Get poor quick

You needn’t wait for your salary to celebrate!!

Is shopping on your mind today?

Get the funds you need, without any extra fee!

Loan ke oopar extra loan!

Cash of Rs X lakh is waiting for you!!!!!!

These are examples of loan notifications on banking and payment apps I get almost every day. Everybody wants you to borrow of late. This lending frenzy is the result of two trends. The first is that, after getting burned, banks have shifted their lending away from large corporations to retail since 2014. The second trend is that fintech startups have realized that lending is the easiest way to make money in India. Pretty much all fintechs that started with investing, payments, and insurance are now betting big on lending.

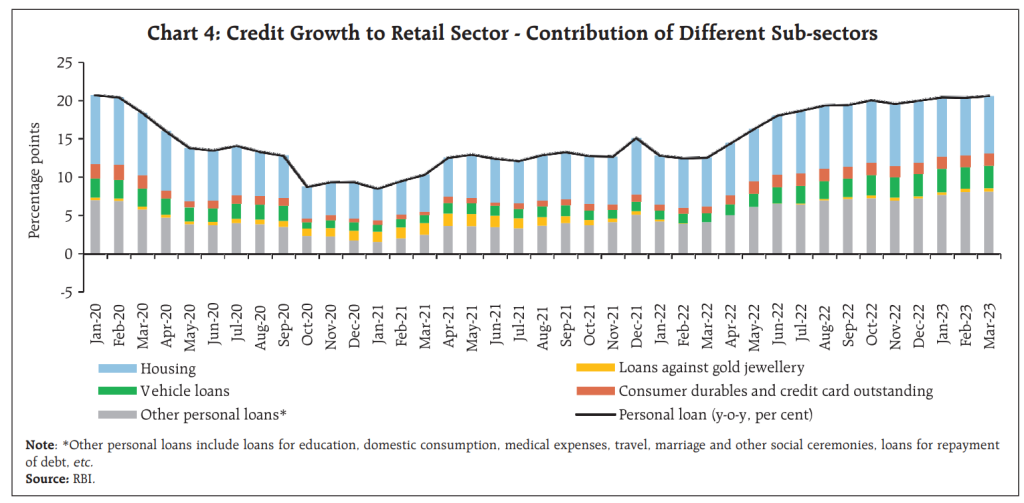

Driven by retail lending, retail credit growth has been scorching hot since bottoming in late 2020. Such has been the shift in lending that retail loans are now the largest part of overall systemic credit. Unsecured personal loans and credit cards have grown the fastest within retail credit.

There’s never been a better time to borrow money. All it takes is a couple of clicks. Credit card loans are growing at 30%, and other personal loans (unsecured loans) are growing at 20%+ year-on-year. I haven’t seen many lending cycles, but I’ve never seen such a frenzied environment. Not to sound alarmist, but this reminds me of the pre-2008 retail mania in housing in the United States.

I’m unaware if the RBI or the banks disclose credit statistics by age group, but credit bureaus do. Looking at their statistics, 50–60% of unsecured loans are in the under-35 age group. Over 35% of borrowers on fintech apps are first-time borrowers, compared to 24% for NBFCs and 22% for banks. I don’t mean to sound alarmist, but this can become an issue in the future, and even RBI thinks so.

The resulting credit concentration in the retail segment can be a source of systemic risk (RBI, 2022). In the long term, such concentration or comovement of portfolio strategies can still result in the emergence of systemic risks. Another retail loan portfolio concentration risk can arise from loan stacking, wherein borrowers can avail of loans from many lenders, which over time can adversely affect the borrower’s capacity to repay. Link.

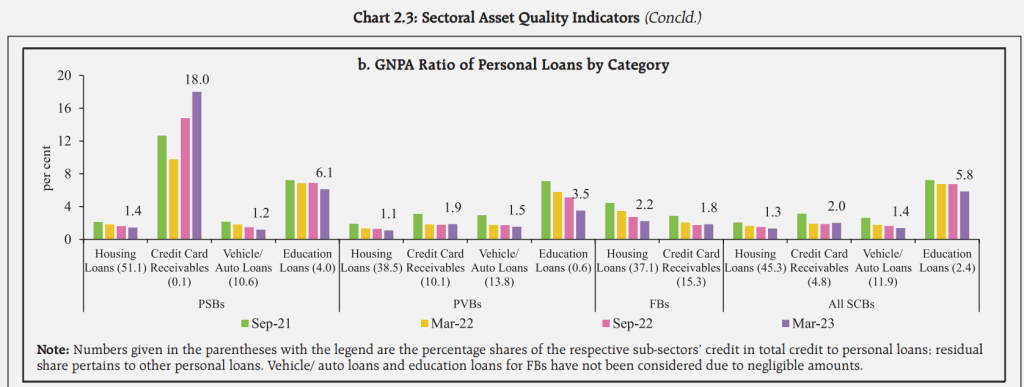

As things stand today, retail non-performing assets (NPAs) haven’t spiked yet—non-performing loans build up over time.

SBI Cards, one of India’s largest credit card issuers, has seen its mix of revolvers, or users who only pay the minimum due every month, drop from 40% pre-covid to 24%.

Revolver credit refers to credit card balances that are not paid in full. Transactor credit refers to the balances that are paid in full.

It’s easy to sound alarmist whenever we talk about debt. A rise in personal and credit card loans doesn’t say much unless you look at granular borrower profiles and the asset side of the household balance sheet. Looking at the big picture, Indian households are not showing any signs of major stress.

But reckless consumer lending booms have almost always ended badly. The great depression of the 1930s in the United States, the 2008 housing lending boom, and the 2019 P2P lending bust in China are some examples that come to mind.

Here’s the household debt to GDP ratio of advanced economies. I’ve highlighted the 2005 -2010 period when the UK and the US had massive housing booms and busts, to give you a sense of the crazy buildup in household leverage. In the run-up to the 2008 crisis, households were leveraged to the hilt. Flipping houses had become a passive income-generating activity for the masses. Note that comparisons between emerging and advanced economies are fraught with complications, and household debt to GDP is a very broad metric. So don’t draw too many conclusions.

Marry now, pay later

Whether this consumer lending boom will end in tears remains to be seen. But there are some worrying signs. From the data disclosed by the credit bureaus, personal loans and credit cards have the highest delinquency rates, though they haven’t reached alarming levels yet. The other cause of concern is that it’s never been easier to get a costly loan. From buy now, pay later to marry now, pay later, doing something you will regret is a click away. Payday and predatory loans have been truly democratized. All you have to do is download an app, and you can get a loan with a 40% interest rate in 2 minutes.

Not all high-interest loan products are from reputable lenders. In the last five or so years, there has been an explosion in the number of shady loan apps with interest rates as high as 100–200%. Most of these illegal apps were run by Chinese entities and were charging high-interest rates, as much as 1000–2000%, and that’s not a typo. The model of these illegal loan apps is to entrap people and harass them into paying more than they owe. Collection tactics can often be brutal and have even led to several suicides. The threats range from harassment calls to the contacts on the borrower’s phone to spreading morphed images. Most borrowers on these predatory apps tend to be young people who aren’t financially literate.

https://twitter.com/sandygrains/status/1675710030128222208?s=20

There’s an increase in small ticket loans among young users in the 20–35 age bracket. Most of the distressed borrowers also belong to this age group, for obvious reasons—they don’t have a lot of money. This cohort has also been hit the hardest with layoffs and pay cuts in the last couple of years.

You can be the biggest genius on the planet, but if you suck at managing debt, you’ll end up broke. Nothing in life scares me more than being in debt. In fact, I’ll take being broke without debt any day over being in debt. I’ve had the privilege of seeing multiple horror stories of people going broke by borrowing beyond their means in my own family.

Debt literacy

I think basic financial literacy is a life skill—emphasis on basic. Financial decisions are a part of everyday life. Not having a basic understanding of credit is asking for trouble. There’s also the fact that credit products become complex over time. The reason I call basic financial literacy a life skill is that just having a basic understanding of saving, investing, and credit can help you avoid an immense amount of grief in life. I saw this tweet recently about paying back credit card dues, and it got me thinking. I’ve seen this with my own friends and family numerous times.

https://twitter.com/StableInvestor/status/1675734365769445376?s=20

Most debt horror stories are due to two things:

- The inability to understand and live within one’s means

- Spending money to deal with insecurities.

Know thy means

Life is a constant struggle between what we want and what we can afford, saving for tomorrow vs. spending today. Endless desires, limited means. We all know that being content in life is the key to a happy life. That sounds nice in theory, but finding the right balance is devilishly hard in practice. Modern life, for all its conveniences and indulgences, is more complicated than ever. The engine of capitalism runs on arousing desires. If people stop buying all the things they don’t need, the world as we know it will cease to exist.

We all make mistakes with money, and there’s nothing wrong with that. Most of us would have gone through a cycle of spending money on things we thought would make us happy, only to experience disappointment, an empty bank account, or worse, an unaffordable credit card bill. As counterintuitive as it sounds, our memorable lessons come from the mistakes we make, not from gyan in books or from people. In fact, I’d go so far as to say that people should make mistakes when they are young. Doing silly things when you are young and have little money is much better than making mistakes later in life when the stakes are high. The trick is to be kind to yourself and learn from it.

Being mindful about how you use money is important because we don’t think hard about every single decision we make. Most of our decisions and choices are on autopilot, which can get us into trouble. I think lifestyle inflation—the tendency of our expenses to grow with our incomes is the result of not being mindful of money.

My personal finance philosophy is to avoid the risk of ruin at all costs. As the saying goes, you can’t play the game if you aren’t in it. This doesn’t mean being conservative; it means taking care of all the things you can and making peace with the outcome of the things you can’t. For example, you can take care of your health, but you can’t control a critical illness. You can focus on your career, earn well, save, and invest as much as you can sensibly, but you cannot control the returns. It’s the same with your lifestyle. If you let it get out of control, ruin is guaranteed. It’s easier to recover from a small setback than from zero. For that, you need to strive for balance in life; this was the topic of my previous post. We can’t have everything. Life is a series of trade-offs.

In a hypothetical world, even if we could have everything, it wouldn’t make our lives any better. You could buy everything you wanted, but it still wouldn’t make you happy because the dopamine rush of buying things wears off quickly. The things that matter the most are the things that add meaning to our lives, and not everything we splurge on adds meaning. Put another way, what are the things you will talk about when you are chilling with your friends and having a drink?

Money is a mirror

Money is like a mirror; it shows us who we are. It exposes our deepest insecurities and highest aspirations. We may not like what we see, but all the money in the world won’t fix that. We all have our insecurities, but one of the most self-destructive tendencies of humans is to deal with their insecurities by spending money. All the money in the world can’t solve our social and emotional insecurities. The sooner you realize that, the lesser the odds of you going bankrupt. The road to looking good, feeling good, wanting the best things, trying to conform, and getting people to like you is paved with a million bankruptcies.

“Be nicer and less flashy. No one is impressed with your possessions as much as you are. You might think you want a fancy car or a nice watch. But what you probably want is respect and admiration. And you’re more likely to gain those things through kindness and humility than horsepower and chrome.” ― Morgan Housel, The Psychology of Money

Open house

The world is a glass house thanks to the internet; nothing is private anymore. From plastic identities to fake looks and debt-funded flexes, it’s like everyone is trying to deal with their self-esteem issues and insecurities by constructing fake realities. This generation is the first fully online generation that’s constantly exposed to all the stupidity in the world. Young people recklessly borrow to splurge because they’re influenced by all the wrong things on social media.

Humans are social creatures, and the desire to belong is hardwired. We all face conscious and unconscious pressure to look and act like others so that we can conform and belong. This drive to belong can often be costly. I don’t think we can ever get rid of such insecurities. I think that the best we can do is be conscious. Being at peace with a version of ourselves that we can live with is a lifelong journey.

You can write all the articles in the world asking people not to borrow money they can’t afford, but youthful arrogance is one helluva drug. Maybe the only way they’ll learn is by making costly mistakes.

Keepsakes

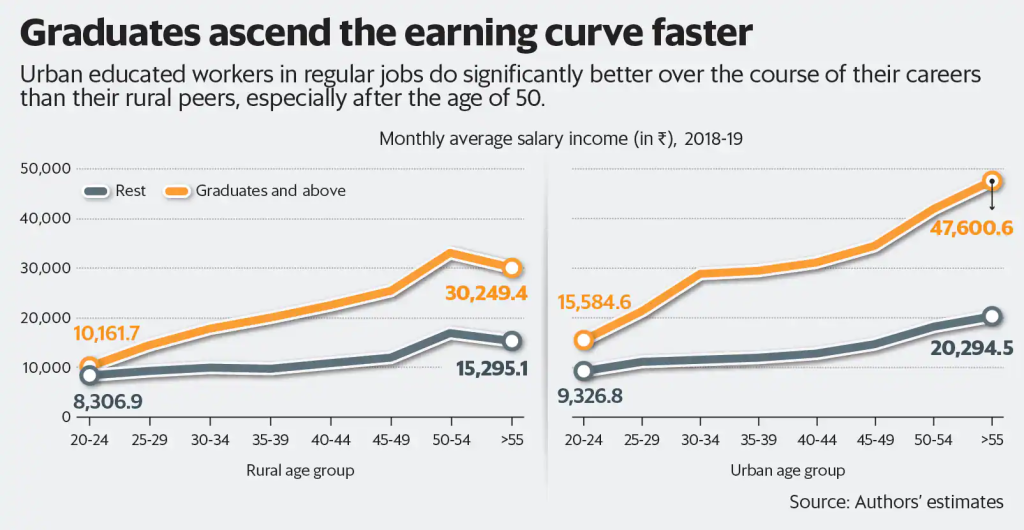

- Not all debt is bad. Most of us will need a loan to build our dream house or get a good education. Despite all the BS Twitter threads and LinkedIn posts about education being useless, the available data shows graduates earn higher salaries. Of course, this data hides massive variation because most Indian colleges are useless, but the point still stands.

- Just because you can get a cheap home or education loan doesn’t mean you should go overboard and borrow too much. If you are getting an education loan, research the pay trends for your qualification and be realistic about your repayment ability.

- As for a housing loan, being conservative is a good thing. Be realistic about your ability to repay the loans. Consider how the housing loan will affect your short-term goals, long-term goals, and your ability to handle unforeseen emergencies.

- Payment history has a significant impact on your credit. The only way you can build a credit score is to repay all your loans on time. The only people who can say all debt is bad are people who have money. For regular people, we will be in situations where we will have to borrow money at some point in our lives. Having a good credit score helps lower interest rates significantly.

- Debt is not just about the numbers. The mental peace of not owing any money is priceless.

- Understanding the basics of debt will help you through your life. Khan Academy has good videos, and Investopedia is also an excellent resource.

- At its core, debt is simple. If you borrow more than you earn, you’re in trouble. Just like companies have a debt-to-equity ratio, you can calculate it personally as well. The lower your debt-to-equity or debt-to-income ratio, the better.

- Credit cards are the costliest form of debt. The interest rates range from 35% to 46%. Don’t get a credit card if you can’t repay the full balance on time every month. Taking a personal loan to repay credit card dues is much better to give you a sense of how high credit card interest rates are.

- Avoid borrowing from apps or borrowers you’ve never heard of before. Chances are they are shady.

- Repaying your loans is as good as getting a guaranteed return.

- You cannot out-earn your bad habits. You need to have the maturity and equanimity to observe your mistakes, bad habits and fix them.

- As you grow in life, learn how to be content. You don’t need to have the best of everything or the latest things.

- Everything with money is personal. Do whatever works for you. You don’t have to worry about what’s right or over optimize things.

Great read..

”The road to looking good, feeling good, wanting the best things, trying to conform, and getting people to like you is paved with a million bankruptcies.”

Good debt vs Bad debt , psychology , conformism…..this article had everything !!! One of the best articles I’ve read till date, even being in the Finance & commerce field for years now.

Credit cards are the biggest scam in the history of payment systems!

Such an insightful article, Bhuvan! Extremely well researched and articulated!

This is the best Article about debt that i have read so far, people are carzy about taking loans. ” I prefer to stay broke then to be in bad debt”

Been using Credit Card for past 10 years after suffering a debit card cloning fraud and loss of money. Recovering my own money from bank since the card was insured was a massive effort. That is my only purpose of using CC. Even if I am a victim of CC fraud, just report in time and don’t pay amount nixed by fraudsters because it was not your money and the card was insured. Excellent article for the young people and women who are the main target of mindless spending promoting capitalism

Can you please tell how minimum amount due (MAD) is also a problem?

It’s not a problem per se, it’s an illusion which invites problems. By paying just the MAD amount, you’re just keeping yourself afloat, while continuously borrowing from (and upsetting) your future-self to satisfy your present-self.

MAD makes you eligible for next tranche of credit amount. The balance of the unpaid money garners interest. You play this trick for too long and will find yourself in neck deep crap soon. When it comes to debt, unless it is to meet the very basic needs of house, education or health…never ever owe money

Used no cost EMI for the first time for six months, feels like a wrong decision now

Why no cost emi is also a problem