Quick Baskets on Kite Web

Placing multiple orders one by one can be slow, especially when markets are moving quickly. Even a small delay is sometimes enough to miss a good price.

If you’re buying several stocks at once or executing a multi-leg options strategy, entering each order separately can become a hurdle.

Quick Baskets on the Kite web makes this easier. You can quickly add multiple orders and place them together in a single click from anywhere on Kite Web.

How Quick Baskets work

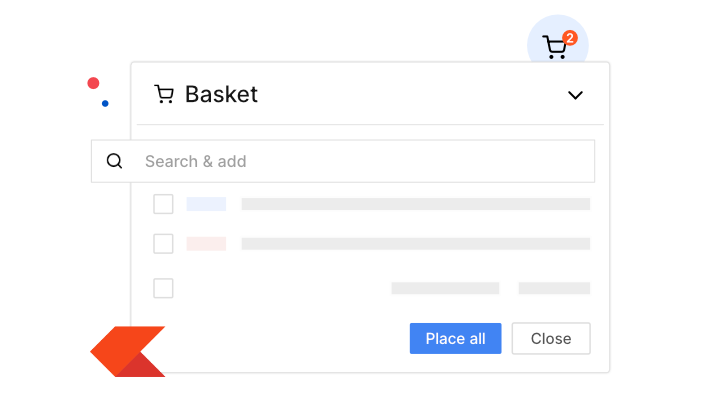

The basket icon is always visible in the top-right corner of Kite Web. Whether you are on your watchlist, checking charts, or reviewing your positions or portfolio, you can start building a basket instantly.

Creating a Quick Basket

- Click the basket icon in the top-right corner

- Search and add stocks or F&O contracts in the box that appears

- For each item, enter the quantity and choose your order type

- If it is a limit order, set your price. If it is a market order, it will execute at the current price

- Once you have set up everything, click Place all

Adding instruments from other pages

You can also add items to the basket from the marketwatch, orders, holdings, or positions page:

- Hover over an instrument

- Click on More

- Select Add to basket

Quick Baskets for options traders

Options traders have a faster way to build multi-leg strategies right from the option chain:

- Enable basket mode in the option chain

- Hover on a strike

- Click B to buy or S to sell

These orders go straight to your basket, ready to place together.

Important

- Quick Baskets are not saved. If you log out, switch browsers, or log in from another device, instruments added to your Quick Basket will be removed. If you want to save baskets for later use, click on Orders and then click on Baskets to create a new basket there.

- On the Kite app, Quick Basket is available in the option chain, which makes placing orders faster for multi-leg option strategies. Read more.

If you have any questions about Quick Baskets, please post them in the comments below.

What is the maximum units I can trande in Nifty , Sensex or Banknifty…is there a limit?

Please provide me BO (Bracket order) facility. I need to place Buy order, Stop Loss and Target Order simultaneously.

This will be of great use for me. If you can not provide this facility, please let me know.

thanks

Pls send Stoploss and trailing Stoploss vedio

can we upload it using a excel

Can this be used for F&O rollover

Is it quick basket for long term investment, please confirm

If I trade Nifty fifty future and long time.

please make video and send on youtube with larger view and bigger alphabe

When executing the basket, it fails sometimes due to margin requirements simply due to the ordering of the buy and sell requests. Any suggestions on avoiding this, or automatically executing the buy and sell orders to avoid failures? Likewise, there is no warning before execution when market orders are blocked for some strikes while other legs execute. Shouldn’t they be all or nothing?

from order page, can you please let add the same order to our saved basket

i have to repeat several non-executed orders manually every day after the are canceled post market hours

One more suggestion, can you please have the same bucket kind of approach for Holdings/Positions as well. Small investors might have purchased a specific sector stock as a bucket. So, this will help in tracking.

Here is the corrected and clearer English version:

I tried. It’s very complicated. Please make it drag-and-drop and also provide a multiplier option.

Also, why can’t you allow flipping between NRML and MIS with a single mouse click, and vice-versa?

Do standard option strategies like iron condors and spreads get executed as ”both or none”?

Please provide BO orders