Basics on Options Shorting/Writing

Traders,

Option writing/shorting is the act of selling either calls or puts first, hoping that the value goes to zero or buy it back at a lower price to earn a profit.

Trading in index options has been surging over the last few years, accounting for almost 75% of the total derivative market turnover on NSE in 2012-13. Most retail traders usually buy options, i.e., buy calls if the bet is that the market will go up or buy puts if going down. The idea behind this post is to explain the basics on option writing/shorting, and how including them in trading can improve the odds of winning.

We use the words option writing/shorting and not option selling, to signify that the options were sold first before being bought. Selling options is used when exiting options that were already bought.

Why Short/Write Options

Here is some food for thought, between 70 to 95% of all options usually expire worthless. What this means is that by buying an option (calls or puts) the odds of losing are significantly more. Now the question is if options buyers are inherently taking a higher risk, who is on the other side of the trade with better odds of winning? The answer is “Option Writers”. Let me explain with a basic introduction to what comprises option premium, different types of options, open interest and an example showing how most options expire worthless.

Option Premium

Option premium, the value of calls or puts that you see on your trading screen has two components, Intrinsic value, and time value.

Premium = Intrinsic Value + Time value

Intrinsic value

Intrinsic value is how much the option is in the money, or simply how much you would get if the options were to expire right now.

- If Nifty is at 6100, Intrinsic value of 6000 Nifty calls is 100 (6100 – 6000) which is how much you would get if the option expired right now.

- If Nifty is at 6100, Intrinsic value of 6200 Nifty calls is 0, since it is out of the money which is how much you would get if the option expired right now.

- Similarly if Nifty is at 5900, Intrinsic value of 6000 puts is 100 and 5800 puts is 0.

Time value

Time value is the portion of premium which is over and above the intrinsic value of an option, i.e., Time Value = Premium – Intrinsic value

Say if Nifty is at 6240,

- Nifty 6200 call is at Rs 100, This premium of Rs 100 = Rs 40 (Intrinsic value)+ Rs 60 (Time value)

- Nifty 6300 call is at Rs 40, This premium of Rs 40 = Rs 0 (Intrinsic value) + Rs 40 (Time Value)

- Nifty 6200 put is at Rs 60, This premium of Rs 60 = Rs 0 (Intrinsic value) + Rs 60 (Time Value)

- Nifty 6300 put is at Rs 140, This premium of Rs 140 = Rs 60 (Intrinsic value) + Rs 80 (Time Value)

Different types of options

- ITM (In the money), all options which have some intrinsic value. So if Nifty is at 6240, 6100 calls, 6300 puts, 6400 puts, etc. are ITM.

- OTM (Out of the money), all options which have no intrinsic value and only time value. So if Nifty is at 6240, 6300 calls, 6400 calls, 6100 puts, etc. are OTM.

- ATM (At the money), all options with strike price very close to the market price. So if Nifty is at 6210, 6200 calls and 6200 puts are ATM.

Open Interest (OI)

The total number of open contracts for any option is called its Open Interest. So if Nifty 6200 Jan 2014 calls have OI of 30 lakh, that means all buyers of 6200 calls together hold 30 lakh contracts sold to them by option writers.

Example

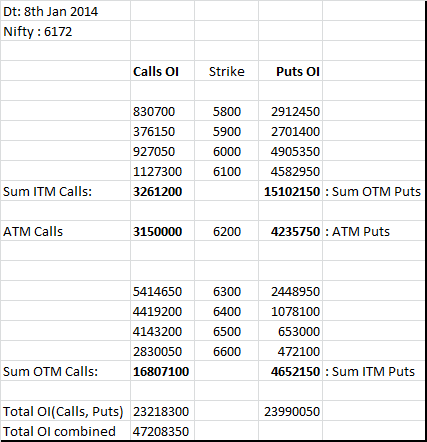

Here is OI data collected for 8th Jan 2014 from the NSE website for both calls and puts for 9 most active strike prices on Nifty.

Nifty OI data for 8th Jan 2014

In the example above if Nifty were to expire today at 6200, the total options that would expire worthless would be : 39295000 (15102150 + 3150000 + 4235750 + 16807100) which is around 83% of the total OI of all calls and puts combined.

Yes, an option buyer can take quick intraday trades for a profit, or be on the right side of the market and have the potential of making unlimited profits, but the odds of winning are always in favor of an option writer who benefits with majority of options expiring worthless.

The underlying reason for this is because of the time value component of the option premium (Premium = Intrinsic Value + Time Value). A buyer of an option is continuously fighting time because if the trade doesn’t go in his favor immediately, the time to expiry keeps reducing(time value), and hence the premium itself. An option writer on the other side has time as his advantage, once in a trade as long as the market (intrinsic value) doesn’t move against him the time value keeps reducing, increasing his odds of winning over an option buyer.

Option Writing – Risks

An option buyer has limited risk and unlimited profit potential, so if 1 lot of 6300 Nifty call was bought at Rs 100, the maximum loss on this trade is the Rs 5000 (Rs 100 x 50), and if Nifty went to 7300 the call would make a profit of Rs 45,000.

An option writer has unlimited risk and limited profit potential.

When you write an option, say 1 lot of 6300 calls at Rs 100, Rs 5000 (Rs 100 x 50) which is the premium paid by the buyer is credited to your trading account and this Rs 100 on the premium is your maximum profit potential. After taking this trade if

- Nifty is 6200 on expiry, value of 6300 calls on expiry is 0, and you get to keep the entire Rs 5000.

- Nifty is 6300 on expiry, value of 6300 calls is still 0, and you get to keep the entire Rs 5000.

- Nifty is 6350 on expiry, value of 6300 calls would be 50, you have to give back Rs 2500( Rs 50 x 50) on expiry, but still earning you a profit of Rs 2500.

- Nifty is 6400 on expiry, value of 6300 calls would be 100, you would have to give the entire Rs 5000, no profit no loss.

- Nifty is 6500 on expiry, Value of 6300 calls would be 200, you would have to give back Rs 10,000 whereas you had received only Rs 5000, causing you a net loss of Rs 5000.

- Nifty is 7500 on expiry, Value of 6300 calls would be 1200, you would have to give back Rs 60,000 whereas you had received only Rs 5000, a net loss of Rs 55000.

Since the potential losses are unlimited, it is best as a beginner option writer to be conservative, and allocate only a small portion of your trading capital when starting off.

Option Writing – Margins

Since the risk is unlimited for an option writer, the exchange blocks margin and similar to futures is marked to market at the end of every day. So to buy an option at Rs 100, you need to have only Rs 5000 ( Rs 100 x 50), but to write an option you will need around Rs 25,000 which is marked to market daily, which means that if there is a loss you are asked to bring in those funds to your trading account by end of the day.

Option writing margin requirement varies for every contract, and as on today Zerodha is the only brokerage in India to offer a web based SPAN tool that lets you calculate this.

Example

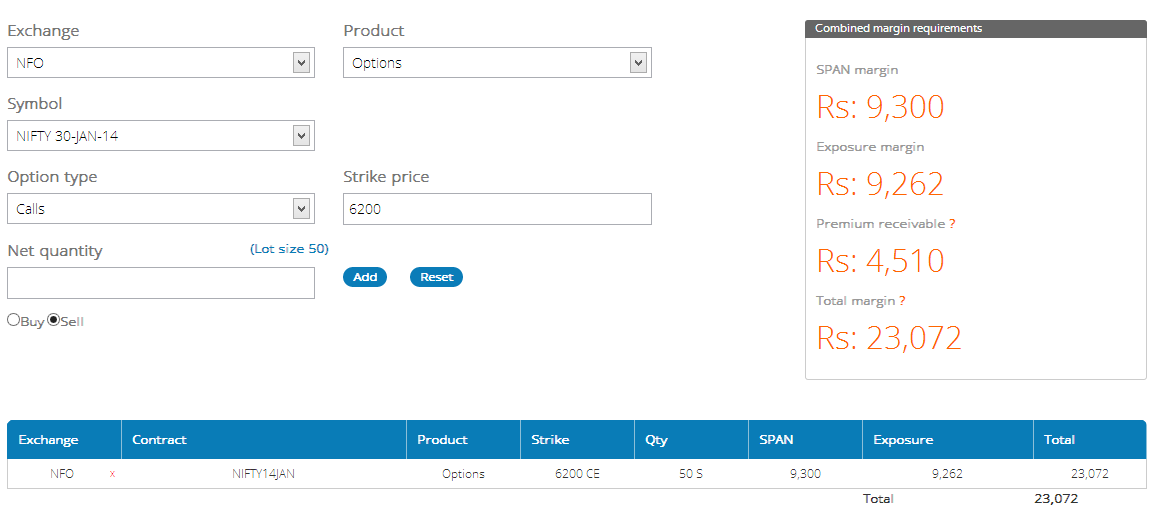

You have a bearish view of the market and Nifty is presently at 6172. You decide to write/short 6200 Jan 2014 calls at 90 expecting to profit if the value comes down below 90 on the premium.

Check the SPAN calculator for the margin required as shown below:

This is just an introduction for traders looking to start off on option writing, exercise caution, and once you are clear with the concepts look at combining short options with stocks, futures, or other long options, to create positions that can increase the odds of winning while trading considerably.

Happy Trading,

I initiated a double diagonal calender trade of just 2 lots with a margin of 1 lakh. I had 5 lakhs in my trading account but there was a debit shown in my ledger ,Can anyone explain what has happened?

During option trading, real time trading opposed by your software when customer seeks profit.

Lot of time i saw that type. Why a customer needs you as broker if uh can’t match real trading time.

Hi,

Is short selling available in options trading ?

Has SEBI blocked shorting in options ?

someone kindly please help with this !

Hi,

I’m curious to know about one particular case as an example.. Can you help me to understand it simple way..

Lets say,

Kotakbank stock price : 1710 on 29th June

Bought : Kotakbank JUL 1800 CE @ 26rs with 2000 quantity

Kotak touched 1740 on 1st July and CE is at 31rs.

Later Kotakbank came back to its old price on 1710 and CE price dropped to 19rs and trader can see the loss here.

Same stock rose to 1738 on 5th July but CE is at 19rs.

So how come, the CE price haven’t moved at all? And what happens to this call when the stock touch 1800 or nearby? Will the trader will be in a position to recover the loss?

with a fund value of 2 Lakh rs, how much quantity can I sell as a ”Put Seller” in Nifty50 or BankNifty. Please Reply

Please start Bracket order without additional margin as its annoying to put one by one tgt and stoploss in perticularly in banknifty and nifty options buying in current volatile market. all are providing BO except you. As a number one broker consider it seriously.

I have done option writing on voltas 2 days back and on that day my position profit was Rs1000 and my fund was Rs40000 and when I saw today my position profit is Rs3000 but my funds was Rs26000. I am not able to understand the reason. Can you explain it?

And also while exiting this trade it require Rs 12000 on 2 days back and yesterday it showed Rs25000 and today it shows about Rs1100. This also I wasn’t able to understand. Can you explain this?

I sold NIFTY MAY 13500 PE Qty 150 . What will happen when it comes in the money

Dear Sir,

My query is that whether the CE sell position can square off automatically without my consent

Thanks

Hi Sir,

I have around 7500 NIFTYBees in my Zerodha account.

I have few questions as below:

1) I read somewhere that nifty etfs can be used as 100% cash margin against option writing.

Please let me know if it is correct?

2) Suppose, I have pledged 7500 Niftybees quantities and suppose current nifty strike is 14500 write One rike price . Suppose, nifty jumps to strike 15500 .

In this case what will happen?

Will my sell call will be sqaured off ?

Do I need to book my loss and then unpledge niftybees and sell in open market to recover my lossed or broker will sell pledged niftybees on my behalf to recover the loss?

Ex: current nifty at 14500

Sold one lot CE at 15000 and afterwards nifty jumped to 15500, then in that case what will happen.

Hi, What is the maximum loss in option selling for indices e.g during market crash and in lower circuit. Is there any mechanism where automatically the positions are squared off?

Hi Zerodha and Nithin,

I have been charged with 12578 as the short margin penalty for the 18th March, where I didn’t carry over that much position for the penalty.

Is this penalty levied for intraday also or only overnight ,

Still if it is the case there is something happened wrong here, Please Help here to correct this debit.

Thanks,

Kiran

Very useful information.As I never traded in options. I am trying to learn options trading and above information is good for basic learning.

Hi Sir,

can you please explain how can i short sell a nifty option and hold it till the expiry date.

For instance, today is 10th Feb and monthly expiry date is 25th Feb. Then how can i short sell a nifty option on 10th Feb and hold it till 25th Feb. I will be squaring off the position on expiry day before close. Also, what is the approximate margin required for this trade (assume strike price 15000).

You can sell the option using an NRML order and hold the position until expiry. The margin required will be shown on the order screen. This margin changes with movement in Nifty.

@Nitin Kamath Sir,

Due to OI restriction, I am not able to buy options outside an certain price limit in Nifty option, due to which I am not able deploy my hedged OPTION trading strategy and also not able to take advantage of margin benefits of the new margin system implemented recently by Sebi . Zerodha suggested an option to open a custodian account with Orbis Financial but there I cannot use the collateral margin, though I have pledged my shares with zerodha. Again without Collateral margin, I am not able to trade OPTIONs with Orbis Financial. Pls provide solution so that I can trade OPTIONs with Zerodha without restrictions with the strike prices and with the collateral margin I get for the shares pledged with Zerodha.

Hi, just a quick question ..as similar in future , is shorting is possible in options ( calls and puts)

Eg. banknifty is trading at 21100, am trying to buy 21200 CE at 200 rs and selling at 220 rs.

Incase if I feel it may go down, then is it possible to sell first in 21200 220 rs and buy at 200 rs?

Yes, you can.

@Nitin Kamath Sir,

I am an old and a satisfied customer of Zerodha. But due to OI restriction, I am not able to buy options outside an certain price limit in Nifty and Bank Nifty options, due to which I am not able deploy my hedged OPTION trading strategy and also not able to take advantage of margin benefits of the new margin system implemented recently by Sebi . Zerodha suggested an option to open a custodian account with Orbis Financial but there I cannot use the collateral margin, though I have pledged my shares with zerodha. Again without Collateral margin, I am not able to trade OPTIONs with Orbis Financial. Pls provide solution so that I can trade OPTIONs with Zerodha without restrictions with the strike prices and with the collateral margin I get for the shares pledged with Zerodha.

Hi Sir,

can you please clarify following doubt regarding compulsory physical delivery policy ?

If I have 1200 nos. Axis Bank shares in my Zerodha account, then is it possible to write 1 no. Call option without maintaining margin in my account?

Hi Zerodha Team,

Your comments and any pro tip will be very helpful. Thanks in advance

Query 1 :- If I Sell PE 600 (Lot size 1200) at a premium of 10 of Infy (CMP of INFY is 700) and it expired OTM.

Will it make any difference in my profift even when price of premium went to 20 after I sold INFY PE 600 Put Option.

Query 2 :- If I Sell CE 750 (Lot Size 1200) at a premium of 10 of Infy and it expired ITM at CMP as 760. What action will be executed here?

Hello Sir..

If, I write a PUT 20000 by 100 Rs premium and at the expiry date premium reach 150 but strike price is 19980.

then, what would receivable premium ?

You would have received the 100 rupee premium at the time of writing.

Thanks for your reply Sir, can you give one Example on how to write option using KITE with particular strike price.

Simply add the option contract to your Marketwatch and place a sell order.

Sir

Can i write option for Intraday perspective? write @ morning and closed by evening.

Yes, you can.

Sir

I have shorted a February call of Indusind bank. My query is as follows:

1. When do I get the premium in my account?

2. Do I need to do anything to claim the premium on expiry?

3. What will happen if I do not square off my short call before expiry?

Regards

JP Sharma

You receive premium as soon as you short. If your call expires in the money, you’ll have to give delivery of the Stock. If it expires out of the money, you needn’t do anything.

Hi Sir,

I have following doubt, due to compulsory physical delivery policy, can you please clarify ?

If I have 1200 nos. Axis Bank shares in my Zerodha account, then is it possible to write 1 no. Call option without maintaining margin in my account?

Why there in no margin available in Buying Options???

If I hold 500 shares of RELIANCE (a stock in the Physical Settlement List) in my Zerodha Demat Account, can I write a Call Option for 1 Lot of RELIANCE (1Lot=500 shares) by blocking my Demat Holding in that stock, and allowing you to deliver from that holding should the Call Option expire ITM – all without requiring any additional Margin money (other than the brokerage, exchange charges & STT to be paid in cash) ? Is there any way to Block or Pledge my Holding to achieve the above in Zerodha Trading platforms?

I would expect this to be possible, but all the articles I have seen on Margins for ITM Short Call positions at Settlement do not discuss how my holding in the underlying can meet all Margin requirements if I am ready to deliver the stock held my Demat account… This is critical for me as I hold stocks which I am ready to let go at a certain (Strike) price, but not enough additional money to pay for Margins in addition to my investment in the stock itself, nor money to buy back the Call Options if the stock price zooms at delivery. So, please clarify on this point, particularly for Stocks in Physical Settlement (where any Settlement obligation can be met by simply delivering the held shares and collecting the Strike price).

I want to write Call OR Put option of Nifty Is it possible for using my Holding share value If yes, you are charging any interest and how much. Suppose I hold 5,00,000/- shares, how many nifty option lots i can write.

You can pledge your holdings and use the margin for taking F&O positions. The process is explained here.

Hi Team,

It would be of great help if you can make me understand the below scenario, i am new to nifty options, hence want to know how loss in option writing happens.

Say i do option sell of banknifty with a strike price of 31000 and the current price is 30000 at a premium of 50 and lot i guess for banknifty is 20.

So till the date of expiry, if banknifty doesnt reach the strike price, i earn the premium which is 50*20 = Rs 1000.

But say if banknifty goes beyond the strike price of 31000, and i decide to sell it at (or reaches at expiry) 32000, will my loss be (1000*20) -1000 = Rs 19000 ?

Thank you in advance, this will really help me understanding option writing.

yes you r right

Kamat Sir

suppose i buy put or call option today and can i square of next day or any other day before expiry? or is it compulsory to hold till expiry? please explain sir.

Hey Guru, not necessarily. You can buy and sell anytime you choose to. I’d recommend that you check out the Varsity modules on futures and options to learn about the basics before trading

1) Suppose I write Call and Put option of Bank Nifty around 220 each ( 220 for Call and 220 for Put), I want to hold this contract till expiry. At the end of first day if premium is 400 ( in call and put combined), then how much amount will be credited to my dmat account and if premium is 500 then how much amount will be debited from my dmat account.. Pls explain

Hi,

On 16 April 2019, I shorted ”TCS APR 2080 CE” at LTP = 68.5

On 23 April 2019, I exited ”TCS APR 2080 CE” by buying at LTP = 70. Close price of TCS on 23 April 2019 is 2155.05

In the position page of Zeroda, it shows loss of Rs 375. (this was expected)

In Funds page, I can see Rs 17500 is debited. Why is this amount debited?

regards

Sreeni

Sreeni, Rs 375 is your total loss for the position. Where exactly do you see the 17.5k debited? Can you confirm the same on your ledger statement or contract note for that day?

I wish to trade in option selling and i have 8 lakhs money in FD account , Can i use this money as colletral for option selling margin money. otherwise kindly guide me how proceed further.

I’m afraid using FD as collateral isn’t available right now.

Hi Team,

it will be very helpful to add option of targeted profit or loss stop loss instead of putting stop loss in the stock price.

suppose if I buy infy futures @720 and I am expecting 5000 as profit.

usually we have to put some top loss sell or some thing like that.

But instead if i have a option of selecting profit target and stop loss target it will be very easy and even very much helpfull.

say I am ok with 5000 profit or 2000 loss, after buying the infy futures @720 , I just have to enter 5k as profit stop and 2k as loss stop.

what will happen in normal situation, Greed makes us to think of more profits and most of them end up with losses.

If i have a option to set my profit limit and loss limit while taking any position, it will be very helpful to not to go Greed and Fear and end up with very well calculated measure.

Hope this can be implemented successfully.

Bhaskar, will pass this as feedback to our product development team.

Dear sir,

I want to write one call and one put for bank nifty weekly expiry at the same time in kite with my mobile, ie: suppos today is Wednesday and I want to write one call and one put today on exactly at 9:15am when market just open, which order type I should use or how can I do it please guide.

And my another query is if I want to keep only one combine stop loss for both my position

Ie: I have written one call at Rs. 40 and one put at Rs. 60, so total premium I can receive is 100 points, now if total value of both options goes higher then 100, it will be loss for me so I want to keep a stop loss at 200 for both my positions means if the total value of both options ever hits 200, it will be automatically squared off my poth positions.

Please guide how can I do this.

Hi,

I was trying to set up a credit put spread in BankNifty options. That’s when my buy put option was rejected with the error message ”RMS:Rule: Option Strike price based on Ltp percentage for entity account-ID across exchange across segment across product”. I got the explanation from zerodha support and understand how this is a measure to contain total exposure of zerodha in BankNifty contract.

However, i feel, Zerodha should take look at this policy. Modification i suggest, is to allow traders to be net neutral i.e. if i write 1 banknifty options contract, i should be allowed to buy 1 banknifty options contract. this way, Zerodha is not adding to its exposure with NSE. Lack of ability to buy nifty option to pair off with a short option position, is forcing me to not execute these spread positions. @Nithin – pl take a look at this and provide your views on how zerodha can enable traders continue with their trading strategies

Mandar, we understand that you should be allowed to buy options in case you are taking covered strategies. However, this is not possible with our OMS as the buy order cannot be matched with the existing position and allow it.

We are exploring ways to resolve this problem.

thanks Faisal. pl explore and let me know about it. My only option is to open a brokerage account with your competition. I will hate to do it as i am happy customer of Zerodha for a number of years. but wont have a choice if this is not resolved as i am planning to explore spread option trading as a serious trading strategy for my portfolio.

Mandar, we are forced to reduce the range of strikes you can buy as we get closer to expiry. So I’d recommend you track the margin calculator page where we display the allowed range(You have a better probability of buying a farther strike right after expiry day)

I understand. but i am looking to write spreads on weekly banknifty options. e.g. even on Friday (today – 04-Jan-2019), i cannot write options that are 300 points away from closing price on 3-Jan-2019. 🙁

How many maximum lot of options I am allowed to buy in Zerodha in a single order?

Hey Mohit,

You can find the maximum trade able lots in a single order here under Freeze quantity.

This is assuming you have the required margins to take the position.

If I write a call option and as long as the losses are less than the span margin the day I wrote it, I don’t have to pump in more money right ?And what if it is a long call spread where my losses in call written is offsetted by the long option I bought.How is a margin call works do I get any notification on the terminal or a phone call?

Why is the capital requirement is so high in risk defined option selling strategy?

don’t you think it should be max risk or margin, whichever is lower?

Exchange mandates that you maintain SPAN + Exposure margin. While you get SPAN benefit for a risk contained portfolio, the exposure margin is fixed.

Do you allow deep otm index option selling aspecally in bank nifty weekly I came to know from trading qn that order gets rejected for deep otm option

Hi Virender, every broker is allowed to only have positions, across his clients, up to 15% of the market-wide position limit. In order to stay within this limit, we’ve had to impose some limits on permissible strikes. This range is always visible here. We’re working on a fix for this that should be live soon.

For almost all stocks for writing an option is similar regardless off lot size but why AdaniEnt options required more than 250000, whether it is rquired only now(Aug- 2018) or for every expiry in every month

Sir

1) If I write a call or put option, can I exit it immediately (just like in the case of buying options).

2) If I write say Nifty 11000 @ Rs.300, and suppose it becomes Rs.320 after 2 days: what is the impact ? Whats i want to ask is – I can make a profit only if its less than Rs.300…am I right Sir.

Hello sir,

I am trying to find options for MCX (Multi Commodity Exchange) but I am not able to find it when I try to search it in Kite watchlist.

Can you please help with this?

Regards,

Yogesh

Dear Sir

if nifty option written suppose Qty 1500 at strike price 10500 and expires at in the money at 10450 how much taxes will be levied

You can check the Brokerage Calculator to see all charges levied.

Hello Sir,

If I write an option and it the results is in my favor and I am getting the complete premium amount.

Is it mandatory to Buy the option to complete the trade OR can I just leave it and still get the profit (Premium amount).

Thanks

how much margin for selling option in expiry days

You can check the margin requirements here.

Good

if you will not buy it till 3:20 pm, zerodha will buy it on your behalf for wherever the price at that time (usually 5/10 paisa ), if you are sure it will expire OTM, then no need to worry about buying

Sir,

I love zerodha for limitless experience. Plz tell me if i write an Nifty Bank expiry day option for OTM strike price @₹10 and it goes 0 at the end. Then what will happen. What i have to do? Do i have to buy it myself or it will b bought automatically at zero. Plz mail me this answer too if possible.

Bank nifty trading 24366 on 3/18/2018.

1 Buy call for 25000 @ pre=42

Question 1. if it goes above 42 on 3/19/2018 , for ex 50 .then profit =50-42=8*40=320, can i book profit on 3/19/2018.? or wait till expiry on 3/22/2018?

2 Sell call for 25000 @ pre=42

Question 2. if it goes below 42 on 3/19/2018 , for ex 36 .then profit =42-36=6*40=240, can i book profit on 3/19/2018.? or wait till expiry on 3/22/2018?

Sir

i have bear a great loss on 25 oct when govt has pour money in sbi as I have shorted due to bad results and NPA . I have also put a stop loss but it opened with a gap so i suffered huge loss do you have any advice how to stop such loss as this loss has dented my trading account badly.

Dear Sir

I have a query. assume only one OI of Asian paint i.e” A” write a call option at strike price 1100 @30,and ”B” buy it at strike price 1100 @ 30. At expiry day, Asian paint moves down to 1090. The price of call option at strike price 1100 is zero and ”B” is not selling his option in order to avoid brokarage and other taxes, then how ”A” will close his position by excersing a BUY option in order to close his short position.

How much you charge in case of partial profit booking…. example – I short (2 lots ) nifty 9400 PE@30 rupees whereas on expiry it settleted at 13 rupees.

So, here would you charge anything on 13 which was not realised???

Thanks

Srinivas…

Hii Nikhil

Greetings

Please Clear my Doubt

If i am writing options say

Future trading at 200 Lot 5000

Short call 210 @ 5 rs

Short put 190 @7 rs

on Expiry it ends at 205

do I get to keep full written premium???? ie (5+7) x 5000= 60000

Hello,

Lets say I have Rs. 1 lac worth of stocks in my account which I can use as margin for writing options. To prevent actual liquidation of stocks, I will also keep Rs. 10,000 in cash in my account. Now, only when the losses from my F&O trade exceeds Rs. 10,000 will the stocks be sold. Is this correct ?

In that case, I should keep a buffer of around 10 to 20% of my stock holding value in cash in my account to prevent liquidation of my stocks in case of small loss on margin.

Please confirm.

Thanks.

Sir,

My doubt is if i am selling LIC housing finance strike price of 600 call at 6.20 rupees of lot size is 1100 ( i need of Span Rs. 53,240+ Exposure margin 31,419= 84659 as per zerodha’s margin calculator) and buy back at 3.20 rupees then How much i will get ????

Second question if i buy back the same at 9.20 rupees then what will i get finally ( what happens span, exposure margins…..Please please i expect your reply…………….

dear sir

If i hold the underlying stock and write call and put options do i still require to pay margins or i can give the stock in my account as margin.

You’ll still have to pay up the margins Surendra since these contracts are cash settled.

Nithin, let’s say if i write a option with a strike price and i forgot to square off on expiry and the my strike price is OTM. Still the writing premium will be given to me rite?

Thanks

Sir….

If I am selling the call option and put a stoploss then what margin I required?

Karan, the margin requirements can be determined from the Margin Calculator on our website.

Hi Nithin,

I have one Quick question.

If I sell One lot Nifty 18Jan 10700 Call is @ 60.00 on Jan 2nd And if Nifty crossed above 10700 on Jan 10th 2018.

What happens to my Contract?

Whether a one Futures lot will be assigned to Trading account or it will wait till the expiry date to calculate Porfit and Loss.

Best Regards,

Raghu

Hello Sir Can I Keep My Long And Short Postition Till Expiry.

If Yes How Can I Do That On Zerodha?

I mean my broker has just three options:MIS,CO,NORMAL(T+5),which means i have to square off my position on the 6th day.

I have one query regarding infy buyback, sorry if it is not the right place to ask

I have infy shares worth 2.02 Lakh Rupees (as on record date i.e. 1 Nov) , someone said i fall under HNI since the amount is greater then 2 Lakh, my query is… if i make it below two lakh by selling 3-4 shares well before tendering it e.g. tomorrow, ..in this case would i fall under retail..?

OR NOW I CANT BE UNDER RETAIL SINCE AS ON RECORD DATE I HAD MORE THEN 2 LAKH RUPEES OF SHARES..?

This has been answered here.

Dear Sir,

(1) I called to ZERODHA for trading option-> I need to sell first SBIN NOV 350CE & hold it for 3-4 days. But, they didn’t taken my order.

(2) Is it possible to hold stock option during first selling & hold it for 5-6 days before expiry ;then buying at low???

How much margin required for selling option & hold it till expiry?

(3) If I have total margin as per ”Zerodha F&O margin calculator”, in my account for shorting stock option & hold it till expiry; So, Can I place this order directly from my mobile Kite app? Or is there require any special approvel from Zerodha team for holding stock options?

Please clarify sir….Thanks in advance!

Prakul, yes you can buy and hold an option till expiry as long as you have the total margin in your account. But since stock options are illiquid you can use market orders, you will have to use limit orders.

Hi Sir,

I am asking this query as on 29 Oct 2017. At strike of 390 Yesbank CE premium is 28 and at strike price of 340 Yes Bank PE premium is 35. If i short these both options I will be in a profit of 13 irrespective of direction of stock. I doubt whether I am thinking on correct lines. Whether I need to buy options at expiry or it will be worthless?

Please explain.

If yes bank closes between 340 and 390 then you make the entire premium on both the short option positions. If yes bank closes above 390 or closes below 340 then you are certain to make the entire premium on one of the option positions but the profit/loss of the other option position will be decided by where yes bank spot closes, which will decide the intrinsic value of the option. It would be best if you explore this module on F&O on Varsity – zerodha.com/varsity

I sold 10100PE 26 Oct expiry on 24.10.2017. On 26.10.17, position was closed by the exchange. But the margin for shorting (Rs.54575) the position is not released till writing this thread. Any expert kindly clarify.

Can the nifty short on the day of expiry be done as ”NRML” or do we need to do with only MIS..?

Yes, you can but the full margin will be blocked.

Thanks for the reply, two more query –:

1.)I am aware that MIS is for intranet but what will be the difference as compare with NRML in terms of margin, do you mean in MIS, full margin will not get blocked.

2.)where can i see margin requirement when i want to short weekly bank nifty, i think Zerodha margin calculator doesn’t give this facility..

1) You just need 40% of normal margins to take MIS positions.

2) You can check out all the margin requirements here. The margin requirements for weekly options are similar to the near month option contract.

Hi sir can we short nifty and bank nifty etf positionally?

Preetam, you can only do it for intraday.

SIR , How to calculate 2 standard deviation of nifty

Sahil, there is an indicator on Kite.

Dear Sir,

Suppose Spot Market of Nifty is Quoting at 9788.

Now say if sell Deep ITM CALL Option of strike 8700 by paying margin and collected premium of Rs 1090 per unit.

At Expiry suppose the Nifty Spot quotes at 9300 and the end of the trading session.

Now here I want to know that in this Scenario what will be my P&L i.e I am making a Profit or loss, because I believe that at the expiry premium is left with Intrinsic value as Time value becomes zero.

You will make a loss of 600 points times the lot size. Also, selling deep ITM options is not really a good idea as the probability of the option to remain ITM is high, which means the chances of you losing money is high.

Never sell ITM option, always sell OTM since after expiry all OTM option premium becomes zero

OTM (Out of the money), all options which have no intrinsic value and only time value, so time value becomes zero as well after expiry

Sir what happens if seller sells in the money options on expiry day just before 10 seconds does this premium is profit of seller because buyer is not able to sell option

Only if seller sells an ITM option, which after market closing becomes OTM will the client make profit. Suggest you to go through the F&O module here: https://zerodha.com/varsity/

Dear Sir,

I have 2 questions:

(1) Can I sell first INFY17OCT1000CE at 9.60 & after 7-8 days bought at 5.10.

Is it possible to hold stock option ( first sell & then buy) for 10-12 days ( except expiry)?

Yeah, you can.

Dear Sir,

I called to ZERODHA for trading option-> I need to sell first SBIN NOV 350CE & hold it for 3-4 days. But, they didn’t taken my order.

Is it possible to hold stock option during first selling & hold it for 5-6 days before expiry ;then buying at low???

How much margin required for selling option & hold it till expiry?

HI Nitin,

I am new to option Trading. I’ve below question in my mind, it will really help me if you can answer.

I had purchased 4 lots of 1500 ( Total =9000) TATAMOTORS SEP 440 CE @ 1.38 and sold @2.90 while stock was performing really well.

Expiry is on 28 Sept.

It is showing the profit of 13679 Rs.

Now, on 28th Sept, if TATAMOTORS Stock price is either below or above 440Rs. In any case, Do I have to bear any losses?

If you’ve already bought & sold, you’ve already realized your profit. There’s no loss regardless of where TATAMOTORS closes on expiry.

Nithin,

Now as buyer has choice not to exercise option on expiry.

If I sell Banknifty 25000 PE at 25 and expiry is 24975. Buyer will not exercise because STT value is 30 points. So as an option seller, will I get my 25 points which I have written or I still need to pay 25 points to exchange to settle by sell position?

Regards,

Dhrutika

With the new window that exchange has opened up, clients can choose to not exercise. Earlier, all in the options were forcefully exercised. Check this post.

Hello

Did you get your 25 rs premium or lost 25rs

Please share

my question is simple.

my other dp with bob trade allow me to sell bank nifty on on the day on 31 agu expiry and 7 sep expiry. and i made profit of Rs 9000 on the 2 expiry day and paid the brokerage around 6000,. but today on 14 sept expity day when i wanted to sell bank nifty 24600 put. they didnt allow me and error was that margin limit exceeded. how it is possible. when i traded on above two expiry my balance was 26000 and 35000 repectively. and i traded 20 lot and 14 lots on these day.

how this is possible. please advise, as they are giving me proper answer, and keep saying we will check.

on more thing.. is there any option in bank nifty where we can sell intraday and no margin as such required (itm otm atm) etc

All positions you take, long/short, itm/atm/otm will require margins.

It’d be a little difficult to explain why another broker didn’t allow you to take a position, my guess is that you wouldn’t have sufficient margins in your account to take the position you were trying to take? Did you reduce the quantities and try to place the order? Also, what was the rejection reason for the order you placed? That’ll help you ascertain the reason your order did not go through.

Hi Nithin,

what will happen if some one shorting a call or put for say (40 rs as a premium) but could not buy it, and after the expiry of the contract, premium becomes 1, 2 or even 0 rs

in this case, would the person be on profit or lose (how the settlement be done)..?

also how much stt will be..? i think 0.05% of 40, that’s it correct..?

If you have shorted an option, you have already paid STT. No STT on buy side. Your selling price – buying is your profit.

Thanks much for all you guidance and support

one query on equity, is that possible to buy any stock in NSE and sell the same on BSE or vice versa (intranet or delivery)..?

Asking because if you see today TCS closing price in NSE was 2,484.35 and same was 2,477.65 in BSE, (difference of ~7 Rs)

If ans to my above question is yes, isn’t any one can take advantage of this 7 rs an make money..?

Intraday not possible, but yes once you have shares in demat, you can sell on one and buy on another. Check this.

Hey Nitin — Lets say on the last Thursday or may be a day back,, i sort sell any nifty OOM CE with primium 10 rs and could not buy it back for some reason so if premium became zero (since it was oom), what will happen if thr wont be any buyer..?

what will be my profit ..?

If premium becomes 0, the strike expires worthless. So you get to keep the Rs 10 as profit that you received for shorting.

Hello Nithin,

I am new to options trading. I read this blog around 5 times, but still I am in a confused state 🙂 However, I just wanna confirm the below for example,

I bought 1 lot (200 numbers) of Dr. Reddys – Sep 28 2300 CE at the premium rate of 15 INR few days before. Today I sold the entire lot for 40 INR premium as the scrip was booming like a rocket. I got some money as profit in my funds. So my query is, in case if Dr. Reddys reach more than 2300 in the expiry date (sep 28), am I in trouble of any losses?

As per your blog what I understand was – if the scrip closed on 2400 on September 28, I need to pay 100(IV)*200 – 20000 INR back ? Please clarify me 🙂

Ah no, you have bought and sold, there is no loss for you after exiting. 🙂 Check the F&O module here: https://zerodha.com/varsity/

Nitin, can I short September expiring option in august and buy it back at any time before 28 sept?

Yes

Sir,

One more question which clear my doubt to great extent.

Suppose i want to buy banknifty of 31aug future (78000 approx as per margin calculator) and 2 lots of put @100 *80=8000.

Then i how much amount i must have in account as per your calculation .

Someone said option amount will be hedged so further amount no need to infuse for 8000.

Kindly clear my doubt.

Sir,

Kindly help me to understand towards option future margin.

Suppose i took banknifty future one lot and buy put options of near strike of future. Now future is losing money and option option is making money. Will margin be adjusted mtm from option or vice versa?

Writing an option and buying an option of same script or nifty and either side is making money will margin be adjusted?

Is margin requirement is different from broker to broker? I enquired angel required 60000 for banknifty future whereas zerodha needs around 78000.

Please clear my doubts.

No, profit from puts won’t get adjusted to futures loss. As future profit/losses are mtm’d daily and not options. Same when it comes to writing an option. Margin requirement is same across brokers.

I have one query, consider I want to play safe and will short at 2.50 to 2.55pm on day of expiry with far away strike price with premium of 40 or 50p and 10000 quantity so in that case what is the minimum amount of investment require. And after selling if I let it expire which anyway becomes OTM then will I get to earn full 50p premium as profit?

You can calculate margin required to short here :https://zerodha.com/margin-calculator/SPAN/

Nithin,

CALL Options are working superb. I understood the bull speard and after testing few attempts with Banknifty I Gained complete knowledge of CALL and Bull Spread. I also Understand BUYING PUT Option first and Selling later.

One Last question, which is still bugging me not sure If I understood it correctly.

Monday –> I Shorted [ SELL –> BankNifty 24700 PE @ 230 ]

Tomorrow is Expiry of july [ I still hold the position but current premium is 60rs ]

if I Buy the PUT Option tomorrow ( close my short position ) let’s say @ 10RS,

What Will be my profit for 1 Lot(40 Qty) !!

SELL BankNifty 24700PE @ 230 PUT

BUY BankNifty 24700 PE @ 10 PUT ( close the position)

Is it simply 230 – 10 = 220 *40 = 8800

what happens If this position expires worthless …

Yes 8800. If it expires worthless it is 230-0= 230*40

Thank You, Nithin,

For staying up this late and answering my queries. Like I said before courses helping me tremendously

and my trades are getting bigger and wider every day. Especially i never traded in index in last 4 yrs, but for last 6 months it has been excellent ride ever since , working with Zerodha.

Thanks again for all that you do.

And in the above question as Praveen had asked when u replied ” you will get to keep the entire 7 points” i think this 7 points profit means 7×75= 525 profit on expiry when the value of option becomes 0. Am i right?

Yes

Sir i am a new option trader. I have a question. While trading option we always see there are three month cycle. Suppose for Nifty Option i chose to short the August Option. I think that Nifty cant cross 11000 till 31st August. So i wrote a Nifty AUG 11000 CE option. Now the major question is does this option expire in this month or it will go till August.

I mean if it didnt expire in July then will it be in my demat account till August Expiry?

Yes, it will be in your trading account till Aug expiry. Suggest you to go through this : https://zerodha.com/varsity/

Dear Nithin i want to know how the settlement price for a OTM option is calculated on expiry. I had shorted a NIFTY 27 JULY 9800 PE today i.e Tuesday @7. Spot Nifty is at 9970. And as only 2 more days are there for expiry so i think NIFTY wont fall 170 points in just two days to become 9800. So in this case what will happen to the 27JULY 9800 PE price on expiry. Suppose on expiry Spot NIFTY closes at 9900. Still it is way far 100 points from 9800. Will the 9800 PE price becomes 0 as it is OTM???

yes will become 0 and you will get to keep the entire 7 points.

Dear Nitin

I am a regular day trader but i have never short options. Recently i accumulated 1 lac capital to start option writing. Before indulging in option writing i have a doubt.

Just i was checking the Zerodha Span calculator and there i found that if i short Nifty 10100 CE i am going to receive a premium of 300. Now as a day trader let take this scenario

On market opening let say i short Nifty 10100 CE at 3.5 Rs and got a premium of 300. Now lets say after 3 hours Nifty 10100 CE is trading at 2.5 and i exit the position to book profit.

In this case my profit should be 75 x (3.5-2.5)= 75Rs.

But what will happen to the premium of 300 that i had received. Do i need to pay back the premium once i exit my short position?

Will that premium be automatically debited from my trading account?

When you short you received premium of Rs 300, when you bought back you paid a premium of Rs 225. So remaining Rs 75 what was left is your profit.

Yes all premiums will instantly get debited from your trading account.

Suggest you to go through the options module here before starting: http://zerodha.com/varsity/

Hi Nitin

My basic question for option writing is what if there are 100 people who are willing to write an option but there are only 95 potential buyers then what happens for those 5 writers.

Pending orders.

Hi. sir;

I have 2 queries…

1) What are the pros & cons of Selling (writing) Deep In The Money (ITM) Call and Put Bank Nifty weekly expiry options.? The premium received is more in ITM compared to OTM.

2) Can I exercise / square off ITM options before expiry such as after 3, 4 days after selling if it is in profit.

Thanks in advance.

1. You can post your question here: https://zerodha.com/varsity/chapter/moneyness-of-an-option-contract/

2. All options that trade on the Indian markets are of European time, which means they can be exercised only on the expiry day. You can however close the position by purchasing back such short option.

1. Suggest you to go through the option module here: https://zerodha.com/varsity/

2. Yes

When I try to buy BANKNIFTY06JUL1723200PE @1.8 my order gets rejected giving reason “Option strike price based on LTP percentage for entity account across exchange across segment across product”.

What does that mean and why does it show this reason ?

Hello Nithin,

One query, you might have answered but still asking.

Bank Nifty Cost : 23260

Sell Bank Nifty 23000 Put 13th Jul 2017 – Cost 93 (x 40) = 3720/-

Now if at the expiry, Bank Nifty goes up, Put value comes down. suppose that cost come down to 10. Then it means (93-10 = 83) then 83 x 40 = 3320/-

This means, you will get profit of 3320/- Is this right ??

How this will happen with margins?

I mean, currently I have having in my Zerodha acc, 4,000/- balance.

When I tried to place the order, it got rejected saying insufficient balance : 24,000/-

This means , for doing the above trade, you require 28,000/- actual in your account.

Is than means that you are buying the same trade with cost of 28,000/-??

and if I goes in profit, do I get 3,320 + 28,000/- back??

Note : I have not included any charges purposefully.

Yes you are right. Yes you are right. When you write options margin gets blocked as it has potentially unlimited losses. Gets released as soon as you exit.

I have a serious doubt, I am shorting a call for Rs 30 1 lot ex:nifty 9700 call with available margin in my account ex:Rs 40000.

next day on market opening nifty went to 11000, what will be the worst case scenario, whether i have to pay remaining amount 50000 approx, what if i do not pay, whether it will be settled within the margin available or i am legally required to pay that amount, just worst case i am asking, as selling options is unlimited loss and paying in crores will not be possible for a common man, is margin is the minimum amount that is enough to exercise my over valued option?

Yes, option writing theoretically can have unlimited loss. And yes, if your account goes into debit, you are supposed to make good of losses. It is legally binding.

If I have sold a naked call option, do I have to square it off to book profit/loss or can I wait for it to expire and keep the proceeds of selling the call option as my profit

You can let it expire.

First of all,i must thank Mr.Nithin and the entire team at Zerodha for always taking the time out and helping out the retail investors and it’s a big deal for us because we definitely don’t have the resources that institutions,hedge funds have.

Now coming to the question and correct me if I’m wrong but whatever i have read about Options so far,the premise is ’Call Writers’ are bears or bearish who expect prices not to move beyond the strike price at which they are active(writing) and ’Put Writers’ are bulls or bullish who expect that a particular strike price where they are active will hold in case the markets slide a bit.

My question is are all ’Call Writers’ bears irrespective of whether it’s ITM,ATM or OTM and similarly are all ’Put Writers’ bulls,irrespective of at what levels they trade at (ITM,ATM or OTM)?

Thanks and good wishes to the entire team of Zerodha

That’s right, Vijay.

Thanks Akshay 🙂

sir,

thanks for you reply,

but i want to ask a question that what is the right time to short the calls or puts in a month.

is it right to short the calls/puts in starting of a month or the right time is to short in the expiry week.

what is the right time to short call/puts?

Check out the option strategies module here: http://zerodha.com/varsity/.

sir i am still not clear why one has to pay margin while selling a put option when he owns the stock? what will the margin be used for….will it be used for buying the stok in case option is exercised?

If you want to take margin against the stock you hold in your demat, you will have to first pledge them and then use the margin to write options. Stocks in demat won’t be automatically considered as margins, exchanges charge a short margin penalty. Check this post on pledging.

sir,

i have to ask one thing that suppose that nifty is on 9200 and i have shorten 9300 call and till the expiry day, i holded that call, then should it squareoff itself on the zero value, or we have to square off it before it becomes zero..

please answer sir

You can let it expire, you don’t need to square off.

Hi sir,

i write call of nifty 9200 @85, if nifty trde will be below 9200 of expiry date. then my write call is Zero. can i leave this or can i buy it in 5 to 10 paisa compulsorily .

You can leave it to expire if you feel your option will expire out of the money.

thank u sir, it will be applicable for index and stock options also.

Yes; the same logic applies for Index & Stock options too.

Sir, can you please let me know that is there enough liquidity in shorting option of Nifty , i mean is it easy to exit midway also if the position is turning to be loss making.

Nifty options no issue.

Sir, can i sell (short sell ) weekly bank nifty contracts..? And if Yes then How to to calculate margin required for that for intrady ..? Because in margin calculator there is only monthly expiry contracts available of bank nifty

Margin for weekly and monthly are almost the same.

hi,

Suppose i take both option call and put together. so is it possible.

let example today reliance CMP is 1400, i am expecting same to goes upto 1500 and then it will goes down.

so is it possible used first call option for profit and den used put option at time when same is down, so finish with call option first at higher price and then used put option when reliance is down.

If you can call the direction of reliance that accurately, yeah, possible.

Hi,

I have bought Nifty call option of march 9300 at 15 Rs. today it’s price is 2.70 Rs., if i wait for expiry day of march 30th then what should be? will it increase price from 2.70 to 7-10 Rs, because on expiry date movement can be seen, please advise… what i do..

Regards,

Vijay.

Vijay, if you have bought 9300 calls, Nifty has to go towards 9300 or above for your calls value to go up. Suggest you to go through the F&O module here. http://zerodha.com/varsity/

Hello,

If i go short on 9300CE of NIFTY expiring on 30th march at rs.14, then total RMS reqd. is rs. 42772.31,

suppose i had exactly rs.43000 in my trading account and after the execution of 1 lot of the above short, can i do swing trading (long) with only the remaining rs.227.69 or can i use my entire 43000rs. for my normal trading?

After you take the position, you will have only Rs 227 left to trade.

Hi Nithin,

Why isn’t there an unlimited plan in options at zerodha?

Ganesh, I have answered here, check it out.

Hi Nithin,

Pl help me understand following:

1. what is Span and Exposure margin?

2. How margin calculator arrives at this value?

Thanks

1. SPAN is minimum margin that exchange requires a broker to block from the client for an F&O portfolio. Exposure is what exchange charges over and above the SPAN, as a margin of safety.

2. This is determined by the exchange itself using SPAN (model built by CME). Complex mathematical calculations go into this, check this link on NSE

I am a zerodha member. Thank you for such an informative article. However, option writing is not that much understood by me. I will understand, but will take time. So I have a straight question for now.

Today is 18th Mar’ 2016. Nifty closed at 9160.05 after touching an all time high of 9216.40 on friday (17th march).

1. Where do I Sell a put to be profitable? 8800 or 9300?

Current price for 8800 Put is 10.75 and 9300 Put is 20.00.

According to Zerodha SPAN/MARGIN calculator 9300 put will get me 10860 as premium receivable and 8800 Put will get me Rs. 506. (As of today, 18th March).

I am looking to sell one or both of the Puts.

2. So where do I have to pay up (back) to the market? If 9300 strike price is reached I will have to pay back the premium? In that case selling 8800 put will actually outright make me loss than profit?

3. Can I and If I, sell 9300 Put at Rs. 20 (current option price) and buy it back at say Rs. 15 price I will make 75×5= Rs. 375 profit, right? And come out of any future obligation too?

4. In that case, will it be profitable selling a Put at beginning of the month or beginning of new series as the price usually falls and keeps falling as the expiry nears? (I am not discussing strike price here, say in an ideal position where I am able to choose a strike price which is not reached till expiry then option price will obviously keep falling due to ”time value” factor, right?)

5. When can I make profit on selling put without buying it back? That is keep all the premium received without buying back contract?

I know things are not as easy as it looks to be. Just trying to find how hard it is….

Thank You 🙂

1. It depends on your view, if you think market will go up, then 9300 puts. If you think market won’t fall below 8800, then that one. The odds of winning on 8800 is much higher, but the rewards are smaller too.

2. ah, this question doesn’t make sense. Suggest you to read the F&O module here: http://zerodha.com/varsity/. Btw, if 9300 is reached, 9300 puts will have 0 value and so will 8800. You make the entire premium as profits.

3. Yes

4. Options have time value and intrinsic value. All things standing the way it is, time value reduces everyday. As an option writer you benefit and the buyer loses. No easy answr to this, read the module.

5. Point2. If you write a put of any strike and if market closes on expiry at or above that price, u make the entire premium as profits .

Hey Nitin,

You are wonderful 🙂 I thought my questions were too vague and you won’t answer but you did. Thank you for taking the time 🙂

I am too cautious as an investor but I do want to take the risk as well so…. the above….

With question (2.) I only wanted to understand when I get to keep the premium and when do I forfeit it. That was the all the exercise for all the questions that I asked.

So scrip price being 9160.5 I wanted to know which strike price for selling a put would have kept me in profit. 8800 or 9300. (both put, selling).

So as according to you:

Taking 9160.5 as reference price and 9300 and 8800 as my selling price;

1. I will be in loss if I sell 9300 put and the price remains below it.

2. Will be in profit if price remains above 8800.

More simply put: At Current price 9160.5, I am selling 9300 and 8800 put. Option expires below 9300, but above 8800. Which trade will make me profit (1.) 9300 or (2.) 8800. How? Calculations? (Can you please :))

I am just trying to understand the concept here first. Will learn about choosing right strike price through actual trading.

Also, how is the payable premium calculated? What is the formula?

Thank You once again 🙂

1. Yes.

2. If market is at 9160.5 yes of course 8800 puts will be profitable.

:), Hey Sumit everything about futures and options is explained in detail here. The calculations aren’t really one line explanations.

I guess you don’t need to answer the above. I find it difficult to focus on words sometimes. The very first sentence of your reply answered my questions already.

But if you could just for the sake, illustrate the results: At current price 9160.5, Selling 9300 and 8800 put. If price remains above 9300, both puts will end in profit, else 9300 put will give loss/partial profit, and 8800 put will remain profitable.

Correct?

Yep

Dear Sir,

I want to know about options selling. Here i am putting some question so plz help me by solving these questions.

1. Suppose i short sell Bank Nifty 21000 call at 20 and that time spot price is 20850. If expiry day spot price is 20950 and premium is 0.05. So i am in loss or profit ?

2. Can i buy back my short position at 0.05.

3. What will happen if i forget to square off my short selling position in the expiry day.

4. Suppose i short sell 21000 call and i am in loss and i want to hold my position till the expiry. So is it possible and if yes so how ?

5. I short sell Bank Nifty 20800 call at 30 spot – 20720 and the expiry day Bank nifty close at 20900 and premium became 55. So am i in loss ? if yes so how much loss i have to bear.

I want to answer just five question and i hope you will give proper response.

1. If you short 21000 call and Banknifty closes below 21000, the entire Rs 20 u got for shorting is your profit.

2. Yes, but you need not as well.

3. It will expire at 0 as it is out of the money.

4. If you short using product type NRML, you can hold on till expiry.

5. If you have short 20800 call and it closes at 20900, that means your option is valued 100. You had short at 30, so you will be in loss of 70 ( 100-30).

Suggest you to go through F&O module on Varsity.

Dear Sir,

Plz tell me ” what would be brokerage charged if a options expire at 0.05 in expiry day.

Dear Nithin Sir,

I am a new customer of zerodha. Do you have any stock suggestion box for intraday or positional call ?

Sir,

Do you have any educational video to understand different technical & fundamental analysis ? Do you have any software to give buy-sell signal in Kite ?

sir,

i would like to trade in currency dervivatives in usd inr options. i have 1L capital . with this 1L i would like to short call options of 3000+ lot . is it possible with this 1L amount?

Each lot of USDINR requires around 1500, so yeah you can trade more than 60 lots with 1lk. Check this margin calculator.

as per ur margin calculator whether i need to look span margin or exposure margin for overnite position

You’ll need to check the ”Total Margin”.

SPAN+Exposure or total margin

Hi Sir,

I paid big exercise brokerage for BankNifty index options. 100 lots (40 X 100 = 4000)

I did not square off the position during expiry day. I thought my position was in ITM, so exchange will settle with exercise.

I bought 21000 banknifty option put and spot price closed is 20070.30 during expiry day

the exercise brokerage (STT) was charged above 1 lakh.

It seems totally meaning less. sometime index closes very close to strike price like .5 point or 1 point less. If someone is not squaring of their position, to settle that .5 paise or 1 rupees, exchange charges big brokerage. This is totally ridiculous. i do not see any value for settling small exercised amount, they charge big exercise brokerage.

i am helpless here. Is there any way to get back my exercise brokerage paid.

Please help me on this.

thanks

Varun, nothing much can be done about this. We are putting up a petition, let us see what happens.

I have one question on writing NIFTY option

In 2009 , when Manmohan govt came back in power again, nifty rose 20%(From 3673 to 4384) in first 6 minutes of trading session. Few call buy option, rose beyond 1000%.

Suppose Had I SOLD/WRITTEN call option, lets say 3700 CE, i would have made huge loss. Basically what i want to know, RMS team would have squared off my position????? And if yes then when. And what if loss occurred is more than the margin blocked. Is that possible?

Yes, as stated in the module, a short option potentially carries unlimited risks. If the markets are extremely volatile, like it was that day, no RMS system can square off all positions. The margins that are blocked as per SPAN covers for the risk on 99% of the days. There’s still that 1% of risk that every broker carries, it’s a business risk. If the account results in a debit, you’ll have to bring in additional funds to make good the losses on your position.

means shorting options is similar like futures

Futures have MTM, there’s no MTM for options. Yes, margins get blocked for both.

SIR,

IF I SELL (SHORT) CALL OPTION UNDER NRML PRODUCT CODE AND I WANT TO CARRY FORWARD MY POSITION TILL THE EXPIRY.

I JUST WANT TO KNOW ON WHICH AMT MARK TO MARKET WILL HAPPEN ON DAILY BASIS I.E ON THE PREMIUM I HAVE RECEIVED OR ON THE MARGIN (INITIAL MARGIN BLOCKED AT THE TIME OF TAKING THE POSITION).

You can carry forward the position provided you have sufficient margins. There’s no MTM for options. If the contract moves against you, the margins required to carry forward the position will increase. You’ll have to ensure you bring in sufficient margins to be able to carry forward, failing which position is liable to be squared off.

Hi, I read another comment about margins somewhere but I’m not very clear.

So my questions are –

1. For margin requirement for FnO/currency/commodities, can 100% of the margin be given through stocks in demat (or pledged stocks)? Of course, the MTM has to be in cash I understand. If not, then what is the split between cash and stocks (or pledged stocks)? I understand there is a haircut associated with shares.

2. For option writing, in case I write and option of Rs. 100 and end of day, the option value is 110, then for the remaining Rs. 10, will it be counted as MTM loss and I should deposit Rs. 10xlot size or will it be deducted from the margin itself?

3. For option writing, how soon will the fund be available to me?

4. For margin through shares – do you still have the policy of making pledge or will it remain in my demat and I will get margin for trading in FnO without having to pledge?

Thanks.

1. Yes, you can take positions with 100% margins in the form of collateral but interest will get charged on any shortfall in cash. The cash-collateral ratio for margins for overnight position should be 50:50. So if you take a position for Rs.1 lac with only collateral, interest will get charged on Rs.50,000/-

2. When you write options, there’s no MTM. When the option moves against you, eod margins will increase. You’ll either have to bring in the margins (by way of cash or collateral), or the position is liable to be closed.

3. Didn’t understand this question.

4. You’ll have to pledge the shares.

Thanks for the quick reply.

For Q3, I meant to ask – If I write an option (assuming enough shares+cash margin available), since option writing entails me getting the premium, how soon is this extra fund available for me to withdraw?

Eg. I write an option with lot size 75 for Rs. 100. This requires SPAN + Exposure margin of Rs 50,000 (And I have 25k in cash and 25k in share collateral after hair cut). So the premium amt – Rs 7500 should be credited in my account right?

How soon can I withdraw this? i.e T+0 or T+1 or only after I close the position or it expires out of the money?

T+1 is when option credit gets settled.

I sell(write) nifty option today & buy back in 3 days. How may days will it take to get back my margin money in to my account for next trade.

Margins get release as soon as you close the position.

When I try to sell NSE share(Eicher Motots) and planning to buy back later. It is not buying and says you dont have that share? Is it like, I can sell shares when I have them in my account?

If you want to do this, you have to use product type as MIS and not CNC. Check this https://kite.trade/docs/kite/ on order types and also all the videos.

Dear Nithin,

Let us assume, I just opened the trading account, for my first transaction can I place sell order(MIS) for an X company and by the end of the day can I buy back the same?

If yes, I tried the above procedure and I got the message as not available to sell the X company.

When you open trading only, only F&O trading is opened. You will not be able to trade equity – either intraday or delivery. You can send us the demat account opening form, prefilled form available on q.zerodha.com

Hello Sir,

Eg: If I short a Call at Rs 10 for 1 lot (750/- premium received )at strike price 8000 and on expiry it reaches at Rs 2 with 7900 as strike price . I do not square off the position . So will I get to keep the entire Premium amount of Rs 750 or will it be auto squared off at Rs. 2 on expiry ?

If you haven’t squared it off before expiry, it’ll be settled based on the settlement price of the stock/index.

Great article.

And would like to clear my doubts.

If i am call writing 10 lots(750) @ Rs.20 and if i am buying back the same 10 lots(750) @ Rs. 1 on the same strike price within the expiry 30 days then please explain & advise how much profit i will earn.

Many thanks in advance

Since you’ve sold at 20 and bought it at Re.1, you make a profit of Rs.19. Total profit is Rs.19*750 = 14250 without considering taxes.

Thanks for your details….

One more doubt is that if i am invested with Rs. 1,20,000. If i am call writing 10 lots(750) @ Rs.20 and if it moved to Rs. 40 on the same strike price or if it goes beyond Rs. 40 then what will be the scenario? Also please explain how much it will be deducted from my total amount of Rs. 1,20,000/-

Also please provide your suggestion for Nifty call writing Jan 2017 series and at what strike price we can write call option(including no. of lots) to my value of Rs. 1,20,000/-.

I am a beginner so please don’t mistake me for these queries….

We’re against giving suggestions/recommendations.

On the query you’ve asked, every time you short an option, margins get blocked. When the contract price goes against you, your MTM losses increase and your margin erodes. This is when you’ll have to bring in additional margins or square off your positions. In the above example, since the contract has caused a loss of Rs.20, your MTM loss would be Rs 750*20 = Rs.15,000. This 15,000 gets reduced from your actual balance of Rs.1,20,000 and you’d be left with 1,05,000. You would have to bring in additional fund to carry forward your position or square off a few lots. Writing options has been explained in detail on Zerodha Varsity here: http://zerodha.com/varsity/chapter/sellingwriting-a-call-option/

Dear Venu,

Thanks for your details….

Rgds,

Jeeth

Dear Venu,

Please note that my call writing option has been rejected by my brokerage when i made the writing for the value of Rs. 11,250 by selling 10 lots @Rs.15 in nifty jan 2017 series. But your explanation is different from that of happened.

They are telling that to my investment value of Rs. 1,20,000/- i can write only 3 lots. Please explain?

If so by iam writing only 3 lots then how much profit i could earn? Pls explain?

Warm Regards,

Jeeth

Hi, have a few queries, please support.

1. If we write an option, should we square off that position before expiry? If that is the case and we forget to do so, any penalty is imposed?

2. When is the premium for option shorting credited to the trading account? On the day of expiry or immediately?

3. If due to market movement, there is an increased requirement for margin, how will the trader be communicated about that and how much time do we have to add funds for the new requirement?

1. Not required to square off, on expiry all options are settled to the underlying price and any p&L is credited/debited. If you have short options, no additional STT (penalty) to be worried of.

2. Immediately (T+1 day)

3. Trader has to keep a track of this, it is best to have all MTM losses in case it is big (more than 10% of margin) transferred into trading account before market closing.

Thanks Nithin for your prompt reply. Regarding the 3rd point, can you please elaborate on the MTM losses and how it relates to SPAN and exposure margin? if in case, we do not have access to market updates, does Zerodha call/email me regd the updated requirement for margin if falling short of existing funds?

No, there’s no call/email done, instead we’ll be sending an SMS alerting you on the shortfalls in margin. But as Nithin’s said, the duty of ensuring sufficient margins are kept in the account always vests on the trader. The trading platforms gives you a live update on the margin requirements for the positions you’ve held.

Am a newbie in trading. Have read the First options module in Varsity.I want a clarification on the most basic issue, Kindly do not laugh if this question may seem foolish to you.

If I am bullish on an underlying asset I can BUY a call option and if I am bearish on it, I can SELL/WRITE a call option. So if both the perspectives of an underlying asset are being satisfied in a single instrument [The call option], what is the need for PUT option ? Are Call buy and Put sell AND Call sell and Put buy not equivalent to each other ?

Thanks…

🙂 the payoff graph for options buying and option writing is completely different. Yes if you are bearish you can write calls, but when you write calls, the profits are limited a and the losses unlimited. You need to put in a margin to take a position, unless buying where you need to bring in only premium. Suggest you to read through the futures and options module here: http://zerodha.com/varsity/

Thanks Nitin… seems as though I haven’t grasped the topic properly…will have another go at it…!!

Hello Nitin,

I want to trade covered strategy in Nifty selling like: Nifty spot price on 24rd Nov is 8006 and i am writing 7800 Put and 8200 Call…at expiry nifty is at say 8000 so i will get full premium for both side…in option chart we can see that there can be seen strong base at PUT and CALL OTM side…can i use that data to trade both side..??

Yep, you can. Also suggest you to go through the option module here: http://zerodha.com/varsity/

Thanks for reply….In option chart there is highest OI at 8000 PUT of 6,339,675 and highest OI at 8500 CALL of 3,610,050….so can i predict that in Dec series Nifty remains in between 8000 to 8500..??

Hmm.. yeah, it can be a theory to follow.

Thanks for the reply…One case study i am indicating..Please suggest me…At Nov 25, there is strong support of OI at 8000 PUT and 8300 CALL…But there is much more OI at 8000 PE than 8300 CALL…it is happening at every month so i will consider CALL or PUT based on highest OI at expiry for next month trade..Am i thinking right..?? please advise me ..

Hiren, I suggest you read up about Max pain theory and how to read Put call ratio numbers on Varsity here: http://zerodha.com/varsity/chapter/max-pain-pcr-ratio/

You’ll be able to make more sense of the numbers then.

sir if i write sbi 250 call at 5 rs and if it rises to 6 rs how much margin more required and at what price broker ask me to increase margin and at what price broker automatically square off my position.

Margin to write SBI calls will be around 80 k to 90 k. lot size is 3000, so rs 1 loss will cause you a MTM loss of Rs 3000. Usually when you lose 10 to 20% of margin required is when broker might start squaring off your position. So say when you start making notional loss of upwards of Rs 9000 (when call goes to 8 and above).

Hi Sir,

The post is awesome.

I am going to write ATM call + put at the start of month and hold till expiry. The premium ofcaurse will be melted to some extent and i am able to get some profits say near about 6-10%.

Now let say i have written call+put at total of 300 and suppose if it goes above 300 then

Do i have to pay more premium?

If yes then how much it will be?

Do my broker will square off the position without asking?

If the total goes down lets say 200 then what about the extra margin amount that i have paid?

1. If the combined premium goes up over 300, that means you have started making losses. If the lot size is 100, if the combo goes to 350, it means you are making losses of Rs 5000. So yes, margin goes up when the premium goes up. It this goes up significantly more than 300, yeah broker can square off if you don’t have enough margin to cover.

2. When it goes lower, margin blocked will reduce, you will have more money let to trade/withdraw.

Dear Nithin sir, suppose i sell nifty 8800 call at 50 rs , if nifty crossess 8800 , to hedge my position in future how many number of future lots to be buy to hedge my postion and what is the formula for this….

Hello Nithin,

I am Asit Maurya.I am a trader in F&O segment.I want to know something.Suppose I have 5 crore rupees and I want to invest it and get 20% (1 crore) everyday so , where should I Invest to so that my order gets executed easily as it will be a huge order it will take too much time to be executed and I don’t want it to be overbought so there should be a good liquidity Please Help.is there any way in zerodha to invest in Foreign Market F&O.

Thank You

🙂 are you saying you want to make 20% daily? I can’t think of any instrument in the world that can give you this kind of return. Your best bet to trade bigger quantities is Nifty futures and options. Indians are not allowed to trade derivatives in International markets, only equity investment.

It is better to trade in Banknifty than nifty and I can make 20% easily.

Great. Good luck 🙂

Hey Nithin,

Today I placed an order of 10000 shares in F&O.It got cancelled and showed that I can only place an order quantity below 2501 shares.Why?.How to remove this

Asit, these limits are set by the exchanges, you can’t place more than the limit set in a single order.

if I short nifty call@oct9500 with say 30 rs 1 lot with margin paid say 50000.

In case market goes up and call price goes to 230.

How margin requirement/MTM is computed.

Hello sir,

I’m new to option trading and wanted to know that what is the process to exercise option contract for option buyer at the day of expiry for ITM position.

Nikunj, all options in India are european, so they exercise automatically. You don’t have to do anything. Check this http://zerodha.com/varsity/ to learn.

Hi Nithin,

In continuation to my earlier question, how to identify whether call or put writing has taken place on a perticular strike price .Also, how to identify call or put buying has taken place in considerable amount on a perticular strike price. Is there any indicator something to measure this?

Thanks.

Nizam, if open interest goes up, it means option writing is happening. But this also means that people are buying more options. The logic here is that option writers are smarter lot, so if open interest of calls go up, so maybe that means market won’t go up. So check for open interest.

Hi Nithin,

Thank you.

When you say:

”if open interest of calls go up, so maybe that means market won’t go up. So check for open interest.”

Do you mean the Open Interest of a particular call strike? or The total open interest of all call strikes listed for a stock?

If you are seeing OI go up on a particular strike, if you believe that option writers are usually right, that would mean that option writers don’t expect price to go above this strike in case of calls.

Hi Nithin,

Thanks for your valuable information and sharing such a nice idea to overcome the risk. I have not seen such a kind of guy like you. Most of the people afraid of sharing info to others by thinking that they will benefit out of it. Even I myself feel the same.

After looking at your posts/sharp response, I realized a lot and trying to develop at least some kind of your personality.