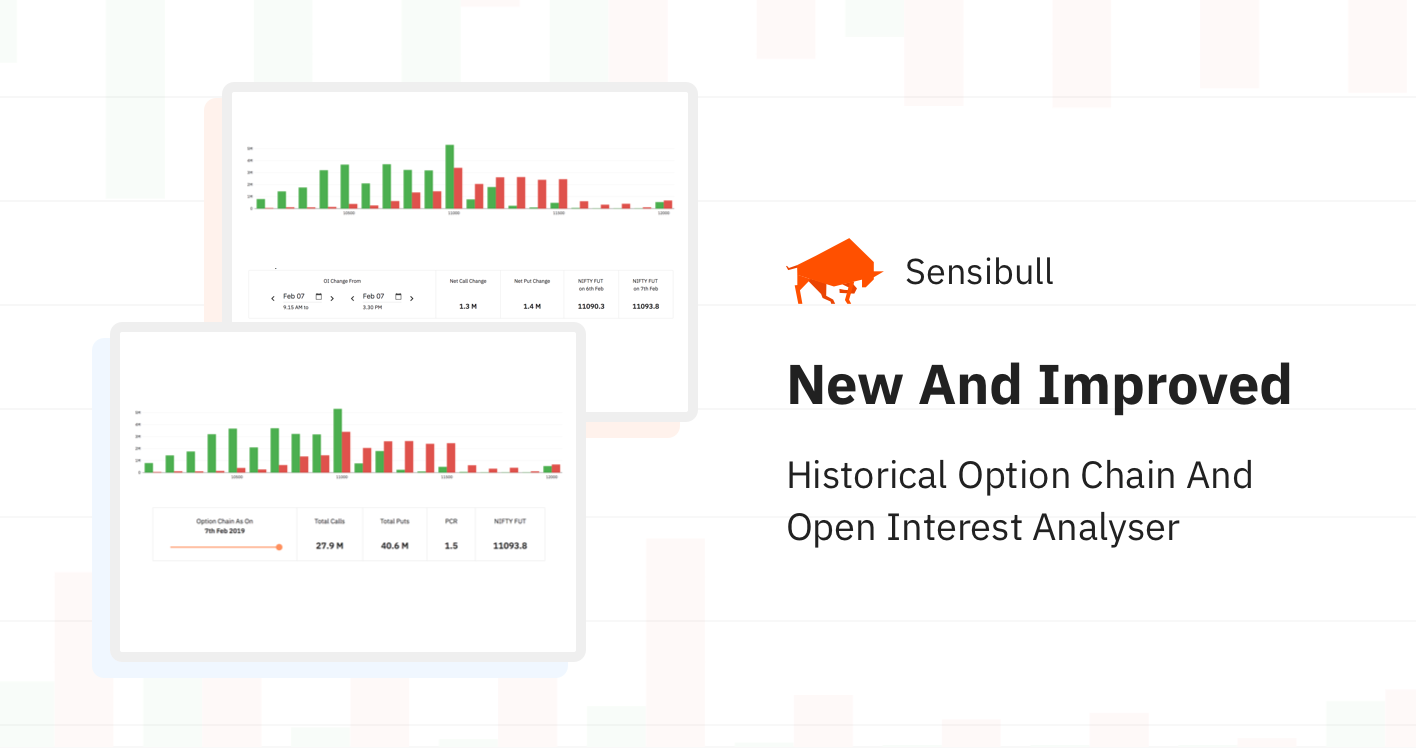

Historical open interest (OI) on Kite

Traders,

The option chain on Kite, powered by Sensibull, now has historical OI analysis. You can now enter a time period and will be able to track how much the open interest (OI) on Calls/Puts on any particular underlying has changed over that period. Currently, the option chain can be accessed only on Kite web, but it’ll also be accessible from Kite 3 mobile, our new mobile app we’ll be launching soon. Until then, if you are using mobile to trade, you can log into https://sensibull.com to access this feature.

Historical OI

How is this of use?

Generally, it is assumed that option writers are the savvier traders as they deploy a lot more capital to take positions as compared to option buyers. An easy way to track which direction option writers are taking is to track the open interest (OI) data. OI going up meaning writers increasing their position size, and vice versa. Historical OI analysis tool helps you understand the OI trend.

- OI on Calls going up would mean option writers feeling bearish and hence writing call options expecting Call option prices not going up.

- OI on Puts going up would mean option writers feeling bullish and hence writing put options expecting Put option prices not going up.

While being on the side of option writers does not always work, this is a great way to detect support and resistance levels. Do check this Varsity chapter on Open interest and this one on PCR/Maxpain. Also, make sure to check out https://sensibull.com, it has everything and more for an options trader.

Happy Trading,

Can we get historical PCR and OI data for stocks in Sensibull?

Why this feature is stopped? It would be very useful for options backtesting.

Hey Vishal, you can access historical OI on Sensibull.

Can I download this historical OI data in excel?

Sir. What is different between intradsy oi and historical oi. Which can take to do the trading.

it is very useful for option traders . i am waiting for it from many years. Thanx Zerodha Team for it. Zerodha is best than any Brokerage farm. Zerodha No1 .

Regarding Earnings,

Recently Kilosokar oil and Enginers Ltd company announced and expected interim divideb/Share is 2.50rs,when will and How will recieve the Amount?Kindly tell me…..

mene withdraw kiya magar fail hogaya koi position bhi khadi nahi hai

me apna pisa kyu nahi nikal sakta

Sensibull is great and very informative. Many thanks for this wonderful initiative. What is more important is that you are giving quality education at a very nominal cost. I am keenly going through all aspects of it. Today I went through the ”FII data” and your video in this regard. I have the following question :

You say that our view should not be against what FIIs are doing. I have checked the FII position (Cum Put OI and Call OI) for last 10 months. I don’t find much correlation most of the times. For example, when FIIs, net Put OI is significantly higher than net Call OI, we should presume that for the next 5, 10 days, the market may fall or may not rise. But the actual result does not support this at least 60% of times. So where I am going wrong ?

Ok…But what about kite mobile update? What about delivery margin funding?

I’m om prakash Sharma and I was open a trading account with you on 4th Feb 19.i also paid fee for the same rs 300. But I don’t receive the 🆔 password

It seems you guys are not sleeping at all! 🙂 can you please add profit/loss target trigger as 2% defined by me. it can square off or alerts user. Many times greed and fear creates unwanted results

Could you please let me know where I can find historical Implied volatility

We will launch this soon

Has this been done? Thanks in advance.

Could you please make video on this, video are always good to understand

https://youtu.be/wMKqGKRnskA

https://youtu.be/C73V59Z7HMc

Hi,

Everything in Sensibull is very well developed and unbeatable. I have one request that please include Call/Put Open Interest change data for the current day as well. It will be more helpful to understand the trend and do Intraday!

Thanks.

Thank you Parth! This will happen before Tuesday

Nice to read about OI. just a thought: We can integrate this data with help of AI and out put of automation result will surprise you.

Thanks Giri. Let is think this through

What does this authorization access means ?

Access holdings and positions portfolio

Place, modify, and cancel orders

Someone else apart from me will be authorized to place orders without my approval ?

Thanks

Siddharth

Hi Sidharth.

All trades on Sensibull are manual and can be placed ONLY by you.

The reason why we ask fro authorization is:

1) To place a trade from our system we need your authorization to route in through our system even if its a manual order you enter

2) To show you Greeks analysis of your position we need to be able to read your positions and orders

3) No one can place orders other than you

Thanks for clarification . I was running all over the web to find this historical out data to validate my strategy . This will help a lot .

Great new all the best Zerodhar team

Thanks Rakesh!

Issue with Getting Historical Data

hi..osum