Buying gold jewellery? Here’s how the pricing works

If you’re thinking about buying gold jewellery as an investment, it’s not the best option. You’ve probably heard this before. The making charges and the gold wastage that occurs during the making of an ornament increase the overall cost, which you might not fully realize later if you decide to sell or exchange it in the future.

Most people are aware of this. When there’s a chance to save some money, we usually find a way to figure it out. But let’s be honest: we Indians have a special love for gold ornaments, and there’s a good reason why India is one of the top gold-consuming countries in the world.

Buying gold during the festive season has become a cultural tradition for many of us. In this post, I won’t dive into why other forms of gold are better investment avenues—you’ve probably heard all that before. Instead, I’ll focus on how the pricing of gold ornaments works.

You should know what you are paying for and why you are paying when you purchase anything.

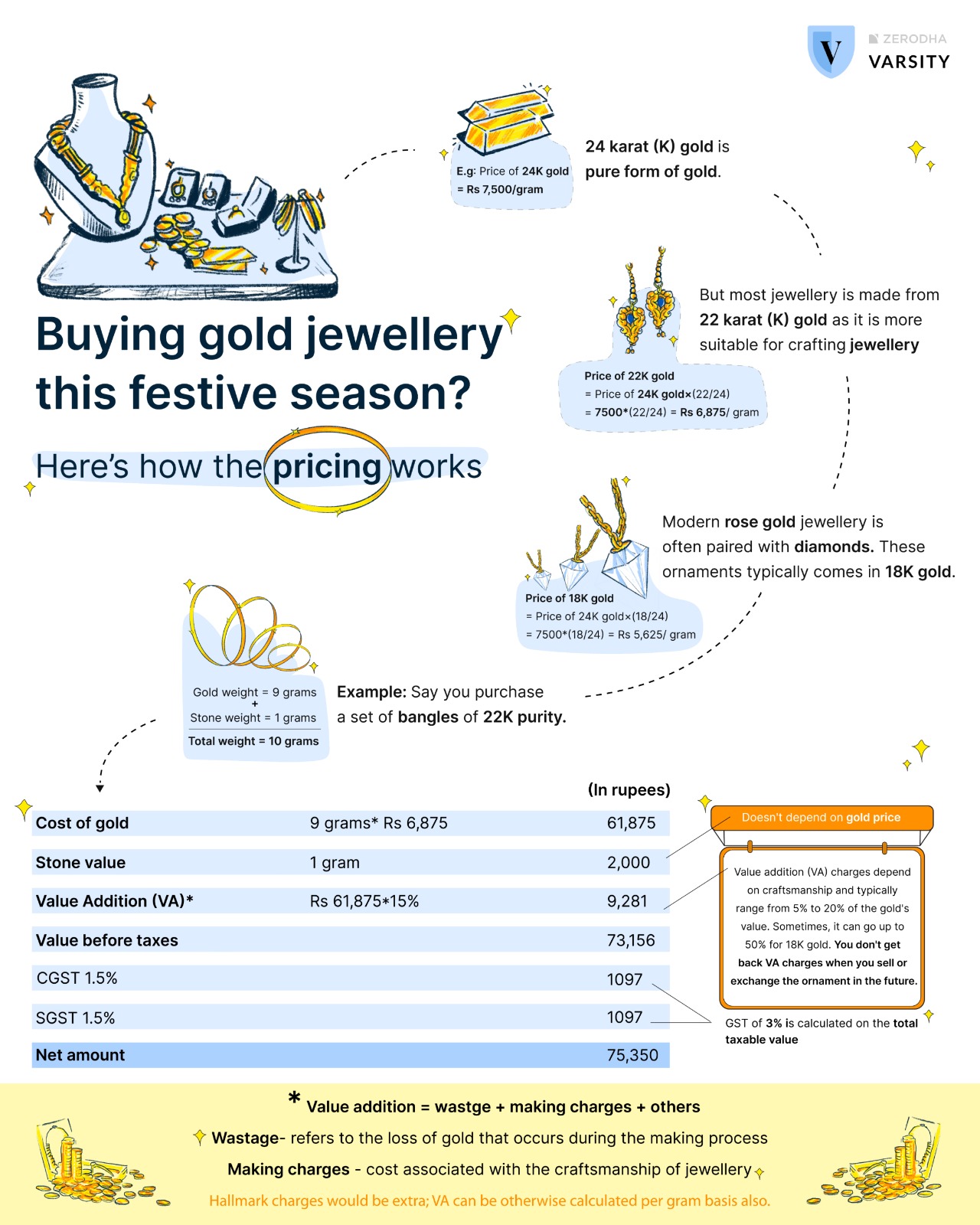

Step 1 – Know the Price of Gold Used

The price of a gold ornament depends on the purity of the gold used to make it.

Generally, the purest form of gold—24 karat—is too soft to be used for making ornaments. That’s why most jewellery is crafted from 22K gold, which is 91.6% pure compared to 24K gold (22/24 * 100).

The market prices you see are typically for 24K gold. To calculate the 22K gold price, you multiply the 24K rate by 91.6%.

These days, modern, sleek ornaments are also available in 18K gold, which is 75% pure compared to 24K (18/24 * 100).

There are ornaments made from other karats as well, so your first step is to know the price of gold based on its purity. The higher the purity, the higher the price.

To get the value of gold in an ornament, multiply the number of grams of gold by the price per gram.

Since most gold ornaments come with stones, the value of these stones is added to the gold value.

This stone value is independent of the gold price and depends on the quality of the gems. If you buy gold jewellery with diamond gems, you’ll also get a certificate confirming their authenticity.

Step 2 – Add Value Added Charges

These value-added charges include making charges, wastage, and other fees.

Making charges are simply the cost the jeweler charges you for crafting the ornament.

Wastage refers to the gold lost during the crafting process. Because the metal is finely worked to create the ornament, some gold is lost in the process.

Together, these charges typically add up to 5%–20% of the gold value. The higher the craftsmanship and intricacy of the design, the higher the value-added charges. Note that stone value is not included in the calculation of these charges.

For ornaments made of 18K gold, the VA (Value Added) charges can even reach 50%.

Since these charges are for services provided, you won’t get back the amount you paid for them when you exchange or sell the ornament in the future.

Step 3 – Calculate GST

On the total value so far—gold value plus stone value, plus VA charges, plus notional hallmark charges—a GST of 3% is calculated.

This 3% GST is split into 1.5% CGST (Central GST) and 1.5% SGST (State GST).

The final price for the gold ornament is calculated using these three steps.

Keep your invoice and any certificates that come with gems safe, as they’ll come in handy if you want to exchange or sell the jewellery in the future

Exchanging Old Gold for New

Many middle-class families exchange older ornaments when buying new ones. Here are a few steps to keep in mind when exchanging gold:

Step 1: Test the Purity of Gold

The gold is tested for purity using assaying machines or other methods to confirm its quality.

Step 2: Melt the Ornament

The ornament may be melted down to separate the gold from any other materials like stones or other metals. Stones, if present, may be returned to you.

Step 3: Assess the Weight

The jeweler checks the weight of the gold after melting. You should cross-verify this weight against your old invoice for accuracy.

Step 4: Determine the Market Price

The exchange value of the gold is calculated based on its weight and the current market price.

Many middle-class families exchange older ornaments when buying new ones. Here’s what to keep in mind when exchanging gold:

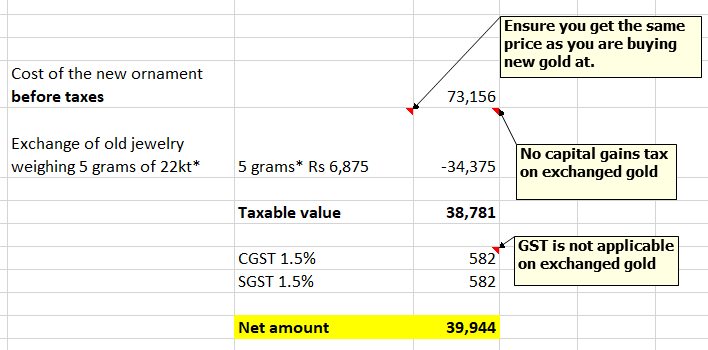

When exchanging gold, first, check the value of the new ornament before taxes, as explained in the above steps. The value of the old gold you’re exchanging will then be deducted from this amount.

After that, GST of 3% is calculated on the remaining balance. If you notice, GST is applied only on the balance and not on the full value of the new ornament—this is because GST is not applicable on the exchanged gold. So, its value will be deducted first when calculating taxes.

Also, exchanging gold for gold does not attract any capital gains tax. Essentially, you’re exchanging gold you purchased at a lower value for gold at a higher value. While you benefit from the appreciation in your old gold, tax is exempted in gold-for-gold exchanges.

Final words

Buyers must ensure that they’re aware of exactly what they’re paying for—and what they’ll realistically recover if they ever decide to sell or exchange the gold in the future. So, next time you’re buying a gold ornament, remember caveat emptor—you should know what you’re paying for and why.

Thank you, Satya!

Hi, i have a query regarding exchange of old gold while buying new one( Step-4) . Please find the details below made by Joyalukas

Taxable Value -564,713.59

CGST – 1.500% -8,470.70

SGST – 1.500% – 8,470.70

Total Invoice Value (in Figure) : 581,654.99

Credit Cards/Debit : 386,000.00

Cards/UPI/Credit Customer ROUND OFF CASH : 2.19

SCRAP EXCHANGE : 195,652.80

Here my doubt is as per step-4, taxable value should be calculated after subtracting scrap exchange value. I have other comments as well who are mentioning the same. Why do most of the jewellery shops calculate like this?

Actually on the GST calculation when we are exchanging the old gold either in 24k coin or in an ornament form for a new ornament in well named jewellery shops, they are saying GST is calculated on the whole value of new ornaments but not as mentioned in Step 4, which says GST will be calculated only on the remaining amount after deducting old gold value.

I have checked in multiple well named jewellery shops yesterday & I got same answer. Requesting you to provide clarification on this and an official supporting government link which supports Step 4.

If your step 4 is correct that will be a huge saving to everyone.

Bought on Nov 3, 2024

New jewellery -58,449.57

CGST-1.500%-876.74

SGST-1.500%-876.74

Total Invoice Value -60,203.05

Old gold SCRAP EXCHANGE-59,903.36

Amount given from hand -300rs

In my case they charged GST on the total value of new jewellery even though my old gold value was greater than the new one.

Is this correct?

Hi Fathima,

Your calculation doesn’t seem to be right. First, value of old gold would be deducted from new gold value ’before calculating GST’, in your case, from Rs 58,449. In your case, the gold you are giving is valued higher than the new ornament you are buying. In such cases, usually jewelers give back the your old gold (after melting) that values the difference between the old and the new gold ornament.

when there is exchange of old gold equivalent to weight of the new gold in an ornament, GST would be calculated only on the value addition charges (wastage + making charges).

There’s no GST on value of gold that has been exchanged.

When we buy gold, is the gold weighed before the stones are fixed or after the stones are fixed

Hi Mukta,

Usually, gold ornaments come with stones and the weight of the ornament is weighed as is.

When calculating the price, gold weight and stone weight are separated. Gold price is calculated multiplying the weight of gold and the gold price in the market, while stone value is pre-decided by the jeweler and is independent of gold’s price.

Hope this answers your question.

there is difference of 5 rupees while calculating 22k gold value from :

method 1. 7500 X 22/24=6875

method 2. 7500 X 91.6% = 6870.

which method is correct ?

Hi Yatharth,

That’s a good question. Mostly, 22K gold pricing is usually displayed as 91.6% of the 24K gold rate. So, I believe the rate is calculated using 91.6% for a 22K gold.

Hi,

Could you please share the GST Act and section number(Exchanging old gold for new) and also website link for the same and from it is active in India.

Hi Suguna,

Sorry, I won’t be able to provide you with the exact section in the GST Act.

In my understanding, when old gold is exchanged for new gold, it is not considered a sale. GST is generally applicable only on the value added.

Hi

I found this link which could help answer your query

https://www.gstindiaonline.com/pages/gstlegislation/press/press-india/2017/Sale%20of%20old%20gold%20jewellery%20will%20not%20attract%20GST%20on%20exchange.htm