December 27, 2023

Old vs New tax regime: Which one is better for you?

Satya Sontanam | Personal Finance, Taxation, Uncategorized

If you are salaried, you will encounter this question at least thrice a year: “Old or New tax regime: which one is more beneficial for you?”

Firstly, at the beginning of a financial year, when the HR (human resources) department in the company asks you to declare your investments. Secondly, towards the end of the year, when the same HR comes back with an email requesting you to submit the investment proofs. Lastly, when you have to file your income tax return.

For starters, in the year 2020, the government introduced a new tax regime under which taxpayers can choose to pay tax at lower rates. However, the twist is that he/she has to forego most of the deductions and exemptions that would have lowered the taxable income.

You can check the tax rates under both regimes here

So, taxpayers now have the option to choose between:

- A lower tax rate on higher taxable income under the new regime or

- A higher tax rate on lower taxable income under the old regime.

The government introduced this system to make the life of the taxpayer easier when filing tax returns, without worrying much about different sections of the Income Tax Act that govern deductions and exemptions. The idea is to phase out the old tax regime entirely and transition to a simpler new tax regime.

But until then, we need to decide which one is better by comparing the tax outgo between the old and the new tax regime. Starting from this financial year (FY23-24), the new income tax regime is set to become the default regime if you don’t opt for any. However, individual taxpayers (without any business income) have the option to switch from one tax regime to another every year.

The income tax department has come up with a calculator that tells us which tax regime is better. In this blog, we will delve into how salaried individuals can use this tax calculator and the key points to note.

Comparison

You can access the said income tax calculator here.

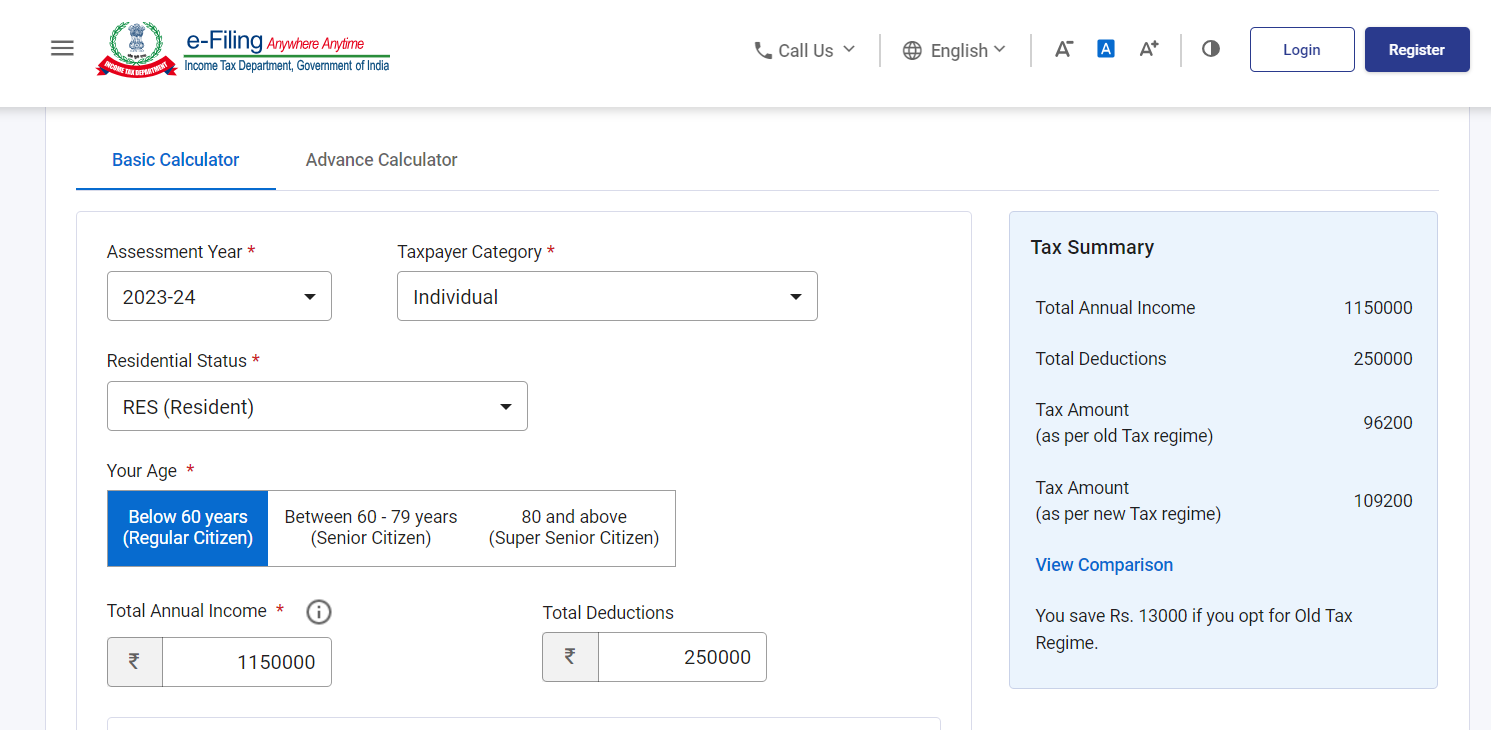

As you open the link, you will see the following page where you need to input a few basic details – assessment year, age, residential status and taxpayer category.

For the financial year FY 23-24, the relevant assessment year is AY 24-25.

When you fill in the ‘total annual income’ and ‘total deductions’ boxes, you will see the comparison of tax amounts between the old and new tax regimes on the right-hand side. As shown in the image, when you fill in income and deduction boxes with, say, ‘Rs 11.5 lakh’ and ‘Rs 2.5 lakh’ respectively, the output is ‘you will save Rs 13,000 if you opt for the old tax regime’.

What is total annual income?

Before you learn what comprises total annual income, remember this: Every salaried individual is eligible for a standard deduction of Rs 50,000 per annum. So, if your total annual income is Rs 12 lakh, you need to input Rs 11,50,000 (Rs 12 lakh – Rs 50,000) in the ‘total income’ cell.

Regarding the definition of annual income, every penny you earn in a financial year that is chargeable to tax at your income slab rate should be considered. Let’s start with the salary income.

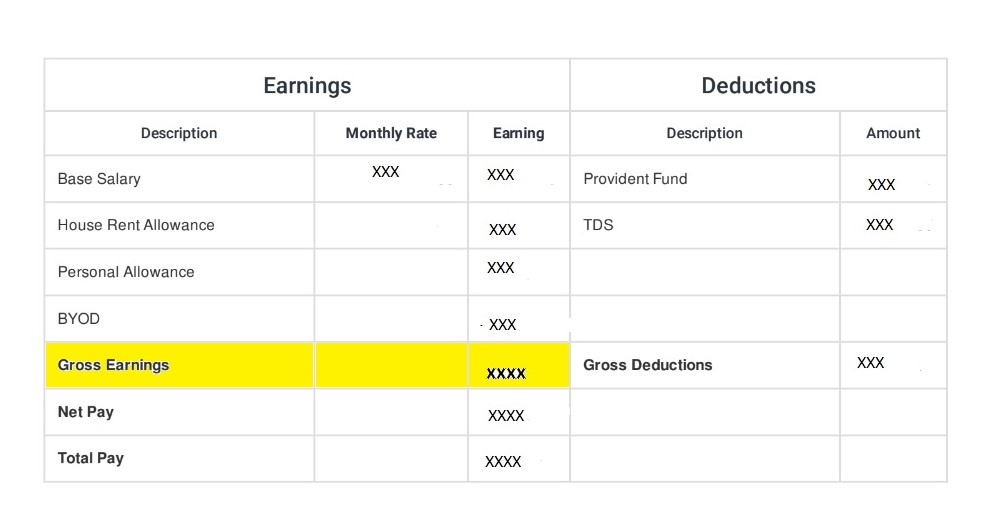

Take ‘gross salary’ per annum. This includes income you receive from your company before deductions such as tax and contributions to the provident fund.

Where to find this number? If you are reading this blog after the financial year ends, you can check this number in Form 16 that the company gives you.

If not, check your latest pay slip. You will most likely find ‘gross earnings’ on the left side of the table.

Consider the fixed component in the ‘gross earnings’ that you would receive every month irrespective of your performance or the company’s. Now, multiply that amount by 12 to get the annual gross income. To that, add one-time/periodical incentives like bonuses that depend on performance and other allowances you received or expect to receive in that financial year.

This gives the annual salary income.

Now, if you have or expect to have any other income chargeable to tax at the income slab rate, such as – rental income (after municipal taxes, interest on a home loan, and a standard deduction of 30%), interest on fixed deposits, or short-term capital gains on physical gold or property – in that case, that amount needs to be added to the ‘total income’ as well.

In summary, you need to add your salary income, rental income (after deductions), income from other sources, and any other income on which tax is chargeable at the slab rate.

Remember, the old or new tax regime you choose when filing your return decides your tax liability for the year. For the financial year 2023-2024, the deadline to file the return for individuals would be July 31st, 2024.

By then, you will have Form 16 to figure out salary income and an annual information statement (AIS from the tax dept.) to get a clear idea of the total income earned.

What about deductions?

In the ‘Deductions’ box, you need to enter all the exemptions and deductions available in the old tax regime but not in the new tax regime. This includes exemptions on HRA (House Rent Allowance), leave travel allowance, and deductions for the payment of professional tax.

Additionally, it covers Section 80C deductions, which encompass investments in tax-saving instruments like provident funds, equity-linked mutual funds, payment of life insurance premiums, repayment of a housing loan, additional contributions to NPS (National Pension Scheme), deduction under Section 80D for health insurance, donations under Section 80G, and payment of interest on a loan for higher education under Section 80E, etc.

Ensure that the amount of deductions and exemptions you enter are within the permissible limits as per the law. For example, Section 80C deductions have a limit of Rs 1.5 lakh per annum.

Conclusion

Once you provide both the ‘total annual income’ and ‘total deductions’ figures, the calculator lets you know which tax regime is more beneficial for you.

For those earning less than 7.5 lakh per annum, tax under the new tax regime is zero. For those earning more than Rs 5 crore per annum, the new tax regime is better because the surcharge has been slashed from 37% to 25% from this year on.

There is a possibility that we might initially consider one tax regime to be beneficial but later change our minds and choose another. After all, we will have a clear idea of our total income only after the end of the year.

Thus, the regime you choose at the time of investment declaration in your company is not final. HR seeks this information only to decide how much TDS (tax deducted at source) to deduct from your monthly salary.

Say, you opted for a ‘new tax regime’ for FY 23-24 and did not submit any investment proofs to your company. When filing IT return for the year, if you realize that opting ‘old tax regime’ will save you a few bucks, you can go ahead with this option and claim deductions and exemptions.

But remember, there is a higher possibility of the income tax department sending you a notice in this case to submit your investment proofs. Nothing to worry! Just a reminder to document and save your investment proofs.

I have only trading income (equity and futures & options), and it\’s less than 500,000. My trading capital originated from outside of India while I was working as an NRI. Now, I am no longer an NRI. Monthly, I am investing approximately Rs 12,000 in mutual funds through SIP. Additionally, I have a family health insurance policy taken out in 2022 for 3 years and make monthly deposits in the \’Sukanya Samriddhi Yojana\’ for my daughter. I haven\’t filed ITR before. How can I file my ITR, and which tax regime can I choose?

Hi Monson,

Please use the income tax calculator mentioned in the story to see which one is more beneficial for you.

The source of your capital will not have any impact on the decision of old or new tax regime.

Since you have trading income from f&o, this will be recorded as business income in your ITR. For individuals with business income, the option to make a switch is available only once. Once you have made a decision, you need to stick with the same regime for the following years as well. Hence, please pay keen attention when you make the decision.