Introducing GTT – Good Till Triggered orders

I am happy to announce a long-awaited feature, GTC, but even better. Introducing GTT (Good Till Triggered) orders.

GTC orders

GTC (Good Till Cancelled) orders are orders that are valid until cancelled. They are most commonly used for placing long term stoploss and target orders. Offering this has been a challenge because exchanges in India don’t support this feature; all pending orders are cancelled by the exchange at the end of every trading day. The few brokers who do offer GTC, essentially re-place all the pending orders which were cancelled by exchange once again on the next trading day. This is not a scalable solution.

We have developed an innovative alternative to GTC that offers all of its features and more. Not only can you place single-leg triggers to enter or exit stock holdings until your price condition is met, but you can also simultaneously place target and stoploss (OCO or One Cancels Other) for your stock holdings.

Creating GTTs

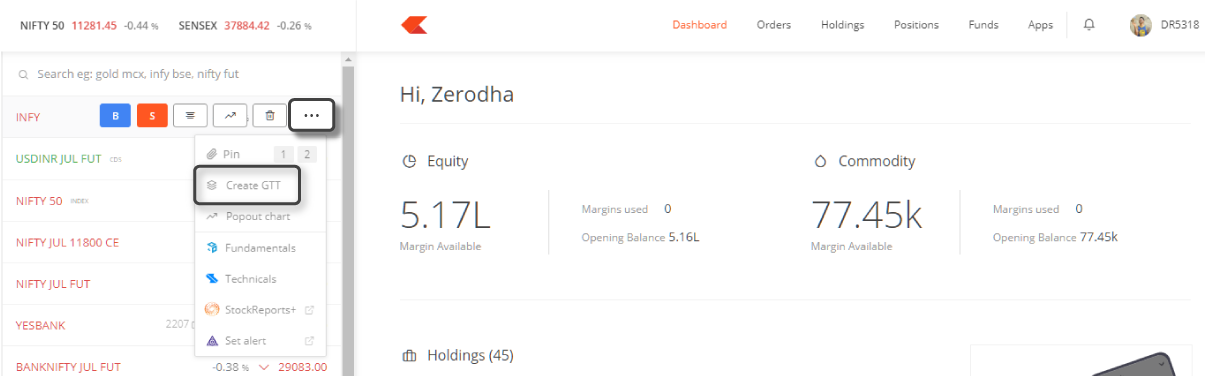

On Kite web, click on the context menu (marketwatch, holdings, positions) to see the Create GTT option.

Creating a GTT on Kite web

On Kite mobile, click on any scrip and click on ‘Create GTT’ on the right.

Types of GTT

Buy GTT

Buy GTT can be used to creating triggers to buy stocks for delivery. When the trigger price is hit, a buy order with the entered limit price is placed on the exchange.

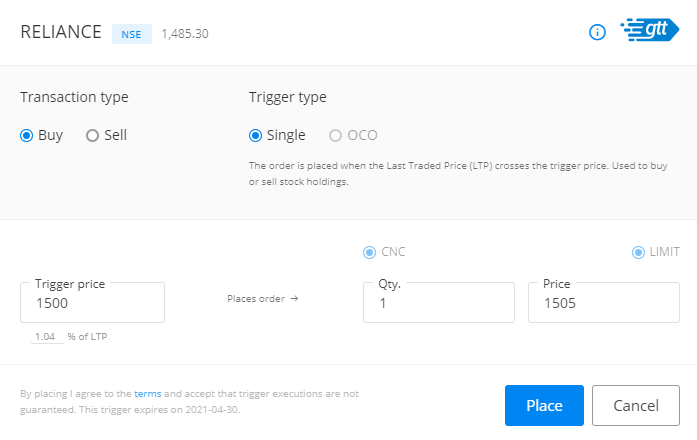

Consider the example in the image below:

Current price of Reliance = 1485.30

Trigger price = 1500

Limit price = 1505

In this example, if the trigger price of 1500 is hit on the exchange, a limit buy order at 1505 is placed. Since the limit price is greater than the market price, the order behaves like a market order and executes at 1500. However, since this is a limit order, it won’t be filled at a price above 1505. The reason for having a limit price higher than the trigger price is to ensure that the order is executed when triggered and doesn’t stay pending and get cancelled.

Buy GTT — Single

Sell GTT

Sell GTT is used to exit current stock holdings, either just a target order or both stoploss and target where triggering of one will cancel the other (OCO).

Sell GTT – Single:

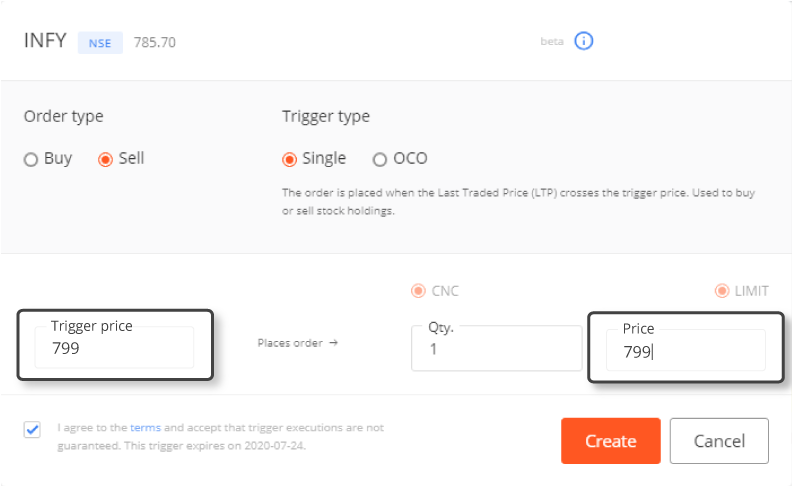

Consider the example in the image below:

Current price of Infy = 785.70

Trigger price = 799

Limit price = 799

In this example, if the trigger price of 799 is hit on the exchange, a limit sell order at 799 is placed. This order will be executed if you have the stock in your demat account and a buyer is available.

Sell GTT – Single

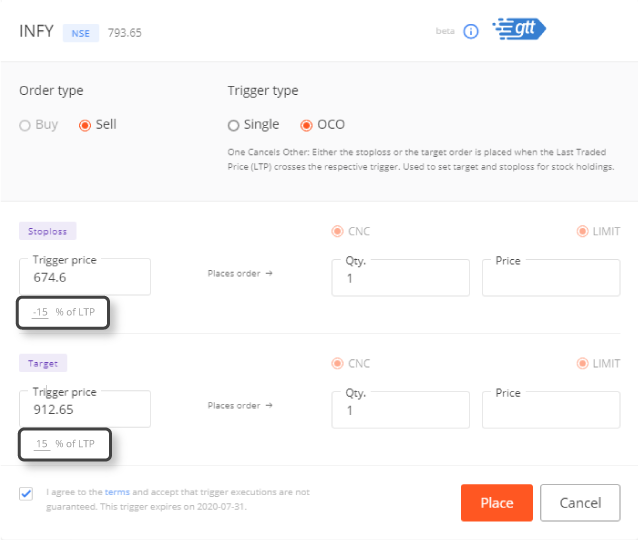

Sell GTT – OCO (One Cancels Other):

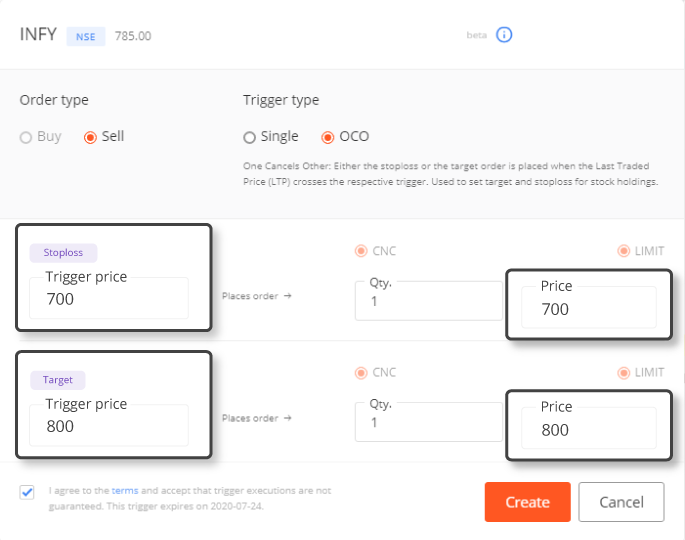

Consider the example in the image below:

Current price of Infy = 785

Stoploss trigger price = 700

Stoploss limit price = 700

Target trigger price = 800

Target limit price = 800

In this example, if either trigger price of 700 or 800 is hit on the exchange, a limit sell order at the corresponding limit price is placed. This order will be executed if you have the stock in your demat account and a buyer is available. The other trigger is cancelled when one is hit.

Sell GTT – OCO

Using percentages to set triggers

You can also easily set your GTT triggers at any desired percentage points away from the LTP. Consider the example in the image below:

Current price of Infy = 793.65

Stoploss trigger price = 674.6 (-15% from LTP)

Target trigger price = 912.65 (15% from LTP)

You can simply change the percentage value below the ‘Trigger price’ field (positive for target and negative for stoploss) and the trigger price will automatically be set to that level. You only have to enter the limit price.

Setting triggers 15% away from LTP

GTT for Nifty and Banknifty F&O

Updated May 4, 2020

We have now extended the GTT feature from to include Nifty and Bank Nifty futures and options. You can also set the target and stoposs as a % of the price at which your order will get traded while placing the order itself. This feature is currently available on Kite web and will be launched on the mobile app soon.

In the image below, while placing a buy Nifty May Futures market order, an SL and target of 1% are set. What this means is that whatever the price at which the market order gets executed, a sell GTT is placed at 1% above and below that price. If either one of these gets executed, the other gets cancelled.

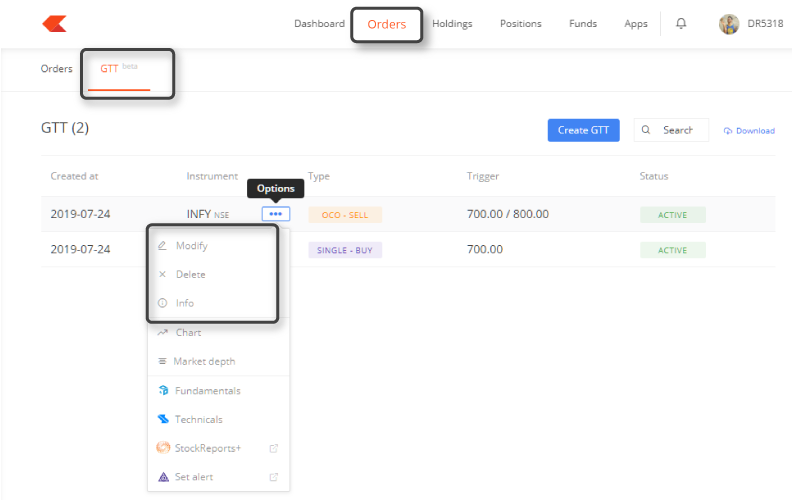

Managing your GTTs

All GTTs placed you place can be managed under the GTT tab on the Orders page of Kite.

GTT Tracking

Margins

You don’t need to have any cash or margins available in your account to create a GTT. The system only checks for margins when the GTT is triggered and an order needs to be placed on the exchange. You will need to have margin available only then.

Validity

- A GTT is valid for one year. If it isn’t triggered within one year, the GTT will be cancelled. You will need to place the GTT again manually if required.

- A GTT trigger is valid only once. So, if an order fired by a GTT is not filled at the exchange for any reason, you will need to re-place the GTT order manually.

- Whenever there is a corporate action, like bonus, dividend (if greater than 5% of market value), stock split, etc., the GTTs for the corresponding stocks will be cancelled before the ex-date. You will have to re-place the GTT manually after the corporate action. These GTTs are cancelled to ensure that the order is not triggered by the movement of stock price due to the corporate action.

Important to know

- When a GTT is triggered, and order is placed on the exchange, it is executed only if the limit price order placed is filled on the exchange. For better chances of execution, make sure to place your limit price higher than the trigger price for buy GTT orders (acts like a market order with the protection of your limit set), and sell limit price lower than the sell trigger price for sell GTT orders. The further away from the trigger, the higher the chances of the order being executed.

- All orders will be triggered and placed only during market hours.

- Orders placed at the exchange by GTTs that trigger will only be filled if you have enough funds for buys and if you have enough stock in your demat for sells when the order is placed on the exchange.

- Our dealing desk does not support GTT; you will have to place, cancel, modify these on your own.

- A maximum of 100 active GTTs is can be placed at a time on one account.

- Sell GTT orders triggered on your equity holdings will not go through as you need to authorise the delivery of your shares using CDSL TPIN. This is not applicable, if you’ve submitted a POA.

Free for use

There are no additional charges for using the GTT feature.

Help us spread the word by letting all your friends know about GTT. It can help save time by not having to login daily to place orders and help save money by having a stoploss in place when an investment doesn’t go in the expected direction.

Happy trading,

1. How to sell RELINFRA shares

2. I created stop-loss but not executed

3. I created gtt also, bo use

I want long term investment in mon100 , so what to do for buying, your website doesn’t support for it only gtt option is there

Can GTT Orders be Introduced For Commodities…

Hi Gaurav, we’re working on it. We’ll keep you posted.

Is GTT available for SDL?

Thanks,

Hi Bhavya, it is.

Is GTT available on Commodity market

Is it possible to put GTT orders in Bulk ?

As more than 10 to 20 stocks GTT orders are require to put, need more time.

If possible to keep the GTT orders in one click is good.

I think the example for Buy GTT doesn’t make sense. Let’s have a look:

Current price of Reliance = 1485.30

Trigger price = 1500

Limit price = 1505

Why would somebody buy at a higher price than the current market price? I would rather buy at current price than to wait to pay more!! Please provide a more realistic example.

Depends on my criteria to go long. Say, my assessment is – if price breaks above 1500 it means this is bullish and I’d like to go long. Else, we are still in neutral/bearish zone.

Right 👍

This feature is help in turtule trading strategy

Place buying GTT order after observing view chart and getting past movements that you are acquainted with.

Is change of exchange is available in GTT. From BSE to NSE or NSE to BSE.

Also all the below details are available with your system

BUY GTT – OCO – not available why ?

How stop loss makes sense when we buy? Buy require trigger price and buy price, no stop loss. SL comes in pictures we sell holding only.

How stop loss makes sense when we buy? Buy require trigger price and buy price, no stop loss. SL comes in picture we sell holding only.

👍e

i am newly

want to trading with help of of gtt but gtt order not placed

Hi Nanhe, could you please create a ticket at support.zerodha.com and provide more details so we can check this?

What is the use of field ”Limit price” in case of ”Sell GTT – Single”?

In case of ”Sell GTT – Single”, what is the use of field ”Limit price”?

If I have made a position of Short in index futures, and I want to place a GTT buy order with SL percentage , what would be the validity of that SL?

Will it be valid till the GTT order is honoured or expired, or only intraday?

Buying GTT order is rejected and showing in GTT tab as rejected. How can i removeit.

Hi Everyone,

Is there any way to find out if a transaction made in Kite was due to GTT or manual action ? I have checked all the reports(Tradebook and P&L). But there is no information regarding how that transaction was made. I really need to find the method of one of my transactions done in Kite.

Could anyone please help me find out ?

Hi, How can I place an order to execute at a specific time irrespective of the price? Is there a way to achieve this?

Thanks.

Hi Shyam, while you can’t place an order to execute at a specific time, we do have a feature called Minutes Validity, where you can set an order to be valid for a certain number of minutes. If it doesn’t get executed in that time, it gets automatically canceled. This feature is not available for BSE F&O and MCX segments. More here – https://support.zerodha.com/category/trading-and-markets/charts-and-orders/order/articles/what-does-ioc-in-the-order-window-mean

GTT order is triggered for buy . Does it means my buy order is placed . If it is so , how can I square it immediately .

Pls provide gtt for commodities too

what happens when the stock price opens down from my SL GTT trigger price and prices both

How to change GTT order from BSE GTT exchange to NSE GTT order

Hi Vijay, you cannot change a GTT order from BSE to NSE or vice versa; it is not possible to directly modify the exchange. Instead, you will need to delete the existing GTT order and place a new one on the desired exchange. More here.

I couldnt change the GTT order from bse to nse before placing order also

Sir, you are a very great man.And your broker company is also very good Never misleads its customers.Nor does she give any useless tips.

Dear sir,

There are three gtt triggered order in my account. I wants to cancel all three, but can not.

So please help me soon

Very informative and easy to understand. Clarified every steps off GTTs in a simple language. It’s good feature for investors to avoid loss and save time. I suggest that before cancelling GTTs for wants of funds or securities, client must be given precautionary warning message to make the funds/securities available in their Demat account before hand.

Is there any possibility to exit automatically if the order is triggered in GTT?

Please explain trigger price and target price

Triggered means buy or sell executed or not ?

Hi Satyanarayana, Trigger price is the price at which the GTT order is triggered. Target price is the price at which the limit order is placed on the exchange when the GTT is triggered.

The GTT order is executed only if the limit price order is filled on the exchange.

GTT very useful..Thanks a lot

Will a triggered GTT buy order be automatically placed once the funds are available, if it was initially rejected due to insufficient funds?

Hi Reddi, the order will not be placed automatically once the funds are available. A new GTT order needs to be recreated once the funds are available.

How to get exchange authorization while putting stop loss in GTT, as no window to get authentication is appeare. The stop loss did not worked whereas the price come down below the stop loss. Thanks.

Hi Gajendra, are you referring to CDSL TPIN authorization? If so, you will have to pre-authorize it. We’ve explained this here.

How to cancel stop loss if I don’t want

Hi Basha, to cancel a stoploss, follow these steps:

• Go to the order window

• Tap on More

• Cancel the pending GTT stoploss order

Note: Stoploss orders cannot be cancelled if it’s part of a cover order. It can only be exited from the order book.

More here.

in gtt order once trigger the price,it placed the exchange. if it is not met the target price the order is cancelled the next day. once trigger , the order is valid for one year not one day. due to the target price is hit, or one year is early.if it is possible it is useful us.

ok

Is gtt order available in MTF Product Also?

Hi Bhupinder, GTT orders for MTF are on our list of things to do. We’ll keep you posted on it.

Any update

Hi, GTT orders can be placed using MTF. More here – https://support.zerodha.com/category/trading-and-markets/charts-and-orders/gtt/articles/how-can-i-use-the-gtt-feature

I want to cancel my GTT order. I am not able to cancel. Can you please help me

On the GTT screen, There are 3 dots after the name of the scrip. Here you can delete the GTT order.

How to make sell order in pre market in Zerodha at the time of listing of IPO.

how to cancel gtt order

Can we use GTT orders for booking our profit or putting SL for long term orders?

If yes, Please specify if there are any limitations? Also, do we need to enter TPIN everyday or it will be valid for one year.

What bullshit you are creating.? Make it easy everything. Give options to Advance users also. I stoped trading because of these complications.

One thing in this TnC seems not correct and one addition is required.

1) The statement which seems not correct is – In section GTT OCO, mentioned that ’This order will executed if you have a stock in demat account and buyer is available’. Here, any shares if we buy then it takes time to till T2 day to reflect in CDSL, that is demat. But i think the stocks which bought on T0 or T1 then also oder will execute. Please investigate.

2) The thing which is not covered or i missed to understand is – Suppose if i place order for SL. Share bought at 100 Rs, SL order in GTT as 96 for trigger and 95 for Limit. Assume if stock has and went to Lower circuit at 95.5, first my order will trigger but not sure by this scenario the will be executed if any buyer is present at 95.5. or it is compulsory that limit should reach 95 then order wille excute, similarly for UC i have doubt please clear.

sir how i can creat braket order (entry/stop loss/target/quantity) using GTT when market is not running

Hi Ashwini, the Bracket Order feature has been discontinued. Here’s an article that explains why.

You can use GTT orders to place targets and stop loss. More on this here.

Why do we have both Trigger price (TP) and Limit sell order (LSO)? Was not TP sufficient? I understood that the LSO should be more than TP.

It is very useful for selling stocks with GTT.

Can you please incorporate feature like, Suppose I want to execute GTT order only between 3.00PM to 3.30PM.

It is very useful to many people , if it is provided

Hi Venkata, will bounce this off our team. Thanks for the feedback.

I placed 2 gtt orders for MON100

1st one was Buy order at 196.5 for 280 quantities and 2nd one was sell order at 200.5 for 280 quantities.

But my sell order got triggered first how can I execute the buy order at the LTP

BPCL STOCK I PLACED A SELL ORDER, SHOWED ME GTT, ORDER EXECUTED, WANT TO CANCEL GTT ON BPCL, IM UNABLE TO DO IT KINDLY CANCEL GTT ON BPCL

Hi Ajaz, once the GTT is triggered it will become inactive and will be automatically removed from the GTT tab. The order placed once the GTT is triggered cannot be canceled or modified.

Dear Shruthi,

my GTT orders were triggers yesterday, but NOT executed. Are these triggered orders still active as on today, as GTT shows status as ”Triggered”. What will happpen to such orders ? It shows validity for 1 year. I want to cancel such triggered orders, but am unable to do so. Please guide / help.

Hi Rajesh, once the GTT order is triggered, a limit order is placed, which will execute at the price you’ve specified or a better price, until then the order will remain pending. We’ve explained this in detail here: https://support.zerodha.com/category/trading-and-markets/gtt/articles/why-did-my-gtt-order-trigger-but-was-not-executed

Once the trigger is hit and the order is successfully placed on the exchange, the trigger is automatically deactivated. More here- https://support.zerodha.com/category/trading-and-markets/charts-and-orders/gtt/articles/what-is-the-validity-of-a-gtt-order

In one single GTT order, i need entry, stoploss, target. Please provide

I want it by one week pls will I get it

Thanks for this feature and a great write up. A quick question on the But GTT order example. Is this correct? The example says limit price (₹1505) to be greater than trigger price (₹1500) and expects it will execute like a market order when triggered – this seems incorrect. Or am I understanding incorrectly?

Hi Anandh, for better execution, its best to keep some difference between the trigger and limit price. So once the GTT is triggered, the limit order will execute at the best available price in the market. We’ve explained this here: https://support.zerodha.com/category/trading-and-markets/gtt/articles/gtt-market-orders

Very useful information and tension free facility provided for trading in desired stock at desired price after market hours. Thanks for the easy explanation with examples.

I m very glad to know that its all time free and time saving to tension information for all friend in this critical time also for money saving. Its best idea for GTT I hv now understand it very clearly

So thx your team

How to place gtt when option value is .05

Can I put a GTT order on an option where the quantity is more than 1800?

Can I use GTT before opening the market

Hello Team,

Can we have option to H-Over on trigger and Price and other tags for quick functionality check ?

Also sorting option for watch lists based on currently available columns(Name,Price change,% change and current stock price)

Thanks

Is it possible to place a GTT with product type MIS.

Fantastic feature in fast varied market index.

is zerodha is working on drag and drop trading feature which is available on tradingview charts? A new OPPORTUNITY feature by which you will capture a new market cap .

Hi Sainath, will bounce this off our team. Thanks for the feedback.

Is it possible to place an order through GTT without any trigger price so that it will be executed at the opening price of a share?

It was a very useful Post on GTT. Thank you.

Is there a feature in Zerodha or can you create one to split my holding into different wallets or buckets such as for long term holding, or short term selling or free shares?

Suppose I hold 100 LT shares and I want to keep 75 for long term and use the 25 for short term trading? This will ensure that I do not have to keep track for each of the scrips I hold.

Hi Muthukumaran, will bounce this off our team. Thanks for the feedback.

My stoploss is triggered but stock is not sell in gtt order.

Is gtt is better’ than bracket order .

I was looking for bo order and requested many time to support team but after reading about GTC or gtt order.i am little bit calm now

. I Will try to apply in Nifty and bank nifty.

HOW TO CANCEL TRIGGERED GTT ORDER IN ZERODHA

Hi, the GTT order cannot be cancelled, once triggered, the GTT will become inactive and will be automatically deleted by next day.

Can we place Bulk GTT orders.? Something like an excel sheet, we prepare all the stop loss and trigger prices for our holdings and click on upload instead of entering single GTT every time.?

Hi,

I tried to place-GTT on Bandhan Bank Qty 390 @ Triggir price- 208.67; Qty- 390; Price- 208.55

Error creating GTT – ‘Cannot add more than active triggers.’

What is this ?

Thank You,

Plz do something about scalpers….some one click order execution and placing order quickly for future price ….make it simple for us

Can i place GTT order for Nifty Option CE strike 26000 in which trigger is based on nifty index price?

Why is the GTT not available for Commodities/ Crude Oil F&O?

If Through GTT , option trade executed in normal delivery, what happen of stop loss if market open next trading day in Gapup/Gapdown

Hi,

For GTT, what is the date it is applicable till? Can we make it applicable for next one week, one month, one quarter etc.?

Regards,

Gayathri

Hi Gayathri, a GTT order is valid for one year or until triggered, whichever is earlier.

Sir”BO ”AMO/PMO me and ”NCL” GTT BUY me ”OCO” bhi diya jaye

Dear sir Still more development required in zerodha application and taking too much time while triggering orders

Hi Sagar, we’re sorry about this. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

i have 2 queries.

1. If i have a stock in T1….. Can i place stoploss?

2. Can I raise buy order with stoploss in GTT ?

Yes, Dipak. You can do both.

Please show the curve contour for price movement in place of straight line shown presently to help the day traders for taking decision accordingly.

Hope it will be revised in the price movement page

Sir how to delete a buy GTT order as after clicking it does not show option of modify or delete

Hi Pankaj, if the GTT order is already triggered, it cannot be deleted. It will be automatically removed the next day.

Actually I don’t understood in GTT that if I put buy order in oco as per my understanding supposed 100 Rupees is the price I wanted to buy at 90 Rupees my target will be 110 and stop loss will be 80 Rupees why GTT is always showing trigger price stop loss should be more than target price .

I had placed GTT BUY order, which was triggered 2 days ago and was not executed.

But that GTT order still appears in GTT book, showing TRIGGERED, and validity of 1 year.

There is no option of deleting such triggered GTT orders.

When will this triggered order disappear from GTT book?

Hi Ibrahim, once the GTT is triggered, it will become inactive and won’t be triggered again. The triggered GTT will be automatically deleted by the next day. If it hasn’t been deleted, please create a ticket on: https://support.zerodha.com/ so we can have this resolved at the earliest.

If gtt meet trigger price specified number stock automatically sold or need TPIN

Hi Prem, CDSL TPIN authorization will be needed if you haven’t submitted DDPI. You can check the status here. If you have not submitted DDPI you can do it by following the steps given here.

I placed two GTT sell orders. After gtt sell order executed the amount doesnt shown in funds. How long will it take to show the amount in available funds

If stoploss is triggered for any stock… Stock will automatically sell or I have to sell it manually? If it sales automatically then after how many hours?

Hi Rahul, once the GTT is triggered the sell order will be placed on the exchanges. The execution will depend on market factors, like price at the exchange matching your sell mit price.

on 05_07-2024 to day i had 72 unit of VRAJ_BE, 0ut of which 30 has been sold

remaining 42 were in my accout

further i placed several order For sell through GTT FOR QUANTITY. -45

-QUANTITY. -30 QUANTITY. -30. ,QUANTITY. -12.

I undrstand that 75 extra unit ( which i did not possess in my account (VQ7357) was placed for sell hence it was not allowed TO TRADE. While they all GTT are triggered

But i am unable to delete it once it is triggered. will it disappear tomorrow.

WHY NOT YOU PLEASE INTRODUCE TO MODIFY & DELETE THE GTT otder once triggered but not traded.

himanshu kumar sinha

VQ7357

Hi Himanshu, we’ve noted your feedback and will look into the possibilities. Thanks.

Please provide option for GTT is valid till what date.

If not executed then it should be cancelled automatically.

Hi Priyank, will bounce this off our team. Thanks for the feedback.

why I can’t place OCO order in KITE Mobile App

Can I use GTT for intraday orders?

Hi Shobana, GTT can be used only as a CNC order and not as an intraday order.

Gtt sell order CDSL tpin authorisation must or not?

The GTT orders selection of Exchange is not available when placing GTT orders. it’s defaulting to BSE.

Thanks for GTT, but I can’t find cancellation procedure, please send details through Email

Hi, Can we place a Target order and a Stop Loss Market order instead of a Stop Limit order when placing an OCO GTT order?

why gtt order window has no option to choose exchange like in normal order create window.

Hi, we’ve noted your feedback and will look into the possibilities. For now, if you want to place GTT on a specific exchange, you can add scrip trading on that exchange to the marketwatch and then place the GTT order.

If I buy intraday and create gtt to sell, it will sell those stocks only right? Similarly for selling intraday and then placing gtt to buy

How to sell shares with dynamic stop loss(Trailing stop loss) limit.

Hi Punit, trailing stop loss is not available as it comes under algo trading. This feature was previously available as part of Bracket Order. We’ve explained why BO has been stopped here

A VERY VERY GOOD CONCEPT.

Can Sell GTT – OCO be used for existing positions in stock options and index options?

triggered gtt order ko kese cancel kare

Hi Dikshita, once the GTT is triggered it will become inactive and be automatically removed from the GTT tab, it cannot be modified or cancelled.

Hi, This is much useful because if trigger not completed, we need to place new one cancelling previous one. Welcome this new measure.

Here, please tell, can I look chart and orders placed in same screen without minimizing one another? For modificiation of order placed while seeing chart, now I minimize chart and open order placed. If I can do modiciation in relevant to chart move in same screen, it would help me please.

Zerodha is a fantastic platform for investment and trading the stocks.It is very convenient to use and many technical analysis tools and indicators present in Kite App helped me to learn how to trade and invest in stock market.

What is mis and cnc while placing selling order?

How to check if poa is signed? And confirm to clarify if I hv signed poa then once the sale order is placed, mo need to do cdsl pin authorisation

Hi Sandeep, we’ve explained what MIS and CNC mean here.

You can check your POA details here.

If it is active, TPIN is not required.

For Sell GTT orders, do we need to authorize on the date of creation/modification of GTT or we must authorize on the date of trigger of GTT?

Hi Punit, on the date ff trigger. You can either pre-authorise it at the beginning of the day after 8 AM or activate a DDPI to avoid the TPIN process.

Pls provide entry stoploss and Target in one order together, in gtt SL is given only when I try to sell, it should also be given with buy order, Amo/ PMO should also be given with buy order along with Target and SL

Sir please provide Bracket Order in position stocks entry in long term

Hi Saheb, the bracket order feature has been discontinued for some time now. Here’s an article that explains why.

Is there any charges if buy GTT price triggered and enough money in account OR sell GTT triggered and not enough stock in the account?

Hi Vinayak, GTT is completely free, and it has no additional charges.

Please provide the explanation about the need to authorise the delivery of your shares using CDSL TPIN. This is not applicable, if you’ve submitted a POA.

Hi, we’ve explained why you need to authorise your shares with the TPIN here.

Yes, this is not applicable if you have already submitted a POA.

hi this is karthik , i have a question regarding on auto upgrade stoploss or target

ex; my price is 100 stop loss is 90, target is 110 but when it goes 105

my stoploss is 95, target is 115 but it goes 110

my stoploss is 100,target is 120

this feature is available in zerodha,if ia where i can find it?

As I did some transactions of F&O in GTT , but now I want transactions in normal , then I close GTT

I have an active GTT for sell placed which I need to delete but is not getting deleted saying trigger price has been activated.

The order has already been rejected.

Kindly help me delete this GTT

Hi Saurabh, once the GTT order is triggered, it will become inactive and the placed order can be canceled by going to orders screen. The inactive GTT order will be automatically deleted from GTT orders tab by next day.

I want to enable GTT order.How i do it?

Hi Gourab, you do not have to ”enable” GTT; it is a feature already pre-existing. Here’s how you can use it.

Dear

I want a pdf view of my investment with charges

Kindly include MIS order option in GTT orders.. Otherwise the app is jus perfect..

Hi, thanks for the feedback. We’ll check on this.

Hi, I creat the GTT, but it creat in BSE, how to change the GTT from BSE to NSE.

Hi Guru, you cannot modify the exchange in a GTT order, you can delete the existing one and select the stock from the preferred exchange and then create a new GTT.

SIR PLEASE TELL.HOW TO. CANCEL GTT CREATED ON RPOWER SHARE

Hi, GTT orders can be canceled by going to Orders > GTT on both Kite web and mobile app.

As sell GTT will not be executed then what to do so that a sell GTT can be executed.

How to create GTT at lower than LTP

Hi Dhrubajyoti, the process remains the same.

Would it be possible to provide an option to set an absolute price for TP and SL instead of a % value ?

Setting % value means that in order to set a precise TP and SL values I need to convert the price to % value that matches my precise TP and SL points and then enter that % in the order ticket.

Hi Lakshmi, your feedback has been noted. We will check into the possibilities.

Why no TRAILING STOP LOSS feature????? . I’ve waited a long time for this feature in GTT. Planning to move my ionvestments elsewhere as this is a crucial feature for my strategy of trading and i belive its the same for lots of other traders.

Hi Joji, trailing stop-loss is not available as it comes under Algo trading. This feature was previously available as part of Bracket Order. We’ve explained why BO has been stopped here.

If I want to place a Buy order with stop loss as well as target, then I will have to place two GTT orders

1. GTT to buy when desired LTP is hit

2. Another GTT Order with OCO option to sell either at stop loss or at target price

Why don’t you provide a common single GTT option for this ?

Hi Vivek, your feedback has been noted. We will check into the possibilities.

This GTT is a great feature indeed. Only yesterday I decided to move my portfolio to Zerodha (from a full service provider) mainly due to GTT. You will see over the next month the actual size of my portfolio when the move fully happens.

I request you to include a BUY example where the buying price is lower than the LTP.

I mainly would use GTT for two purposes:

a. For not having to enter orders every day – both BUY and SELL

b. To place orders outside the daily limits

I think GTT feature of kite is very good but I want you to make it possible that Entry, Stop loss and Target orders can be placed together even after market hours

Hi Kamal, will bounce this off our team. Thanks for the feedback.

Why Market price option is not there in GTT for Options

Hi Deepak, you can use GTT order as a market order, we’ve explained how to do it here.

Sir,option trading me iska use kar skte he.

Why GTT order are not been allowed for commodities market

Hi Gourav, GTT orders are currently not available for Currency and Commodity F&O. This is on our list of things to do, we’ll keep you posted on it 🙂

Hi Shruti any update on this

Hi Shruti,

Its been more than a year since this comment, is there any update on GTT for commodities market now

OCO is a feature I have been awaiting for. Excellent. It is very nice that you & your team keep thinking about features those will be beneficial to your users. Thanks a lot.

Heard that you had some Heart related issues. Wishing you a quick healthy recovery !!

I am absolutely New player in this field so I want to know how we can cancel the stoploss and trigger status because I want to hold my portfolio for long time but we observe my shares sell on trigger price but I am not interested to sell the same.

Hi Rajbadhur, you can cancel the GTT order anytime by going to Orders > GTT.

GTT got triggered but since CDSL not authorised order not executed .

Now it is showing as triggered but not executed . How do I sell my equity now . I am not able to delete the GTt , how do I delete the same

Hi, If I am creating a GTT for buying a stock, would I have to add funds in the demat account then or it will ask for funds when the price is triggered? For ex- If the trigger happens at 11 AM but the stock price still moves upper and there are no funds in the demat account at that time. What will happen to my order? I am asking this because if there is any idle fund in my demat account for a longer period, it gets transferred to my bank account automatically.

Thanks

Hi, you will have to ensure you have the funds available in your trading account. Else it is bound to be rejected due to insufficient funds.

Very nice platform created fro small investors who have other work during market hours, no need to login or fear of losses when persuing other work

Thanks

Why my gtt rejection??

How can sell my holding shares tell meee

Very nice feature leaving us tension free, thus saving time and keeping us worry free.

How can i authorized cdsl tpin for sell gtt order

For all time

Hi Manish, your sell GTT orders need to be pre-authorised using CDSL TPIN every day since the validity of the TPIN lasts only for a day. Alternatively, you can submit a DDPI to avoid using the CDSL TPIN.

How can we Authorize with CDSL after GTT sell is triggered?

Hi Tariq, the GTT sell order needs to be pre-authorised. We’ve explained how to here.

Hi

Plz generate my GTT application

Thank for unveil of ZERODHA application because now knowledge of market and sensex made easy.

Can i not place GTT’s for intraday options positions?

Hi Goutham, GTT orders can only be used for CNC/NRML product types, not MIS. However, with CNC or NRML you can buy and sell on the same day, and it will be considered an intraday trade.

My GTT is triggered. I don’t want to authorize CDSL and sell the instrument now. How do I cancel my GTT now?

Hi Aasif, once your sell GTT is triggered, your order won’t be executed until you authorize it via CDSL TPIN. If you don’t wish to sell the instrument, don’t enter your TPIN and authorize the sale.

BTW, once the GTT is triggered, it’ll become inactive. If your order isn’t executed, it’ll show as open in the ”Orders” tab, and you can cancel the pending order from there.

I’m unable to generate GTT in my demat account. Please help me Sir.

Hi Chowdhury, what seems to be the issue? Could you please create a ticket at support.zerodha.com with details of the issue, so we can have this resolved at the earliest?

Gtt is very useful

After creating a GTT for SELL, How do we get the CDSL authorisation to ensure that the SELL goes through?

Is it possible to change the Exchange, i.e., NSE to BSE or vice versa?

I can not update GTT asy price.

System not allow to keep SL and target less then 0.25%.

So we cant keep SL and target at our price..

Why there is 0.25% is mandatory??

While buying orders u have provided GTT in % for stoploss or gain…pls modify both option in the form of % or digit while buying in mobile app.

Why OCO is not allowed for intraday (MIS) F&O? Please add support for this.

I have a stock in my holding. I want to create a gtt that gets triggered when stock price reaches 3,00,000. I am not able to do the same . Please help.

Hi Puneeth, what seems to be the issue while setting up a GTT? BTW, you can set up a GTT with any price less than 1,00,00,000.

Hi

Is there a way i can create /import bulk gtt orders for holdings. i see this feature is useful more often is what i feel. kindly share us the information on how to it

–

Ram

Hi Ramalingam, you can create 250 GTT orders at a time.Explained here.

GTT is valid for one day only or for long term also?

Hi Dinesh, we’ve explained this here.

A good feature!

Have a query though!

GTT was placed at a higher price for sell. GTT gets triggered when the price was reached. Since CDSL authorisation was not made, the item could not be sold.

Now, later in the day, price being higher than the triggered price, if the seller gives authorisation, would the time be sold at the triggered price or the new price at which the seller wants to sell?

It would be helpful to receive a reply!

Thanks in advance!

Hi, once a GTT is triggered but fails execution, it will remain failed. You can manually execute a new order by authorising the sell order with a T-pin. To avoid this, you can pre-authorise your GTT sell order, explained here

Feature request: Please add single execute/submit switch for all GTT orders, what happens when market starts at 9:15 some scrips have abnormal rate fluctuation, so if execute or submit button available than user can execute all GTT order at their own time.

My GTT is triggered, did not execute due to lack of a CDSL PIN. I want to cancel / modify the order. Unable to find a way to do that. Pls advice.

Hi Rao, once GTT orders are triggered, they cannot be modified or canceled. You can pre-authorize the sell GTT orders here.

HI ,

i have another query for gtt order.

why cant you provide trigger price and market price order inspite of trigger price and limit price order for target and stop loss.

it will sure execution of gtt orders.

Is the any limitation from exchanges on market order for gtt.

Thanks

I am waiting for reply from you people for my last question its more than half month still no answer.

Can we use Sell Type Single GTT as a Stoploss?

When we place order for options for overnight position we have gtt option but there is only % option showing they should have both absolute amount like stoploss 30 points target 30 points.it will be help a lot.

We’ll check on the possibilities, Rakesh, Thanks for the feedback. For now, if you want to make any midifications to the GTT order you can do it by going to Orders > GTT.

HI ,

i just talked to customer care and lots of people have same demand to display in absolute nos in place of percentage but you people do not look serious. I am working in option and you know how much volatality is there.

we are going to calculate percentage into nos and we do not have time for this.

Please do this asap.

Thanks

If we have a sell GTT active. Do we need to authorize the delivery shares using CDSL TPIN everyday?

Yes, Phani. To ensure that the order isn’t rejected once triggered, you will have to do CDSL authorization everyday.

Last Wednesday I had placed an GTT order for stoploss it didn’t triggered and I loss Rs. 6015/-

Pl refund the amount

Hi Vipin, we’re sorry to hear this. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

I am not able to delete GTT order, please,thanks.

Hi Suryakant, only active GTT orders can be deleted. Triggered GTT orders cannot be deleted. We’ve explained how to delete them here: https://support.zerodha.com/category/trading-and-markets/kite-features/gtt/articles/delete-gtt-order

Gtt nahi lagta kiv

Hi Ganesh, could you please create a ticket at support.zerodha.com with more details? Our team will check and get back to you on this.

How do I create an order having validity of more than 1 day (user defined expiry date)? Let’s say Infy trades at 1400 and I would like to buy it at 1200 (+- 5% is okay). Rather than logging every day I want system to buy it for me when price gets triggered. Is this possible?

Hi Abhishek, you can already do this using GTT orders. However, the validity of a GTT order is one year from the date of creation or until triggered, whichever is earlier.

GTT for Sell has triggered once, but i dont want to sell the shares now. iam not able to remove the GTT now. unknowingly i selected GTT while buying i wanted to keep the share for long time

Hi Karthikeyan, once the GTT order is triggered it’ll become inactive. The order can be canceled from the order’s screen, if not executed.

Hi Karthikeyan, if you haven’t already pre-authorized the sale, you can avoid entering the CDSL TPIN & OTP if you don’t wish to sell your shares. Once the GTT is triggered it will become inactive and will be automatically removed from the GTT tab. The order placed once the GTT is triggered can be canceled from the orders tab, (if already not executed).

Coz sometimes support level is at 1490. If its break Then We will Buy it so

How to cancel/delete a triggered order?

In case a lower trigger(Means LS) actuation will target be still considered if SL price is not reached.

Hi Arvind, once the GTT is triggered it will become inactive and will be automatically removed from the GTT tab. The order placed once the GTT is triggered can be canceled from the orders tab, (if already not executed).

Hello. For GTT can we add feature of sorting as per alphabetically. After placing few orders, one needs to check manually which is added and which is not.

Hi Laxmi, you can sort using the alphabets on the web. However, this option isn’t available on the app, we’ll pass this as feedback and look into it.

In the GTT Buy Order example:

”Current price of Reliance = 1485.30

Trigger price = 1500

Limit price = 1505

In this example, if the trigger price of 1500 is hit on the exchange, a limit buy order at 1505 is placed….”

Why would anybody do all this to buy at 1505 when it can be bought at CP of 1485.30? Am I missing something? Or, is it sell function applied, as it is, to buy side. Make sense in selling at a target price, but not to wait and watch and the buy at higher price!

Hi! I placed a Single Sell GTT order for Titan today where my Trigger Price was higher than Limit Price but as soon as my trigger price hit my holdings were sold even when the price did not come to limit price. Shouldn’t my holdings be sold at limit price set by me and not trigger price?

Hey Hursh, a limit order will execute at the price specified or a better price, that is the price specified for a lower price for a buy order and the price specified or a higher price for a sell order. When your GTT was triggered, since the CMP would be higher than the sell price specified, the order was executed at the best available price in the market. We’ve explained this in detail here.

I had created OCO GTT order on LT22OCT 1900CE NFO today with SL 36.75 and target 51.15. GTT was triggered at 9:18:54 but could not fire, why? what is the reason? I am sitting at 3735 loss.

Hey Sampat, once the GTT order is triggered, a limit order is placed, which will execute at the price you’ve specified or a better price. If the price goes beyond the limit price specified, the order will remain pending. More details here.

how to place bulk gtt order in zerodha

I just switched over to Zerodha due to discount brokerage and found that it doesn’t have bracket orders, huh!! BO orders are the most important for Risk Management as we can’t be trailing SL manually with other order types. Will move out to other brokerage till Zerodha brings back BO orders as my strategy heavily dependent on BO to minimize loss. Wake up Zerodha and help retail traders.

Zerodha is really worst .. don’t use this app . many times i have raised the complaint but still no there is no response . this is the very worst behavior and too worst .

I have created the GTT on 18-08-2022 it was created but next day ie 19-08-2022 07:33:00 am it was expired . Very worst behavior and cheating the people .I have evidence for that .

Zerodha is very big and No.1 flatform for Trading.

I feel bad, about trailing loss is not available

Hi Team,

2 features require into GTT order.

1. Bulk GTT Order create using excel

2. Bulk GTT Order Delete from the GTT Screen.

Hey Harsh, we’ll pass this on as feedback to the concerned team and will look into the possibilities. Thanks.

Hello,

What is the progress in the ’Bulk GTT order through excel’?

Also, what is progress into merging the equity and commodity account into one?

We are waiting for above mention problem to be solved from a long time. it is nothing but the sheer loss of opportunity.

Thanks,

I placed a GTT order while buying nifty option premium. The GTT order is still showing in the order section even after 2 days my stop loss got executed. Is this order still open? Why it is taking long to get disappeared.

Hey Soumyajit, once the GTT is triggered, it will become inactive and will be automatically removed on the next trading day.

holding option i create gtt (OCO) i see on top stock BSE,,, but i was buy NSE stock~ which my hold ,,will it create any problem / charge

Hey, stocks in your demat account don’t have any exchange mapped to them. You can sell the stocks on either exchanges, there are no additional charges for this. Kite holdings display the exchange price where the previous closing was higher. Explained here.

thank you for respond / reply

Thanks for this wonderful feature… I would like to provide suggestion if we can put market price order if GTT hits triggered price…As current price is 100 and Triggered price is 102 than system automatically place Market price order… It will help to buy at Open Price purchase… thank you….

Hey Vatsal, in the above scenario presented by you once the GTT is triggered, the order will execute at the best available price in the market, but not beyond the limit price specified by you. We’ve explained how this works here.

suppose if i place trigger of 100 rs and limit buy price 101 but in volatile market suppose market move direct from 99 to 105 will gtt get trigger or not??

Hey Nandan, the GTT order will trigger, and limit order will be placed at the price specified by you. If the price moves beyond the price specified the order will remain pending. For better execution, you can keep some difference between the trigger and limit price. So once the GTT is triggered, the limit order will execute at the best available price in the market. You can check out this support article for more details.

hi team how to calculate GTT target percentage????

plz explain in option trading not equity

Hello team,

I had 25 qty(buy) BANKNIFTY in my account which I was holding from yesterday. I had kept a GTT(sell) for it but then I manually exited it(Sell). I forgot to delete the GTT. After this point, I have no BANKNIFTY future holdings in my account. Neither sell nor buy.

Later in the day at 3:16 pm I see that the GTT has been triggered and a BANKNIFTY SELL order has been placed. Can you please change this feature because as I manually exited my position and also there were no other banknifty future holdings in my account the GTT should not have been triggered and order shouldnt have been processed. Even if it gets triggered it shouldnt have been placed because I had no bank nifty futures in my account to be sold.

Thank you

BNF futures can be sold even when you do not have an existing position. You can Buy then Sell a future , or you can Sell and then Buy a future.

how will zerodha know you are sqauring off or creating a new short position….the feature ur demanding makes no sense…it will be annoying for person who want to create fresh short and at same time his gtt for open position will also get cancelled…

In option trading nifty buying a call in GTT oco order how to place a order and stop loss.

Hey Pranay, currently you’ll have to visit the GTT order page to edit or modify your trigger price. We’ll take this as feedback and will look into the possibilities. Thanks!

Hi Team,

While placing a normal GTT order, the trigger price and target sale price is the same. We have to edit the trigger price once the order is executed. Can you please add a option to set the trigger price on the first page itself so that there is no need to edit the trigger price.

Please provide an import option, from excel into GTT.

Hi,

Below as per Zerodha expalination w.r.t GTT help

——————————————————————–

https://zerodha.com/z-connect/tradezerodha/kite/introducing-gtt-good-till-triggered-orders

Buy GTT

Buy GTT can be used to creating triggers to buy stocks for delivery. When the trigger price is hit, a buy order with the entered limit price is placed on the exchange.

Consider the example in the image below:

Current price of Reliance = 1485.30

Trigger price = 1500

Limit price = 1505

——————————————————————–

MY QUESTION

Can i use GTT the same to Below current price

Current price of Reliance = 1485.30

Trigger price = 1300

Limit price = 1290

Anyone please confirm. OR Someone from Zerodha please confirm if the above is possible where i place GTT orders to get good entries /buy on DIPs

Hey Sunil, yes, you can use GTT order to buy below the CMP as well.

Old content and poor GTT plateform..pathetic..why are you not allowing BO/AMO/PMO too..conect with me if its under paid serives ..dont know where to connect and have the complete demo of using ZERO..you wanna make now peoples money to ZERO

Good evening traders

I am novice to do trading at Zerodha and today being second day, few points to ponder and I may be corrected for inexperience.:

1) On FNO segment and on position page, once the order get executed ,you get only the P&L and LTP(Which keep changing),Theres no sign of Bought price and sold price.

2)On execution of orders on similar strike(Option) NIFTY 17500 CE/PE the cost price change to the cumulative avg price of the same strike price.

Problems I encountered :

Scenario One:If your previous trade on FNO Cost price was Rs 100 SELL price @ 110 and you generate a profit of Rs 1000(Nifty Lot 50)

Scenario Two: Current trade on same Nifty 17500 CE/PE and I bought the strike at Rs 110(Nifty 1 Lot=50),and now my cost price shown in position page as avg Rs 105 (when compared to Previous order bought at 100)

Now I see on screen that my avg price is at 105 and I decide to sell off at 108 thinking Rs 3 profit, however actually I am loosing Rs 2 x 50 =Rs100/Lot) on my second trade.

The cost price appears for a second while buying the lot but it disappears very soon and you tend to forget or notice what price you bought for and get distracted with the avg price on the position page.

Can something be done to it ?

Its better to have the cost price of each trade while doing the assessment on your position during trading time and even before execution and sold/sq off price at the end of the trade with P & L and LTP.

pls do revert.

Cheers

Pls introduce square off all position with one click on the counter. Merits and demerits are well known to all traders….as well as to the administrators here.

A No 1 brokerage farm must meet the minimum expectations of traders.

Cheers

Check the executed orders under the order Tab.

the live prices that you see, are in the ”position” Tab and the ”order” tab is on the left side.

Sir,

I realised that FROM MARKET WATCH I CAN CREATE A GTT ’CNC’ SELL ORDER FOR STOCKS WHICH I DON’T EVEN OWN !!!!! How is this possible? This shows:

1) The GTT order system is flawed. In CNC, how can I sell stocks which I don’t own?

2) The GTT sell order created from market watch is not linked to the holdings.

Also, there is no provision to choose the exchange. In some cases, it is either BSE or NSE by default.

Please provide feedback on these issues and resolve them.

In Zerodha GTT Sell OCO order placed, say last day closing rs.100, Target Trigger price Rs.107 & limit price Rs.107. if the opening market price is Rs.110. …at what price sell will happen?

Can GTT be used for Stock Future buying or Selling ?

People talk much about Trailing Stop Loss.

Is it available on Zerodha?

Probably, this question might have been answered somewhere. But honestly, no time to search.

Please do reply.

Can I place a GTT Buy Stop Loss Limit order?

E.g, CMP is 10, I would like to buy @10.6 only when LTP crosses 10.5. How can I do this using GTT?

WILL GTT STOPLOSS CAN BE TRIGGERED IN PRE MARKET OR IT WILL ONLY GET TRIGGERED AFTER 9:15.

Hi

Cover order Banned by Zerodha from today itself for Bank Nifty and all other option trades.

Can we use GTT order in place of cover oder. Is it working or its also banned for Bank Nifty.

Please confirm.

No need to me, how to cancel gtt if creat by mistake.

Let’s say i want to buy Naukri Futures @6700 rs, 1 lot, positional. I want to keep a stoploss @6030. So, can I say buy Naukri Fut 1 lot at 6700, GTT Stop loss -10%? Would this GTT SL Order exit the current long position of the future or create a fresh sell order? Please do let me know.

Dear Team,

GTT and watch list is a very useful feature.

Many like me are feeling that a maximum of 50 GTT and 250 watch list per account is not sufficient.

Please increase it both up to 500 and 1000 respectively , so it can benefit us more

I saw some comments above, they also requested to increase the GTT and watch list limit of 50 and 250.

Please consider our request

Thanks and regards

Umesh Gupta

Sir,

I am a new user of Zerodha.

I placed a GTT order for a stock on 06.08.21. The GTT was triggered on stoploss side on 09.08.21 morning before aurhorisation to CDSL for sale. As a result the GTT order is not executed till now inspite of authorising. Price of the stock is falling further, but I do not understand what should I do now.

Please advise early to avoid further loss.

Regards

KK Ghosh

How can option writers use GTT feature? It seems like the current validation logic restricts them from placing GTT because SL must be a negative percentage (which is a positive % for an option writer) and target must be a + % (which is a negative % for option writer)

I also have this query. Eagerly waiting for reply and resolution.

Dear Team,

GTT is a very useful feature.

Many like me are feeling that a maximum of 50 GTT per account is not sufficient.

Please increase it up to 200, so it can benefit us more

I saw some comments above, they also requested to increase the GTT limit of 50

Please consider our request

Thanks

Sandeep

Please

Hello Team,

I had one doubt about margin requirements using GTT orders.

consider this example;

let’s say I’ve 4L as my capital, & I bought say 10 lot of Bank Nifty at avg price of 450.

So net margin needed should be 1.13L.

Now Let’s say I place GTT OCO order, so either my SL or TGT gets triggered. In this case, when the order gets triggered would I face margin issues, or I don’t need any additional margin in my account?

Some brokers allow Bracket Orders (BO) in Index options, & with above example I wouldn’t face any issue, placing BO. I hope GTT OCO for index options is a substitute for BO on Intraday level, since you don’t allow BO anymore.

I shouldn’t really any additional margin (when GTT is triggered) is my understanding, but pls advice for above example.

How to auto-trigger purchase when the stock price dips to a particular level from LTP?. The example cited in the ”Buy GTT” section of the above page shows current price of Reliance as 1485.30 and the trigger price as 1500. Why would anyone prefer to buy when the stock reaches a higher price. Is it possible to set auto-buy trigger price below current price so that order can be placed automatically with-in next few days whenever there is a dip in stock price?.

I see GTT is very useful feature and many of Zerodha’s customers including myself are using it extensively. I do all my trading through GTT. Many like me are feeling that maximum 50 GTT per account is not sufficient. I would like to know following things from Zerodha.

1. Why there is limit of maximum 50 GTT per account at first place?

2. Is there any plan of increasing this maximum limit? if yes, How many? My personal suggestion is that at least 200 GTT per account is required.

Hi..

If a stock closed at upper circuit….. and if, I placed buy GTT at next upper circuit after the market.. So, at what sr. no. do my order will stand.. I mean i will be considered as first buyer next day or have an advantage for buying the stock than other people who add manually next morning for the same stock at upper circuit. Pls elaborate.. How system works ?

Sir,

does GTT stop loss trigger takes care of Gap Down opening. Will it trigger ?

For GTT orders, can you provide an option to have Stop-Loss Market price instead of insisting on a Limit price always ?

In many cases, if the market gaps up or down, the GTT gets triggered, but the order is not executed if the market price is above the set limit (for Buy order) and below the limit (for Sell order).

Please provide an option just to set the Trigger price, and let the order be executed at the market price.

ONCE TRIGGERDED CAN A GTT ORDER BE MODIFIED OR CANCELLED, IF YE THEN HOW?

Will GTT place orders in pre-Open market hours ? There are few stocks which open in UC and lot of pending buy orders. What i know is that if some body sells when multiple orders are there, then priority is given for orders which are placed first.

Is there any option to place order on priority during pre-open market hours from Zerodha ?

I have placed Buy order in GTT which got executed also I have placed the same order for sell which is triggered and i exit from this trade so there is no any order i can see in position but still I can see the same order for selling executing on Days Order List, will that we lose for from my account?

Is there no option to have GTT for Intraday cover orders?

We really need this feature and can’t go to losses without booking profits.

If this can’t be done on Zerodha, we’ll have to look on some other brokers.

Thanks and please respond to this.

GTT has a very NEGATIVE FEATURE…I have placed a BUY order for RELIANCE with TRIGGER PRICE.. YESTERDAY it was triggred but TRADE is NOT EXECUTED so far..NOW I WANT TO CANCEL or MODIFY the order..it is very sorry to say that the order is now shown under the TAB of PENDING ORDERS and under GTT tab the order is shown as TRIGGERED and not ALLOWED to do anything..As per your website, such orders can be modified under PENDING ORDERS TAB.. But THERE IS NO SUCH FACILITY.. TODAY, I tried calling CUSTOMER SERVICE, but no one answered, as usual..I have sent a mail to DP@ZERODHA, the reply is they will attend to the ticket in 24 hours..LACK OF ORDER MODIFICATION FACILITY FOR triggered, GTT orders speaks very POOR about ZERODHA.. May I hope you will look into this??

Sir

Need Trailing Stop Loss Option. Earlier i use to do in BO orders but that option was removed off late … Trailing SL is very much required for traders.

This is on our to-so list, Ramakanth.

I cant see the option to create GTT for intraday.

Can you help me with how to do so?

Thank You

Can I place gtt for an after market order of F&O?

Super feature for working professionals, no need to keep checking the price movement to place/exit orders.

Just enter the price or % , and place an GTT order, system will automatically take are buying/selling at pre-defined desired price.

You guys are rocking in bringing the innovations to the Indian Stock Market.

Hoping many more innovations.

Cheers

Active investor through Zerodha

Super feature for working professionals, no need to keep checking the price movement to place/exit orders.

Just enter the price or % , and place an GTT order, system will automatically take are buying/selling at pre-defined desired price.

You guys are rocking in bringing the innovations to the Indian Stock Market.

Hoping many more innovations.

Proud of the entire Zerodha family.

Cheers

Active investor through Zerodha

Hi, I am trying to create a GTT, I put the company name in the Search however its just searching I the details are not getting displayed.

I tried putting several companies but it doesnt work. Just keeps searching, no info displayed. Please advise.

Hello,

1. Whenever I tried to pay-in through UPI payment, bank (ICICI Bank) is declining. As a result I am using Net Bankiing and for that payment, Zerodha is deducting an amount every time. Why my payment to Zerodha through UPI is being declined ?

2. I tried to place a GTT order for sell of a scrip (I am having that much scrip in my demat account) as trigger price 158.65 and limit price 158.95 (market price was 155.30). Unfortunately, the limit price was placed as 185.95 (due to typing mistake). In fact, I had not noticed it at the time to place GTT order. Now, the price has triggered but naturally the order was not executed. As a result, it is showing as ”TRIGGERED”. In GTT order, it is still (after 4 days) showing as ”TRIGGERED”. I tried to cancel it and place a fresh GTT, but can’t do it. My question is How it should be cancelled and I may place a fresh GTT order for that particular scrip. Will it be automatically go if I place a new GTT order ? Now the scrip is trading aroung 165, so I would like to sell it.

Please clarify.

Dipika, Try using NEFT with the bank account registered with Zerodha it is free at Zerodha and as per RBI it is free even for any bank. Also try support pages to cancel GTT if not try to amend / modify GTT Limit price.

mr SAMEER, you have advised DEPIKA to go to SUPPORT pages to CANCEL or MODIFY the TRIGGERED GTT orders, but I am sorry to say, there is a suggestion there, to go to PENDING ORDERS and MODIFY.. I am asking you, whether, you have done practically? Please try one GTT order for yourself, get it triggered and see. EVEN FOR DAYS, IT WILL BE LIKE THAT WITHOUT EXECUTION AND OUR FUNDS WILL BE BLOCKED…THIS IS A VERY BIG LACUNA IN YOUR SYSTEM, WHICH NEEDS TO BE ADDRESSED IMMEDIATELY….

MY CASE IS A LIVE EXAMPLE AND IT IS STILL PENDING….THERE IS NO HELP FROM CUSTOMER SERVICE, AS USUAL..

I am new to Zerodha and reading this GTT order example , I still do not understand this example given for BUY GTT order in CNC (cash) section. Which is mentioned as bellow.

Current price of Reliance = 1485.30

Trigger price = 1500

Limit price = 1505

Can any one elaborate why should I place GTT to buy at 1500 or 1505 (Limit) when Reliance current market price is 1485.30?

please provide a feature to define default stop loss, why because ’m doing intraday I’ll take 10 to 20 trades approximately everyday so what’s happening here in every single trade i should change the stop loss from -5 to -2.

Please add some option to define fixed stop loss while placing the order it will automatically enable the GTT stop loss with defined one.it will be very useful to everyone

Thanks,

Sashikumar G

Hi, I by mistake I have crested one GTT sell and my account also debit the amount ! I have holding for same CAMS and wants to simply sell those and by mistake create GTT sell option, Pls guide me how to cancel that, trying to do but unable to do so ?

Pls help, I am new in your platform

What time will GTT execute on next of trading i mean if i place a GTT for any stock and that stock is on UC then my order will get placed at sharp 9:00 am or will be at 9:15am

Direct numbers would be good rather than the percentages in NFO for SL and Target

We need more than 50 GTTs atleast 150-200. Even if you want to charge, its okay. But please increase the number of GTTs that we can place from 50 atleast to 100 if not more. Also is there any other way that we can place GTT like orders if you are not providing such facility?

Would you please consider increasing number of GTTs per account to 150-200 instead of just 50. Its okay even if it is a charged service.

This should be available for MIS/Intra day orders as well. It is unfortunately not available for that.

I need to place stop-loss and target both during the day and I want one of them to be executed and other gets cancelled.

This is pretty standard feature in all brokers outside India.

can a gtt order be placed in illiquid stocks like sakar healthcare , in which selling is not permitted on same day, if gtt is placed and triggers, what will happen?

mra gtt sell nhi ho rha hai. sell kr rhe hai to reject ho rha hai. normal m bhi sell nhi ho rha hai

Hi,

I have a suggestion to enhance this feature :

In addition to cash, can you provide a provision to use liquidbees instead of cash for funding the GTT buys ? As we do not know when the GTT order is going to trigger, it would be better to have the cash in the liquidbees.

Looking forward to hearing from you.

Hey, this is not possible since you need an up-front cash margin to take trades.

Please post an official video of placing GTT including that in options

Need target and stop loss trigger to work in MIS order.

can i placed gtt in intra day

Hi,

Can GTT be used for Intraday orders (one which are not settled)?

Dear Zerodha,

I dont know how to use Zerodha much as I am a fresher.

Pls clarify as to why do we need to place an order with higher price while creating a GTT, while buying a share at either current value or lower value..??

Thanks

Sorry , cancel my above post . I had to click on GTT . Got it, it is there.

Sir, It is a GOOD idea to protect your portfolio by placing GTT. This will /should protect against the sudden fall .Thanks . I will try Target price also. Thanks once again.

Dear Nitin , I liked this feature of creating GTT. I learned today only. Read most of the comments and the blog as well.

I have just ( On a Sunday) created a GTT for one of my stocks for stop loss limit sell order. The stock is trading at 345 and I have placed sell order ,Triggr at 338 and limit also at 338 ( It could have been 337,336 332 etc Am I right here , it has to be equal or lower than the trigger ?).

But when I look at the order book , there is no indication. It should be visible for modifying ,or may be because it is Sunday today. But off market hours one can place such orders ,I presume .

Kindly clarify ?

i am a new comer with Zerodha.

How to open the screen for intraday trading???

Will I still be required to authorize my GTT sell order.

Today I have place the limit order. The order reached the limit price. But the order not successful.

i have put gtt order for selling stock. i authorise order daily night. but still when my stoploss hitted it showed that you need to authorize your share. plese give solution of this problem.

one of my stock triggered at Rs.10.5, but not executed due to CDSL authorization. Now price of that share is Rs.10.25. I am not able to edit or delete the GTT. How can I edit or delete the GTT?

You’ll need to create a new GTT. The triggered GTT cannot be edited.

When a GTT is triggered, now It should be in the GTT list, right. A GTT that got trigger 10 days back is still on the GTT list, but why?

Triggered GTT should be removed from the GTT list just like the orders list gets refreshed on daily basis.

I have doing stoploss Gtt but somthing is rong hapend pls halp

In Gtt one thing missing in buy order trigger price for purchase price in OCO if I want to buy 100rs mp stock at 105 then trigger price stop loss and target should be activated

How to remove a already ”TRIGGERED” GTT order from my GTT Order List ?

I have taken a position in options, say, sold call option of a stock. Now I would like to exit the position when price reaches a particular level. Usually, I keep watching the price and square off the sold call position by buying it back9Exiting the position). Now, under the GTT facility, I can place a separate buy call at the required price under GTT. But will it be treated as a squaring off of sold call option?

Dear CEO Mr. Nitin,

Thank you so much for this. I stared using recently for buying options. now I’m able to control my losses by machine and sentiments, emotions are not in picture. I need to decide only how much loss i can bear. Usually the options returns are much more if losses have been taken care. I made great losses due to emotions. Thank you.

One Question-

Generally I do trade for intraday. and successful in closing positive, But if I carry forward an bought option for next day. and market gap opens in other direction then how SL trigger will act.

For example I purchased Nifty option at 100 with stop loss of 5% . i.e if option value hits 95 SL will trigger but what if on next day option price hits 90 or less at open on next day will SL trigger as it is set to 95? or it will wait for option price to hit back 95. If it is so then I wouldn’t venture to carry forward option as it may never hit.

Seek your advice.

and Thank you again for featuring this.

1. It would be helpful if the buying of a stock with target and stop loss is enabled in GTT also like in the case of Bracket order.

2. It would be great if the trailing of stop loss is enabled in GTT.

Suppose I place a GTT order for buying Call Option on Tuesday (T-2), lets say for a premium of Rs. 10 per share, lot size of 6500. Trigger is set for 10, price to be executed is also 10. CMP is lets say 15.

Now, the trigger is activated on Wednesday (T-1) or Thursday (T), but will the order get executed, as exchange doesn’t allow to enter fresh long position on Wednesday and Thursday?? Does the GTT order get registered at Exhchange on Tuesday itself?? Or does Zerodha place the order with exchange only once the trigger is reached, lets say on Wednesday or Thursday??

GTT seems relevant. How about a GTT at a portfolio level, i.e., across a set of stocks or other assets?

How to place SLM (Sell) Orders for Nifty / Bank Nifty options in GTT ?

Can you enable the GTT feature for Intraday(MIS) trading as well?

GTT is meant for overnight orders. If you want to trade intraday, you can use normal SL and limit orders. 🙂

I can use GTT for overnight orders to set target & SL and need not monitor it as either will be hit & executed. I cannot to same with intraday trades. If I set GTT on it and it it’s triggers trade is executed in NRML mode and doesn’t square of my position. Why can’t you trigger a trade in intraday if underlying trade is in MIS category? Is there any way to set target/ SL for intraday trades?

Where we can see the placed GTT?GTC?

GTT buy order example looks incorrect—If the price of a stock today is 1485.30, why will I want to set a GTT order to buy it at 1505—I would rather buy it right away at 1485.30? Am I missing something?

I have the same doubt. Why would anyone want to buy a stock higher than it’s current price??

This is just an example. One can choose to buy at any price.

You are right . But there are other scenarios as well. Please consider the following.

A. If the market opens gap-up, the LTP (Last traded price) could be skipped with a jump to 1500/1505 levels, so your chances of buying is above those levels, that way it makes sense.

B. If you want to take an conditional entry position and expect a break out near the resistance, you place your trigger just around the resistance anticipating a rally to exit.

Hope this helps

sir.i have a doubt . if i am long on bank nifty jan futures cmp 31285 if i set target as 300 points as trigger and 301 points as my limit price where i want to sell it.and i set a stop loss trigger 300 points doen and 301 as my limit price to sell on down side. and if monday market opened with a 600 points gap up and what price my target will get executed sir?

I’ve created a GTT and it got triggered but didn’t result in a trade. Now that I would like to delete this GTT, their isn’t any option to delete; please help as I’m new to Zerodha. Appreciate your quick response.

Hello Zerodha team, Please can you share why is there a limit of 50 GTTs per active account ?

We would like far more number of GTT setups to cover a prospective portfolio of buys and sells.

I dont see a reason why this is so much in restriction. Please can you change it to a much higher number or even unrestricted.

Nice to have feature requests:

1) Should be easy to group GTTs, organize them

Can I place GTT order for option writing

I am a beginner in share market and online trading

I have placed a target trigger 8.75 for South Indian Bank ,I bought 50 shares for 8.40 in GTT.

Today the target price of 8.75 is reached and then I got a message that it is triggered but I need to provide authorization using a CDSL TPIN. I did so.

Considering the above scenario please answer my below doubts.

1. How many days it would take back to get profit ?

2. After the target trigger occur, should I click sell/Exit again. Because I can still see the share in holdings list and as well GTT list. I have authorized it also.

1. When you book profits, the sale value will be credited to your ledger on the same day on an accrual basis. You’ll be able to withdraw the amount to your bank after the actual settlement of the trade which is trading + 2 days in case of equity and trading + 1 day in case of derivatives.

2. When the GTT is triggered, the order is automatically placed on the exchange. You can go through the Important to know section of this blog.

Granules stock currently at 377

I want to place a buy order when the stock falls to 360 and then touches 365.

Can I put a GTT for this?

This is a great feature for swing traders like me. Just a suggestion/request. Is it possible to add a trigger for cash price levels when buying the futures of the underlying? I mean it would be great for me to enter/exit equity futures based on price triggers on cash/underlying since I/most swing traders primarily use cash charts for price levels but have to take futures for optimum position size. Currently I have to manually predict an equivalent price in futures with trigger based on EOD/CMP price differential in future-cash price levels while using GTT which cause a slight entry slippage. TIA!

My Question is – If i paced GTT Order, but is it possible to get execute without TPIN? (If Delivery Position) if yes please tell me what is the process, if not than no use of GTT.

Does not market trigger …very dispointing …my GTT order is not executed . Please support market trigger for GTT

Suppose I don’t have any sell target. I just want to place a stop loss.

Say I bought ONGC at 78. Its currently trading at 89. My target is open as I am track my target near the end of day. Though I have a stop loss of 86.2. If 86.2 is hit I want a order at 86.1 to be placed automatically.

Can this be done???

Please reply.

Is stop loss price suppose to be lower than ur buy price?

GTT order is an amazing feature. Can someone from Zerodha confirm that GTT orders are free ? Unable to find this information.

The last bit of the post says:

”Free for use

There are no additional charges for using the GTT feature.” 🙂

They are. Standard brokerage applies when it is triggered. Since most of these would be delivery orders, nothing would be charged for those.

Is there option to cancel triggered GTT if still not executed

You can cancel it from the orders section of your orderbook on the day it is triggered. If you don’t do it, it’s cancelled by the end of the day automatically.

GTT was triggered but not executed. Still I can’t delete this. Can anyone please help me out how to cancel that GTT order?

Hi

I am trying to place GTT order. I need to place with Target & Stop loss. But am not able enable this feature. Is there vdo on how to do this?

How I delete GTT Order after Triggered Price ?

GTT is unique and very helpful to save profit. However, the stoploss need to be manually updated every other day. Can we please add trailing stop loss feature in GTT orders. It will be very helpful from customer usage perspective.

Team

how much are you charging for GTT?