Average Directional Index (ADX)

About:

The Average Directional Index (ADX), Minus Directional Indicator (-DI) and Directional Indicator (+DI) represent a group of directional movement indicators that form a trading system developed by Welles Wilder. The Average Directional Index (ADX) measures trend strength without regard to trend direction. The other two indicators, Plus Directional Indicator (+DI) and Minus Directional Indicator (-DI), complement ADX by defining trend direction. Used together, chartists can determine both the direction and strength of the trend. Source: stockcharts.com

What should you know?

- ADX system has three components – ADX, +DI, and -DI

- ADX is used to measure the strength/weakness of the trend and not the actual direction

- ADX above 25 indicates that the present trend is strong, ADX below 20 suggest that the trend lacks strength. ADX between 20 and 25 is a grey area

- A buy signal is generated when ADX is 25, and the +DI crosses over –DI

- A sell signal is generated when ADX is 25 and the –DI crosses over +DI

- Once the buy or sell signal is generated, take the trade by defining the stop loss.

- The stop loss is usually the low of the signal candle (for buy signals) and the high of the signal candles ( for short signals)

- The trade stays valid till the stoploss is breached (even if the +DI and –DI reverses the crossover)

- The default lookback period for ADX is 14 days.

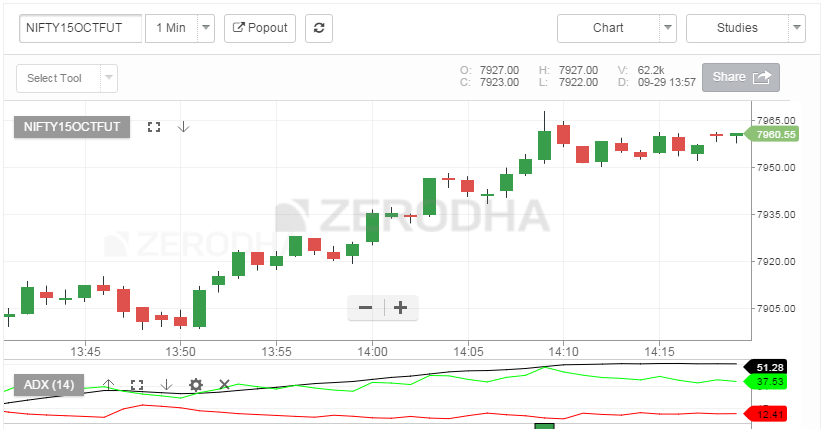

On Kite:

Load the ADX indicator from studies. Kite gives you an option to change the lookback period; by default, the lookback period is set.

You can customize the colour of all the three components of the ADX system. Click on ‘create’ to load the indicator –

By default, the ADX indicator is loaded below the instrument. The black line represents ADX, ensure it is above 25 while looking for the crossovers.

Alligator Indicator

About:

An indicator designed to signal a trend absence, formation and direction. Bill Williams saw the alligator’s behaviour as an allegory of the market’s one: the resting phase is turning into the price-hunting as the alligator awakes so that to come back to sleep after the feeding is over. The longer the alligator is sleeping, the hungrier it gets and the stronger the market move will be. Source: infimarkets.com

What should you know?

- The Alligator indicator is overlaid on the price chart.

- The indicator comprises three simple moving averages – 13, 8, and 5-period averages are used.

- The 13 period MA refers to the Alligator’s jaw, 8 period MA refers to the Alligator’s teeth, and the 5 period MA refers to the Alligator’s lips.

- By default 13 MA is coloured blue, 8 MA is coloured red, and 5 MA is coloured green.

- A buy signal is generated when the following condition is satisfied –

- All three MA’s are separated.

- The price is above the 5MA, 5MA is above 8MA, and 8MA is above 13 MA.

- Once the above condition is satisfied, it means that the asset is trending up.

- When the uptrend is established, it is upto the trader to identify a good entry point within this trend.

- A sell signal is generated when the following condition is satisfied –

- All three MA’s are separated.

- The price is below the 5MA, 5MA is below 8MA, and 8MA is below 13 MA.

- Once the above condition is satisfied, it means that the asset is trending down.

- When the downtrend is established, it is upto the trader to identify a good entry point within this trend.

- Periods, when the 13, 8, and 5 MA are intervened (or moving flat), is considered a ‘no trader’ zone, and therefore the trader is advised to stay out of markets.

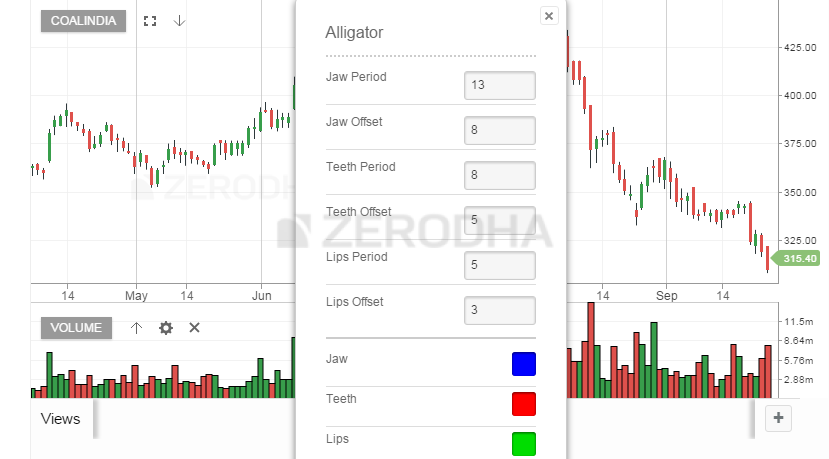

On Kite:

Load the Alligator indicator from the studies. As you can see, the moving averages’ default values are loaded, i.e. 13, 8, and 5.

As you can see, the indicator input also loads the ‘offset’ values for each MA. Default values also load these offset values. Offsetting or displacing the moving average reduces the number of whipsaws in the average. Needless to say that you can change the default values for moving average and offset to any value that you deem appropriate. Further, you can even customize the colour of each indicator to your preference.

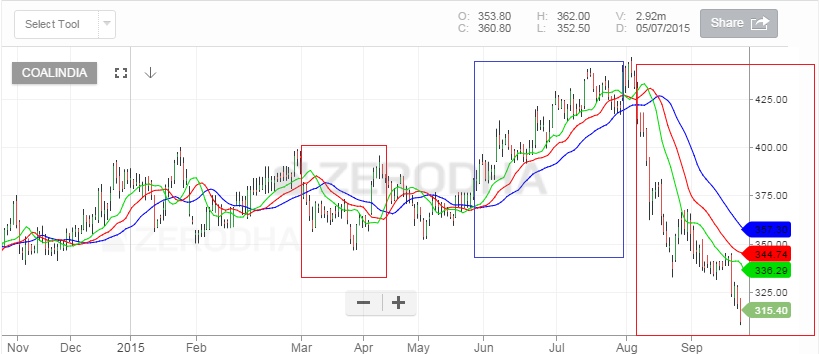

Here is the snapshot of how the indicator looks when the indicator is overlaid on the chart. There are 2 instances when the sell condition is satisfied (highlighted in red) and 1 instance when the buy condition is satisfied (highlighted in blue).

Aroon

About:

Developed by Tushar Chande in 1995, Aroon is an indicator system that determines whether a stock is trending or not and how strong the trend is. “Aroon” means “Dawn’s Early Light” in Sanskrit. Change chose this name because the indicators are designed to reveal the beginning of a new trend. The Aroon indicators measure the number of periods since price recorded an x-day high or low. There are two separate indicators: Aroon-Up and Aroon-Down.

A 25-day Aroon-Up measures the number of days since a 25-day high. A 25-day Aroon-Down measures the number of days since a 25-day low. In this sense, the Aroon indicators are quite different from typical momentum oscillators, focusing on price relative to time. Aroon is unique because it focuses on time relative to price. Chartists can use the Aroon indicators to spot emerging trends, identify consolidations, define correction periods and anticipate reversals. Source: stockcharts.com

What should you know?

- The indicator measures the number of days since last high or low is made. Hence the indicator is a measure of time relative to the price.

- Aroon consists of two-component – Aroon up and Aroon Down.

- The default value for Aroon is 25 days. Aroon up measures the number of days since the last 25 day high occurred and Aroon down measures the number of days since the last 25 days low has occurred

- Both Aroon up and Aroon down are plotted side by side.

- Aroon Up/Down is lower bound to zero and upper bound to 100

- A buy is generated when Aroon up is above 50 and Aroon low is below 30

- A sell is generated when Aroon down is above 50, and Aroon up is below 30

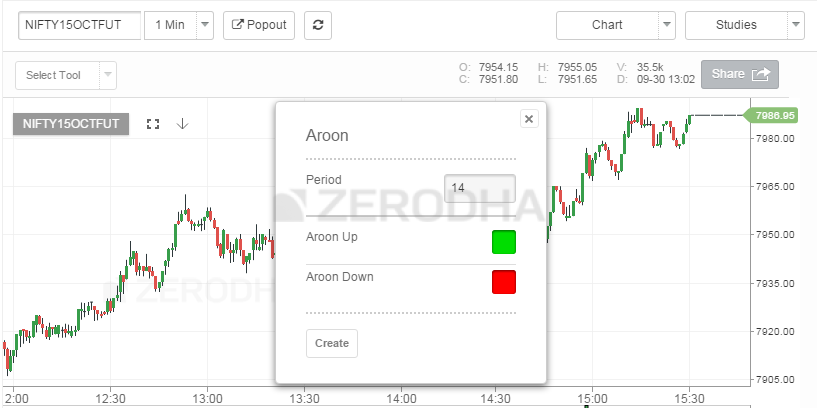

On Kite:

Here is the snapshot of the indicator when loaded from studies –

As you can see, the default period is 14, feel free to change this to any number, you wish. 14 here represent the ‘number of days’. Remember if the period is 14; the Aroon measures the number of days since the stock made 14 days high/low.

As you can see both Aroon up and Aroon Down are plotted.

Aroon Oscillator

Aroon Oscillator is an extension of the Aroon indicator. The Aroon Oscillator measures the difference between the Aroon up and Aroon down and plots the difference in the form of an oscillator. The oscillator swings between -100 to +100, with the ‘0’ level as the centre point.

The snapshot below shows the Aroon Oscillator loaded on to the chart –

A reading above zero means that Aroon-Up is greater than Aroon-Down, which implies that prices make new highs more recently than new lows. Conversely, readings below zero indicate that Aroon-Down is greater than Aroon-Up. This implies that prices are recording new lows more recently than new highs.

As you can see, the Aroon Oscillator is either going to be positive or negative the vast majority of the time. This makes interpretation straight-forward—time and price favour an uptrend when the indicator is positive and a downtrend when it is negative. A positive or negative threshold can be used to define the strength of the trend. For example, a surge above +50 would reflect a strong upside move, while a plunge below -50 would indicate a strong downside move. Source: stockcharts.com

Average True Range

About:

Developed by J. Welles Wilder, the Average True Range (ATR) is an indicator that measures volatility. As with most of his indicators, Wilder designed ATR with commodities and daily prices in mind. Commodities are frequently more volatile than stocks. They were are often subject to gaps and limit moves, which occur when a commodity opens up or down its maximum allowed move for the session. A volatility formula based only on the high-low range would fail to capture volatility from gap or limit moves. Wilder created the Average True Range to capture this “missing” volatility. It is important to remember that ATR does not indicate the price direction, just volatility. Source: stockcharts.com

What should you know?

- Average True Range (ATR) is an extension of the True Range concept.

- ATR is no upper or lower bound, hence can take any value

- ATR is stock price specific, hence for Stock 1 ATR can be in the range of 1.2 and Stock 2 ATR could be in the range of 150

- ATR attempts to measure the volatility situation and not really the direction of the prices

- ATR is used to identify stop loss as well

- If the ATR of a stock is 48, then it means that the stock is likely to move 48 points either ways up or down on average. You can add this to the current day’s range to estimate the day’s range. For example, the stock price is 1320; then the stock is likely to trade between 1320 – 48 = 1272 and 1320 + 48 = 1368

- If the ATR for the next day decreases to say 40, then it means that the volatility is decreasing, and so is the expected range for the day.

- It is best to use ATR to identify the volatility-based SL while trading. Assume you have initiated a long trade on the stock at 1325, then your SL should be at least 1272 or below since the ATR is 48

- Likewise, if you have initiated a short at 1320, then your stoploss should be at least 1368 or above.

- If these SL levels are outside your risk to reward appetite, then its best to avoid such trade.

On Kite:

As you can see, the default value of ATR is 14, which means to say that the system calculates the ATR for the last 14 days. Of course, you can change this to any value to wish. Here is the snapshot –

Once you load the chart, ATR is plotted below the price chart as seen below –

So the next time you place a stoploss make sure you check the ATR value to see if stoploss level is relevant. You may also want to read more about volatility and its application (including volatility based SL) – Click Here.

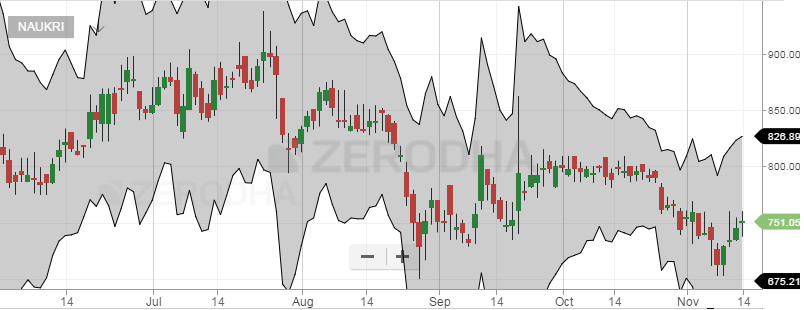

Average True Range Band

The ATR bands are an extension of the ATR concept. The idea is to plot an envelope around the stock price to evaluate if the stock prices are behaving “normally” or trending in a particular direction. To do this, the ATR band calculates the upper and lower band.

What should you know?

- The ATR band calculates and plots the upper and lower envelope around the stock price.

- To begin with, a moving average of the stock price is calculated.

- The ATR value is added to the moving average value, and this forms the upper envelope.

- The ATR value is subtracted to the moving average value, and this forms the lower envelope.

- If the stock price penetrates either the upper or lower envelop, the expectation is that the stock price will continue to move in the same direction. For example, if the stock price has penetrated above the upper envelop, the expectation is that the stock will continue to move higher.

- You can even use the ATR bands as an alternative to the Bollinger Bands trading system. You can read more about the Bollinger Band (section 15.2)

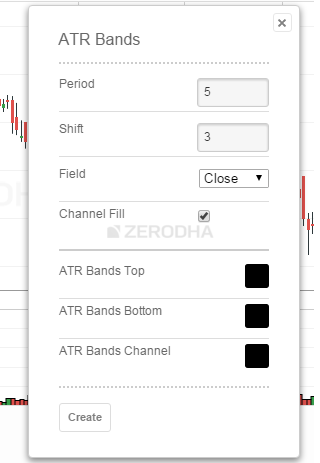

On Kite:

When you load the ATR band from studies, you will be prompted for a few inputs –

Period refers to the MA time frame; the default value is 5 days. You can change this to whichever time frame that you deem suitable. We would suggest you ignore the ‘shift’ parameter. For the ‘field’ option select ‘close’, this means to say that you are plotting the MA values on the closing prices. The rest of the options are mainly aesthetic features, feel free to explore them. Once you click create, you will see the ATR bands plotted on the chart.

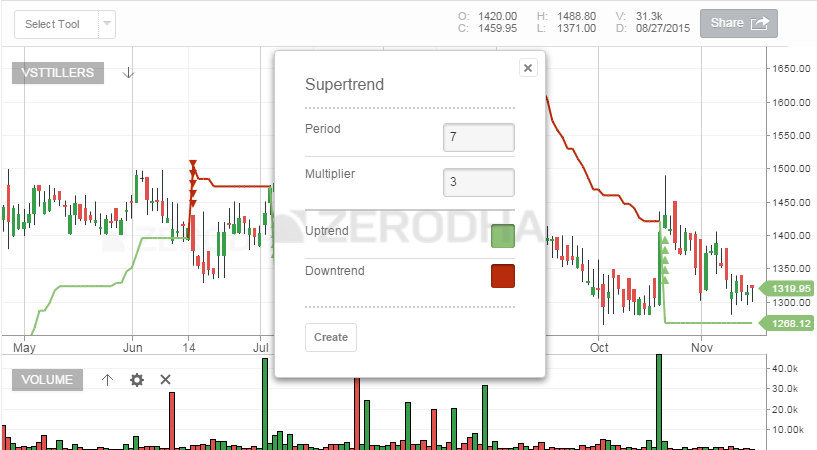

Super trend

Before understanding the supertrend indicator, understanding the ATR is necessary as the super trend employs ATR values to calculate the indicator values. The supertrend indicator is plotted over the price chart of the stock or the index. The indicator line changes its colour between green and red based on the price moment in the underlying. The super trend does not predict the direction, rather once the direction is established, it will guide you by initiating a position and suggesting that you stay in the position until the trend sustains.

What should you know?

- When plotted, the supertrend indicator appears like an alternating green and red continuous line.

- A buy signal is generated when the stock/index price turns greater than the indicator value. At this stage, the indicator colour turns green, and you can also see a crossover of the price versus the indicator (price greater than indicator value)

- Once the long position has been established, the trader is advised to hold the position till the price closes below the green line. So in a sense, the green line helps as a trailing stoploss for the long position.

- A sell signal is generated when the stock/index price turns lesser than the indicator value. At this stage, the indicator colour turns red, and you can also see a crossover of the price versus the indicator (price lesser than indicator value)

- The sell signal can be used to initiate a fresh short or exit long. Although waiting for the sell signal to exit the existing long position can sometimes lead to the loss. So the trader should use his discretion here.

- Once the short position has been established, the trader is advised to hold the position till the price closes below the green line. So in a sense, the red line helps as a trailing stoploss for the short position.

- Supertrend is basically used to identify a trend. Therefore, it works best in a trending market.

- The supertrend indicator, when compared to a regular Moving Average trading system generates fewer false signals; for this reason, the super trend indicator is preferred over a Moving Average trading system.

On Kite:

When you select the Supertrend indicator from the list of studies, you will be prompted for two inputs – Period and Multiplier.

Period refers to the ATR number of days. The default value on Kite is 7, which means that the system will calculate the ATR value for the last 7 days. You can input any value you deem suitable.

The multiplier refers to a value by which the ATR will get multiplied. The default value on Kite is 3, so whatever is the ATR value, it will get multiplied by 3. The multiplier is a crucial input for Super trend. If the multiplier value is too high, then a lesser number of signals are generated. Likewise, if the multiplier value is too small, then the frequency of signals increase, hence chances of generating false trading signals are quite high. I would suggest you keep this value between 3 and 4.

Once the indicator is plotted, this is how it appears on the chart –

Notice how the indicator changes the colour as the price moves. Also, whenever the buy/sell signal is generated, green and red arrows are generated (respectively) prompting the trader to go long or short on the stock.

Volume weighted average price (VWAP)

VWAP is one of the simplest indicators to use. It works on the principle of averaging the traded price in terms of volume traded. Let me give you an example to help you understand this better.

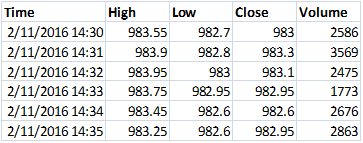

Here is how Infy traded between 14:30 and 14:35 on 2nd Nov 2016 –

The data is quite simple to understand; for example, at 14:32, 2475 shares were traded; it made a high of 983.95, low of 983, and closed the minute at 983.1.

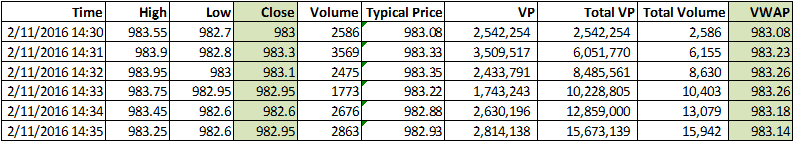

Now, we use this data and compute the VWAP price. To do this, we calculate the following –

- Typical price = which is the average price of High, Low, and close

- Volume Price (VP) = we get this by multiplying the typical price with its volume.

- Total VP = This is a cumulative number, which is got by adding the current VP to the previous VP

- Total volume = This is again a cumulative number, which is got by adding the current volume to the previous volume.

- VWAP = We get this VWAP number by dividing the Total VP by Total Volume. The resulting number indicates the average traded price, weighted by volume.

Let’s do the math on Infy data –

As you see, the VWAP is a dynamic number, changing based on how the trades flow in.

How to use the VWAP?

- VWAP is an intraday indicator, use it on minute charts. Often when you plot this, you will notice a jump at 9:15 AM, when compared to previous day’s data. Ignore this jump as it means nothing

- VWAP is an average, and like any indicators employing averages, this too lags the current market price

- VWAP is used for 2 main reasons – to get a sense of intraday direction and to get a sense of the efficiency of order execution

- If the current price is below VWAP, then the general opinion is that the intraday trend is down.

- If the current price is above VWAP, then the general opinion is that the stock is trending higher.

- If the VWAP lies in between the high and low, then the expectation is that the stock will remain volatile.

- If you intend to short a stock, it is considered an efficient fill if you short the stock at a higher price than VWAP.

- Likewise, if you intend to go long on a stock, it is considered an efficient fill if you go long at a price lower than VWAP.

On Kite:

Open the chart of your preference and select VWAP from the studies dropdown –

Note, VWAP can be applied only on an intraday time frame and cannot be applied on EOD data.

Once you select the time frame (1 min, 5 mins, 10 mins etc.), the engine calculates the VWAP and plots it on the chart as an overlay.

You can now visualize the VWAP and the current market price and plan your trades accordingly.

Why is vwap different for different time frames

Hello Sir,

Up until now, you had discussed candlesticks, volumes, S&R and other indicators and made a checklist according to that for us to use while shortlisting trades. So my question is- in this chapter, there are many more indicators that you\’ve discussed like VWAP, Supertrend, ATR, etc- how important are these for me to consider ? Can I just go by your Grand Checklist ?

Yes, you can, and also there is no need to learn all indicators. Pick and choose the ones you understand well and use them 🙂

Hello Kartik sir Aditya here, \”As you can see, the indicator input also loads the ‘offset’ values for each MA. Default values also load these offset values. Offsetting or displacing the moving average reduces the number of whipsaws in the average\” there are 2 things that i need to ask in this statement, 1) what is the meaning of offset values? , 2)what is the meaning or reducing whipsaws in average?

Aditya, an offset in the context of a moving average means shifting the moving average line forward or backward on the chart.

> Positive offset: Moves the moving average forward/right, i.e., into the future.

> Negative offset: Moves it backward/left, i.e., into the past.

Whipsaws are false signals — when a moving average crossover or signal suggests a new trend, but the price reverses quickly. E.g., MA crossover says “buy,” but price drops soon after. This leads to frequent, small, losing trades — that’s a whipsaw

thank you sir for helping me out]

Happy learning, Aditya! Good luck!

Hi There is a indicator called majority rule. I understand that it is computed using multiple indicators and taking a vote between them as to whether they are signaling a bullish or bearish sentiment. Which indicators are used in this voting and what are the settings for those and is there an option to change the indicators used or their settings?

Ah, not sure about this, need to check myself.

Thanks for the response. Can you check and let me know please.

Hi karthik, may be i am asking silly

but when said \”A buy signal is generated when ADX is 25, and the +DI crosses over –DI\”

do this mean that +DI is moving upwards to downwards and -DI is moving downwards to upwards ?

Thats right, end of they day these are Moving averages and its variants.

Please sir say more about cpr for long and short time frame and for next day trend analysis. Thanx

What exactly would you like to know?

how to set the RANGE FILTER BUY AND SELL INDICATOR

Ah, not sure. I\’ve not used this indicator myself.

Hi Karthik,

I wanted to ask that if I want to trade in a specific sector or industry say IT sector. And there are hundreds of stocks. How can I identify my opportunity universe therein. Is there portal or something where I can get particular stocks no matter large or small cap but with good fundamentals which would act as further filter to identify the opportunity universe?

Also, there are many indicators mentioned and taught here and in previous chapters. What would be you top 3 indicators among all?

Thank you in advance :p

Its simple – first identify factors that makes sense. For example, within IT sector lets say you want to look at companies which have 30% PAT or 20% ROI. When you apply these filters, your tracking universe becomes smaller and manageable. You can do this either on screener or on Tijori.

Hi Karthik Bro

You have mentioned VWAP as an Intraday Trend Identifier.

If Price is above VWAP – Trending Higher

If Price is below VWAP – Down trending

But you mentioned if some one intend to short the stock, short the stock at a higher price than VWAP, similarly if intend to long, long the stock at a Lower price than VWAP.

Can you just explain the contradictory.

Regards

Nishad

Nishad, short higher if you expect the price to go lower than the VWAP. Thats the idea 🙂

Is the volume and ADX indicatior similar ? as both shows you the trend. the only difference is that adx indicates buy/sell signal. Right?

Yeah, you can look at it that way 🙂

Is there indicator which can show \”buy\” \”sell \” embedded for intraday or scalping

Hmm, no, not sure what you mean.

Hi Karthik and Vipul,

Can any one of you explain the strategy in a bit more detail which Vipul has mentioned in his below comment:

\”I think Super Trend is the best indicator or what I would say as super Profit machine. We should see first identify the 30 min Super Trend Signal – whether buy or sell and then see 5 min Super Trend signal line to enter the trade as per the 30 min Signal. Eg. if 30 min signal is in sell mode (red line above), then in 5 min mode take every sell signal that comes with stoploss of 5 min signal line. I have minted tons with this strategy hence sharing. Karthik Sir can elaborate further if there are any chinks in this strategy. Alternatively you may combine any longer term time frame to judge primary trend and take decision as per shorter time frame supertrend eg. 1 hr – 10 mins 🙂 Thank you\”

I understood how supertrend works, but am not able to grasp what is being said here and how to setup trade as per this strategy.

I\’ve not used the indicator much, so cant really comment on this Abhishek.

Hello..

If i didn\’t get wrong..

So you mean to say go long when the premium price is below vwap, and, short it when premium price is above vwap??!

Please look at the intrinsic value of strikes to know its moneyness.

Hi Karthik

When you say ATR bands can be used as an alternative to BB, wished to understand as the interpretations to both are different and why is that so.

For BB, upper band indicates an expensive price hence a shorting opportunity while ATR upper band means higher momentum upward so a long opportunity.

Am i missing something here?

ATR is a single band, the same that is the center band of a BB. YOu can use that as a measure of volatility.

While ADR is calculated as the average of x candlesticks ranges (H-L), how is ADR % calculated?

I am referring to the fact that in TradingView when we use use Average Day Range indicator, we can change the scale from Regular to Percent and then it shows in %. But not able to understand on what basis the percent has been derived. Hence the question.

Ah Daljeet, I\’d suggest you check the Tradingview documentation for ADR. They will have a detailed explanation for ADR.

Hi, in the chapter on Bollinger Bands, you had mentioned that when the stock price crosses the upper band, it is in the over-bought region and consider shorting it. Similarly if it goes below the lower band, it is in the over-sold region and consider going long on it.

In this chapter, for ATR Bands, you mentioned that when the stock price crosses the upper band, it is expected to move in the same direction and hence consider going long and vice-versa when the price goes below the lower bands.

This is opposite and yet you say consider the ATR Bands as an alternative to Bollinger Bands. Why?

One way to look at it is that the price momentum would continue and therefore the bet in same direction. It is a counter intuitive approach.

Hey Karthik

I was going through some charts and found Supertrend to be working really well. At worst, it makes us exit at break-even. Seems like I can long on some stock in trend and forget about it for a few weeks until I get the exit signal, giving decent passive returns of ~3% a month.

But I know if it\’s too good to be true it isn\’t true. So, what\’s the catch here?

TIA

End of the day, it is an indicator. So nothing is guaranteed here 🙂

Hello Sir,

Really grateful to you for this content. My doubt is that when we should realise that the selected indicators are not working especially in today\’s market context when market is on all time high?

Anand, there is no concrete answer to this, you will have to constantly evaluate the indicator\’s effectiveness given the market condition. Having said that, a series of false signals is usually a good time to check under the hood.

My WVAP figures are showing on the charts. What could be the reasons?

Sorry, dint really understand the query, can you elaborate?

Hello Karthik sir, I have some queries, :-

Q 1) do candlestick patterns work most time in intraday time duration like 15 mins , 5 mins or 1 hour? As learned in the first module , higher the time duration in the charts, higher the accuracy with the candlestick patterns.

Q 2) How volumes play a role in intraday charts, if the candle is forming a bearish marubozu with less volumes , can I consider it as a valid pattern for a steep downmove and how can I get a volume confirmation as well with a valid candlestick pattern in intraday?

Q3) If candlestick patterns are forming but with less volumes, can we consider it as a valid pattern or invalid *IN BOTH INTRADAY AND EOD CHARTS. 🙂

Q4) I have a confusion while drawing a trend line , When we draw a trend line , we connect the \”highs\” or \”lows\” of the candles or and move it in a downward or upward direction in candlestick charts. but in line charts we have only closing prices in it , so if we connect all the closing prices and it will form a trend , but which one is more relevant while drawing trend lines? we can identify the bird\’s eye view of trend from line charts, but is it technically correct to draw it with \”highs\” and \”lows\” of the candle?

Q5) If a bearish engulfing forming in the downtrend that means , the stock is in downtrend , there can be more fall in the stock ? vice versa to bullish engulfing in the uptrend.

Q6) Last question, I learned about many indicators in varsity but too many indicators are giving me different views while taking a trade, I am Getting distracted and confused after seeing so many indicators in a chart. Can I use only 1 indicator that is RSI and depend only on price-trend-volume action for my trades? 🙂

1) While it can be applied to any time frame, I think 10 or 15 mins is better compared to 5 or 1 min

2) Pay particular attention to volume. Always a good practice to trade on higher volume candle

3) I would not be too comfortable with that

4) Its ok to connect highs or lows or even open and closes. Best to draw trendline on candles instead of line chart

5) Yes, of course. Nothing is certain in markets.

6) Stick to moving averages, its simple and effective in my oinion 🙂

Hi why is MVWAP indicator not available in Zerodha?

No, on charitq we can apply the moving average indicator based on vwap data, and it will function similar to MVWAP.

Studies option is no longer available in Kite I guess.

Ah, please do call the support desk to reconfirm this.

Market depth mot showing in our zeroda app.

Company name -Supreme Engineering Ltd

Please check once with support desk.

Sir,

I read your topic on short selling and got the answer.

Sure, happy learning 🙂

Sir,

Can we make short selling in CNC in zerodha? Or is it only allowed in MIS?

Sir,

I have the following two queries on Aroon/its oscillator:

(i) As we learnt, Aroon talks about the number of days since we watch a particular number of day\’s high/low. Hence, as per definition, if we are looking for Aroon high/low with a look period of x days, then shouldn\’t the value of Aroon high/low <= x. Kindly confirm.

(ii) Also we understand to buy/sell when Aroon high is above 50 and Aroon low is below 30 and vice versa for sell. Now, I would like to know that these figures from 0-100 for Aroon high/low—- Are those a calibration based on pre set logic since? Please suggest.

(iii) Regarding the oscillator, the difference is plotted between -100 to +100. I would like to know if this difference is also plotted based on pre set logic and calibration?

1) Not really, there could be instances where the stock is in a prolonged trend and therefore not make any high or low

2) Yeah, these are based on preset logic

3) Yeah

Wherefrom & How may i download the Zerodha \’Pi\’ software in my PC ?

That s/w is no longer available, Bijay.

Sir,

If I follow candlesticks, volume,S&R,dow theory, fibonacci, MACD,RSI……will it be enough to set up trade or Do i have to also follow the other indicators (chapters which you briefed in the last three chapters)?

Please suggest from your own experience.

Namskar sirji mujhe ek sal ho gaye trading karte huye ab tak mai profit 1rs bhi nahi le paya aur loss 8 lakh kar chuka hu. Pl.margdarshan dijiye. Aur

option trading ke liye kon sa indicators best hota h.

Can we apply VWAP indicator for long term?. If not for what is the best time frame to for 1 day trade.

Not sure; what are you referring to here? Long term or 1-day trade?

Hi, in VWAP, can you provide how u calculate the 1 Standard deviation, cause chart IQ values are mismatching with tradingview in zerodha

Not sure. Can you create a ticket for this? Someone from the charts team will get back to you.

Hello Karthik sir, I have a small doubt on point # 6 in Super Trend where it is mentioned that \”Once the short position has been established, the trader is advised to hold the position till the price closes below the green line.\”

Sir, my doubt is that it makes sense of \”price closes below green line\” for long position. Does the \”price below green line\” also applicable for short position? Thanks

No, that is specific to the green line, short positions only.

How to use VWAP indicator on Banknifty and Nifty daily charts.Kindly share the information.it will be helpful to me.

The usage is the same across instruments. Have explained VWAP in this chapter itsef; let me know if there is anything specific you\’d like me to elaborate on.

I need a clarification. In Point 7 of ADX, are you referring to the candle where there was a crossing or the candle in which we entered the trade? Sometimes, we might be entering the trade later than cross over.

Appreciate your guidance.

It is the candle where the crossing is there (signal candle).

Hey!

Are we supposed to know all these indicators?

As these are quite a lot🙄😅.

Learn a few and stick to it 🙂

Hello team Zerodha. Why is the indicator \”Chandelier Exit\” not there in kite app. Or else is there any alternative the the above mentioned indicator for buy and sell signals? Please mention if any.

I\’d suggest you call the support desk for this.

Did you check under ‘studies’?

My kite doesn\’t show studies. Please help.

I\’d suggest you call the support desk for this, they will guide you.

Sir, if you could please answer this question asked previosuly:

We are creating our own supertrend indicator algorithm and are facing issues with respect to initialization of ATR. The issue is when the market begins at 9:15 am, how do we initialise the ATR?

1- Do we take previous day’s last minute True Range

2- Do we take the Last Close minus Today’s Open

3- Do we continue the ATR series from the last reported close

This becomes important since in times of gap up or down, initialization can affect the starting of supertrend series.

Thank you

1) Thats not possible, you will have to take the day\’s ATR. Maybe start your indicator at 9:20?

2) Yes

3) Yes

Can be trade in sideways trend and if yes then which indicators to use?

Try the RSI or MACD.

Also, just like real time prices are available through API, can we get real time value of ATR also through API?

Thank you

Ah, no that won\’t be possible. But if you get OHLC, you can build, right?

Dear Sir,

We are creating our own supertrend indicator algorithm and are facing issues with respect to initialization of ATR. The issue is when the market begins at 9:15 am, how do we initialise the ATR?

1- Do we take previous day\’s last minute True Range

2- Do we take the Last Close minus Today\’s Open

3- Do we continue the ATR series from the last reported close

This becomes important since in times of gap up or down, initialisation can affect the starting of supertrend series.

In alligator indicator you explained about offsets. What are offset values and how do we use? Whether they are supposed to be same as the value of indicators?

Thank you.

They are used as a smoothening factor, VB. You can use the indicator without the these factors as well.

A question.. not really from thia chapter but from intraday trading … So a hypothetical situation say on day 1 I shorted a stock at 916 at 9:20 am and it closed at 910 but I did not squared off my position .. and on day 2 the stock opened at 890 what would happen will my short position continue at day 2 or would it be auto squared off on the end of day 1 … And what would be final p&l … Conditioned I\’m using zerodha.

It would be squared off on day 1 itself, but just in case there is no liquidity or the stock hits a lower circuit, then the position will be short delivered.

hey Karthik, just now checked the ADX on TradingView there is the ADX line but no +DI and -DI lines on intraday chart of 15 minutes, am I making a mistake or there is something else I should know, please help!

Thank you!

I think they have separated out the +DI and -DI bit as a separate indicator. Need to check this myself.

Hey Karthik,

Minor correction:

Under Supertrend point #6, \”below the green line\” should be replaced with \”above the red line\”.

Thank you for the detailed write-up.

Checking, thanks for pointing out.

in zerodha kite how to set VWAP Indicator.i am try to use VWAP indicator but not success. please help

You can load this as an study Nilesh. Its is quite easy, but can you call the support desk if you are finding it tough to figure out, they will explain easily over the phone.

sir what should be the time frame for vwap to use.

YOu can start with EOD charts and see how it goes for you Anup. Then you can start tweaking.

Is Bar replay feature available in Intraday timeframes like 5,10,15 minutes?

I don\’t think so, Arjun. But I need to double-check this myself 🙂

So the ATR says price is limit each day right…

Sorry, dint get that.

It looks like typo here

“ Change chose this name because the indicators are designed to reveal the beginn……”

Checking on this.

Hello Sir,

I plan to purchase X stock on a positional basis.

Sometimes I feel despite the weekly momentum indicators being bullish, my stop loss is hit in the ATR in the daily section.

Possible if the stock is highly volatile.

Hi Sir,

When using ATR, do I use it on a weekly basis or daily basis?

I\’d suggest daily.

Hello Sir,

There is a good chance if Nifty breaks below 15500 on and ends up closing 15400/15300 etc.

This would result in a substantial loss for me.

How would I place a trigger stop-loss order for this, as let\’s say intraday 15500 breaches my trigger stop-loss would get activated and my position is exited. However, the market recovers and closes at 15550 which means my stop loss should not be valid.

Thats now how it works 🙂

You place a sl, the price acts as a trigger. If it hit the price, SL is executed, you can\’t really say the market bounced back and SL was not valid.

Hello Sir,

I hope you and your family are doing well.

My question is When should I apply each technical analysis study and tool to with respect to different time frame?

Obviously higher time frame rules as mentioned earlier.

But for example assume nifty has a daily support of 15500. In the hourly and 15 min chart the support breaks, so do I close my long positions or wait for nifty to close below 15500 on the daily chart?

Good chance nifty go lower and close at a lower level and I would lose substantially?

How does one intertwine Monthly, Weekly and Daily charts?

Sourya, if you\’ve established that 15500 is the support for Nifty on the daily chart, then you wait for it to close below that level on the daily chart. The problem when you mix time frames is that you\’ll be in and out of trades more often than you\’d want.

Hello Sir,

I have rarely seen ADX move to 25 while the DMI concurrently cross each other. Usually the DMI is already above after which the ADX has crossed.

Also often we see the ADX line around 30-40 and now slowly reducing.

When can one enter into these scripts as the ADX could reduce to 28-29 and against start to increase?

How does one enter positions like this?

You can see this happening when there is momentum picking up in the script. Not a common occurrence in a flat market.

Hello Sir,

For using ADX.

Many a times the +DMI is way above the – DMI and after which the ADX reaches 25. Would this be considered a buy signal as the +DMI has crossed over the -DMI way before the ADX reaches 25.

Also often we see the ADX line around 30-40 and now slowly reducing.

When can one enter into these scripts as the ADX could reduce to 28-29 and against start to increase?

Some traders do, but I\’ve had mixed experiences. I\’d suggest you test this for a few signals and see how the trade pans out.

Hello Karthik,

Suppose bank nifty is trading at 34684. It has an ATR of roughly 700 points, so that would mean I would have to set a stop loss at 33983 or lower correct?

Isn\’t the range very high? It could lead me to take a substantial loss per trade if my trade goes wrong.

That\’s right David. The larger the range, the lesser the probability of SL getting triggered. So your capital must ensure you can take this kind of risk.

Dear Sir,

These are part of the Advance Get Software from E signal.

Have you heard of it?

I\’ve heard, never used it. I\’ve used Metastock for a long time, comes from the same Indian distributor I guess.

Dear Sir,

Have you done research on Elliot waves? JTI(Joseph Trend Index)? Make or Break? TJ\’s Elipses?

Do you know about these and are they good to use?

Nope, I dont know this indicator.

Thank you so much!

Good luck, Pranay!

I think I found it. Just need confirmation if DMI is the combination of ADX, +DI, and -DI.

Thats right.

Hi! Is there a way to get the +DI and -DI lines on TradingView?

I\’ve not specifically checked this, but it should be a part of the ADX.

sir, I have been following you since last year and I learned many things this last year and I wanted to take this to next level and improve my skills in the field of investing. As I wanted to know more about the markets and the psychology to deal in the markets. It would be great if you share your investing experience so I get few more insights and how to overcome some biases. Can there be a chance to contact you and have a video session or a call to discuss above-mentioned things. I would like to hear from you.

I\’ve shared everything I know here 🙂

Hey Karthik,

In the Aroon Oscillator indicator under the \”What should you know?\” section, point 6. \”A buy is generated when Aroon up is above 50 and Aroon low is below 30\” shouldn\’t that be Aroon down rather than Aroon low?

Sorry, dint quite understand that.

Hello Karthik,

Thank you so much for all the materials that you have authored. I had even gone through your financial stories for kids, which will be helpul for future generations.

Look at this chart –https://www.tradingview.com/x/vdQ09POr–. In this chart I have added fibonnaci retracement and MACD. And I have noticed that every time signal line crosses EMA (above) there is a retracement in the chart to a fibonnaci retracement level.

1. will this be always true?

2. Should I consider this as a strategy to trade this stock next time?

Glad you liked the content! Happy learning.

1) No, not always true.

2) Maybe you should back test this before you take it live.

Hi sir,

I really want to thank you from my bottom of my heart for the well written notes. These notes are going to be turning point for every trader..

Sir one request, can you please explain ichimoku clouds in detail…As you say filter the news from the noise.. So I want to do the same on this particular topic with your explanation..

Thanks in advance! 🙂

Thanks, Arijit 🙂

I\’ve not used IC much, hence don\’t think I can explain it well 🙂

Vwap is not working in my platform don\’t way I follow all instructions but it not working

Please do check with the support desk for this, Vikas.

Can you add new indicators (scripts) in tradingview (Pine editor is available)?

Not for now, Kumar.

My doubt is similar to Tagore.Point 4&5 and 7&8 are saying opposite. if CMP is below VWAP than should we short or should we go long . For example present Nifty 50 is below VWAP.

What Stop Loss we should keep for VWAP , Aroon and Aroon Oscillator .

I guess this is a mistake, checking on this.

My doubt is regarding the VWAP discussed above, and from the points 4 and 5, it says if the current price is lower than VWAP then, it\’s a down trend and likewise if current price is higher than VWAP then, it\’s an uptrend. So, I could say one can \”short\” in the former case and go \”long\” in the latter, but the points 7 and 8 says completely opposite.! So, sir can you please explain in detail.

That\’s right, let me check the point again. Maybe a mistake.

CPR is available on kite mobile ?

Not yet, hopefully soon.

In VWAP, aren\’t the points 4 and 8 contradictory (similarly point 5 and 7 contradictory)? If price is above VWAP, then stock is trending higher (point 5); so how is shorting the stock considered an efficient fill (point 7)?

I guess I need to reword this, thanks for pointing this.

Sir for intraday 15min chart should we use one day ATR or 15min ATR

For one day it might be 20

For 15min 4-5

For 15mins, I\’d suggest you use 10-period ATR, see how it goes and then reevaluate.

Sir can ATR be used for Swing trading

Or for that should we use sqr rt of number of days and find volatility and keep that as a so

Which one do you prefer and used by you

Thank you😊

YOu can use ATR directly for swing, no need for the conversion. I kind of prefer ATR since its easy to use on the fly.

In zerodha, VWAP is not applicable for indices like NFTY , BNFTY.

But some of brokers like Angel etc. have option to use this indicator on indices.

Please guide.

Are you sure? Have you checked both ChartIQ and TV?

Dear Karthik,

kindly explain the application of Aroon in intra day scenario and what should be the suggested period in the same case?

You use this the same way as you\’d use for end of day, Ravi. YOu just have to shrink the timelines.

Hello Karthik,

First Thank You for so much for the Info.

Can you also update on how to trade on channels and trend lines?

Channels and trendlines can be traded just like the way you trade any range. Usually in a range, the movement is sideways, but in a trend/channel, the stock price is trending in a particular direction, this is the only difference.

valuable lessons

Happy leaning!

Please add list.

Trend/indicator name for intraday, short term and long term.

Trend/indicator name for options trading.

Sorry, dint get that.

For the ATR do you use the Current market price? or the price range within the day?

Yes, CMP is used.

if stock price will not cross that band then how to use this indicator ? because as per the description :-

\” If the stock price penetrates either the upper or lower envelop, then the expectation is that the stock price will continue to move in the same direction. For example if the stock price has penetrated above the upper envelop, the expectation is that the stock will continue to move higher \”

I have looked at the data of 1.5 year and i didn\’t see any signal.

You wait for those extraordinary moves 🙂

Hi Kartik Sir,

I was drawing ATR Band in Kite. I found stock price never penetrates either the upper or lower envelop.

You can even look at the example given by you for ATR in below link. Candles are not crossing envelop.

https://zerodha.com/varsity/wp-content/uploads/2016/02/Image-11_ATRbands_created.png

Kindly clarify if my understanding is incorrect.

Regards

Ishwar

These are volatility bands, which are higher and lower than the CMP, hence it never penetrates unless there is a sudden spike in price.

Dear Sir,

I have tried MC crossover, Price action, NR 7 etc.

it seems the stock goes down as soon as I buy it, and have lost money in all methods.

Can you suggest what should I do to stick to simple basics and get on track?

Scale back and paper trade these strategies for a few weeks if not for months, Satish. You will get a sense of what\’s happening in the market and then you can scale back with real money.

I\’m confuse on the application of vwap.

If the current price is below the vwap we assume the stock will go downward so why should we go Long and enter the trade at a lower price than vwap?

VWAP changes continuously. Use this as a reference price and not base your trades entirely on VWAP.

Do we have the option of putting standard deviation bands on vwap in Zerodha ?

Thats basically the BB on VWAP, I not sure of this is possible.

Ok Sir. Thank You.

Good luck, Sunny!

1.Sir, what approach you ideally follow to FIND small cap or mid cap stocks that are good in value since they are not known as such and holding period is for long term ?

2. Sir, what happens once the 100% authorised capital is utilised and the company wants to issue more shares ? They will file for increasing the authorised capital and then can promoters bring in more capital to increase their stake ?

3. Sir, just want to confirm. Looking at the options data just gives us the sentiment of what the others are thinking i.e whether they have a bearish/bullish view this no way afeect the actual prices of the underlying for eg: Bank Nifty ?

4.Sir, in case of BTST trade how is the brokerage and other charges are charged since the delivery is not taken comapared to taking delivery and then selling it ?

1) Approach is common across any size of the company – good balance sheet, ethical promoters, operationally profitable, plus a moat around the business. Holding period is valid as long as these things are valid

2) Yes, this pass a board resolution, take necessary approvals and increase the number of shares

3) Not really, its hard to conclude market sentiment just by looking at the option data on a stand alone basis

4) Brokerage is not applicable for BTST, for other charges please check this – https://zerodha.com/charges#tab-equities

To Karthik Sir (not a query this time)

Let me take out this moment and thank Karthik Sir and the whole team of Zerodha for this wonderful Initiative (I know its been there for few years now but it still remains wonderful and always will) 🙌🙌🙌

I wanted to learn about candlesticks at first and I started searching for it on google and I guess (this word is just to add poetic effect read as CERTAINLY) I landed at the RIGHT PLACE and I won\’t be leaving it for quite some time now 📚😍

I started this module 15/20 odd days back and \’Technical Analysis\’ is the first module I got started with and I don\’t really know how these days went so quickly as I was so engrossed by the simplicity of the language in which concepts are written 😱

This is without a doubt BEST STRUCTURED COURSE (now I believe ZERODHA VARSITY as a whole) available on the internet and way way BETTER than any of the PAID COURSES one would do. This is nothing less than Gold for anyone looking for knowledge on Financial front be it a newbie from any background or a experienced person from finance background.The way the things are explained is quite astonishing and at the same time simplified such that you can keep reading it all day long 💯

Another thing to point is quick solution to the queries posted, Karthik Sir is always there to solve queries and that too real quick since it has become a part of daily routine Karthik Sir follows. I think now I will be posting too many queries here in and out in the future (I hope I don\’t irritate you though) and stay connected to you in some way or the other as it would be a privilege for us to have you in our little journey and get guided through your simplicity and calmness 😇

The EFFORTS taken by the whole team at VARSITY can be seen in the content presented and it will now pay dividends throughout ZERODHA\’s Journey ✅🔝

I wish ZERODHA the BEST in the future and I thank once again to the WHOLE TEAM of ZERODHA and KARTHIK SIR for this 🙏

Thanks,

SUNNY BHADRA ✌

Hey Sunny, thank you so much for the kind words and all the encouragement. Its overwhelming. I hope you continue to like Varsity and I hope we continue to post good meaningful content here. Happy learning 🙂

Also, feel free to post as many queries as possible, will be happy to share my response to it.

Thank You 🙏🙌

Understood Sir. This little comments add too much value. Thank you very much.

Can I share such things in future as well to know your views ? Will it be ok ?

Please do, will be happy to share my thoughts.

Sir is this a good example of Fibonacci https://in.tradingview.com/chart/JRLhTAZi/ ?

Just want to validate.

Yup, it is. But somehow I\’m not too convinced with such a large time period. I\’d prefer if the peak and trough is within 3 months.

Ok Sir.

Thank you Sir for the quick response.

Can I know when are you planning to upload the reading on scales and how we will be getting notified ?

I haven\’t planned anything for now, maybe I\’ll do that.

Sir, can you please explain :

1. Different types of scales Log vs Regular Scale vs Percentage, etc. How they are interpreted and what are the differences between them ?

2. What does the \’offset\’ option in indicators settings mean and example regarding how it actually works ?

3. Do you use any of the indicators personally from the supplementary reading ? which one will you recommend ?

4. Supertrend indicator or Moving Avg (Simple and/or Exponential) which one you prefer to use ? and in MA Simple or Exponential ?

5. i) Is there any other useful INTRADAY indicator other than CPR ?

ii) what indicators and/or charts or combinations of both i.e. trading setup will you recommend for intraday ?

Sorry for asking too many questions at one go. Will wait for your reply.

Thank You.

1) I\’ll probably put up a chapter on this

2) You can ignore this

3) I prefer the good old indicators – MA, BB and RSI

4) EMA

5) Indicators are not my main source to trade, its the candlesticks 🙂

Can you explain how to set targets in the ADX system?

ADX won\’t help you set targets, you will have to use things like support and resistance for setting the target.

Hi Karthik,

How should supertrend be interpreted/used on the tickertape screener. I am new to investing so a detailed reply will be very appreciated 🙂

Anu, its best to look at ST on Kite and use it the way we have discussed in this chapter.

Sir, any book you would recommend to develop a trading mindset or for technical analysis?

I\’d suggest you read up the articles here – https://zerodha.com/varsity/module/innerworth/

Sir, there are so much indicators, which indicators are best to use? For both long and short. And if using MACD, then we should even use the above indicators for confirmation or not?

I\’d personally prefer indicators like moving averages, BB, ATR, CPR.

Okay, next chapter ?

This is the last chapter in this module.

Hi,

Please elaborate about Central Pivot Range and Pivot Points and its setings too, how Central Pivot Range can be access on trading view chart.

Thanks

Vandana

The next chapter explains CPR. But CPR is available only on ChartIQ for now.

Sir, can you plz advise me which indicator from the one listed above should be my priority if i am looking for buying stock in Short team holding .

I\’d say Moving averages 🙂

hello,

came across Dr. Alexander Elder\’ s book titled \”come into my trading room\”, wherein he described the technical analysis tools he found himself, (Elder\’s Force Index and Elder\’s Ray). I find both of them very important as far as gauging the power of bulls and bears during a particular timeframe. Both of these indicators are there in our studies.

Can u please elaborate how to read / interpret these indicators in zerodha?

thanks

rupesh

Ah, I\’ve not used these myself. Need to educate myself on this 🙂

Hello, since last couple of days, facing problems on PI software. Most of the time it says Operation Time Out for even the smallest action like adding new script. Even clicking on Help or any of the command also it says the same thing. Can you please guide what to do?

I\’d suggest you contact the support desk for this, not much that I can do to help.

while trading based on ADX indicator..should there be a recognisable candlestick pattern be formed or is this not a necessary condition?

As an overlay, it is ok to look for a recognisable CS pattern.

Thank You SIr

hello Karthik,

Thank you for very wonderfully explaining all the indicators. I have gone through all of it . i really find ADX and MA working for me. About Supertrend, I saw a similar looking indicator called UTP indicator ( which the shaw academy people were promoting ) . Are there any similarities or both are different ?

I\’m not sure about the UTP indicator, in fact, have not heard of it. However, I personally prefer to look at the price action, as manifested by candlesticks as my primary source of trade identification. Indicators of all types are secondary for me.

Dear Karthik,

In Nifty and Bank Nifty charts, why cant we see volumes.

Indices in spot are not really traded.

Hi Karthik,

Thanks for reverting back. Do you have any preference among these indicators as they are many and diverse. Obviously not all of them would satisfy their conditions so just asking for an expert opinion.

I prefer the good old MA and Bollinger Bands 🙂

Hi Karthik,

Are the above indicators also part of the grand checklist and should they be satisfied for qualifying trades? Another question I have it in candlestick patterns we take a buy decision when the prior trend is a downtrend but in alligator let\’s say it won\’t satisfy the buy condition because the prior trend was a downtrend. What according to you is more preferred here?

Also how are these indicators different from what we discussed in the technical indicators chapter previously.

These are indicators, and all indicators have the same spot in the checklist. I\’d prefer to give more weightage to candlestick patterns than indicators, including the alligator.

Hi Karthik, In Alligator indicator while waiting for 13,8,5 SMA to move above or below each other(waiting for signal) large part of the move is already completed. This can be seen mainly in down trend. Is there any way to run over this limitation?

Not sure, the idea is to capture a part of the overall big trend.

Hi Karthik

Which are the best indicator for intraday trading .As i am unable to get much data from Vwap

I\’d rather rely on candlesticks for trading intraday rather than the indicator.

yes i have tried both tv and chart iq

but zerodha new indicators introduced list contains this indicator

The new update was stalled, will release shortly though.

I am not able to find Anchored VWAP in the studies draw down list

how can i locate this indicater

Have you tried both TV and ChartIQ? If its not there in both then I\’ve afraid the indicator is not available.

sunil kotian says:

August 26, 2017 at 10:27 am

helo sir

fibonacci tool is not found…its a very good tool.pls do something about that

Reply

Karthik Rangappa says:

August 26, 2017 at 4:50 pm

Not found where? It’s there in both Kite and Pi.

Reply

In Kite, While clicking on the drawing tools, it appears left side of the window (not underneath the cursor!)

I also struggled few days (few weeks !) to locate this hidden menu.

Ah, yes, this is a collapsable menu 🙂

Hi Kartik,

I have two questions.

1. Possible for +DI and -DI to avoid crossover for extended time ? Does it mean we should not enter ?

2. How often do ATR and Range width coincide ? Can both be used together to set Stop Loss ?

1) I\’m not sure if the crossover can stay for an extended period. Anycase, if it does, then I\’d avoid a trade stay on the conservative side

2) ATR can use used as a stop-loss, not sure about the width colliding part.

Hi karthick, I\’m just a beginner and just completed your technical analysis module. Now I planning to practise what I\’d studied so far.

Btw, do I really need to understand these indicator, that you explained above?

Wishing you all the very best, Mithun! It is good to know these indicators, does not harm 🙂

Hi Kartik,

Not sure why ADX with +DI & -DI is only present in ChartIQ and not on Trading view. I\’ve been saving many indicator templates in TV and wanted to add ADX/DMS as well. But just for +DI/-DI signal lines, I\’ve to constantly switch between TV and ChartIQ.

Unfortunately, there is nothing much we can do, Nithin. Will bounce this off with the TV team anyway.

Sir, I\’ve added the ADX indicator from the indicators section and I can the see value and Line on the graph of ADX but I cannot see the +DI and -DI lines on the graph. What do I need to change in order to see the +DI -DI values or lines?

Did you try trading view?

how to use super trend for btst trades?

The same way you\’d for swing. No difference.

Hello Karthik Rangappa,

I tried this with 1Min interval but it wasn’t even close.

This is last 15 trades of 22nd May 2020, between 3.15 to 3.30 pm (1 Min interval)

VWAP I received is “9037.80”, VWAP I saw on chart is ~9012.

OPEN HIGH LOW CLOSE VOLUME Typical price VP Total VP Total Volume VWAP

9016.05 9022.75 9015.55 9022 68100 9020.1 614268810 614268810 68100 9020.1

9022.05 9025.4 9020.8 9025.05 62925 9023.75 567819468.8 1182088279 131025 9021.852919

9025 9031.55 9025 9030.35 76725 9028.966667 692747467.5 1874835746 207750 9024.480126

9030.45 9041.4 9030.45 9041 120975 9037.616667 1093325676 2968161423 328725 9029.314541

9041.05 9049.9 9041 9049.05 111000 9046.65 1004178150 3972339573 439725 9033.69054

9049 9051.5 9043.55 9044.5 104400 9046.516667 944456340 4916795913 544125 9036.151459

9044.6 9052.8 9039.2 9040.2 95100 9044.066667 860090740 5776886653 639225 9037.329035

9038.65 9041.4 9036.5 9036.5 36450 9038.133333 329439960 6106326613 675675 9037.372424

9036.65 9039.95 9036.35 9037.95 29850 9038.083333 269786787.5 6376113400 705525 9037.402502

9037.6 9038 9035 9035 42750 9036 386289000 6762402400 748275 9037.322375

9035 9040 9032 9036.85 70725 9036.283333 639091138.8 7401493539 819000 9037.232648

9037 9038.85 9034.85 9038.1 36975 9037.266667 334152935 7735646474 855975 9037.234118

9037.95 9040 9037.95 9039.5 57975 9039.15 524044721.3 8259691195 913950 9037.355649

9039.55 9041.85 9039.35 9040.5 54000 9040.566667 488190600 8747881795 967950 9037.534785

9040.35 9043.35 9040 9041 70725 9041.45 639456551.3 9387338346 1038675 9037.801378

Is your VWAP formula correct?

I tried this with 1Min interval but it wasn\’t even close.

This is last 15 trades of 22nd May 2020, between 3.15 to 3.30 pm (1 Min interval)

VWAP I received is \”9037.80\”, VWAP I saw on chart is ~9012.

OPEN HIGH LOW CLOSE VOLUME Typical price VP Total VP Total Volume VWAP

9016.05 9022.75 9015.55 9022 68100 9020.1 614268810 614268810 68100 9020.1

9022.05 9025.4 9020.8 9025.05 62925 9023.75 567819468.8 1182088279 131025 9021.852919

9025 9031.55 9025 9030.35 76725 9028.966667 692747467.5 1874835746 207750 9024.480126

9030.45 9041.4 9030.45 9041 120975 9037.616667 1093325676 2968161423 328725 9029.314541

9041.05 9049.9 9041 9049.05 111000 9046.65 1004178150 3972339573 439725 9033.69054

9049 9051.5 9043.55 9044.5 104400 9046.516667 944456340 4916795913 544125 9036.151459

9044.6 9052.8 9039.2 9040.2 95100 9044.066667 860090740 5776886653 639225 9037.329035

9038.65 9041.4 9036.5 9036.5 36450 9038.133333 329439960 6106326613 675675 9037.372424

9036.65 9039.95 9036.35 9037.95 29850 9038.083333 269786787.5 6376113400 705525 9037.402502

9037.6 9038 9035 9035 42750 9036 386289000 6762402400 748275 9037.322375

9035 9040 9032 9036.85 70725 9036.283333 639091138.8 7401493539 819000 9037.232648

9037 9038.85 9034.85 9038.1 36975 9037.266667 334152935 7735646474 855975 9037.234118

9037.95 9040 9037.95 9039.5 57975 9039.15 524044721.3 8259691195 913950 9037.355649

9039.55 9041.85 9039.35 9040.5 54000 9040.566667 488190600 8747881795 967950 9037.534785

9040.35 9043.35 9040 9041 70725 9041.45 639456551.3 9387338346 1038675 9037.801378

Hard to read through the information. VWAP is based on every tick, as you can imagine, there is data loss with 1 minute, but this is the closest. What is the % difference?

I need some help in calculation of vwap. I\’m actually writing some code using developers.kite.trade to automate vwap strategy.

My question is, how do I use interval to get price and volume list ? For ex. in above example, you used 1 min interval to show vwap calculation, let say if I want to calculate vwap for 1st 15 min candle than which interval should I consider? If I get all trades between 9:15 am to 9.30 am by 1min interval and If i calculate vwap for these many prices, than will I get correct vwap as per Zerodha charts?

Yup, you can use the 1-minute interval, it is a close approximation.

hi

there r two charting platforms in kite,

In chartiq platform, i am not able to find indicator named \’RATIO\’, so if anybody can help.

Second thing is in tradingview charting platform , when i place an indicator, and then after trying to place moving average of that indicator i am not getting right input dropdown. is there any way of putting moving average indicator of any indicator .

if anyone can help

thanks

ritu

Ritu, I\’d suggest you call the support desk, they will guide you through this.

I was trying VWAP in Pi to create a scanner, Could you please let me know the trading script OPCODE for VWAP in PI. I want to try LOW < VWAP(14). Would that be possible?

Ah, I\’m not familiar with that scripting language.

Hey Karthik, thanks for your response. I am kind of new to this platform. I got the answer…As you mentioned we can use Volume Profile along with Functional lines to determine the S&R levels. But when we use the Up and Down arrow keys, the level change. This might be because of the change in period intervals which is happening automatically? Could you clarify this?

I think so too, but I\’m not sure 🙂

Hi Sir,

I was going through the benefits of sing PBV(Price by Volume) to find put Support and resistance levels easily. Are there any similar indicators or combination of indicators that can be used to achieve the purpose of PBV ?

Regards,

Anand Pai

Hmm, I\’m not sure. Need to check this Anand. But I\’d anyway prefer to use the line approach to spot the S&R.

Supertrend

Karthik Sir

Point No 6

Once the short position has been established, the trader is advised to hold the position till the price {closes below the green line}. So in a sense the red line helps as a trailing stoploss for the short position.

is wrong

it should be the price closes above the red line.

If am i wrong please correct.

Sure, let me check this.

Hi Karthik! Because of the prices dropping since the COVID-19 outbreak, I\’m finding it difficult to find the S&R levels. Is there a different way to find S&R during such times?

Hi Karthik,

Firstly, thanks for the amazing material. Detailed to perfection! Wishes for many more.

In the TA section, is there any scope to add Trendline and Gann analysis.

Trendline yes, will add that sometime soon. I\’m not sure about the Gann analysis 🙂

Many a times I find difference in Pi and Kite data points and I don\’t know which one I should prefer for data accuracy (usually I prefer Pi). How reliable is Kite data points doing back testing of VWAP data with intraday time frame (5m, 15m) up to 30 days?

Minor differences are always there, Ajit. Do read this – https://tradingqna.com/t/why-does-two-charts-of-the-same-timeframe-look-different-on-the-same-platform/4715 . I\’d suggest you stick to Kite.

sir, many people says that reading books will not help in trading. After reading all the content thus we need to furthue do any technical analysis course???

I get that. But the issue i face is, Those cancelled SL orders gets executed at current prices. As explained above. I don\’t know how it happens ? Unfortunately, i can\’t send the screenshot here.

Hmm, if the order is cancelled, how can it get executed? I\’d suggest you speak to the support agent for this anyway.

Good Afternoon Sir,

I am facing an issue while cancelling the Cover Orders while doing Intraday.

That is , after I square off my existing CO position completely, when I try to exit/cancel the Stop Loss order from pending orders tab. Those orders gets executed at current Market price as a result decreases my overall profits.

For ex. If I Buy CO Infy at 670 with SL 655 and Sell it at 675 with SL of 690. After this when i try to cancel those pending SL, they both gets executed at current price.

Please help sir, How to avoid such scenario ??

Vaishak, when you exit, there is no need to cancel right?

Sir

Can I short stock in swing trading if some bearish pattern is formed on EOD charts?

Yes, but you\’ll have to do that in the Derivatives segment.

hi, unable to set VWAP indicator on NIFTY chart..kindly advice asap..

Suggest you call the support desk for this, Dinesh.

Hello Karthik,

What\’s your take on the Elliot Wave Analysis?

That\’s one thing I\’ve not tried, so I really don\’t know 🙂

its on chartiq. thanks

no on tradingview

I see only a red line

I tried the adx indicator +di and -di are not showing .

where can I find that?

On ChartIQ?

Can you please also add CCI indicator

Can you reply? For my post –January 27, 2020 at 4:39 pm

Posted the reply.

Dear Karthik,

Qw 1) How can we track volume of FII/DII activity from live intraday chart ?

Qw 2) When we select 5 minute chart & we see large volume with large price. But on next 5 minute we see that huge price down with huge volume.(Example Bharti Airtel). It’s an intraday loss. Whats your suggestion as you experience professional !

THANKS

-Janesh Suthar.

1) Not possible

2) It could be a scalping algo which has bought and sold in quick successions.

I request you to sort comments based on number of like.. so that people can get help with most helpful comments first.

Also please try to add value to the original article which comments already provided

We\’ve been wanting to do this for a while. Hopefully soon. Thanks for pointing this anyway.

Hi, I tried to compare your VWAP indicator with the one I have on MT4, but I found out that on MT4 we have VWAP Period (calculating average x candles VWAP values back). May I know what default value you use? and is it possible we can have Period input?

Thanks.

Not sure, need to check the defaults. Btw, you can custom set it to whichever value you need.

Thanks Karthik,

This is in continuation with my previous post and your reply.

I am not sure if I can post a Stock directly here or not, but to make my case more clear I am putting that. If you see VEDL it has good fundamentals and technicals and in Zerodha, TradingView and other platforms and forums VEDL has given Buy call from Friday i.e. 27th Dec 2019. But this stock is more in rangebound or declining. Where is the demand and supply part playing here if most forums and our own technicals and fundamentals are saying to Buy why is it declining? What is that we are missing? Please refer to my point 2 from the above previous post

If some information is not sure like fundamentals are not strong or technicals are not strong then we can say different POVs can be there, but if both are good then why the different POVs?

The stock can be bullish from all angles but if the market is not interested for some reason, i.e. the stock has no activity, then it can remain sideways or in whichever state it is in for a long period. Remember, the saying, \’markets can stay irrational for longer than you are liquid\’?

So it is just a matter of time before these factors start to kick in and move the stock.

Hi Karthik ji,

Thanks for providing education to the people here who are either doing mistakes on their own or with so-called advisors and ultimately losing money. I believe Zerodha and your efforts will help in controlling or even stop that.

Here I have a few questions which are bogging my mind for some time:

1) If one is interested in Intraday/BTST-STBT/Swing then the fundamental analysis of stocks is not important? Only technical analysis is fine?

2) Since the information is known to most like technical and fundamental even then why stocks are not moving in one direction? Even I have seen today for example in multiple places including in Zeroda, TradingView and many other news/stock websites VEDL is buying signal but still in intraday it is in rangebound and below VWAP. This is indicating price action (by the investors/traders) is not completely following or not caring about this or they have a different set of information which we general retail investors/traders don\’t have access to?

3) How to know instantly (using an alert system or software) smart money is entering into or leaving the stock? I know you told how to check this using Volume and Price but checking each stock takes time hence if there is an auto mechanism that alerts us would be good right.

Appreciate if you can throw some light to get more information as this behaviour is interesting to me day by day.

1) That\’s right. Either TA or Quantitative model will help

2) Eventually, the supply demand dynamics come into play. This matters for intraday price movements

3) Volumes are the only way out for this. You will have to associate this with the price and make your conclusions

Hi Karthik,

Thank You for the response.

Can you take a look at Super Trend and let me know the Math behind it. Since Investopedia dont have the details, what you put out here is going to be the authoritative reference point for the future generations.

In case that is going to take time, can you email me the Math in Excel.

Thanks Again.

Pavan.

Will try and do that, Pavan. Thanks.

sir i did not understand how does supertrend indicator plotted of price label? when does it plot upper label from current price and plot lower label from current price? I am confused about it. please sir clarify these.

Monirul, have tried to explain in the note itself.

Hi Karthik,

How is the Supertrend calculated. Why cant I find it in investopedia ?

Is there any standard reference formulae on the basis of which Supertrend is calculated ? Do you have any excel sheet ? Or do you have the basic algorithm which Zerodha has used to calculated Supertrend in Kite ?

Can you please help.

Thank You.

Pavan.

Hmm, I\’ve not really looked at the math behind the super trend. We use the charting engine from 3rd party, so we use whats pre-packaged.

Hai Karthik ,

How to use Vwap as Stop Loss ?

I\’m assuming you know what VWAP is. So essentially VWAP gives you a price, which you can use as a stoploss.

Sir ,

in this chapter you explain us about adx . while plotting adx there is only one line there are no crossover lines . how to set it ? . the setting is also is not having those options on kite . see here : https://www.tradingview.com/x/RAvkyJE0 . There is no option to set +d1 and -D1. Where am I going wrong ?.

Sheedhar, use the ADX smoothing and DI length instead. Else, you can always switch back to ChartIQ.

Sir,

You were going to check & revert back. Please see my post dated 2 Aug 2019 & your reply dated 3 Aug 2019.

regards,

ulhas

Hi,

In the lectures above, it is frequently mentioned to load an Indicator from \”Studies\”. But I am unable to find Studies anywhere on TV.

I load indicators from the Indicators tab on TV but it does not give me the option to load Aroon Oscillator or ATR bands. The Aroon Up/Down and ATR indicators are available though. Have the Aroon Oscillators and ATR bands been removed for redundancy or are these loaded from somewhere else?

I\’d suggest you call the support desk for this, Nikhil. They will guide you through this. Thanks.

Hi Karthik,

I am having a difficulty understanding the Aroon Up and Aroon Down.

If the default value is 25 days, how can the value of Aroon Up or Aroon Down be greater than 25?

The last 25 day high/low has to be within the last 25 days only. So, how can the value be greater than that?

25 day high/low could have happened \’n\’ days prior right?

Hi Sir – How to get option of MA on volumes in Trading View as i am not getting volume option in MA settings.

I\’d suggest you call the customer support for this, Abhishek. They will help you.

Can you please tell how does zerodha calculate the indicators like ADX, RSI & SUPERTREND.

i tried to calculate them excel but my values dont match with it on day chart. i tried to download the bhav copy and considered the series EQ for all stocks.

These calculations are done by either ChartIQ or Tradingview (our charting partners) and not Zeordha.

Hello sir,

Information provided by is so useful for beginners like me.

I follow all your notes and material provided by you in Varsity.

I have a small doubt regarding \” trailing stop-loss\”, because of this I am not able to get good profits.

My doubt is

I purchased a stock at 100.00 and kept stop-loss at 99.5 and my target is 102.00, trailing stop-loss by 1.00.

If the stock price goes to 100.25 then what would be my stop-loss and target?

Will they be \”Stoploss = 99.75 and target 102.25\” or \” Stoploss = 99.5 and target = 102\”

What is the actual significance of trailing stop loss by 1.00?

If you intend to trail by 1 point, with 10 points lead, then everytime your position leads by 10 points in your favor, you trail your SL by 1 point. So if you have initiated the position at 100, with 99 SL, then when the position leads by 10 pts, i.e. @ 110, your SL moves to 100.

Why does the super trend shifts to right when the multiplier is increased and vice versa when it is decreased ?

This is because of the momentum, Omkar.

Respeted Sir,

I many time request you to show average traded price in 4 digits (121.4763). But till today it is not updated. I thick there should not be any problem. This is very useful in commodity.

regards,

ulhas

Will check this, Ulhas.

Option chain in NSE website shows open interest of call & put option

Then What about Future contacts where can found open interest of Future option

It is there in the futures contracts page of the stock itself. You can also check the market dept in Kite for the contract to see its OI. Check this – https://zerodha.com/z-connect/tradezerodha/kite/open-interest-on-kite-charts-and-more

While using Supertrend indicator for the purpose of Positional trading, how am i to tune

the parameters accordingly?