag to it (if you see some issues with it), but just release it already!

how do we check date of purchase for holding stock

Hey Bhavika, you can check the purchase date using the ”View Breakdown” option. You can check how-to here.

Hey,

It would be great if you could add feature to track external portfolios, like bank fd, etc..,

Please introduce feature of showing XIRR and CAGR for equity part of the portfolio. It will help in analyzing how one is performing on long term basis, I could see that this was promised as a feature by IT team since more than 2 years.

Please take this one on priority.

Hey Vivek, there are some complexities involved with edge cases which is why this has taken time. Having said that we’re close, please bear with us.

Sir

Mere pas BPCL and iocl ke 10 /10 shear he lekin unka dividend mere account me abhi tak nahi dikha Raha he ples hepl me

Hey Kishor, the dividend payment date is generally 30-45 after the record date and the payment will be credited directly to your primary bank account. The record date for IOCL is 9th February, while for BPCL it is 11th February. You can check out more details here.

Please introduce showing of dividends along with holdings/profit loss for each equity. It will help in tax planning.

Hey Sheikh, you can check dividends received on Console and this will also be part of the Tax P&L report. You can check out more details here.

If Zerodha`s tech guys add below two features in the analytic portal then it will help us a lot and it will be like adding a feather in the cap.

1. Display average CAGR for overall portfolio performance.

2. Display the overall dividend amount received also a report for dividend amount received in the selected time range.

Hey Anop, we’re planning on displaying CAGR on Console for the portfolio soon.

A dividend report is also available, check out this article for details: https://support.zerodha.com/category/console/portfolio/holdings/articles/where-can-i-track-dividends-of-my-stock-holdings

Hi Nithin,

Do you have any option in your app, where I can compare my portfolio with Indices or other stocks, do let me know?

Hey Charan, this is on our list of things to do 😀

The ETF Constituents Shares should be also shown in the breakup as MutualFund Constituents.

I cant see the NSE Stock Analysis on my portfolio, that is showing BSE Stocks Analysis & prices in all stocks on portfolio, please give the suggestion to resolve the problem.

Hey Amol, the stocks in your demat account don’t have any exchange mapped to them. You can sell them either on NSE or BSE, regardless of which exchange you bought the stocks. Your Kite holdings will reflect the exchange price where the previous closing was higher. More details here.

I am holding an stocks for 4lakhs and around 26 stocks, 80% large caps, 15% mid and 5% small, I am 36% years old, so it is good way to be in stock market or i should change my plan.

how it will see to them in my holding please give me solution

i have not get back my 3 shares of 3iinfotech after listing

what should i do for it

Is their any possibility to change timeframe of charts to 25 minutes and 75 minutes

I have many stocks in mu portfolio, i want to create folder similar to smallcase (like one for bluechip, short term) . Is there an option for that? Not looking for small case as i want to track my existing investment

I have 60 day challenge active in F&O segment.

How can I get info / break up of 60 Day challenge amount being shown? Can you please help me with break up of the 60 Day challenge amount

I have purchased 10 shares of AFFEL INDIA on 06.10.2021 before split at the rate of 5535.10 and now on 07.10.2021 it is splits 2:5 but in my account only 10 shares are there at today’s rate of 1154 where is my remaining 40 shared??? Please do the needful.

You’ll have to wait for around 2 weeks for your split shares to be seen in your holdings

Please introduce the XIRR functionality for Stocks.

Hi folks,

Great job by you , Just a small feedback , was going thru the interface with Sharekhan especially on Options front ( You too can refer if u wish to ) , you can view the Option chain ( similar to the one in NSE Website ) and can place order directly from there , here in Zer0dha , we have to search the CE/PE everytime and get it done, try to incorporte this , its would be very handful for us intraday or option sellers.

i added 550 shares of RELIANCEP1-E1 manually as told by you after paying second installment. when i added manually you also credited automatically 550 RELIANCEP1-E1 to my account. i sold all the shares. but in P & L show 550 shares RELIANCEP1-E1 in my account which is not shown in holding too. please tell me how to delete this dummy entry or you should do it on your side.

Please see if it is possible to show the quantity of stocks held more than 1 year in the dashboard. It is useful to sell. e.g. Quantity (> 1 year) as 60 (28)

I’m unable to see the complete break-up of my holdings:- Large, Mid and Small Cap shares. The sum of Large, Mid and Small Caps is also not 100% but is much less. How can I see the exact distribution?

Where I can see the list of Large, Mid & small cap stocks.

hi

how can we save the charts when i use any indicator in any stock then every time i have to select again same indicator pls suggest

I request to you, plz add a option to buy digital gold from same place.

Overseas stocks of my MF are not visible on console, since MF I’m invested in have 20-25% invested in 3-4 US stocks, I’m getting disproportionate view of my final investments. I request Zerodha to add Overseas stocks as a sector for analysing in console.

Because 3i infotech delist from NSE/BSE for some times. It will again listed in NSE/BSE so that keep patience.

Sir mein 3Iinfotech 230 share kharida tha but 28 aug 2021 se mera portfolio me show nehi kar raha hai please help me

Same my issue….same share..sir

Hi…

I got an allotment in NFO, it is showing in my Coin mobile APP, but not showing in Portfolio analytics in terms of percentage.

Raised case but that not given any resolution and directly closed the case.

Iwant to open a minor dmat account in name of my son Mr .Divyansh .Itried many times after summitting fee but the process was not completed till now. no one could support me.please help me .

i dont see any option to see only those scripts which are not tagged. Please include it.

Please introduce the XIRR functionality

All of my investment is via coin app towards direct mfs. But, my console portfolio analytics shows a high ratio of OTHERS (49.84%) when compared to LARGE CAP, MID CAP & SMALL CAP. Looks to be a bug in classification.

I’m unable to view the complete break-up of the Large, Mid and Small Cap shares. In Portfolio analytics, the summation of Large, Mid and Small Caps is not 100% but is much lesser. How can I see the exact distribution?

Will zerodha alert me of the appropriate time to exit the stock?

any update on showing the IRR . Would have thought it is a much simpler feature to add than a lot of the other stuff already there

Is there any way to have more options in the ”Holding” menu (now ”all stocks”, ”kite only”, ”small case” and ”mutual fund” are available). If a menu to select Long and short term investments it would be nice..otherwise we have to choose multiple brokers for short term / long term investments. (eg. if i am trading with TataElxi at a fixed amount say 2 lacs, and, i want to buy the Tataelxi shares for long term from the profit of trading and keep in the ”long term” holding..how can i do? is there any option to segregate like this..(other than ”Small Case”)

Quite bottom of the comment thread.

Tags is a great idea. However, you should also show allow users to see holdings by tags.

eg. If I have created buckets of stocks and have tagged them, I should know what is the total amount of holdings per tag and what is the % holding of the tag in the entire portfolio.

Brilliant work. Really amaezing to see my own portfolio being analyzed so vividly.

Dear Sir,

tomorrow i.e 24th Jun’21 Shyam metalic & share was listing but when i search the share name in watchlist i can not find . can you pls help me about this .

Hi, Could you please two important parameters in the ”Fundamental” popup?

1. Total debt of the company

2. percentage of the promoters share pledged

Possible?

*Could you please add two important parameters….

Portfolio Analytics is great inciative- Team keep it up. I am using it to monitor my portfolio for a will now. The Only suggestion I have have is if you can add to more coloums (or better if we can customise it) for Return% and Portfolio Weights% ( I am being greedy Holding period). This filter wil make it really easy for us who are not techincal and don’t know how to use it in excel or any other place . through Holding period we can plan for tax for short period or long period ( able to use break up for different purchase here only) so please consider the same waiting for your reply option Your Platform Customer and A Big Fan

its free or any chargers?

i am trying to change my primary account as secondary and secondary account as primary .I tryed fro console but not happen

Please tell me charges and other tax price ditle send me and slow the problem so need full request

why is happstmind shown in others

why is irfc in others category.. shudnt it be in finance

why is dixon under others category

I HAVE OPENED A AC WITH ZERODHA NO IS HC7038 IN SINGLE NAME NOW WANT TO ADD SECOND NAME AND NOMINEE ALSO HOW CAN I DO THIS SUGGEST ME VIA MAIL I TRIED MANY TIMES ON YOUR GIVEN CONTACT NOS BUT NO REPLY

Consolidated holding for all family members is necessary requirement…

Sir,tried to open ac,fill up all information,but at least I came to know my mobile no is not linked with adhar,i am getting problem please refund my 300 in same account.

Thanking you.

Sir maine 2 lakh investment kiya tha par par mere pas 1.63 lakh aur 17000 main balance hai ple help sir

Sir ,

Mere pass megh company ke share the vo 17/05/2021 tk to mere holding me show kar rahe the but ab show nhi kar raha hai ?

Plz bataye . Aapka koi customer care no. Ho to bata dijiye.

This is because the stock has been suspended from trading. You’ll have received an email informing you of this.

Does it include the pledged stocks in insights by tickertape?

Yes, it does.

मुझे जीरोधा एप्लीकेशन ऑपरेट करने में दिक्कत आती है तो किस नंबर पर कॉल करें

What is the procedure if I have to transfer shares from other broker to Zerodha

Thanks a lot for this Team Zerodha 🙂 it’s really helpful and yes I am currently reading the book Nudge 🙂

Why is it showing Dixon’s sector as ”others”? It was showing it correctly until last month (Consumer durables).

Will get this checked with our data vendors.

kya sail 100 ke par jayega ya nahi

Tickertape is showing the PE ratio of my portfolio is -346.29. What does it mean? Although my portfolio is up by ~20% (for many months).

Worst app

.everything written very old fationed without any highlight .there should be a front page with option of all stocks with group of stocks of various nifty s like Bank nifty ,metal nifty etc.no indication of which is growing or declining as per the current market with pillor type graphical presentation.I heard a lot about Zharoda but a lesser known company like religaire is having better app than zarodha.

My holding screen does not reflect the correct amounts.

Have created a ticket #20210223768649 one month back. Still nobody bother to look into this. How can I resolve this issue?

Vijay

Hi,

Are any improvements to the ”overview” section? It would be great if we are able to expand pie chart pages to a bigger screen to get a better visual presentation of holdings with % weight without that annoying scroolbar and also sort based on weight

Hi in my console percentagewise splitup for all the stocks are given. When I sum all the percentages it is not equal to 100. It is somewhere around 80 percent. This is because one of the shares account for about 20 percent of my portfolio but it is not visible in the console. If I add this 20 percent then my total holdings will be equal to hundred. This share i got from IPO three months back.

Kindly help me with this.

Thanks

Please add few more relative reports that would help us actually evaluating the stops to hold or sell the stocks. Also simple, compound returns reports..stock returns vs. my holding returns..etc..

I hope I’m not asking too much…:-)

Hey! These are on our list of things to do 🙂

आज खरीदा हुवा share दुसरे दिन प्लस मे है तो सेल कर शकते है क्या ? चार्जेस ज्यादा तो नहि lagenje

Need separate portfolio tabs in holding section in Kite.. so that we can start testing different strategies in separate portfolios.

Portfolio analytics is good, but it would be great, if it can also show Portfolio IRR Returns..

How can we check total amount of dividend received in 2020-21 in one report?

I would expect a way to track your holdings value over time .. that is your current holdings value as a chart like candle stick ..

Under portfolio analytics, my debt etf is classified as ”others” and gold ETF is classified as ”gold”…

Do you have any plans to make it better? If now, can you suggest other applications/software can can help with overall portfolio management.

why my holding stock HDFC GOLD average cost is 0.00? please update average cost or quantity.

i take the HDFC GOLD stock in the range of RS 4414*50 quantity but than it show RS 44.14*50 quantity.

Dear Sir/Madam,

Maine 05 feb 2021 ko URJA-RE-R ka Total qty.48 buy kiya tha jo ki mere account mai nahi dikh raha hai but only console me show ho raha hai.

please look into the matter and help at the earliest. also check aisa kyu hua at software end.

Hi, Do you provide Loan Against Securities? If yes, how to obtain it. I have tried through console but there is no option for it . Could you please guide.

Absolutely I feel the same…moreover one more portfolio filter with weightage of shares to portfolio is required to concentrate on latest stocks and avoid a long back bought stocks..

Hey Pranitha, this is already available in the portfolio analytics pie chart. The last chart shows the weightage of the top 20 holdings in your portfolio.

Hi,

Is there any reason not to show age of the holding in days/month or year ?

That is a basic data point for investors.

Without that, investors can not differentiate between 10% profit in 1 month vs 1 year.

Please add that feature.

Thanks

Hey Prashanth, the portfolio page on Console shows the number of stocks held on a long term basis with a separate tag. Also, have you checked out the holding breakdown feature on Console? Here we show the breakdown of your holding with the purchase date, quantity, price, and period of holding. Just click on options and select view breakdown from any of your holding in your portfolio.

In portfolio holding section, I can not get current price of stock as it is showing previous day price and current value stock. Please help me how can I get current price of stock in my portfolio.

Hello,

How do I see my overall portfolio’s XIRR in Zerodha coin. I would like to specifically know this for my different SIP in different funds? Currently I am able to see individual fund wise XIRR.

I am also looking for same

Hi,

Feature Request – If a comparison to the Nifty 50 or 500 is also made available then it’ll be really helpful to see our portfolio performance.

Hi Nitin

It would be great if we can track our portfolio against index like nifty, sensex. Can we get that kind of feature, many broker provide that.

Regards

Deepika

I can see my mutual fund holdings in portfolio. But not able to redeem it. Also I have invest through coin but now coin do not shows this fund. Please guide me.

Sir, can i get some report in zerodha or tickertape wrt dividend received to me against equity holded by me, how?

You can check this here:https://support.zerodha.com/category/console/reports/articles/where-can-i-track-dividends-of-my-stock-holdings

iam investment in uvsl share at 10000 rupees but holding is not viewable of share so fear of moment the idea tell me every one

Hey Aswin, this stock has been delisted. See this circular with details.

Suggestion. For liquid fund investment via Zerodha, please treat it as margin on redemption. Else no benefit of using zerodha liquid fund facility for keeping cash. Thankyou for a great platform.

Sir mere amount se 1300 RUPE jam ho gyr sir chak karna

sir,

when i try to sell call opstion against our future holding, our order rejects because of insufficient margin

but actual we have sufficient surplus margin than requried margin . that time what we do . To whome we complain so than our order will exicute

Hi

How may i select, for sale, a higher value purchase so that i can retain the lower value lot. Example

i bought X co 10 share @ 50

added X co 10 share @ 75

now CMP is dropping to 80 from high of 90

i will like to offload the lot @ 75 and keep the lot @ 50

However the FIFO principal the sale is done of the @ 50 lot and the higher priced one @ 75 is retained and leads to loss.

What is securities balance, is it related F&O?

since 2 weeks in my kite zerodha app the chart is not displaying and noticing to refresh the chart, till then it be showing the error messaging and not able to see the chart. please help me to resolve the problem

I want to generate report in Zerodha of how much Dividend (Interest income) has been generated from my Debt Mutual Funds

In Portfolio insights, only four options are available namely Beta, PE Ratio, Price forecast & Red flags.

Kindly include the following for better analytics

1. 5 years Sales Growth of Portfolio vs 5 Years sales growth of Sensex/Nifty.

2. 5 years Profit Growth of Portfolio vs 5 Years profit growth of Sensex/Nifty.

3. Portfolio PE Ratio vs Sensex/Nifty PE Ratio

4. Portfolio PB Ratio vs Sensex/Nifty PB Ratio

5. Portfolio 5 Year ROE vs Sensex/Nifty ROE

6. Sharpe Ratio

7. Sortino Ratio

Does Insights provide the analytic information (tickertape) about the stocks that have been pledged?

Sadly no. Please fix this

I have purchased advanced enzymes 150 shares but it’s not showing in my holdings.. what’s the issue I cannot understand please help

Madam hamne 7-10-2020 tarikh ko Deepak fertilizers RE ke 80 stock liye the , lekin 10 tarikh se vo hamare portfolio me show nahi kar rahe hai, consol me dikh rha hai lekin vha se sell nhi ho sakta ,aur 12 th October ko vo share expire ho chuke hai , hamare 1500 ru invested hai , so plz , thodi jankari dijiye aage kya karna hoga because ham naye invester hai . So plz we want need your help.

My holdings breakdown in Large, Mid and Small caps do not add up to 100. I have only equity stocks investments. No mutual funds. Please advise.

Same here. Not able to understand why

Please anybody clarify me on this

Hi Parag, we only consider the top 40 stocks based on present value or invested value. If you have more than 40 stocks in your portfolio, it will not match 100%.

Sir

Yesterday morning I was sell my indusind bank share 18@555 and purchased indusind bank share again 18 @541 but now showing my portfolio indusind bank share @ 618 why

Portfolio Insights need to pay or free of cost ????????????

Can you please provide either yourself or through your APP partners a Portfolio Mnagement feature such that I can management my portfolio better with reports and metrics instead of taking the data from here to another app such as MProfit or Askkuber.com thanks.

I think that this is the only missing link in your great platform.

Thanks

I second this thought… If it is possible to arrange my stocks under separate portfolios under Kite, I need not look at other app integrations. Smallcase is great, but not insulated from human errors on Kite.. Zerodha can do well to provide an option under profile preferences if anybody wants to keep their longterm portfolio under Smallcase protected from the dynamic daily trading and market volatility on the Kite platform…

Sir , maine upper circuit lagne se pahile 50 share sell kiya our market closed hua . Fir 2 din ke bad reversal 50 share hua but abhi O share mai holding mai nhi dekh rahe but view breakdown show kr rahe and portfolio mai unrelease profit minus lakh dikha raha please help me to sort this matter .

I bought sbi liquid fund on zerodha coin plateform but not displayed in console of kite app in portfolio holdings what is the reason

Sir mere share holding me ha mere ko unko nikalna ha so plz give me suggestions

It will be better if you add feature to compare the portfolio with nifty 50 or similar index.

For ”long term investors” one of Key parameter to measure the portfolio performance is ’CAGR’, because that’s how we will be able to do comparative analysis with best performers in the market. Majority of the retail investors will not be tracking their investments separately due to which it wouldn’t be possible for them to measure actual CAGR of their portfolio. If our trading accounts can provide that crucial information then it would be really helpful. Hope this feedback is given due consideration as it is useful for all long term investors

This will be a most wanted feature on understanding how the portfolio performed year on year. Will be very helpful

Hi Sir,

I have a query in understanding portfolio insights powered by tickertape. I have a total of 42 holdings. The price forecasted 26.5% up by next year. The PE ratio shows as 0.83%. How to judge/understand this PE ratio? Is this PE favorable to my portfolio growth.

Dear sir/Madam,

I have applied to purchase RComm shares of 300+300 @3.4Rs via NSE exchange on 30.07.20. Received receipt for the same on 03.08.20. But is reflects in Holding from BSE Exchange. Pls suggest How?

I hv set both TPIN for Buy and sell. For selling, even after two time price triggered in selling stop-loss, quantity not sold. Message comes, contact to your depository. Pls suggest.

Your holdings are displayed based on which exchange has the higher previous close price. Explained here.

Can you show different colors for the pie chart instead of different shades of blue? It looks very dull, currently.

Ser detail of purchage amount visible but extra tow amountrs_118 .oandrs590.00defuct pl.explane it

Sir,

In the kite overall holdings, there are currently groups available as Kite, small cap, mutural funds & All Stocks. We would love to have a group created by user and group certain equity holdings into the group for better management. Please allow customised group creaton by user under the holdings. It greatly helps.

HI,

Zerodha is there any provision to have a graphical representation of our investments against the Bench mark indices like nifty, nifty mid cap etc. which will give clear indication whether our investment is able to beat the major indices.

unable to open kite.zerodha in desktop need help if it is disabled today..

Sir call me mera payment Ac me bhi show ho Raha hai

Best create a ticket on our Support Portal.

Hi,

How to check the IRR for all stocks which includes the sold holdings returns.

Thanks

Zerodha हिंदी में कब आयेगा।

Is it possible to show sub-sectoral analysis? Currently it shows Bharti Airtel, IRCTC and Info Edge all under a single sector (Communication) but these three stocks are completely different from each other and diversified.

Hi,

Is there a plan to show annualized returns or CAGR against individual stocks in Console?

Regards,

Siddhartha

Hi team,

Have been using the service for the past 1 year and find the service to be great. However, there are a couple of suggestions which may help as customers and it would be great if you could add them.

1. All the etf I have are shown in others category and stock specific division is not available.

2. Sovereign Gold Bonds are also shown in others

Both of these lead to others section being very high and does not show the real picture.

It would be great if you can convert it into something like you did to mutual funds.

Regards

Sir. Kindly request. Pls reply about my question. Today when I was tradeimg. That time after my all delivery increase 1 rupes Extra. And after selling going 1 rupes less. How can is it possible. Expecting reply.

Hi,

I found a bug that my ”Today’s P/L” in the Kite App is showing wrong value (less as compared to actual days P/L) from past week. Can you guys fix that error please.

Thanks

Please create a ticket on our Support Portal so someone can check.

Sir kindly help me to know how to sell equity holdings of PSB in console as if lock in period expires still that holdings does nt appear to exit

Best reach out to our support desk for account-specific queries like this.

may I know how much i have gained/loss from starting my investment in euity on your plateform.

Can someone please tell me how to download images of the various pie charts?

Sir mene reliancerl share kharidha ek hapthe ke baadh aadha share bhej dhiya us ke baadh bakhi share holding me nahi dhikare .pls bakhi share bhejna tho kaise bhejdheka pls reply

hi m ajay dusodia please analyse my portfolio is it low risked high risked long term or short term

sir, I added 1000 rs to my account, margin available is 375.47 and in investment is showing 390.60rs. adding both it will be 766.07. my question is where is remaining amount 233.93. I did not got any loss till now. if it deducted for penalty how to check that information

Hello, Can I trade in futures and options? I am new to Zerodha, so please help/ thanks. If no then what should I do to activate this? Pl help/ thanks

Ritika ji aapse ek help chaiye thi vo ye h ki mere share portfolio me show nhi ho rhe h jabki mene ek hafte pahle order lagaya tha nd sab kuch details shi bhari thi plz help me

good initiative really helped here.

Hi,

The portfolio analytics feature is an excellent upgrade to the console. I have a suggestion in this regard. A feature to compare the performance of the portfolio to broader market indices or sectoral indices would be a great addition.

PS if this feature already exists kindly let me know.

This is in the works!

Sir I bought 3 Tata motors cnc shares in zerodha on 30 April….on 5th May I saw it was there in my holding section of portfolio…but on 6 may it is not there ,my holding section is empty..I’m completely restless..plz help

I had 500 Daawat shares which I am not able to see right now.. Please let me what’s wrong?

Those shares were pledged since a long time. Now they have suddenly disappeared from my holdings section.

Bro I’m also unable to see my Tata motors holding share..it was there till yesterday..but today it is not there..I don’t know where has it gone..

If u get any solution of the problem plz let me know.im restless.

Namaskar

Sir,

mene kl Intraday me Share ko ShortSell kr diya

stopLoss nhi lgaya to Me Loss me chla gya..or Buy nhi kr paya..

squreOff time thk

to mere A/c se Pura Funds Debit ho gya hai or.Funds Balance Minus- me bta rha hai..

help me Mera Fund kb aaye ga A/c me

help me Plz plz

Me stock kal holding me show kr rahe te pr aj kucha bhi show nahi ho raha he

Namaskar

Sir,

mene kl Intraday me Share ko ShortSell kr diya

stopLoss nhi lgaya to Me Loss me chla gya..or Buy nhi kr paya..

squreOff time thk

to mere A/c se Pura Funds Debit ho gya hai or.Funds Balance Minus- me bta rha hai..

help me Mera Fund kb aaye ga A/c me

help me Plz

the insights is not functioning.

Can you raise a ticket on our Support Portal with more details? Someone will get in touch.

Hi Team,

I have purchased two share on last week, this share not to show in Holding and I am not able to sell it. So can you help me for the same.

Best Regards,

Swapnil

Hello,

Can you please add new feature where I can see change in PL in % for my portfolio per month/Quarter/Year?

This will give very good idea for log term investor how his portfolio is functioning MoM or YoY.

Thanks.

Gm ,sir ,,,,i am 2 shere purchase ,,,but not sell , holding not show ,,why

HI,

Tikertape is chargeable platform or free?

Hello

Aap se mera anurodh hai ki mere problem ko solv karege Aap mai abhi naya hu aur Maine kuch share kharida lekin aaj 5 day ho gaye o folding me so nahi kar raha hai help me

Sir good evening

Sir I had purchased amber share on 13/04/2020 on same day it show in portfolio but today it not will not show

So.please resolve this issue

Regards

Manoj kumar

Best create a ticket on our Support Portal for such account specific queries, Manoj.

Hi,

Please show some where like total amount invested into shares from beginning(credited to zerodha from bank) and total value of shares now(investment value in portfolio + unused funds). It will be useful to see how much effective in trading.

सर मेरे पोटफॉल्यो में इलाहाबाद बैंक,PVP-Z यूनाइटेड बैंक के शेयर शो नहीं हो रहे। प्लीज चेक करें।

मैं अभी नया हु मुझे ट्रेडिंग की भी नॉलिज नही ह, मेरे कुछ शेयर होल्ड हो गए ह, उन्हें कैसे सेल करु, और जो 3 अप्रैल को खरीदे थे वो भी दिखाई नही दे रहे हैं।मुझे उनकी जानकारी दीजिये

बस Kite पे जा कर ”holdings” पेज से सेल्ल आर्डर डाल दें।

Hi sir mujhe trading ke baare me kuch bhi gayan nahi hai please help me to hindi

Hi sir mujhe trading ke baare main kuch bhi gayan nahi hai please help me to hindi

Hi sir mujhe trading ke baare main kuch bhi gayan nahi hai please help me to hindi

Hi sir mujhe trading ke baare main kuch bhi nahi gayan nahi hai please help me

Mene 28th feb ko 2 stock buy kiya lekin aaj 2 march ho gaya h mera stock mere account me show kyu nahi ho raha h ….Only console me show ho raha h….Aap ke staff ko call karta hu to Wo call bhi reacive nahi karta msg ka reply bhi nahi kar raha h …Itna kharab service kyu h aap ke company ki ..Me abhi new hu stock market me to help karo ..Account opening ke time pe reply kiya aap ke staff ne Aab nahi plzz reply karo nahi to me SEBI ko complaint karunga letters send karke. BC…

Hi Shivam, this will be because you haven’t submitted your PoA or given online consent allowing us to debit shares from your demat account when you wish to sell them. Once you give online consent, you’ll be able to see the stocks on the Kite holdings page. You’ll see the link to give consent on the holdings page of Kite web.

KUCH NA KAHO.

Sir,My wife had withdrow 4800 /- from her zerodha account ,processed was successful on 21 January 2020 ,but money was not deposited her bank account.Sir, now what to do ?

Best create a ticket on our Support Portal for help.

Hi,

Thanks for the analytics feature. It’s really helpful

Not sure if this is feasible, but could you please provide an option to add details about the existing stocks from other systems as I have been keeping those stocks there for a long time. This can give me a holistic view of my entire portfolio.

Thanks

Nitin,

There is an urgent need of Consolidated view of all the holdings in multiple family accounts. Most businessman have multiple Zerodha account in family members name but managed by single person. There is a urgent need to visualize all investment in one place. You might choose to not breakdown Mutual Funds holdings but consolidated just based on Mutual fund scheme name.

Thanks.

This is on our list of things to do.

Is using ticker tape free?

Yes.

As usual, a great initiative by Zerodha.. 🙂

I am so glad I am part of the Zerodha family..

Nitin – is there way I can see performance of my portfolio over time in chart, compared to benchmark?

Hey Sandeep, this is on our to-do list. Should be available soon. 🙂

Still not available, how can i compare with benchmark

Very Nice Feature — Dream feature…

But this portfolio analytics shows some of the stocks which I don’t own, and conversely doesn’t show stocks which I own.

Help…

Hi, can the portfolio analytics also include debt mutual funds, I might be holding different bonds from the same company through different mutual funds. Some data around concentration on a particular company, average holding period etc will help

Very nice sir thank you for your support

Thanks, It’s a great initiative ..

Great Service ! I was managing my portfolio different site. Now it will reduce lot of my manual work and also help me to analyse and take quick action if required.

Thank a lot Zerodha

Suggestion: Please add one column ”ISIN” in trade book report.

Will pass this feedback on to the concerned team.

By far this is the best app that I have used for investment. Till date my experience has been beyond my expectations. Now with introduction of this feature i really am impressed and thanks to Zerodha team for such wonderful initiative.

Great Work! Truly living upto the name Zero-dha.

It will be great if you have some tool where you can check your portfolio or part of you portfolio’s performance against an index or a mutual fund.

Excellent feature.

Is this service free or it will cost me some money.

Also please let me know via mail or comment which services are free in kite account and which cost me extra money.

Hey Siddhesh. There is no extra charge for this. Everything on Kite is free. If you use services from our partners listed here, you’ll need to check the pricing page on their website.

I agree. Good observation.

its an amazing ………

Is there any way i can transfer my MF portfolio to Zerodha.

I have direct MF registered with AMC sites

Can you find a solution to this??

Jabbardast nithin

This proves y zerodha is greatest amongst its peers.

Thanks

Add a feature where we can upload our Existing MF Investment, like Upload CAMS Consolidated Account statement. This helps in viewing all the funds at one place.

We’ll pass this feedback on to the concerned team.

Any update on this ?

Can I import external portfolio and have a consolidated view

Great job guys. Keep rocking…

How to revoke the ticker tape authorization?

Hey Siddharth, there is no one-time authorisation. The authorisation is only valid for one session. If you try looking at insights after restarting the browser, you’ll see that you’ll need to authorise once again.

What a beauty! Zerodha at it again.

Hi Nithin,

Thanks for the very useful update. I have always admired zerodha for the very clean UI and was not disappointed with this update either.

Great, One more great feature and reason to be with Zerodha, Have couple of suggestions

1. Annualized return on each holding, as well as for the whole portfolio

2. Graphical Comparison of components of portfolio with different indices, like nifty, sensex, small cap etc..

This is on our to-do list, Shashank. 🙂

Is Annualized return available now?

Hey Rajiv, not currently but we’re working on it and will keep you posted 🙂

Hi Zerodha Team,

Please enable Annualized return feature, I guess now days every other broker have this basic feature.

Thanks,

We’re working on it, Narendra. We’ll keep you updated on it 🙂

Thank you Shubham and Zerodha Team for your update and keeping this feature in your to do list,

Thanks,

Hi Zerodha Team,

Almost 3 years for Annualized return feature, any update on this?

Thanks,

Hi Narendra, there are some complexities involved with edge cases which is why this has taken time. Having said that we’re close, please bear with us.

Hi Zerodha team,

Please enable the feature to see the Annualized return. This will help to access the performance.

Hi Nithin,

Good to see this initiative. I have seen that we are collaborating with multiple small companies for example in this case with Tickertape. Can you please ensure and do a risk analysis for having exposure of your client data to outside vendors don’t have a risk either for you and more for users.

Hey Himanshu, you need to authorise tickertape to read your data to see insights. This is not a one-time authorisation, but something you need to do every time you start a fresh session. As such, your data remains safe. 🙂

Much needed! I see that my gold fund (quantum gold) isn’t reflecting in the split of my portfolio as a separate investment in gold. Can that be rectified?

Will Zerodha be listed one day for trading? 🙂

Actually, it doesn’t match with my folio. When I have high exposure to small cap funds, it shows otherwise.

Was looking forward to something like this.. Awesome.. checking it out right now..

Looks nice with all the colorful graphs and pie-charts.

Any option to transfer this data to PowerPoint presentation? That will be great help to share same with peers (since one cannot give username/password).

Good Work, Zerodha 🙂

Nice feature.

This visualization is superb and it provides very good information. Hats off to the team 😀

awesome , u rock !!!

One suggestion pls provide drill down on STOCK donut chart.

Great move….it will help me a lot….kindly allow us to seperate long term holdings short-term and interday shares and allow us to sell from any holdings we want. I have to use 3 demats for three trades due to fifo followed.

Hey Manu, stocks in the demat account always move in a FIFO(first-in-first-out) fashion. Even if we display this differently on Console, for taxation purposes, you’d still have to show the transactions in FIFO.

Np….at least I can have my long term holdings…everytime I sell interaday stocks using cnc…i end up selling my stocks in holdings…so I wanted an solution…….is zerodha bringing any update in coming days

Intraday trades don’t have any effect on the stocks in your holdings.

is there any feature available to calculate annualized return on holding. Currently it shows absolute Rate of return.

Hi I want long time portfolio investment my number is 9594609493

Very good step.

,Sir, This is very good feature which helps long term investors. Thank You .

pl send

This latest addition is an absolutely fantastic provision for a long time investor……Too good…Zerodha is fast becoming or has already become a one-stop solution perhaps unrivalled by anything around….a big thank you and a thumbs up to the developing team

Thanks, very useful tool

Hi Zerodha team.. thanks for continuous improvement.. still there is a long long way to go.. this platform needs lot of features in option front. Like even a basic option chain is NOT available.. I am not sure if you have seen think-or-swim platform..

Hey Soumen. Option chain is available on Kite. Click on the ”…” button on any option contract in your marketwatch and click on ”option chain”.

Excellent feature…..

god bless you & zerodha team.

There should b a separate column in kite or console on XIRR returns on our stock from the day of investment. I mean my XIRR retuns on that stock instead of Absolute returns bcoz absolute returns does *not* take into account no of days,month or years of investment. Some mutual funds give this.

¶

i Agree! need same…

This is in our list of things to do on Console and will be added for stocks in one of our future updates. By the way, we are already showing the XIRR for mutual funds on Coin. Do check this post.

Thank you very much for the update.

I saw this new feature few days back. However, its not working well in Microsoft Edge. When I keep mouse pointer on the pie-chart, it jumps and not allowing to select any of the items.

Hey Rakesh, we don’t support Microsoft Edge in its current avatar. I would recommend you use Firefox or Chrome. However, Microsoft will soon release Edge based on the Chrome engine where this will work fine. You can download the new Chrome-based edge here even now.

Good features.

It’s very useful platform and good work for trading like short & long term investment.

Great. Useful updates.

Very good feature. I welcome it

There should b a separate column in kite or console on XIRR returns on our stock from the day of investment. I mean my XIRR retuns on that stock instead of Absolute returns bcoz absolute returns does take into account no of days,month or years of investment. Some mutual funds give this.

This is in our list of things to do on Console and will be added for stocks in one of our future updates. By the way, we are already showing the XIRR for mutual funds on Coin. Do check this post.

Hi,

Any chances that we can get this out ?

With absolute gains, we cant gauge the portfolio exactly.

Its been almost 2 years since your comment, but still no XIRR for stocks. Do you have any update on the feature?

Hey Munjal, we’re working on it, will keep you posted.

Please prioritize this feature. It adds to the overall insights about the profitability of everyone.

Any update on this?

Hi Rahul, we’re working on it. This has taken some time due to some complexities involved with edge cases. For now, you can check this article to know how to calculate XIRR/CAGR.

Much awaited and has been asked so many times earlier. Finally. Thanks

Aisa kuch banao jisme long term holdings alag ho Jaye or short term trading ke stock alag alag dikhne lage.bhai long term holdings bik jati hai iss chakkar me.

Hey Arya, stocks in the demat account always move in a FIFO(first-in-first-out) fashion. Even if we display this differently on Console, for taxation purposes, you’d still have to show the transactions in FIFO.

Very good feature. I welcome it

very good

I would like to split my portfolio into different purpose – eg: buy a home, Children education. This will help me have a different analysis criteria for each portfolio. I can’t do a goal(or other idea) based portfolio in Zerodha now.

This will help me manage my trades and save a lot of time that I spend on other tools to do the same.

Tagging holdings the way you’ve described is on our list of things to do and will be the next major update to Console. 🙂

Awesome 🖒

excellent 🙂

Awesome 🙂

Cool, let’s begin

When will you introduce customization of holdings? Eg.I would like to keep Long Term, Medium and Short Term holdings separate. Currently you only have provision to separate Small Case Holding separate. Your CSR says this is in pipeline. I am waiting for you to enable it, so that I can move all my holdings in ICICI Direct to Zerodha. It is becoming difficult to monitor and manage multiple accounts.

Hey Siji, tagging holdings the way you’ve described is on our list of things to do and will be the next major update to Console. 🙂

”Insights” blew my mind! Very close to my estimates. Keep up the stunning work, Team Zerodha. Way to go!

Dear Sir

This is very useful for long term investor. If possible can we get total dividend received during year at one place from all stock

Regards

Murlidhar Khedkar

Hey Murlidhar, the dividend report is available in the P&L report. Just download the P&L report on Console for any period and refer to the EQ Dividends Breakdown sheet to find all dividends received during the selected period.

There is a major feature from angel broking which I miss a lot.

Angel broking portfolio would show individual transaction for a stock.

Like, I’ve bought ABC stock four times with different prices. It would show the quantity and price and dates when I expand for the transactions view.

Please consider that as well.

Yes, I too miss this feature. In ICICI Direct too we have this. In Zerodha, we have to go to console… its a pain.

Hey Jigar, this is already available. Click on the ”…” on any of your holdings and click on ”view breakdown”. You’ll see when you bought, price, and the age of the investment.

Thanks Matti .. only that icici direct has the full past stock chronology of transactions , whereas inZerodha it is for stock qty currently held . May be some more data down the time line may be made available to check few past entry / exit points

Sir today i have sell out bank of baroda share qty 30 @ 54.75 for amount Rs 1642.50 & ONGC total qty 100 @84 for amount Rs 8400/- total sell out price Rs 10042.50 + bal ₹2.44 = 10044.94 . But you shows available funds for ₹ 8036.44 only, why…? Where is my ₹2008.5 Please clarify. My total investment on 2/12/20 is Rs 114540.40 and today after sell Which is up to ₹ 113594.34 why are you reducing it . Today’s amount after sell out ₹115602.84 – deduct your charges and today total amount comes upto _ 115556.84. Please correct and confirmed .

Hey Motilal, as per the latest peak margin rules, only 80% of proceeds from sale of stocks is credited the same day. Explained here.

I have invested in MFs that invest in foreign (US) stocks. However I don’t see them under the detailed portfolio breakdown. I am able to see the same against that fund name in moneycontrol and also the fund’s website. Why does it not show up in the portfolio analytics?

Hi

Will you please add the feature of displaying CAGR/XIRR?

It will be of great help for long term investors.

+1

Same +1

+1

+1. IRR for long term investments would be a boon. You have been working on it from long time as shown in your replies at various platforms. But request you to provide it soon.

Please add the XIRR field in portfolio view across individual stocks and at overall level

+1

This is in our list of things to do on Console. We’ll try to add it in one of our future updates 🙂

I cannot stress how important this feature is to long term investors. Please consider making XIRR front and centre to any analytics reports that you build.

+1

+1

+++++1, Need it for better planning . I am hoping its not that complicated to add as well

+1

मैने zerodha account open किया है. पर POA form नही भरा. आज मैने कुछ stock sell किए पर उसका amount मेरे account मे नही दिख रहा…

+1

would like to see CAGR when I choose longterm holdings filter from consoles Holding tab

+1. User must be able to see XIRR

Very nice initiative. Would be immensely helpful to see where capital is deployed and how’s the performance.

Keep up the great work.

Waiting eagerly to see the US Investments through Zerodha and quick payout to bank.

Hope that it will be done soon.

Good initiative for customers

There is a data of account holders being shared of their personal mobile number to the third party for private banks for their business and promotion please never share those details I have messaged you but no response in Twitter hope you take care of this @Nithin Kamath we are proud of your work you have built never break it

great start, guys. it would be lit, if you bring options portfolio analytics (beta weighting, portfolio balancing, consolidated payoff chart for different instruments) too under this project.

Thanks for the suggestion, Harris. We’ll discuss this internally and find out what all could be offered here. Also, you might wanna check out our partner, Sensibull. They’ve got a custom strategy builder, along with some other cool features, which you can use to build your own strategies and visualize the P&L.

Excellent! Much awaited feature.. Thanks

Gold should be a separate class. It does not seem to be there as a separate.

Thanks again!

Hey Tarakesh, we do have gold as a separate asset class. Currently, you might be able to see only goldbees under this. We’ll be adding all of the gold mutual funds and ETF’s to this soon.

i think Zerodha team should work more for Intraday trader or Option Trader …. Like

1. For option trader we don’t have Spread order option (to open strategy).

2. For Intraday Trader there is no Option Chain available in web platform (KITE).

Hey Nitin, option chain is available on Kite web and mobile. Click on the ”…” on any option contract in your market watch and select option chain. Spread orders coming soon!

Hey thnxs man @Matti…. for ur quick reply

1. i know option chain available if we have any strike Price in watch list … it would be better if we can open Chain with simple Script symbol too…

2. & BIG thanks for SPREAD ORDER if it is coming soon… i know u guys also waiting for SEBI notification for Hedge margin 😉

Quadrant q3 report is profit .but why these stocks down ward????

Hey Satyanarayan, sorry I didn’t get you. Are you referring to the tax P&L here?

Zerodha keeps providing useful updates. Thanks guys

Excellent Move

Nice feature for me, it used to analysis my portfolio better way.

Is tickertape that of zerodha or 3rd party.

If it is 3rd party then doesn’t it mean sharing my data with them?

Hi Saurabh, we don’t share any personally identifiable information with tickertape. We also now have an authorisation that you have to make agreeing to share your portfolio details with tickertape. Only after your consent will your portfolio be shared with tickertape for insights, keeping you in control.

How to revoke authorization for tickertape ?

For other app like smallcase, coin,etc there is option in kite to revoke but i am not seeing this .

Either there is option everytime to authorize OR there should be option to revoke.

For other app like smallcase, coin,etc there is option in kite to revoke but i am not seeing this .

Either there is option everytime to authorize OR there should be option to no authorize .

Hey Ashish, you need to authorise every time because that way your data is always in your control.

You don’t need to revoke this authorisation because it’s only valid for one session. As soon as you close the browser, you’ll need to reauthorise tickertape.

Sir, This is very good feature which helps long term investors. Thank You Sir

Great Initiative !!

Ritika ji aapse ek help chaiye thi vo ye h ki mere share portfolio me show nhi ho rhe h jabki mene kal hi order lagaya tha nd sab kuch details shi bhari thi plz help me

Sir I want to help u

Zerodha account open kiya h, but no received mail from zerodha.

Pse send information my zerodha account how Match take long lime open my account.

Thnks

go and sign up again, you will receive the User ID, once you find User ID reset it.

How do I get details of settlement with required no.

Hi Munir,

You can get this information in your on the top right side of your ”Holdings screen”

Dear Gentlemen/Ladies – zerodha team ;We are not able to view multiple charts , please suggest how to do it

thanks

Hi, I got a message of crediting of bonus share of Josts Engineering on 22.5.21 in my portfolio and doubling it after split but the same is not shown in my portfolio

Maine IRCON liya tha 3/4/2020.kal mere holdings

me show kar rha tha. But aaj ni show kar rha hai .plz help

This will show up from tomorrow.

Hello,

While withdrawal i am invested in icici over night fund, but right now i am not getting how to withdraw that over night fund please help in that by step by step please…

mere bhi show nahi kar raha h route ka .kya solution h plz help me

wait for T + 2 days to show in your account