How to gift stocks, bonds and ETFs and the tax implications

Happy Diwali everyone, if this festive season you are looking to gift something to your loved ones, we think stocks, ETFs, and bonds are the perfect gifts, and they are quite literally gifts that keep on giving. They are also a great way to introduce your loved ones to investing and capital markets and in turn, help in the financialization of our country. Watch this below video to know how you can gift stocks, ETFs and bonds to your loved ones.

Understanding tax implications on gifts in India

The festive season in India is a time of joy and celebration, marked by various occasions, including Navratri, Diwali, followed by weddings. It’s also a season when gifts are exchanged as a symbol of affection and celebration. However, it’s crucial to be aware that gifts, especially those of substantial value, can come with tax implications.

Today, we’ll explore the tax implications of gifts in India, what qualifies as a gift according to the Income Tax Act, and how to calculate and declare the taxable value of gifts.

What is considered a gift according to the Income Tax Act?

A gift is defined as an asset received from an individual or organisation without making any payment, or by paying less than the fair market value.

The Income Tax Act categorises gifts into three types:

- Monetary Gifts: This includes sums of money received through cash, cheque, draft, or bank transfer.

- Gift of Movable Property: Gifts such as jewelry, shares, bonds, paintings, or even Virtual Digital Assets (VDA), like cryptocurrencies, fall under this category.

- Gift of Immovable Property: Real estate assets, like land and buildings (residential or commercial), are considered gifts of immovable property.

Tax implications on gifts in India

As per current tax laws, gifts received by an individual worth more than ₹50,000 in a particular financial year are taxable. If the total value of gifts received in a year exceeds this limit, the entire value is subject to taxation.

The recipient of the gift is liable to pay taxes on it, and these gifts are categorised under ‘Income from Other Sources (IFOS)’ and taxed according to the individual’s income tax slab.

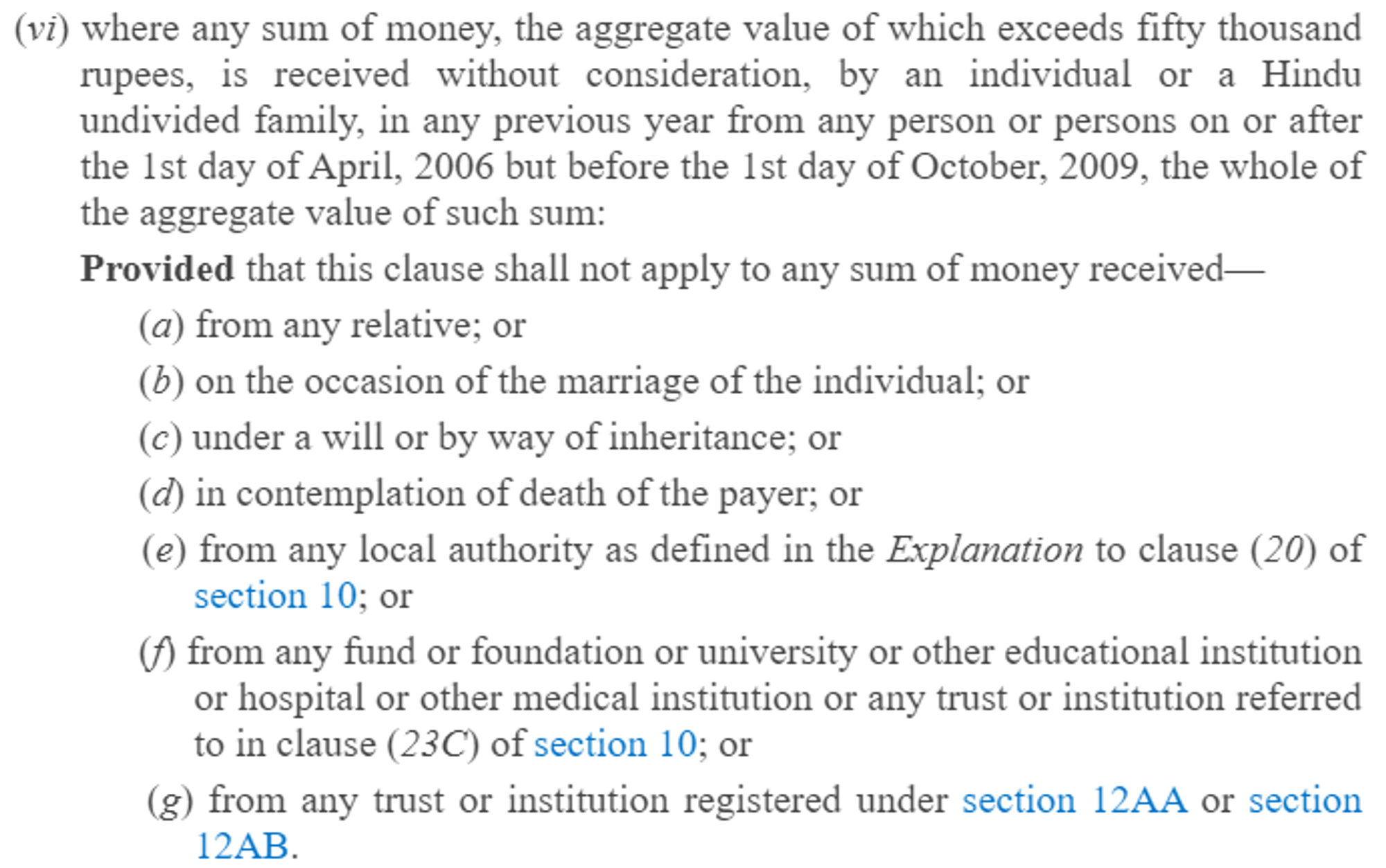

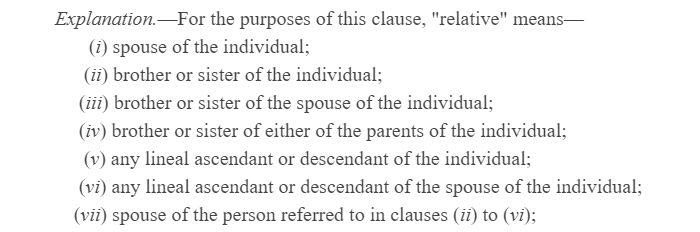

However, there are exemptions:

- Gifts from relatives: Gifts received from specified relatives, such as spouse, siblings, uncles, aunts, grandparents, in-laws, and more, are non-taxable, regardless of the value.

Source: Income Tax Department

- Gifts on marriage: Any gifts received on the occasion of marriage, regardless of their value, are exempt from taxes.

- Gifts under a will or by inheritance: Inherited assets are not subject to taxes.

- Gifts from designated institutions: Gifts from certain designated institutions like local authorities, educational institutions, hospitals, and charitable organisations are tax-exempt.

Source: Income Tax Department

Source: Income Tax Department

It’s important to note that any income earned from investing the received gifts or assets is taxable. For instance, interest income from gifted money, rental income from gifted property, or capital gains from the sale of gifted shares is taxable.

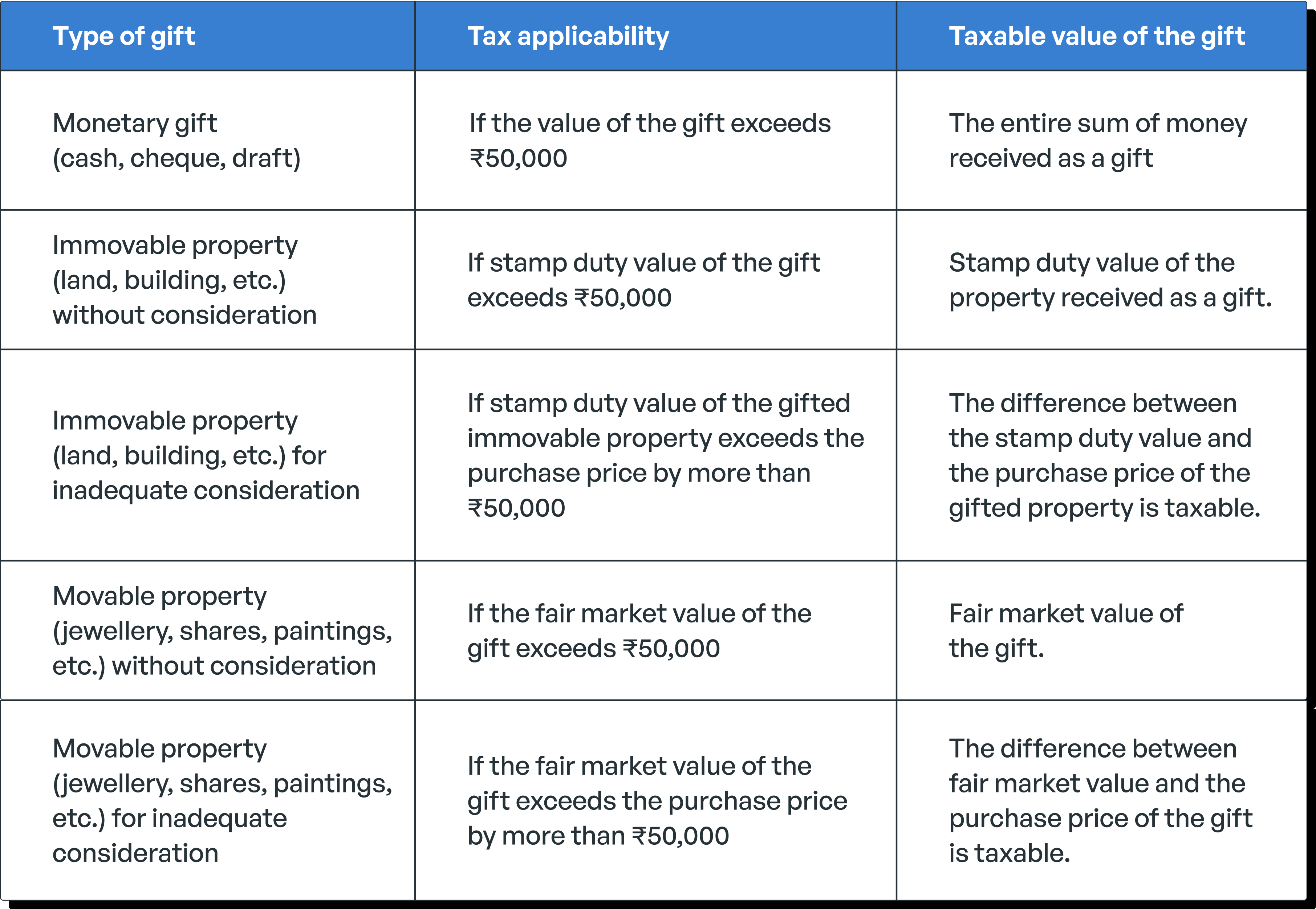

Calculating the taxable value of a gift

The Income Tax Act provides specific rules for calculating the taxable value of gifts. Here’s how it works:

Monetary Gifts: If you receive cash, cheque, draft, or other monetary gifts exceeding ₹50,000, the entire amount is taxable.

Immovable Property: If you receive immovable property without any payment, and the stamp duty value of the property exceeds ₹50,000, the taxable value is the stamp duty value.

However, if you do make a payment but the amount paid is less than the fair market value for immovable property, the difference between the stamp duty value and the purchase price is taxable, provided that it exceeds ₹50,000.

Lastly, the taxable value of movable property is also calculated similarly to that of immovable property.

You can also check the table below for details.

How to declare tax on gifts in India?

The recipient of the gift, known as the donee, is responsible for declaring the value of the gift while filing their Income Tax Return (ITR).

This should be done under the ‘Income from Other Sources’ head, and the tax liability on the gift is calculated based on the donee’s income tax slab rate.

For example, if someone’s total annual income, including the gifted amount, falls in the 30% tax bracket, the gift will be taxed at the applicable rate.

In conclusion, while gifts are a joyous part of Indian culture and celebrations, it’s essential to declare and pay taxes on gifts when applicable.

We would also advise you to keep the necessary documentation and proofs to verify the genuineness of the gift and source of funds with the donor.

If you found this information valuable, please feel free to ask any questions or share your thoughts in the comments. You can also visit Quicko, India’s leading tax filing platform if you want any further assistance with understanding the tax rules related to gifts in India. We can help you every step of the way – right from calculating the tax implications on your gifts to declaring them in your ITR.

Thank you very much for the swift reply.

Suppose if i gift shares valued Rs.500000 to my daughter who is a minor, will tax implications apply?

Does gift received becomes INCOME or when it is liquidated and money is withdrawn it will be part of income ?

Hi Unni, we’ve explained the income tax implications on the gifting of shares here also, the tax implications for a minor account here.

1.Does gift received becomes INCOME or when it is liquidated and money is withdrawn it will be part of income ?

2.Can we shift equity from ICICI to Zerodha without any COST implication?

Hi Pankaj, we’ve explained the tax implications in the hands of the receiver of the gift here.

You can transfer your shares, and acquisition prices for all the securities transferred to Zerodha can be manually updated. More here.

My zaroda account is not working not

Hi Kaniram, what seems to be the issue? Could you please create a ticket at support.zerodha.com with details of the issue, so we can have this resolved at the earliest?

My kyc is

I want to transfer my demate account from Integrated to Zerodha. What is the process transfer. My all existing equity in integrated will be transferred to Zerodha? Is any tax applicable,

Good

My account is not ativate please activate

Hi Kaniram, we’ve explained the process for activating the account here.

My son had demat account with BOID 1208160008349558 with you.Iam sorry to inform you that we lost him on 01.08.2018.Today I received account statement from CDSL for 30th sep 2023.erlier to this we did not know about his DEMAT account. Please guide me in this regard.

Hi Ravishankar, our deepest condolences for your loss. Please create a ticket here and we’ll have our team assist you.

👍👍

Very good

Best & Essey App

Happy Diwali to Zerodha also.

Zerodha is doing a great work for Retail Investors. Keep it up Mr. Nitin. Our good wishes to Zerodha.

Thanku so much happy Diwali

Best treding aap

Zerodha simply awesome app

Cheers!

Very good zerodha app

This is very good platform in stock market, because easy to investing 👍

Thank u so much happy diwali 🎇🪔 Zerodha IELTS good friendship in the platform 🎉♥️ my treating family 🫂…….🎆👍

😊This is very good platform in stock market, because easy to investing 👍

And Great Understanding Portfolio 🤝

Very good app

Thank u so much

Happy Diwali 🪔🪔

User friendly 🤗🤗

This is a very good pletform

I’m satisfied with Zerodha, because of transparency, all over good behavior, trusted organization,

it’s my own experience,

Thanks a lot.

Thanks zarodha

😊This is very good platform in stock market, because easy to investing 👍

And Great Understanding Portfolio 🤝

Thank you very much, Happy Diwali to you too

❤️❤️❤️

Zerodha is very good user friendly

Good app

Good idea, if Zerodha provides discount in AMC for family accounts😉

Okay

Very good zerodha thanks for good support

Zerodha is very good 👍