Children’s financial literacy playbook

India is full of pleasant surprises, and the country never ceases to amaze you.

A few months ago, the CEO of Nagpur Zilla Parishad (Mrs Saumya Sharma) asked if I could volunteer to help them build a framework to impart financial literacy to children across 1500+ schools, each with an average of 125 children. I readily agreed as this is a topic close to my heart 🙂

Sitting in Bangalore, I devised a framework with a learning outcome. The framework, in my view, was reasonably well-rounded and covered all aspects of the building blocks of personal finance, designed especially for children. While the draft framework seemed ok, the ZP office subtly suggested that I spend time with the students and the teachers and tweak the framework slightly. Some of the ZP schools already had a ‘few’ things going in terms of financial literacy (more on this soon), so the framework had to sit on top of what was already at play.

The children at these Zilla Parishad (ZP) schools are mostly Adivasis. In most cases, these kids are the first member of the family to step inside a school and join a formal education system. Parents are day wagers and small business owners making enough to sustain the family on a day-to-day basis. The parent’s involvement with the child’s schooling starts and stops with encouraging them to go to school regularly. Unlike urban parents, parents here do no follow-up on homework, after-school activities, parent-teacher meetings, remedial classes, or extracurricular activities. Nothing.

For these children, the school and its teachers are second parents, and these kids rely on the schooling system to guide them in all aspects of life. It took a while, but I eventually realised building a financial literacy framework, or, for that matter, any other academic framework without factoring in the cultural context, was useless.

Why financial literacy, though?

Well, these kids will eventually start earning and contributing to either the local economy (hopefully) or get a job in a nearby city. Either way, the families’ finances are likely to improve. While this happens on one side, on the other, savings and financial products are getting noisy. With many investment options, identifying simple and effective options is getting tougher by the day. Besides, there are enough and more triggers for an individual to spend on things that are not needed. Add to it bank frauds, Ponzi schemes, phishing scams, and loan scams; you will soon realise that it is not easy for an individual not to fall prey to one of these financial scams.

In the long run, small decisions like buying a Bluetooth headphone on an e-commerce website just because of a flash sale will not significantly dent your finances. But a decision to park your hard-earned money in an investment scheme without recognising that it is a Ponzi scheme will undoubtedly hurt. Such financial decisions can set you back by multiple years, taking the family back to where they started.

Usually, it does not take much to recognise what’s good and not good for your finances.

In most cases, teaching basic finance foundational concepts right from an early age is enough to set you on the right track. A few of the ZP schools had already identified this issue with the financial literacy gap and had implemented a plan.

This is where I was mind-blown. 🙂

Some of these schools have basic infrastructure and are located far from Nagur. For instance, the ZP Upper Primary School, in Narkhed, is about 1.5hrs drive from Nagpur. The ZP Upper primary school in Ramtek is also about an hour’s drive, bordering the Pench National park.

My expectations were low, especially on the financial literacy bit, until I spoke to the teachers and kids at these schools.

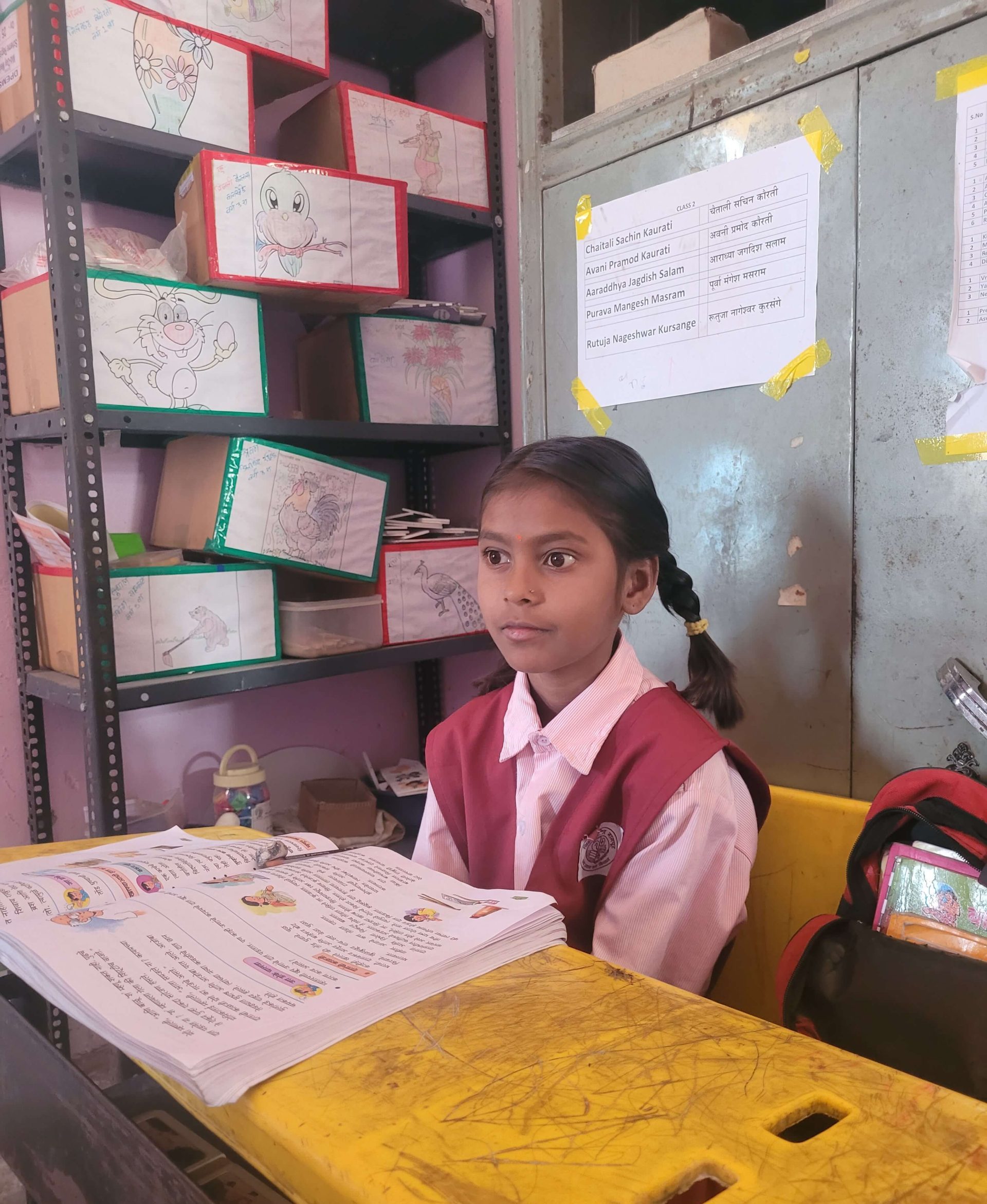

Some of these schools run a ‘sort’ of savings bank program in the school. The purpose of the savings program is to ensure kids develop a habit of savings regularly, and these schools have gone all out on it 🙂

This is how it works –

The school simulates a banking system with just the savings bank part and is run as a student committee-driven initiative. The teachers briefly oversee the process but don’t get too involved. They let the kids manage the entire show.

The source of funds for children is usually from parents or relatives, as they get small amounts now and then. When I say small amounts, I’m talking about amounts like 4 Rupees, 10 Rupees etc.

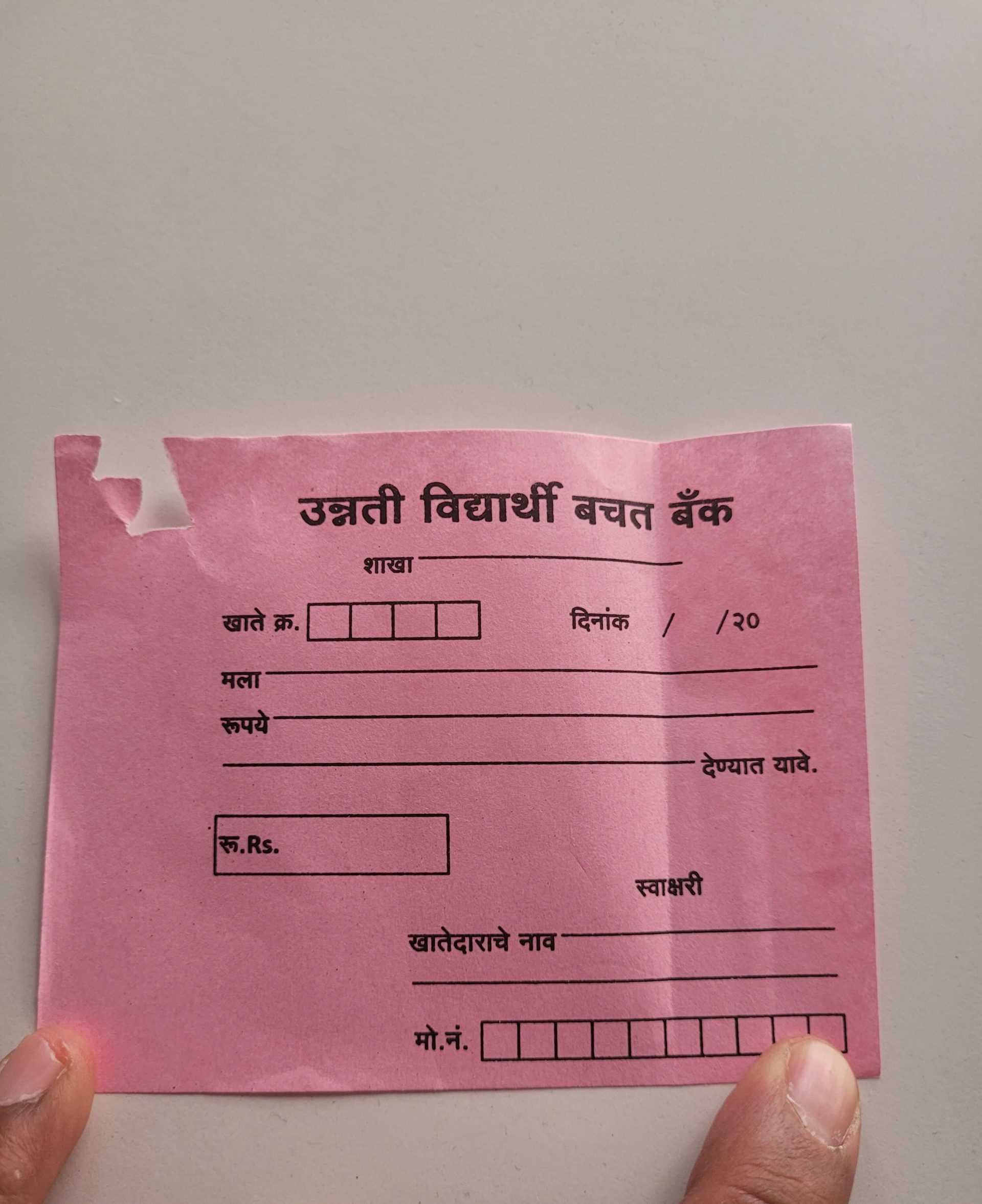

The kids get this money and deposit it with the school’s savings system. The deposit happens via a ‘ deposit slip’, just like in an actual bank. The kids must fill out a deposit form and deposit the money to the committee member managing deposits.

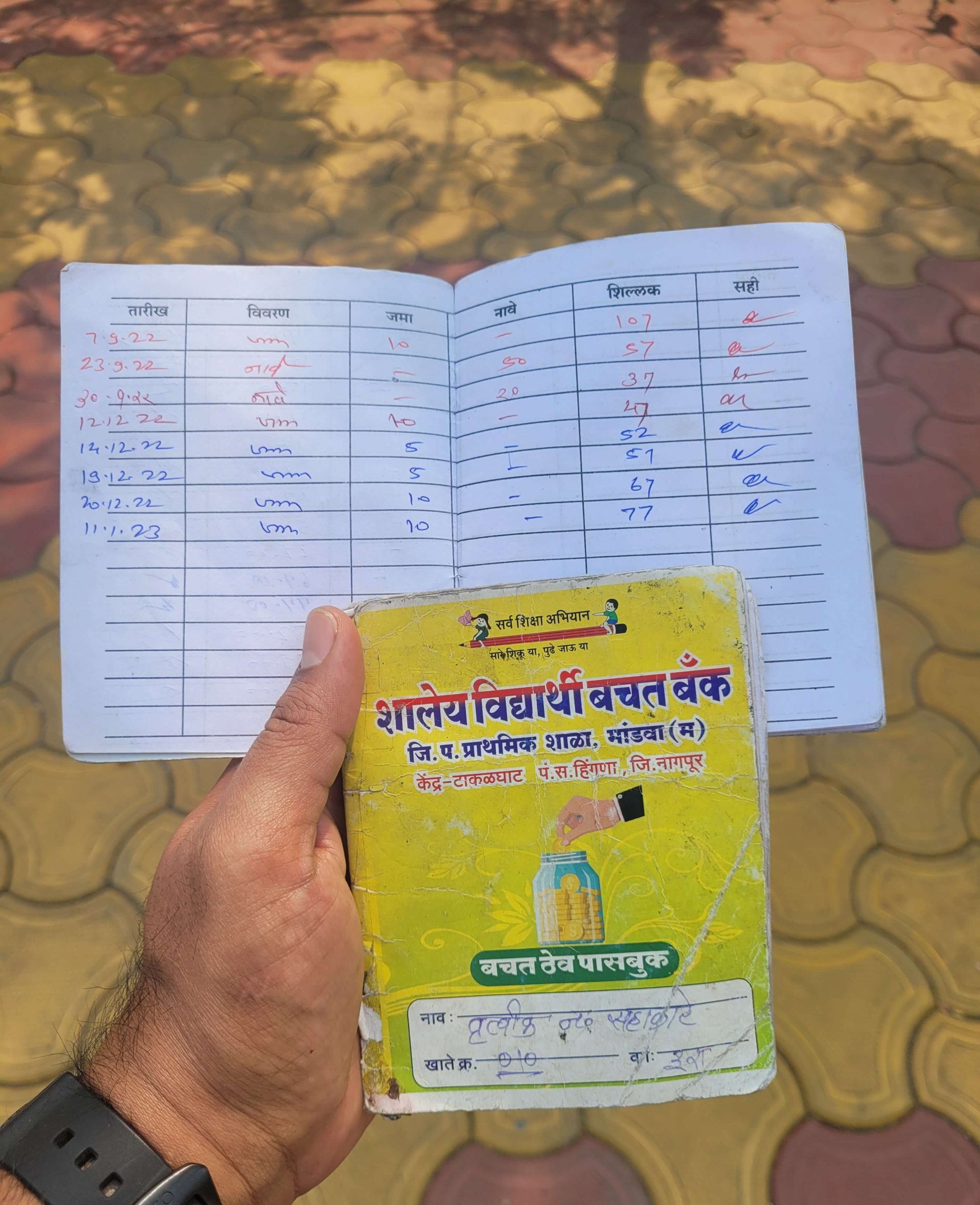

At the end of the day, the headmaster gets the money deposited in a real bank close to the school. Not just that, the kids have a school ‘pass book’, where an entry is made against the deposit, and the balance is updated.

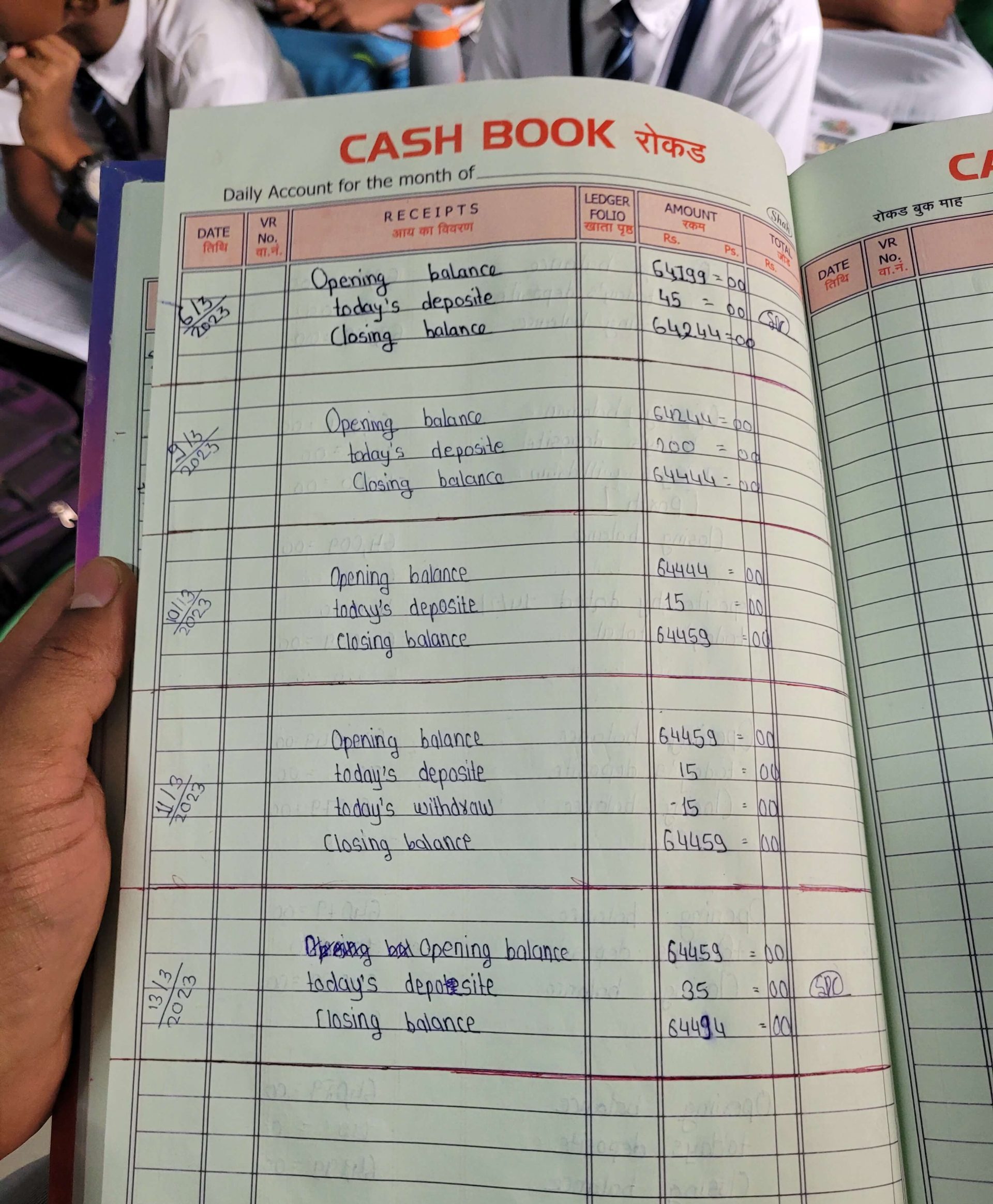

The school ‘bank’ maintains a cash book, updated daily with the total deposits and withdrawals for the day. The closing balance of the previous day is the opening balance for the day; add deposits minus withdrawals, and the closing balance for the day is updated.

Talk about experiential learning 🙂

Children save and use the funds for multiple reasons. But the primary purpose is to buy books and stationery, sometimes even to visit nearby towns on field trips. But there are other interesting stories on how the kids end up using their savings.

For instance, the story of Kingale Kailash Wankhede, studying at ZP School, Mandwa, is super inspiring. Kingale’s parents are daily wagers and depend on the availability of daily work to bring food to the table. Last month, around Maha Shivrathri, they could not find their daily labour opportunity due to a series of holidays leading to the festival. On Maha Shivratri, the family had 0 money on them to buy the ‘Upwas’ related things to celebrate the Maha Shivratri festival, a festival which is important for them. When the family was scrambling for money, Kingale offered to withdraw her funds from her savings to help the family.

All of her 75 Rupees (saved over six months) was withdrawn to support the needy family.

I asked her how she felt about withdrawing everything she had, and without batting an eyelid, she said it was her proudest moment. What’s the point of saving when the family is suffering, she asked me 🙂

If this is not an example of children learning to build an emergency corpus all by themselves, I don’t know what else is 🙂

Here is another example that blew my mind.

The kids regularly have vocational training sessions and learn essential skills like woodwork, sewing, agri skills, handicrafts etc. The kids at the ZP Upper primary school in Narkhed took a liking to diya painting. The kids upped the game by buying diyas from the local market from their savings. Each dia at Rs.1.8/-. They painted the diyas attractively and sold the same in the market for Rs.3.2/- a piece.

The profits are deposited back into the bank 🙂

The factors playing out here are pretty interesting – capital allocation, nurturing risk-taking skills, entrepreneurship, an eye on profitability, team building, and of course, creativity. All these factors are bundled into a single powerful experiential learning experience.

By the way, fund withdrawal is documented, not just with a withdrawal slip but also a handwritten letter explaining why the child wants to withdraw funds. No questions asked, but the committee, along with the teachers, try to see if the child can be helped in any other way besides breaking into the savings. Withdrawals are generally discouraged, and they do this in an interesting way – through leaderboards.

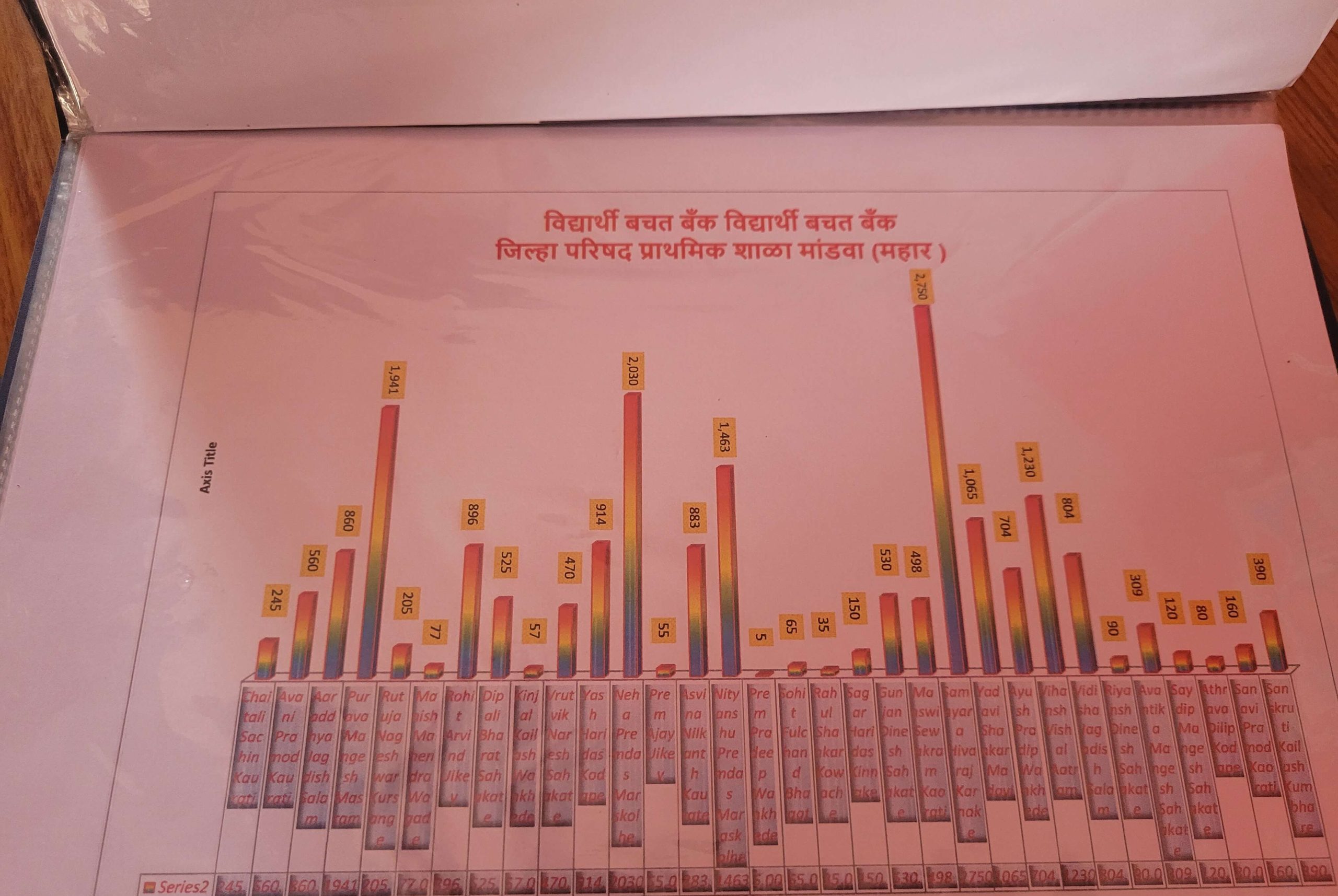

Every month a leaderboard of who has saved the most on a cumulative basis is generated. The kids benchmark themselves to their friends and aspire to top this chart, which means the efforts to save money and not spend on frivolous things are ingrained early in their lives. Indirectly, this also encourages the kids to not spend on frivolous things, and savings as a habit is ingrained early in their lives.

Savings is more of a habit that one cultivates rather than a skill that one develops, and to me, this is a perfect example of inculcating the habit of saving early in their life.

While the kids play a major role in driving such an initiative, we cannot ignore the role of the teacher. An initiative like this is only possible with a deep teacher-student connection. When we talk about Government schools, we generally look at them rather sceptically. I’m guilty of doing this until now, but I stand corrected.

I get a sense that the teachers in these small Govt schools are deeply involved with the child’s overall welfare and more empathetic towards students. They are connected culturally and socially, which adds so much more context to the overall learning process.

Right when I was internalising all these things, a kid walks up to me and starts talking in Japanese. Yup, you heard that right. Japanese. It was just too much for me to digest, but when I spoke to the teachers, trying to understand the Japanese connection, I was told that the pandemic forced them to school the kids online, which meant the kids got access to several online learning tools. One kid decided to learn Japanese, and that sparked a wildfire and inspired several other kids to learn Japanese. So now, children across a dozen ZP schools speak Japanese. It’s a thing there, in Narkhed and Ramtek 🙂

Nagpur ZP CEO, Mrs Saumya Sharma tweeted a video of this a while ago –

https://twitter.com/saumya__ias/status/1627148602882801664?cxt=HHwWgIDS-ZDC5ZQtAAAA

The visit to ZP schools has left a mark and is something that I’ll cherish and share with people for a long time to come. I’m secretly hoping that a lot more Govt schools have similar stories to share.

I have several personal questions to answer to myself, I certainly know that I’ll have to rework the financial literacy framework and up the game; these kids know a lot more than we imagine 🙂

Meanwhile, this is a great practical financial literacy playbook that schools can adopt. We will use this playbook and add more learning elements to this. We, at Zerodha, would be happy to collaborate with Govt schools to implement this playbook and spread financial literacy in the country.

It’s a great initiative. Every school must implement this innovative idea. I will try to initiate this inspiring idea in my school. Thanks Zerodha to introduce it.

Respected sir,

It’s our pleasure that you visited our small school and inspired our students. It was a great day for our students that a person from a big financial community gave them future economical ideas and goals. We wish to invest some money of our students saving in share market to help to create their future, so we need your help for this. I will call you personally.

Thank you very very much.

H.M. Z.P.Upper Pri. School Thugaon Nipani, Narkhed

Wow. Just wow. This country will never stop amazing me. A kid in a village with no Japanese connection is speaking in Japanese. Talk about globalisation. Amazing stuff.

It is amazing to see how India is changing and how much potential we have. This is so great, Also Mr. Kamath I really want to create an impact big enough like you are doing currently. Great work truly appreciated

Great work by Zerodha team, these such stories make you grounded and realise the potential of such young kids. More power to such schools!

Very inspiring indeed!

This is so inspiring! I am now wondering whether the kids who go to Pvt schools can ever have this kind of learning & experience. Financial literacy is indirectly helping them in growing as emotional strong! As Nagpur is closer to where I live, I would be happy to volunteer on this project if there’s any opportunity.

Amazing !!! Great to see financial literacy being taught at grass roots level and such initiatives being taken up in Govt. schools where the impact can be maximum.

Reading whole article and feeling happy from inside, It’s a great initiative towards the financial education. Happy to know about that the Government schools are also implementing these personal financial methods to encourage financial literacy.🤩

Best wishes sir for this new journey 🤗

Simply superb! Financial literacy can have a multiplier effect on the oveall economy. Financially literate

individuals can have higher regular savings, which would lead to investment in right channels and income

generation & increase the welfare of the society. Excellent work Team Zerodha!

Really amazed to read all the work 🙌 . Hope this experiential learning be part of all the schools

Karthik Sir, you are an inspiration! And I am so proud of India! Indeed a land of amazing wonders!

Financial literacy in schools as part of basic curriculum should be mandatory! And kids get to have a solid fundamental from their childhood. And as we speak – The power of compounding works here as well!

Such a feel good and pleasing experience!

The more we connect to the roots more such stories are lying buried to be heard. I landed up in this post because I was intrigued by the word ‘ ‘ ‘ financial literacy play book’. I m a mother of two kids, a homemaker and trying to learn money management and investments. Can u please share more details on this??

I am 90s kid , recall post office savings scheme for school kids way back then , it’s joy in saving 1 rs , 5rs and talking about it with fellow classmates. really good to see similar activities in schools are alive. I still remember moment I withdraw my 110 rs after finishing my school .. 🙂🙂It’s simple but impactful to a kid..

cheers

Srikanth

Beautiful, inspiring, builds hope that we’re heading in the right direction.

Power to you and Zerodha that you are going beyond your normal call and exploring ways to spread it far and wide. Infact, knowing that govt schools are imbibing this in children from an early age is fabulous. Will look forward to hear from you on your journey to transform and guide school children towards right investment and product.

Thanks

I totally agree with you when you say ”teachers in these small Govt schools are deeply involved with the child’s overall welfare and more empathetic towards students.”

As a volunteer of Youth for Seva, I am associated with a government school (KPS Basavanagudi). I too see that the teachers take a lot of interest in the development of children. The pace of teaching is not uniform accross the class. One child may be in Chapter 3 of a subject whereas another child of the same class would still be in Chapter 1 since he/she had so far not understood it completely. I was enchanted because despite the high fees charged by the private schools, such personal care and attention towards a child is very hard to come by.

I am quite inspired by your post. I am eagerly looking forward to the developments in this space. I too in the meanwhile will do my best to impart financial literacy to the children in KPS in all ways possible.

I had most Goosebumps ever reading something 🙂

This is so cool ! Amazed to see the teachers and management of the school teaching the importance of money management! More power to them

good work

Great work by zerodha

I hope they can understand the importance of time

I wish we develop a holistic curriculum in every school to focus more on practical implication of bookish informations..