JPY-USD: The Great Carry Trade

The ‘USD—Yen’ carry trade has been all over the news lately. The term ‘Carry trade’ may come across as a fancy new trading technique, especially to newbies to the capital market, but carry trades have prevailed in the market for decades and were particularly popular in the 1990s.

Here is your quick guide to bring you up to speed with the current Yen-USD carry trade hype.

Let’s start from scratch.

Every country is different and has its own political and economic problems. Countries devise unique ways to solve their local problems.

If you look at just the economic problems in isolation, then the problem eventually boils down to two things—either a country is fighting inflation, where the prices of goods and services are increasing by the day, or the country is chasing growth, where it wants to produce more of its breadwinners to register higher incomes.

Regardless of what the country wants (economically), they do so by tweaking the interest rates in the economy. For instance, if a country is fighting inflation, it will try to keep the interest rate high so that the circulation of money in the economy is tightened.

If the country is chasing growth, it will keep the interest rate low to make access to money cheaper to fuel growth.

Hence, different countries have different interest rates in the economy. It’s the job of the central bank to determine the country’s economic needs, set interest rates, and monitor it regularly.

There is a direct correlation between the interest rate and currency movements. If inflation is high, that means something is fundamentally wrong in the economy, and therefore, the central bank tends to increase the interest rate. Such currencies usually depreciate over time.

Alternatively, the currency backed by low interest rates in the economy is considered to be doing well or a strong currency.

Now this is where things get interesting – as long as the interest rates between two countries differ, there is a scope for ‘carry trade’. Let us say Country A has a low interest rate, and Country B has a high interest rate. Broadly speaking, a carry trade can be executed in the following manner –

- Borrow funds at low interest rates from Country A

- Convert the borrowed funds into the currency of Country B

- Invest the converted funds into assets of Country B, usually the short-term sovereign bonds issued by Country B

- Wait for the maturity of bonds

- Upon maturity, square off the trade

- Convert the proceeds back to the currency A

- Repay the borrowed funds

- Pocket the interest rate differential

The idea behind this trade is that you earn the interest rate differential by virtue of ‘carrying’ the asset belonging to the country with the higher interest rate. Of course, institutions with larger risk appetites can deviate from Govt bonds and T-bills and venture into stocks, commodities, and corporate bonds. Most institutions do.

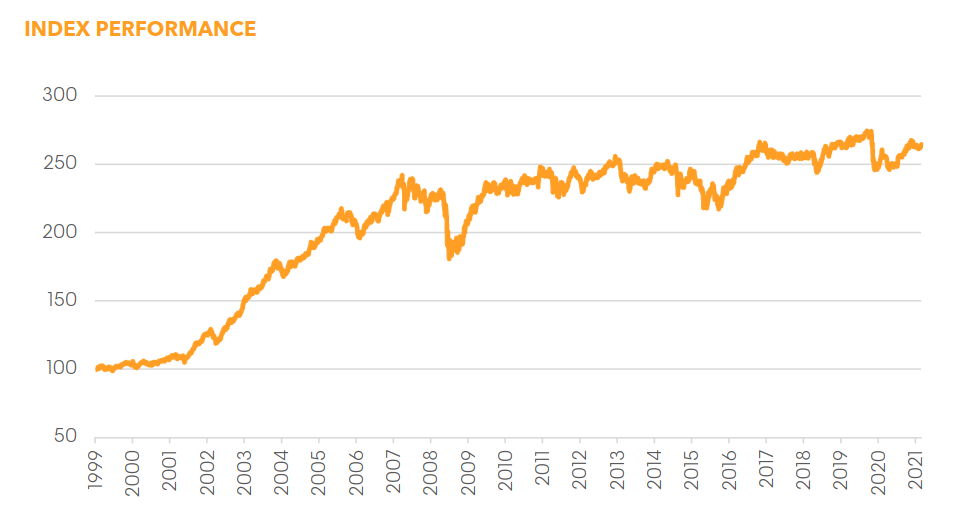

Historically, these carry trades seem to have done well.

The graph above shows the performance of carry trade in G10 currencies, and the index is called “Bloomberg GSAM FX Carry Index”. You can google it and compare it against stock indices to see relative performance.

But what can go wrong here?

We will talk about the risks shortly, but to begin with, the implicit assumption here is that the costs of executing a carry trade are not prohibitive. The costs of a carry trade include the cost of borrowing, conversion charges, settlement charges, banker’s fees, taxes, and lastly, brokerage. The carry trade should generate enough profits to pay off all these charges and still be profitable. For this reason, many carry trade opportunities appear profitable on paper but may not work out if you were to factor in the actual cost of running the carry trade.

For a carry trade to work, the interest rate differential should be large, like the Yen—USD carry trade that exists now.

As of July 2024, the interest rate in Japan is near zero, thanks to the prolonged deflationary economic environment, and the rate in the US is around 5.25% to 5.5%.

Forex traders borrow in Japanese Yen at near zero percent, convert to USD, invest in short-term US-denominated bonds and t-bills, upon maturity, convert back to Yen, repay, and pocket the interest rate differential.

Given the largish interest rate spread, the Yen-USD carry trade can easily absorb the costs. However, apart from costs, there are a few systemic risks involved in carry trade:

- The economic winds can change overnight, and interest rates can fluctuate. Remember 2020, covid era?

- Changes in Govt policies or political affiliations

- Changes in interest rates impact currency rates. A weaker currency can strengthen, and a stronger currency can depreciate at the same time.

- Speculations on economic prospects lead to currency volatility, thereby increasing the mark-to-market losses.

- Changes in currency rates can impact the profitability of the carry trade.

So much so that carry trade can result in losses. Perhaps that’s why traders talk about picking up pennies before a steam roller in the context of carry trade.

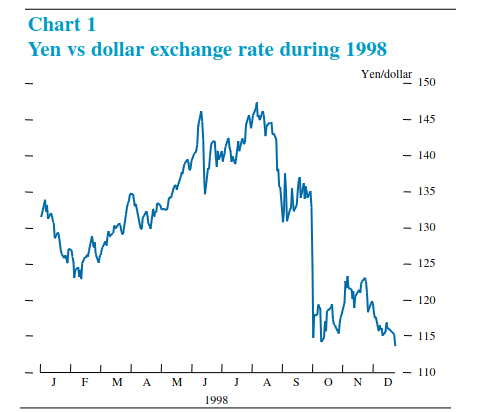

In fact, whenever traders talk about carry trade, the 1998 Yen-USD saga is recounted. Back in Oct 1998, within a week, the Japanese Yen rose 17% against the USD, meaning the Japanese Yen strengthened while the USD weakened. In other words, the JPY-USD currency pair cracked 17%.

Years of profitability in the Yen-USD carry trade were crushed within that one week. All profits were wiped clean.

Coming back to the present day, similar sentiments are triggered in the carry trade world with the recent JPY-USD movement.

The USD-JPY pair cracked nearly 7% in July 2024, backed by the possible interest hike by the Bank of Japan (BOJ) and perhaps a rate cut by the US Fed. The decision of both BOJ and the US Fed is expected around the last week of July 2024.

Now, how does the carry trade impact you, your investments, and the world markets?

Well, institutions have borrowed trillions of Yen and channeled the funds across various emerging markets. Any distress in the carry Yen-USD trade dynamics will imply that these institutions will have to wind up their risk-carrying trades, which means they will have to sell the ‘carry’ assets. Position unwinding will therefore lead to 2nd order effect across all markets.

Being petulant here but in the second chart above (titled Chart 1), the y-axis is titled Yen / Dollar. it should be the other way around i.e. USD / JPY

Did you write about carry trade anyway in varsity modules sir ?

Great article! I have a query regarding Short term and long term impacts on change in interest rates. During high inflation, Central Bank raises Int. rates which lead to more capital flows in that country resulting in Currency appreciation in the short term. But as high inflation will lead to lower purchasing power – currency will depreciate in the long term. Is my understanding correct? As we are witnessing right now JPY/USD rate has appreciated, is it because of increase in Int. rates by BOJ? And if Yes, then isn’t is good for Carry-traders as the currency where you have invested has appreciated?

why YEN currency strength has Increased suddenly ?

Thanks for sharing knowledge on stock market and economy related topics

Thank you for a detailed and clear post. One thing I need to clarify: If the borrowed money is invested in emerging assets that provide higher returns than the updated interest rates, wouldn’t it be wise to continue with the current investments and repay the borrowed money later, after realizing profits from the emerging markets?

Usually its not invested in emerging assets, but rather in assets where the interest rates are higher. But this is a typical carry trade arrangement. But risk taking institutions do borrow cheap and invest in emerging countries, but that exposes them to many risk factors, which may prevent them to hold trades for longer duration.

Very informative and thanks for sharing your knowledge .

Thanks Dishant, glad you liked it 🙂

Very informative

Happy reading!

Who are these institutions and where have they invested the money?

Large institutions, hedge funds, banks etc. They usually invest in countries where the interest rates are higher.

Would this be considered an arbitrage trade?

Hi Vishal, arbitrage trades are riskless while this trade involves open ended risks. Therefore, this is not an arbitrage trade. 🙂