You can now participate in auction markets

Encouraging greater participation in the auction markets and reducing the impact of auction penalties due to short delivery have been on our to-do for a long time. We have had situations where the losses have been up to 20% due to the lack of liquidity in auction markets. This is because there was no retail participation, and it was just proprietary brokers.

Starting now, if you hold stocks in your demat, you can participate in auctions where you can potentially sell your share at prices higher than the current market price. The auction market opens every day around 2:30 PM for 30 minutes. As participation increases, the gap between regular markets and auction markets should reduce, especially for mid-cap and small-cap stocks. This will help traders with short deliveries avoid large penalties.

Auction markets

If you have traded stocks for intraday or stock derivatives (F&O), chances are you would have faced a short delivery and an auction penalty. Let me explain with examples.

Say stock XYZ was trading at Rs 100, and you shorted 1000 shares, expecting the price to fall by the end of the day. You could buy it back and make an intraday profit if it did. Selling a stock without owning it is called a short sell. If you bought the stock before the end of the day, then you are not obligated to deliver the stock. But what if the stock hits an upper circuit of Rs 120 (20%)? It’s not possible to exit the position.

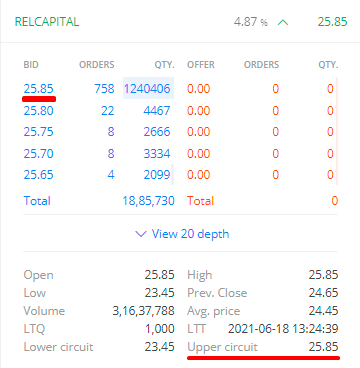

The upper and lower circuits are the maximum a particular stock can move in a day. The percentages can vary from 5% to 20%. Stocks in the derivatives segments (F&O) don’t have any circuit limits. At the upper circuit, there will be only buying orders at the circuit price, and transactions happen only if someone places a sell order at that price. Usually, the transactions stop as sellers are unwilling to sell the stock, given the buying interest at the circuit price and a high chance of the stock moving further up the next day. It is exactly the opposite if a stock hits a lower circuit; there will be only selling orders and no one buying.

This is how the market depth of a stock will look at the upper circuit.

Going back to our example, now that the stock is at Rs 120 with no sellers, you can’t buy back the stock before the end of the day. This means you have to deliver the shares you sold to the exchange the next trading day. If you don’t deliver the shares, the exchange will buy 1000 shares that were short-delivered in the auction markets on T+1 day and deliver them to the buyer on T+2.

Assume that on T+1 day, the current market price of stock XYZ is Rs 121. Depending on the stock’s liquidity, the auction market price could be as much as 20% away from the current price. 20% in our example could mean the stock in the auction market will be trading at Rs 145. If you bought the stock in the auction, you would lose up to Rs 24,000 (Rs 145- Rs 121 x 1000) due to auction impact cost or auction penalty. The Rs 24,000 is a risk-free profit for the seller in the auction market.

Short delivery can also happen if you hold a stock F&O position at market close on the expiry day. If you are holding a sell future, buy in the money put option, or short in the money call options at the close of expiry, you have to deliver the quantity of the underlying stock to the exchange on the next trading day. As explained above, failure to deliver stocks will lead to an auction and a potential penalty.

The ~200 stocks trading in the derivatives segment are liquid mid to large-cap stocks; hence, the auction market for them also tends to be pretty liquid. The impact cost of the auction is usually relatively small.

In India, only index derivatives are cash-settled; all stock derivatives are settled through physical delivery.

You can also get into a short delivery situation in an equity BTST (Buy today, sell tomorrow) trade, that is, if you have sold the stock before the stock has been credited to your demat account. If the seller fails to deliver to you for whatever reason, you also end up short delivering.

We believe that by making the auction market accessible to retail investors, it will improve liquidity, making it more efficient. While customers willing to sell a stock in an auction can demand a higher price and generate profit by selling at higher than current market prices, the increased participation should reduce the spreads and help traders stuck in short delivery positions.

How to participate in auction markets?

- Every day between 12 PM to 2 PM, exchanges publish a file which will have quantities of all stocks that will be bought in the auction markets on that day. We update that here: https://zerodha.com/auction.

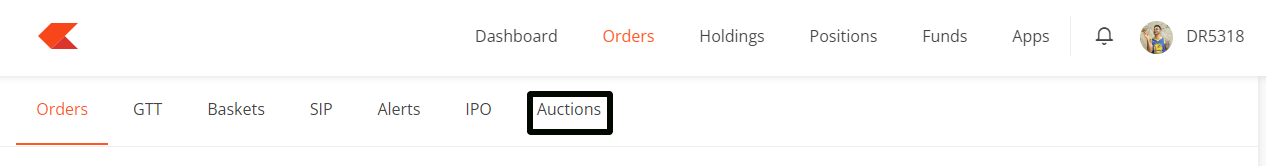

Building a utility to alert customers about specific stocks is on our to-do, but will take us some time. - In the orders section on Kite, you can see the Auction menu.

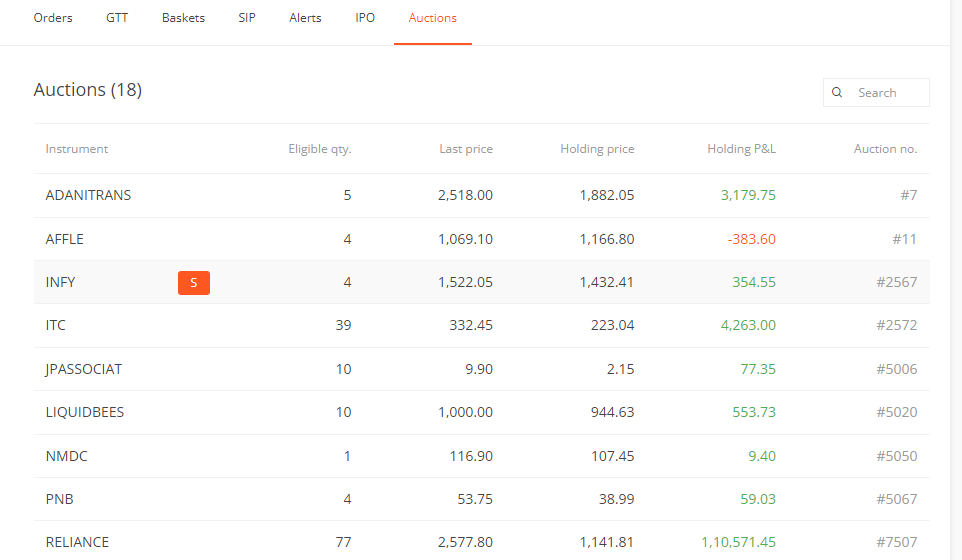

- When the auction markets open at 2 PM, you will see all the stocks in your holdings, including the eligible quantity that you can offer in the auction markets on that day.

- You can click on the sell button to see the market depth of the auction market and the price at which the other offers are made to sell. You can then place a sell order at the price that you want.

- All auction orders are collected until 2.30 PM. Based on the best price available, the auction orders are then filled at around 2.30 PM.

- If your sell order is filled, you will, just like in the normal market, receive 80% of the sale proceeds that will be available for trading immediately. You will receive the full funds like in the normal market on the next day. The sell credit from auctions will be a separate entry on the ledger, and a separate contract note for the auction trade will be emailed.

Common queries

Can you buy stocks in the normal session and sell in the auction market?

No. Since the auction session is conducted to settle the buyer who was short-delivered, you will only be able to sell stocks already lying in your demat account. Stocks purchased on the same day or one day earlier will take T+1 days to be settled in your account.

What happens when you sell stocks in an auction and then buy back in the normal market?

Stocks sold will get debited from the Demat account by the end of the auction date. Stocks purchased will be credited on the next trading day.

Aren’t auctions conducted on T+2 days, and stocks settled on T+3?

Over the last year, the Indian capital markets have been moving from T+2 to T+1 equity settlement cycle. Until we were in the T+2 settlement cycle, an auction was conducted on T+2 days for short-delivered quantities and then settled on T+3 days. But now that we are in a T+1 settlement cycle, the auction will be conducted on T+1 and then settled on T+2.

Can auction orders be modified?

No, auction orders cannot be modified. However, you can cancel and place a fresh order with a modified price or quantity during the auction session.

Can I cancel my pending or partially filled auction orders after the auction session ends?

Pending and partially filled orders cannot be cancelled after the auction session ends. The exchange will automatically cancel them at around 4:30 PM. Also, if you participate in the auction and the order is pending or partially filled, the shares cannot be sold in the normal market for the day. Please keep this in mind if you plan to sell your unfilled shares in the normal market on the same day. Make sure to cancel pending orders before the end of the auction session if you wish to also place a selling order for the same stock in the normal market.

What happens if the shares sold on the auction are short-delivered for any reason?

Suppose the auction seller fails to deliver by T+1. In that case, the trade shall be closed out at the highest price prevailing across the exchanges from the day the trade was executed to the auction day, or 20% higher than the settlement price on the auction day, whichever is higher.

Are there any additional charges for selling in the auction market?

No, we will treat this as any other equity delivery sale trade for which the brokerage is zero (we charge a token of Rs 0.01, irrespective of the value of the order for equity delivery trades). Other charges, such as exchange transaction charges, stamp duty, DP charges, and STT, will apply as usual.

At what price can I place an order?

You can look at the market depth of the auction symbol, as explained in Step 3 in the section above, and place an order by checking the current price in the normal market. The circuit limits in the auction market are set at 20% of the previous day’s closing price.

When are auction markets most active?

Typically, many stocks hit their upper circuit on extremely bullish days. Also, on the T+3 day after the monthly expiry of stock derivative contracts or the last Thursday of the month. But from Feb 2023, the auction for short-delivered quantities on expiry of stock derivatives will also happen on T+1 day after expiry.

Are the auction market timings fixed?

While the auction market typically starts at 2 PM and remains open for 30 minutes, sometimes the opening can be delayed by up to 45 minutes. There are also rare instances when the auction market can be cancelled completely on a given day.

We hope that you will participate in the auction markets, not just to benefit if there is any opportunity to generate risk-free profits, but also to help improve the efficiency of the auction markets by reducing the impact costs.

Super

I just got a notification that I hold some shares which are eligible for the auction market. However, I don’t see the Auction tab in the Orders’ section. Please help.

Go to Bids and then Auction

It’s good for next Laval

How to increase the probability of selling at the auctions market? Does the lowest bid get through or how does it work?

Hi I have pledged 10 units of liquid bees. I also have say 100 units of liquid bees which are not pledged. When I place sell order of say 20 liquid bees in auction market (2 to 2.30 pm) I get message that your pledged units will reduce. Why I get such message when unpledged quantity is adequate? Does it result in pledging/ unpledging charges?

Nice one. Like this. We can sell high at auctions and rebuy at normal (if there’s no UC, else both will be same)

Yas

Please check ✅

How will the taxation take place if i participate in the auction and buy back the same quantity after selling in the auction? Suppose I have 500 shares of a particular company and i participate 300 quantity and buy back the same quantity and after a few days i sell all 500 shares in normal market, will it lead to double taxation assuming it is a short term trade?

Hi

i got a mail from zerodha and a deadline to revert and when i asked the support for explaination and requested for a a call, i wanted to discuss need elaboration on the content

i have been writing since friday and untill today i havent recieved a call they only say that they tried but i havent recieved a call this is a excuse i get each time when i request for a call.

the mail i recieved i am unable to reply to it as it is no reply email, and when i write to customer support they give me the same unclear response , i call the customer care since saturday not a single call was picked

and i ask for a call back i get a lame excuse,

there is no email id where i can revert as well on the mail

so if the deadline is missed you will be held responsible

pls call immediately this needs to be resolved

Hi, we believe someone from our team has reached out to you. If you have further queries, you can get back to us on the ticket raised.

What if a share price strikes upper/lower circuit on exchange during being auctioned?

Hi, daily list is not being updated on Zerodha website for last 10 days although list is available on Kite but only of such scrips which one has in demat account.

I think this will have adverse impact and will decrease the equity volume in normal market as every one will be interested to earn 2000bps extra in auction market, this will somewhat create artificial demand of the F/O listed securities in normal market

My Zerodha ID : YV1403

I have requested for activation of my F&O segment for both NSE & BSE but not activate till date.

Please look into this matters.

Thanks and regards

Madhumita Sarkar

ok

Hi, i have shares of Divis Lab so I can see in Kite that today (i mean 24th March) Divis Lab was auctioned at Rs 2836.95. Where can i see auction price of such shares which I don’t have for example Aban offshore?

Where can I see auction price of shares which I don’t have for example ABB, Abott India, ABFRL, ACC, Adani ent, Adani Green, Adani Ports etc

There is an internet page of Zerodha website on which we can see list of shares for which auction would be held on that day. That list is uploaded by Zerodha generally between 12.30 and 1.30 pm. Today auction did not take place. In such cases my suggestion is that Zerodha should intimate (state) on that webpage that auction will not be held today so that Zerodha subscribers know it well before 2 pm

Hi Mahesh, yesterday was a settlement holiday. The auction markets are closed on settlement holiday.

Thanks for reply

Good platform for earnings

Only 5 orders of sellers are visible on zerodha kite app. How to see 20 or more orders? Are 20 orders visible on nse website? It is regarding auction.

It is regarding market depth

I am not able to see the list of shares available for auction at the given link for the last two trading sessions I.e., for 13 & 14 March 2023

Hi Harsarn, NSE publishes the auction list between 12 PM and 2 PM and this will be updated here.

Why don’t the exchange buy the stock from the market instead of doing auction? Just curious, so asking.

Yes, same question. When share are available in general market which could be easily bought why should there be a scenario of Close Out which is heavy amount?

If i sell a share in auction and buy the same share on the same day in normal market, will the share be not in my demat account for one day? In some cases may i miss dividend record date or buyback record date etc?

If i sell shares worth Rs 1.01 lakh in auction and buy exactly same share same quantity from normal market on the same day for Rs 1 lakh will the fund requirement be only about ₹ 20000? Will there be any penalty if funds in trading account are only 20000 and not 1 lakh?

What is total number of companies (shares) which are eligible for auction? I mean total number of companies which are either in f&o or are eligible for short selling? Can small cap or micro cap companies (shares) come in auction?

Hi Mahesh, all the stocks that are traded on the exchange can come in the auction.

Thanks Shubham

How do i get details of auction trades ie number of shares auctioned and price, for such shares which I don’t have in my demat account

Hi Mahesh, you can check the list of stocks in the auction here: https://zerodha.com/auction

Thanks Shubham

Hi Shubham where can I check final auction price of such shares (companies) which I don’t have in my demat account ?

Same question, where can I see Actual Volume of all shares during the Auction session, Kite shows only the shares that are in my holding. What if my position is going into auction but I don’t have that share in my holding, how could I see the Live Auction?

I havent recieved my Id and password mail

Hi Shrikant, please create a ticket at support.zerodha.com so that our team can have this checked and assist.

I want Zerodha news letters to get myself updated with current market scenarios,

Is there an API available to fetch Order Depth and Place Orders for stocks available in Auctions.

Hi Pancham, APIs are currently not available for Auctions. We’ll take this as feedback and check on the possibilities 🙂

How does one see the the list of stocks in the NSE website? In NSE, I can only see ”Stocks in Call Auction” and that did not have the scrips that I have in my Demat though they were listed in Zerodha auctions page.

Hi Vimal, you can find the list of stocks and their quantities for auction each day here if you hold stocks that are listed for purchase in the auction session, you will see them under the auctions tab and the eligible quantity of shares you can sell will also be displayed.

Is there any hidden quantity in the market depth like ”disclosed quantity”? Or does ”Total” in market depth indicate the actual total number of shares being sold by everyone?

If we sell the share in auction and buy back at the same time, will it be consider as intraday or both trans. will be individual?

Hi Atul, selling a stock in the auction market and buying it back in the regular market is not an intraday trade. It will be considered as individual trades.

Hi Shubham, do I have to authorise by tpin before selling in auction? Like we do in normal market transactions?

Hi Harsha, yes TPIN authorization is required.

Suppose seller likes to auction all his shares of particular script say, 10, is it possible for exchange to debit only required of 5, leaving remaining 5 shares in demat. is that possible? and about dp charges?

Hi Kasturi, the eligible quantity of shares that you can sell will be displayed in the auction window. And since this is treated as any other equity delivery sale trade and regular DP charges will be applicable.

When will the auction participation for retail investors be allowed for BSE Auctions as well?

Hi Neeraj, auction orders are allowed only in the NSE exchange, they cannot be placed in BSE’s auction market.

Hi,

I see article is meant for T+2, could you please modify and publish for T+1 and timelines for auction in that case. as we are no more stocks left in T+2.

Best Regards,

Gurucharan Nayak H

I loss too much amount by short selling of shares which i don’t have…. And unluckily that stock hit upper circuit on that day… So unable to buy on same day….Which get covered in auction market after 2days…. Which burn my hands with huge amount…..which Get directly cut from my portfolio amount… So be cautious….😔😔

Will auction sell price be minimum 20% higher than the normal share price for the same day ?

Hi Adrita, the auction market price could be as much as 20% away from the current price, however, you can look at the market depth of the auction symbol and the normal symbol and place a competing offer price.

Like always, you people are revolutionaries of the Indian Stock Broking Industry.

No over exaggeration at all.

I could not even think of being able to experience markets at this level of transparency and simplicity about 9 years ago.

Thank you Gentlemen.

This is the main reason I trade only with Zerodha. Pioneer in market.

Will there be dp charges for tendering in auctions (if accepted)?

Hi, yes this is treated as any other equity delivery sale trade and DP charges will be applicable.

Interesting indeed, especially with the auction shares list readily available in ”orders”. It will give opportunity to retailers to earn more than current price and the short seller to purchase at a ”lesser than circuit” price.

This will also help the short sold trader, chance to get settlement at little low price due to maximum participation in auction…

I want to know about this

Hi, when & How I shall come to know that my shares are accepted in auction

Hi Jigar, if your sell order is filled, you will receive 80% of the sale proceeds which will be available for trading immediately. The sell credit from auctions will be a separate entry on the ledger, and a separate contract note for the auction trade will be emailed.

great initiative from zerodha for retail participants..

continue your reform process ..

and continue to be the market leader in broking business ..

if i were to offer my shares in the auction, when do i get me shares back, i mean like SLBM or ALBM?

Hi Bhavana, by offering shares in the auction you are selling it to the exchange not lending. So you won’t be getting your shares back as it is sold.

Hi,

Thanks, how can i lend my shares? not interested in selling them

can you guide

Hi Bhavana, we’ve explained the Securities Lending and Borrowing process here.

Can lending the shares will also be made available on zerodha. So that retailers can lend the shares for some fixed income. I believe NSE has that facility.

Hi Yogesh, we’ve explained the Securities Lending and Borrowing process here

Yes

Can we also purchase shares from the auction?

Hi Neekita, no you can only sell stocks from your holdings in the auction.

What is the difference between selling at the auction and lending shares? Does Zerodha support stock lending by its clients?

Hi Selvakumar, during the auction session, you sell your shares to the exchange for shares that are short-delivered. Whereas in Securities Lending and Borrowing (SLB) you lend or borrow securities for a specified price and time. We’ve explained the SLB process here.

Can i sell shares from my holdings directly in auction at the price more than the current market price?

Hi Mithilesh, you can generate profits by selling at higher than current market prices. Check out the above article to know at what price you can place an order.

Hi,

I see article is meant for T+2, could you please modify and publish for T+1 and timelines for auction in that case. as we are no more stocks left in T+2.

Hi Guruvharan, now that we are in a T+1 settlement cycle, the auction will be conducted on T+1 and then settled on T+2. We’ve explained this above too under common queries 🙂

Sir, can this feature even made better by restricting max Loss to upper circuit limit of scrip or share instead of 20 percent

Say if stock UC 5percent then max limit should 5 percent instead of 20 percent why 20 percent though I understand that is applicable for that shares having 20 percent limit that way we can protect investors fund capital also more people will feel secured these can be recommended to SEBI ,nse or bse with brokerages support this is possible

In worst case limiting max Loss to one percent more than the share circuit limit is better option

Hi Venu, the 20% limit in the auction market is set by the exchanges.

I think it will be an opportunity for many if you know which stocks are to keep which will help you earn returns .However too much volume can aslo diminish the returns.i mean just for sake of selling someone might settle for less but there is also a possibility that it will be at minimal level . Ambiguity exist , time has its own answers for any given question. If someone say that only those who benefit from this who hold stocks in their demat ,but the short seller were already in problem so it , I think it should make them(SS)indifference. (Different opinions are respected )

When this facility will start where I can see the auction windows

M.balasubramanian QQ7126

The auctions feature is already available on Kite, Balasubramaniam. You can access it from the ”Orders” section both on the Kite web and app (please make sure you’ve updated the app to the latest version).

It would have been really useful if you showed the total number of shares listed for auction as well. Saves the user the hassle of downloading the excel sheet from the exchange and searching for the number. At least I couldn’t find the total number on mobile app.

The total number is available on the Market depth

@Arun I’m not talking about open orders in market depth… I’m talking about the total number of shares being auctioned by the exchanges for short delivery. Using that number and looking at the market depth, I can place my order so that it gets filled at the highest possible price.

Never mind, I see that the auction quantity is displayed in market depth when the market is open.

Dear Sir, regarding Orders- Action options does not activated by kite app, I can follow the action timings, but how can I do participate it.

Hi Deepak, you can check the number of shares being auctioned for each stock here: https://zerodha.com/auction

Sounds great!

Just to make sure…

If I’m a very short-term cash swing trader & I’m in a minimal loss, will this help me exit my holdings in minimal profit or cost to cost? Please advise. TIA

I want to lend my holding..

please explain the process

Hi Nitish, we’ve explained the Securities Lending and Borrowing process here.

plese provide this message in hindi

What is AF?

Hi, this is the tag used by the exchange for Auction orders.

Nice 👍

After a long time, Zerodha has come up with an amazing feature. Good job to those who worked on this.

Now, that’s called real gentlemen feature provided by and as a broker. This feature clearly shows that Zerodha is genuinely working towards making Indian stock market as transparent as possible to the retail traders. Thumbs up from my side….

Well put

Dear Team,

Good idea for small stocks trading.

Dear Sir. The AUCTION facility is NOT visible in mobile kite application could you please guide

Go to Orders section and then go to the fifth tab.

Hi Narsimha, please make sure you’ve updated the Kite app to the latest version, The auctions features is available under the ”Orders” section.

Seems good.how do we seel our holdings in auction?

Hi Prakash, we’ve explained the process above.

How do we short sell the stock??? Not for Intraday…. Is it possible??

Hi Dattaraj, carrying a short position overnight in the equity segment is not allowed. If you wish to, you can do so by shorting futures or via Securities Lending and Borrowing. You can learn more on SLB here.

Good

The sale proceeds will have exchange STT deducted? Or they will be considered as off market transactions?

Hi Raghavendra, this will be considered as equity delivery trade for which the brokerage is zero (we charge a token of Rs 0.01, irrespective of the value of the order for equity delivery trades). Other charges, such as exchange transaction charges, stamp duty, DP charges, and STT, will apply as usual.

Best

Nice good

Nice

Good

Nice

Good idea

How do I know if I have a short sell of the share?

Hi Pankaj, if you short sell in equity and do not buy back the stock on the same day it may result in short delivery. Buyers are notified through email and a kite notification when a short delivery happens. And the defaulting seller is sent an auction note and is obligated to pay an auction penalty to the exchange. More here.

Best

Nice

How i can re-upload my financial document if rejected by zerodha team. I haven’t my user i.d. and password then how i can login.

Hi Arju, could you please create a ticket at support.zerodha.com so our team can check and assist? Also, we see your account is opened and login credentials have been sent to your email. More details here.

Do check out your spam folder as well.

Can I tender in auction if I have pledged my shares for margin.

No Prakash, pledged shares cannot be sold in auction due to the risks of short delivery. Explained here: https://support.zerodha.com/category/console/portfolio/pledging/articles/pledged-quantities-not-being-sold-in-the-post-market-session-and-auction-market

I think, pledged shares can’t be auctioned as Zerodha has a separate process for unpledging? If the unpledging and selling can be integrated in one then it would be possible to put pledged shares for auctioning? Kindly explain. Thanks in advance!

Hi Naushad, you will not be able to sell pledged stocks in auctions due to the risks of short delivery. Explained here: https://support.zerodha.com/category/console/portfolio/pledging/articles/pledged-quantities-not-being-sold-in-the-post-market-session-and-auction-market

Start my account

I am so excited

I didn’t realize that there was a way to solve for this auction penalty problem. I have been on the wrong side of this many times. Thanks for enabling this feature.

I don’t think this will solve the problem.for the short seller.

It will benefit others who have the stock in their possession and willing to participate in the auction. For them it will be risk free oppty.

However practically speaking I think it will benefit only those investors who have already built a good repository of that specific stock. Also if it is a commonly traded stock the chances of getting a good return will be poor simply because there will be too many bidders at the auction. One will have to settle for a very small return. But then the consolation is that anything is better than nothing since one is merely arbitraging on stocks lying idle with the DP.

Hats off to you for your useful information explained in simple terms