Invest in Sovereign Green Bonds (SGrBs) on Kite

The government of India has various responsibilities, like providing social services, building infrastructure, providing various subsidies, and also paying interest on existing debt. To pay for these things, it relies on various sources of income like income tax, corporate taxes, excise duty, dividends from public sector companies, and so on. The money the government collects isn’t always enough to pay for all the things it does which means it’s in a shortfall or deficit. To meet the deficit, the government has to borrow money and it does so by issuing government bonds of various maturities. Since the government is the safest borrower, government bonds tend to have high demand from insurance companies, mutual funds, corporate treasuries, and even retail investors. The government raises the money it needs by issuing government bonds (G-Secs) and then pays for all the things it wants to do from building schools, hospitals, roads, and other things. In case, you didn’t know, you can invest in government bonds, treasury bills, and state development loans on Kite.

When a government issues bonds, there’s no restriction on what kind of projects or purposes it can spend on. Apart from all the regular investments that the government has to make, given that climate change has become an existential issue, it also has to invest in green energy, mitigating the effects of climate change, and so on. Globally, one way governments have been funding green projects is by issuing a special type of bond called a “green bond.” Unlike regular bonds, the money raised from green bonds can only be spent on green projects as defined by accepted standards. In the 2022 budget, the finance minister announced that the government of India would also issue green bonds and the Reserve Bank of India (RBI) issued the first trance in January 2023. We couldn’t offer these bonds until now because the stock exchanges weren’t supporting them yet but we’re happy to announce that you can now invest in Sovereign Green Bonds (SGrBs) on Kite.

What’s the difference between a regular government bond and a sovereign green bond?

As we explained earlier, the money the government raises from issuing sovereign green bonds can only be invested in “green projects.”

Do I get a higher yield or interest on sovereign green bonds?

No. If anything, you should in theory earn a lower yield on green bonds. This is because you are getting an opportunity to invest only in bonds that are good for the environment and allow you to express your values in a specific way. Certain investors are willing to pay a premium or “greenium” for such bonds, which in turn reduces the yield. The evidence for greenium is mixed globally and the same is the case in India as well. The yield on green bonds is more or less, in line with regular government bonds, so there’s no major difference.

Are there any tax benefits for government bonds?

No. The taxation is the same as regular government bonds.

- Interest payments (coupons) from G-Secs and SDLs are taxed at your slab rate.

- If the bond is sold within 12 months, Short Term Capital Gains (STCG) at your slab rate will be applicable.

- If the bond is sold after 12 months, Long Term Capital Gains (LTCG) of 10% without indexation will apply. There’s no provision for indexation on Government Bonds.

How to invest in sovereign green bonds (SGrBs)?

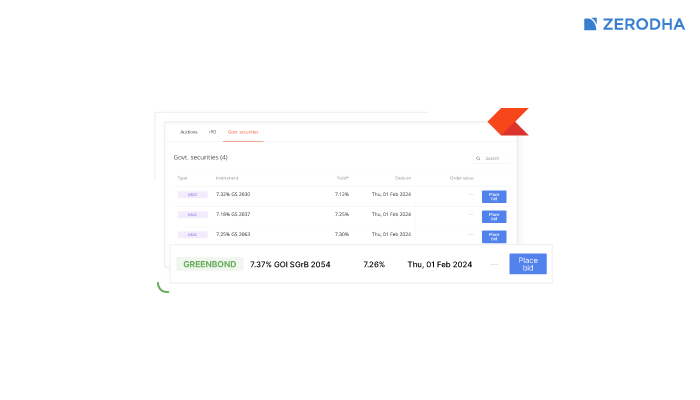

The process for investing in SGrBs is the same as investing in G-Secs, T-Bills or SGBs.

To invest on Kite web:

- Login to kite.zerodha.com.

- Click on Bids.

On the Kite app, tap on Bids and then Govt. Securities.

Note: The funds will be debited from your trading account. Please ensure to maintain sufficient funds in your trading account on the issue end date.

How do SGrBs work?

- Just like G-Secs, SGrBs are long-term bonds with maturities ranging from 5 years to 30 years.

- SGrBs pay a fixed interest rate that is paid out every 6 months and credited to your bank account. The principal is paid upon maturity of the bond.

- There are no lock-ins for these securities. Just like G-Secs, T-Bills, SGBs and SDLs, SGrBs are listed on the exchanges, but liquidity is an issue. So, ideally, you should invest if you intend to hold these bonds till maturity.

- SGrBs can be pledged for margin and are considered as cash equivelent.

Nomenclature of Sovereign Green Bonds

The nomenclature of SGrBs is the same as G-Secs. For example “7.37% GOI SGrB 2054”

- 7.37% is the annual interest rate or coupon. This interest is paid out twice a year and credited directly to your primary bank account.

- GOI denotes the Government of India.

- SGrB – Sovereign Green Bond

- 2054 – The year of maturity

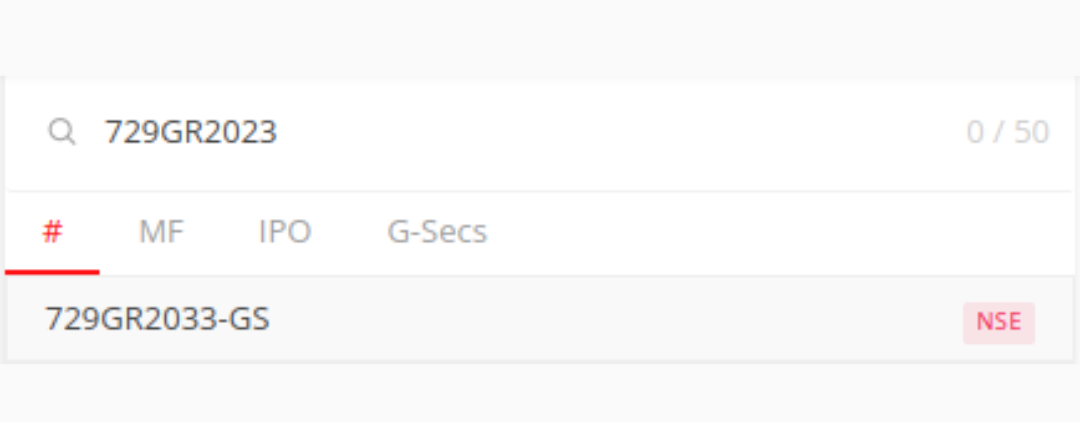

Trading symbol of Sovereign Green Bonds

Sovereign Green Bonds are also listed on the exchanges and one can buy or sell them just like stocks. The trading symbol for SGrBs on the exchanges is as follows:

- 729: Annual interest rate or coupon paid by the bond

- GR: Green Bond

- 2023: The year of maturity

- GS: Government Security

Check the issuance calendar for upcoming issues of SGrBs here.

If you have any questions about Sovereign Green Bonds or want to learn more, check out this post on TradingQnA.

Knowing how to manage money is an important life skill, but most Indians aren’t equipped to manage their own finances. This is partly because schools and colleges don’t teach us anything about money. When people start earning, they are in the dark and make simple mistakes they could’ve avoided, or worse yet, fall prey to fraudsters and scammers.

One of the best ways to teach your child about the basics of money is to get them involved early. This is because we learn some of our most important money lessons when we are young—lessons that stick with us for life. Helping Indians learn how to manage their money is a cause that is near and dear to all of us at Zerodha. We’ve been doing this for well over a decade through Varsity Modules, Varsity videos, offline workshops at schools and colleges, and through Zerodha YouTube, Zero1, Z-Connect, TradingQnA, etc. We even launched Rupeetales and the Varsity Junior video series for kids.

The one thing we also wanted to do was help parents save and invest in a simple and easy way for their kid’s future. We’re happy to announce that you can now open a Zerodha account for your kids online and invest in stocks, mutual funds, and bonds with your kids. To encourage more parents to invest together with their kids, we made minor account opening free and are also waiving off the Annual Maintenance Charges (AMC).

hello

Can we pledge Green bonds to get Collateral margin for FnO?

If yes, do they come under cash equivalent collaterals?

Yes, Green Bonds can be pledged and are considered as cash equivalent.