Introducing Sensibull — the Options Trading Platform

Traders,

Options trading is probably the toughest business to make easy money. Yes, it seems easy, but less than 1% of options traders make any money in the long run. The reason for this is because most people trade options as if it were a lottery ticket. Through the Options module on Varsity, we educate many option traders, but knew that there is a lot more to do to get people to move away from just trading naked option buying of Call/Puts to trading strategies where the odds of winning go up substantially.

Find below a post from Abid, Founder@ Sensibull – startup we have partnered as part of our Rainmatter initiative, India’s first options trading platform. The objective is to eventually offer whatever possible to help you stay profitable when trading options and help you stop before losing a lot.

Sensibull is India’s first options trading platform, offering everything from simplified options trading for new investors to powerful trading tools for the pros. Sensibull aims to make options trading safe, accessible, and most importantly, profitable for all.

Sensibull was founded with the absurdly impossible vision of making the small guy win against the big guy in financial markets. Here’s what’s in store:

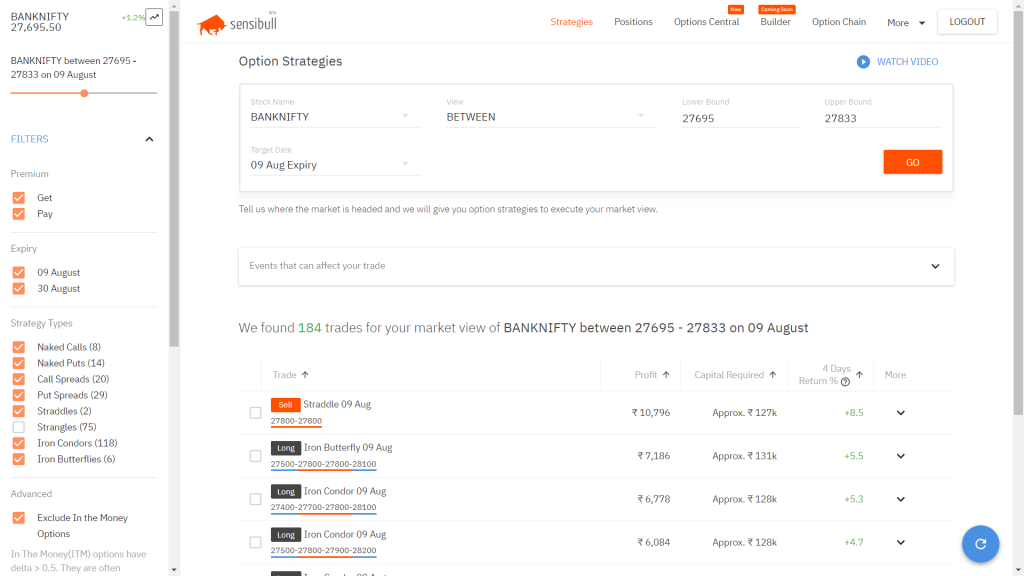

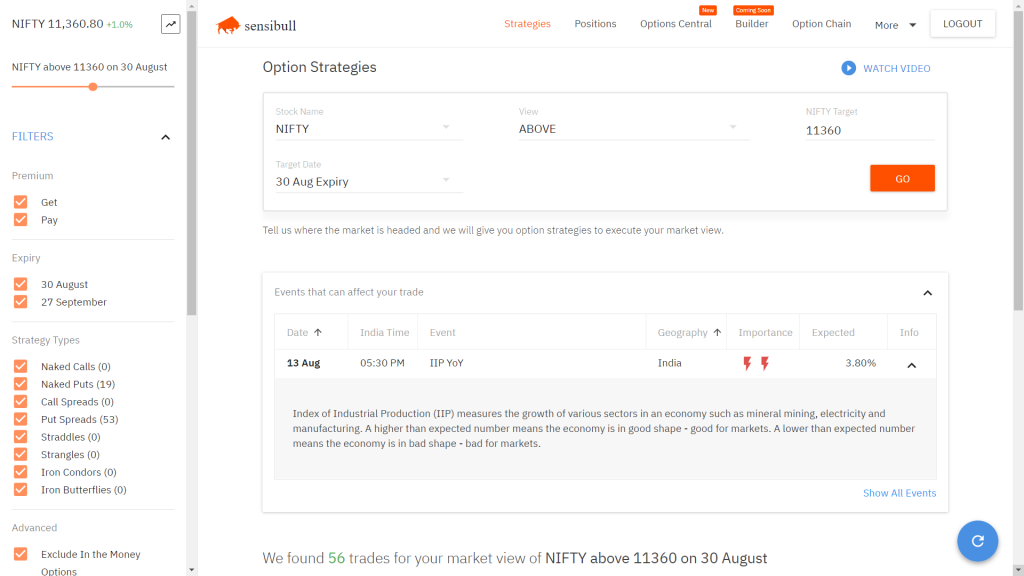

Strategies Engine

If you have a target for the market or a stock, Sensibull tells you the right Option Strategies for your target. This means you can trade options without knowing options, just by knowing the stock and its direction. We will take care of the underlying math for you.

Spot the best strategies for your view.

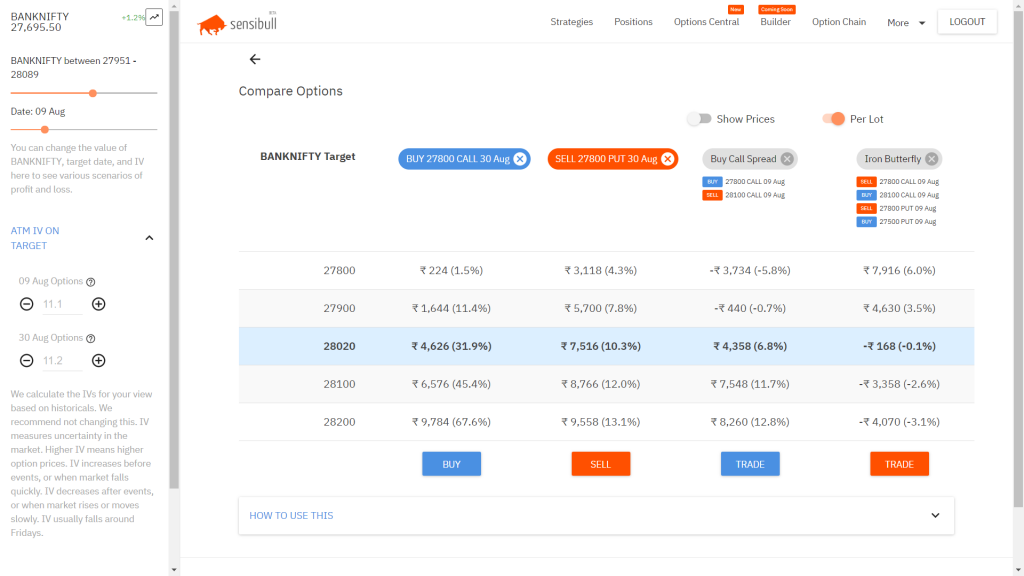

Compare Options

If you are not sure which is the best option, compare them side-by-side under various scenarios.

Confused about which option is better? No more!

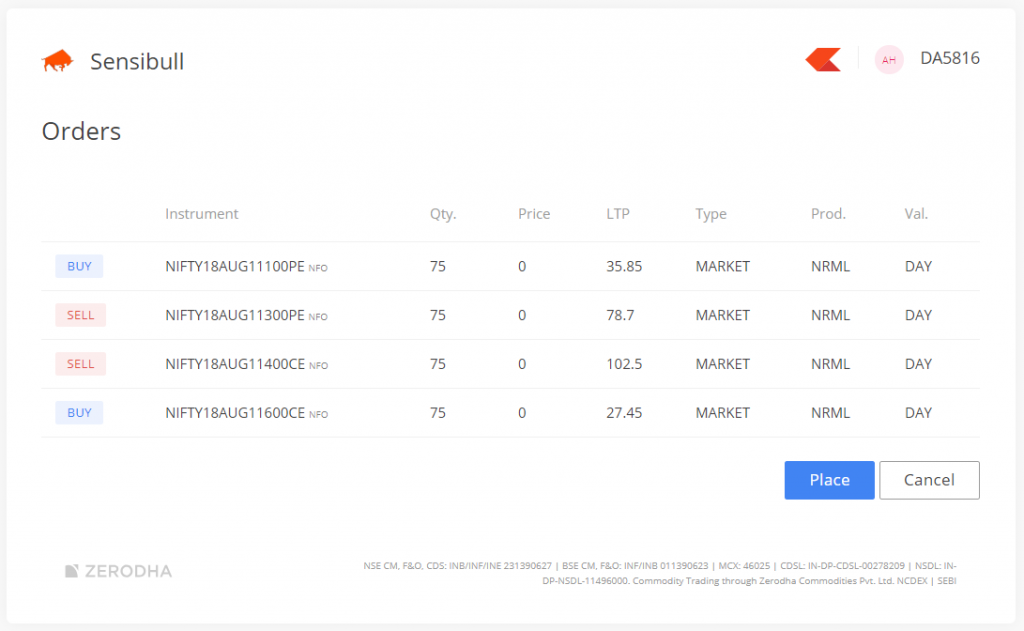

Single Click Strategies Execution

Execute complex strategies like Spreads, Butterflies, Condors, and so on with a single Click.

Use Basket orders to execute the options in multi-leg strategies simultaneously

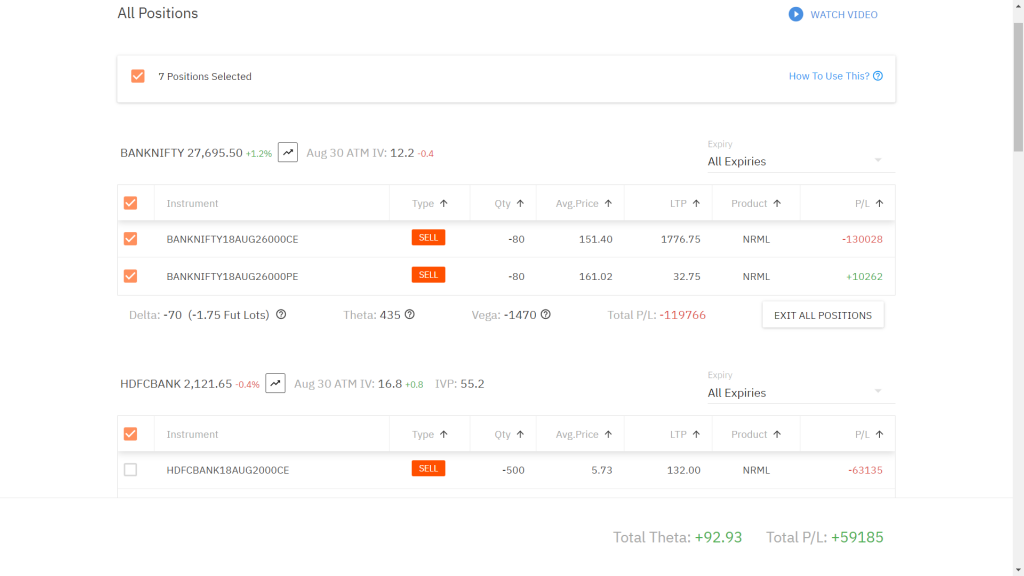

Positions with Strategy Tracking and Real-time Greeks

Group your positions as strategies and see real-time P&L and Greeks.

Tracking positions was never this easy

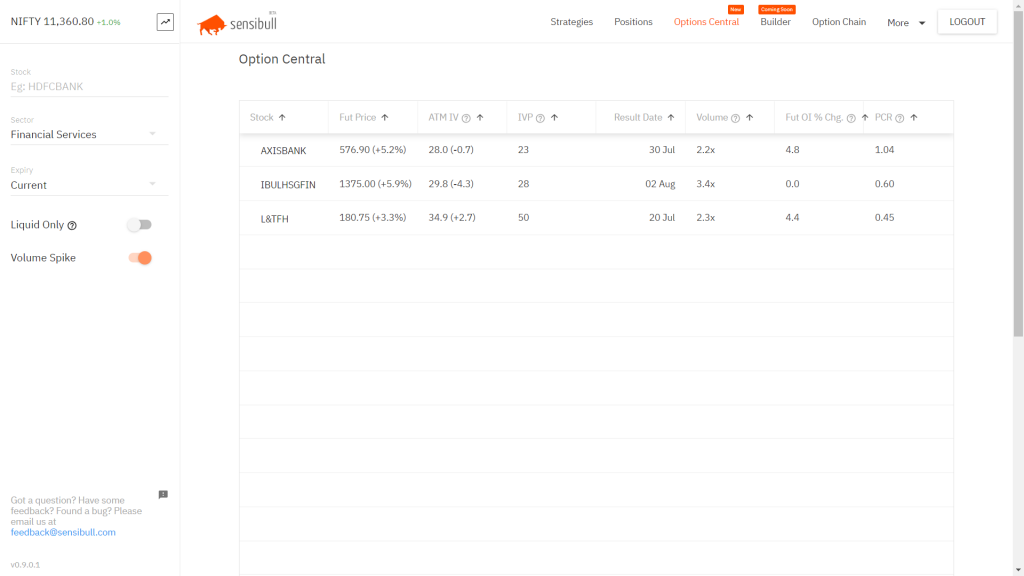

Option Central

The one-stop solution to spot great options trading opportunities. Get IVs, IV percentiles, Events, Volume Breakouts, OI Buildups, PCR etc, all at one place!

Spot great opportunities with little effort

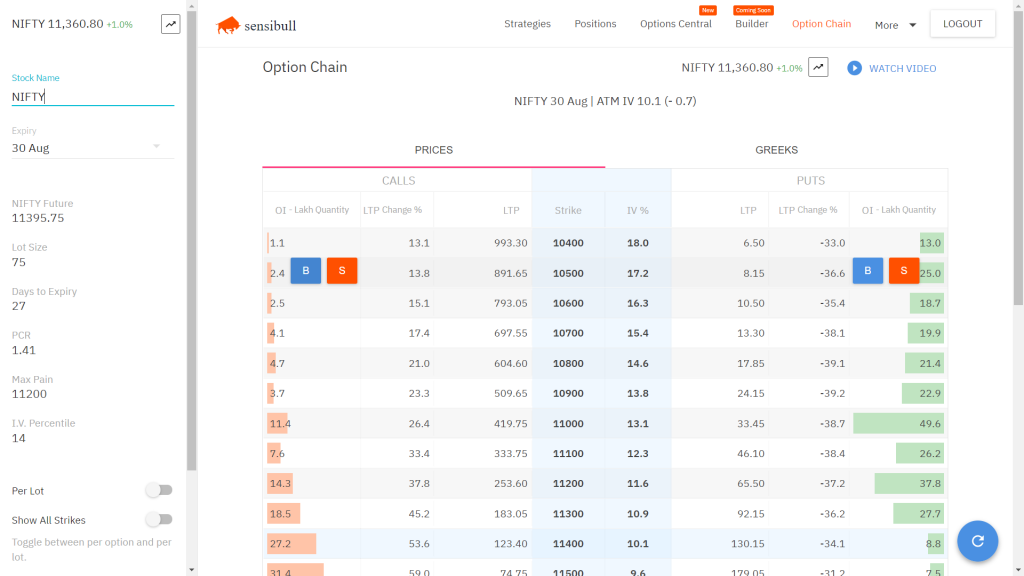

Enhanced Option Chain

Easy-to-use and visualise, it gives you the entire OI buildup picture in a glance. It comes with real-time Greeks, built-in events warning, IV Percentile, PCR, etc.

Get the full OI picture at a glance

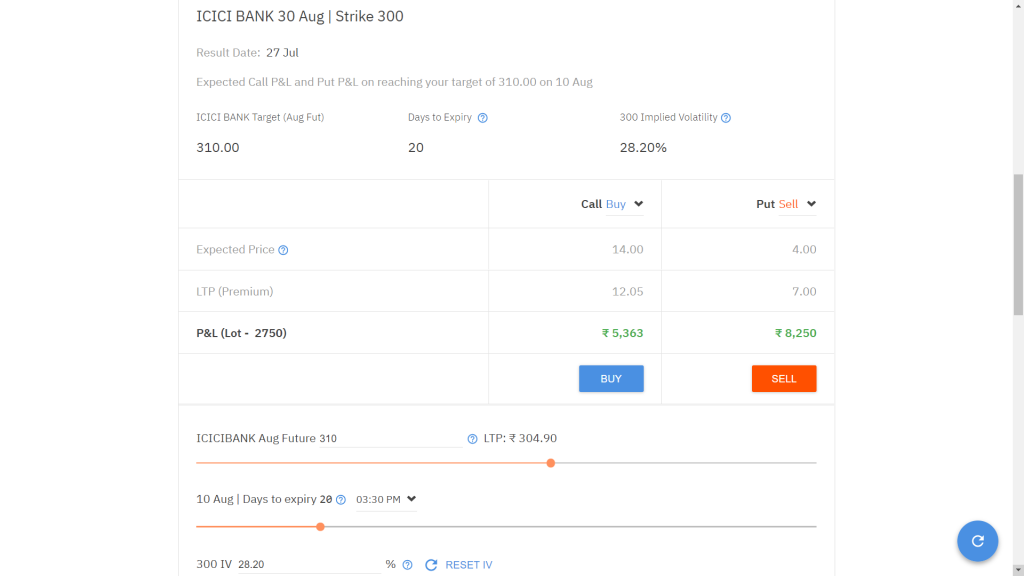

Black Scholes Analyser

Analyse a single leg call or put option side by side, with scenario analysis.

Simulate different scenarios using the sliders

(Not just another) Event Calendar

Sensibull’s events calendar focuses on only the most important events, and cuts through the noise. Not just that, it is connected across the site, so that when you take a trade anywhere in the site, it notifies you about the event risk. It tracks macro events, as well as FNO results.

Protect yourself from events

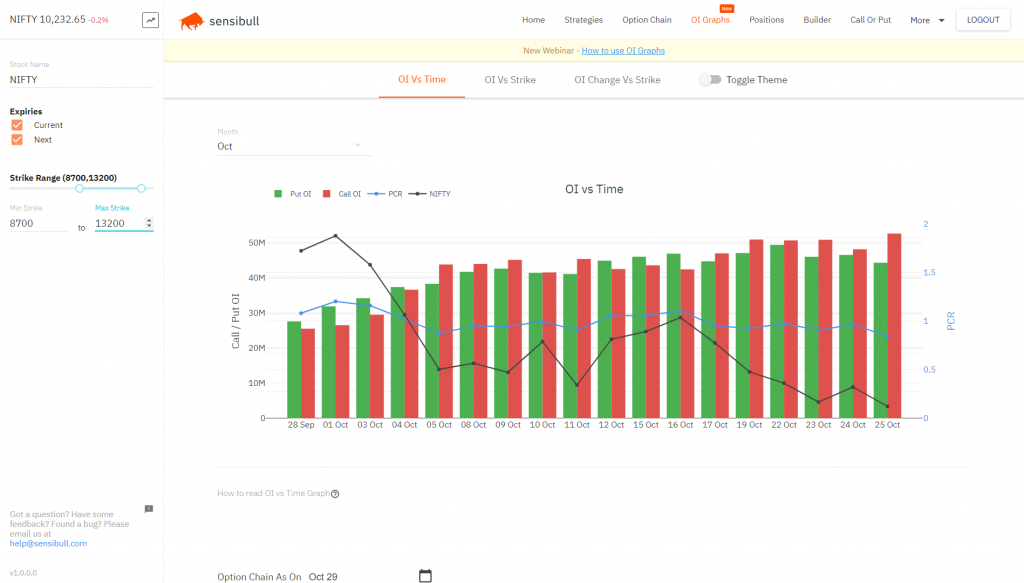

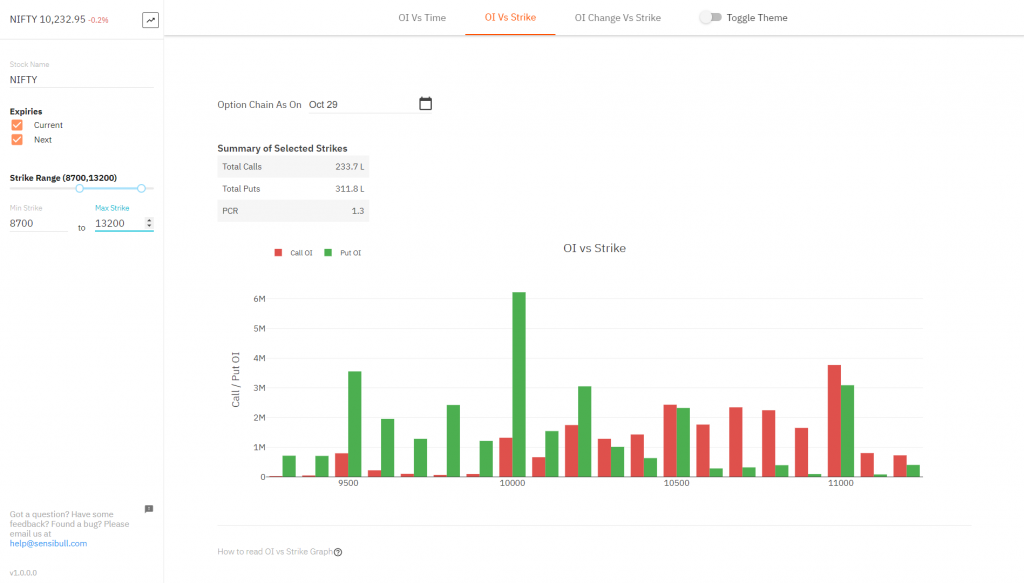

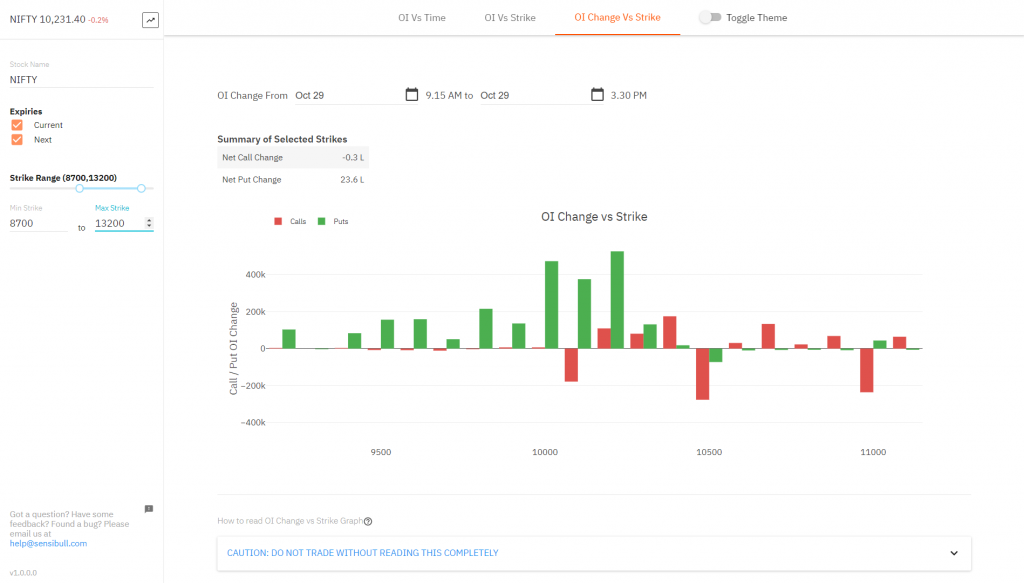

OI Analyser

The most comprehensive, one of a kind, one-stop solution for all your OI Analysis.

The OI App has three parts:

-

- Change in OI with the change in the underlying and time.

- OI versus strike

This is an option chain. But not just another option chain. This lets you go back in time and pull out the option chain for any past date. This also helps you easily identify supports and resistances based on the OI build up - OI Change

This tells you the change in OI in a specified time period. So if you want to know how much OI got added in the last three trading sessions, you can do it very easily here.

Education

Free YouTube webinars on all things under Options Trading.

Sensibull Trading on Youtube

Coming Soon

-

-

- Custom Strategy Builder

- Currency Options

- Technical Alerts

- Mobile App

- And more…

-

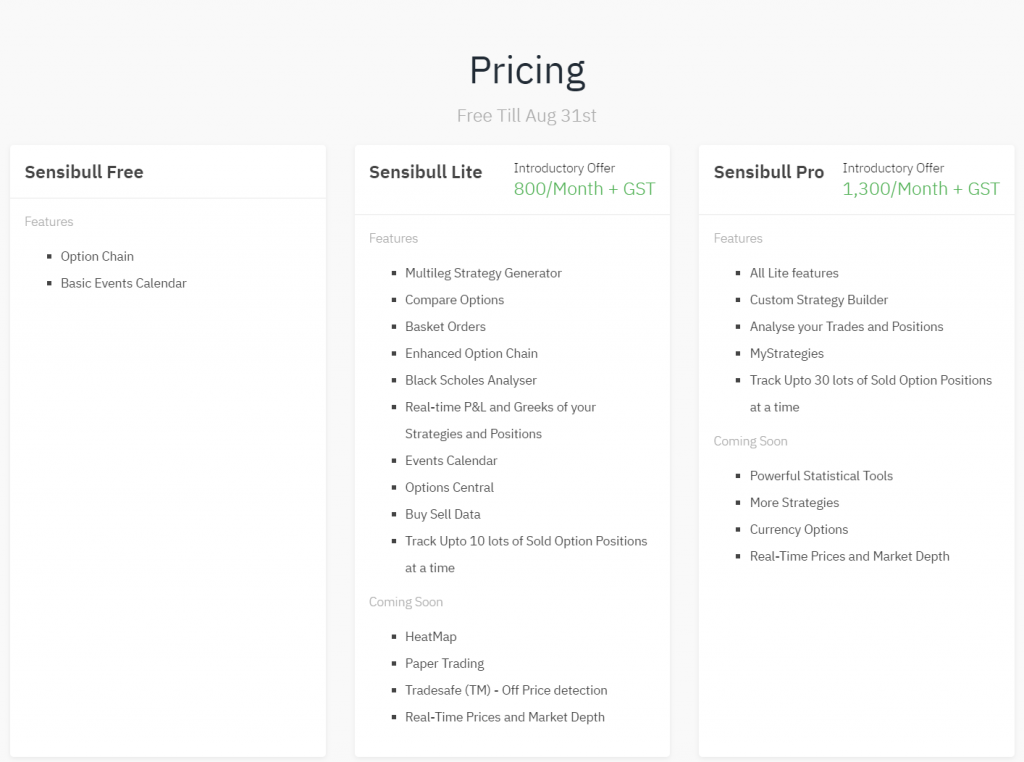

Pricing

Pricing

Can you please shed some light on Option premium intrinsic value component?

Is it dependent on underlying future or spot?

e.g. Nifty is trading at 18696 and Nifty future is trading at 18812 then which one should I track while buying CE/PE?

Thanks in advance

Give me this app

I wany virtual trading in option. what will be charges for one year.

is this free or any hidden charges apply ?

I want to know does the option platform has probablity ITM tool? Also are the greeks available on free trail?

Sensibull is not getting connnected from zerodha

if I entered with a strategy of two legs, buy nifty 8400 CE and sell nifty 8200 CE. whether it required the same capital/margin as if i enterd with zerodha kite? Or only up max loss?

You can set an price/ P&L alert on this condition on Whatsapp

https://web.sensibull.com/alerts

Regards,

Abid from Sensibull

do you have any feature wherein an exit order can be placed based on some conditions?

For example: If my short strangle decreases by certain points, system should close my position (limit or market). I used it for one month but didn’t find this option.

Note To Team Sensibull

To Team Sensibull,

I just wanted to share some thoughts about your in house advisory service ’Sensibull Research’, your external advisory service(which you guys are experimenting with) and also regarding the collaborative course on Options Strategies with NSE Academy which you guys started a short while ago.

First thing first, this is a fantastic initiative and coming from you guys makes these services and courses, etc authentic and reliable which is very much required in this industry of advisory services and online courses and all that.

I do have some suggestions which I wanted to put across. I hope you guys will at least go through it once.

1. Please don’t stop doing all those live virtual classes on all things Options from Options greeks to Options strategies and whatnot. These virtual classes are very very useful to all of us who are even remotely interested in Options Trading.

2. I am pretty sure serious Options traders from all over the world are loving Sensibull Research’s detailed research reports/blogs which you guys have started publishing since a few months back. This is exactly what we want from a research advisory service, in-depth technicals and Options data points analysis not just some random price targets and absurd recommendations of what to buy and sell.

3. Further expanding on point no 2, I really hope that the new advisory service will have this thing as a paramount priority. The rationale behind every trade should be explained in depth with data, charts, numbers and all that.

It will help retail traders understand and learn about the extreme nuances of Options trading and not see these in house well-researched recommendations as gambling tips and bets.

4. I also read on your official Twitter account that you are inviting registered, experienced and skilled Options traders to publish there advisory calls on your platform.

Again, a wonderful initiative and very much appreciated but I hope stringent vetting process will be there for selecting who can and who cannot provide such advisory calls. Proper monitoring of profitability and other parameters should also be there. Every trade should be backed by a research note (if possible) with charts, data, and numbers, etc and the rationale behind the trade should be explained in detail to the extent possible.

Let the newbie retail participants understand how much effort, knowledge, skills, and whatnot go into successfully deploying an Options trade or any other trade for that matter. This is not a casino. This is a proper science and an art as they say.

This is a huge issue with this stocks/derivatives advisory industry in India. Zero transparency what so ever. AS a CA CFA myself I have faced this issue of bogus advisory services fooling small-time newbie traders on the false pretext of bumper profits and whatnot.

And lastly, this is not my first time saying this but what a wonderful initiative Sensibull is. Beautifully crafted by what seems to be a very passionate and learned team. From the UI to all those sophisticated tools and now the advisory services, Sensibull is like a dream coming true for any Options trader that’s for sure. Keep up the good work guys.You guys are the best.

I have been publicizing your platform since one year to my colleagues, friends, clients, etc and some of them are really happy with your product,including myself.

Kudos to the whole team as usual,and I am dead sure you guys are not stopping anytime soon.Keep surprising us guys.I expect a lot more innovative,cutting edge stuff from Sensibull in the coming future as well.

I hope you guys will at least glance at my small,very basic suggestions whenever you get an opportunity to do the same

Dear sir,

I have purchased a paid subscription of Sensibull for virtual option trading. It does not shows how much money I have spent in purchasing or selling options. Secondly, suppose even if for some option contract current LTP is rs.100 you can purchase the same for rs.5, it will not get rejected.

Does Zerodha option trading platform have these two things in its platform?

1. Charts showing the max-loss and break-even points when I execute a complex option strategy like condor or butterfly?

2. Charts of premium vs strike rate for a given expiry date with the greeks calculated?

i how do i unsubscriibe sensibull. i dont want it. it was by mistake i am here.

Dear,

I have stopped using the software and I have revoked the software number of times and still you are taking money from me..

Pl call

dear sir,i subscribed sesibull.i cant understand sesibull.i want to unsubscribe sesibull.kya mujhe mera balance money vapis mill sakta hai.if u can than thanks for it.

I will suggest to create a forum of option traders to get feedback to keep improving this platform also option traders can communicate between them also

Kudos to the whole team at Sensibull.You guys have created a very powerful and useful tool for all kinds of options traders with a very elegant and easy to use UI.Abid sir,as a finance student and a newbie options/futures trader who is more than eager to learn about the intermediate and advanced concepts of options such as greeks,strategies,volatility based concepts and what not,I can’t thank you enough for doing all these live classes on learn app and on your Sensibull education channel.You have no clue how insanely useful they are for aspiring options and futures traders like me.Sir,I just have a humble request for you,as you guys keep updating Sensibull with more and more features and sophisticated powerful tools please don’t stop doing these live classes/courses.Please try to develop a full fledged course related to all aspects of options trading under 3 modules.Beginner, intermediate and advanced(from what’s a call/put to volatility skew/surface,greeks,delta neutral strategies etc) so that aspiring traders like me can study about options and more specifically learn practical and advance aspects of options/trading directly from you in a structured manner.Learning directly from you will be like a dream coming true for many of us .Your time tested knowledge,B school background and all that years and years of practical experience of trading options across asset classes will come very handy for newbie students/enthusiasts/traders alike.Thank you and wishing you and your team the very best .

Thank you very much Archit.

Your comment made my day 🙂

We will never stop doing these classes, and we will continue adding more and more modules to help spread the knowledge to everyone!

It’s great. Is it possible to track real time technical indicators like RSI, ATR…etc also?

Hello. We do not do that. Streak does that stuff though

When you are releasing paper trading feature in lite version?

Hello. Was scheduled for mid November. Hit some delays. So before mid December

Good that zerodha has partnered with other folks and has done this. Not sure what the other brokerage firms are doing – spinning the same old wheel again and again I suppose.

I recently have developed a small code to generate additional data, find max pain value, volatility cone automatically using historical data (little bit of self boasting 🙂 ). This would be a good addition to me.

Please make it a bit cheaper, as the current pricing is a bit expensive for beginners like me.

We are working on it

Hello Zerotha community,

Indeed this is new facility you are providing which is good in itself for advanced trading.

However, there are lots of Option open intrest analysers are available in market similar to this one. But there is no one providing real time open interest analyser for future contracts. I this ”Sensibull Analyser” is equiped with future contract analysis and real time data for index as well as stocks futures?? If not then any plan to bring such module in zerotha kite or Pi soon or later ? It would be good to see the facility for future traders.

Thank you.

Jignesh.

Hey,

We moved to real time prices 2 days back.

We are moving to OI with 10 minutes updates in a couple of weeks

I think its too early to put a price to this platform that too 600/1300 a month. You should have given sufficient time to the users to test the platform and understand the benefits.

During the initial free look period, most of the features were unavailable.

This high price should be preventing, many potential users like me. Moreover, prices shown here is not live

I was looking for this type of platform, which are available free in western countries.

Hey Siddharth, Sensibull does offer a 7-day free trial to the ’Pro’ tier. This should be enough to evaluate the platform. Additionally, the platform does offer the basics at no charge. If everything were free, how would the business make money? 🙂

Thanks for the reply.

I’m not expecting free, and completely understand that no business can provide free stuff.

Considering the site which is still in Beta stage (as mentioned in the disclaimer), charging 1300 a month seems overpriced.

Since you are running a business its completely up to you to set up the price, this was just a suggestion, as many people including me will not be able to access it because of its high price.

Cheers !!

how can i see its working in real time

You can simply log into Sensibull and check out the features. 🙂

Hi, I only deal in futures of commodities, do you also have OI data for commodities such as base metals or crude oil?

Not yet. We will get there in some time

I am holding dmat account in Zeroda Please guide how can get access to Sensibull option chain?

Hello,

https://trade.sensibull.com/optionchain

I have paid 1300 to be a pro member. Now I used Builder in Sensibull to place four transactions as part of strategy.

When i place the order all of them are getting rejected. But, I do see some bid quantities in the option chain.

What is the issue ? Am i doing something wrong ?

Sadly, there is no chat nor phone support for this. This is not good particularly for the Pro members.

Please look into it.

Akansha,

Can you please drop a mail on abid at sensibull dot com. I’ll reply/ help you out right away

Hi Team,

I am completely new to options trading and would like to open an account with zerodha for options trading. Till now I have only theoretical knowledge which I gained from Varsity zerodha and other sites. However, I am not able to decide on the initial capital that I can earmark for options trading. I can put in a maximum of 1.5 lakh. But I am not sure whether this amount is on the higher side considering I have no prior experience of trading in options. Please help me decide.

Hello,

This is the optimum amount of capital you should have if you are planning to sell index options. You could buy options for less money, but buying loses money in the long run

I can’t believe you said buying options is a losing game in the long run. You are a software/tool provider. You are not a trainer/financial adviser. The guy who was asking is a novice trader. He might get influenced by your words and may choose selling options without understanding the risks. There are people who makes money by buying options too. If buying options is a losing game, options won’t exist. There has to be a buyer for the seller to sell.

Anyways… you get the point.

Hey Vijay,

Thanks for your comment. It gives me an opportunity to clarify things with people who follow us on public fora. Let me put a few points forward.

1) ”Buying Options loses money in the long run”.

This does not mean do not buy options. This does not mean option buying is stupid. Buying an option isn’t a losing trade the same way playing Russian roulette is a losing trade. It’s not a stupid thing to do.

2) I am not a trainer or a financial adviser. But I am not sure if you need to be one of those to have a view on something which is statistically evident. Statistically, 75-85% of the options expire worthless. You can get enough stats on that with a cursory google search

3) We have always asked people to sell with protection. In case of naked option selling, there are risks. But they are greatly diminished the moment you buy. And we have been die hard preachers of keeping risks limited

4) Buying options presents a unique loser level problem. Technically, someone can blast his entire account on OTM purchase. A sell spread restricts the bet size to the margin available. So sell options work out better for a lot of retail investors who have a tendency to double up and buy OTM lotteries. This unique psychological problem trumps any statistical fat tail advantages buying options can present.

To answer your question on option buying wouldn’t exist, let me put it this way

Insurance companies make profits by selling insurance. Most people’s insurance never comes useful as they live long full lives. That never stopped anyone from buying insurance. You would not think ”LIC will make money off me in insurance, let me not make them profitable.” You will think, ”What if in the rare chance I get a call from above” 🙂

I hope that helps

Never thought I will consider paying 1300 Rs per month for a trading software as semi retail investor, hats off amazing platform built by you guys.

One issue is I am not able to trade to Next week Banknifty options, although current week and month end are available, am I missing something. On 2nd October, 4th oct abd 25th oct Banknifty available but 11th and 18th are not, please clarify.

Amazing work, this software will save so much money overall only with increased execution efficiency.

ANDROID APP is a must, I am sure you will release it soon, consider me a paid subscriber the day you launch Android app as I can not access laptop during office hours.

Great Work !!!

Hello Saurabh,

Thanks for the words of encouragement

1) All Bank nifty expiries are not available in Strategies Engine. This is because expiries other than the weekly and monthly expiries are not liquid. You could access them in builder though

2) We are planning to launch an app before the end of this year. Please bear with us till then. We will make the current parts of the platform more mobile friendly by then

also the price of premium which i need to pay or a strategy is different from what i need to pay in reality. creates problems in calculations

Not sure what you mean by this, can you please mail us at help at sensibull dot com?

unable to place any trades through sensibull directly.

it defeats the purpose of paying for the app.

i wanted to deploy a strategy directly from sesnibull but it doesnt do that.

Hey Akash,

Didn’t understand this. Can you please shoot us a mail on help at sensibull dot com

While using Sensibull, are Zerodha a/c funds used for trading purpose?

Yes.

pls give me information about Sensibull

[email protected]

Sir, today I checked out sensibull, I have come to know that some of the options are strongly mispriced, comparing with the prices of Kite. On closing of 31 Aug, the BANKNIFTY 27th Sept. put option of strike has closed on 495.8 in market, whereas for sensibull its showing 625.8. This can strongly affect my P&L. Take note of this, and fix the bug/problem, existing in the software.

Hello,

This can happen only for deep ITM strikes. As a rule of thumb, we do not expose that strike to users unless you explicitly choose deep ITM.

Couple of inputs from us:

1) We will have real-time prices soon, which will solve this issue

2) Even when we do have real-time prices, it is advisable to not go to ITM options or illiquid options in general

Hi,

I have a question about hedging using options. I generally buy 100 or 200 shares of scrips like Ashok Ley, Adani etc.. and keep them for a few days. Is it possible to use Options to hedge this much position (only 100 or 200 shares) against any sudden fall in prices of these scrips. Why I am asking is that in the case of Ashok Leyland the lot size for options is 4000. But my cash position is only 100 to 200. How can I use options to hedge such smaller quantities that I generally trade?

Please reply soon.

Thanks.

Hedging Position with option is , not a profitable idea , It is just a concept, only index movers / or Big fund houses do it.

Hedging makes sense only when you have large institutional portfolios. If you are a smaller sized trader, the impact costs, bid offer spreads, time value decay etc kills the sense in hedging

Hi

Looks good.

Please update the frequency of data refresh for both CMP on option premiums and option greeks there on

I extensively use kite where figure are always moving:) , here it seems static though it changes sometimes on F5.

so the question how frequently data refresh is happning

thanks

Thanks Paramjit.

We will have real time prices by the end of this month. All the prices in Sensibull are delayed by 3-20 seconds.

Checked the Platform.. Impressive.. Though Lot of improvements required

Like,

Currency Options (Need to add)

Option Screener for Individual Stocks

Option Builder need improvement (Need to increase size, option to Full screen etc, Better graphics etc.)

The Cost per month seems to be Little High…

The following prices would have been comfortable..

100 – 200 for Light

200 – 300 for Pro

Hello

1) USD INR is coming before the end of September

2) There is Option Central. We will keep building on it

3) We will improve builder soon

Let us see if we can do anything about the prices. Thanks for the inputs

Hi

Why does your I.V numbers differ from NSE?

why no reply? No answer?

also your prices in sensibull versus Kite / market is differ quite a lot. This is misleading and quite harmfull.

Hi Satish,

I appreciate your concern. We will have real-time prices in a month.

Meanwhile to prevent harm we have mentioned that the prices are off by 15 seconds everywhere in the platform. We also have a last updated time stamp

Satish,

Sorry about the delayed reply. We are just six people racing against time every day

Quoting the answer from the Black Scholes page of Sensibull

WHY IS THE IV ON NSE WEBSITE DIFFERENT FROM OUR IV?

NSE uses Black-Scholes model with a constant interest rate assumption of 10%. The observed interest rate in the market is not 10% but it varies time to time with changes in Reserve Bank’s repo rate and interbank lending rates. The fault is NSE’s IV calculation can be very clearly inferred by the fact that IV of the ATM put and call are two significantly different values in NSE option chain whereas they should both have the same IV.

Please create a desktop application too for option trading like tastywork app

It Still needs many Additions , and repairs , And we need to get useto Please Try to keep it free for few more days ,

THank You

Hello,

Once we have a few more features, we will launch another trial run. Please be patient with us till then

Sir

In BUILDER , There is no option to select MIS order only NRML order is chosen by default

Hello, you can modify the order as follows:

In the Kite Publisher window there is a context menu which opens if you hover near the trade.

We will include MIS in builder soon

Is the MIS simulator ready? It’s been 2 years already.

Please help I am not able to do options trading

RB4170

Have mailed to everyone but didn’t get any reply

Please check if F&O segment is enabled for you. To enable that, you have to give Form16, Salary slip or bank statement or ITR

It reminds me of tastytrade kind of thing.. It will be nice to have something like that.. I watch their videos and they makes option trading as easy as cake.

Is there any way to execute a trade in a certain condition

E.g

I will want to buy 11700 call as soon as Index Nifty crisses 11620. I would place the instruction and it would execute automatically.

Is it possible

Hello Bhabani,

We are working on this feature in our roadmap. We will keep you posted. If you have logged into Sensibull ever, you will get a mail update about it

Its Great Initiative by zerodha.Is there any learning platform so can via guidance.OR is there any whats app group so people can guide you so can trade with free mind.

What is the meaning of

1.margin available

2.Margin used

3.Total account value

Please can anybody explain me with example.

Dear Sir/Madam

one more importatt strategy u want to filter in the system that is DELTA NEUTRAL strategy i am using this strategy using frequently but its very diffcult for me to find manually in call and put side please bring one strategy for delta neutral as soon as possible

Thanks

Riyas

Sure. We will try to get delta neutral strategies separately.

A GOOD INITIATIVE FOR OPTIONS TRADERS. IN WHICH WAY IT WOULD BE HELPFUL, LOOKING FORWARD.

Thanks a bunch Makrand!

Hi

Used the Sensibull for the first time today. Very good tool for options trading.

Some comments / suggestions from my side :

1. There is considerable time delay for orders placed in Sensibull to be transmitted to Kite. Maybe different servers or whatever – you could look into this

2. For strategies involving selling options in one or more legs, total margin requirement is not available. Or, may be I am missing it – is the Capital required column showing the margin requirement ?

3. Charts of only the underlying seems available. In the options chain, you could add button for charts of options at various strike price. Becomes bothersome to switch to Kite to look at options chart of a strike price.

4. Waiting eagerly for strategies on single stocks and payoff diagrams. When is it due?

Thanks again for this tool for options trading. Keep it up and keep such innovations coming….

1. We are making our own system without going through the Kite Window. It will be live soon

2. The capital requirement is the margin requirement. It is roughly right now, you will see a more precise version in the coming week. Also it does not show MIS margin separately and shows only NRML, we will correct that too

3. Philosophical terrain 🙂 We are building Sensibull also with the aim of making sure the smaller trader does not make mistakes. The technical charts of options are not super reliable, and can lead to mistakes as they have interplays of Vol and Time value. So to keep things simple for the common man and not to overload him, we made a conscious choice to limit ourselves to Underlying graphs, which are more reliable and liquid

4. Definitely before September 1

Thanks for the encouraging words, please feel free to mail us on [email protected] if you need any more help. The mail channel is way faster

Dear Abid

According to Mr. Karthik in Option strategy chapter, ( Zerodha Versity) – Bull Call Spread is ”Lower Strike Long – Upper Strike Short”, but in Sesibull – The Bull Call Spread is combination of ”Lower strike Short – Upper Strike Long”, I am confused. Please clear the doubt.

We do not use the word ”BULL” call spread.

We use Call Spread.

A call spread has calls at an upper strike and a lower strike.

When you buy a lower call and sell an upper call, it is a bullish view, and hence a bull call spread. We call it buy call spread for simplicity

When you sell a lower call and buy an upper call for protection, it is a bearish view. We call it sell call spread for simplicity

I would say terminology does not matter. Please focus on the underlying view, which is bullish or bearish, and how you execute it.

As Shakespeare said, ”A rose by any other name would smell as sweet” 🙂

You made life easy :-). My existing strategies got pulled into sensibull display and shows greeks. I have been doing all this stuff in xls and HTML utilities just for personal use which is time consuming. You made it everything on just click of mouse button. Few things which I see missing and could be useful for trader.

1) Open Interest Vs Price movement chart for series (I plot it using google charts) which can give me at what all price buyers and sellers are getting active.

2) Dashboard view of selected strategies with all important greeks, if I am only treading in 3 types of strategies and not interested in other 200 strategies being populated. If user can do that it will be plus.

3) Filtering options with low volatility.

4) Premium movement Vs Time decay graph for straddle and strangle strategies.

Hey thanks so much for the encouraging words.

1. OI vs price Movement – Will add to feature requests

2. I did not understand this

3. You can do this on Options Central. Just sort the Options by IV percentile and you will land on that. We will add an additional filters view on Central Soon

4) Did not understand this part. You mean to say price versus Theta graph? Could you explain this please? Thanks!

2) Let me explain other way, currently page populates 200+ strategies based on user inputs, can use select 3-4 of them as watch list and monitor it and can execute it at right time.

4) Yes, theta graph will also do. My initial request was Premium Vs Time in reference to underline stock price movement. For example, If I select Nifty 11300-11400 strangle, I should be able to see the premium movement for series wrt Nifty price movement.

2 – Got it. Will do

4 – Now I got it. You mean a graph where the payoff of a strategy is superimposed on the underlyings graph with time. So basically your graph is the NIFY and Strangle plotted together against time. This we are planning to do. SHouldn’t be long

What one user needs is a Trading Platform which can fit to the nearest standards of many excellent ones in USA. Your efforts on sensibull looks commendable but it’s of no use to work with unreliable, inconsistent etc.. system KITE, which can be the foundation like.

Zerodha is making more mistakes and not sensible.

As another customer asked you should waive off options trading charges, when small players are doing why not Zerodha.

See the add: NO brokerage charges, STOP paying brokerage, etc..

Change is a must for Zerodha.

It seems the max pain value is not getting updated in Live.. It is displaying old value

Hello, I will check and get back on this. Thanks for letting us know. We just made the max pain live day before yesterday. Did you have this experience today?

Can you think of giving option of sorting the options as per strategy.Say i am employing three strategies : Put calendar spread, Strangle and straddle. I would like to see my positions in these three groups, so that I can Book profit or Exit depending on how that startegy is performing

Yes, this is coming soon in the feature called MyStrategies which will let you group your positions into strategies.

Hello,

I have just signed up with Zerodha. where should i get the trading tab. How should i purchase the share ?

I’m using sensibull from last ten days and it is quite useful. Here are few suggestions from my side.

1) Please introduce open interest chart and change in OI per strike price in chart(bar chart) form so that we can visualise it better. There are lot of sites in internet which offers similar chart and I dont want sensibull to miss it.

2)Also, FII/PRO/DII data right now is available only for the current day. I would like to have this data from the start of the current expiry may be in a table format.(This is just to track how is the flow of fund from FII/PRO/DII in this expiry).

Thanks for the encouraging words

1) OI & Change in OI – Yes

2) We are adding this, we will let you pull the whole series, for any date.

@ Abid,

I am new to options trading and would like a closed ended answer from you or any others- neutrally.

How accurate are the potential P/L calculations for the option strategies?

Is it possible that while trading Bank Nifty/ Nifty- by using market instead of limit, the fine line between profits and losses might get eroded?

I would appreciate your reply in layman terms, if you have the time.

Regards,

John

bravo

Thanks Manas!

Excellent. I want to learn and trade. Waiting for the entry. Heena

Hello,

Please check https://www.youtube.com/besensibull for Option Trading Videos

Please include Custom in Strategy Types

in strategy types>>>

Strangles im not abel to short sell 11500pe and 11400ce , please allow it

thanks

Hello,

Yes to both. We will add a custom strategy builder

I want to join it.

Very impressed by the hardwork you guys have done to make this! This is surely going to be a hit in long run! My best wishes to team Sensibull 🙂 Looking forward to join your platform..

P.S. You guys can introduce 5 day trial free/reduced costs so everyone could give it a try before actually investing in it 🙂

Thank you Vikram. Sensibull is free till September 1. After that day, everyone new will get a 7 day free trial

Dear Mr.Kamath, Great addition to the array of tools already existing. you are truely understaing retail invester needs.

IT VERY GOOD STARTUP WITH IT

IF ANY ONE WANT TO START WITH OPTION PLEASE CONTACT WITH US

When will it be out for commodities?

Hello. There is only crude oil which has commodity options now, and volumes are discouraging. We are looking if the segment will pick up volumes.

Nice initiative only by Zerodha in Option Trading in Bharat Market. Thanks a lot to zerodha.

Let us know when it will be launched & what are the charges for it?

Thanks! It is live.

http://trade.sensibull.com/options

The pricing is here

https://sensibull.com/#pricing

good news for us… how can we get those things ?

http://trade.sensibull.com/options

How do I get started and what are the pricing

Thanks! It is live.

http://trade.sensibull.com/options

The pricing is here

https://sensibull.com/#pricing

Improve your trading platform first, then talk about something else, very very poor platform you are serving us, make it like TRADING VIEW.

Hope you will improve yourself.

please introduce some products for commodity also.thanks

wow. The options strategies builder is awesome. Hope you can introduce for Individual stocks soon.

Thank you! We will introduce it for single stocks also very very soon

When single stocks options strategies will be available ?

Hello Yogesh. The top stocks should come in before September 20th. Anything outside could involve illiquid options.

Can this be exposed over REST API along with data ?

Could you be a bit more specific on what exactly you are looking for?

An REST API End Point to get information from SENSIBULL. Like some webservice which returns JSON/XML data containing the full Option Chain of a Stock etc..

how to buy it sir??????????????????

Is it possible to put an entry trigger for options (based on the futures value)? for example, I want 11000 call option to be bought if Nifty future crosses 11030. Similarly, can i put Stop loss in options based on underlying value in futures?

Hi, we are working on this soon!

kindly provide future oi and volume chart and option iv chart in our regular chart, thats will help a lot

thanks

Hello. We are already working on this

please reduce options brokerage or introduce fixed monthly plan.

Hello Praeek,

is it possible to introduce per class payment so that we can register only for classes that we are interested in instead of paying as a whole for 3 months or 6 months?

If you meant to ask this for a LearnApp, please type the question in that blog post. Lets keep this space only for Sensibull 🙂

Hey Abid and team. Thanks for building such a world class platform. I have a query: IVP is calculated on 6 months data or 1 year data?

Thanks Abhinav for the kind words. We are using 1 year data

I interested in investment at shares for which I have to open account please suggest in this regard

@Byregowda K M, Dude you can use this link ( https://zerodha.com/open-account )to open an account or zerodha.com–> Open an account Click will do for you?

Good move

Very useful for trade

Zerodha is always ahead

Looking forward to it

Great

Thank you!

is there any students discount?

Students should be studying and not trading right? 🙂

Just kidding. I’ll see what we can do and get back on this? Thanks for the idea

Great idea.Zerodha is always one step ahead.

Thanks!

Hi. I am eagerly waiting to learn the complex of options.thanks a lot.

Hey! Here are some resources from us:

https://www.youtube.com/besensibull

http://medium.com/@besensibull

Please give advice about option trading.

Hey! Here are some resources from us:

https://www.youtube.com/besensibull

http://medium.com/@besensibull

I have a fool proof option strategy .I have a data to prove it.I want to commercially explore the same.Can it be jointly done .Pl reply tkyu

Hey,

We are not in advisory services, and we do not have the authority to do that. Please contact a SEBI registered adviser for the same.

Hey nithin . My query is if i select a strategy which is 4legs ( IB ) for ex . N execute will all legs be sent as market order n what about position sizing ? ( if i punch 7500qty nifty ) so all order execute at once

Hello,

The orders will go as a basket order. All legs will execute together in a single order. This can be market or limit – you can modify that on the order window.

There is no position sizing or splitting the order from our end for now, as we are targetting retail traders to start with. So if the order is below the quantity freeze number, it will go through.

im unable not see BASKET ORDER button, is there a way to place basket order of 2-3 scripts , or 2/3 different options ,

Right now you can do a basket order from http://trade.sensibull.com/options suggested strategy. The other basket order you are looking for is coming soon.

Hello,

Can you be little more specific about the limit order for Basket orders. Do I have to specify limit price for each and every leg of Options strike or one limit price for all the legs issufficient?

I want to join it.

Hey you can just go to trade.sensibull.com/options and get started. We are free till September 1st

Hi

I tried to open the link few times but nothing is appearing. Kindly guide.

thanks

Hi can you please try clicking on this

http://trade.sensibull.com/options

Sensibull: On the expiry day, from 9.15 AM itself, the geeks Theta, Delta etc are indicated as if the time is already 3:30 PM.

Hence the analysis values are not useful at all on the expiry day. Theta is shown as 0 from 9:15 itself. Which is not true at all.

Please incorporate the minutewise updated values. I wanted to upload a screen print, but this blog does support attachments.

regards

Prince Thamburaj

great congratulations

can it be automated with algo platform

tnx

Hello,

Not yet. Automated trading is not allowed for retail traders according to the Internet Based Trading Guidelines.

Fantastic Abid! I know a bunch of people who would love to learn Options from you 😀

Thanks Prateek. Would love to share the little bit I know

Nice start … I will suggest to build an active forum of option traders and get constant feedback to keep improving this platform…. Waiting for Android app ?

Forum is a great idea. Android app – We will pick it up soon. Was just testing the waters with the web. Now that the response there is encouraging, we are all gung ho to go to android. If you have any suggestions, feedback, queries, feature requests etc, please feel free to reach us on [email protected]

Dear Sir

Does it mean that I can buy a stradle, etc instead of executing different legs separately . Please clarify.

Yes, you can create a straddle and trade it with a single click. However, you are not really buying a straddle, you are buying a call and put as two separate legs

Super

Thanks Manohar

Hi, when will you add currency option strategy in Sensibull?

Please include the Chapter under Zerodha University on OPTIONS TRADING

Varsity already covers Options. Check it out here. 🙂

I am new in zerodha, could you please tell how to place FO order .if there is any tutorial please let me know.

Thanks

New one kindly tell how you may help to earn money

Hi ,

I see option trading and strategy building is chargable in Sensibull which was not earlier in desktop software.

I have logged in Sensibull and when I tried to build my strategy they ask me to pay subscribe. Atleast this feature should be free for zerodha.

Actually I my problem is , I want spread my option so that I can use proper margin. Could you put some light here?