FY23-24: Step-by-step guide on filing tax return for traders

Filing Income Tax Returns (ITR) can be challenging, especially for stock market traders involved in different segments such as Futures & Options (F&O), intraday trading, and delivery-based trading.

So here’s a step-by-step guide if you want to file the ITR yourself.

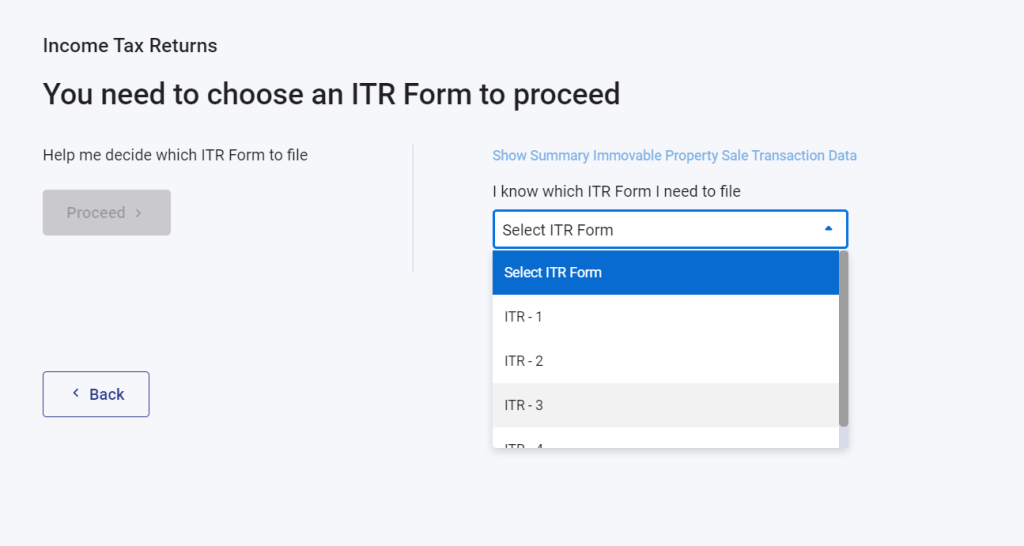

Step 1: Go to the e-filing portal > File ITR > Select assessment year (AY 2024-25) > Select ITR form (ITR-3 for trading income). Note, if you have just capital gains on sale of equity shares and mutual funds, you need to select ITR-2.

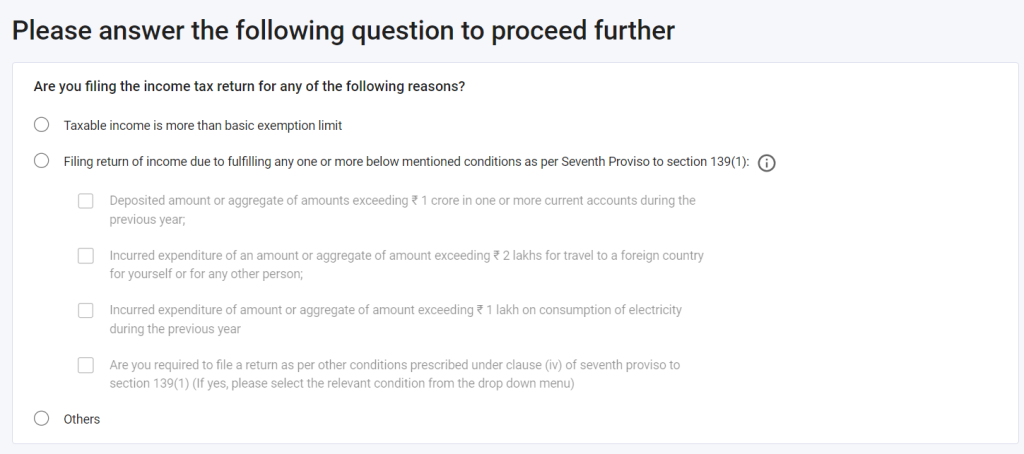

Step 2: Select the reason for filing the ITR and proceed. If your total income is more than Rs 2.5 lakh, you need to choose ‘Taxable income is more than basic exemption limit.’ This limit is for those choosing the old tax regime. If you choose to file your taxes under the new tax regime, the limit is Rs 3 lakh.

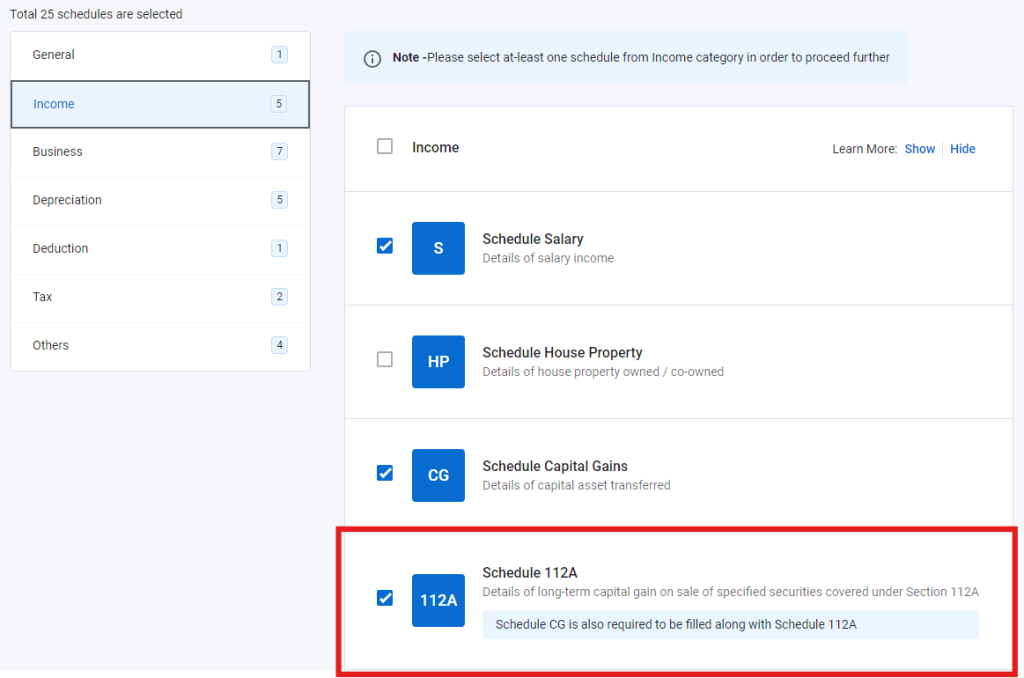

Step 3: Now, you’ll have to select the schedules applicable to you. Most of them are selected by default but you might have to add a few more. For example, if you have LTCG from equity shares and mutual funds, go to incomes and add schedule 112A.

Step 4: Next, we’ll have to add details in all these schedules.

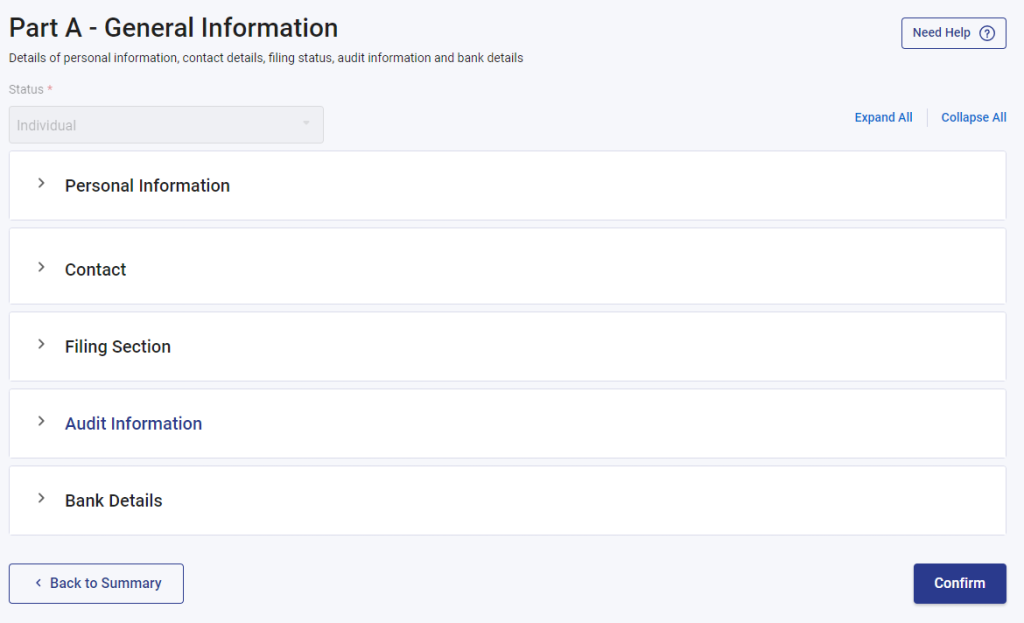

First, go to Part A– General Information schedule. Here, fill up your personal details, bank account details and basic information about your filing status like filing due date, tax regime and residential status. You’ll also have the option to declare whether or not you are opting for a tax audit. Check eligibility conditions to maintain books of accounts or audit – here.

Step 5: For income from F&O (not including intra-day trading income)

- For taxpayers liable to maintain books of accounts

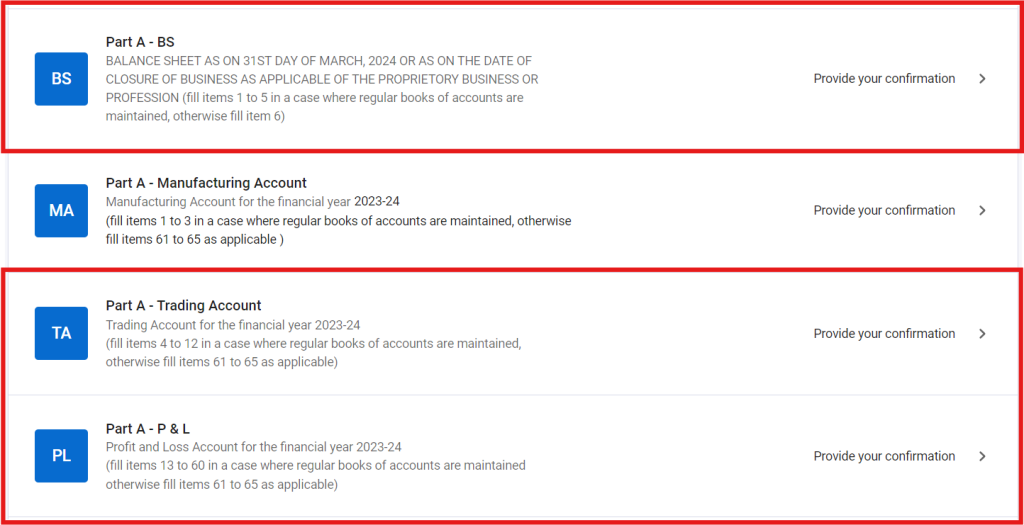

- Income from F&O is treated as business income and the businesses liable to maintain books of accounts will have to primarily fill these three schedules: Part A – Balance Sheet, Part A – Trading Account and Part A – P&L.

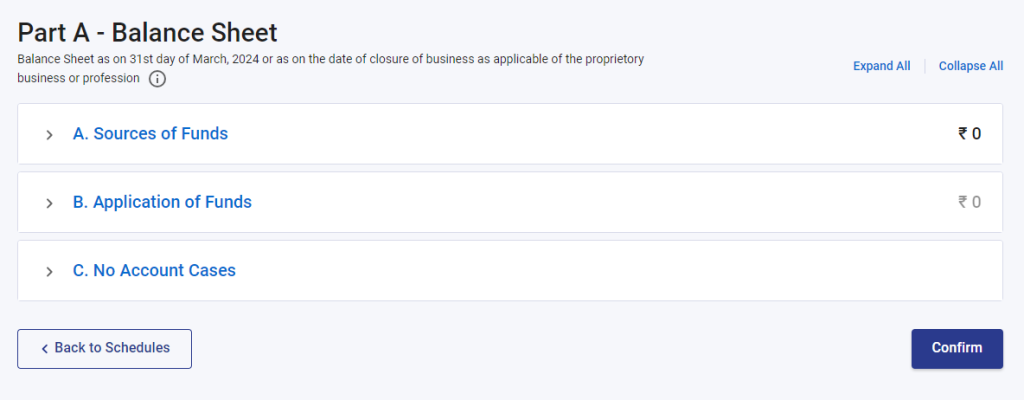

- Under the Balance sheet, add your sources of funds (proprietor’s capital) and application of funds (bank balance, your broker balance, or any cash in hand).

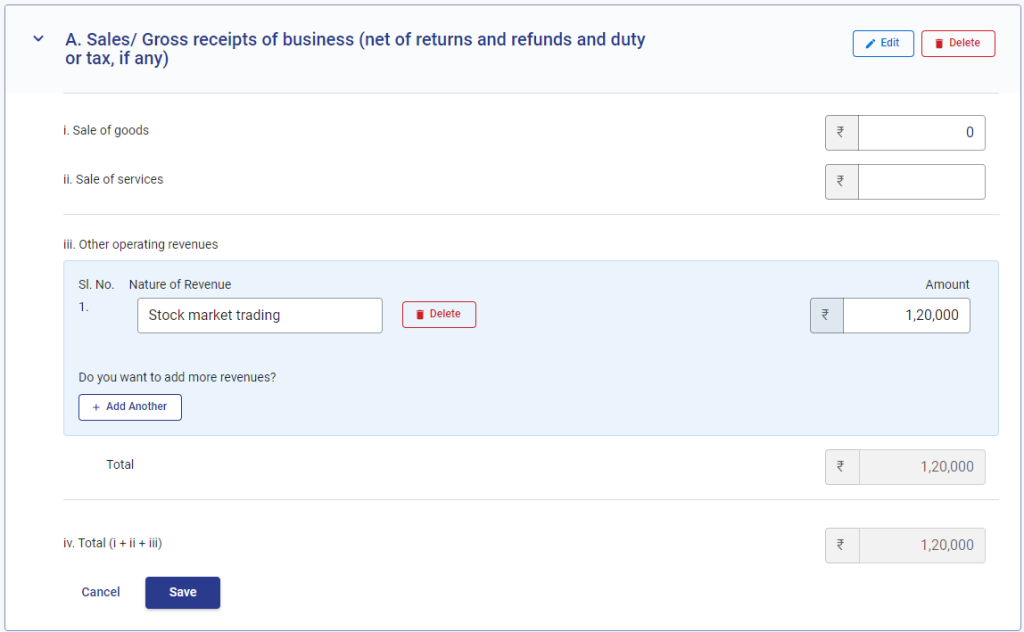

- In case of net profits, you’ll have to go to trading account > expand 4. Revenue from operations > click on Add Details > expand A. Sales/Gross receipts of business > iii. Other operating revenues > Mention ‘Stock market trading’ under Nature of Revenue > Add the total amount of your trading profits.

- In case of net losses, you can skip the above step and go to schedule Trading Account > expand 9. Direct Expenses > Click on Add Details > Mention ‘Loss from trading’ under Nature of Direct Expenses> Mention the loss amount.

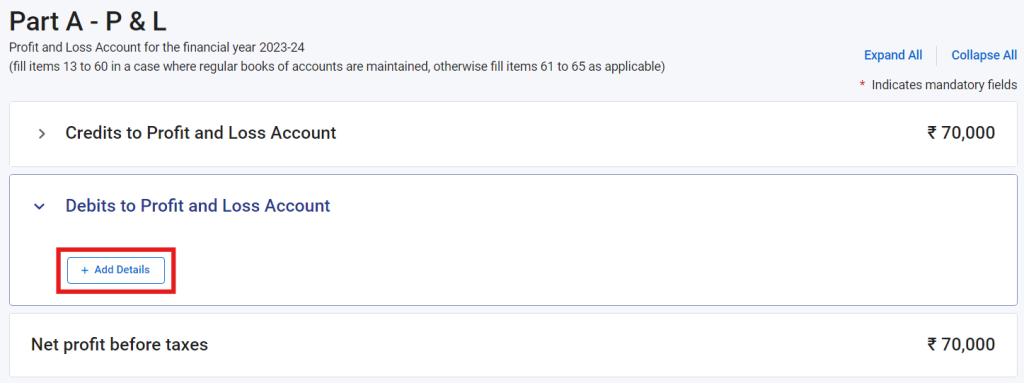

- Next, to claim the expenses, you’ll have to go to Schedule P&L. Here, expand Debits to Profit and Loss Account > Click on Add details.

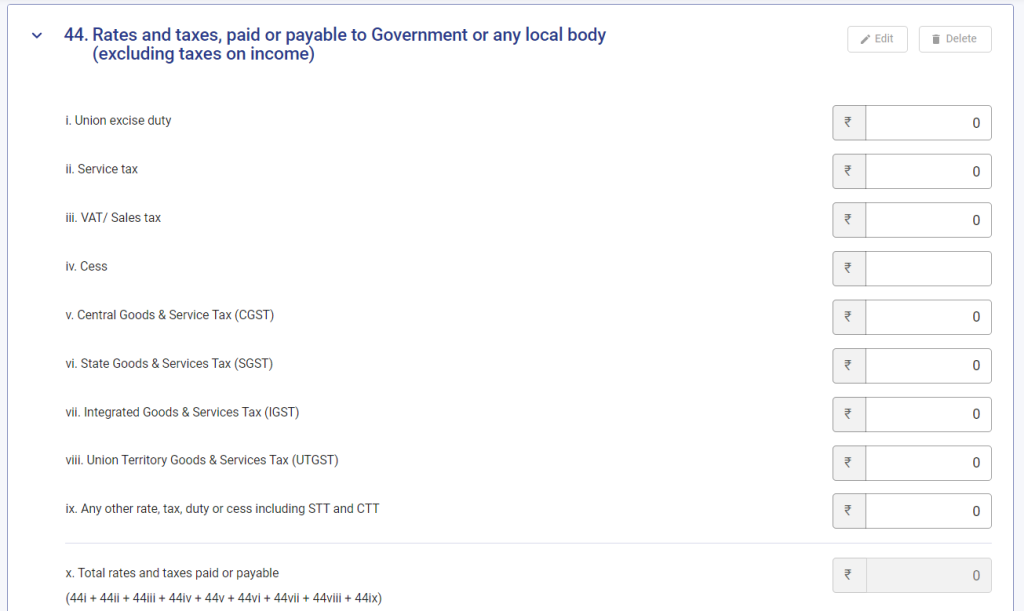

- You’ll see a long list of expenses. For most trading-related expenses, you’ll have to go to page 2 > Rates and taxes, paid or payable to the Government or any local body. Add all the expenses and click on save.

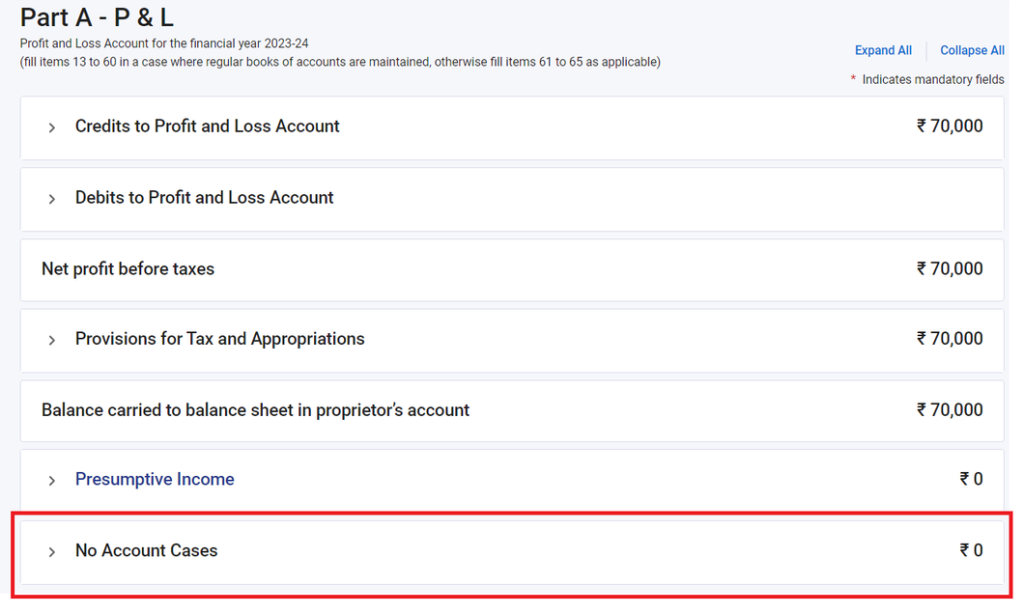

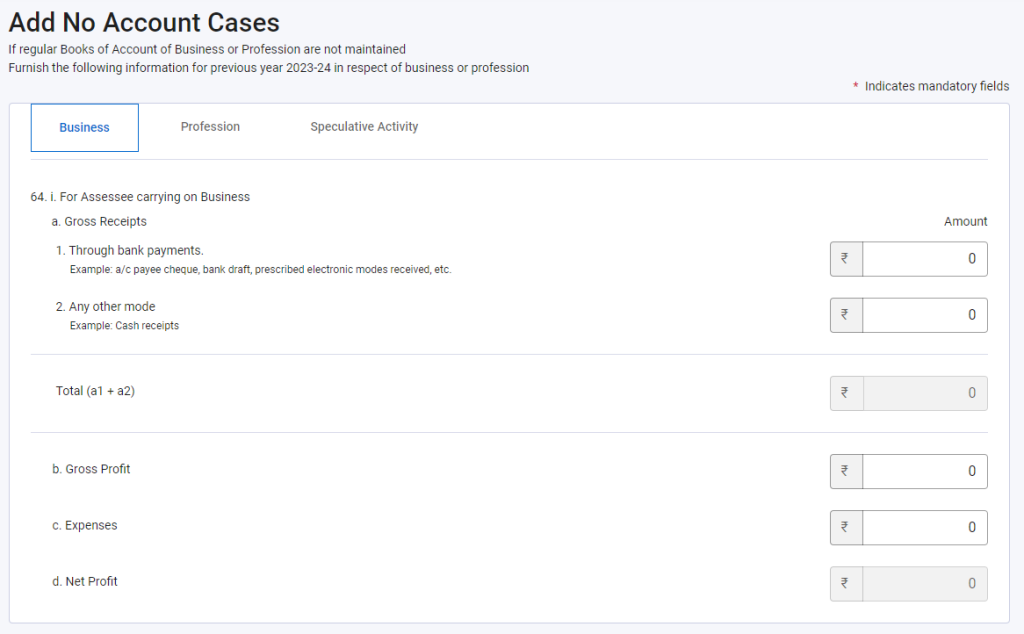

2. For taxpayers not liable to maintain books of accounts, the steps below will apply.

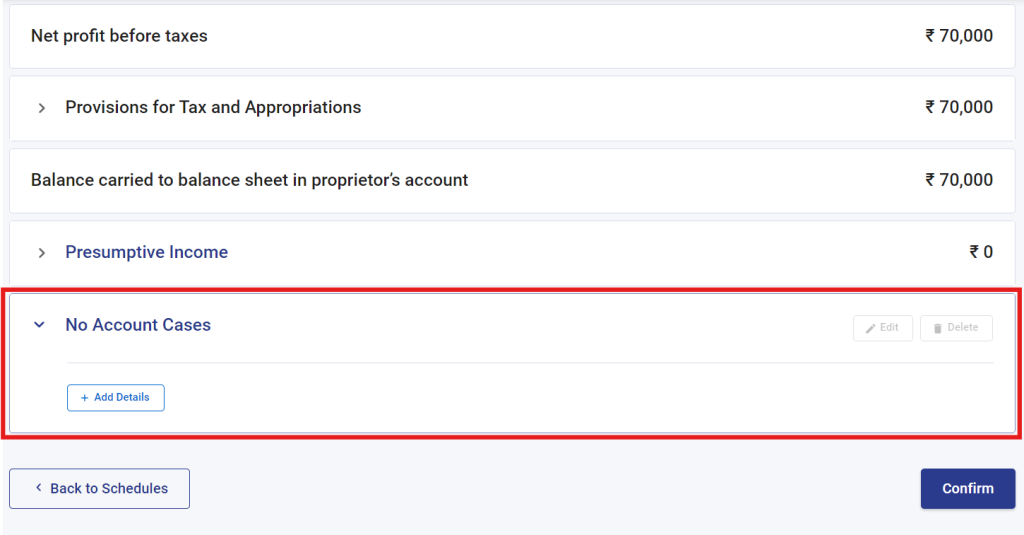

- Go to schedule P&L > No accounts case.

- Click on add details > business, and fill up the necessary fields.

- Next, go back to schedules > Balance sheet. Here as well, go to no accounts case and enter the necessary details.

Step 6: For income from intraday

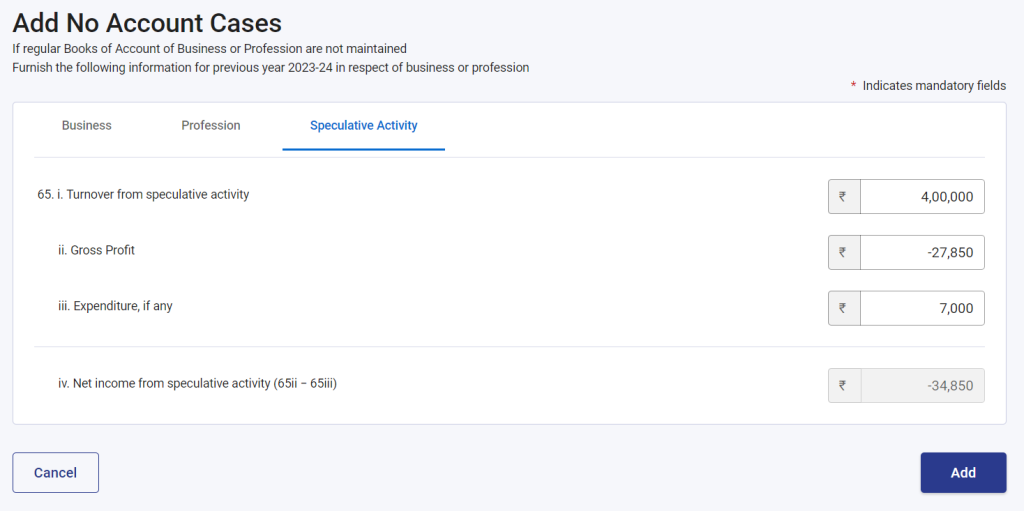

- Intraday income is treated as speculative business income and needs to be reported a little differently. You must go to Schedule P&L > No accounts case > Add details.

- Go to Speculative Activity > Add your intraday turnover and profit/loss.

Step 7: For short-term (STCG) and long-term capital gains (LTCG):

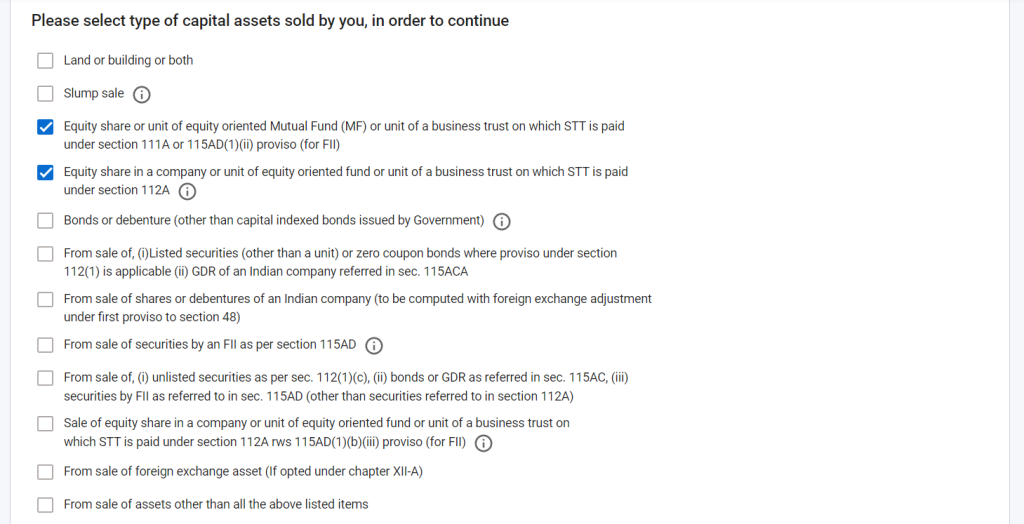

- Go to Schedule CG > select the type of capital gain.

- For listed shares and equity MFs, you’ll have to select:

- STCG — Equity share or unit of equity oriented Mutual Fund (MF) or unit of a business trust on which STT is paid under section 111A or 115AD(1)(ii) proviso (for FII)

- LTCG — Equity share in a company or unit of equity-oriented fund or unit of a business trust on which STT is paid under section 112A

- Click on continue.

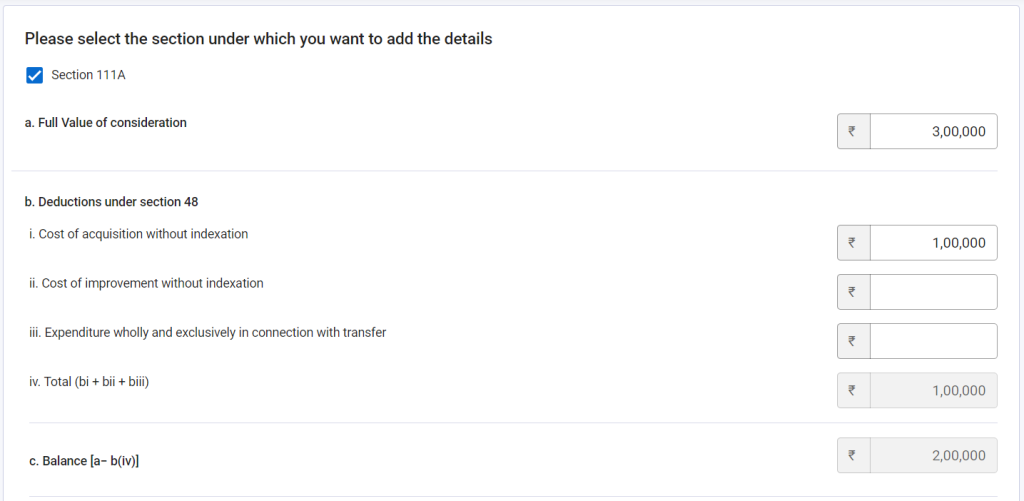

- For adding STCG, expand ‘Equity share or unit of equity oriented Mutual Fund (MF) or unit of a business trust on which STT is paid under section 111A or 115AD(1)(b)(ii) proviso (for FII)’ > Add details > Select section 111A.

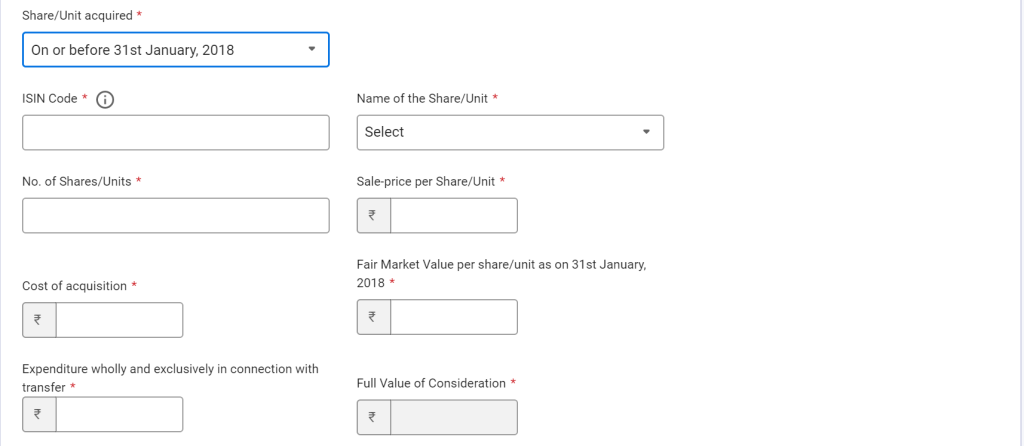

- Similarly, you can add your long-term capital gains. For listed shares and mutual funds, schedule 112A is applicable. You’ll have to fill in details the following details and you can find them in the capital gains statement provided by the platform or the mutual fund house.

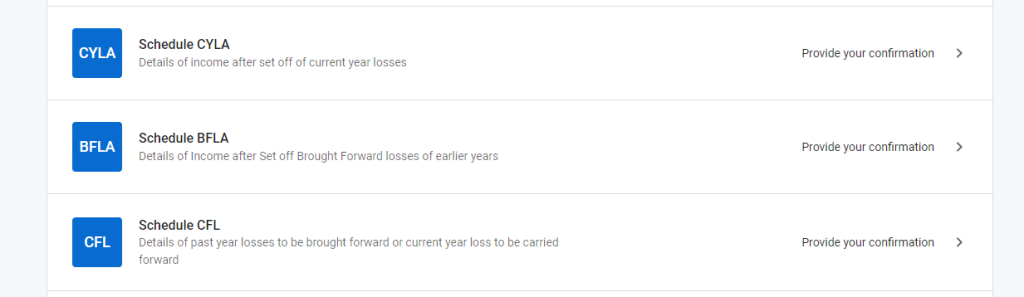

Step 8: Now check the details of your set-off and carry-forward losses under schedule CYLA (current year loss adjustment) and CFL (carry-forward loss).

Schedule CFLA includes the details for your current year losses that have been adjusted against current year incomes. The remaining losses will be carried forward to future years and reflected under schedule CFL.

If you had reported any losses during previous FYs and they are being adjusted against this year’s income, those details will be available under schedule BFLA (brought forward loss adjustment).

Step 9: Lastly, once all of these details are added go to schedule TI (total income). Here you’ll be able to see a comprehensive view of all the incomes that you’ve reported. And next, go to schedule TTI (tax on total income) to know your tax liability on the entire income.

Review all details thoroughly and if you have any tax dues, pay and proceed to verification. You can now preview your return and e-file.

Remember, this is not a comprehensive guide and you may be required to add more details based on your income situation. I would suggest you to consult your tax expert in case you find this overwhelming or need personalised advice. At Quicko, we allow you to import your capital gains/trading transactions from the broker platform.

The above questions are answered by Surbhi Pal from Quicko. This is for informational purposes only. Consult your tax expert for individualized advice.

Can we deduct the cost of training we took for Stock market Trading study in the ITR filing. (as an individual, not company)?

Hi, how to add info in itr 3 in i have more than one demat account

I have pension OS and CG and speculation income filling ITR3 in balance sheet asked column of ITR3 1sundry debtors 2. Sundry creditors 3.amount of total stock in trade 4. Amnt of cash bal aaa kindly guide in item 3 Which stock should be shown

Please can you update the Article as per current FY .

How to fill the ITR 3 form for the profit from sale of listed security as business income.

Stcg excl sheet and ltcg excl sheet cumpalsary yes or no I write total buy and total sale value and total expenses in return yes or no my account demand stcg and ltcg sheet for return

How to show F& O profit or loss

and Buyback of share Details

It’d be more helpful for clients of zerodha if zerodha could provide taxpnl details in the format of the excel sheet “Schedule112ADtls_download” of the Incometax exportal. So that it can be uploaded to the ITR without any hassles.

How to claim depreciation on assets like mobile , monitor ?

I AM HAVING INTRADAY GAINS AND IT IS TO BE REPORTED AS SPECULATIVE INCOME. BUT THE P & L SCHEDULE IS NOT AVAILABLE IN ITR2. WHETHER I HAVE TO TAKE ITR3 FOR REPORTING THIS GAINS

For no account case, at point no 64, can you explain what is gross receipt in respect of FNO trading

Last year I had loss from F&O but I filed ITR1. So can I carry forward that loss by entering details in Schedule CFL of ITR3 this year ?

Also if I am selecting No account case then how do I show F&O loss in ITR3.

Hi Suvendu, you can post any taxation related queries here.

Hi! Can anyone guide me for filling Balance Sheet schedule of ITR 3. I have only Intraday, STCG and interest income from bank FD and RD What is to be shown in proprietor’s fund/capital. Should I show only balance or capital held in the form of shares or should I add bank FD along with shares values also to show in proprietor’s fund/capital. Thanks. Please reply me, bcz last date of filing ITR is very close.