Invest in government bonds and sovereign gold bonds on Kite

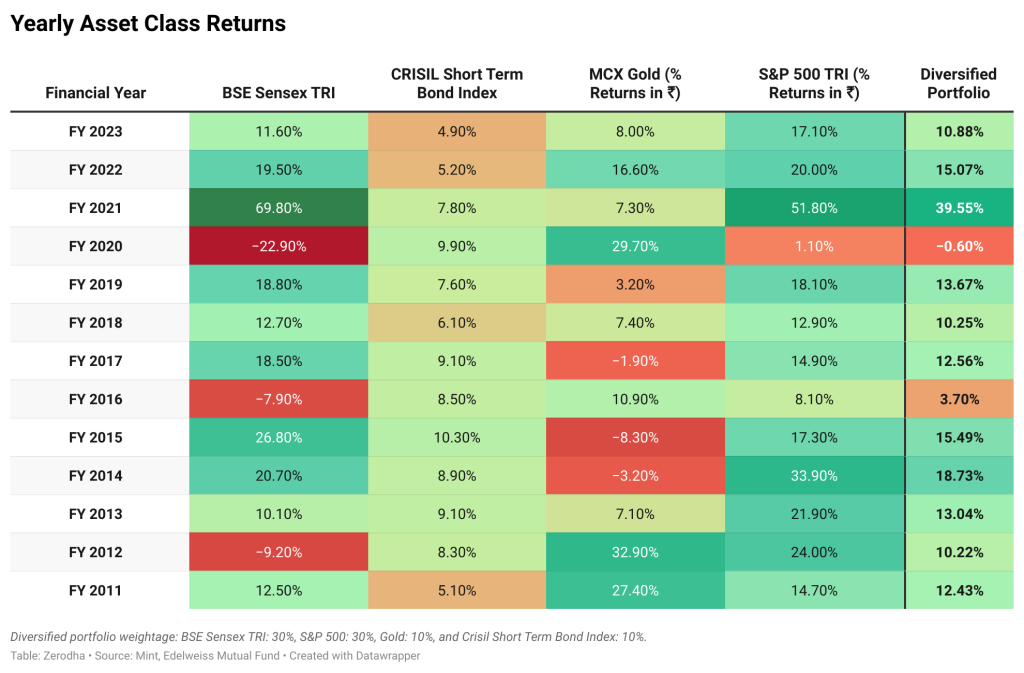

An ideal portfolio should have a mix of multiple asset classes like equity, debt, and gold. Diversification helps you reduce risk and behave better.

Everybody knows how to get equity exposure, either through stocks or equity mutual funds. But when it comes to debt, most people don’t know all the available options.

If you want debt exposure in your portfolio, government bonds are the safest option. Treasury bills (T-bills), GOI dated bonds (G-Secs), and State development loans (SDLs) were available for investment on Coin, but we have now moved them all to Kite. Click here to invest.

Treasury bills (T-bills)

T-bills are short-term debt instruments issued in maturities of 91 days, 182 days, and 364 days. They are ideal for short-term needs. Treasury bills don’t pay any interest. They are issued at a discount and redeemed at par. For example, a 91-day Tbill can be issued at Rs. 98, but you will receive Rs 100 when it matures. The difference of Rs. 2 is your return.

GoI dated bonds (G-Secs)

G-Secs are long-term bonds issued by the government. They are the safest type of debt instrument and are guaranteed by the government of India.

- G-Secs are issued in maturities ranging from 5 years to 40 years.

- They pay a fixed interest rate that is paid out every 6 months and credited to your bank account. The principal is paid upon maturity of the bond.

- There are no lock-ins for these securities. All G-Secs, SDLs, and T-bills are listed on the exchanges, but liquidity is an issue. So, ideally you should invest if you intend to hold these bonds till maturity.

- These bonds can also be pledged and are considered as cash equivalents.

State development loans (SDLs)

SDLs have all the same features as G-Secs. While G-Secs are issued by the RBI on behalf of the central government, SDLs are issued by state governments. A common question investors ask is if SDLs have the same government guarantee. Shaktikanta Das, the RBI governor, clarified in 2019 that state development loans have an “implicit sovereign guarantee.”

How to understand government security symbols?

Treasury bills (T-bills)

For T-bills, you will see a symbol like “91 Day T-bill.” This is self-explanatory.

G-secs

RBI reissues existing bonds and also issues new bonds periodically.

For reissued G-Secs, you will see symbols like 7.18% GS 2037.

7.18% is the interest rate or coupon. This interest is paid out twice a year, and you will receive this in your bank account.

GS refers to government security

2037 is the maturity year.

If a government bond is being issued for the first time, you will see a symbol like “NEW GS 2033.” The yield is unknown when a government bond is issued for the first time. RBI conducts an auction to discover the yield, and once it’s discovered, the bond will then be allotted to you at that yield. The interest rate and yield will be the same for a new bond. So, in the case of a new bond:

NEW GS refers to a newly issued G-Sec

2033 is the maturity year.

State development loans (SDLs)

The symbols of SDLs are similar to G-Secs. For example, “6.81% PB 2031” or GA SDL 2031

6.81% is the interest rate or coupon. This interest is paid out twice a year, and you will receive this in your bank account.

PB refers to the state issuing the bond. In this example, it’s Punjab.

2031 is that maturity year.

If a state government bond is issued for the first time, you will see a symbol like “GA SDL2033.” The yield is unknown when a state government bond is issued for the first time. RBI conducts an auction to discover the yield, and once it’s discovered, the bond will then be allotted to you at that yield. The interest rate and yield will be the same for a new bond. So, in the case of a new bond:

GA is the state (Gujarat) that is issuing the bond.

SDL is short for state development loan.

2031 is the maturity year.

Sovereign gold bonds (SGBs)

If you want to diversify your portfolio with gold, sovereign gold bonds are one of the best options. SGBs are issued by the RBI on behalf of the government of India.

Advantages of gold bonds:

- Issued and guaranteed by the government of India.

- 2.5% interest per year over and above gold’s market returns.

- All gold bonds have a maturity of 8 years, with the option of premature redemption after 5 years. Gold bonds are also listed on the stock exchanges, and you can exit them anytime.

- No expenses or brokerage on investments through primary issues. There’s no brokerage on SGBs bought in the secondary market, but exchange and SEBI charges will be applicable.

- No capital gains tax on bonds purchased during issue and held until maturity. Interest is taxed at your slab rate.

- If bonds are sold within 3 years, STCG will be applicable, and above 3 years, LTCG will apply.

- Here’s a comparison of SGBs vs. physical gold, digital gold, and gold funds.

Note: It’s unclear if bonds purchased in the secondary market and held for more than 3 years are eligible for capital gains exemption. We are trying to get clarity on this.

Government bonds order window timings

| Security | Day | Time |

| Treasury bills (T-bills) | Monday to Tuesday | 6 PM on Tuesday. |

| State development loans (SDLs) | Opens and closes on Monday | 6 PM on Monday. |

| GoI dates bonds (G-Secs) | Tuesday to Thursday | 8 PM on Thursday. |

Note: The dates may change due to trading holidays.

Learn more about government bonds on Varsity. You can keep track of all upcoming issues of government bonds and sovereign gold bonds on TradingQnA:

Issuance calendar for T-Bills.

How to invest in government bonds and sovereign gold bonds?

To invest in government bonds or SGBs on the Kite app, follow these steps:

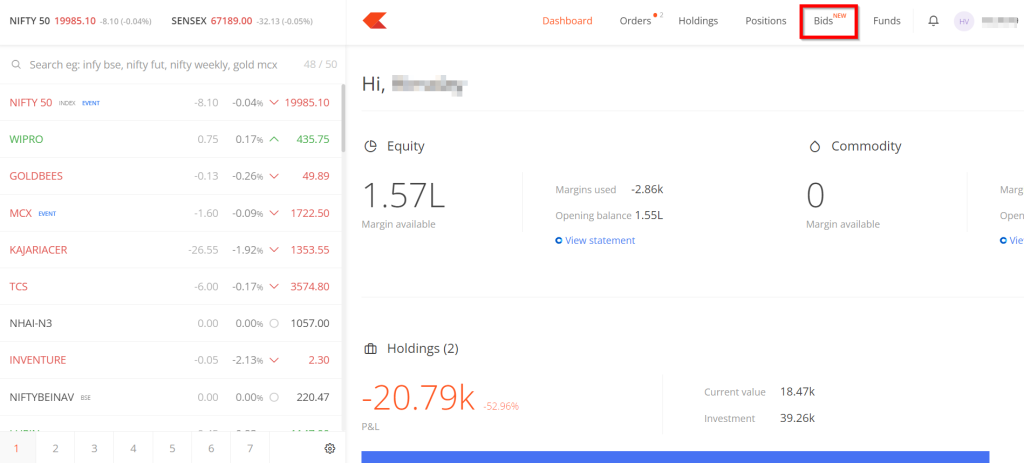

- Tap on Bids.

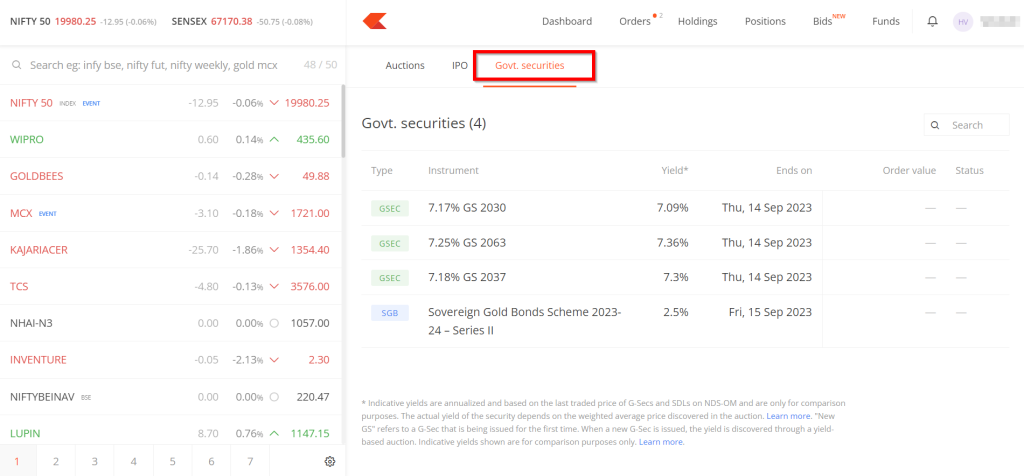

- Tap on Govt. Securities.

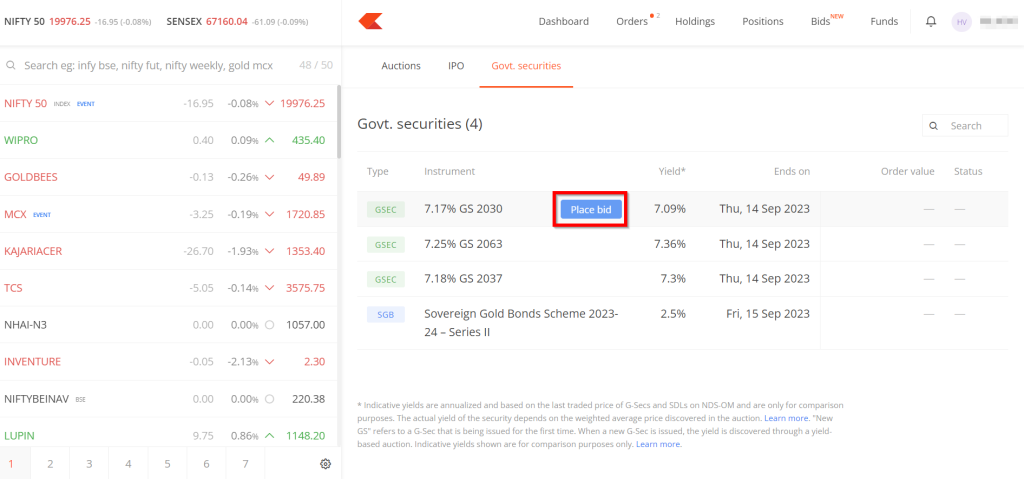

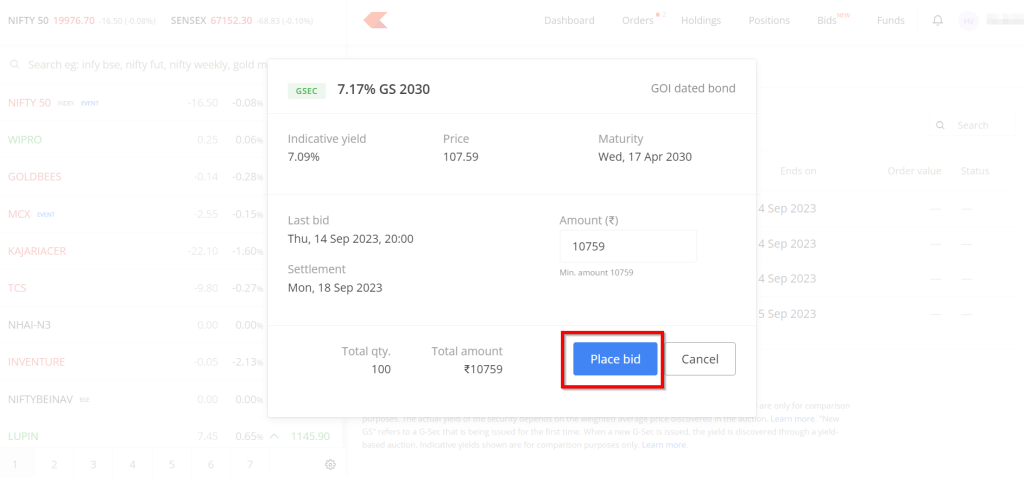

- Tap on the security you want to invest in and then on Place bid.

- Enter the amount or use the “+” and “-” buttons above the keyboard to adjust the amount

- Swipe to place the bid

To invest in government bonds or SGBs on Kite web, follow these steps:

- Login to kite.zerodha.com.

- Click on Bids.

- Click on Govt. securities.

- Click on Place bid.

- Enter the amount.

- Click on Place bid.

I always face issue in updating price for shares transferred from by other Dp to Zerodha. There were more than 5 tickets were raised. When clicked on fix this on console the relevant scrip was not showing even though it was showing in holding when clicked on all scrips the scrips are not listed alphabetically, Isincode was not displayed, there is no search button

Zerodha is least bothered to fix this bug. When today complained they are asking to send screenshot

Hi, I am an NRI an active user of Zerodha. Can I buy Sovereign gold bonds (SGBs) from the secondary market on the Zerodha Kite App?

My money was deducted for SDL order and now I have an email saying order was declined because BID REJECTED BY RBI, and my money will be refunded.

Can anyone explain, what happened and why?

I purchased SGB yesterday, but it still shows pending. Normally how long does it take to execute the order and reflect on my Demat account?

Hi Hanis, if you are buying from secondary market then SGBs will be credited to your demat account on T+1 day.

If you are investing in new issue of SGB, then the allotment and credit can take up to 15 days.

As per Zerodha website, 0.06% brokerage charge is waived on Government Bonds (G-Secs), Treasury Bills (T-Bills), Sovereign Green Bonds (SGrB), and State Development Loans (SDLs) from March 1, 2024. However, there will be other charges at the time of buying and selling on these securities. Please share information on it.

Thanks,

Bhavesh

Good day

Kindly advice how i can buy Bond, Name NTPC ltd & Edelweiss

Thank you Team Kite for publishing the Video. Couple of follow up questions.

1. Once the bid for SGB is placed, does it take the IPO route? i.e. I may or may not get the allotments? OR bids are final, subjected to availability of Funds?

2. Once the allotment is done, how do I receive the RBI issued certificates as proof SGB issued by RBI on my name?

3. Applying with Kite, would mean ”Online” application and will come with 50INR discount/Gram. Is that a right assumption?

Appreciate your efforts to revert on the above queries.

Hi Alec, the bids are final, subject to availability of funds.

2. Certificates for SGBs purchased through the demat (online) mode are not issued by the RBI anymore you can view them on Console holdings or CDSL Easi’s portal. More here.

3. Correct.

Where can I find the allotted bond details? Earlier I used to check them from coin portal but now, in kite, I can only find page where I can buy new bonds and no info related to existing allocated bonds.

Hi sir If I buy g sec or sdls after how many days I can sale in secondary market ie before maturity date once demat account credited or I want to wait some minimum time

When will sgb be credited in demat account as the settlement date was friday i.e. 23/02/2024.

It is not showing under my holdings.

Hi Utkarsh, the allotment dates are tentative and can change. Generally, it takes 10–15 days from the issue closure date for the SGBs to be credited to your demat account. You will get an email from CDSL once the SGBs are credited.

Hi, have received this message of Zerodha account being debited shortly for SGB. Can anyone clearly specify it would be from the Equity fund account right?

Yes, Karan. The funds will be debited from available funds in the equity segment.

Will I get 2.5 interest if I buy SGB from Zerodha?

Hi Jayaseelan, yes, you will. More here.

After making Bid in Kite, what is the process? Do I have to credit my kite wallet with the required amount?

Hi Ram, funds will be debited from the Zerodha account on the last day of the order collection window. Please ensure to keep sufficient funds in your trading account. More here.

If someone being option seller wish to make investment among these bonds, which type of bonds qualifies for security Pledge for margin for Option Trading.

Hi Bijendar, G-Secs and T-Bills with maturity of 365 days can be pledged for collateral margin. You can check the list of all the approved securities here.

Can you please confirm if I have to keep 61.5k rps in Zerodha in order to place the bid. If the bid is placed and approved, but if I don’t want to buy the bonds then in that case how it works?

Where to check/modify the bid placed for sgb

I have placed bid for the SGB.

The funds have to be kept in the equity account or commodity account?

I have placed bid. When am I required to pay. Will payment be made through my trading account or from my saving account

HI,

I have placed bid for the SGB. However I was not asked to keep fund in the account.

I want to know below..

1) Will my Bid get rejected as there is no fund in acocunt?

2) Will I be send any notification to add funds once allocation is made or BID goes through?

3) OR anything else..

I dont want to miss the opportunity to invest in this..

appreciate your guidance

While placing bid for SGB, from where the amount will be debited? Trading account or linked bank account?

Hi Mamata, funds are debited from the available cash in your Zerodha account on the last day of the issue. Credit from stocks sold on the closing day of the issue will not be considered towards the purchase of the ETFs.

I purchased SBG last year, and we are supposed to get 2.5% yearly. where will the amount will be credited in my saving account or zerodha account and how can I verify it?

Hi Sushil, the interest is paid once every six months to your registered bank account (bank account mapped to demat account. Could you check your bank statement for the SGB credit, it would be a NEFT transfer from Central Depository.

If I place the bids for SGB, when and from where tge amoynt will be debited?

From zerodha funds? Do I need to maintain the sufficient balance?

Hi Chirag, funds are debited from the available cash in your Zerodha account on the last day of the issue.Credit from stocks sold on the closing day of the issue will not be considered towards the purchase of the ETFs.

I have the same question

”I have placed the bid for SGB and it even showed as “Placed” however later i realised that there wan no enough funds in my account, how is it possible to place a bid if there is no enough balance in the account, please clarify?”

And when the money will be ducted so that we have sufficient funds.

Hi Nagesh, bids will be placed since funds are debited from the trading account only on the last day of the issue for Sovereign Gold Bonds (SGB) orders. The order is rejected if sufficient funds are not available. This has been explained here.

Hi, Funds need to be added under Equity or Commodity, for Sovereign Gold Bonds?

Hi there,

Please advise if the funds for Sovereign Gold Bonds need to be added to Equity, and if there is an additional approval that has to be provided before the funds can be used to complete the purchase?

Hi, funds are debited from the available cash in your Zerodha account on the last day of the issue.Credit from stocks sold on the closing day of the issue will not be considered towards the purchase of the ETFs. You can add funds to your equity segment.

Hi Mahesh, under equity.

I have placed the bid for SGB and it even showed as ”Placed” however later i realised that there wan no enough funds in my account, how is it possible to place a bid if there is no enough balance in the account, please clarify?

how do I pay for the bid i place for the gold bonds? Will it be deducted from my balance or would that be an UPI payment (approval request sent to me)?

Hi Vivek, funds are debited from the Zerodha account on the last day of the issue. More here.

What are the tax rate

Hi Pramesh, we’ve explained this here: https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/govt-securities/articles/gsecs-taxes

What are the tax rates for g sec, sdl, and t bills

I Really don’t know how to invest in these please guide me..

Pl mention the name of bonds&how I can purchase the bonds on mobile app

Pati

Sir. Meri I’d par KRA KI problem mere se solve nahi ho rahi hai

Es problem ka aap hi sudar kare

DHANYAD

📊

Hi Balaram, we’re sorry to hear this. Please create a ticket at support.zerodha.com so we can have this resolved at the earliest.

What about ”RBI Floating Rate savings bond, 2020”? Currently this can be purchased thru RBIDirect portal. Can this be purchased thru Zerodha?

no

Good app tqq u so much

Ok

How I can grow

How profit is taxed

Hi Sujal, we’ve explained the applicable taxes here.

How profit is taxed

Hi, we’ve explained the applicable taxes here.

Does everyone who bids gets allotted the bonds?? Or if there’s a hierarchy, what is it based on?? Just luck or the amount invested…

Hi Vishal, securities are issued for limited amounts, so there is no guarantee of allotment if the number of bids received is higher than the issue size. However, if the allotment is not received, attempts can be made at the next auction. RBI carries out multiple issues a month.

Why can we edit the bud price for the t-Bills?

If i want to buy at a discounted price only

Hi Avinash, orders can be edited before the bid close date. https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/govt-securities/articles/edit-delete-gsec-order

T-bills are issued at a discount price only. More here.

How to inverse. Demo please

ok

How to invest in government bonds.

Hi, we’ve explained this here

Hi try account UPI I’d fail

Bank which

🙏👍

Not understand

👍🙏

👍

All the best

Hi Jayesh, liquidity is an issue only if you wish to sell the SGBs in the secondary market. If you hold till maturity, the liquidity doesn’t matter and the amount will be directly credited to your primary bank account.

KYC update

Hi if I buy SGB from secondary market and hold till its maturity will it be taxable.

Suppose I buy SGB of Dec’28 maturity in Dec 23 and hold till Dec’28 is it taxable

Hi Shyam, if held until maturity, i.e., 8 years, there is no capital gains tax. More on SGB taxation here.

What if there is no liquidity to sell off the SGB bond, will I be impacted?

Or would it be auto credited directly onto my account at the time of

Maturity? Please clarify both scenarios!

Hi Jayesh, liquidity is an issue only if you wish to sell the SGBs in the secondary market. If you hold till maturity, the liquidity doesn’t matter and the amount will be directly credited to your primary bank account.

Hi sir

I purchased SGB units of series SGBSEP31II-GB. They are appearing in console. I want to pledge them for margin. But these bonds are not there in the approved list of securities along with other SGBS. What could be the reason? Will they be added in future? How do I know if they are added to approved list?

Hi Rajendra, the list of securities available for pledging is decided by the Clearing Corporation (CC). You will be able to pledge the newly issued SGB when it’s approved by the CC. You can check the list of all the approved securities here.

I purchased 26 units of SGB on Friday 13 Oct (yesterday) from Secondary market but on today 14 Oct these units are not visible in my holdings. When I can see these units in my holding?

Hi Pankaj, could you please create a ticket on: https://support.zerodha.com with details of the issue, so we can have this resolved at the earliest?

I have also bought SGB Series September. I received a email on 28th Sept from CDSL that units are credited to your account. Can you tell where to see on console? I am not able to find units allotment anywhere.

Hi Shubham, the newly issued tranche of SGB is yet to be listed on the exchanges. Once listed, it will show in your holdings on Kite. Until then you can check it on Console holdings under ISIN: IN0020230093.

How can I set up a notification when a sovereign gold bond becomes available?

Most of the times I am pretty late when the bond becomes available.

Hi Bharath, this is currently not possible. You can however, check the SGB issuance calendar here.

Hi i hHi i have bought SGB through zerodha on SEP 15 ,2023 ,Now its been more that 15 days and i got the mail from CDSL and investment is started to appear on portfolio but it is showing only qty but not showing invested amount and price variation or P&L .Also it does not appear inside holdings of kite app or coin app.What should i do?

Hi Akshay, the SGBs are credited to your account. Once listed on the secondary market, you will be able to see them under Kite holdings and the price details will be update automatically. Until then, you should be able to see the units only on http://console.zerodha.com. The listing date is currently not known, it usually takes 10-15 days from the date of issuance for the SGB’s to list on Exchanges.

I have also bought SGB Series September. I received a email on 28th Sept from CDSL that units are credited to your account. Can you tell where to see on console? I am not able to find units allotment anywhere.

I have purchased SGB through icici bank account with Zharodha demate I’d. The money is deducted on 20 Sept. Where will my show in my portfolio.

Hi Rajesh, the SGB will show in your holdings on Kite once it is listed on the exchanges. The listing date is not know yet.

Hi,

I’ve purchased the sovereign gold bond thru Zerodha. Its been processed and money got debited from zerodha account. But I could not see the processed bonds. Suggest me how Can I find it. Thanks

HI Prasanna, the allotment dates are tentative and can change. Generally it takes 10–15 days from the issue closure date for SGBs to get credited to your demat account. You will, however, get an email from CDSL once the SGBs are credited

¶

I have applied for SGB II . The status is showing ”PROCESSED”.

Then how do I check in my dmat account.

Hi, the allotment dates are tentative and can change. Generally it takes 10–15 days from the issue closure date for SGBs to get credited to your demat account. You will, however, get an email from CDSL once the SGBs are credited

I had invested in SGB and DP ID & Client ID was given of my Zerodha, purchase was done on 11-09-2023 but I am not able to check in zerodha about allotment of SGB. Zerodha statement also not showing details of holding SGB. How i can check and track my allotment and where in Zerodha ID.

HI Piyush, the allotment dates are tentative and can change. Generally it takes 10–15 days from the issue closure date for SGBs to get credited to your demat account. You will, however, get an email from CDSL once the SGBs are credited

activat nhi ho rha ha

Has interest been credited for SGBs, this year(2023) I’m unable to see it in bank account, usually by june -july I used to get it.

Hi, if you are not getting interest payment for SGBs, you can write to CDSL & NSDL who act as RTAs. You can write to CDSL from here and NSDL here.

The interest is paid out every 6 months from the date of issue of the bond. The date of issue can be found here.

Can NRIs invest in Sovereign Gold Bonds? I have NRO non PIS account with zerodha.

What action needs to be taken after placing the bid? How will I make the payment? Will it be deducted from the funds or will I have an option to make the payment through UPI?

Iam starting investment ment today

I hv purchased 10 gm sgb today. Still want to purchase more gms with new order. What to do? Pl suggest.

For SGB order throught zerodha.

Money will be deducted from funds in zerodha, or from my bank account?

I have a similar question. I have placed a bid. Now where should I deposit the money? In zerodha account?

Yes, Pankaj. You have to maintain funds in your Zerodha account.

From your Zerodha account, Arun.

I have already placed an order in coin site for Sep SGB. Do in need to cancel the order in coin app and place the same in kite app or order placed o. Cpi. Is enough ?

No Ravi. You don’t have to cancel the order placed on Coin. For now you can place an order on Coin as well.

SGB Bid is placed, how the amount will be debited from my account or i need to keep the amount in Zerodha funds within my account?

Hi Hemant, you need to have sufficient funds in your trading account.

I have placed SGB bid first than added amount to kite account.

Will that be a issue for payment for the bid?

No, Hemlata.

How will be the payment for SGB bid? Will it be debited from Fund balance in zerodha or directly from Bank account?

Hi Rijesh, the funds will be debited from your trading account.

Trading account means Zerodha – Kite funds or bank account?

Please clarify

Kite funds, Indra.

I want to invest in SGB Sept 23 issue. But I find the process of applying in Kite very very cumbersome. Still unable to make out how to do. Why can’t you have a single app for all kinds of investments

Hi Rangrajan, sorry to hear this. Could you please elaborate on the difficulties you seem to have faced?

Hi, Is there any charges on SGB if we purchase on new bond and sell during maturity? As Banks are also offering the sale of SGB. Please explain the difference between Bank vs Zerodha buying,

There are no charges for investing in new issues of SGBs on Kit, Ashish.

Hello,

I have placed big for SGB today and have transferred the bid amount to the zerodha demat account. How do I get know if the bid is placed and amount is debited.

Hi Amogh, the order will be processed on the issue closing date, you can check this on the order window. Once the order is processed you will get an email on the registered email ID.

Hi

Recently I saw a bond 1018GS2026 , It traded at 130/-. My doubt is…as the GSec earns only 10.18, even if accumulated interest is also worked out…why it sells at so high a price of 130 ?…Can you enlighten me on the logic behind this ?

Hi , I have placed the bid for SGB, but there is no confirmation email and I can’t check the status on Kite mobile , can the system be updated to send a confirmation of bid placed or make the bid available to see in Kite mobile ? Thanks

Hi team

how do I buy T-bills through zerodha platform? please give me he steps or link

thank you

sree

is it possible to buy RBI Floating rates bonds too through Zerodha? if so could you please share the link.

Hi, I have placed bid for SGB. For executing the order on last day, total available margin (Cash +

Collateral) will be considered. Right? Means both cash plus non cash both will be considered?

Will I be able to see the amount of coupon that I will receive every year?…is there a table or something like that.

how to invest in SGB .

If price of gold had fallen by maturity date, will I incur loss on redemption (excluding interest rate payment)?

Hi,

What is the amount to be filled in SGB. For example it shows 5873 today?. Is that for 1 unit. If i need to buy say 2 units then should i type 11746/- . Same way for govt securities. also i saw it auto corrects the amount even if i type amount in excess . say i type 12000/- it corrects to 11746/-. Please change the GUI like normal buy and sell instead , by typing the qty but in multiples.

Thanks

The rate is fixed , you can only change the quantity and amount will be auto calculated!

Hi Rajesh, the minimum investment amount is fixed and you need to place bids in multiples of this. You can enter your desired amount and it’ll automatically get rounded off to the nearest quantity.

Also, we’ll note down your feedback and check if we can provide an option to enter the quantity.

Is it possible to buy via kite app

Hi Senthilkumar, government bonds and sovereign gold bonds are currently available on Kite web and will soon be available on Kite mobile.

The required money should be in the Demat account or Bank account for SGB and for G Secs ?

Yes, Ashutosh. You need to maintain sufficient funds in your trading account.

I am not getting 2.5%interest on SGB in my bank account.What should be done and where to check

Even I’m not getting the interest to my bank account. Not getting message notification as well. Please help on where and how to check.

I have placed the bid in SGB. When this bid amount will be deducted ? Amount will be deducted from directly from bank account or fund should be available on Zerodha ?

Hi Suresh, the funds will be deducted on the issue closing date (September 15, 2023) from your trading account.

Please avail it in kite app

Will be available soon, Dillip.

Do you provide loan against bond? if so what is the interest rate tenure and the process. How do I repay only Interest like OD or we repay in EMI principal + interest. Are there any preclosure and AMC charges?

Hi Asha, check out the approved list of securities that can be pledged as collateral to avail a loan. We don’t provide loan against bonds.

Can you clarify on how much time it will take to pledge G Sec or SGB bought during issue.

Hi Mahesh, G-Secs and SGBs can be pledged once they are credited to your demat account and listed on the exchanges. G-Secs are alloted in T+2 working days after the auction on Friday. For SGBs it can take 15 days from the issue closure date.

When will CORPORATE BONDS be available on zerodha? Since a long time on coin it says coming soon

We’re working on it, Abhay. We’ll keep you posted.

What are the charges that are incurred if we buy the treasury bills or Gsec from secondary market ?

Hi Ravi, The brokerage for buying and selling on the exchanges is 0. However, charges like STT, Exchange Transaction Charge, Stamp Duty, etc. will be applicable. You can check list of all charges here: https://zerodha.com/charges/#tab-equities

After placing bid for SGB in primary market .Do I need to keep funds ready in kite?

Is it true that the SGB order will be cancelled automatically if I don’t have the funds available in kite app on the last date?

Hi Ritesh, you will have to maintain sufficient funds in your trading account on issue closing day else the order will be rejected.

I’ve placed order for SGB in September issue but have kept the amount required in the bank account. Do I need to shift it to Zerodha kite for successfully bidding.

Hi Kumari, you need to transfer the amount to your Zerodha account. If sufficient funds aren’t there in your account on the issue closing date (September 15, 2023), the order will be rejected.

Hi should we add funds to ’equity’ or ’commodity’?

so g-secs will be stopped on coin ? or will continue there also?

Hi Sanket, G-Secs will be stopped on Coin.

> 5. No capital gains on bonds purchased during issue and held until maturity. Interest is taxed at your slab rate.

you mean ”no capital gain tax” right? Cause, as per my understanding, capital gain/loss will be there depending on price at what you purchased SGB 8 years ago and price at what you are selling now.

Yes, Sanket. It is capital gains tax. Fixed the typo.

Do i keep the funds in equity?

Yes, Nikita.

It will be better if you can share a video showing all the procedure.

NO

Yes I’m thinking about it.

Aj 91D-t bills chi issue value kay chalu ahe sangu sktat ka

1 why sdl are not allowed for collateral ?

2. why some g secs in allowed list of clearing corp are not in your list ?

3. when list of gsec issue dates after sept 2023 will be available ?

When will we receive the Interest? How do we get to know which bond has what plan of payouts?

Hi Ashutosh, interest is credited every six months from issue dated. You can check interest payment dates for G-Secs here: https://tradingqna.com/t/interest-payment-dates-for-government-bonds-g-sec/144912

And SGBs here: https://tradingqna.com/t/interest-payment-dates-for-sovereign-gold-bonds-sgbs/145120

What is the meaning of bid here and how it effects. Meaning the indicative yield shows 7.36% and the price is 105.35. Does it means the effective return value is 100 and the 5.35 is the premium of the bid and on maturity we get the price 107.36. Please clarify and elaborate. Also the maturity date is missing in the government bonds please indicate the date of maturity also on the portal.

Hi Nishant, 7.18% is the interest rate or coupon. This interest is paid out twice a year, and you will receive this in your bank account. The interest is paid on the face value, in this case, Rs. 100. 105.35 is the price of the bond, it is the estimated weighted average rate of all allotments to competitive bidders + accrued interest + markup value (difference between the lowest and highest bid). More here.

The maturity date of the bond is shown on the order window itself along with indicative yield and price.

if i buy through zaro. where i can see my investements/

Hi Ravi, once the bonds are credited to your demat account and listed on the exchnages, these will show in your holdings on Kite and Console.

Hi Shubham,

I am not yet able to see them for Sept’23 Tranche. Please check.

Hi,

What are the tax rates for g secs and sdls and treasury bills?

Hi Uma, we’ve explained this here.

It will be better if you can share a video showing all the procedure.

Please give us the link to proceed further. And also expecting the answers to the questions asked, like minimum amount and minimum holding time and also how to sell?

Hi Shankar, you can invest in government bonds here. The minimum amount required in mentioned on the order window itself. There is no lock-in period. The G-Secs and SGBs are listed on the exchange. So you can sell them on the exchange just like stocks. However, on the exchange the liquidity is low. So, ideally you should invest if you intend to hold these bonds till maturity.

For SGBs, there is option of premature redemption after 5 years. You can check the process for this here

If I buy through Zerodha, where can I see my investments in Govt bonds in Zerodha?

what will happen to SGB principal at MATURITY will it be deposited back in my zerodha account or i will be issued physical gold ??

Hi Neha, upon maturity the amount will be credited directly to your bank account. The redemption price is determined by the simple average of closing price of gold of 999 purity of previous 3 business days from the date of repayment. More here.

At the time of maturity ,the gold rate available at that time will be directly credited to your bank account directly.

Say you purchase @5000 & at the time of maturity you get @7000(say gold rate at that time)

Hi Ravindra, once the bonds are credited to your demat account and listed on the exchnages, these will show in your holdings on Kite and Console.

I can see my SGB order has been processed but can not see them anywhere in the portal.

Where can I see it allocated to me and sell (if required)?

I am facing the same issue if not able to check on the SGB bonds which i already purchased

I m facing same problem. After buying sgb-iii series I m unable to see in my zerodha account.

How to sell, what are the limits of minimum hold or there is lock in time?

Hi Ghanshyam, the G-Secs and SGBs are listed on the exchange. So you can sell them on the exchange just like stocks. However, on the exchange the liquidity is low. So, ideally you should invest if you intend to hold these bonds till maturity.

For SGBs, there is option of premature redemption after 5 years. You can check the process for this here.

Can l cancel my order