US Fed Rate Cut: How it affects traders and investors?

The US central bank – the Federal Reserve (the “Fed”) – meets every other month to set short-term rates. Given the vaunted position held by the American economy and sheer size of assets linked to these rates, the meetings draw a lot of attention.

It is understandable that rates, bond, and currency traders spend a lot of time and effort modeling rates. But should you – a trader in the Indian markets – worry about short-term rates on the other side of the world?

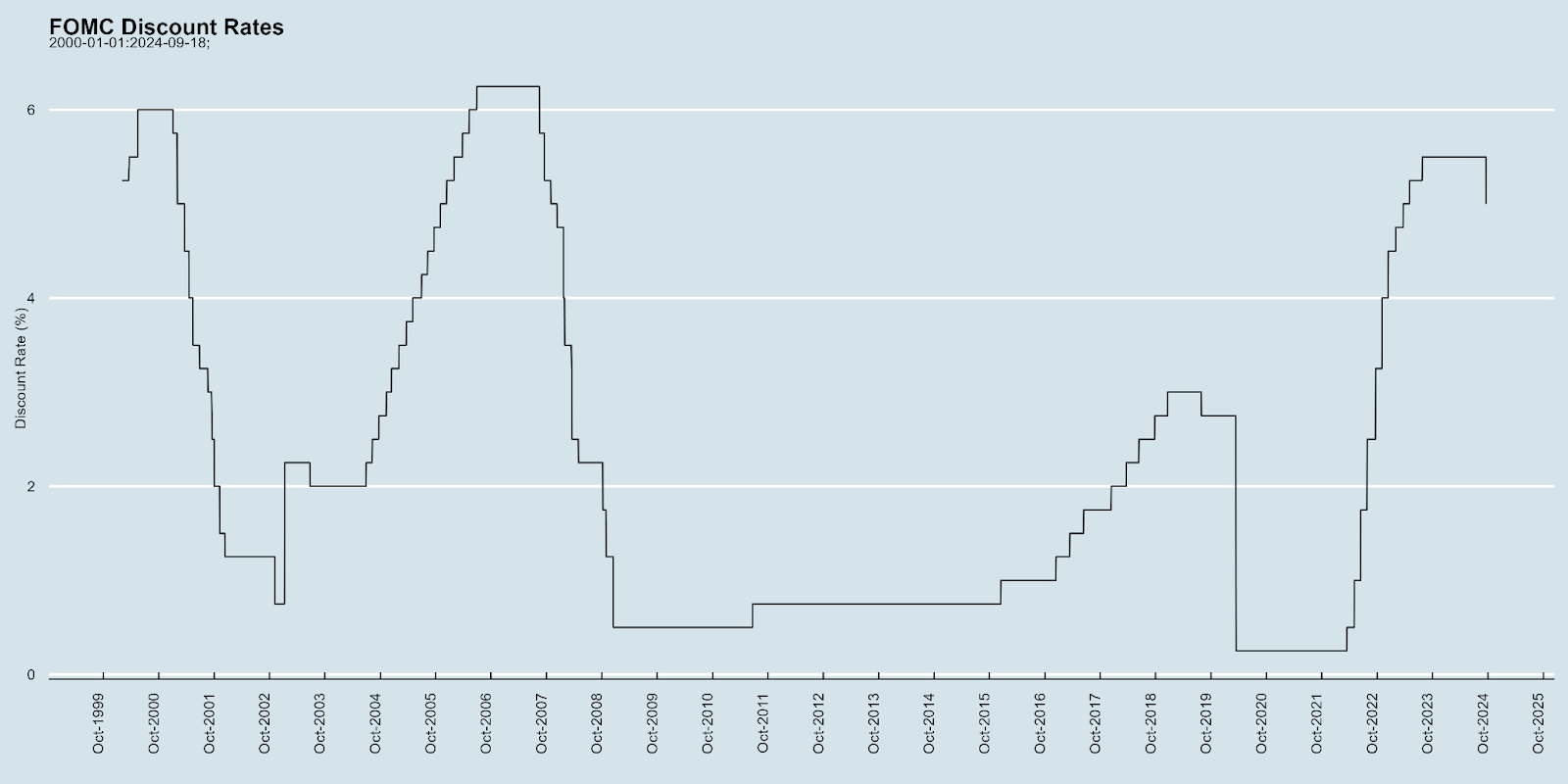

Since 2000, there have been around 125 FOMC meetings. 54 of them, roughly 44% of the time, have been a “hold” – i.e., no change. 41 of them (33%) have been a “hike,” and 28 of them (22.5%) have been a “cut.”

The rationale for these decisions has varied from the dotcom meltdown in the 2000s to the GFC, COVID-19, inflation spikes, etc., and so has its long-term effect on equity markets.

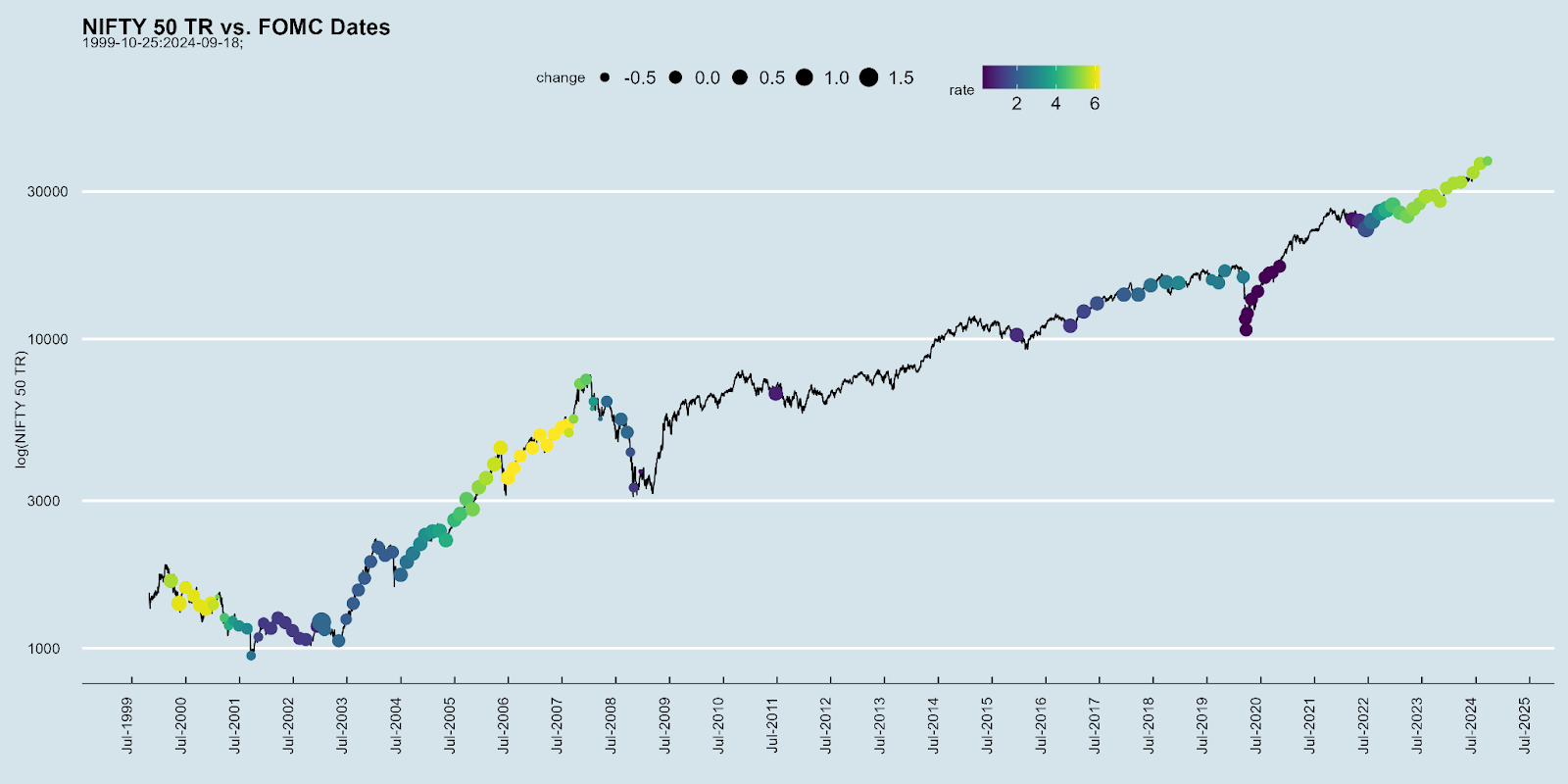

In the long term, what matters to equities are factors like earnings growth, return on equity, productivity, etc. So, if you are looking for the effect of Fed decisions on Indian equities, then you are looking at very short-term data.

What happens five days around Fed announcements to the NIFTY 50?

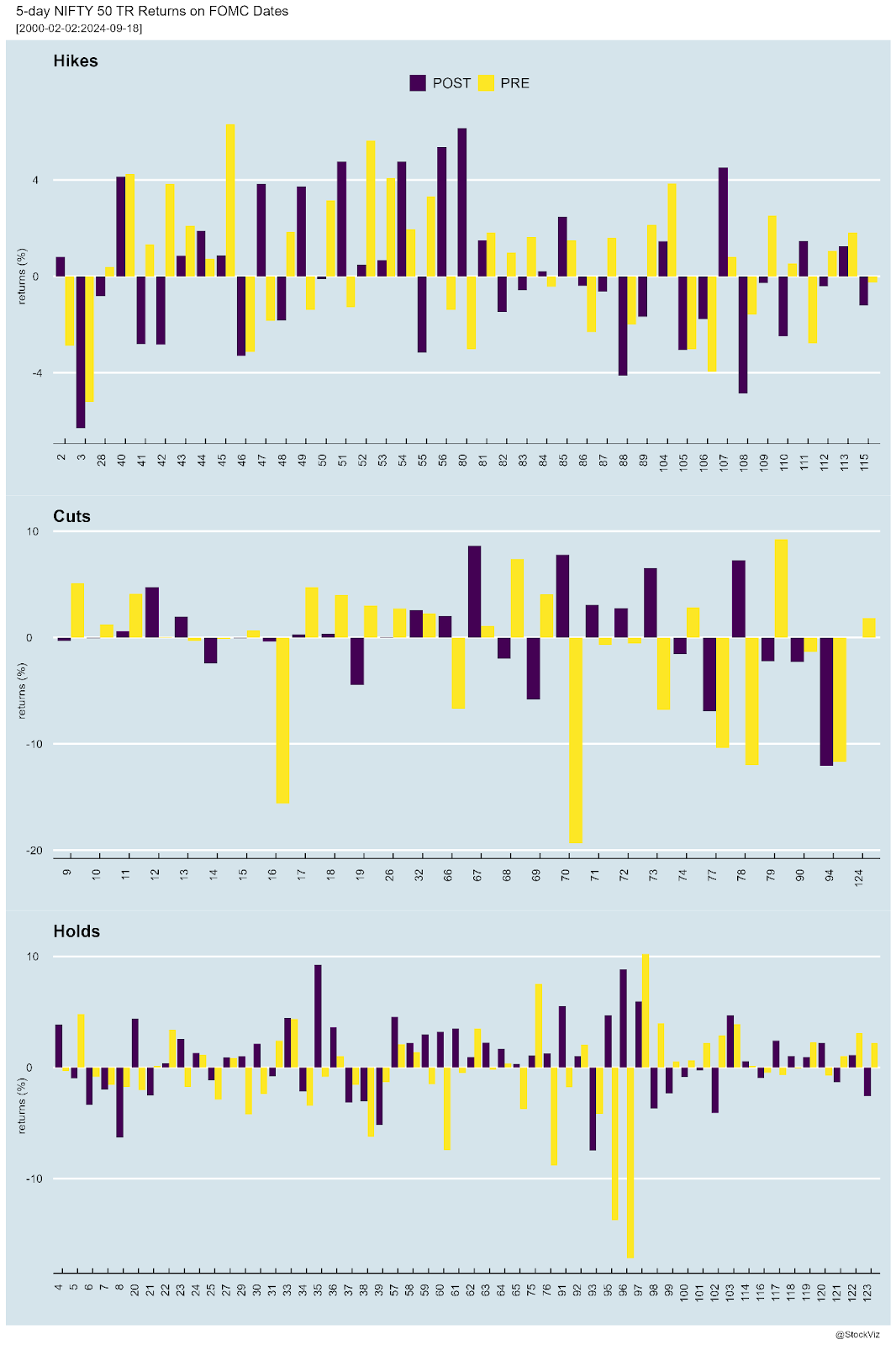

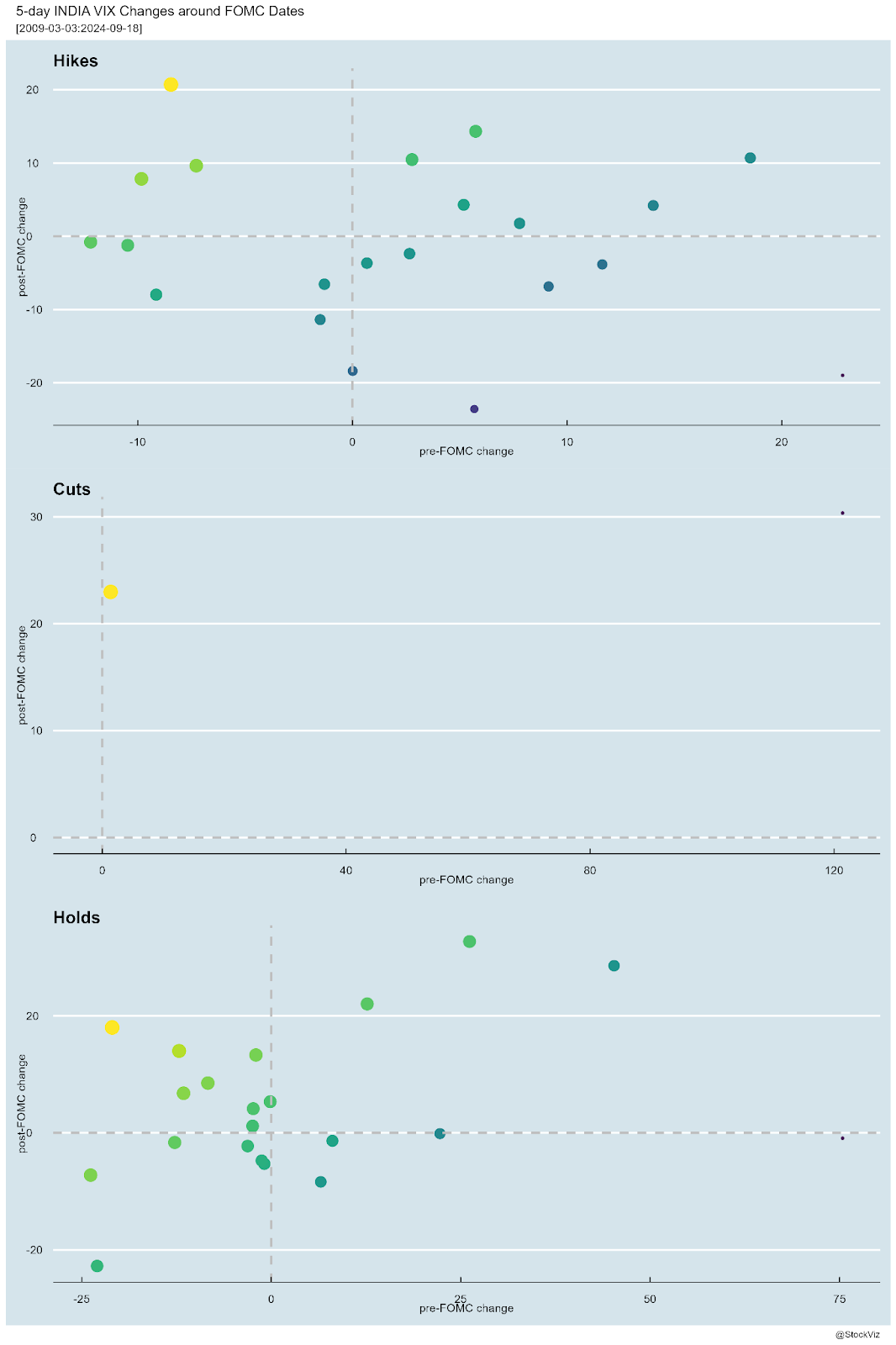

While there are a lot of theories on what “should” happen but it looks like there are no strong effects. If there were any signs of auto-correlation, they should be apparent when you plot the returns by date.

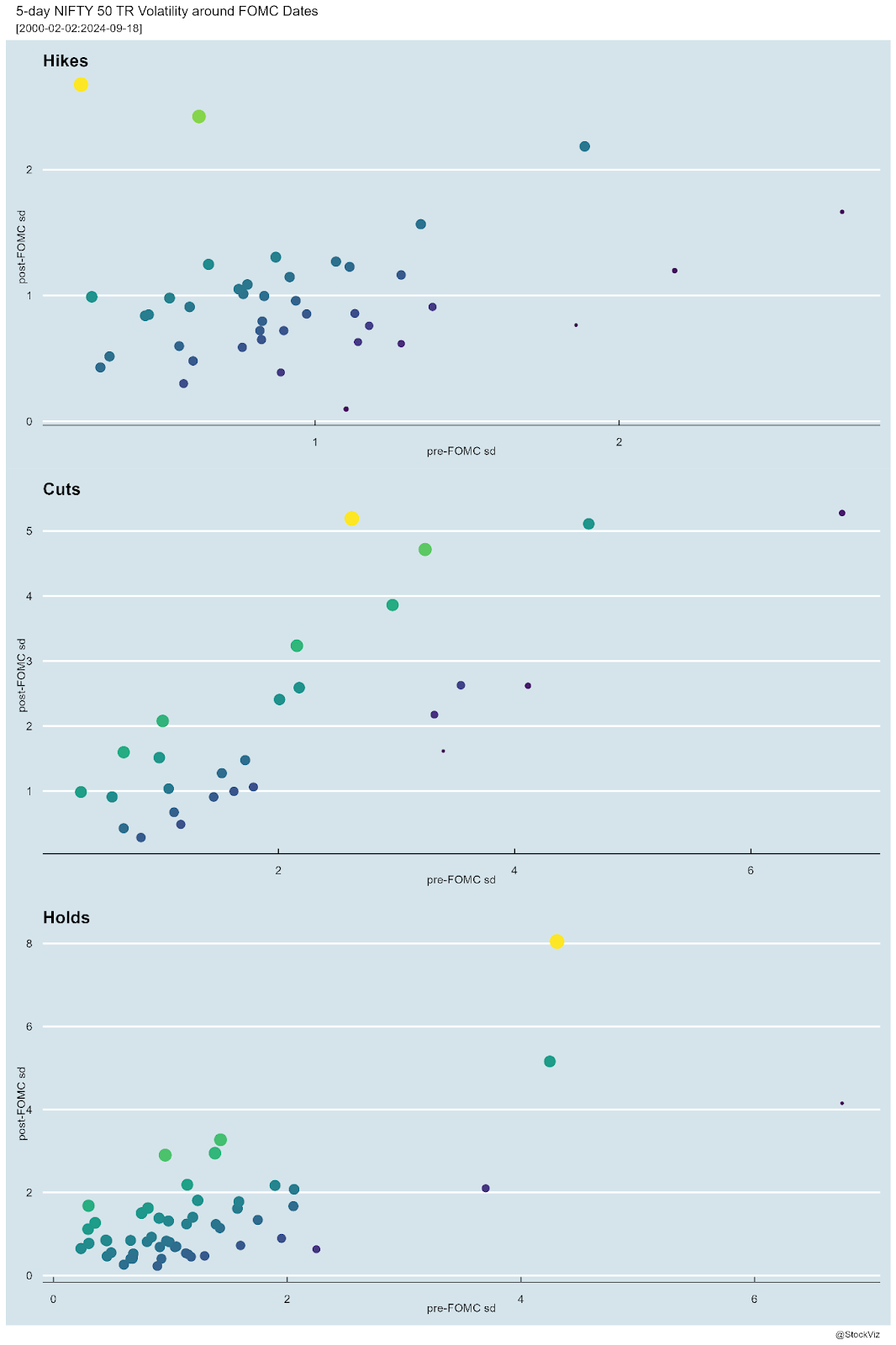

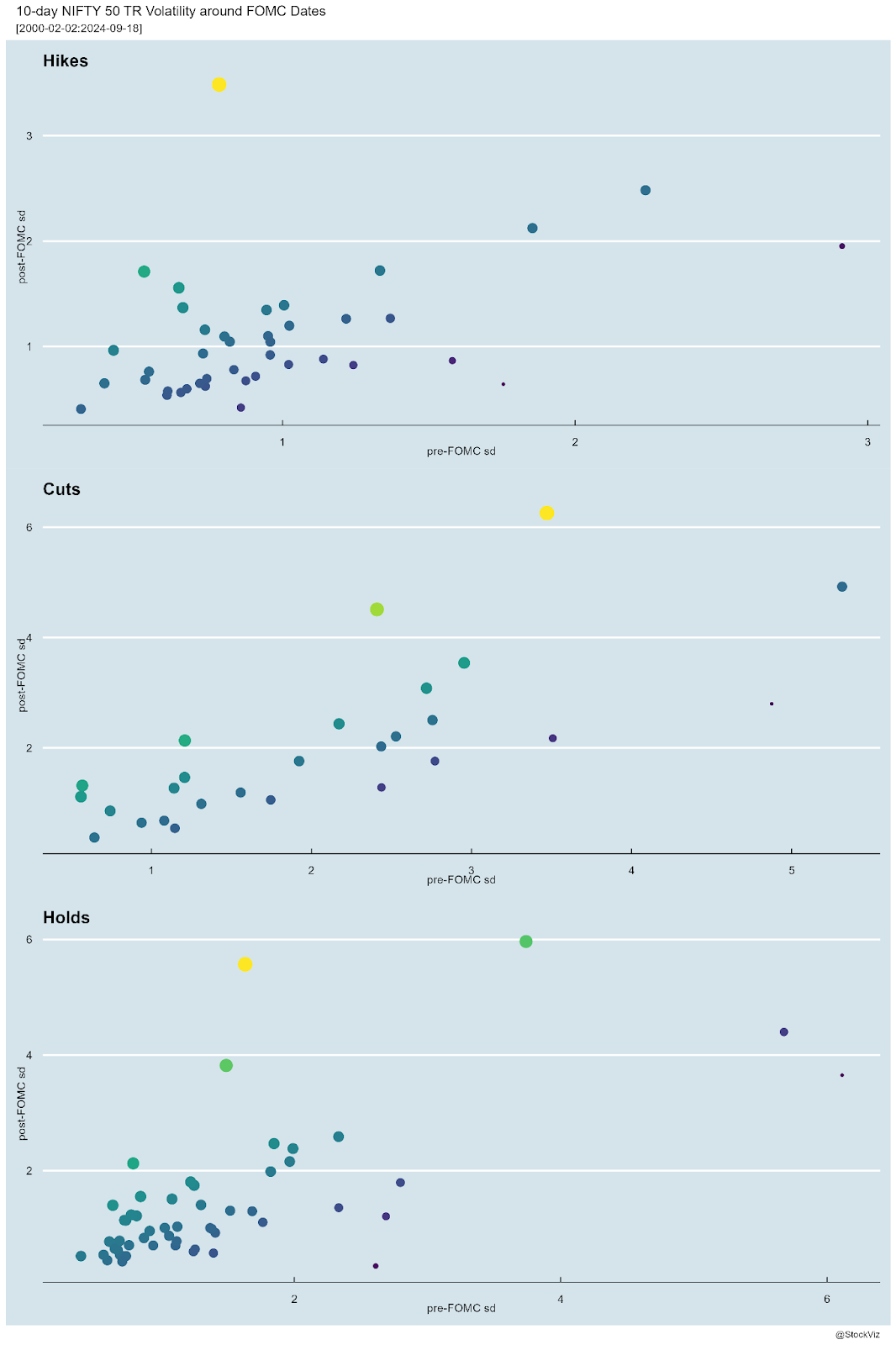

So, trading directionally may not be wise. What about volatility? Measured as standard deviation, post-FOMC volatility largely correlates to pre-FOMC volatility.

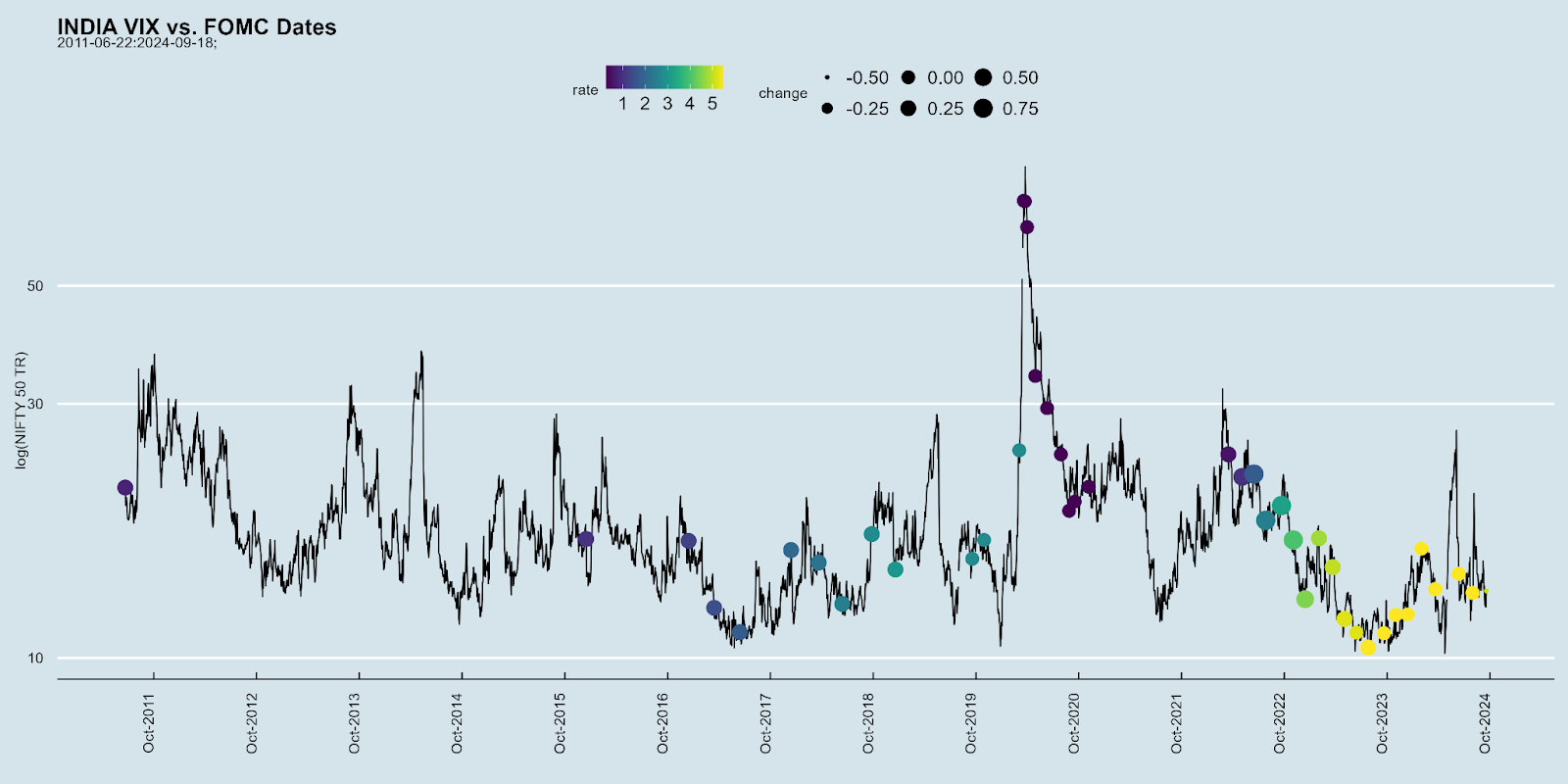

Overall, does VIX seem to chop around a bit?

If you absolutely want to trade FOMC, then perhaps betting on implied volatility moving around a lot might make sense. Basically, trade vega.