7.1 – Income Tax Return (ITR) Forms

The last step of taxation is filing your Income tax returns (ITR), and this can be done using ITR forms. Find below a brief explanation of everything important on ITR that you need to know as an investor/trader.

I have noticed from my interactions with many that they are confused between the two actions i.e ‘paying income tax’ and ‘filing income tax’. Many are of the opinion that if they pay income tax the act of filing income tax is not really necessary. This is not true, let me explain why.

Paying Income tax – If you are employed and draw a salary you very clearly know that your employer on your behalf deducts tax (based on your tax slab) and pays the income tax on your behalf. This is usually called ‘Tax Deducted at Source (TDS)’. Now, what if you have an income source besides your salary?

For example for the given year assume besides drawing a salary, you also made a profit by actively trading delivery based equity trading. As we now know this activity falls under “Non-speculative Business Income”. Since the employer is not privy to this activity it becomes your responsibility to declare this source of income to the Income-tax department and paying the appropriate amount as tax.

Filing Income tax returns – Filing income tax returns is a mandatory way of communicating to the IT department all the sources of income you have including your salary. An Income Tax Return Form (ITR) form is simply a form that you need to fill up declaring your sources of income. There are different ITR forms for different sources of income. You may wonder why I should file my returns when I don’t have any other source of income besides salary. Well, in such a case by virtue of filing your income tax returns (via appropriate ITR form) you are officially communicating to the income tax department that you do not have any other source of income.

So in essence, the act of filing your returns is your official communication to the IT department about all the sources of income that you have along with the tax you have paid against that income. You do this via the prescribed ITR forms.

More formally, an ITR is a prescribed form through which the particulars of income earned by a person in a financial year and taxes paid on such income are communicated to the Income-tax Department. There are different types of ITR forms, one needs to select the appropriate ITR form, based on the different sources of income. These forms can be downloaded from here https://incometaxindiaefiling.gov.in/

7.2 – Different ITR forms

In the context of this module, which is focused on individuals having investments as capital gains or trading as a business income, the important ITR forms to know about are:

ITR 1 – when you earn a salary, interest income, or rental income from only one house property, you can use ITR 1 forms to file your income tax returns (total income up to Rs 50lks). This is the most common type, but if you have capital gains or trading as a business income, you can’t use this ITR form.

ITR 2 – for individuals and HUF not carrying out any business/profession and when you have a salary, interest income, income from house property or income from capital gains, you can use ITR 2. So if you are an individual who only invests in the market (remember investor, hence capital gains), you need to use ITR2

ITR 3(ITR 4 renamed to ITR3 from 2017) – when you have a salary, interest income, income from house property, income from capital gains, and income from business/profession, you can use ITR 3.

So if you are an individual who is declaring trading as a business income, you have to use ITR 3. If you are an investor and trader, you can show trading under business income and investments as capital gains on the same ITR 3 form.

ITR 4 (ITR 4S earlier) – this is similar to ITR3 but with a presumptive scheme, if section 44AD and 44AE used for computation of business income. ITR 4 can’t be used to declare any capital gains or if losses have to be carried forward. So you can use ITR 4 only if you have business income (speculative + non-speculative), but it is best avoided if by use of this form you are reducing your tax liability.

7.3 – Exploring ITR 4 (4S until 2017)

The advantage of ITR 4 is that it can be used by taxpayers who do not maintain a regular book of accounts or want it to be audited (refer chapter 2) provided your turnover is lesser than Rs 10 Crores for the year.

You can get away without maintaining books or getting audited if you firstly calculate turnover based on section 44AD (check the previous chapter) and then declare 6%* of this turnover as your presumptive income. You have to then pay taxes adding this 6%* of the turnover to your other income and pay tax as per the slabs.

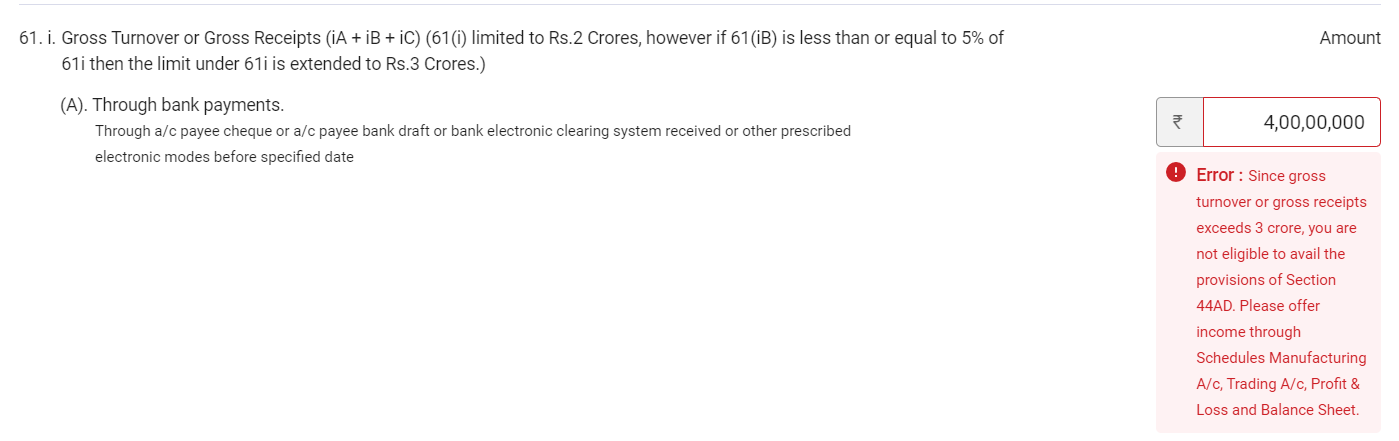

To opt for Section 44AD, the maximum turnover should be Rs 2 Crores until FY2022-23; from FY 2023-24; the threshold limit has been increased to Rs 3 Crores provided 95% of the receipts are by way of digital mode.

You will not be able to opt for 44AD; if you are declaring more than 3 Crore.

So if you are a trader with turnover less than Rs 10 Crores for the year (was Rs 1 crore until FY 19/20) and profit less than 6%* of the turnover with only business income (not possible if you have capital gains), you can declare presumptive income of 6%* of the turnover, and get away from the need to get your books audited. You need to pay Advance Tax only for the 4th Quarter i.e 15th March installment.

For example, assume my salary was Rs.500,000/- for the last FY, and I had incurred F&O loss of Rs.25,000/- on a turnover of Rs.400,000/-. Since my profit is less than 6%* (25,000/400,000) of my turnover I will need to use ITR4, maintain books, and have them audited. Instead of this, I could use ITR4S and declare 6%* of Rs.400,000/- (business turnover) or Rs.24,000/- as my presumptive trading business income even though I have incurred a loss.

Update: % is reduced from 8% to 6% from AY 2017/18 or FY 2016/17

My total income for the year is Rs 500,000 (salary) + R 24,000 (business income) = Rs.524,000/-. Therefore my tax liability would be as follows –

Upto Rs.250,000 – No Tax

Between Rs.250,000 to Rs.500,000 – 5% – Rs.12,500/-

Between Rs.500,000 to Rs.524,000 – 20% – Rs.4,800/-

Total tax = Rs.12,500 + Rs.4,800 = Rs.17,300/-

Here, by virtue of declaring a presumptive business income of Rs.24,000/- I’m paying an additional tax of Rs.4,800/-. This works out to be a cheaper alternative than getting an audit done for which the CA fees could have been Rs.15,000/- and above. So using ITR4 would make sense only if your turnover is low, hence declaring 6% of turnover as income would work out cheaper than paying an audit fee to the CA.

7.4 – Exploring ITR 3

ITR 3

ITR 3 is a comprehensive ITR form. As said above, it is applicable when you have all heads of incomes say, salary; income from house property; capital gains; income from business or profession and income from other sources (say interest income).

Declaring FNO Income under presumptive scheme (44AD)

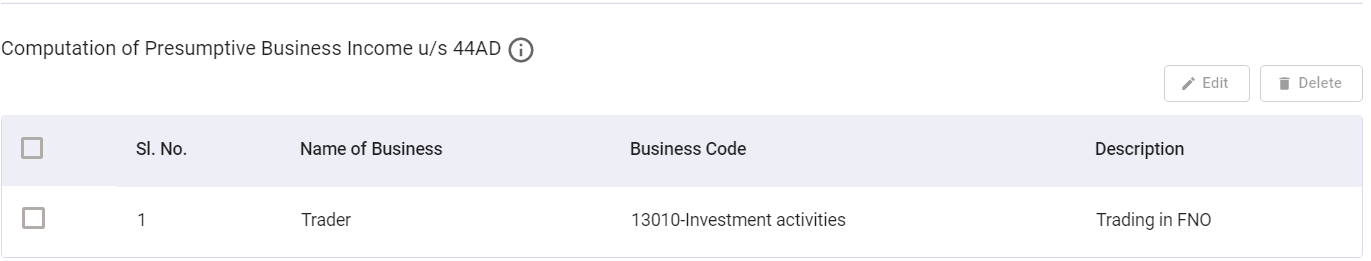

From FY 2018-19 onwards, one can use ITR-3 even when he or she wants to declare business income under presumptive scheme. The income tax department has inserted the option to declare income presumptive scheme in Schedule PL. Hence, traders can make use of it. One can use this form to declare capital gains or capital losses or if losses have to be carried forward and any interest income.

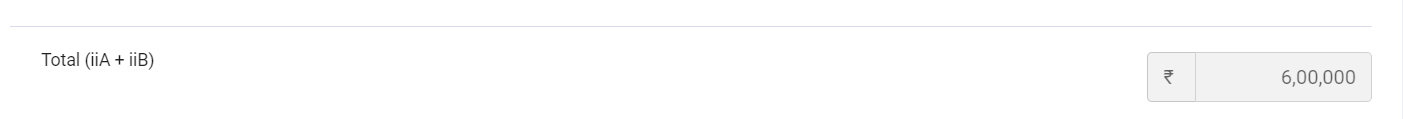

As shown in the above image, assume the turnover in Rs 1Cr – one can declare 6% on Turnover i.e Rs 6Lacs profit and pay tax accordingly as per applicable slab rate.

Further, you can set off current year losses and the brought forward business losses against this presumptive income (Rs 6Lacs). You can also claim deductions under Chapter VI-A Part B i.e 80C to 80GGC. These eligible deductions will reduce your income further which in turn taxes as well. We will discuss more on this in upcoming chapters.

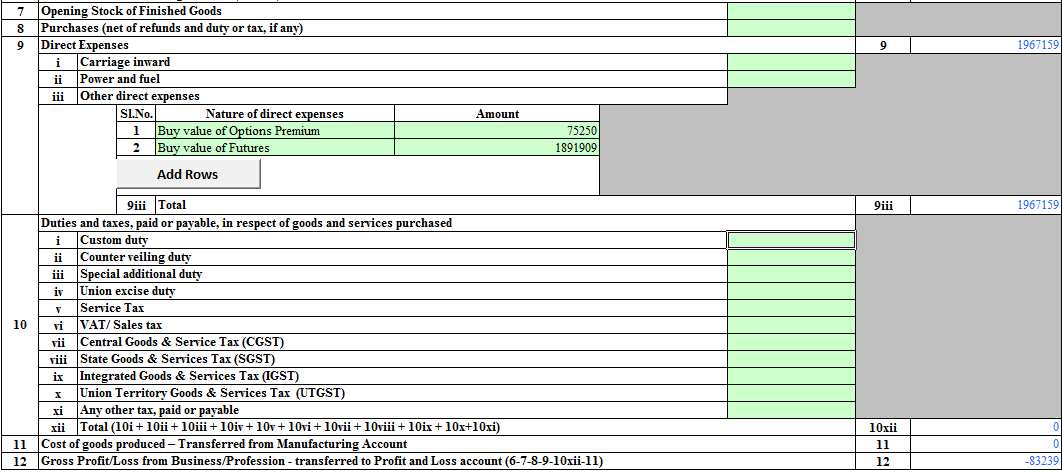

Consider this example:

- Income from Business: Rs 6Lacs (as above)

- Loss from House Property: Rs 1.5 Lacs

- Carry forward business loss from previous years: Rs50K

- Investment eligible under 80C: Rs 50K

Taxable income will be 3.5Lacs.

What did I do?

I set off F&O Income of 6Lacs with loss from house property (interest paid on housing loan) and business loss from previous years.

Net business income after set off becomes Rs 4Lacs. I further reduced it by 50K which makes taxable income: Rs 3.5Lacs.

Important note: Once you opt out of the presumptive scheme in a financial year, you cannot declare income/take benefit under this scheme for next 5 years.

Say, you declare F&O income under presumptive scheme (44AD) for FY 2022-23 and for FY 2023-24 assume you incur losses and you decide to carry forward such F&O losses. Thus, you opt out of 44AD and declare loss under normal provisions of the income tax act.

Suppose, in FY 2024-25 you make profit and if you decide to declare F&O profits under the presumptive scheme; you can’t for FY 2024-25 and until FY 2028-29.

Further, assume you declare income under presumptive scheme for FY 2022-23 as you see in Image 1 and next year i.e FY 2023-24 you decide to declare less than 6% under normal provisions and your total taxable income is more than basic exemption limit, then tax audit is applicable and you are required to maintain books of account.

This applies for 5 consecutive years from where you opt out of presumptive scheme – which means say; you opt out of presumptive in FY 2023-24 and for FY 2024-25 to FY 2028-29

- you are required to get audit done

- you are required to maintain books of account

if your total income exceeds the basic exemption limit.

Hence one should be careful before switching into or switching out of presumptive scheme.

One who opts for presumptive scheme has to pay whole advance tax in one go on or before 15th March of the Financial Year.

44AD is not applicable for a Non-Resident.

Declaring FNO Income under normal provisions i.e maintaining books (to carry forward loss)

What are normal provisions?

Normal provisions means a tax payer or trader is required maintain books of accounts i.e Balance Sheet, Profit and Loss account unlike in presumptive scheme where you one need not maintain books of account.

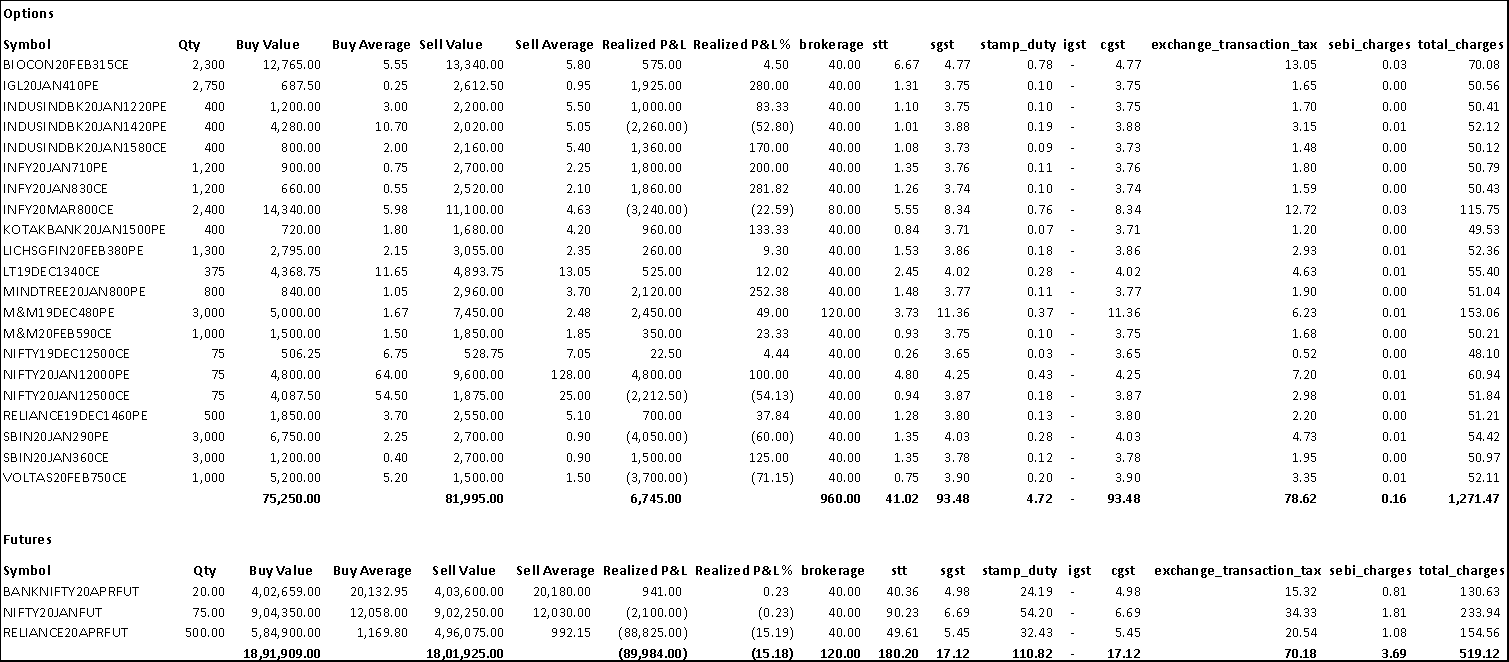

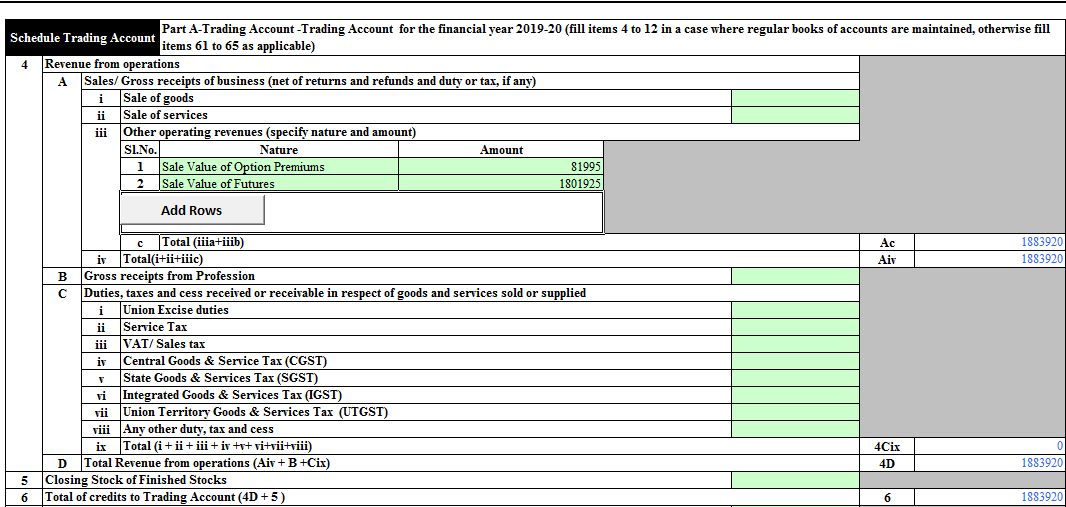

Consider the following example:

I have entered the sell value of and option premiums and sale value of futures under Point 4(image 3) since there is no option to exclusively declare the sale details of FNO.

Next, I have entered the buy value of options premium and futures under Point 9(image 3).

If you see, there is a loss of Rs 83,329/-

As part of expenses, you can claim all the expenses attributable to earning the FNO Income. Some of the examples:

- Salaries, if you have people helping you trade.

- Rent, if you are using a dedicated office for the trading activity.

- Brokerage charges, taxes, and all other trade-related expenses.

- Advisory fees, consultancy, depreciation of laptop, and etc.

After the calculation of net profit or loss, you will pay tax as per applicable slab rates.

Trading options is considered as a non-speculative business income irrespective of being intraday or delivery.

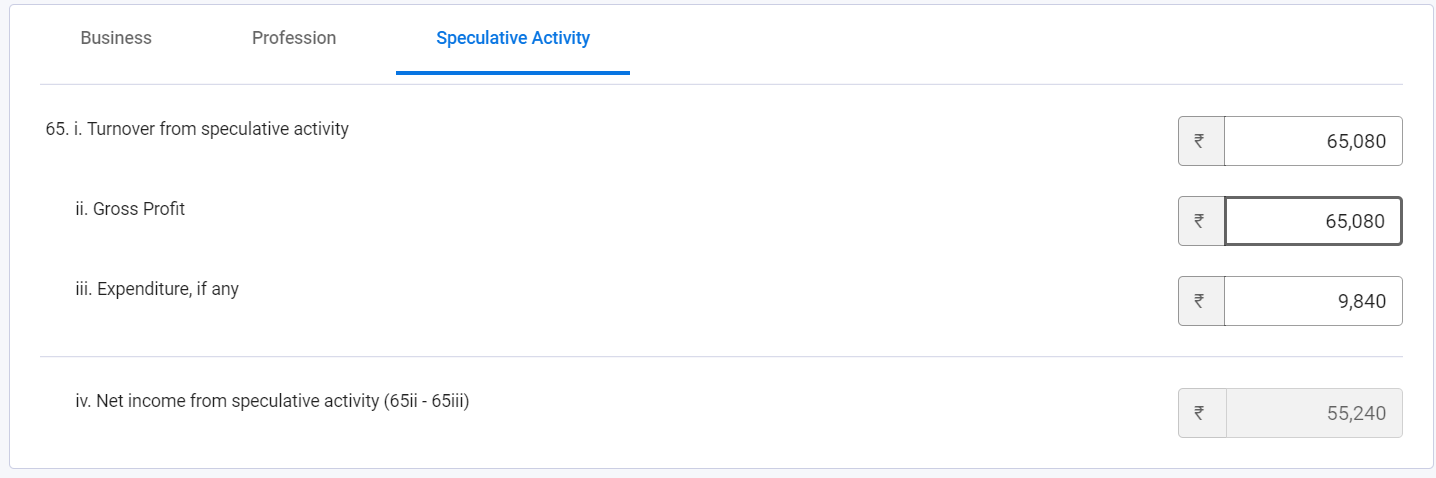

Declaring Speculative Income:

Speculative Incomes basically consists of intraday gains as most of them are leverage based trades and done without the intention of taking delivery.

You need to declare the speculative income in the Schedule PL.

As shown above, I have filled indicative figures to a give a perspective. These speculative gains are taxed based on slab rates which you fall.

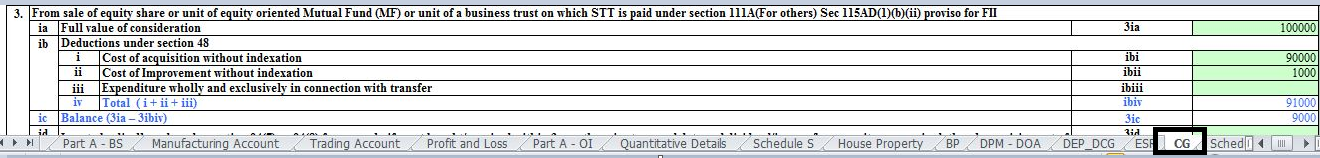

Declaring Capital Gains:

Short-Term Capital Gains:

Capital gains are declared in Schedule CG and 112A. Short Term Capital gains are straight away declared in Schedule CG and Long Term capital gains are declared in Schedule 112A.

Refer above; I have details of Short Term Capital Gains (again indicative figures) in Schedule CG.

Example:

Sale Consideration: Rs 1 Lacs

Cost (Purchase Price): Rs 90K

Expenses: Rs 1K

Short Term Capital Gain: 9K

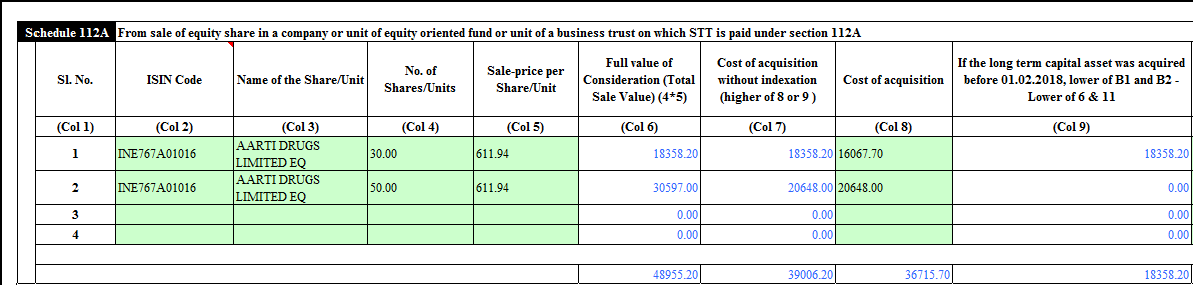

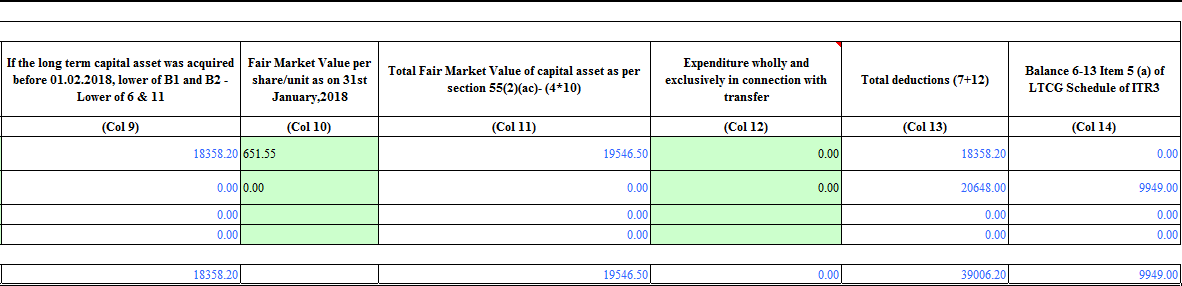

Long Term Capital Gains:LTCG are taxed @ 10%/12.5% depending upon the date of sale on or after 23rd July 24 exceeding Rs 1.25 Lacs

Continued…

Consider this example:

Assume I have purchased 30 shares before 31st Jan 2018 @ Rs 535.56 and 50 shares after 31st Jan 2018 @ Rs 412.96. I have sold entire 80 shares in April 2024.

For shares purchased before 31st Jan 2018, grandfathering clause shall apply and there will be no tax on gains accrued upto 31st January 2018. Refer #1 – since FMV as of 31st Jan 2018 is more than the sale price of (Rs 611.94), there is no question of capital gain, and since the gain is already accrued – it is exempt, and you can see in column 14, it is ZERO.

In #2, the grandfathering clause shall not apply, and the capital gain of Rs 9949/- (Rs 30597 minus Rs 20648) is calculated accordingly and taxed @ 10%/12.5% as applicable, exceeding Rs 1.25 Lacs.

The highest Price quoted on 31st Jan 2018 shall be considered as FMV on 31st Jan 2018.

Refer to this link – you will get the FMV details of all the shares as of 31st Jan 2018.

In ITR 2, you need to declare the capital gains in the schedules CG and 112A, as discussed above.

7.5 – Quick FAQ and notes

How to file the return of income electronically?

The income-tax department has established an independent portal for e-filing of return of income. You can log on to www.incometaxindiaefiling.gov.in for e-filing the return of income. Check this very nice video on e-filing put by the IT department.

Is it necessary to attach documents along with the return of income?

ITR return forms are attachment-less forms. Hence along with the ITR form (whether filed manually or filed electronically), you are not required to attach any document (like proof of investment, TDS certificates, etc) unless if you fall under the audit case.

However, these documents should be retained by you and should be produced before the tax authorities when demanded in situations like assessment, inquiry, scrutiny, etc. But in audit cases, a soft copy of the balance sheet, P&L, and any notes along with the audit report needs to be attached.

What is the difference between e-payment and e-filing?

E-payment is the process of electronic payment of tax (i.e., by net banking or SBI’s debit/credit card)

E-filing is the process of electronically furnishing (filing) of return of income.

Using the e-payment and e-filing facility, payment of tax and furnishing of return is quick, easy, and hassle-free.

Is it necessary to file the return of income when I do not have any positive income?

If you have sustained a loss in the financial year, which you propose to carry forward to the subsequent year for adjustment against subsequent year(s) positive income, you must make a claim of loss by filing your return before the due date.

What are the due dates for filing returns of income/loss?

If no audit: July 31st

If audit: September 30th

What is to be mentioned as the “nature of business” on ITR 3 (ITR 4 until 2017)?

Nature of business can be mentioned as Trading-Others (Code: 0204) – until 2017

For FY 2017/18, Code: 13010 – Financial intermediation/Investment activities. This seems to be the closest category to investment/trading related activity.

If I fail to furnish my return within the due date, will I be fined or penalized?

Yes, if you have not furnished the return within the due date, you will have to pay interest on tax due. Also penalty under Section 234F of Rs 1,000/- if income is less than or equal to Rs 5 Lacs and Rs 5,000/- for taxable income above Rs 5 Lacs.

How to show profit and loss on the balance sheet?

You can show all positive turnover as gross receipts, and negative turnover as gross sales.

Can a return be filed after the due date?

Yes, you can. Return filed after the prescribed due date is called a belated return. If one could not file the return of income on or before the prescribed due date, then he can file a belated return. A belated return can be filed within a period of one year from the end of the financial year or before completion of the assessment, whichever is earlier. A belated return attracts interest and penalty as discussed in the previous FAQ.

For Example – In the case of income earned during FY 2022-23, the belated return can be filed up to 31st Dec 2023. However, one can file an updated return under Section 139(8A) after 31st Dec 2023, with additional penalty of 25% of additional tax(tax plus interest) within 12 months from the end of the relevant Assessment Year.

Penalty will be 50% of additional tax(tax plus interest) if updated return is filed within 24 months from the end of the relevant Assessment Year.

Key takeaways from this chapter

- The act of paying your taxes is called “Tax Payment”, which can be done via e-payment

- The act of communicating different sources of income and tax paid against that is called “Income Tax Return filing”

- Filing income tax returns is mandatory, even though you have paid taxes

- An ITR form should be used to file taxes

- Use different ITRs for different sources of income

- ITR 4S for presumptive business income. Use this to lower your cash outflow (paying taxes versus audit fees)

Phew! That brings us to the end of the taxation module. Keeping it simple is most challenging, especially a topic like this where almost every other word is a jargon. Hopefully, I have done a decent job with it, and this module acts as your ready reckoner for everything on taxation when trading and investing.

Financial discipline is the key to long term wealth creation, and it starts with the compliant filing of your income tax returns. It is best not to avoid or postpone especially with the advancement of technology and reach of our income tax department.

Do help spread the word,

Happy Trading,

Nithin Kamath

Zerodha

Special thanks to Tax IQ for providing valuable inputs throughout this module.

Disclaimer – Do consult a chartered accountant (CA) before filing your returns. The content above is in the context of taxation for retail individual investors/traders only.

Namaste, I had sold an IPO and need to declare. Will have to file ITR2 but what all documents are needed to refer from Zerodha in order to figure the gains and and required unique IDs to be shared with ITD (in case).

Respect Sir,

I am Palash Sarkar,a CG employee.In my Taxpayer Information Summary (TIS) shows 4 types of information categories as follows:

1.Salary. -8,79,772

2.dividend. -3,679

3.Interest from savings account -309

4.Off market credit transaction.-21

I brought 21 no.of unlisted swiggy share in FY24-25.Now the share has been listed.

My question is which ITR should I file and how to show the \”Off market credit transaction\” in ITR?

Thanking you,

Palash Sarkar.

Hi Palash ji,

Since you have not sold the shares till now, you don\’t have to disclose anything in your ITR.

As far as the information given by you you can file ITR 1.

But if you receive any income from these shares like dividend you have to show them in other sources.

I will be happy to help if you connect with me.

Thanks.

I have a long-term capital gain of Rs 82000. There is an option in ITR 1 form which says Income on which no tax is payable: Long term capital gain under section 112A income not chargeable to Income tax. I have entered this amount in this column. But to my surprise it is noticed that the same amount is added to my total income for computation of Annual Income tax. But the rule clearly says that if the Long term capital gain is less than 1.25 lakhs, this amount will not be considered for calculation of income tax. I understand that many others have also faced this same problem. I feel there is some fault in the software which calculate the income tax in ITR 1.

I have income 100000 as honorarium and 130000 as short term capital gain. Should i file IT Return?, how much tax to be paid and which itr form is to be used…

Hi – I have not declared Interest Income while filing Income Tax for this year. Can I file rectification return? – You can file updated return under Section 139(8A) – Rectification return is not possible.

Hi

I have not declared Interest Income while filing Income Tax for this year. Can I file rectification return?

Sir my f&o turnover is 2 lakhs with net loss of 25000 and gross loss of 11000, should I file itr

Dear Sir

If there is stcg of 33.4k and ltcg of 1.78k. Can i substract stcg frm ltcg andpay tax on remining

Sorry in last 6 months

Hi Nithin

Please be guided about the taxable amount if in my zerodha account in f&o trading

Total Profit=Rs5,00,000/-

Total Loss =Rs7,00,000/-

————————

Total Turnover=Rs12,00,000/-

Then Sir what will be the taxable amount in this case where my net loss is Rs2,00,000/-in last 56 months ?

MY long term income is 150000

And short term income is 300000

How much tax should I pay?

In new tax or old tax regime

Hi

Is it OK to file tax under presumptive (44AD) if I do trading (Delivery Equity- Treated as business and FnO) by calculating the turnover ?

hi, If my primary income is from trading (Delivery based equity and FnO), Can I file tax under presumptive taxation by calculating the turnover and paying for 6% (My turnover less than 3 Cr) ?

Can zerodha fill ITR OF HIS ZERODHA ACCOUNT HOLDER ON PAYMENT

I have F&O business loss and substantial profit in both LTCG and STCG which I can use to setoff the F&O business loss.

My question is, can I decide to setoff the entire F&O loss from my STCG and not touch the LTCG? (Because setoff against STCG is beneficial to me since it has a higher tax rate than LTCG)

Or is it compulsory for me to setoff against the least taxable income (LTCG) first and then, if there is still any balance use the STCG balance?

Has anyone else faced such situation? If yes, please can someone share their experience?

Thanks so much.

The acquisition cost of all my IPO allotted shares sold in FY 2023-24 is shown aa \”0\” In the AIS.

I tried to submit a feedback as \’ Information Not Fully Correct\’ and was presented with the columns to fill in the information.

I filled the acquisition cost but there were other columns ie:- \’Unit FMV\’ and \’FMV\’ These fields too had \”0\” values.

I obviously didn\’t buy these shares before January 31 2018 (No fairmarket value grandfathering warranted) as they were recent allotments. So the question is should I leave those two columns (Unit FMV and FMV) as it is = \”0\”?

Please help as ny CA has no clue and I don\’t want to kesa up while doing this.

Sir,

From where I get long and short term capital gain.

Thanks a lot for such a detailed description of ITR\’s. Could you also guide us what the business code Or Nature of business do Futures & options trading falls under? As there is no definite business code to select for such activity in ITR 3.

Nitin sir Namestay . I am retired employee and getting pension round about Rs 6 lac . Now i have started Equity trading and earned Rs 3 lac in 1st QUATER . sHOULD I DEPOSIT TAX @ 15 ./. oR I HAVE TO DEPOSITE TAX ANNUALY. AND hOW MUCH, PLS SPECIFY 15 PER5CENT OR OTHER , THAN U SIR

I am a salaried person and my annual income from salary is Rs. 679060 during the FY 2023-24.

Instead of above, I have earned Rs.215000 – 4000(charges deducted) = 211000 from short term trading. Which ITR form I have to fill? Is it necessary to fill ITR for this Rs. 211000? Pls. advice.

Sir,

I have the following profit for AY-2024-25.

STCG Rs. 146958.00

LTCG Rs. 157494.00

Total.Rs.304452.00

Opted new tax regime by default.

My total income is less than taxable income.

1. Should I have to pay AMT @18% as Capital gain is more than Rs. 1 lac

2. If I opt old tax regime can AMT be zeriosed.

3. I have Short term capital loss of Rs.250000.00 for previous year. How can I set off. It is not showing in the new tax regime.

Please advise sir.

I have pension income INR 6,92,000/-

Short term equity profit INR 5,79,000/- and intraday loss of INR 52,000/-

Divident and intrest etc INR 10,000/-

Till year 2022-23 I was filing ITR 1 as there was normal profit in equity.

My question, which ITR form should I use and do I require audit, if yes a CA will do it or/and how??

Hi Sir, if we have past FNO loss being carried over but has income from salary and capital gains from mutual funds only this year. Should we file ITR 2 or ITR 3 then? Thanks.

Respected Sir,

I am Palash Sarkar and salaried person also a tax payer,me and wife have demat accounts.She is a housewife.Monthly I send some money approx rs 6000 from my account to her account and from there the amount is invested in stocks.

Is there any issue from IT dept to my wife or myself also?

Thanks in advance

Palash Sarkar

If we have booked long term profit and losses in stocks and mutual funds during a financial year and we have net LTCG but below ₹1,00,000 do we need to show it in ITR 2 or can we still file using ITR 1 because anyways there are no taxes for LTCG gains below ₹1,00,000

Hello Mr. San,

My Salary is 20Lac per annum.

I do ‘only’ Equity on Kite. I do not do intraday or Speculative business.

As per zerodha taxpnl excel file ‘Equity’ sheet :

short term profit = Rs 12,500

long term profit = Rs 87,000

Equity Dividends = Rs 2,120

Charges

sum of various ‘Account Head’ = Rs 1120

Other Credits & Debits = Rs -910

1. Can you please suggest for FY2023-24, which ITR form should I use?

2. Can I deduct Charges from my profit?

3. Under which head do I have to declare ‘Dividends from Equity’ ?

Hello Mr. Nitin,

My Salary is 20Lac per annum.

I do \’only\’ Equity on Kite. I do not do intraday or Speculative business.

As per zerodha taxpnl excel file \’Equity\’ sheet :

short term profit = Rs 12,500

long term profit = Rs 87,000

Equity Dividends = Rs 2,120

Charges

sum of various \’Account Head\’ = Rs 1120

Other Credits & Debits = Rs -910

1. Can you please suggest for FY2023-24, which ITR form should I use?

2. Can I deduct Charges from my profit?

3. Under which head do I have to declare \’Dividends from Equity\’ ?

Intraday profit 28000

Short term profit 700000

Long term profit 108000

Pension 400000

Intt 320000

Itr 3 bharna hoga?

Intraday profit kahan show karu

Kya income tax advance tax me jama karna tha?

Hi Puneeth

I have FNO loss, ST loss, LT gain along with FD interest and Salary, can I knock of my FNO & ST loss with my other incomes? Which form is applicable to me?

ITR-3 is applicable. You can set off current year FNO Loss with all incomes except Salary.

Hi San,

Thank you very much for your prompt response.

I have FNO loss, ST loss, LT gain along with FD interest and Salary, can I knock of my FNO & ST loss with my other incomes? Which form is applicable to me?

Hi Ibrahim malek,

Sir ..iam a free lance Tourist guide on average earn 1.5lac year , and do stock delivery less than 10 days also trading of index future …so which itr form I fill?? You need to fill ITR-3 since you have traded in index future.

Sir ..iam a free lance Tourist guide on average earn 1.5lac year , and do stock delivery less than 10 days also trading of index future …so which itr form I fill

HI

Hi, I have not filed Income Tax for FY 22-23, Can I file the returns now? if so what form I should choose?

Yes, you can file Updated Return[Section 139/(8A)] now. ITR Form depends upon the Sources of Income you have.

Hi, I have not filed Income Tax for FY 22-23, Can I file the returns now? if so what form I should choose?

HI Prasad,

i have done intra day trading from january 2023 till date. During intial days i have made losses. As on day my losses are more than my profits. My question is when i use itr3 should i deduct my total loss ( gross loss) from turnover and also deduct all expenses relating to trading to arrive at my actual income – Deduct all purchase cost and expenses from sale value. Turnover is for the purpose of determining audit applicability.

If this is true my total income from intraday trading is a loss of 2.5 lakhs. Then what will be my tax liability due to this trade. please clarify – if there is loss, there is will be no tax liability for Intraday activities.

i have done intra day trading from january 2023 till date.during intial days i have made losses.As on day my losses are more than my profits.my question is when i use itr3 should i deduct my total loss ( gross loss) from turnover and also deduct all expenses relating to trading to arrive at my actual income.

If this is true my total income from intraday trading is a loss of 2.5 lakhs.Then what will be my tax liability due to this trade. please clarify.

Hi Sir,

Salary 4.5 LPA

Intraday profit – 663.5

Short term profit – 71.11k

Short term turnover – 9L

Long term profit – 125.3

Intraday turnover – 663.5

Which Itr should I file?

Sir, I have no other income source and I have a loss of 17 lacs in F&O in current FY 2023-24. Which form of ITR used for tax. How can I carry forward my loss amount in next year

My salary is 6.5L p.a and I made a short term profit of 12k and long term profit of 25k. Which itr should I have to apply.

Under Schedule CG of ITR-3, I have STCG loss of -1,60,000 for positional trading (within Equity share on which STT is paid under section 111A). Since the profit is negative, I am not able to input quarterly negative values under the section F (Information about accrual/receipt of capital gain). The ITR-3 filing would show an error during the verification at the end and would not allow to file the ITR return. How to do.

hi, I created a Zerodha account in April 2021 and have been doing my trading since but I have never withdrawn the amount out of the account to date. Also currently I am facing losses of 8 lakhs including total P&L from the start of the account, so my question is do I need to apply for tax returns? if so can I apply for past 2 years?

Hi Manish,

Hi,

I am trading in FNO. I have incurred losses. Don’t want to carry forward losses.

Is it mandatory to file Income Tax Return? – If the total Income is less than the basic exemption limit before Chapter VI-A deductions and Capital Gain deductions, then it is optional to file the Income Tax Return.

However, if the business turnover exceeds 60 Lacs and your overall income is less than basic exemption limit; you are required to file the return.

Hi,

I am trading in FNO. I have incurred losses. Don\’t want to carry forward losses.

Is it mandatory to file Income Tax Return?

Hi Ganapathi,

Recently My LIC policy maturity amount received, and I need to fill ITR2 based on my income.

Could you please let me know where this LIC maturity profit amount must be mentioned in ITR 2.

If no TDS is deducted; then please declare under Schedule EI(Exempt Income)

Hi Sir,

Recently My LIC policy maturity amount received, and I need to fill ITR2 based on my income.

Could you please let me know where this LIC maturity profit amount must be mentioned in ITR 2.

Thanks in advance

Ganapathi

Hi GS Babu,

I am a private Employee, I do Intraday (Speculative & Non Speculative Trading), Long term & Short Term trade.

I have loses in Short term & Speculative & Non Speculative trades. I made profits in long term trades.

Please suggest what income tax form should i submit – You need to file ITR-3.

How carry losses in trades? – If you file the return before the due date – you can carry forward the losses.

Whether audit is required? – that depends upon the turnover

For how many years i can carry forward losses? – you can carry forward loss upto 8 years incase of FNO Loss and upto 4 years incase of speculative loss

Nitin Sir, I am a private Employee, I do Intraday (Speculative & Non Speculative Trading), Long term & Short Term trade.

I have loses in Short term & Speculative & Non Speculative trades. I made profits in long term trades.

Please suggest what income tax form should i submit.

How carry losses in trades? Whether audit is required? For how many years i can carry forward losses?

Hi Rupa Bhattacharyya,

1. I have a previous year Short term loss of Rs.165000/- which was carried forward.

2. This year ( AY 2023-24) I have short term profit of Rs.20000/-, speculative Income of Rs.3600/- and Interest income from Bank Fixed Deposit of Rs.122000. Therefore for the FY 2022-23 I have a total income of Rs.145600/- which is below the taxable income.

Query:

a) is it mandatory to set off ST profit of Rs.20000/- from 165000/-? – Yes, as per the provisions it is mandatory to set off the losses irrespective of the income limit.

b) As my current year (FY2022-23) income is below the taxable income can I carry forward the entire amount of Rs.165000 without setting off – It can\’t be done.

1. I have a previous year Short term loss of Rs.165000/- which was carried forward.

2. This year ( AY 2023-24) I have short term profit of Rs.20000/-, speculative Income of Rs.3600/- and Interest income from Bank Fixed Deposit of Rs.122000. Therefore for the FY 2022-23 I have a

total income of Rs.145600/- which is below the taxable income.

Query:

a) is it mandatory to set off ST profit of Rs.20000/- from 165000/-?

b) As my current year (FY2022-23) income is below the taxable income can I carry forward the entire amount of Rs.165000 without setting off.

Your valuable advice please 🙏

HI Namratha,

I am salaried working. I have received perks in the form of ESOP. Should I need to use ITR1/ITR2?

Please file ITR-2;

Hi,

I am salaried working. I have received perks in the form of ESOP. Should I need to use ITR1/ITR2?

Hi Shiv Prasad Chatterjee,

I have no income from other source except share sell (delivery/intraday(very rare),bank interest,MF sell (Equity& Debt),dividend interest from Soverine gold ,Nation Highway (NHAI) Bond,

please please advice which ITR form to be filled.

Pls file ITR -3; Pls declare Intraday details in Schedule PL, Capital Gains in Schedule CG and Interest Income under Schedule OS.

Hi Nitin

I have no income from other source except share sell (delivery/intraday(very rare),bank interest,MF sell (Equity& Debt),dividend interest from Soverine gold ,Nation Highway (NHAI) Bond,

please please advice which ITR form to be filled.This really helps me.

Thanks and Best Regards

Hi Rabi,

Please guide me on which ITR form I should choose.

Freelancing but on a monthly basis income – 8-9 lakh/year

Trading – losses of 22000

capital gains – Nothing as of now

Please use ITR-3.

Hi,

Please guide me on which ITR form I should choose.

Freelancing but on a monthly basis income – 8-9 lakh/year

Trading – losses of 22000

capital gains – Nothing as of now

Thank you

Hi Sharmila Joun,

Please find the category FOR ITR-3 BETWEEN SPECULATIVE INCOME OR NORMAL INCOME:

1- MIS CASH EQUITY TRADE INCOME———————– Speculative Income; taxed as per slabs

2-SHORT TERM TRADE INCOME————————– Capital Gains; taxed @ 15%

3- LONG TERM TRADE INCOME————————– Capital Gains; taxed @ 10% (upto 1 Lacs – it is exempt)

4- OPTION TRADING LOSS INCOME——————- Normal Income; taxed as per slabs

PLEASE TELL ME CATAGORY FOR ITR-3 BETWEEN SPECULATIVE INCOME OR NORMAL INCOME

1- MIS CASH EQUITY TRADE INCOME———————–

2-SHORT TERM TRADE INCOME————————–

3- LONG TERM TRADE INCOME————————–

4- OPTION TRADING LOSS INCOME——————-

HI Hari,

I am getting only the following options: modified return; after condonation and updated return.??

After logging in, Click services and Select Rectification in the drop down. Thanks

Hi,

I am getting only the following options: modified return; after condonation and updated return.

Hi Hari,

I had incurred losses in fno and capital losses. But I declared only capital losses. What is there remedy? What is updated return?

Suggest you to file Rectification return. An updated return cannot be filed if there is a reduction of carried forward loss. (typo error in earlier reply)

Hi Hari,

I had incurred losses in fno and capital losses. But I declared only capital losses. What is there remedy? What is updated return?

Suggest you to file Rectification return. An updated return can be filed if there is a reduction of carried forward loss.

Hi,

I had incurred losses in fno and capital losses. But I declared only capital losses. What is there remedy? What is updated return?

Hi Somesh,

can you explain how the income tax is calculated on the sale of shares like say I have 10000 shares of a company purchased in batches like 500 + 1000 +200 + 1000 etc

also sold in batches like -1000 , -500 etc (with a combination of both buy and sell in between them)

how do i calculate the profit / loss based on First in- First out principal of income tax, any excel file in this regard will be great?

It will be calculated based on FIFO method – First in First out method.

hi

can you explain how the income tax is calculated on the sale of shares like say I have 10000 shares of a company purchased in batches like 500 + 1000 +200 + 1000 etc

also sold in batches like -1000 , -500 etc (with a combination of both buy and sell in between them)

how do i calculate the profit / loss based on First in- First out principal of income tax, any excel file in this regard will be great

Hi Djay,

My only income is trading. Turnover 45 lakh in F&O, gross profit 3.85 lakh, net profit after charges is 2.55 lakh.

AA] Is audit required? = Turnover is not required since turnover is less than 10 Crore( I assume this is the first time you are having FNO Income and not opted for presumptive for previous years).

BB] In case audit required, what happens if I dont get it audited = Penalty for Non-Compliance w.r.t. Audit shall 0.5% of turnover or Rs 1.5 Lacs; whichever is less.

CC] ITR 3 or ITR 4 to be used? = You can use either ITR3/ITR-4; suggest you to use ITR4 since you have FNO Income.

DD] How to show 6% as turnover profit in order to not get audited as mentioned above? = Under Schedule BP; Item # E1(a) – Enter the amount of Rs 45 Lacs and further under Item # E2(b) 6% of E1a or the amount claimed to have been earned, whichever is higher – Enter 6% of 45 Lacs i.e 2.7 Lacs.

Refer this – https://incometaxindia.gov.in/forms/income-tax%20rules/2023/itr4_english.pdf

My only income is trading. Turnover 45 lakh in F&O, gross profit 3.85 lakh, net profit after charges is 2.55 lakh. Is audit required? In case audit required, what happens if I dont get it audited. ITR 3 or ITR 4 to be used? How to show 6% as turnover profit in order to not get audited as mentioned above.

Hi ,

I have not declared Capital Gains for last year. Heard income tax is sending notices. Is there an option to declare now? – You can file the update return for last 2 years i.e FY 2020-21 and FY 2021-22.

Hi ,

I have not declared Capital Gains for last year. Heard income tax is sending notices. Is there an option to declare now?

Hi ,

I have not declared Capital Gains for last year. Heard income tax is sending notices. Is there an option to declare now?

Hi Pranjal,

If we sold some equity shares before 1 year and pay 15% STCG tax on it, do we have to again pay income tax on the remaining money on which we already paid 15% tax?

No, only one time. In other words – 15% STCG Tax is only Income Tax.

If we sold some equity shares before 1 year and pay 15% STCG tax on it, do we have to again pay income tax on the remaining money on which we already paid 15% tax?

Hi Avinash,

myself working in PSU, apart from salary drawn(approx. 18lakhs) i have a net loss of 1.3lakhs under options category. kindly suggest the

AA] itr form and audit requirements – You need to use ITR-3 Form; we need to know the turnover to check the audit applicability. If turnover is less than 10 Crore – then audit is not applicable (I assume you have traded in FNO for first time)

BB] what needs to done to get rid of audit – You can declare 6% profit on the turnover and avoid audit.

Sir,

myself working in PSU, apart from salary drawn(approx 18lakhs) i have a net loss of 1.3lakhs under options catergory. kindly suggest the

1. itr form and audit requirements.

2. what needs to done to get rid of audit.

Hi Kinjol Basu,

1. If I only have business income and my profits are more than 6% of the turnover, can I use ITR4 then? – Yes, you can use still ITR-4 if you want to declare more than 6% of the turnover.

2. What exactly does the Section 44AE say in respect to the stock market since didn’t find it? – Section 44AE is not related to stock market. It is applicable for business of plying, hiring or leasing goods carriages having not more than ten goods carriage vehicles.

Hi Sir,

1. If I only have business income and my profits are more than 6% of the turnover, can I use ITR4 then?

2. What exactly does the Section 44AE say in respect to the stock market since didn\’t find it?

Hi Hari,

I downloaded offline utility. Not able the find the option 139(8A)? – I assume you have downloaded Common Utility(1 to 4). You need to download specific excel based utility. As of now, it is available only in Excel version utility.

Hi,

I downloaded offline utility. Not able the find the option 139(8A).

Hi Hari,

I want to file Income Tax return for Last year. How to file it? – Now, you can file only updated return as per Section 139(8A). You need to fill offline and upload it. Utility can be downloaded here. https://www.incometax.gov.in/iec/foportal/downloads/income-tax-returns

Hi I want to file Income Tax return for Last year. How to file it?

Hi I am a selfemployer and want to know which form should I fill cause my pa saving is 2.5lks

i am a investor but accidentally i make profit for rs 10 on trading. now can i filed income tax return in itr 2

Thanks for the good info.

All the best

Regards

Dear Sir,

I am doing Intraday and my income is less than 250k i haven\’t made any profit till now.

My Intraday turnover is 25.56k and loss is 8.83k. Is there any problem if don\’t file Income tax

Hi , I am salaried and annual income of above 11L and I do investment as well trading and I have seen only loss of around 6 lakhs.

I have already file income tax only for my salary in ITR1 slab… Now I am worried if I need to file tax return for trading. If so can I agin file it in ITR 3 , or is it fine to leave as I had only loss.

Please help

I have bank f.d interest income,intraday profit/loss,

STCG,LTCG.Is a senior citizen.If the total income is

less than rupees 3 lakh,which itr form to fill.If income

reaches more than rupees 3 lakh then which itr form

to submit.Best regards.

Mera ek shop hai aur mai equity share me investment kiya hu kya mujhe ITR file karna chahiye to kaun sa itr aur meri income 2.5. Lac se kam hai

Sir I am government employee with gross income 700000 and doing trading incurred loss 670000 in F&O and profit 25000 in equity my question is do I need to audit form CA and which ITR from I have to file sir My demat account is in Zerodha

If this is the first year of FNO – then no Tax Audit is applicable.

Sir I am government employee with gross income 700000 and doing trading incurred loss 670000 in F&O and profit 25000 in equity my question is do I need to audit form CA and which ITR from I have to file sir My demat account is in Zerodha

I am a govt employee with gross salary 5.1 LPA.. not coming under tax stab with no TDS. I do intraday and invest in delivery and mutual funds. I also have some long terms gains less 1lacs. Which form should I submit?

Respected sir,

Recently I have filed itr3 with some tax liability. But I have choose pay later and submitted the forms and e verified also. How can I pay the tax online now?

Please suggest

Thanking you

Palash Sarkar

As what income do we file muthoot NCD interest in ITR?

Mine salary is 4.5/-PA

F&o 51k loss turnover 22lacs

Intraday 1k loss

Which itr I have to fill? and do I need an audit?

Hi Nithin,

I have couple of questions

q1. Realised P&L vs Net realised P&L what are we required to pay tax on?

q2. Is there a way to get long term capital gain report from zerodha or we need to manually segregate short and long term capital gains from the overall p&l report

Hello there,

I do not havw any salary income .

Also I have no other income.

I only deal in intraday, btst and short term that too sometimes.

So my realised profit is 1600 rs. And unrealised is 4100. For the period 23rd july 2021 TO 22nd july 2022. Which ITR should I file.

No doubt the income is less than taxable income slab i.e less than 5 lac, but last year my friend filed ITR 2 so which ITR should I file this year. And do i have to attach tax p&l and p&l statement by zerodha?

I m a govt employee my annual salary is apprx 8 lacs & I m investing in stock market few times it intraday & few time it\’s STCG.

Which form I need to fill for ITR AY 2022-23

I am investment equity shares and intraday trading start in may month 2023 can i fill up itr- 3 assignment yr 22_23.

Actually I read most of your comments and than decided to file itr 3 as I was

1. A PSB employee

2.Futures and options profit – Rs. 30,710

3.Commodity market profit – Rs. 52,700

So total profit from share market was – 83,410

Later I came to know about quicko site,it automatically fetched all data from zerodha but it was automatically directing to fill itr 1 with no mention of my share market income in that.

i have salaried income and i invest in equity shares and do fno trading so which income tax form i should fill.

I\’m a govt employee and my salary is more than 6 lakh and I have some short term capital gain.

Which ITR form should I fill up?

if i have only income from share short term capital gain around 4 lacs.

Turnover sale amount is about 30 Lakhs.

which itr to be used to avoid tax, to show as share trading business.

Or to bifurcate as capital gain?

Sir,

I have the following details for FY 2021-22:

Income from Bank FD Rs.58418.00

Income from Dividend Rs.650.00

Intraday Income Of Rs.3045.00 (Turnover Rs.3045)

Short term profit of Rs.9087.00

F&O Loss Rs.82108.00 (Turnover Rs.168262.00)

Previous year Short term loss Rs.165000.00

Under Section 80C PPF Deposit of Rs.41000.00

My income is below basic examption limit.

Please advise me

1. As F&O Loss Rs.82108.00 (Turnover Rs.168262.00), should it be presumptive @6% of Rs.168262.00 in no account cases in schedule P & L.

2. Can I show Turnover of Rs.168262.00 and zero profit in itr 3 to skip the hazard in no account cases in schedule P & L.

3. How can I carry forward the f&o loss without Books & avoiding audit.

4. is deduction claim Under Section 80C is applicable to my case

Thanking you

Regards

Sir,

I have the following details for FY 2021-22:

Income from Bank FD Rs.58418.00

Income from Dividend Rs.650.00

Intraday Income Of Rs.3045.00 (Turnover Rs.3045)

Short term profit of Rs.9087.00

F&O Loss Rs.82108.00 (Turnover Rs.168262.00)

Previous year Short term loss Rs.165000.00

Under Section 80C PPF Deposit of Rs.41000.00

Please advise me

1. As F&O Loss Rs.82108.00 (Turnover Rs.168262.00), should it be presumptive @6% of Rs.168262.00

Or can I show Turnover of Rs.168262.00 and zero profit in itr 3 to skip the hazard.

2. is deduction claim Under Section 80C is applicable to my case

Thanking you

Regards

Hi Anony1122,

Concluding my query all in all – which form I have to fill, will there be audit required (based on what I read – it’s a no ) but more light on this would be appreciated.

In Form 10IE – what will be nature of business profession – Select Other Services

In ITR form 3 – what will be nature of business profession – Select 13010-Investment Activities

Hello Everyone ,

I am a bit confused and need suggestions on below queries :

a> salaried individual with income from dividend , Interests from RD/FD , STCG and intraday.

b> STCG around 9k (realized P/L excluding charges/debits-credits)

c> Intraday only time in a year with profit around 600 – 1000 only

From reading zerodha varsity docs , it seems I should file ITR 3 but confused on intraday part as profit is around 1000 only , it is going to be form 3 or not if not then which ITR form ?

d> I thought to fill up ITR form 3 since I opted for new tax regime last year but wants to continue with old tax regime from this year , it seems to be compulsory to fill up form 10IE but there\’s a limit to choosing either of the tax regime only once if you are having business income . Now , in case in future , if there\’s no Business income of any kind majorly from intraday STCG LTCG so I am assuming we can switch to any regime since it will be ITR1 or ITR2 (if STCG or LTCG).

Concluding my query all in all – which form I have to fill , will there be audit required (based on what I read – it\’s a no ) but more light on this would be appreciated.

In Form 10IE – what will be nature of business profession

In ITR form 3 – what will be nature of business profession

Thank you in advance .

Hi Rupa Bhattacharyya,

I have the following details for FY 2021-22:

Income from Bank FD

Income from Dividend

Intraday Income of Rs.3045.00

Short term profit of Rs.9087.00

Previous year Short term loss of Rs.165000.00

Previous year Long term loss of Rs.16000.00

My net Income for FY 2021-22 is 53000.00

Please advise me

1) Which ITR should I fill in – you need to fill ITR-3.

2) Is it necessary to make good ST Profit of Rs.9087 with PY ST Loss of Rs.165000.00 or carry forward the entire PY ST loss of Rs.165000/- as my income is less than taxable income – you need to set off ST Loss with ST Profit.

Good Evening Sir,

I have the following details for FY 2021-22:

Income from Bank FD

Income from Dividend

Intraday Income Of Rs.3045.00

Short term profit of Rs.9087.00

Previous year Short term loss of Rs.165000.00

Previous year Long term loss of Rs.16000.00

My net Income for FY 2021-22 is 53000.00

Please advise me

1) Which ITR should I fill in

2) Is it necessary to make good ST Profit of Rs.9087 with PY ST Loss of Rs.165000.00

or carry forward the entire PY ST loss of Rs.165000/- as my income is less than taxable income.

Thanking you in anticipation.

Sir please guide me in filling itr

I am a salaried person (8.5lakh pa). Recently I started investing on share market (1.5 lakh invested so far) and sell some share for about 4 thousand profit. Still can i filled itr1 in income tax return filing or not

Hi my Salary income is 6.5Lkhs

Options trading loss 94770 +13220 charges

Turnover 19.59 lakhs

Which itr to be filled?

If I want to carry forward losses do I need to get audited

I’m student .. all the investments of mine are in feature and options so can u please tell me what should i do if my profit is above 2.5L perannum

Hello nitin sir,

I am residing in dubai, i do trading in zerodha. My salary is around 9 lakhs per annum. I have a loss of around 35 lakh in fno and commodities. Which itr to be filled by me to carry forward my losses.

hello Nitin ji

My query is

if my turnover is less than 5 crores and I am showing f & o profit less than 6 % in ITR3, Do audit require?

In ITR 4 under presumptive scheme,can I show 6 % profit even if it is more than 6 %?

Hi Sir,

My salaried income is 1.5lkh pa..and in last financial year i have made 15k profits from investing..do I need to file itr?if so then which itr form?

Sir, I am a Government employee having salaey Imcome for FY-2020-21 was 2100000/pa and TDS deducted. F&O loss 2,27000 with turnover 480000 and non speculative short term gain of 209000 with turnover of 5200000. I can\’t do trading as government employee. But what to do now and which ITR to be files. I

Hello Nithin, thanks for the clear explanation on topics.

I am holding a share for more than 2 years. It\’s price has run up recently at around rs. 320. I want to sell its call option at strike price of rs. 380 and receive premium income. Suppose, at expiry, share price reaches rs. 380 and I have to deliver the shares. Will the profit on sale of these shares be considered as long term capital gains or business income?

Consider I have a loss of 80K in STCG and Salaried income of 5.8L, Can this loss be used to reduce my IT on a whole?

will my net income will become 5.8 – 0.8 = 5L? so no tax?

Hii sir,

If I consider my stock investments as a business income then my mutual fund capital gain in same FY considered as capital gain or as a business income ?

my total income from option trading about 400000/-and have no other source of income. So my question is

1. Which ITR form should be used

2. Do I need an audit

3. If i don\’t make the audit then what is tax liability

Sir, is any chance to look this module in hindi?

CLARIFICATION REQUIRED ON F & O : WHICH TURNOVER I HAVE TO SHOW IN ITR, WHETHER TO CALCULATED AS PER IT CALCULATION ( CONSIDERING NEGATIVES & POSITIVES ) OR ACTUAL SELL VALUE OF F & O, THIS INFORMATION IS NOT AVAILABLE IN ANY F & O DATA

Hi Naveen,

How much do you have to earn to trade stocks on pay taxes?

If it is Short Term Capital Gain – you have to pay 15%.

If it is Long Term Capital Gain – you have to pay 10% for gains exceeding Rs 1Lacs.

If it is FNO Income – you have to pay tax as per your slab tax rates.

How much do you have to earn to trade stocks on pay taxes?

Hi Shaun Fernandes,

I am 22yrs old, I live abroad with my parents but dont work, I do investments and traders in stock market, I have no idea is to how should i file my ITR and which forms i need fill etc. I dont have any source of income except small amount from stocks and mutual funds, and some capital from my parents for trading and investing.

Can you please help me with this matter?

If you have only Capital Gains – you need to fill ITR-2.

If you have FNO Income/Loss along with Capital Gains – you need to fill ITR-3.

Check this video out from quicko…https://www.youtube.com/watch?v=IJnymlMo4iY

Hi Sir,

I am 22yrs old, I live abroad with my parents but dont work, I do investments and traders in stock market, I have no idea is to how should i file my ITR and which forms i need fill etc. I dont have any source of income except small amount from stocks and mutual funds, and some capital from my parents for trading and investing.

Can you please help me with this matter

Hi Ayaan,

I am a govt. employee. my income is 10 lakh p.a. i made a profit of 10000 in short term equity shares. which itr form should i fill?

You need to fill ITR-2.

I am a govt. employee. my income is 10 lakh p.a. i made a profit of 10000 in short term equity shares. which itr form should i fill?

I do intraday(some times), STCG LTCG, but overall income is less than 2.5lakhs..

Do I need to file income tax return.

I do intraday(some times), STCG LTCG, but overall income is less than 2.5lakhs..

Do I need to file income tax return.

Hi Jipson,

I am company director with taking an annual package of 5Lakh 90 Thousand.

I have received I do have shares through Zerodha and Gains as reported by console is

LTCG 19,190 and STCG 95,190 . I dont do intra day trading.

I have received bank interest of 2 Lakhs from my bank account

File ITR-2.

I am company director with taking an annual package of 5Lakh 90 Thousand.

I have received I do have shares through Zerodha and Gains as reported by console is

LTCG 19,190 and STCG 95,190 . I dont do intra day trading.

I have received bank interest of 2 Lakhs from my bank account

Kindly advise which ITR I have to use

Thanks

I have losses of about 10k this year,i have done quite a few intraday trades,is filing the itr 3 form mandatory?My net income is less than 2.5 lakhs

I use to file itr 4 earlier but in previous year i done some commodity trading?

Can i file itr 4 now ?

Hi Pallavi,

I am unemployed,n dont have any source of income.have not even completed a year since i started trading.my trading capital is hardly 15000 or less, n did not earn any profit.I wish to file itr from next year.will it be ok.or if i dont file will i have to pay penalty or something?pls guide.

Filing of return is optional if your income is less than basic exemption limit.

Since you did not earn any profit – it is optional.

I am unemployed,n dont have any source of income.have not even completed a year since i started trading.my trading capital is hardly 15000 or less, n did not earn any profit.I wish to file itr from next year.will it be ok.or if i dont file will i have to pay penalty or something?pls guide.

Thanks

Hi Ramesh

Account under loss ,which form will filled,

If loss is relating to only Capital Gains, then file ITR-2

If loss is relating to FNO or both Capital Gains and FNO, then file ITR-3

hai sir account under loss ,which form will filled,

Hi Nithin Sir,

I have invested LIC One time investment of Rs. 50000/- about 5 years back, Now after expiry received Rs. 1,14,000/- that is a gain of Rs. 54000/-

Also Chitfund Dividend of Rs. 69125/-

I need submit ITR-2, Request you to suggest where in ITR-2 I should mention LIC profit and Chitfund Dividend.

Thanking you sir for Help.

Sincerely.

Ganapathi

Hi Sir,

I have earing from Privet job CTC 2.64Lpa + variable 30K

now from stock swing treading I have earned profit 5,500/-

loss 1100/-

do I need to IT return ?

Sir

Last Year (2020-2021)

I Lost 1.50 Lakh Rupees On My Total Investment, & In This Financial Year (2021-2022) I Got Profit Around 90 Thousand. Last Day I Received Mail From Zerodha Regarding This,

(As per this SEBI circular, we are required to ensure that your latest income details are updated on your trading account on a yearly basis.

Please update your latest income range and also upload any one of the following documents as income proof:

Bank account statement for the last 6 months

Latest salary slip

Copy of ITR acknowledgement

Copy of Form 16 in case of salary income

Networth Certificate issued by a Chartered Accountant

Demat holding statement

Upload income proof

Please upload your latest proof of income by clicking on the above button by December 24, 2021, without which the income range we have on record will be considered current)

Now I Want To Know, How I Can Save From Tax, Because Of Those Lost Year Loses? Please Reply

Hi Atul,

Salary 6 lakh pa

STCG-4 lacs

LTCL-1 lakh (loss)

Intraday profit- 6k

Which ITR to file? – You need to file ITR-3

FY- 202-21

salary 6 lakh pa

STCG-4 lka

LTCL-1 lakh (loss)

Intraday profit- 6k

which ITR to file?

Sir, I don’t have any source of income. I started trading from may 2021. I mostly do delivery for short term capital gain with few intraday. My total profit minus losses is -3000. So do I need to file Itr. And if yes then which itr?

Hi Ebung,

I am salaried. My salary is around 4L, for which the income tax has already paid through department. I did trading equity. As a new trader i did intraday for few times to learn how it is done. All buying and selling was done in one year, in 2020. The total profit after selling all was around 1.2L. What ITR form to be used? What else are required?

You need to file ITR-3.

Declare Intraday details under Schedule PL.

I am salaried. My salary is around 4L, for which the income tax has already paid through department. I did trading equity. As a new trader i did intraday for few times to learn how it is done. All buying and selling was done in one year, in 2020. The total profit after selling all was around 1.2L. What ITR form to be used? What else are required?

Hi Ankur,

Which ITR to use for Salary Income, House Property Income, Other Sources viz Interest n Dividend Income, Inter day Loss on Shares, Intra day Profit and F&O Losses.

You need to file ITR-3.

Hi Saurabh Gupta,

Sir my mom has house rent income and she earned LTCG from mutual fund of 98k(LTCG upto 1lakh is Exempted so i need to mention this on ITR Or not) in a financial year then which itr form to file?

You need to file ITR-2. Declare Rental Income under Schedule HP and you need to mention Long Term Capital Gains although it is 98K under Schedule 112A.

WhicH ITR to use for Salary Income, House Property Income, Other Sources viz Interest n Dividend Income, Inter day Loss on Shares, Intra day Profit and F&O Losses.

Thanks

Ankur Bhasin

9897999134

Sir my mom has house rent income and she earned LTCG from mutual fund of 98k(LTCG upto 1lakh is Exempted so i need to mention this on ITR Or not) in a financial year then which itr form to fill?

Hi sir,

can you please share the draft format of Financials for F&O trading updated ones,

and my client is having only income from Trading, what assets should be included in B/S and where should we report the B/s and P&L in ITR-3

Thanks

HI Shaan,

My taxable income is 4,90,000 (0 tax due to rebate)

STCG is 13,000.

Intraday Loss is -5502(negative) on turnover of 41,76,274.

Due to my STCG my total income is going above 5 lakhs thereby removing the rebate (17k tax)

Question 1 ->How is the total taxable income calculated ?

Is it => Salary + STCG + Intraday? (if we add intraday losses to total income then tax liability is Rs 0 as income is Should i fill ITR-3 ? and if so then will i be able to save tax by showing Intraday losses ?

In your case, taxable income will be Salary + STCG because Intraday is speculative transaction;

Loss from Speculative(Intraday) cannot be set off against STCG.

Taxable Income will be Rs 490000+ Rs 13000 = Rs 503000/-

Also, you should fill ITR-3 in your case.

Hi Nithin,

My taxable income is 4,90,000 (0 tax due to rebate)

STCG is 13000

Intraday Loss is -5502(negative) on turnover of 4176274

Due to my STCG my total income is going above 5 lakhs thereby removing the rebate (17k tax)

Question 1 ->How is the total taxable income calculated ?

Is it => Salary + STCG + Intraday ? (if we add intraday losses to total income then tax liability is Rs 0 as income is Should i fill ITR-3 ? and if so then will i be able to save tax by showing Intraday losses ?

Thanks,

Shaan

Hi Sujan manna,

I am a govt employee. I only invest in mutual fund .which ITR I have to fill up??

ITR-1 because you have only invested in mutual fund.

If your salary income is more than 50 Lacs, fill ITR-2.

Hi, I am a govt employee.i only invest in mutual fund .which itr I have to fill up??

Respected sir,

I Palash Sarkar going to file ITR3 .In schedule capital gains ,the column F. information about accrual/receipt of capital gains.how can I file this?

Please suggest.

Thanking you

Palash Sarkar

Hi,

I Palash Sarkar going to file ITR3 .I have received ₹37 as dividend.Please suggest me in which column I can show this amount?

Please declare the Schedule Other Sources. (i) – Dividend Income [other than (ii)]

Respected sir,

I Palash Sarkar going to file ITR3 .I have received ₹37 as dividend.Please suggest me in which column I can show this amount?

Thanking you

Palash Sarkar

Hi Saurabh

I have salary income around 9 lakh and I have invested in shares but I have not sold any one in that FY 20-21 then In that case do need to fill ITR 3 or ITR 1 will be fine? Only I received dividend.

You need to file ITR-1. Declare dividend under Income from Other Sources.

HELLO SIR,

I AM A PENSIONER IN PSU BANK . MY PENSION AMOUNT ALONG WITH INTEREST & DIVIDEND INCOME IS WITH IN TAXABLE LIMIT. THIS YEAR, I REDEEMED SECURITIES UNDER ELSS AND MADE A LTCG OF AROUND

Rs. 26000/- ONLY , ie,WITHIN TAX EXEMTION LIMIT FOR LTCG

OF Rs.1 LAC.

CAN I FILE THE RETURN IN FORM ITR-1 OR ITR-2 THOUGH THE INCOME ALL PUT TOGETHER LESS THE TAX EXEMPTIONS SUCH AS SAVINGS UNDER

80 C, STANDARD DEDUCTION, INTEREST UNDER 80 TTB ETC .

THE QUESTION IS EVEN IF LTCG IS WITHIN THE EXEMPTION LIMIT, WHETHER ITR- 2 HAS TO BE USED OR ITR 1 WILL SUFFICE ?

IS

I have salary income around 9 lakh and I have invested in shares but I have not sold any one in that FY 20-21 then In that case do need to fill ITR 3 or ITR 1 will be fine? Only I received dividend.

Hi

My wife is housewife, trading in share market (delivery based only). She want to file her IT Return for more than 5 lakh income for current year (2021-22).

She had B.Com degree & trading for last 12-13 years. But till this year she won’t generated profit more than 2.5 lakhs. So she not filed IT Returns yet.

I want to know which IT Return you will file for her? ITR 2 or 3?

ITR 2 if you have delivery based trades. You need to fill the details in Schedule CG and 112A as applicable.

My wife is housewife, trading in share market (delivery based only). She want to file her IT Return for more than 5 lakh income for current year (2021-22).

She had B.Com degree & trading for last 12-13 years. But till this year she won\’t generated profit more than 2.5 lakhs. So she not filed IT Returns yet.

I want to know which IT Return you will file for her? ITR 2 or 3?

How to carry forward F&o losses in new Itr portal, is it mandatory to compete tax audit

Salary is 10 Lacs plus short term capital gain was 2 lacs and long term capital gain was 1.5 lacs intraday profit was 50000 and intraday loss was 45000 how can i fill income tax return please attach one excel file if possible.

Hi Moushmi,

We know to avail presumptive scheme under 44AD, ITR4 can be used. However ITR3 also has sections to declare income under 44AD. So, can one use ITR3 and still avail presumptive scheme under 44AD for FY20-21?

Yes, one can use ITR-3 and take benefit of Section 44AD.

Hi Sanjay,

I am not salaried person but intra day income about 50000 and short term gain about 300000 .what fill itr?

You need to fill ITR-3. Declare Intraday details in Schedule PL and STCG in Schedule CG.

I am not salarised person but intra day income about 50000 and short term gain about 300000 .what fill itr

Hi,

We know to avail presumptive scheme under 44AD, ITR4 can be used. However ITR3 also has sections to declare income under 44AD. So, can one use ITR3 and still avail presumptive scheme under 44AD for FY20-21?

Hi Jayanta,

Sir, if I hold a share for lifetime, do I have to file incometax every year.

You need to pay tax when you sell and make profit.

Also, when you receive Dividend.

Sir, if I hold a share for lifetime, do I have to file incometax every year.

Sir, please reply.

Hi Rupa Bhattacharyya

Can I file ITR3 online directly using new portal or should I prepare the return offline mode and then upload in the new portal,please advise.

Both can be done; however suggest you to file online directly.

Good evening sir,

Can I file ITR3 online directly using new portal or should I prepare the return offline mode and then upload in the new portal,please advise.

Hi Ramesh,

I am 19 years old and this is my first year where I have generated an income.

I have following income (Profit and Loss as well) from trading (Intraday and short term) activities

1. Short Term Profit Rs. 72000

2. Intraday F&O Loss : Rs. 14000

3. Equity Intraday Loss : Rs. 11000

My total income is less than 2.5 Lacks and F&O turnover is also < 2 Cr

My question is :

1. Is it mandatory for me to fill ITR – It is optional; but suggest you file the return.

2. If yes, which form I should fill – Applicable ITR is ITR3.

We all ready pay it when sell and buy stock for example stt gst stamp duty dp charge tb bi hme or alg se tex pey krna padega

Dear Sir,

I am 19 years old and this is my first year where I have generated an income.

I have following income (Profit and Loss as well) from trading (Intraday and short term) activities

1. Short Term Profit Rs. 72000

2. Intraday F&O Loss : Rs. 14000

3. Equity Intraday Loss : Rs. 11000

My total income is less than 2.5 Lacks and F&O turnover is also < 2 Cr

My question is :

1. Is it mandatory for me to fill ITR

2. If yes, which form I should fill.

Regards,

Ramesh Survanshi

5.9 – Turnover and Tax audit

When is an audit required?

An audit is required if you have a business income and if your business turnover is more than Rs 5 crore for a financial year (from FY 20-21). In the case of digital transactions (equity transactions are 100% digital), this turnover limit is Rs 5 crores. For equity traders, an audit is also required as per section 44AD in cases where turnover is less than Rs.5 Crores but profits are lesser than 6% of the turnover and total income is above the minimum exemption limit.

As per above explanation from Zerodha platform – Audit is required because my turnover is less than 5 Cr. and having loss with salary income more that minimum exemption limit.

But you replied that – In my case audit is not required – could you please explain How?

Hi Rupa Bhattacharyya,

I have interest income from FD in Bank and income from intraday trading also.

Is intraday trading a business income?

Yes Intraday falls under the income head PGBP(Profits and Gains from Business or Profession). Pls file ITR-3 for the current year.

filed ITR 3 for AY 2020-21 to carry forward loss of Rs.637000.00 (Short term).

This year (AY 2021-22) I made a profit of Rs.127000.00(short term).

Please advise me which ITR form should I fill this year to carry forward remaining loss of Rs.(637000-127000).

Yes sir, I have interest income from FD in Bank and income from intraday trading also.

Is intraday trading a business income? Please guide sir.

Hi Rupa Bhattacharyya,

I filed ITR 3 for AY 2020-21 to carry forward loss of Rs.637000.00 (Short term).

This year (AY 2021-22) I made a profit of Rs.127000.00(short term).

Please advise me which ITR form should I fill this year to carry forward remaining loss of Rs.(637000-127000).

You need to file ITR-2 if you don\’t have any business income in the current year, otherwise ITR-3.

Further, you need to fill details of carry forward loss in Schedule CFL so that you can set off the same.

Good evening sir,

I filed ITR 3 for AY 2020-21 to carry forward loss of Rs.637000.00 (Short term).

This year (AY 2021-22) I made a profit of Rs.127000.00(short term).

Please advise me which ITR form should I fill this year to carry forward remaining loss of Rs.(637000-127000).

Hi Karthik,

Hi after uploading Zerodha Tax P&L statement in Quicko, Nature of Business is mentioned as “09-Retail and Wholesale 09028-Retail Sale of Other Products” by default. Do I need to change it to “13010 – Financial intermediation/Investment activities” as mentioned in this document.

Both are correct.

Hi Vivek Kumar,

I’m a Govt employee having a gross salary of 12 lacs p.a. I do intraday and long term trading and there is a gain of 1.93 lacs from trading.

AA] Kindly suggest do I need to file ITR 1 after showing trading income as other income or other ITR file – You need to file ITR-3 declaring your intraday transactions and long term cap gains.

BB] If I don’t show trading income and only show salary income in ITR 1, is there any problem? Yes, this amounts to under-reporting of income and penalty can be levied.

Hi Goru,

For FY21; I am having F&O loss of 1.5 Lac (Turnover – 50 lac) and Salary Income 8 lac . Total taxable income (including salary) is more then basic exemption limit. (note: I was also having losses in previous years in F&O having turnover less than 1 Crore with salary income that leads total income more then basic exemption limit, and I had filed ITR 1 only during all previous FYs. not disclosed any loss related to share trading in return, First time want to show trading loss in return, that means never filed return under presumptive taxation 44AD).

AA] Is tax audit is applicable on me for FY 20-21 ? – Tax audit is not applicable for you; since the turnover is below the threshold limit and you have never opted for 44AD.

BB] Which for do I need to file for return? If you want to carry forward your losses; you need to prepare books and file ITR-3.

Also, you have an option to declare minimum profit @ 6% and file ITR-4.

Hi after uploading Zerodha Tax P&L statement in Quicko, Nature of Business is mentioned as \”09-Retail and Wholesale 09028-Retail Sale of Other Products\” by default. Do I need to change it to \”13010 – Financial intermediation/Investment activities\” as mentioned in this document.

I\’m a Govt employee having a gross salary of 12 lacs p.a. I do intraday and long term trading and there is a gain of 1.93 lacs from trading. Kindly suggest do I need to file ITR 1 after showing trading income as other income or other ITR file. If I don\’t show trading income and only show salary income in ITR 1, is there any problem?

Hi Team,

My Question is related to Tax audit for FY 2020-21.

For FY21 I am having F&O loss of 1.5 Lac (Turnover – 50 lac) and salary Income 8 lac . total taxable income (including salary) is more then basic exemption limit. (note: I was also having losses in previous years in F&O having turnover less than 1 Crore with salary income that leads total income more then basic exemption limit, and I had filed ITR 1 only during all previous FYs. not disclosed any loss related to share trading in return, First time want to show trading loss in return, that means never filed return under presumptive taxation 44AD).

1. Is tax audit is applicable on me for FY 20-21 ?

2. Which for do I need to file for return.

Hi Vysakh,

Hi, I have an salaried (bank job) income of 6.6lakhs and other allowances. I do some swing trading now and then. Which ITR should I file?

You need to file ITR-3; if you are treating the gains from swing as Business Income.

You need to file ITR-2; if you are treating the gains from swing as Capital Gains.

Hi Karanpreet Singh,

1. Total 1.6 lac salary received

2. Dividend income of 1.5 lac

3. Stcg loss of 88k

4. F&o profit of 21k, turnover is 89 lacs.

5. Intraday loss in equity is 3k.

Ques is

AA] Which ITR should I file if I don’t want to carry losses? You need to file ITR-3 as you have FNO income.

BB] Audit is required or not? – No as your turnover is below the threshold limit.

CC] And balance sheet and p&l is necessary? – Yes, you need to prepare Balance Sheet and PL; if you declaring FNO income as per normal provisions of taxation.

Hi Venkatesh,

I have made these in FY 2020-21:

Intraday/Speculative profit 2820.55

Intraday/Speculative turnover 3945.35

Short Term profit (STCG) 23714.04

Long Term profit (LTCG) -6199.55(loss)

Options Turnover 36133.75

Options Realized Profit -3633.75 (loss)

Dividends 1580

Saving Account Interest 17860

Need your help in couple of questions I have.

AA] I guess I have to use ITR3 in this case, right? Yes, you have to use ITR-3.

BB] Am I supposed to get audited even for small loss of 3633 and turnover of 36133? That depends whether you have opted for 44AD presumptive taxation in the scheme in the previous year or not. If you are opting of presumptive scheme in the current year; then audit is NOT applicable.

CC] If yes for Q2(BB), instead of loss can I show (presumptive) profit and pay tax according? – Yes, you can presumptive profit @ 6% and pay tax accordingly.

DD] What if I file ITR2 not showing the F&O at all. In other words, is it an offence not to show F&O loss? – Yes ; further for misreporting of income; IT department can levy penalty.

Hi Anjali,

My taxable income is: 276000

I made a profit of 52,750 as STCG in equity trading

I incurred a loss of 16,080 in F&O trading

My query:

AA] Which ITR form is applicable in this scenario? – Applicable ITR Form is ITR-3.

BB] Is audit required considering my above income and loss? – If you have incurred FNO loss for the first time; then Audit is not required. OR

If you are opting out of presumptive scheme in the current year; then audit is applicable.

Hi, I have an salaried (bank job) income of 6.6lakhs and other allowances. I do some swing trading now and then. Which ITR should I file? Can someone please help me

Hello Nithin please answer,

1. Total 1.6 lac salary received

2. Dividend income of 1.5 lac

3. Stcg loss of 88k

4. F&o profit of 21k, turnover is 89 lacs.

5. Intraday loss in equity is 3k.

Ques is

1. Which ITR should I file if I don\’t want to carry losses?