Introducing 20 depth or level 3 data on Kite

Hindi: इस पोस्ट को हिंदी में पढ़ने के लिए यहाँ क्लिक करें।

Over the many years trading and interacting with traders, I have constantly heard complaints that institutions have a big edge over retail traders due to lower trading costs, better platforms, and access to level 3 data. With our technology, and with our partner startups through the Rainmatter initiative, we have not only bridged this gap but have given retail traders an edge over institutions with better products and pricing. In the same spirit of democratisation, I am super excited to let you all know that we are now ready to give you all access to level 3 or 20 depth market data for the first time in India, probably the world.

What is level 3 or 20 depth?

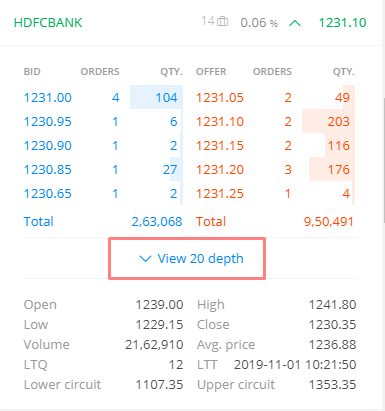

Normally when you check the market depth for any scrip, you see the best 5 bids and offers, this is also called level 2 data.

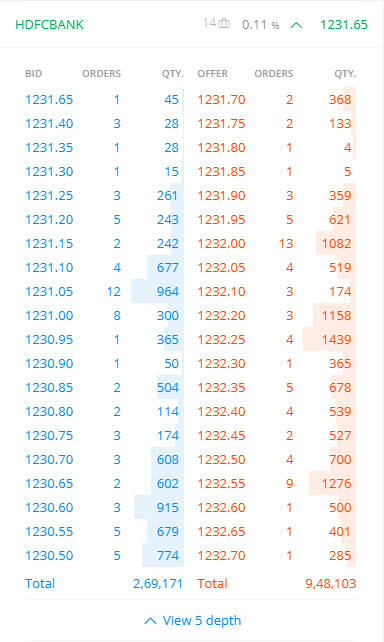

Level 3 or 20 depth is the market depth with 20 bids and offers.

How are we bringing this to you?

The normal data feed that you see on the trading platforms is provided to the brokerage firm by the exchange which is then streamed to the clients. The default is 5 market depth which typically updates up to 3 times a second. We are fortunate that Indian exchanges give data feed for free for trading clients of their members unlike in developed markets where end clients have to pay for it.

Many exchanges also have premium data feed called Tick by Tick (TBT). As the name suggests, this data stream gives you every single change in the price of bid/ask and all trades on a scrip. This data stream as you would imagine needs exponentially more bandwidth to stream out of the exchanges, which is not technologically feasible. So exchanges have created a space within their premises (called the “colo” for colocation) where they share this data feed with participants who lease servers. Being in the colo also means faster updates on the data feed. Until now, large institutions, brokerage firms who trade high-frequency arbitrage, market making and other such latency-sensitive strategies using algorithms were the ones consuming this data feed.

Our new system sits within the exchange colo and consumes large volumes of real-time TBT data, converts it into 20 depth for retail consumption, compresses the data, streams it to our data center over a dedicated leased line, from where it is streamed to Kite to our users.

How is this useful?

This adds significant value to active traders or those who intend to trade large quantities by giving them insights that is not available on the standard, limited market depth view. Knowing where the most number of bids and asks are placed incrementally across 20 depths as compared to 5 can be a trading edge. Access to 20 depth can also help reduce impact costs on large orders. And of course, level 3 feeds tick faster and deliver more quotes.

Check this example of Yes Bank 70 Calls when the stock moved 30% and trading activity spiked. With 20 depth you can see the demand and supply almost across the entire price range of the calls. You can not only figure where potentially there could be support and resistance on the price due to higher bids/asks, but also get an estimate of the price at which your larger orders could get executed.

Check out this chapter on Varsity where Karthik explains how to use the 20-depth to your benefit.

How do I access it?

For the beta launch, we are opening this up only to our active trading clients; those who have generated over Rs 100 in brokerage in the last 4 weeks. We will keep updating this list every 3 days and expand the beta program. 20 depth is now available for everyone by default. In addition, it is only available for NSE scrips (Stocks, and F&O). As you can imagine, this system is technologically complex and resource and bandwidth-intensive for us, and hence will be a part of our upcoming bundle of premium features. For now, it’s available as a free preview.

While we’ve been building tools and features to help our users with an edge when trading, we have also been working on building a system that actively aids traders do smarter risk management and build discipline. Stay tuned.

Happy Trading,

can we get 20 market depth through websocket for algo trading

HI,

Where can we get Time and sales data on the screen. can you pl provide some insights on this…

Regards

Hello Shruthi,

Is the time and sales data( aggressive market buy hits on ASK and aggressive market sell hits on BID) offered in websocket streaming? Again, not the pending limit orders but orders that were actually hit on BID and ASK.

Nowadays the 20 market is showing only on nse stocks it does not showing for the F&O stocks and index strikes..Please help me to fix this and get this..

Hi Rajesh, we’re having this checked. Please refer to the 5 depth for now. We’re sorry for the inconvenience.

Is Level 3 data now available for option contracts?

Hi Gurjyot, this is on our list of things to do. We’re working on it and will keep you posted. However, cannot provide a timeline at this moment.

Can Zerodha provides API for market depth data ? 20depths or 5 depths ?

Hiii

Is 20 bid & ask available for f&O contracts???

Hi Vinay, not yet. There seems to be an issue with 20 depth for some FNO contracts, which has already been reported. In the meantime, please refer to the 5 depth.

What is”total “ in market depth ?

Hi Sunil, it is the actual total quantity of all the bids under the bids section and all the offers in the offers section. We however show the best of 5 and 20 in the depth.

20 Market depth is neither available in BankNifty options and nor in HDFC bank options. What’s the issue?

Hi Harsh, there is a known issue with 20 depth for some scrips. We’re working on fixing it. Please check the 5 depth for now. We’re sorry for the inconvenience.

Sir in futures and options 20 market depth is currently unavailable since last 2 months for all contracts, and it’s been very difficult to trade in fno without it. i tried raising ticket but they closed it by saying we are working on it ,and only few are facing this problem. its been 2 months please help. raising ticket is not helping here.

Hi Manohar, there seems to be an issue with 20 depth for some F&O contracts. We’re working on fixing it. Please refer to the 5 depth for now. We’re sorry for the inconvenience.

Hi Zerodha Team,

Seems 20 depth does not work at all since long.

Hope you must be aware of by this time

Chill

Hi Subhash, there seems to be an issue with 20 depth for some scrips. We’re working on fixing this. Please check the 5 depth for now. We’re sorry for the inconvenience.

This feature isn’t working. Has this been gone ?

Hey, there seems to be an issue with 20 depth for some scrips. We’re having this checked. Please refer to the 5 depth for now.

hi ,

Great work. Just wondering what logic/math is being used to fetch Market depth data say for particular time interval, if I look for best 5 bids and best 5 offers , on what basis system identifies and read those?

If this is available also in CDS AND MCS EXCHANGE WILL BE GREAT.BUT IT IS NOT THERE

Hey Karthikeyan, this is on our list of things to do. We’ll keep you posted on it 🙂

How to enable 20 market depth data for currency trading

Mr. Nithin,

Market depth 20 is a great feature and is really helpful. Can you also add features like time and sale like just price, qty & time . It would be very helpful to track the volatility

Also exchange along with it would be great, or just LTP, LTQ, time like HH:MM:SS WOULD be very helpful

Also exchange along with it would be great, or just LTP, LTQ, HH:MM:SS WOULD be very helpful

Dear Sir, but top 20 ask bid qty still not available in kite connect API, please look into it. thanks.

Hi Sir,

I was thinking if prints could be added to 20 depth.it would give better insight to the trader.Kinly let me know if prints could be added to the level 3 data.

Krishna

Prints show the buy orders and sell orders executed in a separate window.If bid orders are repeatedly printing with lower prices the stock price is coming down and vice versa.I think foreign brokerages show the trades executed in a separate window.Also called time and sales if i am not mistaken.

This feature is not working anymore.

IAM not able banknifty please return my money kindly confirm for the same. UL 2061

I can’t sell my bank nifty options and lost my money zerodha please return my money

Sir, Reduce the margin of crude oil to Rs.3500/- and natural gas to Rs.3500/- per lot.

We find it difficult to trade on commodities.

Also bring 20 depth in commodities also.

thanks.

Bid to ask spread is still showing abnormally high spreads as usual. Cant trade when we dont know what price we can get. It’s not just bank nifty, even individual stocks showing similar phenomena. Please ket us know what’s going on

Dear All,

i am not able to sell bank nifty, Please return my money.

Kindly confirm for the same.

Regards

Ravi

I am not able to sell my bank nifty lot..

I am now stuck with my orders. Zerodha please help.I am not able to sell my bank nifty lot..

there is issue is selling the trade . not even being sold using SL or Limit.

Such things with zerodha ,unexpected.

Sl orders are not working in zerodha… Sometimes they do but many times they dont. Please stay away from zerodha…

GOOD JOB

Hi,

I am facing issue while sell bank-nifty lot, after keep limit order having also issue to execute.

Good,,, this is on our list of things to do.

Good

Good option

GOOD

testhello

”>s{{7*7}}’s

It is good, is it available for MCX or not.

As I trade in MCX. After my working hrs.

Is there any chance to Increase working time of NSE like MCX till 11.55 in future.

Hey Niraj, this is on our list of things to do, but will take time. As for market timings being extended, this is solely based on the exchange’s decision.

What’s the plan for providing tick by tick data? As well as, can you provide export chart functionality from Kite?

Hey Ravi, streaming tick-by-tick data over the internet isn’t really technically feasible, so this isn’t going to happen any time soon.

why its not feasible? just store them in your server, send slowly as receiver receives it. you dont need to send to the client instantly.. few second delay is fine but he should be receiving the all trades(all ticks) in that second.

There are MILLIONS of ticks per second. Even if we store them on our servers, streaming them could take a lot longer than you think! Especially in India, where the internet infrastructure isn’t great. We would rather provide fewer, but more realtime data to our customers than all ticks that are significantly delayed.

This 20 depth data not be shown to my kite app why this happens

Hey Raghunath, we’ve enabled 20 depth for all our users on the mobile app as well as the web. Please ensure you have the latest version of the app to see it.

Nitin Sir, pls remove or reduce API cost for robo trades, as many brokers are nowadays giving free of cost.

Then use the free one bro!

Pls add the CPR pivots like Trading view..

Please add this feature for the currency derivatives segment as well.

Yes Nishant, this is on our list of things to do.

It’s extra guide lines for quick decision making

Thank you

no use from this we can’t see real supply and demand in level 2 level 3 … why dont you guys provide level 1 data

You can get it by setting up colo servers at the exchange for which it will cost 18 lakhs+/annum.

I hope that will be useful for you.

How about Commodity? Do we have this feature?

Not yet, but it’s on our list of things to do.

Thanks Nithin,

I noted the same today morning in Auropharma. Thanks for the service…

Thanks A Lot to Zerodha Team for such Wonderful feature. Moreover, Zerodha is only platform where such feature is available.

Nice Job !!

Great. Much needed.

Could you also provide upper circuit and lower circuit values on pop-out graph page like you alwasys show when someone see market depth.

for eg on https://kite.zerodha.com/chart/ext/ciq/NSE/JKPAPER/3036161

if you click that lighting sign icon and market depth page doesnt have lower and upper circuit information. please correct.

Thank you for pointing this out. We’ll look into this and add the fields.

Great now we are seeing at level 3 data, my question is can we see how many contract are traded at a particular price , just how jigsaw displays it.

Thanks

Hey Rahul, you can use the volume indicator on the charts for this.

I hope this is the correct place to post this? wrt the OPTIONS dropdown on Kite-3, can the ADD and EXIT buttons be separated with some other functions? Second time now that an ADD became EXIT (small orders . . .) because of the fact that the buttons are right next to each other. Thanks.

Hi, when this feature can be made available on zerodha pi.

Hey Ashish, the 20-depth feature will only be available on Kite.

Gr8.. When this feature will be available for MCX commodities??

Not able to view 20 market depth, I have generated more than 100 Rs. brokerage in last 4 weeks

Hey Deepak. We update the list once every 3 days, as stated in the post above. You’ll get access soon. 🙂

i dont see view 20 market depth

Hey Vinod, this feature is currently only available to clients who have generated more than Rs. 100 in brokerage in the last 4 weeks, as the above post says. If you have recently crosse this threshold, you will start seeing the 20-depth soon.

Sorry I’m posting a message unrelated to the 20 mkt depth.

This is very simple request, which I have put forward several times over mail/phone with no positive solution.

I use ADX/DMI family of indicators a lot. My simple request is that in Pi charts the colour of DI Minus should be Red. The Di Plus is Green already, which is correct. Only DI Minus in your system is in Blue instead of Red. There is no provision to change the colour too. In the mobile Kite you have given the correct colours (Red for DI – and Green DI+).

This change of DI minus into Red would save me lot of time. I trade only in commodities and currencies.

Thanks for your time.

Very good feature and quite helpful at times, thanks to Zerodha team.

I have generated more than 100 Rs. brokerage in last 4 weeks, still unable to view level 3 data on kite web/app. How can I be able to view this?

Hey Pranay, you should get access by teh end of this week.

could not see 20 level data, i have generated more than 100 in brokerage, is there other way to enable it

thanks

We enable new accounts that breach the 100 brokerage threshold once a week. You should see it soon.

Why I can not see the level 3 depth, Even I have generated the required brokerage!

Can anyone clarify that?

Sir, I have not show this 20 Depth.

How do i access/enable market 3 depth in kite.

Hey Gregory, this feature is available automatically for all customers who have generated Rs. 100 or more in brokerage in the past 4 weeks.

Thanks for keep spreading and sharing ur excellence with us.

Good feature for whoever uses this. However I feel a trading ladder should be offered with the ability to view traded quantity at a price and standing bids/offers in RT, this not only shows market depth but other important information as well.

Some of the charting tools I would like on kite are

1. Trading from the chart

2. Volume based indicators like volume delta and Volume profile (with buy x sell information)

3. Market profile

4. Time independent range bars with volume (range bars should never be time dependent) – emphasis on range

5. Time independent renko bars with volume (renko bars should never be time dependent) – emphasis on brick size

6. Time independent fixed volume candles (just like range bars but instead of price range as input these have fixed volume as input) – emphasis on volume

7. Order flow charts

These are some of the tools I used as a prop trader on various platforms, if these tools are available to the retail investor then they will better equipped to make a decision.

Personally I would pay a premium for the above mentioned features and a lot of my trading colleagues would also be willing to do the same but I don’t think I will be comfortable doing the same for the level 3 depth feature. Interesting thing is exchange provides the data that is required to calculate and show these on the chart RT.

RT= Real Time

All the bars should have the ability for custom intervals, we do not have custom intervals for time also, this has to be a priority feature that needs to be included in the future releases. Why restrict the traders? Give them full independence and freedom to explore and choose their own set of parameters.

You can change the highlighted scrip in the marketwatch using arrow keys. 🙂

i dont see the option, is it deactivated?

test comments

Thank you Nithin sir for updating this information and which will really helpful to retail investors.

can you add one more feature that is order from chart like other website fyer. this is helpful to catch the price that we want

Hey Santosh,

we’re working on such a feature on kite, we’ll keep you posted.

add bajaj finance

Kanath you are a visionary in trying to understand this stock market science.

This seems to be a v useful feature and you are right it will take some time for non institutional traders to understand the usefulness.

can we expect this level 3 service available for MCX scripts also in the near future?

This is no good without the tape of LTPs and without tape this is not level III. Also I’m not able to see this option on my Kite. Kite charts hang after sometime and won’t update. Placing order on kite takes so much time, atleast 3-4 seconds. You should have allowed traders to use NSE platform. Also Pi says chart sql error and some .net mismatch and is totally unusable. Even Pi has some delays and not very snappy. So I’m stuck with bunch of broken trading tools. Hope you will fix them someday.

And few more suggestions if you don’t mind (all on kite browser pc). When I pin LTP of an instrument to top-left list, there is no way to unpin that. There should be a way to configure the indices list on that. Also there is no way on the browser to see the current index prices of banknifty and others.

For keyboard shortcuts, there is no way to configure them, it should be +/F1 and -/F2 for buy and sell not B and S which is in opposite directions. And even B and S doesn’t work, I had 3 instruments and the last one is got highlighted for keyboard shortcuts, no way to change that.

Also switching from chart and order list is very difficult. Chart to order list is fast, but order-list to chart sometimes takes 10s to load. This is on trading view which I prefer to chart IQ. Other than this, kite browser platform is good. Today is my first day on your platform. Fingers crossed.

Hi! Can you give me some more clarity on what you’re saying about the pinned indices? We haven’t added an un-pin option because they’re just two items and pinning something else just replaces whatever was previously pinned.

We’ve assigned B & S as keyboard shortcuts because that’s simply more intuitive. Easier to remember ’B’ for Buy than F1 for buy.

You can change the highlighted scrip in the marketwatch using arrow keys. 🙂

Dear Sir,

This is a good one.

Also, implement this in MCX also.

As always, much ahead of competition! Way to go, and way to be!!

Good Work

i like to lock or hide option beside every strategies on streak strategies for other users on my pc . so no one can modify/alter/ delete / my strategies by any other person.

Really most useful feature i was searching for last two years….talked with tens of experts and all were clueless…Thanks for bringing this …!!

Is team zerodha is working on the Executed orders for improvements? Can it add feture like LTP on executed orders??

We have submitted account opening form online, it is rejected as mobile number was associated with another account, now we changed it. But your team tells we need to manually open account now and online signup not possible. Can you please check. None of your team members contacted for application rejections nor we received any email. I only came to know when I called your office after 3 days. This is not good customer service.

My id is RD4184. 20 depth facility is not available in my account.kindly do the need ful.

Thanking you

Please update to 20 depth or 3 level

But zerodha system is devoid of mention of mention of 52wH and 52w L as well as high lows of lf 5years, hope team zerodha, rainmater will make it mandatorily available( as told to me….its readily avaialble FREE with system of other brokers) also it was there in Znest

Hi. Check out the ”Fundamentals” widget on Kite. It already has the 52 week high and low along with some more information.

20 debth is very helpful & its really amazing experience.

thanks mr nithin kamath .

Good job…. Now also make your API fees to zero for active customers. Otherwise we are limited by your UI to do our research

Thank you Nithin sir for updating this information and which will really helpful to retail investors

3 time i call customer but my problem bis nit solve im trying to add fund in Commodety then the fund added in equity…

Can you please raise a ticket on our Support Portal?

Is it available through kite connect api?

Not right now.

I am still looking for the API to get Market Depth data

Useful information Mr. Nithin Kamath keep it up for feeding knowledge to retailers..!!!

This is wonderful tool for active trader or scalper

Thank you zeroda

Please start this features in mcx data too…

Thanks for this great service is is revolution for trading

I am not able to see the 20 depth sir

Hi Jai, as stated in the post above, this is currently only available to active customers who have generated more than Rs. 100 in brokerage in the past 4 weeks.

generated rs.158 brokerage , still this feature is not available on my id

Hi Aami. I see that you’ve crossed the 100 thresholds only recently. You should get access by next week. 🙂

Thank you sir giving such facility

Congratulations! Keep up the good work. However, a word of caution. Karvy crisis is a real & now event unfolding right in front of our eyes. Let mistakes of others enlighten our way forward. All the best!

Please launch this feature in KITE app

Hey Srinath, this is available on the Kite app now. 🙂

I am trading long time but I am happy this app

Please luanch this facility in mobile application…..

Hey Keval, this is now available on Kite mobile. Please update to the latest version of the app.

i am not getting, why

As stated in the post above, this feature is only available for clients who have generated Rs.100 or more in brokerage the past 4 weeks for now. Will roll it out to more users in some time.

my last 4-week brokerage generated is more than 200 but still, I can’t see 20depth

You should get access to this feature tomorrow.

How can access in this future

Explained in the post above, Prem.

very good

Am unable to see Level 3 can you pls help.

Can I pay Rs 100 to see the 20 Depth data? I am not able to see the 20 Depth data in my account.

Hi. This isn’t possible right now, but it will be available in some time.

very useful to retail trader.

kindlya introduce this in Pi also.

Thank you.

hi, thanks for depth ( 20 ) data, but can i have it through websocket streaming??

Thanks

Dharma

Not right now.

so when it will be available .

I have not yet able to view these 20 no. even after having high brokerage i.e more then 100Rs.

Sir,

Not able to see 20 depth option in my desktop kite. Also I am unable to find out, how much brokerage I have paid to Zerodha in last 4 weeks? Kindly suggest the way out?

zerodha software chart is good to identy fi levels, thanks to zerodha team

Thank you very much Sir.

Can I expect you to introduce CPR range ?

Excellent initiative by Zerodha! Could we have it for Commodities too?

Given all trades happen in the same account, like intra day trading, swing trading and delivery trades (for investment).

It would be good if you can provide the option of having different dashboards for trading and delivery trades.

So that I can clearly know how is my trading peformance.

Very Good Job

THANK YOU VERY MUCH…..

When this will be available in Commodity

Hi Nitin, Plz make this Lvl 3 data available on MCX too. Plz plz plz

Fantastic!

Will this feature be also available in Kite Connect API ?

Do we have to sell to generated over Rs 100 in brokerage?

my zerodha not show more depth how to activate pls advise.

thanks

Hi,

Does this feature available in API?

Regards

BNS

Not yet.

Good feature added, but still on kite web and app it is showing only 5 orders.

Hi Sunil. This feature is only available for accounts that have generated Rs.100 in brokerage in the past 4 weeks. Your account has crossed that threshold only a couple of days back. It’ll be enabled fro you soon!

I am not able to view the 20 depth feature in my browser..

Does it show only through a particular browser

Hi Simon. As stated in the post above, in the beta stage, this feature is only available for customers who have paid more than Rs. 100 in brokerage in the past 4 weeks.

the option is not available in my account is there any problem

Great work Nithin and Team Zerodha. how about a desktop version of Kite

Hi Madhu. As stated in the post above, in the beta stage, this feature is only available for customers who have paid more than Rs. 100 in brokerage in the past 4 weeks.

very good

the option is not available in my account is there any problem. neither on market depth nor on order

I have Same issue

As stated in the post above, in the beta stage, this feature is only available for customers who have paid more than Rs. 100 in brokerage in the past 4 weeks.

Hi Nitin, Great Work.

When will this be available for commodity segment ?

Also the Rs 100 brokerage criteria is for Futures/Options & not for commodities ?

Good opportunity

Good

thanks good

I am not able to see the Level 3 data in my account. Please help

As stated in the post above, in the beta stage, this feature is only available for customers who have paid more than Rs. 100 in brokerage in the past 4 weeks.

I am not able to see the Level 3 data in my account. Please help

As stated in the post above, in the beta stage, this feature is only available for customers who have paid more than Rs. 100 in brokerage in the past 4 weeks.

Why the condition of the minimum brokerage

where there this option is available free on trading view

pl. remove this condition,’& provide it unconditional

hope you will think

thanks

Hi Ganesh, we will offer this as part of our upcoming premium subscription plan. In the meantime, in beta stage, we’ve only opened it up to a few customers. This isn’t available on any other platform at the moment.

Thank you sir

Great work Nithin and Team Zerodha. You guys continue to amaze.

Now that Pi is out in the world how about a desktop version of Kite ?

This isn’t really on the books. Kite as a desktop platform wouldn’t really add any value or convenience.

Very useful facility to ease the user.

Also, kindly in option market watch the scripts like PE or CE will not come serially as we saved eg. 27000, 27500, 28000…., the next day opening this will jumble with PE 27000, CE29000, PE 28000 … these are very confusing while while watching market. I already informed to technical team. kindly rectify the same.

Also the restricted 5 marketwatch limit may be increase to 10 in option Index in PI platform/Kite etc.

Thank you

I do not see we can do any inference with this option, tested today with couple of stocks, as volumes constantly changes on each price, neither it gives any idea of support or resistance as per my observation, but i still appreciate Zerodha for creating new tools

I suggest you check out this chapter on Varsity to understand possible uses of the 20 depth.

this is not show on my trading dashboard

As stated in the post above, in the beta stage, this feature is only available for customers who have paid more than Rs. 100 in brokerage in the past 4 weeks.

Its not showing 20 depth, just tried today in system.

As stated in the post above, in the beta stage, this feature is only available for customers who have paid more than Rs. 100 in brokerage in the past 4 weeks.

very useful option given. its too good its also available in commodities. it helps more if it give for small inverters who are not active traders to generate Rs.100 brokerage.

very useful option given. its too good its also available in commodities.

Lete raho operators aur thug brokers ki. This move could also help in the market efficiency. I hope ki itni efficient na ho jaye ki trading kam ho jayen.

THANK YOU SO MUCH SIR

Dear Team,

I suggest this facility should be available for all user’s of Zerodha. Now there is a category of Rs. 100 Brokerage for couple of days.

Dear Team,

I suggest this facility should be avaliable for all user’s of Zerodha. Now there is a category of Rs. 100 Brokerage for couple of days.

please do something for oi data in live market

Yesbank’s 20 depth data struck since one hour showing same since 1030am.

It’s very useful level 3 data for retail investors.Great done by ZERODHA !!!

There is no free preview – you are opening your 20 depth bid/ask data only to people who pay min 100 in last 4 weeks. People who do large volume of transactions are penalized. Either you stop showing that it is free preview or offer to every user. very simple.

Client Id DT 2498

A lot of thanks for your hard work and really very good news for retail traders.

Please keep up and God bless.

I have not got this feature. When would be this available for all zerodha users?

thankyou zeroda

Hi Zerodha,

Looks like there is an issue fr L3 data during 9.00 to 9.15 am. It shows all zero’s.

Please check

This is very much useful to beginner like me. Thank you sir.

Superb….also get trade from chart ….like fyres …it really gets easy and convenient for traders to trail stops …

Hi,

I can’t see market depth order in my zerodha kite Web platform. As it promise from you. I am a active trader and investor. For trading there are other platforms and vendors too who provide level 3 data. As it is free preview I wanted to see in my account but can’t see. Do sumthing about it. In USA it’s totally free. I have written to your support but there is no reply from you. When you launch it in premium I will be the first who will subscribe.

Thanking you.

Fyers is providing this facility from long time, also free of cost without any conditions and you are showing you are just first broker in India, just improve service first and then become good broker. Your services are just pathetic nothing else.

Welcome for the Amazing feature..it will be beneficial for all zerodha members..thanks to Nitin sir.

Great to take leadership. Many congratulations, Nithin. Keep it up. Regards, J. R. Patadia.

Ng

This is amazing. I am eager to see this in zerodha kite app soon.

Good zerodha platform good service

Great.. zerodha also look to give freebies in terms of Free Sensibull pro, streak full features etc to clients who give brokerage above some threshold per month or per quarter. Look into this also.

This is a good feature to trader…But why zerodha is late to introduce BO for MCX segment? Here i feel other brokers have edge over zerodha and many traders are opting other brokers for MCX market trades..

Owsm sir,

Kindly show rate change with %change and 52 week high/low.

Nice

Great feature that retail traders have been waiting for a long time. This is very useful for day traders for scalping.

As a follow up, it would be helpful if Zerodha can also provide Time and Sales window/indicator that is based on depth of market or level 3. The Time and Sales window prints a day’s executed orders along with timestamp. This is very useful for intraday scalping.

Many prop trading firms as well as several day traders in the US use level 3 along with Time and Sales window for trading. This technique is known as Tape Reading. Almost all trading platforms in the U.S. including Interactive Brokers, TD Ameritrade, E-Signal, etc provide this useful feature.

Look forward to this indicator from Zerodha.

Congratulations and Thank you Nithin, this is great data info for retails

Sir, HEARTY CONGRATULATIONS! It is very good and we all will enjoy. Can you please add this in Zerodha varsity explains step by step how to use deep 20 for profitable trade.

Best regards

Congrats Nitin Sir. It would now definitely help me now to trade actively….. i am going to restart my trading step by step… You and your team are always first in many things you have introduced to retail and small investors or day traders. It is a happy moment for me and others who are aligned to your institution.

Hello, great news. Will this be available on Pi (laptop)? Thanks.

Good sir

This feature only enabled for users generating Rs100 revenue in last 4 weeks.

What about traders who only do swing trades and no brokerage on those?

How are they going to avail this feature even if they are very active?

Dear Nitin Kamath Sir

You are an great Asset of our Nation.

Regards

Santosh Bhor

From Navi Mumbai

v. nice, thank u, sir, its help a lot for trading and this is the first time that I have booked a profit.

wounderful

thanks

i would like to see orderflow with this and make zerodha internationl level

i am not able to see the 3 level ….why it is so? how can i check it?

How do i access/enable market 3 depth in kite.

Nice option and as stated earlier when can we have stop loss enabled for futures ?

Dear Nithin Sir,

This is great initiative to give retail trader similar platform as institutional trader which was like a drem come true!.

I have a small suggestion that is it possible to do total of this 20 bid/ask quantities by the total number of orders??

This will give simple average of number of quantity by each order signalling where is the smart money /

Dear Nithin Sir,

This is great initiative to give retail trader similar platform as institutional trader which was like a drem come true!.

I have a small suggestion that is it possible to do total of this 20 bid/ask quantities by the total number of orders??

This will give simple average of number of quantity by each order signalling where is the smart money ?

Congrats !!! This is an excellent feature to be made available for retail clients. But Nitin sir kindly confirm if this is available for API data feed access too or its just for web at the moment.

Where can I see prints (time and sale) for each transaction?

Is it available in any Indian platform?

If anyone knows kindly answer.

Nice addition, but we are working person. So not possible to access. if available on mobile app, would be good for us.

Hi team Zerodha!

Yet another addition to the features offered. Great going!

Cheers!

thanks zerodh for use full research

Excellent feature. I was longing for this kind of data from a very long time. I have many more ideas which if implemented will give useful information to traders.

Hi, Nitin

Now, you have stopped NEST trader. But, spread window is available in this software only and not in kite or pi. This NEST was useful to traders having large F&O position which needs to be rollover using spread window. Kindly introduce spread order window in kite or pi as it will be very difficult to rollover large quantities without spread order window.

Sir!! Just Awesome.

Of course this is wonderful information for retail investors – Subject to how to interpret this information for their trades . In real time, from this information, Institutions may lead retailers to enter into trade thru their dummy limit orders. Be aware and don’t blindly rely on those information. And also still market orders of institutions still invisible as quick update in market depth panel.

Hi NITIN,

This is most important think form trader Point of View…..

Very Like,

One More Request to you also Trying to Option Chain Live Feed in ZERODHA terminal…………..

thats very IMP……………

Thanks………………………..

Dear Nithin Kamath i Narasimhulu NQ4729 Recently Joined you have improving continuously to client work to easy way, i wat to suggest one more in ,

Mobile kite version you have provide Dark Theme this cool option is good for Eyes Why not Same Black themes to Web Version if you bring to web version

Everybody happy to easy work.thank you From T Narasimhulu 9880074849

Narsimhulu,

We will consider this for the next update on Kite Web.

Hii,

Thanks for the new update. I have just one request to improve the charting experience. It seems the candlestick pattern sometimes does not show the accurate values. You have to refresh multiple times to get the actual highs and lows.

Fantastic!

Sir, Its a very revolutionary step taken by your team for retail investors. Please make & post an Video on how to use this data for intra-day trading in Stocks as well as Index.

Great …

Congrats to Zerodha Team for bringing this amazing feature.

It will be very helpful for retail traders to understand better supply & demand patterns.

Thanks a lot.

Sir,,,

Thank you for updating day by day,,,,

thanks a lot ,,,

but,,,

I Requested to the technical team for,,,,,,

30 seconds

15 seconds need to improve chart timing period,,,,,

Please

Sir,

Thank you

Prabhakar.c

THANX A LOT

sir

i am new for share market , i am a learner from zerodha trading platform by 6 months , so i cant generate rs 100 brokerage in 4 weeks please provide this 20 market depth to all for 6 month.

Nithin sir, yo are truly inspirational, Thank you

Hello Sir,

I would like to suggest you, Please increase our margin limit like 20X for intraday and 10X for delivery in equity cash. I think this suggestion is very useful for all traders. Thank you…

Mayur,

Intraday margins limits are set based on a range of factors including stock and index volatility, impact cost, etc. We believe we offer reasonable leverage using BO/CO/MIS.

We have been working on offering margin funding on delivery trades too:)

thanks.

this is also for currency trading it’s mine cds or not ? this is amazing work for retail player . thanks to team zerodha

Niranjan, currently it is only available for NSE EQ and F&O.

sir, chart ka softwer algse bnaye usme bascket scrip bnaye like a nifty 50 midcap 100

thank u zerodha giving us this oppertunity

now that all the data Is available, kindly add market profile and order flow

Nice initiative for better transparency.

Indicator applications needs to be useful on kite.

Great Nitin Ji….. Great….. Great…… Many Greats…….

Thanks for this update.

Is this feature available for everybody. I am not getting the option to view the 20 depth…

Clement,

As this is in beta, this is only offered to clients who have generated a brokerage of Rs 100 in the past month.

Good Work Team Zerodha, you people are adding new features time by time which makes you way ahead to your peers.

thanks sir u r lord of stock market beginers…huge thanks..

PLEASE REDUCE DP CHARGES ON DELIVERY FOR SELLING. ITS TOO MUCH TO TRADE ONLY ONE SHARE i.e. ABOUT RS. 15.93

thanks for level3 MR. KAMATH……

Since 20 years I was waiting for thanks to kite that made my dream come true.

very good, nice that will helps us.

sir for swing traders like me is it available or not to view in your beta version ,as I am not able to see it

India no.1 brokerage company to zerodha

As this is in beta, this is only offered to clients who have generated a brokerage of Rs 100 in the past month.

I am not able to see Level 3 DATA why?

Thank you so much Mr. Kamath.

Hi Sir Thanks a lot for this It will benefit to all traders.

Thanks Zerodha You proved again that India’s number 1 brokerage company. Thank you.

Thanks Nithin & Team for your great efforts. This would definitely give Investors like me an edge in trading confidently.

In the past with just five quotes I had to wait for a long period of time to find no. of buyers/sellers and quantity asked/offered near the round figures of a Quote. This change will give me an idea of no. bids/offers near a round numbered price.

Once again thanks to You and your Team for all the efforts.

Thank you Zerodha, no such trader is providing this facility in India yet, I have only been connected for 5 days but I will get a lot from this future.

Great work with this initiative !!!

Can you also include Market Profile charts on kite. I’m an active trader at Zerodha and I would like to club this 20 depth with Market Profile charts. This would be a killer combination. Hoping for Market Profile charts on Kite for a very long time. When could this happen

I agree with Pradeep’s view and request Nithin and his Team to arrange for Market Profile Charts at the earliest.

Fantastic……it s help full more accurate trade

Nice

Stupendous step by Nitin ji Kamath ,this man has given new definition to equity market by which :

Stock market=Zerodha …

Thanks Nitin Ji for introducing this feature to us. You make us so comfortable with Zerodha. Thanks!👍🙂

i am not able to see this feature in kite web what can be the reason

Excellent news and we’ll done. A Huge Thanks to the entire Zerodha team for this. Keep up the great work. Best wishes…

Mobile app working very slow , chart section taking more time for loading.

First improve required section after that add additional options sir.

Price sequence also coming slow. Plz update .

Loading of price quotes are slow when compared to charts many times. I request to make these basic things faster and robust before keep on adding features. Please make the basic platform stronger and robust. Features are welcome and can wait. Thanks Zerodha for the all efforts.

Nice

Great work sir, this will very help full when stock make high volatility and we can find price and quantity in single box. Thank u sir.

Thanku sir!

Excellent work for team zerodha

Congratulations

Spcsaliy for Retail inventor

Thank you

Thank you for such a great effort and continuous improvement.

Next milestone in zerdoha history.. well done…

Thanks for this great feature.

Request you to arrange for us Level 3 Market Depth for MCX COMMODITY market also.

Excellent innovative initiative

First improve your system which always hang in even medium volatile market.

Will this be available for MCX trading? I wish to get hands-on this. Exciting!!

It is super, if fix buy & sell button (M, LM, SL, SLM, and normal / MIS) without pop that will be wonder to order in same web chart’s screen

Really appreciable 🙂

one more thing please provide feature like metatrader where we can analyse thousands of stocks using right click.

This is an excellent initiative and another first by Zerodha! So kudos to Nithin and team!!!

Nithin, i just have one niggling problem when trying to use market depth for the uses you have mentioned in the article… which is that most large order quantities are hidden through the ”Disclosed Qty” feature… So the market depth is not so reliable as it may seem… So even in the Level 3 data, the real order sizes will continue to be hidden through Disclosed Qty?

Manish,

Yes, there is no solution to finding disclosed quantity orders as it is an exchanged offered feature. L3 data can still be useful to you in many ways in determining the number of orders, the median of buy and sell prices, etc.

Congratulations! to you and your team for bringing this feature to us. This will definitely hell us to improve our strategies. Keep trading.

Thank u nitin sir

I do all my trade on mobile,

Many(almost every day) a time I wish I could see more bid level so as to for some edge, see resistance/ support etc..

Technical Chart in not working fast using Zerodha kite on laptop os10 need help

Technical Chart in not working fast using Zerodha kite on laptop os10

Excellent. Contineous technical upgradation is must .

congratulations to entire Zerodha team.

One more feature that we need is , during intraday total value of all trades should be given.

Hello Sir

Very good feature..

Looking for scanner in zerodha platform also much awaited feature of option chain for all FNO Stock

Regards,

Mangesh

Kudos to Nitin ji n team Zerodha …. We love u …. n hope to grow with u …. Looking forward to a more comprehensive screener from zerodha

Nice job.always thinking about trader’s…

Starting new journey to pocket retails using this fancy stuff. Zero brokerage with add on with so called premium features… First stabilize your platform. Most of the event days you system dies…

sir, really I don’t know how to make use of the above facility, please if possible one live webinar for the same.

Super, liked it, more use full. thanks for keep raising the bar.

Hi ,if it is faster than exchange feed why don’t you guys also stream it from colo for top 5 bids offers and ltp

Vishnu, we plan to move LTP and charts data stream also from TBT colo data in the coming weeks.

Superb.. let us know other Premium options too

Nithin,

Excellent…Will be helpful if the kite API data retrieves it?

Finally Tape Reading is possible now.

Awesome zerodha. One of the most awaited information available now at Zerodha.

Are you guys planning to roll out feature in currency & commodity segments?

Hope it will be available for Commodities also..

this is available with kite api?

Zerodha.. We love you….this is the very good feature

Superb !!!

For the interest of Traders!!

good option

When this facility available? is it from Nov ? as I am not seeing on kite web on Nov 1.

As this is in beta, this is only offered to clients who have generated a brokerage of Rs 100 in the past month.

Hello Team..

Extended market depth is a excellent and premium feature..

Thanks you very much for the same…

Will it also be available in Commodity in near future?

Probably the best way to fake amateurs by seeing the market depth. Now more losers are going to be in the market.

Hi Kamath,

One more suggestion…

While adding scripts to Market watch, we could able to select only one script at a time, If you provide option for selecting multiple then it will be really great value addition.

Ex.. Banknifty Option CE /PE for multiple strike prices

Bhaskar,

This feature was added to the Kite mobile app. We will add this to Kite Web in the next update.

Will this be available in pi

Badri,

No, this won’t be available on Pi.

1 request also please provide some screener also that should have some basic feature like top gainer ,looser, active stocks volume gainer also these helps a day trader. Thank you

Sumit,

Have you tried Streak(www.streak.tech)?

This is already available on the Streak Scanner. Read all about it here. 🙂

Great work. Hope with colo servers, we could also get higher number of ticks [around 40-50] per second. May be even a paid service.

Shailesh,

We plan to display LTP from colo TBT data too, however, it is not possible to broadcast 40-50 ticks per second to a normal computer or mobile 🙂

This is great,

But i requested to you that please provide this to all zerodha user ,even those who did not met your last 4 week brokerage condition.

So that every retail trader get benefit from it and please provide this feature in zerodha kite android app also.

This is only restricted in the beta period. Soon, we’ll open this up to all our users as part of our upcoming packaged subscription plans.

Super happy with your this feature . It’s like a dream come true specially for a day trader like me. It helps a lot in day trading .thank you so so much for level 3 data

Nyc… We want trend line

Nice

Very bad software is that chart study is not good zooming is not properly working .pointer is not available on chart.non use martial available on chart and very complicated.so bad

Hi Kamath,

Congrats for introducing new features in Kite…

If you add below facilities then it will be really great full for the traders in real terms..

1. Common Ledger for Equity and Commodity (Like Tradejini, BMA, Prabhudas Leeladhar etc)

2. Instant fund withdrawal facility

3. Bracket Order for MCX

Bhaskar,

All of these things are planned to be completed in the coming month.

Very good feature

Great!!

Thanks to Nitin and zerodha team

excellent initiative taken ahead of others.

Awesome…Great going.

Fantastic. Very very useful. Intraday-Trade is going to become extraordinarily more brisk and profitable. EAGERLY AWAITING this facility in MCX-COMMODITY segment too. Please extend at the quickest.

Thanks a lot for doing a wonderful job. Best wishes.

Very Nice

congratulations Nithin sir & zerodha team ..👍

What is the benefits for small retail investor?

Thanks Zerodha…. Enabling the retail trader has been your focus and it will take you places.

Pi has become a neglected child for zerodha …nothing is being done to that …for small community of traders Pi is everthing…plz enhance Pi too

How to know 20 depths in application??

Great Sir Thanks

Please Provide Tick Data On Chart

Level 2 also shows quite a lot of market depth especially when you look at INTERACTIVE TRADERS ( BBT) platform, but it is a PAID platform..also on SPEED TRADER platform ( all these are for those who trade American markets) ..as active traders we are getting it for free. That is a plus for sure..always useful to see if there are big bidders or offers for stocks in play..big bids means sell and big offers means buy for traders..sounds counterintuitive but that is how it plays out.

i am not able to get in my account , please what happened?

Wow……..🤗🤗

This is very useful to everyone,Thanks for the same.

Thanks for bringing this to Kite, I hope Zerodha and clients including me and million others can create new milestones together..

Thanks again @Zerodha

Fantastic move!

Kudos, zerodha for bringing value to your platform.

slowly and steadily freebi will end in zerodha, it will become premuim

Fabulous Nithin and hope that you will continue giving such great options across the fraternity on the house perpetually. AM sure it will catapult Zerodha as the number one brokerage house of India

Thanks for this update 🙂

Please fix the charting issues of KITE.

It’s awesome and u r really trying to safeguard retail traders..Thank u Nithin….

Kadak

GREAT JOB..! Thank you for the wonderful development..!

I’m really glad that this proffesional tool is available to all retail trader’s, that is good feature that makes zerodha trader to a professional trader,

broker with such good technologies i’m really happy😁 keep up the good work Zerodha and team👍

Plz provide more indepth on open intrest and how it pulls the market .

Sir, very useful for those who have been looking to trade based on order flow analysis.

thank you for introducing new features at a regular interval.

Sir,

humble request to kindly introduce CPR (central pivot range) in your trading platform. this is very useful for the trader and available on another platform.

thanks…!

Please give margin in option trading.

I was hoping to see this feature in Kite. As it was not part of Kite I was looking for some other options, but now I can use it in Kite only. Thanks for adding this feature.

YES SIR

Keep it UP and Going You are Taking so much interest in helping the Common man like me I Thank You so Much, You are Blessed, My humble request is to improve the Font Colour on the Graphs/Charts as I find it Difficult to read the OHLC values even Slightly the Size will be Beneficial, I know You will take heed to my request Thank You Very Much.

Thanq very much, Congrats to zerodha team, please activate in mobile app also as early as possible. Excellent feature.

Great Devlopment ZERODHA

But , KATE Application is very slow. Please improve it

Thank you very much….. ZERODHA

Thank you very much….zeroda

when will the facility of trading in internationl market available Probably?

We’re currently working on taking this live and should be able to offer this in beta soon. I wouldn’t be able to commit to a timeline just yet though.

Superb . This will be very helpful

When level3 data is available for mcx segment?

Suggestion for one improvement on this 20 depth data.

is it possible to highlight the rows of highest bid & offer quantities ?

this will be an indicator of demand and supply zones.

Hi Raghavendra, this is already available on the market depth. You’ll see bars in the Qty column that represent the number of bids/offers at that price.

Excellent as usual zerodah

special thanks to mr nitin

i admire your way of bringing new ideas and implement effectively.

Great step in tbe right direction.

Please also give option to save chart. Data to excel like you have on pi platform.

Thanks for adding this feature. This is a real sheet 🙊😅.

Excellent…

Please reduce pricing of learnapp subscription. Humble request from aspiring traders.

Awesome ..

Zerodha at its best…. just a suggestion …wouldn’t it be great if you could provide margins for intraday within the mobile app..

Yes, this is on our list of things to do. 🙂

This is going to be one of the biggest advantage in trading industry. Congrats on this Nitin!

When will applicable this option

This is already live. Since this is in beta right now, only people who have generated brokerage more than Rs. 100 in the past 4 weeks, can see this.

I am waiting for this feature

i can not see this option on mobile app.

Hi Pratik, as stated in the post above, this is currently only available on the web platform. We’ll make this available on mobile soon. In the meanwhile, you can open kite.zerodha.com on your mobile browser to use this.

So nice features

Thanks team zerodha for updating latest and latest

It will help us lots

Again thanks team zerodha

Very useful great work. Keep improving congratulations to zerodha team

WOW!!!! FINALLY!!! I’ve been wating for this!!! Thank you!!! Waiting for Hotkeys Next. Please bring them as soon as possible!!

pl. also suggestion that witch chart pattern make in stock/index display on your every client watch list stock so many your clients save money they are do not any traning further institute it all knowledge on zerodha platform so do any action in it . it is humbly request . zerodha is best

Awesome

Appreciate.!

Wonderful feature.

Very useful for traders.

Hi Nithin,

How NSE allowed this..?

This will make huge volatility…!

NSE sells this data for a cost to anyone who wants it. 🙂

it’s indeed a great feature n a very helpful tool for the traders… thanks Nithin and team Zerodha for bringing this innovation for its clients.. best wishes for a huge success !!

Advantage Taders……..Good facility provided

Very good info

another great step towards technology …. thanks for all your efforts for strengthening retail traders

WONDERFUL

Nithin,

Its very appreciable kind of work you are doing as usual. I am afraid , I am not able to access it as I am investor at present, not actively trading, so I may not making any brokerage as I am buying equity on no brokerage. but my equity portfolio is 19 lakhs plus which is with Zerodha. I hope you will expand the criteria for the people who can access it. thanks,

Vinod

Good initiative. Hope zerodha will keep it either free or charge only a nominal amount later. Any congratulations.

congrats…..for these kind of upgrades

but it is not showing yet….i can’t see.. when will be available

Good Tool, Indeed… Happy Trading..

Awesome feature.

You are doing excellent job of empowering retail traders, unleashing competition and leaving far behind all the brokerages, same as what Mukesh Ambani did with Jio to other telecom operators.

Also regarding the premium for this feature, I hope you will offer it a very reasonable price as you always keep in mind the retail traders benefit.

Keep doing more good things.

This is excellent. Meanwhile, if include the Session wise volume profile indicator that would be best forever.

volume profile would be excellent

also tick by tick data

I have been wondering why market depth was limited to 5.

Now, this one is really cool feature Zerodha added!

Thanks much.

You guys are really making it great for traders. But please consider GTT for FNO as soon as possible and sometimes order placement shows error at critical times. So please try to improve that as well.

Rest all kudos to you guys are doing excellent job.

True 👌

Wow,

It’s amazing, this shows your business model, serving client eventually build the healthy business, hope other too follow, this new feature, make feel we are close to the edge and can win more trades.

Will there be more bandwidth requirement on our side?

Thanks much,

Hope the premium will be affordable to all clients 🙂

Its great that you are advancing way ahead of your rivals at the same time please do try to fix problems of hanging on in important days like just few days back on Muhurat trading. Otherwise there is no issue with Zerodha I think all are satisfied by Zerodha.

VERY GOOD FEATURE

this is awesome. pl. put on in future that big volume profile price straggle with demand and supply zone and last 1 weak which price was demand and supply zone to indicate on pup up chart or indicate on stock detail menu.

Zerodha doesn’t stop to amaze!

super super marvellous excellent, NO COMPARISON WITH ANY ONE OF ZERODHA , BEST OF BEST

THIS TOOL IS BEAUTIFUL FOR US THANK YOU NITIN SIR

Big move! kudos!

Its not started yet today 1/11/2019

when it will start??

mr kamath congrats for your new achievement , kindly look into streak software for which you dont have any tele support for this which impact many trader not to participate, for which your software is not able to use by many trader, kindly look into it, i have already wrote a comment ,email but you people dont bother , what is the use of this software and a huge investment,

R,

Hi Ravi,

Streak provides priority email support during market hours, where we try to address your queries asap and address any other queries in 24 working hours, also 30mins call with Streak expert is available for ultimate users, based on scheduling the call over the email.

Please write to [email protected] for any further assistance.

Good feature. But 20 depth with Rs. 0.05 for every entry in that bid/offer list means Rs.2 deep which is not very useful. IMHO it does not make much of a difference.

If you are planning to offer it as a premium feature in future (with price to be paid by the user), then I would suggest (subject to technical feasibility) grouping all the bid counts in Rs.1 (i.e., like for e.g. 11870.05 to 11870.95 for nifty) and show the total bid and offer count for that range. This would be more useful for us as we will come to know a much greater depth of Rs.20. This would enable us to find the nearby support and resistances much better.

thanks,

neeraj

Neeraj, valid point, it will be nice if it cover the day full price range

Agree with u. That should be the ultimate goal. For that, the group size should be adjustable by the user , like Rs.5 or Rs.10 instead of Rs.1, which I mentioned earlier. Otherwise the list will be too long.

not showing in the mobile app…

Thanks team Zerodha for you efforts to make trading easy and profitable.

Yet another Global benchmark standard set by ZERODHA platform. Greater Transparency for active traders to take maximum benefit out of it with no additional cost due to level3 implementation. Great job Nithin.

Great initiative by Zerodha Keep rocking.

I believe Zerodha hava association with globaldatafeeds.in currently datafeed permonth is very high, See if Zerodha can directly give us the datafeed with reasonable pricing.

Excellent addition for traders.Zerodha should also add PCR ,IV,& OI in graphical form & also change in OI tick by tick.Hopefully we can see this soon.

Wow. Thanks a lot man. I love companies that provide value even when they’re ahead of the curve already. Thank you.

Good work congratulations.. zerodha team

Well, i am not well versed with Trading Jargon, but i can certainly see the potential benefits which we can reap in.

Zerodha is the Best.

Kudos Nithin & team !!

i want to clear and smooth chart….and watch list more than 50 stock in a row

This is first initiative taken by zerodha for retail investor to put ahead and fight with institutional.

Another First from Zerodha, Wow.

I always had a doubt, that

(a) Do large brokerages have access to this information of ’placed orders’ at Level-3 ?

(b) Do large brokerage platforms see more info of the order than retail trader ? eg when an order is placed for 3N quantity , but Display Qty is punched as N , then do some large broker platform see the total actual qty of 3N or only N can be seen ?

Can someone from Zerodha help to answer these query,

Regards.

1. Like I have mentioned in the post, tick by tick data has been available as a premium feed from exchange for a long time. Anyone who could afford it can subscribe to it, not just brokerage firms.

2. No, brokerage firms see exactly what you see in the market depth.

Awesome. Zerodha is alway best and first to introduce the latest technology.

Excellent ,Nithin Made wonder job for traders felling ,,,,,,, best hard work the team

wonderful sir. thanks..

I have a request sir., Can u make available / provide us with CAMARILLA PIVOTS AND MURRAY MATH STUDIES IN ZERODHA PLATFORM FOR CHARTING PURPOSE pls..

Thanks once again for all your efforts..

Congratulation Nitin and Zerodha team.

Can I request you to introduce ’Trade through Chart’ feature. Drag and drop price line should popup modification window to modify the order. It should also have the current profit and exit option.

Thanks a lot.

Best regards,

Chaitenya

Yes we need same like fyers ..

This is also on our list of things to do. 🙂

Thats absolutely fantastic. Thanks for providing this. Great work!

Great Feature @Nithin & Team.

Meanwhile, the basic feature of ”instant withdrawal” & remittance to bank accounts will be a great value-add; as well in beating out the existing market players like ICICI direct, while this will dramatically help customers too.

This is on our list of things to do, Hari.

Simple feature that is not available elsewhere. Awesome thought to provide free feed to all users. Thanks to Zerodha

WOW. VERY HEPLFULL SRVICE FOR EVERYONE , I CAN NOW PLACE ORDER WITH MORE CONFIDENCE.

Hi,

Request you to provide this feature for free for people who generate some decent brokerage instead of making it as premium and charging.

Excellent !! you did it as promised, we are expecting more features in Zerodha Kite , as a number 1 trading platform in India

Zerodha Revolution ……………..

Appreciate the continuous efforts taken, though the initiatives are for the progress of the stake holders, but helps the zerodha customers too.

Appreciate this Win-Win approach Nithin

Great Step!

Super Nitin Kamat, hats off to your great work, unbelievable

you can take low brokerage on options trading

Nice Sir,Really Helpful As Expected….. thums up

Good one!

good ….

Team Zerodha,

You are the guardian angel for the army of retail traders.

Thank You Very much for this innovative Value addition… Best Wishes to Team Zerodha… keep innovating…

Great improvement!!

When would we expect this change to reflect in data sourced from API ?

Thanks,

Ravi

That’s amazing

Zerodha is the best, thanks for creating a great trading platform

HOLY **** !! CHEEEEERS ,,, i am almost shouting out Nithin like Saaaaaaaachin Saaaaaaaachin.

Wow…What an innovation

omg this is going to awesome

thankssssss nitin sir

Its amazing to see that being a discount broker, you are giving us better platform, facilities and features than a full service broker. I am very happy to get the benefits of all these features. I am also proud to be your ex-neighbour.

Great update Nitin sir

But facing problem with price and values, charts will showing one price and Market Depth will showing another values.

please solve this problem soon

Thank You very much for the feature, which was previously available only to the bigshots. Now a small trader can place the Target/stoploss at correct level

How you guys are coming out with all these new features when existing big traditional brokers have not done any substantial upgrade to their platforms in last decade, well-done.

Good Work Nitin sir, And i like to view the expired options chart. Can you help me on this. It will be useful for options trading

Wow super Zerodha for give us the edge.

There is one more option that I would like to suggest. I would like to download the watch list on a day to day basis. If it is possible can you enable this option which would help us in comparing the price action on a daily basis (each sheet separately).

Thanks

Thank you for the update and concern over traders

I am probably one of the oldest clients of Zerodha. I don’t comment otherwise. However, I appreciate and congratulate Zerodha for this feature.

wonderfull amazing

I am not able to see the Level 20 market depth on Kite Web for my account, while I see it is available for other Zerodha users.

In last 4 weeks brokerage given should be >= Rs 100/-

No one in the entire industry is at par with you guys. Thanks for this. Hope 1 day we have to option to see the actual quantities instead of disclosed ones

Good Information on Kite..

Jai Ho Zerodha-Kite .. Cheers..!!

good one great sir .

PLS ADD IN OPTIONS OPEN INTREST CHANGE INDICATOR FROM YESTERDAY EASY FOR DAY TRADER TO SEE AT ONE PLACE ONLY .

Its really amazing feature.Its gives a clear idea of market depth. Zerodha is simply best.

awsome job Z

Hi,

I’m not able to view it

Thanks

super

Great, ThanQ

Very innovative from Zerodha.

Keep it up and best wishes.

Thanks a lot for providing level 3 data.I am really thankful to you.

its a good step… but please increase leverage…

thank you for this update

finally we have it

Amazing feature. Keep em coming!

thanks for depth, sir i want to know when will u start the Bracket order in MCX ?

?

Excellent

Wow

awesome, expecting timesales features also please

Great.. Ek training blog jaroori hai..

thank you Nitin, really appreciate your efforts for your clients.

This is awesome.

Saw this excellent development. Great tool for intraday traders.

Super…. Wonderful…. Excellent….

This is awesome and Zerodha is the best.

This is by no means to demoralise Zerodha. It may be useful for other people I don’t know. But from what I observed I tried using it today – this depth details only lead to confusion and made me avoid a trade because I saw a heavy sell order at a certain point. However the moment the share traded closer to that price, that sell order disappeared. Usually institutional investors don’t keep orders pending. In fact even retail traders put Buy SL orders and they are not immediately visible on the market depth. It probably was some retailer or stock manipulating cartel that keeps shifting orders as prices move closer to that level. I don’t know how it works for others but I found that this isn’t really so much of a help while trading in stocks unless you’re a really big trader who can scoop up all pending orders in no time. I thought it might have been an exception with that share only and tried a Sell SL on another share just below where there was a huge buy order pending. However the sell order executed and then bounced even though the buy orders below that were of very low quantities. My SL got hit.

There is an excellent chapter written on this topic in Zerodha Varsity. Please check it, it may help you.

https://zerodha.com/varsity/chapter/supplementary-note-the-20-market-depth/

Fantastic as usual n way ahead than others …congratulations Nithin sir & zerodha team ..👍

Nice option

Congratulations and Thank you Nithin, this is great data info for retails..

vgood

Awesome

Nice. Good development. It is an edge forward.

Please introduce tick data like in motilal oswal

Thanks for this update, and advanced feature, which would definitely help in our perspective.

Please…please….please…. just launch the SLBM/PLEDGING ANY MF/DAY TRADE CNC USING COLLATERAL…..

I agree, this is need of hr. Big chunk of money can come to Zerodha

Pledging of Mutual funds will bring rains of money into zerodha

Wonderful addition…Thank you

Good job Mr. Nithin!!!

pl reduce th charges of steack platform. for retail traders, newcomers its high. make this platform free for a 6 month. on trail basis.

Hi Ma’am, I think that won’t be possible because Streak is not Zerodha’s direct product. It is a partner product.

ok

Please enable the Streak free for 6 month with paper trading , at least this help the retail traders.

1. Streak is associate with Zerodha and is paid product….

2. The Charges paid to Streak product particularly Scanner are not justified because…

(a) Although it is beta version…

(b) At present lots of drawbacks and practically quiet difficult and the commands /attributes are very limited to produce required results like for Stoc-RSI Based scan is also not available…

(c) I personally wrote dozens of mails for improvement and even for manual also… but no progress…. or the speed of improvement is not there at all… I dot understand that why these people are not improving scanner….whethere they has asked professionals services for Scanner or doing just by hiring newly recurites programmers… !!!!

3. The present condition of Scanner (beta version) is very pathetic and I deiced not to renew Streaks Service now and to shift somewhere…

Mr Kammath can you please take the issue in your hand now ….

Can someone from Zerodha callback me I can tell the things over tele in a better way….

Download link please

Very much helpfull. Thanks a lot.

nice sir

For currency derivative 5 depth only seen. There is no 20 depth data

Already written in the information that it is only for stocks.

Very very nice option sir, very useful for small investors sir. Thanks for this

Thank you, it helps understand volumes better

Great innovation ! for Kite platform. Hope more to come with the help of AI which will keep you ahead amongst all.

Great sir,

I came to know about this changes by a youtube channel Ghanshyam Channel. Thanks keep it up.

Can i use this feature for bank nifty?

PLEASE REDUCE DP CHARGES ON DELIVERY FOR SELLING. ITS TOO MUCH TO TRADE ONLY ONE SHARE i.e. ABOUT RS. 15.93

Thanks

Very nice I am going to make a video on this topic thanks zerodha.

THANK YOU SO MUCH SIR !!

GREAT JOB

Congrats Nitin for giving out this, thanks Rainmatter !! Thank you Nitin a 1st world premier of this setup.

sir

congratulation and thanks sir for updating this advanced feature. But sir please sagest any strategy ,so that

i can earn at least rs1000/day.

thanks sir.

Either in Cash or in Stock futures, if Stock at around 9.20 AM:

OPEN=LOW—-> Then you Buy the Stock

OPEN=HIGH—->Then you sell the Stock

This will surely works.. It has bee back tested.

OPEN=LOW means 9.15 to 9.20 – 5 min candle is it?

Please explain in detail on how to use this strategy.

Share one example if possible to better understand. Thanks!

Simple, first get equipped with how mkt works. Then how much capital you have to earn 1000 a day? One strategy works is pivot points n charts. Learn this n u will make it. 2 lots in banknifty just need to hit 25 points.

Congratulations Nithin sir & Zerodha team !! Keep Rocking

Excellent work by Zerodha team….no other broker has it, i think. This gives a clear picture for Huge Qty traders.

Any extra brokerage charges for this level 3

I AM NOT ABLE TO SEE 20-DEPTH

I am also not able to see the level-3 data from chrome browser.

But it is working for me only in Mozilla Firefox browser in Laptop and it is not showing in mobile either in chrome or mozilla browsers or in kite app.

Please ignore my comment above.

The following info might be the reason why you are not able to see the data.

Quote from the above article:

”we are opening this up only to our active trading clients; those who have generated over Rs 100 in brokerage in the last 4 weeks.”

This is nothing to do with any browser.. if you are an active trading client in Zerodha, you will be able to see it in Kite Web for NSE stocks & futures.

It means that you have made your system more bulky which means more trading glitches like before. Please improve your trading downtime that we have faced before and lost hefty amount.

This is a pretty critical drawback for Zerodha looking at past data. That’s why I have been gradually reducing my trades on Zerodha.

Thank you and congratulations for this new feature. However I suggest you should release a video on how to use 20 depth data for trading edge.

Sir,

e chote indicator se faida nahi hi , kounsi be indicator use hone ka soft karo like MT4 , thob sabko use hoga Sir

very good please introduce gann levels also

Really very good feature came in zerodha trading platform. it is very useful. Thank you Nitin Sir and Zerodha

HI I AM NOT GETTING 20 DEPTH OPTION IN MY ZERODHA KITE

I am also not able to see the level-3 data from chrome browser.

But it is working for me only in Mozilla Firefox browser in Laptop and it is not showing in mobile either in chrome or mozilla browsers or in kite app.

So try it in Laptop in Mozilla Firefox browser.

Please ignore my comment above.

The following info might be the reason why you are not able to see the data.

Quote from the above article:

”we are opening this up only to our active trading clients; those who have generated over Rs 100 in brokerage in the last 4 weeks.”

This is nothing to do with any browser.. if you are an active trading client in Zerodha, you will be able to see it in Kite Web for NSE stocks & futures.

Nice working sir bt customer care number sir koi v lg nhi rha why sir m try again again bt koi response nahi

What are you hearing when you try to reach our support desk?

Fantastic Move

Similarly Zerodha should be the first to give real time data on charts. One gets the view that they are 1 minute or more delay in the studies and charts…With 20 line depth if the studies and charts also react in real time it will be a fantastic offer to the loyal members…

Thank for this new update, but we want this 20 depth data on mobile Kite App too…

Hi Sandy, please update to the latest version of the Kite app that has 20-depth.

sir yeh aacha tradind platform h es ko dowload kaise kar

Thanks a lot! Truly investor friendly. Please keep it up.

Am using mobile .how can i get market depth and chart view same time in one screen ?

I’m afraid that isn’t possible due to the limited space available on a mobile screen.

Hi, In portfolio what ever the charges incurred for buying a share if those charges added to buying price it would show real PL. Please implement it also.

Check out the P&L report on Console. It has all charges included.

BANKNIFTY 4th JUN 21400 CE NFO – NOT MOVING FROM LONG TIME

Zerodha bestest platform what majority traders feel.

Ease

Comfort

And adding new option is a boon.THANKS to entire team

Why this 20 depth level 3 is not made available on Pi?

It should be given on Pi and even faster platform Nest Plus.

Kite is slower to operate.

Kite is our flagship product and is the fastest in the market with sub 40ms response rate. We’ve been rolling back Nest and PI since these are legacy systems and aren’t easy to make changes on.

Hello Sir

I have doubt in this statement