Save for your retirement with National Pension System (NPS)

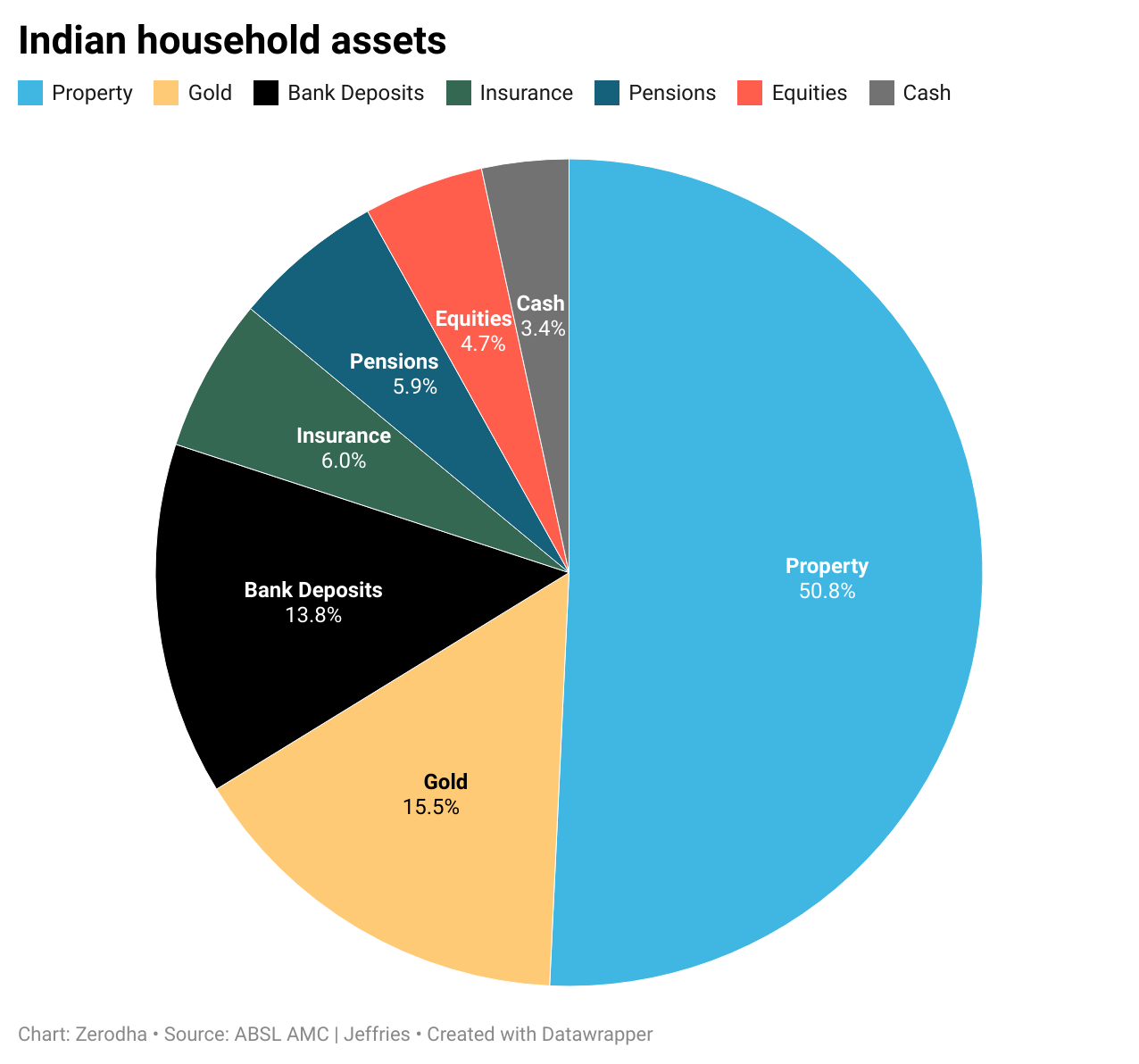

A comfortable retirement is the ultimate goal we all work for, but the available data shows that the vast majority of Indians are probably not prepared for retirement. Let me give you some numbers to illustrate the point. The National Stock Exchange (NSE) has about 9 crore unique investors registered with it. So the total number of unique Indian investors with demat accounts will be in this range since NSE is the biggest exchange. There are just about 4.3 crore unique mutual fund investors. But if you look at this as a whole, only 4.7% of total household assets are invested in equities.

The most popular savings avenue for the vast majority of Indians is bank fixed deposits (FDs), with over Rs 100 lakh crore. Provident funds are the next popular option. There were 29 crore subscribers, with 6.8 crore active subscribers. The other popular investment options for most Indians are insurance policies like endowment policies and unit-linked insurance plans (ULIPs). The rest is invested in property and gold. This makes most Indians asset-rich and cash-poor.

This is just the asset side of Indian household balance sheets. Even without looking at the liability side, you can safely assume that most Indians are probably not investing as much as they should be for a comfortable retirement. We no longer live in a world of defined-benefit pensions where the employer would guarantee a pension. It’s up to us to prepare for retirement. In fact, some experts would argue that India is already facing a pension crisis due to the nature of the government’s pension liabilities.

Over the 13 years of Zerodha, our mission has naturally evolved from just providing traders and investors with the best tools to helping them do better with their money. A big aspect of that mission is to help people prepare for their retirement. It was with this goal in mind that we applied for the National Pension System (NPS) license and got it a couple of years ago. Due to a few regulatory challenges, it has taken us some time to launch. Since NPS will be on Coin, its launch was delayed due to the discontinuation of the pooling mechanism for mutual funds. This was a huge change for us, and it was as good as rebuilding Coin from scratch.

But we’re happy to announce that NPS is now live on Coin.

Why National Pension System (NPS)?

NPS is a brilliant option for saving for your retirement because it forces you to invest in a diversified portfolio of equities and debt by default. It’s also one of the cheapest investment options out there and tax-efficient. Since NPS is a product aimed at helping people prepare for retirement, it comes with a lock-in. All NPS investments are locked until the subscriber turns 60, after which you can withdraw the money.

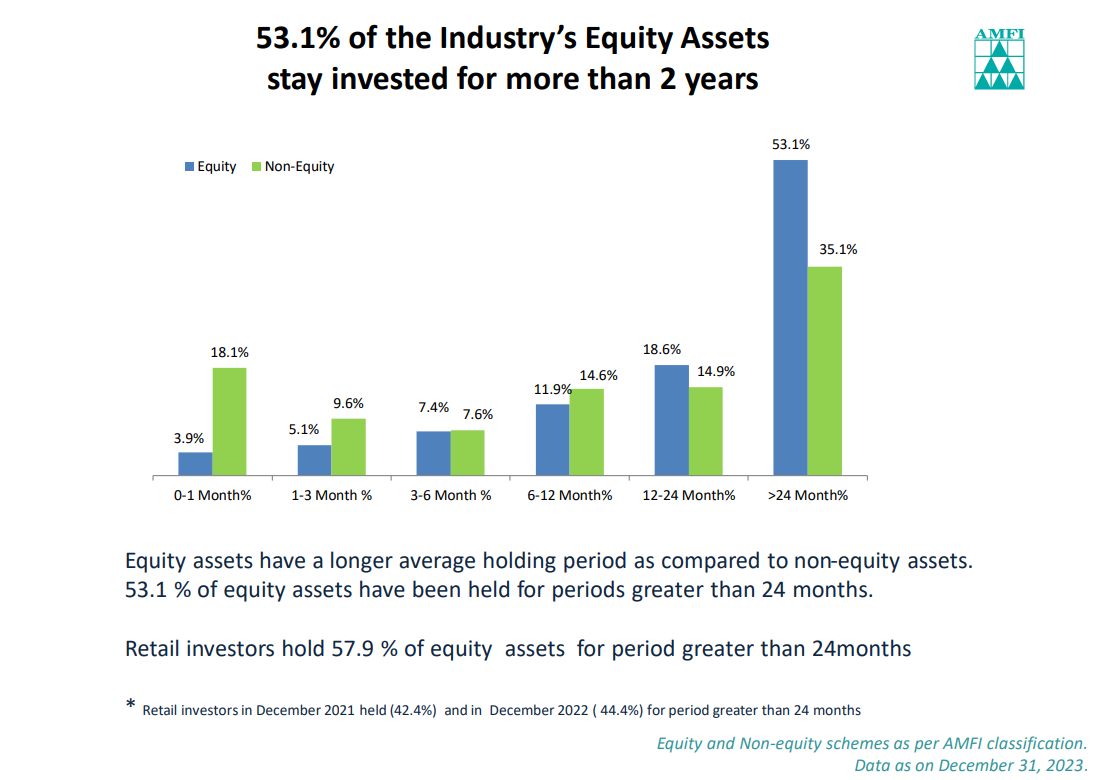

This lock-in is a feature, not a bug. AMFI publishes data on what percentage of investors hold their assets for what period. As per the latest data available, only 50% of investors held their equity funds for more than 2 years. AMFI doesn’t disclose the data, but anecdotally, the longer you look at this data, the shorter the holding period becomes. So the lock-in period in NPS stops people from potentially doing silly things.

There are two ways of investing in NPS.

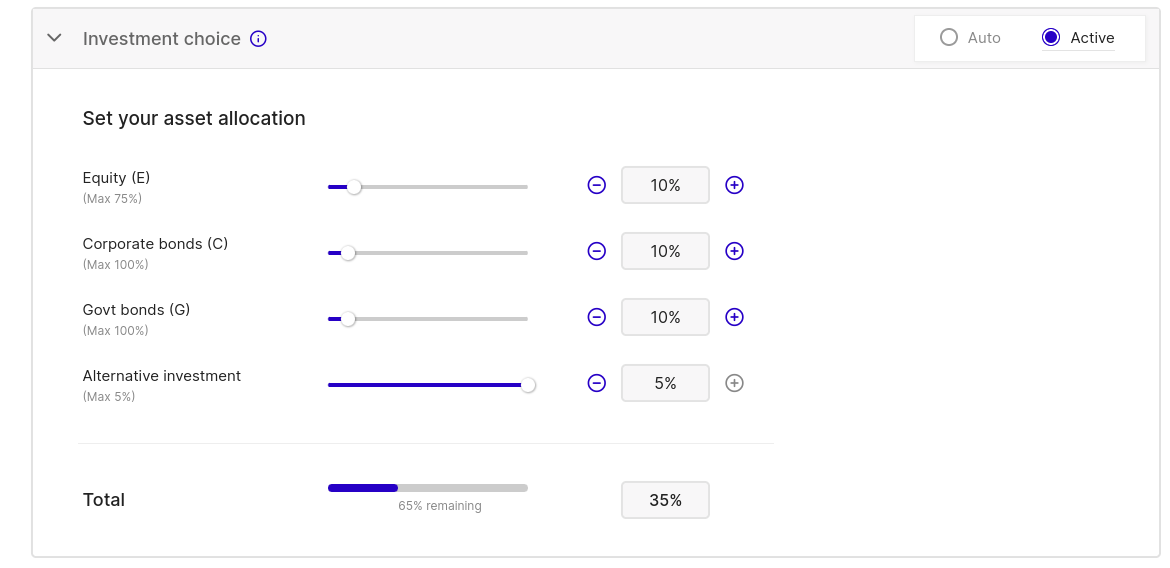

Active choice

Under active choice, you can choose how much to invest in equity (E), government bonds (G), and corporate bonds (C). For example, 50% in equity, 25% in government bonds, and 25% in corporate bonds. The maximum allocation to equity is 75%, and for bonds, it’s 100%.

There are 10 pension fund managers, such as ICICI, HDFC, and others, who manage the investments under the NPS. You can choose who to invest with.

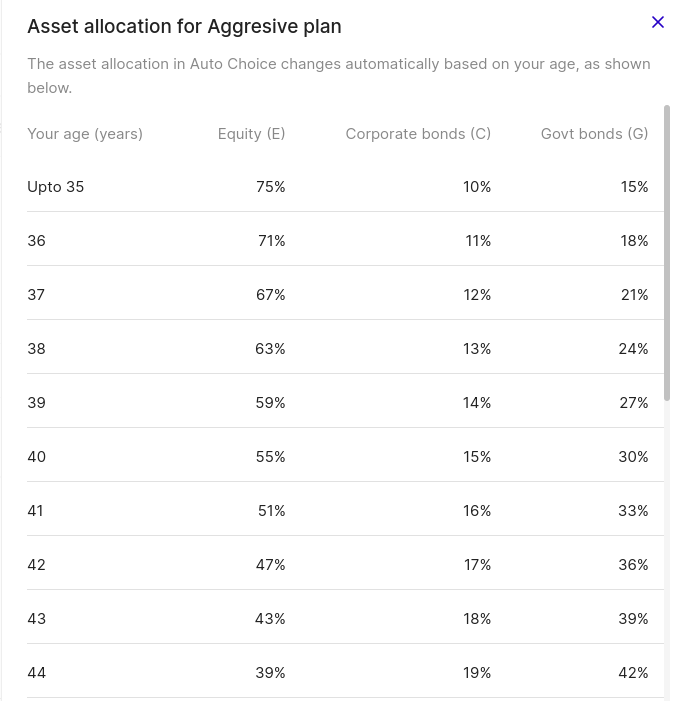

Auto choice

If you don’t want to actively choose the allocation, you can choose the auto choice instead. Under auto choice, your allocation to the two asset classes will be decided automatically based on your age. The younger you are, the higher the allocation to equity, and vice versa. Here’s an illustration of how the allocation will look under the aggressive plan of auto choice. Similarly, there are moderate and conservative options under auto choice.

Tax benefits

Investments in NPS are eligible for tax deductions of up to Rs 50,000 under Section 80CCD. This is over and above the deduction limit of Rs 1.5 lakh under Section 80C. So, in other words, by investing in, say, ELSS and NPS, you can claim deductions up to Rs 2 lakh.

Upon maturity, you can withdraw 60% of the corpus, and this is tax-free. The remaining 40% has to be compulsory annuities. Annuities are financial products that take a lump-sum payment and provide regular income. So, let’s say you buy an annuity of Rs 1 crore. Insurance companies that sell annuities take that Rs 1 crore and pay a monthly amount. So the logic is that this 40% becomes your pension.

Mutual funds vs. NPS

Both NPS and mutual funds have their merits, and I don’t think it’s a question of what is good and what is bad. Using NPS for your core retirement investments and then complementing that with mutual funds works well.

Charges for investing in NPS

An account opening fee of Rs. 200 is charged. A fee of 0.25% of the investment amount + GST or Rs. 30 + GST, whichever is higher, is charged on each contribution. Other charges apply as specified by the regulations.

How to invest

NPS is currently live on Coin web and will soon be available on the Coin mobile app. Click here to invest.

What’s next for NPS on Coin?

The transactional journeys are live on Coin. We are working on adding more tools, such as calculators, financial planning tools, and better data about pension funds, scheme performance, and allowing Tier 2 accounts. We’re also working on integrating mandates to help you create SIPs.

Only new NPS subscribers can invest. We are working on allowing existing NPS subscribers to move their accounts to Zerodha.

Useful NPS tools

NPS pension calculator

Historical performance of NPS schemes

When can I move existing NPS account to Zerodha?

We’re wroking on it, Sri. We’ll keep you posted on it.

What’s the status of this feature to link existing nsdl protean NPS account to zerodha?

I’m getting below error while i try to create NPS account, I have raised a ticket 4 days back still no responds even in the ticket

An error occurred (404) when calling the HeadObject operation: Not Found

Hi Brieuk, sorry to hear this. Getting this checked. You will have an update on the ticket at the earliest.

Hi i am student i have not pan card my uncle of pan card

Can my employer contribute to this NPS account if i create via zerodha?

Hi Praveen, this falls under corporate NPS which currently is not offered.

Can I have more than one NPS account? I am an existing NPS holder as a gov employee. What is the minimum and maximum amount that can be invested in NPS per month?

Hi Dhruba,

1. You can hold only one NPS account.

2. The minimum investment in Coin is Rs 1000/- and maximum is up to the permitted limit allowed your bank for transfers.

Hi I want to invest in a pension plan, how do I start?

HI Shamsair, we’ve explained the investment process here.

When will zerodha start SIP in NPS account in zerodha

Hi Sowmiya, we are working on this, for now you’ll have to make lump-sum investments.

Give some option to track tier-i accounts. I am a govt employee.

Exchanges have temporarily restricted trading in your account. Please check this link for possible reasons. Read

more.

Hi Dileep, please create a ticket at https://support.zerodha.com so our team can have this checked?

I currently have my NOS account with KFintech KCRA, can you suggest if I could transfer this acount to COIN? if yes then how?

Hi Nikhil, we’re working on enabling existing NPS subscribers to transfer their accounts to Zerodha. Will keep you posted.

Thank you

NPS ar good hindi me translation ka option bhi hona chaiye jyade se jyade samaj me aaye or who apply kar sake

Best trading platform 😉

I want to open my NPS

Hi Mani, we’ve explained the process here.

I started nps about 3 yrs ago , can I migrate itmy nps acct no 110137089781 to zerodha ?

Hi Ashok, we’re working on enabling existing NPS subscribers to transfer their accounts to Zerodha. Will keep you posted.

😇💯💥☻️

I find Zerodha Kite the best broker. It has a simple plot form. There is no confusion about anything.

I have an existing NPS tier 1 account, can I transfer the same to zerodha coin? Please update when this feature is added to the platform. Thanks

Reply

Hi Prem, we’re working on enabling existing NPS subscribers to transfer their accounts to Zerodha. Will keep you posted.

So trusted app

I have an existing NPS tier 1 account, can I transfer the same to zerodha coin? Please update when this feature is added to the platform. Thanks

would like to move from NSDL to Zerodha. look forward to this advise

How do i start my NPS Account

Hi Harshal, we’ve explained the process here.

I have an existing NPS Account, can I transfer this account with Zerodha?

Hi Rishikesh, we are working on enabling existing NPS subscribers to transfer their accounts to Zerodha. Will keep you posted.

Please full tamil language

Thanks

Any help me my account no working

Hi Venkatapathi, what seems to be the issue? Could you please create a ticket at support.zerodha.com with details of the issue, so we can have this resolved at the earliest? We’ve explained the process of creating a ticket without logging in here.

You can track the ticket via email updates in your registered email ID.

I like this scheme

My acoustic isn’t activated yet, its been a week and more, as im paid 200 for the verification, the service from zerodha is disgusting please take necessary action asap

Hi Fayis, we’re sorry to hear this, could you please create a ticket here so our team can have this resolved at the earliest? You can also contact us on our account opening helpline: 080 4719 2020. https://zerodha.com/contact

We’ve explained the process of creating a ticket without logging in here

You can track the ticket via email updates in your registered email ID.

Willing to join the same

How to migrate NPS account from other broker to coin?

How can I save for future? I am retired person.

I think mutual fund is much better than NPS. I am a NPS enrolled employee and I countinue it from last 13 year. After 13 year I think mutual fund return is better than NPS. NPS gives 08 %-09 % return whereas all mutual fund including index fund gives minimum 12%-15% return. On the other hand mutual fund provide more options i.e. one time investment when market down which increase our return.

With 40% becomes my pension so let 40% = 1cr and I buy a annuity of 1cr then how much money I would recieve?

NPS ki jaankari hindi main honi chahiye

This is very true story & amazing thing

Hai

I am a investment in the NPS, but till today I have not received a card.

I am pensioner, my age is 64 years,i can I join NPS Scheme, i am interested.

Hi Dattatray, the maximum age to subscribe to NPS is 65. You can continue investing in NPS upto the age of 70, after which you must exit. Check out the this article for more details.

Hi Shruti G , I am 53 yrs Old So how do I save?

We’ve explained how to invest in NPS through Zerodha here.

Plz Hindi language explain.

An error occurred (404) when calling the HeadObject

operation: Not Found

I already raised ticket still not resolved

Please confirm nps deadline is March 28th or March 31st to show under 80ccd

Pls demo

My age is 46years as of now can I join nps scheme

Hi Manoj, you can invest in NPS if you are between the ages of 18 and 65.

Please add snapshots in your document. I couldn’t find the option in Coin app

Hi Diptesh, NPS will be available on the Coin app soon. We’ll keep you posted.

Hindi mein samjhao

I m new… I sont know how to registered in nps… I wants this pension scheme….

Hi Alok, we’ve explained how to invest in NPS through Zerodha here.

I m 44 Years old and in Semi Government Services.. I Hv NPS ac Monthly Saving More Than 10 Thousand. How I can change my asset allocation or Which are good for me

I have NPS account opened through ICICI bank in 2018 and how can I fund the NPS tier 1 & tier 2 from Coin with SIP investment

Hi Praveena, as of now, existing NPS subscribers cannot shift from another CRA/POP to Zerodha. Zerodha is working on enabling the migration of NPS subscribers from one NPS service provider to another.

Hi, is the facility to transfer from ICICI Direct NPS to Zerodha available now?

I am 43 now how much I am interests

Hi Vaishali, you can invest in NPS if you are between the ages of 18 and 65.

My age 38 how much monthly investment

Hi Mahesh, you can invest in NPS if you are between the ages of 18 and 65.The investment amount is your choice.

Daughter age 37 how much monthly investment we have to do

Hi Sankari, you can invest in NPS if you are between the ages of 18 and 65.The investment amount is your choice.

Give the full details and benifit with time period.

Please do let us know when you do this ”We are working on allowing existing NPS subscribers to move their accounts to Zerodha.”. I already have an nps account. But I feel it will be more convenient if it will be inside coin app. Thanks!

Hi Ashish, will keep you posted.

Plz update after one year

Can NPS pledged as cash collateral for trading?

Hi Ravindra, no, NPS investments cannot be pledged for collateral margin.

Dear, what an existing NPS subscribers can do in coin?

Hi Satheeeh, as of now, existing NPS subscribers cannot shift from another CRA/POP to Zerodha. Zerodha is working on enabling the migration of NPS subscribers from one NPS service provider to another.Will keep you posted.

Benefits

My age 35 details nps

Kite mujhe bahut achcha Laga Dil se

What is the benefit and legal security to open nps account in zerodha?

How it is different from nationalised banks?

Hi Pinak, we’ve planned a bunch of useful features that improve the investing experience, plus you get the benefit of a combined portfolio view. NPS investment data will eventually be on Console, where you can see all your investments in one place.

I already have a nps account, and I invest or track via coin app

Hi Sopan, as of now, existing NPS subscribers cannot shift from another CRA/POP to Zerodha. Zerodha is working on enabling the migration of NPS subscribers from one NPS service provider to another.

Please update as to one can contribute to NPS after 60 years of age.

Thank you.

Hi Mathivanan, maximum age to subscribe to NPS is 65. A subscriber can continue investing in NPS upto the age of 70, after which they must exit. More here.

My age is 28 can i invest in it

I am already having NPS Tier-2 account. Kindly update when it becomes available to move to zerodha please.

Hi Radhamani, we’re working on it. Will keep you posted.

I already have a nps account can we map/connect to it on coin or kite.

Kindly guide

Thanks

Hi Kavita, as of now, existing NPS subscribers cannot shift from another CRA/POP to Zerodha. Zerodha is working on enabling the migration of NPS subscribers from one NPS service provider to another.

Much awaited addition, will wait for existing NPS accounts to be transferred to zerodha.

e-nps is much cheaper, your charges are too high

My age is 47

Can l take a NPS

You can invest in NPS if you are between the ages of 18 and 65, Sanjay.

My age is 45+ can i have NPS? Share all details

You can invest in NPS if you are between the ages of 18 and 65, Suman.

My age is 45+ can i have NPS?

how it works tell me

If i invested in NPS ,,can i claim it while filing ITR under sec 80CCD

Hi Balaji, you’ll be eligible for Tax benefits of upto Rs. 2 lakh if you are under the old tax regime. i.e. Rs 50,000 under section 80CCD over the Rs. 1.5 lakh deduction under Sec 80 CCE. More on the NPS tax benefits here.

Kindly make a YouTube video on this about how to open NPS account through coin

Very Good 👍🏻

I am interested

How do I transfer my existing NPS ACCOUNT from UTI to zerodha/coin?

Hi Shankhala, as of now, existing NPS subscribers cannot shift from another CRA/POP to Zerodha. Zerodha is working on enabling the migration of NPS subscribers from one NPS service provider to another.

Can we get collateral benefit for option trading on NPS investment?

Hi Anil, no, NPS investments cannot be pledged for collateral margin.

How do I transfer my existing NPS ACCOUNT to zerodha/coin?

Hi Anil, as of now, existing NPS subscribers cannot shift from another CRA/POP to Zerodha. Zerodha is working on enabling the migration of NPS subscribers from one NPS service provider to another.

I have NPS account registered under karvy,shall I transfer to zerodha coin platform

Hi Vinod, as of now, existing NPS subscribers cannot shift from another CRA/POP to Zerodha. Zerodha is working on enabling the migration of NPS subscribers from one NPS service provider to another.

How do I get my already enrolled NPS details in coin?

Hi Vikram, as of now, existing NPS subscribers cannot shift from another CRA/POP to Zerodha. Zerodha is working on enabling the migration of NPS subscribers from one NPS service provider to another.

My age is 43 send me ur investment plan details

I am 42 years old howmuch minimum lumsum investment

Hi Rameshwar, the minimum investment in Coin is Rs 1000/-. Here’s how you can invest.

What is the minimum amount which needs to be invested and at which age I would be getting the benefits

Hi Sanjay, the minimum investment of Coin is Rs 1000/-.Check out the FAQ section for more details on post-retirement benefits.

After me , what happens to the money?? for example , I live up to 80 Years 😀 , after that will my wife get the pension ??

After my wife , what will happen to the money ?

When a subscriber passes away, the NPS account’s entire savings will be disbursed to the nominee or legal heir.

1. What is the Mandatory Annuity that we have to buy with the accumulated money at the age of 60 ?

2. Any reasons we can withdraw bulk money for medical , Marriage or Education purposes??

Hi Rakesh,

1. We’ve explained it here.

2. The conditions under which NPS withdrawals can be made are mentioned here.

Now I am 48 + how much should I invest in NPS monthly basis to get 30,000/- per month pension after 65 years of my age, thank you

Please advise

Yearly 50000 u can invest in NPS

I am 56 can I invest lumsum

Need to transfer my existing NPS account to Zerodha NPS ..: all investment under one roof

Hi Nitin, for now, only new NPS subscribers can invest. We are working on allowing existing NPS subscribers to move their accounts to Zerodha.

Hindi me batao

Can transfer existing NPS to coin?

I am getting below issue while opening the account please let me know what needs to be done.

An error occurred (404) when calling the HeadObject operation: Not Found

Hi Anuj, we’re sorry about this. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

What is the maximum contribution amount per annum

My age 38

Nsp mai kitne rupee par month ka nsp karna chaiye mujhko please bataiye

Send message in hindi please🙏

I am interested how to investment

Hi Raju, you can invest in NPS on Coin. We’ve explained the process here.

Zerodha, The team requests that you send messages to me in Hindi, not in English.

Very good scheme I can apply for that my age 43 years

How to find in Coin?

It will be use lumpsum or SIP?

GOOD

As NPS is very nice scheme , I’m 55 yrs old , working with state govt may I apply for NPS…how to open this scheme??

Yes, Uttam. You can invest in NPS. We’ve explained the process here.

Very very nice information 👌

What amount be deposited initially and what will be possible returns after twenty five years

I need to start up

Dear zirodha team,

Can I transfer my cams nps account.

Hi Annash, currently only new NPS subscribers can invest. We are working on allowing existing NPS subscribers to move their accounts to Zerodha.

plz explain how to invest

Hi Tina, you can invest in NPS on Coin. We’ve explained the process here.

How much applying? Process

It will be great if we can link our existing accounts to it….

I am interested

Very nice information about NPS

How To Invest

Hi Jainam, we’ve explained the process here.

I have some physical shares with me

How to de meterialise

Hi Balajeet, we’ve explained the dematerialization process here.

I am already doing NPS directly with portal can I move the same to coin ? If so kindly let me know the process

Hi Abhishek, currently only new NPS subscribers can invest. We are working on allowing existing NPS subscribers to move their accounts to Zerodha.

How can i start investing in NPS through COIN?

Hi Subrat, we’ve explained the process here.

Can a govt employee who has a NPS account can open a new nps with zerrdha coin

This is not possible, Vikas. Currently only new NPS sucscribers can invest on Coin. We’re working on allowing NPS investors to move thier account to Zerodha.

Nice information i am investing but starting 2027

I’m interested investor in NPS

Charges for investing in NPS

An account opening fee of Rs. 200 is charged. A fee of 0.25% of the investment amount + GST or Rs. 30 + GST, whichever is higher, is charged on each contribution. Other charges apply as specified by the regulations

What are the additional benefits we get for paying these charges?.

It will be very helpful if you allow existing NPS subscribers to move their accounts to Zerodha.

We’re working on it, Subir. We’ll keep you posted.

How to invest in nps?

Hi Santanu, you can invest in NPS on Coin here. We’ve explained the process here.

excellent

How can i shift my existing nps account to coin?

Hi Mahesh, currently only new NPS subscribers can invest. We are working on allowing existing NPS subscribers to move their accounts to Zerodha.

How to invest in NPS

Hi Biswajit, you can invest in NPS on Coin. We’ve explained the process here.

Good

its better to buy electoral bond than investing on nps

I am getting this error:

An error occurred (404) when calling the HeadObject operation: Not Found.

Can you please guide me through

Hi Chaithresh, we’re sorry about this. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

My NPS account is frozen. I would like to close this and start with Coin afresh. Is it possible?

I have existing NPS account. Is it possible to link/transfer it to Zerodha Coin?

Hi Parag, for now, only new NPS subscribers can invest. We are working on allowing existing NPS subscribers to move their accounts to Zerodha.

Hi sir.

I have one question. can I pledge NPS fund to have collateral margin for trading.?

Hi, NPS cannot be pledged.

NPS contributions on Zerodha has regular mutual fund esque type of commissions, the very thing Coin is against. Any reason for percentage based commissions?

Please add filtering by CAGR value to Coin. The current CAGR filter is useless. My benchmark for liquid funds is 7%. However, you guys provide option to filter between 5% and 10% only. Literally every debt fund falls in this category, so filtering is completely useless and does not remove anything.

For equity fund, my personal benchmark for the previous year is 18%. However, I cannot filter >18% and you guys include everything above 15% too.

When designing it itself such glaring problems should have been obvious.

Can we pledge NPS?

Hi Adarsh, NPS investments cannot be pledged for collateral margin.

Hi Team,

Can we pledge this?

Hi Laxman, NPS investments cannot be pledged for collateral margin.

How I do this?

Hi Vidya, we’ve explained how to invest in NPS here.

Can we transfer our existing NPS tier 1 account from other fund managers to zerodha?

Hi Praveen, existing NPS account holders cannot currently contribute via Coin. This feature is only available for new NPS investors. However, we are working on enabling existing NPS subscribers to transfer their accounts to Zerodha.

The lock in period is till 60. But what I find intriguing is why a investor is stopped from going for choice of options I.e active or auto at 50 years itself. I had invested in nps in 2016 and my investment agent went for auro choice then itself. I feel it’s a blunder on his part. Please comment on the loss to me.

All the best in your new NPS endeavor.

Hi,

Can we do SIP’s in NPS. Is this function already available.

Hi Rohith, this is on our to-do list. Will keep you posted.

What is the advantage of having the NPS account on Zerodha /Coin instead of having it directly on these Portals? ( CAMS, protean or Kfintech….)

Hi Munish, we’ve planned a bunch of useful features that improve the investing experience, plus you get the benefit of a combined portfolio view. NPS investment data will eventually be on Console, where you can see all your investments in one place.

Porting existing NPS to Coin is really the most wanted feature. Hope it does not take another 2 years to implement👍

Hi, we are working on allowing existing NPS account holders to register. However, cannot provide a timeline at this moment. We’ll keep you updated.

Good initiative, please bring in feature to port existing NPS account to Zerodha.

Hi Anil, we are working on allowing existing NPS account holders to register. However, cannot provide a timeline at this moment. We’ll keep you updated.

Hi,

Can I manage existing NPS account from Coin?

Suresh

Hi Suresh, currently existing NPS account holders cannot manage via Coin. This is only for fresh NPS investors, we’ll let you know when we onboard existing NPS account holders 🙂