Create your own smallcase

Traders,

Portfolio investing is probably the best way to invest in the stock markets since you are taking a diversified approach to investing in stocks (more here).

However, investing in portfolios is a cumbersome process, involving at least 3 different portals and 100+ clicks for each of the four steps involved.

- Discover/Create – finding portfolio-related research or creating your own portfolio happens on different platforms – your broker research, advisory, screeners.

- Buy – to buy a portfolio of 20 stocks, it takes you over 100 clicks/20 minutes to buy each stock.

- Track – since brokerage interfaces do not support multiple portfolio tracking, you have to export your portfolios onto spreadsheets or portfolio tracking apps & tools to see how they’re performing.

- Manage – investing more in a specific portfolio, or rebalancing/exiting the portfolio takes another 120+ clicks on your broker interface.

With smallcase now – you have access to 60+ readymade portfolios (or smallcases) – each of them tied to a market theme, trending idea or an investing strategy helping you take an informed decision about where your money is going. At the same time, this is seamlessly integrated with your broker – so you can buy & manage portfolios in 2-clicks. Get started instantly by logging in here.

This week, we also launched the ‘Create your smallcase’ feature; to help you build your own portfolios and invest in them easily.

In 3 steps, you can create your smallcase and invest in it immediately.

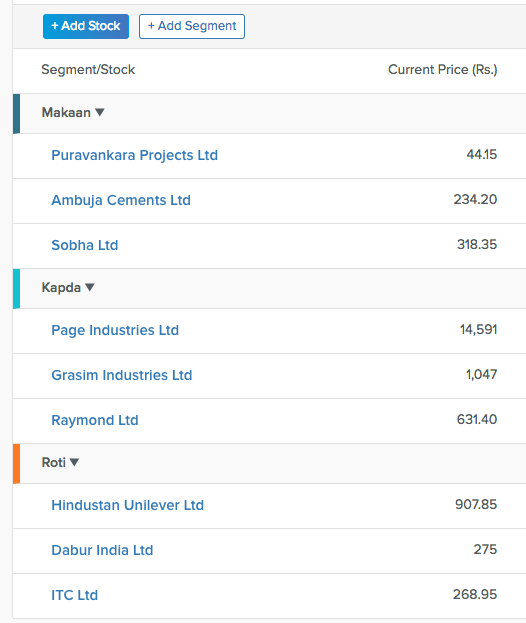

1. Select your stocks & organise them by segments

- A smallcase is a weighted list of up to 20 stocks.

- Get started with adding a stock, and use the similar stocks widget to see more stocks in the same sector.

- Once you have added all your required stocks, use ‘segments’ to organise and categorise them as shown.

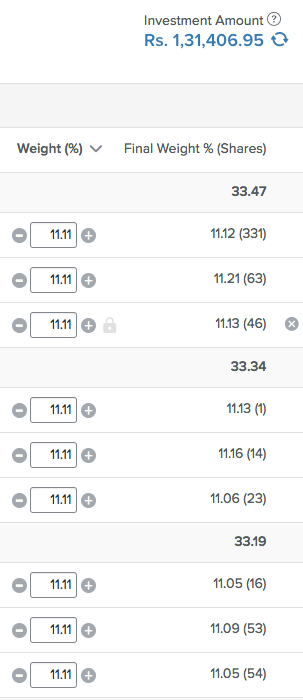

2. Assign a weighting scheme for these stocks, or weight them individually

- You can pick between an Equi-weighted or Market Cap-weighted scheme to weight your smallcase (more on weighting a portfolio here).

- Else, you can assign individual weights to your stocks or even choose the number of shares for each stock.

- While assigning weights, you can see the final weights/shares for that stock along with the minimum investment amount for this smallcase.

- This minimum amount ensures you’re buying the stocks with the weights you have allocated.

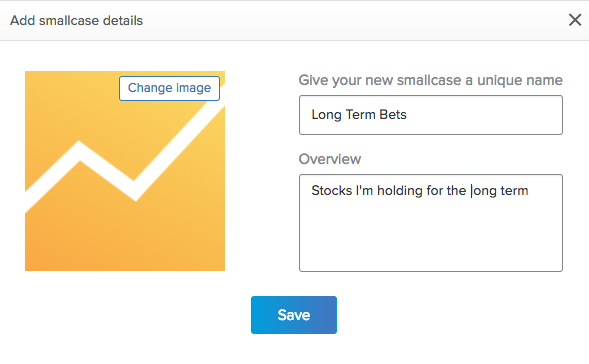

3. See the past performance of your created smallcase & buy it instantly

- While adding your stocks, and assigning weights – you can see how the smallcase would have performed in the last 1 year with respect to the general market (Nifty).

- Once you are happy with the stocks, weights – you can add details for your smallcase – image, name, overview and buy it immediately.

- Or you can also save your smallcase for later, track it on your Drafts page and buy it whenever you feel like.

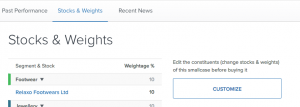

Customise an existing smallcase

You can also use an existing smallcase to start with, and customise the stocks (add or remove stocks), change weights and then buy. When you do this, you will not receive any updates made to the original version of the smallcase though – so only customise a smallcase if you know what you’re doing.

You can customise a smallcase from the Stocks & Weights tab of that smallcase page.

With this feature, it’s now easy to create, buy, track & manage multiple portfolios for different use-cases you may have, for example

- Long Term Holdings

- Bets for this month

- Dad’s Portfolio, Kids’ education

- Replicate a portfolio from your advisor

- Buying a portfolio of stocks mentioned in a news article etc.

The fees for buying a customised/created smallcase are the same at a flat Rs. 100 (or 2.5% of the investment amount, whichever is lesser) for each smallcase. No additional charges from our end when you invest more, add/remove stocks or exit your smallcase.

Note

- You can only add NSE stocks to create/customise your smallcase.

- Your smallcase will be private and will be visible only to you.

We’re adding more options to help you create your smallcase better & easier – better way to select your stocks, easier weighting options and more. Tune into a webinar to learn more about creating your smallcase here. Do let us know how we could improve this experience for you, by commenting below.

Happy investing!

I have created smallcase portfolios. It gets saved as ”Draft”. I am unable to ”Invest” through my own creation. How do I do it?

Can I make my own smallcase and publish it for public??

So this 100₹ charge is for the first investment and for subsequent SIP performed it will be charged again for the SIP transaction amount, right?

and these charges are in addition to the charges by broker or does it include broker charges (zerodha in my case)?

What are the current charges for self created smallcase?

1st time : 100+GST

For additional amount investment/rebalance, what are the charges levied by Smallcase investment through Zerodha?

is it (rs. 100) a one time charge or it’s on a monthly or yearly basis charge?

Hi Priya, the fee is per transaction.

If I create a smallcase, can other people make investment through it.?

I have a few stocks in my portfolio, can I use these to create a smallcase (Means using the existing stocks in that customised smallcase as it becomes very easy to monitor and manage

I want to create my smallcase defined by stock quantity. Under 10,000. How can I do that

Hey Amul, the process for creating your own Smallcase has been explained here.

Suppose I created a Smallcase for myself. Will I be charged just after the creation or charge will be levied when I actually bought stocks/ placed orders from that smallcase.

Hey Lokesh, there is a one-time fee of ₹100 + GST when you purchase through Smallcase. Explained here.

Nice artical Car Keys is very useful. Thanks for posting such a piece of information Thanks for sharying.

hi,

is it possible to put stop loss in small case? I am trying to invest in some penny stocks through creating a small case portfolio. kindly advise. thanks

Hi Team,

I have created multiple smallcases, but the issue which I am facing is all of the stocks under those smallcases are showing in Kite too, and it’s really difficult to track the stocks which I bought directly from the kite.

Do we have any option to hide the ones which are from smallcase?

Hi,

Is it possible to add same stock in 2 different segments in one smallcase that I have created?

Can I create a small- case of my stocks already in my Kite Zerodha?

Hi,

1. Can we please have charts for created smallcases that I invested in?

2. When I invested in created smallcases, why it placed some orders on BSE and some orders on NSE?

3. Because of q2 above and the fact that smallcase is tracking only nse stock prices, current value of investment in smallcase portal is different than the actual current value in kite app. Can you please look into this and reply to me?

Thanks

Dear Team ,

I have created one small care and purchased. All small case stocks are showing in kite holdings .

Is there any option to hide or remove them from kite ??

Dear Team,

-Hope same 100rs one time charge is applicable for self created Small case also…. Please Confirm ?

-How dividend distribution will be done for self created small case ? ( if any stock which my smallcase contains pays dividend )

Say i want to do SIP monthly in a smallcase i created.. And i start with suggested minimum amount. Won’t that minimum amount change after a month with change in individual share price? And also, even with weighed system, won’t it lead to fractional ownership of shares?

I have created smallcase, initial investment amount is showing as a 47,000 but SIP amount is 14,000.

How SPI will work, how zerodha decide which stock to buy with this 14,000 SIP amount?

Is there a broker available at smallcase who would monitor the markets and manage the weighing of shares accordingly ?

Hi Team,

Can I create and share it across my family members of 5 people all are having zerodha account. If I invest on one small case which I’ve created and if all family members are invested on this small case? Will 100 Rs from each account will be charged?

Also if someone outside who bought smallcase created by me, will I get any amount?

If I do monthly sip on single small case will I charged 100Rs for each month?

Please reply

Regards,

Jagadeesh

i created a smallcase then it was saved as a draft, but after purchasing it got deleted from DRAFT list, now i have exited smallcase and again want to buy it…. but cant find my that created Smallcase in draft or watchlist, help me out how can i save my Created smallcase for lifetime here.

Hello,

Could you let me know if I already have a same stock which is also part of the small case how I can differentiate between the small case allocation and my kite stocks? Are there any lock in period with small cases

Regards

Suresh

There is no lock-in period. You can log onto smallcase to see only smallcase investments.

Sir, if I am creating my own smallcase. Then such charges(ie Rs 100 or 2.5% of investment value, whichever is lower) are also applicable.??

Sir, If i created a Customised Smallcase consisting 10-15 Stocks, then Can it possible to purchase Stocks in weight for example Vedanta weight.02, Reliance.03 etc.. As stock can be purchased in one lot. Then how can smallcase invest. In portion stock

1 script bay and sell charge plz

Hi

I am Dattatray.

I have created three small case. I want to invest.

I have below queries.

1. For customized small case are your analyst doing the review of the small case ? If yes how frequently ?

2. If not, then what is the benefit of customized small case investor ? Why he should invest in small case ?

3. If Yes, What type of suggestions are provided by analyst ?

4. If my customized small case value is Rs 12000/-, how SIP of Rs 5000/- will be invested ?

5. In SIP, is there Flat Rs 100/- charges on each transaction ?

Thanks

1. No.

2. It allows you to invest in one click and easily manage the portfolio.

4. You can’t. If the minimum investment amount is 12k, your SIP has to be above that.

5. The Rs. 100 is charged only on the first purchase, not every transaction.

Instead of setting the weight per stock, i want to edit the no. of shares per stock? How this can be done in Small case?

I played with adjusting the weight of stocks but they alter the no. of shares.

Please suggest.

Hi, Can I Sell My Smallcase portfolio to others? Like We have seen others portfolio to invest in them.

Hey Ali, in order to do this, you need to be a SEBI qualified investment adviser.

Will a fees again be charged if add a completely new stock to my smallcase?

lets say A,B,C already existing in custom smallcase (paid 100 +GST) in the first transaction

Now i want to add D in the existing one.

No, there won’t be any additional charges for this.

Any charges of using small case?

1. Brokerage?

2. Any hidden charges?

There’s a smallcase fee of Rs.100 for purchasing a smallcase and the applicable taxes and statutory charges.

Greetings.!! team samllcase,

Looks cool to make and track the number of portfolio’s with different stocks, but still not convinced with charges as I am already paying brokerages/taxes/fees with Zerodha already on every purchase every stock, even u are delivering my stock at zerodha’s portal. (Here I am only purchasing in bouquet), it’s more or less of tracking portal only, in case I am leaving research on you it’s not much different from a mutual fund (Even in MF I have to do nothing but here again I have to buy/Sell/rebalance Every time).

What’s the future plan with competitors like Money Control, Mojo Stock. I think this will come free of cost with other apps in the near future.

Is there any option to track/graph the performance of my smallcase’s with respect to other smallcase only rather than nifty or S&P 500.

The conclusion is that charges are Very high (not worth) for now with current facilitation.

Still would love to discuss if u can give me a reason to start with smallcase.

Thanks

Gunraj

Hi Gunraj,

The smallcase fee charged is a convenience fee for creating a custom index for your smallcase. The aim with smallcases is to enable investors to either invest in portfolios made by professionals or in portfolios created by them with the stocks of their choice. For investors who are looking for data and information to narrow down on stocks, they can check out https://www.tickertape.in

Currently, smallcases’ performance can only be compared against the benchmark in the past performance chart. Will pass on the suggestion to enable comparison between individual smallcases’ past performance as a chart.

Love the concept but have many questions on the creation of smallcase…

1. Market-cap weighting: any way to inverse it ?

2. Rebalancing: Automating possible ? How often can I rebalance ?

3. Custom weighting: any way to base it off Index ratios ?

Hi there! Addressing the suggestions in order:

1. So, you’d like to give a lower weight to a stock with a higher market cap, yes? This is not possible right now, but I’ll add it to your list of suggestions.

2. Currently, we don’t have permissions to buy & sell on your behalf, so I’m afraid automating rebalancing can’t be done right now. Most smallcases are rebalanced on a quarterly basis. You can view the next rebalance date in the Stocks & Weights section of the smallcase.

3. There’s no direct way to do this – will make sure to pass it on as a suggestion.

If I buy small case can I see through kite? The taxes will it be calculated in kite? What about dividend?

Hi there! Yes, the individual stocks that you buy through smallcases will be visible in your Kite holdings. The tax calculation you see on Q includes smallcase stocks as well. Any dividends declared for stocks in your smallcase are directly credited to your bank account.

Hi,

I’m new to investing and have just started using the kite platform. I had a question on small case pricing.

If I am investing in a portfolio in fixed monthly intervals, i.e., on the 2nd of every month I invest a certain amount into my portfolio, do I pay a flat fee of Rs 100 + tax every month or is the fee applicable only when we create a small case portfolio?

Hi Udit,

You will only be charged Rs. 100 + GST when you first buy a smallcase only. There are no additional smallcase fees for investing more at fixed intervals. Of course, the standard Zerodha charges would still apply 🙂

Can I have a Intraday smallcase which I could sell on your platform. Would like to discuss with you.

Sir when i sell a smallcase consisting of 20 stocks, are dp charges only 15 rs just like single stock or it would be 20×15 =300rupees? This doubt prevented me from buying smallcase. For buying 100 rs ok. But when selling dp charges are the main concern. Kindly clarify the doubt as i cant find answer in any of ur previous discussions

Hi Praveen! Yes, the DP charges are applicable for smallcases as well – just like selling single stocks on Kite, so there’s no workaround for these charges. The greater the amount you invest, since DP charges and the smallcase charges are flat fees, the more cost-efficient it would be.

Is it possible to upgrade the small case;

for example: User purchase a small case with X amount in Jan, he wants to go with the same small case (X -market value applicable) by upgrading it to twice the portfolio (2X) in June, is that possible? if so, are there any charges applicable?

As it is the same portfolio selection, is there any discount in charges?

Hi Abhay, you can invest more in the same smallcase (the amount will change as per the current market prices and weights as per your current holding), no charges from our end for topping up

Usual Zerodha charges will apply

Hello Sir,

I want to remove some specific stock from SmallCase. I have sold that from Kite.

How can i remove that specific stock from smallcase without placing a sell order again.

Thank you

Best contact smallcase support for this. They can do it from the back-end.

I brought urga global shares at 3.2 /1000 and 4.2/3000 in BSE . currently my profit is nearly it is 1500 but it is allocated in NSE and it is showing -380.and also money reduced on BSE price only .can you do needful and also trying to call Zerodha many times but no one can lift the phone.customer support also not there .. please do needful.

Once the stock is in your holdings, there is no concept of exchange. We just show NSE by default. You can sell on either exchange.

You have introduced Terms and Conditions recently. One of the Terms and Conditions reads:-

• As part of this continuing innovation, you acknowledge and agree that smallcase may stop (permanently or temporarily) providing the Services (or any features within the Services) to you or to users generally at smallcase’s sole discretion, without prior notice to you. You may stop using the Services at any time. You do not need to specifically inform smallcase when you stop using the Services.

Do you intend to stop the services abruptly? Such clauses in Terms and Conditions does not inspire confidence in your service.

Hello,

Is there a way to merge 2 small cases as well?

When are you releasing smallcase app for iPhone?

if ur small case advance then ordinary mutual funds u ppl needed to provide xirr returns, pe ratio, pb ratio,Risk Measures (%) like Mean,Std Dev ,Sharpe . all this need to included in ur all smallcase

Hey Srikanth – this should be on the platform soon

hi sir smallcase is wonderful. if u provide xirr returns like mutual funds it will be more helpful

hi u can exclude one time fee of rs-100 and transaction cost . but please include xirr percentage it will be very helpful to many ppl. and if fact u needed to be more advance then ordinary mutual funds. needed more features .

u can write note on xirr returns like this is excluding transaction charges. thank you

Hi Srikanth

Sure, something on our list – will see how we can do this asap. Thanks!

Any chance of XIRR getting implemented?

Interesting concept…..,going to give it a try.

Hi

7I sold stock in small case from kite platform. By mistake. What now…

Hi Sachin – write to us at support [at] smallcase [dot] com

Hi Vasant,

When we remove a stock from small case will it place a sell order? I want to remove stock from small case and move it to kite platform. Technically de-link it from small case and still have it in kite holding. Is it possible?

Hi Harsha – yes, will place a sell order

Write to us at [email protected] with the stock name & in which smallcase it is in? We’ll see what we can do

Hi,

I have created a smallcase of 20 stocks. If I buy the small case, how much charges in total would be applied?

Is it 20 Rs per stock and 100 Rs for small case + taxes? Or only 100 Rs + taxes.

Are there any recurring charges?

Can you please increase the limit of 20 Stocks to 25 or 30 stocks? I have 23 stocks to be bought for long term and would like to buy in one shot the day market corrects.

Equity delivery brokerage is 0 at Zerodha. So only Rs 100+ taxes. Hmm.. the current limit is 20, not possible above that.

Not possible right now Sameer – better to do this with 2 smallcases. Will work more on this soon

Hello

Do you guys have SIP options like taurowealth?

Some of small cases have already peaked in its performance.

How does small considers entry timing from market condition point of view.?

Hi Manish

1) SIP kind of option coming soon

2) We don’t advise on timing/market entry at smallcase. You can perhaps use this to decide mmi.smallcase.com

Is it possible to add ETFs in a custom smallcase?

Only NSE stocks right now, Prashant – ETFs is on our list

What if offer price(Qty) is 00(0) of any share… Does we can buy or not??? ??

Not possible to buy if no one selling.

Is it true that there is a demat charge of INR15 per stock for selling from smallcase?

Yes DP charges are applicable with every broker when stocks are sold from demat.

I have been investing through smallcase and let me tell you it is a wonderful product.Personally have made more money through smallcase than from any other product till date.

Do let anyone tell you otherwise.

For convenience sake can you incorporate an option wherein a specific amount can be withdrawn and the remaining investment is automatically distributed as per the weightage of that particular smallcase….am sure it will be an easy option.

Keep up the good work!

Cheers!

How to calculate income tax profit made by smallcase..?

It works like normal stocks. You calculate based on underlying stocks.

Is there any small case for only Housing Finance Companies ?

Hey Manoj

We have a couple of smallcases that have Housing Finance cos as a segment

Banking Privately – https://www.smallcase.com/smallcase/stocks/SCNM_0008

Affordable Housing – https://www.smallcase.com/smallcase/SCNM_0024?sc=Affordable-Housing

You can customize these smallcases to keep only the stocks you’re looking for and then buy 🙂

can i operate multiple account at a time, like place a order in one parent account automatically opens order in linked accounts

No, you can’t.

Does the small case platform give period of holding and short/ long term capital gains ?

If one invests in more than one small cases,then are all holding and profit/ loss reporting kept separate for these small cases ?

Hey Satheesh, nope – it will be a combined tax statement that you’ll get from Zerodha’s back office that you can use directly

We calculate the P&L for smallcases separately on smallcase.com though 🙂

Hi sir,

Can we sell single stock whenever so need from small case

I m having zerodha Ac

Plz reply

Yes, you can.

Yup, you can – do ensure you sell this from smallcase.com and not Kite – otherwise your activity will not be updated on smallcase.com

Hi Vasanth,

smallcase is a Great idea, really appreciate it!

Few thoughts below-

– Stock selection is key for portfolio performance, as confidence booster please give little insight on how you intend to pick top performing stocks for each time. Also are stocks picked by Algos/scanner/manually

– Would be great to know how the specific smallcases performed through bull and bear phases (pre-2013) like 3yr/5yr/10yr performance for the relevant smallcases.

– Would greatly help if smallcases can be tracked for virtual returns since addition to Watchlist

These would be of great help, Thank you.

Hey Diwakar, just saw this

Have replied to your suggestions here https://talk.smallcase.com/blog/postweek-3-7-apr/#comment-3248683837

Thanks again!

Hi Vasanth and team

Great work in coming up with such a wonderful platform in India!!

I am new to investing and read Joels book recently to educate myself along with others. He has the magicformulainvesting.com for US stocks and I could not find any similar platform for India and had to rely on screener.in for the same to buy a portfolio with his formula a few weeks back! If only you announced a little earlier.

My query here is, how true to the original idea are your portfolios/smallcases based on each of the models used in the site? I am not such an expert yet to go deep and find out but just wondering how it was done.

Again great work and you have made my day!

Hi Prasad, thanks a lot for the nice words, means a lot 🙂 We’ve been up and running since July 2016 – Magic Formula being one of the first smallcases put up. We also have a low-cost version for the same, ICYMI

They’re based on the criteria that the model/theme requires – we have adapted some criteria slightly to suit the Indian markets wherever required. For example, this is how we have built the Magic Formula smallcase http://telegra.ph/How-smallcase-returns-are-calculated-12-22

Happy investing!

Hi Vasanth,

I guess its my loss for not researching enough before starting my investment journey. Well I thank you for your response and wish to say that you have a customer for the smallcase in me as long as I am an investor! I do like the way Magic formula is calculated, cheers!

Hi Zerodha/Nithin Kamath,

Do you have any plans to introduce the ability to pledge the investments made in smallcase for shorting options? I duplicated this post from another thread ”stock pleding” as it is relevant for this conversation thread as well.

The reason for asking is as below.

For example if I invest in 2Lakhs in “Growth & Income” small case which is one of the best performing small case, I’ve various following troubles.

This small case has 15 stocks. I can individually pledge each 15 the stocks to short the options. But, for each stock Zerodha charge 60 rupees for pledging. That means if pledge and unpledge this stock it costs 120rupees for each stock. The taxes adds much more to this number. For total small case it will be 1800 rupees brokerage. If we include the taxes that will way above 2000 rupees. Thats more than 2% of the total investment value for pleding this smallcase to short options.

Can you enable pledge the entire smallcase investment as a single transaction?

This is a concern for many people I know. If you can enable this option, it will greatly help several people.?

-Srinivas

Srinivas, all stocks bought through smallcase show up on Q holdings page. https://q.zerodha.com/, you can login there and pledge the stocks. Check this link for more.

Hi Nithin,

Thank you for reply. Yes, I know the procedue to pledge.

Do you have plans to pledge the entire smallcase as a single investment rather than individual stocks?

Individual stock pledging of a small case which has several stocks almosts cost 1-2% of the total value of the investments of less than 2Lakhs. Are you considering to give an opportunity to pledge the smallcase lot at lower prices than individual stock pledgings?

Regards,

Srinivas

Srinivas, when we pledge stocks the clearing house accepts only individual stocks at a time. So not possible to bulk pledge a smallcase.

iam an nri status can i open a demat account with normal savings account??

No, you will have to come through the PIS route.

First of all, smallcase is a great idea that I like quite a lot. It can be a real boon to portfolio construction for an investor.

However, I did have one idea to add to the conversation, this is something that I see missing from the smallcase platform. I don’t see any ability to use ETF’s, in conjunction with stocks, so the true range of choices in terms of asset allocation is quite minimal. I guess this is primarily because smallcase seems to be a purely stock oriented platform, but surely, multi asset allocation portfolios also qualify as a theme? For example, a portfolio featuring gold, stocks, and long-term gsecs can easily be constructed using ETF’s. Enabling this kind of portfolio construction in smallcase would be really cool.

But anyway, great work on the platform. Truly innovative, and looks like it would be fabulous to use.

Hi Karan, thanks for the kind words & support! Appreciate it

Yup, very true. On our list, hopefully very soon 🙂

Dear Nithin,

I understood your new AMO policy, but there is big problem related to ETF AMOs. Cant put AMO for ETFs like NiftyBees or BankBess as they are not traded in pre-open. Hence are cancelled immediately at 9:00 with a message ” Product not traded in this market.” Please suggest any work around. need to put orders in the evening.

We are working on being able to have AMO’s which can’t be placed at 9.00 am at 9.15 am.

Hi,

I have a suggestion for rising smallcase… if some one invest in Smallcase u have to provide extra Margine in Intraday/Delivery.(according his investment value)

kal jawab milenga kya sir? sir meri problem maine a/c open karne ke time hi batai thi .muze earing problem hai mai sun nahi sakta karke cell phone nahi karta sir.taqlif dene ka erada nahi sir software new type hone se samaj me nahi aata mai 5/6 saal se trading band kiya tha.

Check this user manual https://kite.trade/docs/kite/, has everything about placing orders and videos as well.

hallo sir i do not understand about cover order buy / sell entry. sir cover order me buy kiya to sell on the spot kaise karte hai? aur cover note se sell kiya to buy on the spot kaise karte hai pls tell & guide to me sir .order book me jaker modify karne ke liye destop ke back jana padta hai usme time weste hota hai hai trade rate dn/ up ho jata hai.

Check cover orders video here.

hello,

do you have any plans to introduce co with limit option in kite just like in pi? it would be really helpful.also gtc orders will be superb if you can introduce it.

thanks.

Yep, both on our list.

HOW TO APPLY IPO WITH ZERODHA PI PL HELP ME

Within the Zerodha app you can’t apply for IPO, but this can be done through your bank account using your DP ID with us. Check this link.

Very interesting and cool idea Nithin and Vasanth..I believe it would help the individual retail investors well and also folks who wanted to have SIP kind,simply create a portfolio you are keen about and buy as funds are available or based on the performance and current situation.

Yet to explore how we track the created segments’ or smallcase’s performance.Usually Brokers maintain portfolio view for currently held assets,which is a report or graphical view but did not yet excel to provide a feature to buy right away from it skipping usual Quote,Hold funds and Order process.

It would be helpful if you provide an option to create small case by choosing existing held stocks,do we have one to do that?

Hey! Thanks for the support – this is exactly what we’re trying to achieve – making portfolio investing as easy & seamless as possible

This is how tracking works for a smallcase you have bought http://help.smallcase.com/using-smallcase/manage-your-smallcase/track-your-investments – you can manage (invest more, rebalance/add/remove stocks/shares, exit your smallcase from your Investments page)

Not yet – this is on our list to work on soon. For now, the best way would be to create a new smallcase and buy fresh stocks to view it as a separate portfolio

Please add awesome indicator in PI with adjustable parameters (sma ema periods)

Hi Small Case Team

– Good Concept. Best Wishes for Successful venture.

– Lots of queries on pricing front. Understand price on small case is applicable on initial purchase only. So in case of small case of total value less than 4000, it makes sense to buy one lot and add subsequently. Am i right?

– Any thoughts on integrating sell transaction initiated on small case directly from Kite/Pi

Hey Praphs, thanks for the support! 🙂

– Yup, that works. We count the total amount invested in a smallcase on the day of buy to calculate the charges (Rs 100 or 2.5% of the amount)

– Nope, working on it, but for now – you should sell/manage smallcase stocks on smallcase.com only

Hi Vasanth,

i undertood that for long term wealth genereation smallcase is ideal.

Is there anything we can do for saving tax? if i invest in directly in smallcase.

I know Zerodha does provide mutual fund investment, but just need to confirm that smallcase provide that facility.

Please advice.

Hey Vikas, nope – for now, tax saving on equity products is only available via ELSS MFs – not on direct stocks

Hi,

If we create a small case portfolio and buy 1 lot, after couple of days – I change the weightage and buy again – will I have to pay 100 more ?

If I add or delete a stock in the same small case portfolio that I bought previously and buy again, will I have to pay 100 again ?

Can I sell only one stock of portfolio separately through zerodha? If I sell will my small case portfolio holding reflect that?

Small case order is limit order or market order?

Can we place off market order that can get executed only market opens?

One suggestion – please include sip way of investing in small case portfolio

”You can only add NSE stocks to create/customise your smallcase ” – why this restriction? a lot of valuable small caps are listed only in BSE. Is your theme/strategy based smallcase also have this BSE restriction? then you must be missing some good smallcaps!!

Yup, our smallcases also only have NSE stocks – optimizing for liquidity here

BSE is on our list of to-dos

I hope you will understand, Timing is everything in Market. Don’t let your TODO list piling up.

Somehow, zerodha/kite is not as impressive as it used to be!

Howlong ?

No GTC orders!

No BSE in smallcase!

Stuck/crash/Not-login in RUSH hours, OMG!

No Q data-sync now!

f2f errors at off-market hours. Still!

No realtime data/LTP from NSE before pre-open! have to check it in google finance 8.30-9.

buggy T1 quantity profit/loss calculation in ’Holdings’

No sector wise pictorial view in Q.

Come on Nitin and Vasanth!

Just learn how good its, the free ET-Portfolio page!

An year back, Kite and Q was amazing., But no more now.

Something seriously going wrong in Zerodha recent times., and you have no time to correct it ?

Bala, yes we are facing issues on Q, we are in verge of moving it from our backoffice vendor to inhouse. What issues are you facing on Kite?

Hi, waiting for the BSE stocks to be included in smallcase. Have created one but not able to invest via smallcase as 2 stocks in the portfolio are only in BSE. Please include this feature at your earliest convenience

SIr, by investing in smallcase, is there any locking period?

Nope, none at all. You can sell your smallcase anytime the markets are open

The concept is most effective for long term investing though, just saying

Small Case is a very good platform. Its a great experience in Zerodha so far 🙂

Thanks for the support Sumeet!

Allow portfolio N smallcase based day trading with fixed amount based stop loss N fixed amount profit booking target. As soon as the specified amount is achieved the total portfolio will be sold. Alow portfolio N smallcase shorting to allow theme based short selling, with higher margins

Hmm, more for long term investing right now 🙂

Is there an option to create small case to buy F&O stocks ?

Nope, just NSE equities for now

Team Zerodha,

Great initiative. Thanks.

The coolest feature is to see the past performance of your smallcase. Which is very cumbersome in case of all individual stocks.

Thanks again

Yay!

Existing holding can be add in small case…? by crating new my own small case.

Nope, not right now – you’ll have to add new stocks to a smallcase

Will work on this too in due course of time

Hi.

Really, if I put money in one of your pre existing small cases without customising, how is it different from a mutual fund ?

Similar in concept, that you have a portfolio exposure

Here, no expense ratio, instead just a flat fee = so more cost-effective

each smallcase is related to an idea/theme/strategy = more relatable

you own all the shares and are in complete control = transparency

🙂

Request you to make an app for smallcase.

Hey Dipankar, we already have an app for tracking your smallcase here https://play.google.com/store/apps/details?id=com.smallcase.android . Building the full-fledged order placing one too!

Please do a IOS app.

1. Can we see where existing smallcase is investing in detail ?

2. Annual & other charges ?

Hi Bhavik

1) Yes, you’re buying these stocks into your demat account – you can see the constituent stocks & weights for any smallcase on its page under the 2nd tab

2) Only a one-time flat fee of Rs. 100 per smallcase bought – Z charges apply as usual

When is iOS app coming?

Dear Sir,

Even the concept of smallcase is good i feel the charges are a bit high. As a sample purpose suppose we buy one small case as the the charges its coming around Rs.200 for one small case ie (Rs.100+Rs.40+All the STT & ST). IF the cost is Rs.200 then we are never and ever going to get any returns even from one small case.

Regards,

Sonjoe Joseph.

Hey, these are all flat fees so the cost percentage for your investment decreases with a higher amount invested. Working on optimizing this for smaller amounts as well

Also, this is a long term investing platform 🙂

I know its flat amount but still the cost is on the higher side. Since u already have a tie up with Zerodha from yr side also the cost is to be Rs.20 so the total small case cost should not go above Rs.100. For Zerodha clients u guys u need to charge only Rs.20 then only even the small invest clients can be profitable in the longer term. Now a days the logic of the business is to increase the volume and not to charge high. Only those guys will only sustain in the longer term.

Regards,

Sonjoe Joseph.

Got it, will work on this. Thanks!

Game changer…:)

😀

how to and where to create smallcase

http://www.smallcase.com/create, you can access this once you login with your Zerodha credentials at http://www.smallcase.com/login

A small clarification….suppose (don’t laugh at this stupid querry)

1) I create a watchlist with 6 stocks, irrespective of segment

2) I add 50K

3) Assign number of shares to be purchased

4) Start trading everyday (intra and not positional)

Possible….or I got it all wrong

With smallcase, no. We only do delivery orders, since this is more of a long term investment platform 🙂

Okay….thanks

i have my portfolio (already invested), is there any way i can track it? Currently i believe i can’t change buying price so what if somebody like me who has already invested and want to track/create smallcase for same?

Umm.. not right now, you’ll have to create a new smallcase right now for the same – so from next time

Will think of how we can export your current investments to a smallcase

Super Kool…

Place, modify, and cancel orders – is it ok to give this permission.

and pls quote the information regarding pricing

Hey! Yup, we cannot place orders without your permission/approval each time – no worries there!

Charges for buying a smallcase is a flat Rs. 100. This is over & above the usual Zerodha charges for buying/selling stocks

hi,

consider we invested in one small case, if one of the shares in the small case has gone down drastically, if i want to buy the same and add in the small case, can we do it.

Please advise.

regards

Hey Baiju, yup – you can add/remove stocks in your smallcase – more here http://help.smallcase.com/using-smallcase/manage-your-smallcase/add-or-remove-stocks

Is it a chargeable service ? how the brokerage will be processed – for each stock or for portfolio

Brokerage is per stock, we charge a flat Rs. 100 for each smallcase you buy

its mentioned here http://help.smallcase.com/fees-on-smallcase/fees-taxes-for-buyingselling-stocks

please do check

There are so many issues with kite(web). It was down yesterday during crucial market hours. There are so many other issues I have mailed on kite app and ite(web). When will you address them ?

We have made a few changes which will ensure that yesterday’s issues won’t happen again. Post the system change, today’s performance was the best it has ever been at market open. Check this link for more details. If you have any other queries or issues you can write to us at [email protected].

only benefit i lost in 2016 Jan to 2017 Rs,6.75 lac previous since 2009 to 2015 more than 55 lac

now iam totally wickedness in finance support iam thinking best to stop the trading

Sir, I am not able to do this in Kite, is this some new update to be rolled out or in other app?

Yup, this is on http://www.smallcase.com/create – you’ll have to login with your Zerodha credentials on http://www.smallcase.com/login to start 🙂

Is Convenience fee of Rs 100 also applicable on custom made smallcase?

Yup, the same convenience right? 🙂

Is this charges also for viewing existing small cases, say I want to see the existing small case and feel like only couple of stocks are worth so instead of buying small case I would buy only couple of stocks using kite.

I want confirmation before logging into small case with my creds

Hi Paresh! There are no charges for viewing smallcases. You are only charged when you invest in a smallcase. Details of the charges are available here – https://zerodha-help.smallcase.com/fees-and-taxes/charges-for-smallcases

Can we add stocks after we have bought smallcase ?

why route of smallcase join? please suggest me.

if you are a client of zerodha , with the same login credentials you can login in smallcase.com & choose the basket or create your own basket, if you dont have an account with us yet please provide your contact no i will call & help you or you can reach me on 09916312020

Portfolio investing is the right way to invest for the long term – more here https://talk.smallcase.com/modules/portfolio-investing-explained/benefits-of-diversification/

what charges?

Hey Mukesh, same charges as buying a smallcase – flat Rs. 100 to buy a smallcase http://help.smallcase.com/fees-on-smallcase/fees-taxes-for-buyingselling-stocks

Is the Rs 100 charge for 1 smallcase a 1 time charge or each time u add investments to the same small case? Any other brokerages or charges from zerodha or u?

Same Question , One Time 100 Rs(Lifetime,or Monthly) or For Each Smallcase u Buy Seprate 100Rs

Each time you buy a smallcase, it’s Rs.100/- that you’ll have to pay.

Can we add stocks after we have bought smallcase

i am having same question?is it one time charge ?Suppose i bought one small case paying 100 rupees is there any additional charge will come in any circumstance?

You are not clear at all. I invest in a small case once and pay Rs.100/-. Suppose, I invest in the same small case again. Do I need to pay 100 rupees again ? If I do SIP in a small case, will you charge 100 rupees each time? The creator of the small case rebalances the portfolio. If i too decide to go with the rebalancing, do i need to pay 100 rupees again? More clarity required when you answer rather then simply saying flat 100 rupees is applicable when you buy a small case. Such a fee in addition to the advisory fee for the small case is exorbitant.

I created my smallcase.. dont want others to see the same.. how do I make it private?

Hey Mihir, your smallcase is only visible to you and is private by default. No worries there!

Waiting for this so long.. yayyy

Me too

8139td5wbm

dik54vmvqi><

heelo

aftdsnl60l62z6538oa8jz2sgjmda4ywqki7avz

Sir allow portfolio based day trading with fixed amount stop loss and fixed amount profit booking trigger. Irrespective of stock prices the trigger should sell total portfolio as soon as profit or loss amount trigger ACHIEVED. Allow shorting of small case with multiple margins . allow options to be included in small case for hedging purpose.

Sreeja Pradeep

Hey Pradeep – on our list of things to do – adding portfolio/smallcase-level alerts to take decisions easier

Anything other than equities in a smallcase is further down the line – not anytime soon

If I created smallcase portfolio and their amount will be 10,000/-can I start it with 100/-

By sip ???

I think so you shouldn’t charge or charge only Rs.20 to someone who creates his own Smallcase. Why so high charges for a person who does his own research and makes a Smallcase. It should be Zero or Max Rs.20 according to me. Hope you try to reduce your Charges