algoZ – An Introduction

Traders,

Have you always thought that algos, program-based trading, backtesting tools are privy to a select few? We at Zerodha have introduced algoZ to break this myth by offering an algo product completely free of cost and more importantly by dedicating an entire section on Z-Connect to train you on writing/backtesting/going live on a technical analysis strategy. You don’t need any programming background but at least basic technical analysis knowledge is a prerequisite.

What is algoZ?

algoZ is a complete TA (Technical Analysis) based “Algo Suite” for our retail clients.

What this means is that other than just charting, you can actually write a strategy, backtest it to see if it would have made money and once decided you can take the strategy live semi-automated. If you’d like to fully automate your trades, you’ll have to sign up for a Dealer Terminal which will have an additional option to automate the trades, do speak to our support team about this. We will also be getting help from professional programmers to explain how to convert your technical analysis strategy into a code.

Remember that algoZ is based on technical analysis. Click here to know how to invoke charts on ZT.

We will divide the section of algoZ on Z-Connect into

1. Showing you a basic example on how algoZ works, so you know how easy it is.

2. How to use an Expression Window to write your strategy? We also have an explanation on the various fields and their uses, see the pic below of the expression window to get an idea of how it looks like:

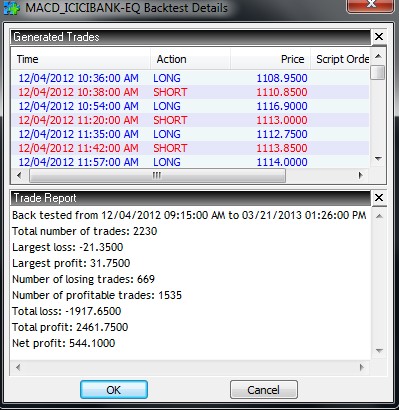

3. How to backtest a strategy to know if your strategy would have made money or not in the past and reading the details on the backtest window. See the pic below:

4. Taking your strategy live, semi/fully automated. How to preset orders for your strategy and use the various fields in the preset order/alert preference box. Explanation on how to run multiple scripts/programs at the same time and manage them. How to act on alerts when your strategy gives a buy/sell indicator.

Pic showing the preset order/alert preference window

Pic showing how multiple scripts/programs can run at the same time

Pic showing a sample alert window

5. Tutorial on Writing a Strategy: Interact with our programmers and get help to understand how your technical analysis strategy can be converted into code. It might be a little tricky to start off with, but we will be by your side assisting you as usual to learn this in the simplest possible way. We will cover basic to intermediate strategies in this section.

As usual, you can ask us questions at the end of every blog and we will be more than happy to answer any query you may have. Tutorials on writing a strategy will be a complete subsection as I’d assume this is where you would need the most help. Everything else is pretty simple. To reiterate, we will not be teaching you technical analysis, but we will be showing how you can write your strategy, backtest it to see if it would have made you profits and take it live either semi or completely automated.

How will this compare to a professional charting software?

a. You will have almost all commonly used indicators, but a professional charting software will have a lot more options. The charting interface on a professional charting software would be better.

b. The charts can be plotted against almost any time frame starting at 1 minute. You can customize your candles/bars from 1 minute to anything you want just like other charting tools. In the beta version, you will not have access to as much data as you will find in a professional charting software. You will have intraday data of upto 22 days and daily charts of more than 3 years.

c. Not only will you have features like writing a strategy & backtesting, as explained above, you will also have an option to go live which would not be available on other regular charting software.

Advantages of algoZ

1. algoZ will offer extremely low latency feeds since it is integrated into Zerodha Trader. Professional charting tools integrate external feeds to their software which may increase latency.

2. “Opportunity – spotting to execution.” Since algoZ is on ZT, whenever your strategy presents an opportunity, you will have an option to either automatically or semi-automatically execute (a buy/sell window pops up and you just have to click OK) or manually place the order. Compare this to a professional charting tool; you will keep tracking charts/alerts on a different window and whenever an opportunity arises, you will have to switch between screens to your trading platform and place your order manually, which might mean a crucial few seconds.

3. Finally, the cost. Today the cost of licensing a professional charting tool would be a one-time fee of between Rs. 5000 and Rs. 25000 and a recurring data feed cost of between Rs. 1000 and Rs. 4000 per month based on how many exchanges’ data feed you subscribe to. This could mean a big overhead on your trading capital.

At Zerodha we constantly try to offer not only the best services/products but also try our best to be as cost effective as possible to keep you in “profits.”

algoZ would be completely FREE for all our active clients on ZT (Zerodha Trader) starting April 24, 2013.

*if the above menus are not pre-enabled on your ZT, send an email to [email protected], we will have it done for you in a jiffy.

As Jesse Livermore says, “The price pattern reminds you that every movement of importance is but a repetition of similar price movements, that just as soon as you can familiarize yourself with the actions of the past, you will be able to anticipate and act correctly and profitably upon forthcoming movements.”

If you follow Technical Analysis,algoZ should improve your odds of winning significantly.

**Do note that all support for algoZ will be provided online only on Z-Connect. If you have queries on writing, backtesting, or taking strategies live, make sure you ask us on the applicable blogs.

Explain your technical analysis strategy in detail on the applicable section and we will help you write the code for your strategy at no cost for you.

Disclaimer

The formulas or codes that we help you write is our view on your query. Zerodha is not liable for the correctness of it or for any trades that you take based on it. algoZ/Nest Pulse is provided as a tool to help you trade better, make sure that you double check before taking any trade based on the signals generated.

Happy Coding,

Effective September 2016, algoZ will no longer be available. The product has reached its end of life and will no longer be supported.

I want to take trail of Z connect

I want

can i merge multiple technical indicators simultaneously,if yes then give an example like addition of indicators by using\” ,\” or \”and\” what?

Hi Deepak, we no longer offer support for algoZ. I suggest you check out Streak where you can do this and more.

[…] algoZ – An Introduction […]

Hi,

I am new to trade and zerodha.

I want to start with commodity – crude mini.

Wanted to automate simple strategy with supertrend signal + RSI.

Who can guide me?

Thanks

Hi,

Is there any software or algotrading helps in finding Arbitrage Opportunity created to enter instantly?

Thank you.

How to start alogZ in kite

can u expalin me how to trade in algo automated software trading system

Hey Sailaja, you should check out Streak. A brand new product that makes algorithmic trading extremely easy.

i deployed the but order not exucuted can you help me

How to place an order? Suppose I have bought a stock ICICI Rs.316 and wants to sell it on Rs.318 and stop loss will be Rs.315.So do I need to place buy order than place other sale order for Rs.318 and 3rd for stop-loss order total 3 order?Please explain step by step?

Yes, you\’ll need to place a limit sell order at 318 and SL/SLM sell order at 315.

Hi nitin ,

Greeting from me , myself Biswa from kolkata.. i am a big fan of ZERODHA , I am really glad for Broker like ZERODHA is available in our era , which makes trading is easier than anyone think\’s before ..

As a trader my humble request is please provide some paid-workshop about ZERODHA tools and program like how to use it , how many tools are available or how to automate your trade etc..

wish you many many good luck for our life . and waiting for your valuable solution.

Please tell me if this is possible with streak, I want to buy if LTP moves above 2 days high.

Thanks

Rakesh

Can you please just write an algorithm for both of the conditions,

1. Stock Intraday Momentum crosses below 35-buy signal & stock Intraday Momentum crosses above 70- sell signal

2. Close > EMA (close,50)-for buy & close<EMA(close,50)- for sell

The algorithm should satisfy both of the conditions.

If it is not feasible to program for both of the conditions. Please write the algorithm for the point number 1 mentioned above.

Best post this query here Maheswaran.

Pl help me to backtest & code my following Strategy for intra day futures trading:

Chart Setting:3 Minutes

Studies:

1)VWAP

2)Time series forcast(period-14,Field-Close)

3)ADX

Strategy1:To go long

Buy when Two Green candle sticks finish in succession above the Vwap line & +DI is above ADX & -DI below ADX line

Exit Long Position

Exit when two Red candles finish within Time Series forecast line Downward Cusp in succession.

Strategy2:To go Short

Sell when Two Red candle sticks Finish in succession below the Vwap line & -DI is above ADX & +DI is below the ADX line.

Exit Short Position

Exit when two Green candles finish within Time Series forecast line Upward Cusp in succession.

Can you make a script as per my requirement ? For that to whom I have to contact … please reply me through mail … thank you

Please post your requirements here: https://tradingqna.com/c/algos-strategies-code

A fellow forum member may be able to help you out.

Hello sir,

Is there any option buy/sell a option with single click.

With pre defined these 4 settings .

1. Buy/sell at market price.

2. Trailing Stop loss 10 points.

3. Target price 15p points.

4. Qty. 5000

There is no readymade solution for this. You can probably explore Kite Connect to build your own.

Bracket order with market price is possible?. Can we do it with out fill a form like icicidirect \”cloud order\”

We don\’t offer BO at market price right now. We\’re testing this on our and will release it soon. Until then, you can place an entry order slightly above market and it would execute at the market price.

where can i get option chain 5 minutes historical data of Bank nifty ,with the following details .

Underlying Spot Price

Strike Price

Ask price

Bid Price

Last trading price

Implied Volatility

In zerodha there is not a facility of

OCO order type. With Stop loss and target limit order at same time. as this facility is provided by upstox . I request you to do as needful.Hope for gentle support.

Ritesh, we are working on this.

Hi Nitin,

I have been through the Trading Q&A which I found out to be very useful indeed for traders and investors.

You and your team have done a great job a round of applause for that. I must say trading is now fun for me after using the zerodha kits and pi.

Alot of my personal queries were solved just by going through and reading the questions and answers.

However, to automate my intraday trading strategy, I need a tradescript for Supertrend and if not that then will need a tradescript for multiple time frame strategies.

With such an advanced platform like Zerodha everything is possible. Why cant the team come with a solution to getting a tradescript for Supertrend and multiple time frames.

Arjun, thank you. Currently tradescipt doesn\’t support supertrend. However, you can code it in AFL and use Amibroker to fire orders to Pi using Pi bridge.

Hi nitin

Can a calender spread order can be fired for spread in future segment for example

1) bpcl – oct 2017 buy

2) bpcl – nov 2017 sell for a spread of 3 , when the spread is 2 a cover order can be fired on algoz platform , can any of your proggrammer can create code for the same please inform .

sudheer

Dear Nithin ,

I am wondering is it possible write a code buy signals

buy signal when 52 week high, macd positive, psar positive, price break resistance and volume increasing by 100%

and if possible could u help me to write a code pls. also can Pi give me alert when this criteria met and also do i have to add stocks or it will pick itself.

sell signal when red renko bar complete.

Thanks

Anand

You can check this section and also post your question here.

Hi Zerodha,

I want to make option segment strategy for algoz trading, in which i want fixed some parameter and tested to how much profit get (according to strategy) before buy call or put.

That is below:

(1) how much % amount of Demate A/c use- 100 or 90% etc

(2) Min No. of lot- Auto/Manual

For manually type 1 or 2 lot etc

For Auto it logarithmic check how much number of lot you can purchase, accordingly number of lot buy.

(3) Max Number of lot- Auto/Manual

For Auto if demat A/c have 1 crore than logarithmic check how many lot you can purchase, max lot is restricted by choose % of buyer for max lot (in 4th condition) for that call or put.

Example- if 4th condition 20%, than logarithmic check number of max lot is 20 than 20 lot auto buy.

(4) % of buyer for max lot-

(5) buy signal given have Min price above it buy-

(6) buy signal given have Max price below it buy-

(7) % of profit to change SL from cureent stop loss value to new stop loss value-

(8) Number of transaction/day- 5 or 6 etc

(9) at a time maximum of Number of Running call or put –

Ah won\’t be possible on algoz. You might need to use some other programming language, you can use https://kite.trade/

Hi Zerodha,

I am very much interested in working on the algoZ software,how can I download the same.If it is a online platform then kindly provide a url by which I can access it.

Thank you!

It is called expert advisors, available on our desktop platform Pi. Check this: https://zerodha.com/expert-advisors/

Hi Team,

i am using Zerodha PI.

I am facing issue while querying the stock and find the appropriate stock for buy and sell.

i have used the simple logic where SMA 10 greater than SMA 50 but i am getting stock in filter where stocks have SMA 10 less than SMA 50. i am using periodicity 1 min

Can you help me understand y is that ?

I have also used corssover query from script doc still same results. pls help me understand how i can use SMA for 1 min period pattern.

Thanks in advance.

Regards,

Vinay

Waiting for your reply.

Is it possible to do query on the basis of 1 minute candle.

like SMA 10 > SAM 50 or SMA 10 Crossover SMA 50.

Regards,

Vinay

Use the below

CROSSOVER(SMA(CLOSE,10),SMA(CLOSE,50))

Also can post in the below link for any more help on tradescript.

https://tradingqna.com/c/algos-strategies-code

Can you check here: https://zerodha.com/expert-advisors/. If you are not able to still code this, can you post it in algos section on tradingqna.com

Hi Nithin

1) I have strategy which are in excel, can anyone from team help me to code it down in algoZ ?

2) Do these automated trading work on standard deviation, correlation or basically pair trades?

3) Is there option to automate trade from Excel itself on the terminal ?

Thanks in advance

1. You can use Kite APIs to connect your excel to Kite. Check this: https://kite.trade/

2. hmm.. this is upto you.

3. If you have coding skills, quite simple to do this.

Greetings,

I would like to know whether algoZ is a product like pi, kite or online portal. Also share appropriate link to access algoZ.

Thanks

It is in Pi. Check this section: https://zerodha.com/z-connect/category/tradezerodha/pi-tradezerodha

Hi, I want to know , how can I trigger buy sell signals from an excellent sheet, on any of the zerodha platforms.

Is possible, please help me connect with someone from support, to implement it.

My user ID is ds7598

hmm.. not possible currently.

To algo trade Do I need to be online always..? or have my computer connected to internet always?

Depends on how you set this up, but if it is running on your systems, yeah it has to on and connected to internet.

Dear Sir ,

I am an individual trader and I want to fully automate trade. I am already having an account with zerodha . But I just trade using kite web application. What are the other resources and Procedures I need /follow up to get this done. Is there any additional charges?

Check this : https://kite.trade/

Is it possible to do Algotrading in Options using your terminal?

Fully automated is possible, but you will need to get exchange approvals.

I have my NISM certificate. I want Dealer terminal. What is the procedure to get it.?

How can I do algo trading ?

Can anyone contact me in this regard ASAP?

Thanks

Neha, can you send your contact details to [email protected]

Dear Team,

Whats the difference between Pi and AlgoZ.

Pi is the latest version.

Thank you very much for the clarification. 🙂

Hello Sir,

In order to have a full automation of algoZ one need to be registered person with Zerodha.What is the full procedure of it that I can follow and can get the dealer terminal to have the full automation of algoZ. Since the Pi is semi automated and in order to place buy or sell order automatically for multiple script which is time consuming process to do manually.

Can we use any other plugin to automate the placing of buy or sell order. Kindly mention. Thanks. Udit.

Please send an email to [email protected] to get more details on automation.

hi

in back testing they calculating daily gaps, how can i discount that gaps and calculate. how can i build confidence in trading sir

Super trend indicator is not possible to code in tradescript or will be available soon

hi

can i get alert when supertrent get triggered on pi

Supertrend can\’t be coded on tradescript language for now.

hi,

i have one strategy in algo trading i want to back test and i don\’t know how to code that strategy can you help me sir,

algo trading also work in mcx and currency ?

Best to run such a backtest on platform like amibroker etc. We don\’t really have the bandwidth to help code strategy. Complete automation is possible provided all approvals are taken.

Is it possible for Zerodha account holder to get live real time tick by tick quotes , which will be fed to our application software which in turn will spot the opportunity and shall place order (buy /sale) to Zerodha (All automated ). Reply is requested on mail.

Check out https://kite.trade/.

Is there a demo version available? Is there any historical learning for algorithms that can be applied?

No demo as such. No historical learning, you can backtest your strategy.

Which programming language is used while writing the strategy? Is python one of them?

Yes, you can code using python.

Plz call me on 8233644890. Im a trader and Would like to know more about Algo trading use

Our support offices are closed today and tomorrow on account of Dusshera and Moharram. I suggest you call us on Thursday and speak to one of our support staffs who ll help.

Can I place such orders like sell nifty 8700 ce & nifty 8700 pe when the sum of their premium is above 250₹

Not currently Akii

Are such orders possible on any other softwares ?

For now no. But we might have something in the future.

Can it possible to place an order with case mentioned below.

Suppose a stock moving up. LTP Rs 10.80. And I want to place an order @ Rs 11.05 exactly at time when stock touches Rs 11.10..? I have tried to do so using buy stoploss (SL) method but in that case trigger price can\’t be greater than the limit price. So I m searching for other alternative to do so.

Kindly reply as soon s possible

Only way is by using SL

But when I use buy stop loss(SL) with Limit price Rs 11.05 and trigger price Rs 11.10 then I get error msg \”trigger price cannot be greater than limit price\”.And this what I actually want but your system dont accept.

I dont understand the reason as if trigger price is more than there is also some probability of order execution or it may remain pending.

Please solve my problem

Manowar, that is how stop losses are designed as a product.

Sir plz let me know if u can place buy stop loss(SL) with Limit price Rs 11.05 and trigger price Rs 11.10.

Not possible Manowar. If Trigger is hit at 11.10 and you send a buying limit order at 11.05, it will most likely not get executed. Stoplosses are put to ensure exits, hence limits below the trigger not possible. If you want it this way, you will have to set trigger and limit both at 11.05.

Can it be possible using alogz..? Is there any other trading platform to do so with programming script..?

No

I dont have much knowledge about stock market and want someone to invest my money through their well tested algorithm. Please let me know how you can assist.

Sameer, we don\’t provide readymade algo\’s.

Hi

I have account with Zerodha. May i know from where I can download AlgoZ? I am very interested in Automated trading, any help is much appreicated.

Thanks

Satheesh

I spoke to the customer care, they say AlgoZ has been decommissioned. Now, how to do fully automated trading?.. Someone please advice.

Thanks

You can use Pi, much more advanced version of algoZ. Check this post.

Hi Nithin.. Are you saying that using EA, I can trade fully automatically?

Thanks

Full auto trading is not possible, it is semi-auto

Hi, what should I do to have full automated functionality?

You need to register as an authorized person, get strategy approved. You can send an email to [email protected]

Sir,

How can one register with Zerodha as an authorized person?

send an email to [email protected]

Hi,

Previously post, I can see that Algo trading is no more avaiable like comment. Can you please confirm whether algo trading exists with you and if who can i contact to write my alogirthm.

If not avaiable, how can I link my algo logic with pi or kite.

Thanks

Vinodh J

Vinod, algo\’s to give order alerts can be done directly on Pi. Complete auto trading won\’t be possible on Pi though.

Hi,

Can I contact customer care to get more details or can somebody cal me tomorrow morg to 9789702908. To have clear discussion on this.

Vinod, we don\’t help clients in designing algo, we can facilitate execution if you already have an algo running. You can send an email to [email protected]

Can we use AlgoZ with PI?

Nithin

1.) You said that Algo trading is not allowed for retail traders in India then how is it possible now?

2.) In which cases/segments do we have to take permissions from the Exchange?

3.) Is Bracket Order a type of Algo Trading?

4.) Does algoz give only the indicators when to buy/sell or do they have an \’Order Window\’ also…If we write our own Algo then how can we convert it into an \’Order Window\’ (As seen in Bracket Order)

Also sir, I want to know that whether trading through tradescript is an algo trading?

Or they are two different things?

As long as there is a manual click to fire order, it is not algo trading. So what is on Pi is technically not an algo.

Arun, we have moved away from algoZ. This product is no more available. We have on our platform Pi backtesting + semi-automated algo engine. Check this: http://zerodha.com/z-connect/tradezerodha/pi-tradezerodha/eas-for-auto-buysell-signals-pi

Bracket is a pre-approved algo by exchange, but yeah it is.

Can we trade through Amibroker Chart ?

Yes, you can using PI bridge. Check this post.

Dear Sir

Do you provide Amibroker Plugin i.e. Trading from Amibroker Chart and What is the cost ?

Please reply

Ok, But you give the facility of Algo Trading. It is free or Chargeable.

Please reply

These are semi-automated tools, they are free of cost.

Dear Sir

If I have a successful Trading Strategy then I want to know that without opening computer or chart it can be executed in my trading account ????

or

No interfere of human in trading if trading strategy is good- It is possible ?

Please reply.

Thanks

Exchanges are not very keen on retail doing auto-trading.

Hi,

I want to execute buy and sell order for a particular share automatically at set price for definite number of time in a trading day.

ah.. not possible.

Ok. Thanks Nithin for the prompt reply.

1. Can we have Donchain channel included in Pi at a later stage in future if it did not exists at this stage.

2. Moving Average envelope indicator to be modified in Kite/Pi, the way it looks in Economic times charts is better. Its just a expectation from my end based on different charts I have seen over the period of time although I am not sure on the difficulties in developing the same.

Please ignore if does not make sense as you are the better judge.

Thanks,

Thulasee Ram

Hi,

I am new entrant to Zerodha. I have checked both Pi and Kite. I see Kite charts are better when compared to Pi. May I know the reason and is there any way the charts are displayed in Pi as in kite.

Below are some differences:

1. CCI indicator is better in Kite compared to Pi. In kite, we see overbought and oversold lines of 100 and -100.

2. Donchian channel is not visible in Pi where as I can see the same in Kite and I am not sure whether it exists in pi and I overlooked it.

Please advise.

Thulasee Ram

Since Kite is web based, it uses a different charting library, what is used on Kite can\’t be unfortunately used on a desktop platform.

Hi

The examples shown are here are for Pi? I am unable to find the options or menus shown in the snapshots in the Pi trading tool.

-SR

Check this http://zerodha.com/z-connect/tradezerodha/pi-tradezerodha/eas-for-auto-buysell-signals-pi

hi,

I want to buy a certain stock in every 1% down and sell the same at 2% up.

Can you pls help me with the Algo?

Regards,

Abir

Da1153

Abir, can u ask all coding queries on tradingqna.com

Please provide me Algo code for trading conditions

Buy when SMA 9 cross SMA 18 and exit Long trade when SMA 4 cross SMA 9

Sell When SMA 4 cross SMA 18 and exit Short trade when SMA 4 cross SMA 9

Do ask all your coding queries here: http://tradingqna.com/algos-strategies-and-code.

Hi Nithin,

I have opened a new account in Zerodha.

I am basically trying to screen for stocks based on a certain strategy (so every morning I want to choose and focus on 5 stocks out of the whole gamut of stocks that are being traded)

I thought AlgoZ would help me do that – but I still see a white chart .

How could Zerodha tools help me do this?

BR,

Palani

Palani, we have introduced a much more advanced version of it on Zerodha Pi. Check this link: https://zerodha.com/pi/ on how you can get started.

is algoz and pi are same?

if not , then how to login to algoz or use algoz.

algoz was what was available on NEST, but it is not anymore. Pi has a much more advanced coding/backtesting engine on it.

Hi,

I want to start completely automated algo trading. I want to build in strategies that would decide whether to buy or sell a future based on the current values and moving averages of the underlying spot (say Nifty). I want this to be completely handled by the software itself without any manual intervention. Is it possible in Zerodha?

It is possible, but you can\’t do this as a retail client as per exchange norms. Check this post. Unless you are proficient technologically, it is best not to automate.

Hey Thanks for the prompt reply. A few more questions

1. If the restriction is only for retail then how is retail defined?

2. From the link shared by you it seems that it will have to be a combination of Amibroker, Global data feeds and your platform to do it? Isn\’t your platform alone sufficient?

3. Do you provide any support in converting an algo into actual code?

4. Is the code capable of also reading the current position and the margin available in account?

1. If you have to automate you need to get registered as an authorized person with us on the exchanges.

2. Our latest platform Pi has automation capability, but we are still not live on it yet. http://zerodha.com/pi/. But you can use the amibroker (with or without Globaldatafeeds) and use pi bridge to automate. Check this.

3. We could give it a shot, we usually help with only the simple ones.

4. If you use the bridge to automate, for now you can\’t get the position or margin. But we are working on it. You could take the API route to automate, but will be a lot more expensive. (running cost of atleast around 15k per month).

Is it possible to use Future to future algo in Equity and Commodity @ Zerodha?

As in?

HI Nithin,

I could see Algoz was not enabled for me. When approached support team, they conformed me that Algoz feature was permanently withdrawn due to licence issue.

Is there any other platform available in ZT where our statergies/backtesting are available.

Thanks,

Surya

Our new platform Pi which is in beta has advanced backtesting options. Check this section.

Hi Team,

My query is related to dependency of writing an algo. I want to know whether I can only write an algo which would depend on charts? Because I don’t use charts or technical analysis. I use various calculations and trade depending on breaking those levels. Is it possible for me to write an algo which will let me trade using different parameters which I calculate depending on previous elements like open, high,low, last trade or previous close of a stock or index.

Yes possible, Check this post, similar to how we have built a bridge for Amibroker, we can build a bridge to any analytical platform. For example, bridge to excel. So you can run your strategies on excel, and fire orders from there. But yes, you will need a tool to run your strategy from.

hi sir

i am buy amibroker afl

so want to set algo sever

sir i am teding mcx

who is parson ya company provide sever

who many pay monthly

so sir plz guide me

plz reply

[email protected]

I am not able to log on to Nest plus account and my id is not showing up there. I tried to enter the user id and pw as my zerodha id but still I could not log on. any other reason for this or can any one suggest any alternatives for this.

Srinivas, Omnesys/Reuters the vendors for NEST have stopped supporting NEST plus for charts. You can open charts without using NEST plus, shoot an email to [email protected].

Hi,

Is it possible to semi automate the entry such that at single click of a mouse the SL buy / sell order will be placed. The entry point will be decided by multiplying the current day high / low (at the time when mouse is clicked) by x% and rounding it up to one decimal point (like in an excel sheet). The scrip will be pre decided( We can select the scrip by clicking on it and then click the automated entry button).

The scrip will be in NSE Futures and current day high / low will also be in futures only.

Yes, should be possible in our new trading platform Pi. Here is the link, we will have the final release out by 1st week of Jan.

Hi,

Is it possible to create a program which will buy / sell the highest gainers / losers of the day which have moved above x% (x will be pre defined) few seconds (maybe 30 seconds or 1 min) before close of day. The Buy / Sell will happen in Futures segment but stock selection will happen based on highest gainers / losers in Cash segment (Among Nifty 50 Stocks only).

No Anantha, tradescript doesn\’t have the functionality to trigger orders in futures based on the condition on cash.

Dear Mr. Nitin,

I have a strategy for trading in cash(positional) over a wide range of nse scrips(volume based screener).Is it possible to semiautomate the process of trading? The strategy is in amibroker and I test it on all stocks together. will the entries and exits be automated according to the strategy(handling many scrips at a time)? My hope is that I would be able to simplify the process of execution so that I can delegate my wife to take action when I am not there. Will algoz be helpful in that perspective?

Thanks

Bipin, in our new platform Pi we have built a bridge to Amibroker. So you can run all your strategies on Ami including entries and exits, whenever a buy/sell comes through, a buy/sell order window is initiated on Pi. Your wife will basically will just have to click on the buy/sell button. We should have have the final release of Pi in the next few weeks, we will also run a video on how to use the bridge.

Cheers,

Thanks a lot for the prompt response, Mr. Nitin. Though I am using a different broker right now, I am looking forward to get associated with Zerodha soon.

Please check this zerodha support ticket 361180. It would give you the issue I am facing.

This is regarding NEST Plus access for my newly open account @ zerodha (DR2148). It\’s around 10 days since my account was opened. But, proper NEST Plus access not received. Please help in resolving this issue ASAP

It would be good for the new account opening people and easy for zerodha, if a document stating the steps to be followed for the newly opened accounts is shared beforehand. This will save everyone\’s time.

Thanks

We\’ve been sharing this update with most of our clients who\’re having problems with Nest Plus… Please read on.

It\’s very important to note that if you are a Zerodha client who has been mapped on Nest Plus directly you will see black charts and you will be able to automate your trades using algoZ….

Note that if you\’re seeing white charts, it means that you have a basic version of Nest Plus which may be showing you unclear data. If you are having problems doing a clean update of Nest Plus, please read on…

Kindly follow the below procedure in order to upgrade your Nest Plus plugin:

Download the Nest Plus 2.9.0.0 (zip) file from this link. Ensure you\’re using Version 3.11.2 of Zerodha Trader. Do NOT use the older version.

Once downloaded, you will have to unzip the folder, then open the folder Nest Plus 2.9.0.0 and copy all the contents.

Go to C://Program Files/Omnesys/NEST3 or C://Program Files(x86)/Omnesys/NEST3 and paste all the copied contents into it.

While pasting the copied files, you will get a prompt \”Confirm Folder Replace\” for which you have to choose \”Do this for all current items\” and click on Yes. Once you\’ve clicked on Yes, another prompt to Copy File would pop up for which you have to tick \”Do this for all conflicts\” and then select the Copy and Replace option.

Once the above procedure is followed, your Nest Plus plugin would be upgraded and you should see black charts.

Note that all of Zerodha\’s clients are automatically registered on Plus to get additional features. To check if you\’re registered on Plus as a Zerodha Client, do this:

1. Go to Nest Plus* > My Nest Plus Account > Plus Dashboard on Zerodha Trader

2. On Plus Dashboard check if your client ID shows up on top. If it does, great.

3. If your client ID doesn\’t show up, choose \”Logout/Login with new Plus ID\” and key in either of the following:

a. username: CLIENTID or ZERODHA_CLIENTID

b. password: CLIENTID or ZERODHA_CLIENTID

*Note: This works only on your Zerodha account. If this still doesn\’t work, please feel free to write back our call our support number.

Will all the algoZ features get carried to Pi? What additional features we could get apart from those already present in algoZ?

Can I place an order to buy call option (nifty call option) based on the underlying price (value) (e.g. nifty value)?

No

Can this be done using any other tools in zerodha like to be launched Pi or the amibroker tool?

Pi is a lot more advanced, check this. We are building a bridge to connect Ami to pi.

Sir

Please clarify my doubt

-What type of actions SEBI will takes defaulter company\’s shares which are hold by customers either in electronic/physical form after closed or takeover by another company?

(Assume the situation (It may seems like satyam ) :

1. January: I owned 1000(purchased cost is: Rs 100 per each) number of shares of a company ,

2. June(after 6 months): Share value goes up and up finally reached to Rs 500.00 each, as per company financial reports I believe the growth and decided to hold the all 1000 shares(present value is 1000X500=500000).

3. September: Share value dropped to rupees from 500.00 to 10.00 (due to audit reports of that company declared that all the growth is false and fraud).

4. October: Now I decided to hold the all 1000 shares until government\’s Legal declaration.

5. November: After a long time when I try to sell the shares the message appears \” presently shares are not trading in BSE/NSE ).

Now my question is

Question No-1: If company get closed ( i.e. vanished )– then how I can sell the shares that I hold?

Question No-2: If the company takeover by other one and changes ISIN number of all old company\’s shares — Then How I can sell the shares?

1. You will not be able to sell on the exchange. If you find a friend or someone else who is ready to buy, you can do an offline share transfer.

2. If the ISIN changes, your shares will automatically get converted to the new ISIN.

Hi,

I need some clarifications on AlgoZ.

I\’ve a strategy EMA_Crossover. Here when I tried Backtesting, trades were taken weirdly. There are more Entry Short positions than Exits. Similarly Long positions.

My script is very simple. Enter at one cross over and exit at other cross over. I\’m not sure why there are different number of entry and exits in Backtest result.

Here are my doubts:

1. How do I set target profit for each trade?

2. How to back test multiple symbols?

3. How to force entry at open and exit at close?

I tried same algo on Amibroker and it worked fine without any issue.

Regards,

Ravikiran.

Hi, how to code the script for intraday trade??

You need to first have a strategy.

Hi Nithin,

I am new to this, so bear with me if it sounds amateurish. Would need help to strategize the following:

All this is one a 5-minute chart

Buy Setup:

Bullish MACD crossover with both lines above 0 AND

EMA (9) clearly below closing price of the candle.

Sell Setup

Bearish MACD crossover AND EMA (9) crossing the candle.

Vishal, your strategy is already coded on this post, what you have to do while backtesting/going live is to open a 5 minute chart and then run this.

When I wrote my strategy in algoZ & closed my ztrader and logged back in to my mobileapp. When the strategy execute, the alert will show on my mobile or not ?? What I have to do if I have no internet where I am working except in my cell phone. …..

in short

I have some very good backtested strategy but wants alert on mu mobile app…

Abhishek, presently the alerts will popup only on the trading platform (ZT) and not possible to be sent on the mobile.

thanks wow, what a stunning fast relay i appreciated your feed back

hey,

ZERODHA TEAM can you please provide a sample code for penny stocks….

Mahabaleswar,

If you can give a technical analysis strategy we can code it for you.

Hi

Can we have OHLCV indicators like Open Interest, bid, bidsize, ask, asksize, tradesize, change, %change which are updated every second.

Regards

Rajesh

Updated every second where? On the charts or marketwatch? Everything you see on marketwatch are updated live.

Will the Algo be running on my computer or Zerodha servers ? In other words will it stop running if I have a power failure or internet outage ?

On your computer, so yes if you logout and login, you will have to go back and run the script again.

Ok. And will the positions be squared off automatically every day or will I be able to take delivery if the algo does not get a sell signal that day.

HI

WHEN ALGOZ WILL BE ENABLED FOR MCX(COMMODITY)?

We\’re having some problems with approvals between our software vendor and the Exchange. This will take a lot more time before it\’s enabled. We\’ll keep you updated on any new developments.

Ok sir for that I have to open a account at zerodha right

hello I am Ravi and I would like to know that this Algo Z will help ,me out for intraday & Commodity ,Forex strategy also and l am new commer to this field your technical people will help me out to this My Own Strategy kindly reply thanks .

Ravi, yes we can help you code the strategies, Check this link, but we can code only if you have a strategy, for which you will have to read up on technical analysis on your own.

Cheers,

Hi,

Do you have paper trading account?

If yes how to asses it?

thanks

No Velappan,

No paper trading account as of now.

Cheers,

I would like to find SMA(5) is decreasing or increasing ?

Any update on this ?

Ravi, increasing or decreasing in relation to the stock price? If the idea is to buy above SMA and sell below SMA, Buy: Close>SMA(Close,5) and Sell: Close<SMA(Close,5) . If you meant something else, do let me know.

i would to compare SMA(5)

Say the current SMA(5) with the previous SMA(5) and find if its increasing or decreasing..

Thanks

Ravikumar

if(sma(close,5)>=ref(sma(close,5),1),1,0)

Hi please help me to code for this strategy

Buy : (EMA 8 crossover on EMA 20 ) and (raising ADX above 21 ) and ( both macd and macd signal crossing above zero reference) and (macd is 2 times difference of macd signal )

Buy Exit: mod of (macd and macd signal difference ) is less than or equal to 1

Kiran,

Buy:

(Ema(Close, 8) > Ema(Close, 20)) and (Adx(14) > 21) and (Trend(Adx(14)) = up) and (MACD(13, 26, 9, SIMPLE) > 0) and (MACDSignal(13, 26, 9, SIMPLE) > 0) and ((MACD(13, 26, 9, SIMPLE) * 2) > MACDSignal(13, 26, 9, SIMPLE))

Buy exit:

MACD(13, 26, 9, SIMPLE) – (MACDSignal(13, 26, 9, SIMPLE) =< 1

I have a few questions.

1. How does this handle costs(brokerage, taxes, slippages)?

2. How does the futures testing work? I mean how does it calculate the point value of a contract?

3. Is there any way to extract more price volume data from Nest either for use in Nest or for APIs?

Nachiket

1. There is no way to include costs into backtesting bit of the strategy.

2. All entries and exits are given at the close of a candle/bar.

3. We are working on launching our new platform, where we will have intraday data for more than 1 year, until then you can only backtest upto the amount of data available on the chart. EOD is available for more than 10 years, intraday data is available only for 22 days.

Cheers,

One year of data! That\’s great! Can\’t wait.

How open is the software (to the data center or support staff), will my strategies be visible to others or it is secured for the user. I wouldn\’t want to lose my advantage if I am able to come up with a really good formula. Have you people thought about IPR (w.r.t formulas devised by individual investors) while designing this software.

Govind,

No one has access to your strategies that you write and test on this, it stays within your computer.

Cheers,

Is it possible to use algoz option on zerodha mobile app?

No,it is possible only the desktop application for now.

When will it come on Mobile?

On mobile not possible.

Zerodha,

I would like to have something like this. Can I do it. At present for Icici bank PE1000 bid rate 2 ask rate 2.

I would place buy order at 2. If this order gets executed then buy 1020 PE at market rate.

These are conditional orders on 2 different contracts, this will not be possible.

This will be possible with fully automated dealer terminal, right? How can I learn about that more i.e. to get dealer terminal access of course after fulfilling the requirements. I am RK1215.

Hi Nithin,

How many years of bactesting can be done on your software for a single scrip say Banknifty?

Anantha, backtesting on algoZ can be done for 22 trading days with 1-minute data. You can also backtest on historical data for about a year or so, depending on the kind of scrip. However, we wouldn\’t recommend backtesting on algoZ for historical data just now. It\’s great for intraday data.

Hanan,

1 year of backtesting wouldn\’t be sufficient as the sample size wouldn\’t be large enough to make any statistical inference. I believe in developing black box trading systems to trade for myself and my system has been tested for 3 years(on Banknifty current month contract). I was looking for data before 2011 and wasn\’t able to find it anywhere. If you can help me with it. I\’d be grateful.

How to put the ‘trailing stopless’? For example I bought at Rs 100 and I want my stopless to shift higher automatically if the price moves up. Say trailing stopless = low – (high+low)/2

Trailing SL can\’t be put the way you have asked presently. Check this blog which shows an example of how to take a strategy live and setting SL.

How to put the \’trailing stopless\’? For example I bought at Rs 100 and I want my stopless to shift higher automatically if the price moves up. Say trailing stopless = low – (high+low)/2

How to write algo code with the following condition

EMA

——–

CMP CLOSE > 4 EMA.AND 4EMA > 9EMA AND 9EMA >18 EMA SHOW BUY SIGNAL

CMP CLOSE < 4 EMA.AND 4EMA < 9EMA AND 9EMA <18 EMA SHOW SELL SIGNAL

ANY INTER MINGLING BETWEEN THE EMA LINE BOOK PROFIT

RSI 14

——–

RSI 80 SELL SIGNAL

BOLLINGER BAND —–20

————————————

CROSS ABOVE 20 DAY AVERAGE BUY SIGNAL

CROSS BELOW 20 DAY AVERAGE SELL SIGNAL

IF TOUCH UPPER BAND EXIT LONG

IF TOUCH LOWER BAND EXIT SHORT

MACD

———-

SHORT DURATION -12, LONG DURATION -26 , SIGNAL PERIOD – 9 ( SLOWER LINE)

IF FASTER LINE > SLOWER LINE .AND. BELOW THE 0 LINE BUY SIGNAL

IF FASTER LINE < SLOWER LINE AND ABOVE ZEROLINE SELL SIGNAL

Did you code this? How did you code it?

Hi,

Can you help me to get this strategy

I\’ve the following Indicator

EMA(CLOSE,14)

SMA(CLOSE,40)

SELL

1. Angle of EMA(CLOSE,14) is less than 0 \’

2. EMA(CLOSE,14) crosses SMA(CLOSE,40) from up

EXIT

Angle of EMA(close,14) gets near 0\’

And vice versa for Buy Call

buy reliance: 0.1 % above market price

can i place an order like this at pre-open time (9am – 9.07am) by using algoZ or any other methods

Yes, you can. There\’s no need for you to code this strategy on algoZ. You can simply place a SL-M or SL order to execute above a certain predefined price. 🙂

i wants to buy 15 shares at 10 am, suppose total buying value is 100000, can i sell automatically all the shares by using this technique , when the total share value reaches at 101000

Yes, you can do this both ways:

1. You can place a target order in your regular buy/sell order window by keying in the price and the quantity you would like to sell.

2. You can also have target orders placed through algoZ.

HI,

I deal in NSE FO segments mostly and want to have an algo based terminal. I have below queries.

1. About NISM certification : there are many types of NISM certification course which one i need to take.

2. Once i have algo based trading terminal, will my existing trading interfaces ( mobile, web based and NEST ) will work or they will be obsolete.

3. Will you provide a new software altogether then do it have a android mobile based counterpart?

Thanks and Regards,

Dinesh Kumar Sen

Hi! Our answers to your questions are:

1. You need to take the NISM certification for FO, the link is here.

2. Everything will work as it was working – with the added ability to fully automate your trades. 🙂

3. Like we said, you\’ll continue to trade on the existing software. No, Android still doesn\’t have a platform on which we can completely automate our trades.

We have it on the drawing board and it will get developed within the next few months.

1. But the current softwares ( specially your web and android trading app) do not have automate options. So Is this the NEST Application which will provide me the options to automate ( like an option of trailing stop loss).

2. If i feed one strategy, say simple trailing stop loss, Then can i close the application. Stop loss will automatically keep on shifting even when the app is closed?

3. Who can provide me what to prepare for NISM exam.

4. Also please consider to provide the demo or small training for algo based plateform i3 module.

1) Yes, the Zerodha Trader Software allows for automating trades.

2) Yes, SL keeps on getting adjusted even if you\’ve logged off.

3) You can look up for this information under the Education tab of the NSE website.

4) We can send you the demo video that we have for it.

Will the Algo script running, consider the carry over positions? Suppose I carried a long position from previous trading day, then will the script genate exit signal for that carried over long position?

The algoZ script will treat each trade day individually without considering the previous day\’s positions. However, this will not affect your strategy in any way.

If you had taken a position the previous day in NRML, then any new signal generated the next day will square off your existing position as long as the quantity is the same for yesterday and today.

How do I invoke algoZ?

Guess it is not enabled for you yet. We will enable it for you, check this blog

Cheers,

SIR AN NISM CERTIFICATE IS NEEDED FOR FULLY AUTOMATIC ALGO Z OR DEALER TERMINAL BUT WHICH SERIES OF NISM CERTIFICATED OR ANYTHING ELSE WILL BE REQUIRED ? NEED IN A LITTLE DETAIL SIR.

Series 8 certification, the link is here: http://www.nism.ac.in/index.php?option=com_content&view=article&id=375&Itemid=299

Hi,

Is it possible to have Metatrader(MT4) generated signals get executed in Nest terminal with the hellp of Nest trade plugin? (Like Amibroker to Nest).

Plus trading plugin, https://plus.omnesysindia.com/NestPlus/Plus/PlusPage.jsp?prd=plus_api , can be used for this, but it will have to be done from your side and we won\’t be able to support you in putting this up.

when you will be getting approval of Algo for MCX? any tentative date?

Exchange hasn\’t given approval yet, we have no clue on this.

I work in office so for trades i mostly rely my price alerts. But mail is some times very slow. Can you privde SMS alert?

SMS alerts are not viable due to the cost involved for sending SMS alerts in India. The best option is to go for email alerts or you can have the app Zerodha Mobile running at all times on your mobile. The app is fairly stable and can be active for the whole trading session allowing you to use your mobile for other functions, too.

HI Zerodha,

Does zerodha provide. email alerts for trades also. Like if a trade is done i recieve an alert.

Does the same available on your android app and web app?

Thanks and Regards,

Dinesh Kumar Sen

Yes, you can set alerts for trades or for price movements. These alerts are usually available only by email. If you have a smartphone, the best thing to do is set alerts and you can receive them on your mobile itself. Or you can view all the orders as they get executed on your Zerodha Mobile app. To download the Zerodha Mobile app go to http://trade.zerodha.com/download

Hanan,

Can I have e-mail alert on when our strategy gives a buy/sell indicator? It would be really helpful for working people like me, we can just act based on the e-mail alert.

Thanks,

Midhun

Hmmm.. currently not possible.

Hi,

Can I write a algo for option strategies (Strangle , straddle, etc) that works on more than one strke price (more than one script)?

Thanks

You can write an algo only for price movements of a single chart using our algoZ interface. This chart can be of an option, future, or equity. If you\’d like to try option strategies, simply go to Nest Plus < Tools < Option Strategy on ZT. This allows you to play around with option strategies by giving you the payoff table.

I need live nifty future data for my custom application.How much it will cost me? How can i download at run time live?

Dinesh,

To get live data you will need to go to a data vendor, we will not be able to provide on a different application.

Raja asked:

Hi,

I have a query regarding algo Z for zerodha

I saw the intro on your site

http://www.zerodha.com/z-connect/blog/view/algoz-an-introduction

I wanted to know,

how many symbols can be monitored at a time with an algorithm coded in algoz?

is it possible to code a strategy that will monitor the entire futures segment?

Raja,

Once you write a strategy, you will have to run it for every individual scrip separately. You cannot have 1 strategy and run it on multiple futures at one time.

sir,

I cant use algoz live & back test option.i have already mailed to [email protected] got reply from u r side.but yet not activated live & back test option.plz help me

regards

Radhakrishnan

Sir,

me to facing same issue.last week i can use algoz(live & back test option).but now only showing edit option.plz help me

regards

Sreejith

my client id is RS1496

Hi Zerodha,

Thank you for your Response.And also thanked for enable live and back test options in my account.

Thankfully ANIL

Sir,

I cannot use algoz live and backtest options from jun 03,

pls hellp.

By vinayan

Vinay,

Will get someone to call you back on this and have this issue fixed.

Hi Zerodha,

Still i didn\’t see the live & backtest options. i have several times login and logout ,and also waiting.How many time will take this options are enable in my accout?

Anil

Anil,

I guess there must be an issue with the installation, can you send an email to [email protected] with your client id.

Have any upgradation process are in progress? I didn\’t get any live& Back test options on AlgoZ,Only Edit option have seen.Pls reply this comment at the earliest.If any problem pls write when it done….

Thanks

Anil

Yes, there was an upgrade underway. Please log off and login again to see your backtest option. If you still don\’t see the backtest option after logging off and logging in again, then it will be active by end of day today. We thank you for your feedback.

The most basic thing is from where to access algoZ?

I mean i cant find it..

Kindly comment

Vapor,

open a plus technical chart(shift +P) for any stock, right click and you will see the option to edit/backtest strategy..

If you are not seeing this, guess you are not enabled yet, then send an email to [email protected], we will enable it for you..

Nitin,

For individual investor/Trader is is possible to trade Fully automated?

What is the requirement for enabling the same.

Thank you

Vikas

Vikas,

An individual investor/trader on a retail terminal cannot fully automate the trades. For doing this, you would need a dealer terminal, which will require you to be an Authorized person with us and also be certified(NISM) for using the dealer terminal.

Cheers,

Hi,

What would be course/exam in NISM that a person need to take for this.

Thanks

Can I do this algo trading only for intraday or for positional also? Any manual for the system setup or the allowed expressions or formulas?

You can trade for both. User manuals are here

Hi Nithin

My name is Bhaskar H. K. my question is can I trade with AlgoZ for cover orders? if yes how to?

Regards

Bhaskar

No, the cover order feature from algoZ is disabled for now.

Can the system pick up buy/sell signals from an excel file(which is updated from another data source like amibroker)

Chandan, we have stopped supporting algoz. We are in the verge of launching Pi, probably the most advanced trading platform in India. Check this section, where we have discussed on features and how to request for beta.

You can see some of the examples here..

Hi, I do not see any link for user manual …

Hai,

First of all thank you zerodha,for your efforts to drive us to make profit.

my question is ,where can I download your new version?

Sasi,

The new version of ZT should be available early next week.

Excellent initiative . Kudos to Zerodha and team. Will start experimenting right away.

Thank you . Usually I dont write this anywhere online but this is an exception please except it.

YOURS FAITHFULLY…

Thanks Shri and best of luck with your trades.

Cheers

Hi,

I understand Nest Pulse provides feature to write strategy / algo trading. How is algoZ different from Nest Pulse.

Regards

Chandra

Chandra it is basically a bunch of things added to PULSE. Also PULSE is paid while this would be free.

How to write for inside candle transcript or code ?

Rihi, check this post.

Is the backtesting restricted to a few scripts or is it global? To be more clear, if I write a strategy, say a simple strategy of return > 5% in the day, could I test this strategy on all the available scrips or just only those selected. Could I backtest on aggregate data or is it restricted to the scrips I choose?

I haven\’t gone through the entire manual (sorry for being lazy :)).

Uber, You can backtest individually one scrip at a time. We are lazy in a way I guess.. 🙂

Is there a way such that I could automate the process of running the scrip one by one instead of adding the conditions manually. Say, I need to test every equity for the above condition?

Presently not possible, but we will look at offering this kind of a feature in the future.

Cheers,

Hi Nithin,

i just spoke to customer support and i got reply that full automated trading is not possible with zerodha even after having Nism Equity & Derivative VIII certificate.

can you expain everything to me clear my doubt about it

We\’ve shared with you links of the Kite Connect API using which one can connect to any 3rd party or customized platform to fire generated signals to the Exchange. We don\’t provide any automation softwares as such.

Can we use ninja trader for fully automated trading

If you have the tech skills, yeah you can. But we don\’t offer any tool as such.