Online pledging of stocks for trading F&O

Traders,

You can now pledge almost 1000 approved securities (Stocks & ETFs) to get collateral margin which can be used for trading futures and options on equity and currency.

Pledging a Stock

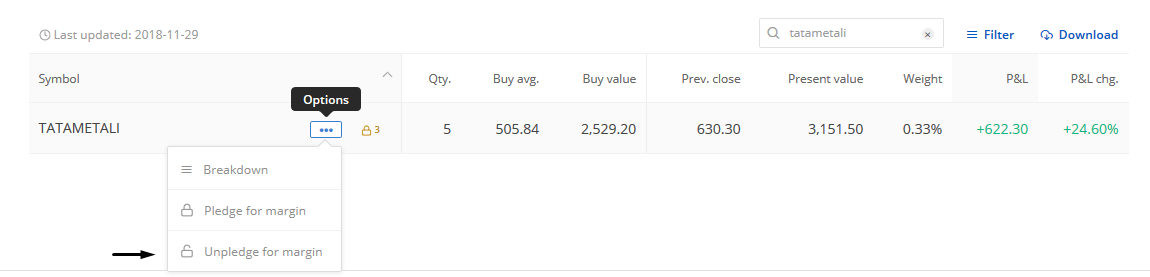

Visit the holdings page on Console and in the holdings table, hover the cursor on the stock you want to pledge and click on ‘options’ and select pledge for margins.

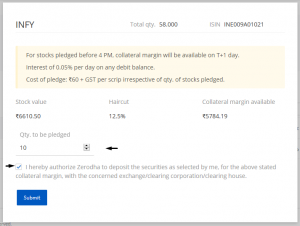

Once you do, you will get a pop-up, which will show how much margins you will be eligible for. Enter the quantity you wish to pledge and click on Submit

You now need to authorise your pledge requests as explained in this post.

You now need to authorise your pledge requests as explained in this post.

- For all pledge requests placed before 4:00 PM, the collateral margin will be available to trade on T+1 day (next working day). All requests placed after 4:00 PM will be processed only on the next working day.

- Margins will be provided after the applicable haircut. Check this list for the applicable haircut on various stocks. A haircut of 10% would mean that if you pledged stocks worth Rs 1 lakh, Rs 90,000 (90% of 1 lakh) will be added as collateral margin to your trading account.

- You can see this margin under the heading Direct Collateral on our trading platforms Pi (desktop), Kite (Web/mobile), and NEST.

- You will be able to use this entire margin after haircut for taking intraday or overnight positions in Futures, and for writing Options of equities, indices, and currencies. You will not be able to use this margin to buy Options or take further positions on the equity segment.

- Exchanges stipulate that for overnight F&O positions, 50% of the margin needs to compulsorily come in cash and the remaining 50% can be in terms of collateral margin. If you don’t have enough cash, your account will be in debit balance and there will be an interest charge also called delayed payment charges of 0.05% per day applicable on the debit amount. So assume you take positions that require a margin of Rs 1 lakh, you will need at least Rs 50,000 in cash irrespective of how much collateral margin you have. Assuming you don’t have this Rs 50,000, whatever you are short by will be the debit balance for the day, and interest will be applicable for that amount. Check this link for more information.

- Liquid bees are considered as cash equivalents by the exchange, so the above 50% rule wouldn’t apply. So margin received from pledging liquid bees will be as good as having cash in your trading account.

- All interest accumulated will be debited once every month on the ledger. A link to see cumulative interest calculation can be found on the holding page itself. Check the picture below.

- All pledged stocks will be debited from your demat account until they are unpledged again. The entire process of pledging and unpledging will cost Rs 30 per scrip irrespective of the quantity. So if you pledge 100 shares of Infosys and 200 shares of Reliance, the total cost (pledging + unpledging) will be Rs 60 (Rs 30 x 2). This charge will be debited from your ledger the day you place the pledge request.

- You will continue to get benefits of all corporate actions like dividends, splits, bonuses, etc. on the stocks you have pledged.

Unpledging a stock

On the Holdings table in Console, you can see the pledged quantity marked next to the symbol name. Hover your cursor on the stock and click on ‘Options’ and choose ‘Unpledge’.

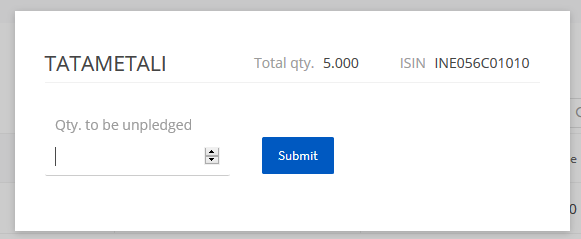

Enter the quantity you wish to unpledge and click on Submit

- For all unpledge requests placed before 2:00 PM, stocks will be credited to your demat account on T+1 day. Any request after that will be processed on the next working day. So for example, if you unpledge at 1:00 PM on Monday, you will get the credit of stock in your demat account before trading commences on Tuesday. Anything unpledged after 2:00 PM on Monday, you will receive the stocks only before trading commences on Wednesday.

Do note that if you start running trading losses on F&O using collateral margin, and don’t provide the requisite marked to market (MTM) additional capital, we will have the right to square off your pledged holdings to make up for the losses.

Pledging of stocks is a good way to run strategies like covered calls (pledge stock and short OTM call options), arbitrage between stock and future, and also for taking higher leverage. We will soon start accepting mutual funds also to provide collateral margin.

Happy Trading,

Have pledged my holdings & same are available in my funds – but unable to make any F&O intra-day trades using these pledged funds.

Does something need to be done?

I have activated the kill switch for F&O both exchanges.

Hi Team, I want to buy stocks on MTF say with 1 lakh want to buy Niftybees for 5 lakhs. Then will pledge the NIFTYBEES. How much margin will i get to do Option Selling on top of it pls

Hi, you cannot pledge MTF shares for margin. We’ve explained why you are required to pledge them here.

I fixed deposit in 10 lakh in canara bank

I pledge in trading account

Trade f&p ?????

Hi Bharat, you can’t pledge fixed deposits (FDs) as collateral with Zerodha. More here.

Hi team ,

can you please help in understanding

– interest rate ion collateral margin post pledging?

– can the collateral amount be used for long term equity holding?

TIA

Hi Amit,

There aren’t any interest charges for using collateral margin, however, you must maintain a 50% cash component in your F&O trades; otherwise, interest will be charged on the shortfall and any unfunded F&O losses at rates of 0.035% and 0.05% per day, respectively.

No, these margins can be used for equity intraday trading and futures & options writing (equity and currency F&O) only.

I have a zerodha account. I had 201 shares of Varun Beverages. Out of this 191 were pledged. and 10 were open. The stock went through a stock split of 2:5.

The pledged qty is still showing the same numbers 191 while the open qty is revised to 25. The face value of Rs 5 has become Rs 2. Why the pledged qty not updated to 191*2.5 as per the new split ratio. Its showing a serious dip in my PnL. Please help resolve.

Hi Sudhir, we’re sorry to hear this. Could you please create a ticket on: https://support.zerodha.com/ so we can have this resolved at the earliest?

Can we use 100% pledged collateral margin for positional option selling without having cash/liquidbees??

When can we pledge zerodha fund house mutual fund to get collateral??

Can we pledge NCDs (secured bonds/ debentures) ? If yes, then what is the haircut ?

Hi Nikhil, you cannot pledge NCDs. You can check the list of securities available for pledging here.

Guys tell me agar mene 300 shares of wipro rs of 75000 pledge kiye then kitna rupaye charges katenge

Guys btaiye

Hi Nitendra, the cost of pledging is ₹30 + GST per request, per ISIN, irrespective of the quantity pledged.

I have mutual fund holdings in MF Utility. How will I pledge this security. Please answer.

Hi Shubham, you will have to transfer the mutual fund investments to your Zerodha account before pledging them. We’ve explained the process for transferring mutual funds here.

is the interest of 0.05% applicable for selling options on intraday trade , if the cash balance is not sufficient in my account , or it is applicable for holding positions

Hi Abhilash, the interest of 0.05% will be applicable only if cash balance in your account is negative overnight.

Hi sir,

Good Day …

Shall we use a Pledge margin 100% for Option selling in intraday or it requires 50% Cash

Hi Yuvraj, you can use 100% collateral margin for intraday option selling. The 50:50 rule is applicable only to overnight trades.

Equity Mutual Funds can be Pludged Now? like -large,small, Midcap funds..Plz Reply.

Hi Shaik, you can pledge mutual fund investments too. You can check the list of securities on which pledging is allowed here.

i had 1600 itc share and i had sold atm call can i wait till last day of expiry or it will required extra margin in the last week of expiry

Hi Naresh, the exchange blocks physical delivery margin only for Long ITM stock options. Since you’re holding a short option position this will not be applicable. You can learn more about physical settlement here.

Does zerodha has made meber-wise limit for securities or is it done by other brokers also? Is it a compulsory requirement by SEBI?

Hi Keshav, the limit is set by the clearing corporation. We’ve explained this here. To check whether the limit has been reached or not for a particular security, you can check this sheet.

I got the Member-wise limit for your security is reached

How to know the what is member wise limit for a particular stock or bond

If I buy GSEC 5 year bonds that are accepted by the clearing organization,

for example 1 lakh gsec..

I pledge it and get Rs 90,000 in collateral Margin.

Question:

My main account has 100rs only.

1. Can I use this 90k, for doing Intraday Equity like buying 100 shares of ITC, with out maintaining balance in cash.

1.1 Will I get margin of 90k, or 450k (x5) for intraday trading.

2. Can I use it for selling INTRADAY without maintaining balance in cash account. (without 50%).

Thanks.

Hi Jayant, you can use collateral margin for equity intraday trades. The intraday leverage you will get will depend on the stock you’re trading, you can check this on the order window on Kite. 2) You can do this too.

However, would suggest you maintain cash in your account to cover for losses and charges as collateral margin cannot be used toward this. If you do not have sufficient cash, your account will result in a debit balance, on which interest will be applicable at 0.05% per day.

can i get margin benefits from an unlisted bond that are being holded in my zerodha acc, if so how much

Hey Tanishk, you can only pledge securities that are approved by the clearing corporation. You can check the list here.

Hello Zerodha Team,

I need clarification on pledging shares. Zerodha follows the rule of [50% Collateral margin & 50% cash/cash equivalent] for overnight option selling positions at the client level. Is the same rule applies to intraday option writing as well or 100% collateral margin can be used for intraday positions?

Hey Mayank, for intraday trades, you can use 100% collateral margin.

The haircut on zerodha is different from the actual haricut on CCIL’s website for government securities. Most securities which have a haircut of 10% on Zerodha actually only require 1% or 3% haircut on CCIL’s official list. Can zerodha please make the update for the same?

https://www.ccilindia.com/RiskManagement/SecuritiesSegment/Lists/RMEligibleSecuritiesforSGF/Attachments/1252/Securities%20Segment%20Notification_26092022_NI_TBILL.pdf

Hi Nithin,

Why and for how long zerodha holds the dividend received on the pledged stocks?

I have not been paid dividend for the pledged shares since Jun 2022. Although the amount is visible in the dividend report downloaded from console.

Thanks

Hey Tarun, the dividend for pledged shares is directly credited to your primary bank account. This doesn’t get transferred to us now. If you are eligible for dividends and have not received even after the dividend payment date, you will need to contact the RTA of the company. Explained here.

Thanks Shubham.

can i buy in hedge strategies like buy a CE and sell a CE of nifty with my collaterral margin of suppose 40000 intraday? margin required is 20000 as per zerodha under basket order . or is it used for only selling and not buying?

Hey Kushal, the collateral margin can only be used for trading futures and selling options, for buying options you will need cash balance in your account.

Have you started accepting mutual funds to provide collateral margin.

suppose i have colleteral balance as 200000(2 lac) and 100000 (1 lac i.e 50% of cash balance) in my cash balance.

now if i take a trade of 250000 (2.5 lac) then how much interest is charged in one month on this trade.

Hey Ashutosh, to trade F&O, you need to have 50% of the margin requirement in cash or cash equivalents. If not, interest at 0.035% per day will be charged on the shortfall of the cash margin requirement. More here.

One of the stock I hold cannot be pledged (not in the approved list): JPpower. Is it possible to request for the approval? if not,

May i know how is the securities approved, I mean on what criteria? (I understand that my second question is related to exchange decision, and we don’t have a say in it, I asked it, out of curiosity to learn)

Hey Harsha, JPPOWER is currently in ASM Stage 1, hence not available for pledging. You can check out more details here. You can check the list of all the approved securities here.

Pledge Margin suddenly removed and positioned in fno open…How is this possible…should give at least a week’s notice to clear the fno position before removing the margin.

This is not acceptable at all…

Suppose someone buys 90lac in Future on pledge margin today without giving any prior notice suddenly all margin is removed. How one can arrange 90lac cash on the same day?

You should give the trader enough time to clear fno position…Forward this to Exchanges.

Hey Somnath, please create a ticket at support.zerodha.com so that our team can check and assist.

Sir, for example I have 300 shares of Infy, which is equivalent to one lot, I pledge these shares and out of that margin and cash, I shorted one call option at a particular strike, on expiry the strike price goes ITM, Can the pledged stocks(without un-pledging) be used to settle at expiry? Or It should should have been compulsoryly un-pledged before expiry?

I don’t want to face short delivery and auction penelity, please clarify.

Hey Kumaresh, you will have to unpledge the stocks before the expiry to deliver them.

Hii Nitin,

Can i use pledge stock margin for Currency Intraday Future trading ???

Yes, Satish. You can use collateral margin for trading in Currency F&O.

Sir, I have following questions;

1. Is cash margin of 50% is needed for intraday index option selling?

2. Is cash margin of 50% is needed for (intraday) index option strategies like butterfly, iron condor, where we use to do both buying and selling of options?

Hey Pradeep, for intraday trades in F&O you can use 100% collateral margin. The 50:50 Cash – Collateral requirement only for overnight positions.

Hi Nithin,

my question regarding collateral margin

50% cash component rule is for positional fno position only or for intraday also?

Hey Kaushik, the 50:50 Cash – Collateral requirement is for overnight positions only. Not for intraday trades.

if i get 1,00,000 rupee by pledging what will be the interest rate? how it is calculated every day?

Hello,

Have few questions please.

1. I want to buy index option only for intra-day purpose can i do that using collateral only ? is cash required ?

2. If Yes and if I make a loss of e.g 500 on intraday trade then what happens ? how this gets adjusted ?

Hey Devendra, collateral margin cannot be used for buying options, for this, you’ll need cash in your account. Collateral margin can only be used for intraday equity, trading futures and short options. You can learn more on this here.

1. In pledging Is 50% cash requirement needed even for intraday options trading where no overnight positions will remain?

2. Do pledged collateral automatically unpledge every day or it can stay pledged as long as we need. So if I pledge today I pay 30₹ and I can keep it pledged say for one year without need to pleading it again during that period?

3. While buying mutual fund from your pledge approved list do I need to buy from coin app or kite app. What is the difference.

4. I would request you to have a dedicated blog detailed pledging and charges explanations for intraday options trading (specially short straddle etc) without any generic info.

Hey Akash,

1. For intraday trades you can use 100% collateral margin. The 50:50 Cash – Collateral requirement is only for overnight positions.

2. The securities you have pledged will remain pledged until you unpledge them.

3. You will have to invest in Mutual Funds through Coin, it is our mutual funds platform. Through Kite, you can invest/trade in stocks, F&O etc.

4. You can check out all the charges here. Also, you can easily calculate all the charges using our Brokerage Calculator.

If you have any queries, you can reach out to us by creating a ticket on our Support Portal.

Suppose I have Non cash component collateral as 400000 and cash component collateral as 200000. So total collateral as 600000.

I understand that

1) No penalty will be levied if i have used total 600000 for intraday option selling. and

2) penalty for 200000 (400000 – 20000) will be levied for positional option selling.

Kindly clarify my assumption.

Thanks well in advance

That is right.

Hey Uma, right, you can use the entire collateral margin for intraday trading. However, for overnight positions, you will have to maintain minimum 50% margins in cash or equivalent and the remaining 50% can come from the collateral margin, using a collateral margin more than 50% will attract interest on the excess margin used. You can check out more details here.

If that is so then the above answer from Zerodha team is incorrect, Uma will pay interest on 1,00,000 in case of overnight position because cash component required is 3,00,000 and available cash is 2,00,000

Is Zerodha is accepting FD as a collateral for F&O trading ?

Hey Surreddy, we accept Equity stocks, SGB’s, G-Sec & MF’s for collateral margin but not FD’s. You can check out the list of securities available for pledging here.

What is the meaning of 0.05% per day of the debit amount?

I have 1000 shares of NMDC and I will get 1.4L by a pledge, so do I have to pay this interest on 1.4L?

Hey Mitul, no, the interest charge of 0.05% is only charged on the shortfall amount or the debit balance in your account.

Hi,

for how much period we can used the pledged margin for F/O trading like 1 year -2 year or till we unpledged it..

and if ans is till unpledged it then the charges that you take 30 rs for pledged and haircut is approximately 8% for liquidbees is taken for once only?

Hi Team,

I have pledged but i not used the amount for a 7 days and unpledged on 8th day . Whether it interested will be calculated for a 7 days ?

I am have 50% margin as collateral and 50% in cash, If I am doing a calendar spread, the margin required is around 35k for nifty, I am having a total margin of 40k. As the days passes I will be incurring the loss in the option which I have bought and will make profit in the option which I have sold. Will I be asked to add more funds? Will the margin requirement increases? Will there be any margin shortage as I will be holding it overnight for many days??

I have a Demat A/C with a broker linked to NSDL and want to continue with this broker for equities.

Can I open an Zerodha Account for Trading in in F& O and can i pledge my shares from the Non Zerodha Demat account as collateral for margin /Option selling ?

you will be able to pledge only the shares only in Zerodha’s demat account.

Sir,

can’t these funds be pledged for margin benefit ?

UTI NIFTY INDEX FUND – DIRECT PLAN

UTI NIFTY NEXT 50 INDEX FUND – DIRECT PLAN

UTI MID CAP FUND – DIRECT PLAN

UTI NIFTY200 MOMENTUM 30 INDEX FUND – DIRECT PLAN

UTI NIFTY INDEX FUND-DIRECT GROWTH PLAN-GROWTH

UTI NIFTY NEXT 50 INDEX FUND – DIRECT GROWTH PLAN

UTI MID CAP FUND – GROWTH PLAN

these are available here – https://docs.google.com/spreadsheets/d/1vRI4NKpJ-3mnOWxUhSRMSQD5txy8QNumzSQrdfGKyL0/edit#gid=0

Dear Nitin / Zerodha Team,

You are requested to add one additional statement in Console under Portfolio tab for Pledged stocks and their valuation after hair cut having following columns

SYMBOL

HOLDING QTY

PLEDGED QTY

HAIR CUT %

AVG COST

PREV CLOSE

CURRENT VALUE (HOLDING+PLEDGE QTY)

COLLATERAL VALUE

Hope you support customer satisfaction with this update in Console

Thanks

Hiresh

Sir , Pledge option not showing on my scripts…

Can I use 50% margin from pledging liquid funds and the rest of 50% from pledging stocks/ other mutual funds? or the remaining 50% should be actual cash?

if i get pledge amount as 1lakh and in my account i m having 0 ruppees. can i use that 1 lakh for intraday equity, future option trading ? is there any penalty for this type of trading in intraday? extra fund needed in account?

Hi,

I want to pledge my shares for intraday index option buying..I’ll maintain the drawdown amount as the cash balance..like 30% cash balance..can I able to do intraday option buying..I read all the comments This collateral margin is only for option selling and futures.. but I wanted to do option buying..

Hello.

As I have learnt, charges for pledging shares are 30+GST per request.

If I pledge shares and keep it pledged for few days, are there any daily charges for keeping shares pledged?

If i have cash collateral of liquid fund, everyday i need to pledge for margin or can i use for option selling some days to months with 30+gst till i unpledge

Hi,

I would like to know few details regarding pledging.

1. Can SGB can be used for pledging?If yes is it considered as Cash Equivalent or Collateral?

2.I read some above comment of Nithin saying once pledge they don’t track where the margin is used.If so then can it be used to buy delivery based equity.

Can you please answer this above query?

1. SGBs can be pledged and they are considered Cash equivalent. There are two separate lists available on zerodha site for non-cash Collateral and cash collateral

2. Pledged Margin can be used for any kind of margin trading.. And EQUITY delivery CNC is not margin trading, you need hard cash for that

3. Similarly – margin can be used for SELLING options, but naked OPTION BUYING is cash product, cannot be done with margin

Scenario1:

I have pledged my shares and got 20lakhs as margin. But have to maintain 50 percent cash to trade in Futures & intraday. If I pledge my Sovereign Gold Bonds worth another 20 lakhs(after deducting the haircut), can I trade for 40 lakhs without keeping any extra cash in my dmat.? (considering SGBs as cash instrument).

Scenario2:

I have pledged only my Sovereign Gold Bonds worth another 20 lakhs(after deducting the haircut), can I trade for that entire 20 lakhs without keeping any extra cash in my dmat..? (considering SGBs as cash instrument).

When I contacted Zerodha regarding this, two persons gave me different answers, and I got confused. Considering the diversified investment and optimisation of the fund I was thinking about the above possibilities.

Hope I can hear from you soon.

Can ”Covered bonds” be used as a collateral for option selling ?

i am holding about 5 lakhs worth of bharat bond ETF for pledging, after 8% haircut shall i use the entire amount for my overnight holding position of options or only 50% can be used from pledging and other 50% as cash, please explain

Hi,

I requested for pledge the shares and later i have decided to cancel the request.

Will i get any charges if cancel the request?

Sir,

Is FIFO applicable to pledge the securities?

For e.g.

I bought 10 shares of ABC at Rs.100. After few days I bought 10 shares of ABC at Rs.110.

1) I want to pledge only 10 shares of ABC. Which lot of shares get pledged? 1st lot (Rs.100/share) or 2nd lot (Rs.110/share)? If i want to sell remaining 10 unpledged shares, for consideration of profit, which buy value will be taken? Rs.100 or 110?

2) I want to pledge all 20 shares. After some days I want to unpledge only 10 shares for selling purpose. Is it possible? Which 10 shares will be unpledged? Rs.100 or Rs.110?

Thank you!

The shares bought first will be considered sold.

Can this pledging margin used for Equity delivery?

Sir , can margin obtained by pledging shares be used for

MCX commodity futures trading ? ( these positions can go overnight )

May I unpledged and sell the shares immediately as both are T+1.

can we trade with 100% equity collateral?

could you give some examples of cash equivalents other than liquid bees

I have Liquidbees in my Holdings but i do not see the option to pledge them when i go on console ! Why?

I only see options of 1) Fundamentals 2) Stock reports 3)Set Alert & 4) Create Algo

Sir, I understand that the collateral margin cannot be used for Option Buying (Ie. CE buying and PE buying). However, can we buy Futures with this margin? If so how much cash margin and how much collateral margin is required?

I have pledged CDSL shares and got the margin too. Suddenly, yesterday, CDSL is showing as 100 % haiurcut and amount got reduced from the available collateral. Why it is so? It can further be noted that there is no reduction in CDSL share price recently. Infact, the price has appreciated and there were no violent movements in the share price of CDSL. How such sudden mid of the month decissions be taken resulting cash balance gpoing into negative and the consequent penalty?

hello

I have pledged my portfolio to be used for option selling.

Now if i want to sell one of the stock from the portfolio can i sell it if i already have an equivalent amount of cash in my account so as not to be effected by short of margin/margin penalty.

CAN I COLLATERAL NIFTYBEES

Will Liquid Funds be considered as cash equivalents ? or just Liquid bees !

Hi sir,

If I create Covered call by pledging delivery position, and my call is in deep ITM on expiry, I need to sell my Pledged delivery stock to cover this losses. But If I unpledge it, then I will run short of Margin for my Call position. So , first I have to square off my Call position. If I square of my call position, then my cash balance will be in negative. Can I Square off both the pledged delivery position and call option at the same time for my covered call strategy ?

Hi, If I pledge liquid bees to take position in F&O and once I square-off F&O position, do I have to deposit cash in my account if position squared-off is in loss or Zerodha will recover difference by selling liquid-bees?

Eg: If I buy 1 lot Reliance April Future @ 2020 for which margin is approx. 67000 and I pledge liquid bees of INR 100,000. After few days, I sold Reliance April futures @ 2000 and there was loss of INR 5000. Do I have deposit cash or Zerodha will recover by selling liquid bees amounting INR 5000?

accumulated interest will be debited monthly, what it means….

If I have covered CALL option on stocks pledged. And the option expires ITM (in the money). And I dont square off the CALL option. Will the stock automatically unpledged and exercised?

eg. I have 550 HDFCBANK stock in my account.

I pledged all 550 and got collateral margin after haircut.

Now I do covered call of 1 lot (550 quantity). For this 50% margin I got from pledged collateral. And 50% I provided as cash.

Now this option expires ITM. then will the stock automatically get unpledged and exercised?

After this new Pledging and margin rules of Sep 2020

– Can we use 100 % LiquidBees Collateral margin for Intraday Writing option and futures?

– Can we use 100 % Stock/MF Collateral margin for Intraday Writing option and futures?

– Can we use LiquidBees Cash equivalent collateral margin for Intraday Buying option ?

I have 20+ stocks pledged for margin purpose and wanted to pledge few more stocks but in options it is not showing the pledge or unpledged options. Kindly let me know if there is any time duration for the pledging.

I could pledge in the phone app but not in the web console (Chrome browser). Please check whether there is any issue.

Shares should be unpledged before selling.

What is haircut% in margin for pledging SGBs

Hey Avinash, I suggest you look at the sheet linked above.

I have following questions regarding pledging –

1) Are SGBs considered as liquid bees when pledged?

2) If SGBs are pledged, can I use that Collateral (Liquid funds) margin for equity intraday in cash segment?

3) If answer to Q. 2 is ”yes”, since 50% cash rule will not be applicable for collateral (liquid funds) margin for pledged SGBs, can I use this margin when my Available cash is over, or I still have to keep some Available cash?

It will be very kind of you, if you clarify this and send answers on my email id.

Can Goldbees be pledged as collateral ?

JUST A SUGGESTION

CAN WE HAVE A FEATURE WHEREIN WE CAN CLASSIFY OUR HOLDINGS LIKE

1.LONG TERM

2. SHORT TERM

3. MEDIUM TERM

AS PEOPLE CREATE MULTIPLE ACCOUNTS TO MANAGE THESE TRADES WHICH IS FOR LONG TERM 1 ACCOUNT AND FOR MEDIUM TERM DIFFERENT ACCOUNT TO AVOID CONFUSION.SO CAN WE THINK TO GIVE US THIS FEATURE TO CREATE TABS IN HOLDINGS COLUMN

Hello sir,

Is it not possible to buy options using the collateral margin received by pledging?

No

Can we buy bank nifty options with pledged margin.

Can I take a loan against equity in forms of pledge, what will be loan interest rate?

Now that pledging does not move stock out of our demat and they are pledged with CDSL only, we see that other brokers like Angel etc. are providing real time margin on pledge and real time unpledging. So can zerodha not do the same and reduce the time for pledging and unpledging making it real time ??

May I know why is pledging option not available for ” UTI NIFTY INDEX FUND – DIRECT PLAN ”.

I have say Infosys shares in my demat account and I want to write covered call on that holding.

Please clarify: –

1) As I have the shares in my demat account, will I be charged margin while writing covered call?

2) If my shares are pledged, can I sell them through Zerodha? Or should I unpledge them first before selling?

Kindly clarify.

” Liquid bees are considered as cash equivalents by the exchange, so the above 50% rule wouldn’t apply. So margin received from pledging liquid bees will be as good as having cash in your trading account. ” is this still allowed or any changes , please clarify.

Same here. My portfolio consists of 70% of LIQUIDBEES. So assuming I’m pledging all of my portfolios and I have less than 50% of the position I’m taking in cash in my account, will I be getting the penalty charges?

if i am holding shares in another dp, how do i pledge in favor of my zerodha account for f&o margin purposes

Hey Dharmen, you’ll have to move the holdings to your Zerodha demat account.

is pledging mutual funds available now?

”Exchanges stipulate that for overnight F&O positions, 50% of the margin needs to compulsorily come in cash and the remaining 50% can be in terms of collateral margin.”

For intraday FNO trading, like option writing can I use 100% margin from collateral? Will SEBI new margin rules affect this?

Please reply to this. I also want to know this.

You will need 50% cash for all positions.

Will the Liquid mutual funds pledged as collateral be considered as 100% Cash equivalent or only 50% cash equivalent?

Hello,

I am not able to pledge my funds which are KOTAKNIFTY and KOTAKBKETF.

I came to know from zerodha support that – the number of securities which can be pledged is limited member-wise by the clearing corporation. And that limit has already been crossed for these 2 funds.

So I wanted to know the names of the ETFs (based on NIFTY and BankNIFTY) which have still not crossed this limit. So that I can buy them and pledge for collateral margin.

Thanks.

Same question from me ?

Same question here but Zerodha team did not respond to this query since Oct 2020 🙁

I have 10lakhs as cash i account and another 12lakhs as pledged amount in liquid mutual funds.

when i sell options which one will be picked up first .

After pledging, our holdings don’t appear in Holdings. But in Console the current values of the stocks are not updated more than once a day. How do we track the values of our stocks intraday.

Thanks.

hi,

I have one lot hindustan petroleum shares (2700). I want to write a covered call option. Is it possible to hedge the position without maintaining margin?

No, you’ll need margins to place the F&O order.

Hello Nithin,

Have a question:

Can I split my capital as 50% for Bharat Bond and 50% as Liquid bees, pledge both and use it for trading F&O overnight positions

Yes.

Wanted to know what happens to the haircut while the security is pledged. Does the 10% of 1Lakh (10,000) continue to appreciate in value or not?

Yes, it does.

I own 600 petronet stock.

now if i pledge 300 stock out of 600 stock, Cost of pledge= (₹30 + GST)

now after 1 week, if again, i’ll pledge remaining 300 stock, do i have to pay (₹30 + GST) AGAIN??

i understand, you can unpledge scrip in multiple part without any cost, but is this also possible in pledging ?

Yes, you’ll be charged for each pledge request.

i am unable to un-pledge my mutual fund.

Please Help

Sir, If we pledge ”money market funds”, is it considered as cash equivalent like Liquidbees or we should maintain 50% cash ?

Can someone please answer this?

Kindly let me know if I can use the collateral margin for mark-to-market losses.

Hello there,

Can I use my Fixed deposits as margins and trade in F & O’s & Equity stocks?

Thanks

Shravan

Suppose I have some shares of reliance and I pledged 5 shares. After some days I bought 5 more shares of reliance and I want to pledge these 5 shares. Do I need to pay charges once again ? Or the charges are fixed ?

Hi,

Can you please let me know why do we have some Regular MFs under the Non-Cash Pledge list but not their Direct plans. For ex. Can Robeco Emerging Equities Fund.

Thanks

Anshuman

Will look into this.

Can I pledge NHAI Bonds – bought last year – Please advise.

You can check the full list of securities available for pledging here.

.

I have query regarding the pledging system, once i pledge the stocks we can take the over night selling positions in options. As per the margin rule only 50% of money can consider from pledging stocks and remain 50% we have to add cash in my trading account.

for remain 50% can i use the liquid bees or debts funds as collateral to selling options without adding money or do we need to add money to trading account ? Please provide your inputs

Supposed I bought 100 shares of xyz company at 500 2 yr back and pledge them for margin. Now 2 months back same company stock around 600 say I buy 50 shares. This 50 shares are in my holding.

Now if I sell 50 shares which shares would be sold one that have been bought at 500 or that which I bought at 600?

on this sell — short term capital gain or long term capital gain ?

in this case — how FIFO apply ?

please answer

Has zerodha started giving FNO margin against sovereign gold bonds?

Hi,

I am facing this issue of inability to pledge Bharat Bond FOF purchased through Coin app despite of it being listed in the securities that can be pledged for margin on zerodha. I purchased this units solely for the purpose of pledging.

I have written to your support and generated multiple tickets regarding this, but till now no acknowledgement received let alone resolution of the issue. I also endeavored to reach your customer care lines which are always busy but never got connected to a executive even after waiting for half an hour or so (multiple times).

This is really not expected from a broker which has received the best startup of year award- keeping your clients in limbo. I humbly request you to help me in this regard, so I could execute my trades accordingly.

Can you please update the list of approved mutual fund list with names of Mutual funds, we are unable to find most of the codes in NSDL website

What will happen if i have 10L worth of equity shares and after pledging those shares i get 5L margin from zerodha and i also have liquid bees worth 5.5L and i also pledge liquid bees, Now after the hair cut i get 5L cash equivalent……..

1) So can i freely trade in f&o with 7.5L (5L from bees and 2.5L from equity, since 50% cash to collateral rule applies) am i right ?

2) Also will the pledging take place according to the LTP, for eg i bought bajaj finance @1800 now its close to 3600 so the haircut of 40% will be applicable to 3600 right??

awaiting your reply

If i pledge 1 lot of shares and do one covered call in that stock, is margin in cash be still required? if so why?

Yes, because the rule says that 50% of the margin is required to be in cash.

Yes, it is based on per request basis irrespective of quantity.

As explained in the article Liquid bees don’t have this rule applicable. Similarly is this 50-50 rule not applicable to Nifty bees too?

Hi Zerodha team, Can i sell my pledged share directly ?

Hi Zerodha team,

I have two questions regarding the Margins:

1. In the approved list of categories GOLDBEES is considered under the cash section? I have taken the GOLDBEES but the pledging option is not available in the console. Please help.

2. I have read that the pledging cost is Rs60 per scrip, can you guys throw some light what does this exactly mean.

For example: I have 30 shares of Reliance If I pledge 28 today I will be charged 60 bucks.

In future if I buy 10 shares of Reliance and then pledge 8 of them, will I be charged again Rs 60? Please clarify .

Dear Zerodha Team,

I have kept my Liquid ETF as a collateral since last 0ne Month. But till time I have not received any interest part anywhere. c an you please let me know when and where I will get that???

Surprisingly, I have raised Ticket for the same query buy Zerodha is not answering it since last week.

There is no use to keep collateral if we dont pay back.

Hi Nithin,

I heard, SEBI updated the new rules and regulation about the pledging and margin process. Is there any article I can refer to and understand.

Check out this post.

can we do positional trade FNO with Liquid bees collateral margin ? or its only for intra day trading?

You can take positional trades too.

Hi,

Suppose in my account I have 20L = 10L cash + 10 L from collateral margin.

And if I take some future position of amount 10L, then will it be from cash first or mix of that.

Also, if I take another 7L future position then do we need to arrange 50% cash or it would be settled with 20L.

Hey, How can we pledge liquid mf worth more than 2 lakh in a scrip?

can we pledge sgb bonds in demat as collateral or not ?

Please add HDFC Overnight fund in your pledge mutual fund list RT only icici overnight available hdfc liquid only available please add overnight fund of hdfc as well

Is goldbees considered as cash component . Can I pledge goldbees to use it as margin in F&O to trade weekly and monthly contracts.

Hi, Nithin..

If I do option writing on MIS and have no cash in my demat account have only pledge margin. Can I affected by 0.5% penalty per day ? thank you…

Hello Sir,

I purchased LIQUIDBEES and i wanted to pledge it for trading. But, unfortunately, the above mentioned options are not available if i check in the holding page. I tried this during market hour and also, after market hour. No luck. Is there any changes in the UI done to pledge? Please support. I could not reach support portal – might be because of the reduced support staff. Appreciate if i get a response. Thank you

@ArulvelRamanan N .. Someone else I know is having same issue (I purchased LIQUIDBEES and i wanted to pledge it for trading. But, unfortunately, the above mentioned options are not available if i check in the holding page) ….

Would like to know if this issue got resolved for you…thanks

I am going for the following trade :-

My aim :- Sell Options and buy a protection.

To able to incur less margin requirement, I do the following:-

(1) Buy an option

(2) Sell an option.

Margin requirement = 60000 (say) for the complete trade.

Now the document about pledging says that you cannot use margin to buy options, so i need to pay say 30000 (say) from the cash. Now for selling options i can use pledged margin, but the requirement is say 150000. So in this case i need 75000 in cash and 75000 can be used from pledged margin. So in effect i need 30000+75000 = 100000 as cash to execute this trade.

OR

i need 30000 as cash to take this trade.

Please clarify.

On holding table option menu as shown above, There is no Pledge option showing for me on any of the stock. . Why is it so? kindly note that all my shares name are in your 1000 securities list.

same with me as well, in fact I have infy and ITC

Hello Sir,

Why I see all of sudden of Available margin as ( Cash+ Collateral ). How to get rid of it. I just want to see only Cash. Please help.

I wanted to pledge NLC which is there in your list but the option for pledging is not there, can you help me out. Also by when will you allow pledging of Bharat Bond?

I have not received the dividend pay outs of my Pledged shares of Hndustan Unilever (HUL) – 50 nos of shares. Though I have already received the dividends in my account on 03rd Jul 2020 for my unpledged shares of same HUL. Pls guide me.

Hi Nitin ,

I just want to know do Zerodha accepts Bharath Bonds or Govt Bonds as collateral.

If so can you kindly know the procedure to accept as collateral in your platform?

Not right now, Saurabh, but soon.

Sir,

why i am not finding option for pledging ”SETFNN50” in console.

Because this isn’t on the list of securities accepted by the exchange. Check the list of approved securities in the post above.

Please allow pledging in F groups which consist of debentures

Hey Aditya, we are working on something for this. You should soon be able to pledge a lot more securities. We’ll keep you posted.

I do not see the option for pledging for Bharat Bonds. i.e EBBETF0430-F and EBBETF0430-F.

Will pledging for Bharat Bonds be availble any time soon ?

Hey, Bharat Bond ETF’s are pledgable. However, we see that these aren’t yet settled in your account and are currently under T1 holdings. You can pledge these only after the securities have been credited to your demat account which happens on T+2 days after the purchase. Go through this support article for more.

Hi

can i pledge/collateralize ETFs online. i have ICICINXT50 & SETFNIF50 which is in the list of ETFs eligible for collaterlization. but when i right click against the above in my console/kite, pledge option is not coming.

online pledging is available only for Stock?

You can pledge allowed ETFs too. Please raise a ticket on our Support Portal if you are unable to.

Hii Nitin, I have 5 lakhs of rs in Post Office Monthly Income Scheme can i use it as collateral to get margin at zerodha?

If pledge the liquid bees – what time i need to do ?

timing of Pledging and unpludging timing ?

how long day’s can i pludge the liquid bees ?

1) If i purchase Bharat Bond ETF and Pledge it, will it be considered as Cash component or Equity?

2) If Niftybees (say 10L) is the only Pledged security i have (and no cash or cash equivalent securities) and use it fully to sell options and trade Futures, what is the penalty and where can i track or calculate this penalty?

From the collateral margin can we implement closed Options strategies like,

Bear Call Spread / Bear Put Spreads / Iron condors where for every sold option there is equal number of bought options. Do I need separate cash for purchase of option.

Consider : Collateral margin is received selling liquid bees.

Hello,

Whenever I see to trade a options I see Margin required & Capital required.

Say for example: Capital required is 50K & Margin required is 40K.

So Do I need 90K all together

OR

Only 50K capital is enough?

Thanks,

Trilok

AXISCFDG INF846K01CX4 AXIS LIQUID FUND – DIRECT PLAN – GROWTH OPTION

HLFGTGR INF179KB1HP9 HDFC LIQUID FUND – DIRECT PLAN – GROWTH OPTION

B153GZ INF209K01VA3 ABSL LIQUID FUND – DIRECT PLAN – GROWTH OPTION

IPRU8096 INF109K01Q49 ICICI PRUDENTIAL LIQUID FUND – DIRECT PLAN – GROWTH OPTION

FILFDSIPGP INF090I01JV2 FRANKLIN INDIA LIQUID FUND – DIRECT PLAN – GROWTH OPTION

LFAG-GR INF204K01ZH0 NIPPON INDIA LIQUID FUND – DIRECT PLAN – GROWTH OPTION

IPRU9425 INF109KC1OO2 ICICI PRUDENTIAL OVERNIGHT FUND – DIRECT PLAN – GROWTH OPTION

ICICILIQ INF109KC1KT9 ICICI PRU MF LIQUID ETF

LIQUIDBEES INF732E01037 Nippon India ETF Liquid BeES

this list also considered as cash equivilalent like LIQUIDBEES???

Can anyone please confirm this?

can someone answer ?

Hey Sundar, you can check all the cash equivalent securities listed in this sheet.

Is the margin recieved by pledging liquid funds equivalent to cash as it shows it as liquidbees collateral?

I tried to pledge liquid funds for 2.5L for single instrument HDFC Liquid fund. It is giving the message that you cannot pledge more than 2L for single instrument and getting exceeded by 50K.

Why is this so? It was not mentioned that there would be a limit.

Hey! The pledge limit for online DIS is still in place. You can pledge up to 2L per scrip and 10L overall a day. You can place a pledge request over multiple days to pledge a higher value. We are seeking the depository’s approval to lift this rule.

hi,

i unable to find below ETF/Mutual fund

Security Symbol: LFAG-GR

ISIN: INF204K01ZH0

how i can buy this LFAG-GR.

If it is comes under Mutual fund. how can i pledge?

it is act as cash component like LIQUIDBEES or 50% rule applied?

You can purchase this liquid fund on Coin, our mutual funds platform.

Hi Nitin,

I have liquid bees worth 5 lakh which I want to pledge for writing Nifty options.

Q1. How much additional cash I need to have in zerodha account if I wish to write Nifty options wort 5 lakh ?

Q2. If after a week I close the trade and plan to place another options writting Trade after few days, do I need to unpledge the liquid bees in interim period and again pledge for taking trade or can they be kept pledged ?

Q3. If I keep liquid bees pledged for long time, do they keep generating returns during pledged period or I loose the returns ?

Q4. All the above questions in relation to Liquid Funds- Direct plan as well.

Thank you.

Which are the liquid bees which can be used as liquid bees collateral in zerodha ?

There’s a link to the list in the above post. Check it out.

Hi Team,

I am holding 500 reliance shares pledged on my zerodha account as on 13th May. If I unpledge my request on 14th May record Date will zerodha credit the shares back on the same day and will I be eligible for Rights issue ?

Hi,

Do you consider Bharat Bond as the collateral and if yes is that considered as cash equivalent as Liquidbees.

Thanks

Supposed I bought 100 shares of xyz company at 500 1yr back and pledge them for margin. Now 2 months back same company stock around 600 say I buy 50 shares. This 50 shares are in my holding.

Now if I sell 50 shares which shares would be sold one that have been bought at 500 or that which I bought at 600?

SO FOR NON POA ACCOUNT LIMIT FOR PLEDGING IS 2 LAKH CAN WE USE Online Delivery Instruction CONSENT INSTEAD OF POA FOR PLEDGING ANY AMOUNT > 2 LAKH

No, you will need to submit physical PoA to pledge more than 2L in single request.

instant unpledge is available now?. If not, by when will it be available?

Sir can I pledge hdfc liquid fund (in demate form) as for margin

If you pledge shares on Zerodha the charges levied are Rs 60+taxes. I want to know how long we can keep the shares pledges without any additional charges or penalties. I mean, 3 months, 6months, years etc. Or it can be indefinitely pledged with no extra charges or consequences? Thanks in advance.

Suppose I sell a put option and keep the position overnight. The span and exposure margin is 80k I have around 90k cash equivalent pledged liquid mutual fund in my account. Will there be any extra cash requirement or it will suffice?

Hi Team,

If I invest in 100 shares of liquid bees and wana to opt for pledging.

1. Can I use that collateral amount to trade other ETF’s like bankbees or niftybees or goldbeees for short term?

2. Do I need 50% of cash?

Thanks in advance.

1. You can only take intraday equity trades with pledged margin, not overnight.

2. No, liquidbees are considered cash equivalent.

After I pledge my liquid mutual fund holdings, I find that the holdings in that folio becomes zero. Does it mean that you are transferring the mutual fund holdings to your name? Is it safe, since how can I prove that those mutual fund holdings are only pledged and not sold to you? In short, Please inform whether there is any risk in pledging shares and mutual funds for collateral margin.

Are liquid MF ( for ex: ICICI PRU liquid fund) purchased on the coin platform available for pledging. If so how is this done: through Coin or Kite or console? Further what is the unpledging mechanism. My query is specifically for liquid debt mf shown on zerodha list as equivalent to cash and procured on Coin platform

Hi,

I have pledged 199 units liquidbees. I wanted to pledge 200 units but it was giving an error that I can pledge maximum of 2 lac per instrument. So my question is, is this requirement per pledge request? If I buy 100 units of liquidbees again then can I pledge it or I can pledge total of 2 lac value of liquidbees only?

URGENT – Have purchased ICICI Prudential Liquid Fund – Direct Plan – Growth using COIN with intention of pledging. But cannot see pledge option. Please help to pledge. Also cannot see ISIN number in dashboard of investments in COIN.

Hello.

Suppose I’ve invested & pledged a certain amount in ICICI overnight fund (say, transaction 1). After some time, I decide to invest & pledge certain amount in the same fund (say, transaction 2).

Wanted to know whether I’d have to unpledge the securities from transaction 1 before I can pledge the securities of transaction 2? Or I can pledge the transaction 2 securities just directly?

Anyone?

Sorry, missed your comment. You don’t need to unpledge. You can just pledge the new purchase.

can I pledge nifty bees, if yes i’m not able to pledge since its been more than t+2 days

Hi. i Want to know what are the charges for pledging shares. Also if i sell options worth 2.5-3 lakhs and take overnight position in that so do i also need to have 50 % margin for me funds or i can use full amount of pledge shares.

And does it also same for intraday postion. ?

Also if i buy options intraday than also do i required to maintain 50% margin or again can use full amount of pledge shares.

Every pledge request is charged at Rs. 60. You need 50% cash margin at all times. Any shortfall will lead to a penalty being levied.

What about equity. Do we need margin in that also ?

Yes, but you can only take intraday equity trades using margin. Delivery/BTST trades will need full cash.

When trying to pledge TCS of 250 quantities, it is throwing error that Pledge can not take place more than Rs.2,00,000. Can not understand this error. Nothing described in support.

This would happen if you haven’t submitted your PoA, in which case the limit for pledging per instruction is set at 2lk. If you want to pledge more than that, you’ll have to create multiple pledge requests or send a physical PoA via courier.

according to current scenario if i have to sell one nifty strike of CE 9000 total Margin required is 1,37000 along with that if i bought 9200 CE margin is now 66,700.

My question is which margin i have to maintain now with my collateral (with 50% etf & 50% liquid bees) 1,37000 or 66,700?

and my second question is for buying this 9200 ce i have to transfer some money from my bank account to my trading account equal to the amount required to buy this option this transaction will be free if i have account in IDFC bank ?

Mohit,

You need to maintain Rs 66700 in your account once you have both the positions.

Yes, buying options require cash and you can fund your account using UPI/Netbanking/IMPS/NEFT.

Of the 4 methods mentioned above, only Netbanking transfers are charged at Rs 9+GST, the rest are free of cost.

Yes, if you have an IDFC account, you convert it to a 3 in 1 account and transfers from that account will be free too.

Why has the hair-cut for pledged shares increased dramatically. Initially it used to be 12.5% across the board. Now I see haircut has increased to min. 40% across the board. Why such sudden increase and when will it be brought back to 12.5 %?

Chetan, the haircut is determined by the ’Value at Risk’. When the market volatility is high, like right now, VaR is higher, so haircut is higher.

When will you start taking mutual funds for pledging as collateral?

I have AXIS FOCUSED 25 FUND (G) nearly 21000 units in my demat account.

Hello,

How to use collateral margin from liquid bees for trading in commodities?

That’s not possible right now. You can only use pledge margin to trade equity and equity index F&O.

I have ₹10 lakhs cash lying in my Equity/FO account.

Can I buy LIQUIDBEES (10% haircut) for Rs 5 lakhs (5 lakhs I keep as cash for emergency over night currency/futures or lot of intraday trading of equity restricting free margin next day ) & use for ”intraday” Currency & futures trade margin requiremnt?

Since I wont have any position at the end of the trading day (equity/currency)- will I will be charged any interest if I use the pledged margin collateral ?

Also let us say (with 5 lakh cash) , I trade ”intraday” -10 trades or so buy side 5 lakhs -sell side 5 lakhs -no position at the end of the day . what will be my margin available next day ?

Liquidbees collateral is considered to be cash equivalent. You can use this margin to trade derivatives and hold overnight positions without having cash as well since the collateral is considered to be cash equivalent. Interest will not be charged unless your account goes into a debit balance.

In the example you’ve given, you’ll have a margin available of 5L – charges, the next day.

When will you start taking mutual funds for pledging as collateral?

I have AXIS FOCUSED 25 FUND (G) nearly 21000 units in my demat account

Hello Team,

When can we expect to have pledging option for Embassy -RR, please advise.

I can’t see option to pledge SETFNIF50 in kite.

Hello, I have invested & pledged some amount in liquid mutual fund, and wanted to redeem it. So for that, after unpledging it, can I place the redeem order on the same day or do I need to do it the next day? Assuming all this is done before 1 pm.

Anyone?

Hey Sachin, you’ll have to wait for the next day to redeem.

Hi Team,

Pledging option is not available for SBI cards Position, please look into it

SBI Cards isn’t allowed for pledging by the clearing corporations, so you won’t be able to pledge it.

If i pledge 50k liquidbees and will i have to add another 50k cash or its not necessary for liquidbees and what r the charges for pledging as i see its 60-70rs per stock……..so is it monthly or how it works (the charges for pledge ….every month or just once or depends on trade and can u explain with example. thanks

any one who can reply

Sorry, missed your comment. If you have 50k liquidbees, that is considered cash equivalent and you don’t need additional cash margin. The pledge charge is per pledge instruction. If you pledge only once, it’s charged only once.

So, if I pledge liquid bees and trade sell options and fut n number of times……..for 6 months….. I’ll be charged let say 70 rs (for example) only during this 6 months, its not 70 rs every month or 70rs per trade

I hope i get this reply asap, as im thinking of pledging

You will only be charged once for the pledge. The trades will be charged brokerage normally.

Hi,

Can i do option buying for hedging my sold option with liquid bees as collateral or

not .

No, you need cash balance to buy options. Collateral balance will not be enough.

Could I pledge my liquid mutual funds ?? what are the charges ? what is 0.05% interest rate ?

What is the interest on Liquid bees and Nifty bees and what is the frequency of payout?

Dmart has been changed to Dmart -BE..is it removed from the collateral list and the earlier pledged would not give us the collateral limit ?

Hi Nithin

now pledged liquid funds are also considered as cash like liquidBees. is it?

Yes, liquid funds are also considered to be cash equivalent.

Yes.

Does this mean my 50% margin can come from pledging liquid funds and rest 50% from pledging stocks/ other mutual funds?

Pledge/Unpledge button not visible for SETFGOLD-E. I hold 300 scripts but in the holdings/Options Pledge/Unpledge is not displayed. I was able to pledge the same script earlier.

We’re working on this and will fix this shortly. In the meanwhile, please contact our support desk for help.

I have pledged SBI

Am I eligible apply IPO as Existing Shareholder category in case of SBI offers shares in sub-subsidiary which has this special category for existing shareholder ?

Since you’ve pledged your holdings for margin, you will not be able to apply successfully in the shareholders’ category. The RTA will check if you had at least one share of SBI in your demat account as on Feb 18, 2020 in order to mark your application valid in the category.

Ok

If you have enabled liquid fund pledge, is there any plan to enable equity funds also for pledging? Why you are now allowing all kind of MFs?

Hi,

My question is regarding pledging a combination of liquidbees and stocks:

Let’s say I have 100k as liquidbees collateral, 50k as stock collateral and 30k cash in my account. I see that I am entitled to sell options worth 160k total margin. If yes, then why does available cash shows a negative balance even though margin appears as positive and my unrealised profit is positive too? Does that mean I’ll be charged an interest because this number appears negative? Can I safely ignore the number against available cash as long as margin available and total P&L shows positive numbers.

Thanks,

Vaibhav

Hey Vaibhav, you’ll have 180k margin available to trade. This is because liquidbees is considered cash equivalent, and that will balance your 50% cash requirement for the stock collateral. In this case, the available margin wouldn’t be negative until your position requires more than 180k margin. I’ve considered the 50k stock collateral after applying the haircut for simplicity.

I know that 50 % margin for a covered call has to come from cash, but if I’ve pledged say 10 lakhs in Liquid Fund, then I can invest the 9 lakhs (amount after haircut) for the purpose of covered call, right?

Yes.

Nithin,

In your Road map, Any plan to accept Bank Fixed Deposit (FD) or 3rd Party FD as collateral in near future on Zerodha?

Thanks

Ravi

Sir,

I have 400 RELIANCE shares in my DMAT account.

Can I pledge them and buy 100 more reliance as well as sell a OTM option ?

Please guide me

Hey Aditya, you cannot use this collateral margin to buy more shares, here is an article which explains how you can utilize these funds.

I have pledged certain amount of liquid funds and have some cash in the trading account. Where can I see the split up of how much cash is available and how much margin money from pledged liquid fund available at any point?

You can see this on the funds page on Kite.

I bought 2 Nos of LIQUIDBEES and the same is shown as holdings in ”Console”. As explained, I tried to pledge the same, but there is no option displayed for pledging in the sub menu. Please help.

You can pledge any of these securities only after they are in your demat account. In your case, you have bought liquidbees on 16/01/2020 which are yet to be settled (the settlement cycle for equity is trading +2 days). The units will hit your demat today and you should be able to pledge it tomorrow.

Following SEBI/Exchange’s instructions, Zerodha has been faithfully/blindly reversing entire cash balance back to bank and also unpledging all the pledged holdings, which I keep to maintain ”available margin”. Zerodha applies extra charges, when I bring back the cash to my trading account, and also when I pledge back my liquidbees units, in order to recreate my ”available margin’ level. Any ideas, what is the way forward to continue smooth trading. Zerodha Support has not been of any help, other than explaining the Exchange’s rule.

how do we sell a pledged shares on the same day ? otherwise, we have unpledge and wait for a day or two to sell it off

This isn’t possible as of now. However, we’re working on making instant unpledge available in the coming few weeks.

Hi Matti – what is the ETA for this? This will be hugely beneficial for us.

Hi,

Is pledging of Mutual Funds started?

With Zerodha IDFC FIRST Bank 3-in-1 Account can I pledge IDFC First Banks’s Fixed Deposits ?

If i pledge my liquidbess of wroth 1 lakh for margin or collateral. as liquidbess is equivalent to cash,can i use the money for delivery based trade of equity.Is it possibe.

sir,

i bought 100 of indianbulls shares at 750 a year ago and it became longterm holdings now.

and now i bought same indianbulls shares of 100@300 which is short-term holdings and i want to sell only the short term holdings of qty 100@300. pls let me know how?

Hey Vinod, shares are always debited from your account on the First In First Out basis. Therefore, you will not be able to do this. The shares which were purchased initially will move out of your account first.

Hi,

In case of the initially bought shares are pledged then how is it treated ?

1. Bought 100 qty @750 and pledged

2. Bought 100 qty @300 and sold.

The pledged shares aren’t touched.

hi sir;

i have started 25000/month sip in zerodha coin.i would like to know that after year my MF worth will be 3 Lakhs

after that could i pledge my MFs to zerodha for margin?

One more question( my previous question is answered already in the past)

I have 10 quantities of Maruti in DP. Suppose if I pledge 5 nos and average the rest and sell. Will, all the 10 get averaged price wise or the unpledged shares will be averaged as a separate entity? Am I allowed to do this?

Thanks very much for answering this.

Hey Sheena, didn’t get you here. Can you please give a more detailed example? The average price calculation is on a pure FIFO basis excluding intraday transactions. There is no separate calculation for pledged holdings.

I have hdfc life shares in delivery. Can I pledge it and use the same money for trading intraday, including hdfc life?

Thanks

Yes.

Why should there be a charge for pledging my shares; other trading platforms do not charge for this service. I opened an account at Zerodha because your charges seemed low but once I started trading I realised that there are a lot of other hidden charges.

Hi Alka, this is a one-time flat charge of Rs.60. The charge exists because there’s effort, and hence cost associated with the act of pledging.

Please allow overnight funds of all AMCs to pledge with haircut of 10%, as i think they are more secure than liquidfunds.

Any plan for the same?

Will look into the possibility of allowing this.

Hi Nithin/Zerodha team,

What is the plan and ETA for following:

1) allow pledge/un pledge of major debt / equity / balanced mutual funds for margin. Currently only liquid funds are allowed to be pledged.

2) allow pledge of securities for MCX margin.

When are you going to start accepting Bank FDs as collateral ?

This will take some time.

Hi,

I am already using zerodha. I have following doubts and suggestions regarding pledged shares.

1) Can I sell pledged shares directly without unpledging??

2) Suppose I have 500 shares of HDFCBANK shares and I pledged them for margin and I want to do covered calls every month. As now we got rules to settle the stock options physically, What happens if the call I sold becomes ITM?? Will you settle or will you treat this like I don’t have shares shares in my demat account, will you close my call positions 2 days before expiry??

3) The additional units I get for Pledged liquid bees will be credited to my demat or will you add to my pledged liquid bees??

Siva,

1. No, you would have to unpledge the stocks, the stocks will move back to your demat account, after which you can sell them.

2. If your covered calls become ITM, you need to unpledge them on or before the expiry day, and we will deliver the shares to the counterparty. If you fail to unpledge, this will go into short delivery and auction settlement.

3. The additional units will be moved to your demat account. If you wish to, you can pledge them again.

Regarding second point, If i have pledged and doing covered calls. If the option I sold becomes ITM will your risk management team closes the position automatically as I don’t have those shares in my demat account??

Hi,

1) Which are all the liquid funds that zerodha treats equivalent cash.list please.

2) In case option selling, for overnight MTM loss any extra cash required even though you have above enough

collateral margin.

3) why debt fund invested in Coin not considered for collateral, at least 50%?

Hello, i hv another doubt, if i buy for example niftybees and liquidbees 50% each and hold on colleteral then still 50% cash required or it will manage by my liquid bees equivalent to cash.

Pledged liquidbees will act as cash equivalent.

Liquid bees are considered as cash equivalents by the exchange, so the above 50% rule wouldn’t apply. So margin received from pledging liquid bees will be as good as having cash in your trading account.

This rule also apply 4 liquid mf or i hv to keep 50%cash??

Anyone plz give answer about liquid mf also equivalent to cash or 50% applicable

Liquid MF is considered cash equivalent and you wouldn’t need 50% cash margin.

I am trying to buy liquid fund from the list of collateral but I can not find any in the kite!! Please help

Also will this liquid MF be treated as cash equivalent or will require additional 50% cash??

Sr. No. Security Symbol ISIN Scheme Name For every Rs 100 worth of stock pledged, you’ll receive collateral margin of Rs.

1 AXISCFDG INF846K01CX4 AXIS LIQUID FUNDDIRECT GROWTH 90

2 HLFGTGR INF179KB1HP9 HDFC LIQUID FUND-DIRECT PLAN-GROWTH OPTION 90

3 B153GZ INF209K01VA3 Aditya Birla Sun Life Liquid Fund – Growth-Direct Plan 90

4 IPRU8096 INF109K01Q49 ICICI Prudential Liquid Fund – Direct Plan – Growth 90

5 FILFDSIPGP INF090I01JV2 Franklin India LiqFund – Super Inst Plan – Direct 90

6 RELLTPDPGP INF204K01ZH0 Reliance Liquid Fund – Direct Growth Plan – Growth Option 90

7 IPRU9425 INF109KC1OO2 ICICI Prudential Overnight Fund Direct Plan Growth 90

Hi Sachin. There are mutual fund schemes. You can buy these on Coin.

Matti, are LIQUID FUND considered as the cash component? or do we need an additional 50% cash?

Why is Nifty 31st Oct options are not displayed on kite zerodha now whereas Nifty 7th Nov options are being displayed. What all weekly options will be displayed in kite zerodha.

Hey Vinay. The weekly contract and monthly contract for the last week are the same. So, you’ll not see an Oct 31 option, but just an Oct option.

Thanks Matti

If I pledged for Rs 1000 and received Rs 900 (assuming Rs 100 gone for haircut); what happens to the haircut money Rs 100. When I un-pledge will I get back the whole Rs 1000 (which includes Rs 100) assuming I made no trades or no losses with the pledged money. If the stock from which I pledged rose 10 % meanwhile, will this 10% get adjusted for the whole Rs 1000 i.e. including haircut money ?

When you pledge a stock, you still own it. So, yes, if the stock rose by 10%, you get back 1100.

How can I cancel my pending please request?

You can go to the holdings page on Console and click on the ”…” button on the stock and click on ’Cancel pledge request’.

Hi Nitin Kamath,

Quote: ”You will be able to use this entire margin after haircut for taking intraday or overnight positions in Futures, and for writing Options of equities, indices, and currencies. You will not be able to use this margin to buy Options or take further positions on the equity segment”

Question; Why Zerodha don’t allow to use the margin money received from collateral for Options Buying? because you are allowing for options writing but why not options buying? kindly clarify.

Regards,

Murugan.

When you pledge stocks, you get margin to trade, not actual cash. In order to buy options, you need cash, because the premium paid to buy is credited to the seller.

The option to pledge is not appearing for my holdings

I have read this thread from top to bottom since 2016 and carefully crafted my questions.

1) Time and again (since 2016) it is said that Zerodha is working on instant un-pledging of shares so that they can be sold instantly. Has this been achieved ? Can we now unpledge and sell our stocks instantly since now no IIFL is involved and Zerodha itself is full-fledged demat provider ?

2) Say we are holding a stock Reliance as pledge and we sell call options against our pledged holdings. Now price of reliance rises and we want to close both (position in equity as well as buy back calls).. Can it be achieved (as our holding of reliance is pledged) ?

3) Lets say i have 1 lac stock which i pledge and receive after haircut say 80K and say 10K cash. So total Margin available is 90K. Now i sell a call for which i have margin say 50K and i receive premium of say 10K So total cash becomes 20K (10K my own cash + 10K premium) and margin is 50K for which you need 50% cash i.e. 25K

So will i be charged interest on 25K-20k = 5K or 25K – 10K = 15K on the date of trade.

4) Do you now T+7 or T+2 delivery against margin to place CNC / NRML order to buy equity ?

5) Say i have 10 lac collateral margin and 10K cash. So i sell a Future which results in M2M of 50K so my ledger is in 40K debit by end of day but since i have huge collateral of 10 lac so sufficient margin is there. I understand that i will be charged interest on 40K debit + 25K margin required = 65K but if i don’t have funds to clear debit but have sufficient collateral margin to keep it covered (like in this example 10 lac) is my pledged position or f&o position in danger or will you keep holding it all till i have sufficient collateral margin to cover.

A quick response in this regard is highly appreciated. I opened a new account with Zerodha. I am already trading with other brokers since 15+ years so your replies will help me plan my trades and positions i make at zerodha..

Best Regards,

U.S. Goel

is the Collateral Margin received by pledging Liquid Bees allowed to be used in trading Intraday equity?(as Collateral margin of Liquid Bees considered Cash equivalent)

You can make intraday trades only.

I saw in the list of shares/ETFs for pledging some liquid ETFs other than liquid bees. But when I phoned and asked, I was told it was allowed for some time, but is not allowed now. Please clarify which liquid or debt ETFs or MFs are allowed for pledging now like liquid bees.

Hey Ajit, we currently accept 18 ETF’s and 6 Liquid Mutual Funds as collateral. These instruments are mentioned in the list of approved securities shared above in the blog.

Thank you. I shall try and see. On phone your support team mentioned that only liquidbees is allowed, and other liquid funds stopped for the present.

where can I find the list of shares eligible for pledging?

Mani

Is the pledging of shares is for some specific period,as my shares which I had pledged are now unpledged

Why no reply?

Hey Ramesh, in case the collateral margin hasn’t been used, the shares would have been unpledged as part of quarterly settlement. Read here to know more about quarterly settlement. You can verify the same with the retention statement you must have received on your registered email id on the day the shares were unpledged.

Can HDFC Sensex ETF or ICICI Sensex ETF money be used for margin for trading Futures and Options?

I’m afraid not. Only the securities listed on the sheet mentioned above can be pledged.

Can u please tell us from when we will be able to pledge MF for collateral margins for FnO?

It has been long overdue for more than couple of years now…

Thanks in advance

I have open positions in 2400-CE and 2160-PE of HDFCBANK for September 2019 expiry. The equity of HDFCBANK is due to be split from the face value of Rs.2/- each to Re.1/- each on 19th September 2019 (prior to the contract expiry day of 26th September 2019). The equity price will be adjusted as a result of the split in the face value. How will the option premium and option contract be adjusted?

Hi sir,

Shall we give bank deposits or any other thing as collateral for trading in options.

I’m afraid that’s not possible.

Hi sir. My ID DN0317, I want to pledge the shares of Gencon . But which not listed in your list.

I spoke with your customer care. They are saying t’s management decision. We can’t add from our end.

Kindly add gencon in pledging list It will be beneficial for both of us. In form of capital for me.

Hey Nithy,

the approved scrips for pledge is usually EQ category scrips which are liquid, we do not allow any other category scrips.

can i pledge liquidbees for buying gold mini future, and what is the procedure..

Hey Vinayak,

when you pledge liquidbees, you receive collateral which can be used only in the Equity, F&O and CDS segment. The same cannot be used for MCX segment.

I have pledged shares of HDFC Bank and am using the margin available for taking an overnight position in NSE FO. The shares of HDFC Bank is scheduled to be split up with Ex-date of 19th Sep 2019. Upon split-up of shares will the additional holding be pledged automatically OR once that is credited to my holding I would be required to pledge the shares again?

The split shares will automatically be pledged. You wouldn’t be required to do anything.

Many thanks Matti!

Hi I am a positional option trader, can I get collateral margin if I pladge my liquid bees ?

Means collateral for trading Oprions(over night holding)

For option short selling YES

But not for option buying

Futures (Both buy and short sell ) allowed

Sir

I pledged shares some months ago, I didnt use margins for a long time. Now when I checked there are no pledged stocks. I want to know why my pledged stocks unpledged automatically.

Hi Nitin,

I understood that there is a rule that 50% cash is required to maintain for taking F&O Position.

But that rule is for broker not to traders.

Many other brokers are accepting, 100% collateral , Why not you..

Zerodha is great platform, I don’t want to switch to other, But this rule kills me.

If others are able to do, Why not zerodha ???

If this rule is not there, My returns are tippled.

Double from trading

One more leg from underlying stock

do we need to maintain 50% cash after pledging LIQUIDBEES too?

No, Liquidbees collateral is cash equivalent.

hello sir,

What is the Interest charged if i pledge Liquid bees of Liquid mutal fund to get margin to Trade in F&O

is interest charged only if i do FO Trading by margin from pledging liguid mf or bees?

Interest is charged at 0.05% per day only if you don’t have 50% cash margin available. If you have the required 50% cash margin, no interest is charged.

but Liquid mutual fund are treated as Liquid bees right. still 50% cash margin is required?

Hi Sir , I have few queries related to Stock Pledging. could you please clarify.

1. What if Pledged Stock price goes up or down. will it have impact on Margin given by zerodha ?

2. what is the max validity of Pledged stock ? can I pledge for one year or is there any limit on time ?

3. when I unpledge , the credited stock to my demat account will have market spot value or deviation in that ?

Hi.

1. Margin offered varies in line with the current value of the stock and is revised daily.

2. You can pledge for any amount of time.

3. The value of the stock is always what it is trading at.

Thank you sir for clarification about Pledging and Unpledging.

sir , what will happen if I forget to exit or square off the contract on expiry date.

could you please clarify both cases like F&O BUY and SELL contracts.

The article says,

”Pledging of stocks is a good way to run strategies like covered calls…”

If I pledge the shares equal to the contract size of the call option, do I still need to bring in an additional margin (SPAN + Exposure) to write a call option on the stock?

The risk in the short call option is completely covered by holding (and pledging) shares of the stock.

That wouldn’t be possible. The exchanges mandate that 50% of the margin has to necessarily come from cash.