Lessons from trading on Yes Bank

Over 7 lakh people currently hold stocks in their demat account with us. The current market fall has been quite sharp (especially in midcap and small-caps) and hurting most of our investment portfolios. While there has been wealth destruction across the board, three companies stand out not just in value lost, but also in the number of people who have been affected – Yes Bank, Ashok Leyland, and Tata Motors.

As a part of our risk management strategy, we monitor the aggregate movement holdings and positions across our client base. I am compelled to share some recent statistics given the crazy amount of wealth destruction. Nearly 2 lakh of our clients hold Yes Bank with an unrealized loss of over 59%; 1.25 lakh hold Ashok Leyland with loss of 40%; over 1 lakh hold Tata motors with over 51% loss. Among the three, it’s just crazy the amount of wealth Yes Bank has destroyed.

There are some valuable lessons to be learnt here.

What matters the most when trading isn’t really the strategy or advice that gets you to buy a stock. I had bought a few shares of Yes Bank in my personal account during this fall myself considering it a value-buy, but the keyword here is “few”. Even the best strategies never work 100% or even 90% of the time. If you toss a coin enough number of times you are right ~50% of the time. So, the strategy to enter a trade is not really that important, but what you do when the trade is on.

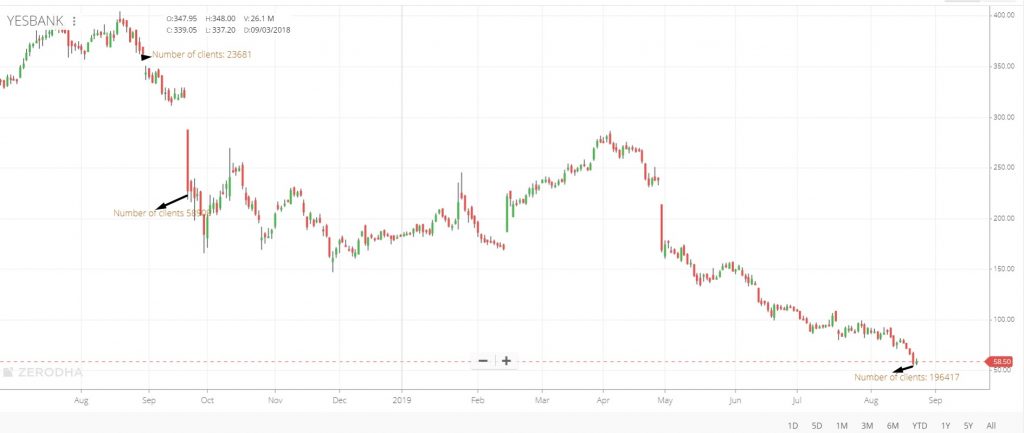

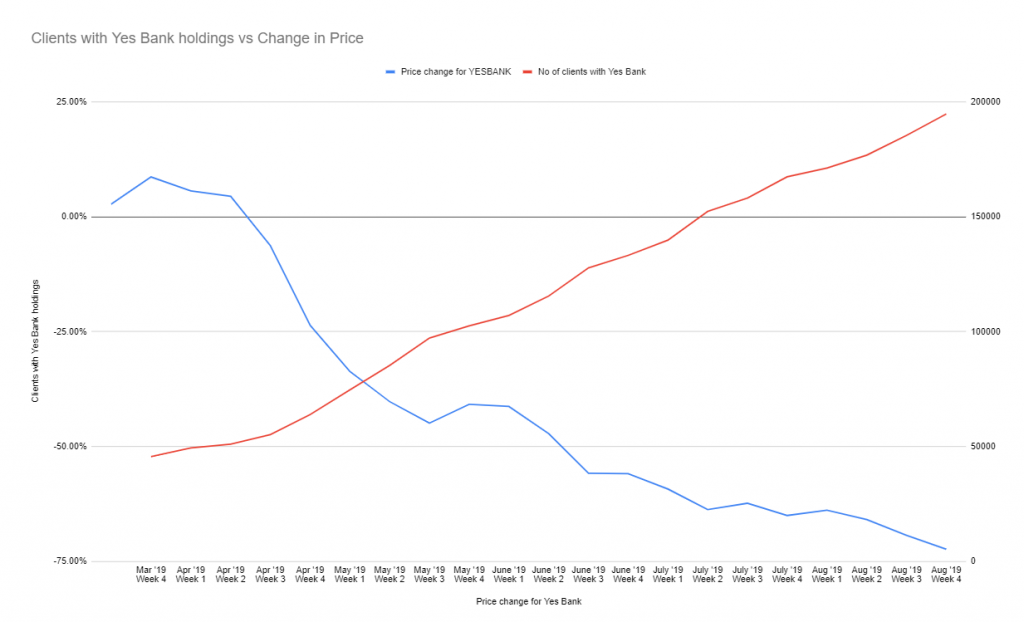

Here is the Yes Bank chart for the last year with the number of our clients who held the stock on different dates – 27th Aug 2018: 23681, 21st Sep 2018: 58909 (after the first fall), 22nd Aug 2019: 196417 (post all the blood bath).

Buy low – sell high is a myth

We have been sold countless discounts and freebies thanks to VCs/PEs pushing companies to do whatever possible to grow fast. This has generally put more money in the hands of all of us, which is a good thing. In the business of trading though, if a stock price is down and it seems like it is a cheap buy, odds are, it will continue to become cheaper. The optimal way to trade is to buy stocks that are doing well and sell them higher as they grow.

Avoid averaging down

Averaging down means continuing to buy a stock on its way down to reduce the average acquisition price in hopes of turning losses into profits with a smaller uptick in the market price.

This is the single biggest mistake made by traders not just beginners, but also the experienced. 1.96 lakh of our clients who currently hold Yes Bank have bought the stock on an average at least 4 different times, mostly on the way down considering how the stock has behaved the last year. Yes, there are many times where averaging down might have worked, but the issue with this strategy of averaging down is that one bad trade is enough to wipe out all previous earnings and more.

Have a stop-loss

In this entire fall, if someone bought Yes Bank, I don’t think it was a very bad trade. It is a bank that has done well in the past and if the stock price is down over 80% from the top, it is extremely tough to resist the temptation. I got sucked into buying it as well. But, here is the most important aspect of trading stocks — before you put any money in, make peace with the maximum amount that you are willing to lose on it, or know your stop-loss. Follow either of the below rules.

- Only invest money that you can afford to lose completely, where you are ready to hold it forever, where it does not make a material difference to your life. Here, your investment value itself is the stop-loss, which is what I personally follow.

- Have a stop-loss to ensure you get out when the investment turns against you. For beginners, ideally, no single trade should result in more than a 1% loss on the trading capital. This 1% number can gradually grow with experience and profitability. That is, if your total capital was 1 lakh, only around 5000 should have been invested in Yes Bank, with a stop-loss of 20% (1000, 1% of 1 lakh). On breaching this stop-loss, the position should’ve been exited completely, booking losses.

You can use our GTT (Good till triggered) orders for long-standing stoploss orders on your holdings.

Taking such small trades might seem immaterial, but that is the only way to survive. Those who hit lotteries by being extremely aggressive typically end up losing all the winnings in the long run.

The disposition effect

The disposition effect is the tendency of investors to sell assets that have increased in value and hold on to those that have dropped in value. This is a real problem that traders have to fight against all the time. Check this link for more. One of the ways to avoid it is to practise hedonic framing, a mental exercise. Do look this up.

Mix technicals with fundamentals

I did a podcast with Jack Schwager last year (if you don’t know Jack, make sure to read Market Wizards, a must-read for everyone who wishes to do anything in this trading business), check this link.

A big issue trading stocks with popular fundamental analysis strategies, especially for retail traders is that, when the stock price falls, the reason to buy the stock just feels a lot better. So if you bought Yes Bank thinking it was a value buy because the PE went from 40 to 20, at a PE of 10, it becomes much more attractive. This could tempt you into “averaging down”. The best thing about technical analysis (TA) is that most strategies don’t allow you to go against the trend. This means typically TA won’t allow you to buy a falling stock. By incorporating simple TA strategies like moving averages into your trading as a means of building discipline, you can potentially avoid wealth destruction.

Should I hold or buy Yes Bank?

I have no idea 🙂 I don’t think there are any out there who do as well. But if you are someone who has lost some money on this, think of the loss as a fee you’ve paid to learn the above lessons.

Happy Trading,

Is it more than a million clients of Zerodha holding YESBANK shares now? If possible, please enlighten us on current situation on wealth destruction part.

i’m a beginner trader and i think people learnt lot of things in it which is mention above .

i make strategy in yes bank.

i sale 30 ce 7.50

buy mar future 33.25.

i will take this trade for expiry date.this is safe or not

Now I need some experts’ comments on YESBANK’s share performance…which is trading at just 39.05 rs..

Mr Nithin,

Your team is rejecting my account request just because I am abroad right now and requested account opening from here. I am not NRI. They did not even check before rejecting my request. Post rejection, I get email from them. This is how Zerodha functions or treat their customers?

Any official comments from Zerodha now that investor money has doubled in 1 month. 🙂

I averaged Yesbank and now average price is 77. No. Of shares 1100. Whether, don’t know keep it or not.

Guys I believe yes bank can go up to 200 in year 2021 for now I can say rest in peace

Nicely composed article for new borne traders and investor coming to share market with some hope…

i have account with zerodha, i want to place 50 Cover Order(buy/sell-

based on my strategy) at 9:15 am on 50 different stocks automatically.

how to do it?

You’ll have to place these manually, since automated trading isn’t allowed for retail. You can place these orders as Amos and they’ll get placed when the markets open.

Well, I got blown with only 100 shares from 240 to 200 fall .. but, as a market old timer , I have seen huge no of stocks , which r darling to market and now, untraceable. and so are the businesses.

In 1987, Orkey was market darling, And, were in textile leaders vanished in early 90s. So many stock I know, got IPO listing at Huge Price, and rose thereafter and valued peanuts.

Best way , in stock market , Howevey, Dow 30 stocks are changed very rarely. And, some of stocks are there for last 100 years. and , so are in nifty like HDFC , SBI from mid 90s with IT packs, And, Lever, ITC, And, tata, ACC, Amujas, etc.

But, we are in difficult times, to hold and sleep with stocks in love.

Very well written Nithin. Thank you for enlightening us.

Eye opening message from Nitin.

Me too hold this with 40 % loss.

No more holding …no more sentiments… and no more hope for Yes bank …. going to sell on tomorrow.

More pain ahead for YES Bank investors

https://www.thehindubusinessline.com/portfolio/stock-fundamental-analysis-india/more-pain-ahead-for-yes-bank-investors/article29253207.ece

Does the data regarding your clients positions and its size have any implication on your trading decisions?

It would helpful if you publish similar data on how many percentage of your clients have lost their life’s savings trading at a loss trying all the different strategies and how many have actually made any money.

Is this a shit stock?

I have been holding it since 280 it went close to 400 I didn’t sell and I have it now. I average small quantities on every 10% fall. But I do it because unlike Jet I have faith it will recover. My family account is in Yes Bank as well, which is working fine. Also the new CEO Ravneet Gill is taking right decisions to clear up the mess Rana Kapoor and his daughters created.

Good article.. Just opened my eyes how all these brokers have data about retail positions which they may be tempted to share with operators.. Huge privacy issues. SEBI should look into this….

Wah! kya bataya. Koi taali bajao iskeliye.

For your privacy concern, each broker has to monitor each and every position of a client as a part of RIsk management. This has to be done by each broker. This is not your social media account, sooch, samaj, aur phir likh bhai.

Nithin,

I really appreciate your effort to put this article, this shows how much care for your Client and their hard earned money.

You are really setting up a example of How A business should grow along with their Client’s wellbeing.

Am really proud to be Client in Zerodha…

God Bless🙏

Hi,

Any suggestion on Tata Motors?

This is because of manipulation and insider traders, I hope. I am involved in doing share trader for more than 13 years. I lost lots of money! Too many companies close down after stealing investor’s money. Really very bad for the country’s future. Most interesting thing is, once we open the webpage https://www.bseindia.com, we observe too many photos of many famous personalities of India – so call all the TOP LEADERS INDIA. These leaders are controlling everything in India. Experience and observation from the control of the share market we can realize the quality of leaders and their future vision. These leaders are busy advertising their photos and listing of any company in BSE or NSE who wants to offer under table money to them. And finally extract money from investors through insider trading and secretly keep the notes in Indian or foreign banks for future generations! Actually no way to trust any situation in India, although I love India because of my native country. All of the leaders including civilians are need to change their mind set, education method, Govt. employment & ruling policies system of this country to lift this country’s prestige and gaining the trust of the whole Universe.

i realized the operator driven nature of this stock two yrs before in 2017. Did a intraday and booked loss. Technicals wont work as u think in this stock… If still want to invest wait at 50 or 25 and gradually increase the size may be a sip kind of strategy.

Yes this is right to mix technical analysis with fundamentals. TA gave indication about the falling stock and few people in my touch still buying and averaging. Stop loss is best friend in investment and trading.

Trading is also a business, one has to know in and out of the business before doing it. A guy doing a scrap business is also rich and a guy doing gold business is also rich as they are expert in their area. How many times you dare to open a business without knowledge?. Then why people do share market without knowledge.

Mr Nithin

Great article , some month before I asked two questions to a manager of a small brokerage house in Kerala.

1. How many clients lost more than 1 crore in your 10 year career

Ans , : so many

2. How many clients took pay out more than 10 lac , other than their investment

And : nobody

I asked him why should you entertain this. Why don’t you train them before they put hard money

He had no answer

You people should tell all hard truth that you know.

Good info shared in the article. Thanks!

Well written. Its a Fact.

Very good written. Kindly keep posting stuff and examples like this.

When doing intrday trading always see closing price of the share.if it trades above closing price willgo up & vice versa.always see trading average of the stock for that day.if it is above that then upside& vice versa.

@ Mr kamat,

Please provide way to view % P Or L in the mobile kite app for stocks in position window. It only shows absolute value. It should also show percentage.

In my view the writer is mixing up investing and trading. This is the common mistake made by many. If you buy a stock on fundamentals, you should hold the stock till there is a change in the fundamentals of the stock. The fundamentals include corporate governance, debts, permanent change in business environment etc. If you are going to apply technicals and fundamentals, you will miss out good stock at reasonable price. In my view technicals is dubious as most of the technical analysis is great after the happening of the event and not before. I invested in CANFINhomes at 300. The stock collapsed to 210. I averaged and I sold at 375. This is only one example. The other counters were INFY, TECHM, etc. In the case TECHM i bought at 650. The stock collapsed to 300. I averaged and sold at 720. If I have applied technicals I would have missed the profit. If technicals is applied strictly one has to sell most of the stocks in the present scenario. So if you are investing do not invest in companies with with Corporate Governance issues, huge debts and companies which window dress their balance sheets. I never invested in YESBANK, PC Jewellers, DHFL, India Bulls, TARAMOTORS, Manpasand etc due governence or huge debt. If I follow technicals I will miss out multibaggers. Do not mix up trading and investing. Keep them in separate demat accounts. Do not touch companies with huge debt and corporate governance, negative cash flows, huge relative party transaction. This is my personal view.

If you follow technicals with a view then you may not miss multibagger

Hello, sir agar kisika los hoga tabhi to kisiko profit milega. Bus vo loss apni capacity ke barabar hona chahiye.

Good read. Thanks for the blog. On Yes Bank one should buy now with a stop at 45 for big upside. I am long now in Yes bank for the first time.

That was a good article. Said the right things. Enjoyed reading it. Thank you. Happy Trading and Investing.

Agree with you Nitin, im one of the unLucky person to hold YB and keep doing average..

Sersly a lessons Learnt.

Lets see if this works ’Where ever you lost, try to get your stuff back on same place’..

Cheers,

~J

Should we hold or buy?I have no idea😀

Just every trader or investors things😀

And it’s difficult to find the trades which which has only 1% stop loss

entry And exit on the same day is better…intraday…we may lose hundreds or below 10k.(maximum)… but holding for long time with out proper knowledge on the stock is…….??…..

It will turn in to penny stock shortly.

That’s why I just trade, mostly with properly backtested strategies. Zerodha’s streak platform has made things simpler, at least now before diving deep into making strategy perfect, I can backtest it and get a broader perspective instantly. Now trading with streak I’ve got more insight, more capabilities, and better control.

Thanks to Zerodha for creating such a platform.

Good information, but some are bigners very confused about the stocks, specifically they confuse to you tube’s videos for intraday trading…..

Yes bank has the great fluctuations on daily basis… This is on us that how much money we need… Keep control over your greed.. I am doing Intrday trading using another broker application… However , i keep control over my greed… On daily basis, i just do one trade for #5000 shares with 1 Rs margin only.. Nd on monthly basis , i am earning 70k to 80k fixed amount. Its not like to earn money in single day only… We all have 6 hours for trading, Just give your best efforts and give 100% concentration, just wait for the time when you are 100% sure that you will not going in loss , then enter the market , buy/sell share , Book your order, and simply go out from market.

Further everyone has there own market skills. Above is mine 😊..

And those you have hold the shares above Rs 150/- ..Just square off your position , As Yes bank share will go upto Rs 80-90 , and again will fall back. It will take around 6 to 7 years to cross Rs 200. So who will wait??.

And Yeah,

Just have a look over JET AIRWAYS share, No buyers and sellers as compare to earlier.

Just square off your position and make new plannings to earn money…

Through controling over your greed. You will recover back your all in loses in 3 to 4 years for sure.. So why waiting???..

Hope so it will help .. 😊

Terrific article! You and team are doing amazing work, Nithin. Kudos!

This article is for traders not for Investors. Patience is a virtue. Keep investing and reap the rewards in the years to follow.

Amazing article .

I booked loss about 50000/ on Yes Bank and now I reeled much relaxed.

This is why I always prefer trading because risk management is inherently built-in in all forms of technical trading. While putting in money into markets, everyone is simply busy looking upto the profits and people are usually not prepared regarding what should be done when the trade is not going in their favor. Zerodha has done a really good job by providing platform like Streak which has helped in building strategies which I am confident trading with and remain profitable in the longer run.

Not to scare someone. Lets look at volumes on monthly charts for all the stocks during 2013-2014. Reasons PE re-rating, Modi’s coming to power and reformsthereafter, Dempgraphy, SIP and beginning Mutual fund era. And tell me whether this fall going to stop?

Also,

1. Consider that over markets are not tht liquid even when it comes to Large caps for an FPI or other.

2. Look at what can be traded on NSE from this year onwards. (do the home work)

Just a real example: I bought Can fin homes 10000 shares at Rs. 2.8 during 2008-09. when it was at its peak rs. 650+/sh i sold it. The reason every day it used to fall 100% of my buy price. Its Dumb t hold isn’t it. I dint regret when i sold in Jan 2018.

I do trading (cash) on stocks today for little amounts to check human sentiments. Its just a test to see if markets are going to withstand. No they are not. I have been losing money (rs, 100 rs,200 ) Max. But this way i know its scary to trade. I don’t know why there is a big idea getting sold like long term and stuff when Global markets are at peak and there are significant risks.

And India will have deficits as we are an ambitious and developing nation with natural disasters most often. Any govt in power has to allocate a lot on this front and when investment pours in ….let me stop here… its a long term story.

Right now be careful.

Yes, Another reason to be vary is China is heading into recession. YOu fill find most over companies big to small have to fight with their currency downgrade and excess capacity in every industry lowering prices. COMPETITION.

Dreams always need to be alive. However, individually money is something to be protected as a retail investor.

Don’t let it go. Its difficult to make it. Warrens rule Never Lose it come to my mind.

Jai hind.

Jis stock ka credit kharab ho usme play nahi krna chahiye.play karne ke liye bahut sare strong stock hai.

Thanks for sharing very good article.

Yes , I believe intraday trading ( including position & swing ) is good than long term investing, previously , i lost 3 Lakhs overall ( out of this 1.2 Lakh from Sun TV ) , and i stopped entire trading and started analyzing how i lost , where the money is going , and who is gaining out of this.

Finally , i started studying many books ( more than 30) and articles and watched YouTube videos , and done enough research with strong back-test with paper trading, with proper money & risk management.

Now , i am earning ( since last 6 months ) consistently daily 20 K to 40 K. and recovered all the losses.

Whatever i lost , i consider as tuition fees paid for my learning , and now i feel happy even in the down trend market.

Finally, i recommend to all, please go with trend wither short term or long term by using moving average.

Market will give opportunity daily and try to utilize conveniently.

Thanks & best wishes.

Only yesterday I was making a profit of about 1000 on this when this suddenly started falling, so much so that I lost around 40000 in a day. Instead of averaging it down, I decided to sell and if I had averaged it out, today my overall losses would be less. With stocks like Yes Bank, one does not know on what basis, it goes down or goes up.

I have no clue why Nitin has decided to pick on Yes Bank as a wealth destroyer. I have made substantial profits by buying and holding it many times and I still hold over 1600 shares in my Zerodah account. Agreed it is a volatile stock but if you analyze it, it overshoots on the downside and the upside. I will continue to keep the faith because:

1) The whole market is in a panic bear grip and even good news (like successful QIP) are being ignored.

2) Yes bank is being punished for EXACTLY the same reasons why it was being cheered – its rapid growth. Banking is a business of risk. Those investing in bank stocks need to realise that some investments may go bad – in case of Yes Bank many hitherto sound companies went under. Who in their wildest dreams would have thought couple of years ago the Jet, Zee, Eveready, Cox and Kings or DHFL or a CG would go bust? Is it the banks fault for lending to such companies? They were highly rated and respected companies. So there does not seem to be anything foul except that perhaps the systems wete not robust. Even RBI audits till last year gave them an ok.

3) Yes Bank has been a favourite of the FII community. Given the flight out of India by FII’s, it is but natural that Yes Bank would fall disproportionately compared to others. Don’t be surprised if the stock goes to 150 in three months if FII buying resumes. It is currently at almost half its book value. Is that fair value for India’s fifth largest private bank? Obviously not. Even if two or three accounts get resolved and some solid PE investor puts in growth capital, Yes Bank will be back with a bang.

In conclusion, all I can say is that at a time the whole market is in doldrums, it is not only unfair to pick up one stock, write a damaging blog post and circulate it among trading community. To say the least, it is unbecoming of Kamath and Zerodah to indulge in such activities.

I dont know , as there are many stocks is available to invest and trading , why people always try to make out of money in the non performing / risky stocks, like yes bank, PC jewelry.

please understand the market sentiment and go with..

Agree with you. Just exiting will ruin the stock more to fall. everyone should give support with stock delivery instead of intra traders. it will definitely go up, just need time to heal the wounds.

I don’t brought yes bank, and brought Tata motors of only Rs.1000

1. Averaging is important but not immediately… Wait for 6 months… Then do it.. U may recover it.. Or keep waiting… Timing is important

2. Can’t remember any stock that has not fallen since July.. Should we exit all… Then buy again.. Then exit… Stupid idea..

3. If all start buying without shorting stock will recover in no time..

4. Indirectly giving advice to exit and directing the stock to fall more.. Is one of the most evil minded idea..

5. If all sincerely work towards buying.. Stocks of any company will go up…

Thanks

Quite insightful post I would say. Many lessons to learn for us still. And very aptly said, that such costs make the lessons be remembered by real professionals. This was a really a much needed back-to-basics session. Thank you Nithin ji !

This is my first and last comment here, I want to share with other users some valuable lessons I have learnt through decades of experience and reading numerous blogs and books on the stock market along with the study of popular stock market crashes.

Through more than a decade of dealing with stocks if I have learnt anything is that capital preservation is the most important thing in this game viz more than making large sums of money it is more important that you don’t lose so much money that it makes you question your ability in the game. This calls for a balanced dealing between Equity and Debt. The percentage of my Networth that is balanced between dealing in equity and debt is always changing and it depends on how the overall market is doing (bullish or bearish). I have pledged to never allocate more than 3/4 of my cash in Equity in any scenario and not less than 1/4 either. This constant and rigorous shift allows me to adjust my holding and keeps me disciplined. I have devised a formula which decides what portion of my wealth stays in Equity and what stays in Debt. This formula hasn’t changed in over a decade and this keeps me disciplined and yields constant returns in various market scenarios marked by greed and fear. I suggest you too devise a strategy or formula and stick to it no matter what. That’s it, the trick to the game.

Also, while buying a stock you should always earmark and prepare in your mind the losses that you can afford to take, it is a contract you make with yourself. Oh, and always diversify as Kamath said about the 1% trading capital rule. Stay strong. Jai Hind.

This is an eye- opener.I lost a lot on trading in YES BANK Options. After some continuous trading (even though Zerodha had proposed necessary restrictions) I lest option trading itself and concentrated in Commodity only.

Please let us know, what to do, already have lot of unrealized loss in dhfl and yes bank… should we book.the loss

Really very happy to read this. Also the mail received on Independence day is very good.

Thank you very much for your message and Support.

Really very happy

Thanks again

K.Damodharan

W d Gann Srtaegy use karo naturally trade karo, use scitific way of trading.everything is cycle in nature like sun.. our plannet….Eart our natural satelite moon..our nearner plannet..like Mars, Venus..any even gallaxy also Milkyway..near star systeme Proxima Century…….Adromeda…second near Galaxy therefore..remember History Repeat.. in stock market 9607266591

Fortunately I do not have shares of Ashok Leyland , Tata Motors and yes Bank. I have dared to book loss at a price of RS.125. advise all to dare to book loss to save from more loss

can i hold yesbank, as im having 114 shares with an average price of 149.05. Your suggestion please

Also add IDEA to your list.

Considering Nitin’s Advisory Write Up and my personal experience, I feel retail investors should not get in to direct equity for the following reasons:

1. We (Retail Investors) have little or absolutely no idea about the business model of a company, the business cycle of that particular business and what factors(external/internal) positively or negatively effect its share price.

2. Further We do not know the wrong doings of a company which are concealed for years, even the experts know nothing about the wrong doings.

3. As long as the things are wrapped up and the stock is doing well all analysts recommend that stock and it keeps going up, once the skeletons are out from the cupboard all hell breaks loose and they continue to fall.

4. SIP long term in equity MF is a better way if you want to build wealth through equity.The plus point is that good fund managers some what know when to exit the stock, even at a loss they don’t hesitate to do it, which retail investors cannot.

5. As a retail investor with 5-10 lakhs capital what can you buy and control. Every company has crores of shares what will you do or how does it matter if you hold 100 or even 500 shares of a company, your stake is not even .0001% of the equity base.

6. Retail should go with SIP, else if you are interested in trading they go for point 7.

7. Study Thoroughly Premium Selling it is better alternative to equity trading and has a higher than 50/50 probability of profit, you can make 3-4 % a month on your capital/margin used.

Bye for now.

I bought future when BJP win at 156 and sold at 113.

Then I bought in equity 2000 share at 115 and sold at 90.

I’ve have always thought Yes Bank is an extremely Intraday Stock for it’s volatility, so I didn’t buy it for short term or long term holding. Worth it!!

200 DMA

eye opener Nithin.. thanks for knowledge sharing.

Thank you for informative article.

Very well narrated.

Dear Sir,

In my opinion, Zerodha platform is not good. There are so many clients who took a loss from ZERODHA, only a few may have profit. I have Rs 48000 loss by the ZERODHA system for non-execution of BUY order, On 19 Jun 2019, I sold 2 lots (Qty-1000) of India Bull Housing finance Future Jun contract, at the rate of Rs 528.42 in cover order (CO). But when I want to BUY at the rate of Rs 499, the order had been canceled automatically and not executed, then I called Ahmedabad Office, Bangalore Office and they executed my order from their system and by the time the rate has been up at Rs 540.00. and I have a loss of Rs 48000 in that trade. I think you should pay for my loss.

Regards,

VK Gupta

Nice message, thanks for taking time for this.

I thinking… instead of waiting till Yes Bank totally collapses you would have alerted your lakhs of traders as ”falling bird don’t try to catch”. That would have saved atleast few those trying to average it.

Its a good lesson that everyone learnt already.

Well said Sir. We can sleep without any thoughts. We can find many stocks by observation in intra day.

Really well written article… It takes lots of courage to avoid buying falling stocks… There are many examples of stocks making lower lows and many investors keep buying them thinking of value buying…

Hope your article reaches many people and lots of wealth distruction stops…

Such a wonderful analysis for all. Thanks a lot. I will share this article with my circle.

Nithin,

I appreciate the time and effort you took to put this post out.

I hope that investors learn the valuable lessons you shared and hopefully prevent big losses.

– VRD

Sir while I buy any share it’s price has been dropped. What’s the matter?

I’ve lost around 50K with intraday

trading, now I want to invest some amount for long term to recover the same, looking for some good advice

Awesome reality well articulated in the article. I think this is happening with majority of traders.

TA will tell you to short the stock today. Let’s see how many have the courage to do it.

I have an emotional bonding with yes bank. It gave me approx 3 fold return within a year and half. With which I bought a property amounting Rs 20 lacs which eventually priced at around 40 lacs now. I am so lucky and grateful to YB. But I will request all my friends to keep aside your emotions when trading or investing. Recently I bought it again at 116 but sold it at 97 bearing loss around 12500.

I think its a good post for all….this kind of reaction is not at all good….and regrading the platform issues…its a common with every trading platform. and kite has developed a lot compared to last year.

Thank you, valuable words & good information & excellent training on how to avoid wrong trade….

Professional are always trading against retailers. Currently most attractive stock in Indian equities is YES BANK. See the volume everyday. Professional used this to attract retailers and take their money.

I read sometime back in Twitter and it’s so true.

If a stock drops 25% or more and is unable to recover the same day, the stock is in trouble.

If it drops again by large % the next day as well, the stock is in deep trouble.

Nothing new, Now a days every few months one stock comes out with such situations. Only problem is we put our emotions and fluctuating mind way above our bearable Stop Loss.

All companies face rough weather during their lifetime. There is a difference between a fraud and a company going through crisis.

I have stuck same as yesbank in nbcc and motherson Sumi same averaging mistake.

Hi Nithin

The story perhaps isn’t about only the 3 stocks you mentioned. An interesting study could perhaps be of stocks which have fallen by 50 percent or more in a year and specifically which fall below sub rs 100 or rs 50. These stocks once they dip below 50 be around the range of 30 to 50 for a year and rhen start dipping again. A case in point being syndicate bank or we can observe the behavior of reliance cap for the next one year. On the other hand sun pharma also fell by 50 pct but it is well above rs 100 so the behavior is different.

i have sold Yes bank last august when it is around 370’s .. reason to sell is i need to buy the house hence.. i sold it .. same for Tinplate , tatasteel , reliance, Infy, and TCS – Glad i did that ..

Holding Yes bank at 213 and did not average. Huge loss

Well said. Very good article … I’m the one who bought yes bank around first fall. Yes bank taught me a very good lesson that why good management is most priority for stock picking.

A Very good lesson to the investors

like me. Excellent article.

Thanks

There are many others like these three stocks, like IDEA….

Nice Article Sir.

Thank you for great lesson. Zerodha is great educationist and zen master of mutual funds & direct cash market in fact all segment, {Hats Off to You…} zerodha platform is really game changer in investment and trading. I OWE YOU ONE, really appreciate it… but Sir company nahi dubti investor doob jata hai. Yes bank still giving 650% + of profit who bought in 2008 fall. it was Rs 8 in 2008. means still more space to FALL. I bought Yes bank @178 and sold it @245 within 3 Weeks time period, since then i don’t have enough courage to buy it again at any level in such massive fall. i think it is FEAR of nightmare.

Nice article. Liked the thought process.

My average price is 318 and this is the reward i get for being patient long term investor – I LOST MONEY

This is very knowledgeable article for investors and traders, i will like to hear more from you. Keep it up.

Thanks

The Great Indian online Gambling Platform. Even God doesn’t know who is deceiving whom. One thing I know minorities like promoters, Company officials, Company authorized operators, zerodha like brokers have all informations about holdings and intraday tradings. So they surely will deceive majority retailers. Universally minority has been looted by the majority.

That’s right also Mention my article, what is going to happen in yes bank.

पढ़कर अच्छा लगा। पर अभी तक जितने भी नियम लगाये सभी फैल है। जैसा सोचते हैं उसके उलट होता है

Even after fundamentally yes bank is very strong tremendous volume of trade is happening on YES BANK some suspicious media roll is going over against yes bank or else 55 was not atall possible each and every bank NPA is atleast 10 to 20% as of now then on a small 13 cr NPA news how come 20% yes bank share can blow down ….quiet confusing ,.

I am in similar situation with Axis Bank. Will Axus Bank bounce back. Avg buy at 744, already lost 50k

Very informative

Great Lesson.

Share market is not for all.

Many good companies turn into bad stocks like ZEE, CG Power, United, DLF, YES Bank, Tata Motors & Power, Lupin etc……..

Instead of buying stocks you should buy ETFs which definitely cover all rates one day. You can easily earn in all market conditions. And 3 – 5% is not a big deal in ETFs. So if you want to average do trade in ETFs. Which is best in class.

Good lesson learnt from this falling stick I hade hold Tata motors , but los lot my wealth in that and sold today.

Thanks a lot for sharing data about 3 losers company. Thanks 🙏 for GTT service. I requesting you to please give service to take BO ORDER IN AMO. For eg. I am a employee I don’t have time to see the market in market time. So I will make MIS BO ORDER at after market time. Next treading day this order will work for me and other benefits is I can make my comfortable multiple company @ different price. Sir I am working on the base of previous day break out strategies. It is not possible at the market time to take mutipal company’s trade because other company’s price breacked all ready before I taken possitation. I like to worke in 5 to 10 company but it’s not possible to take BO ORDER possitation in market time in different company. I hope you understand to me. If not please contact me by mail or call me 9576206745

Fully agree with the blog writer..

Most people try to catch the falling knife and get bleeded.

I remember reading about Dob Bradman, the cricketer who said never assume what is the bowler might bowl always play for the merit of after the ball pitches. His average of 99.99 can never be surpassed ever.

So while trading it works when you do not trade a brand but trade on technical its telling you to go long or not.

It is well known that turmoil at Yes Bank is outcome of huge NPAs on account of certain companies .I do hope that it will overcome it’s shortcomings gradually and reach its earlier glory in future . Personally I have been accumulating this stock and will continue do so .

Excellent article.

Timed very well, when fear rules the market.

Mention my article, what is going to happen in yes bank.

Nice article with current reference but one thing for sure when all Media is with positive sentiment understand it’s time to sell, and Media is dramatically negative about fundamentally good stock means it’s time to buy . After all no one is going to spoon the feed you have to understand the phycology.

Can you please suggest some good books or other references for modern day trading?

The intelligent investor, &

Benjamin Graham on value investing.

I am losing confident day by day in trading and investing due to corporate frauds like accounting manipulation, concealing facts and credit rating manipulation. My portfolio value is going downwards due to PNB, DHFL, CG power, LEEL electricals, yesbank, etc. Why we should spend our time and energy on stocks analysis to get nothing?

The gains I’ve made in other stocks are nullified by these companies.

It’s at a point where it’s like a premium for a call option. You hold the option with premium of your current investment and some upside. Exiting now is too late in the day unfortunately. But yes very expensive and lifetime lessons. First, NEVER believe stock analyts blindly. Second and more importantly, GET OUT WHEN THERE’S GOVERNANCE ISSUE. There’s no smoke without fire. Better to have 80 rupees from a 100 Rupee investment than end up with 40. Similar thing happened in DHFL. Next year or so is going to be tough for the Indian market and economy given the large scale cleaning exercise done. From there on there would be solid fundamentals in most of the firms especially if we in general manage the deleveraging cycle well. A lot depends on smart policymaking in the next year.

Sir, yes Bank was not in accumulation zone form October 2017 and it is clear on Yes Bank Chart, then why people invested in it.

On YES BANK Don’t worry keep calm and silence with patience. You have loose nearly all. U haven’t any now. So hold it for nearly 2 to 3 quarter or next FY2020 21 budget. Sure your loss will recover 30 %. About profit u should hold approx 1 to 2 years.

Best luck to all my friends.

The problem is when it goes up 30% you will not hold it anymore and book early and regret for not booking. If it goes down you will not book losses due to hope. This is the problem we retail investors/traders have..

Does zerodha provide GTC orders facility?

Super thoughts. We should avoid any stock which is facing permanent problems or long-term crisis. We shouldn’t choice this type of stocks without support of fundamental, technical and news flow. We should buy diamond by price of gold, not silver by price of gold. Don’t worry be happy. The earth is moving. Believe me every problem has natural solution. One loss gifts us many lessons for better tomorrow. Grateful.

You could have done some research on the stock and informed your clients in advance so that they could have avoided additional investment for averaging or fresh buying. Lets forget, bygone is bygone.

any one want to see how good shares become bad !!! for traders the darling used to be JPAss for decades peak 323 (adjusted lifetime) now 2 Rs.

FV 2 rupees so it would had been 323*5 =1615 INR and now 2*5 = 10 Rupees …..

just to resemble with ”once upon a time” street’s fav stock…

Sir,

I don’t know and that’s why asking. Are you allowed to read into clients holdings and do analysis and buy stocks. I mean are u allowed as per regulations. If this is allowed you have lots of edge what retail investors don’t have. Please correct me if am wrong. If it is allowed why don’t you publish these articles regularly

I learned the lesson the hardway with Suzlon bought 10000 shares at an avg of 25.. but then I stopped averaging. And, I never repeated this mistake again!

However, I really appreciate this article from Nitin. Not all brokerages can advocate to not average a stock that is going down. An article from Nitin could change the mindset of many new traders/investors going forward. Hats off to you. Keep the good work!

Nice article with current reference but one thing for sure when all Media is with positive sentiment understand it’s time to sell, and Media is dramatically negative about fundamentally good stock means it’s time to buy . After here all no one is going to spoon the feed you have to understand the phycology.

well said rupali. you must have had some pretty bad experiences in stock market trading

I’m absolutely new in Stock Market. This is the first time I enter into stock market. I’m learning the stock market subject only over YouTube Channels and searching various internet websites etc. First Time I’m not investing any High Amount without any proper knowledge. Just I learnt or completed some knowledge about CMS transaction ( Delivery Transaction on cash basis ), Pay in , Pay out, etc. …Next I’m wishing to learn about Derivative ( MIS / INTRADAY ) And Commodity Market step by step. I’m expecting that- within 10 or 11 months I will be abled to acquire perfect knowledge to play in stock market. I love Zerodha So Much.

I am sorry bro. But, if you are successful after 10 months in stock market that will be a wonderful achievement. It is not about just the market, it is more about how you behave when you have a position with profit or loss. So, best of luck!

At this condition still, we have the chance to book the loss and get out instead of losing everything…

Most action in the YES BANK stock occurs during first 30 minutes of market opening, so picking up a pair of indicators which can predict miniscule movements throughout the period or even throughout the day might help traders scalp up profits from the particular stock.

Nice article please give suggestions and information like this.as per market situation.

Thanks

An eye opener article Kamath ji,

I lost 8.00 L in Tata Motors i.e., almost 50% of my capital. One way it is a huge burden on my capital size. Even though I knew about averaging, I put 50% of my capital in this single egg and brought the buying price down and unrealized loss to around 1.00 L. But I did not act promptly and failed to book my loss, with only one single hope that the company was of Tata group and would bounce back. That is the attachment I have for Tatas. The result is I learnt a costly lesson. It is all in the game. One should refine oneself against the odds. That’s it.

I thank you once again for posting this enlightening article.

I want to add one line here. I take full responsibility for what I did. Though I have got reasonable experience, I could not control my emotions. Controlling emotions is also very very important here.

thanks for your valuable advice.

Nice article. Kindly remind us about these types of trading physiological issues with examples which we forgot and carry away sometimes. This article is like a ”whistle blower” to keep us safe. Thanks for the information.

AGREED. I DO NOT BUY FALLING KNIFE.

I have booked 30k loss when it went down from 230 to 170.Fall from 280 to 230 I thought it’s a retracement from 230 to 170 in a day is something fundamentally wrong…

Lost around 500 rupees in yes bank, but this is my first year in buying shares and I restricted myself to just 10000 rupees investment. The stock market seems manipulated to me with the brokers driving up prices, booking profit and exiting. Incidents like yes bank are due to lack of oversight from the central bank and people without morals reaching top positions in Indian industry. I have seen this in my core industry where incompetent ppl become top bosses and their whole effort is towards passing off blame and taking credit.

I have also taken many quantities but today yes bank has again raised a QIP and i think bank is very good for long term .

Thanks sir, for such a great article..

Luckily i don’t have shares of yes bank.

But guys never loose hope

Miracle happens..

Aaj graf niche kal upar bhi hoga😊😊😊😊

good guidance … good awareness given by Zerodha… Thank You..

Dear Mr. Nithin Kamath,

Its very surprising and shocking to know that your firm is scrutinizing and scanning the data of clients to know the behavior of sell/buy for stocks like yes bank.

Very unethical and may be used for any personal gains, if any in future.

Thanks.

IN STOCK MARKET MILLION IS EQUAL TO TRILLION

SINCE JULY 5 2019 MARKET CAP LOSS IS 14.7 LAKH CRORE BUT ACTUAL SALE BY FPI/HNI/….. IS JUST 25K TO 30K CRORES ?????????

TRADE /INVEST IN STOCK MARKET ONLY WHEN YOU ARE KEEPING MONEY IN BANK LOCKER NOT IN FDR/SAVING A/C !!!!!!!!!

Very nice initiative.. as per my understanding and experience in this situations keep it holding unless you are in desperate need of liquid funds accepting the losses .. times change and so do the situations..

I lost 30 k in one day in this. I lost all hopes in stock market now. yes BANK a big NO

Great article Nithin!

Nice article… Thanks a lot

Very nice and informative article Mr. Kamath, Thanks.Specially for an idiot like me who never looses hope on a falling stock.

thank you TEAM ZERODHA for such valuable discussion

Very good article. Combining TA is a must while trading even if you have long term perspective.

Yes nice article.

Nitin Kamath ji please provide real data bacause every time your chart shows something different price while tick data shows something. So kite plateform is not trustworthy. I hope you see this issue in your chart.

Thanks

Helpful , Thank you.

Hi,Not a single bank in Indian history has capsize, so yes bank will also keep floating,,,and yes bank is basically a corporate bank and given loan to various corporates… If they performing bad so as bank…thinks will change…as it happened in Mannapuram finance.i am holding 700 shares at 195Rs ,I will hold and check my limits….ha ha ha

Are you still holding and checking your limits? Lessons shared here are valuable and should be appreciated as some of them are not even learnt during a lifetime.

Hi Nithin,

Appreciable post. I like it. You have all the knowledge and tools of this business.

Thanks for taking care of New Investors like me.

If possible please propose a software of setup or education for investing in only those stocks which have high probability of appreciating our account in long run.

Nice. Thank you. But now I having 2030 share at Rs 110 . So what can I do?

Can anyone tell me, how’s the future trend for PNB shares? I m holding shares of pnb @91 rs. Thanks

Mr Kamath

Stop worrying about yes bank posts.

Better focus on making kite platform more robust by reducing the login , order execution issues. That will help Ur clients more than just posting these yesbank like posts.

Nice Read..

I have lost around ₹8000 in Ashok Leyland, in which ₹2000 in Intraday.

Then I never touched that.

My Overall loss till today is ₹12,000.

Bought it for Btst last year and there was no way of coming out, it kept on falling 😧

Good to read that many are on same boat. can you also publish of rest 5 lakh intelligent people who did not hold yes.

Also publish the best someone made in month, week, day, year… anonymous say top 100 without names but stocks and PL.

Btw, i made hell amount of money by selling the bleeding stocks easy… burned figures few times too..

its a game… and yes 1 lot is good enough to loose without stop loss means almost ~ 1 Lakh INR…. and max ~ 10 lakh … yes tooo much for retail traders….

so keep seat belt on and sit tight, it may be start of long awaited recession, that means better value picks will come at low prices…

One mantra to make profit in such market is …..sit on cash.. so your money saved = money earned + prospective loss in eq+4% interest rate so average 24% if equity was trading at circuit (either side….)

I bought only a few on the day before yesterday @65 seems cheap expecting 10 percent in 2..3.days but the next day it fall 3percent and I exit almost 30₹+brokerage lost I learnt garbage will be useless however is so cheap

Yes is only for traders right for past 1yr only intraday works with its huge volume. However protraders are HNI and who can do any changes in their portfolio any time, It seems like Yes Bank allows to do a bulk deal each day to eat retail investors.

I really learnt from this Yes Bank

in initial beginning learning. And I paid for this. Thanks for the post.

Invested around 5 percent of total capital in yesbank last year. Even though I had read about the 20 percent exit rule, didn’t follow it, and eventually took a loss of 50 percent on the investment (2 percent of capital.) A valuable lesson learned. Agree with everything mentioned in this article. Never put your eggs in one basket; diversify and don’t risk any more than you can spare without fretting over it.

Good points on stop loss and averaging price.

Wonderful article….need more article like this on a regular basis to educate investors to keep their money safe.

Thanks for the article…👍

valuable information but i hope buying in cash and holding it for long time till it comes to cost or profit may be a better way of handling it during this huge crash.

Experienced the same with amtek auto lost all my profits with my capital too. Every second is important in investing.

Thanks Nithin. Beautifully analysed. We want such timely analysis from time to time so that we way see where we are wrong and reduce our future mistakes. Thanks once again.

Everybody is sharing the trading ideas and opinions but nobody is thinking that why is this inappropriate market fall!!!

Indeed sir…a great lesson to be learnt from this stock. However volumes are highest for yes bank.

Dear Nitin Sir,

I am a beginner in this market, you taught me one of the best thing to avoid mistakes in stock market in a simple way.

Golden Words in today market condition ”if you are someone who has lost some money on this, think of the loss as a fee you’ve paid to learn the above lessons.”

Thankyou for this valuable advice. Yes we surely got to learn a lesson from the downfall of the market currently prevailing in the Indian economy.

We don’t know how much time will it take to rebalance the market. We would like to see more articles like this.

Bought Yes Bank when it was touching 100. thought it will be a good gamble. It also came close to 107 only one time in July, but missed the chance to sell as I expected more profit. Now I am making a loss of more than 6000 in this.

I brought nilainfra in price 8rs 7000 shares. Can me give me a good suggestions plzz

I am holding around 9400 yes bank shares at Rs 189 per share, still I am very much confident that shortly this stock will rise from the ashes like a phoenix.

Try writing blogs like these.We love like these blogs.

Agree

Yes Bank 74 rupees 200 stock now sale ya bye

I lossed rs 18000 Today in yes bank

One should understand the difference between the Event and the complete downfall of a company, I agree it’s quite difficult. But a good research will help. In case of Yes bank integrity of the management is questionable with respect to there financial reports.

I do agree with your point of technical analysis along with fundamental analysis. Good article thank you.

I think i am here to loose only 😂😂

Good guidance… Keep us guiding…

I am of the opinion that it is very basic strategy you discussed. Why didn’t you share the reason for this drastic fall of this stock price of more then 80%. Pen them down. And if market is getting nervous on being sell off from FII or economic slow down than why such a drastic fall doesn’t reflect in HDFC Bank or in ICICI Bank stock price.

This is nothing but seems that a shareholder is crying on loosing the money not a type of learning.

If I am wrong, you are welcome to correct me.

Zerodha must ensure to mark ”Most Volatile” stocks in red. It seems stock market is heading towards 2008 style total collapse. Few stocks like Bajaj Finance, HDFCBANK, TCS, HUL, RELIANCE are running the NIFTY50 artificial FAKE index with no correlation whatsoever to actual stock performance. Entire indexed Stocks currently are BELOW 2008 levels.

At this point of time the potential gain is much more than the potential loss. After QIP and another $1.2 billion equity raising planned, the bank is fine financially. TA doesn’t tell the whole story

In last 30 years, averaging has always worked for me.

Thank you so much for great advice..

So Tell us Mr Expert Why marquee investors and funds have subscribed to Yes Bank’s latest QIP?

I am beginner , i took trade in yes bank and loss my 100rs.

Thanks for such informative write

Still if someone who bought even higher and equals to lot size could have sold in the money calls which are of premium around 10% every month he would have still be in better position then just buy & Hold

Why you people have scanned holdings across the demat with you ……Is it allowed ….. How can you access someone’s demat without permission …..Data points are good but is it fair / legal to access information , collate & then publish ….Kindly think over

Completely Agree.

How to have stop loss when your system doesn’t allow set stop loss to be carried over to following days? You can’t wake up everyday and set stop loss for 20 different stocks each day. There is no facility provided by Zerodha itself.

i have lost 4000 till now

hi Nitin, you are so simple to believe! truly a good coach for beginners in stock trading

Guys, try put option..

Nice article.. I too felt the temptation of buying ”once good” stock for cheap – not Yes Bank, but DHFL.. & have been proved wrong there too 😁 & reg the last question, I feel it’s turning out more difficult than once famous ”Why Katappa killed Bahubali” question!

Excellent analysis. I bought few at 170 on the day Yes Bank fell 20% But came out at 160. Even for long term investment Stop loss is a must. TATAMOTORS fell from 600 to 110 and in recent times from 210 to 110. Such a big company is failing ?

Averaging down is a crime . Trader should over come Fear of Missing Opportunity FOMO syndrome. A strict SET SL ENTRY TARGET even for investment would be prudent

Nice sir and best article

Very well explained. Sometimes all we need is stick to the basic rules and don’t fall in trap of greed & fear! I am astonished how the number of clients holding Yes Bank has increased with the price fall.

Nice

I have lost more than 60% of my trading capital. My first purchase of YesBank was at 165. I have been averaging down since then. My average buying price is 130 right now.

I really need some TA in my life.

thank you so much for such a valuable advice.I’ve also lost 30 I in yes bank..

Nithin thanks for writing !!!

You are a good writer and trader and you should think more about such learning initiative.

I bet you and your team can do that Zerodha Varsity is good but some highlights like above should keep coming.

Thanks for sharing your wisdom.

Hope to see more of it soon 🙂

Nice Article, these kind of articles will help retail investors to look at few aspects (you mentioned) before they buy any stock. Keep Writing!!

Now this is what I call a bold article. We as customers want such articles to get to know the reality of the market. Many brokers and their users been trapped with Yes bank and Ashok Leyland. And above all the recession in every sector (minus IT SECTOR) and slow down in India’s economy are the major reasons. The decision for surcharge increase on FPI has teached a lesson to our government too. India is loosing their foreign businesses.

Thanks Nithin, you are actually doing a great job!! Many congratulations for reaching this far, our support will always be there, many more to shift to zerodha very soon…

Very good article and eye opener. Thank you

my opinion and experience in stock market from 10yrs loosing money,don’t invest in stock market invest in fixed deposit your capital guarantee. But in stock market nobody is responsible for falling script,eg:yes bank.1 quarter profit 5%rose in share and 1quater loss 80%fall imagine before investing in stock market,operator are playing in stock market .don’t invest money in stock exchanges.with out proper responsibility, why to keep money in exchanges.burning candle in the air.

Nice article..happy learning.

Thanks..!! Nithin for continuous guidance and analyzing on each share.

The secret is exit soon in loss, wait long in profit.

Happy trading.

Thank you very much for consolation. Timely article and opt advise. I have position in Yes bank. After reading you, I have decided to hold on to the stock and just forget. Ready to lose 100%😃

Nice article, Nitin. This will help us to trade smartly.

Absolutely right.

Penny picking, bottom fishing, very short term trading.

Fulfill all these temptations by playing with very small amount. Keep it separate from main portfolio.

Promise yourself if I can grow 1000 to 2000, only then I am allowed to play with 5000.

If I decrease 1000 to 500 then I cant add but keep playing with 500 until it becomes 2000.

Very insightful analysis. Unfortunately I am one of those who didn’t apply stop loss.

I shorted YESBANK future at market opening on 21 Sep. That profit offset my eventual losses. I sold all my YESBANK holdings around 150 a couple months ago. I still do some scalping on it from time to time, now that it has become a trader’s stock from an investor’s stock. Plan to buy it again if it comes down to single digit… 😀

Trust me, it will come to single digit by the end of the year…

I am comparatively new to trading. If you could publish more these kinds of articles, that would be much helpful.

Dear

I am the biginer in stock market… i have not a single share of yes bank in my account… but i learned a lot from this article…..

Axis & ICICI bank also had similar fate, though not much as Yes bank. However, please have patience (2-3 yrs may be) and test your luck for Turn around. HDFC MF has invested last week through QIP.

We want call from zerodha as we are your users . We need some call, guidance, strategy. Other companies provided calls, but we trust zerodha.

I have yes bank,, I also loss in 20k so pls can suggest me what is next step in this,,,, thanks

I had bought few shares when the script was @175, now today I bought few more stocks @ 59.35. I am sure this stock will bounce back to the high around 230-250 range soon.

Same situation in Ashok leyland plz cover it… As well as we think that it will go up we got our prediction is always wrong.. What should a retail invester to do as large cap stocks are falling like microcaps.

Now, yes bank is very good for learning intraday for bignners, not too expensive, highly volatile, very high liquidity…

Never buy yesterdays multibegger,

Hi,

I asked my friends today to buy and hold the following 3 stocks for 5 years and sell them when they get 50-100 percent returns on any 2 stocks (RS 11000/stock).

They will be holding the 3rd stock for free and for any period of time. That will be pure profit whenever they sell it.

SAIL, YES BANK, TATA MOTORS

Very True

I have encured heavy loss on Yes Bank and still have 250 shares of buying price 85 ehat should i do i can bare a loss on it for next few years?

Have faith …They not bad,It is just bad time to be in such situation.

Can you analyse the reason for its fall to such an extent , in spite of bad loans provisioning ?

Long term investment is bullshit now a day. there is only one law work in market short selling.

Very true, that’s my story i hold all 3.

Sometimes switching from buy to sell side (when, our SL reached & trend change) helps recover the losses & also can end up in positive.

thank you sir ,i am exit in yes bank

The content above should be the lesson of the hour. You have to stick to your trading rules and trade. Loosing less is the secret of gaining more.

Nice explanation. Not only this explains for Yes bank but for other stocks also.

I don’t know why I can’t trust market for a long term…that’s why now I just do intraday now…great information sir.

there is noting called long term . ONly find managers make crores in long term . Keen observation on Intraday especially morning till 1 PM is the key to make money. money management and quick action on stop loss is the key

Great article.

Useful article,

Thanks

your absolutely right, I too did the same in BOI, I closed and learned, I agree with you. Thank you for the excellent article.

ALL THINKS ARE TRUTH.

Its very useful information . I want to ask only one thing If I can invest more and wait for few years is it advisible to add few more at present level because Book Value of share is 105 Rs almost twice than CMP

NBCC is other stock in your list

Should a new investor enter in any of discussed 4 stocks at current level

Thanks and Regards

Dr Joshi

Well said.

It appears that Yes Bank is going to die soon ?

Great

Nice article. Thank you.

Nitin Sir, Appreciate the post, thanks for the insights, hope you do more, like jet airways, reliance communications etc

As a brokerage, you are pressing on ”Trade” not on hold.

Thanks for expressing your honest opinion on current market and specially on shares of yes bank,Tata motors ..apart from lesson learnt it helps in easing frustration that even experienced investors are going through same ,so it’s part of this game called Trading ..and correct for future ..

Thanks for it…

I have earned alot from yes bank recently with short selling the stocks in intraday trade. I feel sorry for those who incurred losses by holding the shares. Give it some time.. let’s hope for the best.

Any suggestions for new entry..

what will be support for Yes bank

nice sir, had u shared earlier,we could hv tried to cut looses. Good advice n do keep on sharing regularly.

it wil be gud if you guide us and send send tips regarding buying and selling shares in stock market like other known brokers.

Although your analysis suggest that people have lost money.

But you look at investment purpose it show that people have still trust in yes bank thats why they are averaging out.

Suggest you to compare dhfl and yes bank and you will see which stock still have investors confidence. Real wealth creation is always from investment not trading

Glad that Zerodha is concerned about client’s losses. Though this good attempt will not bring back losses, it will make investors more cautious next time.

Excellent Article Nithin. Hope you keep publishing more articles using zerodha’s aggregate client data. It gives a more accurate picture of Investor Behavior than one presented in news articles, forums, comment sections etc.

I hold Peninsula land …last one year,I bought it 32 rps 600 shares now it’s running 4.50 …when it going 150 target… Any idea ,any body…

Excellent lession for me. I think yes bank will be in mind through out my life.

Very helpful article . Mostly trader have loss book on Yes Bank. I am saying just stay away. This is no 1 wealth eroder

nice article but it all depends if you are doing Algo trading which keeping you sentiments outside of the triggers and all depends upon the strategy you are using, I am running bearish and seen the profit here

What is the use of telling now about lessons leant after loss . Would have helped some people when the author of this article analyzed that YES BANK is falling knife..

Thanks for the artical

Still holding yes bank .hope it will bounce back…but when no idea..

VERY VERY USEFUL ARTICLE …. PLEASE SHARE MORE OF THESE KIND OF ARTICLES IN THE FUTURE

Nice eye opening article. I lost around 90k in yes bank alone. Kept away from this no profit bank

Nice Artical, we all are reading this after loss…:)

I have lost money in ashokley in one year 30000rs

Good article. Thanks

Definitely, With the kind of fall currently in the market. The most surprising factor is that even the BFSI is doing bad & there comes the real worry. Yes bank stock has almost dumped everyone. From the time of change in top management to the bank looking for fresh raise of funds there is been a clear-unclear path. However, looking at the global trends we just have to keep the hope on the stocks. Stop loss does really works & also as mentioned above ”few” & ”when” would help in recovering the losses precisely.

I hold Rpower average price 6.99/- it’s for next 20 years ..as investment..let’s see what happened.

Lovely and timely advice.

Kindly let us know how to put stop-loss for all the purchases done previously. There is no way out for purchased stocks

THANKS

Hey Nithin

It’s great to see that how much you care about your clients

Well thanks god i’m not holding any three of them

But I’ve lost 37% in NBCC but my holding quantity is just 44

🚥🚥 No comment. Such huge loss made some one who I know

Nyc content

But very late from ur side

Thanks for the Important Insight you have shared,

We are very happy to receive such exhaustive analysis, Exploratory data analysis and learning what not to do on tempting rate,

Happy to be associated with zerodha

Thanks for the suggestion.

Holding yes bank from last 6 months. Averaging every month.

Now.. having holding with 68% loss.

Good article for client

मेरे पास अशोक लेलैंड के शेयर है

”मेरे लिए 5 साल तक शेयर बाजार क्लोज है वाला रूल अप्लाई किया है ”

These two stocks hurt me a lot Yes Bank and Tata Motors .. 🙁

Exit from it he can come on 20 rs or less than also

According to Jeffery they given target of 45 RS for Yes Bank .

Stay cautious and be alert. It may also out from Nifty 50 sooner or later. And may become penny stock one day just like vodafone-idea.

Very well said. I know one uncle who is my neighbor holding Yes bank and averaging from 250 levels and still believe that ” Apna time ayega” but god knows kab aayega.

People who stuck on higher levels should not sell at CMP because some good news are going to come as a hope.

Thanks

”think of the loss as a fee you’ve paid to learn the above lessons”.

I will take this as a lesson and move forward with hope

Thats brilliant article … sometimes just words are not enough .. numbers presented here really confirms how everyone does same mistakes they knew they could have avoided. thanks again.

Very helpful article.

Please share such articles more for free and not paid.

Irrespective of holding YES BANK, everyone should read this article.

A lesson for LIFE.

I usually exit a stock by putting strict stop loss @ 10% downwards the acquisition price. I followed it for yes bank

Very good brother. You will definitely win in the market. : )

still waiting for profit.

HOPE!!

Informative and insightful post. Thank you for sharing real data points.

Thankyou for this article.

We want articles like these.

Good article.. real view of ”why we falling into trap when share price is down”

Yes its true. It really hurt me. As a beginner i invested some of my balance. And yes bank is flipped. I had no idea that it can be loss instead of profit. Hell shit.

Absolutely, Nithin Sir. I remember, just 2 months back, when i having a conversation with a wealth manager from a reputed financial house, he mentioned that he has been advising all his clients to accumulate Yes bank. Yes bank was trading in the range of 95 to 110. He said it was a screaming buy.

Nice

I purchased ASHOKLEY at 141…it came down to 112…but I booked loss at 138 during up..wise decision because it never reach my price again…technical analysis help me here…wave theory…

I will continue to hold Yes bank..it’s technical bank unless like others.. only problem with big clients who are converted into bad NPA.. It will be lesson for lifetime anyone bankers.. have trust on Management and company ..

Even if the company is good the price raise is not sudden like 20% in a day. But fall is always steep. Even if one feels YES BANK is good share buy after it breaks resistance monthly chart is turning

Ultimately we need to make money in Stock Market. There is no sentimental attachment to YES BANK

Very useful message for us.

Agree with you, Nithin. Thanks a lot for sharing your views.

Lost all Capital of 23 Lakhs in these stocks BOB, Yes bank. Really pathetic will never touch this stocks ever.

its GREAT still You alive….. hope this experience make You good fortune…. take some good rest until Your mind fresh…

@143 300 qundity hold for end off life stop loss 0 hope next gvrment 2024

What a initiative.. need more like this in future👏

Very nice article and request you to keep writing more for us.

You have presented the case with good statistics. Very nice information

I have also booked loss in intraday in YESBANK.

Hello, sir agar kisika los hoga tabhi to kisiko profit milega. Bus vo loss apni capacity ke barabar hona chahiye.

Nyc this is a good lesson

Yes, I am also holding yes Bank with a big loss, hoping to gain some day. Your lesson is very useful not just for yes bank but everything that is required. Thank you.

Made 10k profit and in last minute took a bad trade ..that’s gave loss of all morning profits

Well I missed it completely😉…. The fall especially…. Thanks to learning from varsity…. Yes bank.. The falling knife… Which gets sharpened at each fall🤣🤣

i think for retail traders like me the best thing in this market is to look up the past 15 year chart of the stock…before even touching it…yes bank and icicibank for that sake have given huge dips in the past and infosys also so never even load them on your screen…hdfcbank britania marico are some names which were not perturbed by global crash of 2008 hence beter to be with them either for cash trafing or investing…just my observation for fellow traders…guys pl. punish all such companies by boycotting them …let the fiis cry for getting buyers

very nice article for the investors awareness.

Pl. keep bringing awareness topics.

Thanks

Ibulhsgfin, Yesbank, Relinfra are biggest wealth destroyer for me. Bhagwan jaane kab ye stocks upar chadhenge.

Good article appreciate,

Though not read all but points covered are good

The article is too good..the language is very simple and very easy to understand. Instead of giving pure technical.anaylisis like other bloggers do, you have provided a very clear point of view. I think more of.such articles would be appreciated.

Well said

Some loose some gain thr r many other stocks r thr to invest n recover losses..no matter if yes bank falls v fall v stand it took time..all the best who lost in yes bank try other stock invest thr n recover losses

good sir. intraday only best way in market

Another post facto analysis. Wonder where were all wisdom when Yes was falling all this while

Many of my friends averaged as the price fell & caught a falling knife. The correct methodology I was told is get out when the price falls below 50 DMA.

very valuable lessons indeed, sir! thank you for the advice.

I am an amateur to this share market game but after reading your article I get to know so many things about market in just few minutes.

You have written so beautifully and in so simplified form. Would love to hear more often from you. Let’s all get rich slowly and gradually!

Never think Ashok leyland stok falls., fundamentally strong and business is also good abt AL. I booked About 40% loss. If a stock giving loss in return just sell it off and go for better stock…

very valuable lessons indeed, sir! thank you for the advice.

Excellent Article!

perfect

Yes bank will growth .. awesome bank .. some problem s

And whom you think was profiting from these losses…a short trader. Those who know how to make money in the market make irrespective of direction. e.g. if my stop loss is hit I trade with double quantity in the opposite direction. So leave emotions at home and just follow the trend, downward in Yes Bank case.

Nobody can predict market. It’s not number game of buying and selling. I have lost around 6lakh in market and one year of my precious time that could have offered to my family. This is lesson that we can learn from market.

You are lucky…..I had lost around 20 lakh in last 4 years but still I take it as a lesson. The only way to move forward is to learn from your mistakes and never do them again.

Well articulated feelings of Successful person now we the beginner atleast understand it’s not just us but experience also lost in this share.

Thanks CEO for writing out this..

excellent piece of knowledge.. well said!!

Love this kind of content and I’d love to help in writing some if that would be possible – please see if you could start up a financial forum with posts such as this! There is huge potential (business wise too ;))

Dear sir

I humbly requested from you please provide dark mode on your trading view chart .

Very negative.

Great article

Yesterday I lost 6000 RS in yes bank Intraday it broke all the support levels now my capital is 66% down

there were no support in my opinion. it has support in the range of 45 and 55 and surely it bounce today. i made 1 rs gain inaraday as well.

whoer is holding will soon see it touch 75 and then 100 and 125.

now it is time to buy it.

That’s good one but most of the intraday trader focus on this type of shares

I don’t have experience on that but It won’t work anyway

It’s a good article. New strategy should be decided for future investments according to this principles.

The article is very good. However buying at the right time is most important. Averaging is very good tool on should know how to use it, if some one consider it’s just a math formula then they are in trouble.

Yes bank will bounce back 100% just need a vision of 5 years it’s time to invest high and hold minimum 5 years

Great Tips.. Thanks!

When Yes bank @270 I got a call SELL YES at any cost, it won’t support the level of 280+ & I follow the advice.

today I feel very lucky

Request you to remove the ”Strike price is outside the allowed range. Try a strike closer to the spot price.” error from the application and software so that in such volatile market we can buy some cheap nifty/bank nifty options for higher targets…

I had bought few shares last month when the script was @86.40, now today I bought few more stocks @ 59.35. I am sure this stock will bounce back to the high around 230-250 range soon.

Yes, YES Bank will bounce back, but that will take 4-5 years.. You ready to wait that long? then go for it.

I just hope that it will (yes bank) rise again as I am a student and I am nearly 26k in loss only bcz of Yes Bank

Hi,

”The stock market is not your grandmother” they say… Well.. sad to hear about your loss in Yes bank. My suggestion would be sell your stake and buy IDFCFIRSTBANK at 36-39 levels. 🙂 All the best

I have bought 1000 of them, now it’s under 3000 loss, do you think it will grow.

I am also one of the victims of Yes Bank. As rightly mentioned, I went on to by Yes Bank for averaging ended in big loss. I want to wait for a long time, will it be advisable ?

Best share for option straDdle

What about the temptation to accumulate more of Yes Bank 🙈

STOP completely averaging down words. 95% traders lose money due to this averaging. Averaging upwards in your direction of trade is OK

thank you so much for giving such a great advice!😃