6.1 – Turnover & Tax Audit

In the previous chapter, we discussed briefly on tax audit, and when it is required if you are declaring trading as a business income. To determine if an audit is required or not, we need to first determine the turnover of your trading business.

Reiterating – the requirement of calculating turnover arises only when treating trading P&L as a business income (An audit is not required if you only have capital gains income irrespective of the turnover). Turnover is only to determine if a tax audit is required or not. Your tax liability does not get affected by your turnover.

An audit is required if –

- Rs 10 Crores mark – Turnover for the year crosses the Rs 10 crores. Note that the Rs.10 Crore limit is applicable to the financial year 2023 – 2025. This is in the case of digital transactions, and stock market trading is 100% digital.

- Section 44AD – if you are opting out of Section 44AD (Presumptive Taxation) in the current year and FNO Income is less than 6% of the turnover and overall income is more than the basic exemption limit.

I am sure the first thing that came to your mind after reading turnover is contract turnover, i.e

- Nifty is at 8000, you buy 100 Nifty

- Buy-side value = 8000 * 100 = Rs.800,000/-

- Nifty goes to 8100, you square off the 100 Nifty

- Sell-side value = 8100 * 100 = Rs,810,000/-

- Turnover = Buy-side value + Sell-side value = 800,000 + 810,000 = 1,610,000/-

But it is not the contract turnover the IT department is interested in; they are interested in your business turnover.

Read below on how business turnover can be calculated –

The method of calculating turnover is a debatable issue and what makes it a grey area is that there is no guideline as such from the IT department. One article of great help, though, is the guidance note on tax audit under Section 44AB by ICAI (Institute of Chartered Accountants of India, the governing body for CA’s). The article on Page 15, Section 5.10 of this guidance note has a guideline on how turnover can be calculated. It says:

- Delivery based transactions

For all delivery based transactions, where you buy stocks and hold it more than 1 day and sell them, the total value of the sales is to be considered as turnover. So if you bought 100 Reliance shares at Rs 800 and sold them at Rs 820, the selling value of Rs 82000 (820 x 100) can be considered as turnover.

But remember that the above calculation of turnover for delivery trades is only applicable if you are declaring equity delivery based trades also as a business income. If you are declaring them as capital gains or investments, there is no need to calculate turnover on such transactions. Also, there is no need for an audit if you have only capital gains irrespective of turnover or profitability.

- Speculative transactions (intraday equity trading)

For all speculative transactions, the aggregate or absolute sum of both positive and negative differences from trades is to be considered as a turnover. So if you buy 100 shares of Reliance at 800 in the morning and sell at 820 by afternoon, you make a profit or positive difference of Rs 2000, this Rs.2000 can be considered as turnover for this trade.

- Non-speculative transactions (Futures and options)

For all non-speculative transactions, the article says that turnover to be determined as follows –

- The total of favourable and unfavourable differences shall be taken as turnover

- Premium received on sale of options is also to be included in turnover. However, where the premium received is included for determining net profit for transactions, the same should not be separately included.

- With respect to any reverse trades entered, the difference thereon should also form part of the turnover.

- In case of an open position as at the end of the financial year (i.e., trades that are not squared off during the same financial year), the turnover arising from the said transaction should be considered in the financial year when the transaction has been actually squared off.

- In the case of delivery-based settlement in a derivatives transaction, the difference between the trade price and the settlement price shall be considered turnover.

So if you buy 25 units or 1 lot of Nifty futures at 24,000 and sell at 23,900, Rs.2500 (25 x 100) the negative difference or loss on the trade is the turnover.

In options, if you buy 100 or 4 lots of Nifty 26,000 calls at Rs.1,000 and sell at Rs.1,010. Firstly, the favourable difference or profit of Rs 1000 (10 x 100) is the turnover. So, the total turnover on this option trade = Rs 1000.

The above calculations (points 1 to 3) are fairly straightforward; the next important thing to decide though is if you want to calculate turnover scrip-wise or trade-wise.

Scrip-wise is when you calculate the turnover by collating all trades on the particular contract/scrip for the financial year, find average buy/sell value, and then determine the turnover using the above 3 rules with the total profit/loss or favourable/unfavourable difference on this average price.

Trade-wise is when you calculate the turnover by summing up the absolute value of profit and loss of every trade done during the year and following the above rules.

Let me explain both with some examples –

- 100 Nifty Oct future bought at 26,000 and sold at 26,100 on 1st Oct. Another 100 Nifty Oct future bought at 26,100 and sold at 26,050 on 10th Oct. Determine turnover

Using scrip wise:

Average Nifty Jan Fut buy: 200 Nifty Buy at 26,050

Average Nifty Jan Fut sell: 200 Nifty Sell at 26,075

Total profit/loss = 200 x Rs 25 = Profit of Rs 5,000 = Turnover of Nifty Jan Futures

Using trade wise:

100 Nifty Buy at 26,000, Sell at 26,100, Profit = Rs 10,000

100 Nifty Buy at 26,100, Sell at 26,050, Loss = Rs 5000

Turnover of Nifty Oct futures = Rs 10,000 + Rs 5000 (absolute sum of the loss) = Rs 15000

- 100 Nifty Dec 26,000 puts bought at 1000 and sold at 950 on Dec 3rd. Another 100 Nifty Dec 26,000 puts bought at 500 and sold at 480. Determine turnover

Using scrip wise:

Average of Nifty Dec 26,000 puts buy: 200 puts at 750

Average of Nifty Dec 26,000 puts sell: 200 puts at 715

Total profit/loss = 200 x Rs 35 = Loss of Rs 7,000

Total Turnover for Dec 26,000 puts = Rs 7,000

Using trade wise:

Trade 1

100 Nifty Dec puts bought at 1,000 and sold at 950, Loss = Rs 5,000

Turnover = Rs 5,000

Trade 2

100 Nifty Dec puts bought at 500 and sold at 480, Loss = Rs 2,000

Turnover = Rs 2,000

Total turnover = turnover of (trade 1+trade2) = Rs 7,000

Which of the methods scrip wise or trade wise should I follow?

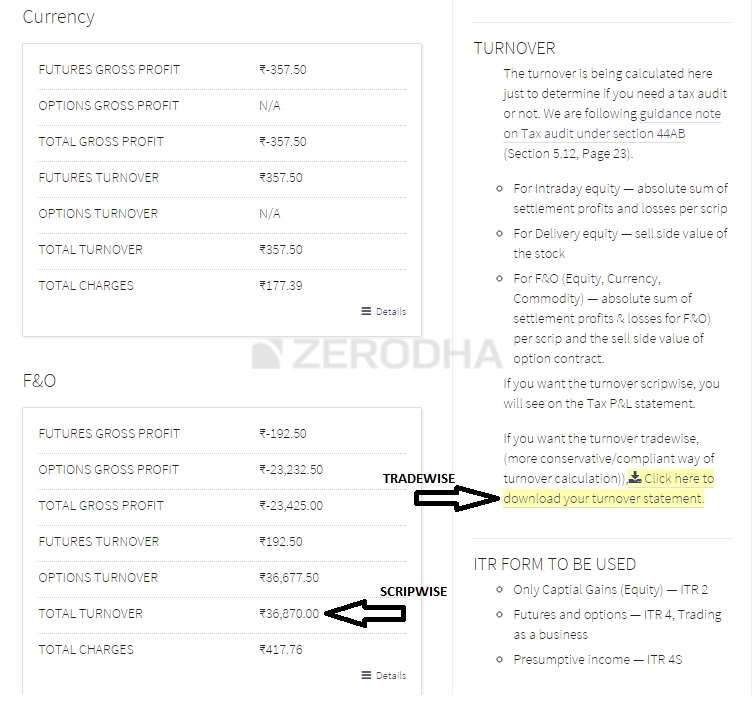

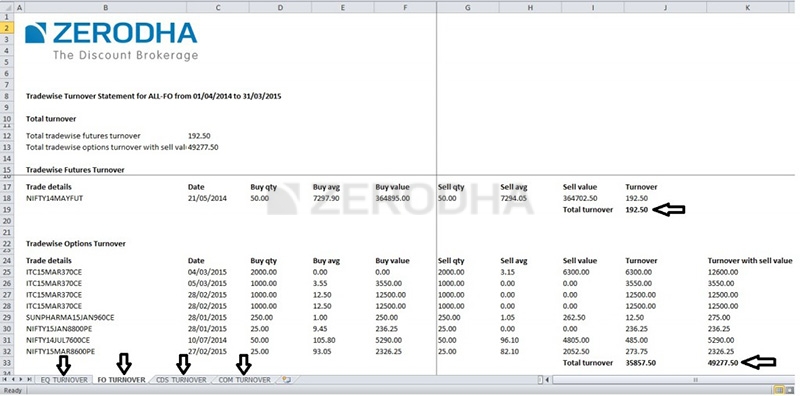

Calculating turnover trade wise is the most compliant way of determining turnover. The tricky bit calculating trade wise turnover though is that no broker (other than us at Zerodha) currently offers trade wise turnover reports. All brokers provide a P&L with an average buy/sell price, which can be used to calculate scrip wise turnover. If you are not trading at Zerodha and are looking at calculating turnover trades, you will have to download all trades done during the year on an excel sheet and calculate turnover manually.

Here are the scrip wise and trade wise turnover reports on Console

Once you determine the turnover, you will know if you need an audit or not, that is if a visit to a CA and have him verify your balance sheet and P&L statements is compulsory or not.

6.2 – Section 44AD

An audit is also required as discussed above if your profit is less than 6% of the turnover and overall income is more than the basic exemption limit and you have opted out of presumptive taxations scheme. By turnover, I am referring to all business turnover (speculative, non-speculative, and any other business you have), and by profit, I am referring to only your net business profits (not including, salary, capital gains, and others). This means that if you are trading as a business and incur a loss, you will most likely have to get the books audited.

But an important thing to remember is that if your turnover is less than Rs 10 crore and if your profit is less than 6% of turnover an audit is not required if your total tax liability for the year is zero. That means if your total income (Salary + Business income + capital gain) is less than Rs 2.5lks (minimum tax slab in the old regime or Rs. 3lks in the new regime), you have no tax liability, and hence audit is not required. But it is advisable if losses are substantial to file the return with an audit.

Applying section 44AD for trading as a business income is causing a huge inconvenience for the retail trading community. Turnover in an ordinary business to turnover while trading on the markets is hugely different. Unlike an ordinary business where there is a fixed margin every time there is a transaction, in the business of trading there is no such guarantee. This section is an unnecessary burden that indirectly gets most small retail traders to have their books audited. We at Zerodha have petitioned to the government through this campaign on Change.org, make sure to support it and also get your trading friends to do the same.

When you show trading as a business income, you will have to file using ITR3, which would mean that like any other business you are required to create and maintain –

- Balance Sheet

- P&L statement

- Books of Accounts

As discussed above, these will need to be audited based on your turnover (either turnover crosses the 10 Crore mark or in case the turnover is less than 10 Crore and your profits are less than 6% of the total turnover). Creating a balance sheet, P&L, and maintaining books of account is quite simple for individuals with just trading as a business income, it is explained below in brief.

6.3 – Balance sheet, P&L, Book of accounts

Balance sheet

A personal balance sheet provides an overall snapshot of your wealth at a specific period in time. It is a summary of your assets (what you own), your liabilities (what you owe), and your net worth (assets minus liabilities).

Creating a personal balance sheet is fairly simple first pull together all of this information:

- Your latest bank statements

- Loan statement,

- House loan statement

- Personal loan statements

- Principal balance of any outstanding loans

- Demat holding statement

Once you have all of that information available, start developing your balance sheet by listing all of your assets (financial and tangible assets) with its respective values. Typical examples of the assets could be –

- Cash (in the bank, in hand, deposits with Bank)

- All investments (mutual funds, Shares, Debt investment )

- Property value ( Cost of Purchase + Duty any paid + Interiors etc)

- Automobile value ( Motor Car + Two-wheeler )

- Personal Property Value ( jewelry, household items, etc)

- Other assets ( Computers, Loans to friends, a plot of land, etc)

The sum of all of those values is the total value of your assets.

Next, you can look at your liabilities, which should be everything you owe. Here are some common liability categories:

- Remaining mortgage balance (Loan Statement)

- Car loans

- Student loans

- Any other personal loans

- Credit card balances

The sum of all of the money you owe is your liabilities.

The difference between your assets and your liabilities is your net worth.

That’s it; this is your balance sheet. Instead of creating one at the end of every financial year, it probably makes sense to update once every few months.

Profit & Loss statement

Profit and loss will summarize your revenue streams and your expenses for the financial year.

To create your P&L for the given Financial Year, you will have to list down all revenues and expenses.

Revenue –

- Realized sale value from your stock holdings (Capital gains)

- The Income from F&O, Intraday, or Commodity Trades. (Speculative and non-speculative business income)

Remember that you can’t add your salary income (if you are working elsewhere) into your revenue stream on the P&L.

Expenses –

- Salaries, if you have people helping you trade.

- Rent, if you are using an office or any space for the trading activity for which you are paying a rental income

- Brokerage charges, taxes, and all other trade-related expenses.

- Advisory fees, consultancy, depreciation of computer, and etc (read the expenses section in the chapter on taxation-traders)

Revenue minus the Expense equals profit.

A Balance sheet helps you understand your networth between two dates and the P&L will give you the reasons why your networth went up or down in that period. Maintaining financial discipline is the key to long term personal wealth creation. A personal balance sheet and P&L will ensure that you are constantly in touch with reality – your assets and liabilities.

Book of accounts/Book-keeping

Maintaining a book of accounts and Book-keeping seem like very complex tasks, and typical reactions I have seen from traders is to get scared of the word and try postponing the decision to learn more on the topic. Again for an individual with only trading as a business income and/or salary, it is super simple- you just need to maintain two books.

Bank book: Take an excel download of all your bank statements, and make a note next to every entry to identify the nature of the transaction. It is also best to keep a copy of all the bills in case of expenses.

Trading book: This should be automatically getting maintained for you by the broker where you trade. The broker should be able to give you a P&L statement including all expenses for the year, ledger statement, and an online repository of contract notes if required. Unlike what many people think, contract notes aren’t really required unless scrutiny by the IT department, and even then if only asked for the same.

As a person who has traded with over 10 online brokers in India, the ledger and P&L statements with all expenses on it will show up any hidden charges by the broker.

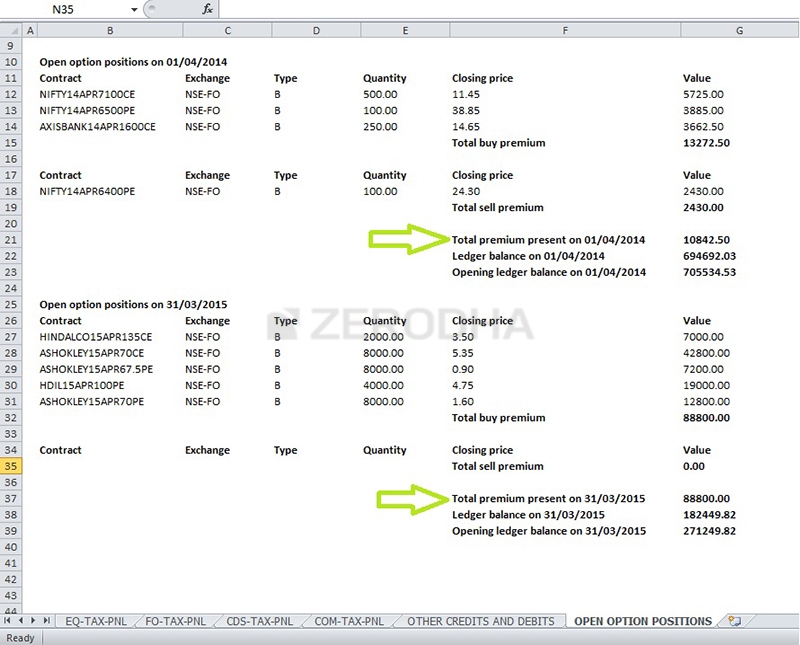

At Zerodha, we take great pride in the transparency we bring in as a business. Every charge other than brokerage is captured on the other credits/debits section on the tax P&L on Console. We also give you a summary with value of all your open option positions starting April 1st and closing March 31st. This is extremely useful when you are trying to tally your ledger with your P&L statement.

We are almost done with the taxation module. The last chapter will have an explanation of what kind of ITR forms to use, and also an excel download of a sample ITR 4 form with all details as an easy reference.

Key takeaways from this chapter –

- Audit of the books is required if turnover is more than Rs 10 Crore mark

- Audit of the books is required if one is opting out of presumptive scheme and FNO Income is less than 6% of the turnover and overall income is more than the basic exemption limit.

- Turnover does not take into consideration the regular contract turnover

- Turnover refers to the business turnover

- Business turnover (for trading as a business) can be calculated scrip wise or trade wise

- Trade wise turnover is the most compliant way of declaring turnover.

- ITR3 requires you to have Balance Sheet and Profit and Loss statement along with books of account

- Balance sheet equation states that Net worth = Assets – Liabilities

- P&L statement details the revenues and expenses

- If trading as a business maintaining 2 books of accounts becomes mandatory – Bank Book and Trade book

- It is advisable to maintain and update the Balance Sheet, P&L, and books of accounts once in every quarter.

Disclaimer – Do consult a chartered accountant (CA) before filing your returns. The content above is in the context of taxation for retail individual investors/traders only.

Please correct the wording of ICAI guidance note in your article. As per your article the options turnover is premium received on sale of options is also to be included in turnover. However, where the premium received is included for determining net profit for transactions, the SAME should not be separately included.

The word \”same\” is replaced with \”then such net profit\”. The new wording is , premium received on sale of options is also to be included in turnover. However, where the premium received is included for determining net profit for transactions, then such net profit should not be separately included.

It means we have to consider the premium on sale of options in turnover. and if the transaction in profit, then does not take that profit in calcalutaion to avoid double counting.

So if you buy 100 qty @ 100 and then sold it @120/-. Then turnover would be Rs.12000/- and not 2000/-. we does not take the profit of Rs. 2000/- in turnover as its alreday part of sale premium. We onle take sale premium as part of turnover.

Hi Sir/Ma\’am,

In the Zerodha Tax P&L excel sheet, under the Equity tab

there are below options:

A. Realized Profit Breakdown-

Intraday/Speculative profit

Short Term profit

Long Term profit

B. Turnover Breakdown

C. Charges

D. Other Charges

For the tax filing, do I need to subtract Charges & Other Charges from Realized Profit and then pay the taxes or should I directly take the number from Realized profit breakdown and pay accordingly based on LTCG, STCG Intraday

Hello,

Suppose my turnover from FnO is ₹20,00,000. My net loss after the brokerage, stamp duty and other expenses from FnO is ₹ 6,00,000. In the profit and loss account, how should the turnover, expenses and profit be reported as there are no purchases? Is Audit mandatory in this case as my total income is more than basic exemption limit.

Note: I have no other business apart FnO. My salary income is approximately ₹ 12,00,000.

Have you opted for 44AD in last of the 5 years? if yes then only Audit is required otherwise no audit required.

in PL you have to show the revenue from the Sale of products 20L and in trading portion of PL you have to show:- \”Purchase Value from Futures and options and commodity\” after adding gross loss to the turnover.

I am 70 years old having account DR 2336 WITH YOU.

Please guide following,

i have pension, saving intrest STCG, DAY TRADING VERY LIMITED

So I am filing ITR 3. BUT I EXPECT LTCG IN LARGE AMOUNT.

LET ME KNOW, WHATtype of audit is required for LTCG?

ANY LIMIT?

REGARDS

No audit is required for LTCG in any case.

Hi – is this article an updated one ?

Yes, it is.

Hi,

I wanted to know that if I have a family office (LLP) through which we invest all our savings into mutual funds and stocks (Long Term) along with few swing trades which are identified as high potential (short term), do we adopt Capital gains as the taxation for these or business income?

We plan on starting to sell options using margin against collateral as well. How would things change in that case.

Help is much appreciated

For MF/Shares we need to check the frequency of the trade to determine the taxability. if you are not a frequent trader (may be through LLP) then there should be Capital gain or loss otherwise business gain/loss.

F & O trading always treats like a business.

In equity delivery based trades as a business,can I keep some stocks as investment?

Being a CA myself I can tell that the explanation givne here is very comprehensive and does not avoid the grey areas.

I am a full-time trader. Sometimes I have liquid cash and I park it in liquid funds. So can I show those Short-term Capital Gains as my business income rather than in capital gains since its a part of the trading business?

Dear Sir,

I am also trader, and faced many problems regarding turnover and Audit. In last i request you please make column in our zerodha account which will mention Audit required or not depending on transaction done in same account. So this will attract more trader to Zerodha to place all trades/transactions at one place and minimise burdon of taxation. YOu can connect any good CA firm to our account with minimum charges. And those have big transaction on Zerodha account, make free to them. This is attract all trader from all other broker to Zerodha.

–Regards

Vikas AVhad

Hi San ,

I am active swing trader so I want to show capital gain as business income , until now I was showing as capital gain but now want to change it as business

So exactly which documents I should prepare and what precautions should take to be safe from any issues from IT dept.

This article is 7 years old so please provide any update article with after new changes of IT .

When we declare investments in balance sheet, do we show the purchase value or the value as on 31st March? Are the rules separate for current and long term investments?

When long term investments become current investments, i.e., in the last year, how to report them?

I have pledged shares, SGBs, liquid bees and debt & equity mutual funds. Should the pledged investments be shown separately and the margin as on 31st March be shown as secured loan? Should the margi be shown as current or non current liabilitiy?

Dear Shri Nitin,

I do trading in future & Options. Is it necessary to include personal assets, liabilities, investments, bank balance etc.in balance sheet for Future & Options Business while filing ITR-3. If so then why?

Hello Sir

Mera ak client share market par completly depended h ; uska intraday trading to pnl me show kar kiya ; ab kuch share wo same day sales nahi kar paya to wo short term me convert ho gaya ;;

tho is case me kya short term ke total sales value and purchase value ; profit and loss ke sales value and purchase value me dikha sakte h kya ; ya use under head capital gain me hi show karna padega

F&O , CASE WHAT WE SHOULD TAKEN TURNOVER OR PROFIT OR LOSS

The intraday turnover scrip-wise (consolidated) and intraday turnover trade-wise significantly varies in P&L tax report for any quarter or an year. I would also raise the issue in support column. Which turnover should I take. The main page takes scrip-wise turnover which is less. Please do clarify.

Hi,

My overall income through interest and dividends and capital gains (STCG as well as LTCG) is about 10 lakhs.

My intraday turnover is around 5000 rupees (which happened by mistake) and my intraday profit was 1000 rs i.e 20%. DO I need an audit.

My doubt is not about turnover.I think you have explained clearly. The issue is regarding brokerage, commission and other charges on Intraday transactions which is not available in the Tax P&L Statement. Even last AY year I had the same difficulty. Please suggest the way to find out the charges for Intra day transactions. Please reply to my mailbox since getting this wage would be difficult. I am filing ITR3

Hi MG,

I have net profit of 4 lacs in STCG with multiple trades carried out in the financial year.

Total sell value is roughly 82 lacs throughout the financial year. Can I declare the income under business income in ITR 3? – Yes, You can do that; but you need to continue to declare the same as business income in the subsequent years as well.

Also can I show my income as 50% of the profit ie 2 lacs under sec 44AD and file it as business income in ITR 4? – If you declaring it as business income; you can apply 44AD and declare 50%.

Hi…

I have net profit of 4 lacs in STGC with multiple trades carried out in the financial year. Total sell value is roughly 82 lacs throughout the financial year.. Can I declare the income under business income in ITR 3?

Also can I show my income as 50% of the profit ie 2 lacs under sec 44AD and file it as business income in ITR 4?

Hi Santosh,

What is the percentage of taxation on income from options trading? Is it according to the slab rate? – Yes, Income from Options Trading is taxed as per slab rates.

What is the percentage of taxation on income from TRADING etf?Is it according to the slab rate? – Equity ETFs are charged at 10% in case of LTCG and 15% in case of STCG. Other ETFs are taxed as per slab rates irrespective of holding period.

What is the percentage of taxation on income from options trading?

Is it according to the slab rate?

AND

What is the percentage of taxation on income from TRADING etf?

Is it according to the slab rate?

Hi Pueeth,

Have decent unrealized LTCG. Can I gift shares to my wife and son in a way that they earn 5 Lacs Cap Gain tax and take benefit of rebate? – please note rebate is not available in respect of LTCG taxable @ 10% in excess of Rs 1 Lacs.

Hi,

Have decent unrealized LTCG. Can I gift shares to my wife and son in a way that they earn 5 Lacs Cap Gain tax and take benefit of rebate?

Thank you

Hi Nithin,

My querry is i have placed a intraday sell order below the 1rs of the upper circuit limit of the stock but it continued to limit in circuit till the end. The stock went for auction My question is whether we declare the losses in speculative income or STCG.

How to Show open positions of Futures as on 31-03-2023 in Balance sheet?

Thanks dear and God bless you

My total sell side value in short term trading is 35 lakh

And

Short term gain is 17000

As per clause if profit is less than 6 % of turnover (35 lakh)

Which is the case here

Do I have to get audit done

Thanks and regards

I have short selling positions as on 31st march

How do I depict it in my balance sheet as trader?

You can declare the open positions under Current Assets.

Hi Nithin

I have short selling positions as on 31st march

How do I depict it in my balance sheet as trader

HI Sanjay,

For example profit from Option selling 1Cr

Loss from option selling and buying 30 lakhs

Can this person opt 44AD?

Yes, you can opt for 44AD if the turnover of FNO transactions is less than the threshold limit of Rs 2 Cr (FY 2022-23)/ Rs 3 Cr (FY 2023-24)

Hi

For example profit from Option selling 1Cr

Loss from option selling and buying 30 laks

Can this person opt 44AD?

Hi Pankaj,

Can a government employee do f&o trading?

No Government servant shall speculate in any stock, share or other investment: Provided that nothing in this sub-rule shall apply to occasional investments made through stockbrokers or other persons duly authorized and licensed or who have obtained a certificate of registration under the relevant law.

More in the link..https://support.zerodha.com/category/trading-and-markets/trading-faqs/articles/can-government-servants-trade-in-stock-markets

Can a government employee do f&o trading

First i would like to thank you for clering the concept of taxation for F&O, Intraday and delivery base trading of shares. Plase clear the same things for Goverment Securieties ie Treasury Bills and Central/State Goverment Bonds. It is imposible to get 4-5% profit of tournover. Then is it necessary to get audited every year? Please clear the concept.

It explains in detail for all categories of business with specific reference to intra day transactions. My single doubt is as an individual day trader with profits around 1000/-, where is the need to files the Balance sheet which seems unnessary. Even if it is shown as zero validation takes place. I personally feel that day traders in equity can file in IT2 2 itself if the Govt brings in the change. Second intra day CNC , I feel should not be considered as intra day since I normally buy back using the High and low of the day. Further full margin is given inCNC trades.

Being a retired bank I do maintain Balance sheet, P&L account of all transactions using BS1 ledger (double entry system). But why is it necessary to show how much i spent on vegetebles, fruits, sundry provisions, rent, loan, bank accounts, eb charges, et al for the simple reason that it is not a business. As a retired banker I am maintaining it for the past 25 years.

Nitin sir your way of expressing the accounting things of trading is awesome. Even though I am an mechanical engineer understand clearly the logic of tax calculation and ITR selection of trading business. Thanks a lot.

This is old article. In your screenshot there is Note on right side saying that they calculate and sum up \”Absolute pofit or loss PLUS premium received \”. BUT now after clarification rfom ICAI. It should be only \”sum up of Absolute pofit or loss\”.

Hi Deepak Saini,

If my profit is more than 6 percent of turnover then can I opt for 44AD and do I need audit?? – Yes, if can opt for 44AD and declare profit of more than 6%. Audit is applicable if your turnover as per ICAI Guidance (i.e sum of absolute differences of all the FNO transactions) is more than 10 Crores and if you are opting out of 44AD in the current year and FNO Income is less than 6% of the turnover and overall income is more than the basic exemption limit.

Do I have to deposit tax on only 6 percent? – No, you have pay tax on profits declared and it is not restricted to 6%.

If my profit is more than 6 percent of turnover then can I opt for 44AD and do I need audit and Do I have to deposit tax on only 6 percent

Thank you so much for all the details and it is informative too..

I am in thinking of opening an trading account under partnership firm..

Can you provide me some details about the taxation process for firm…

Also want to know that can i open corporate account with Zerodha…

Hi Bravo,

I have a Loss of around 8 Lakhs in F & O. Now I Want to Leave Trading. I am a Government Employee. And I don’t fall under the Tax Slab. I also don’t want to Carry forward it as I want to leave trading. So should I need to file ITR 3 Or ITR1 (as I don’t want to show trading as my Business income as i don’t want to carry forward it)?

Suggest you to declare this time and set it off against your other incomes except Salary.

I have a Loss of around 8 Lakhs in F & O. Now I Want to Leave Trading. I am a Government Employee. And I don\’t fall under the Tax Slab. I also don\’t want to Carry forward it as I want to leave trading. So should I need to file ITR 3.

Or ITR1( as I don\’t want to show trading as my Business income as i don\’t want to carry forward it)?

Hi Sandeep,

tax audit is applicable only if 1- turnover is more then rs. 10 crores, and 2- assessee has declared his profit on presumptive basis u/s 44(AD) in any of 5 previous year and wishes to declare profit less then 6% (loss as well).

so if assessee has not used section 44AD in previous years and his turnover is less then 10 crores there is no need for tax audit irrespective of profit/loss – Yes, there is no requirement of tax audit if the turnover is less than 10 Crores and if he has not used presumptive taxation in last 5 years.

tax audit is applicable only if 1- turnover is more then rs. 10 crores, and 2- assessee has declared his profit on presumptive basis u/s 44(AD) in any of 5 previous year and wishes to declare profit less then 6% (loss as well).so if assessee has not used section 44AD in previous years and his turnover is less then 10 crores there is no need for tax audit irrespective of profit/loss.

Hi Amit,

I have a turnover of less than 5cr. My profits from F&O trading is more than 6% of my turnover. My Income from Salary is greater than the basic exemption limit of 2.5L. Do I need a tax audit in this case?

I assume this is your first year of trading; if yes Tax Audit is not applicable because turnover is less than 10 Crore.

I have a turnover of less than 5cr. My profits from F&O trading is more than 6% of my turnover. My Income from Salary is greater than the basic exemption limit of 2.5L. Do I need a tax audit in this case?

Hi Natarajan,

When it is mandatory to maintain books of accounts and audit for option traders?

Tax Audit is mandatory if your turnover in the current financial year is more than 10 Crores and you have to mandatorily maintain books of account.

Suppose, if you had FNO Income for any previous years and you were declaring under presumptive scheme under section 44AD; (meaning currently you are in presumptive scheme upto FY 2021-22)

now if you are opting OUT of presumptive scheme in FY 2022-23 and your FNO Income is less than 6%(meaning either in loss or in profits less than 6%) but total income is greater than basic exemption limit; then you have maintain books of accounts and get the AUDIT done [Tax Audit is applicable].

Since, all the data is available in Tax PL and Equity Statement – it is easy to maintain books of account.

when it is mandatory to maintain books of accounts and audit for option traders?

Hi Natarajan,

Which ITR Option seller needs to be file and how to calculate turnover for option seller? – Applicable Tax Form is ITR-3; Turnover will be the absolute difference between selling price and purchase price.

Which ITR Option seller needs to be file and how to calculate turnover for option seller?

Hi Pradeep Kumar,

My turnover is 36,00,000. My Profit -550000. please guide me – Since your turnover is less than 10 Crores, no tax audit is applicable. Please file ITR-3 and carry forward the loss.

Hi

My trunover is 36,00000. My Profit -550000. please guide me.

NIthin Sir,

my intraday turn over is 7,07,000 and and my profit on intraday is -1.04 L and my profit on short term is 22.24 k showing on Q-office.plz confirm wether audit is required or not is any tax will be applicable for me.

Reply

In case i have turnover less than 5 Cr, net profit more than 6% of turnover and income from salary greater than 2.5 lakh, i am still not liable to get an audit, right?

Also if i am not liable to get an audit, can i show my business expenses and adjust them in profits to lower my tax liability? Or in that case an audit will be mandatory?

This article is great!

Sir,

It is good that Zerodha is providing all required information to investor/trader, including trade wise gain/loss statement. Honestly specking I don\’t think calculating turnover script wise is correct, because in case of gain in one trade and loss in other will give net turnover which will be lower than actual if we do it trade wise.

Please share your thoughts.

Please update this material as per new changes….

Hi nithin Namath Sir My ca told me sale value is considered as intraday turnover.. Is it right?

My ca told me sale value is considered as intraday turnover.. Is it right

Sir,

1- I want to know how manage account book.Please guide me with colome and example & perfoma.

2- If you have any service about manage account book( I have three zerodha accounts ) please guide me and send me contact information With charges.

Can I declare 6% of turnover as my profit in FnO trading even if my profit is less, say for example 2%, and avoid audit.

How calculate turnover for trading and intraday

Suppose my F&O Turnover is Rs 1,00,000 and Profit is Rs 0 than what is my Purchase (debit to P&L) for preparing my Profit & Loss Account ? And how this (Turnover and Purchase) will be reconciled with F&O ledger of Broker.

Hi..excellent explanation. I just want to know that how is income or revenue to be shown in pl account to be calculated in case of f& o trading. Is it the same as turnover as explained above or is it to be calculated in some other manner…

Thanks

Hello Sir,

I have a intraday turnover of 25.56k and my loss is -8.83k, and my salary income is 200k should i have to file Income tax return. If i don\’t file income tax is their any problem.

hi team,

I\’m not able to understand the points which are in double quotes. Can you please clarify what do they mean by \”On Aug 19th 2022, ICAI clarified that however where the premium received is included for determining net profit for transactions, the same should not be separately included\” and \”In respect of any reverse trades entered, the difference thereon should also form part of the turnover\”.

It would be great, if you can explain with an example for Point 1 to 3.

Below is the excerpt,

For all non-speculative transactions, the article says that turnover to be determined as follows –

The total of favourable and unfavourable differences shall be taken as turnover

Premium received on sale of options is also to be included in turnover. \”On Aug 19th 2022, ICAI clarified that however where the premium received is included for determining net profit for transactions, the same should not be separately included.

In respect of any reverse trades entered, the difference thereon should also form part of the turnover.\”

So if you buy 25 units or 1 lot of Nifty futures at 8000 and sell at 7900, Rs.2500 (25 x 100) the negative difference or loss on the trade is turnover.

In options, if you buy 100 or 4 lots of Nifty 8200 calls at Rs.20 and sell at Rs.30. Firstly, the favourable difference or profit of Rs 1000 (10 x 100) is the turnover. So total turnover on this option trade = Rs 1000.

The above calculations (points 1 to 3) are fairly straight forward; the next important thing to decide though is if you want to calculate turnover scrip wise or trade wise.

Sir, It is mentioned on varsity that \”audit is not required if turnover is less than 5 Crore and profit is more than 6%.(2 Crore for F Y 19-20)\”. However the limit is still 2 crore only for FY 2020-21 and 2021-22. You can check latest version 44AD section on the income tax website. It still considers turnover limit of 2 Crore.

Request you to update on this, and correct me if i am wrong.

The turn over limit has been changed since this article is published. Kindly update the limit as per the current structure for the year 2022

In 2021-22 i had an F&O loss of around 47000

And my option turnover is showing Rs 1 crore

What are the guidelines for audit and tax ???is it mandatory for me to get audited ….

if i have outstanding buy position in option and carrying it in next year

in that case what will be my p&L of that option . because when we buy option we have to pay premium upfront and we will receive premium when we will sell it

either we will consider the whole premium value in p&L or we will consider notional loss profit basis on the closing value

Hi Nithin,

I am not sure if you are still going to reply on this. I have questions just out of curiosity to understand the system, why do we need to get the trade book audited if your turnover is less than 5cr and you have a loss (profit less than 6%). It seems a like a double blow as we are retail traders and mostly have profit less than 6% or even loss in their initial days of trading mostly, doesn\’t it sound an unnecessary burden on them to get it audited as well by a CA. I personally don\’t trade much and this audit stuff\’s is not encouraging for me. Can you or anyone enlighten me why is that or am I missing some bigger picture in it?

I also have another question, if I declare my profit more than 6% despite having a loss of 10%(turnover 1L), won\’t there be any issue for me later on?

Thank you so much for your time!

Hi, nitin, kindly clarify that, if intraday total buy and total sell contribute to turnover maximum than 5cr than fo i need to audit the books, can i claim all expenses of zerodha,

can all the brokerage charges and taxes, be deducted while calculating the \”net profit\” for STCG from equity and F&O

Hi,

Please amend the article. This is misleading. In case of a loss from trading or profits less than 6% of turnover, the audit requirement will be applicable only if the assessee had opted for the presumptive taxation scheme under section 44AD in the previous 5 years. In case he has not opted for the presumptive scheme then audit requirements under section 44AD are not applicable and only in case the turnover exceeds the threshold amount the audit will be required to be done.

Please mention here that Tax Audit under section 44AD is only applicable when the Tax Payee is opting for calculation of tax based on Presumptive Taxation Scheme, either in current current FY (for which the ITR is being filed) or in previous 5 FYs.

If I show my F&O income in ITR 4 as business income which business code should I Quote in ITR.

Not able to modify the last post.

Adding more details here so that it is possible for the responder to consider all facts and give advice.

F&O turnover – 3.5 crores

Loss – 7 lacs

This is the first year of trading in F&O

Apart from the above have taxable salary income.

Please suggest if tax audit is applicable.

Thanks!

Hi Harish,

For FY 2021-22 I have a loss of 7 lacs in F&O trading.

Under what circumstances will be the tax audit applicable if I want to carry forward the loss ?

Audit is applicable in below situations:

A] if your turnover crosses the threshold limit of 10 Crores in the current year. (FY 2021-22) or;

B] if you are opting OUT of presumptive scheme in the current year(FY 2021-22) (meaning you had opted for presumptive scheme in the previous year) and your net FNO Income is less than 6%(meaning either in loss or in profits less than 6%) but total income is greater than basic exemption limit; then you have maintain books of accounts and get the AUDIT done [Tax Audit is applicable].

For FY 2021-22 I have a loss of 7 lacs in F&O trading.

Under what circumstances will be the tax audit applicable if I want to carry forward the loss ?

Also, I have read the articles on how to calculate turnover. For options it is the premium on sale of options + the profit /loss.

I think premium on sale of options is only when u short the options ? Or it is also applicable when u buy the option and than sell it ? (This is not actually short)

Thanks

For filing income tax returns I downloaded the P&L statement for shares purchased and sold in FY 2021-22 from Console.

The income tax template in .csv format requires the \’Expenditure wholly and exclusively in connection with transfer(12) \’.

But the downloaded P&L statement from Console does not contain any details about the expenditure incurred on transfer of shares.

How to go about filling in this missing detail?

Hi,plz provide ur opinion –

Last year (FY20-21) Sale of shares trading shown under section 44AD and the sales was Rs.25 lakhs.

As on FY21-22,the sale of shares is Rs.1.8 Crs and the profit is Rs.18 lakhs( intra day -1 lakh and Short Term Capital Gain is Rs.17 lakhs.

Commission,Rent, Salary,Interest paid in the Fy21-22.

Whether the tax audit is applicable,if not applicable which ITR 3 or 4 to be filled and can the provision of expenses can be done.

Considering the expenses the net profit comes to Rs.6.5 lakhs.

Have income from pension and interest from deposits. NO other business

I do intraday and short term trading

Please advise

How to calculate turnover for these two

How turnover is relevant to these two

Which schedules of ITR 3 to fill

And

How to fill the schedules

Please guide

Thanks and regards

I think Zerodha should open a CA wing to help traders in filing F&O tax returns. No need of unnecessary discussions. They can charge the premium, as I found many other CA does not have the knowledge of F&O turnover and lot effort is required to search suitable CA.

My f&o turnover is 3cr

And my net loss is -3 lakh

No othersource of income

Previous year adopt 44AD

So this year i required audit my itr or not?

I want IT year 1=4=2021 To 1=3=2022 P&L.

Share Balances

[email protected]

.

Hi, if my business P&L is loss (<6%) and turnover less than 5 Crores, if my total income (Salary + Capital gains + Business Income) is less than 2.5 Lakhs, I need not get audited – Does this total income after all deductions like 80C, 80D or before all deductions?

Hi Dheeraj,

My income from salary, commission, CG and other heads is 4.5 lacs and my loss in F&o and Intraday is 10k with Turnover 89k , I don’t wanna opt for presumptive tax ….what should I do?…will audit be required? If yes , how can I avoid audit?

If this is the first time if you are incurring F&O and Intraday loss – then no Audit is required as turnover is below the threshold limit of 10 Cr.

My income from salary, commission, CG and other Head is 4.5 lac and my loss in F&o and Intraday is 10k with Turnover 89k , I don\’t wanna opt for presumptive tax ….what should I do?…will audit be required,?

If yes , how can I avoid audit?

As per my opinion the audit is required to be done for future and options business, in the following cases for the FY 2021-22: –

(a) The businesses whose turnover exceeds 10 crores. (Cash receipts and payments do not exceed 5% of

total receipts and payments respectively in case of such transactions, hence threshold limit of 10 crores is

applicable)

(b) A person engaged in business who has OPTED for presumptive taxation- 44AD (8%/6%) in any of the last 5

years but does not opt for the same in the current year.

I think updation required in 6.1 for tax audit clairty as per section 44AD.

I sold i.e., one lot put option of a particular scrip and also sold one lot future of the same scrip, now on expiry day the put option closes in the money. For above F&O transaction on expiry day my positions got converted in cash delivery (one lot buy and one lot sell) i.e., intraday in equity segment @ closing price of cash market. In above trade profit booked in F&O segment whereas intraday loss in equity segment. Now my question is how can I treat the P&L for IT and accounting purpose.

Kudos to you for making available the turnover information is respect of intraday and F&O 0n Zerodha > Console. This information, as far as I know, is not furnished by other broker outfits. However, I wish to point out some of the lacuna in Tax P&L Report in Zerodha>Console>Reports:

1. The Tax P&L provides gross profit SEPARATELY for Intraday, Short Term and Long Term trades. However, the expenses viz. STT, GST, Exchange and SEBI levies, brokerages etc, are SUMMARIZED and not provided separately for Intraday, Short term and Long term trades. Hence, it is not possible to arrive at separate net profits for different categories of trades. This is essential as the tax treatment for Intraday, Short Term and Long Term trades is different. I took up the matter with your team. They responded that no other customers has pointed out this and presently they are unable to provide this info. Hope, Zerodha will look into this issue, as otherwise, Tax P&L report is of no use at all.

2. There appears to be no link to download STT – 10B Form regarding STT paid during a financial year.

what turnover amount to be specified in 3CD ratio part.

Dear Sir, my doubt is how to account a F&O transaction in accounts,whether purchase value and sale value separately account or net profit/loss is only to account.In 3CD form in ration calculation which amount is to be specify as a turnover, whether full sales value or turnover as per calculation to find a tax audit

i buy & sell of share on delivery basis.

i want to file ITR As Capital Gain. for short term & long term.

if my turnover in STCG & LTCG is more than 5cr. shall i need to do Audit.

i intension is only Capital Gain.

In P&L Account where to show the F&O turnover ? And how the Net Profit Is to be shown ?

Section 44AD is for calculating profit and gains on presumptive basis. An individual can opt for payment of tax on presumptive basis under clause 44AD. which can not be changed for next 5 years. Only in such a case audit applicability as clarified in clause 6.2 above is applicable.

In case an individual does not want applicability of 44AD, then audit requirements depend only after limit of Rs 10 cr.

Pl clarify whether it makes sense

Hi MV Sastry,

WHAT IS TURNOVER TO BE SHOWN IN P & L STATEMENT, WHETHER IT IS ACTUAL SALES VALUE OR TURNOVER CALCULATED FOR TAX AUDIT PURPOSE, A LITTLE BIT CONFUSION, PL. CLARIFY

You have to declare actual sales value.

WHAT IS TURNOVER TO BE SHOWN IN P & L STATEMENT, WHETHER IT IS ACTUAL SALES VALUE OR TURNOVER CALCULATED FOR TAX AUDIT PURPOSE, A LITTLE BIT CONFUSION, PL. CLARIFY

Any update on the change.org petition you filed ? It looks like if one has a small turnover (less than 1Cr ) and small profit , even then he is required to have audit done. The CA fees will eat up the meagre profits

If sir I bought 100 nifty @120 rs on 12 dec 2021 and sold @150rs same day ,profit-3000 and turn over-3000.

In 5 jan22 I also bought 100 nifty @130 rs and sold at 100 rs ,loss-3000, turnover-3000.

Financial year 21-22 turnover will be ????

Hi Abhinash,

My f&o turnover is 90 lakhs and profit is 20 thousand I need audit??

If you are having FNO Income for first time in the current year, then no audit is required as your turnover is less than the threshold limit.

If you had FNO Income in previous year and you had declared such FNO Income under presumptive taxation scheme(44AD) and now in the current year if you are opting out of presumptive scheme; then audit is required if your profit is less than 6% of turnover and overall income is more than the basic exemption limit.

My f&o turnover is 90 lakhs and profit is 20 thousand I need audit

1. CALL OPTION SOLD TOT VAL 100 AND LEFT UNDISTURBED TO EXPIRE USELESS ON EXPIRY DAY. HERE THERE IS NO REVERSE TRADE. WHAT IS THE DIFFERENCE?? PREMIUM RCVD IS 100. Hence the turnover will be only 100? or P&L posted 100. Hence Turnover is 100 + 100. Which is correct.

1. PUT OPTION BOUGHT tot val 200 and left undisturbed. It expired useless on expiry day. Reverse Trade was not done to square off the position. Premium rcvd was zero. What is the difference?? P&L posted is Loss -200.

What will be the Turnover. Zero or 200

Pls give your valued guidance.

Hi Rahul,

T/O from speculative buss. : 11 lacs

Profit/(loss) : -170000

Exps : 150000

Net loss : 320000

plz tell me the treatment regarding above data ? the data attracts tax audit, tell me how would i consider the data regarding purchase & sales?

There is no tax audit applicable as the turnover is below the threshold limit.

You can fill the below details in Schedule PL #65

a] Turnover from Speculative Activity

b] Gross Profit

c] Expenses

Hey, my query is, regarding intraday trading

T/O from speculative buss. : 11 lacs

Profit/(loss) : -170000

Exps. : 150000

Net loss : 320000

plz tell me the treatment regarding above data ? the data attracts tax audit, tell me how would i consider the data regarding pur. & sales ?

Hi Dines Kumar Sarda,

If a delivery based equity is purchased and sold the same day, what is it intraday or short term capital gain.

It is Intraday and will be treated as speculative.

If a delivery based equity is purchased and sold the same day, what is it intraday or short term capital gain.

In your article, conditions attached to 44AD for turnover up to 5 crore not mentioned such as cash receipt or cash expenses should not be more than 5% . As also what if profit is above/below 6 or 8%. Requirement of audit. Or when no such audit is required . It needs eleborate discussion for better understanding for 44AD for increased eligibility from 1 crore to 5 crore.

Arvind 9425157452, 9340500061

Hi Ritesh,

If a person has professional income and future and option income. Can he opt 44ADA for profession and audit for future and option business.

Yes you can.

How to offset loss in auction trade of stock options ??

If a person has professional income and future and option income. Can he opt 44ADA for profession and audit for future and option business.

1) Sold Option @ 100 and expires useless. a) Profit 100 and Premium on sell is 100. Hence as per the theory here the TO = 100 + 100 =200 (DOUBLE)

2) Bought Option @150 and expires useless. -ve difference or loss =150 + Premium on sell =0 hence TO = 150 +0 =150

3) Reverse Trade>> Buy OPTION @ 100 then sell @150. -ve difference or loss = -50 and premium on sell =150. Hence TO =ABS(Loss) + Prem = 50 + 150 =200

4) Short sell OPTION @ 400 then buyback @ 600 >> Loss = -200 and prem on sell = 400. Hence TO = ABS(P&L) + prem on sell = 200+400 = 600

Are the above correct. Pls guide.

I still find there is a discrepancy in calculating Speculative Turnover – Intraday Equity Trading.

I found Zerodha to Quicko making this turnover as the absolute values of the difference in buy/sell amount.

But I found this is different in Sharekhan: adding buy and sell value of each share is what Sharekhan calculates as Speculative [Intraday Equity] Turnover

Is there any rule defined for calculation on same by Tax Department of India?

While filing balance sheet part of ITR 3, what should I show in proprietor\’s capital, the total balance in my accounts that I earned from salary or only the money that I transferred from salary account to trading account and the balance I have in trading account?

Could you please provide a template of

Account books

PL statement

Balance sheet

S says:

December 27, 2021 at 10:25 am

Hi Arvind Verma,

Audit is required if you had FNO Income in the previous and you had declared such income under presumptive scheme 44AD and now (for current year) if you want to declare loss and carry forward loss.

If you are having FNO income for first income, then not required as your turnover is less than the threshold limit.

Hi S, Thanks for your kind response, but in this article Mr Nithin has written \”Section 44AD – If the turnover is less than Rs 2 crore, and if profit less than 6% of turnover and total income exceeds basic exemption limit (this section applies only if person’s taxable income other than the loss from trading is more than the taxation slab) An audit is not required if turnover is less than Rs 5 crores but your total income is within the taxable limit of Rs 2.5lks.\”

so I have doubt, my turnover is less than the threshold limit but my income is more than the exemption limit of 2.5lks (althoug after applying 80C dedcutions & HRA, I have no tax liability). Still can I proceed without audit? If you have reference to any section or other information please share. Thanks once again.

Hi Arvind Verma,

Hi Nithin, I m a salaried employee. My income is ₹4.5 lakh, I did option trading with turnover ₹4.3 lakh and had losses of ₹80,000, does audit is required as my income is more than the exempted limit of ₹2.5 lakh?

In financial year 2020-2021 I transferred ₹2 lakhs from my salary account to trading account, while filling ITR in balance sheet should I show these ₹2lakh only as source of fund or I have to show all the balance that I have in my accounts and received as salary?

Audit is required if you had FNO Income in the previous and you had declared such income under presumptive scheme 44AD and now (for current year) if you want to declare loss and carry forward loss.

If you are having FNO income for first income, then not required as your turnover is less than the threshold limit.

Hi Nithin, I m a salaried employee. My income is ₹4.5 lakh, I did option trading with turnover ₹4.3 lakh and had losses of ₹80,000, does audit is required as my income is more than the exempted limit of ₹2.5 lakh?

In financial year 2020-2021 I transferred ₹2 lakhs from my salary account to trading account, while filling ITR in balance sheet should I show these ₹2lakh only as source of fund or I have to show all the balance that I have in my accounts and received as salary?

Thanks

Hi Nithin, I m a salaried employee with income <5 lakh and have no tax liability.

I did option trading where turnover is ₹437000 and loss is ₹80000, now if I file itr 3 to carry forward the loss, do I need audit as the total income is over exempted limit of ₹250000 or there is no need for audit as I have no income from business? Thanks in advance.

Can you share a P&L Format of a F&O trading Business and an Intra day trading business.

I don\’t think you need to provide details of all your assets and liability for business income. you only need to provide it for the business that you are carrying on. If you are only trading in F&O, all you need is to show the balance with broker at then end of the year (including margin for any open position) as asset and the same amount will show up as capital. That\’s it.

Hi team zerodha ,

As per section 44Ad limit of turnover is only 2 crore, in f.y. 21-22 also.

But the limit of 5crore which has now increqsed to 10 crore is falling under section 44AB.

So, plz don\’t misguide people, saying that if profit is equal or more then 6 % of digital transactions above 2 crore then audit is not necessary.

I mean to say that, please don\’t mix THE LIMIT OF TURNOVER of section 44Ab with Sec. 44AD

Hi Nithin

My question is quit different

I am doing all Mf investment, stock trading, and stock investment for the short term and long term in all my family account. We are falling under audit since 2 years and we are doing it. This year (FY 2021-22) we have heavy transactions in intraday and incurred a huge loss but have short term gain in stock also. My CA says you should have to file it under business income, and also said that once you choose you can not shift the nature of business to capital gains so my question is if I stop intraday (speculation) from the next year and I do only short term or long term will I have choice to file in capital gains in future please guide me I am tensed

Hi Nithin

my salary is 10lak and i have done F&O trading .

my turnover is less than 1 crore and i have profit of 2% .

Do i need to go for audit ?

I have to pay extra for auditing . (5k+)

i have to pay tax on my 2% profit which comes in 10% slab.

basically salaried person has to earn more than 6% otherwise dont do f&o trading at all

Hi Sunil,

I need turnover for short term capital gain so from where i will be able to download it.

Download Tax PL from console Zerodha; in Equity Sheet under Short Term Trades – you need to total the sell value column – you will get the turnover.

hello sir,

i need turnover for short term capital gain so from where i will be able to download it.

Fin Year 20-21

Salary income = 20.60 lakh

Short term profit = 1.53 lakh

Long term profit = 0

Intraday/ speculative profit = 8,600

Intraday turnover = 8,600

Futures profit = -10.74 lakh

Futures turnover = 21.87 lakh

Option profit = 75,000

Option turnover = 32.30 lakh

Total F&O turnover = 54.17 lakh

If presumptive taxation scheme not opted,

Kindly suggest

AA] Whether tax Audit is required for filing the return?

If you are having FNO for the first time; then Audit is NOT applicable as your turnover is below the threshold limit.

If you are opting out of presumptive scheme in the current year(meaning you had opted for presumptive scheme in the previous year and declared income under such scheme), then audit is applicable in your case.

BB] Whether Audit is required even when the F&O loss is not to be carried forward (for future years say 8 years)

Yes, If your turnover has exceed the threshold limit; then AUDIT is applicable.

CC] Whether the Short term profit (of 1,53,000) be set off with F&O loss of (75,000 – 10,74,000) during filing current return 21-22.

Yes, current year FNO Loss can be set off against all incomes except Salary.

DD] Whether the lntraday profit (of 8,600) be set off with F&O loss of (75,000 – 10,74,000) during filing current return 21-22.

Yes, Intraday Profit can be set off against FNO Loss.

EE] What are the charges for (a) tax audit and (b) return filing for ITR 21-22.

Check this…https://quicko.com/

Dear sir,

The F&O /Intraday and other details are as follows.

Fin Year 20-21

Salary income = 20.60 lakh

Short term profit = 1.53 lakh

Long term profit = 0

Intraday/ speculative profit = 8,600

Intraday turnover = 8,600

Futures profit = -10.74 lakh

Futures turnover = 21.87 lakh

Option profit = 75,000

Option turnover = 32.30 lakh

Total F&O turnover = 54.17 lakh

If presumptive taxation scheme not opted,

Kindly suggest

1. Whether tax Audit is required for filing the return?

2. Whether Audit is required even when the F&O loss is not to be carried forward (for future years say 8 years)

3. Whether the Short term profit (of 1,53,000) be set off with F&O loss of (75,000 – 10,74,000) during filing current return 21-22.

4. Whether the lntraday profit (of 8,600) be set off with F&O loss of (75,000 – 10,74,000) during filing current return 21-22.

5. What are the charges for (a) tax audit and (b) return filing for ITR 21-22.

Hi nitin sir

My total turnover is 38lakh and total loss 1.8 lakh and I ma salaries person. I apply my ITR and didn\’t show losses is ITR. What I do

Can I get any problems in future regarding this my mistake

Is this trunover require any audit ???

I have been working in a public sector company for the last three years as a Maintenance Engineer. My basic income is from Selary income. My FY 20-21 Gross Selary have ₹ 5.8 Lakh. I have been trading in the stock market for the last three years for capital gains. My Investment is done in options, cash and speculation segments for capital gains. I have suffered financial loss in three years. I have incurred a loss of approximately ₹ 1.25 Lakhs in FY 20-21. My turnover is below two crores. So I have to fill in the audited ITR? And which ITR form do I have to fill?

Please confirm what is the audit fees for this type of audit.

Thanka

I have some gains from Options trading in the USA. I am OCI holder and I am a resident here. I am declaring all my global income in India. The gains from Options are considered as Capital gain/loss the USA where as it is considered as business gain/loss. My only income in India is from stock market investment in the USA . My India income is from bank deposits interest only. My Short term capital gain from selling shares in the USA , after converting to rupees is around 8 lakhs. My Long term loss is around 15 lakhs after deducting long term gains.

My gains are around 3% of my turnover. My bank and brokerage account is in the USA. I have not maintained books of accounts. I am told to file form ITR3 and get it audited by CA as my gains are less than 6%. I can opt for presumptive tax and declare the flat 6% of the turnover.

My first question is – can OCI chose presumptive taxation policy? if yes would it be 6% or 8% ? It is all digital mode of payment from/to USA bank to/from USA based brokerage account.

Would there be any issue if I declare presumptive taxation even though I have actually 3% gains?

Another doubt is about presumptive taxation is declaring flat 6% irrespective of actual gains. Hypothetically if a trader makes 100% again , he/she can opt presumptive taxation and pay only 6% taxes ? Is my understanding correct? Please suggest! Thanks !

Hi.

How to calculate the purchase cost against the turnover calculated as absolute. anyone please?

Hi Haas,

For futures trading should Profit/Loss be calculated based on the completed trades only or should we consider the Lots held on 31st March too?

If only completed trades are considered, does it mean we can do Tax harvesting for Futures transactions too?

You should consider only completed trades.

Hi Nithin,

For futures trading should Profit/Loss be calculated based on the completed trades only or should we consider the Lots held on 31st March too?

If only completed trades are considered, does it mean we can do Tax harvesting for Futures transactions too?

Hi Chaitanya Kumar,

I have future & option turnover is 3crores . For me actually there is loss Rs.25lakhs .pls advise me how to prepare PL there is no expenses.

Download Tax PL.

Under F&O Sheet, you will get the buy value and sell value for Futures and Options.

From that, you will get Gross Profit/Net Profit.

Further, you can include all the expenses such as GST, brokerage, STT etc., on Debit Side; you will get net loss/profit.

Hi I have future & option turonver is 3crores . For me actually there is loss Rs.25lakhs .pls advise me how to prepare PL there is no expenses

@Nithin Kamath Sir, Thank you so much for the useful information in such a simple way. I am very happy to be a Client of Zerodha.

A small request sir, Could you please write an article or explain about claiming presumptive taxation on Options trading. What is the Eligibility, Limit, and all? I have tried Googling but it is just more confusing.

Hi

1. If I make net loss in Intraday or in F&O, the amount will be less than zero (less than 6% profit). Should I have to declare in ITR 3 and claim carry forward or not to declare to avoid tax audit.

2. If I am a F&O buyer , I will be paying the premium. Even in this case is the turnover get calculated by PROFIT+LOSS+SALE VALUE(Premium).

Dear Sir,

Please guide on following mater. if i have intraday profit Rs 1000/- and loss Rs 500/- than Turnover is Rs 1500/- which i have to show in P/L Statement on Credit and Rs 500/- net profit on Debit side but what about of Difference between Rs 1000/- (1500-500), whether it should treat as Purchase value or whatever else. if Tax Audit Applicable.

Hi Umesh Dharavat,

I have one question regarding FNO open positions as on 31st march,

a) do we need to consider M2M of open positions as Profit/Loss to show in Income Tax Return ?

OR b) we don’t require to show Profit or Loss of any open positions as on 31st March & we can show it in next year’s Income Tax return as per actual Profit or Loss ? I have one question regarding FNO open positions as on 31st march, a) do we need to consider M2M of open positions as Profit/Loss to show in Income Tax Return ? OR b) we don’t require to show Profit or Loss of any open positions as on 31st March & we can show it in next year’s Income Tax return as per actual Profit or Loss ?

If a) then how to calculate P&L for open position of Options, since there is no M2M in options.

No need to declare M2M profit or loss for open positions as on 31st March 2021. You need to declare the actual profit or loss in the next year.

Sir,

I have one question regarding FNO open positions as on 31st march, a) do we need to consider M2M of open positions as Profit/Loss to show in Income Tax Return ? OR b) we don\’t require to show Profit or Loss of any open positions as on 31st March & we can show it in next year\’s Income Tax return as per actual Profit or Loss ?

If a) then how to calculate P&L for open position of Options, since there is no M2M in options.

Thanks

Umesh Dharavat

And do I get books of account from Zerodha, or have to do it manually?

Hi Sir,

Please help me with below points as well:

1. When are we required to maintain books of account?

2. This year (2020-2021) was my first year of trading, and my turnover less than threshold, so am i needed to maintain books of account?

Or only filling balance sheet and p&l in ITR 3 would be good, as you suggested?

Intraday income is considered as business income, if my turnover is less than 2Cr ( for example my turnover is 1.80 crore and suppose my profit is 1.50 Crore) then can i file my ITR in 44AD??? If i do so, my taxable income will be 6% of 1.50 crore and tax will be paid according to slab??? Right??? Pls note i dont have any other income…my pure income of 1.50 crore is from Intraday Trading…

Hi Sam,

One more thing, what is the exemption limit for Taxation on LTCG.

Upto 1 Lacs; it is exempt.

Thanks Sir for your reply. I will speak to CA about it.

He was telling i have to go for an Audit as that is required.

One more thing, what is the exemption limit for Taxation on LTCG.

HI Sam,

My taxable income is 6.5 Lakh

Options turnover : 48 Lakh

Options Losses around 70K to 100K

STCG : 20 K

LTCG : 40 K

Is Audit needed here? I have never opted for presumptive taxation earlier and this is my first year of trading.

Since your turnover is less than the threshold limit and you are doing trading for first time; no tax audit is required.

Adding to above query, Also please let me know what should I tell CA.. i mean under some section or anywhere is it mentioned that no Audit will be needed for my case to convince him..

Hi Sir,

My taxable income is 6.5 Lakh

Options turnover : 48 Lakh

Options Losses around 70K to 100K

STCG : 20 K

LTCG : 40 K

Is Audit needed here? I have never opted for presumptive taxation earlier and this is my first year of trading.

I believe Audit is not needed here, but CA is telling Audit is needed here as I have losses in options OR i have to declare 6% profit, if i want to avoid audit, he said.

He told there is no other option to it…

Can you please guide what is correct..

Dear Sir,

I have taxable income. (12 Lac)

Intraday trading loss is -25000.

Scriptwise Turnover is 1.5 L .

Tradewise Turnover is 4.2 L.

STCG – 5500

As per CA – no audit required as audit is for f&o only.

And i have done intraday trading only, which falls under speculative income which is no account case. So here no need to maintain book and audit not required.

Could you please provide clearity on this?

Tax audit is required or not?

If not under which clause?

Which turnover should be used for itr- scriptwise or tradewise?

Is it mandatory to carry forward my intraday (speculative) losses or we can simply igore it if dont want to carry forward

Dear Sir,

I have taxable income. (12 Lac)

Intraday trading loss is -25000.

Scriptwise Turnover is 1.5 L .

Tradewise Turnover is 4.2 L.

STCG – 5500

As per CA – no audit required as audit is for f&o only.

And i have done intraday trading only, which falls under speculative income which is no account case. So here no need to maintain book and audit not required.

Could you please provide clearity on this?

Tax audit is required or not?

If not under which clause?

Which turnover should be used for itr- scriptwise or tradewise?

Is it compulsary to carry forward my intraday (speculative) losses or we can simply igore it if dont want to carry forward?

Thanks.

Hi Kishore,

Gross Total Income (Salary)- Rs. 14,03,039; Option Trading – 44,625 (Loss) ,Total turn over=78000; Deductions 80C/80D/80G- 2,07,084

Long Term capital 6,722

If you are having business loss/income for the first time, then no audit is required as the turnover is below the threshold limit.

If you had business income/loss in the previous year and you had opted for presumptive scheme and further now if you are opting out of that scheme, then audit is applicable.

Dear Sir,

I would like to know whether auditing is required for below mentioned case. I want to carry forward the option trading losses for next Assessment year & if required How much will be the tax auditing charges.

Gross Total Income (Salary)- Rs. 14,03,039

Option Trading – 44,625 (Loss) ,Total turn over=78000

Deductions 80C/80D/80G- 2,07,084

Long Term capital 6,722

Hi Ankit B,

I have an account with Zerodha and my turnover is Rs. 27lacs and P&L is Rs. 4lacs loss. My total income from other sources is below Rs. 2.5lacs. Will I still need an audit?

Tax audit is NOT applicable as the turnover is below the threshold limit and your overall income is less than 2.5 Lacs.

Hi Nithin,

Thanks for this module. I have an account with Zerodha and my turnover is Rs. 27lacs and P&L is Rs. 4lacs loss. My total income from other sources is below Rs. 2.5lacs. Will I still need an audit?

Turnover considered by Tax consultants for delivery based transaction for equity is considered Purchase value or sales value which ever is higher. Something contradicting opinion against guidance note of icai. Please confirm what to follow

HI Deepak,

In Console, when we check for Tax P&L, the profits and charges are reported separately. Are these profit on a gross or net basis (i.e. after deducting charges).

Profits shown in Tax P&L are gross profits(sell value – buy value).

You need to deduct charges to arrive NET profit.

In Console, when we check for Tax P&L, the profits are charges are reported separately. Are these profit on a gross or net basis (i.e. after deducting charges).

Thanks

Hi Nithin,

Section 44AB of IT Act was amended in 2016 and clause e) was added. In case the turnover is less than the notified amount and profits are lower than 6%, an audit is now required only if Section 44AD(4) is applicable in his case. So, someone with F&O losses on a turnover of under 10 crores should not need to get audited if he has not opted for the Presumptive Scheme in the preceding 5 years.

I hope you will update your article to reflect this change, since many people will use it as a standard reference.

Hello sir,

I m options traders & account in zerodha . I want some information about future & options turnover and income tax return related .

Pl call or msg me on 8160874854

Thanks

If on the last day of the FY, I bought an option of INFY and Sold an option of TCS then what I have to show in the Income Tax?

Bought INFY @100

Sold TCS @200

Hi Akshay,

My turnover is 8 crore but i made loss of 20lakhs and still salaried taxable income is 20Lakhs.

Please tell me :

AA] Do i need audit? Any penalty?

Need for audit depends whether you had opted for presumptive taxation scheme in the previous year or not.

If you are not opting out of presumptive taxation scheme in the current year and you are having business/FNO income for the first time – then Audit is not applicable as your turnover is below the threshold limit. You can prepare books of account and carry forward the loss.

BB] Charges of audit and ITR filing?

check out https://quicko.com/

My turnover is 8 crore but i made loss of 20lakhs and still salaried taxable income is 20Lakhs.

Please tell me :

Do i need audit

Any penalty

Charges of audit and ITR filing

and any needed details

I think turnover calculation as shown here is misunderstand and incorrect explained here it\’s should be as follows :

Correct Turnover Calculation on Future & Option

1. The total of favourable and unfavourable differences shall be taken as turnover – it\’s represent only Future Transaction Turnover

2. Premium received on sale of options is also to be included in turnover – it\’s represent only Options Transaction Turnover

3. In respect of any reverse trades entered, the difference thereon should also form part of the turnover. – repetition of Sl.no.1 only for Future Transaction Turnover (no meaning)

Hi Amsa,

My intra-day trade income for the Year 2020-21 is Rs.80,000, whereas turnover(positive+negative profit) comes to Rs.12,00,000/.

Should I report the profit Rs.72,000 (i.e.@6% on turnover of Rs.12,00,000) or the actual realised profit of Rs.80,000/-

If you are treating it as presumptive income – you can declare 6%; otherwise – you need to declare the actual realized profit.

My intra-day trade income for the Year 2020-21 is Rs.80,000, whereas turnover(positive+negative profit) comes to Rs.12,00,000/.

Should I report the profit Rs.72,000 (i.e.@6% on turnover of Rs.12,00,000) or the actual realised profit of Rs.80,000/-

Nithin sir, you should start campaign on Change.org now. You will get many more supporters compared to 7 years back. At that time situation was different and may not be those many traders compared to the latest pandemic period. We should push government to make tax filing easy for small scale traders. It will very difficult to manage complex requirements in ITR for people who work and do some small trades.

HI Pushkar,

Please let me know if i need Tax audit for below:

F&O Turnover: 99,99,879

Equity Intraday Turnover: 97,430

F&O Loss: -2,76,642

Intraday Loss: -71,945

I haven’t opted for presumptive taxation before and my salary income is taxable.

Tax audit is not applicable as your turnover is less than the threshold limit and you have not opted for presumptive taxation scheme before.

Hi Sir,

Please let me know if i need Tax audit for below:

F&O Turnover: 99,99,879

Equity Intraday Turnover: 97,430

F&O Loss: -2,76,642

Intraday Loss: -71,945

I haven\’t opted for presumptive taxation before and my salary income is taxable.

HI

I am still confused, even after reading this article and previous articles on income tax.

Presently my only income is from Short term positional trade.

My realized profits are 30 lakh plus in a year and I do frequent trading. My turnover is above 5cr.

If I declare myself as Trader ( Normal business), I need to pay 30% + tax and my claiming business cost wouldn\’t help much.

So, it make sense for me to continue as short term investor and pay 15% STCG.

My questions are,

1) Do I must declare my income as business income or it is ok to claim as Short term investor and Pay 15% tax?

2) Since, I am paying only STCG, do I still need to be Audited? ( As you mention, for STCG, no need for STCG irrespective of turnover)

3) Can I carry forward my STCG loss?

Your kind reply will be a great help

HI S Radha,

Please guide me how to calculate turnover and profit in commodity trading.