Income tax for traders

Understanding income tax for stock traders

We all hear tales of big-shot traders making big bucks trading in the stock market.

We understand that trading may seem very lucrative, but it sounds a lot simpler than it actually is. It comes with daily volatility and emotional roller coasters of fear, greed, hope, overconfidence, and regret.

And amidst all these challenges, one aspect that traders can’t escape is taxes.

In this article, we’ll delve into the intricacies of income tax for traders, shedding light on how understanding the taxation of trading income can make a significant difference in safeguarding your hard-earned capital.

Why is trading considered a business activity?

See any activity done with the primary purpose of making a profit is called a business activity.

Like a store owner invests capital, manages their expenses, and makes strategic decisions, traders navigate the market to earn profits. Trading demands the attention and commitment of a full-time business, requiring constant vigilance to market trends and the risks associated with market fluctuations.

Now trading is different from investing as investors are believed to be buying and holding stocks for long-term, and hence may not have to actively track their investments.

Now let’s understand how traders make money and tax implications on the same.

How do traders make money and how is it taxed?

Traders generally make money in any of these 2 ways: buying low and selling high or vice versa i.e. selling high and buying low (shorting).

Whichever way you make money, profits from trading are treated as business income, and you will have to report them under the “Income from business or profession” head.

Depending on the nature of your trading activity, it is categorised into two types:

- Speculative business income

- Non-speculative business income

Speculative income arises from intraday transactions, where stocks are traded without taking delivery. Non-speculative income includes profits from delivery-based equity trades, futures and options (F&O), commodities, and currency trades.

Unlike capital gains from investing, business income from trading isn’t taxed at a fixed rate.

Instead, profits are added to the overall income, comprising sources like salary, bank interest, rental income, and other business incomes.

Taxes are then determined based on the applicable income tax slab. For example, if a trader has salary income and business income (both speculative and non-speculative), the tax liability is calculated based on the cumulative income.

Claiming expenses related to trading

Just like any other business can claim expenses related to its business, tax authorities permit traders to claim various expenses directly associated with trading reducing their tax outgo.

These include:

- rent for trading space

- electricity expenses

- employee salaries

- mobile bills, telephone bills, and internet charges

- depreciation of laptop and other electronics

- courses, subscriptions, books purchased for trading education, among others.

However, these expenses must be wholly and exclusively related to the trading business.

What to do when you incur losses?

In the volatile world of trading, losses are inevitable.

As a trader, you can do two things here:

a) Offset these losses by either setting them off against gains from other income sources in the same year

b) Carrying them forward for a specified period and setting-off against future gains.

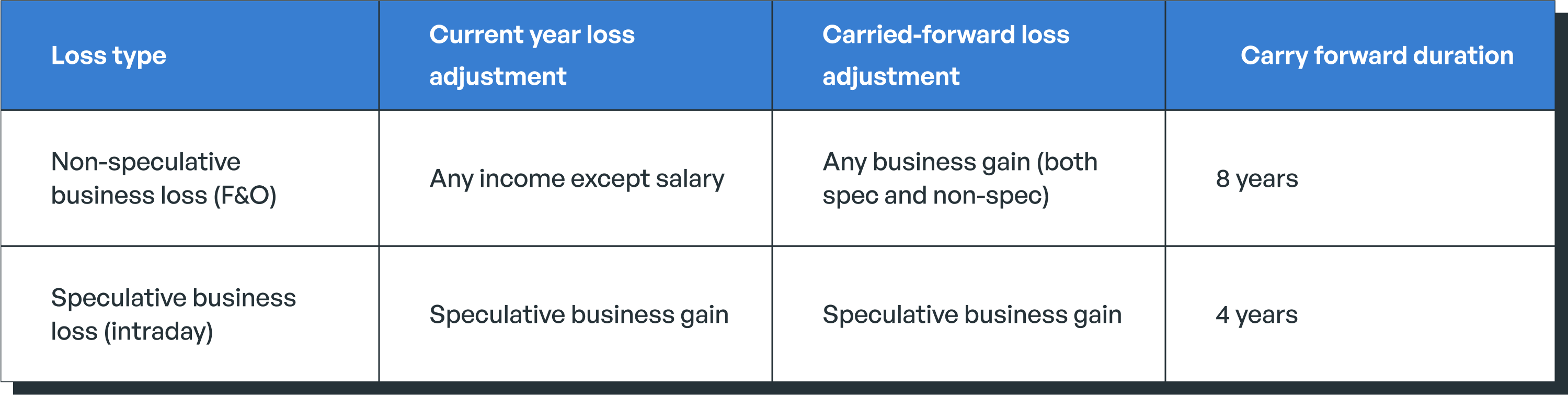

Non-speculative losses can be set off against any other income head except salary, and they can be carried forward for eight years, while speculative losses can only be set off against future speculative profits and carried forward for four years.

Here are a few important points to keep in mind.

- Non-speculative losses, such as those from F&O trades, can be set-off against any other income head except salary income in the same financial year. This includes capital gains, interest income, rental income, etc.

- Further, you can carry forward non-speculative losses for 8 years but carried forward losses can be set-off only against other business gains.

- Speculative losses, on the other hand, like those from intraday trading, can only be set-off against other speculative profits.

- Also, speculative losses can be carried forward for 4 years and set-off only against future speculative profits.

What is a tax audit and when is it applicable?

Traders, like all businesses, are required to maintain a balance sheet and profit and loss statement.

Tax audit involves having these records inspected by a practicing Chartered Accountant, ensuring accurate and complete information regarding income, deductions, and taxes.

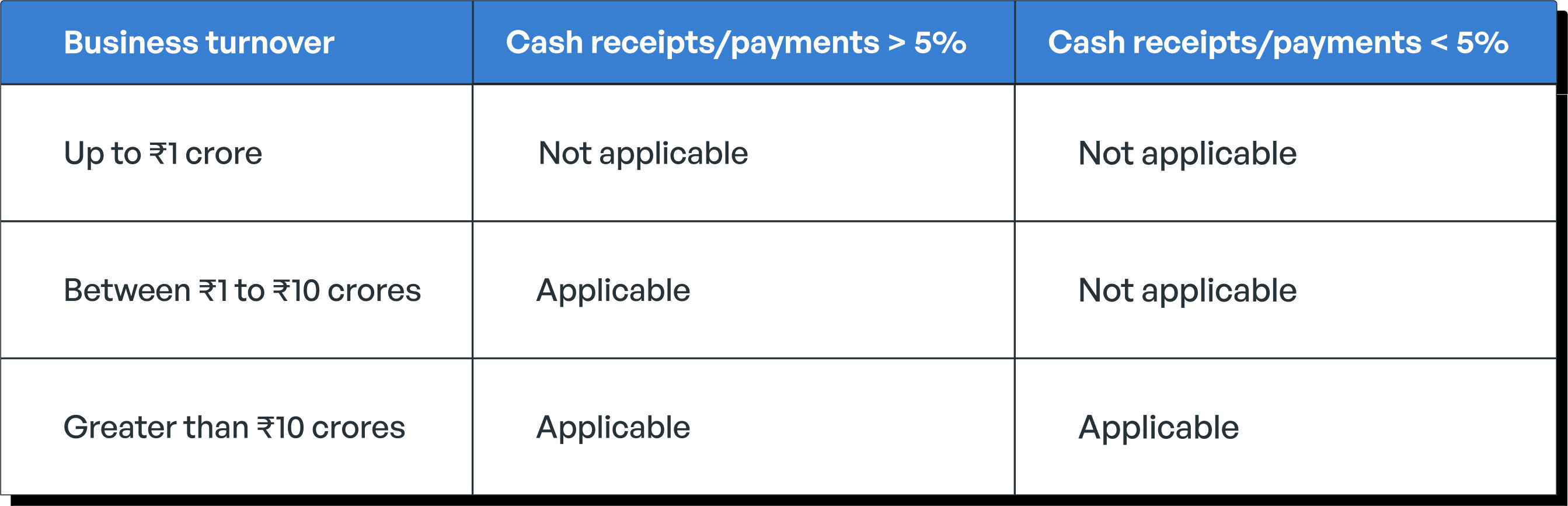

According to Section 44AB of the Income Tax Act, a business is required to have a tax audit carried out if the sales, turnover or gross receipts of the business exceed ₹1 crore in a financial year.

However, this threshold limit increases from ₹1 crore to ₹10 crore in case cash receipts and cash payments made during the year do not exceed 5% of the total receipts or payments. In other words, more than 95% of business transactions should be done through banking channels.

Since intraday and F&O transactions are 100% digital in nature, the turnover limit for a tax audit is ₹10 crores for traders.

How to file taxes as a trader?

Filing taxes is a crucial step for traders, and if you fail to file your ITR before the due date, you won’t be able to carry forward losses.

In case audit is not applicable, you are required to file the ITR by 31st July of the respective assessment year.

And if your business turnover is above the audit requirement threshold, you will have to get the audit done and submit the tax audit report on or before 30th September of the relevant assessment year. And the last date to submit the ITR in this case will be 31st October.

Filing income tax returns requires a checklist of documents including:

- Form 16

- Form 26AS

- Annual Information Statement (AIS)

- Capital gains statement

- Tax P&L statement

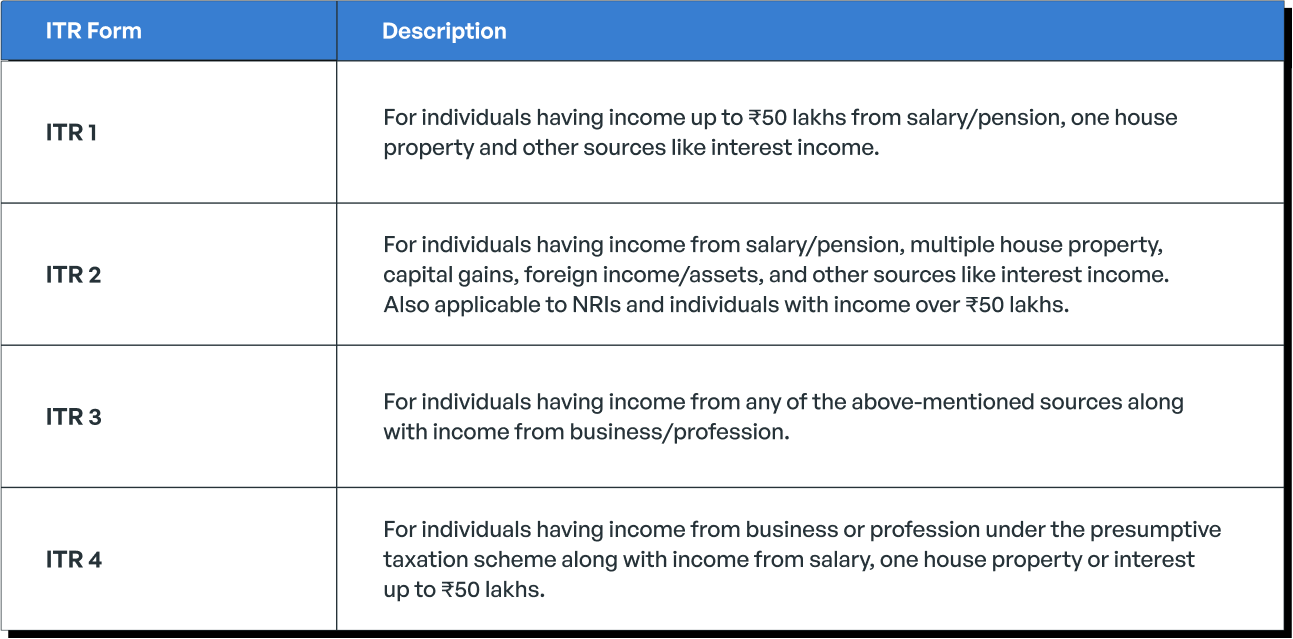

Finally, before you sit down to file your ITR, selecting the right ITR form is crucial. Check the table below to understand which ITR form is relevant for you.

Since income from trading is considered business income, ITR 3 and ITR 4 are applicable for traders, with ITR 3 being the standard choice unless opting for the presumptive taxation scheme.

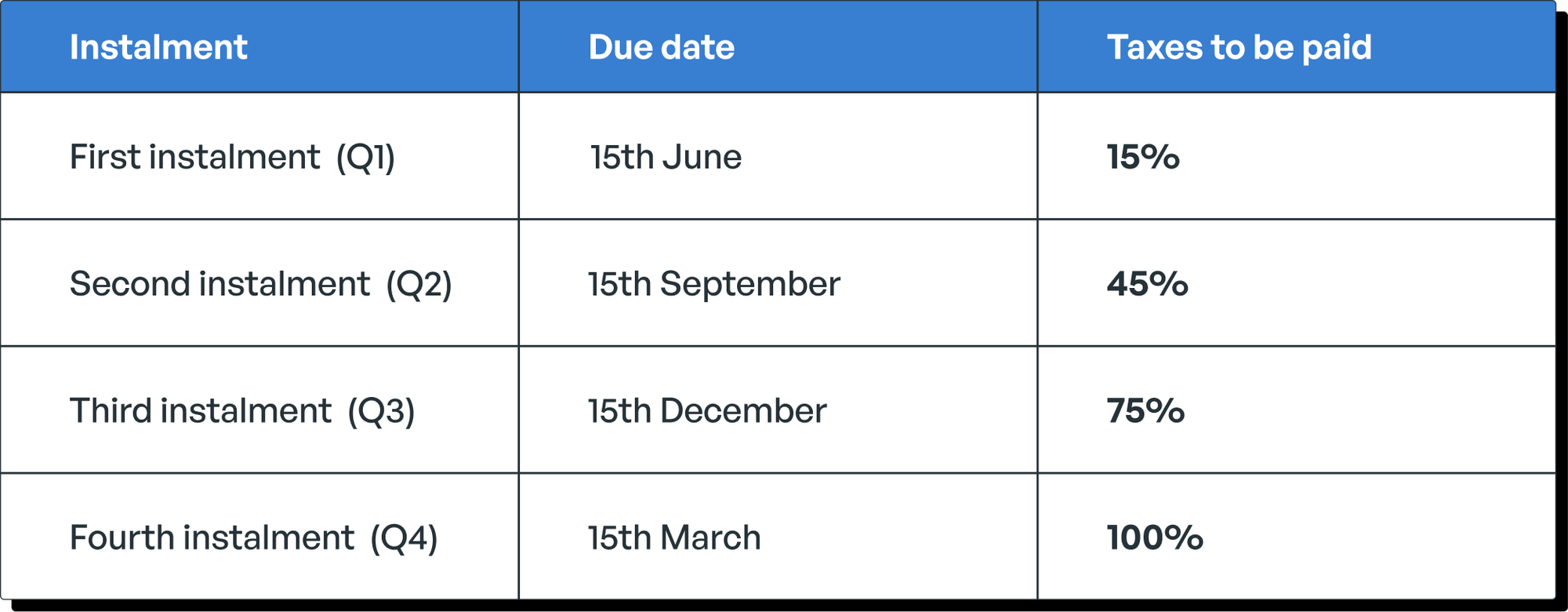

Lastly, it is important to understand that paying taxes and filing ITR are two different things. Payment of taxes should happen as and when you earn income. This concept is called advance tax.

Advance tax provisions apply if your total tax liability is equal to or greater than ₹10,000 in a particular financial year. Whatever your tax liability, it should be paid in four instalments across the year as shown in this table.

If you want to learn more about advance taxes, check out our target=”_blank” rel=”noopener”>YouTube video.

Conclusion

In conclusion, navigating the world of trading requires more than just market insights; it demands a nuanced understanding of income tax implications.

If you found this information valuable, feel free to share your thoughts or ask any questions in the comments.

If you need any assistance with planning your taxes and seamlessly navigating ITR filing process, you can visit Quicko — India’s leading tax filing platform.

Until next time, happy trading!

Hi I do trading in Stocks. And this is the only source of income. Holding period is short term, 2 to 15 days and at times 30 days.

Please clarify what is turnover. Is it the total of profit and loss or the total of Buy and sell value of the share.

Thanks

Dear sir,Madam,

Share Delivery Trade and intra-day and share Dividends

Are my only income.( I Don’t Do any Futures n Options)

1) I Limit My Turnover to Below 10 Crores.

2) I Book Profits at 2 to 4% Maximum.

So Considering the Above TWO Points.

Am I Liable To Go For A TAX AUDIT….???

Please Clarify…

Thank you…

Tushar Arvind mody

I am an individual Sr. Citizen having income from Share trading (LTG, STG & SPECULATIONS),Int. on Bank FD and

Dividend on shares. Total income 8.50 Lac. (Capital gain 6.50 lac , dividend on shares 1.00 lac and Int on FD 1.00 lac)

My questions are

Should I go for tax Audit

Which ITR form should I fill.

WHAT DOES ACTUALLY MEAN FOR TURNOVER.

hi, nicely explained. I have a query:

If someone is a equity delivery trader so his intentions is to sell after taking delivery at swing high but on most of the cases the SL will hit on the same day. So will it be counted as intraday? even though that person is not doing intraday trading he/she is doing delivery trading?

Can’t we set off intraday loss with ou total trading profit in this case?