Application of Option Greeks

To learn more about options, check out this module on Varsity.

In the previous post, we discussed the Option Greeks and got a perspective on what they are. An understanding of the previous article is important for this article. In this article we will attempt to help you understand the practical uses of Option Greeks, and how you can use the Greeks to trade options more profitably.

Option Greeks are also called the option sensitivities, as each of the Greek is sensitive to a particular market variable. Sensitivity represents risk in some form or the other. When you have an open option position, the intensity of these sensitivities have a magnifying effect simply because they exert their influence on the option position ‘simultaneously’. Think about it.

- No one can stop time hence, theta has a continuous effect

- No one can stop the markets from its natural movement, hence the delta is on the move always

- Market participants are always driven by emotions, which translates to market volatility, hence the vega gyrates all the time

To give you perspective, imagine a juggler, trying to juggle 5 different balls while standing at the edge of a mountain cliff. This is what happens, when you trade options! The 5 different balls are equivalent to the Greeks, and the cliff itself is the markets!

The Delta – Always add them up!

The Delta – Always add them up!

As we know, the delta helps the trader understand the rate at which the option premium is likely to change based on a change in the underlying price. Hence delta is highly sensitive to the price change in the underlying. Any naked option position has a non zero (for all practical purpose) delta value.

Before we proceed, let us revisit some basics. We know the delta varies between 0 and 1 for a call option, and -1 to 0 for a put option. For the sake of simplicity, let’s consider the call option delta to vary between 0 and 100, and put option delta to vary between -100 to 0.

Also, the delta of futures is always 100. This is because the future always move (magnitude and direction) in line with the underlying. So, the delta of futures contracts (Nifty Futures, Infy futures, ACC futures etc) is always 100.

Keeping this in perspective, imagine the following situation.

A trader is long 3 lots of Nifty 7800 CE while the spot is trading at 7700. Clearly, the option is OTM(out of the money), hence the delta should be less than 50. Let us assume the delta as 40. The intention is to hold the option position open for 2 weeks. However, after initiating the long call position, the trader is now worried about a potential selloff in markets (maybe over the next two days), hence would like to hedge the open option position.

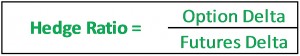

The trader can hedge the position by calculating a simple ratio called the ‘Hedge Ratio’. The hedge ratio helps determine the number of futures lots one needs to short in order to be hedged against the anticipated fall in the market.

The hedge ratio is simply the ratio of the option delta to the futures delta. Remember, the futures delta is always 100.

Hence, going back to the example, the delta of the option is 40 and futures is 100; hence the hedge ratio would be:

= 40/100

= 0.4

This means to hedge 1 option position with 40 delta, the trader need to short 0.4 lots of futures. Since there are 3 lots of option, it would be 0.4 x 3 = 1.2 lots. Obviously one cannot short 1.2 lots, hence the closest approximation would be 1 lot of futures short.

The trader now has 3 lots of 7800 CE long, and 1 short futures position. Think about this in terms of ‘total position delta’.

Without the hedge the trader had 3 lots of Call options with total position delta of 120. In other words, a delta of 120 indicates that for every 1 point move in underlying, the option premium varies by 1.2 points. By adding the short futures position, the trader has now neutralized the delta by 100 points, leaving a total delta exposure of 20.

Imagine that it was possible to short 1.2 lots of futures, in which case the short futures would contribute to -120 delta, which would completely neutralize the long option’s 120 delta. The combined position (3 lots of CE , and 1 lot of short futures) yield 0 delta [120 delta from call option minus 120 delta from futures].

When you have a zero delta position, it is also called a ‘Delta Neutral’ position. When we have a delta neutral position, the total delta of the combined positions is 0. This means for every 1 point change in the underlying, the position moves by 0 points.

A delta neutral position indicates that the option position’s sensitivity to directional risk is completely taken away. When one establishes a delta neutral position, the direction does not matter – the market can go up or down but the position will not get affected. In other words, the direction no longer matters!

Classic delta neutral strategies include the straddles and the strangles.

In a straddle strategy, you buy both ATM(at the money) call and put option expiring at the same time. Consider this example…

Spot Nifty = 7780

Call Strike = 7800

Put Strike = 7800

Both the options are ATM, hence their approximate delta would be:

Call Delta = + 50

Put Delta = -50

Total position delta = +50 – 50 = 0, making it delta neutral.

So irrespective of how many positions you have, always add up the delta to know your position’s sensitivity to direction. Keep the following two points in mind..

- If the delta add up to 0, then you have a delta neutral position. This means you are completely insulated to any directional risk

- If the delta add up to 100 (for example buying 2 ATM Nifty call option yields a combined delta of 100) this is as good as owning a Nifty futures, since nifty futures has a delta of 100

If you aspire to be a full time options trader, I would suggest you internalize the concept of delta quite well as it forms the foundation for interesting strategies such as –‘Volatility arbitrage using dynamic delta hedging’.

Vega – Trade the trend

Vega – Trade the trend

Traders usually underestimate the effect of vega, and the massive influence it has on an options position. Understanding vega and its implication on an option position is one of the keys to successful options trading. In the previous article, we stated that the options premium (both call, and put) increases with increase in volatility. Let us explore this a bit deeper.

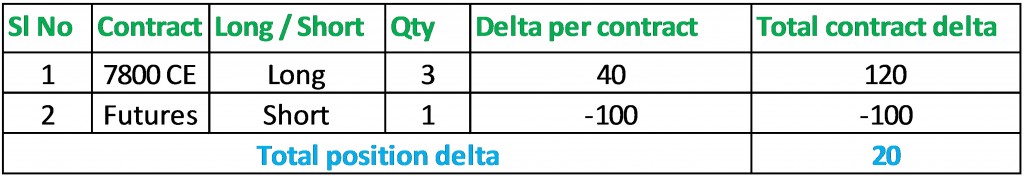

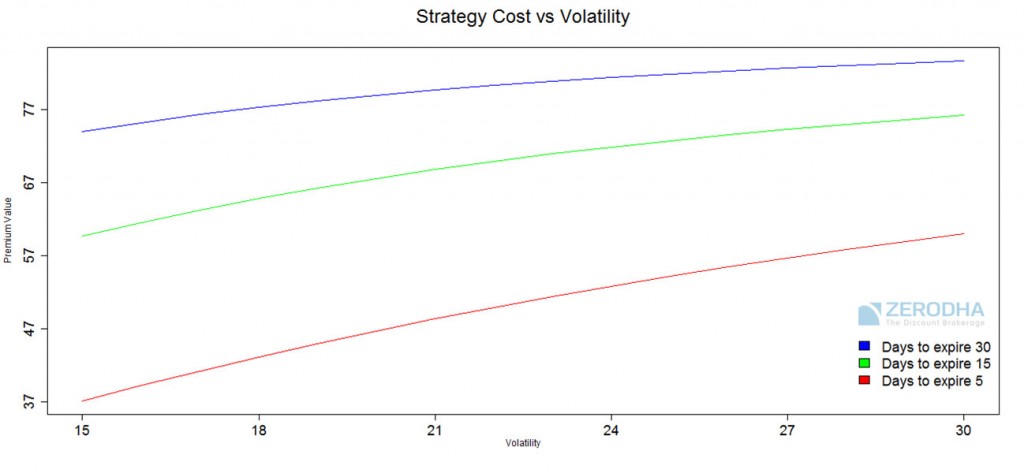

The chart below shows the behavior of a call option premium with regards to increasing volatility, when there are

- 5 days to expiry (red line)

- 15 days to expiry (green line)

- 30 days to expiry (blue line)

The graph below shows what would happen to the options premium, if volatility were to increase when there are 5 days to expiry.

As you can see, irrespective of how many days are left to expiry, the option premium always increases with respect to increase in volatility. However, on a closer observation there are few other things that come to light. When volatility increased from 15% to 30%:

- The call option premium changed to 58 from 37 (54%) when there were just 5 days to expiry

- The call option premium changed to 127 from 69 (84% ) when there were 15 days to expiry

- The call option premium changed to 190 from 96 (97%) when there were 30 days to expiry

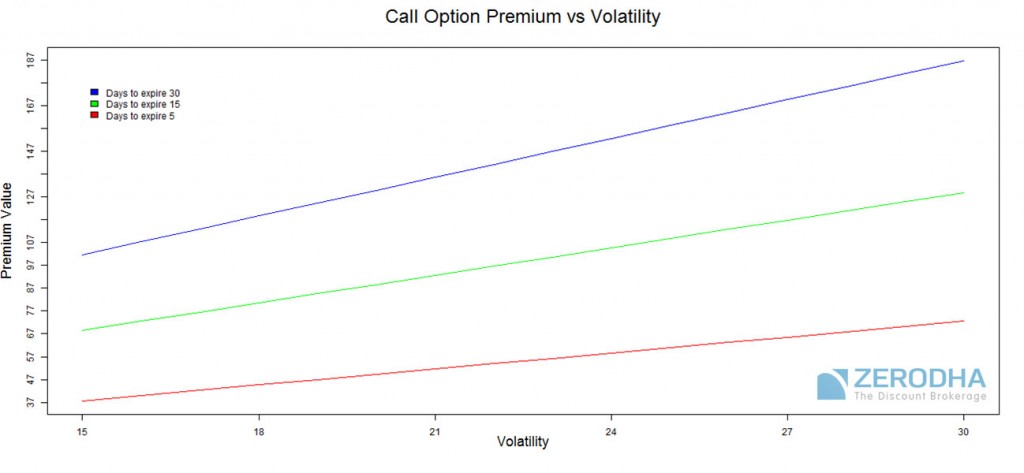

Similar observation can be made for put options.

We can generalize two things:

- Premium always increases when the volatility increases

- The effect of volatility is high when there is more time to expiry. This is because, with more time to expiry, higher the probability of extreme events occurring

Notice, when there were 30 days left to expiry, a change in volatility from 15% to 30% resulted in a massive 97% move in the option premium. However the same change in volatility when there were just 5 days left to expiry resulted in only a 54% move in option premium!

Let us summarize these observations into action items. The following points hold good for a simple, plain vanilla 1 leg option trade.

- When you intend to buy an option, always have a view on vega. For volatility to work in your favor, you should time the option purchase in such a way that you expect the vega to increase. This naturally means one should avoid buying options when volatility is high

- Likewise, when you intend to sell options, you should again have a view on volatility. Avoid selling options when you expect vega to increase. Which means when you are short options, for vega to work in your favor, the vega should fall

- Avoid shorting options when you are at the start of a series (more number of days to expire), and/or expect vega to increase

- When we are close to expiry, shorting options is a good idea, especially if one anticipates a drop in vega

- As a corollary to point 4, one should avoid buying options when there are just few days left to expiry, and/or when one anticipates a drop in vega

A slightly more mature option trader who trades in option spreads may wonder how would the volatility impacts the strategy cost, of let us say a 2 leg spread position such as the bull call spread or a bear put spread.

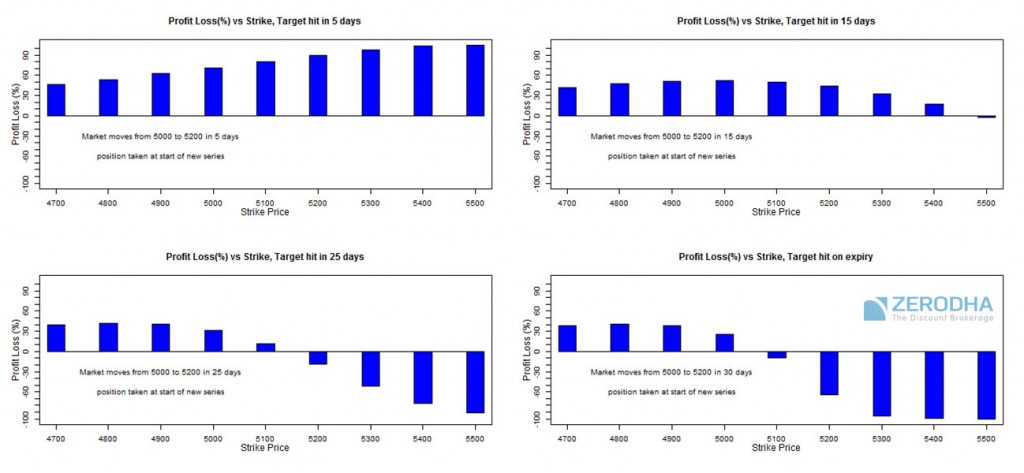

To understand the effect of volatility or the vega on the strategy cost of the spread position, have a look at the following chart.

Looking at the above graph, it is clear– increase in volatility increases the cost of strategy.

On further inspection, it is also quite evident that at the start of a new series (blue line) even with an increase in volatility, the strategy cost does not increase much. However, volatility seems to have a massive effect on the strategy cost when there are fewer days to expiry (red line).

Translating this to an action item, when you intend to initiate a spread position (bull call, bear put), always have a view on volatility, and therefore the Vega. For Vega to work in your favor:

- Ensure the vega is expected to go higher

- If you expect vega to go down, avoid taking the spread trade. One can even look at shorting the spreads

- The vega has little impact at the start of the new series (as in when there is more time to expiry)

- Initiate the spread position anytime after the midway of the expiry. This is when there is a maximum impact of volatility (assuming it is expected to increase)

One can develop visualizations to analyze the effect of vega vs time vs premium (strategy cost) on any strategy. However, the rule of thumb is the same – for a net buyer of an option, increasing vega benefits, and for a net seller of an option, decreasing vega helps.

The Theta – helps you strike right!

The Theta – helps you strike right!

Time has a decreasing effect on the premium. In fact for this reason options are considered a depreciating asset. Previously, we learnt about the time decay factor. However, there is another interesting and important angle to theta. It helps the trader identify the right strike to trade under a given circumstance.

To help you develop a perspective with respect to strike selection methodology (we will first deal with a long call option) we will set up few practical trading scenarios that we regularly come across.

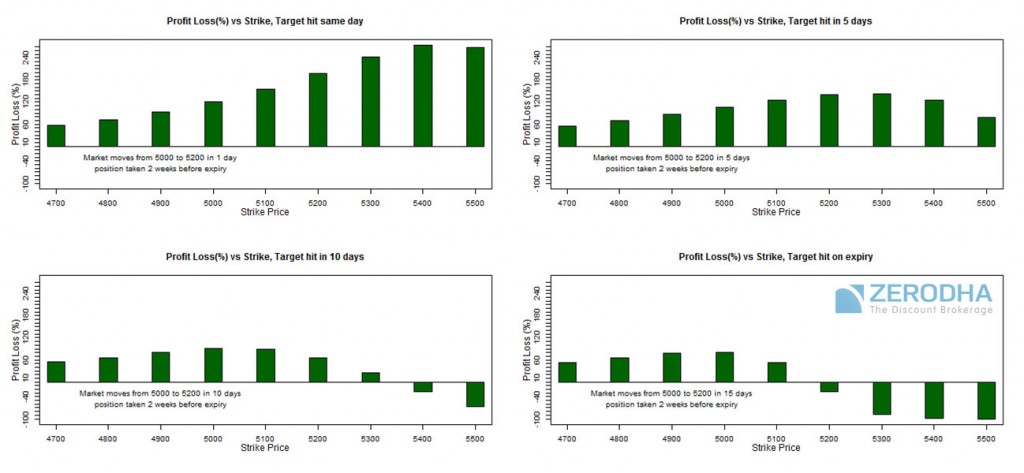

Assume we are at the beginning of a new series, where a stock is trading at 5,000, and we are of the opinion that it will hit a target of 5,200. Given this target expectation, the objective is to select a strike in such a way that it gives the trader maximum bang for the buck.

Now, here is the situation, we are at the start of a new series (maximum number of days to expiry). Which strike of call options would you choose to trade, given the following expectation?

- We expect the target of 5,200 to be hit in 5 days

- We expect the target to be hit in 15 days

- We expect the target to be hit in 25 days

- We expect the target to be hit by expiry

Now obviously, just like the way one size does not fit all, we cannot select the same strike to trade for the above scenarios.

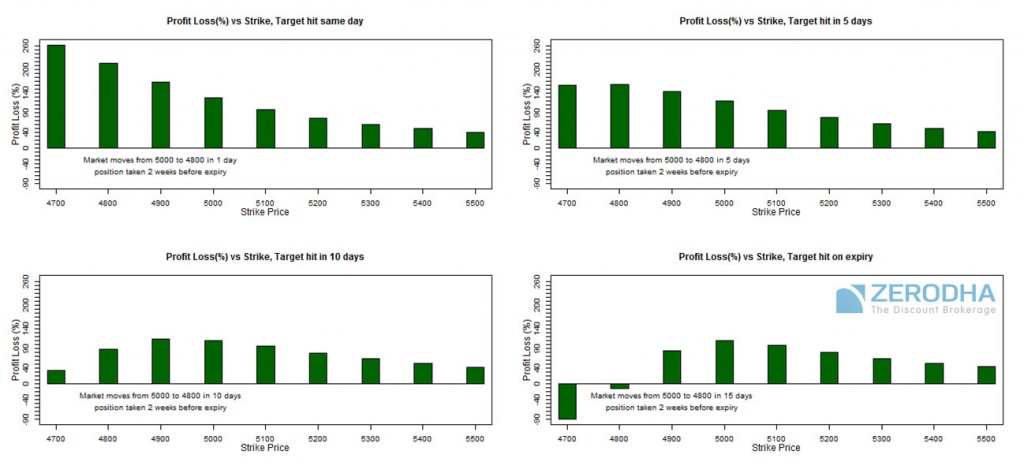

Have a look at the following graphs. It represents the profitability on Y axis, and strike on the X axis.

Look at the first block of chart. In the backdrop of the stock moving 5000 to 5200 within 5 days this chart is telling us what would be the profitability of each strike starting from 4700 (ITM) to 5500 (OTM). Clearly the profitability increases as you traverse from ITM to OTM. In other words, it looks like the best strike to choose in terms of profitability, would be 5500 (OTM).

However, the same strike would have lost money in the 2nd scenario, notice, 5500 actually made a small loss, even though the market moved in the right direction. Also, the graphs suggest that the best strike to choose when one anticipates the target to be hit in 15 days would be the ATM option.

You may have heard of traders say that they lost money on call option, even though the markets moved up. Now you know why this happens — they simply choose the wrong strike!

Look at the 3rd and 4th graph blocks, they are really interesting. The graph is suggesting you choose an ITM or at the best an ATM option when you expect the target to be hit towards the end of the expiry. All other strikes lose money!

Now remember, this is with respect to initiating a position at the start of the series. What if you want to initiate a fresh long call trade when we are half way through the series? Let us assume the same movement of 200 points (from 5000 to 5200), but slightly different scenarios:

- Target hits on the same day

- Target hits within 5 days

- Target hits within 10 days

- Target hits on expiry

The following graph should help you in selecting the strike:

Notice, when we expect the target to be hit on the same day, selecting an OTM option makes most sense. You may have heard of stories where traders doubled their money on the same day trading options, this is because they have selected the right strike for the right situation.

Notice in the 3rd and 4th blocks, again selecting a strike beyond ATM tends to lose money, even if the market moves in your favor.

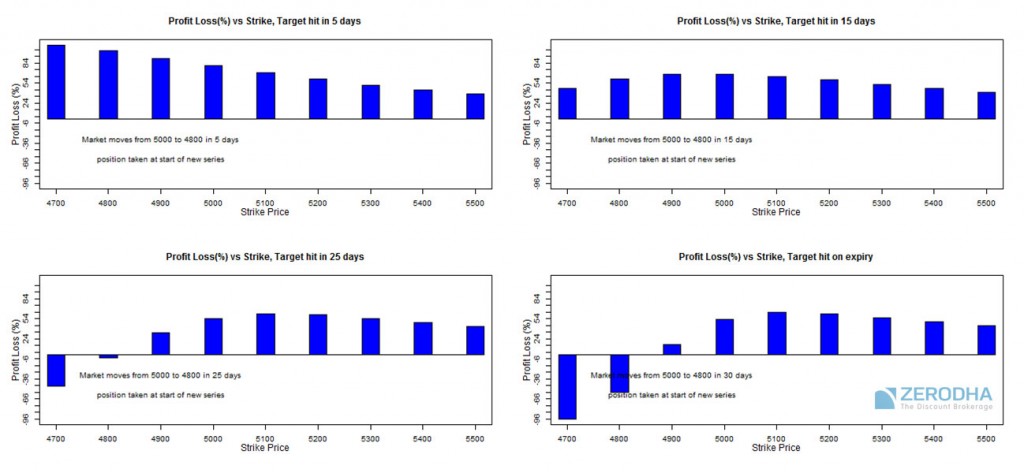

The same logic can be applied to Long Put option. Assume we are at the start of a new series, and you expect the stock to go down from 5000 to 4800 – a 200 point down move. Here are the various scenarios:

- We expect the target to be hit in 5 days

- We expect the target to be hit in 15 days

- We expect the target to be hit in 25 days

- We expect the target to be hit by expiry

The graph below shows us which strikes seem appropriate under each of the above scenarios.

Clearly, the same inference can be drawn as we did while analyzing the call option at the start of the series.

The graph below shows the profitability trading put options when we are half way through the series and expect

- Target to hit on the same day

- Target to hit within 5 days

- Target to hit within 10 days

- Target to hit on expiry

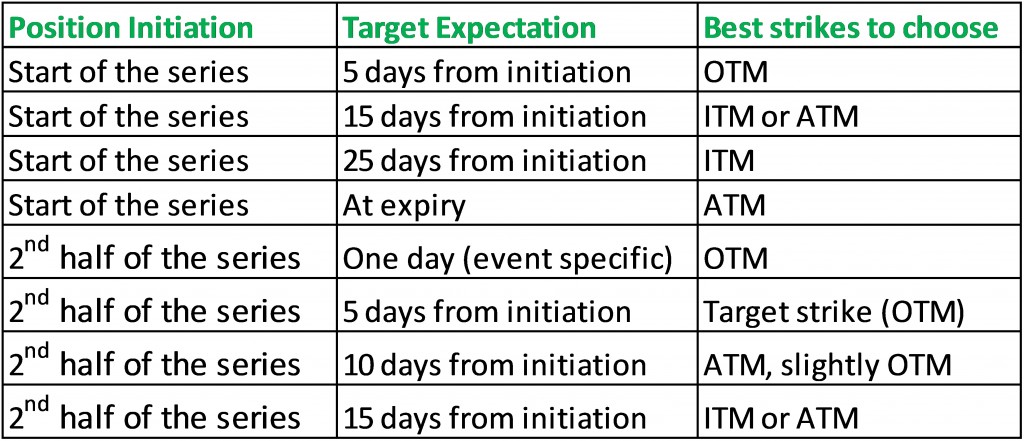

The strike selection methodology irrespective of long call or long put are the same; hence we can generalize it with the following table.

Conclusion

First of all, if you have read through the entire article, kudos to you as I can imagine application of Greeks can be a fairly complicated topic, especially for a person new to this topic. If you plan to take options trading seriously it is imperative that you take the effort to learn Option Greeks and their application in detail.

In the next article, we will talk about using the options calculator to calculate the Greeks.

Until then, stay tuned – stay profitable.

Hi where can I get positional greeks of a strangle

any information of calulation of higher greekssecond order

delta calculation by -sum of gammacharm & vanna

gamma calculation by sum of speed, color & zomma

does option price fr callput is [sum of delta, gamma, theeta]for evry strike

pl enlighten

hello, my question is related to delta neutral strategy. if you are holding shares in portfolio or you have position as BUY in future, it is said dela is 1 (ONE). so you have to take opposite position so as to make delta near to ZERO.

My question as under:

I hold 100 shares of Maruti Suzuki of 9100 cost per share and current market of the said script is around Rs 7600 per share. Whether still I should take its delta as 1 (ONE) per share ? Then what are the options available to me to create DELTA NEUTRAL STRATEGY in this case.

If someone has 100 shares of Maruti of current rate of 7600 and if he desires to create above strategy how it will differ from strategy for shares purchased at Rs 9100. I hope i have explained my querry well.

Kindly oblige and explain.

Asvin

Sir

I have two basic question. First who should delta hedge their position? Both option buyer and writer or only writer and why? Also If i intend to hold a call option till expiry then do i need to delta hedge my position? Yes or no and why?

By know the delta value how we can decide the trend of the stock or index

The delta only tells you the moneyness of the option and is not an indicator of a trend for the underlying.

Dear kartik

Can we have a dynamic delta hedging in kite ( zerodha ) on a covered call strategy /covered put strategy or calender spread , I came to know greek soft offers this , can we expect at zerodha can your research team work out the same please inform.

Regards

sudheer.

Working on an option trading platform. 🙂

I am new in zerodha please guide where i get option Greeks in KITE.

No greeks on kite yet. You can check here: https://zerodha.com/tools/black-scholes/

Option greeks for option portfolio not available in kite . Kindly add this in kite . This will be very useful for monitoring options positions . Sharekhan is already having this feature .

Hi Karthik ,

Great article and perfect examples .

Even though finding the right strikes is a big task , i have a few doubts plz correct me if i am wrong .

Before the FOMC meeting on 14 june i sold banknifty 23100 PE / 23700 Ce and bought 22900 PE / 23900 CE , ratio 1:1 , my aim was to sell high IVs and hedge it, next day after the news I remember very clearly 23100 PE started falling sharply all of a sudden , it was buying 23100 PE at 125 rs at 920 am and by 1030 – 1045 am was at 110 , kept going further down , next day was at 85 rs . Alll other strikes didnt move that much , and banknifty was not increasing when 23100PE was falling , its just the IV went from 13.5 % on 14 june to 12.75% on 15 june .

1A- MY query here is , i think in bank nifty the right strike for a put is 400 points away and for call is 300 points from the future price , is this the right way to look at it ?

1B – Also if i wanna do vol arb , should i sell 2 x 23100 PE and buy 1x 22900 PE and delta hedge it ? The right way would be buy 23100 PE and sell 22900 PE since high IV is at the lower strike , but i dont see the 22900 vol falling as much as the 23100 vol , so i might make a loss right ?

Both trades are totally different , please guide me individually for both . 1A is only good for events , 1B will be for usual trading .

2A – Your graph tells us what will happen to our trades if we select XYZ strikes and assume X number days and Z prices , but since i am a non directional trader how should i find the right strikes ? Eg : In case of Nifty i should be 100 points OTM or 200 points ? And if i am 100 points away the 2 strikes should be 100 points away from each other or 200 points ? And if i trade 200 points OTM the 2 strikes should be 100 points or 200 points away from each other ?

2B – If the right way is to look for selling high vols and buy low vols and make sure the difference between them is big , So for stocks who can move 10 % on a bad day , what should be difference between 2 strikes that keeps my position safe , i want to put trades in such a way that if they dont give me a profit then it should do a minimum loss not a very big one . Is there a percentage that we can calculate , say for eg Reliance might go up or down 10 % anytime , 1 day or 10 days , i dont know , so how far the strikes should be from each other ?

I am looking for a max 1.75 % return per month , i am not interested in more , please give me a few egs of trades that will be the safest .

I would like to meet you and talk personally also , if possible email me your contact number or you can call me anytime on 9769341771.

Regards

Correcting a statement

1B – The right way would be buy 1 x 23100 PE and sell 1.5 or 2 x 22900 PE ****

Hi Sunny,

Glad you liked the article.

1A – There is nothing like a right strike. This really depends on the situations and how the greeks move. Your trading strategy should adapt to these variables.

1B – Yes, when you do vol arb, you got to delta hedge… and for this you may have to slice the orders based on the deltas. The right way is to always sell the strike at higher vol and buy the one with lower vol. So given this, the strikes should be independent of this.

2A – As I mentioned above, the selection of strikes should not be pre decided, it should occur naturally as the situation in market demands. You may want to take a look at volatility cone for selecting strikes.

2B – If you adopt to selecting strikes based on high and low vol, then there is no question of the difference between strikes, it will be a natural outcome.

I’m happy to note that you have a realistic expectation – 1.75% is frankly a decent return expectation.

Good luck and all the very best.

For short strangle Vega is Vega of call+Vega of put. Is it correct

It is for banknifty

What r the ideal values of Greeks for a short strangle of otm 400 points away

For short strangle Vega is Vega of call+Vega of put. Is it correct

Option greeks for option portfolio not available in kite . Kindly add this in kite . This will be very useful for monitoring options positions . Sharekhan is already having this feature .

I have made a portfolio with delta gamma neutral with vega positive, but increase in volatility did not make profit.

similarly I did delta Vega neutral with spread. no profit.

what is the reason could be?

What was the sensitivity to volatility? Although Vega +ve, if the overall position has a low exposure to volatility, then the results may not be great.

Dear Nithin,

It would be really helpful and great if you could provide the option strategies builder in Kite software.

Please let me know if you have this in your pipe line of development. Or Please suggested if you are aware of any web based free option strategies

Regards

PVB

We’re working on building this, will keep you posted.

Hello,

Any future plan to show live greek numbers in Pi/Kite. It will help us to do safe trade.

Dear Zerodha,

I want to know how to protect my call sell option. I am comfortable with option selling . So if i sort any call option with delta less than 0.5 then how i can protect my loss in case the underlying increases and due to that delta increases . I want to know about strategy to minimise my risk with put sell and future call . Looking forward for your response. I am zerodha user.

Regards

Nitesh Kumar

Suggest you to go through options module on varsity http://zerodha.com/varsity/. There is a dedicated section on option strategies.

How to see Greeks on kite software.

Currently no live greeks, you can use this: https://zerodha.com/tools/black-scholes/

Any plans to show this on kite/Pi?

Let us say I pay options premium for the BankNify Short position 19400 CE of Rs.300. per share. I have 5 days to expiry. Now i am sure that at the end of the expiry my option premium will be zero. Assume that the bank nifty is going to be flat. Due to the effect of theta Now my option premium must decrease atleast reduce Rs 60 per day approx. This Rs.60 per day decrease will happen at what rate ? Will it happen at the rate of Rs10per hour? Will it happen overnight after the trading hours? If it is so then, next day the option premium will open at Rs60 less than the previous day? Kindly explain me how the theta will be applied on the premium whether hourly or daily? Please reply to [email protected]

Well, in the first place when you write (sell) options you do not pay a premium, but rather receive the premium. The rate at which the premium will lose money on account of ’Theta’ depends upon the theta of the strike. Usually, the effect of theta is experienced on a overnight basis. The acceleration of theta is higher as one approaches expiry.

I’d recommend you read more on theta here – http://zerodha.com/varsity/chapter/theta/

Hi,

I have some confusion about my Option Trade on Hindustan Petroleum : In the month of August 2016 I bought 1 lot of HPCL September 2016 CE 1300 @Rs.25 . The company has declared Bonus of two shares for one share held and the ex-bonus date is 17th September 2016. Now, in the above circumstances, what will be position of my above CE Option which is due to expire at the end of September 2016. I have two queries.

1) whether the tradable lot will be splitted in view of ex-bonus on 17th Sept.16; if so,

ex-bonus how many lots will be there?

2) Whether the CE1300 (Call) will also be splitted due to ex-bonus in the mid of the Month

(i.e.17th Sept.2016); if so , then what will be the splitting amount / ratio

Please guide

Prabhat check the circular here: https://zerodha.com/marketintel/Circulars/

Thanks for the guidance,

Prabhat

Hello,

is there a tool within zerodha application that given historical volatility of stocks/index and implied volatility at the moment? that would be really helpful to trade , if there is any such interactive chart similar charts are available with interactive broker application.

No Rajat, don’t have it right now. But it is on our list of things to do. It might take a while though.

Hi Karthik,

Can you share a link which explains how I can place pair trading orders for options?

Thanks

Thanks for the article, please could you let me know what are the factors to see the determine whether volatility is going to increase or decrease.Also where can I see the change in volatility for NSE. Thanks

Usually events like budget, corporate results, monetary policy, major political rejigs, geo political issue, extreme market behavior etc drives up the volatility. You can track the volatility change at the index level by observing India Vix – http://www.nseindia.com/live_market/dynaContent/live_watch/vix_home_page.htm

Please illustrate short strangle with delta neutralising. Thanks & Regards. Sastry

The same will be done shortly on Zerodha Varsity.

please let me know how I can make a market watch screen for option trading with all Greeks displayed in one screen beside the derivatives….

like, delta, gamma, theta, vega must be displayed beside the derivative with usual bid /ask price and volume.

please help on this, i m not finding it anywhere.

Hi Karthik,

I have a doubt on Futures contracts. There is always a difference between the current price of the underlying and its futures price and this difference is usually positive (Futures price is higher than current price).

However i have observed that the difference between the current and the futures price changes continuously.

For example today, this morning the difference between Nifty Index & Futures was around 25 however now suddenly it has increased to 65.

So is there a logic or a formula through which we can compute the difference between current price and futures price of the asset?

Thanks

Hello Karthick/Nithin,

Request your guidance on the above question.

Thanks

Sorry, don’t know how I missed this question.

To understand why there is a difference between Futures and Spot I would suggest you read this. I have explained it with an example.

I reason why the difference between the two widens and narrows up simply attributable to demand supply situation.

sir

why option calculator not working after updating 2.9.0.0

plz advise

Can you please call support @ +91 80 4040 2020, someone from support will assist you with this. Thanks.

karthik ji

1. to neutralise delta to 0 after in this instance , is it possible to buy a put of such a strike where the delta value -0.20 .

2. when we sell a put, is the net delta value of that particular put become (+) ? as sell=(-) and delta value of put is always in (-), so….. please clarify if i am going wrong.

regards…

Raj..you are right on both the cases.

1) Yes by adding a PUT option which has a delta of minus 20, the entire position is delta neutralized

2) When we sell a PUT, the delta is positive.

Hi Karthick,

I understand that the time value of options keep decreasing and the rate of time decay is increases as we approach the end of the option’s life.

I wanted to understand in Indian markets, when is this time decay reflected in the option price?

Is it at the start of day or the end of the trading session?

Considering a long weekend, Is the time decay highest before closing for the week or is the decay reflected in the pricing after the markets open after the long weekend?

Thanks

From my experience I have notice the decay drift happens from the close to open basis..especially as we approach the second half of the series.Going by this the decay kicks when the markets open after the long weekend.

Thanks for the greeks.

Regards.

Sharesarthashastra.yola.com

Dear Karthik,

I have a different question,

suppose I have Rs.50,000 in my trading account what will be the safest way of trading to earn 4-5k per month?

Thanks,

Swapnil

At 5K per month on a capital of 50K you are targeting 10% return PM, quite a task in my opinion. You could probably try buying and holding stocks to begin with and see how it goes. Good luck.

Hello Karthik,

I’m eagerly waiting for your article on ’Dynamic Delta Hedging’ is it coming out any time soon?

Thanks

Dear Karthik, I have missed your previous articles/posts. Please let me know how can I read them all, over again now? Uptill now how many articles have been posted?

There are just 3 posts till now, all wrt to Options Trading.

Here are the links for you:

Post 1 – Introduction to Option Greeks

Post 2 – Application to Option Greeks

Post 3 – How to use the Option Calculator

Dear Karthik, i am a graduate with honours in physics. i am also a previous bank employee and now a govt school teacher. i want to start trade in options. as i have to continue my job , it is not possible for me to present before the terminal during market hours. is it possible for me to trade in options ? what are the basic parameters and pros and cons of options trading ?

Sir..unlike futures, options does not require you to stay glued to the terminal. You can begin with small positional trades until you get comfortable with options. For basic parameters (at least on Option Greeks) I suggest you read our previous post.

Thanks Karthik….eagerly looking forward

Can u plz illustrate how to use Options calculator

Will be putting up the post soon.

Hi Karthik,

Thanks for your great effort on Option Greeks,

When can we expect your next post on the same.

Regards,

Nagaraj patil

hello sir, post market open time is 3.40pm to 4.00pm, market price and equity, i have placed order. but order rejected, reason- admin stopped AMO, why? please reply

Check this post. You can place AMO orders only after 6.30 pm.

Hi Karthik,

When you say ’ x days left for expiry’, does it mean ’x trading days’ or ’x calendar days’.

Fakir.

That would be calendar days.

Hello Karthick,What is the code for creating a backtesting based on RSI,Suppose for Reliance I want to do backtesting based on RSI such that It should give buy signal when RSI is less than 30 and Sell Signal when RSI is >70. Is there any way to learn how to code

Deepak can you kinldy post your query here – http://zerodha.com/z-connect/charting-coding-and-backtesting/code-your-strategy-tutorial/code-your-technical-analysis-strategy. It is a dedicated post for coding your technical strategy. I’m sure there are others who will benefit from it as well. Thanks.

Dear karthik

I used to write both nifty call and put option,400 points away from the underlying nifty as a my strategy in the beginning of the series.But the last month and this month (September contract) premiums are very low.For example the combined value of 8400 call and 7600 put is only 19 in September contract.In this scenario nifty option writing is worthless because of less profit.please guide me if you have any other good strategy to get somewhat more profit or correct me if am wrong.Thank you

The premiums are low because the volatility is low. Use the volatility calculation as explained above (see my reply to Guru’s comment) to select the right strike.

Thanks for the reply.Is it advisable to write the next month contract using the above said same strategy.

You can as long as you are comfortable with holding a short option position for so long. Also ensure you multiply the vol with sqrt of 60.

Example : If the daily volatility of Infy is 1.26%, the two months volatility will be 1.26%*sqrt(60) = 9.76%.

Are there any plans to teach Dynamic Delta Hedging? If not can you please refer me to some good source online where i can learn that?

Thanks

Stay tunes on Z Connect Sukesh. We will talk about dynamic delta hedging soon.

Correct me if i am wrong: There is no position which is delta neutral over a wide range of variation.

As the market moves, a position which was delta neutral will no longer be delta neutral??

Is there any strategy where delta stays neutral no matter how much the market moves?

Thanks

You are right. No position stays delta neutral. Delta changes as and when market changes. As far as I know there is no strategy that is delta neutral tru its lifespan.

Manish, I’m a little confused. Can you kindly elaborate the question along with its relevance to options? Thanks.

Hello Karthik

What I meant was

Generally we use average for a particular number of periods with field as close but

I want to use EMA for 20 periods but field highs should be( Simple speaking I want an EMA of past 20 days high)

eg, day 1 50 55 45 49

day 2 55 57 46 50

day 3 54 56 40 51 and so on……..

Here now I want to calculate EMA for second field ie HIGH 55 57 56 ……. for 20 periods

When i used EMA(High, 20) I was informed this only catches the high of past 20 periods rather than returning me EMA

Please guide

Manish

EMA is a more reactive when compared to SMA, hence it tends to stick closer to the prices. You can use any variable (within OHLC) as a data feed to the EMA formula. EMA formula is insensitive to the data you feed.

EMA(High,20) seems to be the right expression.

Hello Karthik

For buy alert expression i use:

SET A = (RSI(CLOSE, 10)) (RSI(CLOSE, 10) > 55) and RSI(CLOSE, 10) > SMA(A, 10) and CLOSE > EMA(HIGH, 20)

For sell alert expression i use:

SET A = (RSI(CLOSE, 10)) (RSI(CLOSE, 10) < 45) and RSI(CLOSE, 10) < SMA(A, 10) and CLOSE < EMA(LOW, 20)

Buy exit alert 0

Buy sell alert 0

But this triggers trade only on the buy side and sell side trades r not generated. Sell expression is exactly simply reverse of buy expression.

I have tried on many scripts , nifty as well as currency for 5 min interval

Could u guide

Manish 9820818028

I have even tried to set a different variable for the sell expression but still it seems not to generate sell trades. What could be the solution ?

Manish

Hello Sir

I want to take an Exponential moving average of highs for 20 days (Generally its close but i want to use field high) I use EMA(High, 20) but I am informed this only catches the high in the last 20 periods so how do i get the average ??

Please guide

Manish

Hello,

Thanks for this wonderful article, really helpful for aspiring option traders.

My question is, to illustrate effect of volatility or vega, you have taken an example of a scenario where the volatility has increased from 15 to 30 percent.

I’m wondering is this example realistic, because volatility in Indian markets won’t show such increases even during critical events such as budgets results etc. I think this might have happened only in 2008 even UPA came to power and the markets touched circuits.

Please advise.

Thanks

Hi Sukesh…glad you liked the article.

Nifty has exhibited Volatility range of anywhere between 14% to 24%…and of course during events it can peak beyond the normal range. However, individual stock volatility can gyrate to a large extent. You may be surprised to know that stocks like Infosys exhibits volatility of close to 45% – 50% just before its quarterly result announcement.

Anyway, the whole point is to illustrate the fact that premiums react sharply to volatility, and one must always have a view on where vega is heading before taking an options position.

Very cumbersome, is it not better to sell ATM call and put options

and wait

for premiums put together to come out ?

Srinivas, I’m assuming you are referring to my reply to Mr.Guru Rao

If yes, well it actually is the right thing to do, unfortunately it is not straight forward, therefore seems a bit cumbersome 🙂

Selling ATM options is quite risky, especially at the start of the series, and when you don’t have a view on volatility.

Sir, Bit confused about ur comment. You have mentioned Selling ATM options are ”the right things to do” and also ”quite risky”..

Can you clarify pls.. Thanks..

Sukesh…you missed the words in between 🙂

I was talking about calculating the volatility and then writing the option at that strike as the right thing to do.

However selling ATM option especially at the start of the series as risky.Suggest you refer the above four conversation to get the flow 🙂

Thanks for correcting me, If i can bother you with one more question..

What does ”At the start of the series mean”, is it Near month options (30 Days?), or 60 Days or 90 Days options?

Thanks

Near Month. For example the article considers today (1st Sept 2014) as the start of the series for September series.

Thanks Karthik for the structured explanation. I would like to know more on writing covered calls. Usually I write OTM calls at the beginning of the series. If the underlying stock moves up, I keep averaging my write position. Allow it till expiry. While I do end up with profits, it is very uncomfortable to keep monitoring the movement every day and average the positions. Is there any specific methodology in writing covered calls – (a) selecting strike price; (b) when to take position; …

Thanks Guru Rao, I’m glad you liked the post.

For selecting the strike, and when to take the positions I would suggest you go through the Theta section of the article. Along with this, I’d also suggest you look for the volatility of the stock. For example, if the monthly volatility of a stock trading at 100, is 15%, then it makes sense to write options beyond the regular volatile range of the stock. In this case, I’d be happy to write 120 Call option.

Calculation as below..

Stock price = 100

Vol = 15%

Margin of safety on volatility = 5%

Total room for Vol = 15%+5% = 20%

Strike to be selected = 100*(1+20%) = 120

Option writing does lead to sleepless night, one has to just adopt to it 🙂

Thank you very much Karthik. I do write covered calls against my holding (infy). Few basic questions – (a) where do I find the monthly volatility info?; (b) do I need to take the average (or something like that) of last few months of ”monthly volatility”?

You can easily calculate the historical monthly volatility on excel. Please check this link for historical volatility calculation – http://tradingqna.com/3804/how-do-we-measure-volatility-for-stock-or-share?show=3804#q3804

Always good to know the volatility range for last 1 year and 6 months. Do let me know if you face any issue in calculating the volatility for Infy.

Hi Karthik, I was able to calculate the volatility for Infy. Not sure how to share the excel with you for verification!!

Here is what I did …

– downloaded Infy data from NSE site for the period 1-Jan-13 to 28-Aug-14

– considered the ”Close Price” and not the ”LTP”

– Daily SD as on 28-Aug-14 came out as 2.03%

– Monthly volatility came out as 9.52% (considered 22 days for SQRT. Hope this is correct)

Let me know if there is any way I can share the excel with you.

If these calculations are correct, going by your earlier explanation, I should select strike price that is … may be around 11% (1.5% cushion) away from the previous expiry closing price.

Ex. Infy closed at 3598.8 on Aug expiry day 28-Aug.

For Sep, with 11% safety, the strike price would be 4000.

Am I right?

This seems correct, however I’d like to see the Excel working once. Can you kindly share it? I’ll send you a test email. Thanks.

Hi Sir, Just wanted to say that I am very excited & looking forward to the launch of the new platform ”Pi”. The teaser seems to be very promising with advanced tools & techniques, unlike anything I’ve seen before.

So, I’m very curious to know when is this being launched. It would be great if you can share a vague idea on the timeframe for its launch, i.e. whether in a few days, weeks, or months.

Thanks,

Jeetu

Thanks Jeetu. Pi should be out soon..just waiting for few regulatory clearances.

Somesh, thanks for elaborating your question. As long as your volatility estimate is right, you will get the a fairly accurate premium value. On the other hand you can feed in the market value of the premium, and then get the volatility estimate. From my experience, most of the option calculators (including Zerodha Trader) works quite accurately.

Thank’s a lot SirJi…

By option calculater we find accurate Delta,Vega n theta then how much accurate option premium we got…

Somesh, can you kindly elaborate your question? Thanks.

Sir, At present we use approx value of option Greek that result some time we find accurate option premium and some time we find +/- 5 point. for ITM Call / Put we use approx + / – 0.50 to 1.So that questioningly we want to know when we use option calculator we find accurate Delta,Vega n theta then how much accurate option premium we calculate.

Thanks for the detailed explanation of Option Greeks,But from where do we get the value of all the Option Greeks such as Delta,Theta,Vega,Gamma etc. Is there any specific site where we can get all the required details. Can you please create the Platform in Zerodha online trading Platform where we get to see the details easily

Deepak, the next post will be on using the Options calculator to calculate the Option Greeks.

Thanks Karthik. On delta neutral, quick question for you – suppose you sell 7800 straddle for combined premium of 300, when the spot was 7700. Now, instead of keeping it till expiry, can you suggest some delta neutral adjustments along the way especially when trade goes against so we get out of straddle position net positive? Nithin – your inputs will also be valuable. Thanks.

Vaib,

A straddle will be delta neutral as long as you initiate the position using ATM option. In the example you’ve quoted the position will not be delta neutral..since 7800CE is OTM, assume a delta of -0.4, and 7800PE is ITM, assume a delta of +0.7. Note, the algebraic sign indicates a short (+ve for Put, and -ve for Calls).

So the total delta adds to -0.4+0.7 = 0.3. Therefore in this position you are exposed to both directional, and volatility risk.

To negate the direction risk, you will have to ensure the delta becomes zero, and stays zero. There are many ways to do this, for example you can consider adding 2 short calls, and 1 short PE..that would make -(2*0.4) +0.7 = – 0.1…closest approximation 🙂

After making this adjustment, the position becomes delta neutral, and the direction no longer matters. As long as your call is right on Vega, you will surely make some profits.

Good luck.

Thanks Karthik. Sorry, I mean’t ATM straddle only. My point – let’s say we sell 7700 straddle for combined premium of 300 when spot was around 7700 only. BEP is 7400-8000. Now, spot comes to 7500, now what will you suggest – book 7700 call, sell 7300 call (since 7700 PE is going against with 200 points ITM)? This will become a short gut with 7700PE & 7300CE sold. I can hedge it like this but I fear of more one way down movement when the short gut range becomes more than combined premium eaten resulting into a loss. If you may guide on these kind of adjustments, would be helpful. Hope I make some sense 🙂

Dear Vaib,

Got your point. I’m going to elaborate a bit for the benefit of other readers..

When you initiate a straddle(both long and short), it is very clear the call is on volatility, and not on the direction of the market. .

When you short the straddle, it implies that you expect volatility to reduce. In other words, you plan to profit from a fall in volatility, and not from a directional movement. Now, in order to fully exploit this point of view, you need to ensure your position is always hedged to directional risk.

When you initiate the position by shorting ATM options, needless to say you are directionally hedged…but when market makes big move, you are no longer delta hedged. Quoting from your own example….

When you initiate the position when mkts are at 7700,

7700 CE delta= -0.5

7700 PE delta = +0.5

Position Delta = 0

However, when the markets falls to 7500 (a 200 point downward drift)..

7700 CE delta = – 0.1 (since its OTM)

7700 PE delta = +0.9 (since its ITM)

Position Delta = +0.8

Notice, with a delta of +0.8, the position is no longer delta neutral…which means along with the risk of volatility, you are also exposed to directional risk.

This also means whenever you initiate a delta neural position, it is neutral at THAT point in time…as and when the markets moves, the delta varies, and hence the position’s delta also varies. The trader has to continuously monitor the position;s delta and ensure they always add up to zero.

You suggested a short gut when markets fall to 7500, lets see how the deltas add up..

Spot = 7500

Short 7700 PE = delta of + 0.9 (as its ITM)

Short 7300 CE = delta of – 0.9 (as its OTM)

Total position delta = 0

(please note, I’ve just approximated the delta’s for ease of explanation)

Clearly, the position is delta neutral…and you can continue doing this, to ensure you are delta neutral. However, there are three things come to my mind..

1) Your costs increase as you pile on more number of trades

2) It would be very hard to terminate the positions anytime before expiry

3) Your estimate on volatility has to be accurate. If the Volatility does not cool off as expected, you may end up making a loss

For something like this to work in your favor, I’d suggest you initiate the position towards the 2nd half of the series. With this..

1) You will benefit from time decay

2) If you are right on volatility,then towards the 2nd half you will have an added advantage of decreasing volatility, and time (see the graph of Vol vs time in the previous article)

3) Premiums will be lower, but so would be the stress on position 🙂

Also, from my experience I can tell you that trades such as these are best done before events such as budget, quarterly results, corporate announcements etc. This is when volatility shoots up, and premiums swell.

Lastly, one of the best ways to play volatility is by initiating trades based on Volatility Arbitrage using dynamic delta hedging technique. I’d suggest you explore this as well.

This turned out to be a post within a post, but as long as it helps 🙂

Good luck.

Thanks Karthik for your comments. To your points –

1. Costs and # of trades will anyway increase in any kind of delta adjustment.

2. We may terminate positions before expiry if spot comes back in the range and we take the benefit of theta/vol.

3. Even if vol remains high, when we shift to adjustment leg, we will get higher premiums to short.

I was hoping if you could provide some adjustments in this straddle case or suggest what to do in case short gut leg range becomes more than combined premium eaten.

We may also want to avoid very frequent adjustments due to cost/complexity involved.

Thanks for your time and inputs.

Yup, costs and # trades are bound to go up. Elevated vols fetches you higher premium, agreed, but this is associated with elevated gamma levels.

As a rule of thumb, I’d personally prefer to keep option legs minimum, and also try to restrict layering up…for the simple reason that it gets too complex.

Anyway, if I were to trade short straddle (expecting the volatility to cool off) I would prefer to adjust the position with futures.

After I initiate a short straddle, I’d profit as long as the market drift is minimum, but more often than not, this is not the case.

Hence as an adjustment strategy, I’d short futures if the markets fall (because option delta turns positive)…and buy futures if markets starts to go up (because option delta turns negative).

Converting a straddle to a short gut is tricky, by doing so somewhere you are increasing the complexity of the whole situation.

I do remember you mentioning that you’d prefer not to touch the futures, but I personally think this is far more manageable than having to deal with multiple option legs.

I hope I’ve added some value…please do feel free to revert.

Thanks Karthik. Yes, your insights are very much helpful. I’ve never tried it on future but will test. Thanks again.

🙂 Thanks, and good luck.

Dear karthik

Thanks for nice and excellent explanation.Because of new to this option writing and Greeks segment, I am requesting you to please elaborate dynamic delta hedging technique.so that I can try practically

Thanks Subramanian. We will surely blog about the technique sometime soon.

Do zerodha have any strategy of showing greeks of options traded as it will help zerodha traders to make strategy

Providing greeks on the trading platform is indeed on our list of things to do and should be available in the not so distant future.

sir, i am using trend following method to trade in intraday nifty fut. instead of nifty fut i am thinking to trade nifty option to save stt and other costs. my system uses around 12 point stoploss and target till end of the day ( riding trend till it ends ).

around 32% trades are winner and 68% are lossers. so basically i am trading with small stoploss for big profits. which option should i trade, buying ITM or OTM or ATM option or should i go for short option. all my postions squareoff at end of the day. pure intraday.

Nilesh, check the table in the theta section from the article above. If you are trading intraday, clearly you are expecting the target to hit on the same day…it is always better you choose slightly OTM options.

hi nithin,

this is not related with subject. but i want to know ,if we have more than one accounts of a group with their consent , can we avail consolidated margin facility to trade in fno ?

No Ajay, not possible. What you will probably have to do is open a partnership/LLP firm, get everyone to invest money into the firm, open a trading account in the firms name and then trade of it.

Not related to the Post but related to Trading Question: How do i add BSE Script in the Market Watch as it allows to add only NSE Script (P.S.: My Account with Zerodha opened today only)?

Check this post, and 3rd image.

Thank you so much for the Prompt reply.

I am using the the HTML Trading Platform & Mobile (as Desktop Trading Platform is not supported with Windows 8.1). Click on the following Link to see the Problem:

https://www.dropbox.com/s/n3cpipng9inisjt/Untitled-1.jpg

It shows only NSE and not BSE.

Ankur, our desktop trading platform ZT works very well on Windows 8.1. Get in touch with us if you’re having trouble installing and using it.

About BSE not being enabled, we’ve made note of this and will make sure you have BSE available for tomorrow’s trading session.

Thank you so much for Prompt Reply.

thank you for this !!!! clear written and explained.

Thanks Karthik for useful information.

I have one query ”how the trade is profitable if delta is 0?”

Swapnil, sometimes the trader may just have an opinion on volatility instead of the direction of the market. For example you may think that the volatility is way too high, and therefore you anticipate the volatility to cool off. Under such a situation you just want to play volatility, and suppress the effect of the market direction. This means you will have to neutralize the delta to zero, and leave your option position exposed only to the variations of vega.

In fact this is what one does (knowingly or unknowingly) when one initiates a delta neutral strategy such as straddles and strangles.

Thanks karthik,

Is there any website which gives daily values for Implied volatility for nifty options for current and next series?

How to know that implied volatility will increase or decrease?

what are the factors affecting it?

Thanks,

Swapnil.

To get a sense about increasing or decreasing volatility one can use a tool called the ’Volatility Cone’. I know, Samoa Sky’s Options Oracle gives this information (it is a free tool). Need to check if they still support the Indian markets. If they do, they are quite good.

Hi I think this may be the wrong place to post my question, sorry for that.

Is there any plans for Zerodha to provide its own demat accounts instead of depending on third party. Is there any plans in the future for Zerodha owned demat accounts.

Yes Sridhar, it will probably take a bit for this.

Thank you very much for you reply Nithin. Other than the demat account opening I see zero issues with zerodha so I thought I a Zerodha owned demat could solve this. I talmost takes 15-30 days for a demat account to open with ILFS where as trade account opens in one day.

Looking forward for the zerodha owned demat account.

Iam a brand new user of kite. I assumed, unless we choose to square off an existing position, all orders by default are fresh positions which is not the case it seems atleast for f&o. If so shouldn’t there be an order type… Buy to open / Sell to open.

Hey Sreenivas, positions for the same scrip are netted off at the exchange itself. So, there’s no point in showing different positions for each order. If you wish to maintain separate positions, you’ll have to use MIS for one position and NRML for the other. The MIS position will be squared off at the end of the day though.