Federal Reserve, Quantitative Easing (tapering), Repo rate

Federal Reserve, Quantitative Easing (tapering), Repo rate – Rise & Fall of Sensex/Nifty

For most people, the Federal Reserve invokes confusion and a whole lot of derision. We keep hearing and reading about how capital markets around the world track what they are doing. It is especially important for all of us to know, since the correlation of our markets to their’s is much higher; because of the influence FII’s (Foreign Institutional Investors) have on how Indian stocks and currency move.

Below is our attempt to simplify on how “The Fed” affects us and the reason for the recent volatility in the very quick rise and fall of Nifty/Sensex:

The Federal Reserve or “The FED”

It is the central bank of United States, much like Reserve Bank of India (RBI) and is tasked to control interest rates, money supply, oversee the banking system, control inflation etc.

The FED is split into four tiers:

a. The Board of Governors

b. The Federal Open Market commission (FOMC)

c. 12 Regional Banks

d. Smaller member Banks

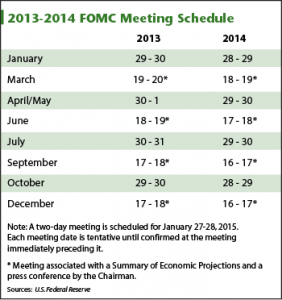

FOMC is the committee responsible for setting monetary policy and it consists of all the seven board of governors who are elected by the US president and have senate approval. The FOMC meets around 8 times in a year and they vote on the policy to be carried out during the interval between the meetings, like on the 18th Sept 2013 which is tracked by capital markets around the world to know the monetary actions that will be taken by The FED.

What are these actions that The FED takes?

Some of the important ones are:

a. Reserve requirement, is how much The FED asks a bank to hold in reserves. The FED uses this to control how much banks can lend out, higher the reserve requirement lower that can be lent and vice versa.

b.Discount rate, is the interest rate charged by The FED to commercial banks and other depository institutions on loans they receive from the Federal Reserve Bank’s lending facility. Lower the discount rate, lesser will be the cost of funds for the banks and hence lesser the cost of borrowing in the markets. Today the discount rates are around 0 and can’t really get lower from here.

c. Open Market Operations (OMO), this is the most important in the present context, OMO is used by The FED to purchase US government bonds on the open market as a means to adjust the Federal Funds Rate which in turn controls the inter-banking lending rates. When The FED purchases more bonds, it reduces the interbank rates and hence banks are incentivized to lend more freely and theoretically boosting the economy.

The above are some of the actions The FED has been taking over the years to boost the economy, control inflation and more. Most of these have lost relevance post 2009 as by then, they had already moved very low. For example, the discount rate is close to zero and there isn’t much left to boost the economy from any of the actions they could take. This is when Quantitative Easing(QE) came into play.

Quantitative Easing (QE):

Since there was nothing much “The FED” could do post 2009, in an unconventional way they said “to hell with everyone else” and started printing more dollars notwithstanding the fact, that they had frowned upon other central banks who had taken similar action in the past.

Usually central banks try to increase the lending activity indirectly by cutting interest rates, lower interest rates encourage people to spend and not save which in turn boosts the economy. But when the rates are already close to zero and would go no lower, The FED decided to print money and started pumping money into the economy directly, which can also be called Quantitative Easing (QE).

How this works:

a. The FED prints money.

b. The FED uses this money and what it has in its reserves is to purchase government bonds from private sector companies or institutions like insurance companies, pension funds and banks.

c. With the increase demand for US government bonds the value goes up thereby making them more expensive to buy and a less attractive investment.

d. The companies and institutions who sold the bonds would now use the proceeds to invest in other companies or lending rather than buying more bonds.

e. With so many more companies and institutions having money to lend, the interest rates stay low, so more money is spent and hence boosting the economy.

Tapering of QE:

The word “Taper” has probably been used by the media a zillion times over the last few weeks. If you didn’t understand what it means then here is the answer. Presently, as part of Quantitative Easing (QE), The FED is purchasing $85 billion in government debt and mortgage based securities every month. Ben Bernanke, The FED chairman has previously indicated that they might start scaling back on these monthly purchases (Tapering of QE) which had caused stress in financial markets as investors feared the end of central bank stimulus.

How do the Sensex, Nifty and Rupee get affected by all of this?

The broader consensus was that since Ben Bernanke had indicated Tapering of QE, The FED would cut it’s monthly stimulus of $85 billion by $10 to $15 billion in the FOMC meet, concluded on Wednesday 18th Sept 2013!

As this didn’t happen, there were a lot of positive takeaways for markets across the world and especially India.

a. FII’s are expected to extend their buying spree in Indian stocks which might also help the Rupee appreciate further.

b. Appreciated Rupee would help reduce the CAD (current account deficit) by lowering our cost of imports on crude, gold and others.

c. This would in turn help our central bank “RBI” to start taking initial steps toward unwinding the liquidity tightening measures such as 99 % CRR (Cash reserve ratio, the amount of funds that banks have to keep with RBI) on a daily basis and others like access through the LAF (liquidity adjustment facility) of 0.5% of NDTL (Net demand and times liabilities), increasing liquidity available to 1% of NDTL, gradual unwinding of MSF (marginal standing facility rate, the rate at which banks can borrow funds from RBI overnight against approved government securities) which was hiked by 200 bps(Basis points), reduction in repo rate (rate at which RBI lends money to commercial banks which was at 7.25% as on 19th Sept) and more.

On 18th September, the US Federal Reserve unexpectedly decided to maintain its economic stimulus, sending markets around the world to record level highs, this is the reason for the over 3% move upwards on nifty and sensex when our markets opened on 19th September to the good overnight news from the US.

On 20th September, the RBI in India has unexpectedly increased the repo rate from 7.25% to 7.5% whereas after the news of The FED, capital market participants in India were expecting it to go down. This has sent the nifty and sensex down by more than 2% today, 20th Sept 2013.

Such are the vagaries of the financial world, as depicted by the the Rise & Fall on Nifty-Sensex over the last 48 hours.

Good morning team zerodha

My holding 5 share in

HCL TECHNOLOGIES

My question is my bonus share which date to credit my demat account ….

answer me please

Front-line stocks are the biggest stocks with the largest mkt caps,

Sgx is the same as Nifty barring the fact that it is traded out of Singapore its meant to mimic the Nifty

Since this opens before the Nifty in India it works as a good leading indicator

1)what is a frontline stocks?

2) when am watching SGX Nifty & Nifty is in the same directions ? why like that…..while we see SGX NIFTY in the morning at 7 AM to 9AM…when it is positive ,nifty will also open in positive ? why like that?

very good article!, Thanks.

Thanks.

very nice article thanks, i have one doubt then how come still feds printing dollar is not devalued against other currency,

The very long term implication of QE in theory should mean gradual devaluation of US dollar.

However in the short term there are a lot of implicit factors supporting the dollar, things like commodities or international trade are dollar denominated and a lot of dominant forces stand to gain from dollar remaining at elevated levels. Also the US dollar is considered as a safe haven of sorts to park money in times of uncertainty.

There has been relative inflation.

We have seen

1) Inflation of stock prices (stocks going up)

2) Infation of bond prices (bonds going up, yields going down)

3) Inflation of commodity prices (crude is pretty buoyant) and

4) Inflation of home prices in the US (half of the QE every month actually goes into buying Mortgage backed securities)

5) Dollar weakening relative to the G10 currencies as potrayed by the fall in dollar index

The CPI inflation is USA is still around 2% but even that is pretty high relatively speaking due to the fact that there would have been severe deflationary pressures if QE wouldn\’t have occured.

Its like saying +2% is much higher than -4%.

+1

Very good article!

very crisp article. thanks

good one