Introducing Console holdings

Our tech team has been working on Console – our reporting tool for the last two years, and it has been a grind covering for all the edge cases. It is probably the only platform that includes P&L and the average price even for stocks transferred in from another demat, all types of corporate actions, tax P&L with turnover reports, and many more. We are now working on adding visualisations and features that can give better insights on your investments and trading behaviour, and help in your goal of earning profits.

Over the next few weeks, we will put out posts explaining everything you can do on Console, starting with Holdings.

Holdings sectoral visualisation

Track your overall portfolio by distribution across sectors, know if it is skewed too much towards any one industry and hence carry much higher risk. Also, check by the profitability of sectors. Drill down to see the percentage weightage of stocks within a sector and its contribution to P&L of that sector.

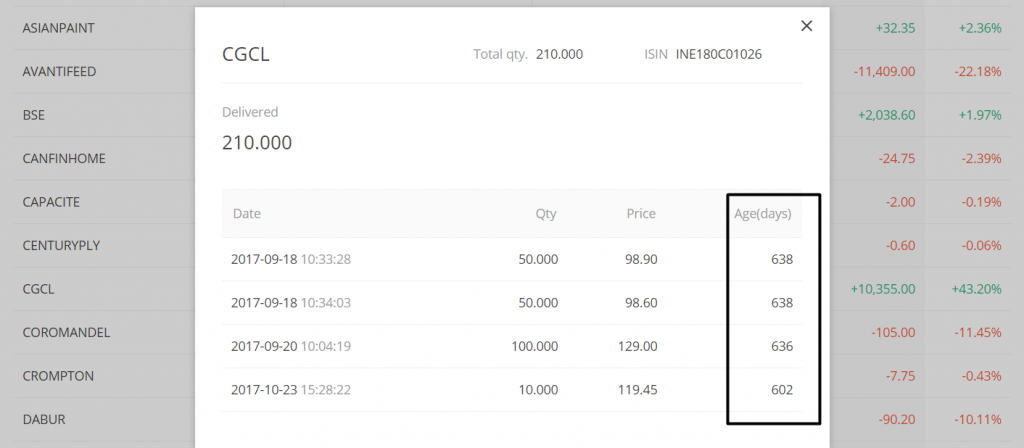

Ageing of stocks

Gains made on stocks held for more than 365 days are Long term capital gain (LTCG), and those under are Short term (STCG). There is no tax for up to Rs 1lk of LTCG per financial year and at 10% above that. STCG is taxed at a flat rate of 15%. It is wise to know before selling a stock if gains would be LTCG or STCG, you could potentially save on taxes just by holding off selling for a few days. Our breakdown of stocks/ageing report shows trades with price and number of days held to let you know if any sell transaction would lead to LTCG/STCG. Note that FIFO (First in First out) methodology has to be used while calculating capital gain if you have multiple trades breakdown for a holding.

Track dividends on stock holdings

This data is available from April 2018 and also shows up in the EQ dividends breakdown section (other credits and debits for pledged holdings) on the P&L statement. With dividend information, you can track your net P&L and even reconcile with your bank account on if you have received the dividend or not.

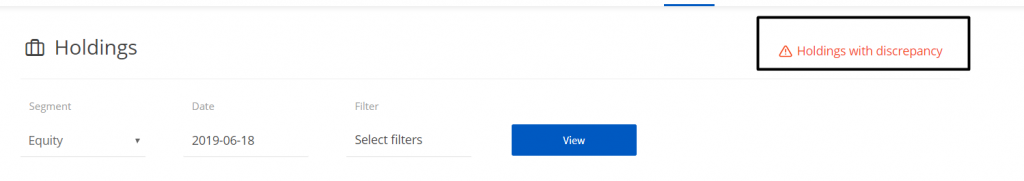

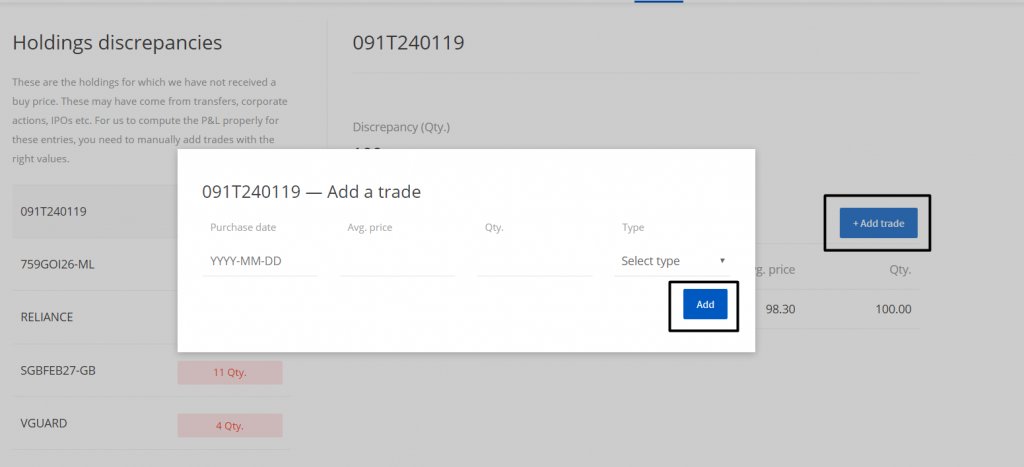

Entering discrepant values

If a stock is transferred in, Console wouldn’t have the buy price for it which is required for all the above reports. We are probably the only platform that allows you to enter not just the buy price but also create a breakdown of multiple trades for the shares transferred in. This can be done, as shown below.

If you haven’t transferred stocks from other demat accounts worried about not being able to enter the buy price and track P&L, we have that covered now. 🙂 Stay updated on Z-Connect on all our announcements, and do help spread the word.

Happy Trading,

Can we have customization button for holdings page where we can add some columns hide some and so on, If I want to see total invested in a stock instead of current value. There is no way we can check other than manual calculation right?

getting error “Required information to perform this action is not available” while trying to add details for NFO Kotak Technology Fund Shares.

Hi Jalaj, could you please create a ticket at https://support.zerodha.com so our team can have this checked?

getting error ”Required information to perform this action is not available” while trying to add details for KSK Shares.

Hi Jagath, KSK shares are suspended due to procedural reasons. Discrepancies cannot be resolved if the stock is suspended from trading. Explained here.

It would be better if you add an additional column in the holdings tab indicating the age of the stock rather than going to the breakdown tab every time i want to check the age.

Hi Team,

I have purchased SGB – Sep 2023 issue on primary market via Zerodha. in my console holding, i could see status showing as Holdings discrepancies but i have tried to add the price and allotment date but getting below error. could you please do the needful at the earliest

Error: Required information to perform this action is not available

Hi Ravi, the price details will be update automatically once the SGBs are listed on the exchanges. The listing date is currently not known.

Hi,

I Got 25 Campus shares as a gift from my husband. Previously I had 19 shares. Now last 25 gifted Shares are credited but showing as Holdings discrepancies. I am unable to update that. My husband brought 20 shares on 2023-08-24 with avg price RS. 300.00 and 5 Shares on 2023-09-13 with avg price 297.5.

Show the total avg price of the 25 shares will be 299.5. Can you please update that.

It’s always showing Required information to perform this action is not available

Hi Sumana, the average price will be updated automatically in 3 working days. Explained here.

Hi, I got my shares transferred from HDFC to Zerodha on 14 Sep 2023 – Trades are very old (still holding) from 2017/2018 and prior in HDFC account. I do not have daily trade details completely available for all these years from HDFC account.. When we transfer from one broker to another will not the past trades get transferred automatically – How to resolve my issue to declare average price, Many belong to LTCG category – I raised a ticket and got feedback that need to enter manually all the trades which seems very cumbersome, as there are close to 200 trades – Is there any way out – Pl guide / support how to handle. With available data I am trying to input manually.

Hi,

How can I see my holdings with each stock weight-age in the console ?

Hi Kishore, we’ve explained this here.

I am not able to add the stocks which are in Holding as discrepancies. Can you please help in adding them to holdings. When tried to add, i am getting as “Required Information to perform this action is not available”.

Hi Nandeesh, the buy average for some of your holdings may be showing up as NA on Kite today. The correct buy average will be updated by end of day and doesn’t affect your trades or P&L.

Please check the buy average in the tradebook on Console when selling: https://console.zerodha.com/reports/tradebook

I am not able to add the stocks which are in Holding as discrepancies. Can you please help in adding them to holdings. When tried to add, i am getting as ”Required Information to perform this action is not available”.

Hey Kishore, please create a ticket at support.zerodha.com so that our team can check and assist.

under which ”relevant topic” should this type of complains be made. I am facing similar isues with two NCD i applied and alloted.

Hi Yashwant, you can create a ticket here.

My question is LTCG and STCG:

Suppose I have total 10 shares of TCS

Bucket 1: 5 shares have ageing of 500 days

Bucket 2: 5 shares have ageing of 100 days

Now I sell 5 shares today, Will that be from Bucket 1 or Bucket 2

OR if I sell 7 shares, Will it be 5 shares from Bucket 1 and 2 from Bucket 2 Or Vice-versa

Hey Sanchit, the shares are debited from your account on FIFO (First In First Out) basis.

I too am facing the same problem , sent mail and raised ticket , but response is there .

Hi

Any update when will the CAGR feature on stocks invested will be shown. Also any update on the STP, SWP feature for Mutual Fund in Coin.

very much needed features.

regards

VB

Hi,

Can we get a simple report generated where it simply shows the number of days for which the securities with respective quantities have been held in our account. The breakup function works only for individual stocks at one time and it becomes really difficult if we have around 100 stocks. Plz assist.

Ticket #20210210359149 is unattended and no response from zerodha support team since 6-mar-2021

Holdings Buy Value column is missing in Holdings report downloaded from kite console. Prior to Feb 2021 Buy Value column as of buy date (average value in case of multiple buy for same share) was available in Holdings report

While we have requested to reinstate ’Holdings Buy Value’ column in Holdings report available for download in console, support team informed us in email about non-impact of p&l numbers variance bug to settlement process. This was not helping our issue of tracking stocks.

Please review our request and provide ”Holdings Buy Value” column in Holdings report

Hi Nitin,

Enjoying zerodha platform. It’s getting tedious while filling IT returns. It will be great if your platform provides holding report of stocks with date of purchase. Off course the breakdown under holding stocks can be seen only for current period but when I try getting it till 31st march 21, the breakdown can’t be seen. It just shows stock-quantity-average price. Is there anyway you can provide date of purchase also

Hi Team,

My Company One97 (Paytm) added 2 shares in my Zerodha account, it is showing with discrepancy when i try to add it manually it is showing ’required information is not available’ Please help here

Hello, I have the bond 95UCL29 in my holdings. But, getting “Required Information to perform this action is not available” error while trying to fix the Discrepancy. Looks like the ISIN is not updated for this bond. Can you please look into this?

Hi Team, my Client ID is EW7058, 2 bonds of PFC were transferred to my account yesterday i.e. on 21 May 2021, when I tried to view these bonds in my holding today, these bonds are coming as Discrepancy. So I tried to manually add these Discrepancy bonds via Console. I am getting an error there that ”Required Information to perform this action is not available”. Please fix this issue ASAP.

Can’t we get a report in console where we can see the ageing of whole of portfolio stock which can be downloaded to excel. Currently, I have to click on break down to see the ageing of specific stock.

Can someone tell me how I can visualize holdings separately for smallcase and other non smallcase stocks bought separately.

Hi Team, Client ID: ZJ3283, 115 shares of Laxmi Organic Industries Limited (IPO) INE576O01020 are allotted to me yesterday i.e. on 23/03/2021 So When I tried to view those shares in my holding via Console, those shares are coming as Discrepancy Shares. I have gone through one of your article which shows how to add Shares bought thorough IPO to your Zerodha account. So I tried to manually add those Discrepancy shares. I am getting an error there that “Required Information to perform this action is not available”. Could you please fix this on urgency because tomorrow morning when this share gets listed, I can do the required action from my end. Below is the required Information:

Requested Lot: 1 (115 Shares)

Lot Received: 1 (115 Shares)

Lot allotted Date: 23/03/2021

Average Price: 130

Please help to resolve this ASAP

Hi Team, Client ID: YR6525, 115 shares of Laxmi Organic Industries Limited (IPO) INE576O01020 are allotted to me yesterday i.e. on 23/03/2021 So When I tried to view those shares in my holding via Console , those shares are coming as Discrepancy Shares. I have gone through one of your article which shows how to add Shares bought thorough IPO to your Zerodha account. So I tried to manually add those Discrepancy shares. I am getting an error there that “Required Information to perform this action is not available”. Could you please fix this on urgency because on tomorrow morning when this share gets listed, I can do the required action from my end. Below are the required Information:

Requested Lot: 1 (115 Shares)

Lot received : 1 (115Shares)

Lot allotted Date: 23/03/2021

Average Price: 130

Please help to resolve this ASAP

For all my stocks in holdings, breakdown is not available since past few days. I tried contacting support but they could not help… Is this feature removed???

I’m not sure if this is a high-demand item, but it would be nice to be able to group my trades into custom portfolios like core book, hedge book, legacy book, etc. It feels like a relatively easy feature to introduce – there appears to be some thing called tag already in Console, which I am not sure how to modify. But maybe this can be extended to a custom portfolio grouping feature..

Hi Team, 28 shares of Home First Finance Company India Limited (IPO) are alloted to me yesterday i.e. on 01-02-2020 So When I tried to view those shares in my holding via Console , those shares are coming as Discrepancy Shares. I have gone through one of your article which shows how to add Shares bought thorough IPO to your Zerodha account. So I tried to manually add those Discrepancy shares. I am getting an error there that “Required Information to perform this action is not available”. Could you please fix this on urgency because on tomorrow morning when this share gets listed, I can do the required action from my end. Below are the required Information:

IPO Subscribed Date: 25-01-2020

Requested Lot: 1 (28 Shares)

Lot received : 1 (28 Shares)

Lot allotted Date: 01-02-2020

Average Price: 518

Please help to resolve this ASAP

Please have a sort based on long term and short term as well in the console holdings

I had squared off all my open poistions today and noticed that SBIN is shoiwng a huge loss of 80K. This instrument was showing that there is a discrepancy. The stocks were not transferred in. How do I get the correct picture of my Profit and Loss in this case.

Regards,

Raj

Hi Team,

4 quantity of South Indian Bank Bond were allotted to me on 07 January 2021. When I tried to view those shares in my holdings via Console, those shares are coming as Discrepancy Shares. So I tried to manually add those Discrepancy shares. I am getting an error there that ”Required Information to perform this action is not available”. Please fix this issue ASAP as I am not able to view P&L for this bond at the moment. Below are the required Information:

Instrument: 1375SIBLPER

Bond Purchased Date: 07 January 2021

Number of quantities: 4

In the trade book, I see the trade history of max last 365 days. How do I get a detailed report of all trades done to date, with the date of purchase, and the price at which purchased?

Hi Team,

47 shares of Antony Waste Management (IPO) are allotted to me yesterday i.e. on 30-12-2020 So When I tried to view those shares in my holding via Console , those shares are coming as Discrepancy Shares. I have gone through one of your article which shows how to add Shares bought thorough IPO to your Zerodha account. So I tried to manually add those Discrepancy shares. Screenshot is attached for your reference. I am getting an error there that ’Required Information to perform this action is not available’. Could you please fix this so that on Friday i.e. tomorrow when this share gets listed, I can do the required action from my end. Below are the required Information:

IPO Subscribed

Date: 23-12-2020

Requested Lot: 2 (94 Shares)

Lot received : 1 (47 Shares)

Lot allotted Date: 30-12-2020

Average Price: 315

Are there any plans to allow us to add our own custom tags to Portfolio/Holdings – so then it helps in filtering the list – an extension to the ”kite only” static filter option that’s currently there…

Yes, Sathish, another couple months to go. 🙂

Excellent…and while at it,, could we also have % change as one of the sorting features? Especially when the portfolio daily PL seems contrary to the market, we are able to see which ones are helping it push up or pull down – essentially helping us out some special focus on such stocks within our holdings?

And at some point extend this to allow % change not just for the day’s PL but allow us to choose from one of the standard periods 1D, 5D, 1M etc so we know the trend of the stocks within the context of our holdings (even better – to have this as a custom view of our holdings that we can toggle from/to the current default view)

I say this as I am not a day trader but monitor the holdings in a daily basis and want to be able to take decisions on the fly…

Could we have a small ”note to self” available in the Portfolio/Holdibgs tab? It helps to record our thoughts in 10-15 words as to why we bought that stock (a metadata of that particular investment, if you will) and helps us decide when having to liquidate for cross puroses…

Something that we could add/see when tapping on that stock (Right around ”Create Gtt”) and on an iPad, as a preview directly on the holdings list itself…

Yup, this will be part of the tagging feature.

Hi Matti, sorry but this tag feature is a bit non-intuitive (perhaps for my simpleton mind) and I am certainly not able to see how to apply it as a trade journal – or as a note to self. Is there a demo video or collateral in how this was imagined to be used as a trade journal? – thanks…

Are you expecting your customers to manually add hundreds of trades in case the portfolio is transferred to Zerodha account? Is there a bulk import of trades for a scrip from an excel? Otherwise this feature is of no use for people who have a long list of trades in another platform and they transfer the portfolio to Zerodha account.

I have 5 shares of Deepak Fertilzer showing as ”Holding Discipency” when i am trying to add them its showing ”required infromation to perfrom the operation doesn’t exist” please check adn suggest why is this showing like that.

thanks,

chandan

Hi Team, 40 shares of Route Mobile IPO are alloted to me yesterday i.e. on 17 September 2020, when I tried to view those shares in my holding via Console , those shares are coming as Discrepancy Shares. So I tried to manually add those Discrepancy shares. I am getting an error there that ”Required Information to perform this action is not available”. Screenshot is attached for your reference. Please fix this issue ASAP, So that I can perform necessary trades once the stock gets listed on 21 September 2020. Below are the required Information:

IPO Subscribed Date: 11 September 2020

Lot received : 1 (40 Shares)

Lot allotted Date: 17 September 2020

Average Price: 350

Please find ticket number for reference. Ticket #20200918855980.

Regards

Taru Gupta

Hi Team, 40 shares of Route Mobile IPO are alloted to me yesterday i.e. on 17 September 2020, when I tried to view those shares in my holding via Console , those shares are coming as Discrepancy Shares. So I tried to manually add those Discrepancy shares. I am getting an error there that âRequired Information to perform this action is not availableâ. Screenshot is attached for your reference. Please fix this issue ASAP, So that I can perform necessary trades once the stock gets listed on 21 September 2020. Below are the required Information:

IPO Subscribed Date: 11 September 2020

Requested Lot: 3 (120 Shares)

Lot received : 1 (40 Shares)

Lot allotted Date: 17 September 2020

Average Price: 350

The ticket no for the above query is 20200918783884

Dear Nithin & Zerodha Team,

My account code is RD4269

250 shares of BORORENEW (INE666D01022) which were a part of my holding for since February 2020 have suddenly disappeared from my holding statement.

It’s been over 4 trading days since my 250 shares of BORORENEW are missing from my Holding statement. I want to sell these shares but I am unable to do so. have raised Tickets and called up Zerodha Customer Care but to no avail till now.

Kindly resolve at the earliest.

Hello, Please allow breakdown view on Kite itself instead of going to console for it

Hi, i buy some shares from kite nd it directly comes to my console account now i am not able to sell them or in my kite there are no even any share in holding, please help.

I bought 13 shares of UBL on Friday and sold all 13 shares on Monday. But while trying to sell it, the order got rejected so many times but finally it got sold once. At the end of the day, when i checked my positions & holdings, i could see (minus)-13qty UBL which implies i sold the UBL stock without buying it. It means that my selling order got completed twice. But if i check my order book, there is no order like i have sold it twice. So kindly explain me this mismatch.

How do i sell the shares that are in equity holding in console please help….

How can I know Total Dividend received during financial year across all instruments with in portfolio ????

Explained here, Murali.

Hi Team, 40 shares of IRCTC (IPO) are alloted to me yesterday i.e. on 10-10-2019 So When I tried to view those shares in my holding via Console , those shares are coming as Discrepancy Shares. I have gone through one of your article which shows how to add Shares bought thorough IPO to your Zerodha account. So I tried to manually add those Discrepancy shares. Screenshot is attached for your reference. I am getting an error there that ”Required Information to perform this action is not available”. Could you please fix this so that on Monday when this share gets listed, I can do the required action from my end. Below are the required Information:

IPO Subscribed Date: 01-10-2019

Requested Lot: 1 (40 Shares)

Lot received : 1 (40 Shares)

Lot allotted Date: 10-10-2019

Average Price: 310

Please help to resolve this ASAP. My Ticket No. is 20191011439203.

We’ve updated the average price for IPO shares on our end. Should show up correctly now.

Same I got alloted shares of HFFC on 1st but cannnot be viewed and shows if trade added, information required,

Can you solve the issue before trade opens tommorow.

Hey, someone from Z-team please help. Earlier we were getting the trade-wise charges details in the console report (P&L report). But from last 10 days, this has stopped. Only the total charges for the day is being shown. The individual charges for each script for the day shows zero. Why was feature removed ? I have checked with your support team. They asked me to download the Tax P&L report. But unfortunately that also does not contain the information (charges for one single script for one particulate date). Your Tax P&L statement gives the charges for one single script for one entire quarter summed up together. How do I know what is the charge added for one single day ? Let’s say I am frequently buying and selling some particular script twice or trice in a week. I want to know the charges added for each day. How & where do I get it ? It seems you have stopped updating that in console (earlier we were getting it simply in the P&L Statement in console). Someone please help, I need that info frequently.

Sir I am unable to sell the holding shown in console. Please guide how to sell it it’s urgent

The sell order should be placed on Kite. Are you able to see the holdings on Kite? If yes, when you place an order, what’s the rejection reason you’re seeing?

Hi, I’m facing the same problem there are no sell option and the present price shows last day closing price.

hi team

same issue with me for acil and cals refineries which i had bought during 2008, i guess.

please assist.

Hi Aditya, please create a ticket at support.zerodha.com with the details of the issue so we can have this resolved.

When I select the Tax P&L option in Console, I get a screen with summary amounts displayed and two links to Download Tax P&L statement in Excel format (one for normal and one for trade-wise P&L report).

However, clicking on either of these links only shows a pop-up window with JSON format text that I can download; but no Excel file !!

The JSON text is useless for my tax filing purposes and converting it to Excel is not easy…

Yet comments from others here indicates that they found a useful Tax P&L statement !!

So, what gives? Is the JSON file instead of Excel some new bug or temporary issue in Console or do I need to do something else to get a Tax P&L statement in PDF or Excel format…? Please respond soon (IT deadline is nearing).

Thanks. Krish.

FYI, I am using the latest version of Firefox browser to login to Console when the above issue of downloading Tax P&L occurs. Not sure if the issue is browser-specific. If so, which browser(s) do you support?

By the way, the Console login page itself does not open when using IE-11 browser!! All you other tools like Kite work on all browsers including IE-11. Why then are you not supporting IE-11 for Console ?

If it is intended to be supported, then this a bad QA job… Even one cursory test to launch Console using IE-11 would shown the issue with the web page that is preventing its display… Can you please get this fixed ?

Thanks.

Regards, Krish

Today the Tax P&L Statement is downloading in Excel format (the JSON text pop-up issue is solved).

Thanks for getting this fixed.

However, both the download links (Tax P&L and Trade-wise Tax P&L) seem to be giving the same statement – Tax P&L. The Header Text (”Tax P&L Statement…”) and content, including F&O Turnover are identical in both.

As I have traded the same F&O scrips multiple times, the Trade-wise F&O Turnover should be different from Scrip-wise Turnover. That’s why I suspect that both the buttons are triggering the Tax P&L statement only and the Trade-wise P&L statement is not being produced.

So, can you please get the Trade-wise Tax P&L Statement download checked and fixed ?

Thanks.

Regards, Krish

The 9th sheet in the tradewise tax P&L report is the Tradewise Exit-Entry sheet which includes the tradewise turnover. There’s no issue with this. Kindly download the report again and check. If you face any issues, request you to raise a ticket on the support portal.

Hi Nakul,

Thanks for the response…

And yep, you are right – the 9th sheet does exist in the Trade-wise Tax P&L Excel with required data.

I had just not scrolled far enough right in the tab-list of the Trade-wise Tax P&L Excel to see the additional sheet

(because I wasn’t expecting to see in this Excel all the other sheets which are identical to the Tax P&L statement).

So no problem here… just my oversight.

Just one remaining item… Can you do something to get Console Home / Login page to open in IE-11 browser?

Thanks.

Regards, Krish

I also find the reports useless. When I want to file my returns, it is going to be too much of hard work for me. They say that they are working on it, hope it is before the next years returns filing, else I will have to go back to ICICI Direct.

Hey, can you please create a ticket from our support portal explaining the issues you are facing? It’ll help us implement things that are not on our list already.

Hi, just noticed that dividend amount shown in the Tax P&L report for a particular stock is different from the amount actually received in the bank account for that stock. How is this possible?

Also, does the Dividend amount is deposited in the bank account by Zerodha or is it directly transferred by the Company?

The dividend amount is directly credited to your bank account from the company in case you had the shares in your demat as on the record date. In case you have pledged the shares for margin or sold on the ex-date, we will receive the dividend and credit it to your trading account within a week of dividend credit. Console shows the dividend data based on the ex-date. It is possible that the company wouldn’t have made the payout yet. If you can raise a ticket regarding this from our support portal, we’ll be able to check and let you know.

This is awesome 🙂 it gives better insights on our investments and trading performance. Great work really appreciated ..

Sir,

Is it possible to give data as per ITR format for ltcg& stcg, for filing returns

Since a/c,opening is easier online,why not for amendments

I e address change,bank a/c change etc

I am getting stockwise brokerage$ other charges occassionaly in CONSOLE.As a result actual capital gain/loss for intraday & short term could not be ascertained separately. Pl. look into the mater.Pl. show short term& intraday PL in TAX P/L separately.-SANTANA

The scrip-wise charges breakdown is available from FY 2019-20 onwards. The charges for all trades executed from 01st of April 2019 is displayed in the P&L report on Console. You can get the segregated charges for intraday, short term, or long term by downloading the Tax P&L from Console.

Hi Nithin,

I have a support ticket #20190327371592 regarding Console holding discrepancy which has been outstanding for 3 months now. All I have got continuously is ”our developers are working on this” despite repeated follow-ups.

Please look into why this issue can not be resolved.

Thanks

Hey Kaushal,

Apologies for the delay. We are having this checked. Someone from our team will get in touch with you through the ticket and have this resolved at the earliest.

Hi

I am using your mobile app. In watch list i can add multiple scrips. Butv there is no Sorting option given. Ideally there should be sort option given. We should be able to view watchlist basis selected sorting parameter. Eg. Scrip name wise ascending descending, % increase decrease wise ascending descending , Last Traded Price Wise ascending descending. This would give better view and we dont have to scroll down everytime and search.

Please make this change. It will be really helpful.

We’ve addressed this in the new Kite 3 mobile app that will be launched soon.

How can I understand how much dividend I received from my portfolio ?? As I more interested for dividend income.

Hey Murlidhar,

You can check the dividend income in the holdings page on Console. Click on the options tab next to each scrip and select the ”View dividend received” option to see the dividend breakdown. You can also download your P&L and find the dividend received for the selected period in the EQ Dividends Breakdown sheet.

THANKS FOR YOUR REPLY , HOW CAN I ADD NOMINEE FOR MY ACCOUNT ??

You’ll need to print, fill and courier the nomination form available here.

It certainly helps. Well done !!! Congratulations for the same.

Another request:

For placing orders for FnO, can you please add boxed values for ”margin required (for that trade)” and ”margin available” in the trading window? That will be a great help. Currently, you have to open a separate window for margin calculator to calculate margin requirement and another window for margin available and another window for placing the trade. You end up losing valuable time.

On our list of things to do.

You guys are great. This is really an awesome updates to reports.

Dear Mr.Nithin Kamath,

Unless the Console assists the investor for Tax filing, all your updated features are just cosmetic changes. Not worth.

Everybody else is offering these features in the market.

The Tax P&L on Console is built with the sole aim of helping you to file taxes.

Sir,

When will you reduce brokerage charges for Trading. As a discount broker, please provide better trading brokerage. Already so many discount brokers have reduced it to Rs 10 per order and some like Wisdom are already offering free trading. Please do something about it.

Hi,

Have some query, not regarding the topic above, why the Zeroadha data in the chart is not matching with the NSE, as I was looking into the Nifty June Future. Today dated 21-06-2019, Nifty Jun Fut HIgh-11842.60 but in the chart, I don’t see this value. I see high was 11839.05 in the chart. why it’s not reflecting in the chart?

Some people taking this as an advantage and selling some other broker data as we can see the data’s are matching in the chart according to the NSE. I have observed it for so many months.

Is this is a drawback in zerodha? this can’t be resolved? do we need to pay for other brokers to get proper data in chart?

Awaiting for the reply

Thanks.

This is explained here.

I have sold shares on Monday 17-06-2019 but i will receive payments in my account on 21.06.19 this is a big delay do something about it wednesday 19-06-2019 was my payout day and i should receive my payment on wednesday only plz reduce this delay of 2days it cost us a lot.

If you’ve sold shares on 17th, we receive money only on 19th (since the settlement is T+2). You can place a withdrawal request on 19th before the cutoff time and you’ll receive the funds in your bank account the same night if you have an HDFC bank account, and on 20th if it’s any other bank. Should never go to 21st.

Also, we’re working on an instant withdrawal process that will be live soon.

Good till Cancel feature ?

On our list of things to do. Should be live soon.

How soon ?

The feature is more or less ready. Just waiting for approvals to go live. Can’t comment on a timeline though.

Any plan to bring BO order types for MCX ?

Yes, we’re working on this.

It will be useful if sectoral and market cap allocation, IRR,CAGR (like in valueresearch portfolio manager) made available

On our list of things to do.

IRR / CAGR is a must have. Your MF app (Coin) does show the IRR very neatly.

Would be super helpful if we can see the IRR / CAGR for each stock in the portfolio as well as aggregate level.

Look forward to an announcement soon on this !! Knowing Zerodha, I am sure you guys would do a super quality job soon to have this incorporated.

Hey

I don’t think they have incorporate this feature yet

Always have a discrepancy problem with LIQUIDBEES-F because I can’t enter unit amounts like 2.004. how do I solve this?

This is due to the dividend getting credited in fractional units. Our developers are working on to fix this bit, will keep you updated on the progress.

facing the same issue. Please update me as well.

Any update on this issue???

Can you please add portfolio system? Holdings show the performance report of all the stocks that we have. We need a system wherein we can create and customize portfolio according to our investing strategies. For example, a portfolio consisting of stocks that we have invested according to high dividend yield, a portfolio of coffee can investing strategy, watchlist, etc.

On our list of things to do. 🙂

Please allow links to compare stocks in your charts

Can you be clearer about this, please?

Holding to margin can be a good update… Just a suggestion.

Future Mini in NSE

Hi Kamath,

We have seen from many years in commodity MCX Futures Mini ( Like Crude Oil Mini, Copper Mini Etc..), which enables the traders trade according to the funds availability also helps in hedging if required.

I would like to know any probabilities of the same in NSE?

Regards

Bhaskar

SEBI requires that the contract value remains above Rs.5 lk for stock and index derivative contracts. So mini contracts are unlikely. Exchanges revise lot sizes every 6 months to ensure the contract value is between 5 and to lakhs.

The console account value includes unrealised profit for Mutual funds and equites which doesnt give clear picture.The dashboard should show as a heading Invested amount, Realised profilt.Unrealised profit and current account value.I have been struggling to get the details from various reports.

Kindly hover your cursor on the Account value header and you will be able to see the formula for the same.

It would be great and more helpful to take decisions, if ***average*** ageing of stocks displays on front screen itself. i.e Holdings sectoral visualisation page in columnar form

I would be more nicer, if we can have a view to see 3 different %P/L

1. actual (which is available today)

2. CAGR (if holds for more than 1 year)

3. XIRR (if invested in share like SIP mode)

any chance to get this info will be extremely appreciated 🙂

This is really excellent. Much appreciated.

Nitin Sir, will appreciate if you can bring the following in Zerodha Kite.

For any option, Delta, Gamma, Theta & Vega values.

For some strategy, Delta of a particular strike price is really important.

I do understand, Sensibull will have those details, but if this can be included in Kite, it will be very useful.

(HDFC Securities has provided this recently through ProTerminal).

Hello,

i have a discrepancies of ’C Mahendra Export’ shares.

Its no more trading nowadays.

when i try to add, it gives me an error – ”Required information to perform this action is not available”

If the stock is not trading then the ISIN will not be active and in this case, Console will not allow you to enter any discrepant values for the stocks whose ISIN is not active.

Nice

It dosnt show dividend information. ”other credits and debits section” is showing -499.9 for last 1 year which i think is account fee only.

Ah, good catch. It shows up in a sheet labelled EQ dividends breakdown. Changed it on the post as well! 🙂

You get all the dividend details in TAX P&L EQ DIVIDEND BREAKDOWN sheet. Kindly note, as of now we show all the dividend details post April 01, 2018.

This is great.

Is there anyway you can integrate console in Kite itself so that we can see all our holdings and everything from the app itself rather than on browser ?

The upcoming Kite 3 app and Console have a tight integration for a more seamless experience on mobile.

hai, when you will allow pledge mutual fund example liquid fund its really disappointing zerodha when comparing others

Hi Nithin-

Can you plz arrange on chart trading on Kite.

Thanks for your earliest attention

– Sukhen

On our list of things to do.

Please release app for Console.

This is a excellent feature. Probably should have been there much before however better late than never….

Excellent additional feature. Well done Zerodha team. The best thing which Zerodha has unleashed on the entire stock trading space is that it has came out with one after another new products, with minimal cost, to add and assist the investors. We have immensely gained the knowledge and saved cost. Now I find even big bank broking arms forced to slash their brokerages. That is the impact of Zerodha. Still no one to beat Zerodha when it comes to statying ahead of time. Great Nitin. Great

PORTFOLIO RETURN SHOULD BE SHOWN WITHOUT PAY IN AND PAY OUT

The P&L for your stock portfolio is calculated without considering any payins or payouts.

Hi,

Now it seems that for calculating P&L FIFO is followed. In case of falling market price it may not be wise to sell the first purchase first and book the loss. Hence is it possible for customer to pick and choose the lot, which is sold / is to be sold.For Tax purpose the existing system may be continued.

P&L is calculated using FIFO because that is the correct P&L for taxation. As for allowing you to choose which holdings to liquidate, or the method of P&L calculation, any change would make no real difference. For example, let’s say you bought 10 mangoes at Rs.20 each and another 20 at Rs.10 each. Now, if you sell 5 of them for Rs. 8, the fact that you spent Rs.400 or the fact that you received Rs.40 will not change. You can assume that your loss is Rs.2 per mango on those 5 sold, or that it is Rs.12. In any case, the money spent and received does not change. When you eventually sell all your mangoes, what truly matters is how much you spent and how much you received.

Ya. I understood it is fine. My point is when a person is a long term investor as well as a swing trader the problem arises since a part of holding is for short term profits. Profit/Loss will be booked based on FIFO, the investor might have bought long ago at a different price for long term investment. He, seeing an opportunity in swing might have also traded to encash the opportunity. If the customer is given a choice to select the lot, then he can do so to book short term profit/loss. The lot which he purchased for long term investment will be in tact with the original price. However the profit for taxation will be different.

Since all trades are averaged out, it would make no difference other than showing you a different number. What we are working on is tagging trades to a strategy or as long-term and short-term. When this is live, you can tag all your swing trades separately and see the P&L for that strategy.

Hi,

I am having the same problem. If I am trading during the day as well as carrying forward some shares, how do I calculate whether overall I am in profit or loss? If I bought shares at a higher price, ideally the average price of my holdings should show a higher number, but since FIFO is used, the average shows a lower number and it looks like my invested amount has lowered.

Is there a way to calculate the actual realized profit/loss? Since the console uses FIFO averaging to calculate the profit and loss, it doesnt give the correct number.

It would make a difference in terms of the taxability of the profit/loss booked. I might not want to book loss on long-term holdings but book profit on short-term holdings.

In your example of mangoes, my tax liability would change if I sold only 5 mangoes and not the whole lot. Booking a loss of Rs.10 is different that booking loss of Rs.60.

Can you please do something so that it just give me one report with all the details (equity, mutual funds, short long, speculative etc etc) so that I can give that to my CA for tax filling without having to worry to collect further details. This is very much needed please.

We already have this on Console, it’s called the Tax P&L.

Very good initiative. T

Someone work on Zerodha PI also. Each update, make it worse.

I agree. A new version of Pi is due

This was much needed. Great.

I there could be more analytics built like CAGR of the whole portfolio and the individual holding , performance comparison with major indices etc..

regards

On our list of things to do. 🙂

Will consider this. 🙂

Thanks to your Tech Team.

Such a facility eliminates a major workflow of having to copy paste holdings to a third-party website for analysis, or skipping it altogether because of the effort required.

The more Zerodha saves time of investors/traders and provides deeper analysis, the better decisions they can make.

very good

to be continue …

thanx Nitin sir

I like this very much. Had requested for a very long time. Can you add some tool that can make us money. 🙂

Awesome feature this is!

Hi

Who said that you are the only platform that which allows to enter the buy price for shares which are transferred in…. ICICIdirect is doing this since ages… Don’t spread fallacious and untrue information for attracting people’s attention… Atleast do some basic level of competitor analysis before making such baseless statements..

hmm… whatever I had seen of ICICI, they allowed you to set a mock portfolio of any stock/trade (similar to moneycontrol portfolio), it didn’t have an option to add buy price to transferred in stock on the main/real portfolio. Also, there was no way to break down a transferred in stock into a breakdown of multiple trades with date. Was just checking on their platform, couldn’t really find, do share it here if you find. Btw, there is no way for us to track what is happening on all the platforms, hence I mentioned,” Probably” the only platform.

Hi Nithin,

They allow you to update all details such as qty, buy price, brokerage etc from link Add New Transaction Manual under Advance option..

Further, i didn’t’ find any word ”Probably” in your above content… Please have it checked once again

The start of the post I had said probably, didn’t realize I had missed out in the second place. Edited it. My bad. Cheers,

There is no option to update transaction charge, brokerage and stamp charge while adding trades in zerodha after transferred from ICICI direct.. Please let me know the avg. price is only the stock price or (stock price + transaction charge + brokerage + stamp duty) ?

Hi Nithin,

It’s surprising to know that you don’t track competition 🙂 . Good to have these small little enhancements, But when do we get to see some real catch up with competition like GTC or VTC or GTD feature which is actually a boon to BTST & delivery based traders, which is being offered by most brokers ( ICICIDIRECT, HDFCSEC, EDELWEISS, SHAREKHAN ) if you didn’t know. Please don’t refer to NSE circular that does not allow this feature. I am told since NSE does not support overnight ordders to protect retailers, Brokers store these order on their servers & execute it the next morning..

Absolutely agree with Vinay. Request Nithin and his team to provide these (GTC/VTC/GTD) features.

Yes, we’re currently working on this.

If it’s possible update the IV tool for option trading in kite platform sir.quite useful like open interest

Nithin Sir

why today not show margin in my account

What are the chances that Loan against securities (LAS) and Collateral funding on MF will be introduced in the upcoming 3 months ?

Quite high. 🙂

This is awesome, loving all the new updates.