SEBI’s “true to label” circular

Update October 1, 2024: The revised Exchange Transaction Charges (ETC) and Securities Transaction Tax) come into effect from today.

Equity delivery will continue to be free at Zerodha. As of now, we are not making any changes to our brokerage.

For options: STT increases to 0.1% from 0.0625%, and transaction charge decreases to 0.035% from 0.0495%.

This results in the cost of trades seeing a net increase of 0.02303% or Rs 2303 per crore of premium on the selling side on NSE and of 0.0205% or Rs 2050 per crore on BSE.

For futures: STT increases to 0.02% from 0.0125%, and transaction charge decreases to 0.00173% from 0.00183%.

This results in a net increase of 0.00735% or Rs 735 per crore of futures turnover on the selling side.

You can check our brokerage calculator to see the new charges. Comparison of old and new transaction charges is given here.

Since STT is charged on the entire contract value for futures, whereas in options, it is charged only on the premium, the impact will be much larger for futures traders.

The impact of SEBI’s new transparent pricing circular on the broking industry.

SEBI recently issued a circular stating that market infrastructure institutions (MIIs) have to be “true to label” in the charges they levy from October 1st, 2024. This circular has an impact not only on brokers but also on trading and investing customers. So in this post, I explain what it means and how it affects you, the customer.

Stock exchanges charge a transaction fee based on the overall turnover contributed by a broker in a month. The more turnover, the lesser the transaction fee. You can see the latest slab-wise transaction charge charged by NSE here. The difference between what the brokers charge the customer and what the exchange charges the broker at the end of the month is a rebate. Such rebates are common across the major markets in the world.

In the US, brokers earn by selling the order flow to one of the thirteen exchanges or a dark pool. The decision on where the order is sent is typically determined by the payment, and dark pools offered by High-Frequency Trading firms win that race.

We earn about 10% of our revenue from these rebates. This could range between 10% and 50% of the revenue for other brokers. For us, this has increased from ~3% to ~10% in the last four years because of the increase in options turnover. Today, 90% of our revenue from these rebates comes from options trading alone. With the new circular brokers will no longer earn these rebates

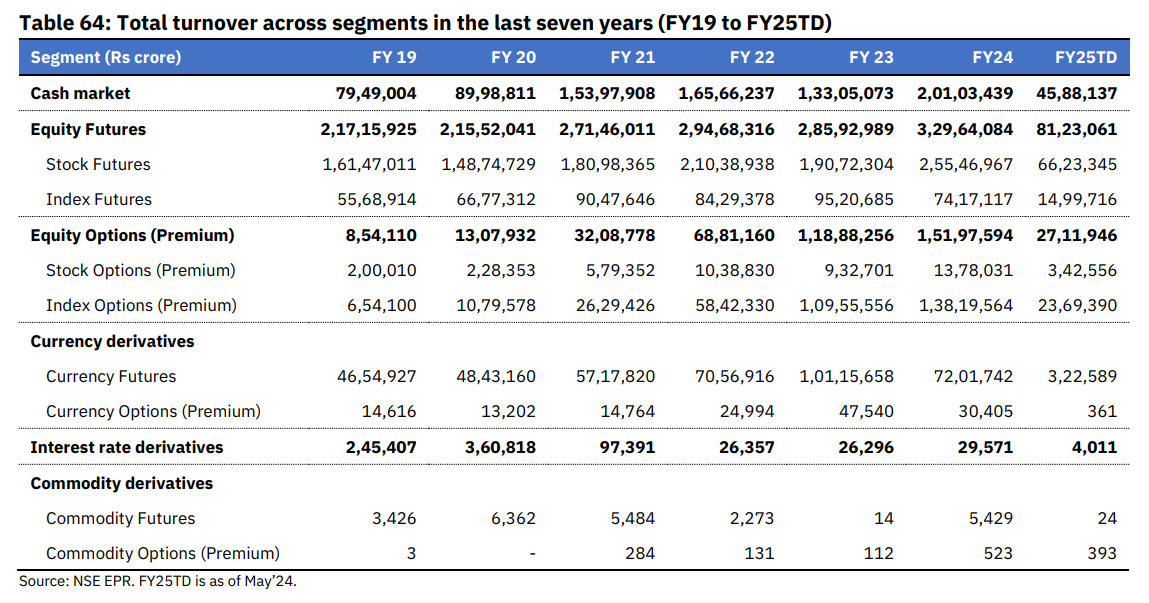

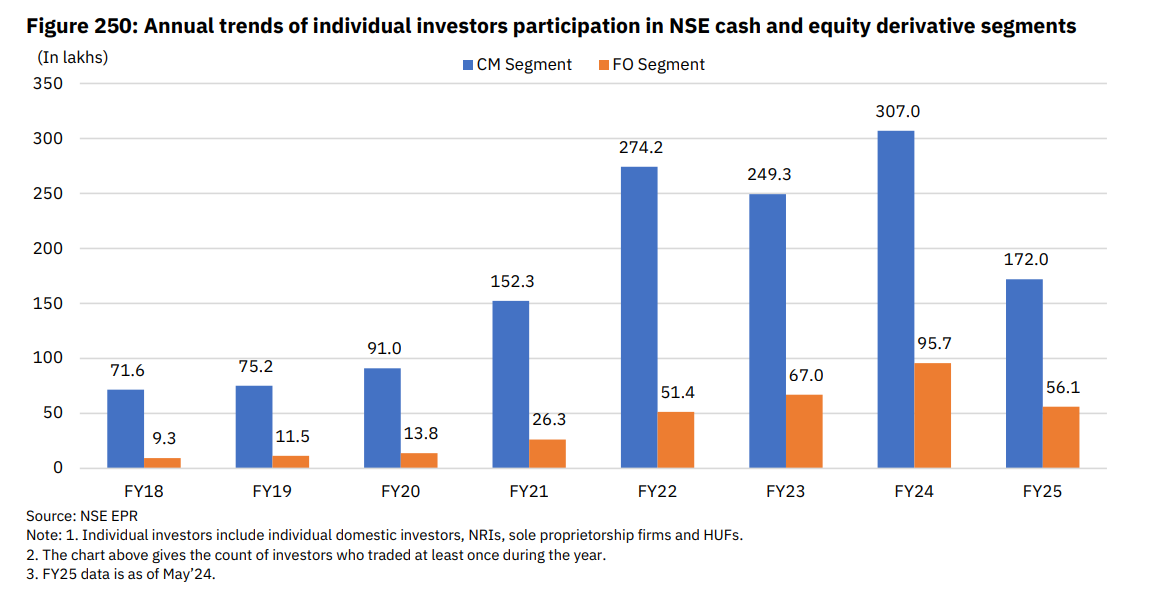

Increase in options trading turnover

As you can see, options trading turnover has increased significantly in recent years, and so have the regulatory concerns associated with it. SEBI has recently set up a working group to study and address the concerns about the steep increase in retail participation in options trading. As I have said several times in the past, including recently, this regulatory risk is one of the biggest risks for a regulated business like a stock broker.

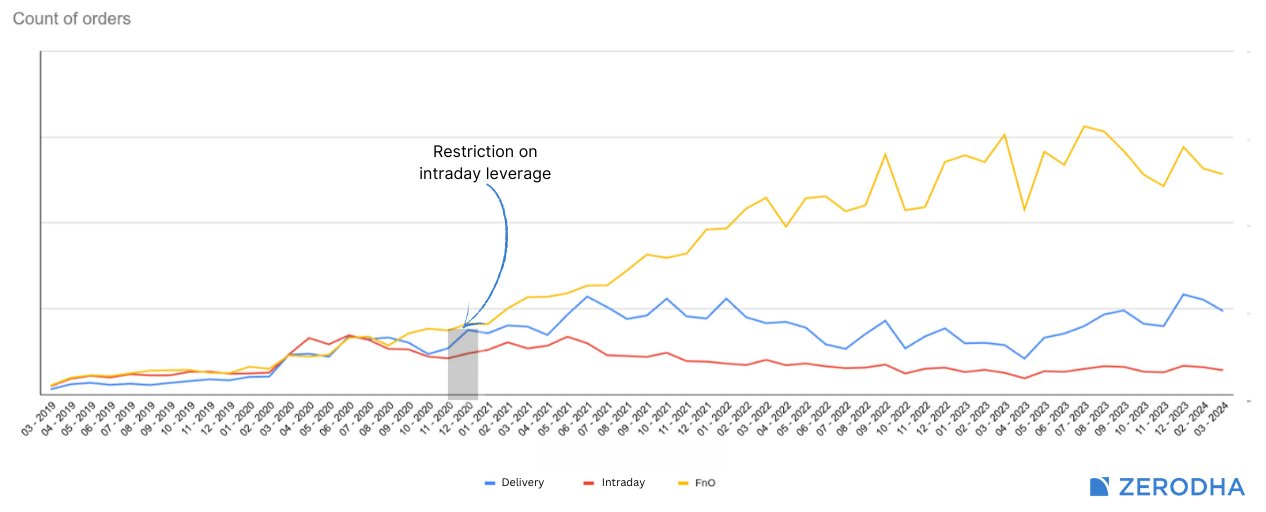

By the way, I think the key reason for the drastic increase in options trading turnover is the restriction of leverages on intraday trading instituted in 2020. Unsurprisingly, traders seeking leverage ventured into options trading in no time.

Potential impact

Since 2015, when we went 0 brokerage on equity delivery, we have subsidised equity investments with the revenue from the F&O trading activity. This structure could now potentially change. As a business, we may have to introduce a brokerage fee for equity delivery investments, which is currently free, or/and increase F&O brokerage.

This becomes all the more important given the big uncertainty around the future of F&O trading volumes. We are still trying to ascertain the second-order effects of the circular. In all likelihood, we will probably have to let go of the zero brokerage structure for equity delivery trades which we have been able to offer for the past 9 years. We are one of the few remaining brokers offering free delivery trades. Many newer brokers who started out with free delivery trades have started charging a brokerage in the last couple of years.

As I indicated earlier, this is a substantial change that will have a significant impact on the financials of all brokers. All brokers may be forced to tweak their pricing models to adjust to the new reality in a few months. The hope with this circular is that the exchanges will pass the benefit to customers by charging the lowest slab. So, an increase in F&O brokerage shouldn’t be of any impact.

If you have any questions, post them on this thread on TradingQnA.

Thanks for giving important information.

Glad to see that ” finally there is an explanation offered by zerodha” no the difference in charges as per nse vs actuals charged in options …had been raising tickets and asking explanations, both NSE and Zerodha..neither offered clear and honest answer..NSE was arrogant to the point of refusing to entertain this query [since i am not a broker] and categorically denied to explain and closed by ticket as ”resolved” without actually resolving it, despite incessant email communications.

Finally they accept that the rebate//delta was a revenue earning mechanism… what collusion!!

Nithin

You acquired more than 30 million customers with promise of zero brokerage for delivery based equity, and that is what defines Zerodha.

Similar to Smallcase, where (you/they) offered lot of free portfolios, before charging their services. However old/existing customers of Smallcase who subscribed when it was free, still get it for free.

Same logic applies for your existing Zerodha customers, it should be free for cash based delivery of stocks. New Zerodha customers you acquire will upfront know, you are not true to your word and let them decide if they want to become Zerodha customer or NOT.

Also, most brokerages offer services on stocks to buy n sell, if they are not zero brokerage. If you start charging brokerage, then be prepared to offer additional services as it cannot be plain vanilla service you currently offer.

This is a push back comment to your wild thought of making money from equity brokerage, using SEBI guidelines, when your CTO writes blogs that it is a 30 member team running Zeodha operations.

Dear sir sebi,

It is showing para 5.5 in your letter 3% will cutting from customer. And after completion transaction will 5 % charge willcut .can you Make free for everyone to earn satisfactory. Please mail

Brokerage on Delivery Transactions:

Considering the zero literacy provided in schools and educational institutions, zerodha is doing a Holy service to small investors, who are diverting their small savings to share market ,can’t take risk in F&O and future trades,

The 0 brokerage on delivery based transactions also encourage more investors to the markets and helps in government to earn revenues , this is also a support of Zerodha to Government.

I request ZERODHA to drop the plan of introducing brokerage on delivery based trades as CRS and encourage other brokers to follow as national service.

Let the Government earn and small investors survive on your efforts.

Thanking you zerodha team,

for your honest services to Small investors.

Why can’t the brokers go to court as the practice of giving rebates or discounts is acceptable in any country or any market irrespective of whether developed or third world country? These people at SEBI must be knowing it but what is driving them is pure jealousy, for which there’s no medicine even in this advanced era.

Beautiful..

I have to close my commodity account . How to process?

Hi Dipti, we’ve explained the process here.

Your profit is more then 4500 Cr . Why you want more money ? Why you want to charge brokerage on delivery ?

Sir, I’ve submitted the request for activation my account in commodity also on 27/09/2024. That’s not activated till now.

Hi Rakesh, could you please create a ticket at support.zerodha.com so we can look into this?

Sir, I’ve submitted the request for activation my account in commodity also on 27/09/2024. That’s not activated till now. OZ9732.

It’s ok our comments would hardly have any impact,but if you are committed to increase equity delivery charges than I wish be true your name and change it as ’nonzerodha’.

Why my equity delivery is charged on every transaction

Hi Maruthi, could you please create a ticket at support.zerodha.com so we can look into this?

This move by SEBI is surely instigated by the big broking house including the likes of ICICI, HDFC Motilal Oswal as they have lost considerable broking income due to the likes of zerodha. These big broking houses have not only milked the customers but have also given pathetic service with zero transparency.

If brokers start to charge for equity delivery, small retail investors will left the stock market.

Future and options should incur huge transaction costs. This would be the only way to stop us from gambling our hard earned money out here

Please apply brokerage charges on delivery orders otherwise your AP (Authorized Person) will die soon…

Will quit Zerodha, if the charges are increased on Equity delivery,,, They are not free now, an increase would mean I have to shell out more to purchase any shares.. Better to quit

Is there any increase in lot size ?

Thumbs down for imposing charges on Equity delivery.

If SEBI has raised charges on F&O, brokerage should do the same on that segment only.

Zerodha has quoted above, ”Equity delivery will continue to be free at Zerodha. As of now, we are not making any changes to our brokerage.” This is NOT true! It should say nearly free because Rs.0.01 is charged for all deliveries in a day.

Thanks Nithin.

Zerodha confirms free equity delivery, Nithin Kamath says ‘will continue to be free’

https://www.livemint.com/market/stock-market-news/zerodha-confirms-free-equity-delivery-nithin-kamath-says-will-continue-to-be-free-11727768962214.html

Dear Nitin & Zerodha team,

I dont mind paying Fixed Small Fee for Equity Delivery considering Excellent Service by Zerodha…..

while ICICI still charge me 0.1% of Transaction value for Equity delivery ( and hence i dont use it ) , i dont mind paying say Rs 20 as Equity delivery fee…..similar to Options fee

But DONT charge anything as % of Transaction Value, keep it Flat & Affordable

Regards

Sunil

Frankly the whole impact due to ”true to label” circular will not be more than 50 cr to zerodha…….. for a comany that made 2900cr net profit after all expenses in FY 23 and 4900 cr net profit in FY 24 is not a big amount. But may be u want to use this opporunity of circular to make some more money for zerodha and yourself………. technically u can increase …… morally not sure…… there has to difference between profits and profiteering

Will quit Zerodha if fee bought for delivery

Please don’t charge Brokerage in Equity Delivery, it will hurt long term investors who rarely trade. You are already charging AMC which many discount brokers aren’t. What’s the Zero left in Zerodha when everything is charged.

Nitin Sir, Please don’t do this to us.

It’ll be a very bad move if you decide to introduce Brokerage on equity delivery even if slightest.

No broker is earning as much as Zerodha. Do you guys really want us to leave Zerodha?

Not everyone from stock market earning Lakhs in every month. We make profit or loss but Brokers earn always.

Brokerage, STT, SEBI TO, Stamp Duty, Exchange transaction charges, CGST, IGST, AMC charge, DP charge, Finally Tax, everyone just want to loot.

Please don’t charge Brokerage in Equity Delivery, it will hurt long term investors who rarely trade. You are already charging AMC which many discount brokers aren’t. What’s the Zero left in Zerodha when everything is charged.

Hi Shivam, equity delivery will continue to be free at Zerodha. As of now, we are not making any changes to our brokerage.

Main screen (Buy-Sell ) is changed so that problem, Before Buy sell ( Positions ) screen is right .

Zerodha is good.

This rules are if you put it in plain language, direct extortion from exchanges and brokers, but burden will be ultimately transferred to traders and investors.

In news and social media everyone is complaining about daily expiries and increasing participation in f&o segment but no news channel is clearly stating why it has happened.

Real reason participants moved to f&o segment is government’s restrictions on markets and increased charges and taxes.

but yeah some people out of ignorance and some out of motive are bashing the brokers and exchanges.

Kindly make Console more accessible and reduce the downtime in the name of maintenance.

I opened my account and after a few days it got shut down. What are you people doing? Such a service is provide I really want an answer, I have waited for it for a long time .

Hi Irfan, sorry to hear about your experience. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

SEBI forcing fee increases when Jio finance enter. Coincidence?

If Zerodha impose brokerage for equity delivery , I will be out from Zerodha.

Hi, equity delivery will continue to be free at Zerodha. As of now, we are not making any changes to our brokerage.

SEBI and the ministry need to educate the loss makers in FnO rather than make it harder for people earning their living through FnO. They are taking the easy way out by behaving like an over protective parent. Rather than teaching the kid to walk, they are tying all their kids to a chair for ”safeguarding” the kids. That’s BS and not a long term solution. The current market cap for India relies heavily on retail speculators and equity linked mutual fund investors that have flooded the market since COVID.. This over protective mentality is going to kill the retailer and eventually hit the overall market adversely.

Sir m ek chota sa broker hu mera jyada profit and loss nahi hota mujhe eske bare jankari Kam h

How much profit do you earn from those 10% of the revenue that you generate from rebates? If you be open to the public at large about that, then they might understand the whole idea behind the concept of increase in brokerage.

Out of the box solutions are required here. Something, which at first sight appears quite stupid, but has the potential to be the best solution. Please consider charging ’Cost plus’ for delivery and cross subsidize non-delivery (options etc.).

Also, industry should raise a demand with Govt. towards compensation of tax and regulatory compliance expenses.

Current (even though we have ”Brokerage Free” model) Buy and sell equity delivery feels costly for Small Equity investors, Specially because of all the STT and DP Charges. Another reason Govt. Is pushing us to pay more tax, that means we work for govt. only, Earn for broker and govt. Shame on this Budget

First promote F&O by making expiry everyday then now put restriction to it. Make suffer only common people.

Looks like now we have to move to another broker or avoid stock market anyway. Even intruducing Rs. 2 for every equity delivery trade would greatly hurt us a lot. Don’t even Think incresing any fee.

This is not so fair !!! Brokers like GROWW , who charges brokerage doesn’t even charge AMC of 360 . If Zerodha ever charges Brokerage + AMC , Then please put down the ”discount broker” tag . And I am honestly out

hello Nitin Ji,

while I have been a long time customer of zerodha, however i have one big complaint. i am an OTM bank nifty and nifty option buyer, however your system restrict entry to outside options especially 3000 points out of the money for bank nifty. this is not acceptable , especially when other brokers are allowing to trade. you allow selling deep otm options but you dont allow buying . i dont understand why is that so. kindly take into the matter and resolve this.

my friends in icici direct are easily doing option purchase for deep otm options, for your knowledge. so it makes no sense that if we want to trade then the broker or your platform restricts this. i have to move out of your family of customers if this is not resolved.

i hope you will do the needful at the earliest.

thanks

Would change the broker,no problem

Hi Nitin,

Thanks for the update. I for one will be fine with a small brokerage on delivery. I don’t want your business to go bust, coz the other brokers will swoop down like hawks and charge exorbitant brokerages. You guys really set the benchmark for them to charge low/zero brokerage. So, I hope you will charge way less brokerage than other brokers for delivery trades. Thanks and all the best.

Probably we need to move out and search for alternative if delivery based brokerage charges are introduced..

Hi Nitin,

Don’t even think of the same, as you know that phonepe has also entered this market, and they are offering free equity delivery and f&o. The company has good amount of fund to bear the loss, to gain the market share.

Hi Team,

If you are planning to charge for delivery then no more investment from my side in your platform. We have other options.

Thank you,

Santhosh

It’s unfair to go out from Zero brokerage. You should stand with your commitment,.Then we will be forced to move to other platforms who offer zero brokerage. Bye bye…

If you even start to charge brokerage on delivery,then I will go to another broker. You shud charge to those who is making lots of money yaar … Jo per anum 5 lakh + profit krta ho…

Please keep in mind the interest of small investors. Who are adding stock like SIP in a very small numbers.

So after reading all this, Its time to close ZERODHA account and Look for Other Trading platform.

FYI – I made several requests on making enhancements all these years in upgrading UI and chart performance ( Drawings to be saved liked trading view portal, Provide on chart create alerts, Trendline and indicator alerts) when none of enhancements can be done then ZERODHA has no right to increase or apply charges for services they were providing for free.

As it is STT is not deductible from Cap Gains while it is a FACTUAL & ACTUAL COST. What if a delivery based trader gets Break Even after STT but since STT deduction is not allowed there is fictional gains and Income Tax is to be paid?. Should the trader borrow or dip into his past savings or Rob a bank to cover the STT deficit.? Now the FM is thinks Middle class is losing money in F&O so wants to raise levies. Is this the solution to help a loser? If FM thinks F&O is non essential activity or gambling why not close down that segment to save the middle class ? The truth is the FM thinks the Stock market is a milking cow because the Bull market is apparently giving free gifts while in reality it s hard work to make money. So raise LTG tax, remove Indexation, increase STG , No STT deduction etc. When the Bear takes over and people desert the market then FM may get a hard reality check. God help our Equity investor

If “Zerodha” is planning to charge Equity Delivery Trades, then count me too out as ur customer, also u will be sooner or later known as ZeroHai.

Hi Nithin and Team,

Slowly people will move away from you once you impose delivery brokerage. You are really greedy person. Seating on huge profit then also displaying such greedy statement suggesting your day of downfall start soon.

You should avoid charging brokerage on equity delivery, else you will lose more customer than the revenue.

Try giving add in services and generate fee from that. Like check how many customers will you loose if you charge for brokerage and how will that affect other verticals like Zerodha capital. You will clearly recognise that free brokerage benefits you more than customers

Though I am a small long term investor in equity & in learning phase. I was thinking to increase my portfolio but if Zerodha charges on equity delivery, I will search for another plateform.

why sebi first introduce for retailar every day expiry . for public participation public loss money for lurnning and now sebi gives number of restriction for small people thise is not fear.

10% revenue hit means only 400 or 500 crore dent in your net profit of 4700crore..at this pace still you will earn net profit of rs. 4000crore plus(excluding any future gain). So if you are still greedy as a broker and not stick to your commitment of name ”zerodha (means zero brokerage) than it means you are no different than other broker.

So if you increase or levied brokerage on equity delivery or other trades you will loose a good chunk of customers…suppose if you loose 5-10% customer than this will be a bigger dent on your profitability

So don’t be greedy and adhere to your name

When you were able to manage Zero brokerage from the start, when Futures and Options were not that much popular, why suddenly that decision has to be reversed. The difference between discount brokers and traditional brokers is that traditional people also provide other services like stock recommendations apart from the trading platform. So can we expect such services from Zerodha also if brokerage is enforced in the cash segment. What about the margin you already have in DP charges? Traditional brokers do not charge DP charges. Will Zerodha follow the same way? Charging AMC for using your platform is a better option than charging brokerage for each equity transactions and it makes sense.

We have been associated with zerodha since early years because of the zero brokerage on delivery trades.Pls keep status quo.Any hike will be detrimental for small investors.If at all an increase is warranted there should be a limit provided to small investors say upto 20 lac trading no brokerage.Thanks.

Hi Pallavi, equity delivery will continue to be free at Zerodha. As of now, we are not making any changes to our brokerage.

Govt and brokers both in collusion sucking smaller investor.. now it’s time to left stock market…indulge in buying GOLD in local Market in physical form on cash to cash basis

If ”Zerodha” is planning to charge Equity Delivery Trades, then count me out as your customer, and also change the name to ”Zerotha”

Hi, equity delivery will continue to be free at Zerodha. As of now, we are not making any changes to our brokerage.

You people increasing and increasing charges and make profit, but now we have many other options.

Respected Zerodha Team,

To keep delivery free, please find an alternative solution. For eg: You may take some reasonable deposit and offer delivery (CNC) free. Please think of a solution which is easy to digest for you and users.

Thanks,

Hi Nitin,

I strongly feel that you should continue with no brokerage policy for delivey,or people will definately migrate to other brokers,even i will suggest you to give interest for the amount which we keep in zerodha funds for buying or adding stocks and interest should be calculated on daily basis,this step will enhance zerodhas popularity and will result in higher subscribers.

Thanks.

leave F&O and focus on equity or find another job and lave trading

I will switch to a cheaper broker. Goverment is sucking us like a parasite.

Dear Sir,

A comparison of the existing charges and the revised new charges on both NSE and BSE option trades will be of great help.

Thanks & Regards,

Hi Shobha, you can check the comparison here.

In case the brokerage for delivery / cnc / positional trades are increased to maximum Rs 20/-, i.e. at per with current and existing Intraday and FNO brokerage charges (Rs 20/- for both Buy and Sale sides), I will opt for closing my Zerodha A/c and shift to any broker who would take lesser brokerage in delivery trades. As per my opinion, yes…. for your sake you may start levying brokerage in delivery / cnc trades; but max limit of that must not exceed Total Rs 20/- (Rs 10/- for both Buy and Sale sides) ….. That means even if you start charging brokerages for CNC / Delivery trades, the brokerage charges must remain half the charges currently applicable for intraday and fno trades.

Hi Nitin,

I clearly don’t understand your point, maybe I need to have one on one conversation to understand this.

But, What I understand from your long explanation is that you are willing to forego the 0 Brokerage on delivery trades.

As far as Increasing taxes on f&o trade is concerned, I believe its a good thing.

Reason being, let me give you a little stats as far as I remember, The trade in equity vs options ratio in India is much more then any developed country in the world. {I AM AVOIDING QUOTING THE NUMBERS AS THE ARTICLE IS NOT ACCESSIBLE TO ME AT THE MOMENT}.

And this is really alarming, and that need to be checked. You pinpointed a great observation that after restriction on leverage, the volumes have increased. I agree with this.

Now, for the earlier part of 0 brokerage, I would like to inform you that 0 brokerage on delivery is what we used to do as word of mouth for your promotion.

If you stop this many traders like me will eventually move to some other alternative.

So ponder over this idea. And try to find a balance. Lately, the number of outrages at kite has increased significantly in the recent past which is alrming too.

Rest assured, you are smart, you established a profitable business and running it successfully for the last 9 years.

I am one of the few who received an early email invitation of yours.

Think.

Dear Sir,

What about us, I am full Time Option Trader & I have Lost My Job, my family depends on share market income to fulfill our daily Needs, from Last 2 Years I made huge losses & In between SEBI increase Taxes & Now Broker will increase Taxes from us, so how can we tackle in Our daily Needs?

Please we don’t want to pay higher brokerage….

Hi Nithin and Team

I joined you guys in year 2017

The time when full-time broker doesn’t provide live data feed for charting software and we have to take a subscription by paying them extra and above it sky high brokerage and charges for trade.

Back then very few discount brokers were their and zero advertisement for discount broking.

Searching on quora on how to pay less brokerage and saw your many post that you posted related to zerodha and services.

Pi trading software, man you provided some heavy tools to use for retail trading back in time, many of the post covid market participants unaware of it.

But you brought the breakthrough products in Indian market for retailers.

Then Level 3 depth data, where a retail can see upto 20 bids and ask

You increased the standards of trading in India and just because of Varisty courses, many youtuber/fin-fluencer running their shops till day.

It was a great run till day with you and your team

And its a hard time for both brokers and Traders as well

So don’t hesitate to pull the string, eventually we all gonna take a hit either by paying for delivery or paying more in F&O segment.

It was a great run Nithin with many market up and down.

Once upon a time Late Mr Dhirubhai Ambani told , “ If you want to do buissness always look at the last Man. But post covid u discount brokers have changed the game,” u discount broker s always look at yourself, but it is not wrong in the “LAW OF NATURE “ but I think it will certainly make u rich with land and’s gold but may not give u mental peace. Which is going to impact your health. And also if u want to look at last man, always look at the price of last strike of the option chain of index option chain, and if the last strike is unable to become “IN THE MONEY CONTRACT “ u r making huge loss of ur health but certainly make wealth. I mean to say for example say nifty future is trading at 24000 and the last strike is 26500 and price is Rs 1 and if a trader buys it and before expiry if nifty does not surpass26500 than u r losing huge health. U people r doing just opposite to what Late shri Dhirubhai Ambani once said.

I am not very sure about this but I think what discount brokers are doing to earn money, in a post Covid scenario,using machines is equivalent to doing sucide , discount brokers can increase their span life, if sebi mandates exchange to charge brokers on per contract/lot basis for every index and stock options contract. For example say Rs 1 or 2 or so per lot.

Hope good for investor.

Sebi directed exchanges and other market infrastructure institutions (MIIs) to implement a uniform and equal fee structure for all members, instead of different fees based on their size or activity.

I think the era of free brokerage is progressing toward its End Phase. Start Brainstorming toward a better product that offer high quality platform such as Tick-By-Tick data, High End Reliable Trading Software etc. If you go with above approach as a business, you will lose your client based left and right. I think we are ready to opt for subscription-based plans. But if You think charging us for equity delivery is a way to sustain in broking industry then might as well change your business name. ZEROdha is meant for ZERO Brokerage

As we know this measure is to reduce retail participation ask SEBI to make regulation like mandatory certification on derivative trading so that people are knowledgeable about what they are doing. SEBI should not do nanny sitting if I decide to trade. People lose money even in equity trading will they close stock exchanges

Also why would you kill the options traders by charging them more….charge them what you pay to exchange…make you money by charging them a flat monthly fee. Same can be done for delivery based trading or create combo packs for delivery n options trading based on the transactions… something similar to talktime models of telecoms

Hi Nithin,

Your profit (revenue – cost) for last FY was more than 1200 crores. I mean how greedy you and other brokers are. Look at other startups , they are barely break-even, and you want all of it. It’s a good initiative and I support SEBI to help retail investors like us. Don’t think that we don’t have a choice, soon new startups will emerge and provide better service than your platform at more competitive price .

Under any circumstances zerodha sh not start charging brokerage on equity deliveries..or else its nomenclature will become contradictory and many customers including myself will be pulling out..instead balanced increase in F &O charges n if still needed,marginal increase of AMC fees can be considered

Hey kamath bro, don’t increase the delivery charges, please increase fno charges because derivatives are the one sebi want to regularise not equity delivery, if u do so like that u may loose equity clients like me 💯💯💯👍🏻👍🏻👍🏻

I think you should give us a option of Yearly subscription. It could be 8k-15k or as you think.

Will need to too how much your prices increase and then compare and go with brokers which provide best value.

Especially with all the problems that Zerodha has been having in peak trading hours.

Don’t want to pay higher brokerage and at the same time have a sub par performance.

I would like to know what is the objective behind this amendment by SEBI. What is SEBI trying to achieve with this? Is SEBI giving the same salary to all employees or are we paying the same income tax if we earn more? It is not a hidden commission that the brokers get. It is their work and volume that earns them a bonus.

Zerodha known for zero brokerage. Don’t charge for equity and may increase for derivatives

Yea sure , keep increasing, who cares, we have many other options

I was very disappointed to read this article. My entire family will have to switch to a different broker (probably with Banks) if you start levying brokerage on delivery trades.