Tax loss harvesting opportunity for fiscal year (FY) 2021-22

Traders,

If you hold stocks or mutual funds in your portfolio that have unrealised losses, you can set off these losses against realised profits, on which you have to pay taxes. To do this, you can book the losses, effectively reducing the realised gains and hence also reducing the tax payable. This act of booking unrealised losses is called Tax Loss Harvesting.

While there is no explicit regulation in India that disallows tax loss harvesting. In the US, if stocks are sold and bought back within 30 days just to reduce taxes on realised gains, they are called wash sales, and taxes are disallowed to be offset. It is advisable for clients trading and investing in India to consult a Chartered Accountant (CA) while filing income tax returns, as they could potentially be questioned by the income tax authorities during tax scrutiny if the same stock is sold and bought back to save on the taxes.

Introduction to Taxation

When you invest in the markets, you potentially have two types of taxes —

-

- STCG (Short term capital gains tax) or tax on gains made by selling stocks or equity mutual funds held for less than 1 year which are taxed at 15% of the gains.

- LTCG (Long-term capital gains tax) or tax on gains made by selling stocks or equity mutual funds held for more than 1 year. First Rs 1 lakh of LTCG is tax-free, and gains above Rs 1 lakh are taxed at 10% LTCG per year.

Do go through the Markets and Taxation module on Varsity for a detailed understanding on taxation when investing or trading.

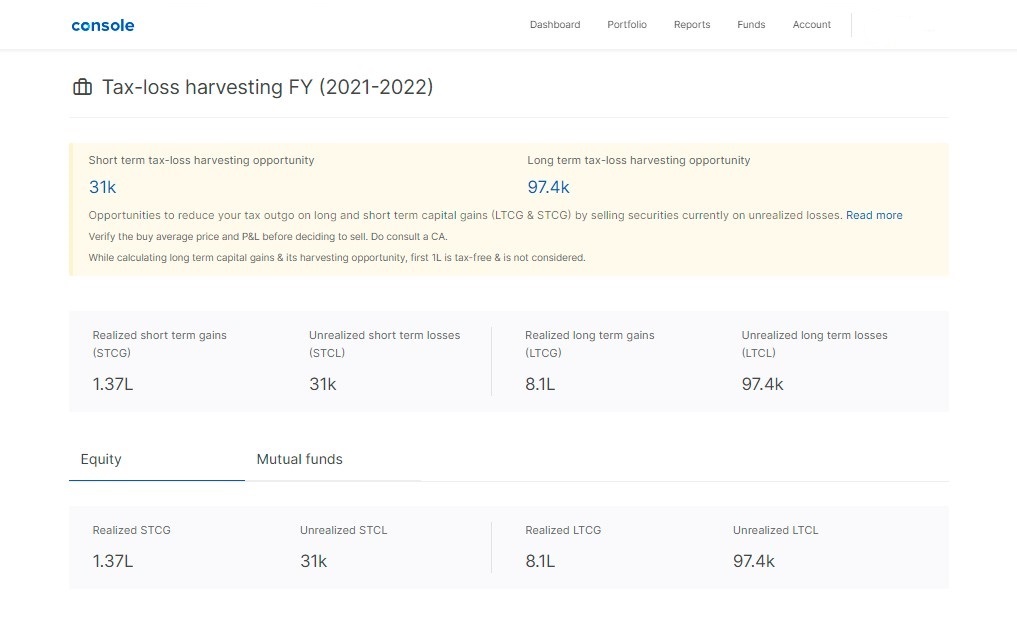

Tax Loss Harvesting report

We have created a report to help you spot tax loss harvesting opportunities in your account. So, if you have realised LTCG or STCG on which you have to pay taxes this financial year, we will show you the amount of unrealised STCL and LTCL you can book to reduce the tax outgo. You can check the list of holdings under unrealised STCL or LTCL on the holdings page. You can check the holdings breakdown and choose the stock you want to sell and book losses to the extent of the realised gains, thereby reducing your realised LTCG or STCG, and hence save on taxes that you would have had to otherwise pay.

To access the tax-loss harvesting report, visit Console.

In the above case, the account has Rs 1,37,000 as STCG on which a 15% tax of Rs 20,550 is due to be paid; and LTCG of Rs 8,10,000 on which 10% above Rs 1 lakh of Rs 71,000 is due. This investor can sell any of the stocks in his holdings under a loss and reduce the LTCG/STCG, and save over Rs 91,550 in taxes. The investor would have to make this transaction before March 31, 2022, to harvest losses for FY 21/22.

If you intend to hold these stocks and don’t want to sell them, you can buy the stock back after two days of selling. Two days because that is the settlement cycle when you buy or sell stocks—it takes 2 days for the stock to be debited from your demat. You can also potentially sell your stock holdings and buy similar stocks in the same sector immediately.

Also, as part of our Rainmatter initiative, we have partnered with Quicko to help you file your income tax returns. They have a special offer for Zerodha customers. Click here to know more.

Happy Trading,

The tax loss harvesting report shows that I have a long-term loss harvesting opportunity. Where can I download a breakdown of this number shown?

Like which stock has how much loss, and how much quantity should I sell?

For example, I may have a stock purchased on 5 different dates at 5 different prices (all more than a year ago), Total X quantity. But only the first 3 of them may be at an unrealized loss, so only quantity Y of X needs to be sold for tax harvesting.

Holding breakdown does not help as I have to go to each stock, view the breakdown and identify those with more than one year and at a loss.

For example, I have 5 stocks A, B,C ,D ,E

A has 5 buy transactions

1. 2021-03-01 at P1 price, quantity Q1

2. 2021-04-01 at P2 price, quantity Q2

3. 2021-05-01 at P3 price, quantity Q3

4. 2021-06-01 at P4 price, quantity Q4

5. 2021-07-01 at P5 price, quantity Q5

Now the current price is P, which is < P1, P2 and P3, but more than P4 and P5. Now for tax loss harvesting, I only need to sell Q1+Q2+Q3 quantity.

Similarly, I have transactions in B, C,D and E stocks, bought at 5 different dates and prices.

How to get a report that gives a date-wise breakdown of all holdings, so that I can find out which stocks to sell and how much quantity.

Pls make one post for fy24-25. Also can you pls make it clear if STCL can be offset against both STCG (both equity and debt) and LTCG.

Please update this page so as to match with IT rates etc for current FY. The information given is obsolete and hence misleading.

Hi,

If i sell my shares on monday for tax loss harvesting purpose, when can i buy back the same shares? Tuesday or wednesday or thursday??

I saw a loss of -(minus) 35 k for STCG after setting off the profits and also a loss of -12.8k for LTCG for last FY 2022-23. Can these be carried forward as Tax Loss harvesting in the ITR?

Hi,

Can i sell my loss making stocks (upto 65k INR) on 31st March 2023 (31-03-2023) and show that loss as tax loss harvesting while filing ITR? Please clarify. Thanks

As i sold shares to book the loss for tax saving purpose, when i can purchase again

How to ensure stock i am selling is coming under STCG and not under LTCG?

Hi Rohit, in the holdings breakdown section you can check the age of your holdings. The quantity that has been in holdings for over 365 days will come under LTCG while those under 365 days will be under STCG. Also, when you sell shares from holdings FIFO (First In First Out) method is followed, this means, the quantity which is bought first is sold first.

For adjusting the Tax loss harvesting – to reduce my STCG

Dear Team,

I have 50 shares of company X at Rs 600 (Purchase price) which incurred a loss of 13K

The current price is 258

For Tax loss Harvesting I sold my 50 shares, Should I buy the same share again on the same day or I can buy a different share at a different price on the same day?

I can see this line on your page – https://support.zerodha.com/category/console/reports/articles/what-is-tax-loss-harvesting ”Tax-loss harvesting is a practice of selling a security that has incurred a loss to help investors reduce or offset taxes on any capital gains income subject to taxation. This practice is accomplished by harvesting the loss. The sold security can be bought back or replaced by a similar one.”

Was confused by this line ”The sold security can be bought back or replaced by a similar one” –

Should the price be similar for a different stock or we should buy the same stock again after selling ??

Hi Srinivas, you can buy shares of a different company on the same day. You can also buy shares of the same stock, however, if you buy shares of the same stock on the day you sold, it will be considered intraday trade. If you want to buy shares of the same company, you will have to do so on the next day.

How can I get a report consisting list of scripts and its transactions suitable for LTCG tax harvesting?

How can I get a report consisting list of scripts and its transactions suitable for STCG tax harvesting?

These two reports need to be separate / distinct, so proper action can be taken in time to save on taxation.

Hi, you can check the list of holdings under unrealised STCL or LTCL on the Console holdings page. You can check the holdings breakdown and choose the stock you want to sell and book losses to the extent of the realised gains.

Dear Team,

I have 2000 shares of company X

Purchase price of first 1000 shares is 100Rs

Purchase price of second 1000 shares are of 80Rs

Average buy price is 90Rs

If I am selling 1000 shares of this company for tax loss harvesting

Then what amount will be considerd as my buy price to calculate tax ? is it the avearge price (90Rs) or the first purchase price (100Rs) ?

Regards,

Denny Johny

Hi Denny, when you sell shares from your holdings, FIFO (First In First Out) method is followed.

I sold shares on 31-Mar-2022, but debited from Demat on T+2 days later, on 5th of April 2022.

This sell transaction will be considered in which financial year, for the purpose of tax calculation ?

Sir i sold out a share with heavy loss on date 30 march so that stcg could be minimize but it is showing in Tax report of FY 2022-23, due to which I will have to pay large amount of stcg. Broker (upstox) is not helping, my hard earned money will be lost, please help me sir where should I complaint about this

I sold shares today to adjust my losses & profit for STCG & LTCG. Will be it be consider eligible for accounting year 21-22 ?

As I read in the comments by ‘ Shubham’ that selling on 30th march or 31st march both are acceptable.

Kindly clearly.

Thank you in advance.

Hey Sunish, the transaction is within the financial year as you’ve sold the shares on 31st March.

why is it called harvesting ? is avoid these taxes just for current tax financial year ? or avoiding taxes for coming tax financial year ? if you do tax loss harvesting in current financial year then we have to pay such taxes in next tax financial year ?

kindly advise.

If I sell my loss making stocks today (i.e 31, March, 2022) in order to set off short term capital gains, will I be eligible to claim tax loss harvesting? Or the stocks have to be debited from our demat account before 31 March in order to claim tax loss on short term capital gains?

Paaras, for tax-loss harvesting, the shares have to move out of the demat account through a delivery sell transaction.

Can we sell this today for tax loss harvesting? or is it too late for this FY.

Hey Abhishek, you can sell shares on 30th and 31st March for tax-loss harvesting.

Shubham Sir I want to know whether the shares have to debited from our demat account before 31 March or even if we place a sell order on 31 March then also we are eligible to claim tax loss harvesting because as it takes T+2 days for the shares to get debited from our demat account?

Hey Paaras, you can place an order on 31st March as it is within the same financial year and book losses for harvesting.

I have a profit of 52000 in STCG(Intraday trading/swing trading in equities) and a loss of 270000 in f&o trading. Do I have any tax liability this year?

YES TAX LIABILITY IS 15% of STCG PROFIT,

U can not set OFF ur STCG profit WITH F&O loss

Can i harvest my tax loss if I sell my shares on 30th March or 31st March?

Yes, Arvind. You can sell shares on 30th and 31st March for tax-loss harvesting.

What if i purchase in nse and sell in bse at same time, will it than count for tax harvesting ?

Hey Divanshu, selling shares from holdings and buying back on the same day will be considered an intraday trade, even if you sell on NSE and buy on BSE or vice-versa.

Hi,

Why is profit made from buyback of TCS and NIIT shares shown as STCG. I believe profit made from buyback via tender route is not taxable in the hands of the shareholder?

Please confirm

Thanks,

Priya

Hey Priya, the Tax P&L report will show a separate entry for the buyback. You can edit the report according to your preferences and not consider it while filing ITR.

Can I offset F&O losses with my STCG (considering F&O is taken as non-speculative)? Also, lets say I have F&O loss of 1lakhs and my STCG is 50,000 – Can the 1,00,000-50,000=50,000 be carried forward next year and used for tax-loss harvesting?

Hi,

As mentioned by Bharat, there is a mismatch in the example provided and the description. Also as investors/traders we pay advance tax on or before 15 March. So the tax loss harvested can be claimed only be claiming refund when we file our ITR. Please correct me if I am wrong.

what is unrealized long term losses in tax loss harvesting report?

how have you calculated this?

In the above explanation, exhibit and description does not match. Request to correct the same.

Thanks

Hello,

How the amount of upfront fees paid directly for any small cases are calculated ? Are these deductable against short/long term term profit ?

Also which is last day of trading for cash segment ?

Regards

If I have both long term holding and short term holding of stock and I want to sell the number of stock of short term holding to book STCL. How can I do that ?

How do I find which stocks are eligible for ”Unrealized short term losses (STCL)” ?

I have a mix of stocks carried over from a few years, I donot know which stock to sell to harvest STCL.

How can I find the stocks eligible for STCL in Zerodha ?

I have the same question – which stocks are eligible for STCL (Unrealized)?

I could not understand from the screenshot of the example shown. Screenshot says something, the explanation has values which are not in the screenshot ?

Can you please recheck and update ? Not able to understand which loss to be checked?

”Short term tax-loss harvesting opportunity” says : 22.34k for me.

Realized short term gains (STCG) shows : 1.17L

Unrealized short term losses (STCL) : 22.34k

Do I need to book losses worth 22.34k Or 1.17L ?

Tax-loss harvesting option is not showing any data for my ID, where as P&L statement for 2021-2022 is showing STGC and LTGC.

May I know the reason.

same with me, my STGC is showing, i do have unrealized lossed but tax harvesting report says –Tax-loss harvesting opportunity doesn’t exist, hope they solve it

my stcg shows a figure , but in the tax harvesting opportunities it shows : Tax-loss harvesting opportunity doesn’t exist, please clarify why

this is solved, thanks zeroda

Tax harvesting concept I understood in detail. But please clarify whether we have club income from shares with other income to derive the tax slab OR income from shares is a different concept ie., 10% or 15% tax rate as the case may be & tax on other income is a different concept.

Hi,

Can you please advise if the tax is on Realised Gains ( both sort and long terms) or Net realised Gains..

if i have funds in my account, can i buy and sell on same day from bse and nse for tax harvesting, since waiting for 2 days the price may move up

Hey Bhoj, selling shares from holdings and buying back the same day will be considered as intraday trade, even if you sell on NSE and buy on BSE. For tax-loss harvesting, the shares have to move out of the demat account through a delivery sell transaction and can be subsequently purchased the next day.

thank you shubham, one question pls,supose i have to do loss harvesting in a share can i buy first then sell the old lot next day, i believe that tax will be calculated first in, first out basis, this is just to ensure that the price does not move up next day

Hi

I m women, will there be any exempt for me from LTCG and STCG.

I m housewife and doing trading.

Also got devidend around 12000 this FY 21-22.

Regards

Devi

I have gifted stocks to my sons on 11/05/21 whose D mat a/cs are with you. Now I have downloaded Tax n PL statement and surprized to observe that the gifted stocks are being shown as ”sold”(no indication of gift), as such notional profit of the gifted stock is included in STCG/LTCG amount, which will attract capital gain tax. Therefore request to please show the gifted stocks separately and not as SALE to avoid unaccountable capital gain tax.

Sir,

Tax bachane ke liye agar NSE me koi stock me loss book karte hai and same stock agar bse me same day buy kar liya to chalega?? ki next day hi buy karenge to hi STCL ADJUST HOGA STCG KE SAMNE

PLEASE ADVISE

Hey Foram, selling shares from holdings and buying back the same day will be considered as intraday trade, even if you sell on NSE and buy on BSE. For tax-loss harvesting, the shares have to move out of the demat account through a delivery sell transaction and can be subsequently purchased the next day.

Can tax loss harvesting opportunity be used in case of option trading?

Hey Raju,

In the same financial you can set off:

1. Speculative business losses (intraday) against speculative gains

2. Non-speculative business losses (F&O) against any income expect salary

You can also carry forward the remaining losses, provided you file your ITR before the due date:

1. Non-speculative business losses (F&O) for 8 years

2. Speculative business losses for (Intraday) 4 years

Read more on set off and carry forward losses here -> https://learn.quicko.com/set-off-carry-forward-loss-income-tax

I only have STCG and STCL. But the scrips where I have STCL also have shares older than one year. In this case to book STCL, I have to sell the shares that are held for more than one year before I can sell shares of the same scrip that are held for less than one year. Please suggest, if there is a way out to book only STCL without selling the shares held for long term of the same scrip.

When i have to sell before 31st march 2022 or 29th march 2022 to set off the losses against the profit. Please advise.

No Idea

Can you clarify whether f&o losses can be used for tax harvesting against stag & ltcg?

Hey Ashish,

In the same financial you can set off Non-speculative business losses (F&O) against any income expect salary.

You can carry forward the remaining losses, provided you file your ITR before the due date. For Non-speculative business losses (F&O), you can carry forward the losses for 8 years.

Nice explanation. But you are using only one image in the above article. So the numbers do not match. If you also embed the MF figures then things become easy. Yours seems to be a WP site, so you can put two images as a gallery (Equity figures and MF figures). Thanks!!

Hey Monica, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Ravindra, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Ram, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Rajesh, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Rasikraj, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Siddesh, AMC is charged per quarter , i.e. every three months starting from the account opening date, and is deducted from your Zerodha account. We’ve explained this here.

Hey Swati, if you’re referring to a profit and loss report for a tax audit. You can download this here.

Hey Govind, you can down your profit and loss reports, here.

Hey Hasnain, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Payal, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Vaishali, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Priya, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Reshma, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Rupesh, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Jaikrit, could you please refresh and try again? Do check on a different browser too.

Hey Pradeepa, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Gobinath, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Srinivas, could you please refresh and try again now? Do check on a different browser too.

Hey Sachin, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Gopinath, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Shashank, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Aparna, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Sandeep, could you please refresh and try again? Do check on a different browser too.

Hey, could you please refresh and try again? Do check on a different browser too.

Hey Rajkumar, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Tejabhai, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Neel, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Mahesha, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Saurabh, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Arif, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Chander, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Hey Syed, a report of the tax-loss harvesting opportunity in your account is made available on Console.We’ve also explained this here.

Profits made on short term Equity holdings are included in the ITR and income tax paid once it exceeds the threshold set. Do I have to pay capital gains separately for the profit ?

.

Please advise.

Hi Aysha, you will have to pay taxes for the Short Term Capital Gains once your income exceeds the basic exemption limit.

my income is 4.5 lakhs is this functional year , I am individual and residents. I have no source of income except stock market ,my gain is stcg so the tax is implemented above 2.5 lakh or above 5 lakh. In my opinion tax is not implemented below 5 lakh income ?

Hi,

My tax harvesting report section says it does not exist. Can you please check and send me my Tax Harvesting Report?

Hey, if there aren’t any tax-loss harvesting opportunities in your account the above message will be displayed. More here.

When there are no realized profits or if realized losses are greater than the realized profits, there will be no tax-loss harvesting opportunity.

What about the Tax on F&O and losses made there. Will the loss in F&O be accounted for TAX?

As Holdings are only being mentioned , need to know how F&O will be accounted for TAX.

Hey Bijoy, In the same financial you can set off Non-speculative business losses (F&O) against any income expect salary.You can carry forward the remaining losses, provided you file your ITR before the due date. You can also carry forward Non-speculative business losses (F&O) for 8 years.

What will be the tax structure in a covered call where underlying stock has been sold with a profit and call has been squared off with a loss. For example, profit on stock short term is 100000 and loss on same stock call writing is -50000.

Hi Hossain, you can set off your losses made in option trading against your short term capital gains in the same financial year.

I have losses in intraday so is tax harvesting applicable

50k investment

Chota investment ke liyeTax zaruri hay key?

Hi Avik, it is recommended that you file your Income Tax Return however small the investment size is. Short term capital gains (selling holdings within one year of buying) will be taxed at 15% and Long Term Capital Gains (selling holdings after one year of buying them) exempt upto 1 Lac, after that will be taxed at 10%.

For all who are asking to send their Tax-Loss harvesting report :

Goto

1) https://console.zerodha.com/dashboard

2) Reports -> Tax-loss harvesting

I need suggestion on this tax loss harvesting, how i will file this .. this is first time. Please guide me

Also please send me the year to year

Of my history on STCG, STCL, LTCG and LTCL of my zerodha account.

Please send my tax loss harvesting report.

Hey Seema, a report of the tax-loss harvesting opportunity in your account is made available on Console. We’ve also explained this here.

Is any funds deducted from account for this report generation?

Hey Shashi, there are no charges applied for generating this report.

How to improve my studies in stock market suggest some sites or stock market expert.

Hey Mahendra, the best place to start is Varsity, it has an in-depth collection of the stock market and financial lessons. You can also check out the other platforms mentioned here.

Dear sir,

I am doing only BTST swing and options trading i have not invested more than 6 month any stock in this case i need to pay tax or it is already cut through dp charges and all…

Hi Darshan, as you have been holding the stocks for less than a year. Any gains/ losses will be considered as short term capital gains which will be taxed at 15% and in case of short term capital losses, you can set them off against short term capital gains while filing your return.

Please send me My Tax Loss Harvesting report.

One stock is delisted , so I got total losses. How to recover it.?

Almost I kept all stock for long-term.

Hlep me regarding this…

Can anyone suggest from where I can study about market for good knowledge!!??

Hey Pratik, the best place to start is Varsity 😀

Can i create a temporary small case with all the stocks and units are in loss and buy them via small case and sell from main holding?

What to do with the smallcase stocks. It is all mixed with the personal portfolio. Will it get affected?

I have many scrips that have now been delisted and are not being traded. How can I book the losses against them and remove them from my holdings.

How do I know how much tax on STCG i have accumulated till date ? From wherw do I check this? Kindly suggest

Hi Dhanesh, you can log in to Quicko using your Zerodha kite login to visualize your Tax P&L and check your realized gains and know what taxability.

Visit us at zerodha.quicko.com. See you there 🙂

Is there a way to know how much I am taxable with the current portfolio

Hi Chandini, yes you can, we have built a tax planning module on Quicko to help you with exactly that. 🙂

You can log in to Quicko using your Zerodha kite login to visualize your Tax P&L and check your realized gains and know what taxability. Check us out on zerodha.quicko.com

Please book your losses and buy the stock after two days or the same time with other Demat accounts to harvest the losses for the STCG and LTCG.

IF I INCURRED LOSS TO THE TUNE OF 50000 on an investment of 2120000 then can I claim this losses during filing itr ?

Jignesh

Hey Jignesh,

In the same financial you can set off:

1. Long term capital losses against long term capital gains

2. Short term capital losses against both long term and short term capital gains

3. Speculative business losses (intraday) against speculative gains

4. Non-speculative business losses (F&O) against any income expect salary

You can also carry forward the remaining losses, provided you file your ITR before the due date:

1. Capital Losses for 8 years

2. Non-speculative business losses (F&O) for 8 years

3. Speculative business losses for (Intraday) 4 years

Read more on set off and carry forward losses here -> https://learn.quicko.com/set-off-carry-forward-loss-income-tax

how to pay tax ???

Hey Anil, you can easily file taxes through Quicko.

Why after two days? Even if I buy back the next day, it should be fine. Because the sale is squared off against the first purchase of FIFO method. In short, other than same day sell and buy, everything else before the end of the year should be fine. Kindly clarify.

Regards.

Why is same day sell and buy not okay?

I need suggestion on this, how i will file this .. this is first time. Please guide me

Hey Abhishek, you can easily file taxes through Quicko.

Hey Shubham, thanks for the mention.

@abhishek, you can directly import your trades to Quicko using your Kite login, pre-fill your ITR with ITD credentials and in case you need help you can have a dedicated tax expert help you with your taxes. You can visit zerodha.quicko.com or write to us on [email protected] 🙂

On clicking The list of shares where long term and short term gain/loss can help for tax harvesting should come. I had requested earlier also

What happens if I have to book STCL and I sell and buy back on the same day? If this will help me booking me STCL successfully?

Can we carryforward options losses

Hey Tushar, since options trading is considered as non-speculative business income – you can carry it forward to the 8 financial years.

For intended long term holdings, can I sell stocks in Zerodha on day T

a) and buy it back on T+1 (as the sold would be debited from demat acct and that bought on T+1 is different settlement settling on T+3)

b) buy it on some other demat account on day T itself

You can do either of the 2 points you mentioned. In the article it is mentioned t+2 considering the client will use the same amount of money after settlement in same demat account

Please update your main article with this information.

Your team has good intentions of informing and guiding investors. But inadvertent incomplete information only increases confusion.

Also in the article it is said “before 31st”, it should be “on or before 31st”.

Thank you

Any update on this, I am still confuse on this date……. please Reply

Hey Satyanarayana, we say before 31st March so that the stocks are also debited from the demat account for settlement. However, one can sell stocks on 31st March as well to book loss for harvesting.

My Broker shows the shares sold on 31 March 2023 in FY 2023-24 report.

Please clarify which FY should I file the tax for these. In FY 2022-23 OR FY 2023-24

Yes Please clarify on this is it on or before March 31st ? Can I sell on March 31st?

Hey Satya, you can place an order on 31st March as it is within the same financial year and book losses for harvesting.

So if I have money to buy, I can buy on T+1 (next day itself) & not wait for 2 days right? ie anything other than intra day is fine. Correct?

Can we not buy it in the same demat account on day T itself? As long as, we have the funds to buy those stocks?

Hey Aayush, selling shares from holdings and buying back on the same day will be considered as an intraday trade. For tax-loss harvesting, the shares have to move out of the demat account through a delivery sell transaction.

You are so correct- dng on same day is intra-day which cannot be used for setting off STCG/ LTCG.

Better to do next day