2.1 – Overview

India needs help from all of us countrymen in developing a tax culture. The fear of the income tax department can be removed only by gaining knowledge of all the basic rules and regulations. Income tax rates in India have drastically reduced from over 90% in the early seventies to now (2020) where no tax has to be paid on annual income up to Rs 3.0lks/2.5lks depending upon the regime opted. But the apathy of taxpayers towards filing income tax returns and paying taxes continues till today.

With the systems used by the IT department becoming sophisticated every year, the chances of repercussions in terms of notices and penalties due to non-filing, misfiling, and concealing information while filing your income tax returns (ITR) is going up significantly.

Similar to how Income-tax (IT) department has access to all your bank account details, they can also check up on all your capital market activity easily through the exchanges as they are all mapped to your PAN (Permanent account number). With AADHAR slowly getting linked everywhere the day isn’t far when the IT department will be able to send you a consolidated activity (income and expenses) statement, similar to how NSDL/CDSL sends for your holdings across all Demat accounts.

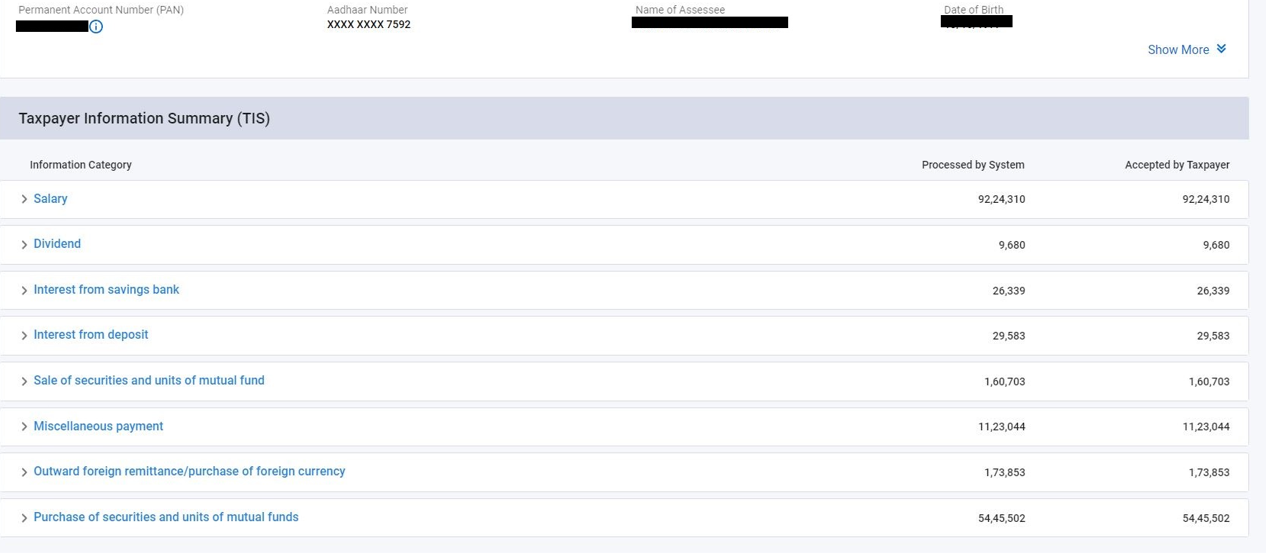

What we predicted long back has become a reality in the form of TIS (Taxpayer Information Summary) and AIS (Annual Information Summary). Taxpayer Information Summary (TIS) is an information category wise aggregated information summary for a taxpayer whereas AIS provides a detailed breakup of Income like savings account interest including post office interest, dividend, rent received, purchase and sale transactions of securities/immovable properties/crypto transactions, foreign remittances, interest on deposits, GST turnover etc.

Here is a specimen of TIS.

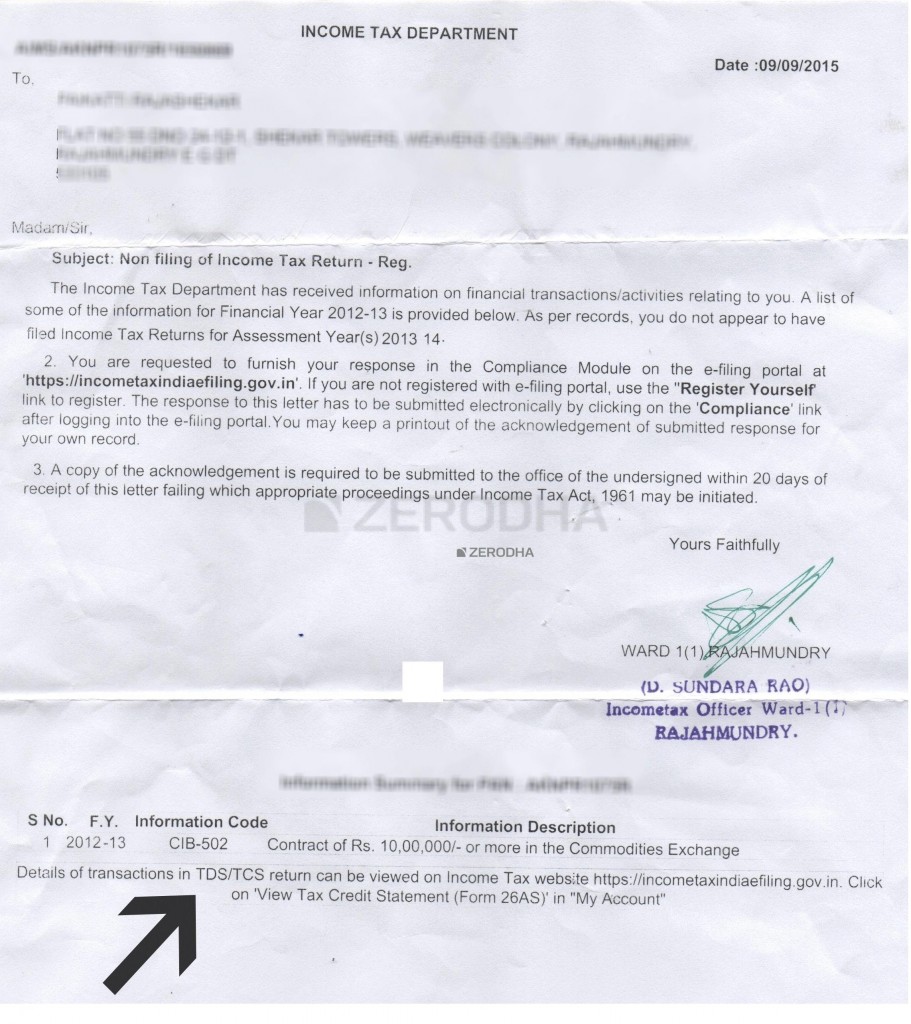

Check this notice received by a client who hadn’t declared his trading activity on commodity exchanges in FY 2012/13. The notice was sent only in 2015 asking for an explanation. Check this link that has a list of various codes in which these notices are sent by the IT department.

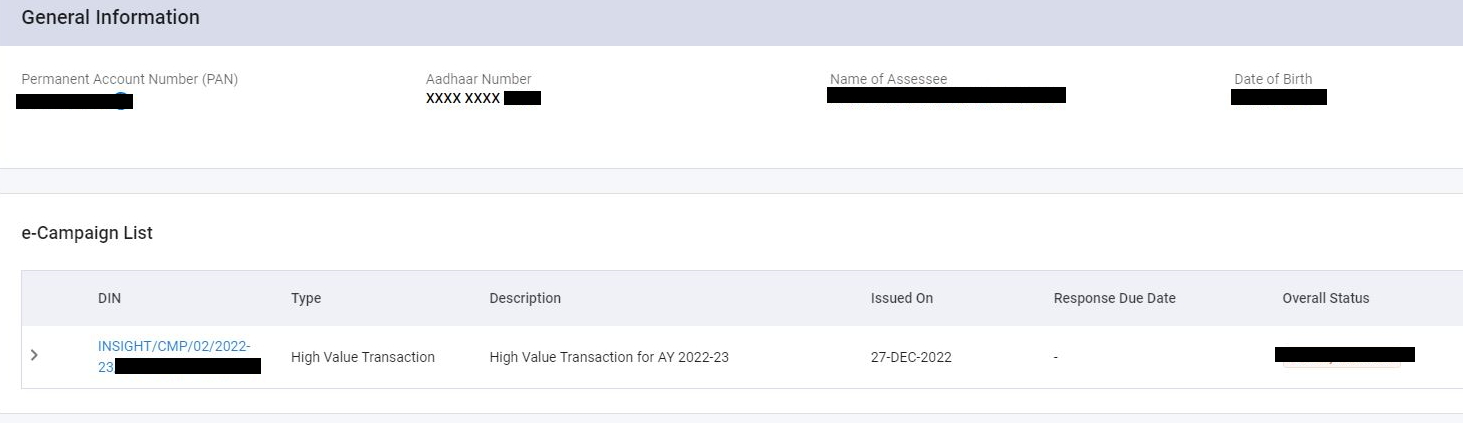

Also, e-campaigns are run where notices are sent to the taxpayers asking them to confirm the transactions undertaken.

Even if the intent is there to be compliant, most people including many Chartered Accountants (CAs) don’t understand the subject of taxation when investing & trading very well. We had put up a blog post, “Taxation Simplified” on Z-Connect many years back simplifying key aspects of taxation for market participants. We received a few thousand queries on that post. Answering all of them it was obvious that we had to do a lot more to simplify all aspects around taxation while trading or investing in the markets, hence this module.

If you only invest in stocks or mutual funds filing returns is quite simple, but can get tricky if trading intraday stocks or financial derivatives (futures and options).

We will in this module break all the concepts down into small easy to understand chapters without any of that jargon typically used by CA’s or tax consultants. Here is a sneak peek into what you can expect going forward in this module –

- Introduction (Setting the Context)

- Basics

- Classify your Market Activity

- Taxation for Investors

- Taxation for Traders

- Turnover, Balance Sheet, and P&L

- ITR Forms (The Finale)

- Foreign Taxation (recently added)

2.2 – What is income tax?

It is a tax levied by the Government of India on the income of every person. The provisions governing the Income-tax Law are given in the Income-tax Act, 1961. In simpler words, Income Tax is a portion of the money that you earn paid to the government of India.

Why should I pay tax?

Yes, India does not offer social security and free medical facilities as being provided in some developed countries, but the government needs funds collected as taxes to discharge a number of responsibilities like Government hospitals, Education, National defense, Infrastructure development just to name a few.

Who is supposed to pay income tax?

Income-tax is to be paid by every person who earns more than the minimum income slab set by the government. The term ‘person’ as defined under the Income-tax Act covers in its ambit natural as well as artificial persons (including corporate).

Only 5 percent of over 130 crore population file income tax returns and only 1.5 crore Indians (<1%) pay any income tax. If you had to compare, over 45% of the population in a developed economy like the U.S.A pay taxes. Part of the reason for such an abysmally low number is also because many Indians don’t earn enough to qualify to pay income tax, but the larger factor has got to do with a lack of tax culture.

Taxes have to be paid based on how much income you earn every financial year. The financial year in India starts from April 1st and ends on 31st March. Do note that year can be specified either as a financial year (FY) or assessment Year (AY).

FY is used to denote the actual year the income was earned for which you are filing taxes. So, FY 2024/25 is the financial year starting April 1st, 2024, and ending 31st March 2025.

AY is used to denote the year in which you are supposed to file your taxes. So, AY 2025/26 is the year when you file the returns for income earned in FY 2024/25. So, AY 2025/26 and FY 2024/25 are one and the same. So, you will use ITR with AY 2025/26 on it to file your taxes for the income earned in the financial year starting April 1st, 2024, and ending 31st March 2025.

2.3 – Income tax slabs in India for financial year 2024/25

All Indians have to pay taxes on the total income earned every year as per the below tax slabs they belong to. You can choose to pay taxes based on the old or new regime.

Let’s first look at the old regime. If you are salaried, your employer would already be paying taxes on your behalf to the government and issuing you a ‘Form 16’ as an acknowledgment for having paid the taxes. Your employer will not have access to all your sources of income, like bank interest, capital gains, rental income, and others. You are supposed to use the form 16, add all your other income, calculate and pay any additional tax, and file your income tax returns before due date every year.

The tax slab for individuals (FY 24/25) is as below –

Individual (age up to 60 years)

| Income slabs | Tax Rates |

|---|---|

| 0 – Rs 2.5lks | NIL |

| Rs 2.5lks – Rs 5lks | 5% of the amount by which income exceeds Rs 2.5lks. |

| Rs 5lks – Rs 10lks | Rs. 12,500 + 20% of the amount by which income exceeds Rs 5lks |

| 10lks and above | Rs. 112,500 + 30% of the amount by which income exceeds Rs 10lks |

Senior citizen (age 60 to 80 years)

| Income slabs | Tax Rates |

|---|---|

| 0 – Rs 3lks | NIL |

| Rs 3lks – Rs 5lks | 5% of amount by which income exceeds Rs 3lks. |

| Rs 5lks – Rs 10lks | Rs. 10,000 + 20% of the amount by which income exceeds Rs 5lks |

| 10lks and above | Rs. 110,000 + 30% of the amount by which income exceeds Rs 10lks |

Super senior citizen (age 80 years and above)

| Income slabs | Tax Rates |

|---|---|

| 0 – Rs 5 lks | NIL |

| Rs 5lks – Rs 10lks | 20% of the amount by which income exceeds Rs 5lks |

| 10lks and above | Rs. 100,000 + 30% of the amount by which income exceeds Rs 10lks |

A standard deduction of Rs. 50,000 is allowed in the computation of taxes. So, your actual taxable income is 50,000 less than your total income.

If total taxable income between Rs 2.5 to Rs 5lks, you can claim for the 5% tax rebate up to Rs 12500/- and effectively paying zero tax.

Surcharge for all the above age groups: 10% of income tax if income between Rs 50lks to Rs 1 crore. 15% if income between Rs 1 Crore to Rs 2 crores. 25% if income between Rs 2 crores to Rs 5 crores. 37% if it exceeds Rs 5 crores.

Surcharge of 25% and 37% is applicable on all incomes except Capital Gains and Dividend. Maximum surcharge on capital gains and dividend income is 15%.

Budget 2020 has introduced a new tax regime where the taxpayer has an option to decide either to pay taxes as per the above slabs claiming the various deductions (eg. Investment in ELSS, House rent allowance, etc) or let go of all deductions except few deductions like 80CCD (2) and opt-in for the below tax slabs. The highest surcharge rate of 37% on income above 5 Crores has been reduced to 25%.

| Income slabs | Tax Rates |

|---|---|

| 0 – Rs 2.5lks | NIL |

| Rs 2.5lks – Rs 5lks | 5% of the amount by which income exceeds Rs 2.5lks. |

| Rs 5lks – Rs 7.5lks | Rs. 12,500 + 10% of the amount by which income exceeds Rs 5lks |

| Rs 7.5lks – Rs 10lks | Rs. 37,500 + 15% of the amount by which income exceeds Rs 7.5lks |

| Rs 10lks- Rs 12.5lks | Rs. 75,000 + 20% of the amount by which income exceeds Rs 10lks |

| Rs 12.5lks- Rs 15lks | Rs. 1,25,000 + 25% of the amount by which income exceeds Rs 12.5lks |

| Above 15lks | Rs. 187,500 + 30% of the amount by which income exceeds Rs 15lks |

In Budget 2023, the tax structure under the new regime was revised and is as follows:

| Income slabs | Tax Rates |

|---|---|

| 0-Rs3.0lks | NIL |

| Rs 3.0lks – Rs 6Lks | 5% of the amount by which income exceeds Rs 3.0lks. |

| Rs 9.0lks – Rs 9Lks | Rs. 15,000 + 10% of the amount by which income exceeds Rs 6lks |

| Rs 9.0lks – Rs 12lks | Rs. 45,000 + 15% of the amount by which income exceeds Rs 9lks |

| Rs 12.0lks – Rs 15lks | Rs. 90,000 + 20% of the amount by which income exceeds Rs 12lks |

| Above 15lks | Rs. 150,000 + 30% of the amount by which income exceeds Rs 15lks |

Further, In Budget 2024, the tax structure under the new regime was revised and is as follows:

| Income slabs | Tax Rates |

|---|---|

| 0-Rs3.0lks | NIL |

| Rs 3.0lks – Rs 7Lks | 5% of the amount by which income exceeds Rs 3.0lks. |

| Rs 7.0lks – Rs 10Lks | Rs. 20,000 + 10% of the amount by which income exceeds Rs 7lks |

| Rs 10.0lks – Rs 12lks | Rs. 50,000 + 15% of the amount by which income exceeds Rs 10lks |

| Rs 12.0lks – Rs 15lks | Rs. 80,000 + 20% of the amount by which income exceeds Rs 12lks |

| Above 15lks | Rs. 140,000 + 30% of the amount by which income exceeds Rs 15lks |

A standard deduction of Rs. 75,000 is allowed in the computation of taxes. So, your actual taxable income is 75,000 less than your total income.

A rebate of Rs 25,000 is available if the taxable income is less than Rs 7 Lacs under the new regime, and it is available only to an individual who is a resident in India. Non-residents cannot claim the rebate.

The surcharge is the same as above.

Health and Education cess at 4% has to be computed on income tax plus surcharge, if applicable.

There is also a concept of marginal relief is designed to provide relaxation from levy of surcharge to a taxpayer where the total income exceeds marginally above Rs. 50 lakh, Rs. 1 crore, Rs. 2 crore and Rs. 5 crore.

Thus, while computing the surcharge, if you have a total income of more than Rs. 50 lakh marginal relief shall be available in such a manner that the net amount payable as income tax and surcharge shall not exceed the total amount payable as income tax on total income of Rs. 50 lakh by more than the amount of income that exceeds Rs. 50 lakh. Sounded like a Bumrah bouncer!! Eh?

Let me explain: Dravid has a total income of Rs.51 Lakhs in an FY 2023-24, he will have to pay taxes inclusive of a surcharge of 10% on the tax computed i.e., total tax payable will be Rs. 14,76,750. But, if he had only earned Rs.50 lakhs, then the tax liability would have been Rs.13,12,500 only.

Isn’t it unfair for Dravid? For earning an extra Rs 1 Lacs, he will end up paying income tax of Rs.1,64,250. Dravid’s tax liability should be reduced to avoid any such excess tax payable.

The individual will get a marginal relief of the difference amount between the excess tax payable on higher income i.e. (Rs.14,76,750 minus Rs.13,12,500 = Rs.1,64,250) and the amount of income that exceeds Rs. 50 Lakhs i.e. (Rs.51,00,000 minus Rs.50,00,000 = Rs.1,00,000). The marginal relief will be Rs.64,250 (Rs.1,64,250 minus Rs.1,00,000). The wall saved Rs. 64,250 because of marginal relief.

From the next chapter, we will start focusing in detail on all aspects of taxation when trading and investing in the markets.

Key takeaways from this chapter

- Filing correct Income tax return is the duty of every Indian

- The Income-tax department has access to your market activity

- Only 5% of Indians file Income tax returns, and ~1% pay any income tax.

- Financial year (FY) is the year when income was earned, Assessment year (AY) is the year you file your taxes on the income earned

- The financial year is between the 1st of April of the current year and the 31st of March of the following year

- The income tax applicable to you depends on the income tax slab you belong to

- The income tax slabs vary based on your age group

Disclaimer – Do consult a Chartered Accountant (CA) before filing your returns. The content above is for your general knowledge only. Content meant for Individual retail investors/traders in India.

i think its time to update the income tax slab to financial year 2025/2026

Please correct the grammatical and semantic mistakes, in the content. Sometimes, it makes things difficult to understand

Noted, Gautam.

If total taxable income between Rs 2.5 to Rs 5lks, you can claim for the 5% tax rebate up to Rs 12500/- and effectively paying zero tax.???

What does it mean?

For 15lks and above, income tax that has to be paid is 187500+30% of amount exceeding 15lks

Can you pls help me understand what is 187500. How did that number come out

Sir, dont take it in wrong way, i just want to tell that is all the percentage of tax or the above data is up to date ??

Most of it is. Check this – https://x.com/ZerodhaVarsity/status/1814553385716359213?t=vzNG8CVg3PfeeeTdhpukpQ&s=19

Time to update slab.

can someone explain this line : \”If total income between Rs 2.5 to Rs 5lks, you can claim for the 5% tax rebate and effectively paying zero tax.\”

how do they claim for rebate? because of what reason?

Hi Sir,

Can you please update the relevant section of chapters with updated Tax deduction and applicable law. So, the content is update as per latest regulation and data.

So, user like me who have recent enter in trading field will be able to relate it.

Regards,

Chandan Pandey

It is good to update the data as per the recent FY.

Karthik Sir , As the income is between 2.5 lkhs- 5 lkhs , then we can claim 5% rebate . is this same is the all other tax slab . Please Sir , it would be very grateful of you if you guide us properly an in detail ?

Now we are in 2023, I think information needs to be updated

Hi Suresh,

Both Individual(Non-Company) taxpayers and Companies; Advance Tax needs to be paid by 15th June, 15th Sep, 15th Dec and 15th March.

Good afternoon.

I am a little confused about the advance tax system.

Do only companies have to pay June 15, Sept 15, December 15 and March 15

While individuals pay Sept 15, December 15 and March 15?

I am currently a business owner and I also have trading/investment income as well. While my relative is employed at my company and he also has his own trading/investment income as well.

So how should one go about it?

Hi I had appeared for the Varsity Certified test and secured 77 but still haven\’t received the certificate. I got the score card is this only the certificate or we will get more. Please shed light.

Can you please create a ticket for this?

well presented. looking for updated blog for ay 2023-24

well presented

Hi Namratha,

I’m having salary of 16 Lacs. Which will be best option to choose? – That depends on the exemptions and deductions you are having. Please try this – https://tools.quicko.com/income-tax-calculator/

What all deductions one can claim under new regime?? Following are deductions are allowable in New Personal Tax Regime :

a) Standard Deduction of Rs. 50,000 u/s 16(ia) to salaried individuals & pensioners [w.e.f AY 2024-25].

b) Deduction in respect of family pension u/s 57(iia), upto Rs. 15,000 [w.e.f AY 2024-25].

c) Deduction in respect of contribution to Agniveer Corpus Fund under the newly inserted section 80CCH (2) [w.e.f AY 2024-25].

d) Deduction in respect of Employer’s Contribution to National Pension Scheme (NPS) u/s 80CCD (2) to the extent of 10% of basic salary and dearness allowance in case of private sector employee & 14% in case of government employee.

e) Transport allowance u/s 10(14) in case of a specially-abled person.

f) Conveyance allowance u/s 10(14) received to meet the conveyance expenditure incurred as part of the employment.

g) Exemption on Voluntary Retirement 10(10C), Gratuity u/s 10(10) and Leave encashment u/s 10(10AA), if any

h) Interest on Home Loan on let-out property (Section 24)

Hi,

I\’m having salary of 16 Lacs. Which will be best option to choose. What all deductions one can claim under new regime??

Hi Namratha,

Can you please share the changes announced in recent Budget for Individual Persons? – Following are the changes

1] The basic exemption limit under new regime is increased to 3 Lacs and slab rates are modified to

a) Upto 3 Lacs – Tax rate is NIL

b) 3,00,001 to Rs 6,00,000 – Tax rate is 5%

c) 6,00,001 to Rs 9,00,000 – Tax rate is 10%

d) 9,00,001 to Rs 12,00,000 – Tax rate is 15%

e) 12,00,001 to Rs 15,00,000 – Tax rate is 20%

f) Above 15 Lacs – Tax rate is 30%

2] Resident individuals with total income up to Rs 5,00,000 are eligible for rebate under section 87A for A.Y.2023-24. The same threshold limit for total income under the new regime (default regime) is increased to Rs 7,00,000 w.e.f. A.Y.2024- 25 for availing rebate under section 87A. The maximum rebate under section 87A in the said regime would be Rs 25,000.

3] The benefit of standard deduction which was available only in old regime is now extended to salaried individual in new regime also.

Hi ,

Can you please share the changes announced in recent Budget for Individual Persons?

Zerodha Varsity is a great initiative by the founders. Thank you for the knowledge you share here. It is very helpful for the aspiring traders like me. But please update this \”Markets & Taxation\” module every year.

Happy learning!

Please update this page acc. to Budget 2023.

Ok.

Sir,l want to know that we have to pay any tax on the money we have in demat ac before converting them in bank.

No, but you will have to pay capital gain taxes on the profits you make from markets. Please do talk to your CA once.

Is the income considered above is a monthly or annual income?

Annual income.

It\’s very useful to the job seekers

Sir, please provide also accounting & Gst system

Ah, outside our skillset. But making a note of this.

Very easy to understand.Thank you for such well written articles.

Happy learning, Ujjal!

After reading the tax rates descriptions in your content, it was the first time I clearly understood how tax deductions work. Until now it looked very complicated but was actually quite straightforward.

Also liked your way of representing the two income tax regimes.

I will now recommend your varsity content to all my friends having the same questions

Kudos to your team.

Great Topic….

But, when we download the complete Chapter of Markets and Taxation, the older version of THIS Basic Section, upto 2015 is seen…

And not till 2020…

😔🙏😔🙏

Nicely written topic (y)

Happy reading!

Hi Vinay,

Sir one more thing you mentioned there is a surcharge on dividend income as well . I am aware of the LTCG , STCG but I was under the impression that dividends are tax free , because my strategy was to sell a covered call and a short put ( basically straddling a short put and short call on either side of the stock price ) this way I can reduce my cost basis and buy a second lot when I had enough money and basically start a compounding cycle where my profits goes right back into buying a lot . I would never sell my shares and just earn money from the dividends . But now I find out even dividends are taxable.

Yes, Dividends are taxable now.

Just to give you a perspective – Dividends received upto 31st March 2017 were exempt in the hands of the shareholder. [Section 10(34)]

Post Finance Act 2016 – Tax @ 10% was applicable for dividends received exceeding Rs 10 Lacs. Eg : If you receive Dividend of Rs 11 Lacs – Upto 10 Lacs was exempt and Rs 1 Lacs dividend was taxed at 10%. [Section 115BBDA]

With effect from 1st April 2020 – Section 115BBDA of Income Tax was abolished and Dividend incomes are taxable as per the applicable slab rates.

Okay sir now I understand . Whatever the tax you are paying , on that tax 10 20 or 30% surcharge will be applied depending on your tax slab .

Thank you for that explanation .

Sir one more thing you mentioned there is a surcharge on dividend income as well . I am aware of the LTCG , STCG but I was under the impression that dividends are tax free , because my strategy was to sell a covered call and a short put ( basically straddling a short put and short call on either side of the stock price ) this way I can reduce my cost basis and buy a second lot when I had enough money and basically start a compounding cycle where my profits goes right back into buying a lot . I would never sell my shares and just earn money from the dividends . But now I find out even dividends are taxable

Hi Vinay,

My question is does the percent gets added normally (for eg 50 lkhs to 1 Cr -what will I be paying as taxes 187500 +30% +10%) or is it 10%on the 30% above 15 lakh(for eg 187500 +30% +10%0f30% above 15 lkhs(33%)) . Please clarify sir because if the percent gets added normally someone who earns above 5 Cr will be paying 67% on whatever he is earning up and above 15 lkhs.

Surcharge is calculated on tax.

Eg: If your taxable income is 60Lacs – you will fall under 10% surcharge category.

Tax applicable on Rs 60 Lacs is Rs 16,12,500/-.(as per slab rates)

Surcharge of 10% is applied on Rs 16,12,500/- which works out to Rs 1,61,250/-

Also, please note the maximum surcharge applicable on Capital Gains and Dividend Income is 15%.

Hello sir

you mentioned : Surcharge for all the above age groups: 10% of income tax if income between Rs 50lks to Rs 1 crore. 15% if income between Rs 1 Crore to Rs 2 crores. 25% if income between Rs 2 crores to Rs 5 crores. 37% if it exceeds Rs 5 crores. so what happens as per the new budget regime of 2020 where i don\’t go for the deductions and i go for this slab (Above 15lks Rs. 187,500 + 30% of the amount by which income exceeds Rs 15lks) .my question is does the percent gets added normally (for eg 50lkhs to 1 cr -what will i be paying as taxes 187500 +30% +10%) or is it 10%on the 30% above 15 lakh(for eg 187500 +30% +10%0f30% above 15 lkhs(33%)) . please clarify sir because if the percent gets added normally someone who earns above 5 cr will be paying 67% on whatever he is earning up and above 15 lkhs .

Hi Rohan,

I am confused as to how do I treat my Tax Liability for my investing and trading activities and more importantly can I claim expenses like (Brokerage, DP charges, Turnover Charge) or deduction of those expenses – Yes, with regards to capital gains – you can claim all the expenses attributable to sale except STT. You can claim STT if you are treating as Business Income.

How should I define my income from investing and trading activities – will it be Capital Gains or Business Income – Since you are trading from last 5 years; you can treat is as Business Income. However – please refer these circulars…

https://www.incometaxindia.gov.in/communications/circular/910110000000000316.htm

https://www.incometaxindia.gov.in/communications/circular/circular-no-6.pdf

Hi, I have a family business which is a registered partnership. It is my primary business and primary source of Income but I am a full time stock trader and investor. I have been trading and investing in stocks very regularly since the past few years. Especially in the last 5 years my trading and investing activity has increased multifold. I have made a profit in Intraday and Delivery basis (equity only). Investing and trading is done from my individual trading account registered under my Individual PAN. I am confused as to how do I treat my Tax Liability for my investing and trading activities and more importantly can I claim expenses like (Brokerage, DP charges, Turnover Charge) or deduction of those expenses. How should I define my income from investing and trading activities – will it be Capital Gains or Business Income. My accountant said that I cannot claim expenses like brokerage and other charges on an Individual PAN as they are not business expenses.

Thanks

Hi Malom Saring,

Should I pay income tax on capital gain as well? – Yes, you need to pay tax on capital gains.

15% on Short Term Capital Gains on Equity Shares and Equity Oriented Mutual Funds

10% on Long Term Capital Gains on Equity Shares exceeding Rs 1 Lacs.

Should I pay income tax on capital gain as well???? ….

Thanks Sandeep.

Hi Satish,

Surcharge is tax(additional) on tax.

It get applicable when your taxable income crosses 50Lacs.

Hi karthik, What is the surcharge that you mentioned on income tax?

HI Arya,

There is no special TAX RATE discount for a defense person as such.

Is there any special tax discount for a defense person?

Is there any difference tax rule between a Defence person and civilian?

Great,Thanks a lot for the detailed explanation . I Have a doubt you mentioned that if you purchase a stock and sell it prior to one year it will be subject to STCG if it’s not actively traded.Can u please define how do you define active trading so that it comes under non speculative income .

Thing is there is no definition from IT for active trading. You, along with your CA will have to justify this 🙂

Thanks a lot for the detailed explanation . I Have a doubt you mentioned that if you purchase a stock and sell it prior to one year it will be subject to STCG if it\’s not actively traded.Can u please define how do you define active trading so that it comes under non speculative income .

Chapter 2.3 will be more clear if we say that income tax for a particular year is determined by the Govt. of India through Finance Act published in gazette as \” Finance Act……………\” ( year- say 2020, an Act to give effect to the financial proposals of the Central Government for the financial year 2020-2021). This act is available at the link : https://www.incometaxindia.gov.in/Documents/News/Finance-Act-2020.pdf

I made total F & O transactions Rs 2 coror facing 3 lakh loss

In such situations it is essential / must to do Auit

How can I carry forward this loss . means suggest me step to carry forward loss

I am a salaries income person and filling the TDS return each year in time. But it is a matter of regrate that I have making losses in stock market year after year, but never shown my losses even in a single year while filling the TDS return. Can I revised the return now? If yes then how many year I can revised my TDS now. Where I should consult for revision of TDS return since there is no CA in my nereby place to consult.

i m sorry its not changed

the slabs have changed now i guess please do update it

sir

if i have filed itr return on 31 aug (within time) ,and still it is not processed ,then is it an issue ?

Sir if I get profit from forex trading what kind of tax I have to pay to Indian govt

Please check this – https://zerodha.com/varsity/chapter/moneyness-of-an-option-contract/

sir

i am holding TATASTEEL since 10 months its divident Ex date was on 4-july-19 but still i didn\’t recieved any divident till now , support is giving vague responses ,kindly clearify…

The dividend payment date is 23rd July 2019. You can refer it on the investor information page on the company\’s website.

Hello sir, I am about to file my income tax. Regarding stocks CA is asking details like name of company, date of purchase, purchase price, date of sale, sale price, transfer expenses, security transaction tax paid in a single document, chronological order.

I have given documents

1. Trade book 2. Tax P & L 3. P & L 4.Ledger 5. Annual global statement 6. holding till 31 march 19.

But he is not convinced. He had asked me to search / inquire more. Where can I get the information. I have raised many tickets in zerodha support regarding this.

One more thing, actually which documents need to given to CA regarding stocks. I am very confused. Please suggest. Thanks.

If i deposit or withdraw money between my bank and zerodha account, will this transaction be reported to income tax department ?

No, unless there is an official inquiry from the IT department itself.

Hi,

Can you please update the document for the LTCG tax which is set @ 10% for profits above Rs 100,000 with proper illustration for better understanding.

Also what i found is the different levels at which a person is taxed is not included in the doc.Also categorizing the different options available like PPF, tax saver FD, equity returns based on the respective tax category like EEE, EET etc.

Thanks

Sir

I am doing a trading in the basis of t+2 basis and when it\’s my only income as I am just a post graduate. How can I identify whether I am liable to pay tax or not… Please help me

Hi Nithin/Karthik,

Now that we have the tax filing deadline I had few questions/doubts after going through multiple sources of information (including varsity).

I am a private salaried individual and I come under 30% slab. But since the last almost three years I have been trading in Options with zerodha. And net-net for this financial year individually and the previous financial years individually I have been on a loss 7 lac + cumulatively summed up 🙁

Now my questions here are as follows:

-> As I am making a loss on Derivatives which is less than 8% of the turnover, do I need an audit from CA for this FY?

-> And I have never filed losses from the previous years as well (my bad). Now I want to file the losses from the previous financial years as well so that I can use it as set-off against any profit in the future for the coming 8 years. Can I do that?

-> Another question which is a bit different from the above ones is that when I was going through q.zerodha.com -> Tax P&L report, I saw that on the page (script wise) it is showing me a turnover of around 20lacs and the respective loss in the F&O segment which is correct. But when I downloaded the excel report (tradewise), it does show me the trades but it shows the summed up turnover as zero “0”. Any thoughts on that as its puzzling me a bit?

Many thanks in advance for looking into my queries 🙂

Thanks,

Jay.

The downloadable PDFs are not updated to the content here sir

We will try and do this in the coming week. Thanks for pointing this.

In the above tax slabs you wrote…

Rs 5lks – Rs 10lks Rs. 25,000 + 20% of the amount by which income exceeds Rs 5lks

10lks and above Rs. 125,000 + 30% of the amount by which income exceeds Rs 10lks

So that means ……

scenario 1……….

if I have income of 6 lakhs then tax amount for income above 5 lakhs i.e 1 lakh will be 25K+20K i.e total 45k tax on 1lakh.

And

scenario 2……….

if I have income of 11 lakhs then tax amount for income above 5 lakhs and below upto 10 lakh i.e 5 lakh will be 25K+1lakh i.e total tax 1.25 lakhs and tax on remaining income above 10 lakhs i.e 1 lakh will be 1.25K+30k i.e total tax 1.55k ….

so the total tax on the income above 5 lakh which in this case/scenario is 6 lakh will be 1.25K + 1.55K = 2Lakh 80K

That means I am giving almost 50% of my profit in taxes. OMGGGGGGGG

Please correct me if I am wrong.

I think you need to change the tax rate as per the budget 2017

grt job Nithin..

suppose i buy stocks worth Rs 100000 is this money exempted from tax deduction??

No, it doesn\’t work like tax saving instruments. If you buy stocks worth 1lk and then sell it for 1.5lk after 1 year, you have to pay no tax on the Rs 50k gain.

I am a west Bengal government employee. I am also doing intraday trading. How can I calculate my tax?

Suman, go through the entire module on taxation. It explains how to.

Great Track…It just helping us a lot about taxation…

Tax slabs are different for women, correct me if i am wrong.

Whether the previous FY\’s unknowingly left out other ncome shall be taken for consideration in the present FY?

Sir

Simple to understand.thank u

very thoughtful, well researched and informative acticle.

kudos to you nithin!!!

thanks a million

It\’s really a great topic and very helpful and need full for every traders n investors n all, Thnq 🙂