How can traders use streaks?

You might have often come across news headlines about market streaks.

- Sensex, Nifty snap 3-day losing streak, rebound amid global rally

- Benchmarks snap 5-day streak, Nifty settles below 24,750, VIX climbs above 14

- Nifty snaps 5-day winning streak, Bank Nifty continues to underperform

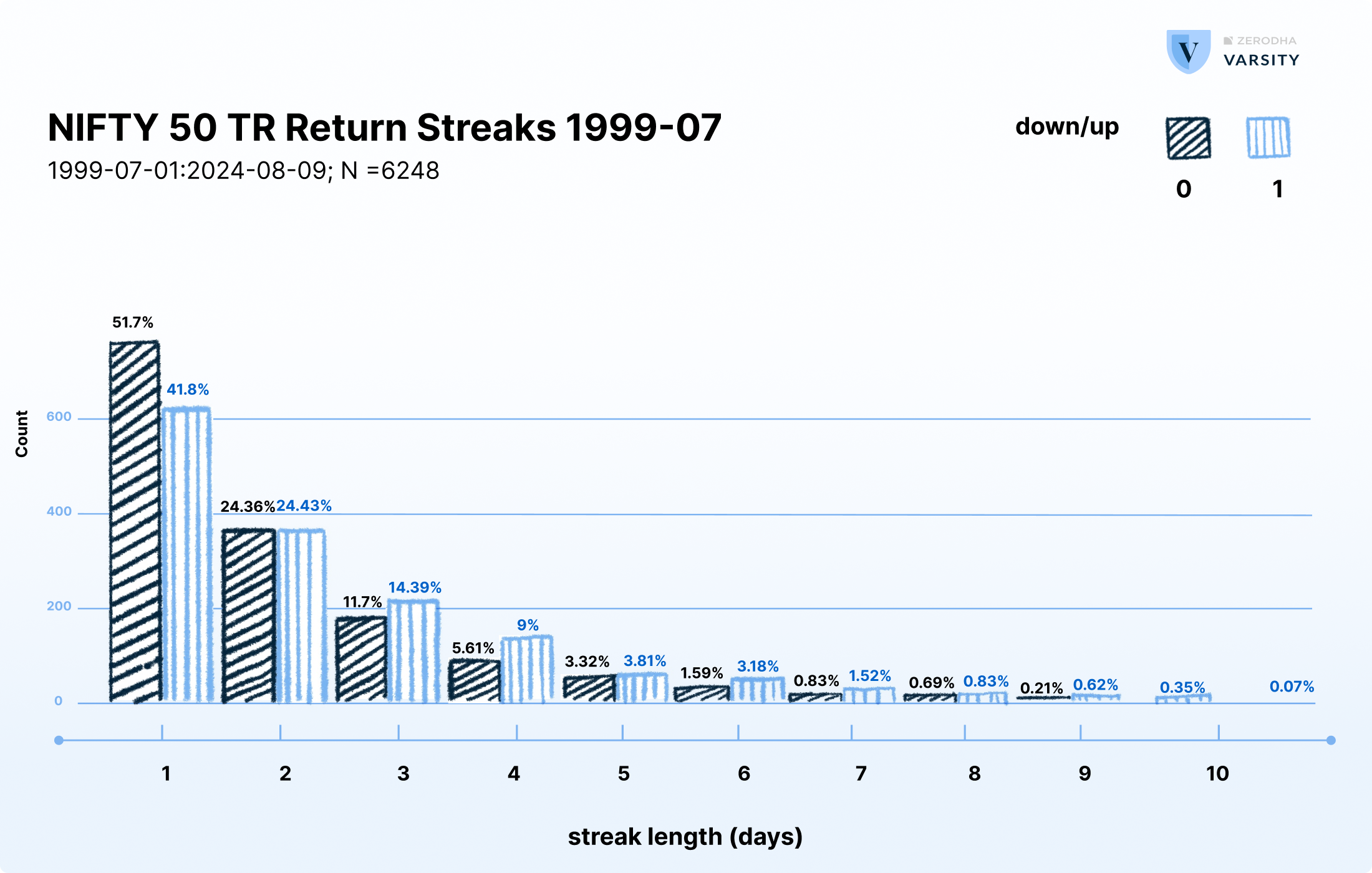

What is a Streak? It is an uninterrupted set of up or down moves. If Nifty 50 closes up for two days or more, it is a streak. The same is true on the downside, too. Streaks are interesting and mostly rare.

Of the 6248 trading sessions since 1999, only 14.4% of the Nifty did an up move for three consecutive days. And only 11.7% times it did three consecutive days of down move.

However, can you base your trades on streaks?

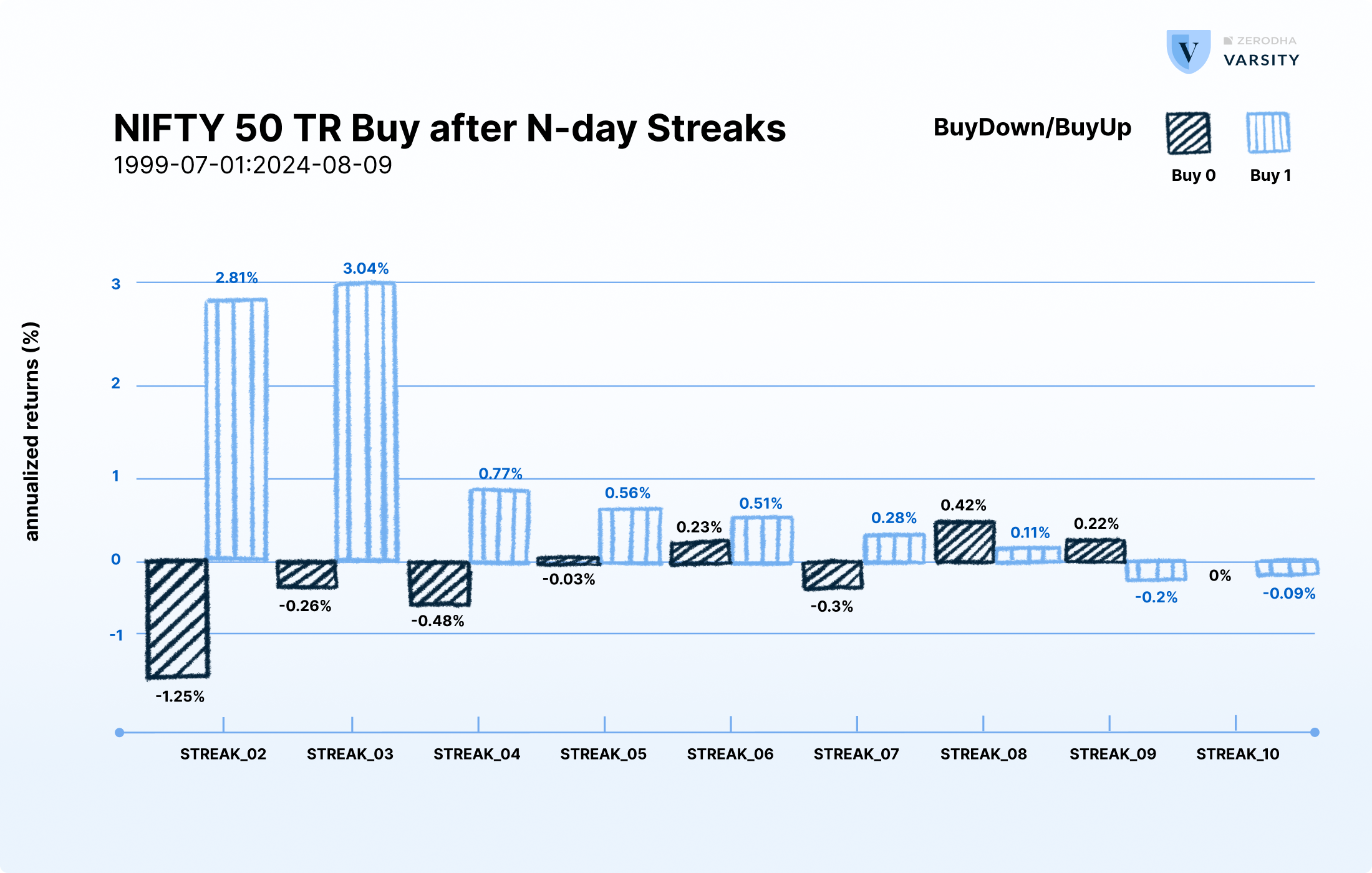

Should you buy after a positive streak, expecting the market to continue higher?

Or should you buy after a negative streak, expecting the market to reverse?

Perhaps not!

Buying after a positive streak might work if you ignore transaction costs and taxes. After the trading costs and taxes, there is barely any profitability left. However, expecting a reversal after a losing streak doesn’t seem promising.

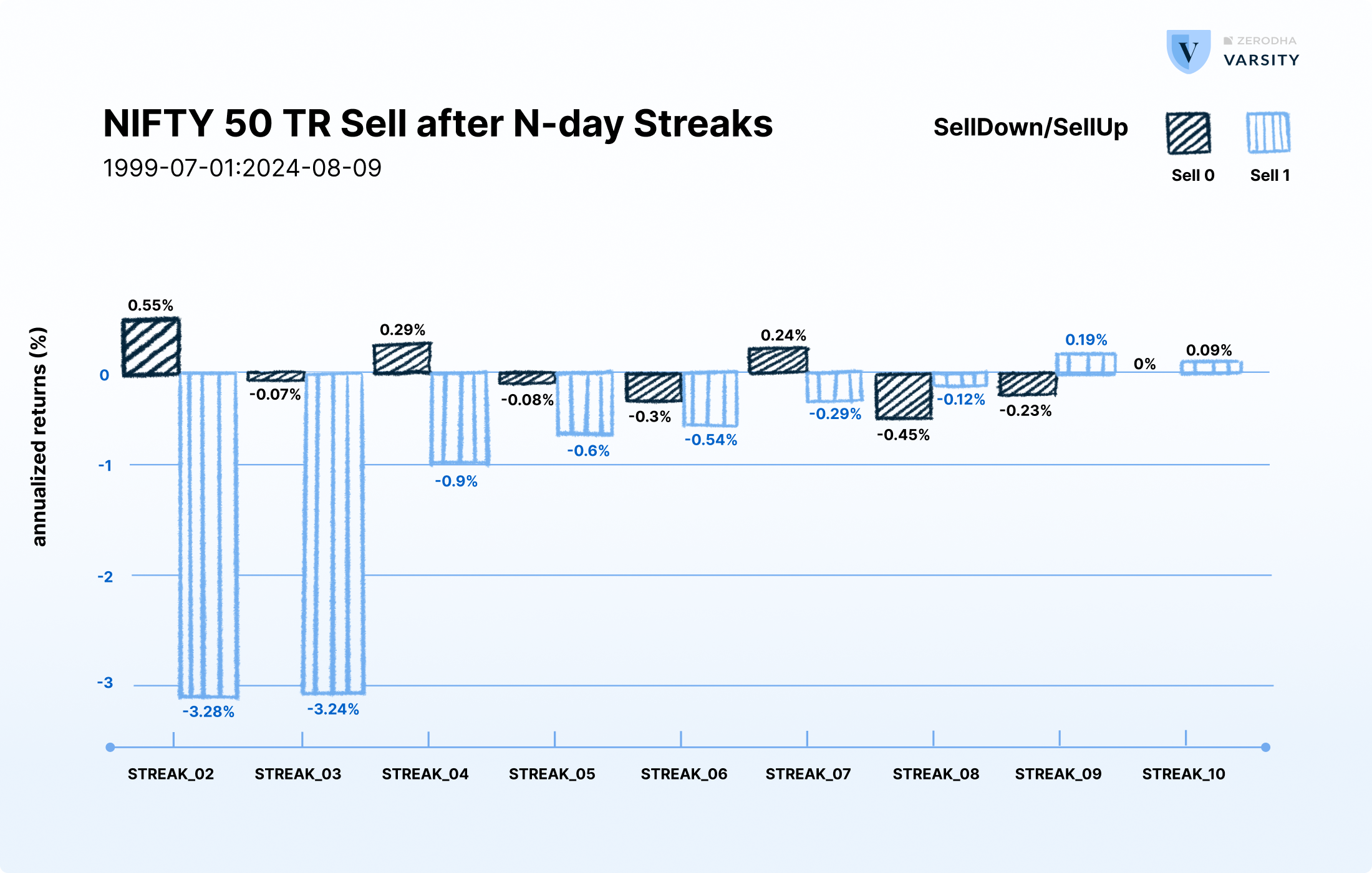

What if you sell after a long positive or negative streak? Historical evidence isn’t encouraging about that, either.

While streaks are rare and hence get reported on, they are not very useful for a trader.

Read the Technical Analysis module on Zerodha Varsity to do informed trading.

Hello Sir/Madam,

I tried to get to know regarding Streak for using stock trading but failed to understand, additionally i tried to find algo trading where i can feed the parameters and trade will take on those conditions but even that also i couldn’t find.

To make it easy,

1. I would be interested to know & use this platform for Intraday for stock & indics, if you could provide any informative study material, videos it will help me a lot.

If it is already available, then kindly send link of it.

Thanking You

Basweshwar

Mob 8928354754

Mail [email protected]