Returns under Momentum

Momentum investing has been around for decades. It was first formalized by Jegadeesh and Titman in their ground-breaking work on momentum: Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency (pdf) in 1993. Since then, there have been hundreds of variants of the same underlying strategy that strike a slightly different balance between risk, reward, and costs. The Indian investing scene is no different. Pretty much all advisors and fund managers run a bespoke momentum strategy that they claim to be superior to those spun by others. However, it is wise to remember the old fishing lore: the lures are made to catch fishermen, not fish.

Image credit: getmyboat.com

Running with the analogy, you can think of a strategy’s maximum profit potential as the number of fish in a pond. As a fisherman, your goal is to catch as many fish as possible. Some people try to do it with a fishing rod, some by casting a wide net and some might just toss in a dynamite. However, ultimately, everybody is fishing in the same pond.

So, what does the typical fish in the (momentum) pond look like?

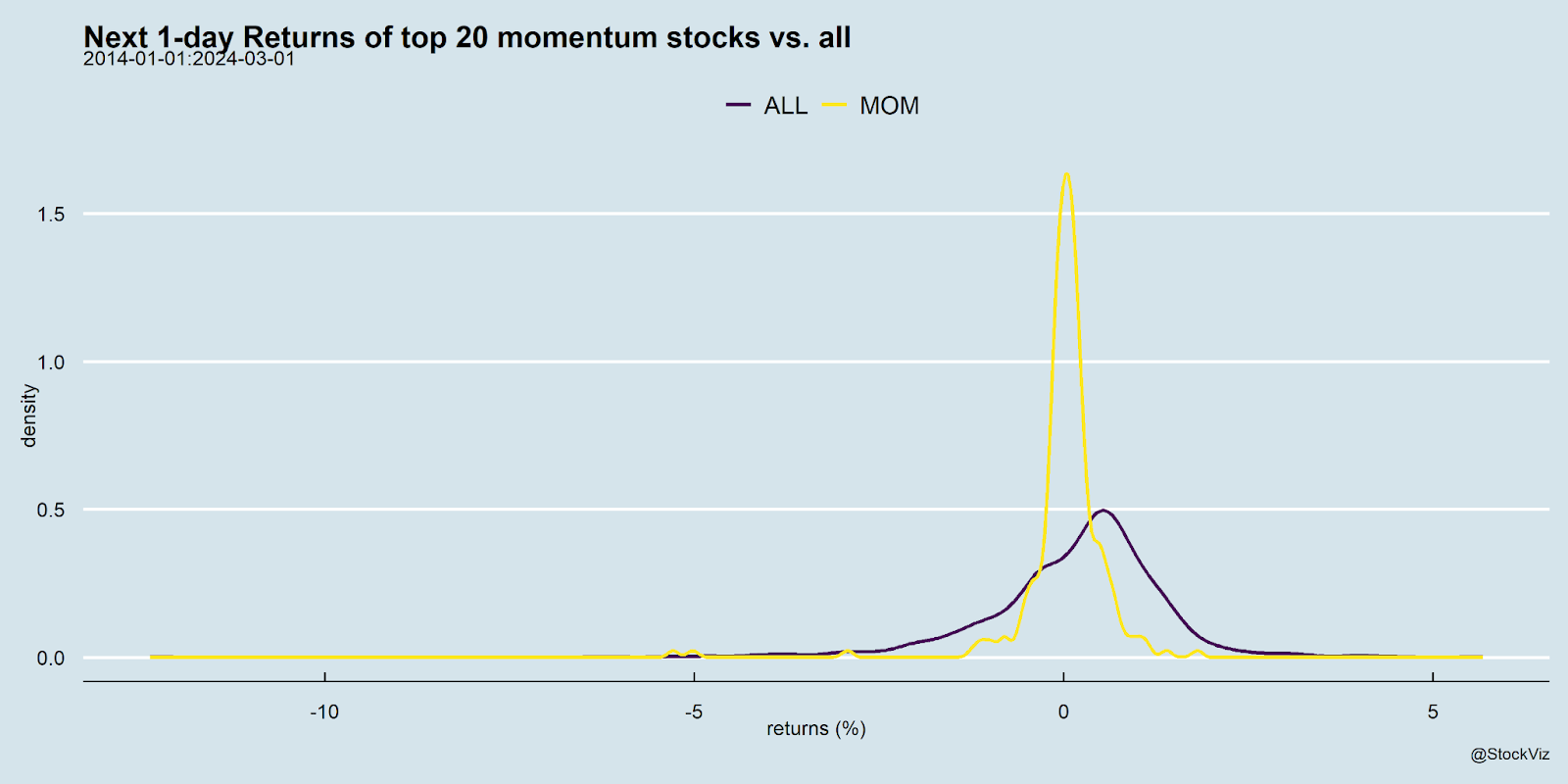

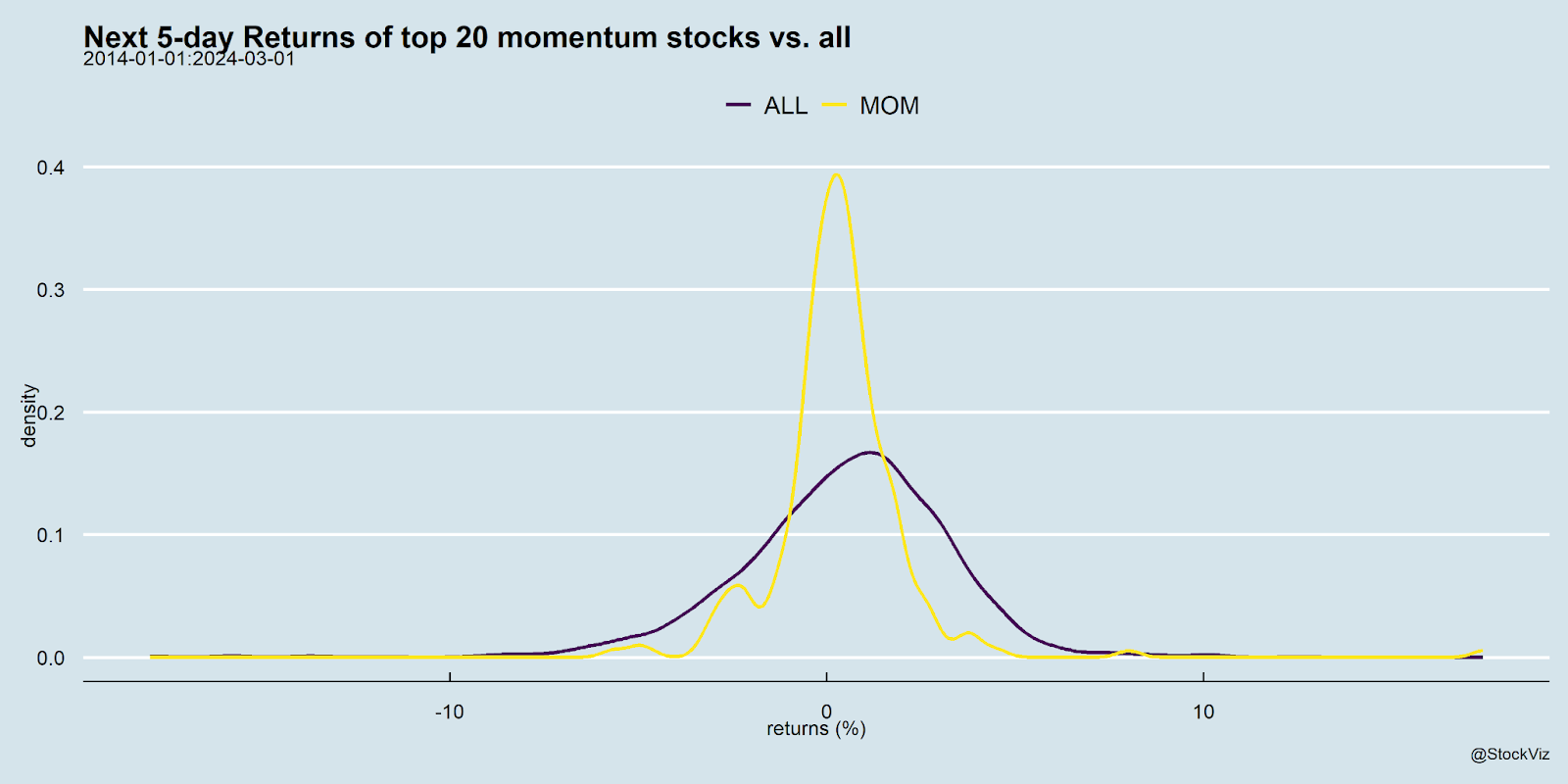

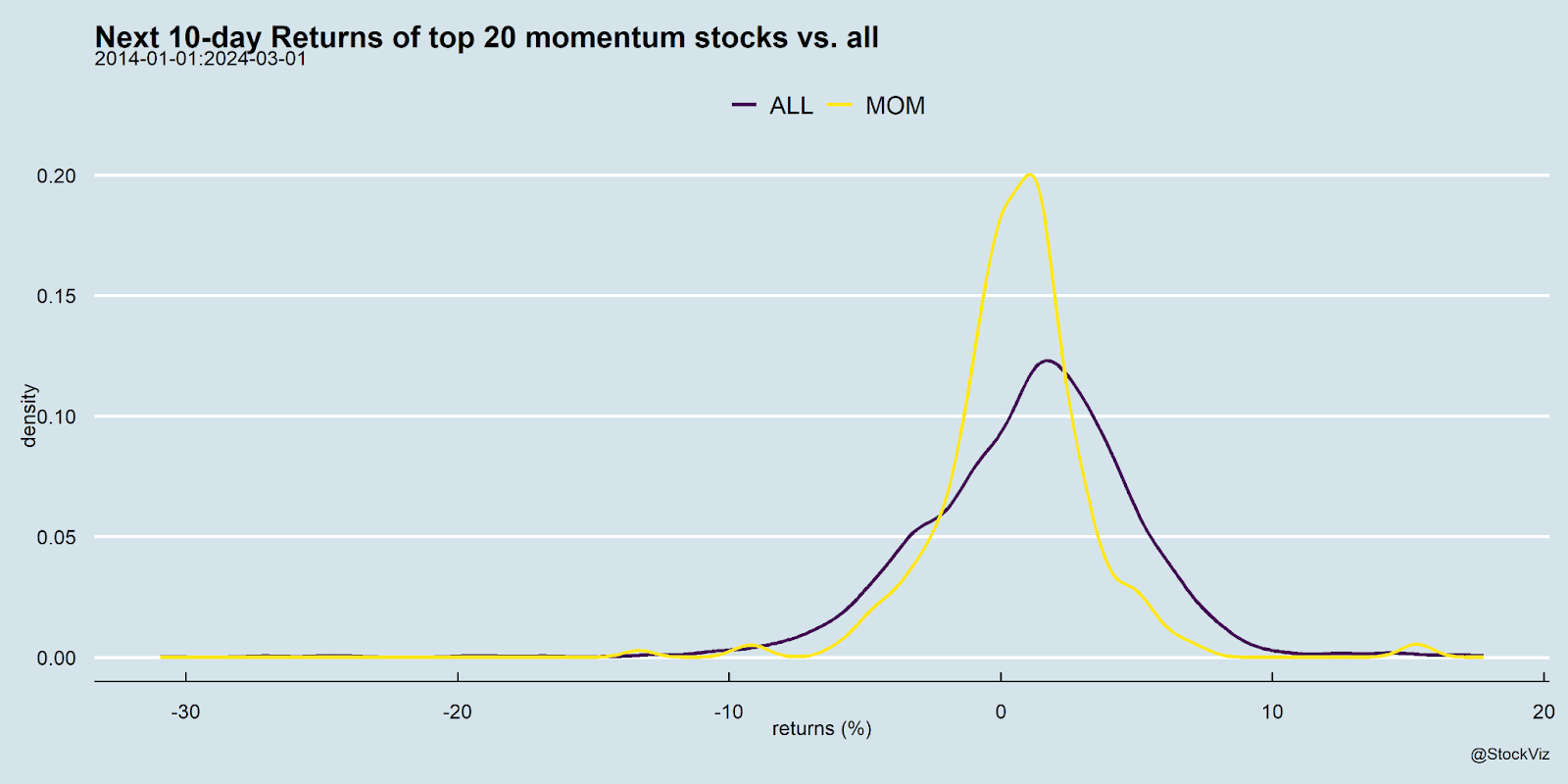

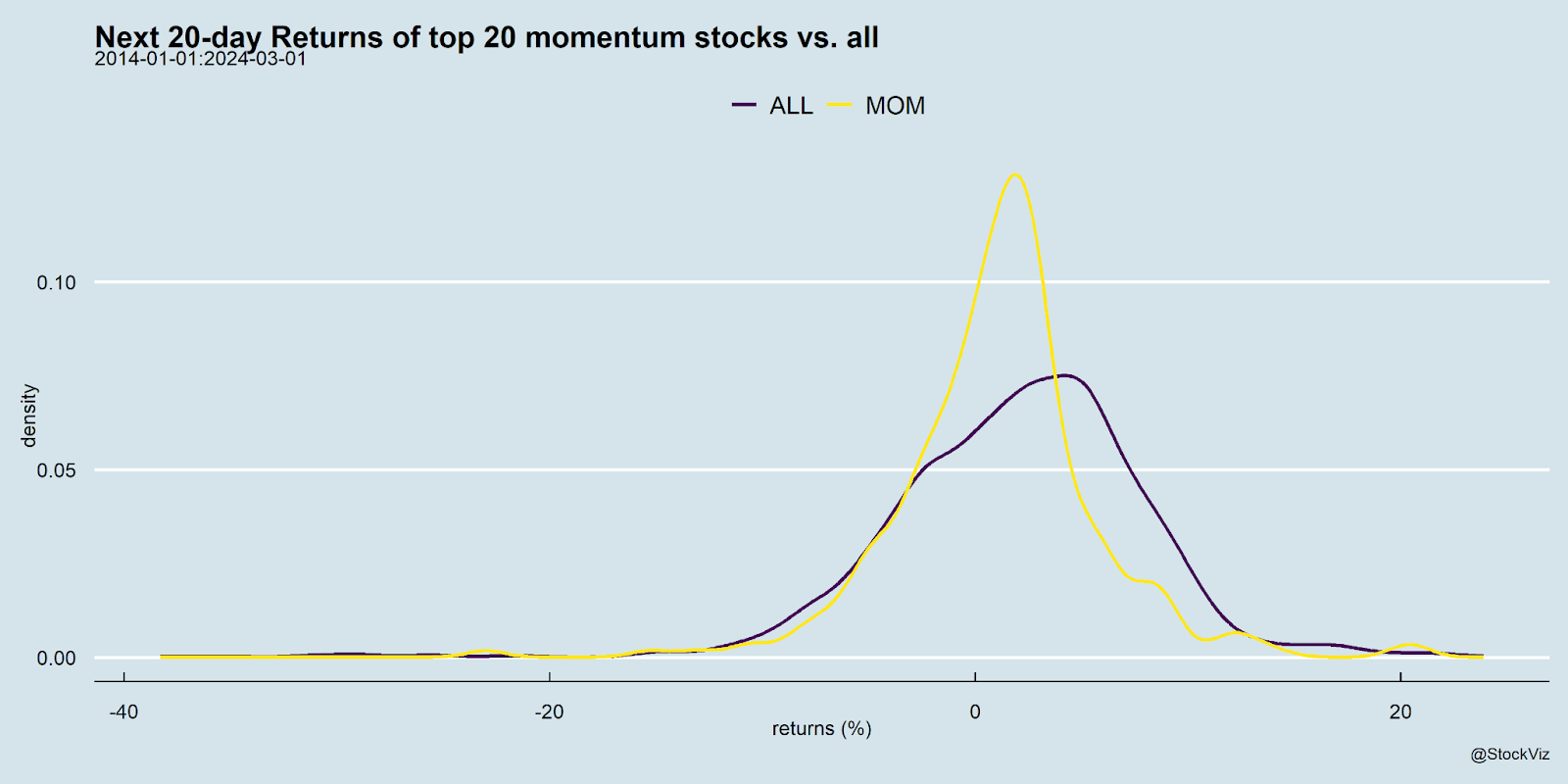

Suppose you created a momentum portfolio every day with 20 stocks. What do the subsequent average returns of these stocks look like?

If you keep it for just a day, then, on average, returns are going to be zero.

If you keep it for 5, you begin to see the tilt. However, in the real world, exploiting this edge could be cost-prohibitive.

Hold it for 10 days and the left tail is still below the overall average.

Hold it for 20 days, as most momentum portfolios rebalanced monthly do, and you are surfing market beta.

Please keep in mind that these are overlapping portfolios, and the charts merely illustrate the shape of the edge. Only stocks with listed futures were considered (‘ALL’ indicates the universe of stocks in the FnO segment.)

What these illustrations also seem to indicate is that the edge attenuates with the holding period. After 10 days, the left-tail advantage ebbs away – i.e., negative returns of momentum stocks look similar to those of the universe. So, rebalancing every couple of weeks should, in theory, give better returns than rebalancing monthly.

Ultimately, no matter the lure, if the fish dwindle in numbers, all fishermen will struggle.