Introducing Zerodha Fund House

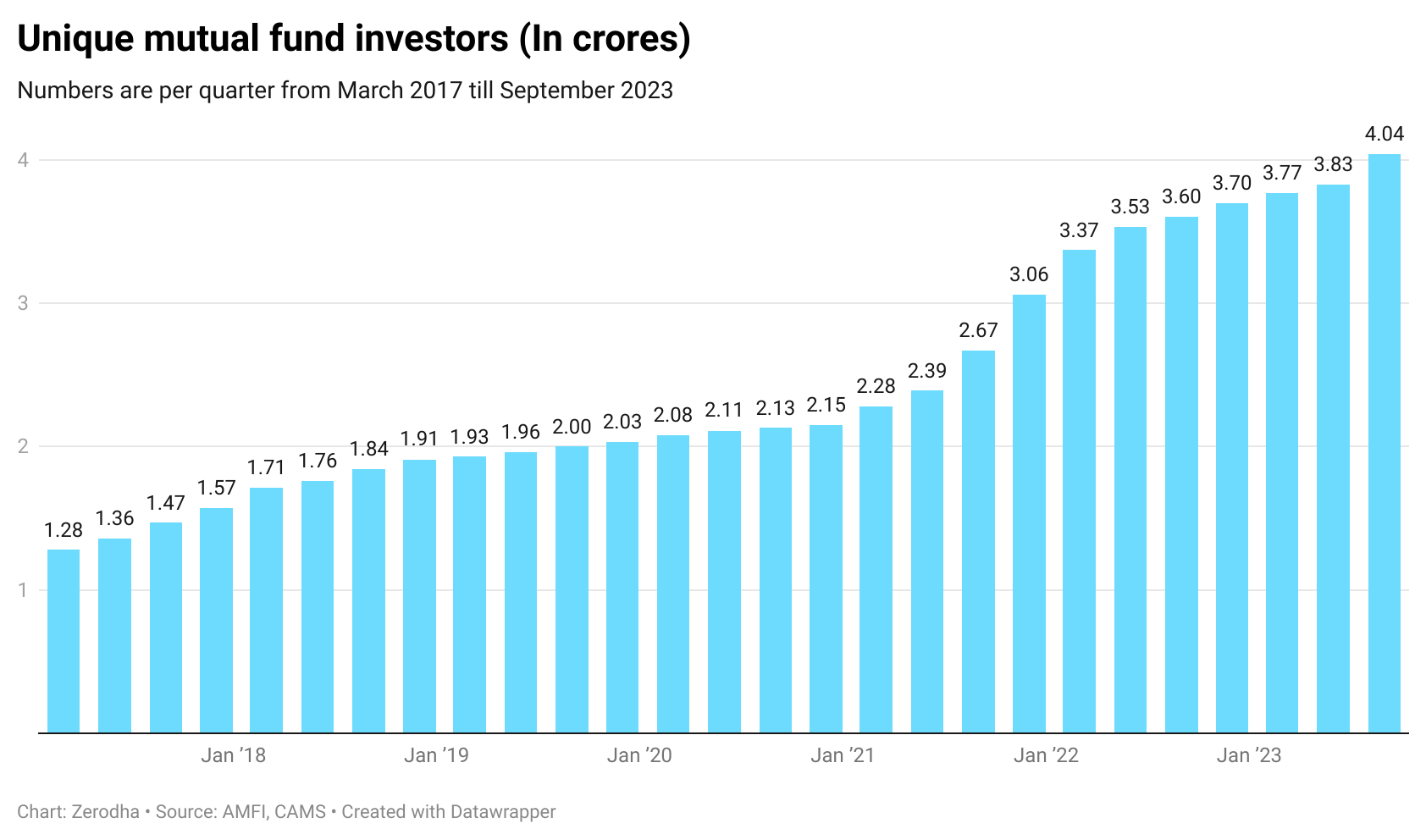

One of the biggest problems for the Indian markets is the shallow participation. We have about 8 crore demat account holders and 4 crore unique mutual fund investors. If you consider the duplication between both, the total number of investors is maybe about 9-10 crores.

If India has to grow, our markets have to expand. While we’ve built easy-to-use platforms for people to invest in equities and mutual funds, we also realized maybe they need easy-to-understand products. This is the only way to get the next 10 million Indians to invest, so we decided to apply for a mutual fund license. We are building the AMC as a joint venture with smallcase. They have 6+ years of experience building investment products, and building this with them and leveraging that expertise was a no-brainer. The AMC will be led by Vishal Jain, who has over 20 years of experience designing passive products. He was part of teams that launched India’s first equity, debt, and commodity ETFs.

It took us a while, but we are super excited to announce that the first new fund offerings of Zerodha Fund House are now open for investment on Coin and all the other direct mutual fund platforms. The two funds we have launched are an open ended index fund and a equity linked savings scheme (ELSS) or tax saver fund that tracks the Nifty LargeMidcap 250 Index. The index has exposure to both large and mid caps and is an ideal fit for core equity exposure in all portfolios.

About the index

- The Nifty LargeMidcap 250 index covers about 84% of the full market capitalization and around 87% of the free-float market capitalization of all listed NSE stocks.

- The index has 50-50 weights for large caps and mid caps. The weights are reset quarterly. The large cap universe is the Nifty 100 index, and the mid cap universe is the Nifty Midcap 150 index.

- The index is broadly diversified across 20 sectors.

Most AMCs can only offer one passive or active equity-linked savings scheme (ELSS) fund. Many offer active ELSS funds because they can charge higher. This makes us one of the few AMCs to have a low-cost index ELSS fund.

Here’s Vishal talking about the philosophy of Zerodha Fund House and about the new funds

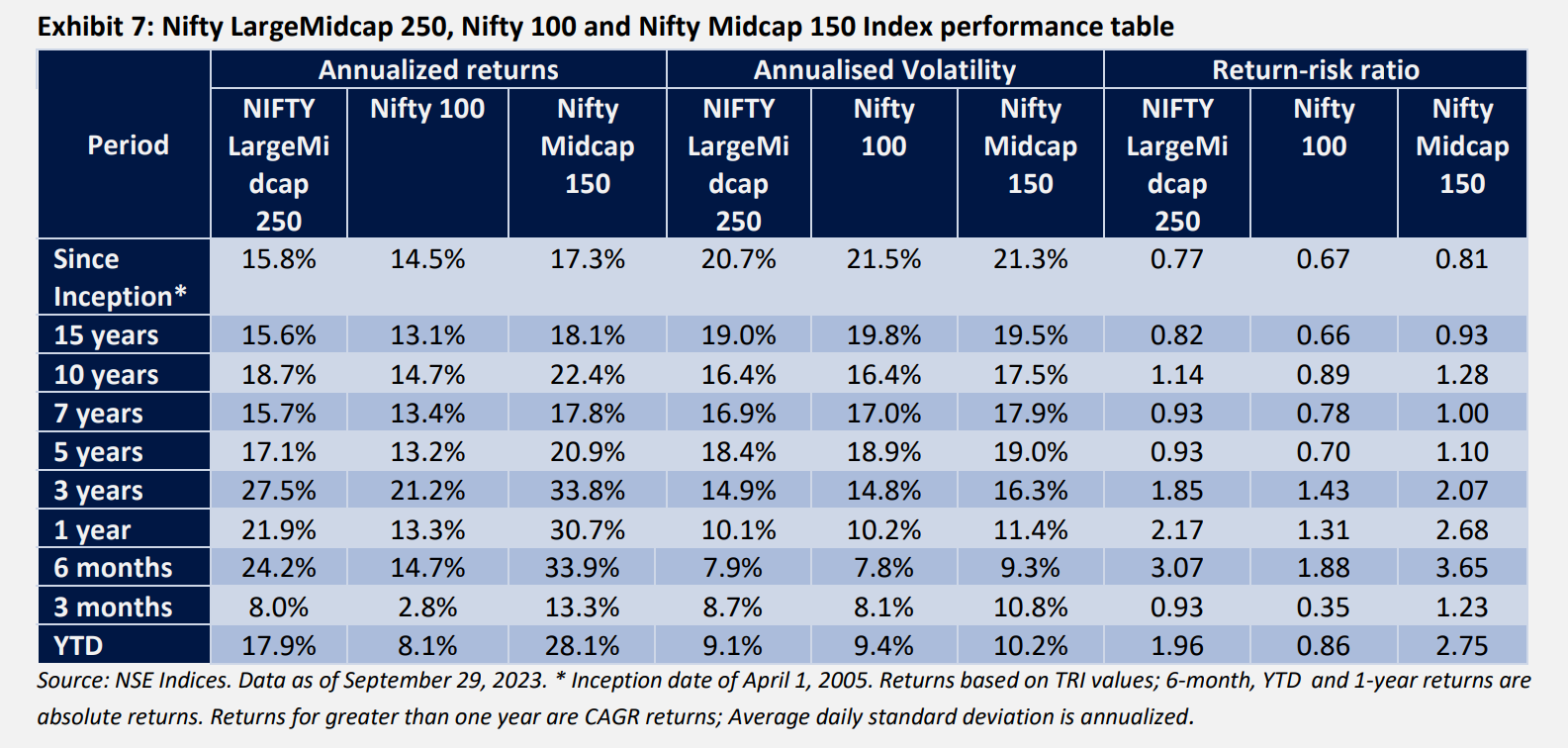

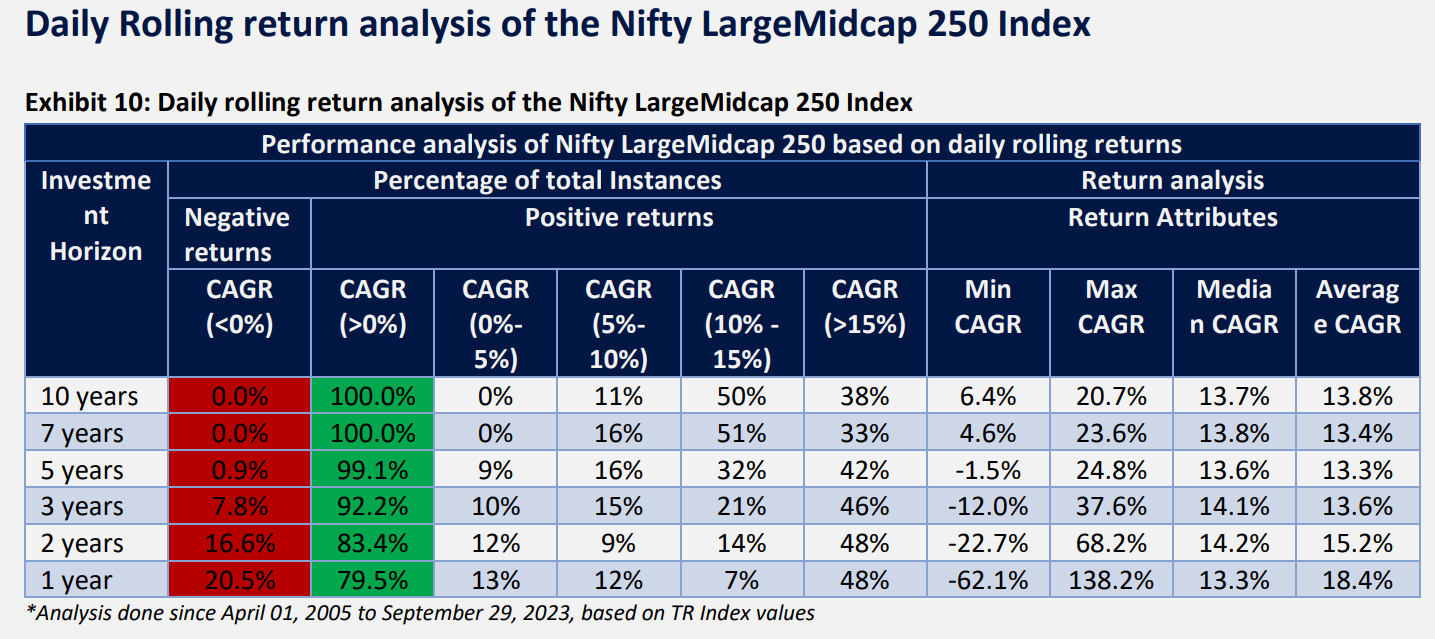

A brief snapshot of the index performance

Check out more details about the Nifty LargeMidcap250 index in this post.

How to invest

The NFOs are open on Coin and all direct mutual fund platforms. Click here to invest through Coin web

There are 43 AMCs, what makes Zerodha Fund House special?

One problem with asset management companies (AMCs) today is that most of them offer both index funds and active funds. The active funds generate most of the revenues, and this creates an incentive for AMCs to treat index funds as an afterthought. This is an intractable conflict at the heart of asset management and often leads to poorly managed index funds with poor tracking compared to the benchmark indices.

We were sure from day one that we wanted to avoid this conflict and also ensure we made things simple for investors. The Northstar in our minds was products that investors could understand and give them broad exposure to all the major asset classes. We will focus only on offering low-cost index funds and solutions built on top of them to help investors reach all their goals.

The logic of indexing

Although it feels like index funds have become popular, most of the inflows were from the Employees’ Provident Fund Organization (EPFO), which started investing in equity ETFs. If you consider index funds as a proxy for retail investments, the AUM is about 1.8 lakh crores, compared to 5.6 lakh crores in ETFs and 19 lakh crores in active funds. These are still very early days for index funds among retail investors.

The passive vs. active debate is one of the loudest debates in finance. While it matters, it’s also a distraction. The goal should be to expand the markets by getting more Indians to invest. This is possible only if new investors understand the mutual funds they invest in. This is what makes index funds special. They are easy to understand and give investors broad exposure to equities, debt, and gold at a low cost. If investors stay invested in index funds over the long term, it’s guaranteed that they will do better compared to most investors. Moreover, the issue of active vs. passive was settled long ago. There’s enough data to show that most active funds don’t beat their benchmarks. Here are a few reasons:

- If an index fund charges 0.3% and a comparable active fund charges 1.5%, the active fund already has a disadvantage of 1.2%. It has to generate enough returns to cover the costs and then deliver outperformance. While these percentages may seem small, these numbers compound over long periods of time.

- There are more smart people—thousands of CFAs, MBAs, and PhDs from elite institutions—trying to compete for the same amount of outperformance with the best tools and resources. Today, smart investors are more likely to compete with other smart investors.

- Most active funds tend to have higher turnover or portfolio changes. The higher the turnover, the higher the costs, which makes it hard to outperform.

- Markets continue to become more efficient over time. Given that we have active mutual funds, PMS’, AIF, and other institutional investors looking for market mispricing, inefficiencies get arbitraged away quickly. Markets may not be perfectly efficient, but they are sufficiently efficient enough to make outperforming hard.

- In 2017, SEBI recategorized mutual fund categories and defined the investment universe for all categories. This further made it hard for active mutual funds to generate outperformance.

Index funds only deliver the “average” market returns after costs, so why should investors settle for the average? Here’s a counterintuitive reality: The performance of most active funds is cyclical—the best active fund of this year tends to be the worst active fund in the next year. It’s very hard to pick the best fund and even harder to stick with the inevitable periods of underperformance.

Most important question isn’t “how can I earn the highest returns?” but rather “what are the best returns I can earn for the longest period of time.” Average returns for an above-average period of time = extreme outperformance. It’s the most obvious secret in investing. — Morgan Housel

Trying to pick the “best fund” or “best stock” is a pointless pursuit. Most investors are better off building a diversified portfolio of low-cost equity and debt funds and focusing on trying to earn more in life than maximize returns.

In 1956, Nobel Laureate Herbert Simon coined the term “satisficing”—a combination of satisfy and suffice. He argued that it’s not possible for human beings to be “maximizers.” In other words, we are not built to consider all the available information and all alternatives to make the best utility-maximizing decision. Rather, our brains are built to only consider some of the information and choices needed to make a “good enough” or satisficing decision.

I think this is a good framework for investing and personal finance as a whole as well. In investing, you are making decisions under uncertainty because the future is unknowable. You can only know the best decisions and choices in hindsight. It’s hard, if not impossible, to pick the best funds and stocks. This means that being satisficers or making good enough choices is what investors should aim for. Investing is not complicated; you just have to do these things and be disciplined and consistent over the long term.

- Keep costs low by choosing broad index funds.

- Invest regularly and increase the investment amount every year.

- Diversify across equity, debt, gold, and real estate.

- Rebalance at regular intervals

- Have clear goals.

- Behave well.

Happy investing.

There is a WhatsApp message received from +91 98453 35486 which says that investment can be done via WhatsApp. Why is it launched like this and is it genuine??

Hi Sanjeev, yes, this message is from Zerodha AMC, which allows you to do SIP payments directly from WhatsApp.

Is there any plan to launch growth variant of tax saver ELSS fund? I do not prefer to receive dividends as they are tax inefficient. It would help the investors if there is a growth fund

Which is the AMC you have floated or registered for this purpose ?

Request you to add Shariah complaint fund as there are only few in the market.

Just saw expense ratio 0.25 for the fund, which is quite high compared to other passive funds in market. We though zerodha offer best expense ratio, instead its turn out to be highest for passive fund.

Yes expense ratio of 0.28% for the Zerodha Nifty LargeMidcap 250 Index Fund is very high for a passive fund. Very odd especially keeping in mind the reason for them to launch a passive fund was to keep costs low.

Sir, please plan to open Zerodha Technology index fund

It will be most helpful for investors

With Regards

Shashanka Pradhan

Horrible day with Zerodha. Why don\’t you have robust system. I wanted to exit the position, it wasn\’t allowing. I wanted to buy it wasn\’t allowing.

Totally unriable with no back up. Atleast app should be independent and customers can use it as an alternative. But no, you guys need to pull up your socks.

Hi Shrikant, we\’re extremely sorry about this. Please create a ticket at http://support.zerodha.com and we\’ll have someone from our team reach out to you. We\’ve explained about yesterday\’s events here.

Will ZFH stop with just 2 funds or expand with many other kinds of index funds. If yes, which once?

Please guide me. How to start the SIP by app.

Hi Prakar, you will be able to set-up SIP once the funds are available for continuous sale and repurchase. Funds will be available within a week of NFO closing date.

hi Team,

Please guide me the path to start SIP. Thanks

Regards,

Rajesh KP

Hi Rajesh, you will be able to set-up SIP once the funds are available for continuous sale and repurchase. Funds will be available within a week of NFO closing date.

Congratulations

Congrats to the team & stay focused on passive investing model! This will differentiate Zerodha from other Fund house.

Good

Nice

👍

Mera A/c not in operation since 6 months or more. Therefore I am now unable to buy or sale any holdings. KYC not accepted at CBILKRA. Please help.

Hi Srijan, please create a ticket at support.zerodha.com with details of the issue so that our team can have this resolved at the earliest.

Fantastic fund

Please send me investment Awareness contact number of Team

Portal says amount of NFO will be de ited directly from my account linked. I have applied yesterday for payment through RTGS. But account is not debited yet. Hence applied again.

Clarify how to make payment. Can I remit through my Bank account directly through RTGS?

Hi, please create a ticket at support.zerodha.com so we can have this checked.

Can able to invest

All the best to Zerodha

Nice 👍

Is non-PIS NRI Zerodha account holder eligible for mutual fund investment using Coin?

Hi Sanjay, if you have non-PIS NRI account, you can inevst in mutual funds on Coin, given you\’re not based in US and Canada. For compliance reasons, US and Canada-based investors cannot invest in mutual funds through Coin.

Can you please share how much will be the expense ratio

Hi Kapil, The Total Expense Ratio (TER) for the scheme will become available after the New Fund Offer (NFO) concludes. You can check the details here.

Can you please share how much will be the expense ratio

Hi Shakti, The Total Expense Ratio (TER) for the scheme will become available after the New Fund Offer (NFO) concludes. You can check the details here.

My self invested 1lakh in Zerodha Nifty LargeMidcap 250 Index Fund today. Can I pledge this for options trading? If yes how much % applicable for haircut.

Hi, the list of securities approved for pledginhg is decided by the Clearing Corporation (CC). Once approved by the CC, you will be able to pledge.

What is the locking period. Any exit load

There is no exit load, John. Lock-in period is applicable only for the ELSS tax saver fund, which is 3 years.

How to proceed in this investment

Hi Rajeev, you can invest in NFO on Coin here. The NFO application process has been explained here.

Whether both these funds have locking period?

Hi Vijay, the Zerodha Nifty Large Midcap 250 index fund will not have any lock-in period. The ELSS tax saver fund will have a lock-in of 3 years.

How can I invest please suggest me

Hi Nikunj, you can invest in NFO on Coin here. The NFO application process has been explained here.

How can I do invest

Hi Divyansh, you can invest in NFO on Coin here. The NFO application process has been explained here.

Please send details

In which platform I can invest?

Hi Sanjay, you can invest in NFO on Coin here. The NFO application process has been explained here.

Sir,

Very Good 👍

Really sorry! but it is very necessary to suggest you that

Some persons (like me) don\’t understand the whole meaning of the matter or any note written in English, so they leave reading in half.

If you do it in English as well as in hindi Or marathi, it is better to understand for us. Thanku sir

Investing in NSE is better compared BSE ,you had given nice information

End user good service

Sir,

Instead of moving here and there and making no money, I am glad to invest through Zerodha. But how to start, please guide. Regards.

I want invest in nifty 50

Good initiative

Good. A vivid and perfect introduction of the fund at launch. Please continue with such comparative analyse on every fund/theme launched by you. Best wishes for all success to Zerodha on their entering a new arena.

Normally when two things are mixed in financial products we need to be aware of its really a good product for us. Ex: ULIP. In this fun we see two index are combined together and highlight that zerodha will keep tracking error less. But having both index the error would increase reducing returns. Can you help in understanding how the tracking error would be kept low? When we already have both index funds for nifty50 andnifty250 should we not go for 2 funds seperate then investing in this NFO ?

I am a student from the above two funds in which should I invest. Is there any lock in period as well. What are the benefits in investing from the above two funds

I have to Invest some amount in Zerodha nifty largeMidcap 250 index fund .I am retired person .please give me some advice thank you.

I wish to zerodha to came MF and they will succeed definitely in this group. wish you all the best

Im planning to trader again but im not able to add money

Hi Ranjith, we\’re sorry about this. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

I am interested in investing

Good news

Very very good, we are happy and interested to grow up with ZERODHA 🙏🙏👍👍👌👌💐💐🍧🍧🔋🔋🔋

I Am interested in investing

Kindly guide

How to invest in zerodha mf give link

I would like to invest as we know you are the best to advise

Thanks

Congrats

I am interested

I\’m invest how to invest

what is the management fees for these funds? thanks

I want to invest in this funds ,Please tell the procedure how to invest

I will too invest in these funds

What is the expense ratio of NFO means Zerodha Nifty Large midcap 250 Index fund ??

Hi Kalapi, The Total Expense Ratio (TER) for the scheme will become available after the New Fund Offer (NFO) concludes. You can check the details here.

How to invest…. I have a zerodha account…. Unable to understand how to invest via coin

Ni Nitin, you can invest in NFO on Coin here. The NFO application process has been explained here.

Although, future can never be guaranteed for returns by any AMC, based on the proven Ethics, Commitment and Pure Focus of Zerodha Team, coupled with Genuine, Integrated Expertise of Vishal Jain in better understanding the strength of Passive Funds, added with low pricing, there is quite a bit of Active Hope, in these new MFs, given the Earnest Interest already in place, in the larger community of investors! After all, Hope and Faith are only the two Active Immeasurable Co-ordinates for such an investment decision, notwithstanding too much contemplation on the credentials of any guaranteed returns, being the well percolated evident outcome of vagaries of the Market’s nature.

I would prefer to go for 250 Index Fund, with a long horizon.

Is SIP option available forcany of these funds?

Hi Sathchith, once the funds open for continous sale and repurchase, you will be able to set-up SIP on Coin.

Can we pledge any ❤️❤️of your funds and do fno trading?

Guide me with benefits of both funds.

I want to invest in TAX saving ELSS. Kindly guide me how to invest??

Please tell me about elss tax saver fund

Finally my search for Good Mutual Fund ends.

Ready to be long term investor with Zerodha.

Hello Team. Can NRIs invest in these funds?

Any diff between ELSS & Non ELSS fund in growth

Please send me the details about this fund. I want to invest in it

Pl provide more details of both the funds at an earliest. Also aprox proposed date to be declared.

Hi Sudhakar, NFO of both funds is now live and will be open until 3rd November. You can invest in NFO on Coin here. The NFO application process has been explained here.

Very good 👍

Congratulations

A reputed brokerage house like Zerodha launching an index fund in already a crowded market does not look nice.I was expecting an active fund.

I will pass it.

Helios looks more aggressive

I m interested in with investment for long term with small amount first

Congrats and best wishes Zerodha.Make efforts to serve and protect the interest of common investors.

Good initiative and trustworthy platform.congrtulations!

We would surely like invest for long term with confidence in order to achieve financial growth.

Very good

Congratulations

Good initiative and trustworthy platform.congrtulations!

Congratulations…

And best wishes

Let\’s start

When is the NFO of the Shariah index fund?

I\’m interested in putting a small amount for a long term.

How ZERODHA is different?

also. People in this industry were trying to say invest in SmallCaps so as to we gets good returns in SmallCaps . i would like to ask you to give good suggestion where to invest my money. i would like to invest lumsum amount one at a time.

Congratulations to the team Zerodha ! It`s very good initiation to enter into Mutual funds, i`m interested in invest in your NFO. Want to invest in long term when comparing to above two i would like to suggest Nifty smallCap also. People in this industry were trying to say invest in SmallCaps so as to we gets good returns in SmallCaps . i would like to ask you to give good suggestion where to invest my money. i would like to invest lumsum amount one at a time.

How can I invest in nifty 250

Hi Ramdev, you can invest in NFO on Coin here. The NFO application process has been explained here.

Congratulations, I will join with you,

Congratulations to the team Zerodha ! It`s very good initiation to enter into Mutual funds, i`m interested in invest in your NFO. Want to invest in long term when comparing to above two i would like to suggest Nifty smallCap also. People in this industry were trying to say invest in SmallCaps so as to we gets good returns in SmallCaps . i would like to ask you to give good suggestion where to invest my money. i would like to invest lumsum amount one at a time.

How to pay the money? Where the gateway is available?

Hi, you can invest in NFO on Coin here. The NFO application process has been explained here.

I believe Kamat brothers and zarodha

I am interested only boz it\’s zerodha

First update your app, why should i have to download another \”Coin\” app to purchase mutual fund. And it\’s not user friendly also . So update kite app so people can buy any mutual fund from Kite only.

Great initiative but how to invest in this funds..is it present in market watchlist on zerodha kite or have to approach your dealer.

Good luck and Best wishes, hope we can create wealth with wisdom of zerodha

Plz share details of fund and how we can invest

Hi Rahul, the index fund tracks the Nifty Large Midcap 250 index. You can check our details on this index here. You can invest in NFO on Coin here. The NFO application process has been explained here.

I am interested but dont know which cos./ funds/ stocks/ bonds are you including in NFO. How to know it before listing? So that decision can be made, if suitable, in a big way.

Hi Rajesh, the index fund tracks the Nifty Large Midcap 250 index. You can check our details on this index here.

How to start on it

Hi Prasad, you can invest in NFO on Coin here. The application process has been explained here.

How to invest in it?

Hi, you can invest in NFO on Coin here. The application process has been explained here.

How to invest

Kase invest kare

Hi Prabha, you can invest in NFO on Coin here. You can check the application process here.

I request Zerodha to have better trading chart layouts just as Trading View.

Congrats for your new adventure. I have no mutual funds investment so far. But I am very much intrest to invest in your NFO because of my trust on ZERODHA team.

Congratulations

JUST 1 QUESTION

WILL BUY 1 CR OF MF

CAN IT BE PLEDGED?

IF NO?

PLEASE NOTIFY ME ON ON MAIL AS SOON AS IT CAN BE PLEDGED

Hi Syed, the list of securities approved for pledginhg is decided by the Clearing Corporation (CC). Once approved by the CC, you will be able to pledge.

Iam interested to invest in your Two funds and What is the Expence ratio and Details of opening Date and other details.

Hi Shivashankar, the NFO is now open and will be open until 3rd November. You can invest in NFO on Coin here. You can check the application process here.

What will be the expense ratio of both the funds ?

Nice initiative!

Congratulations on new path.

Want to invest for long duration.

Need to know the interest rates.

Congratulations once again.

I am ARN MFD

Can I empanel with you !!

Make a YouTube video and post so that we can get clear idea how invest in above funds

Where and how we can buy and sell

Interested

When Nfo will come and how to invest in it. Through kite app or any other one

Congratulations

Which is stocks best invest in long term

How to invest

I already have been using Zerodha & Coin for my investment journey. I am interested for the ELSS fund. How can I start an sip ?

Waiting to invest

Very nice….n awaiting to invest

Why it is impossible to contact zerodha MF customer care, I was tring to invest through mycams, facing problem, if we can\’t call you, how can we contact during any transaction problem. Give us a direct CC no

How to invest

It\’s great to see Zerodh in a new chapter, you have proved in Stock market booking beating all. So let see can you make difference in this field. Congratulations.

Congratulations. I need to invest for 5years and need to know the best returns.

How to invest

Very nice inittitative by zerodha

I want to invest but how

I am interested

I invest but how

Congratulations…..

Let me know the procedure…..

Good initiative. All the best

Very nice to hear all the best I Will be with index fund for now

Pl cfm how to invest..n what is min amount

I want invest but how

Zerodha mutual fund minimum how many years and is it monthly investment?

Congratulations! Zerodha

My best wishes . Iam interested

Congratulations 🎉

Is it lumpsum or sip mode available ? And what\’s the expense ratio ?

good initiative

Can Zerodha help it\’s customers to invest in companies in US etc?

Zerodha is now a full fledged Financial Supermarket. Good Luck!

We are Happy that Applied In Zerodha Index Mutual Fund …We will do SIP also …Zerodha Name is Enough ❤️❤️

How to invest

We are Happy that Applied In Zerodha Index Mutual Fund …We will do SIP also …Zerodha Name in Enough ❤️❤️

Index MF best investment in the future India by zerodha entering MF business that SIP best option.

Congratulations zerodha team.

I just want to ask can we pledge this index fund for margin ?

How can We apply

How to apply

Hi Radhakrishnan, you can invest in NFO on Coin here. The NFO application process has been explained here.

Hi

How can apply, please guide..Thanks

Hi Gaganan, you can invest in NFO on Coin here. You can check the application process here.

Zarodha vary good platform but docomantly vary bad

Ready to invest in nifty 50

After buy can we pledged this fund to generate margin ??

Hi Ankeet, you will be able to pledge the fund once it is approved for pledging by the Clearing Corporations.

Please suggest long time investment share

How to invest

Hi Milind, you can invest in NFO on Coin here. You can check the application process here.

When no will open?

Hi Sampaurna, the NFO of fund is already open. You can invest in NFO on Coin here. You can check the application process here.

Congratulations! My best wishes. I am sure Zerodha would take this business line as well to its zenith shortly. Also I Would ensure to invest.

Good to have new product

How to invest mutulfund

How to invest mutual fund

Hi Chetan, you can invest in NFO on Coin here. You can check the application process here.

Hi Rakesh, you can invest in NFO on Coin here. You can check the application process here.

Great initiative

Vest wises

Bast return strock please till me

english padhna nhi aata, hindi men bhi post kiya kren.

Pls suggest you for long time investment shair

How to invest

Hi Sandeep, you can invest in NFO on Coin here. You can check the application process here.

My brothers were using zero Dar for there I just followed him. There I get clear view about zerodra so when I have started investing I was also chosen zerodra. It’s a nice platform to invest

I want to invest in nifty 50

Congratulations

I will be the initial investor. Best wishes.

How to invest?

Hi Kaushal, you can invest in NFO on Coin here. You can check the application process here.

How do I invest in funds ,pls explain

Very much interested

👍👍

Hi Nagendra, you can invest in NFO on Coin here. You can check the application process here.

Congratulations and all the best wished to Zerodha in MF space. I am interested in sip.

Congratulation

Wow… Wow…

Ready to invest…

New hope arrived

ZERODHA,Bus naam hee kafi hai,we trust u a lot.

I have faith in Zerodha\’s ability and intentions in striving for the financial stability of nation in general and public interest in speicific. Its sincerity and hard work has yielded good results. I wish all success to Zerodha. Very much interested to invest.

Dear sir, kindly send me details.

Can we pledge any of your funds and do fno trading?

Hi Rahul, you will be able to pledge the fund once it is approved for pledging by the Clearing Corporations.

Good luck !

sure I am going to invest in those funds

I will invest only when you provide 98% margin on pledging them.

Please introduce chemical fund

I need further details regarding sip for the above funds, pl let your charges for this above 2 investment in MFs

I trust since 2019 on Zerodha i think next steps is too much wonderful & Profitable for trading Community.

Love you Zerodha

How to apply nfo

Hi Pritam, you can invest in NFO on Coin here. You can check the application process here.

Congratulations and best wished to Zerodha in MF space. I am sure they are going to help common citizens create long-term wealth. Zerodha are market disruptors and I am sure they will do the same in MF space too.

I\’m Connected with Zerodha more than 3 Years.

Very Special Platform for Investment.

I\’m Started a SIP with Zerodha 250 Index Fund.

Can you pledge this fund for margin?

Hi, you will be able to pledge the fund once it is approved for pledging by the Clearing Corporations.

You will succeed in this business.I WANT TO INVEST

Trust on organization is most important and they are leader in this digital era. History of success and efficient administration leads to get more wealth creation. This is the reason I starts investment in zerodha new MF 250 mid small cap.

Congratulations Zerodha, have a great success

Minimum investment?

Hi Tushar, the minimum investment for is Rs. 100 for Nifty Large Midcap 250 index fund and Rs. 500 for the ELSS tax saver fund.

How to invest in NFO

Hi Kirit, you can invest in NFO on Coin here. You can check the application process here.

Expense Ratio?

Will it be like an ETF?

Please launch it soon.

How much maximum and minimum investment and when the fund is opening

maximum aur minimum Kitna investment

Who is the RTA CAMS or kfin?

CAMS

Sir mera fund add nhi ho rahai hai pelese help

Hi Shaikh, we\’re sorry to hear this. Please create a ticket at support.zerodha.com so we can have this checked.

Would love to see funds based on Nifty alpha low volatility 30 and Nifty 100 low volatility 30.

What is your AMC charges. That will go in a long way to get new customers like your demat account.

Hi Esakkinathan, if you hold only one demat account against the PAN and have holdings value less than 50k, then your account is considered as BSDA, on which no AMC is applicable. You can learn more about the BSDA account here.

Dear Zerodha Team

I trust in Zerodha team, any plan to introduce Ethical Fund, Very much interested to Invest in it.

Some times market is very volatile. How we Identify and what we do.

I will invest 20k per month

Make me ensure 30% profite. Per month

Mr farooq… No one dare to launch ETHICAL fund except TATA group. Everyone else are focusing on their profits only and ignoring the 33% customer target base. I hope they will understand one day the power of 33%

How can I start investing in index fund on behalf of my child. Pls advise that gives me 12 years.

Hi Sanjay, currently one cannot make investments directly in minor demat account. We\’re working on making this available. For now, you can invest in mutual funds in your account and then transfer the units to the minor account online using CDSL Easiest. You can check out the process here.

Normally when two things are mixed in financial products we need to be aware of its really a good product for us. Ex: ULIP. In this fun we see two index are combined together and highlight that zerodha will keep tracking error less. But having both index the error would increase reducing returns. Can you help in understanding how the tracking error would be kept low? When we already have both index funds for nifty50 andnifty250 should we not go for 2 funds seperate then investing in this NFO ?

Hopefully you bring ETFs soon too.

And we need better low cost sectorial ETFs and/or index funds, to come closer with US type of products. Most AMC provide this at very high costs.

Though I understand a lot more participation of money is required in this to even be feasible. Hopefully, the low cost will attract more investors and newer participants!!!

Do you have plans to bring small, mid and microcap Index funds?

This would be great options to have

Post comparison with nifty 50

Nothing New in this two mutual fund and this NFO need to prove themselves in market .As wise invester put your bet on proven horses not new.

I believed in zerodha and also put some money in zerodha elss nifty250 index fund.

I am waiting for activation of sip in this fund. Perhaps order will resume till 10th December. I have waited for long for this fund but my income is not great so puting low money per month 5k approx till the goal achieved, approx 10-20 years. Never exit because I believed team zerodha.

Sir,I want to know about Tata motor & Bank of india

sar, I want to know about sakar healthcare and mtar tech. pls tell me

I m an active investor since 2020 on Zerodha platform. I really look forward to start SIP in Large and mid cap ETF.

All the best to Zerodha AMC.

Can i I nvest through my private limited company current account.. .if yes call me..English or Tamil person..

Dear Zerodha Team,

\”allow me to be the initial contributor and extend my congratulations for the establishment of this platform\”

As a client, I have placed my trust in you and your expertise, and I have high hopes that Zerodha will continue to uphold this trust and remain innovative for the foreseeable future. I wish you all the best and hope for continued success.

regards,

Shreekesh Singh

Same issue of Not being able to speak to anyone at Zerodha inspite of multiple attempts. Even Support code is stated by IVR as incorrect!

Hi Anupam, sorry to hear this. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

Sir mera fund add problem ho rahai hai pelese help

Hi, sorry to hear this. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

dear Team,

I am mutual fund distributor. how i can empanel in zerodha AMC