How the Chinese dragon burnt itself

This is the first part of our series ‘Big Trouble in Brittle China’, which covers the many problems with the Chinese economy today. There’ll be more on this in the coming weeks.

California has always had large, intense wildfires. Its climate is wet enough for plants to grow and dry enough that they burn well. When fires arise, they spread easily and quickly.

And yet, today, Californian wildfires are more extreme than they have ever been. 8 of its 10 largest fires ever have happened in the last decade. There are many reasons for this – climate change being the foremost. But there is also another, more curious reason: California is very good at fire-fighting. A little too good. In a cruel paradox, when you put out too many fires, fires become far harder to manage.

Fires are part of a forest ecosystem. They burn off dead plants and dry shrubbery, cleansing the forest of fuel. Prevent them, however, and this plant matter accumulates. Eventually, there comes a fire you cannot control, and then, it all acts as kindling. What may have been an ordinary fire becomes an inferno that is impossible to contain.

Something similar is happening in China.

You’ve probably heard – maybe even with a tinge of dark glee – about China’s recent economic woes. There is more bad news every day: failing stock markets, plummeting foreign investment, spiralling deflation, halting growth… The Chinese economic juggernaut, it seems, is faltering.

It would be a mistake to look at this and conclude that China is hurtling towards certain doom. The world rarely moves in a straight line.

China has many genuine issues, though, which have built up over decades. The country saw an uninterrupted economic boom for over forty straight years. It maintained this boom through good times and bad, by flooding its economy with money through channels created by meticulous, albeit heavy-handed, state planning. The country’s rise has been a sight to behold: the fastest a major economy has grown in the history of the world.

It is difficult to reach this level of growth without taking a few short-cuts, however: and like all short-cuts, they’ve come at a cost. While China is now the world’s largest economy (at least accounting for purchasing power parity), not every part of it has seen the same super-charged growth. There are now imbalances in the economy, where aspects of it are under-developed for an economy of China’s heft.

In a simpler, freer economy, these imbalances would set off sharp, localised crises. Like a small forest fire, they would consume a little corner of the economy. Companies would shut down, people would lose their jobs, court cases would drag on. The economy would scramble to correct its course and, as a result, growth would temporarily falter. China, however, is no simple, free economy. It has suppressed its issues for years. This has allowed it to exploit the same short-cuts for far longer, maintaining its steady rise. But this has only allowed the imbalances to grow deeper. Now that its economy is doddering, they suddenly seem menacing. Like kindling for a fire. If this becomes an economic inferno, it will be hard to contain.

The story of China’s economic struggles is actually a series of many different, interlocking stories. Each of them centres on a short-cut that China took, which has, over time, built a new fragility into its economy. By themselves, these may well be manageable. The risk, however, lies in how they play off against each other, compounding into problems that are far harder to resolve.

Over the next few weeks, in this series, we’ll survey the biggest of these stories.

One: China has plucked the low-hanging fruit

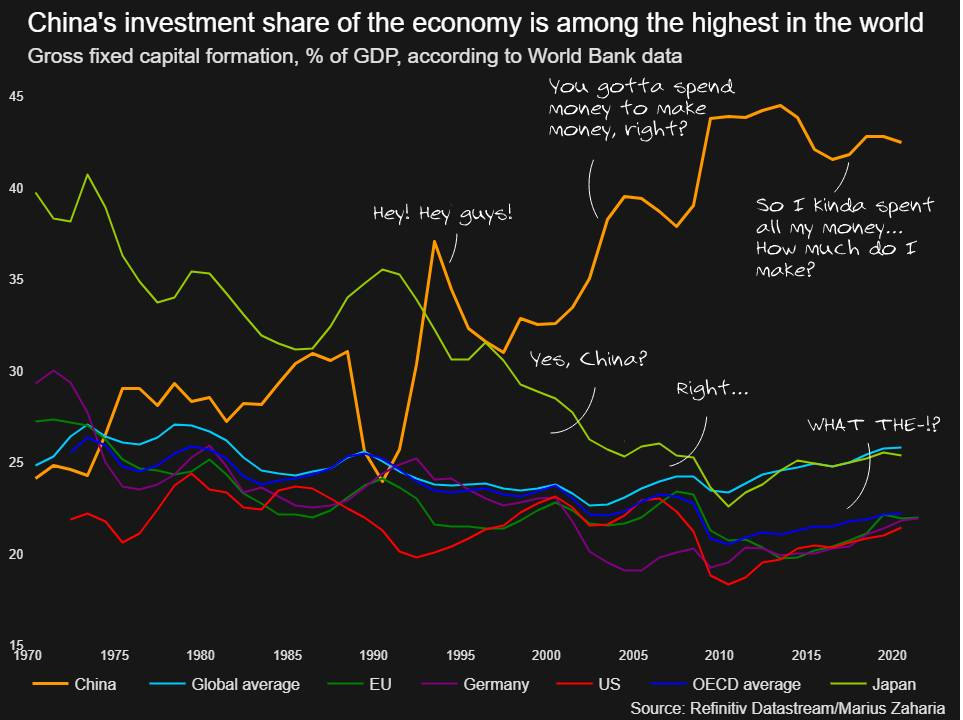

China, more than any other country in the world, runs on investment. Vast sums of money – to the tune of more than two-fifths of the country’s GDP every year – are ploughed into its economy. Each Yuan going in, it is hoped, will create many more.

This chart should tell you what an outlier it is.

Chart by Reuters (link), defaced by us.

This worked well for a long time. China was a large country, with more people than anywhere else in the world. And it was dirt poor. It needed heavy investment: it had to build many things from scratch. As they came up, they plugged many important gaps in the Chinese economy, creating tremendous value. The country boomed.

Alas, good strategies become redundant when their goals are met. After decades of heavy investment, today, those gaps are closing. There are fewer places where funding is urgently needed, and where pumping money can bring near-certain returns.

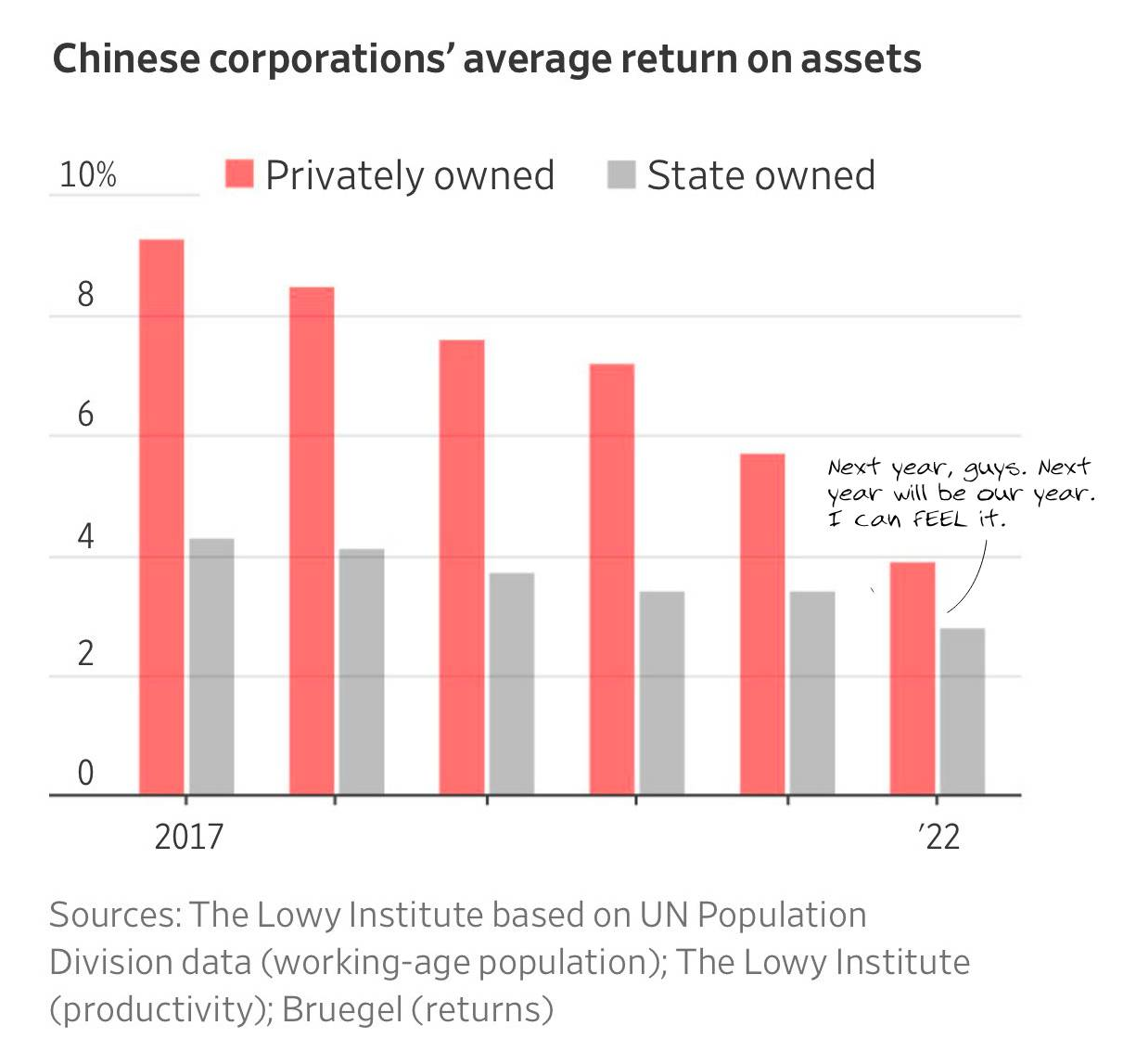

Nevertheless, China currently invests the same share of its GDP every year back into its economy. Every year, this money is doing less for the country. See this chart:

Chart by Wall Street Journal (link), defaced by us.

This is China’s first major imbalance. Its economy is organised around deploying vast pools of capital to plug deficiencies in its economy. These deficiencies are now closing down, and all that money is no longer as useful as it once was. To grow as it did, China must find a new model.

Meanwhile, there has been a cost to freeing up so much money for investment for decades. This cost was borne by the Chinese people, and it is now being felt across its economy. Tune in next week for more.

The map of China used here shows India’s area as part of China.

Please change the map or take down the post.

How can such a big company like Zerodha share such map which shows India’s integral area as part of other country.

Hi Ketan, thanks for pointing this out to us. We have replaced the image.

Force people to spend, time to remove the mask and be true communists for once.

Force people to save less, put a cap on savings and deposits,

What do you mean by cost borne by people.kindly elaborate