UPI, now live at Zerodha

Update [September 2018]- UPI will continue to remain free till December 2018.

Traders,

Unified Payments Interface (UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI regulated entity. UPI is built over the IMPS infrastructure and allows you to instantly transfer money between any two parties’ bank accounts. The number of UPI transactions monthly has grown 20 times from 5 million transactions last year to over 150 million in Feb 2018 thanks to BHIM, Paytm, PhonePe, Tez, WhatsApp, and others. Since UPI is a layer over IMPS, there is no integration required to be done with each individual bank unlike in case of a payment gateway. UPI transfers can be done from any bank account. A maximum of Rs. 1 lakh per day can be transferred using UPI.

Instant UPI transfers are now live at Zerodha.

Free UPI transactions

While UPI is free for all peer to peer transactions, financial service businesses are charged Rs. 15 per transaction. We’ve been able to negotiate a deal with our banking partner to keep this free for the first 6 months, and if the transaction volumes are high, even beyond that. Do make sure to use it and let your friends and family know about it too.

Update [September 2018]– UPI will continue to remain free till December 2018.

How do I do it?

Transferring funds using UPI is quite simple. I’ve described the steps involved in the process below.

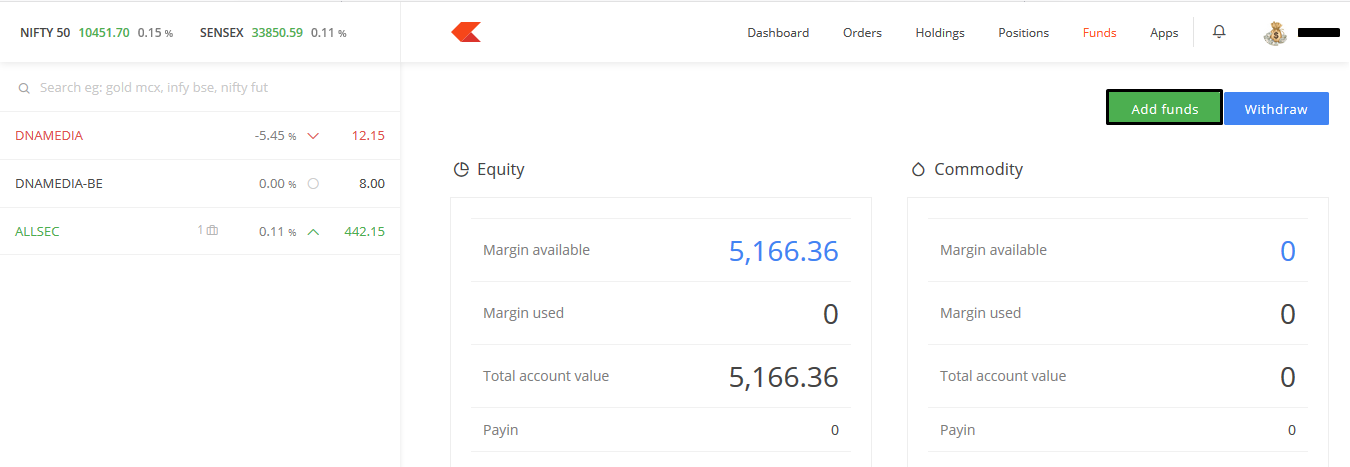

- Go to the ‘Funds’ page on Kite and click on ‘Add Funds’.

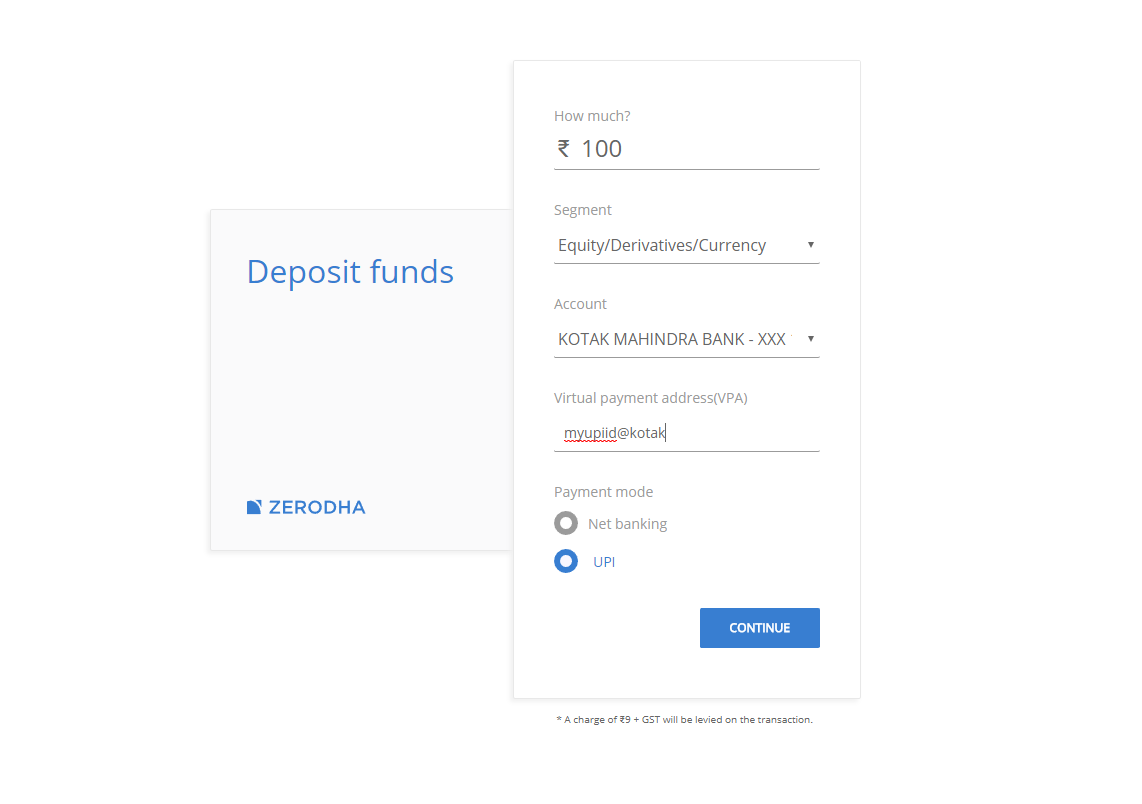

- Select UPI as the payment mode in the window that opens up.

- Once you select the UPI option, you’ll see a field to enter your UPI ID. Make sure the UPI ID is mapped to a bank account that you have mapped with your Zerodha account for the transfer to go through successfully.

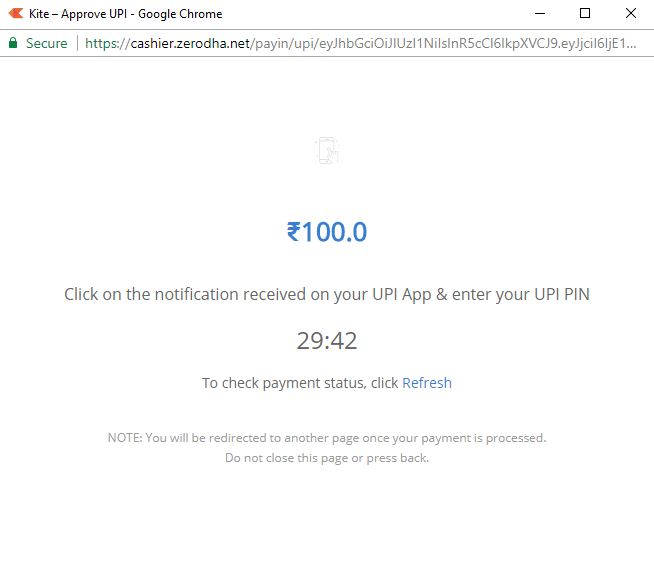

- Enter your UPI ID linked to your bank account (the bank account must be linked to your Zerodha trading account). Once you click on ‘Continue’, you’ll see this page.

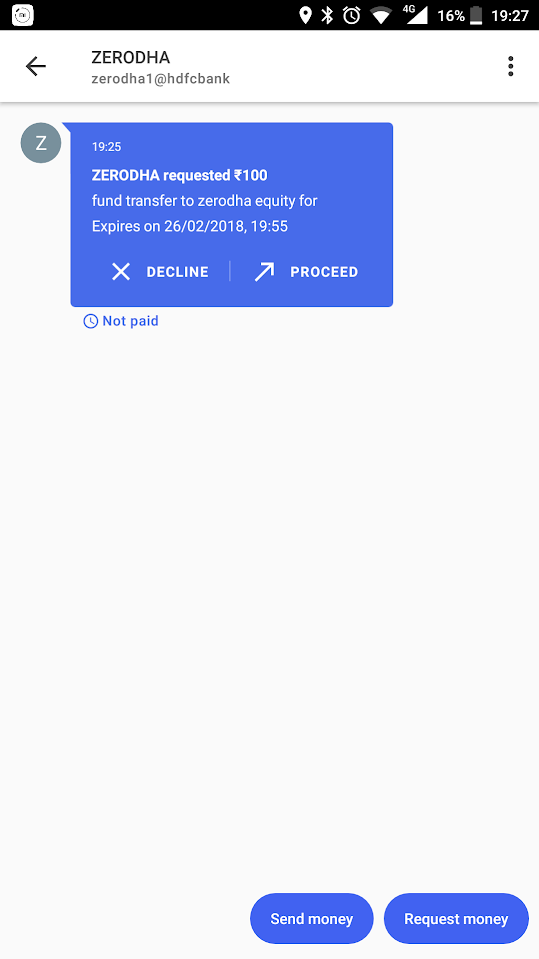

- On the UPI app on your phone, you’ll receive a collect request from Zerodha. Approve the transfer here. This will require you to enter your UPI PIN on the next step.

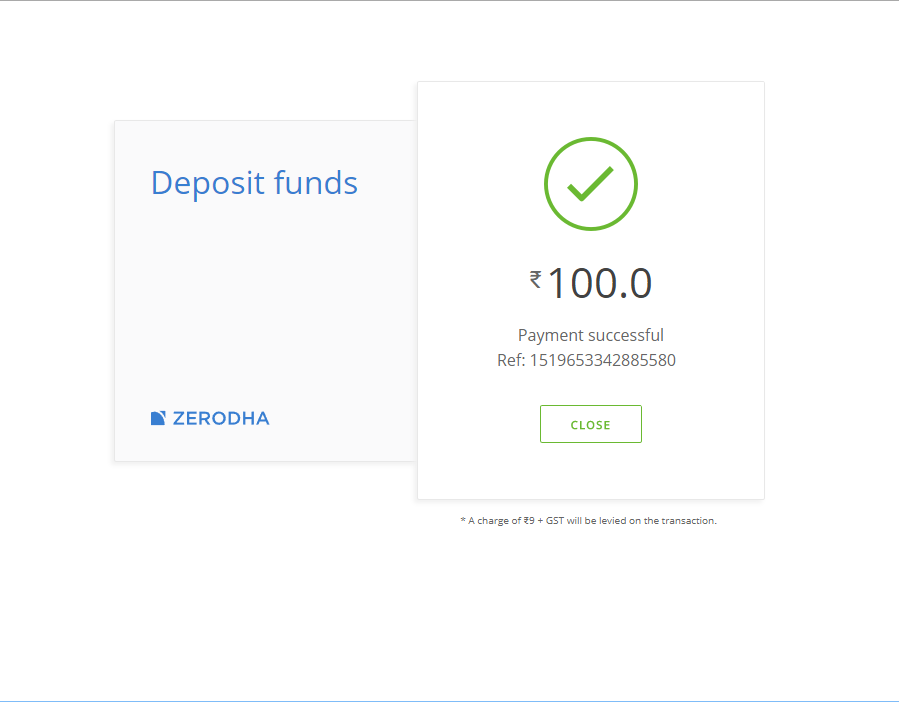

- Once that’s done, you’ll see a confirmation on the Zerodha payment page that looks like the image below. Complete the transfer by clicking on the ‘Close’ button. If you directly close the window, the transfer will not show up on your account instantly, so make sure you do.

And that’s it. The funds will show up on your trading account and you can use them to place trades.

Ensure you make the payment from the collect request, i.e., initiate the transfer from Kite/Pi, and not by initiating a new transfer to Zerodha’s VPA (UPI ID). If you make a transfer to Zerodha’s VPA directly, the money won’t reflect in your account and you will have to raise a ticket requesting for a refund. Also, keep in mind that you only transfer funds from the bank account mapped to your Zerodha account.

Happy Trading,

I want to change my UPI ID, could anybody here please let me know how can I do it? I am currently using BHIM UPI but want to switch to PhonePe. Previously I used phone pay only but today it self unknowingly I registered with yes Bank BHIM UPI , due this I am facing problem while making payment ( purchasing funds)

Reply

I want to change my UPI ID, could anybody here please let me know how can I do it? I am currently using BHIM UPI but want to switch to PhonePe.

Thanks in advance!

I am not able to add funds more than 2000 through phonepe at single time and I have to add funds multiple times to add my desired amount of funds. Thanks.

Hey Prakhar, this might be the limit set by your bank. Would suggest you check with the. Alternatively, you can transfer funds using Netbanking, we’ve explained the process here.

I want to replace my current UPI ID linked with Zerodha with another one as my current UPI ID is not working properly. Please guide me how to change or replace. thank you.

Hi, i am trying to add funds using SBI account but i am not getting procced or decline notification

How can i transfer money from my Net banking without UPI id

How can i change the payment mode from UPI(google pay) to net banking? May i know the process?

Hi,

I had initially registered BHIM UPI app and transferred funds from this to Zerodha. Now, I have Google Pay app also on my mobile with the same bank account (as Google Pay permits some more amount limit per day than BHIM UPI). When I initiate Funds transfer in Zerodha Kite Web interface, the notification of UPI payment goes to BHIM only and not Google Pay. How do I enable Google Pay to make payment to KITE instead of BHIM? and,

Is there an option to choose via which UPI app I can transfer the funds to KITE each time?

I tried adding 35000 to my fund through Google pay and it’s not reflecting on my fund balance.

Money has already debited from my bank account.

Please revert.

my Kotak upi is showing as invalid in Zerodha while applying for IPO though I was able to transfer funds to Zerodha through same upi

for IPO upi id asking . what is the means of upi id?

also let me know by pledging the mutual fund can i buy equity shares .plz let me know

Dear SIr Please let me know is it possible to transfer rs 10lakhs in one short to purchase icici prudent liquid direct mutual funds to my zerodha account.kindly also advice the above said mutual funs is in 3 category, could please explain the difference.

thankyou for your time

how much amount of trading can be done in intraday

can you please add Bharat QR code for payment.

Bharat QR payment is for person to merchant payment so we can transfer money.

I tried to add 75k through G pay and it got deducted from my bank account with Gpay status showing Successful. But this amount is not getting reflected in my trading account.

On 19/04/20 I added an amount to my kite account through SBI BHIM upi. Amount debited in my bank account but not update on zerodha balance. In sbi upi app shows remitter cbs offline. what can i do?

I have opened my Zerodha account long back on 07th November 2019. Due to some unavoidable circumstances I could not operated & traded in this account so far. Now I want to trade through my this account. You are requested kindly guide me how to start. I want to purchase Mutual Funds & Shares. Please guide me.

A K Rajora ID: TK8844

Hi. You can simply log into Kite on kite.zerodha.com to buy stocks, and Coin on coin.zerodha.com to invest in mutual funds. If you don’t remember your password, simply click on ”Forgot password” on the login page and you’ll be able to set a new password.

How I know where mapped to my account

Currently, I m able to add only funds worth Rs. 5000 from my Andhra Bank with UPI per day. It’s very low and almost being impossible to use. Can it be increased or can something be done?

Also, Can I add funds using my husbands bank account?

This is a limit imposed by your bank. Best get in touch with them. Also, no, you cannot add funds from your husband’s account. You can only add funds from bank accounts that belong to you and are already registered at Zerodha.

if we deposit money in zerodha by using unregistered account through UPI then what will happened?

The transaction fails and the amount is automatically reversed.

In case of UPI payment through hdfc bank if you are using i phone you don’t get request on UPI app ?

No such issue, best check with your bank/UPI provider.

i tried to add funds using UPI from my linked account with the correct UPI after which the blue ”Continue” button starts displaying a spinner icon.

but the icon keeps spinning & nothing happens, i have tried this multiple times today & failed to add funds to my account

Best create a ticket on our Support Portal, and someone from our team will get in touch with you to help.

Unable to transfer funds from my Axis Bank acc. using UPI from past on month. Will you please look into this.

What is the error you’re seeing?

If we change our UPI ID in gpay how can we change our UPI ID while withdrawing funds from Zerodha because during withdrawing zerodha does not asks for UPI ID.

Zerodha sends funds to your bank account using the bank account number we have on record. No need to update UPI ID when you change it.

During UPI fund transfer only 5000 is transferred and after

That transaction is failed every time.

I am not able to add my ICICI upi registered via google pay in your IPO section, there the only option for icici bank is with ending @icici , however the upi id provided to me by google pay is with the ending @okicici

While subscribing to an IPO, console shows invalid VPA kindly fix this

Hi,

I was trying to subscribe an IPO in Zerodha console. But when I am entering the VPA, it i saying invalid VPA. I tried multiple valid VPAs, but I am still getting Invalid VPA error message. because of this I am not able to subsribe any IPO.

Please fix this issue at the earliest.

Even I am facing the same it shows invalid vpa

Hi sir,

I have added funds to zerodha account around 4:44 pm but is not reflecting in my zerodha account?

source : GOOGLE PAY

There seems to be a payment failure. Best create a ticket on our Support Portal for help.

I want the monthly COIN SIP to be directly deducted from my Bank account. Request to develop this feature.

Currently I have to remember and manually transfer the SIP amount.

Working on something for this.

I have transfer money through upi today morning and it’s not reflecting in my account by now….. I raised a ticket

Hey,

Somehow I am not able to activate upi from my primary bank account, so if I map a secondary bank account, will I be able add funds through upi of secondary bank account.

Yes. 🙂

Mai payment Kar chuka hu aur payment successful bhi ho gya hai lekin bhir bhi Mai demat account nahi khula hai

Hey Ajay, have you completed the signup process and e-signed your account opening forms?

Paisa paid hone ke bad bhi form nahi bharaya hai Mera demat account payment ke bad kaise khulega iske liye mujhe link bheje

Go to signup.zerodha.com and complete the signup process.

I am trying to add funds through UPI which is failing for last two days. Earlier it was working fine for me. I use karnataka bank account and KBL UPI app. My UPI transactions are getting approved fine but payment is failed still.

Hi,

I tried transferring money through SBI BHIM UPI to Zerodha. I received the notification in my SBI BHIM UPI app but transaction doesn’t happen and it says its communication error. Temporarily, net banking through SBI is disabled. Requesting you to let me know, whether the issue is from SBI or Zerodha. Fyi, UPI is linked to same bank account as existing in Zerodha,

Try using another app like Google Pay with the same account. Should work fine. There’s a problem with the SBI app that we’ve reported to their team a couple of months back.

I have transferred 20K using Google Pay to Zerodha equity account but its not reflecting in funds window. What could be the issue.

I see that the payment was updated within a minute. Are you still not able to see the funds? If so, can you share the URL of the page you’re looking at?

whenever i tried to add funds through sbi upi app it always shows invalid virtual payee address

Hi,

I opted for SIP, every month I am loading money explicitly in zerodha via UPI. How to transfer to my zerodha account via NEFT/IMPF (need bank details)?

when i am trying to transfer the money through ICICI bank using UPI , getting the error customer reference must be 12 digit, and transactions failed, let me know how to resolve this problems?

Yes, even I am facing the same issue with icici and zerodha upi.

Kindly resolve.

now when i am trying to add fund from another upi app like sbi pay its saying wrong payee details and wrong payee vpa

Collect message is not being sent from zerodha to google pau

There was some downtime on the bank servers yesterday. This has since been fixed.

I have sbi account…having trouble since last 4 days via UPI…its saying oer transaction limit exceeded since last 4 5 days….why so? Is there any monthly limit or something like that….i heard about daily limit only

Hey Nishant, there’s no monthly limit as such that I’m aware of. What is the error you’re seeing?

its saying per transaction limit exceeded.

Am not having Union bank UPI system.

can someone suggest me for the same.

i have added a hundred rupees for fund but deducting from the amount

for what?

@Matti,

I had given a VPA the first time using UPI on the funds page and now wish to change it to something else but, am unable to find a way. The page never asks for the VPA anymore. Please help.

I had used upi for opening commodity account in zerodha and while doing my money got deducted and was showing successfull on mobile but was showing failed in kite….i contacted the team and created ticket but even after sharing my proof of successful transaction and my bank statement they were telling money not recieved in zerodha…i aaked for refund but said money os not reflecting in their account ….and after 4 days of followup and waitin the executive told me that we will do offline process…but my concern is if i transfer 25k -50k whats the safety that if transaction gets failed in kite but shows deposited in others account and successful in app.

What is Zerodha UPI address? Can the funds be transferred to the UPI address of Zerodha instead of following the UPI transaction procedure mentioned above?

Is this possible that add fund on kite account via credit card.

Is this option is available on kite web or android app.

Using funds from a credit card to fund your trading account isn’t allowed by SEBI. This can’t be done.

I do have SBI account linked with Google pay and zeerodha .

Can I use Google pay for all future transitions ,and not directly SBI.

Yes, you can.

Hi Team,

Can you please help me..i am not able to add fund using UPI.

when i enter amount=500Rs ,select UPI then click on pay — it throws error ”payment failed”

Any body able to use UPI..for last 3days i am trying but UPI is not working. customer care is also not helping me in this.

Hi Siyaram, what UPI app are you using?

How to find my UPI

You will find your UPI ID in the Settings/Account option of the UPI App you have linked your bank account with.

When I use to transfer via UPI it highlights in my app that due to technical problem unable to transfer fund…. Plz suggest

Which UPI app are you using?

Our UPI integration works fine with Google Pay(Tez), BHIM and UPI apps of major banks

Hi,

Whenever I try to add funds using UPI, it gives error message that payee virtual address not valid. I am using HDFC Bank and this is the bank linked to my Zerodha account. Please advise.

Hi,

I have initiated the Withdrawal request and almost 2 working days have gone and still the amount is not credited. Once your support portal is created only the system creates multiple tickets, but surprisingly no response for those tickets. Before when we send E Mails the system we get responses, now no responses. Kindly improve the system and also the Back office. The back office gets updated after 24 hours if there is no trading is done.

Im trying to add funds using UPI/Google Pay, when I enter amount and select UPI.

Im not getting any notification on my google pay app on mobile so I can approve payment. Is there anything im missing

Please note, mobile number registered with zerodha is on 2nd SIM on my mobile (hope this doesnt make any difference)

After selecting UPI, you’ll also need to enter your Google Pay (erstwhile Tez) VPA in order to proceed with the transaction, Ravi.

Yesterday 9.9.18 I transferred Rs 12000 using Tez payment from my HDFC bank saving account to using coin app and my cash balance also got update accordingly. Thereafter I placed an additional purchased for six mutual funds in my portfolio of Rs 2000 each . But to my surprise this evening I received an email from zerodha informed me that the transaction was failed due to insufficient balance.

Would you please clarify on this.

Thanks

K. Dkhar

RK3237

This email seems to have been sent to you in an error. An order confirmation email should have been sent after this. I see that the units have already been alloted to you.

Not able to transfer funds to kite using UPI, tried several times just says transactions failed

Hi Rajendra, what app are you using? Also, are you sure you’re transferring funds from only the bank account linked to your Zerodha account?

Why am I receiving constant UPI request for 10000 from zerodha1@hdfcbank. I have no relationship with Zerodha and never had any type of account with them, Totally annoyed with, they are sending me every 10 minuts

Does zerodha support s Andhra bank UPI transfers.

Not your ac UPI mony transfer

So please

I am trying to add money by UPI address generated by TEZ app for citi bank.

Tried to add 100 but not able to do it.

What is the error you’re seeing?

how do i contact you. the contact number provided asked for account number.

You can contact them through Twitter.

Sir I trying to add money in equity fund via bhim sbi pay but I not able to add money because there showing invalid payee VPA address before well service adding fund but after update have problems like that.

Hi Guru, this is an issue with the SBI app. We’re in touch with them, but this is something they need to fix. Please use another UPI app for the time being.

Sir I am unable to transfer through TEZ. Can you please look into whats the problem ? I had no problem doing it few days back. It was working but suddenly stopped. Money is getting debited but not crediting to your account. I got refunds instantly saying that your address is not found. Awaiting response.

Can you please email a screenshot to social at zerodha dot com?

Issue with axis bank resolved or not ??

axis bank….upi not working….not showing notification in app….

Hi Hitesh, this is an issue with Axis Bank. We are in touch with them to have this resolved.

I tried since last week to add money using UPI. but not getting the notification on my App

Hi Krishnan, this seems to be an issue at Axis. If you’re using UPI powered by Axis, you’d not receive the notification.

I am not receiving any notification in TEZ while adding funds.

Please help.

I am also facing same issue please look into this..

Hey Dalbir, can you please check if you’ve blocked requests from Zerodha on Tez by any chance?

can use paypal?

UPI is also available for fund withdrawal?

Rushang, there’s no change with withdrawal. Withdrawal process is as earlier.

My Clint ID is xs0917 with Zerodha. I want to transfer funds to Zerodha.

I have stuck at UPI ID.

I don’t know my UPI I’d.

Where can I get the UPI ID?

Thanks

Rajmane

9341100646.

Currently canara bank is not supported in your gateway. Any idea when it will be supported. So that ican do UPI transfer?

Hi Matti,

I have only my SBI account linked with zerodha. But I have two more of my other bank accounts linked with my UPI app. Can I transfer from any of those three accounts through UPI or will it accept only the transfers from the SBI account which is linked with zerodha ?

Thanks.

Only transfers from your SBI account will be accepted.

i have many upi IDs so Which can i use For pay – in

You can use the UPI ID, which is linked to the same bank account [in case of Paytm, for withdrawal] as you’ve registered with Zerodha.

i want to use upi for commodity segment but there is no option for commodity fund pay in via upi

A buggy interface. Wastes lot of time and effort. Mostly shows ”invalid VPA”. 85% time it failed to transfer money.

Hey Raju, this seems to be an issue with certain UPI apps. I suggest you try an app like BHIM or Tez. Should work fine.

can i transfer the money to my trading account at night? if so when will it be credited? immediately or the next working day?

You can transfer funds using UPI at any time. It is processed instantly.

On my ICICI bank imobile app while accepting the payment request it throws “INVALID VPA ADDRESS”. I am using the exact same steps as in this blog post and also getting the sms from icici for payment. I am using iphone with the latest update of icici app.

Several users have posted this and you’re just giving the same lame response without trying to troubleshoot. Please try with some icici user and post a resolution.

Hell,

Looks like not able to click on UPI and not even continue as UPI is not clickable. AS zpin not working can not call even.

How should I go about it now?

Regards

Kalyan

Hey Kalyan, do you mean you are not able to approve the transfer in the UPI app? You can find your ZPIN on the profile page of Q.

Just one more data point from today that this doesn’t work with ICICI Bank. The same error saying invalid virtual address keeps appearing. Tried a few times and gave up on it. Please resolve this quickly.

There was an issue with the older version of the ICICI Android app that has been resolved in the latest update by ICICI. If you’re still facing issues, I suggest you use another app, like Google Tez or BHIM. Should work just fine.

It is not working with ICICI App on iOS as well. Can we get resolution for using ICICI App directly?

Please post different Banks’ daily limits.

KMB, Axis, ICICI, IDBI, SBI, BOI, BOB, PNB, etc

Hey Anant, these limits are something you’ll have to fund out from your bank.

I did a UPI transaction using UPI app. I got the error ”remitter cbs offline” on HDFC’s app and transaction failed at Zerodha’s end. I tried again and it failed again. But amount was deducted from my account both times and now I’m 1L short. 🙁

Sir

Please make the withdrawal faster like deposits instant if possible with more optiona cant wait for 24 to 48hrs just for small withdrawal

Dear Zerodha,

Congratulations! It’s nice to see a new process added for money transfer into trading account.

But what about withdrawal? Forget about instant withdrawal request, you guys don’t permit your clients to place withdrawal request upto 8:45 am (in Equity segment) like other brokers (e.g. Upstox/RKSV, SAS etc.)! The most painful thing is that, in Zerodha the withdrawal cut-off time is 8:30 pm and one has to be extreeeemly lucky if his/her ledger is been updated on or before that time in the evening of that day. Generally….very rare. So if one wishes to take out his/her own profit of that day or the total, it’ll be close to impossible.

So, I’m requesting you, please change the cut-off time of placing withdrawal request (Equity segment) from evening 8:30 pm to morning 8:30 am. It’ll immensely help us as a client to get some more time to plan/place/modify our withdrawal request. Please think…..if not instant, give us a little more time.

Yes, it’s true. Back office update takes place at late night or next day.

Zerodha should change the cut-off time from evening to morning 8.30 am – 9.00 am like some other discount brokers.

Because, many times we don’t get the time at evening & miss the strict cut-off deadline.

I am adding funds in Zerodha through UPI. An error occurred as ”invalid VIRTUAL ADDRESS” while authorising the same in ICICI BANK.

Please sorted out the matters.

Thanks

XB3821

I havr the same error.. With upi transfer from my icici account. Pls help..

Hey Akshay, there seems to be an issue with the ICICI app. Try using a different app, like BHIM/Google Tez and the transfer should go through.

NOT WORKING!!

Error: Beneficiary payment address restricted.

UPI payment not working. Getting error as ”Invalid Request”

Hey, yes. There seems to be an issue with the ICICI app. Have reported this to ICICI. A fix should be released soon.

There could not be a better example than this …

Wednesday 28th March is the last trading day in March 2018 (financial year ending) also F&O expiry. Well now a lot of traders will be in a dilemma of should they withdraw funds on Tuesday and get the same in their banks on Wednesday or should they use those funds to trade on Wednesday. But if they choose to trade on Wednesday, they wont have access to that cash till Saturday (provided banks are open) and if not Saturday, they will have to wait till Tuesday 3rd April to get the funds in their banks. Now only if Zerodha allowed instant withdrawal as well, traders could have traded till 330pm on Wednesday and then requested a cashout to have the funds in their banks to use for the rest of the week while markets and banks are shut.

Makes sense ?

Not able to transfer funds through UPI as it continues show invalid UPI

Hi….UPI integration is a good add on for depositing funds.

As per you the transaction is free. But, after depositing money through UPI, it is showing as additional charge of Rs. 9 & GST will be levied (In the payment transaction screen). Although, no such amount is deducted from my deposited money.

Thanks.

Hey Sandeep, that applies to transfer of funds via NetBanking.

What about transfer from Zerodha account to primary account?? The main issue is getting money faster in to my account than Zerodha’s.. With Angel and other brokers, funds get transfered within few hours same day of request made.

Please respond to this open query of mine I posted above.

I generally initiate an imps/neft from bank’s net banking to your account… Is that charged? Please clarify this..

NEFT/IMPS is not charged by us, but your bank may charge you. UPI is free. Also, NEFT takes time to be updated. IMPS is generally instant but, as I said, bank charges may be levied.

When i try to transfer money through UPI – when i try to authorize in my mobile app (ICICI) it is saying ”INVALID VIRTUAL ADDRESS”.

Please address this issue.

There’s an issue with the ICICI app that we’ve reported. This should be fixed by the ICICI team soon.

Issue while transferring from icici upi. The message says zerodha1@hdfcbak is valid address. followed the exact steps in the blog. Please check from your end.

There seems to be an issue with the ICICI Bank app. We’re in touch with the NPCI to get this resolved.

Thank you Zerodha for providing UPI for fund transfer.

It was a bit of process transferring funds by net banking.

Did not work. ICICI UPI failed with an error that zerodha1@hdfcbank is NOT a valid address. Is it still not live?

There seems to be an issue with the ICICI Bank app. We’re in touch with the NPCI to get this resolved.

Still not resolved,failed with icici upi.

What would be the charges after 6 months on transacting through UPI?

2 month back I purchase 100 shares with zerodha but since last 20 days I am trying to sell but admin is rejecting or getting cancelled I loss 3000 in this daily the value is going down please tell me how I can sell zerodha is not giving any response please help me to sell these shares

🙁 not working for me…say virtual address not validate. I am using ICICI bank.

There seems to be an issue with the ICICI Bank app, Sachin. We’re in touch with the NPCI to get this resolved.

Hi,

Could this be, looked at ASAP.

UPI on Zerodha on Beta stage, was working fine with my ICICI accnt. But, now its showing error – Invalid Virtual address.

the zerodha upi address showing up is zerodha1@hdfcbank

zerodha1@hdfcbank is indeed the right UPI, Akash. The UPI requests not being processed by your bank app is something you’ll need to check with your bank. In the meanwhile, you can use another UPI app, like BHIM or Tez, and the transfers should go through fine.

It’s awesome… Fund transfer done within fraction of seconds

That’s why ZERODHA is my first choice…

Superb work by Zerodha team… Thank u very much…

Zerodha is getting money fast, within a second…..awesome

But the Clients are still waiting for 24-48hrs to get back their own money.

So Zerodha team can cheer…..natural

But what about us?

How the Id and Pin generated.

thanks for this facilily

Recently one of my family member was trying to open an account with zerodha, and he holds a saving account in one of co-op banks in Karnataka.. when we was trying to open the account online and pay the account opening fees through net banking, he came to know that his bank name is not in the list..

Now wat is the procedure to open the account..he doesn’t have any other sb account with other bank

I do not get about the UPI app. What app i should install in my phone?

Appreciate your efforts.

Hello Zerodha Team,

I have made transfer of 10000 Rs using UPI option. When I checked Ledger report, it shows Debit entry for ”Being Payment Gateway Charges Debited” of 10.62 Rs.

It means, it is not free. The same amount of charge being debited as that of Net banking.

Please clarify.

When was this transfer made, Brijesh?

on my ICICI bank app while accepting It says ”INVALID VPA ADDRESS”. its not working. kindly look into it.

I made a transfer using UPI. The transaction shows complete in my banking app but amount is not reflecting in Zerodha. Please help..

I see that you’ve transferred from your Kotak account, which is not mapped to your trading account. You need to transfer from your ICICI account or map your Kotak account as a secondary bank account. The transfer you’ve made will have been reversed to your bank instantly. You wouldn’t receive an email for this.

Can we withdraw unused funds through UPI ?

Very good move…other than being free, UPI doesn`t require to login in any portals/website for payment. It is hassle free, easy and quick.

Good Move.

For HDFC/ICICI, final charges/transaction would be?

As the post says, Rahul, no charges.

What should one do if he or she wants to use this platform actually I want to make a suitable references for my kind information from u.

Thanks a lot

need to transfer fund from bank account to zerodha trading account.

what is UPI ? how It works ?

what is Virtual payment address ? how to create UPI and map it with bank ?

why it is necessary to have UPI app in mobile ?

We’ve been able to negotiate a deal with our banking partner to keep this free for the first 6 months,

May i know what does this line means? after 6 months, will UPI transfer also will be charged as like other mode transfer?

I go on to say ’and if the transaction volumes are high, even beyond that’, Vinoth. Right now, this is a pilot. If the bank sees that the volumes are high, we’d be able to keep this free even after the 6 months.

ok. Got it. Thanks

what about, after 6 month you are going to charge 15 rupee.as you mention above .

Right now, this is a pilot. If the bank sees that the volumes are high, we’d be able to keep this free even after the 6 months.

How to get upi id

Icici bank is showing error as invalid virtual address when accepting upi collect request from zerodha. Not able to do upi transfer

same here.

Same issue here with ICICI Bank.

Nice Services

I tried with ICICI iMobile app UPI payment and when I accept the payment rerquest, it’s complaining ”INVALID VIRTUAL ADDRESS”. Not sure which end the problem is.

I have canrabank account but this account is not add Zerodah software so how am use upi through add payment

All banks are supported for the UPI fund transfer Mahesh. Simply select the UPI option on the payment page and enter your UPI ID.

I tried today via ICICI UPI it said invalid transaction Invalid User Address !!!!

i don’t know my UPI id how to Genrate ? Any Demo ?

What is Status of Crux Software to Replace Q back office ?

Kite Phase Out Date Plz tell ?

Kite 3.0 is Ready to Replace kite old version ?

Is this also available on NRI PIS accounts with Zerodha?

What is the procedure to change my bank account at Zerodha trading account..?

Best features added in zerodha thanks

Hi Team,

It will be very much helpful if you implement something like that let us to withdraw the amount instantly which is atleast half of the margin available in the account just to enable faster and efficient way to utilisation of our money for the time being you come up with any other better way to enable waster way to withdraw the amount just like depositing. I think one who withdraws the half amount of margin available will not issue related to payment settlement at day end because your RMS immediately deduct the required margin from one’s account.

Can i transfer funds to my brother’s account using my UPI if?

hi, can Zerodha as broker withdraw or use any client’s fund from his trading account with or without client permission?

if a client only works in delivery bases and demat all his shares, will again any broker or Zerodha can touch client demat holding or not?

what is the purchase limit for retail trader on single company shares in one bid or multiple bid?

thanks

Good job.

Is the same arrangement (UPI) available while transferring funds from Zerodha to our accounts

No, withdrawals are processed once at the end of the day after trade process for a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

Why thinking so critical?

If a client takes a trade after placing withdrawal, the back office will be notified & the fund transfer will be blocked.

Or before fund transferring, back office will check if there is any trade or not.

Or after placing the withdrawal request the client will be allowed to trade only on excess fund if there is any. otherwise will be blocked from trading.

And there will be another 1000 ways.

Zerodha is technically so advance…..they can do it if wishes.

Isn’t it?

Can I use VPA provided by third party apps? for example if I have SBi account linked with zerodha and I am using phonepe for UPI (SBI account linked with phonepe), then my UPI extension will be @ybl instead of @sbi. But I am using SBI account through phonepe, so can I input @ybl VPA?

Yes Kalyan. That shouldn’t be an issue.

I’ve made two UPI transection for adding fund and each time I have been charged RS. 10.62 saying Being Payment Gateway Charges Debited –

I believe these transactions were made before today? The charges for UPI transfers were waived off starting today only. Any UPI transactions you make henceforth will not be charged.

Hi Team,

How do i generate UPI ID ? how can i link it to my Bank Account ? Could you please help us providing a detailed document for the same

Thanks in advance.

Thanks,

Naresh Kumar K

Good move, but you are taking money from public very fast. Why you don’t apply the same logic for withdrawals. We are losing interest in small. But on the whole deposits of us (customers) you are getting big amount as interest. Giving back customer’s money is not a big task in these technically advanced days. Kindly make available of UPI based withdrawals also.

Withdrawals are processed once at the end of the day after trade process for a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

Deposit through UPI without charges are only for 6 months.

Why only 6 months…??

Its the easiest way so it should be free all time.

Hey Mohit, if the transaction volumes are high enough, we will be able to ask our banking partners to waive off this charge for perpetuity. For now, we’ve negotiated this as a pilot for 6 months.

So there will be a charge of 15₹ on every transaction after 6 months?

Hey Swaroop, if the transaction volumes are high enough, we will be able to ask our banking partners to waive off this charge for perpetuity. For now, we’ve negotiated this as a pilot for 6 months.

Usually 9+GST will be charged for add funds via kite app, would like to know, still it is applicable?

Not for UPI, Aslam.

Good to hear this feature is live.

Thanks Zerodha. Keep Rocking.

Nice step .

today sent RS 100.00 to zermcx@hdfcbank from ZR4296 from airtel payment bank through

upi plz add this amont to my ZR4296 a/c

yours

Ravishanar.T.G

9740768092

This would only happen if you transfer funds to our UPI handle directly from your UPI app. Such transactions have been blocked as there is no way for us to track them to update your fund balance with us. If you use the method described in the above post, should work fine.

Does gateway cjarges applicable for UPI transaction?

No.

Good Move

I saw some people mentioning charges you deduct for depositing money through imps or neft. I have never cared to check my backoffice and nor have I seen you deducting out of the transaction amount initiated. Do you deduct deposit charges against imps/neft based deposit transactions later on from the funds available? Please Clarify whether you deduct or not?

IMPS/NEFT are charged by the bank, not us. The payment gateway has a charge of Rs. 9 + GST. But this wouldn’t be applicable to the UPI transfers.

I generally initiate an imps/neft from bank’s net banking to your account… Is that charged? Please clarify this..

Please Respond

I saw some people mentioning charges you deducr

No charges, Nakul.

its need of hours

thanks .

Can’t we transfer directly from my UPI app using zerodha UPI id? like a paying a biller?

No, there’s no way for us to track the transfer and so these are not allowed.

Is it possible for you to provide option to clients to register their UPI I’d. Then you can easily track UPI transaction directly initiated by users.

Adding funds to zerodha is not a big deal currently. Using net banking its done in real time . Its available 24×7. But withdrawl of funds is not real time.it takes more than 12 hrs for funds to get credited to the clients account in accordance with withdrawl request. If the next day is a bank holiday the credit occurs only on the next workIng day. But upi is a 24×7 realtime service so if withdrawl is possible through upi then it will be verymuch helpfull. Otherwise there is nothing great in bringing upi to zerodha as we have netbanking facility which is real time.

Withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

Please explain How it is defferent from the present IMPS system in zerodha.

we have been getting credit instantly.

can i use tez app for fund transfer

Yes, you can.

Adding funds to zerodha is not a big deal currently. Using net banking its done in real time . Its available 24×7. But withdrawl of funds is not real time.it takes more than 12 hrs for funds to get credited to the clients account in accordance with withdrawl request. If the next day is a bank holiday the credit occurs only on the next work

Withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

1Please Dont copy paste same answer for different question.2

Why don’t you process withdrawals through IMPS for below 2 Lakhs withdrawals. It will be helpful to small investors who is really need fund’s on urgent basis. And above that normal.

Raj, the process to do that would be a huge operational overhead and so hasn’t been used.

Please add Credit Card as well. It will be great if done.

You can’t use funds from credit card to trade the markets! It’s not allowed!

Is there any portal charges like netbanking

As the post above says, no charges fro UPI.

Is it possible to withdraw some money, using UPI from Zerodha funds?

Withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

It is saying that charges are 9 + gst whether it ia applicable

That is only applicable to the NetBanking option. Having it updated to offer more clarity.

Very Nice move initiated by Zerodha! Keep It Up Team Zerodha

Good move, it should be implemented to withdrawal options also, if any emergency we can’t able withdrawal the amount on same day.

Withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

What about Withdrawing fund’s via UPI ?

Withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

Sir,

By mistake I transferred rs.10000/- to zerodha account from unregistered bank account ,

How can I get money in my account. Please help me!

Mobile no .9730098230.

You can create a support ticket here: https://support.zerodha.com/category/funds/adding-funds/articles/add-money-using-upi-to-my-trading-account

I tried but It says invalid UPA address

This would only happen if you transfer funds to our UPI handle directly from your UPI app. Such transactions have been blocked as there is no way for us to track them to update your fund balance with us. If you use the method described in the above post, should work fine.

Nice one but also immediately withdrawal amount provide very helpful

Withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

When I tried to approve from my ICICI, it is saying invalid UPI address.

This would only happen if you transfer funds to our UPI handle directly from your UPI app. Such transactions have been blocked as there is no way for us to track them to update your fund balance with us. If you use the method described in the above post, should work fine.

I tried to transfer funds using upi through my ICICI bank account. Payment request was received but after logging to bank accounts and clicking on accept payment following error was displayed:

”Invalid payment address”

same error for me as well

This would only happen if you transfer funds to our UPI handle directly from your UPI app. Such transactions have been blocked as there is no way for us to track them to update your fund balance with us. If you use the method described in the above post, should work fine.

I tried using method described in the blog. I received the notification in ICICI UPI section in pending request. But when I accept it it gives error that invalid virtual address. I am not transferring directly from ICICI to zerodha1@hadfcbank. the request is sent form ZERODHA web application as described in the blog.

Please update your icici bank app. It worked for me after update. Thanks

Same issue here with ICICI. Even after following steps mentioned in the blog.

what are the charges for deposit through UPI ?

As the post above says, Gayatri, no charges.

1. Is there any limit for per day transaction ?

2. Please confirm, is it only for 6 months ?

You can transfer a maximum of Rs. 1 lakh per day. Per-transaction limits are set by your bank and differ from bank to bank.

For now, the transactions are free for 6 months. Depending on the volumes, we’d be able to talk to our banking partners and keep it free perpetually.

Please make this arrangement for withdrawal funds also. As a customer we use both add and withdrawal funds option time to time, so this easy transfer option should be available for both ways.

Because withdrawal is more important than adding funds in emergency times.

Withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

But at least you have to consider allowing instant transfer once you ascertained how much clear balance is available at the end of the day.

As I said, we’re working on a solution for this.

Is there any news about direct deduction from bank account for Mutual fund ?

who will provide upi id or how to get it?

maximum limit

Good to see Zerodha being amongst the first Financial Service providers to integrate UPI option for instant credit of funds.

In terms of time required to complete the transaction, I think the Net Banking option will be marginally faster. What do you think?

Wouldn’t make much of a difference Mandar. Takes about the same time.

fantastic guys!!! keep going with the good work

How much time it will take to update funds in Zerodha and my bank account???

Hai much time it will take if we withdraw the money from zerodha to ur bank account through this upi transaction

Hey Akshay, the UPI transfer is only for transferring funds to your Zerodha account. Withdrawals are still processed once at the end of the day after trade process.

This is the norm everywhere. Taking from us is always quick with various options. Giving us seems to be very difficult and lenghty process. Zerodha need to change this if you are different from the rest. I placed withdrawal request on 16th May 4pm. Generally, I receive SMS by same day night stating withdrawal processed. Today I did not receive that SMS. I guess I won’t receive my money by 17th May morning.

Withdrawals are processed at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

Thank’s too all of ZERODHA team

Please do something for sending money back to our bank account. Bringing money to Zerodha is easy and taking back to Bank is hard nut. Hope Zerodha comes up with that soon

Hey Mohan. Withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

But at least you have to consider allowing instant transfer once you ascertained how much clear balance is available at the end of the day.

Thanks for providing better service by deploying UPI. It really makes the transaction hassle free.

Very easiest method to add fund and security also. I think Rs 10000 per transaction and Rs 20000 per day

You can transfer a maximum of Rs. 1 lakh per day. Per transaction limits are set by your bank and differ from bank to bank.

Please post different Banks’ daily limits.

LIke few of other trading platforms, zerodha should also have facility to move money between Equity, Commodity, Currency and vice versa..everytime a separate transfer has to be done for separate instrument.. Can this be also looked into?

I second that. Hi

This is because regulation doesn’t allow for transferring funds between segments. Read more here.

Very Good news

Thanks

Great work!

Great

That’s wonderful. Have been waiting for UPI support since its instant and free of charge. Well done.

Nice move??

U hv not furnished the transaction cost for withdraw. Pls mention it..

We don’t charge anything for withdrawals.

Very easy to use but some restriction(s) in UPI of max Rs. 10K in single transaction.

Hi Rajesh,

Transaction limits are bank dependent so they vary. Some banks allow transactions upto 1 lakh as well.

The per transaction limits are set by the banks. The daily limit set by NPCI is 1 lakh per day.

Whats the limit per transfer?

The per transaction limits are set by the banks. The daily limit set by NPCI is 1 lakh per day.

good initiative by zerodha.

it will help large quantum of people can not handle net banking.

now its easy to pay through UPI.

Great and keep up the good working going, I guess zerodha is most innovative in a short span of time, which added features circling customers and not just personal gains.., I wish zerodha had ”stop loss and take profit” at the same time in cover order would have been a great great thing for users and other feature I could think about is, ”T+5” 🙂

Great job zerodha

One more suggestion is plz provide option chain at our terminal.

Maybe you can try Sensibull platform by them. Hope it helps 🙂

https://sensibull.com/

Very good move from zerodha, is it support for widraw amount ?

Withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

But at least you have to consider allowing instant transfer once you ascertained how much clear balance is available at the end of the day.

Good ,but lost more money no profit

A much needed option indeed.

What are the daily and Monthly Limits On Amount Transferred?

And if i have two accounts linked then can i use them Both For UPI?

Daily limit 1 lakh

Hey Krishnal. The daily limit set by NPCI is Rs. 1 lakh. Per-transaction limits may be set by your bank. Yes, you can use either account for transferring funds via UPI.

Hi,

Great move indeed!. However, is it possible to transfer funds to Zerodha from two different bank accounts whereas only one is mapped to Zerodha trade?

No. Funds need to be transferred from the bank account mapped to the trading account.

Tried it, got a request on my UPI app on the phone.

Tried transferring, it said zerodha1@hdfc (or something similar) was an invalid VPA. Please work on the bugs, thank you.

i had a similar issue with icici app. Updated the app, issue solved.

Actually the vpa automatically entered is wrong.

Zerodha1 40hdfcbank.

Unable to correct it also.

Please look into it at the v earliest as I too cannot transfer any funds……

This is an issue with the way the SBI app reads the VPA. Using another UPI should address this. We’re in touch with the SBI team to get this fixed.

Yet problem. Not resolved

@hdfcbank UPI still cannot be added. It is interesting to see a bug from 2018 still lives in the zerodha console. Folks. it is 2021 now – are you not looking to fix it?

Awesome. Even though regular txns takes less than 5-10 min to reflect in trading account, this definitely helpful. Appreciate your efforts.

Regards,

NK!

welcome improvement.

Currently canara bank is not supported in your gateway. Any idea when it will be supported. So that ican do UPI transfer. Now everytime i need to do NEFT/IMPS.

Hey Vishwa, UPI is separate from the payment gateway and you can use it to transfer funds using your Canara Bank account.

Alright thanks

Thank u for adding one more great feature.

it was about time!

It’s awesome to have so many ways to fund your account. Some of them instantly. It just makes the whole process more and more efficient. However should it not be both ways. Literally 10 minutes ago, I was speaking to Zerodha customer service requesting for a withdrawl request I made to be processed on urgent basis. If through UPI and IMPS you can instantly transfer to Zerodha, should we not be allowed / able to transfer from Zerodha to our bank also ?

Good idea Priyanka.. Zerodha think over it…

Hey Priyank, withdrawals are still processed once at the end of the day after trade process, and with a good reason. Only once the trade process is done can we ascertain how much clear balance is available in the account to process a payout. While instant payouts are possible, if you take a trade during the day, this situation gets tricky. We are working on addressing this concern and will figure out a way to make this happen soon.

Not a valid reason. Zerodha always limits the transaction based on real time funds availability based on deducting the amount from ledger and holding it. Rest of the amount is clear and should be able to transfer instantly.

Furthermore, all brokers allow overdraft and charge hefty interest also on negative balance, so there is no need to wait for trade closure.

While I appreciate this one directional upi, as suggested by many the reverse also should be easily possible.

I totally agree.

I too agree, with Zerodha withdrawal is one of the biggest pain points. I hope you address it soon.

I completely agree. Its high time Zerodha comes to terms with this.

Hope you all missed the actual settlement process, once the trades are closed they can have a clear and proper info regarding clear balance you can request. As trade are in process due to market volatility we need get usage of extra balance as generally mentioned in the margin amount so it need to be clear actually this far better practice to safeguard themselves and even us paying heft interest and penalties.

As per my knowledge no other broker paying immediately to the bank accounts except Banks who run Securities like ICICI who pay instant to our account but remember their brokerage

Zerodha is no usual broker. They are supposed to be technologically advanced and thus expected to solve it first and fast.

Vinit, thanks for the kind words, but as I’ve said above, there’s just no way to know how much clear balance will be available at the end of the day.

is it any charges applied for UPI paymeny F.Eg like 10.23 in IMPS transcation

Hey Udith, no charges for the UPI transactions. Mentioned in the above blog post.

Is this free transfer only for 1st 6 months??? IF so what are the charges later on…?

Does than mean if we withdraw fund it will be transferred to out bank account imminently?

Withdrawals will be as usual. The UPI is only for deposits.

Sir,

Withdrawal is most important to save n grow money

So withdrawal should must be activated as soon as you can…

It is most awaited thing

All traders need it first of all.

To be fair, you ought to consider UPI for withdrawals as well.

I second it. Withdrawals by UPI must be allowed so that surplus funds may be withdrawn immediately after closure of trading activities.

Good news

Good move.

Good move.

Yesterday I raised request of transfer of amount of 50k . from my google pay , amount is deducted from Sbi bank through google pay but nt reflecting Neither on my funds Nor on Reversed to my Google pay Account

Best create a ticket on our Support Portal for all account-specific queries.

Did your issue got resolved ?

Maximum transfer limit?

The daily limit set by NPCI is Rs. 1 lakh. Per-transaction limits may be set by your bank.

Is there a limit to the amount that can be transferred?

Max. of Rs. 50,000/day & Max. of Rs. 25,000/transaction.

is it also possible to transfer money back to bank account through UPI ?

C-13 ansal villa satvari and subscribe

sir i added through upi on sunday it is showing under payin and i cant withdraw it

Hey Tushar, that’s because withdrawable balance wouldn’t have been updated on Sunday. You’d still be able to withdraw this amount.

The daily limit set by NPCI is Rs. 1 lakh. Per-transaction limits may be set by your bank.

ICICI Bank limits it to 20000.