Start investing in mutual funds @ Zerodha

Traders and Investors, our mutual fund platform coin.zerodha.com is now live. Continuing with our tradition of innovation, there are many firsts.

Easy execution

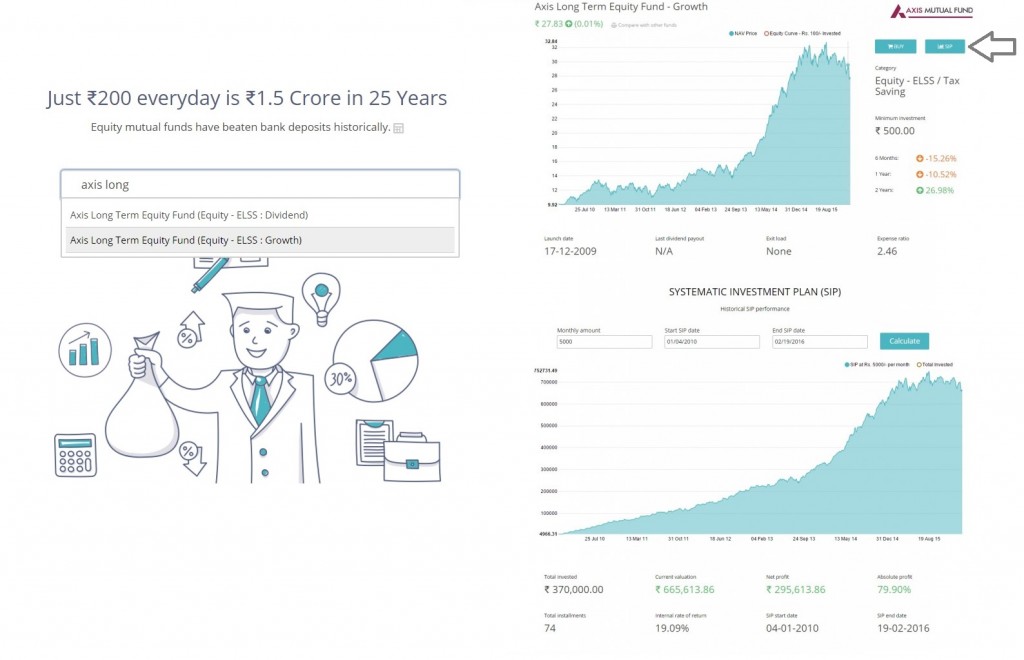

- Search any fund.

- Analyze historical performance.

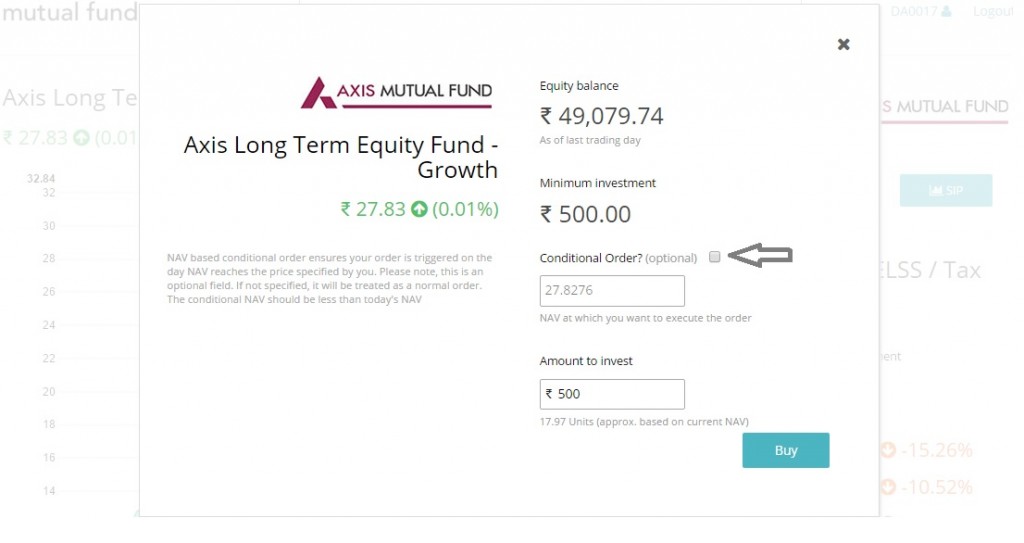

- Click on Buy for lump sum or one time investment, and SIP (systematic investment plan) if you intend to invest small amounts of money at fixed interval automatically.

You are just one click away from buying any mutual fund after logging into the platform. To login use your trading (Kite) login ID and password. Currently mutual fund purchases are enabled for only those clients who have Zerodha demat account (Not IL&FS or any third party demat account) mapped to the trading account. If you don’t have a demat account opened yet, print the pre-filled form available here, sign, and courier to have the account opened within 24 hours.

For everyone investing in mutual funds for first time, it is important to note that unlike stocks where price changes every second, the NAV (Net asset value) price of mutual funds change only once at end of every trading day. Orders placed to buy or redeem a fund are typically executed based on the NAV price of the next trading day.

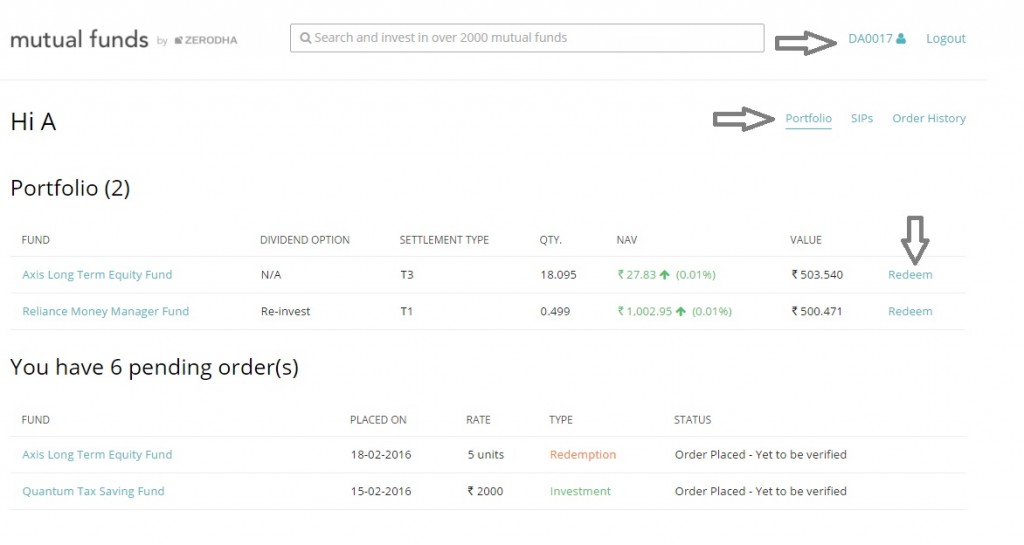

Mutual funds in Demat

- Among the first few platforms in India to offer convenience of holding mutual funds in your demat account along with all your stock holdings. A single portfolio view for all your investments.

- Investments using a demat account also ensure that your dependents get easy access in case something unforeseen were to happen in the future.

- Similar to how you can pledge stocks, exchange approved mutual funds (list will be shared soon) can be pledged to receive margin for trading F&O. Essentially investing in mutual funds at Zerodha will be very similar to investing in stocks.

Zero fees

Mutual fund investments similar to investing in stocks at Zerodha will be absolutely brokerage free.

Order placing

- All orders to purchase or redeem mutual funds placed before 1.30 pm are placed on the MF execution platform (BSE Star MF) on the same day (T day), and will be executed on the end of day NAV price.

- Orders placed after 1.30 pm are placed the next trading day (T+1), and will be executed on the T+1 NAV price.

- Buying mutual fund requires you to enter the value or amount in rupees whereas redeeming requires you to enter the number of units. This is different from stocks where you enter quantity of stock and price at which you want to buy or sell.

- Out of the 40 AMC’s in India, we are currently empanelled with most of them. If you are not able to search for a particular fund house, it means we are in the process of getting empanelled with them.

NAV tracking conditional orders

For the first time in India you can now set conditional orders which track the NAV price. Whenever your preset NAV trigger price is reached, an order with value to buy or redeem mutual fund units is placed. NAV’s are declared by mutual funds before 11pm everyday, and such NAV tracking conditional orders are placed before 1.30 pm next trading day if your set NAV trigger is met, to ensure you get to buy or redeem immediately.

These orders are good or valid until cancelled. An email alert is sent as soon as any conditional order is placed. This will ensure that you don’t have to keep checking NAV prices, and can run your investments in MF on an auto mode.

You can place similar orders like above to redeem mutual fund units by visiting your portfolio and clicking on redeem. You can also cancel all pending conditional orders and view your order history as shown below.

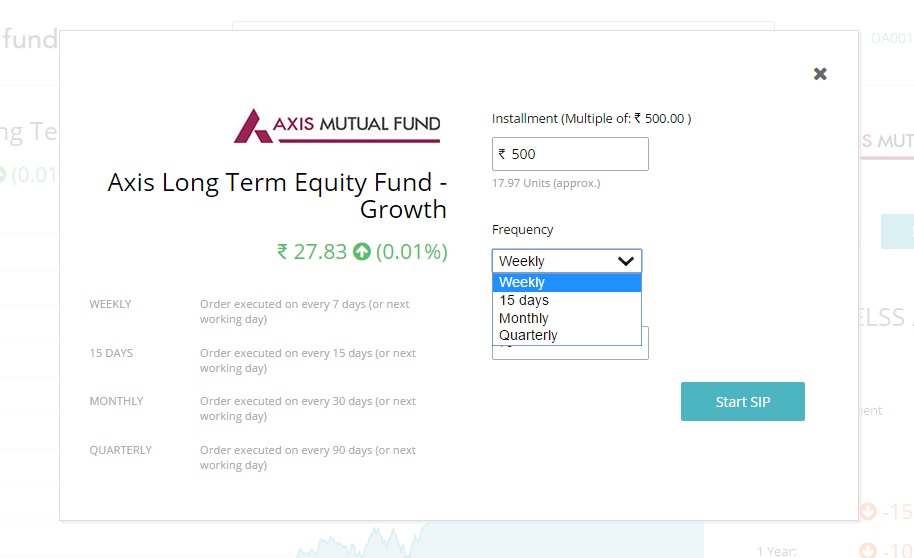

Easy SIP

SIP or systematic investing plan is when you invest small periodical amounts instead of lump sums. This is a very popular way of investing and rupee cost averaging over long period of time ensures that investor gets maximum value even with volatility in the markets.

Traditional mutual fund platforms require you to sign up ECS or NACH mandate so that these small periodical amounts can be debited from your bank accounts. This is quite a tedious on-boarding process, and requires one mandate for every fund house.

On the Zerodha MF platform, you can start as many SIP’s as you want with a click of a button without having to sign any mandate forms. As long as you have funds available in your Zerodha trading account on the buying date set by you based on your SIP interval, the SIP order will be placed. We will also send an email alert before the SIP date.

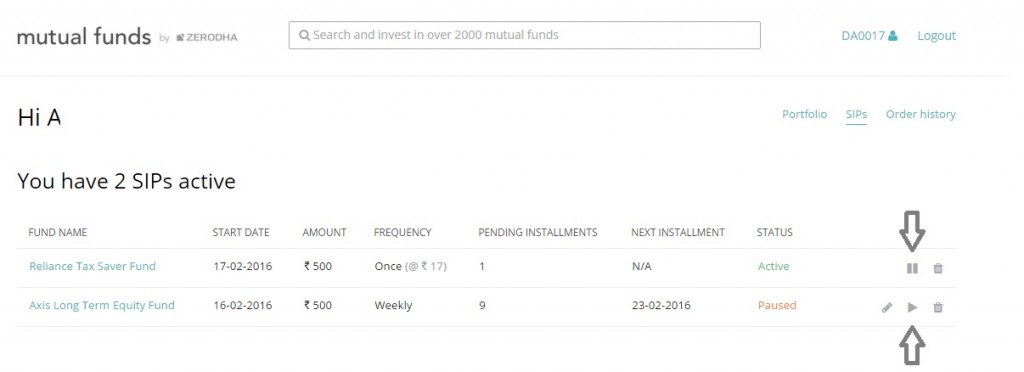

All SIP orders can be paused and restarted anytime by visiting the SIP menu as shown below.

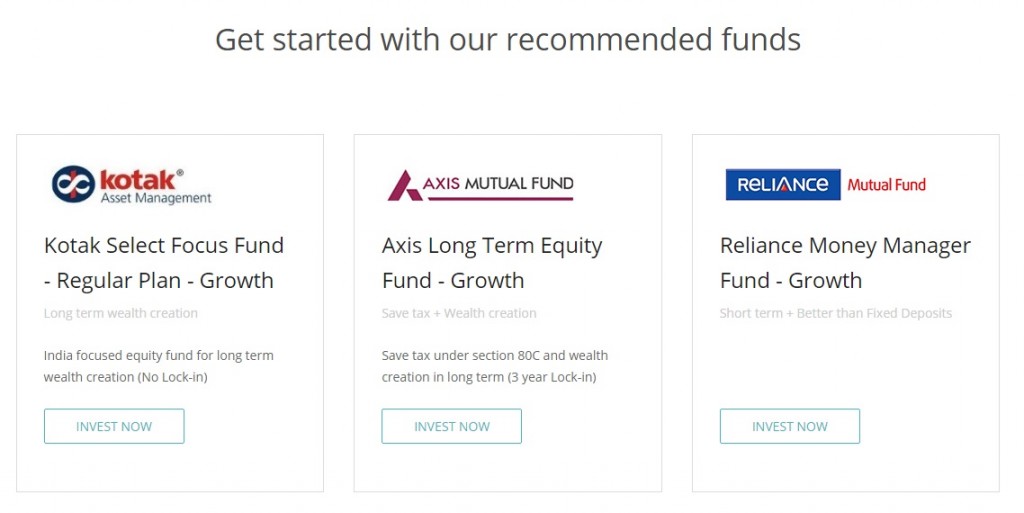

Don’t know where to start?

We have selected three funds for you to get started investing in mutual funds. A diversified fund for long term wealth creation with no lock-in period, a tax saving fund to create long term wealth but with a lock-in period, and a debt fund for fixed income with no equity exposure.

Visit coin.zerodha.com to start investing in mutual funds now.

Happy Investing,

i am looking to open mutual fund account

Hello sir, I am Mitali mehta please contact on 9106036314

Hello,

I am biggner with zero knowledge of invest in SIP. As i said i have no knowledge about SIP investing so i need something which can suggest me to invest in SIP without loosing, i dont want much profit but avoid to loose. So is it possible. Kindly guide me.

Sir I can’t able purchase the NAV and I have problem in login to cashier Please try to recover it soon

Summary: The user is not able to click on the search box ”Start Investing in Over 2000 mutual funds”

Steps to reproduce:

Note:- https://zerodha.com/z-connect/general/start-investing-in-mutual-funds-zerodha

1) Click on the link above.

2) As you enter the website, navigate to the search box on the website that displays a message as ”Start Investing in Over 2000 mutual funds”

3) Click on the search box

Observed- The search box is not clickable and does not work as intended.

Expected – The search box should be clickable and work without any issues.

Hi, is it possible to open minor account in zerodha to invest in mutual funds with minor account?

Hi Rajendra, yes it is. The account opening process is mentioned here.

Check out the FAQ section to learn more about investing in mutual funds for minors.

I already have Demat account in Zerodha, how can I start 5 mf of sip ₹ 500/ month for each.

Is there any way to place conditional order for mutual funds with the new system of payment directly from linked bank account?similar question by Sid on 30 Jan24 is unanswered!

Hi Veera, we’re working on bringing this back. Will keep you posted.

There is nothing in the app just 4details of ltp, total p/l n days %

How could u arrive without previous close n how will know individual performance with %, sharekhan is musch better, in one line they will all detaila live p. Cl, open, high, low ltp, days p/l, days %, overall p/l n overall %

Hi Srinivasalu, we are continuously looking to improve our users’ experience, if there is anything specific we can look into, please contact us at https://support.zerodha.com.

Is conditional order functionality discontinued?

i am mutul fund distributor ARN HOLDER i want to zerodha mutual fund distributor empanlemnt so please provide link or procedure on my mail id or my contact no 9814934710

Hi team,

Can I buy/sell mutual funds without having a trading account? I am willing to have just the demat account because if the losses in the equity and options market.

I am trying to login with mutual fund in zerodha for the first time and the website mf.zerodha.com not working..

getting message as ”There seems to be an issue reaching our systems. This usually indicates a network issue. ”

tried to open with broadband connection and mobile data also, same error appears.

Hi Bharat, ycou an login to Coin, our mutual funds platform at coin.zerodha.com.

Can I use fund balance in Kite to buy mutual funds in Coin?

Hi, funds in your Zerodha trading account cannot be used to invest in mutual funds anymore. The funds for all purchases will have to come from your primary bank account linked to your Zerodha account. Check out this detailed post for more information: https://t.co/x2HAB8tgFF

HI

I am totally new to this platform. I am retired person and wish to invest in MF. Please help me how to invest through zerodha

Hi, you can invest in mutual funds through Coin, our direct mutual funds platform. You can check out the process here.

SIP are failing now since RBI said cannot use trading account for mutual funds. How to create new SIP now?

Hey Partha, as per new SEBI regulations, funds in the trading account cannot be used for MF investments. You will have to make the payment from the primary bank account linked to your Zerodha account. We’re also working on making mandates available for automatic SIP investments. Please check out this post for more details.

there are tow types of Mutual fund ,Direct (directly through AMC)and Regular,Can direct Mutual buy from Zerodha? Means if you b

buy through Zerodha platform Mutual plan will be direct or regular?

Hey Swati, all mutual funds offered on Coin are direct plans. You can learn more here.

Dear Team,

I am using your app but not how to use for SIP(mutual fund), please guide me through Zerodha APP.

Sanjay Kumar Jha

Hey Sanjay, we’ve explained the process for starting SIPs on Coin here.

hi, I placed sip from zerodha, got a mail directly from each AMC about my investment details. When I did lumpsum investment from zerodha, I got a mail from zerodha about my investment details but not directly from the AMC this time, Why? this happens. when we do lumpsum investment if we get from direct AMC confirmation will give more confidence of our investment.

1. The order was placed 2 days ago, but the status still shows as TMC. Has the order been placed? If not, when will it be?

2. I had placed request for an e-mandate. But since it was delayed. I paid an amount of 10,000 however it is not reflecting on my account. How do I resolve this?

I have my MF SIPs in Fundsindia. How can I transfer all the SIPs to Zerodha without closing the SIPs?

I placed an order for two SIP’s on Friday evening, an dita Monday evening but still my portal shows processing- order sent to AMC.

I selected the date 10th so that I can begin my payments from today itself.

Will it now get delayed for a month?

Please help me

Hi I wanted to buy Mirae Asset NYSE Fang + ETF, but it is neither listed on Kite Zerodha nor Coin Zerodha. I tried buying it directly from Mirae website, but they are asking for Distributor ARN number, subdistributor ARN number, EUIN Code, EUIN declaration, blah blah blah. I am unable to find correct ARN number for Zerodha on Google. My relative bought the exact same ETF while this fund was an NFO from ICICI Securities easily. I fail to understand why Zerodha, being the No. 1 broker in our country failed to list the ETF on their platform? And it still has not.

Hi facing similar issue with transferring sip from distributor to zerodha. Does anyone have any solution for this yet?

Hi ,

Please can someone will help me in this error, i am trying to buy a mutual fund of Mirae asset emerging bluechip fund – direct – growth plan. When i go click to proceed it gives me popup that ” Order Placing Failed. Purchase not allowed for today” . Please suggest. Thanks.

I am facing this same issue. Has anyone found any solution for this?

Dear Sir I want invest in SIP 15 years and my target is 60lacs .so how much monthly i have start SIP

pLEASE LET ME KNOW

I took 3 sips. I was ready with everything balance and orders in my coin account for the last 2 days. But the orders were ”processing” and ”sent to AMC” only at 11.30 pm last night. And since then they are stuck like that. No investment yet showing. Now my coin balance is also showing some negative amount. What is going on does it take so long usually?

Shreya, we’ve explained it here; you can create a ticket here for further queries on this: https://support.zerodha.com/category/mutual-funds/buying-and-selling-through-coin/articles/how-long-will-it-take-for-the-mutual-fund-units-to-show-up-in-my-demat-account

I placed an order for MF (direct – Lumpsum) on 2-Apr. since 5-Apr or 6-Apr it is showing ”order sent to AMC”. it is 7-Apr today and the status has still now changed. Is this normal?

Do you recommend best Mutual fund to invest? Also do you review my portfolio and give some advise?

Hi Ramanan, we don’t really offer advice. Best consult a professional investment advisor.

I want ot purchase NFO of tata private Bank ETF. how to apply in zerodha

This process is similar to IPO. You can go to the Tata AMC’s website and apply through ASBA.

the link https://mf.zerodha.com/ is not working

This has been moved to https://coin.zerodha.com where we now sell only direct funds.

What is the max value allowed for investing in Mutual Fund (Through coin) per instance

Varies from fund to fund but as a retail investor, I don’t think you should worry about the max limits.

in case of buying mutual fund, can i transfer money from my Sb A/c directly on the instance of buying OR is it required to transfer the fund to My-zerodha a/c ahead (of purchase of MF).

You’ll need to have funds in your Zerodha account.

Hi,

I want to invest lump sum amount in Mutual fund what is the procedure how to avail

Hey Tushar, you can simply log into Coin and place trades.

Hey Matti

I already have zero dha account enabled to trade in FNO and Commodities. Now I want to trade and invest in equity and mutual funds too, what is needed to enable my zerodha account for this?

Hi Nitin,

I want to open demat account with Zerodha what kind of formalities I need to complete? Where can I get the form and other stuffs if any?

I want to trade in equities as well as I want to invest in Mutual fund as well.

Kindly help!

DO NOT INVEST IN MUTUAL FUND THROUGH ZERODHA COIN PLATFORM. YOU WILL FACE MULTIPLE ISSUES AND ZERODHA MUTUAL FUND TEAM WILL NEVER CALL YOU BACK EVEN WHEN YOU CALL THEIR SUPPORT TEAM 1000S TIMES. SUPPORT TEAM WILL REFUSE TO TRANSFER YOUR CALL NOR MF TEAM WILL CALL YOU BACK.

I haven’t started direct Mutual Fund SIP yet.

1. Zerodha should allow the ECS mandate and other settings like drop-down based selection of Joint holder for the SIP and such.. If I have to ensure that I transfer money to Zerodha account every month then it’s too cumbersome. Please, can you look at an easy option for ECS setup, joint holder setup etc.

2. Redemption should be allowed in Units as also Rupee. You can incorporate the conversion calculation at your end and automatically redeem that many units only.

Hope you incorporate these earliest.

Best Regards

Hey Satish, working on this.

I want to buy mutual fund for my two nephew and both of them are below age of 18 is it possible to open up there demat account on zerodha??

Hey Priyank, we don’t offer demat accounts for minors as of now.

suppose u registered for sip for 3k. and didnt have any funds for that month. will it attract any charges.

No, there are no penalties or extra charges.

Sir, I am new at Zerodha platform, I bought a mutual fund. I want to modify this mf but can’t. There was no edit option,why ?

Hey Amar, what do you mean by ’edit’ a mutual fund?

Hi,

In Coin, do we get tax statements as well especially for Direct MFs, which could help us in filling the returns ? Especially after this year’s announcement to have LTCG tax @ 10% beyond 1 year of holding and beyond 1 Lac ??

If not, then what’s the way out ?

Kindly confirm.

Not right now, but we do plan on adding these reports soon.

Any tentative time / month ? Till that time, do we need to keep a track of all sellings of MFs on our own ?

Also, in regular (non-direct) MFs, do we have the same issue of tax reports ? and what’s the charges for keeping those non-direct ones or do they have the same 50INR/month charges ?

hello,

Due to recent SEBI circulars (SEBI/HO/IMD/DF3/CIR/P/2017/114 and SEBI/HO/IMD/DF3/CIR/P/2017/126), some of the Mutual Funds have changed their portfolio drastically, some have even gone ahead and changed their names or will soon be..

So, my question is what happens to the SIPs that I have created on Coin for these MFs (with their old names) post name change ? Will it be terminated automatically, but, I have to create new SIPs for these manually or will they be created automatically as well ??

Can Zerodha please clarify about this ? Better would be to send an info email to everyone investing in Coin, as this is a very generic query !

If it’s merely a name change, then your SIP would continue as is in the newly named scheme. However, if the fund is merged into another fund, then you’ll have to delete your SIP and start a fresh SIP in the new fund. We’re dealing with this on a case-by-case basis at the moment as the AMCs haven’t announced one single date for these changes and this differs from fund to fund.

Hi,

Pls confirm, if you have annual step-up facility available in SIP, means e.g., if someone would like to increase SIP by 10% annually ?

Hi,

Can somebody kindly confirm ?

Hey Anuj, sorry for the delayed response. No, this isn’t available right now, maybe in the future. With our SIP model though, editing SIPs is very easy, so this shouldn’t be a problem right now.

Thanks Matti.

Hi Team,

Was going through your page and interested in investing in MF through coin platform of yours, Could you please let me know what would be the one time charges that i need to pay to you as i dint have demat or trading account in my name and what would the other charges or formalities required for beginners .

Hey Kavish, the account opening charge is Rs. 300. Your investments will be free for the first 25k you invest. Once the total invested value is above 25k, you’ll be charged Rs. 50 per month.

Hi ,

Thanks for revert, so one time opening is Rs. 300 this include opening Demat ad trading account, and i am planning to invest through monthly SIP as you provide platform for Mutual Fund -Direct schemes,

Thanks Matti.

Hoping to see the new one soon.

Hi,

I would like to know how do i get statement of all my MF holdings on a particular day.

I am able to get this for Equity holdings but for MF, it shows only for today and not for a particular day in past.

May be there is a way but i am unaware of it as of now.

Thanks for any clue you may be able to provide.

As of now, that’s not possible. The new backoffice, currently in the alpha testing stage, should have this feature.

I have a Zerodha Account. I want to buy Most NASDAQ Top 100 funds. It is an ETF. How can I?

You can search for N100 and add the ETF to your Kite marketwatch and buy.

Hi, need a clarity. can we buy direct MF plan from coin zerodha… need a answer in Yes or no

Thanks

Yogesh

Hello Sir/Madam,

How do I transfer the existing mutual funds into the new zerodha account? I’ve an existing DMAT account in NJ india.

Can you please tell me the process? Also will there be any charge if I transfer my NJ portfolio to the Zerodha?

Thanks,

Mayur

How will i get margin against the mutual fund I hold in coin?

Hi,

I need to apply for rights issue started today for Piramal Enterprises. Please advise on procedure.

Regards,

Pavan

I am quite impressed with the facilities you are providing. I am trying to get in touch of my Relationship Manager allotted by Zerodha. He seems to be busy all the time and i dont get a call back too. With such poor response in customer service, i have become quite reluctant in starting the investments

Sorry to hear that Karthik. Will take appropriate action.

Can we invest in Direct Mutual Funds through Mobile App?

The Coin mobile app is being developed and should be out in a few weeks.

what type of MFs are offered by zerodha either direct plan or regular plan

hi,

i am investing in ELSS through coin. now i don’t know where to find the supporting document in ZERODHA to attached with my Tex deceleration.

please help

i am already treading in zerodha. i have plan to start sip in zerodha .is there any charges for start sip in zerodha ?

and i have a one question

1) if i am putting sip in zerodha the minimum locking period ?

ex: locking period 3 year means can extern the locking period.

Is this really a good time investing in mutual funds???

Hi, recently i have open zerodha demat account with equity. i would like to invest in mutual fund but i have few doubts…

1. investing timing for mutual fund means its open from mon to fri orelse ?.

2. please guide me, i have two bank accounts shall i use one for equity fund another one mutual fund?

3. shall is exit within 1 year?

4. how to find out ”equity” mutual funds, debit mutual funds

5. shall i use to add funds from my both account or ?

I have partial units of liquid bees in my Demat but it is not visible in Coin. How can I place request to redeem them?

Hey Nithin,

Why do we need to pay annual maintenance charge for maintaining Demat account when we are dealing only in mutual funds since MF do not require to hold any demat account.

The mutual funds you purchase on Coin are, in fact, in demat form.

Hi,

Yesterday I transferred 20,000/- Rs to Zerodha HDFC bank through SBI bank. That was IMPS transaction. But I am not seeing the amount in zerodha. Actually I applied for MF in Aditya birla policy. But due to insufficient balance, it couldn’t be processed. please fix it asap. you service promise is very unsatisfying. i created zerodha only because of people’s recommendations, now i am facing this problem. my 20000 got stuck.

Hi,

I want to start SIP. But initial minimum investment shows 5000 to start SIP.

Also please confirm the amount will be directly debited from my bank account or do i need to manually transfer funds to zerodha every time (as its very tough process)?

Thanks,

Gagan

I understand that no brokerage will be charged. But is there any exit load MF company will charge me?

Generally they charge 1% exit load. There is one more company Scripbox.com that helps us maintain the common MF portfolio like yours. They also do not charge any fee. They mention that they get commission from the 1% exit load from MF that MF company charge to customer.

Is there any Exit load in Zerodha MF?

I am opening an account with zerodha. Now if i open an account do i need a separate account for Mutual funds i mean something new activation with extra charges for coin?

No Manjunath, anyone with a Zerodha account can use Coin.

Hello,

I want to invest in mutual find via SIP. I will try to open a Zerodha demat account for this purpose.

I have following questions

1. Should I get CKYC done from CAMS etc prior to opening demat account with Zerodha?

2. If I buy MF units on zerodha platform – what is the procedure to stop SIP? Is it online or do I have to send a signed physical form to your office?

1. No Pranav, we’ll do the KYC for you.

2. You can simply log into your Coin account and start or stop your SIPs whenever you want to.

Hi Team,

In case this is being monitored i just want to raise a concern that i believe that Zerodha does not gives an ear on the need of small investors . I want to invest in RGESS through Zerodha so wanted to open account and wanted to discuss about the same .Since last week i am trying to contact Zerodha customer care over call but its getting engaged for more than 1 hour when i tried multiple times. I also mentioned in Zerodha website and multiple other websites to Zerodha to give me a call back but never received any callback . Also i raised 2 tickets for the needful but getting a mail just stating that your queries would be answered if you call to the mentioned number and again after calling as i stated above.

If anybody is monitoring this its a humble request to kindly give me a call back and discuss

because if this kind of scenario is there then how can i have trust in future on Zerodha that they will answer my queries promptly.

Thanks,

Can you write to quality[at]zerodha.com with your contact details? Someone will get in touch. Also, RGESS tax benefits were stripped in the 2017 budget and we don’t offer these accounts anymore.

Hi Matti,

Surely i will mail to the support team.

But RGESS scheme would be stripped off from financial year 2018-19 as stated in the offical government gazette,

RGESS website ,NSDL and other websites so this would be the last year where one can invest in RGESS .

Kindly let me know if still i can invest in RGESS through Zerodha or not.

Thanks ,

Shirish

Is there any way to transfer my units (regular plans) from another brokerage firm to zerodha coin account.And that too in direct plan?

This has been answered here.

Hello Nithin Kamath sir,

Please clarify the concern mentioned below:

Zerodha will charge a subscription fee of Rs 50 per month above MF investment value of first Rs 25,000.

This Rs 25000 is only one time or applicable for every financial year i.e. Rs 25000/year of MF investment value?

I hope you will guide me soon

Himanshu, once your investment value goes beyond Rs. 25k, the 50 Rs. subscription kicks in and is active for as long as you are on the platform.

Dear Team,

I am a Mutual Fund distributor. Is there any way I can use the Zerodha platform for my clients to invest in mutual funds. I am also registered as an Associate with Zerodha

Hi Zerodha team,

I have been using a zerodha demat account for a year. I want to do an SIP in an equity share – is it possible? Or is SIP possible only for mutual funds? Please guide me.

Equity SIPs aren’t possible as of now. We are trying to add this feature soon.

Hi Nitin,

i am investing in equity and mutual funds through ZeroDha kite and Coin. My Father also wants to invest in the mutual funds. i have suggested him to do this through Zerodha-Coin due to ease of investing and better returns in direct plans rather then regular plans. But i have 2 practical queries,

1. As he is not a techie person and he can not use either Mobile apps nor web platforms. In this situation how he can take a hold and commands over various activities for his investments like purchasing redemption or or transfer money from his zerodha funds back to his bank account. Is there any offline way?

2. I want to tell the steps or process to get values of all my investments in equity or mutual funds to my nominee after my death.

Thanks

Ankit Bajpai

[email protected]

1. Unfortunately, Coin is a completely online platform.

2. The nominee needs to merely write to support[at]zerodha.com in the case of any untoward incident and we’ll help them claim the holdings.

Hi Nitin,

I have been trading with Zerodha since last two months and I am happy with it. I am also buying Direct Mutual Funds using Coin platform and this is really very amazing. My many of the friends have joined after me and they are also happy with it.

If you consider then i have few suggestions regarding Coin platform:

1. Could you please provide bookmark/Favorite or wishlist kind of feature where I can create my own list of Mutual funds which I want to buy in near future.

Here is a good website for reference : https://www.moneyfront.in/mutual-fund/mutual-fund-explorer.aspx

2. Instead of just listing all funds on one page could you please provide sorting and filtering options with various criterias like by AMC, by Fund type etc.. . That will be really very great full to find best mutual funds from thousands of funds.

3. Could you please add NFO ( New fund options ) section as well as include those newly listed funds on page so user can also buy any of them.

If you will consider and will implement above listed features then it will be great help from you for MF buyers.

Thanks & Regards,

Jignesh Raval

[email protected]

How can i pay next installment of sip after buying it?

Unfortunately,I place an order on L&T emerging business fund.he dedited my money 5000 on zerodha account &order sent to ASC.HOW to cancel that order.I need required money urgent

Jeyanth, if the order has been sent to the AMC then I’m afraid you won’t be able to cancel the order. You will be receiving an allotment of the units shortly, you can just redeem the units then. You can write to us at [email protected] for more.

I want to invest on the Mutual Funds via Easy SIP way. I want to understand following. Please help me to clarify before I start invest as I am a begineer.

1. Let’s say I start a SIP with 5K per month for 3 years. Can I stop it after an year but keep the units and sell it later?. In that case , the AMC has to be notified about my original plan was 3 years but I stopped it after a year?. Or the control is with Zerodha only?.

2. Also Let’s say initially I started a SIP for 1 year and then i want to extend it to for one more year. Is it possible?. or i have to start once again new SIP for the same fund?

3. You have mentioned that ”Direct mutual fund investments up to ₹25,000 (cumulative) are free. Thereafter, a platform subscription fees of flat ₹50 / month is automatically deducted from your Zerodha account”. Is it monthly 25K ?

1. You can do this entirely on the Coin platform.

2. Again, Coin will enable you to do this.

3. No, this refers to your total investment value. So, if you have only a SIP of 5k per month running, subscription charges will kick in form month 5 onwards.

Hi,

I want to invest in ELSS, currently I have requested for 25000 in aditya birla sunlife tax relief growth 96, I haven’t yet chosen the lock in period (3 years). How will I get the tax benefit. Can you please help me out here.

The lock-in for ELSS funds is already there. Not something you need to choose. Just show the investment when you’re filing your taxes for the tax relief under 80-C.

Which are best funds to invest in SIP

L&T Emerging Businesses Fund-DP (G) 35

Mirae Asset Emerging Bluechip Fund (G)

ADITYA BIRLA SUN LIFE SMALL & MIDCAP FUND – GROWTH

SBI Small & Midcap Fund -Direct (G)

We, at Zerodha, have always believed that you should make your own investment decisions while you let us handle the execution.

SBI Small & Midcap Fund -Direct (G) – Can i invest in zerodha. Also will sip amount deducted from zerodha account or bank account.

This fund has been temporarily suspended since November 2015, so investments in this fund aren’t possible at this time.

Can you suggest me the best from the below?

– L&T MIDCAP GROWTH DIRECT PLAN

– RELIANCE SMALL CAP GROWTH DIRECT PLAN

– MIRAE ASSET EMERGING BLUECHIP GROWTH DIRECT PLAN

– TATA INDIA CONSUMER GROWTH DIRECT PLAN

– UTI TRANSPORTATION AND LOGISTICS GROWTH DIRECT PLAN

To Stop or edit the SIP amount how many business days before do i need to change in the COIN?

Hello,

I have an account with MF utility(ECAN account). With MF utility, there is an option to link our demat account with the MF utility account. Doing so credits the mutual fund units into the demat account when purchased through the MF utility portal.

The MF utility portal states that , once the mutual fund units are in the Demat account, further redemption is possible only by submitting a request to the DP.

So, in a case like this, does Zerodha allow me to redeem my units online? Or should i be submitting a physical redemption request for each and every redemption?

Kindly clarify.

Hi Kiran,

It will be easier if you simply invest through COIN. If you are investing via MF utility in demat mode then you would have to submit a physical redemption request for each redemption.

Hi Team – Would love to see more options on Mutual Funds. Was trying to find some for Franklin Templeton on here but failed.

do i need to add money to trading account first for SIP or every cut of date amount will be deducted from linked account? is there any option i can set auto deduct from linked account?

Nikhil, yes you need to have the funds in your account and we don’t directly debit your bank account. To avoid transferring funds to your trading account each time you can set a standing instruction which will automate this process. You can check this post for more.

Hi,

Actually, I want to buy a mutual fund through the coin. I want to buy it for 10 years. Can I do it like- 1st I will buy for 1 year and then again renew it for 1 year and so on.

If yes, Will it give me more return ?

Amin, yes you can. You can invest lump sum any time you wish to. You can also start and stop SIPs whenever you choose to easily. Returns depend on the quality of the fund and market conditions, better to consult your financial advisor about it.

Is there any commission or brokerage for SIP through Zerodha?

Hey Deepu, we sell direct mutual funds and hence no commissions. 🙂 Check this post for more.

For MF SIP – do I need to transfer money to Zerodha funds or will it be deducted from my linked bank account

You’ll need to transfer the funds to your Zerodha account for the SIPs.

Please let me know about Pledging of mutual fund units are started now?

Not yet.

I just started using COIN platform for direct mutual find investment.

But I am disappointed to know that I am not getting any P&L and Tax P&L statement similar to what we are getting for equity.

Also options for STP, SWP are not availabe. CAGR values are also not shown.

This will give a lot of clues and relief while filing IT return.

Can you say, when these facilities will be available?

We’re working on the P&L reports. We’ll roll out an update soon.

Hi

How can i stop the SIP in zerodha MF.

Thanks

Hi Murali,

Once you click on the SIP/Conditional tab on your dashboard, you can click on the pause or delete icon next to the status column. If you pause your SIP, then your further installments will not be placed on the due dates but the SIP instruction will not be deleted from the SIP window. But, if you click on the delete icon then the SIP instruction will be deleted from the SIP window.

Thanks Faisal

Hi Nithin,

I would like to start the SIP. Can I just open an account for SIP( MF). And apart for 50 rs/month, is there any other charges/commission by Zerodha on buying or redeeming the amount?

Thanks

Rahul

Since MF is in demat, when you redeem there is a Rs 5.5 DP charges. Currently only MF account not possible. You need to open the demat as well.

Hi,

I have been purchasing some ELSS over the past few months from zerodha platform. However I have a small doubt- as per my knowledge there is a lock in period of 3 years for the mf we buy under elss. However from my coin platform on zerodha- I am getting an option to redeem the units I have purchased even within months of the purchase date.

Out of curiousity I even tried placing a redemption order for 0.01 units out of a larger number that was bought just a week back. And the order was successfully placed. Am I missing something ? How was i able to place an redemption order on elss units before their maturity ?

Hi,

We have observed that you have cancelled the order. The order was placed on COIN platform but if it was processed and sent to the AMC then you would receive a rejection reason the next day with the remarks ’Units under lock-in period’. We give that REDEEM tab on COIN for all funds. Also, if you have invest in ELSS funds on several dates the the 3 year lock-in period will be calculated for each date of investment so the option to REDEEM is provided irrespective of whether the units are in lock-in or not. If you click on the drop down arrow next to the P&L column in your portfolio you can see the details how each allotment for the same fund.

That clears the doubt . Thanks for the prompt reply. I must say forum help on zerodha is really good.

Hi Team,

As a Scenario, I have ordered for SIP plan for the particular fund on Saturday and Cancelled on very next few minutes and Order status changed from Pending to Deleted.

Do we have to pay charges for this?

No.

Will I get investment proof for MF if I invest through Coin?

Yes.

I could not find all the Mutual Funds here. I was searching for Mirae Asset Emerging Bluechip Fund (G) and could not find.

Will it be added soon?

Raghu, Mirae hasn’t yet enabled direct in demat mode on exchange platform. We are speaking to them.

Hi, can i withdraw only part of my MF units? Say i have ”158.946” units. is it possible to redeem only 100 units?

#150925 is my ticket id.

Yeah you can.

i am planning to open an account with you . Are there two separate platforms for equity trading and buying Mutual funds or one account works for both .

One account works for both.

I am banking with HDFC so I would prefer intra bank transfer for SIP deductions to avoid bank charges

Could you please provide Zerodha bank details or point to a link where I can get those details

https://zerodha.com/fund-transfer

I tried to add beneficiary for Account Number ZERNSE and getting pop up like Account number should be numeric

I got the alternate Bangalore branch Account number ..Thanks

Just scroll down that page, you have alternate number which is in numeric.

Hi,

I have added 2 MF SIP in my portfolio. But when that status will change and i can see there minus amount in my fund as margin utilised. Not sure how much time it will take to reflect.

Please guide me on on this,

Thanks.

This happens end of the day on the SIP date.

Similar to how you can pledge stocks, exchange approved mutual funds (list will be shared soon) can be pledged to receive margin for trading F&O. Essentially investing in mutual funds at Zerodha will be very similar to investing in stocks.

When are you releasing this?

Some more time.

Hi Nithin,

Sorry for posting here, but I am facing promblem in account opening. I send a form but forget to write a mobile no. On envelope. I have already sent a account opening form before but it gets rejected due to 2nd holder’s proof issue. Now, i send a another form but forgot to write the mobile no. on envelope. You can crosscheck my no. Because it is already written in my bank passbook detais photocopy, already 10 days have passed due to sending form twice. Please take it seriously and solve it.

Have escalated this to the concerned team.

1. For Zerodha users with only MF transactions over INR 25000 (no equity trading at all), is the flat charge of Rs 50 per month over and above the Rs 300 annual maintenance charge? Or will such users ONLY pay Rs 50 per month (with no additional annual maintenance charge)? Kindly clarify.

2. Are ALL MFs available on Coin? If no, how many?

1. Coin subscription charges are over and above Demat AMC.

2. The list of all MF’s available are here.

For SIP, when you said ”you are avoiding mandate and as long as funds are available SIP will be executed”, isn’t that without mandate we have to transfer the funds to equity account every month and paying you the internet banking fees of 9/-+GST? That’s too much overhead.

And to avoid this changes I don’t want to transfer lump some at a time and keep it in equity account which is not giving me any interest.

Please help me understand this better.

Banks allow you to setup a recurring transfer facility which allows you to automatically transfer funds to a select beneficiary on a specific date. You can use this facility to transfer funds to your trading account to meet your SIP payments.

Thanks. I got it.

But in AMC’s can be registered as billers in bank websites, so that SIPs can be automatically deducted and the service is free of cost.

In COIN case, we may need to pay them with NEFT (though Standing instruction), which costs an amount.

Any plan to make ZERODHA a biller? Or can I use intra bank transfer instead of NEFT to save on these service changes?

We’ll explore this possibility, yes you can do an Intra bank transfer also if you are banking with HDFC.

I have to mantain balance in my bank account? or in my zerodha account? for payment of sip installment which i bought through coin.

In zerodha account. The day before the SIP we send you a notification so that you can double check.

hi, i want to buy L&T Emerging Businesses Fund – Direct Plan – Growth with monthly sip of rs 1000/-. What amount should i fill in following?

Initial investment (Minimum: ₹ 5,000.00 )

₹ ————-

Frequency

—————-

Installment (Minimum of: ₹ 1,000.00 in multiples of: ₹ 1.00 )

₹

Total installments (Until cancelled )

To start off on this, your first installment has to be 5000, after that you can do Rs 1000/month. So 5000, monthly, and 1000

Hi Nitin,

Thanks for your valuable reply. One suggestion here can you please add ”How to setup SIP” in Zerodha’s user manual videos.

Thanks!

Paras Joshi

Hi Paras,

You can check this information in this COIN webinar where Nithin talks about direct mutual funds and the features available on COIN platform. You can skip to 14:00 to understand the procedure to place orders and create SIPs.

I’m NRI ,want to transfer my MF portfolio with zerodha.When & how can I do it plz

Anand, you want to transfer into Zerodha demat or out of it?

Hi Nithin,

I want to transfer from Icici Direct to Zerodha as ive heard ur services are v gud & user friendly. My bank a/c is with icici bank.

thanx

ICICI direct would have given you DIS slips. On that slip, mention your zerodha dp id and mention all the shares and quantity that you want to move. Submit it to ICICI, you will have it in your zerodha demat the next day.

that’s great Nithin 1-,I have only Mutual fund holding currently that I want to transfer to zerodha and close my account with icici direct.2- will I be able to buy /redeem /switch easily form zerodha MF account like I did with the ICICI direct account as I hv my savings account with icici bank?

Anand, firstly unlike ICICI we offer direct mutual funds. Savings you make are immense. Check this: http://coin.zerodha.com/. Since we are not a bank, the buying experience may not be as good as ICICI as money has to be transferred to the trading when purchasing.

Great no prob. Can u ask someone to help me open my account with u all plz.

Which is better weekly 1k SIP or Monthly 4k SIP?

Also could you please add how much would you have made with weekly SIP on mutual fund page like monthly calculator?

hmm.. weekly or monthly doesn’t really do much of a difference. Check Karthik’s answer here.

Even for mutual fund held in DEMAT mode, still there is a FOLIO NUMBER assigned.

Just wanted to know, Let’s say in zerodha-coin platform, I have already invested in a scheme of a Fund House so that I’ve already got a folio number.

So When next time I’ll invest in ANOTHER SCHEME of the SAME FUND HOUSE then that will be allotted in ANOTHER NEW FOLIO NUMBER or those new scheme units will be allotted in to the EXISTING FOLIO NUMBER.

This depends upon the AMC as they decide whether the same folio number should be assigned to another scheme. Generally, most of the AMCs assign a different folio number. But, if the units are in demat mode then your DP ID number is more significant that the folio number.

Hi Team,

In the above post you talk about ’NAV tracking conditional orders’.

My question is that is it really a good idea to redeem a lump sum fund which has crossed an expected NAV but has not completed an year? I say this because most of the good performing funds come with an exit load of 1%.

How wise is this decision then?

Ah yeah, if there is an exit load, then you have to factor that in.

Hi,

Im having demat account in zerodha and now im interested in mutual funds as well. Where i can get executive details and much more information about zerodha mutual funds.

Check this: https://coin.zerodha.com/

when are you planning to launch IPO from zerodha. It was promised in oct 15

IPO without being a bank is very tough. SO unless SEBI allows another way to do this. Btw IPO can be applied to by using Zerodha demat and within your online banking. Check this.

First of all, I would say big thanks to Zerodha team for there great effort to reducing brokarage charges & providing financial literacy.

I have two questions: 1) Is there any extra charge for NRI, apart from Rs. 50/Month subscription for Mutual Fund. Bcoz there are 0.1% on equity delivery charges for NRI. 2) I have purchased Direct Growth plans from AMCs website. Those are not in Demat format. How can I shift them on Zerodha Platform.

I missed to read above comment of Babajan. Zerodha is not offering MF to NRI. is there any possibility later, it can be availble for NRI?

We are working on making it happen.

Dear Nithin well made post,

i have some quires regarding mutual funds

1. What zerodha will charge for NRI’s to buy mutual funds

2. What is the Max NO. of Mutual Funds can buy NRI’s

Currently we are not allowing MF for NRIs

What are charges applicable (from zerodha side) once a customer redeem his/her Mutual Fund?

Rs 5.5 + GST charged by CDSl. We don’t charge anything.

My SIP’s are not deducting automatically though I have selected 30 Days period which says that your next installment amount will be deducted after every 30 days but the same is not happening. Please suggest what to do.

Can you email to [email protected]

Normal SIP mode is still not added to the platform. When can I expect this?

Normal SIP mode: Minimum investment amount 500 and initial investment amount 500.

I know normal SIP has lesser minimum to start, but the way we are doing it makes it more convenient/flexible. You can also have quasi nach mandate of sorts set. Check this post.

Hi,

I see that Franklin Mutual Funds are not listed on your website [1]. Is there an exclusion criteria for not dealing with certain MFs on Zerodha platform ?

[1] https://coin.zerodha.com/funds

Thanks,

Rahul.

Franklin haven’t enabled direct MF on exchange platform, hence we are not able to offer.

Dear nitin sir;

is it possible for zerodha to allow trading in Crypto currency like BITCOIN etc ?

Regulators in India are still aren’t allowing it to happen.

sir then how zebpay, unocoin and companies like this are offering bitcoin trading?

Not necessary that they’re complying with the rules set forth by the Govt. Best to avoid.

Hi,

Normal SIP mode is still not added to the platform. When can I expect this?

Normal SIP mode: Minimum investment amount 500 and initial investment amount 500.

Thanks,

Raghavendra

Will SIP amount be auto debited from my bank account or do i need to keep funds in zerodha equity account?

Sir, how can we check the overall performance of our mutual fund portfolio in zerodha? what i mean is that, throughout a year i invested a total amount of 1lac in different mutual funds, and with time i redeem some of them. now at the year end i want to see exactly how much i made profit? kindly help

Yes you can, your portfolio will show you this. Btw, we will have detailed P&L soon in our new version of Q.

Hi Team,

I’ve one query. As I know investment upto 25k in a year will not charge any brokerage where as after that zerodha will charge 50Rs per month. My query here is suppose I utilize 25k in 1st 6months and after that in 7 & 8 month I don’t buy anything, but in 9 & 10 month I do some more investment in MF so in this case will be charged only for month where I do investment i.e 9 & 10 or I’ll be charged from 7th month?

Also from which year you consider as 1 year is it calendar year or financial?

Once you exceed 25k, you will be charged from the 7th month onwards.

Hi Nithin,

You consider 1 yr as 1- Apr to 31- Mar (Financial Year) ?

NO TEXT …..I doubt I made an error in my e=mail id given ,since no way i can check it just a …”nothing” post

Sir,

I would like to make some MF (Direct) investment through your platform. Since i am having some holdings which I have invested directly with various AMCs .

Sir, for some reason/s which I don’t want to disclose (Sentiments or whatsoever) I want to keep the folio Nos which were already been allotted by the AMCs . since I have the option to choose the distributor when I am logged in the AMCs site while purchasing, n if gave your ARN Number will the new purchase reflect in your site (Coin) as a regular plan?

and thus transferring my folio number to your platform as a regular plan and make additional purchase as direct on the same folio?

hope you understood what clarification I needed n sorry to bother you with the complication

thanks n regards

Karuna

Hi Karuna,

Your query is slightly ambiguous so let me ask you the following questions ?

1) Are you asking if you can purchase from the AMC website (mentioning our ARN no. and your Zerodha demat account no.) and expecting this to reflect in COIN platform?

2) Do you want to transfer the units to your Zerodha demat account and want to continue the investments through COIN.

3) Are you asking if the folio number can be common for regular and direct plan investments in the same scheme ?

What are the annual charges/fees for opening Mutual Fund account that is investment savings account OR Demat account with Zerodha..?

The AMC for the demat account with Zerodha is Rs.300. There isn’t any ana=nual charge for Mutual fund account where you could invest up to Rs. 25000 for FREE

and at Rs. 50 per month is charged thereafter. Check here

Hi Zerodha

I have a few queries regarding transfer of MF from ICICI Securities

1. ICICI Direct does not keep my MF in Demat Form. I can access all my MF through there portal and Buy and Redeem through the same.

2. Does Zerodha do the same way or does Zerodha mandatorily buys MF in Demat form?

3. I have heard there are issues in transferring MF from a Non Demat Online Form/Account to Demat form/Account. It is a tedious process as number of entities increase in the transaction.

4. Also the Turn Around Time and Charges for redeeming a Dematerialised MF are higher as compared to MF in Online form with ICICI Direct?

5. ICICI Direct claims that in online form your MF funds are in your trading account in 1 day whereas funds of Dematerialised MF will take 3-4 days

6. How to transfer Non Demat MF to Zerodha?

Hi Rohit,

1) The redemption will always happen according to the redemption settlement time of the particular funds whether its here or with any other distributor. For example, if you have place the order on Monday before the cut-off time and if the settlement time for the fund is T+3 days then the amount will be credited to your account by Thursday morning. Even ICICI would follow the same cycle when the client places the redemption for that particular day.

2) There is a certain process that needs to be followed when you are dematerializing your mutual fund units for which a physical form along with some other documents will have to submitted. You can click on this link for more information.

3) If ICICI is claiming that the redemption amount is credited to the trading account the next day itself irrespective of the settlement time of the fund, then they might be crediting it from their own account into the client’s account and would be charging interest till the actual redemption amount is not credited.

I am trying to login https://mf.zerodha.com with zerodha kite account but getting the following error message.

”Mutual Funds is not enabled on your account.

Please contact Zerodha support for further queries.”

Please help me to enable mutual funds in my zerodha account

I am guessing you dont’ have demat account with us or have our old partner IL&FS account. you will need to open new one with us.

Hi I want to search MF investment by way . Suppose I want to invest 500 or 1000 in MF one time so i will select 500 to 1000 amount range and all mf of 500 to 1000 Will be displayed on screen .

Dose it possible

Ah currently not, but we have a screener coming up.

Hi, I have 2 mutual funds SIP through zerodha. But they are both regular plan, if I want to convert them to direct plan, what would be the procedure for that?

You can stop them and start on coin. You can exit whatever is already invested and buy it again under coin.

Dear Sir,

If I purchase through MF platform, please let me know-

1) whether the units are deposited in demat form ?

2) if yes , can I get margins against those units if I pledge them?

3) if I redeem them, where the funds are transferred – to trading account or bank account ?

Thanking you ,

Dr.Suhas Kothavale

1. yes

2. Currently not, but plans to do it in future

3. Trading account.

Also we are now the only brokers to offer MF in direct form. Check this: http://coin.zerodha.com/

Thank you Nithin for instant reply, please let us know if we can get margin against MFs.

Hi Nithin/Venu

I am just wondering, what would be the best date in a month to invest in SIP by auto debit?

Would it be the 1st, 5th, 10th, 15th, 20th or 25th?

I know it probably makes no sense to time the market, but are there any behavioral issues we could be missing out here? could you please let me know ,what would be best date ? 🙂

I wouldn’t have an answer to that one 🙂

expalin the diffrence between direct and non direct regular plan

https://tradingqna.com/t/what-are-differences-between-direct-and-regular-funds-and-do-they-make-a-difference/10578/2

Some of the fund like sbi blue chips is not found in direct plan weather i can invest such fund through coin

We’re working on getting more funds on the platform.

Why don’t you start debit card/netbanking payments / direct payments from bank account like OTM (One Time Mandate) facility. Atleast the bank charges for transfer of fund can be minimized. If I have a SIP of Rs1000/- per month, you charge Rs.9 just to transfer it your account or NEFT charges by bank. Through OTM facility this can be scrapped.

We’re exploring this option. Will keep you posted of any updates.

Hi Nithin,

I want to start ELSS (Tax Saving Fund via Coin) ,

1.can i able to do SIP through coin for Tax Saving Funds as well ?

2. as i am not able to see Franklin India Taxshield Scheme. is there added or yet to be add ?

3. say for example i have done SIP around 3 year for Non tax saving or tax saving, ( rs 50 will be charged for per month if investment grows more than 25k irrespective of transactions and funds) assume, after 3 years ,i don’t redeem but still compound interest keep on adding for these funds. assume that compound interest it self only growing as more than 25 k having said that , i have not done any transaction, Still will that Rs 50 will charged ?

Correct me if i am wrong. Thanks in Advance

Thank you

1. Yes, you can. You’ll have to start a SIP for an ELSS fund.

2. These are the available funds for now: https://coin.zerodha.com/funds ; We are in touch with AMC’s to get more funds onboard.

3. Yes, 25 will get charged every month once you exceed the initial investment of Rs.25,000

Even though i have not done any transactions. Still i need to pay rs 50 ( if my compound interest it self only growing as more than 25 k ) so in this scanario, it will be like every month i will be paying irrespective of transctions done or not ?

Yes, you’re right.

Hi, Scenario: Today is 12th April. When I am trying to schedule ( after closure of market) a SIP on a MF for say every 10th of the month, why is that it is also scheduling for trade the very next day. I do not want the system to trigger the trade for next day. I want the trigger to happen on 10th May. Also why does it want a sip schedule to have minimum investment of say 5k at the first trade (Assuming this fund has 5k limit when bought in lump sump. Sip is usually 1000 or 500 INR only)? Appreciate a quick reply.

Cool thank you 🙂 Hope you will provide soon 🙂

Hey ,

Nithin/Team

I had pinged you below things on long back ago but i didn’t get any reply could you please provide your input

April 2, 2017 at 1:09 pm

Hey Nithin , do you guys offer any fund adviser for MF Or Stock Or Both if So please let me know what will be cost. Because we not get good time to see performance of our port folio quarterly or early etc ,being in IT it will be difficult for me . so any advice will be appreciable. and helpful for me

Ajay, currently we don’t do any advisory.

i am new to coin of zerodha.i have Dsp tax saving(G) on SIP.

while going through the dashboard.I saw an option to redeem and the units..how can i be allowed to redeem without completing the three yr lock in.(i am new to mutual funds)

If you put a redemption request, it will get rejected. Get your point, this shouldn’t show for tax saving funds. Getting this corrected.

Want to open a monthly SIP. I have a zerodha account. I want the money be deducted from my bank account. Is it possible or I have to maintain the balance in zerodha account only? because then every month I have transfer money to zerodha account and that will be one extra task.

Saket, currently it is only from trading account. We alert you one day before so that your account is topped up. We will bring direct to bank facility soon.

hello sir,

i am trying for more than 3 days to know.

If i am buy one mutual fund @ amount of 5000 ( exit load 1 % and expense ratio 2.51 ) and after 2 month its value 5400 then what will be total amount in my hand after all calculation…

please help me.

Hitesh, you will always get back that days NAV multiplied by the units you have. So Rs 5400 – Rs 54 (1% exit load).

Hi Venu/Nithin,

Thanks for your valuable reply, I went though above link what you have mentioned but i got some questions,

Here you go 🙂

By Considering your example

i.e.

To give you an example, assume you make an investment of Rs.12000 the first month, 5000 second month. Your total investment is Rs.17000. In the 3rd month, if you exceed Rs.25000, charges of Rs.50 start getting applied.

To continue your Example,

Assume, Note On 3rd Month ,current holding is Rs 17000

Scenario 1:

4th month on 2nd date ,i will make an investment of 10,000 so total will be 27,000 so Rs 50 will be deducted ? .

and

Assume,in the same month 22nd , i will make another Rs 5000 ,so total will be rs 32000 ,in this case also rs 50 will be deducted ?

Scenario 2:

Assume, if i have two funds,

Fund 1 : after 3rd month, fund contains Rs 20,000

Fund 2 : after 3rd month, fund contains Rs 22,000

So in the 4th month,

i will add Rs 7000 to Fund1 so total will be Fund1=rs 27000

and will add Rs 10,000 to fund 2 so total will Fund2=rs 32 ,000

In this Scenario ,how much amount will get deducts , is that only rs 50 OR Rs 100 ?

Scenario 3,

Consider Single Fund say Fund-A,

after 5th Month Fund-A=Rs 35000,now in the 6th month i will be adding rs 5000 so total will be rs 40,000

so in this case also Rs 50 Deducts ?

if so then it will be always greater than Rs 25000 only so Rs 50 will be keep on deducting on till 25 Year if My MF is long term of 25 Years

i.e if this is the case then, 50*12=600 per Year and about 25 Years *600=?????

Correct me if i am wrong. Thanks in Advance for your Reply 🙂

Hey Ajay, pricing on this is as simple as it gets. You pay Rs 50 per month, do as many transactions on as many funds as you want after the first Rs 25,000. So yes, 25*600 at end of 25 years. Compare this to buying mutual fund normally, you could have paid upto 20lks instead of this Rs 15000.

Thanks Nithin for straight and perfect answer 🙂

Hey Nithin , do you guys offer any fund adviser for MF Or Stock Or Both if So please let me know what will be cost. Because we not get good time to see performance of our port folio quarterly or early etc ,being in IT it will be difficult for me . so any advice will be appreciable. and helpful for me

adding one more point,

4. I am seeing in google that there is no charges for mutual fund in zerodha,is that correct ?

i.e Mutual fund investments similar to investing in stocks at Zerodha will be absolutely brokerage free.

please do confirm the same. and i i see if mutual fund investment more than 25 k per month brokerage charges will rs 50 ?

i am confused . could you please clarify this one as well,

thank you,

AP

Earlier when we were offering Regular plans, there were no charges. However you’re paying commissions to the AMC (Asset Management Company) by investing in Regular plans. Coin allows you to make investments into Direct funds. The kind of additional returns that you’ll make by choosing a Direct fund over regular is enormous.It’s explained in detail here :https://tradingqna.com/t/why-invest-in-direct-mutual-funds-on-coin/11738

Hi Nithin,

Could you please clarify the below thing, i am new and existing user of zerodha account

I want to make investment in MF’ ,like lum sum or SIP

1. if i invest SIP amount as per my wish. Like 5k -10k per Month

what is the charges applicable for this. like brokarage charges etc

2. if i want to invest in lum sum amount in mutual fund below 25k per Month, is the any charges for that commission etc.

3. I hope ,if i am investing more than 25 k Per Month then ONLY rs 50 charged.

is that including all mutual funds (total transaction of 25k per month)

or

Per transcation if it exceeds 25k then charges applicable ?

Thanks in Advance.

Ajay Patil

1. There are no charges for investing using Coin.

2. There are no charges upto Rs.25000. 25000 is not on a monthly basis. If you use the platform for investments of more than 25000, the charge gets applied. To give you an example, assume you make an investment of Rs.12000 the first month, 5000 second month. Your total investment is Rs.17000. In the 3rd month, if you exceed Rs.25000, charges of Rs.50 start getting applied.

hi Nithin,

Does zerodha now provide SIP where it doesnot get cancelled when the fund stops accepting new fund like in the case of DSP micro cap fund recently. ?

our SIP is simulated using lumpsum. So if a funds stops accepting lumpsum, yeah it will stop .

Hi,

Need two information.

1. Will i be charged little extra if i buy a MF from Zerodha, instead of buying directly from Fund house ? Approximately in % what will be the extra charge.

2. Can i invest SIP amount as per my wish. Like if i wish to invest 3k in one month and 5k in other, is that possible ?

1. Just the Rs 50/month extra after your first 25k worth direct investments. No % and all.

2. Yep absolutely, you can change amounts, start/stop and do whatever every installment.

Hello, the new Coin platform looks promising. Thank you.

Just a question – do you maintain a list of MF that we could invest in via Coin platform? I guess not all funds are currently covered by it. If so, kindly share the location of the list. If not, could you please publish it?

Also, any tentative dates for when would the ”SBI Pharma Fund – Direct Growth” be available for investing via Coin?

Pratik, HDFC/Franklin/SBI funds are missing. They should all start appearing in next 1 week.

Thank you, Nithin

Hi, Just now happened to see the below quoted message when I tried to login into my MF account. Does it mean that for MF investments we are being charged Rs 50 every month as a platform subscription fees? Would appreciate if somebody could explain to me about the new changes in Zerodha MF platform. Thanks.

”Direct mutual fund investments up to ₹25,000 (cumulative) are free. Thereafter, a platform subscription fees of flat ₹50 / month is automatically deducted from your Zerodha account. If you wish to cancel your platform subscription, you may exit all your direct mutual fund holdings.”

Cherian, we went direct today on mutual fund investments. Check this post.

Okay thank you Nitin.. Now I get it..

Does Zerodha become my broker if I buy through Zerodha?

Since returns on MF bought through a broker are different from those bought directly, I was wondering which returns will I get here.

Yes, currently if you buy through Zerodha, we will be your distributor. About direct mutual funds, give us time till weekend.

Hi.

I am existing member of Zerodha. I would like to invest in MF through SIP model that zerodha has.

My query is – since this will be a regular investment (not direct) some percentage will go to commission. Now I am making investment every month then every month I will have to bear this commission?

However somewhere in above discussion I read that MF investment is free. I would like to understand how?

Ashish, yes that is how regular model works. Every month a certain commission goes to the distributor. That said, if you give us time till this weekend, we have a surprise for you on this.

Thanks for prompt reply Nitin.

I was about to start SIP in 4 funds from Friday.

Looks like I have to wait till this weekend 🙂

Thanks again.

🙂 yep, wait till monday.

Hi Nitin.

Is there any changes in MF platform this weekend? I am not able to see direct MF investment options.

Just got this URL – https://coin.zerodha.com/ which is getting redirected from mf.zerodha.com

In morning this redirection was not there.

Many Thanks.

It is live now: https://coin.zerodha.com/

Dear Nithin,

Why is Zerodha treated as a distributor and unable to provide Direct Plans, but startups like Oro Wealth, Invezta are able to provide Direct Plans for MFs?

Is there some risk with those companies, or they breaking some rule?

Praveen these companies are registered as RIA’s, no risk investing through them. Btw, we might have some good news on this front for you very soon.

I have invested in a mutual fund with SIP on a monthly basis, the allotment has been done on 17th Feb but I have purchased it on 16th Feb. When the funds will be deducted from my account for the 2nd month as the No. of days displayed as 31.

Hi,

The fund in which you had invested was DSP BR Micro Cap Fund. The AMC has temporarily suspended fresh investments via lumpsum and SIP from February 20th but allowed existing SIPs to continue. But, we cancelled all the SIPs in the system for this scheme since we follow our customized SIP. You can click on the link below to learn more about it.

http://support.zerodha.com/kb/faq.php?id=341

Also, you can start investing in DSP BR small & Midcap Fund as the fund manager is same for both the scheme and the AMC is focusing on garnering more investments in this particular scheme now.

You can write to us at [email protected] or [email protected] for further queries.

Dear Sir,

Suppose I redeem Reliance Money Manager fund unit present in Zerodha demat , where the redeemed amount goes ? In my bank account or in my trading account with Zerodha.

Thank you.

Suhas Kothavale

If you have placed any redemption orders through our mutual funds platform then it will be credited to your trading account.

Hi,

I wanted to know if i can apply for CPSE ETF FFO which is about to open for retail investor from 15th to 17th March 2017,

I already have zerodha trading and demat account, please confirm if i can go for CPSE ETF FFO or do i need to go via Directly to AMC(RMF) or any other brokerage firms.

A quick reply will be highly appreciated.

thanks

PD

You can do it through us, when the FFO is open, you will see an apply button on this page: https://zerodha.com/cpse-etf/ (currently shows detail of the last CPSE FFO)

Hi Nitin,

First I would like to thank you for quick response (I never seen where a founder of an startup is making customer on top priority,even in Holi festival you helped me with early reply, I

Wish you good luck and many more milestones for Zerodha)

Now I have a doubt , will I get 3.5% discount which govt is providing to all retail investors?

Also is there any minimum unit I need to buy ?

Regards

PD

Yes you will get the 3.5% discount. Minimum is Rs 5000, we have just taken the page up for you to apply. Check this. https://zerodha.com/cpse-etf/. If you have any queries, check this

I bought 2 DSP SIP’s from zerodha.But when I called the DSP support they say I never bought any SIP plan instead I bought lupsum.Is this a form of cheat.Because my DSP blackrock Micro cap fund got closed as I don’t have existing SIP plann.

Sudip, Check this answer. Selling SIP is more lucrative as fund houses pay more commission compared to selling lumpsum. The reason we simulate a lumpsum as SIP is because of all the convenience that it gives, mentioned in the link above. They have a midcap/smallcap fund which essentially has same investment philosophy that you can shift to.

I placed an SIP order today morning at 8.30. Till 9.15 pm the status is showing Order placed – Pending verification. Why is this taking so long? at which day’s nav shall i get the units?? If i’m placing the order in the morning of 27th, shouldn’t i get the units at the nav declared end of day 26th??

Hi,

Once you place the order on T day before the cut-off time of 1:30 pm, then you would receive the allotment of the units at the NAV of T day (AMC publishes the NAV in the night after 9 pm). You will then receive the units in your demat on T+1 day (most probably by afternoon) and the same would reflect in your portfolio on the mutual funds platform.

So, when you had placed the order today before the cut-off time, the status would have displayed ’ Pending Verification ’. After the cut-off time, it is now showing ’Order placed – pending verification ’. Tomorrow morning it will reflect as ’ Order sent to AMC ’ and then by afternoon as ’ Allotted ’.

You can click on the FAQ link below to understand the order settlement process.

http://support.zerodha.com/kb/faq.php?id=309

Does not work like that it seems as far as status goes. Its not 1:30 PM and it shows sent to AMC. So if i want to cancel order placed before 1:30 PM – it will not be possible as order shows right now at 12:52 as sent to AMC

I want to bu DSP BlackRock Micro-Cap Fund – Growth mutual fund.But it is not showing when I click on ”Explore funds” in https://mf.zerodha.com/. But if i search ”DSP BlackRock Micro-Cap Fund – Growth in zerodha” Then I can see the mutual fund and can also buy.Why it is not showing in explore funds section.

All new purchases in this fund has been stopped.

But I can buy.Just I have search directly from Google.there is buy option.

Check this article, tells the reason why they stopped accepting new funds.

Hi..recently, I received an email from Zerodha that all investments including SIPs into the ”DSP BlackRock Micro-Cap Fund” have been suspended and hence all our standing instructions i.e. SIPs will be deleted. But, I read on their website and also valueresearchonline that existing SIPs registered on or before Feb 20 will be allowed to continue .

Here’s the exact text on quote ”However, the fund-house said the scheme will continue to allot units for subscription transactions pursuant to SIP, STP, Dividend Transfer Plan, Super SIP facilities registered prior to Feb. 20. and pursuant to declaration of dividend under the dividend reinvestment option offered under the Scheme”. Here’s the link : https://www.valueresearchonline.com/story/h2_storyView.asp?str=33070 .

Since my SIPs were started last year (May 2016), I assume that I should be allowed to purchase units even now. Can someone please clarify what’s happening here ? Am I missing something ? thanks !

Regards,

SPR

Hi SPR, the SIP we run is a simulated one, which is essentially a lumpsum that gets invested systematically based on your requirement. This gives flexibility to the user to do what he wishes, start/stop whenever, start SIP without any bank mandate forms.

Suppose I have a sip of rs:1000.Every month rs:1000 has been deducted from my account.What will happen if I unable to give money after continuation of few months?

Nothing happens, that months SIP misses. You can come back and start anytime in the future, or redeem the SIP that you have paid for, or continue holding to what is bought. You have absolute freedom.

Although I registered for a weekly SIP in DSPBR Micro Cap fund through zerodha mf, it is sent to DSPBR as a lumpsum instead of SIP by zerodha. The dspbr website shows that as lumpsum. I also lost out of continuing the sip as DSPBR has stopped taking fresh deposits (lump sum) although they are accepting existing SIPs.

Prem, like I have mentioned earlier, we run a simulated SIP. Essentially lumpsum invested end of every month. This gives extreme amounts of flexibility to our clients. Btw, you can look at DSP small and midcap fund, it follows the same objectives of investment.

Hi,

I want to Know Charges for Redeeming Mutual Funds on Zerodha MF Platform.

No redeeming charges, but since the MF is in demat form, CDSL DP charges are applicable. Rs 5.5 flat irrespective of the value of the fund.

https://www.smallcase.com/login

login form selection is coming out of border

Hey, can you send me a screenshot at vasanth [at] smallcase [dot] com

Will investigate

Hi Nithin,

Have you started offering margin against mutual funds held in Zerodha?

Thanks,

Ratan

Not yet.

Hi

I am in process of opening demat account with Zerodha, and finding an online platform to transact in mutual fund really gives me more reason to open it.

I want to understand few queries regarding mutual fund if you may address them:

1. Do you provide only the regular plans or direct plans as well? For e.g. some platforms like invezta and oro transact only in Direct plans which are cheaper than regular plans.

2. Most of the MF transaction platform do claim that they don’t take any charges but they adjust NAV and credit less units after deducting the charges in customer folio. Hope you are not involved in this malpractice.

1. For now only regular plans, but we give the convenience to keep it in demat form unlike others.

2. Of course not.

Sir,

I would like to know there is any brockerage or charge for selling MFs from ZERODHA Demat.

Thanking You

No brokerage charge. But since you have MF in demat, when you redeem, there is a DP charge applicable. Flat Rs 13/debit irrespective of how many units you redeem.

Dear Nithin,

First of all thank you for providing such a beautiful platform to trade in markets. Hope our journey continues for long. Wish you good luck for upcoming years.

Actually my concern was is Rs50 will be through out same from here or else there will be any changes in recent years?

Thank You

Mitesh

The plan is to keep the charges the same.

Sir, I need recommendations/advises to sell old not good performing MF and reinvest in new good performing MF regularly as offered by scripbox and goalwise. Are you supporting this type of service? They are also not charging any fee. Goalwise is automatically doing it for me. Please explain.

Sanjay, currently we are not running any advisory as such. You can pick and choose whichever MF to buy with us, and you get the benefit of buying it in Demat form.

Hi, recently I applied for CPSE ETF through zerodha demat..I got confirmation about the allotment also via email and SMS. But I can’t see my units anywhere in my demat…today listing also done. Can u help me pls

Ramarao, can you wait for until end of day, if it still doesn’t show up, can you email [email protected] with your client ID.

Hi,

I have got a doubt. If I’ve SIP due and my Equity balance amount is not enough to pay for SIP. What will happen in that scenario?

What if I’ve holdings? Will SIP amount get deducted from my holding?

Is there someway I can download all the transactions that is happening in my dmat account? Will this include SIP amount as well?

If there is no cash balance, the SIP installment will get rejected. Holdings wont’ be affected. You can login to Q.zerodha.com or directly on the CDSL website to see all transactions in your demat.

Dear Sir,

I wanted to ask about Reliance Money Manager fund which is just like saving account with high interest , they can provide ATM card also for redemption. If I invest excess amount (parked in Zerodha trading account for getting margins) into this fund through Zerodha platform and I wanted to redeem it in emergency as like for buying equity or opting margins for derivatives ( option strategy) , is it possible to redeem as it happens with ATM card?

Instead of this, but liquidbees (which is like the reliance money manager fund itself). You can sell liquidbees and immediately trade on F&O.

Suppose we started a weekly SIP and after paying 2 installments can we stop that SIP?

Yes

SIp Amount direct deduct from bank is it possible???

Not currently.

What happens when we redeem our existing mutual funds? I mean where is the amount credited that one had invested earlier…

How to get them back to my bank account and is there any fee charged for the same and how much?